NPC “Witt-Will motor truck plant, 52 N Street N.E., Washington, DC” 1915

And I could easily quote a dozen pieces that contradict this.

• Greece, Eurozone Close To A Deal Before Friday’s Eurogroup (Reuters)

Greece and the euro zone are close to a deal on a financing-for-reforms package, a senior Greek official said ahead of a crucial meeting of euro zone finance ministers later on Friday. The official, speaking on the condition of anonymity, said Greece had made a lot of concessions to reach an agreement and that the euro zone should show some flexibility too. “We have covered four fifths of the distance, they also need to cover one fifth,” the official said, adding Greece wanted to clinch a deal on Friday, but that it would not back down in the face of pressure from the Eurogroup.

Read more …

“The deputies are “close to an agreement but (it is) subject to political discussion..”

• Greece-Eurozone Positions Move Much Closer after Deputies’ Meeting (MNI)

Eurozone deputies have drafted a statement that could well serve as a basis for a compromise between Greece and the Eurozone, to be examined by finance ministers Friday The positions of Greece and the Eurozone over future financing for Athens moved much closer at a meeting of finance ministry deputies in Brussels, three sources with knowledge of the discussions told Euro Insight Thursday. One source, a veteran Eurozone official, said, “positions seem to be reasonably close.” Speaking on condition of anonymity, he added that Eurogroup deputies had drafted a statement that would serve as a basis for a compromise between Greece and the Eurozone, to be signed off subsequently by finance ministers.

The deputies are “close to an agreement but (it is) subject to political discussion,” a second source with knowledge of the talks said. A third source confirmed that Eurogroup ministers would meet Friday in Brussels for a political discussion and to check the text. “Everyone has to check with the boss,” he said. Germany’s reaction to the compromise from deputies will come under particular scrutiny Friday given its recent cool reaction to Greece’s recent stance on its future financing. Still, the draft is “broadly” based on a Greek submission from earlier Thursday, the second source added. Earlier Thursday, the Greek finance minister Yanis Varoufakis sent a letter to the Eurogroup president Jeroen Dijsselbloem saying that Athens recognized the current agreement with its EU lenders as “binding vis-a-vis its financial and procedural content.”

However, the letter also stipulated that the extension should only go ahead by “making best use of given flexibility in the current arrangement.” The letter was an attempt by Athens to bridge differences with Germany and other Eurozone countries over the wording associated with an extension of financial support for Athens from the EU, which runs out at the end of this month. Martin Jager, a spokesman for the German finance ministry, said earlier Thursday that Greece’s submission was not deemed sufficient and did not stick closely enough to the current bailout agreement. There was no immediate reaction from the German finance ministry to the report of progress at the deputies meeting in Brussels Thursday.

Read more …

“..over years and decades, this goal is almost entirely illusory.”

• Why Greece Won’t Ever Be Able to Pay Off Its Debts With Austerity (Bloomberg)

The Greek negotiators who went to Brussels in mid-February to argue for more lenient terms from their lenders were especially concerned about one thing in any new deal: the target for achieving and keeping a primary surplus. A measure of austerity, it’s what a government earns in taxes each year, minus what it spends on everything except interest payments on its own debt. It’s usually expressed as a share of gross domestic product. Under its four-year-old bailout program, Greece has dragged itself from a primary deficit of 10% to a 3% surplus, at great cost in jobs lost. The terms of the bailout demand that Greece reach a surplus of 4.5% and hold it for the length of the program. There’s little reason to believe that’s possible.

Since 1995 all the countries of the euro area reached an aggregate primary surplus of 3.6% only once, in 2000. That number is back below zero. (Even Germany, the Federal Republic of Austerity, reached its own peak of 3% only twice, in the last quarter of 2007 and the first of 2008.) In 2011 the Kiel Institute for the World Economy looked at the records of all Organisation for Economic Co-operation and Development countries from 1980 to 2010. It found that few countries could maintain a 3% surplus and almost none could keep a surplus above 5%. This suggested a limit to what countries can do, the report concluded. They could cross those thresholds briefly, but “over years and decades, this goal is almost entirely illusory.”

Last year, Barry Eichengreen of the University of California at Berkeley and Ugo Panizza of the Graduate Institute in Geneva found that from 1974 to 2013, only three countries ran primary surpluses of 5% or more for a decade: Singapore is an island city-state run by a benevolent autocracy. Norway has oil wealth. For Belgium, the 1990s were a time of growth—Eichengreen and Panizza say countries that hold a primary surplus for many years are likely to be enjoying a good economy, which Greece doesn’t have. And 4.5% is not all that Greece’s lenders are asking. In theory, the country will pay off its debt through thrift and economic growth until it can reduce its debt to the euro zone standard of 60% of GDP. To do that, says the IMF, Greece must sustain a primary surplus of 7.2% from 2020 to 2030. Only Norway has maintained a surplus that high for that long.

Read more …

The problem with this is, Greece never dropped any key demands, it’s just what peple like to see.

• Greece Drops Key Bailout Demands, But Germany Still Objects (AP)

Greece heads to another round of negotiations Friday after dropping key demands for a bailout settlement, but still faced stiff opposition from lead lender Germany, which criticized Athens’ latest proposals as a “Trojan horse” designed to dodge its commitments. Eurozone finance ministers agreed to hold their third meeting on the Greek debt crisis in just over a week after Athens formally requested a six-month extension of loan agreements with rescue creditors that expire this month. Going back on recent election campaign pledges, Prime Minister Alexis Tsipras’ government said it would honor debt obligations and agree to continued supervision from bailout lenders and the ECB. Late Thursday, Tsipras held phone conversations with French President Francois Hollande and German Chancellor Angela Merkel after Germany sharply criticized the Greek offer during preparatory talks in Brussels.

