DPC Times Square, New York Times building under construction 1903

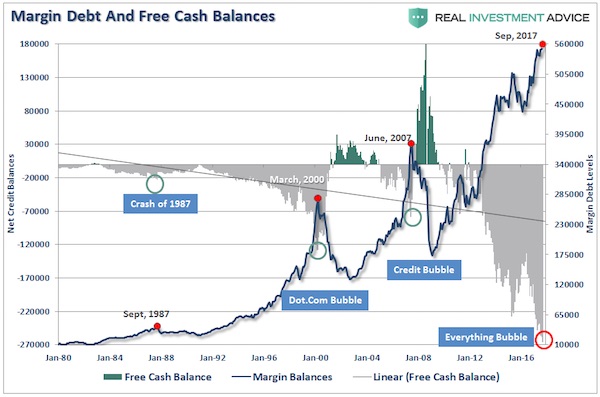

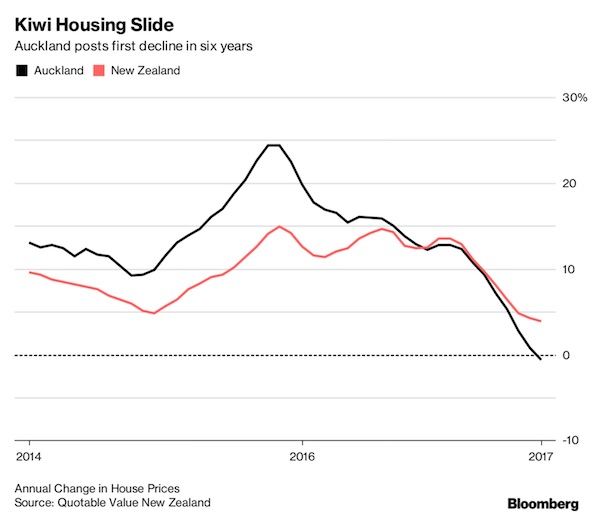

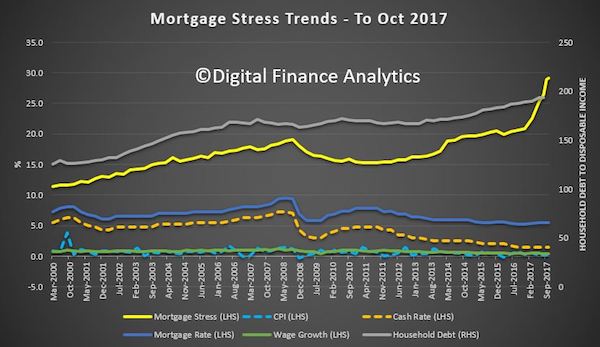

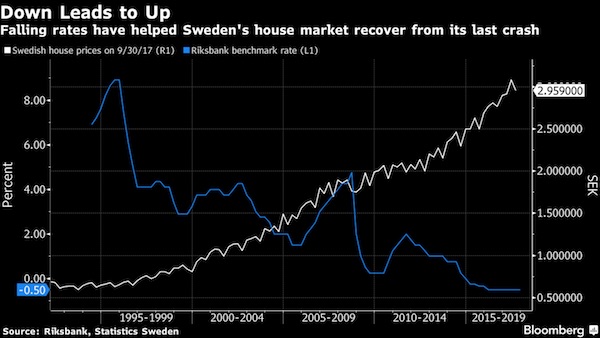

Debt has grown everywhere. Ever less is needed to make it pop.

• How Libor’s Surge Will Help Pop The Global Bubble (Colombo)

