Horacio Coppola Avenida de Mayo entre Bolívar y Perú, Buenos Aires 1936

UPDATE: There is a problem with our Paypal widget/account that makes donating hard for some people. What happens is that for some a message pops up that says “This recipient does not accept payments denominated in USD”. This is nonsense, we do.

We have no idea how many people have simply given up on donating, but we can suggest a workaround (works like a charm):

Through Paypal.com, you can simply donate to an email address. In our case that is recedinghorizons *at* gmail *com*. Use that, and your donations will arrive where they belong. Sorry for the inconvenience.

The Automatic Earth and its readers have been supporting refugees and homeless in Greece since June 2015. It has been an at times difficult and at all times expensive endeavor. Not at least because the problems do not just not get solved, they actually get worse. Because the people of Greece and the refugees that land on their shores increasingly find themselves pawns in political games.

Therefore, even if the generosity of our readership has been nothing short of miraculous, we must continue to humbly ask you for more support. Because our work is not done. Our latest essay on this is here: The Automatic Earth for Athens Fund – Christmas and 2018 . It contains links to all 14 previous articles on the situation.

Here’s how you can help:

For donations to Konstantinos and O Allos Anthropos, the Automatic Earth has a Paypal widget on our front page, top left hand corner. On our Sales and Donations page, there is an address to send money orders and checks if you don’t like Paypal. Our Bitcoin address is 1HYLLUR2JFs24X1zTS4XbNJidGo2XNHiTT. For other forms of payment, drop us a line at Contact • at • TheAutomaticEarth • com.

To tell donations for Kostantinos apart from those for the Automatic Earth (which badly needs them too!), any amounts that come in ending in either $0.99 or $0.37, will go to O Allos Anthropos.

Please give generously.

Article by Mish. Graph annotation by Jesse Colombo.

