DPC Grace Church, New York 1905

• The Blistering Pace Of Dollar’s Rally Is Rattling Markets (MarketWatch)

• The Blistering Pace Of Dollar’s Rally Is Rattling Markets (MarketWatch)

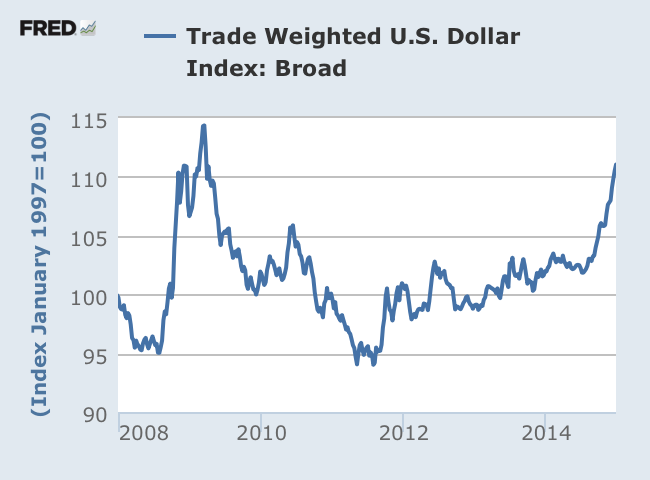

It’s probably not the dollar’s unrelenting march higher that is unsettling U.S. stock investors, but it might be the speed of the rally. “I think what people are concerned about is the pace of the dollar strength,” Douglas Borthwick at Chapdelaine said. “Countries can always adapt to currencies strengthening or weakening, but certainly as the dollar strengthens very, very quickly it leaves very little chance for others to adapt,” he said. On a trade-weighted basis, the dollar remains far from its highs in the mid-1980s and early 2000s, but the pace of the rise over the past half year is the second fastest in the last 40 years, noted David Woo at Bank of America Merrill Lynch.

The ICE dollar index, a measure of the U.S. unit against a basket of six major rivals, is up 9% since the end of last year alone to trade at its highest level since late 2003. U.S. stocks dipped significantly, leaving the S&P 500 down 0.9% and within a whisker of erasing its 2015 gain after clawing back some of its earlier decline. The long-term correlation between the direction of the dollar and the S&P 500 is near zero, analysts note. But there have been periods when the dollar and stocks marched either in lock step or in opposite directions for significant periods. In the end, it all seems to come down to context. If the dollar rises because investors are confident about the future of the economy, then stocks can rise, too, as was the case in the late 1990s.

“..currencies where countries have higher deficits or fiscal issues are under increased selling pressure..”

• EM Currency Turmoil As US Rate-Hike Jitters Bite (CNBC)

Emerging market currencies were hit hard on Tuesday, while the euro fell to a 12-year low versus the U.S. dollar, on rising expectations for a U.S. interest rate rise this year. The South African rand fell as much as 1.5% to a 13-year low at around 12.2700 per dollar, while the Turkish lira traded within sight of last Friday’s record low. The Brazilian real fell over one% to its lowest level in over a decade. It was last trading at about 3.1547 to the dollar. Meanwhile, Europe’s single currency fell as low as $1.0731, its lowest level in 12 years, fueling talk of a move closer to parity against the greenback. A perception that a U.S. rate hike could come sooner rather than later has been building since the release of Friday’s stronger-than-expected U.S. non-farm payrolls report.

Analysts said that concerns about fiscal issues were compounding weakness in some currencies. In the case of the euro, the massive quantitative easing (QE) program just unleashed by the ECB weighed. “It’s a case of broad-based dollar strength amid increased expectations of a U.S. rate hike this year,” Lee Hardman at Bank of Tokyo-Mitsubishi told CNBC. “So currencies where countries have higher deficits or fiscal issues are under increased selling pressure, such as the South Africa rand, the Turkish lira and the Brazilian real. The euro is weakening on its own accord because of QE.”

“..the higher the dollar goes the more likely investors will flee developing nations..”

• Here’s Why Draghi’s Inflation Bomb Could Prove to Be a Dud (Bloomberg)

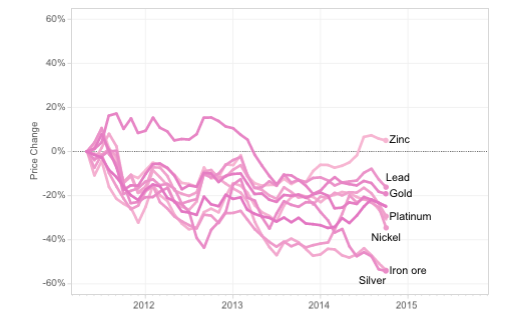

Mario Draghi’s inflation bomb could prove to be a dud. That’s because the weakness in the euro resulting from the European Central Bank’s €1.1 trillion quantitative-easing program risks being more than offset globally by the deflationary impact of a stronger dollar. Making that case as the euro trades around its lowest in 11 years against the greenback is David Woo, head of global rates and currencies at Bank of America Merrill Lynch in New York. He’s telling clients that pressure from a rising dollar threatens to rattle emerging markets, undermine U.S. stocks and curb commodities prices. Here’s how:

First, the higher the dollar goes the more likely investors will flee developing nations; that will make their borrowings in the U.S. currency more expensive, damaging their already-shaky outlook for growth. As Woo notes, the Turkish lira and Mexican peso have both reached or traded near all-time lows against the dollar in the past few days and Brazil’s real is at its weakest since 2004. China, which manages the value of its yuan against a basket of other currencies, may be forced to devalue to keep its products cheap in the international marketplace.