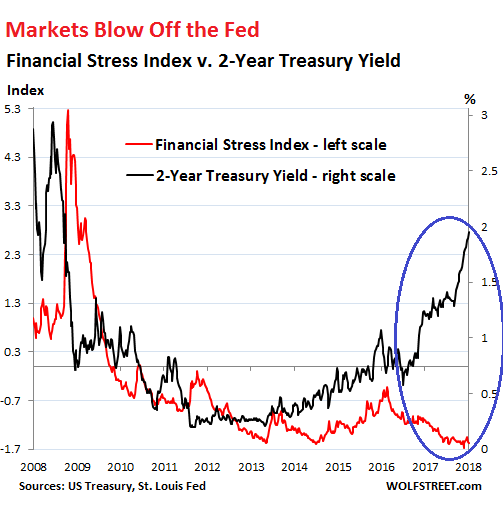

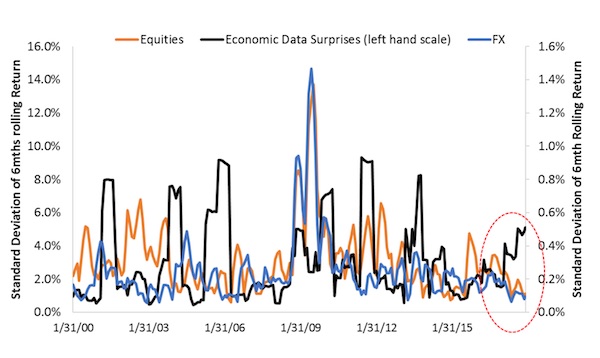

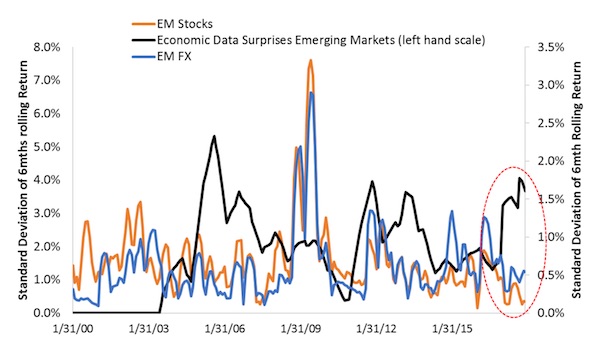

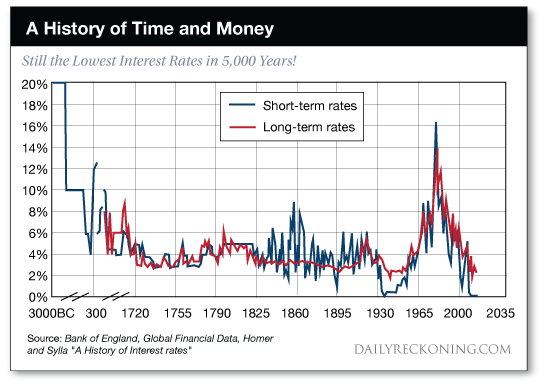

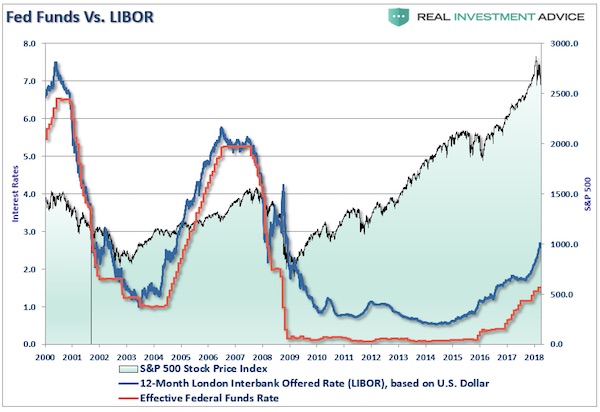

As the world’s most important benchmark interest rate, approximately $10 trillion worth of loans and $350 trillion worth of derivatives use the Libor as a reference rate. Libor-based corporate loans are very prevalent in emerging economies, which is helping to inflate the emerging markets bubble that I am warning about. In Asia, for example, Libor is used as the reference rate for nearly two-thirds of all large-scale corporate borrowings. Considering this fact, it is no surprise that credit and asset bubbles are ballooning throughout Asia, as my report on Southeast Asia’s bubble has shown.

Like other benchmark interest rates, when the Libor is low, it means that loans are inexpensive, and vice versa. As with the U.S. Fed Funds Rate, Libor rates were cut to record low levels during the 2008-2009 financial crisis in order to encourage more borrowing and concomitant economic growth. Unfortunately, economic booms that are created via central bank manipulation of borrowing costs are typically temporary bubble booms rather than sustainable, organic economic booms. When central banks raise borrowing costs as an economic cycle matures, the growth-driving bubbles pop, leading to a bear market, financial crisis, and recession.

Similar to the U.S. Fed Funds Rate, the Libor has been rising for the last several years as central banks raise interest rates. While rising interest rates haven’t popped the major global bubbles just yet, it’s just a matter of time before they start to bite.