Greek media, including state television, widely quoted a German representative at the talks as saying the Greek offer “rather represents a Trojan horse, intending to get bridge financing and in substance putting an end to the current program.” The comments were confirmed by a senior official in the Greek Finance Ministry who could not be identified because the talks in Brussels were not public. In Berlin, government officials did not comment publicly on the remarks, but told The Associated Press they accurately reflected the German government position. Germany argues that Greece has failed to provide detailed alternatives to cost-cutting reforms imposed by the previous government that helped the country balance its budget after decades of excessive borrowing. Greek and European markets were largely unaffected by the German response.

“If there’s no agreement in the next few days there is a risk of (a bank run) because liquidity in Greek banks is very limited and there are many who say that capital controls are very close,” said Evangelos Sioutis at Guardian Trust. Although Greece emerged from the recession with a primary budget surplus last year, it faces a spike in debt repayment in 2015 with hopes of a full return to markets hit by renewed uncertainty and a resulting surge borrowing rates. [..] in its latest proposals Thursday — carefully worded to avoid reference to the bailout agreement or “memorandum” — it scaled back those aims to seek more modest primary budget surpluses, budget-neutral growth measures, and calls for a deal later this year to improve bailout loan repayment terms. Greek officials appeared visibly irritated by the latest German objections. “All the conditions are there for a transition agreement to be achieved,” Deputy Prime Minister Giannis Dragasakis said. n”At this moment it appears that there are powers that would like Greece on its knees, exactly so they can impose their will.”

Read more …

Must read by Ambrose.

• ECB Risks Crippling Political Damage If Greece Forced To Default (AEP)

The political detonating pin for Greek contagion in Europe is an obscure mechanism used by the eurozone’s nexus of central banks to settle accounts. If Greece is forced out of the euro in acrimonious circumstances – a 50/50 risk given the continued refusal of the creditor core to acknowledge their own guilt and strategic errors – the country will not only default on its EMU rescue packages, but also on its “Target2” liabilities to the European Central Bank. In normal times, Target2 adjustments are routine and self-correcting. They occur automatically as money is shifted around the currency bloc. The US Federal Reserve has a similar internal system to square books across regions. They turn nuclear if monetary union breaks up. The Target2 “debts” owed by Greece’s central bank to the ECB jumped to €49bn in December as capital flight accelerated on fears of a Syriza victory. They may have reached €65bn or €70bn by now.

A Greek default – unavoidable in a Grexit scenario – would crystallize these losses. The German people would discover instantly that a large sum of money committed without their knowledge and without a vote in the Bundestag had vanished. Events would confirm what citizens already suspect, that they have been lied to by their political class about the true implications of ECB support for southern Europe, and they would strongly suspect that Greece is not the end of it. This would happen at a time when the anti-euro party, Alternative fur Deutschland (AfD), is bursting on to the political scene, breaking into four regional assemblies, a sort of German UKIP nipping at the heels of Angela Merkel. Hans-Werner Sinn, from Munich’s IFO Institute, has become a cult figure in the German press with Gothic warnings that Target2 is a “secret bailout” for the debtor countries, leaving the Bundesbank and German taxpayers on the hook for staggering sums.

Great efforts have been made to discredit him. His vindication would be doubly powerful. An identical debate is raging in Holland and Finland. Yet the figures for Germany dwarf the rest. The Target2 claims of the Bundesbank on the ECB system have jumped from €443bn in July to €515bn as of January 31. Most of this is due to capital outflows from Greek banks into German banks, either through direct transfers or indirectly through Switzerland, Cyprus and Britain. Grexit would detonate the system. “The risks would suddenly become a reality and create a political storm in Germany,” said Eric Dor, from the IESEG business school in Lille. “That is the moment when the Bundestag would start to question the whole project of the euro. The risks are huge,” he said. Mr Dor says a Greek default would reach €287bn if all forms of debt are included: Target2, ECB’s holdings of Greek bonds, bilateral loans and loans from the bail-out fund (EFSF).

Read more …

The key stumbling block remains the clearer language regarding the conclusion of the current program, as demanded by Greece’s creditors, and more details regarding the attainment of fiscal targets.”

• Varoufakis Meets Euro Partners as Greece Seeks to Avoid Default (Bloomberg)

Greek Finance Minister Yanis Varoufakis returns to Brussels for a third meeting in two weeks with his euro-area counterparts in an effort to strike a deal that will let Europe’s most-indebted country avoid default. In a formal request on Thursday to extend Greece’s euro-area backed rescue beyond its end-of-February expiry for another six months, Varoufakis said he would accept the financial and procedural conditions of the existing deal while asking for negotiations on other elements. German Finance Minister Wolfgang Schaeuble almost immediately rebuffed the latest Greek formula, saying the country needs to make a firmer commitment to austerity. A “positive” conversation between Greek Prime Minister Alexis Tsipras and Chancellor Angela Merkel later on Thursday sparked investor optimism for a deal.

“Hopes for a compromise at today’s Eurogroup have been raised,” analysts including Nikos Koskoletos at Athens-based Eurobank Equities wrote in a note to clients on Friday. “The key stumbling block remains the clearer language regarding the conclusion of the current program, as demanded by Greece’s creditors, and more details regarding the attainment of fiscal targets.” While the euro lost 0.4%, Greek bonds rose for a third day, with the yield on the three-year notes down 80 basis points at 16.26% at 11:09 a.m. in Athens. That compares with a record 128% in March 2012. The Athens Stock Exchange index also rose for a third day, advancing 0.8%.