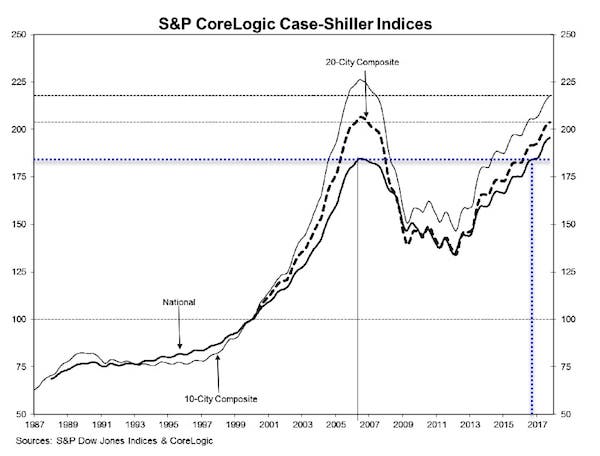

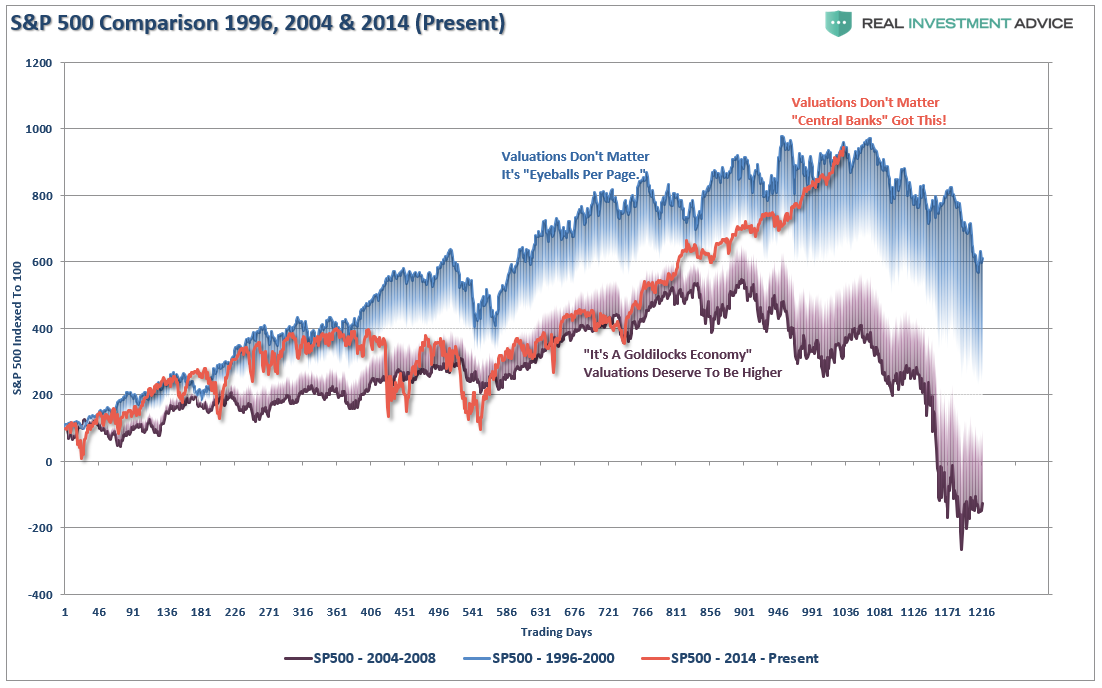

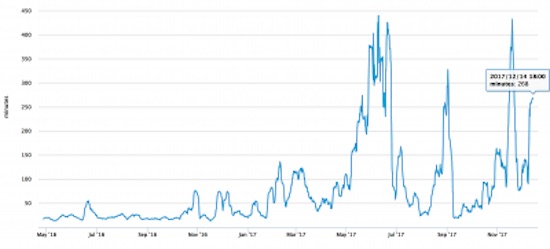

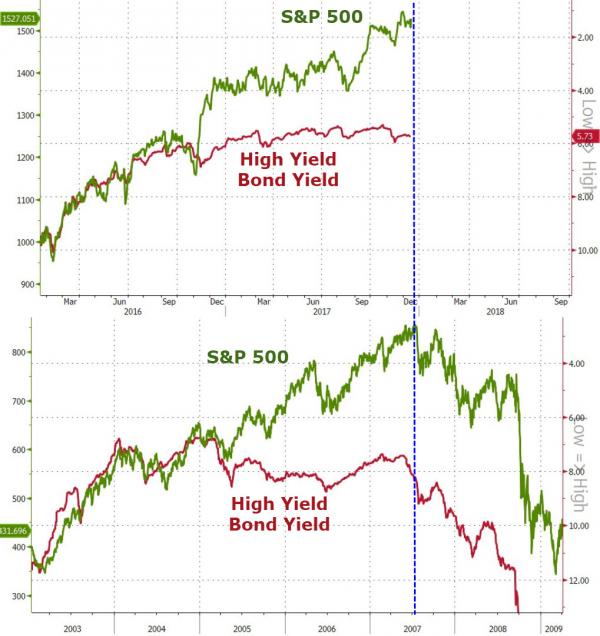

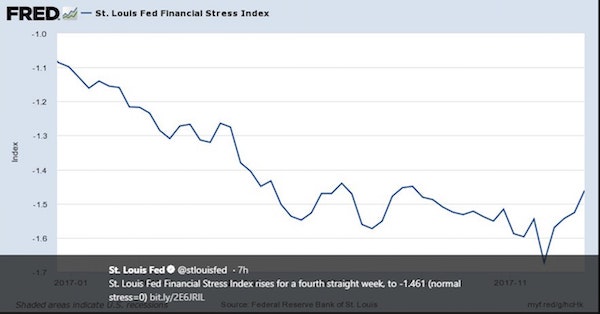

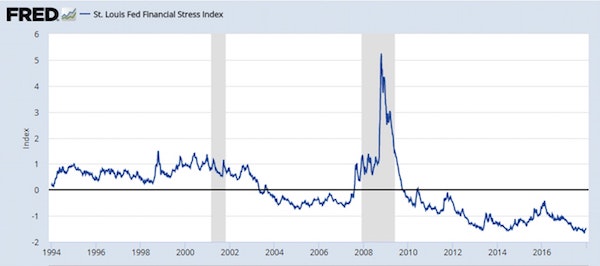

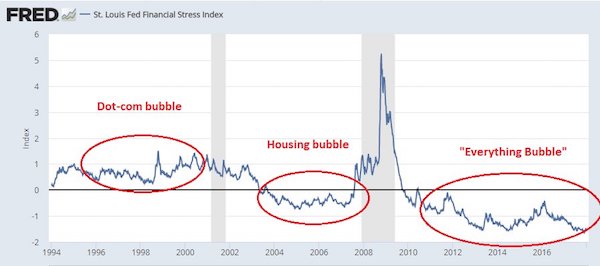

As we head into 2018, the St. Loius Fed reports there is no financial stress. The STLFSI measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. The average value of the index, which begins in late 1993, is designed to be zero. Thus, zero is viewed as representing normal financial market conditions. Values below zero suggest below-average financial market stress, while values above zero suggest above-average financial market stress.

Financial stress has been negative since June 18, 2010. I expect 2018 will not be so complacent.