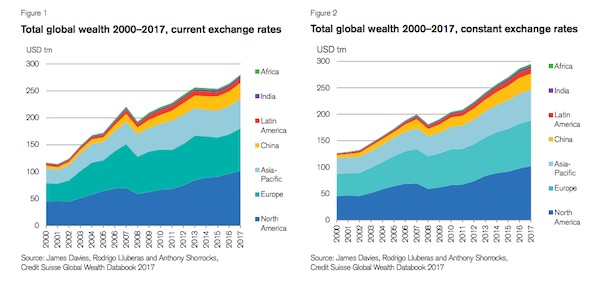

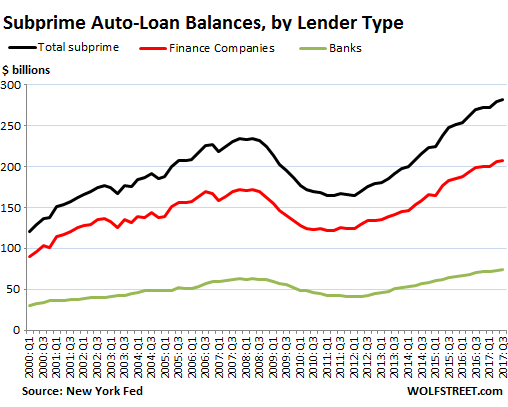

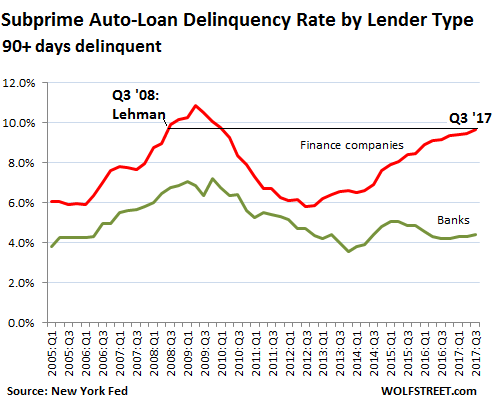

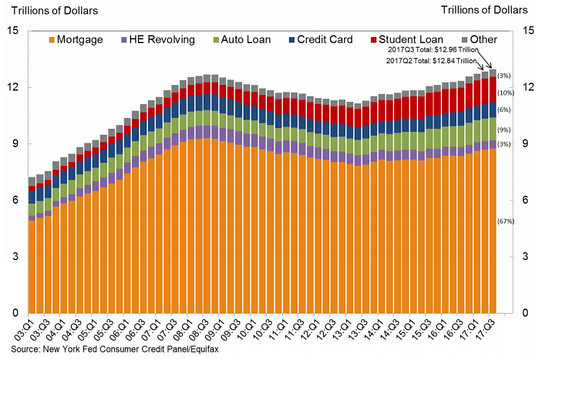

While most economists and financial journalists view the rising Libor as part of a normal business cycle, I’m quite alarmed due to my awareness of just how much our global economic recovery and boom is predicated on ultra-low interest rates. With global debt up 42% or over $70 trillion since the Global Financial Crisis, interest rates do not need to rise nearly as high as they were in 2007 and 2008 to cause a massive crisis.

What could have been. Excellent piece.

• America First – R.I.P. (David Stockman)

When the Cold War officially ended in 1991, Washington could have pivoted back to the pre-1914 status quo ante. That is, to a national security policy of America First because there was literally no significant military threat left on the planet. Post-Soviet Russia was an economic basket case that couldn’t even meet its military payroll and was melting down and selling the Red Army’s tanks and artillery for scrap. China was just emerging from the Great Helmsman’s economic, political and cultural depredations and had embraced Deng Xiaoping proclamation that “to get rich is glorious”. The implications of the Red Army’s fiscal demise and China’s electing the path of export mercantilism and Red Capitalism were profound.

Russia couldn’t invade the American homeland in a million years and China chose the route of flooding America with shoes, sheets, shirts, toys and electronics. So doing, it made the rule of the communist elites in Beijing dependent upon keeping the custom of 4,000 Wal-Marts in America, not bombing them out of existence. In a word, god’s original gift to America—the great moats of the Atlantic and Pacific oceans—had again become the essence of its national security. After 1991, therefore, there was no nation on the planet that had the remotest capability to mount a conventional military assault on the U.S. homeland; or that would not have bankrupted itself attempting to create the requisite air and sea-based power projection capabilities—a resource drain that would be vastly larger than even the $700 billion the US currently spends on its global armada.

Indeed, in the post-cold war world the only thing the US needed was a modest conventional capacity to defend the shorelines and airspace against any possible rogue assault and a reliable nuclear deterrent against any state foolish enough to attempt nuclear blackmail. Needless to say, those capacities had already been bought and paid for during the cold war. The triad of minutemen ICBMs, Trident SLBMs (submarines launched nuclear missiles) and long-range stealth bombers cost only a few ten billions annually for operations and maintenance and were more than adequate for the task of deterrence.

Likewise, conventional defense of the U.S. shoreline and airspace against rogues would not require a fraction of today’s 1.3 million active uniformed force—to say nothing of the 800,000 additional reserves and national guard forces and the 765,000 DOD civilians on top of that. Rather than funding 2.9 million personnel, the whole job of national security under a homeland-based America First concept could be done with less than 500,000 military and civilian payrollers. In fact, much of the 475,000 US army could be eliminated and most of the Navy’s carrier strike groups and power projection capabilities could be mothballed. So, too, the air force’s homeland defense missions could be accomplished for well less than $50 billion per annum compared to the current $145 billion.

New York Fed report.

• Optimism of US Manufacturers “Plunged” the Most Ever (WS)