Germany, the biggest contributor to Greece’s €240 billion rescue, is the chief advocate of economic reforms in return for aid to Greece. Since winning a national election on Jan. 25, Tsipras has abandoned demands for a writedown on Greek debt, pushed back the timetable for raising the minimum wage and decided against blackballing the international auditors keeping tabs on the government. “Admittedly, the letter sent by Greece marks significant progress,” Paris Mantzavras and George Grigoriou, analysts at Athens-based Pantelakis Securities wrote in a note to clients today. “It also contains a number of ambiguities that are hard to be accepted by the Eurogroup in their current form.” Still, the fact that the group is holding a meeting implies that the letter marks a sufficient basis for discussion, the analysts said.

Tsipras held a 50-minute telephone call on Thursday with Merkel. After the call, Tsipras said the conversation had a “positive tone” and was aimed at finding a mutually beneficial solution for Greece and the euro area. He also spoke with Francois Hollande and was assured by the French president that he would do whatever he can to help Greece and will discuss the issue Friday at a meeting with Merkel, a Greek official said. Merkel and Hollande are scheduled to meet in Paris Friday.

Read more …

“I think there’s a parallel, but the tools exist if the European Union wants to keep Greece in and if Greece is willing to stay in..”

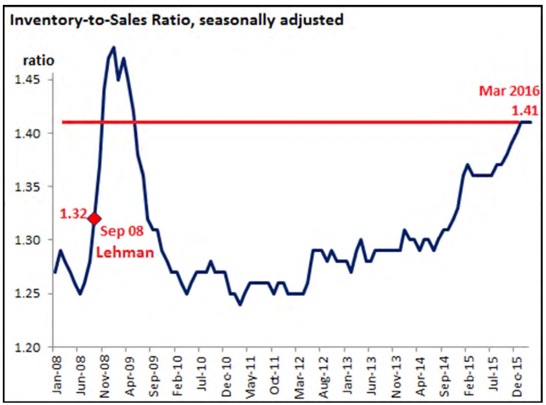

• Has Greece’s ‘Lehman Moment’ Finally Arrived? (CNBC)

A key week for Greece’s economic future drew to a close on Friday with the country facing the very real threat that it’s running out of money and key analysts warming to the idea that it could be on its way out of the euro zone. Euro zone finance ministers are set to meet Friday to discuss Greece’s latest proposals to extend its loan agreement. But with Germany already rejecting the plan, there is very little hope that an agreement will be announced. Another meeting in Brussels for next week was already being touted before Friday’s meeting even began. The main problem for the fiscally disciplined countries like Germany is that, despite the ground Greece has given up in the last week, it is still asking for the bailout loan without all of the strict austerity conditions that come with the money.

Greek economist Elena Panaritis, former member of the Greek Parliament and the World Bank, drew comparisons with the collapse of the Lehman Brothers in 2008. As with the fall of the big U.S. bank, market-watchers feel euro zone policymakers want to show the world they will only be pushed so far — with the result being Greece would be allowed to exit the euro zone. Panaritis thought there was a “political statement as well as economic statement” being made during the negotiations. Randy Kroszner, a former U.S. Federal Reserve governor and the professor of economics at the University of Chicago Booth School of Business, agreed that there were comparisons between the two events.

“I think there’s a parallel, but the tools exist if the European Union wants to keep Greece in and if Greece is willing to stay in,” he told CNBC Friday. “Even though it may be quite ugly, the likelihood of complete chaos is much lower. So that gives policymakers more willingness to say ‘Hey, we’ll take that risk’.” Greek concerns have roiled markets since the anti-austerity Syriza Party came to power in Greece in January and have been a major focus all over the globe. Data from Google reveals that searches for the term “Grexit,” a shortening of “Greek exit,” have surged and has dwarfed similar interest shown throughout the whole of the euro zone sovereign debt crisis which begun in 2011.

Read more …

“The written document does not meet the criteria agreed in the Eurogroup on Monday.”

• Greece’s Request for Loan Extension Is Rejected by Germany (NY Times)

Germany on Thursday dismissed Greece’s latest effort to resolve the impasse in debt negotiations between Athens and its creditors. Greece, as expected, on Thursday requested a six-month extension of its loan agreement with the European Commission and European Central Bank. In a two-page letter to eurozone officials, the Greek finance minister, Yanis Varoufakis, said his country was prepared to “honor Greece’s financial obligations to its creditors.” But a German Finance Ministry spokesman, Martin Jäger, quickly issued a statement saying the letter from Athens was “not a substantial proposal to resolve matters.” Germany, as the eurozone’s largest economy, is probably the central player in the proceedings. The head of the Eurogroup of 19 eurozone finance ministers who are negotiating with Greece, scheduled a Friday afternoon meeting to consider the proposal, as Athens sought to break a deadlock in debt talks amid fears of Greek insolvency.

Unless Greece revises its offer before Friday’s meeting, approval might be hard to obtain. Mr. Jäger said, “The written document does not meet the criteria agreed in the Eurogroup on Monday.” He was referring to a meeting this week that ended in acrimony, with eurozone finance ministers giving Greece a deadline of Friday to come to an agreement with its European creditors or risk a cutoff of further loans. The issue is how closely Greece is prepared to abide by the tough conditions underpinning its bailout loans, which total €240 billion. Mr. Varoufakis’s letter, much of it written in legal language, indicated Greece was willing to abide by the general terms of the bailout loan agreement, but not necessarily an underlying memorandum of understanding that contained crucial conditions for the country to receive loan payments.