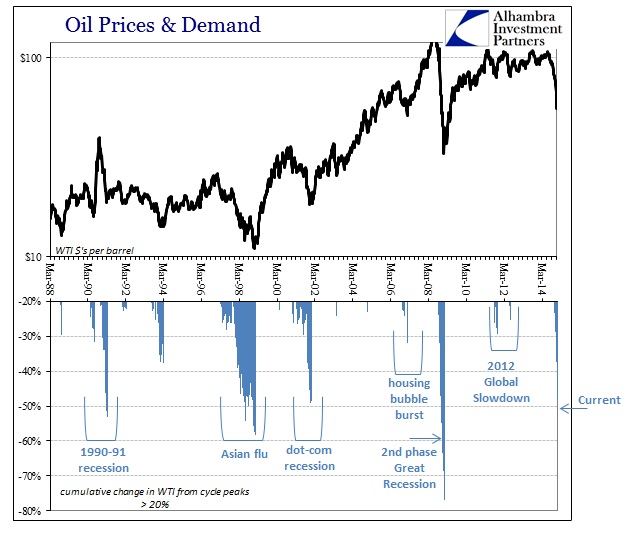

Next, because commodities are priced in dollars, the higher the greenback goes the more downward pressure will be applied to oil prices. Bank of America already says the likelihood is greater that crude falls rather than rises. Finally, Woo estimates the dollar’s rise is starting to undermine profits at home. U.S. companies in the Standard & Poor’s 500 Index get 40% of their earnings from overseas and the index has fallen in 19 out of 27 trading days this year in which the greenback gained. “The obvious implication is that investors are becoming concerned about the ability of the U.S. economy to cope with the strengthening dollar,” Woo said in a report to clients Monday. “The decline of euro/dollar below 1.10 may be less benign than it may appear at first.”

Pretty big losses.

• Stronger Dollar Sends U.S. Stocks to Biggest Drop in Two Months (Bloomberg)

U.S. stocks fell the most in two months as the dollar strengthened to near a 12-year high versus the euro amid speculation the Federal Reserve is moving closer to raising interest rates. Intel and Cisco lost at least 2.4% as technology companies in the Standard & Poor’s 500 Index led declines. United Technologies Corp., Goldman Sachs and Home Depot dropped more than 1.8% to pace losses among the biggest companies. The S&P 500 retreated 1.7% to 2,044.16 at the close in New York, falling below its average price for the past 50 days for the first time since Feb. 9. The Dow Jones Industrial Average lost 332.78 points, or 1.9%, to 17,662.94. Both indexes erased gains for the year. The Nasdaq 100 Index fell 1.9%. About 7.1 billion shares changed hands on U.S. exchanges, 2.8% above the three-month average.

“A continuation of dollar strength and euro destruction is certainly raising some concerns,” Michael James at Wedbush Securities said in a phone interview. “I don’t think there was any one specific event or item that caused this, but the fact that it’s a trend that’s been going on for the last several weeks is concerning given the levels we’re at now.” Concern the Fed may start raising interest rates this year amid a strengthening economy has weighed on equities and helped boost the dollar. In his last speech as president of the Fed Bank of Dallas, Richard Fisher said the central bank should begin to gradually raise rates before the economy reaches full employment to avoid triggering a recession.

“..the Iran production growth story is just one but it makes factors such as Libya’s piddly production oscillation and rig count obsessions in the US pale into insignificance.”

• Get Ready For A Much Bigger Oil Shock (CNBC)

So what’s the biggest trade in the markets right now? Could it be the one way bet on European fixed income with Draghi’s massive bond-buying program set to obliterate anyone who challenges ludicrously low bond yields? Or the tech bull position with the Nasdaq around year-2000 highs? For now let’s ignore the collapse in euro zone yield and the nose-bleeding valuations in tech and concentrate on my favourite trade – the brutal battle being fought in the oil market. Last week, InterContinental Exchange revealed that the hedge-betters and speculators were piling into the oil trade in levels not seen since the middle of last year. You remember the middle of last year, that was when crude was still at $110 per barrel, pretty much double where it is now. So are we setting ourselves up for another massive bout of volatility after a few weeks of relatively calm price action?

