Paul Gauguin A Day of No Gods 1894

Behind the curtain.

• The State of the American Debt Slaves (WS)

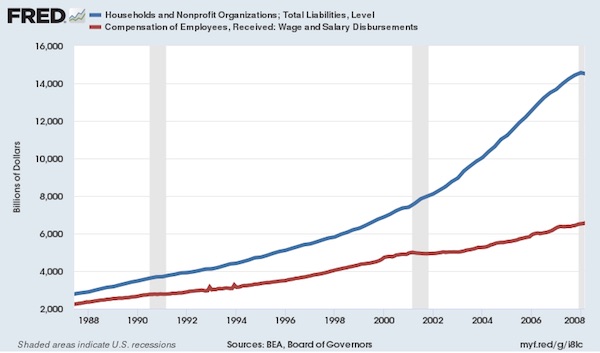

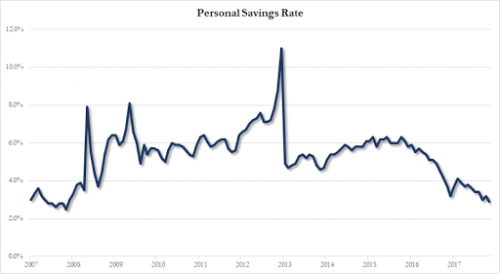

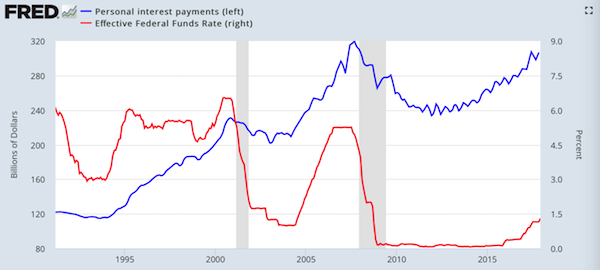

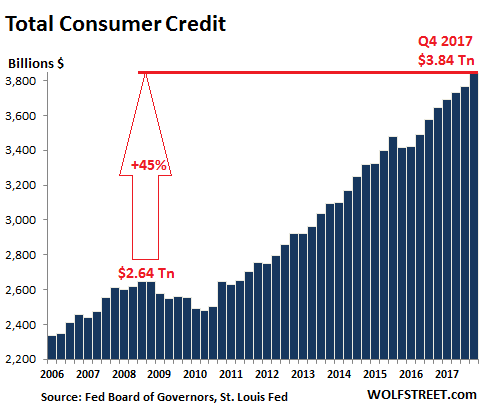

Total consumer credit rose 5.4% in the fourth quarter, year over year, to a record $3.84 trillion not seasonally adjusted, according to the Federal Reserve. This includes credit-card debt, auto loans, and student loans, but not mortgage-related debt. December had been somewhat of a disappointment for those that want consumers to drown in debt, but the prior months, starting in Q4 2016, had seen blistering surges of consumer debt. Think what you will of the election – consumers celebrated it or bemoaned it the American way: by piling on debt. The chart below shows the progression of consumer debt since 2006 (not seasonally adjusted). Note the slight dip after the Financial Crisis, as consumers deleveraged – with much of the deleveraging being accomplished by defaulting on those debts. But it didn’t last long. And consumer debt has surged since. It’s now 45% higher than it had been in Q4 2008. Food for thought: Over the period, the consumer price index increased 17.5%:

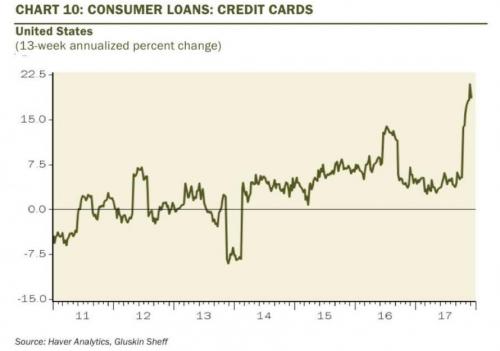

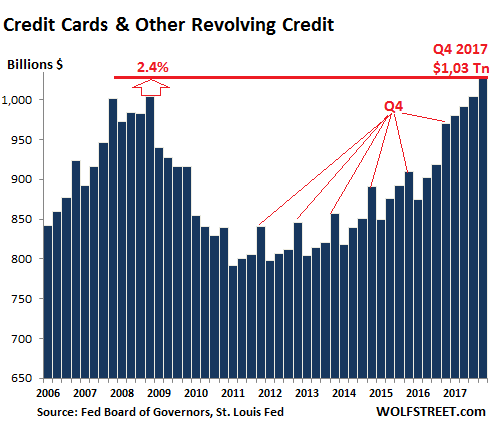

Credit card debt and other revolving credit in Q4 rose 6% year-over-year to $1.027 trillion, a blistering pace, but it was down from the 9.2% surge in Q3, the nearly 10% surge in Q2, and the dizzying 12% surge in Q1. So the growth of credit card debt in Q4 was somewhat of a disappointment for those wanting to see consumers drown in expensive debt. The chart below shows the leap of the past four quarters over prior years. This pushed credit card debt in Q3 and Q4 finally over the prior record set in Q4 2008 ($1.004 trillion), before it came tumbling down via said “deleveraging.” These are not seasonally adjusted numbers, and you can see the seasonal surges in credit card debt every Q4 during shopping season (as marked), and the drop afterwards in Q1. But then came 2017. In Q1 2017, credit card debt skyrocketed to an even higher level than Q4, when it should have normally plunged – a phenomenon I have not seen before.