Jesse’s annotations: “Bubbles form during periods of very low financial stress”.

Check back minutes later and it’s rising.

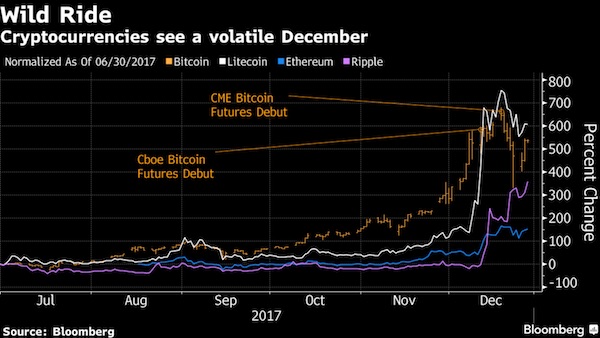

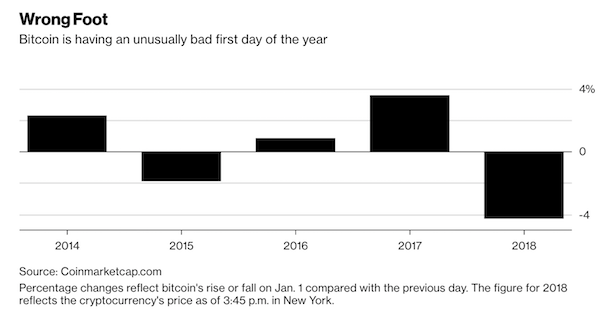

• Bitcoin Is Already Having A Bad Year (BBG)

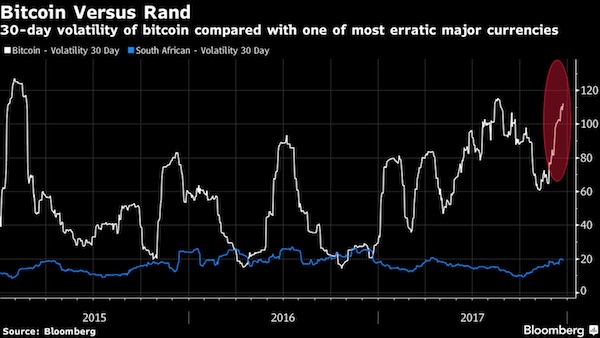

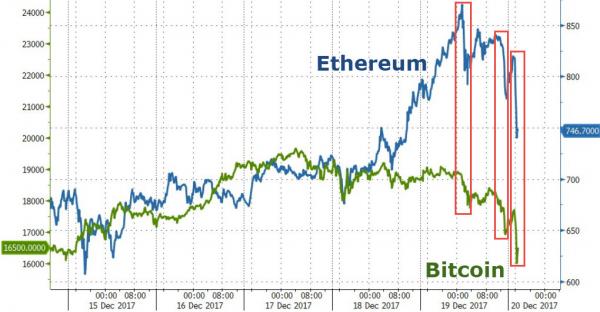

Bitcoin is already having a bad year. For the first time since 2015, the cryptocurrency began a new year by declining, extending its slide from a record $19,511 reached on Dec. 18. The virtual coin traded at $13,624.56 as of 5 p.m. in New York on Monday, down 4.8% from Friday, according to data compiled by Bloomberg. That’s also a fall from the $14,156 it hit Sunday, according to coinmarketcap.com, which tracks daily prices. The cryptocurrency fluctuated in early Asian trading on Tuesday.

