Cyclone, Oklahoma, 1898

Arbitrary numbers.

• Dow 19,000 Is No Cause For Celebration (MW)

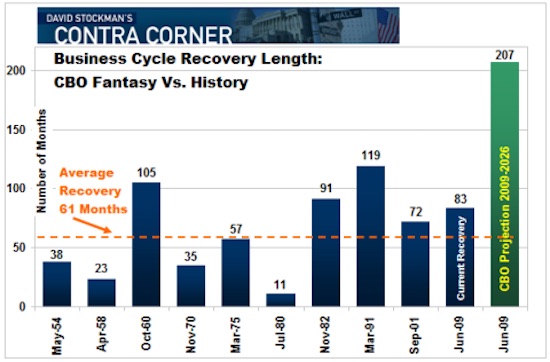

The Dow Jones Industrial Average closed above 19,000 on Tuesday for the first time. How is this news? I’m sure you remember the spell-binding chase for the Dow to break 18,000, or those thrilling days when the Dow crossed 17,000, or hunted for 15,000. If you don’t remember those benchmark days – which occurred in December 2014 and July 2014 respectively, the latter being 14 months after the Dow had crossed 15,000 – then you also recognize that Dow 19,000 is equally no big deal, post-election rally notwithstanding. In fact, the Dow itself is no big deal. The Dow is the Kardashian of indexes – a celebrity benchmark, famous because it’s known rather than because of what it does.

Every round number on the index hits the news cycle hard, largely because there is so little real news out there. In early November, for example, people were talking about nine straight down days on the S&P 500 – the first nine-day losing streak in 36 years – as if that was somehow meaningful, even though the total decline on the index amounted to just 3.1%. (By comparison, the S&P 500’s last nine-day skid – which ended in December 1980 – shaved 9.4% off the index, according to FactSet). Tuesday’s headlines included a 13-day winning streak for the Russell 2000, its longest win streak in more than 20 years. The Russell benchmark gained roughly 15% during that stretch – an achievement largely unnoticed because it wasn’t the Dow or S&P 500.

Round numbers and little factoids are amusing and interesting, and are obvious fodder for the talking heads. Currently, the talk is whether the post-election rally can continue and if the Dow can roar on to 20,000, or if the quick rebound since the election has pushed us closer to a point of go-no-further. Focusing on the meaning of the Dow passing a landmark, however, misses the bigger point, which is that the Dow is a virtually meaningless benchmark. The Dow is important to people because it’s what they know, the staple of every market-oriented website, every radio-station market update, every newspaper’s daily business section, and the centerpiece of the 20 seconds of coverage that every national newscast guarantees the investing world each day.

Criminal. And deadly. The ultimate pyramid scheme.