The longs are out in force, according to the data but are they too early in calling an end to the oil price rout? Brent may have had a fantastic rally in February, having plummeted to the low $40s region after last year’s rout. But was that a dead cat bounce ignoring the still dreadful near term fundamentals? Despite a lot of excitement about the falling rig count and the huge number of job expenditure cuts across exploration and production, there is still over-production not only in the US but also across the world. In fact, if you believe the bears, then the US will shortly run out of storage space above ground. The guys who’ve been in the industry and have seen cycle after cycle like this keep telling me that the cure for lower prices is lower prices. But when will we see supply and demand responses to $50-60 oil?

Well, many of the global wells just can’t afford to stop just yet, whether it is because of the need for Middle Eastern petro-dollars of the demanding Texan bank manager who still expects the oil well-related loan to be serviced. Surely the key factors in where we go next have still to come to the fore this year and we are still at the appetiser stage. For many, June will be the main event. That month is when the next scheduled OPEC meeting is due to take place and it is possibly the most likely time we will see a supply response from the group representing around a third of global production. The end of June just also happens to be the deadline for the Iran nuclear deal. If – and it’s a big “if” – Iran gets a framework agreement by the end of this month, the country will be desperate to ramp up production of oil as quickly as possible. And, believe me, it may take them months if not years but they really want to ramp it up.

Iran doesn’t just want to up its levels from the current 2.8 million barrels a day. It wants to first get to the 4 million barrels it was producing back in 2008 and then it wants to keep going on and on and on. That will set up Iran for a huge row with Saudi over OPEC production levels. Yes, the Iran production growth story is just one but it makes factors such as Libya’s piddly production oscillation and rig count obsessions in the US pale into insignificance. So for me the phoney war going on in the oil market at the moment may just result in a stalemate until the middle of the year. That is when we may get the real battle. The one that may just justify at least one side of the extreme calls from $20 to back up to $90 per barrel.

A morally bankrupt monster.

• Thomas Piketty on the Eurozone: ‘We Have Created a Monster’ (Spiegel)

SPIEGEL: You publicly rejoiced over Alexis Tsipras’ election victory in Greece. What do you think the chances are that the European Union and Athens will agree on a path to resolve the crisis?

Piketty: The way Europe behaved in the crisis was nothing short of disastrous. Five years ago, the United States and Europe had approximately the same unemployment rate and level of public debt. But now, five years later, it’s a different story: Unemployment has exploded here in Europe, while it has declined in the United States. Our economic output remains below the 2007 level. It has declined by up to 10% in Spain and Italy, and by 25% in Greece.SPIEGEL: The new leftist government in Athens hasn’t exactly gotten off to an impressive start. Do you seriously believe that Prime Minister Tsipras can revive the Greek economy?

Piketty: Greece alone won’t be able to do anything. It has to come from France, Germany and Brussels. The International Monetary Fund (IMF) already admitted three years ago thatthe austerity policies had been taken too far. The fact that the affected countries were forced to reduce their deficit in much too short a time had a terrible impact on growth. We Europeans, poorly organized as we are, have used our impenetrable political instruments to turn the financial crisis, which began in the United States, into a debt crisis. This has tragically turned into a crisis of confidence across Europe.SPIEGEL: European governments have tried to avert the crisis by implementing numerous reforms. What do mean when you refer to impenetrable political instruments?

Piketty: We may have a common currency for 19 countries, but each of these countries has a different tax system, and fiscal policy was never harmonized in Europe. It can’t work. In creating the euro zone, we have created a monster. Before there was a common currency, the countries could simply devalue their currencies to become more competitive. As a member of the euro zone, Greece was barred from using this established and effective concept.SPIEGEL: You’re sounding a little like Alexis Tsipras, who argues that because others are at fault, Greece doesn’t have to pay back its own debts.

Piketty: I am neither a member of Syriza nor do I support the party. I am merely trying to analyze the situation in which we find ourselves. And it has become clear that countries cannot reduce their deficits unless the economy grows. It simply doesn’t work. We mustn’t forget that neither Germany nor France, which were both deeply in debt in 1945, ever fully repaid those debts. Yet precisely these two countries are now telling the Southern Europeans that they have to repay their debts down to the euro. It’s historic amnesia! But with dire consequences.SPIEGEL: So others should now pay for the decades of mismanagement by governments in Athens?

Piketty: It’s time for us to think about the young generation of Europeans. For many of them, it is extremely difficult to find work at all. Should we tell them: “Sorry, but your parents and grandparents are the reason you can’t find a job?” Do we really want a European model of cross-generational collective punishment? It is this egotism motivated by nationalism that disconcerts me more than anything else today.SPIEGEL: It doesn’t sound as if you are a fan of the Stability Pact, the agreement implemented to force euro-zone countries to improve fiscal discipline.

Piketty: The pact is a true catastrophe. Setting fixed deficit rules for the future cannot work. You can’t solve debt problems with automatic rules that are always applied in the same way, regardless of differences in economic conditions.

Great read. h/t Yves.