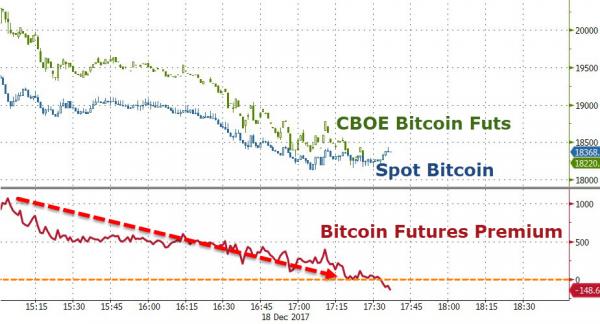

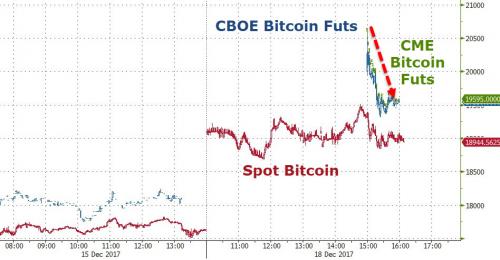

Bitcoin got off to a much stronger start last year, and then kept that momentum going, helping to create a global frenzy for cryptocurrencies. It rose 3.6% on the first day of 2017 to $998, data from coinmarketcap.com show. It ended the year up more than 1,300%. That rally drew a growing number of competitors and last month brought bitcoin to Wall Street in the form of futures contracts. It reached the Dec. 18 peak hours after CME Group Inc. debuted its derivatives agreements, which some traders said would encourage short position-taking.

Any questions?

• Bitcoin Fever To Burn Out In ‘Spectacular Crash’ – David Stockman (CNBC)

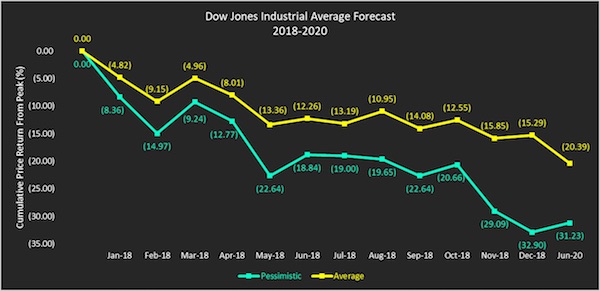

David Stockman, President Ronald Reagan’s former director of the Office of Management and a relentless Wall Street bear, is warning investors that the cryptocurrency boom will end disastrously. “It’s basically a class of really stupid speculators who have convinced themselves that trees grow to the sky,” he told CNBC’s “Futures Now” last week. “It will burn out in a spectacular crash. All of these latter-day speculators will have their hands burned to a crisp, and they will learn the proper lesson.” Stockman’s latest prophecy isn’t exclusive to bitcoin. He’s been saying a “gigantic, horrendous storm” could soon hit stocks. In September, he warned investors that a 40% to 70% correction wasn’t too far down the road. On Friday, the Dow Jones Industrial Average flirted with 25,000, with the S&P trading just shy of a new record.