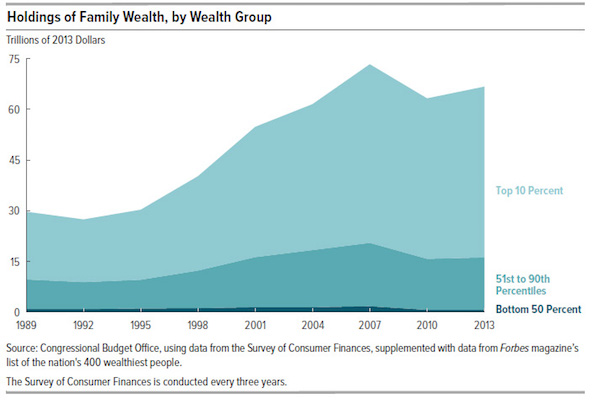

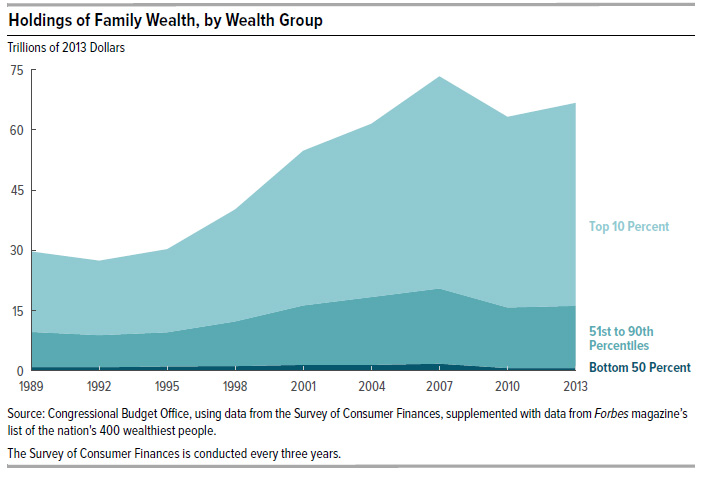

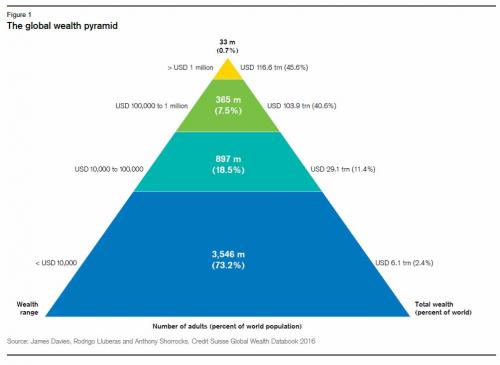

• Global Wealth Update: 0.7% Of Adults Control $116.6 Trillion In Wealth (ZH)

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent “anti-establishment” revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the “shocking” political backlash of the past few months suggests that the lower ‘levels’ of the pyramid are increasingly unhappy about.

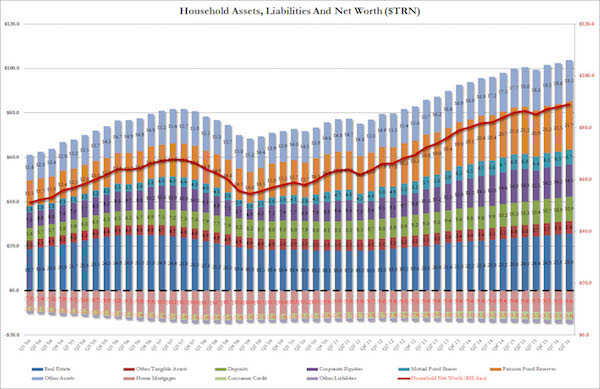

As Credit Suisse tantalizingly shows year after year, the number of people who control just shy of a majority of global net worth, or 45.6% of the roughly $255 trillion in household wealth, is declining progressively relative to the total population of the world, and in 2016 the number of people who are worth more than $1 million was just 33 million, roughly 0.7% of the world’s population of adults. On the other end of the pyramid, some 3.5 billion adults had a net worth of less than $10,000, accounting for just about $6 trillion in household wealth. And inbetween is the so-called global middle class – those 1 billion people who rising anger at the status quo made Brexit and Trump possible.

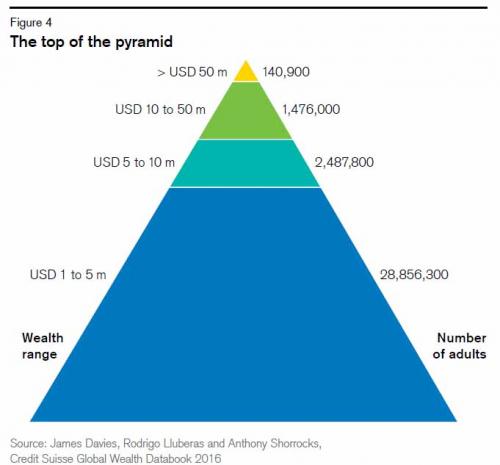

[..] How about the very top? Things here are even more nuanced, with 28.9 million people whose net worth is between $1 and $5 million gradually tapering off to just 140,900 Ultra High Net Worth individuals who control more than $50 million in assets each. Of these, 50,800 are worth at least USD 100 million, and 5,200 have assets above USD 500 million. The total number of UHNW adults is about 3% higher than a year ago (4,100 individuals), and the increase has been relatively uniform across regions, except for the higher than average rise in Asia- Pacific countries (10%)

How about a lost century?

• We Could Be In A ‘Lost Decade’ Of Global Wealth Growth (CNBC)

