Lewis Wickes Hine Whole family works, Browns Mills, New Jersey 1910

Beautiful Brexit bursts bubbles.

• Brexit Opens Up Bank Fault Line From Milan To Lisbon (R.)

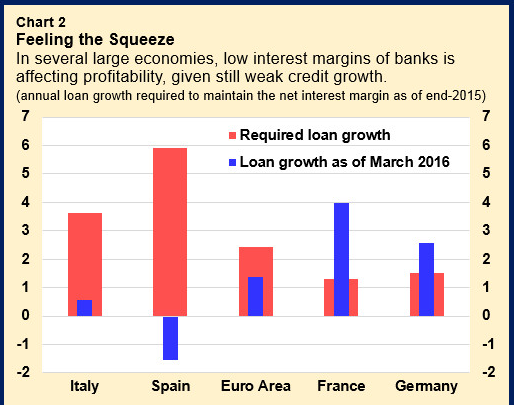

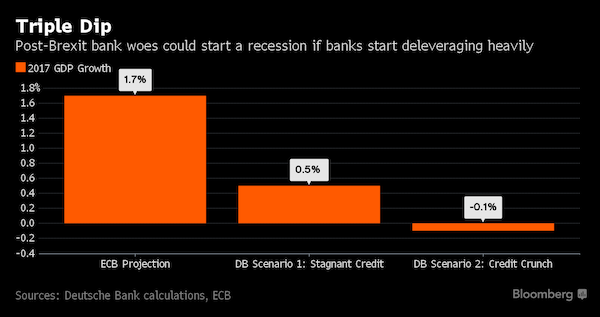

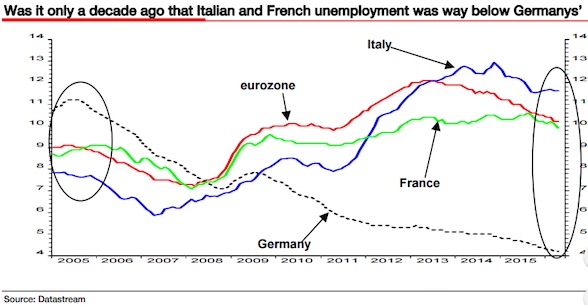

The ripples from Britain’s decision to leave the EU have spread across Europe to its southwestern edge, where Portugal is quietly struggling to contain a banking crisis. Since Britain’s shock vote on June 23 for a “Brexit”, attention in the banking sector has mainly focused on Italy, where non-performing loans are causing concern, bank shares have tumbled and confidence has sunk. Political tensions in Europe have also deepened, with Rome and Lisbon trying to bend EU rules on helping laggard banks but meeting resistance from economic powerhouse Germany and the executive European Commission. “It’s putting the whole banking system under stress,” said Gunnar Hokmark, a lawmaker in the European Parliament, echoing the nervousness expressed by investors who spoke to Reuters.

“It will be serious for countries in a fragile situation,” said Hokmark, who helped write rules imposing losses on bondholders and large depositors of failing banks which Portugal and Italy want loosened to allow state help. Portugal’s problems have attracted fewer headlines than Italy’s but its predicament is potentially no less painful. Data show Portuguese savings are being spent, unlike in Italy, and private debt is much higher. A euro zone official who asked not be identified said Portugal’s situation was as critical as Italy’s but it was unlikely to be treated with leniency because it was smaller and posed no “systemic” threat to Europe’s financial stability. Portugal sees it differently. “Wherever you look, there is a threat or a risk,” said Filipe Garcia, a financial expert and consultant in Portugal.