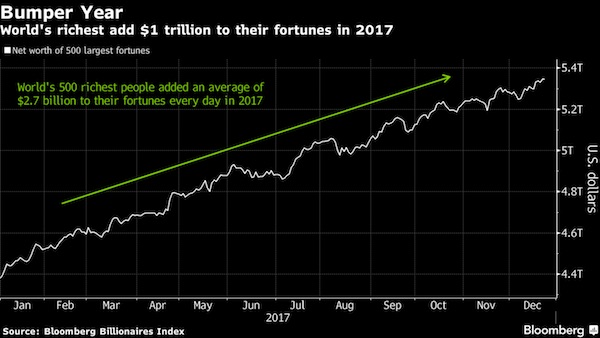

Stockman blamed the Federal Reserve and central banks for creating the hype surrounding the stock and cryptocurrency markets. He argued that too much liquidity was pumped into the marketplace to deal with the 2008 global financial crisis — noting that not even regulators can improve the frothy situation. “What we really need to do is not think these are regulator problems, but understand they’re monetary problems,” he said. “It’s an irrational, overheated market like never before.” In the past two years, bitcoin prices have soared by more than 3,000%. Its wild price swings have sparked debates on Wall Street over how much it’s really worth. Bitcoin’s less expensive peers such as litecoin and ether have also surged. Stockman can’t put a price tag on them.

“I have no idea. I mean it could double or triple from here or it could fall to zero. But the point is that it’s not real money because real money for transactions has to be stable,” he said. According to Stockman, the CBOE and CME decisions to add bitcoin futures to their exchanges don’t give this emerging asset class legitimacy. “Anytime Wall Street sees an opportunity to shear the sheep, and they see the sheep stampeding to the slaughter, they line up with some new gimmick to take advantage of the circumstances. That’s all,” he said. “There is nothing that’s being validated by the opening up of a futures market. It’s just everybody trying to get on the train for the ride,” he added.

Who needs the poor?

• Britain’s Benefits System Has Become A Racket For Cheating Poor People (G.)

When Moira gets scared, she cuts herself. “It’s my way of taking control.” Right now she’s very scared. In a few days she faces a tribunal that will judge whether she is entitled to her disability benefit. She has been through forms and examinations and the officials who tell her one thing and those who tell her another, and she is nearly broken. In a low-ceilinged office at the back of a housing estate, she starts sobbing. “I cannot live like this any more.” Steph Pike lets Moira talk, before telling her, “stay focused”. After years as a welfare rights adviser, Pike knows what tribunals want: short, direct answers shorn of humiliation and pain. Now in her late 40s, Moira was raised in care, went to jail and has been repeatedly cheated of her benefits. Part of her life story is of being let down and punished by authority – but Pike needs her to set all that aside. “Bear with me,” Pike keeps saying. “This is important.”

Such meetings are normally confidential, but for three days over two weeks I had exclusive access to Pike in her work for the Child Poverty Action Group charity. I saw her advise others who appeared to have been wronged by state officials – and I accompanied Moira to that tribunal. That our benefits system is broken is no longer up for debate. Ministers are told universal credit is a fiasco and MPs weep over starving families in one of the richest societies in human history. Even rightwing tabloids run grim updates on how men with terminal cancer are declared fit to work just weeks before they die. Such cases are described as shameful. As failures. They are lined up like so many one-offs – not representative of fair-play Britain. But Pike and her colleagues know different. They see a system that routinely snatches money out of the hands of people who need and are entitled to it and bullies claimants with contempt.

Moira never went looking for welfare advice; she was just starving That’s Moira’s experience, too. Her trouble started when she found herself feeling steadily worse – and so did as she was told and rang the Department for Work and Pensions. Her recent back operation hadn’t worked, the arthritis in her spine, hips and knees was getting worse and the heavy-duty painkillers were wrecking her kidneys. She was summoned for a reassessment in Southend, a 70-mile round trip from her home in London – tricky for a woman who cannot walk more than 10 steps without crutches. Claimants such as Moira are entitled to a home assessment, but Pike told me they are often dispatched “miles away”. She was still told off for being late, says Moira. After the examination, she lost her personal independence payment.

Selling to the west and east.