• Why Understanding Money Matters in Greece (Rob Parenteau)

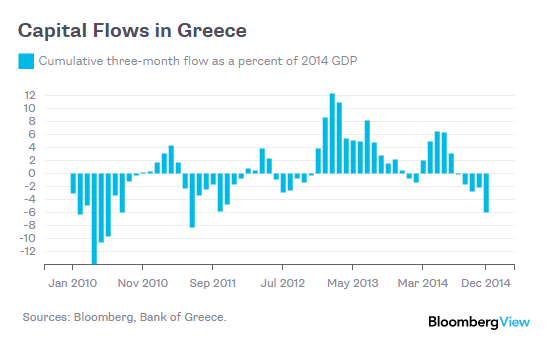

As Greece staggers under the weight of a depression exceeding that of the 1930s in the US, it appears difficult to see a way forward from what is becoming increasingly a Ponzi financed, extend and pretend, “bailout” scheme. In fact, there are much more creative and effective ways to solve some of the macrofinancial dilemmas that Greece is facing, and without Greece having to exit the euro. But these solutions challenge many existing economic paradigms, including the concept of “money” itself. At the Levy Economics Institute conference held in Athens in November 2013, I proposed tax anticipation notes, or “TANs”, as a way for Greece to exit austerity without having to exit the euro.

This proposal is based on a deeper understanding of what money actually is, and the many roles that it plays in the economies we inhabit. In this regard, Abba Lerner captured the essence of modern fiat currencies, which are created out of thin air by modern states with sovereign currency arrangements. Lerner’s essential insight is contained in the following passage from over half a century ago (and, you will note, Lerner’s view informs much of the neo-chartalist view espoused by advocates of what is called Modern Monetary Theory):

The modern state can make anything it chooses generally acceptable as money…It is true that a simple declaration that such and such is money will not do, even if backed by the most convincing constitutional evidence of the state’s absolute sovereignty. But if the state is willing to accept the proposed money in payment of taxes and other obligations to itself the trick is done.

The modern state, then, imposes and enforces a tax liability on its citizens, and chooses that which is necessary to pay taxes. That means a state with a sovereign currency is never revenue constrained. In fact, the government has to first create the money before the private sector can find a way to get the money it requires to pay taxes and by government bonds. Taxes and bonds are therefore not really the source of government funding or finance. Wait, what? The government itself ultimately is the source of money required to pay for government expenditures. Taxes simply give value to money, as households and nonbank firms cannot create money – that is counterfeiting. Instead, they have to sell an asset or a product or a service to the government to get money, or they need to be beneficiaries of government corporate subsidy or household transfer programs to get money.

Weird coincidence?

• Varoufakis Unsettles Germans With Admissions In Documentary (Reuters)

Greek Finance Minister Yanis Varoufakis has described his country as the most bankrupt in the world and said European leaders knew all along that Athens would never repay its debts, in blunt comments that sparked a backlash in the German media on Tuesday. A documentary about the Greek debt crisis on German public broadcaster ARD was aired on the same day euro zone finance ministers met in Brussels to discuss whether to provide Athens with further funding in exchange for delivering reforms. “Clever people in Brussels, in Frankfurt and in Berlin knew back in May 2010 that Greece would never pay back its debts. But they acted as if Greece wasn’t bankrupt, as if it just didn’t have enough liquid funds,” Varoufakis told the documentary.

“In this position, to give the most bankrupt of any state the biggest credit in history, like third class corrupt bankers, was a crime against humanity,” said Varoufakis, according to a German translation of his comments. It was unclear when the program was recorded. Although strident criticism of the way Greece has been treated is typical for Varoufakis, a Marxist economist, the remarks caused a stir in Germany where voters and politicians are increasingly reluctant to lend Greece money. Bild daily splashed the comments on the front page and ran an editorial comment urging European leaders to stop providing Greece with ever more financial support. “The Greek government is behaving as if everyone must dance to its tune. But there must be an end to this madness. Europe must not be made to look stupid,” wrote a commentator.

Syriza is not taking the attempts at humiliations lying down.

• Tsipras Says Will Pursue German War Reparations (Kathimerini)

Prime Minister Alexis Tsipras Tuesday expressed his government’s firm intention to seek war reparations from Germany, noting that Athens would show sensitivity that it hoped to see reciprocated from Berlin. In a speech in Parliament, launching a debate on the creation of a committee to seek war reparations, the repayment of a forced loan and the return of antiquities, Tsipras told MPs that the matter of war reparations was “very technical and sensitive” but one he has a duty to pursue. He also seemed to indirectly connect the matter to talks between Greece and its international creditors on the country’s loan program. “The Greek government will strive to honor its commitments to the full,” he said.

“But it will also strive to ensure all unfulfilled obligations toward Greece and the Greek people are fulfilled,” he added. “You cannot pick and choose on ethical issues.” Tsipras noted that Germany got support “despite the crimes of the Third Reich” chiefly thanks to the London Debt Agreement of 1953. Since reunification, German governments have used “silence, legal tricks and delays” to avoid solving the problem, he said. “We are not giving morality lessons but we will not accept morality lessons either,” Tsipras said. In comments to Parliament later PASOK leader Evangelos Venizelos said it was important not to link the issue of reparations with Greece’s talks with creditors.