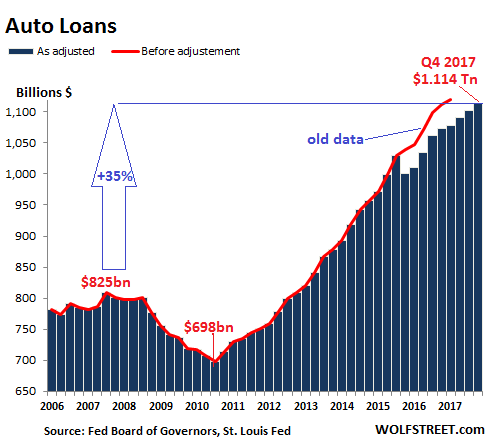

This shows what kind of credit-card party 2017 and Q4 2016 was. Over the four quarter period, Americans added $58 billion to their credit card debt. Over the five-quarter period, they added $109 billion, or 12%! Celebration or retail therapy. Auto loans rose 3.8% in Q4 year-over-year to $1.114 trillion. It was one of the puniest increases since the auto crisis had ended in 2011. Since then, the year-over-year increases were mostly in the 6% to 9% range. These are loans and leases for new and used vehicles. So the weakness in new-vehicle sales volume in 2017 was covered up by price increases in both new and used vehicles in the second half and strong used-vehicle sales:

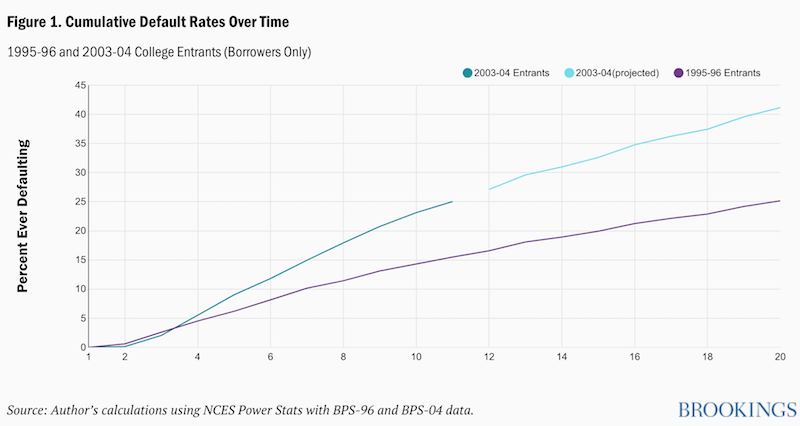

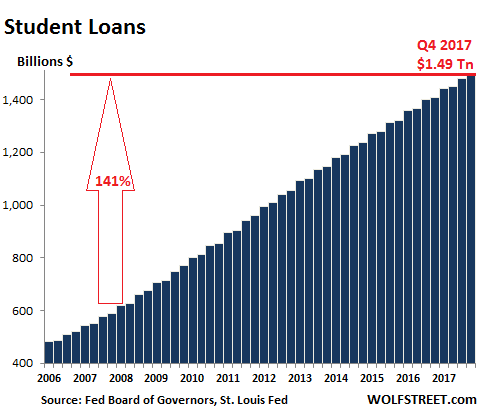

[..] Student loans surged 5.6% in Q4 year-over-year. This seems like a shocking increase, but the year-over-year increases in Q3 and Q4 were the only such increases below 6% in this data series. Between 2007 – as far back as year-over-year comparisons are possible in this data series – and Q3 2012, the year-over-year increases ranged from 11% to 15%:

It hasn’t yet though. Wall Street can’t handle reality.

• Reality Returns to Wall Street (Rickards)