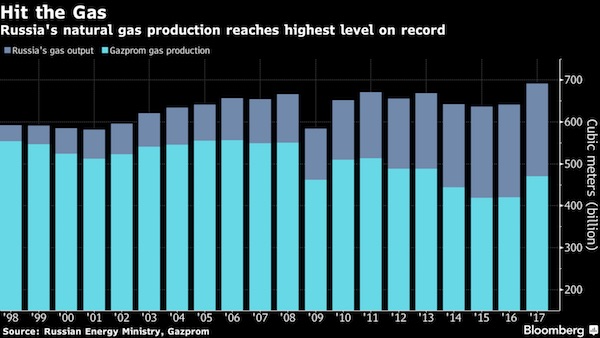

• Russia Posts Highest-Ever Natural Gas Output in Expansion Drive (BBG)

Russia registered its highest-ever natural gas production last year amid plans to expand into China and boost sales of liquefied natural gas. The nation’s output of the fuel jumped 7.9% to 690.5 billion cubic meters, according to data emailed Tuesday by the Russian Energy Ministry’s CDU-TEK unit. That beat the previous record, set in 2011, by 2.9%. Russia, the world’s largest gas exporter, is working to boost output with plans to increase production of LNG with new plants in an area that stretches from the Baltic region to its Pacific coast. That will put the country up against the biggest producers of the super-chilled fuel, including Qatar, Australia and the U.S. Russia has resources to increase its LNG production almost 10 times by 2035, led by the privately-owned Novatek PJSC in the Arctic, according to the nation’s Energy Ministry.

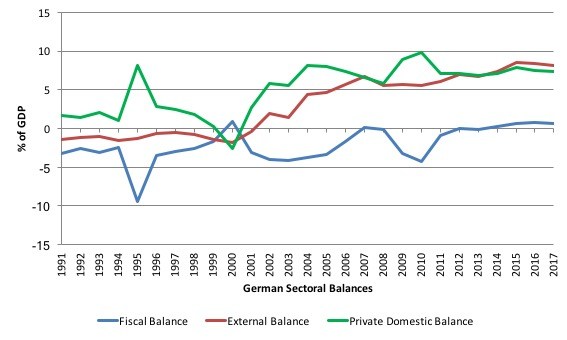

The country is also working to keep shipments to Europe near record levels this year as state-run Gazprom PJSC, the continent’s biggest supplier, plans to start pipeline exports to China in late 2019. Gazprom meets more than a third of Europe’s demand for natural gas, Russia’s biggest and most lucrative market worth some $37 billion in revenue this year. The U.S. became the world’s largest natural gas producer in 2009, leapfrogging Russia thanks to its fracking revolution. It pumped 22.1 trillion cubic feet (about 626 billion cubic meters) of dry gas in first 10 months of 2017, according to December data from the U.S. Energy Information Administration. This was 11% higher than Russia for the same period.

Create chaos.

• US Is Running The Same Script With Iran That It Ran With Libya, Syria (CJ)

Two weeks ago a memo was leaked from inside the Trump administration showing how Secretary of State and DC neophyte Rex Tillerson was coached on how the US empire uses human rights as a pretense on which to attack and undermine noncompliant governments. Politico reports: The May 17 memo reads like a crash course for a businessman-turned-diplomat, and its conclusion offers a starkly realist vision: that the US should use human rights as a club against its adversaries, like Iran, China and North Korea, while giving a pass to repressive allies like the Philippines, Egypt and Saudi Arabia. ‘Allies should be treated differently -and better- than adversaries. Otherwise, we end up with more adversaries, and fewer allies,’ argued the memo, written by Tillerson’s influential policy aide, Brian Hook.

With what would be perfect comedic timing if it weren’t so frightening, Iran erupted in protests which have been ongoing for the last four days, and the western empire is suddenly expressing deep, bipartisan concern about the human rights of those protesters. So we all know what this song and dance is code for. Any evil can be justified in the name of “human rights.” In October we learned from a former Qatari prime minister that there was a massive push from the US and its allies to topple the Syrian government from the very beginning of the protests which began in that country in 2011 as part of the so-called Arab Spring. This revelation came in the same week The Intercept finally released NSA documents confirming that foreign governments were in direct control of the “rebels” who began attacking Syria following those 2011 protests.