Read more …

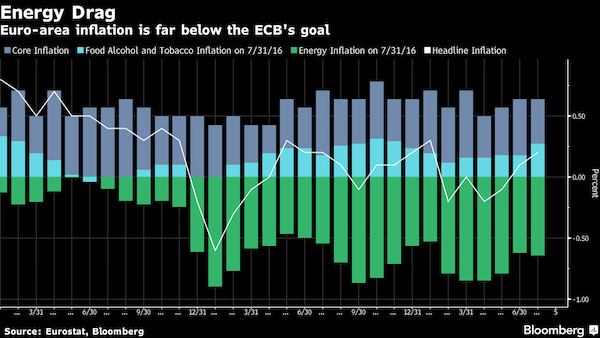

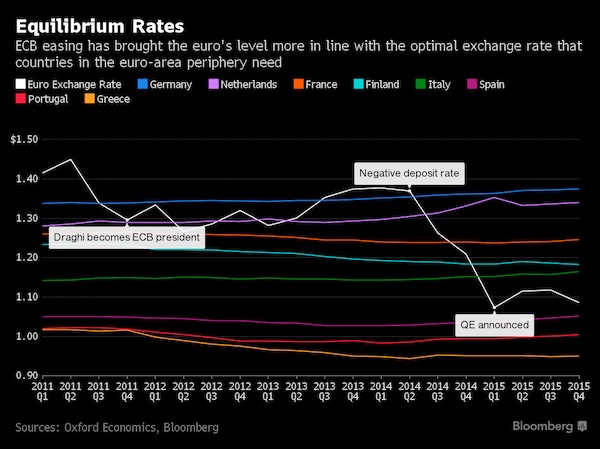

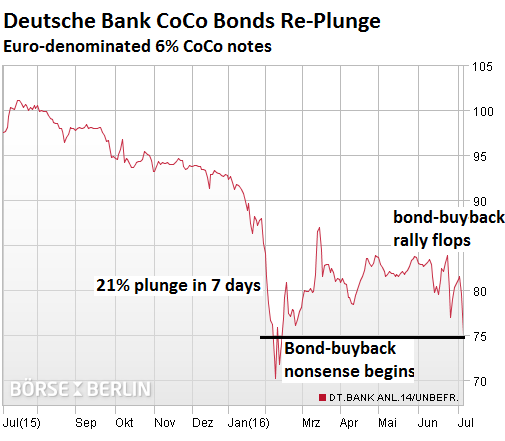

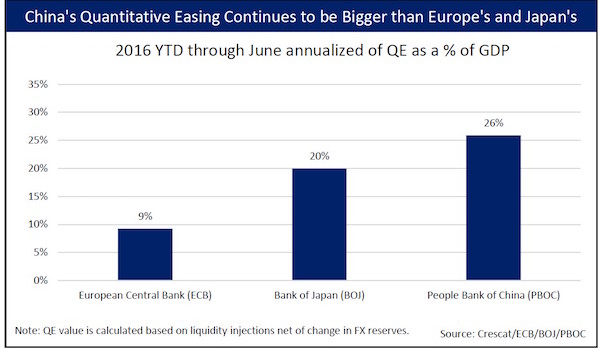

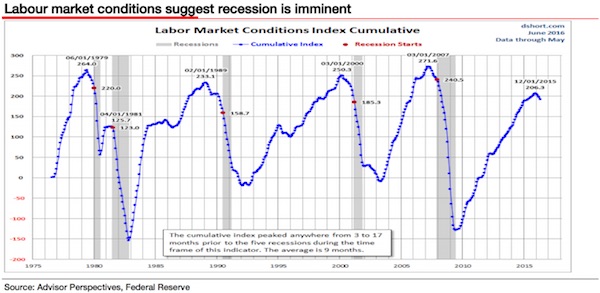

How much did Draghi spend to reach this point?

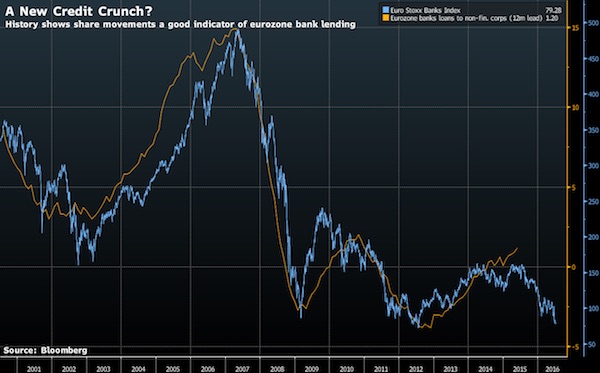

• Europe Banks Close to Breaching 2011 Crisis Lows on Italy Woes (BBG)

European banks have fallen to levels not seen since the worst days of the region’s debt crisis as turmoil surrounding Italy’s lenders intensified. Worries about market contagion dragged the Stoxx Europe 600 Banks Index just 1.4% away from its 2011 low. Most of Europe’s banks lost at least 40% of their value in the last year – Banco Popular Espanol, Banca Monte dei Paschi di Siena, Deutsche Bank and Credit Suisse reached fresh record lows this week.

Read more …

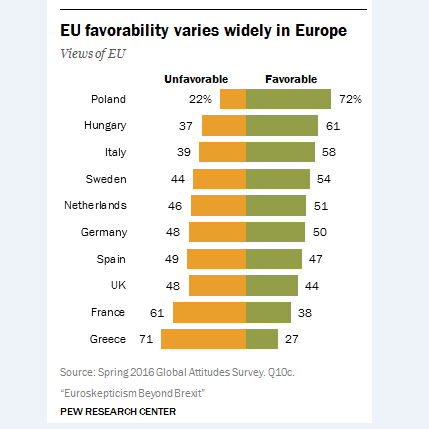

If EU sanctions Madrid and Lisbon, it can’t leave others be.

• EU Declares Spain, Portugal In Violation Of Deficit Rules (EuA)

The European Commission on Thursday (7 July) officially declared Spain and Portugal in violation of the EU rules on government overspending, the first step towards unprecedented penalties against members of the 28-country bloc. “The Commission confirms that Spain and Portugal will not correct their excessive deficits by the recommended deadline,” the EU’s executive arm said in a statement. If endorsed by the EU’s finance ministers, the Commission is then legally obliged to propose fines against the two neighbouring countries, which were both hit hard by the financial crisis. “Lately, the two countries have veered off track in the correction of their excessive deficits and have not met their budgetary targets,” said Valdis Dombrovskis, the EU Commission’s VP in charge of the euro.

“We stand ready to work together with the Spanish and Portuguese authorities to define the best path ahead,” he said. Many EU powers led by Germany have long hoped for the Commission to finally crack down on public overspenders, but with populist fires burning after the Brexit vote, ministers meeting in Brussels on Tuesday could decide to delay their immediate endorsement. “There is uncertainty creeping in light of the UK vote result,” an EU diplomat told AFP. France and Italy will be the most willing to delay the penalty process, fearing that their own years of EU rule breaking would put them next in line for a sanction by Brussels. Ahead of the Commission announcement, Portuguese Prime Minister Antonio Costa warned that Brussels would foster a rise in Euroscepticism in Portugal if EU sanctions are applied.

Read more …

Brexit bursts bubbles. Is that a bad thing?