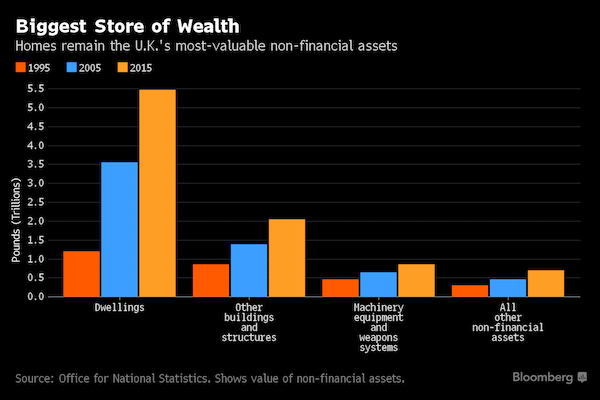

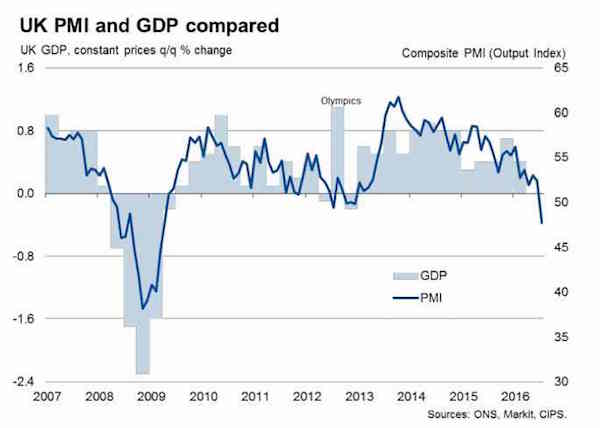

Concerns that we are in a “lost decade” for global wealth growth have been given further credence by the latest “Global Wealth Report” released by the Credit Suisse Research Institute on Tuesday. According to the researchers, “In recent years, there has been a growing sense that the economic recovery is shallow, and has not reached all layers of society. Evidence from our global wealth database supports this view.” “While exchange rate movements sometimes obscure trends, wealth per adult and median wealth have grown well below their potential during the last nine years, compounding fears that we are in the midst of a lost decade for global wealth growth,” the paper continues.

The 1.4% rise in global wealth over the 12 month period to June 30 has only kept in line with population growth, meaning that for the first time since 2008 the wealth per adult measure has remained flat, according to the research. The paper burrows down into country level data which show that exchange rate fluctuations were the biggest drivers of changes in wealth for different nations over the period. Most notably, the 15% plunge in the British pound driven by Brexit translated to a $1.5 trillion loss for the U.K.. Meanwhile Japan’s 19% jump – which added $3.9 trillion to its wealth pile – was exactly aligned with gains in the yen as the Japanese currency bounced back from earlier weakness as its central bank was increasingly seen as running out of tools with which to force its depreciation.

Trump will listen. But these folks must recognize why he won and they did not: they can’t command the room like he can.

• Willing To Oppose Trump, Some Senate Republicans Gain Leverage (R.)

It is no surprise that Democrats in the U.S. Congress will oppose Donald Trump but the most important resistance to fulfilling the president-elect’s agenda is beginning to emerge from Republicans on Capitol Hill. A small number of influential Republicans in the Senate are threatening to block appointments to Trump’s administration, derail his thaw with Russia and prevent the planned wall on the border with Mexico. The party held onto control of the Senate at the Nov. 8 election but by only a thin margin, putting powerful swing votes in just a few hands. That empowers Republican Senate mavericks such as Rand Paul of Kentucky and Ted Cruz of Texas. Both were bitter rivals to Trump in the 2016 Republican presidential primary.

Paul, a libertarian lone wolf, says he will block Senate confirmations if Trump nominates either former New York Mayor Rudy Giuliani or former U.N. Ambassador John Bolton to be secretary of state. South Carolina’s Lindsay Graham has started publicly outlining places he might be willing to oppose Trump. He is against the Mexican border wall and is delivering warnings against Trump’s intention to revoke legal status for undocumented immigrants brought here as children – although that would not require congressional approval. Graham, a traditional Republican foreign policy hawk, strongly disagrees with Trump’s attempt to improve ties with Russia. “I am going to be kind of a hard ass” on Russia, Graham told reporters recently. “We can’t sit on the sidelines” and let cyber attacks blamed on Russia “go unanswered.”

Accounting tricks are supposed to keep zombies alive.

• EU Draft Plan Eyes New Bank Creditor Class To Bear Losses (R.)

European banks would be able to issue a new category of debt that could be wiped out in a crisis only after shares and bonds, but before more secured instruments, such as covered deposits, under a draft EU law seen by Reuters on Tuesday. The proposal aims at facilitating the building up of capital buffers for banks against losses at time when shares and bonds are losing value, forcing lenders to pay more to build the required cushions. The draft law, to be published by the European Commission on Wednesday, would create a new category of “non-preferred” debt instruments that would be bailed-in -suffer losses- only during a bank resolution, the draft text said.