The fretting over human rights has occurred throughout the entirety of the Syrian war, even as the governments publicly decrying human rights abuses were secretly arming and training terrorist factions to murder, rape and pillage their way across the country. We’ve seen it over and over again. In Libya, western interventionism was justified under the pretense of defending human rights when the goal was actually regime change. In Ukraine, empire loyalists played cheerleader for the protests in Kiev when the goal was actually regime change. And who could ever forget the poor oppressed people of Iraq who will surely greet the invaders as liberators?

Conveyor belt.

• More Than 170 Refugees Reach Lesbos, Samos Early New Year’s Day (K.)

More than 170 undocumented migrants reached the shores of Lesvos and Samos in the early hours of New Year’s Day, according to government figures. The first incident occurred at 12.30 a.m. when a plastic boat carrying 52 people reached the coastline of Mytilene, the main port of Lesvos. Another 83 migrants arrived at 1.30 a.m. on another boat that followed the same route from neighboring Turkey. Shortly after midnight, a vessel belonging to the European Union’s border monitoring agency Frontex intercepted another plastic boat east of Samos, with 38 people aboard. All the migrants were transferred to reception centers on the two islands.

“..The family now live in Athens and are getting to know their new neighborhood until their asylum hearing – unfortunately set for 2019, despite Laila’s age…”

• Syrian Grandmother Defies Perils To Cross Aegean At Age 110 (K.)

How far can a desire to see a loved one take us? Laila Saleh was so desperate to see the granddaughters she helped raise that she didn’t think twice about following the rest of her family out of northern Syria, despite being 110 years old. Her yearning to see Nisrin and Berivan, who had fled Kobani for Europe three years ago and now live in Germany after being granted asylum, bolstered her determination. “The journey was not easy, of course,” Laila’s grandson, Halil, told Kathimerini as he welcomed us into an apartment rented by Solidarity Now for asylum seekers in downtown Athens. The family, which is of Kurdish descent, traveled from Kobani to Izmir on the Turkish coast, and from there to the Greek island of Lesvos by inflatable boat. “Our grandmother can walk a little bit, but not long distances.”

Their group consisted of seven people, spanning four generations, and tried to ensure that as little as possible of the journey was on foot. When finding transport proved impossible, Halil and his father would carry Laila. “I carried the two children, one on my front and one on my back,” said his young wife, Saousan, as she played with twins Azar and Ari, Laila’s great-grandchildren. Despite the enormous challenges of the journey and a treacherous sea crossing – a first for Laila – the idea of leaving the elderly woman behind never crossed her children’s minds. “Our house had been bombed and we had to rent another one, but living conditions were bad,” said Halil. “Even though Grandmother is independent, she wouldn’t want to live anywhere without her children.”

The family had already suffered tremendous loss and there was little to keep them in war-ravaged Kobani. “In Syria, it is the duty of the youngest son to take care of his mother when she grows old,” said Laila’s son Ahmet, who has a heart problem and couldn’t carry his mother alone. He thankfully has his wife of 33 years, Ali, by his side, who helps care for the elderly woman. “I sleep very lightly at night because she often needs me,” said the 58-year-old woman. “She is very confused right now because of all the changes,” she added of her mother-in-law. Born in December 1907, Laila had a birthday this month, though the family does not know her exact date of birth. He longevity may make an impression on outsiders, but the family thinks it normal. “Our grandfather, Laila’s husband, died at the age of 115. That was in 1987, and Grandmother has lived with us since,” said Halil.

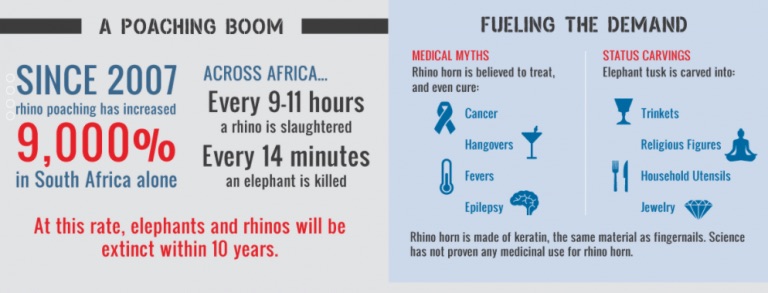

“.. a 9000% increase in rhino killings since 2007 in South Africa alone..