Given the above, what’s that deal worth?

• Greece Got a ‘Deal’ in February, But Things Still Haven’t Calmed Down (Bloomberg)

On February 20th, the Eurogroup came to an agreement with Greece on a way forward that would allow Greece access to further bailout funding. The agreement covered the way forward for Greece and consisted of three main elements.

• Greece would come up with a set of budgetary measures that would allow a successful review by the institutions.

• Greece would then implement these measures.

• The institutions would disburse funding to Greece as successful implementation progressed.With this deal in place, it briefly seemed like things would quiet down for Greece, for a few months at least. Unfortunately, a sticking point has already emerged, which was highlighted at yesterday’s Eurogroup meeting. That sticking point is due to the very slow progress on meeting any of the elements of the February deal. The institutions are now going to take a larger role in formulating the measures Greece must undertake. The first meeting between Greece and the institutions is due to take place in Brussels tomorrow. If these meetings can produce measures that are acceptable to both sides, that will be a first step. But for Greece to access further funding it will have to also take the second step and start to implement those agreed measures. With time running out, there should be willingness on both sides to expedite this quickly. Recent events have shown, however, that each step forward in the process only happens at the last possible moment.

Let’s all get sunk in a bottomless pit.

• Eurozone Central Bank Buying Crushes Yield Curves (Bloomberg)

Euro-area government bonds with longer maturities surged as the region’s central banks bought sovereign debt for a second day, pushing yields closer to those on shorter-dated notes. That’s flattening so-called the yield curves of debt from Germany to Italy. Euro-system central banks were said to have purchased securities, including German five-year notes with a negative yield, under the ECB’s expanded quantitative-easing plan, according to three people with knowledge of the transactions. Belgian and Italian securities were also acquired, one of the people said. As the ECB and national members embark on purchases of sovereign debt designed to boost price growth in the region, rates on short-term securities are below zero in seven euro-area nations, meaning a buyer now would get less back than they paid if they held them to maturity.

That’s boosting demand for longer-dated bonds, particularly as the ECB’s rules preclude purchases of debt yielding below its deposit rate of minus 0.2%. German 30-year yields dropped the most in more than two months and touched an all-time low. “Nobody wants to fight the flow,” said Felix Herrmann, an analyst at DZ Bank in Frankfurt. “We have many investors who are desperately looking for yield. They are simply scaling into those bonds that yield some interesting pick up.” The yield premium investors demand to hold Germany’s 30-year bunds instead of two-year notes shrank to 100 basis points, or 1%age point, at 3:59 p.m. London time, the least since October 2008. The spread is down from 234 basis points a year ago. A yield curve is a chart of rates on bonds of varying maturities.

The Bundesbank may struggle to meet its buying quotas given the amount of German debt yielding less than the ECB deposit rate, SocGen analysts wrote in a client note. Germany’s seven-year yield dropped below zero for the first time since Feb. 27. “Without good purchases in the short-dated bonds, where outstandings are big, it is difficult to see how the Bundesbank is going to get its share of the program done,” the analysts wrote. Germany’s three-year note yields reached minus 0.24% Tuesday, while the four-year rate touched minus 0.197%, less than one basis point from the ECB’s deposit rate.

Longer-dated bonds are also being favored after policy makers last week failed to agree on how to share losses from buying bonds with negative yields. 78 of the 346 securities in the Bloomberg Eurozone Sovereign Bond Index already have rates below zero. “For me, as a fund manager, it doesn’t make sense to hold any bonds with a negative yield, so I’m happy to sell,” Christoph Kind, head of asset allocation at Frankfurt Trust, which manages about $20 billion, said Monday. “We are selling to the brokers, not directly to the ECB, but maybe in the end this will be bought by the ECB.”

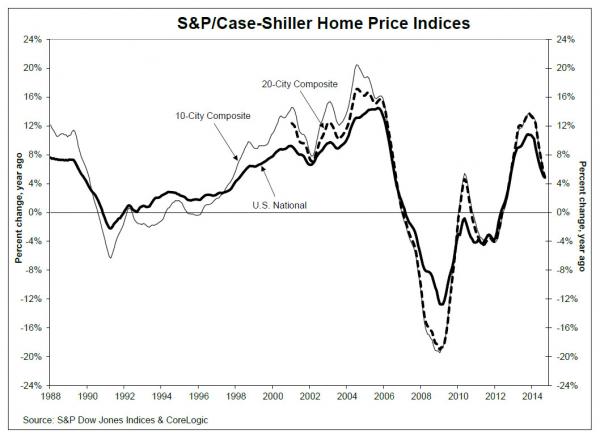

Because that’s the only way to keep the housing industry alive.