The document is part of a wider legislative package aimed at reviewing EU rules on capital requirements for banks. Only debt instruments with a maturity of one year, and that are not derivatives, can be included in the new class. Lenders issuing such instruments will have to stress in contracts their ranking, which will be lower than secured debt such as covered deposits, derivatives or tax liabilities. The law is also aimed at creating a uniform ranking of bail-in-able liabilities across EU countries, which have so far applied in divergent ways new bail-in rules in force since the beginning of this year. The bail-in regime is meant to reduce costs to taxpayers in the event of a bank crisis, while increasing losses for the lenders’ creditors.

The field is still very slow to wake up, even if more of them raise their -timid- voices.

• Economists Need To Get Into The Real World, Says BOE’s Haldane (Tel.)

Economists are too detached from the real world and have failed to learn from the financial crisis, insisting on using mathematical models which do not reflect reality, according to the Bank of England’s chief economist Andy Haldane. The public has lost faith in economists since the credit crunch, he said, but the profession has failed to thoroughly re-examine its failings to come up with a new model of operating. Instead, he fears, it is still using the same failed analyses, and is still failing to speak effectively to the public. This applies to an all manner of areas, from studies of the financial meltdown to analysis of the Brexit vote. “The various reports into the economic costs of the UK leaving the EU most likely fell at the same hurdle. They are written, in the main, by the elite for the elite,” said Mr Haldane, writing the foreword to a new book, called ‘The Econocracy: the perils of leaving economics to the experts’.

The chief economist said that the Great Depression of the 1930s resulted in a major overhaul of economic thinking, led by John Maynard Keynes, who emerged “as the most influential economist of the twentieth century”. But the recent financial crisis and slow recovery has not yet prompted this great re-thinking. “Thus far at least, the present crisis has yet to spawn a Keynes for the twenty-first century. And nor have we witnessed any great leap forward analytically. Perhaps it is simply early days,” he said. “Salvation for the economics profession probably lies not among existing academic and policymaking dinosaurs, like me, but among the new generation of students of the discipline.” For now, economists need to focus on reviewing their models, accepting a diversify of thought rather than one solid orthodoxy, and on communicating more clearly.

A bit hard to convey what Dmitry means in a news overview, you’ll have to read the article.

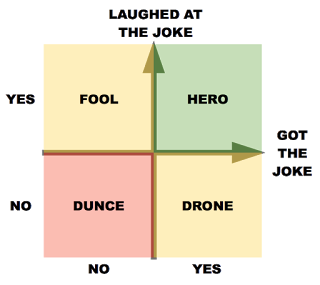

• Of Dunces, Fools, Drones and Heroes (Dmitry Orlov)

Some time ago I posted three T-shirt designs, with no explanation as to why. “Here are some shirts,” I wrote, “reasonably priced, in all styles and colors, free shipping on orders over 100 USD, yadda-yadda.” Just as I expected, a few people got it, and a few of those ordered some shirts. The rest had no idea; some even confessed to that in the comments. That was a test. It was a success. Now that all eight of the planned designs are available, I offer the full explanation and rationale behind this, my latest humanitarian intervention/fundraising effort. In all my travels and conversations, I have proven to myself beyond all doubt that the decision on who to talk to should have nothing to do with race, age, class, gender, ethnicity, nationality, IQ, profession/trade, educational level, criminal record, party affiliation, gang/militia membership, religious persuasion, military training/rank, drinking/drug habits and whatever else you might try to use to categorize people. Categorizing people based on their public attributes just doesn’t work. So, in determining who is worth talking to, all we have to go on is gut feeling, first impressions and happy accidents. But is this, I ask you, in any way optimal? No, it is not!

That is why I decided to step in and help. The eight designs may have some artistic merit, but they are not exactly art; in fact, they should be regarded as precision mental calibration instruments. Each design features a simple nautical motif consisting of a circle and the 16 compass points. Around the circle is a tag line. Inside the circle is a fish. The tag line is a pun about the fish. Confused? Read on! Each of the designs is a cognitive test. As you walk around wearing one of these shirts, looking for people worth talking to, you can apply specific methods, explained below, to interpret the way they react to your shirt. You can then make an objective determination as to whether a particular person is worth talking to. The determination is based on that staple of business consultants, Four-Quadrant Analysis.

In this case, the two dimensions being mapped are:

x-axis: Did the person get it? (No | Yes)

y-axis: Did the person laugh? (No | Yes)

Yeah, bring in the old guard. The return of Monti. That’ll work miracles.