Many of those conditions, which include cuts in government spending, higher taxes and other economic changes agreed to by a previous government in 2012, became so politically unpopular that the leftist Syriza party was voted into power last month on an anti-austerity platform. And the memorandum would still require Greece to carry out additional austerity measures that the previous government had not yet put into effect, including changes in labor law that could make it easier for private companies to lay off workers. As a result, the government of Prime Minister Alexis Tsipras is treading a fine line, trying to come to terms with its European creditors while not seeming to give too much ground on his promises to Greek voters. The Greek proposal is for a six-month extension of the country’s loan agreement, but “under different terms,” said Gavriil Sakellaridis, a government spokesman.

Another senior government official, Labor Minister Panos Skourletis, said on Greek television on Thursday that the country’s request for an extension to its loan program “in no way translates into an extension of the existing program, nor will it be accompanied by the known disastrous measures.” Unless Greece can come to an agreement with its international lenders, its current bailout program would expire at the end of the month, and the government might soon not have enough money to meet its debt obligations. The lenders are the EC, the ECB and the IMF. At this point, the Eurogroup of finance ministers is the party negotiating on behalf of the European creditors. The group’s signoff would be required before any Greek proposal could move forward for final European approval. The meeting on Friday would be the third of its kind in two weeks.

Read more …

“Greece requested to extend its “master financial assistance facility agreement.”

• US Urges Greece, Creditors To End Impasse (CNBC)

A senior U.S. Treasury official on Thursday urged Greece and its creditors to make concessions to end an impasse over Greece’s loan agreement. U.S. officials are “closely” monitoring ongoing negotiations as they have generated increased uncertainty for the global economy, the official said. Greece will take an immediate economic hit if talks among its government, the EU and IMF break down, the official said. The official noted that U.S. Treasury Secretary Jack Lew spoke to top European finance ministers on Thursday, but couldn’t speculate on the timing of a potential deal. The official added that Athens and the EU need to find a “constructive way forward” that includes an emphasis on Greek fiscal reforms.

Germany on Thursday rejected Greece’s plan to prolong its loan agreement for six months and renegotiate the terms of its bailout with creditors including the EU and IMF. Berlin’s rejection raised the chances that Greece would run out of money in the coming weeks. The German government called the Greek proposal, which included some concessions from its anti-austerity ruling party, “no substantial solution.” Earlier Thursday, Greece requested to extend its “master financial assistance facility agreement.” In the proposal, Greece pledged to cooperate with creditors in reworking the terms of its €240 billion bailout package without taking unilateral actions. The Eurogroup of finance ministers is set to discuss the Greek plan on Friday. Its existing bailout program expires on Feb. 28.

Read more …

“Sometimes, banks are like small children. They ask for too many things. They want five dishes for dinner. And the state has to be like a father that says no. One dish is enough and after that you must go to bed.”

• Meet Europe’s Newest Austerity-Hating Politician (CNBC)

Pablo Iglesias is just 36 years old, and yet, he could become the next prime minister of Spain. That’s a fact that looms large among European finance ministers as they continue their bailout negotiations with Greece. According to multiple sources who spoke with CNBC, finance ministers and prime ministers on the continent express concern that if they give leniency to Greece, they will embolden other anti-austerity movements. Iglesias’ party, Podemos, is at the top of the list. Podemos (Spanish for “We Can”) cemented itself in the Spanish political scene by garnering more than a million votes in May elections for the European Parliament, where the party now holds five seats. The accomplishment is all the more extraordinary for coming from a political party little more than a year old.

Even more startling, the most recent polls for the general election coming this autumn show Podemos with a small lead over the two long-standing establishment parties, an indication of just how much resonance the party’s “anti-austerity” platform has with the Spanish population. Iglesias sounds similar to his close friend Alexis Tsipras, Greece’s new prime minister: “Austerity measures are destroying Europe,” he told CNBC. “As a pro-European, I think we are in a situation in which we must rectify.” Iglesias is diminutive in stature, but he looms large in the minds of other European leaders as he rails against the very reforms they think will make Spain and the rest of Europe more competitive. He wants to raise the Spanish minimum wage and lower the country’s retirement age, a step that he believes will reduce youth unemployment.

Restructuring the county’s debt is also on his list, although such a step would be highly likely to scare off creditors and lead to higher interest rates in Spain. In an interview with CNBC at the New York Stock Exchange, he wanted to highlight greater state intervention in banking. “There is a part of the financial system that must undertake social functions, and that implies that there must be mechanisms of public control,” he said. “There must be devices that assure that there will be credit for small- and medium-size businesses and families. From there, it is fundamental to use the public sector.” Iglesias indicated a certain degree of disdain for financial institutions: “Sometimes, banks are like small children. They ask for too many things. They want five dishes for dinner. And the state has to be like a father that says no. One dish is enough and after that you must go to bed.”

Read more …

There’s a new question out there: how stupid does stupid get? Oh wait, I already used that somewhere else….

• Ukraine: UK and EU ‘Badly Misread’ Russia (BBC)

Britain and the European Union have been accused of a “catastrophic misreading” of the mood in the Kremlin in the run-up to the crisis in Ukraine. The House of Lords EU committee claimed Europe “sleepwalked” into the crisis. The EU had not realised the depth of Russian hostility to its plans for closer relations with Ukraine, it said. It comes as European Council president Donald Tusk called PM David Cameron to discuss how the EU should respond to ongoing violence in eastern Ukraine. The report also follows comments from UK Defence Secretary Michael Fallon, who has warned Russian President Vladimir Putin poses a “real and present danger” to three Baltic states. He was speaking after RAF jets were scrambled to escort two Russian military aircraft seen off the Cornwall coast on Wednesday.