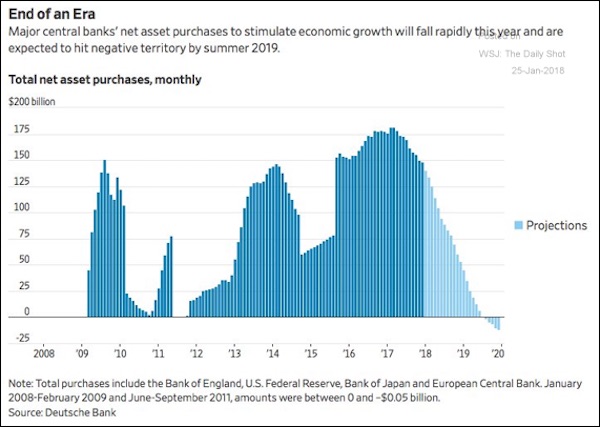

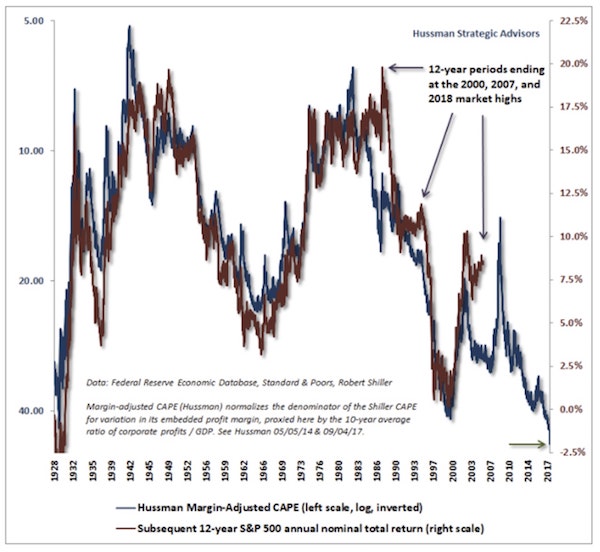

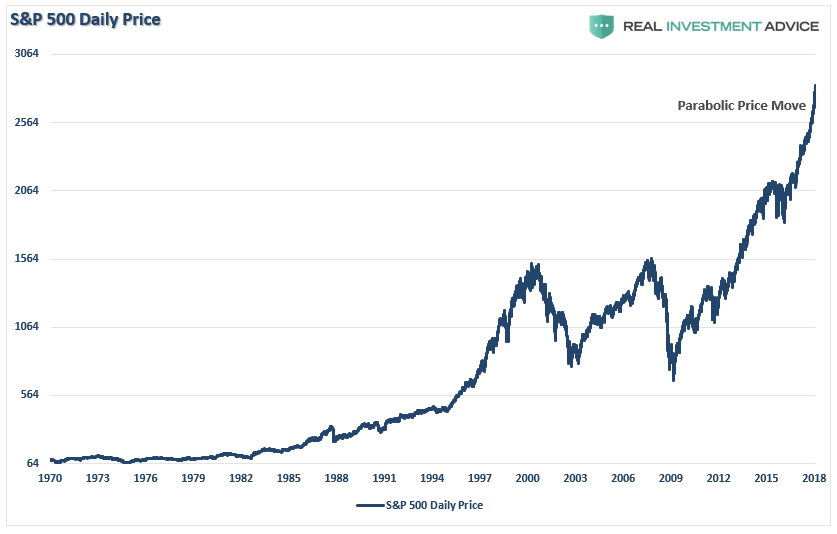

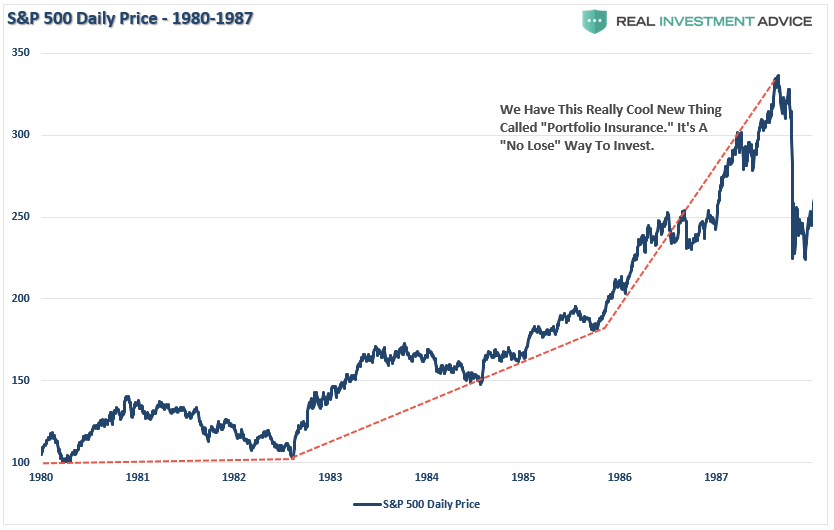

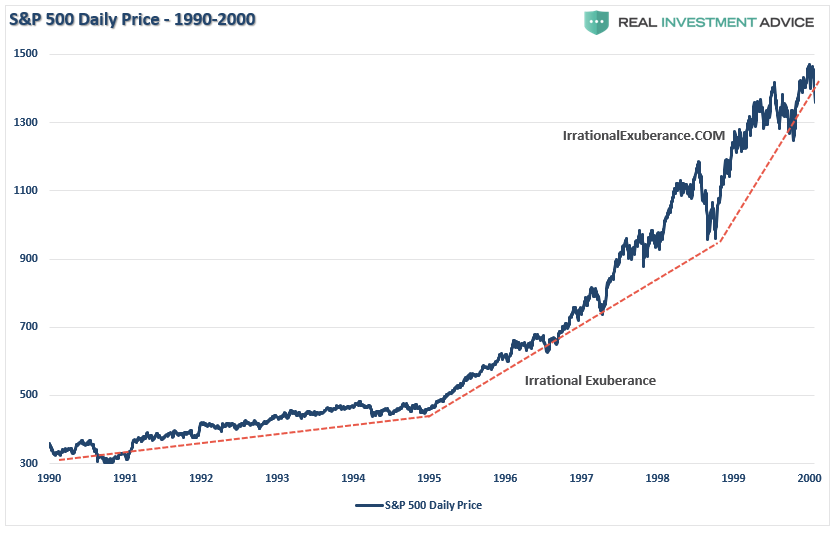

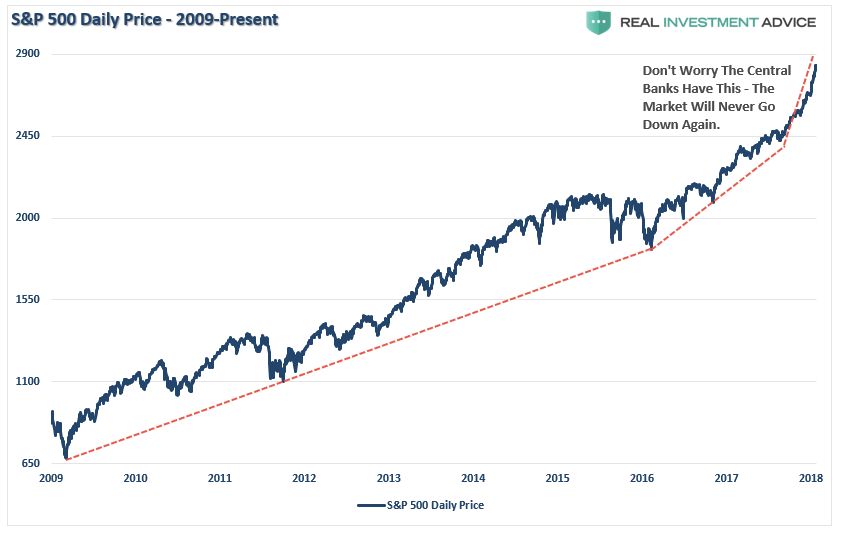

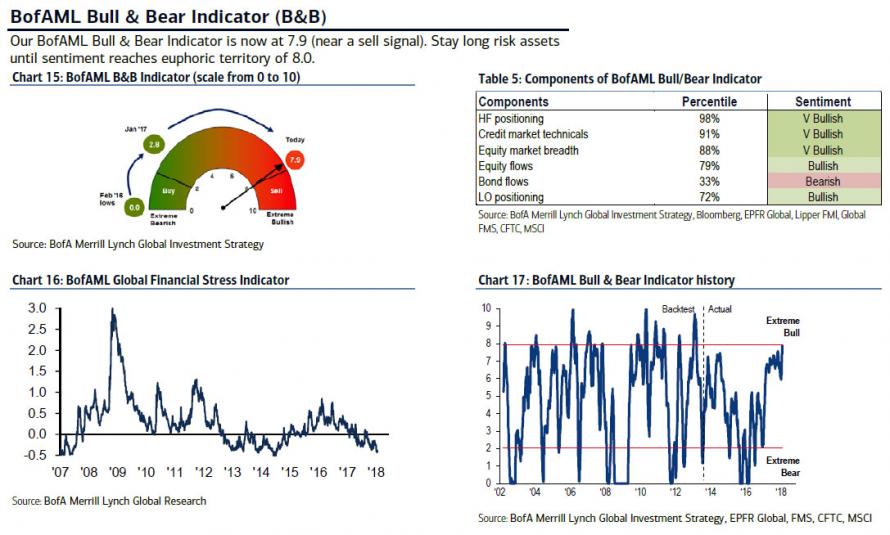

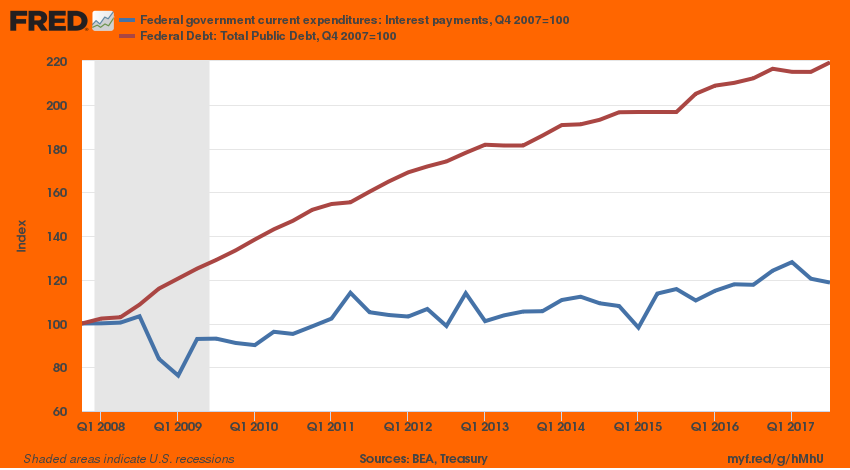

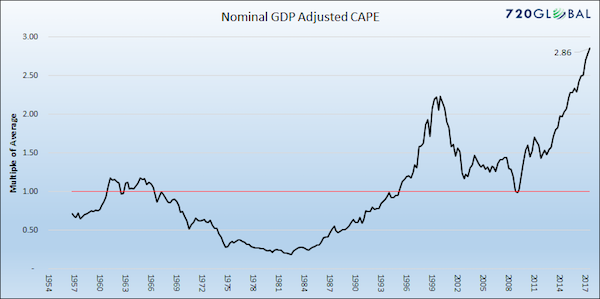

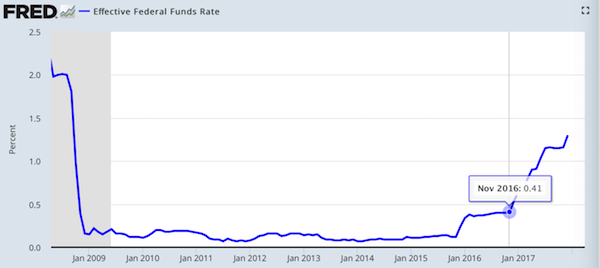

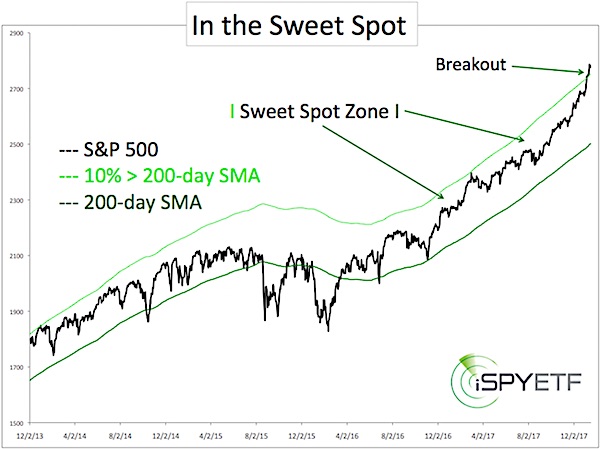