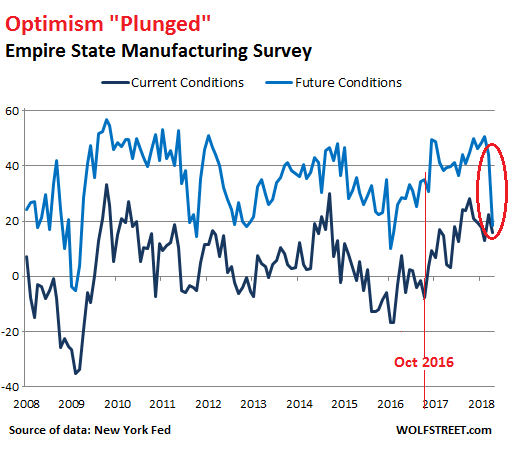

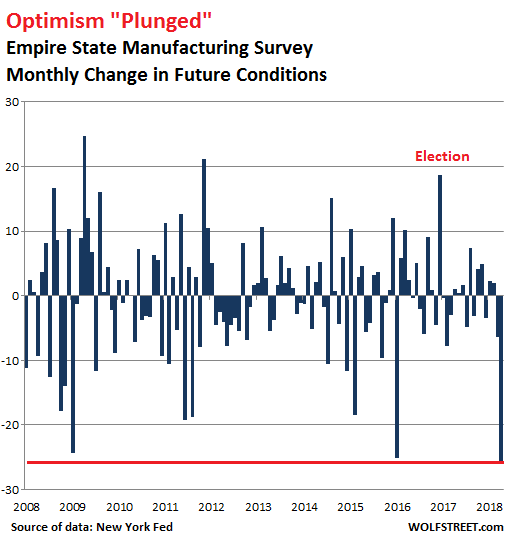

Something strange happened in the Empire State Manufacturing Survey released by the New York Fed this morning. The survey has two headline components: The index for current conditions and the index for future conditions six months down the road. The first index behaved reasonably well; the second index plunged the most ever. Executives are notoriously optimistic. In the survey, which goes back to 2001, expectations for future conditions are always higher than current conditions, and often by a big margin, even early on in the Financial Crisis before all heck was breaking loose. The index of future conditions reacts to events. For example, it spiked after Trump’s election. So today’s biggest plunge in survey history is a reaction to an event.

“Optimism tumbles,” the New York Fed’s report called it. And more emphatically: “Optimism about the six-month outlook plunged among manufacturing firms.” The headline index is based on a question about “general business conditions.” The sub-indices are based on questions about specific aspects of the manufacturing business, such as new orders, shipments, unfilled orders, employment, etc. [..] This chart shows the General Business Condition indices for current conditions (black line) and forward-looking conditions (blue line) with the plunge circled. The thin vertical red line indicates the last survey period before the November 2016 election:

The 25.8-point April plunge took the index from 44.1 points in March to 18.3 points in April, the largest monthly plunge ever. The second largest plunge (25.1 points) occurred in January 2016 as credit in the energy sector was freezing up and as the S&P 500 index was on its way to drop 19%. The third steepest plunge (24.3 points) occurred in January 2009, during the Financial Crisis. The chart below shows the month-to-month changes in the forward-looking general business conditions index:

China doesn’t need US in cloud computing.

• US Planning To Open “Third Front” In China Trade Spat (ZH)

In news that broke (conveniently, we should add) shortly after the market closed on Monday, the Wall Street Journal is reporting that the White House is gearing up for what would be the third front in its nascent trade spat with China. As the paper points out, Trade Representative Robert Lighthizer is preparing a fresh trade complaint – again under Section 301 of the Trade Act of 1974 – the same section of the trade act under which the US filed its complaint about China’s intellectual property abuses, aka the first salvo in the US’s trade war. This time, Lighthizer is aiming at China’s unfair restrictions on US companies trying to establish a foothold in China in high-tech industries like cloud computing.

As a general rule, China requires foreign firms to partner with a domestic firm in a “revenue-sharing agreement” before they can gain entry to the Chinese market. By comparison, the US allows Chinese firms like Alibaba to function almost totally unfettered. To be sure, Lighthizer has yet to decide whether to go ahead with the complaint, leaving the tariffs on steel and aluminum and the investigation into IP abuses as the only concrete actions that the White House has taken to hold China accountable for what Trump has described as decades of abuses on trade (threatening to impose tariffs on $150 billion in goods doesn’t count).

“All hell breaks loose..”

• US Cuts Off China’s ZTE From American Tech for Seven Years (BBG)

The U.S. government said Chinese telecommunications-gear maker ZTE Corp. violated the terms of a sanctions settlement and imposed a seven-year ban on purchases of crucial American technology needed to keep it competitive. The Commerce Department determined ZTE, which was previously fined for shipping telecommunication equipment to Iran and North Korea, subsequently paid full bonuses to employees who engaged in the illegal conduct, failed to issue letters of reprimand and lied about the practices to U.S. authorities, the department said. “Instead of reprimanding ZTE staff and senior management, ZTE rewarded them,” Commerce Secretary Wilbur Ross said in the statement.

“This egregious behavior cannot be ignored.” The ZTE rebuke adds to U.S.-China tensions over trade between the world’s two biggest economies. President Donald Trump threatened tariffs on $150 billion in Chinese imports for alleged violations of intellectual property rights, while Beijing vowed to retaliate on everything from American soybeans to planes. Trump on Monday accused China along with Russia of devaluing their currencies, opening a new front in his argument that foreign governments are exploiting the U.S. China’s Ministry of Commerce rapidly responded to the ZTE ban, saying it would take necessary measures to protect the interests of Chinese businesses.