The committee’s report said Britain had not been “active or visible enough” in dealing with the situation in Ukraine. It blamed Foreign Office cuts, which it said led to fewer Russian experts working there, and less emphasis on analysis. A similar decline in EU foreign ministries had left them ill-equipped to formulate an “authoritative response” to the crisis, it said. The report claimed that for too long the EU’s relationship with Moscow had been based on the “optimistic premise” that Russia was on a trajectory to becoming a democratic country. The result, it said, was a failure to appreciate the depth of Russian hostility when the EU opened talks aimed at establishing an “association agreement” with Ukraine in 2013. The Ukraine crisis began in November 2013 when pro-Moscow President Viktor Yanukovych’s government abandoned an EU deal in favour of stronger ties with Russia – prompting mass protests that led to his downfall.

Subsequent unrest in Ukraine’s peninsula of Crimea led to its annexation by Russia – which has since been accused of stoking conflict between pro-Russian separatists and Ukrainian forces in the east of the country. Committee chairman Lord Tugendhat said: “The lack of robust analytical capacity, in both the UK and the EU, effectively led to a catastrophic misreading of the mood in the run-up to the crisis.” The UK had a particular responsibility to Ukraine because it was one of four signatories to the 1994 Budapest Memorandum which pledged to respect Ukraine’s territorial integrity, the committee said. Neither Britain nor the EU had a strategic response on how to handle Russia for the long term, it added. A Foreign Office spokeswoman said no-one could have predicted the scale of the “unjustifiable and illegal” Russian intervention in eastern Ukraine.

Read more …

Good stuff from Yves.

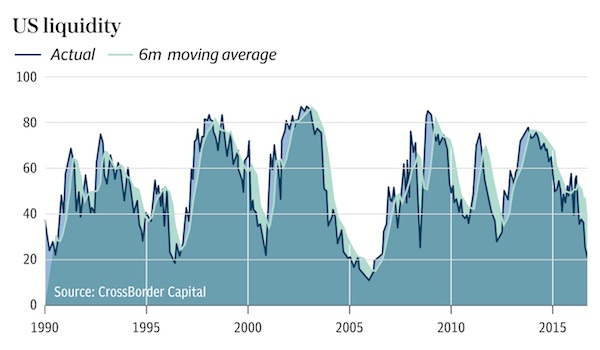

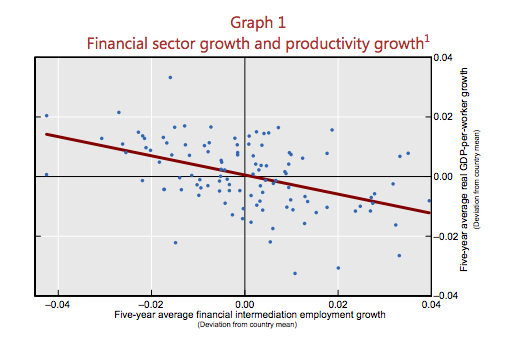

• Two New Papers Say Oversized Finance Sectors Hurt Growth and Innovation (NC)

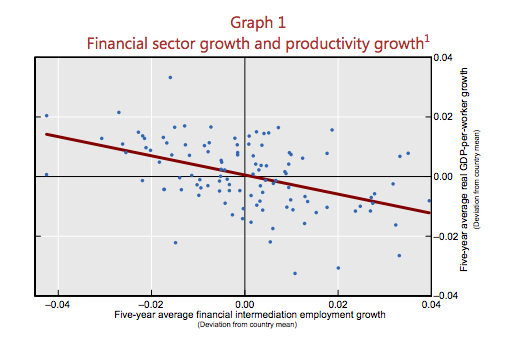

In a bit of synchronicity, two new papers confirm the long-held suspicion that Wall Street is sucking the life out of Main Street. The BIS has released an important paper, embedded at the end of this post, which has created quite a stir, even leading the orthodoxy-touting Economist to take note. Titled, Why does financial sector growth crowd out real economic growth?, its analysis of why too much finance is a bad thing is robust and compelling.

This article is a follow up to a 2012 paper by the same authors, Stephen Cecchetti and Enisse Kharroubi, which found that when finance sectors exceeded a certain size, specifically when private sector debt topped 100% of GDP or when financial services industry professions were more than 3.9% of the work force, it became a drag on growth. Notice that this finding alone is damning as far as policy in the US is concerned, where cheaper debt, deregulation, more access to financial markets, and “financial deepening” are all seen as virtuous.

The paper is short and accessible, so I strongly encourage you to read it in full. The paper starts by looking empirically at the fact that larger financial sectors are correlated with lower growth rates:

And the big reason is one that is no surprise to anyone in the US, that finance has been sucking “talent,” as in the best and brightest from a large range of disciplines, ranging from mathematicians, physicists, the best MBAs (which remember could be running manufacturing operations or in high-growth real economy businesses) and lawyers. The banking sector’s gain is Main Street’s loss.

Read more …

A losing proposition.

• Saudi King Unleashes Torrent Of Money As Bonuses Flow To The Masses (NY Times)

European leaders are still battling over austerity. The United States Congress is gearing up for another fight over the budget. But in Saudi Arabia, there are no such troubles when you are king — and you just dole out billions and billions of dollars to ordinary Saudis by royal decree. Not surprisingly, Saudis are very happy with their new monarch, King Salman. “It is party time for Saudi Arabia right now,” said John Sfakianakis, the Riyadh-based Middle East director of the Ashmore Group, an investment company, who estimates that the king’s post-coronation giveaway will ultimately cost more than $32 billion. That is a lot of cash, more, for example, than the entire annual budget for Nigeria, which has Africa’s largest economy.