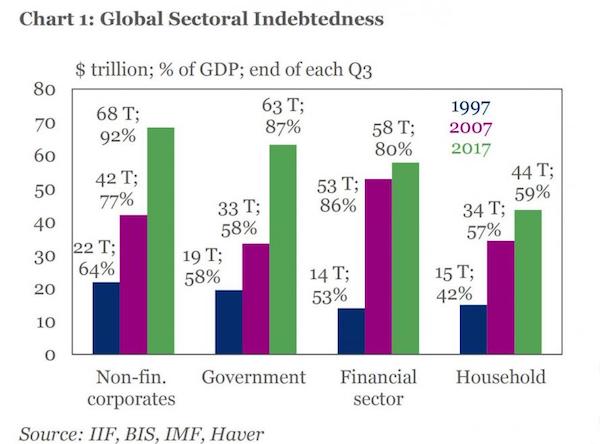

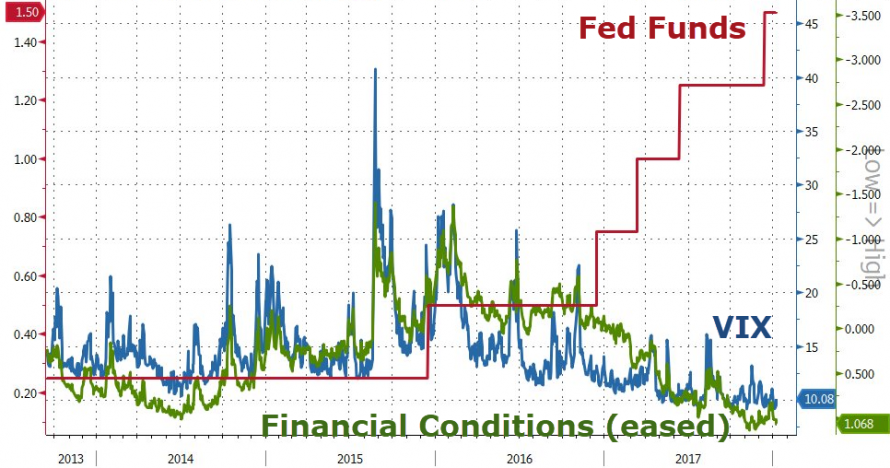

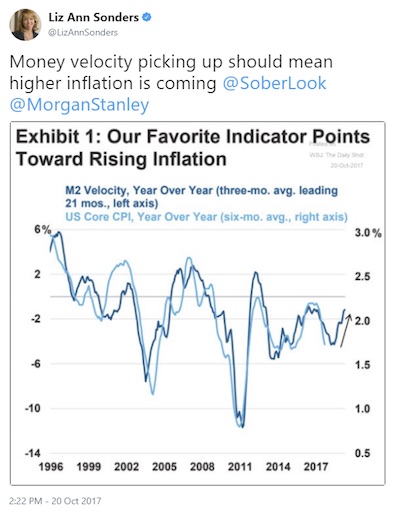

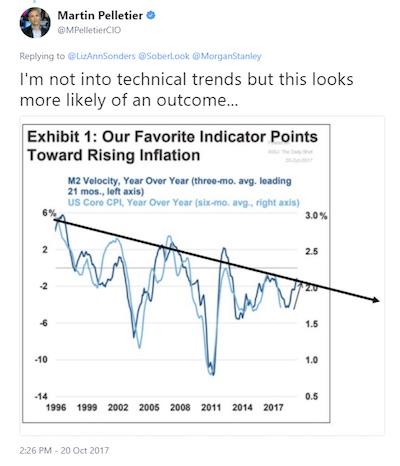

In a recent article, Yale scholar Stephen Roach points out that between 2008 and 2017 the combined balance sheets of the central banks of the U.S., Japan and the eurozone expanded by $8.3 trillion, while nominal GDP in those same economies expanded $2.1 trillion. What happens when you print $8.3 trillion in money and only get $2.1 trillion of growth? What happened to the extra $6.2 trillion of printed money? The answer is that it went into assets. Stocks, bonds, emerging-market debt and real estate have all been pumped up by central bank money printing. What makes 2018 different from the prior 10 years? The answer is that this is the year the central banks stop printing and take away the punch bowl. The Fed is already destroying money (they do this by not rolling over maturing bonds).