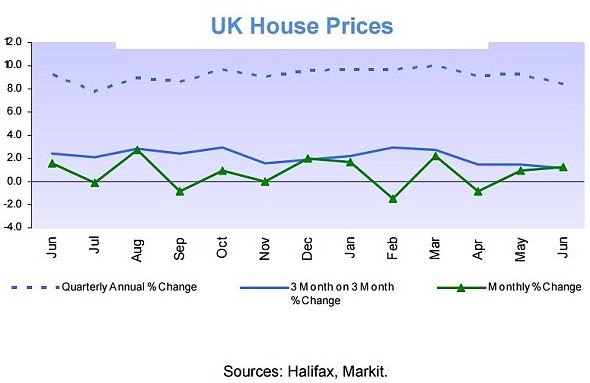

• UK Property Fund Turmoil Continues As Three More Firms Cut Value (G.)

Shopping centres, office blocks and warehouses worth up to £5bn could be put up for sale as the turmoil in the UK commercial property sector prompted by the Brexit vote forces fund managers to revalue their portfolios or temporarily prevent investors withdrawing their savings. With the pound under pressure on the foreign exchange markets, fund managers Legal & General, Foreign & Colonial and Dutch-owned Kames cut the value of their property funds on Thursday. L&G cut the value of its £2.3bn fund by 10% – following a 5% cut last week – while F&C and Kanes both cut by 5%. Aberdeen Fund Management announced on Wednesday it was halting trading in its property fund for 24 hours and devaluing it by 17% – thought to be the biggest adjustment ever made by a property fund.

Aberdeen has since extended the trading ban until Monday. Others have suspended dealings for longer, starting with Standard Life’s decision on Monday to halt trading in its £2.9bn commercial property fund, leading to a cascade effect with Aviva, Prudential’s M&G, Henderson, Columbia Threadneedle and Canada Life following suit – taking the total value of property funds suspended to £18bn. Mike Prew, equity analyst at Jefferies, said buildings could be sold to find the cash to repay investors in the funds: “We estimate that £3bn to £5bn of assets could be put up for sale but it’s a trading vacuum and what sells is likely to get a hefty Brexit discount. “Buildings are now being readied for sale but keys to cash can typically take three to six months.”

One of the factors weighing on sentiment is uncertainty about the role of London as a financial centre outside the EU. George Osborne, the chancellor, met the heads of major international banks including Goldman Sachs and Morgan Stanley on Thursday to discuss ways to keep the City as a major trading centre. “We are determined to work together,” they said in a joint statement.