• Why Does America Continue To Subsidize Housing For The Wealthy? (Guardian)

Many people in the US have given up on the American dream of owning a house: US homeownership rates have now dropped to the lowest point in almost 20 years. But the government shouldn’t be focusing on trying to raise that rate – for now, their priorities should lie with increasing affordable housing. For too long, well-off, high-income homeowners have benefited from generous government support. All the while, ordinary Americans are struggling to pay the rising rent. It is time to stop prioritizing home sales – increasingly out of reach for many Americans – and help everyday people attain a much more basic, and pressing need: affordable housing. Since the Great Depression, US housing policies have aimed almost exclusively at encouraging Americans to become homeowners.

Housing policies favor and heavily subsidize homeownership because it is said to help create strong communities and build family wealth. But it would be a mistake to continue with this approach now. Homeowners receive tax benefits for their housing expenses, mostly because of the enormously expensive mortgage interest deductions, which disproportionately benefits higher-income taxpayers. But no such support is offered to lower-income renters. The government should consider introducing housing tax credits or other tax benefits that would help those who are struggling to pay the rent. The federal government should also consider providing tax subsidies for land trusts or shared equity plans that help renters become homeowners but share the home’s appreciation with a third-party.

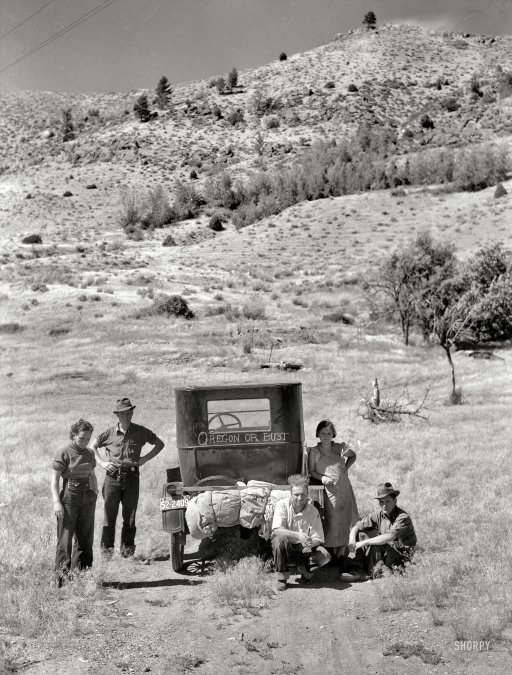

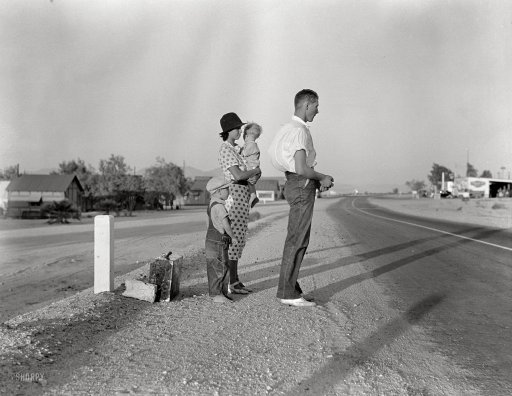

The old have policies have failed; we need to try a new approach. Though housing policies succeeded in encouraging renters to buy homes until the 1990s, homeownership has now become unaffordable for lower- and middle-income Americans largely because they do not have savings, and they have unstable and stagnated income – which has changed little (adjusted for inflation) since 1995. Because housing sales have been sluggish since the 2007-2009 recession, the US government has repeatedly tried to get people to buy houses, and keep existing homeowners in their houses. Yet programs like Hope for Homeowners program, the Home Affordable Modification Program and the Home Affordable Refinance Program all failed to achieve their goals of preventing owners from losing their homes, largely because of design flaws.

The homeownership problem is particularly acute in young adults, who entered the labor market at the time of the recession. Overall unemployment rates in 2007 were only 4.6%, but then soared to 9.3% by 2009. The jobs that have been created since the recession ended have mostly come from the low-wage retail, service and food/beverage sectors, making it harder even for young adults who have jobs to save money for a down payment – or even to pay rent. Student debt, which has skyrocketed, isn’t helping: average student loan balances increased by 91% from 2003 to 2012.

Sounds sort of smart, but most debt is with the shadow banks, and that remains open.

• China’s Solution to $3 Trillion Debt Is to Deal with It Later (Bloomberg)

China’s government has a creative solution to address repayment concerns hanging over more than $3 trillion in regional debt. It will deal with it later. The Finance Ministry issued a 1 trillion yuan ($160 billion) quota for local governments to convert maturing high-cost debt into lower-yielding municipal notes to be repaid at a future date on March 8. Questions left unanswered include whether investors will be forced into the swap, how much transparency there will be over assets involved and whether the liabilities will strain the nation’s finances. China’s bond risk rose the most in a month on March 9 even as debt-rating companies welcomed the government’s plan to address regional debt, which Mizuho estimates may have reached 25 trillion yuan, bigger than Germany’s economy.