It said the Shenzhen-based company has cooperated with hundreds of U.S. companies and contributed to the country’s job creation. For ZTE itself, the latest U.S. action means one of the world’s top makers of smartphones and communications gear will no longer be able to buy technology from American suppliers, including components central to its products. ZTE has purchased chips from Qualcomm and Intel, and optical components from Acacia Communications and Lumentum. A seven-year ban would effectively cover a critical period during which the world’s telecoms carriers and suppliers are developing and rolling out fifth-generation wireless technology. “All hell breaks loose,” wrote Edison Lee and Timothy Chau, analysts at Jefferies, after the export ban was announced.

But what to believe of the numbers?

• China Industrial Output, Investment Growth Miss Expectations (R.)

China’s industrial output grew 6.0% in March from a year earlier, missing expectations, while fixed-asset investment growth slowed to 7.5% in the first quarter, also below forecasts, data showed on Tuesday. Analysts polled by Reuters had predicted industrial output growth would cool to 6.2% from 7.2% in the first two months of the year. Investment growth had also been expected to ease, to 7.6% in the first three months of the year, from 7.9% in January-February. Private-sector fixed-asset investment rose 8.9% in January-March, compared with an increase of 8.1% in the first two months, the National Bureau of Statistics said on Tuesday.

Private investment accounts for about 60% of overall investment in China. Retail sales rose 10.1% in March from a year earlier, beating expectations of an increase of 9.9%, compared with a rise of 9.7% in the first two months. The government has set an economic growth target of around 6.5% this year, the same goal as in 2017. Actual growth last year came in much stronger at 6.9%, due largely to an infrastructure-led construction boom, resurgent exports and record bank lending.

Causation, correlation.

• Is Tesla The Next Enron? (MW)

There’s more than enough to get distracted by — and be nervous about — over the next few days, but judging from the upbeat premarket action on Monday, investors aren’t exactly scrambling around to load up on risk-off assets. Geopolitics aside, hope abounds that the next leg up could be fueled by what corporate leaders have to say this week regarding their quarterly results. “It is still early in the earnings season, and as we hear from the CEOs we will find out if the market will refocus on fundamentals and away from the macro news,” says Jill Carey Hall, equity strategist at Bank of America Merrill Lynch.

Tesla however, doesn’t report its results for a while. Until then, you can expect the FUD to keep flying as the haters tangle with the Musk faithful — and Musk himself — over where the company is ultimately headed. Count Harris Kupperman of Praetorian Capital among those outspoken bears, and, just like renowned short-seller Jim Chanos did late last year, he recently compared Tesla to one of the biggest fails Wall Street’s ever seen — Enron. He used this overlay, our chart of the day, to illustrate his prediction:

Elon Musk relishes the opportunity to return fire at his critics, like when he recently threw shade at the Economist for questioning Tesla’s stability. That hardly convinced Kupperman. “He hasn’t hit on any target or deliverable with any sort of reliability for years now. Why should I believe him now?” he writes. “Remember in 2016 when he said they’d be profitable and didn’t need any more money? Or when they said that in 2017? He’ll probably be saying the same thing at the bankruptcy hearing.”

“Traditional automakers adjust bottlenecks on the fly during a launch..” “This is totally out of the ordinary.”

• Tesla Puts the Brakes on Model 3 Production Line (BBG)

Tesla is temporarily suspending production of the Model 3 sedan for at least the second time in roughly two months, just after Elon Musk admitted to mistakes that hindered his most important car. The company informed employees that the pause will last four to five days, Buzzfeed reported Monday. A Tesla spokesman referred back to a statement provided last month, when Bloomberg News first reported that Model 3 production was idled from Feb. 20 to 24. The carmaker said then that it planned periods of downtime at both its vehicle and battery factories to improve automation and address bottlenecks. The hiatus is another setback for the first model Musk has tried to mass-manufacture.

In addition to trying to bring electric vehicles to the mainstream, the chief executive officer had sought to build a competitive advantage over established automakers by installing more robots to quickly produce vehicles. Last week, he acknowledged “excessive” automation at Tesla was a mistake. “Traditional automakers adjust bottlenecks on the fly during a launch,” Dave Sullivan, an analyst at AutoPacfic Inc., said in an email. “This is totally out of the ordinary.” Tesla employees are expected to use vacation days or stay home without pay during the Model 3 downtime, though a small number may be offered paid work elsewhere at the factory in Fremont, California, Buzzfeed reported.

The shutdown is taking place a week after Musk gave CBS This Morning a tour of Tesla’s assembly plant and said the company should be able to sustain producing 2,000 Model 3 sedans a week. He said manufacturing issues that had been crimping output were being resolved and that Tesla probably will make three or four times as many of the cars in the second quarter. Tesla built 9,766 Model 3 sedans in the first quarter. The company said in an April 3 statement that the process of boosting production and addressing bottlenecks during the first three months of the year included “several short factory shutdowns to upgrade equipment.”

Will Zuck ‘honor’ the invitation. Looks like he may have to.