Read more …

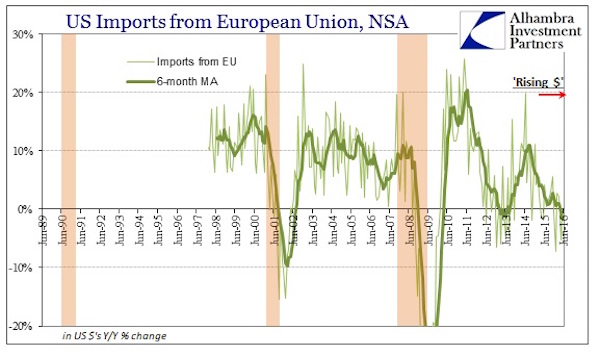

Ambrose lags me by a week: Deflation Is Blowing In On An Eastern Trade Wind

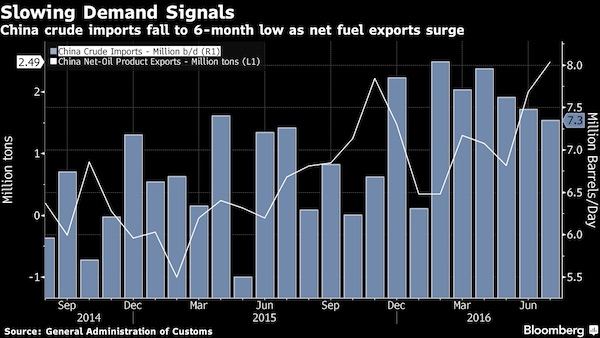

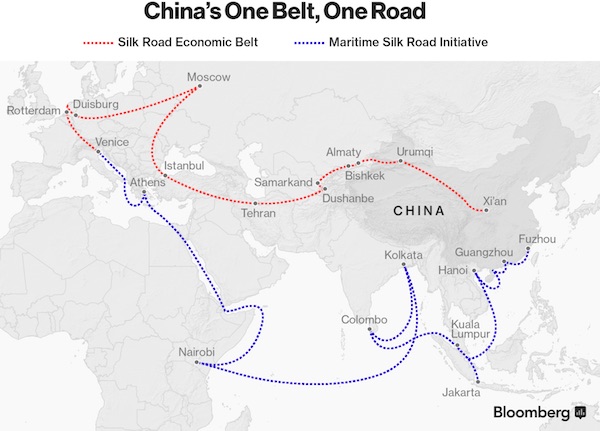

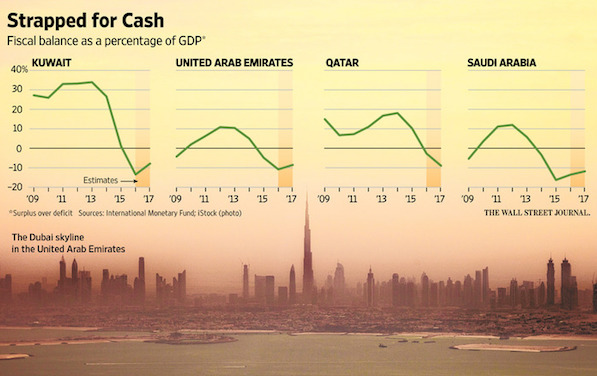

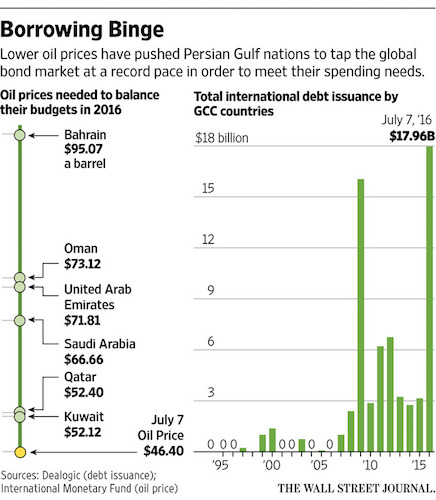

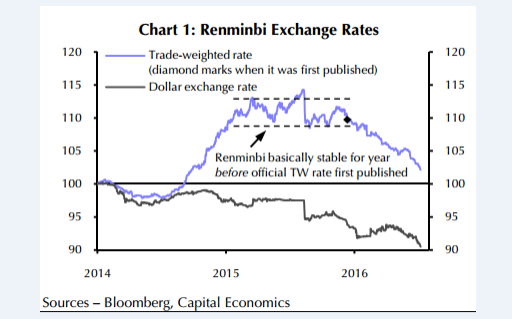

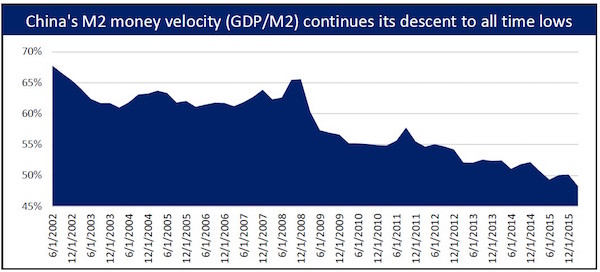

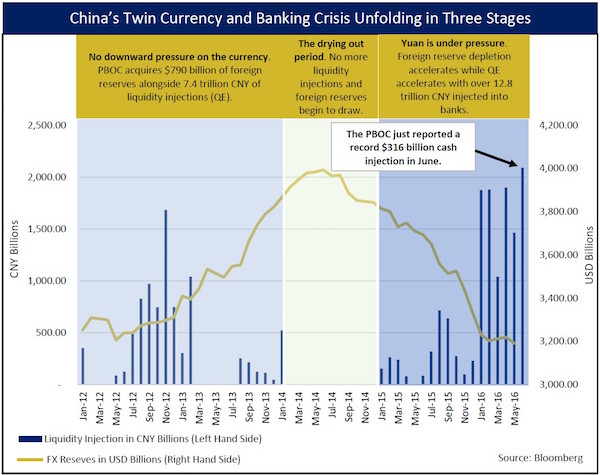

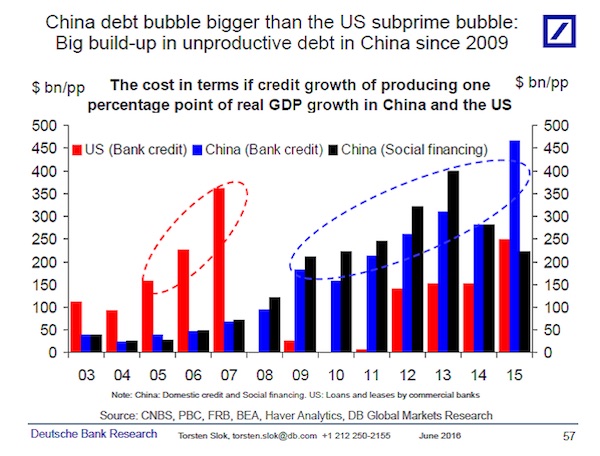

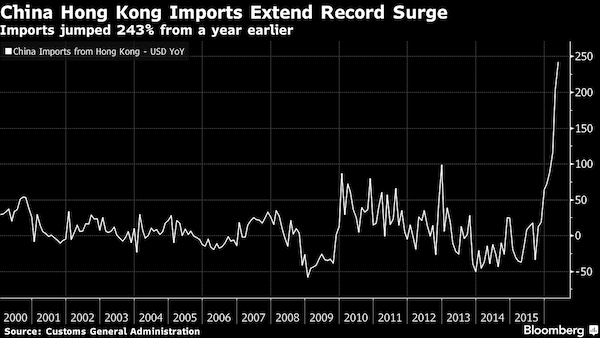

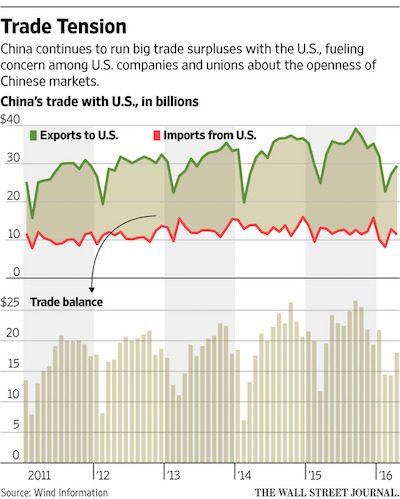

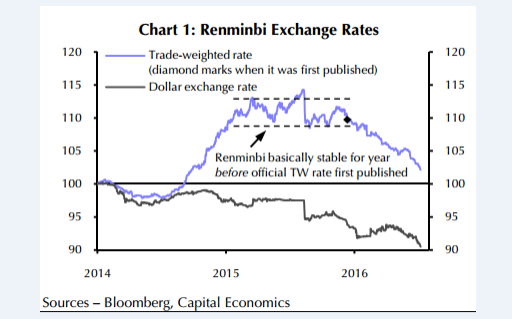

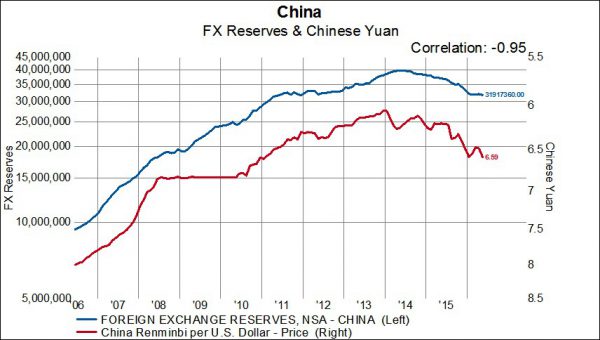

• World Faces Deflation Shock As China Devalues At Accelerating Pace (AEP)

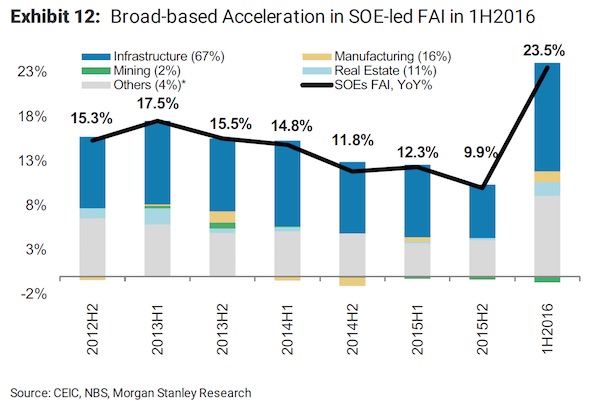

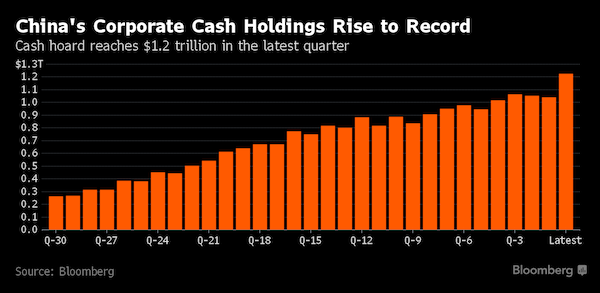

China has abandoned a solemn pledge to keep its exchange rate stable and is carrying out a systematic devaluation of the yuan, sending a powerful deflationary impulse through a global economy already caught in a 1930s trap. The country’s currency basket has been sliding at an annual pace of 12pc since the start of the year. This has picked up sharply since the Brexit vote, suggesting that the People’s Bank (PBOC) may be taking advantage of the distraction to push through a sharper devaluation. “This makes a mockery of the PBOC’s suggestion that its policy is to keep the currency’s value stable,” said Mark Williams, chief China economist at Capital Economics. “Markets will not take PBOC policy statements at face value in the future.”

Mr Williams said it is unclear whether Beijing intended to deceive investors all along when it gave categorical assurances earlier this year, or whether it is feeding on events. Either way the markets have stopped believing what they are told, storing serious trouble for the authorities should there be another surge in capital flight later this year, as widely expected. “When it comes, the PBOC will find