Since King Salman ascended the throne of this wealthy Arab kingdom last month, he has swiftly taken charge, abolishing government bodies and firing ministers. But no measure has caused as much buzz here as the giant payouts he ordered to a large chunk of the Saudi population. These included grants to professional associations, literary and sports clubs; investments in water and electricity; and bonuses worth two months of salary to all government employees, soldiers, pensioners and students on government stipends at home and abroad. Some private companies followed suit with comparable bonuses for their Saudi employees, putting another few billion dollars into people’s pockets. Some of the government spending will come over years, but most will hit the Saudi market this month, including the bonuses.

About three million of Saudi Arabia’s 5.5 million-person work force are employed by the government, Mr. Sfakianakis said. So, for the moment at least, there is little talk about human rights abuses or political reform. Saudis are spending. Some have treated themselves to new cellphones, handbags and trips abroad. They have paid off debts, given to charity and bought gold necklaces for their mothers. Some men have set aside money to marry a first, second or third wife. One was so pleased that he showered his infant son with crisp bills. “The first thing I did was go and check my storerooms,” said Abdulrahman Alsanidi, who owns a camping supply store in Buraida, north of Riyadh. He expected a 30% jump in sales.

Saudi rulers have long used the wealth that comes from being the world’s top oil exporter to lavish benefits on their people, and many Saudis describe royal largess as part of a family-like social contract between rulers and loyal citizens. But the new spending comes amid change and uncertainty for the kingdom. King Salman ascended the throne after the death of King Abdullah and announced the bonuses as a good-will gesture to his people. But because about 90% of government income comes from oil, the drop in world prices has reduced state revenue by about 20%, said Rakan Alsheikh, a research analyst at Jadwa Investment. His company projected that the government would run a record deficit of $44.5 billion in 2015. The new spending could increase that deficit to $67.2 billion, or 9% of GDP, Mr. Alsheikh said.

Read more …

Hamsters in a wheel.

• Supertankers Speed Up as Oil Prices Fall (Bloomberg)

The world’s supertankers are moving at the fastest speeds in 2 1/2 years as a collapse in oil prices spurs demand for cargoes and drives up daily returns owners can make from deliveries. Very large crude carriers, each about 1,000-feet long and able to transport 2 million barrels of oil, sailed at an average of 12.57 knots this month, according to data from RS Platou Economic Research, an Oslo-based firm. The fleet, whose steel weight is about 27 million metric tons, last moved that fast in August 2012. Tanker rates have surged amid signals that China accelerated purchases of crude to fill its stockpiles after Brent crude, the global benchmark, collapsed last year. Prices plunged in part because OPEC pledged to keep pumping oil amid a global oversupply.

The ships earned an average of more than $71,000 a day since the start of January, the best start to a year in Baltic Exchange data that begin in mid-2008. “Freight rates are high because there’s a lot of oil trade at the moment,” Frode Moerkedal, an Oslo-based analyst at Platou Markets, an investment adviser linked to the research company, said by phone on Thursday. “OPEC has refused to cut production so there’s more oil being shipped.” VLCC speeds from 14-to-16 Feb. were 6.7% higher than 14-to-16 Nov., according to Platou. The speed for the ships when voyaging without cargoes rose 10% over the same period to 13.31 knots.

The daily average rate to hire a VLCC on the benchmark Middle East-to-East Asia route was $71,772 so far in the first quarter, compared with an average of $47,614 in the fourth quarter, according to Baltic Exchange data. VesselsValue, a London-based firm that provides shipping data, also estimates VLCCs are sailing at the fastest since 2012. The acceleration is in part because falling oil prices have cut fuel costs and made it more profitable for owners to transport cargoes, said Kaizad Doctor, analytics director. Ship fuel is known as bunker. “This can be attributed to the simultaneous decrease in the oil prices and the consequent reduction in bunker prices but also due to the increase in rates caused by the Chinese re-stocking cut-price crude,” Doctor said.

Read more …

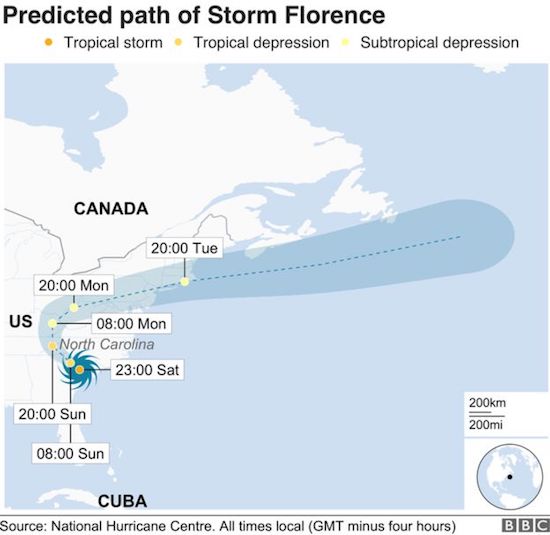

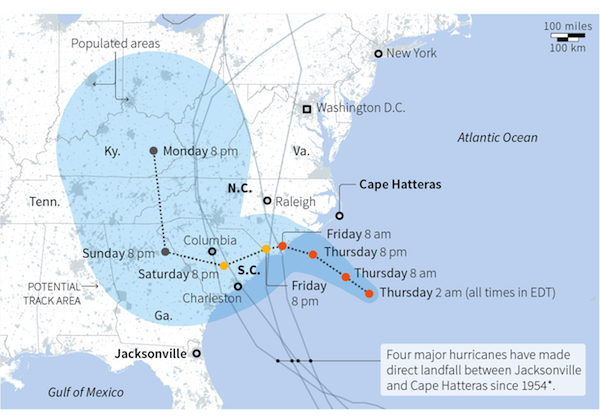

Luckliy it hits a low population density area. Someone told me winds could reach 300 km/h, that’s insane.