• Facebook’s Next Big Headache: Europe (Axios)

The risk to Facebook’s business coming out of last week’s Mark Zuckerberg hearings is minimal. The threat to its business in the EU, where aggressive regulation has already passed, is massive. The latest: The European Parliament has issued a second invitation to Facebook CEO Mark Zuckerberg to appear at a joint committee heating. EU Justice Commissioner Vera Jourova had a phone exchange with Facebook COO Sheryl Sandberg urging Zuckerberg to pay the Parliament a visit, according to the Associated Press. “I expect that Mr Zuckerberg will take this invitation because I believe that face-to-face communication and being available for such communication will be a good sign that Mr. Zuckerberg understands the European market,” Jourova told CNBC Friday.

“Facebook has more active users in Europe than in the US,” tweeted parliament member Guy Verhofstadt. “We expect Mark Zuckerberg to come to the European Parliament and explain how he will make sure Facebook respects [the forthcoming General Data Protection Regulation].” Facebook spent more than $2.5 million on its in-house lobbying in Europe last year, according to disclosure records. The company says that a total of 15 staff are involved in its EU lobbying efforts. European regulation was a prime topic of discussion even during Zuckerberg’s congressional hearings last week. Sandberg visited Brussels in January to discuss Facebook’s commitment to privacy and compliance with Europe’s new sweeping privacy rules.

Facebook faces several very real threats to its business model in Europe this spring.

• GDPR: The sweeping General Data Protection Regulation will go into effect in late May, putting in place strict new privacy rules. U.S. tech firms face punitive fines if they do not comply.

• ePrivacy: An updated version of the EU’s ePrivacy directive, which is set to go in effect in conjunction with GDPR in May 2018, will add greater regulation of data tracking through cookies and users’ ability to opt-out of data collection.

• Antitrust: Facebook was fined by EU antitrust commissioner Margrethe Vestager last May for allegedly misleading officials when it acquired WhatsApp. She signaled to reporters in Washington last week that she’s still keeping an eye on the social giant, but noted that the European government has no official stance on whether the company is a monopoly. She said a German probe and new data rules could mitigate some concerns about Facebook’s power.

When your defense is that others did it too, you’re not winning.

• Facebook Hit With Class Action Suit Over Facial Recognition Tool (AFP)

A US federal judge in California ruled Monday that Facebook will have to face a class action suit over allegations it violated users’ privacy by using a facial recognition tool on their photos without their explicit consent. The ruling comes as the social network is snared in a scandal over the mishandling of 87 million users’ data ahead of the 2016 US presidential election. The facial recognition tool, launched in 2010, suggests names for people it identifies in photos uploaded by users – a function which the plaintiffs claim runs afoul of Illinois state law on protecting biometric privacy. Judge James Donato ruled the claims by Illinois residents Nimesh Patel, Adam Pezen, and Carlo Licata were “sufficiently cohesive to allow for a fair and efficient resolution on a class basis.

“Consequently, the case will proceed with a class consisting of Facebook users located in Illinois for whom Facebook created and stored a face template after June 7, 2011,” he said, according to the ruling seen by AFP. A Facebook spokeswoman told AFP the company was reviewing the decision, adding: “We continue to believe the case has no merit and will defend ourselves vigorously.” Facebook also contends it has been very open about the tool since its inception and allows users to turn it off and prevent themselves from being suggested in photo tags. The technology was suspended for users in Europe in 2012 over privacy fears.

Also on Monday, Facebook confirmed that it collected information from people beyond their social network use. “When you visit a site or app that uses our services, we receive information even if you’re logged out or don’t have a Facebook account,” product management director David Baser said in a post on the social network’s blog. Baser said “many” websites and apps use Facebook services to target content and ads, including via the social network’s Like and Share buttons, when people use their Facebook account to log into another website or app and Facebook ads and measurement tools. But he stressed the practice was widespread, with companies such as Google and Twitter also doing the same.

We’re booming.

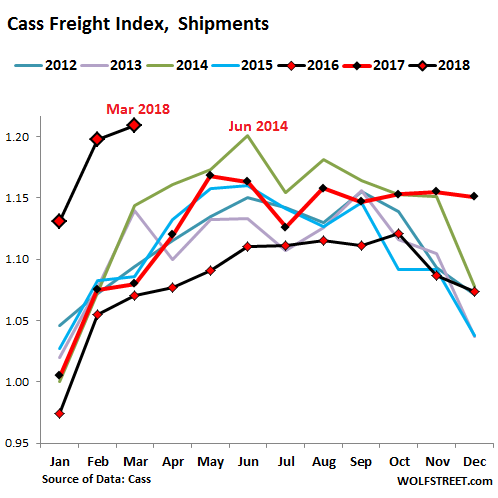

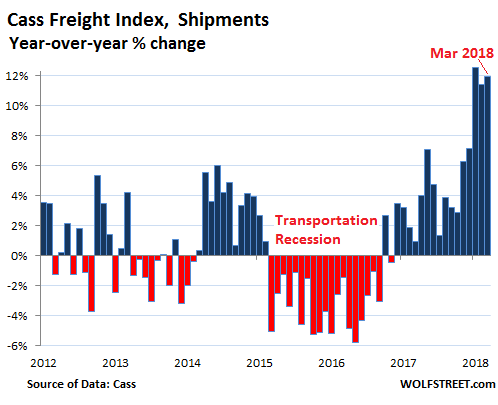

• US Freight Expenditures Surge 15.6% from Year Ago (WS)