Last week, the Fed reduced its balance sheet by $22 billion. While that doesn’t seem like much when you’re talking about a $4 trillion balance sheet, it was the Fed’s largest cut to date. Funny how the market hit the skids just after this happened. But you haven’t heard the mainstream media mention that. By the end of 2018, the annual pace of money destruction will be $600 billion — if the Fed under new chairman Jerome Powell stays on course. The ECB and Bank of Japan are not yet at the point of reducing money supply, but they have stopped expanding it and plan to reduce money supply later this year. In economics everything happens at the margin. When something is expanding and then stops expanding, the marginal impact is the same as shrinking. Apart from money supply, all of the major central banks are planning rate hikes, and some, such as those in the U.S. and U.K., are actually implementing them.

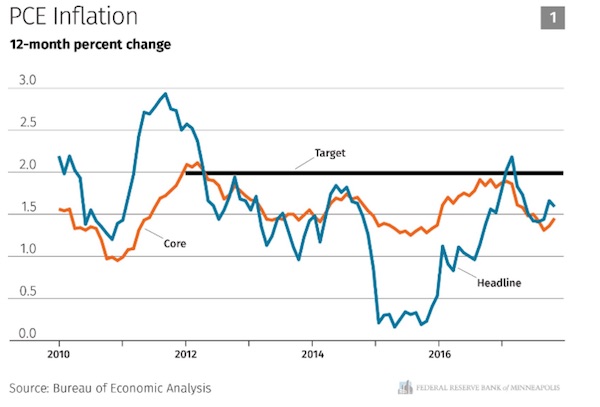

Reducing money supply and raising interest rates might be the right policy if price inflation were out of control. But despite a recent uptick in some inflation measures, prices have mostly been falling. The “inflation” hasn’t been in consumer prices; it’s in asset prices. The impact of money supply reduction and higher rates will be falling asset prices in stocks, bonds and real estate — the asset bubble in reverse. [..] This will not be a soft landing. The central banks — especially the U.S. Fed, first under Ben Bernanke and later under Janet Yellen — repeated Alan Greenspan’s blunder from 2005–06. Greenspan left rates too low for too long and got a monstrous bubble in residential real estate that led the financial world to the brink of total collapse in 2008. Bernanke and Yellen also left rates too low for too long. They should have started rate and balance sheet normalization in 2010 at the early stages of the current expansion when the economy could have borne it. They didn’t.

Obviously.

• Plunge Protection Team To The Rescue- Again (PCR)

What happened? Did the market sneeze, cough, or was something misread and today perceived in a different light? In my opinion this is what happened: The Plunge Protection Team, as they have done on previous equity market drops, or the Federal Reserve operating for the Working Group on Financial Markets, sent a purchase order for S&P futures to the trading floor. The hedge funds, seeing the incoming bid, front-ran the bid by stepping in and buying S&P futures. This pushed the market back up, ended the correction, and prevented financial panic.

The Plunge Protection Team was created in 1987, approaching the end of the Reagan administration, in order to prevent a market correction from costing George H. W. Bush the presidential election as Reagan’s successor. The Republican Establishment was desperate to reestablish its control over the party. The Republican Establishment, convinced by Wall Street that the Reagan tax cut would result in high inflation, found themselves instead confronted with a long economic expansion. In those days that meant that the expansion could be nearing its end, and a stock market correction could deny the presidency to George H.W. Bush. To prevent any such correction, the US Treasury and Federal Reserve created a “working group” to intervene in the stock market in order to support values. Whenever the market starts to drop, the team purchases S&P futures which halts the market decline.

We have witnessed this on several occasions. And, most likely, again this week. Pundits who speak about “market forces” are speaking about something that doesn’t exist. “Market forces” are the interventions that support existing values with money infusions. How long can the fraudulent valuation of equities continue? My sometimes coauthor Dave Kranzler and I think it can continue until the dollar as reserve currency comes under attack. Neither of us believed that the fraud could be perpetrated this long. The two other world powers, Russia and China, are moving away from use of the US dollar, but the consequence for the dollar could still be in the future. In the meantime, liquidity supplied by central banks and the interventions of the Plunge Protection Team could send equity prices higher.

Time to replace Draghi.