• Cyclone Slams Into Northeast Australia (Reuters)

Tens of thousands of Australians hunkered down on Friday as a powerful cyclone crossed the northeast, damaging houses, bringing down trees, cutting power lines and causing flash flooding, while a second storm made landfall to the west. The major storm caught Queensland state almost unawares after it intensified in just a few hours before slamming into the coast midmorning as a category 5 system – the highest rating. Emergency services scrambled to evacuate thousands of homes in the direct path of Cyclone Marcia before pulling out and warning anyone who had not left to barricade themselves inside to avoid wind gusts peaking at 285 kph (177 mph). Rail lines to coastal ports, an essential part of Queensland’s A$280 billion ($218 billion) commodities export-driven economy, were brought to a standstill.

“Stay indoors, don’t go outside,” Queensland Premier Annastacia Palaszczuk told a news conference as the storm passed over the coastal town of Yeppoon, home to 16,000 people about 550 km (340 miles) north of the state capital, Brisbane. She warned the 75,000 residents of Rockhampton, just south of Yeppoon, that Marcia still posed great danger even though it had weakened to a category 3 system: “The eye of the storm is heading directly towards you.” Meteorologists said the worst of the winds should ease by Friday afternoon local time but warned heavy rains and flooding were likely to continue for several days and extend inland. More than 10% of Australia’s sugar crop is at risk from Marcia, an industry body warned. The world’s No. 3 exporter of raw sugar is set to produce 4.6 million tonnes of the commodity in 2015.

BHP Billiton suspended rail lines hauling coal from its inland collieries to the massive Hay Point shipping terminal on Friday until further notice. Marcia’s forecast trajectory indicated the impact on coal mining was expected to be less severe than in 2011, when Queensland missed its annual coal export target by 40 million tonnes after storms dumped unprecedented amounts of rain into coal pits.

Read more …

There’s a new question out there: how stupid does stupid get?

• How Rudy Giuliani Marginalized Himself (WaPo)

Here’s Rudy Giuliani Wednesday night on President Obama, according to a report in Politico: “I do not believe — and I know this is a horrible thing to say — but I do not believe that the president loves America. He doesn’t love you. And he doesn’t love me. He wasn’t brought up the way you were brought up and I was brought up through love of this country.” First off, a piece of advice. If you have to preface what you are planning to say with “this is a horrible thing to say,” you probably shouldn’t say it. Second, Giuliani’s comments seems to reflect a final stage of his transformation from serious politician to guy-who-says-inflamatory-things-just-to-say-inflammatory-things. (Remember his comments about the deaths of young black men last fall?)

Let’s be clear: NO politician with any sort of national ambition – or any sort of ambition at all, really – would say what Giuliani reportedly said about Obama. Not one. Questioning patriotism is a line that simply is not crossed at that level of politics. And there’s a reason for that: Once you question whether someone “loves” this country, the possibility – remote as it may have been before that comment – of a civilized debate between two sides goes out the window. But there’s something even more noxious, politically speaking, going on with Giuliani’s comments. It’s not just the questioning of Obama’s patriotism but also the suggested “otherness” of Obama that is at work here. “He wasn’t brought up the way you were brought up and I was brought up,” said Giuliani. Context matters here – and makes matters worse for the former New York mayor.

The setting was a private dinner – featuring Wisconsin Gov. Scott Walker – at a New York restaurant to a group described by Politico as “60 right-leaning business executives and conservative media types.” Making the “Obama isn’t really like you and me” argument in that setting plays into a corrosive racial narrative that Republicans have worked very hard to steer away from – and smartly so – during the Obama presidency. So, why the hell did Giuliani say it? Most likely because he believes it. Remember that Giuliani’s most formative experience as a national politician was the terrorist attacks of Sept. 11, 2001, when he was serving as New York’s mayor. In the aftermath of those attacks and during the entirety of his 2008 bid for president, he was the most aggressive voice in the party for an active policy to root out the growing threat of non-state terrorists.

Read more …

Well, that’s a surprise…

• US and UK Spy Agencies Stole The Secrets Keeping Your Phone Secure (Engadget)

You might not have heard the name “Gemalto” before, but you almost certainly have one of their products in your pocket. As the world’s largest maker of SIM cards, it’s a company that’s directly responsible for making sure your cell phone connects to the right wireless network. According to documents released by Edward Snowden and obtained by The Intercept, though, it was also the target of a covert, coordinated hack committed by NSA agents and allies at Britain’s Government Communications Headquarters. Their goal? To quietly get their hands on the encryption keys that keep our phone calls and text messages private so they could tap people’s communications without raising suspicions. Gemalto never saw it coming.

The operation sounds more than a little like a pulp cyberpunk novel, starting with the creation of the Mobile Handset Exploitation Team in mid-2010. It was ajoint team of operatives from both agencies, and they promptly got to work. It wasn’t long before they breached Gemalto’s networks and used malware to open a backdoor (later hacks targeted some of the company’s biggest rivals). Then they used the NSA’s XKeyscore tool to dig into the email and social accounts of employees in search of data that would lead them in the right direction. Eventually, through prolonged surveillance, the team succeeded in harvesting millions of so-called “kis” – the encrypted identifier shared by your SIM card and the wireless carrier it’s attached to.