The ministry’s 500 billion yuan municipal bond trial and the auction of 100 billion yuan of special bonds is insufficient to meet local-government financing vehicle debt due this year while funding budgets, Moody’s Investors Service said. “It will buy time for the government to solve the local debt problem, as the transition period takes three to five years,” said Ivan Chung, a senior vice president at Moody’s in Hong Kong. “The 1 trillion yuan debt-swap plan will be able to cover the refinancing needs of the maturing bonds this year, as municipal bond issuance is not enough.” The government is seeking to rein in local-government borrowing while accelerating infrastructure spending to defend a 7% economic growth target. Regional authorities set up thousands of funding units to finance projects from sewage systems to subways after a 1994 budget law barred them from issuing notes directly. Their fundraising helped liabilities jump 67% from the end of 2010 to 17.9 trillion yuan as of June 2013.

“That doesn’t jump out at me as a significant enough change.”

• Yellen Meets Senate Bank Chief With Fed Transparency in Focus (Bloomberg)

Federal Reserve Chair Janet Yellen reached out on Tuesday to Republicans who want to shake up the central bank, meeting with the powerful head of the Senate Banking Committee who has called for more accountability from the Fed. Yellen declined to comment after her 25 minute-long meeting with Alabama Republican Richard Shelby at his offices in Washington. Shelby earlier told reporters that “what we are doing is trying to figure out exactly what we need to do legislatively to make the Fed more accountable to the people and to do a better job as a regulator.” Lawmakers from both parties have voiced concerns about the central bank and are narrowing their focus to the New York Fed, which is the target of proposals to either make its president subject to Senate confirmation or dilute its policy powers.

Republicans have complained about the Fed’s aggressive monetary policies and what they consider regulatory overreach. Democrats have accused the Fed of failing to police the largest banks to prevent the kind of excessive risk-taking that contributed to the financial crisis of 2008. Shelby previously said he’s looking “very strongly” at a proposal from Dallas Fed President Richard Fisher, who is retiring next week, that would strip the New York Fed of its permanent vote on the policy-making Federal Open Market Committee.

Fisher’s staff has already responded to questions about his proposal from Shelby’s aides. Sherrod Brown, the senior Democrat on the Senate banking panel, said on Tuesday he favors a plan to make the president of the New York Fed a presidential appointment requiring Senate approval, like members of the Fed’s Washington-based Board of Governors. “The way we have the Fed structure, banks have so much influence over their regulator,” Brown, from Ohio, told reporters. “I don’t know if it should go any further than the New York Fed but it makes a lot of sense that the New York Fed be selected by the president and be confirmed.” While saying he would like to look more closely at the Fisher proposal, Brown said, “That doesn’t jump out at me as a significant enough change.”

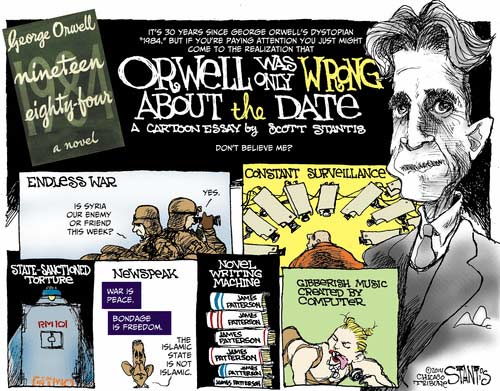

You can call it the Silly Empire, but that seems to ignore that chaos is the goal, rather than the means.

• Chaos: Practice and Applications (Dmitry Orlov)

The term “chaos” has been popping up a lot lately in the increasingly collapse-prone world in which we find ourselves. Pepe Escobar has even published a book on it. Titled Empire of Chaos, it describes a scenario “where a[n American] plutocracy progressively projects its own internal disintegration upon the whole world.” Escobar’s chaos is tailor-made; its purpose is “to prevent an economic integration of Eurasia that would leave the U.S. a non-hegemon, or worse still, an outsider.” Escobar is not the only one thinking along these lines; here is Vladimir Putin speaking at the Valdai Conference in 2014:

A unilateral diktat and imposing one’s own models produces the opposite result. Instead of settling conflicts it leads to their escalation, instead of sovereign and stable states we see the growing spread of chaos, and instead of democracy there is support for a very dubious public ranging from open neo-fascists to Islamic radicals.

Why do they support such people? They do this because they decide to use them as instruments along the way in achieving their goals but then burn their fingers and recoil. I never cease to be amazed by the way that our partners just keep stepping on the same rake, as we say here in Russia, that is to say, make the same mistake over and over.

Indeed, Escobar’s chaos doesn’t seem to be working too well. Eurasian integration is very much on track, with China and Russia now acting as an economic, military and political unit, and with other Eurasian states eager to play a role. The European Union is, for the moment, being excluded from Eurasia because it is effectively under American occupation, but this state of affairs is unlikely to last due to budgetary problems. (To be precise, we have to say that it is under NATO occupation, but if we dig just a little, we find that NATO is really just the US military with a European façade hammered onto it Potemkin village-style.)