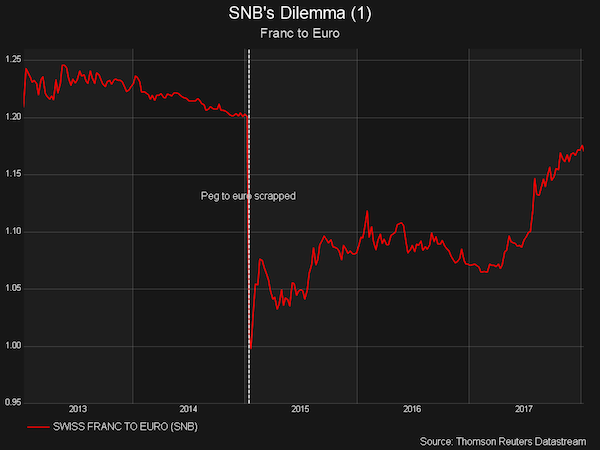

• Weidmann: ECB Should Wind Down QE After September (WSJ)

The European Central Bank should wind down its giant bond-buying program after September despite a stronger euro currency and volatility on global financial markets, German central bank President Jens Weidmann said Thursday. Speaking at a conference in Frankfurt, Mr. Weidmann, who sits on the ECB’s 25-member rate-setting committee, said “substantial net [asset] purchases beyond the announced amount do not seem to be required” if economic growth “progresses as currently expected.” ECB officials are weighing how quickly to phase out their stimulus policies as the region’s economy heats up. The ECB has pledged to buy €30 billion a month of eurozone bonds at least through September under its €2.5 trillion quantitative easing program, and ECB President Mario Draghi has signaled that the program won’t end abruptly.

Mr. Weidmann didn’t rule out a short extension of QE. But he argued that the eurozone’s economic recovery might be more advanced than that in the U.S. when the Fed wound down its own QE program in 2014. “The favorable economic outlook lends credence to the expectation that wage growth and therefore domestic price pressures will gradually increase,” Mr. Weidmann said. This week’s pay deal in Germany’s engineering sector “is consistent with this picture,” suggesting that inflation will pick up in Germany as unemployment falls, he said. Crucially, he urged policy makers not to be distracted by a rising euro or the situation in financial markets, which have gyrated wildly in recent days amid concerns about the reduction of monetary stimulus from central banks. “U.S. equity prices rose over a prolonged period without any notable corrections, which was unusual given that valuations have been high overall, Mr. Weidmann said.

There’s more to this than meets the eye. Expected loss was more than three times that. A mixed bag.

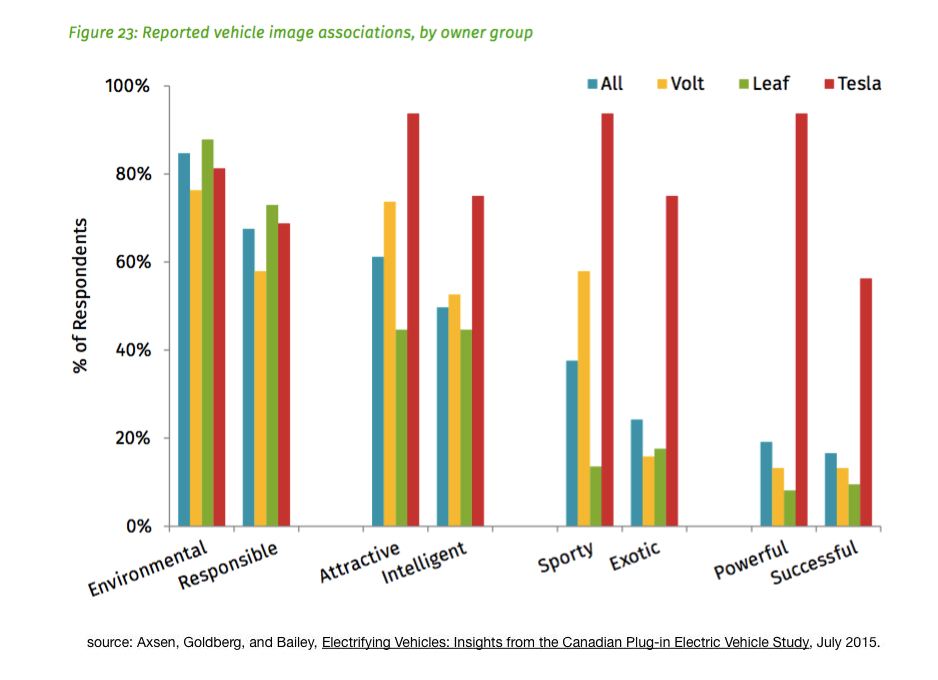

• Tesla Announces Biggest Quarterly Loss Ever (G.)

The tech billionaire Elon Musk sent one of his Tesla electric cars into space yesterday, a day before the company that built it announced its biggest ever quarterly loss. Musk’s Tesla electric car and energy storage company lost $675.4m in the three months ending 31 December, the company announced on Thursday, compared with a loss of $121m for the same period last year. The company has been spending heavily as it rolls out the next generation of electric cars, the Model 3 sedan, a semi truck and other products. The company has struggled to keep up with is production targets for the Model 3 but said it would probably build about 2,500 Model 3s per week by the end of the first quarter and that it plans to reach its goal of 5,000 vehicles per week by the end of the second quarter. On Wednesday Musk’s private aerospace company, SpaceX, blasted a cherry red Tesla Roadster sports car into space in a successful test of its Falcon Heavy rocket.

The car and its dummy driver are now heading towards the asteroid belt. Tesla delivered 101,312 Model S sedans and Model X SUVs last year, up 33% over 2016 and ahead of its targets, according to preliminary figures released last month. But it fell woefully short on the Model 3, which went into production in July. Tesla made just 2,425 Model 3s in the fourth quarter, and has pushed back production targets multiple times. At one point, Tesla had 500,000 people on a waiting list for the Model 3, but it’s not clear if all of them are continuing to wait. On a call with analysts Musk said production was getting back on track. “If we can send a Roadster to the asteroid belt we can probably solve Model 3 production,” he said. Musk is set to collect a $55.8bn (£40bn) bonus – probably be the largest ever – if he can build Tesla into a $650bn company over the next decade. In the meantime the 46-year-old has agreed to work unpaid for the next 10 years.