Shipment volumes in the US by truck, rail, air freight, and barge combined surged 11.9% year-over-year in March, according to the Cass Freight Index. This pushed the index, which is not seasonally adjusted, to its highest level for any month since 2007 and for any March since 2006:

After the US transportation recession in 2015 and 2016, the industry was recovering at an every faster pace. In the chart above, note how the red line (2017) outpaced the black line (2016). And 2018 has turned into a transportation boom. March is normally still in the slow part of the year, but this March blew past even June 2014, the banner month since the Financial Crisis! “Volume has continued to grow at such a pace that capacity in most modes has become extraordinarily tight,” Cass explained. “In turn, pricing power has erupted in those modes.” The chart below shows the year-over-year percentage changes in the index for shipment volumes. Note the double-digits spikes over the past three months:

The index, which is based on $25 billion in annual freight transactions, according to Cass Information Systems, covers all modes of transportation — rail, truck, barge, and air — for consumer packaged goods, food, automotive, chemical, OEM, and heavy equipment but not bulk commodities, such as oil, coal, or grains. This kind of surge in volume has consequences in this cyclical business. During the “transportation recession,” orders for heavy Class 8 trucks collapsed, triggering lay-offs and throughout the truck and engine manufacturing industry. The opposite is now the case: Orders for heavy trucks are hitting records.

Yeah, it’s a vulnerable system we’ve built. And that goes for all sides.

• US and UK Blame Russia For ‘Malicious’ Cyber-Offensive (G.)

The cyberwar between the west and Russia has escalated after the UK and the US issued a joint alert accusing Moscow of mounting a “malicious” internet offensive that appeared to be aimed at espionage, stealing intellectual property and laying the foundation for an attack on infrastructure. Senior security officials in the US and UK held a rare joint conference call to directly blame the Kremlin for targeting government institutions, private sector organisations and infrastructure, and internet providers supporting these sectors. Rob Joyce, the White House cybersecurity coordinator, set out a range of actions the US could take such as fresh sanctions and indictments as well as retaliating with its own cyber-offensive capabilities. “We are pushing back and we are pushing back hard,” he said.

Joyce stressed the offensive could not be linked to Friday’s raid on Syria. It was not retaliation for the US, UK and French attack as the US and UK had been investigating the cyber-offensive for months. Nor, he said, should the decision to make public the cyber-attack be seen as a response to events in Syria. Joyce was joined in the call by representatives from the FBI, the US Department of Homeland Security and the UK’s National Cyber Security Centre (NCSC), which is part of the surveillance agency GCHQ.

The US and UK, in a joint statement, said the cyber-attack was aimed not just at the UK and US but globally. “Specifically, these cyber-exploits were directed at network infrastructure devices worldwide such as routers, switches, firewalls, network intrusion detection system,” it said. “Russian state-sponsored actors are using compromised routers to conduct spoofing ‘man-in-the-middle’ attacks to support espionage, extract intellectual property, maintain persistent access to victim networks and potentially lay a foundation for future offensive operations. “The current state of US and UK network devices, coupled with a Russian government campaign to exploit these devices, threatens our respective safety, security, and economic wellbeing.”

That’s a lot of potential clients you’re missing out on. And potential loans to issue.

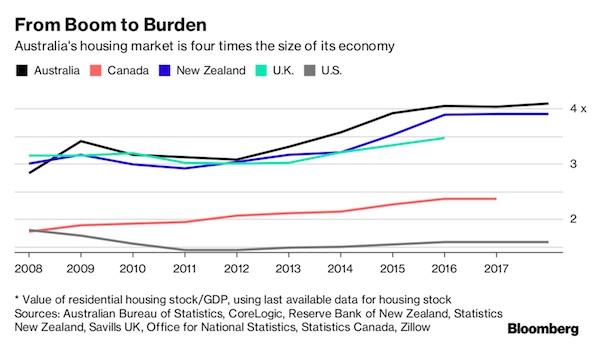

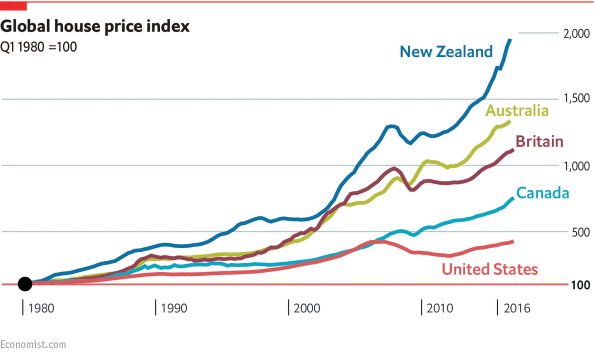

• One In Three UK Millennials Will Never Own A Home (G.)