itself sorely lacking in credibility. It may have to intervene on a large scale to maintain control,” he said. Factory gate prices within China are falling at a rate of 2.9pc, further amplifying the deflationary impact. Analysts fear that Beijing is engaged is an undeclared policy of beggar-thy-neighbour mercantilism, trying to avert an industrial crisis at home by exporting its overcapacity in steel, shipbuilding, chemicals, plastics, paper, glass, and even solar panels, to the rest for the world.

“When you have a relatively closed capital account like China, it means that any currency move like this is a policy decision,” said Hans Redeker, currency chief at Morgan Stanley. “They seem to be overriding their own model and letting the remnimbi (yuan) fall to improve competitiveness. They are in the same sort of deflationary syndrome as Japan in the 1990 but on a much bigger scale. The global economy is in no position to absorb this.”

Read more …

Again, Deflation Is Blowing In On An Eastern Trade Wind.

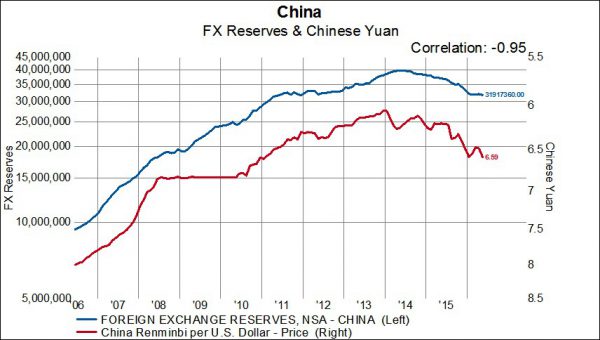

• Forget Brexit, Watch China And The Renminbi (VW)

As the world’s attention has been fixed on Brexit and meltdown of the European financial system, China has been quietly devaluing its currency without causing too much turbulence in the financial markets as it did the last time policymakers attempted such a strategy. On Wednesday the yuan fell to a fresh five-and-a-half-year low against the dollar extending its slide to a fifth straight session, after China’s central bank sharply weakened its official guidance rate as the dollar surged. The yuan traded as low as 6.6955 against the dollar at one point, closing in on the psychologically important 6.7 level. China’s policymakers have made it clear that they are willing to let the yuan fall as low as 6.8 per dollar in 2016 to support struggling exporters, a depreciation of 4.5% for the full year matching last year’s decline.