WIll it really require Russia to halt this disaster? The US can’t do it?

• Turkey Accused Of Recruiting ISIS Fighters To Attack Kurds In Syria (Ind.)

Turkey is recruiting and retraining Isis fighters to lead its invasion of the Kurdish enclave of Afrin in northern Syria, according to an ex-Isis source. “Most of those who are fighting in Afrin against the YPG [People’s Protection Units] are Isis, though Turkey has trained them to change their assault tactics,” said Faraj, a former Isis fighter from north-east Syria who remains in close touch with the jihadi movement. In a phone interview with The Independent, he added: “Turkey at the beginning of its operation tried to delude people by saying that it is fighting Isis, but actually they are training Isis members and sending them to Afrin.” An estimated 6,000 Turkish troops and 10,000 Free Syrian Army (FSA) militia crossed into Syria on 20 January, pledging to drive the YPG out of Afrin.

The attack was led by the FSA, which is a largely defunct umbrella grouping of non-Jihadi Syrian rebels once backed by the West. Now, most of its fighters taking part in Turkey’s “Operation Olive Branch” were, until recently, members of Isis. Some of the FSA troops advancing into Afrin are surprisingly open about their allegiance to al-Qaeda and its offshoots. A video posted online shows three uniformed jihadis singing a song in praise of their past battles and “how we were steadfast in Grozny (Chechnya) and Dagestan (north Caucasus). And we took Tora Bora (the former headquarters of Osama bin Laden). And now Afrin is calling to us”.

SImply refuse all US food imports. It’s not that hard.

• Huge Levels Of Antibiotic Use In Us Farming Revealed (G.)

Livestock raised for food in the US are dosed with five times as much antibiotic medicine as farm animals in the UK, new data has shown, raising questions about rules on meat imports under post-Brexit trade deals. The difference in rates of dosage rises to at least nine times as much in the case of cattle raised for beef, and may be as high as 16 times the rate of dosage per cow in the UK. There is currently a ban on imports of American beef throughout Europe, owing mainly to the free use of growth hormones in the US. Higher use of antibiotics, particularly those that are critical for human health – the medicines “of last resort”, which the WHO wants banned from use in animals – is associated with rising resistance to the drugs and the rapid evolution of “superbugs” that can kill or cause serious illness.

The contrast between rates of dosage in the US and the UK throws a new light on negotiations on Brexit, under which politicians are seeking to negotiate trade deals for the UK independently of the EU. Agriculture and food are key areas, particularly in trading with the US, which as part of any deal may insist on opening up the UK markets to imports that would be banned under EU rules. When negotiating outside the EU for a new trade deal, the UK will come under severe pressure to allow such imports. Over the summer, a row broke out over the potential for imports of US chlorinated chicken – bleaching chicken, according to experts in the UK, is a dangerous practice because it can serve to disguise poor hygiene practices in the food chain.

But Ted McKinney, US under-secretary for trade and foreign agricultural affairs, told an audience of British farmers last month he was “sick and tired” of hearing British concerns about chlorinated chicken and US food standards, providing further indication that the US government is likely to strike a hard deal on agricultural products as part of any trade agreement. Antibiotic use in the US is three times higher in chickens than it is in the UK, double that for pigs, and five times higher for turkeys, according to research by the Alliance to Save Our Antibiotics [..]

Suzi Shingler, at the Alliance to Save Our Antibiotics, said: “US cattle farmers are massively overusing antibiotics. This finding shows the huge advantages of British beef, which is often from grass-reared animals, whereas US cattle are usually finished in intensive feedlots. Trade negotiators who may be tempted to lift the ban on US beef should not only be considering the impact of growth hormones, but also of antibiotic resistance due to rampant antibiotic use.”

Gorundhog Day in all its glory.

• Concerns Grow Over Conditions At Greek Refugee Camps (K.)

Concerns are rising about conditions at reception centers for migrants on the islands of the eastern Aegean amid delays in much-needed infrastructure upgrades and increasingly cramped conditions, with reports of a spike in cases of mental health problems. Last summer, authorities completed a feasibility study for an upgrade of the drainage and sewerage systems at Moria, the main reception center on Lesvos. But the plan appears to have become mired in bureaucracy. Originally designed to house 1,000 migrants, the camp at Moria is currently hosting nearly seven times that number. The overcrowded and dirty conditions, and the uncertainty, are taking their toll on the mental health of many camp residents, Gavriil Sakellaridis, the head of Amnesty International’s Greek chapter, said on Wednesday.

Following a visit to camps on Lesvos and Chios, Sakellaridis expressed concern at the large number of migrants suffering from depression and called for the transfer of asylum seekers to the mainland. “The living conditions of asylum seekers at Moria and Vial [on Chios] are an open wound for Greece and Europe and for human rights,” Sakellaridis said. “The lives of those people have been put on hold for a period of up to two years in some cases and as a result the cases of despair and mental distress are growing,” he said.