• Renzi’s Party Wants Early Election in Italy If Referendum Lost (BBG)

Prime Minister Matteo Renzi’s party would seek early elections in Italy by the summer of 2017 if he loses a referendum on constitutional reform, according to a senior official. Lorenzo Guerini, deputy-secretary of Renzi’s Democratic Party, said in an interview that the group would try to reform the electoral system and then push for a fresh ballot if the “No” campaign wins on Dec. 4. He declined to say whether the premier would stay on to lead that effort or honor his promise to resign after a defeat, but he insisted Renzi would remain leader of the biggest party in parliament. “If there is the political will, we can work over a brief period on a new electoral law, and have elections with a new electoral law soon, by the summer of 2017,” Guerini said in his Rome office.

“If there are not the political conditions and the electoral reform is used as an excuse for a weak government surviving, we’re not interested.” Both the euro and Italian bonds have fallen this month amid concern that a rising populist mood will derail Renzi’s plans for reform and put another crack in the European project. The insurgent Five Star Movement is aiming to capitalize on a “No” vote to force Renzi out and wants another referendum, this time on Italy’s membership of the euro area. With Five Star just behind the Democratic Party in the polls, part of the Italian establishment is looking to hold off another vote until the current parliamentary term ends in February 2018.

Mario Monti, who headed a technocratic government between 2011 and 2013, said he expected there to be no early ballot whatever happens and said Italy should prioritize stability rather than rushing into another vote. “In case the ‘No’ were to win, I would expect first of all Mr Renzi to stay on after all,” Monti said Tuesday in an interview with Bloomberg Television’s Francine Lacqua. “If he at all costs wanted to leave, I would expect the president of the republic to form a new government with a new prime minister, but very much from the same center-left political spectrum which is now the Renzi majority.”

I’m waiting till Putin takes revenge for the Russian jet downed last year. The West is too weak to take on Erdogan.

• Erdogan Says EU Lawmakers’ Vote On Turkish Membership ‘Has No Value’ (R.)

Turkish President Tayyip Erdogan said on Wednesday that a vote by the European Parliament on whether to halt EU membership talks with Ankara “has no value in our eyes” and again accused Europe of siding with terrorist organizations. “We have made clear time and time again that we take care of European values more than many EU countries, but we could not see concrete support from Western friends … None of the promises were kept,” he told an Organisation of Islamic Cooperation (OIC) conference in Istanbul. “There will be a meeting at the European Parliament tomorrow, and they will vote on EU talks with Turkey … whatever the result, this vote has no value in our eyes.”

Leading members of the European Parliament on Tuesday called for a halt to EU membership talks with Turkey because of its broad purges in the wake of a failed July coup. More than 125,000 people – including soldiers, academics, judges, journalists and Kurdish leaders – have been detained or dismissed over their alleged backing for the putsch, in what opponents, rights groups and some Western allies say is an attempt to crush all dissent.

Erdogan said on Tuesday the measures had significantly weakened the network of U.S.-based cleric Fethullah Gulen, whose followers are accused of infiltrating state institutions over several decades and carrying out the coup attempt. Erdogan, and many Turks, were angered by the Western response to the putsch, viewing it as more concerned about the rights of the plotters than the gravity of the events themselves, in which more than 240 people were killed as rogue soldiers commandeered fighter jets and tanks. He has also repeatedly accused Europe of harboring members of the Kurdistan Workers Party (PKK) militant group, which has waged a three-decade insurgency against the Turkish state and is deemed a terrorist organization by the EU and United States.

Get so sick of this. More reforms will be called for. Rinse and repeat.

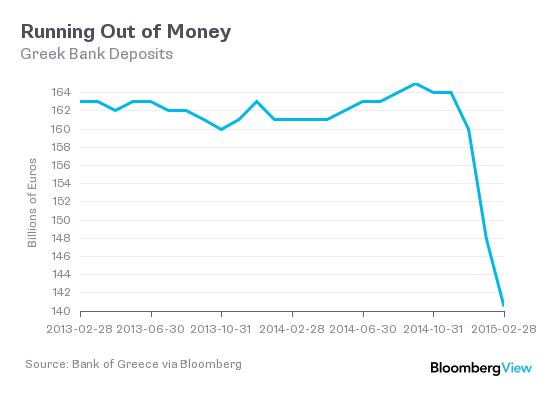

• EU Finance Ministers To Discuss IMF, Greek Debt (Kath.)