By striking before the keys could be transferred to Gemalto’s carrier partners, the MHET could scoop them up hand over fist, and (surprise, surprise) there’s no firm word on how many of more those keys have slurped up by Western intelligence agencies. So what’s an intensely curious government body supposed to do with all these things? Use them to speed up the surveillance process, naturally. With a treasure trove of keys at their disposal, groups like the NSA can take the easy way out and use data collection tools (like “spy nest” antennas sitting atop embassies) to slurp up encrypted communications on the fly. Since they’ve already got the keys handy, they can just decrypt voice calls and text messages at their own leisure. The whole thing is equal parts brilliant and horrifying.

Worst part is, we’re probably all susceptible to surveillance. The combination of Gemalto’s worldwide prominence and the NSA and GCHQ’s craftiness made sure of that. We’re not totally screwed, though – using secure services like TextSecure and SilentCircle for calls and texts add an extra layer of protection the NSA can’t easily break into. These days, basically nothing is 100% secure, but that doesn’t mean we have to make it easy for any potentially prying eyes.

Read more …

“Most struggle on far less than $1 a day.”

• Millions At Risk From Rapid Sea Rise In Swampy Bay of Bengal Islands (AP)

The tiny hut sculpted out of mud at the edge of the sea is barely large enough for Bokul Mondol and his family to lie down. The water has taken everything else from them, and one day it almost certainly will take this, too. Saltwater long ago engulfed the 5 acres where Mondol once grew rice and tended fish ponds, as his ancestors had on Bali Island for some 200 years. His thatch-covered hut, built on public land, is the fifth he has had to build in the last five years as the sea creeps in. “Every year we have to move a little further inland,” he said. Seas are rising more than twice as fast as the global average here in the Sundarbans, a low-lying delta region of about 200 islands in the Bay of Bengal where some 13 million impoverished Indians and Bangladeshis live.

Tens of thousands like Mondol have already been left homeless, and scientists predict much of the Sundarbans could be underwater in 15 to 25 years. That could force a singularly massive exodus of millions of “climate refugees,” creating enormous challenges for India and Bangladesh that neither country has prepared for. “This big-time climate migration is looming on the horizon,” said Tapas Paul, a New Delhi-based environmental specialist with the World Bank, which is spending hundreds of millions of dollars assessing and preparing a plan for the Sundarbans region. “If all the people of the Sundarbans have to migrate, this would be the largest-ever migration in the history of mankind,” Paul said.

The largest to date occurred during the India-Pakistan partition in 1947, when 10 million people or more migrated from one country to the other. Mondol has no idea where he would go. His family of six is now entirely dependent on neighbors who have not lost their land. Some days they simply don’t eat. “For 10 years I was fighting with the sea, until finally everything was gone,” he says, staring blankly at the water lapping at the muddy coast. “We live in constant fear of flooding. If the island is lost, we will all die.” On their own, the Sundarbans’ impoverished residents have little chance of moving before catastrophe hits.

Facing constant threats from roving tigers and crocodiles, deadly swarms of giant honeybees and poisonous snakes, they struggle to eke out a living by farming, shrimping, fishing and collecting honey from the forests. Each year, with crude tools and bare hands, they build mud embankments to keep saltwater and wild animals from invading their crops. And each year swollen rivers, monsoon rains and floods wash many of those banks and mud-packed homes back into the sea. Most struggle on far less than $1 a day. With 5 million people on the Indian side and 8 million in Bangladesh, the Sundarbans population is far greater than any of the small island nations that also face dire threats from rising sea levels.

Read more …

“Cambridge Beauty Chocolate, contains as much as a 300 g fillet of Alaskan salmon..”

• Wrinkle-Smoothing Chocolate To Make A Splash (RT)

The first wrinkle-removing chocolate is set to hit stores and spa salons in the UK as soon as March. The anti-aging chocolate is not only capable of improving skin conditions, but is low calorie and safe for diabetics. The tantalizing new product, called Esthechoc, has been developed by the Cambridge-based company Lycotec. The founder of the company, Dr Ivan Petyaev, is a former researcher at Cambridge University. The researchers say their anti-aging chocolate is based on 70% cocoa dark chocolate and contains a wealth of the antioxidants astaxanthin and cocoa polyphenol. The developers claim just a small bar of 7.5g of the Esthechoc, which is also called Cambridge Beauty Chocolate, contains as much as a 300 g fillet of Alaskan salmon. Dr Petyaev says the researchers used the same antioxidants that keep goldfish gold and flamingos pink.

These substances improve the blood supply to the skin, thereby reducing wrinkles and making the skin look younger. We used people in their 50s and 60s and in terms of skin biomarkers we found it had brought skin back to the levels of a 20 or 30 year old, Petyaev said as cited by the Telegraph. So we ve improved the skin s physiology. According to the Lycotec scientists, the volunteers who ate the chocolate every day for four weeks of trials had visibly improved the condition of their skin. But while the benefits may come in a flash, working out the bite-sized fountain of youth was a far more laborious process. Esthechoc is the result of 10 years of extensive independent research on cocoa polyphenols and free radicals, as well as clinical exploration and numerous trials, a spokesman for the firm said.

Over 3,000 patients have participated in medical research and clinical tests. The creators of the anti-aging chocolate say it also improves blood circulation, and since it only contains 38kcal, it will be safe even for people suffering from diabetes. The researchers say they hope to attract customers at spas, salons and similar outlets. Nevertheless, critics of the anti-aging chocolate say the antioxidants work better if applied to skin directly rather than being taken orally. They have demanded more clinical trials to prove the effectiveness of the product. Dr George Grimble, nutritionist of University College London, told the Telegraph that while it had a good track record science-wise, it is too early to say what the long term benefits might be.

Read more …