This time around China’s central bank is trying to send a message to the markets that it has the depreciation under control. Reuters reports that traders believe state-owned banks across the country are offering dollars to soothe markets while the People’s Bank of China has been intervening in the foreign exchange market to slow down the yuan’s decline. Forex reserves fell by $27.9 billion in May to $3.19 trillion, their lowest since December 2011 although currency movements are almost entirely to blame for the decline. The renminbi depreciated by 1.8% during May. FX reserves increased by $10.3 billion during March and $7.1 billion during April.

Read more …

Not enough paper left.

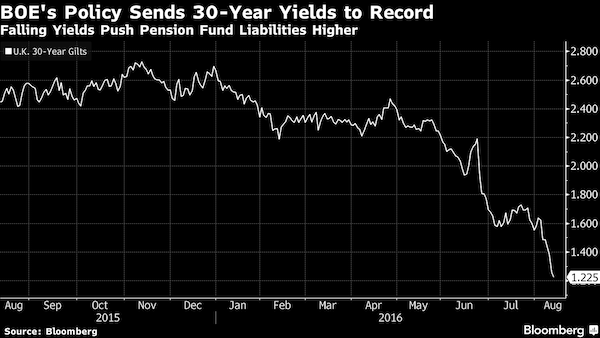

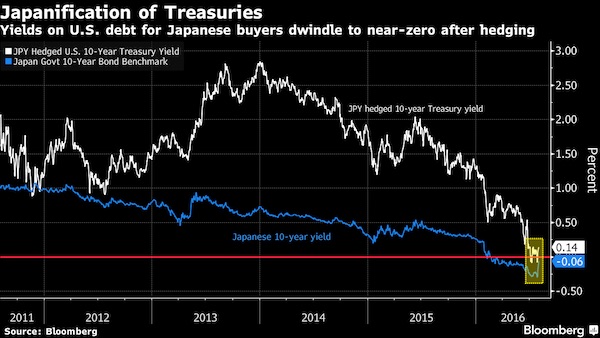

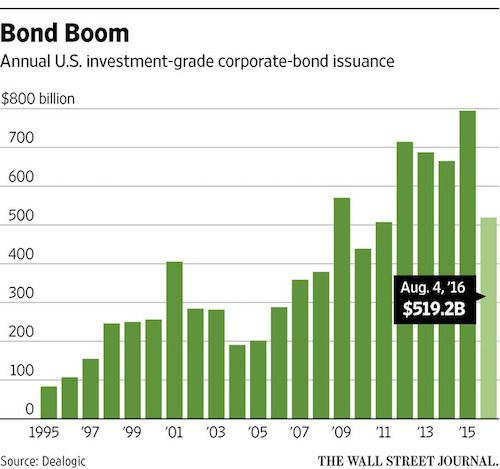

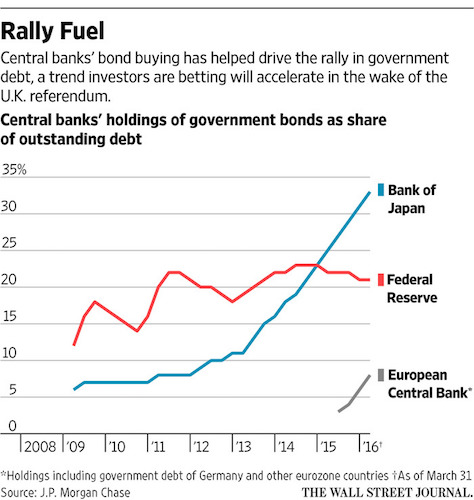

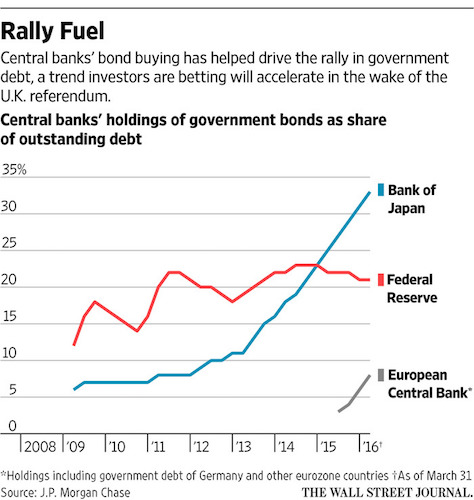

• Central Banks Put Squeeze on Sovereign-Debt Market (WSJ)

Christopher Sullivan, a money manager in New York, is worried that when he needs U.S. Treasury bonds one day, he might not be able to get them. On the surface, the concern might seem unwarranted: The U.S. Treasury has $13.4 trillion in debt securities outstanding, making the U.S. bond market the largest in the world and Treasurys among the most easily traded asset classes. But Mr. Sullivan, who oversees $2.3 billion as chief investment officer at the United Nations Federal Credit Union, said he is afraid that he may soon be squeezed out of that market as central banks continue to vacuum up high-quality debt around the world and nervous overseas investors turn to Treasurys for relief.

A buying spree by central banks is reducing the availability of government debt for other buyers and intensifying the bidding wars that break out when investors get jittery, driving prices higher and yields lower. The yield on the benchmark 10-year Treasury note hit a record low Wednesday. “The scarcity factor is there but it really becomes palpable during periods of stress when yields immediately collapse,’’ he said. ”You may be shut out of the bond market just when you need it the most.’’