Finance ministers of core European Union countries are expected to meet later this week in Berlin to discuss the possible concessions Brussels could offer to secure the participation of the IMF in Greece’s third international bailout, paving the way for debt talks. Government officials suggest that the IMF, which has yet to decide whether to join Greece’s third bailout, is to blame for the slow process of talks between Greece and its creditors. In a media briefing on Tuesday, government spokesman Dimitris Tzanakopoulos acknowledged that the differences between Greece and its creditors remain too great for an agreement on all prior actions to be reached by the December 5 Eurogroup meeting and said that Athens was aiming for a political agreement by that time.

There is enough time until December 5 for agreements to be reached in talks on labor laws, fiscal issues and the overhaul of the Greek energy sector, Tzanakopoulos said, noting that the government has shown the political will necessary to achieve a breakthrough by the deadline. However, he said, this political will does not include “a willingness for new austerity measures and concessions on matters of principle such as labor rights.” Elaborating, government sources said authorities will not retract their demands for the restoration of collective labor contracts. If all differences have not been bridged by December 5, Greece’s creditors should issue a political decision and make good on their pledge to launch talks on debt relief, Tzanakopoulos said.

Denouncing the CON21 accord is not the worst of things. Because it doesn’t achieve a thing.

• Trump: ‘Open Mind’ On Quitting Climate Accords (AFP)

US President-elect Donald Trump said Tuesday he has an open mind about pulling out of world climate accords and admitted global warming may be in some way linked to human activity. “I think there is some connectivity. Some, something. It depends on how much,” he told a panel of New York Times journalists. Asked whether he would make good on his threat to pull the United States out of UN climate accords, he said: “I’m looking at it very closely. I have an open mind to it.” But he said he was also wanted to see how much the Paris climate accord “will cost our companies” and its impact on US competitiveness.

The Republican billionaire businessman has called climate change a “hoax” perpetrated by China and threatened to pull out of the agreement on limiting greenhouse gas emissions. The accord was reached in Paris in December 2015 after negotiations involving 195 countries. The worldwide pact to battle global warming took effect on November 4. The agreement sets a goal of limiting the rise in global temperatures to two degrees Celsius (3.6 degrees Fahrenheit) over pre-industrial revolution levels. The United States, the second biggest emitter of greenhouse gases after China, ratified the accord in early September, with strong backing from President Barack Obama.

What are you going to do about it?

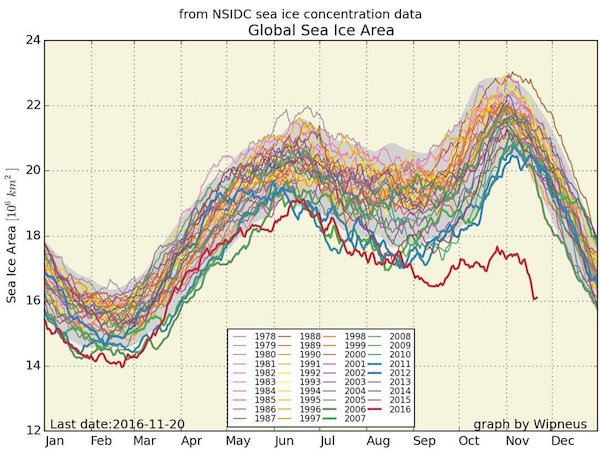

• Sea Ice Reaches A New Low (Economist)

Measuring sea ice is difficult. Not only does it only appear in the most remote, inhospitable parts of the world, it is constantly either melting or forming. Since 1979, satellites have made the job easier, but they can give a misleading picture. Using satellite images to tot up the total area of sea ice risks mistaking surface melt for open water during the summer melting season. Scientists at the National Snow and Ice Data Center (NSIDC) in Colorado instead measure sea-ice extent by dividing the images into grids and counting any squares with more than 15% ice concentration as “ice covered”. Sea-ice extent is always larger than sea-ice area, but this method eliminates melt-season inaccuracies.

Scientists are interested in sea ice as a marker -and amplifier- of climate change. Its bright surface reflects 80% of the sunlight that hits it back into space. When it melts, the uncovered dark ocean surface absorbs 90% of the sunlight, which heats it up, causing more ice to melt. In recent years, the melting season in the Arctic has been ending later in the year, leading to less time for new ice to form. As a consequence, the total sea-ice extent in September 2016 was over 3m km2. smaller than in September 1980, although not as small as in September 2012, the worst year on record.