One in three of will never own their own home, with many forced to live and raise families in insecure privately rented accommodation throughout their lives, according to a report by the Resolution Foundation. In a gloomy assessment of the housing outlook for approximately 14 million 20- to 35-year-olds, the thinktank’s intergenerational commission said half would be renting in their 40s and that a third could still be doing so by the time they claimed their pensions. It predicted an explosion in the housing benefits bill once the millennial generation reaches retirement.

“This rising share of retiree renters, coupled with an ageing population, could more than double the housing benefit bill for pensioners from £6.3bn today to £16bn by 2060 – highlighting how everyone ultimately pays for failing to tackle Britain’s housing crisis,” the report read. It calls for a radical overhaul of the private rented sector, proposing a three-year cap on rent increases, which would not be allowed to rise by more than the consumer price index, currently 2.5%. The report adds to a growing chorus of demands for rent stabilisation. Jeremy Corbyn called for rent control during his speech at the Labour party conferencelast year.

The Resolution Foundation wants “indeterminate” tenancies as the sole form of contract in England and Wales. These would replaced the standard six-month or 12-month contracts demanded by most landlords. The thinktank said this would follow , where open-ended tenancies began in December 2017, and is the standard practice in Germany, the Netherlands, Sweden and Switzerland. Greater security of tenancy is vital as more families are raised in the private rented sector, the report said. The number of privately renting households with children has tripled from 600,000 in 2003 to 1.8m in 2016.

How bad is it? “About 1 million plastic bottles are sold each minute around the globe..”

• Scientists Accidentally Create Mutant Enzyme That Eats Plastic Bottles (G.)

Scientists have created a mutant enzyme that breaks down plastic drinks bottles – by accident. The breakthrough could help solve the global plastic pollution crisis by enabling for the first time the full recycling of bottles. The new research was spurred by the discovery in 2016 of the first bacterium that had naturally evolved to eat plastic, at a waste dump in Japan. Scientists have now revealed the detailed structure of the crucial enzyme produced by the bug. The international team then tweaked the enzyme to see how it had evolved, but tests showed they had inadvertently made the molecule even better at breaking down the PET (polyethylene terephthalate) plastic used for soft drink bottles.

“What actually turned out was we improved the enzyme, which was a bit of a shock,” said Prof John McGeehan, at the University of Portsmouth, UK, who led the research. “It’s great and a real finding.” The mutant enzyme takes a few days to start breaking down the plastic – far faster than the centuries it takes in the oceans. But the researchers are optimistic this can be speeded up even further and become a viable large-scale process. “What we are hoping to do is use this enzyme to turn this plastic back into its original components, so we can literally recycle it back to plastic,” said McGeehan. “It means we won’t need to dig up any more oil and, fundamentally, it should reduce the amount of plastic in the environment.”

About 1m plastic bottles are sold each minute around the globe and, with just 14% recycled, many end up in the oceans where they have polluted even the remotest parts, harming marine life and potentially people who eat seafood. “It is incredibly resistant to degradation. Some of those images are horrific,” said McGeehan. “It is one of these wonder materials that has been made a little bit too well.” However, currently even those bottles that are recycled can only be turned into opaque fibres for clothing or carpets. The new enzyme indicates a way to recycle clear plastic bottles back into clear plastic bottles, which could slash the need to produce new plastic.

Most intelligent species ever.

• More Than 95% Of World’s Population Breathe Dangerous Air (G.)

More than 95% of the world’s population breathe unsafe air and the burden is falling hardest on the poorest communities, with the gap between the most polluted and least polluted countries rising rapidly, a comprehensive study of global air pollution has found. Cities are home to an increasing majority of the world’s people, exposing billions to unsafe air, particularly in developing countries, but in rural areas the risk of indoor air pollution is often caused by burning solid fuels. One in three people worldwide faces the double whammy of unsafe air both indoors and out.

The report by the Health Effects Institute used new findings such as satellite data and better monitoring to estimate the numbers of people exposed to air polluted above the levels deemed safe by the World Health Organisation. This exposure has made air pollution the fourth highest cause of death globally, after high blood pressure, diet and smoking, and the greatest environmental health risk. Experts estimate that exposure to air pollution contributed to more than 6m deaths worldwide last year, playing a role in increasing the risk of stroke, heart attack, lung cancer and chronic lung disease. China and India accounted for more than half of the death toll.

Burning solid fuel such as coal or biomass in their homes for cooking or heating exposed 2.6 billion people to indoor air pollution in 2016, the report found. Indoor air pollution can also affect air quality in the surrounding area, with this effect contributing to one in four pollution deaths in India and nearly one in five in China. Bob O’Keefe, vice-president of the institute, said the gap between the most polluted air on the planet and the least polluted was striking. While developed countries have made moves to clean up, many developing countries have fallen further behind while seeking economic growth.