” .. a rhino is slaughtered twice a day and an elephant is killed every 14 minutes…”

I’ve said it before, unless and until the penalty for killing big game is death (and even then!), we won’t solve this.

• Drones Over Africa Target $70 Billion Illegal Poaching Industry (ZH)

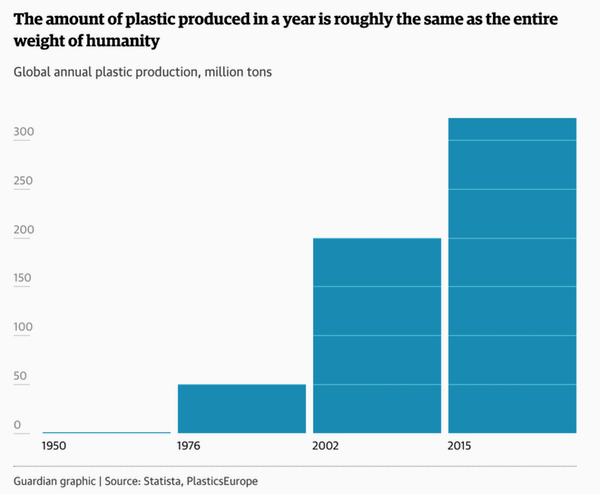

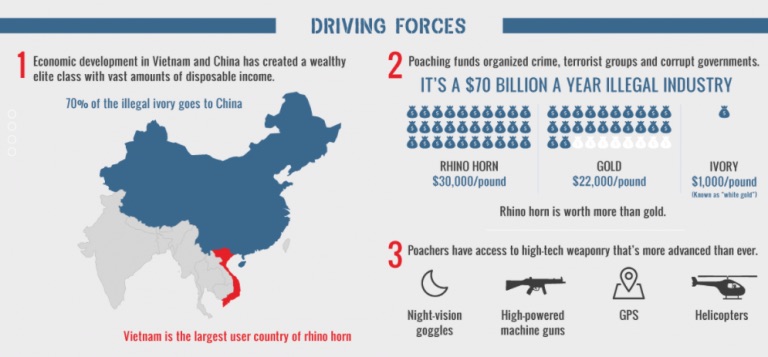

In addition to the central bank-created bubble in financial markets, there is another bubble festering in the fields of Africa, called the “poaching boom.” Economic development in Vietnam, China, and the United States have fueled an illegal $70 billion industry of killing elephants and rhinoceroses for tusks. Poachers illegally hunt elephants and rhinos under the cover of darkness using surveillance equipment and high-tech weaponry.

The boom in poaching has contributed to a 9000% increase in rhino killings since 2007 in South Africa alone. Across Africa, a rhino is slaughtered twice a day and an elephant is killed every 14 minutes. According to Air Shepherd, a wildlife conservation group aimed at stopping poachers through a new AI drone system that targets poachers said, “at this rate elephants and rhinos will be extinct within 10 years.”

According to Air Shepherd, a wildlife conservation group aimed at stopping poachers through a new AI drone system that targets poachers said, “at this rate elephants and rhinos will be extinct within 10 years.” Air Shepherd has already conducted 6,000 flight hours over the skies of Africa testing the new AI drone system. Air Shepherd’s drones use high-tech airborne sensors, such as thermal infrared vision to detect heat coming from human or animal bodies. The mobile command center fits into the back of a van and uses AI systems developed by researchers from Carnegie Mellon, the University of Southern California, and Microsoft to detect potential poachers.

For now, the new AI drone surveillance system could greatly expand the area of coverage used to protect endangered wildlife by spotting poachers and alerting officials before the killing of an elephant and rhinoceros occurs. Which begs the question: are AI drones set to disrupt an illegal $70 billion industry in Africa? Perhaps, but not without a fight. Which is why we expect that the poaching industry will soon unveil a new set of aggressive countermeasures, which renderd the drone system powerless, which leads to the next question: are we about to observe the first drone-on-drone violence deep in the bowels of Africa?