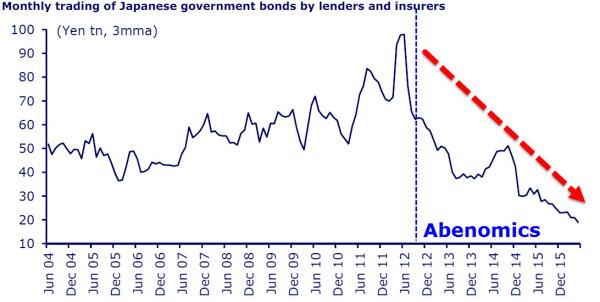

On Wednesday, the yield on the 20-year Japanese government bond fell below zero for the first time, joining a pool of negative-yielding bonds around the world that has expanded rapidly over the past year. In Switzerland, government bonds through the longest maturity, a bond due in nearly half a century, are now yielding below zero. In Germany, government debt with maturities out as far as January 2031 is trading with negative yields.

Read more …

Kuroda and Bernanke are meeting next week.

• Bond Market Is In An ‘Epic Bubble Of Colossal Proportions,’ Says Boockvar (CNBC)

One of the most crowded trades on Wall Street is about to implode, says one market watcher. “We’re in an epic bubble of colossal proportions,” Peter Boockvar, at The Lindsey Group, said Tuesday on CNBC’s ” Futures Now “. Global yields have been tumbling to record lows, with many dipping into negative territory. The U.S. 10-year hit its lowest level ever this week as traders continue to seek safety in the bond market. Yields move inversely to prices. However, Boockvar believes that this activity is a ticking time bomb for the global economy. He reasoned that U.S. Treasury yields are being dragged down by negative-yielding debt out of Germany, Japan and Switzerland and misplaced monetary policy, and is therefore skeptical as to how much longer the rally can continue.

“It could be central banks that end this,” said Boockvar in regard to upward momentum for bonds. In his recent coverage, he reacted to the newly released FOMC minutes and further questioned the Fed’s ability to act effectively. “They’ll call it being ‘patient.’ Their forecasts are now irrelevant, their communication is now meaningless and their tools to handle whatever might come our way are toothless,” noted Boockvar when describing the Fed’s ability to address a flattening yield curve. In Europe, concern for Italy’s economy continues to rise as that nation struggles to maintain negative interest rates while simultaneously raising capital for its banking system, which is straddled with mounting debt.

“Maybe Italian banks are telling us that central bankers and their negative interest rate policies are actually destroying the Japanese and European banking system?” asked Boockvar in the CNBC interview. He reasoned that Bank of Japan Governor Haruhiko Kuroda and ECB President Mario Draghi could take a look at what’s happening in Italy and decide that their respective monetary policies are the wrong course of action. Ultimately, Boockvar warned of the fallout that could occur if multiple nations opt to end what he referred to as a “negative deposit rate regime.” “Even if they put it back to zero, imagine the carnage, at least in the short-term bond markets,” concluded Boockvar.

Read more …

Once again: how to kill a city.

• Race And Real Estate: How Hot Chinese Money Is Making Vancouver Unlivable (G.)

Here’s one,” says Melissa Fong. She’s browsing online real estate listings in a cafe near Vancouver’s City Hall. Behind her, the mountains of the North Shore – the view that launched a thousand bidding wars – rise through mist. “Three-bedroom townhouse, 1,400 sq ft, C$1.5m (£800,000). You could start a family in a place like this. Way, way out of my price range, though.” Fong moves on, scrolling through half a dozen homes, each smaller than the last, until she arrives at a tiny, 500 sq ft condominium on the east side of the city. “Unassuming” would be a generous way to describe how it looks from the photos, which, tellingly, are all exterior shots. “You could live there if you only had one kid, right?” she says with a grim smile.

An urban planning researcher, Fong divides her time between Vancouver, where her elderly parents live, and Toronto, where she’s finishing a doctorate. She grew up in Vancouver, has deep roots in the city, and plans to settle here with her husband, a home renovator. But she has looked on with a mixture of frustration and horror as the cost of housing in Canada’s famously liveable city rise beyond the means of young professionals like her. “When you think it can’t get any worse, it does. So you keep adjusting your expectations, you know?”

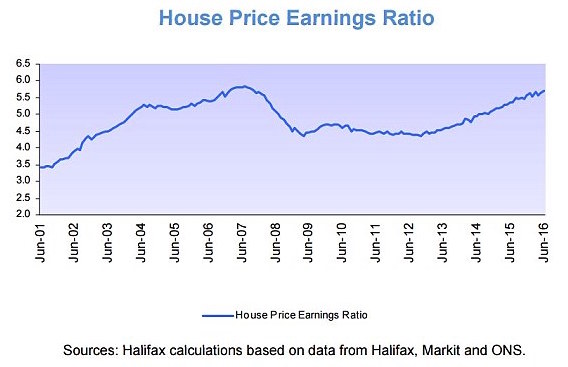

Over the past year, the price of a single family house in Vancouver increased by an incredible 30%, to an average of $1.4m. It’s just the latest, most dramatic jump in an already dramatic long-term trend that has turned the beautiful but unassuming Canadian city into one of the world’s least affordable, with a housing price-to-income ratio of 10.8. That’s third after Hong Kong and Sydney, and well ahead of London, which ranks eighth at 8.5. Driving the rise is an unprecedented flood of foreign capital, mainly from China.

“What you have is a huge pool of very wealthy people who want to hedge against uncertainty back home,” says Thomas Davidoff, a real estate economist at the University of British Columbia (UBC). “Combine anxious money – a lot of it – with a beautiful gateway city that has limited space to build, low property taxes, lax regulation on capital flows, and wealth-friendly immigration programmes, and you get a market like this one,” – a market where an ordinary house with a waterfront view can sell for $15m while people earning local wages struggle to buy or rent a home.