And so the term “empire” seems rather misplaced. Empires are ambitious undertakings that seek to exert control over their domain, and what sort of an empire is it if its main activity is stepping on the same rake over and over again? A silly one? Then why not just call it “The Silly Empire”? Indeed, there are lots of fun silly imperial activities to choose from. For example: arm and train moderate opposition to a regime you want to overthrow; find out that it isn’t moderate at all; try to bomb them into submission and fail at that too.

Russia won’t stand for it.

• ‘We’ll Buy Reverse Gas Supplies At $245’- Ukraine’s President (RT)

Ukraine will pay $245 per thousand cubic meters for the gas it will get through reverse flow from Europe as the country diversifies its natural gas suppliers away from Russia, President Petro Poroshenko has said. Ukraine has significantly reduced its energy dependence on Russia, and will buy Russian gas through reverse flows from Europe at $245 per 1,000 cubic meters, Ukrainian President Petro Poroshenko said in a TV interview Monday. “We have lived through the winter; we bought only 2 billion cubic meters of gas with the last purchase at a price of less than $300 per 1,000 cubic meter. As a result, it all came down to the Russian Federation having had to apply for a pumping volume increase of 68%, which crashed the gas market. And today we will buy gas for $245 under reverse deliveries,” Poroshenko said.

Ukraine has increased the amount of gas collecting in its underground storage facilities to 23 million cubic meters per day compared with 8 million cubic meters in February, according to the data provided by the GSE association on Tuesday. Currently the country is accepting 10 million cubic meters of Russian gas daily at a price of $329 per 1,000 cubic meters. Ukraine claims it pays 15% more for Russian gas than Europe. Ukraine currently receives reverse deliveries of natural gas from Slovakia, Hungary and Poland. Gas supplies from Hungary have been reduced by Ukraine and stand at 715,000 cubic meters a day from March 7, which is almost 5 times lower than in February, according to reports from the TASS news agency. Capacity from Slovakia remains at 37.7 million cubic meters a day. Poland can deliver up to 717, 000 cubic meters a day compared with 840,000 cubic meters in February. Last week Ukraine imported 330 million of cubic meters of natural gas from Europe, and 81 million cubic meters from Russia.

Send her home and keep her there.

• US Applies Pressure to States Opposing Anti-Russian Sanctions: Nuland (Sputnik)

The United States government is applying pressure to European countries that oppose sanctions against Russia, US Assistant Secretary of State for European Affairs Victoria Nuland said at a US Senate hearing on Tuesday. “We continue to talk to them bilaterally about these issues,” Nuland said of Hungary, Greece, and Cyprus, whose leaders have opposed anti-Russian sanctions. “I will make another trip out to some of those countries in the coming days and weeks.” Nuland noted that “despite some publically stated concerns, those countries have supported sanctions” in the European Union Council. Additionally, discussions between the United States and Europe have continued, Nuland said in her opening statements to the US Senate Foreign Affairs Committee.

“We have already begun consultations with our European partners on further sanctions pressure should Russia continue fueling the fire in the east or other parts of Ukraine, fail to implement Minsk or grab more land,” she said. The United States, the European Union and their allies blame Russia for fueling the internal conflict in Ukraine and have imposed a series of sanctions against Russia targeting its defense, banking, and energy sectors. Russia has repeatedly denied the allegations and responded with targeted export bans. Some European nations including Greece, Hungary and Cyprus, have opposed further sanctions, and Spain has recently stated its opposition as well.

Obviously.

• It’s NATO That’s Empire-Building, Not Putin (Peter Hitchens)

Just for once, let us try this argument with an open mind, employing arithmetic and geography and going easy on the adjectives. Two great land powers face each other. One of these powers, Russia, has given up control over 700,000 square miles of valuable territory. The other, the European Union, has gained control over 400,000 of those square miles. Which of these powers is expanding? There remain 300,000 neutral square miles between the two, mostly in Ukraine. From Moscow’s point of view, this is already a grievous, irretrievable loss. As Zbigniew Brzezinski, one of the canniest of the old Cold Warriors, wrote back in 1997, ‘Ukraine… is a geopolitical pivot because its very existence as an independent country helps to transform Russia. Without Ukraine, Russia ceases to be a Eurasian empire.’

This diminished Russia feels the spread of the EU and its armed wing, Nato, like a blow on an unhealed bruise. In February 2007, for instance, Vladimir Putin asked sulkily, ‘Against whom is this expansion intended?’ I have never heard a clear answer to that question. The USSR, which Nato was founded to fight, expired in August 1991. So what is Nato’s purpose now? Why does it even still exist? There is no obvious need for an adversarial system in post-Soviet Europe. Even if Russia wanted to reconquer its lost empire, as some believe (a belief for which there is no serious evidence), it is too weak and too poor to do this. So why not invite Russia to join the great western alliances?

Alas, it is obvious to everyone, but never stated, that Russia cannot ever join either Nato or the EU, for if it did so it would unbalance them both by its sheer size. There are many possible ways of dealing with this. One would be an adult recognition of the limits of human power, combined with an understanding of Russia’s repeated experience of invasions and its lack of defensible borders.