Read more …

Lemme guess. Because it’s f**king broke?

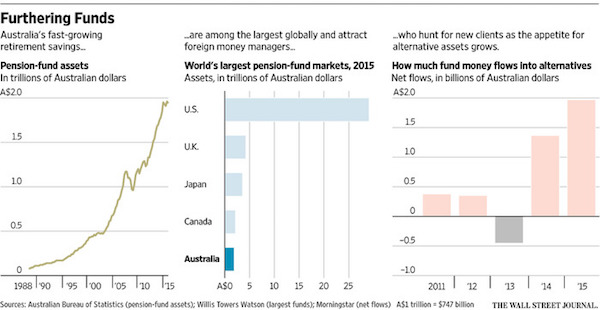

• Why Australia Could Be About To Lose Its AAA Rating (VW)

Australia’s AAA credit rating was under pressure even before the election and is now looking decidedly shaky. Ratings agency Standard & Poors has moved Australia’s rating outlook from “stable” to “negative”, due to debt and a poor chance of budget repair. This follows warnings from the other major credit rating agencies – Moody’s and Fitch Ratings. The problem is budget repair will only become harder over the coming years, whatever the final numbers in the parliament. On the parties’ approach to budget repair, the Coalition and Labor are virtually indistinguishable as far as the credit agencies are concerned. The May budget projected a deficit (in underlying cash terms) of A$37 billion in 2016-17, gradually falling to $6 billion over the four-year forward estimates.

Labor’s plan is to reduce the deficit from $39 billion to $11 billion over that time. Both Coalition and Labor forecast a return to surplus over the subsequent years and indeed quite large surpluses ten years from now. Budget repair on this scale was utterly implausible before the election and is fiction now. The government’s so-called “zombie” budget measures were baked into its projections over the forward estimate period. These were mainly the cuts to university funding, family payments and the Pharmaceutical Benefits Scheme. None of these had any prospect of being legislated with the past Senate, never mind with a larger, more powerful set of crossbench senators.

The Parliamentary Budget Office estimates these “zombie” measures to be worth $8 billion in total over the forward estimates. This accounts for roughly half of the difference between the total projected deficits of Coalition and Labor over the same period. In short, there is little or no prospect of achieving the budget repair that is a pre-requisite for maintaining Australia’s AAA credit rating. Both sides of politics need to spell out to all Australians what this means. The effect of a credit downgrade is like an income cut to households, businesses and government.

Read more …

Blair won’t be jailed, neither will Dubya or Cheney. But we could at least try to make sure this can’t happen again. By telling them of consequences before they pull these things.

• Chilcot’s Judgment Is Utterly Damning – But It’s Still Not Justice (Monbiot)

Little is more corrosive of democracy than impunity. When politicians do terrible things and suffer no consequences, people lose trust in both politics and justice. They see them, correctly, as instruments deployed by the strong against the weak. Since the first world war, no British prime minister has done anything as terrible as Tony Blair’s invasion of Iraq. This unprovoked war caused the deaths of hundreds of thousands of people and the mutilation of hundreds of thousands more. It flung the whole region into chaos, which has been skillfully exploited by terror groups. Today, three million people in Iraq are internally displaced, and an estimated 10 million need humanitarian assistance.

Yet Blair, the co-author of these crimes, whose lethal combination of appalling judgment and tremendous powers of persuasion made the Iraq war possible, saunters the world, picking up prizes and massive fees, regally granting interviews, cloaked in a forcefield of denial and legal impunity. If this is what politics looks like, is it any wonder that so many people have given up on it? The crucial issue – the legality of the war – was, of course, beyond Sir John Chilcot’s remit. A government whose members were complicit in the matter under investigation (Gordon Brown financed and supported the Iraq war) defined his terms of reference.

This is a fundamental flaw in the way inquiries are established in this country: it’s as if a defendant in a criminal case were able to appoint his own judge, choose the charge on which he is to be tried and have the hearing conducted in his own home. But if Brown imagined Chilcot would give the authors of the war an easy ride, he could not have been more wrong. The Chilcot report, much fiercer than almost anyone anticipated, rips down almost every claim the Labour government made about the invasion and its aftermath. Two weeks before he launched his war of choice, Tony Blair told the Guardian: “Let the day-to-day judgments come and go: be prepared to be judged by history.” Well, that judgment has just been handed down, and it is utterly damning.

Read more …

PCR gets mad: Elect Hillary and die.

• More Obscuration From The British Establishment (Paul Craig Roberts)

Sir John Chilcot, a member of the British establishment and also a member of the Butler Inquiry, the responsibility of which was to determine if the so-called “intelligence” used as the excuse for the US/UK invasion of Saddam Hussein’s Iraq was “fixed” to justify the invasion, has, after seven years of delay, finally issued its report. Remember, there was a leaked memo from the head of British intelligence that the intelligence justifying the Iraqi Invasion was “fixed” or orchestrated to produce the justification for the invasion, a war crime under the Nuremberg standard established by the United States. Chilcot’s job was to make this fact go away or assume less importance and to protect the Butler Inquiry’s orchestrated verdict that, despite the word of the head of British intelligence, the intelligence was not fixed.

In other words, Sir John’s assigned task under the guise of an “impartial inquiry” was to absolve former UK PM and war criminal Tony Blair not of all responsibility but of all responsibility deserving of prosecution. Sir John’s report is akin to FBI director Comey’s report on Hillary: They did it but they didn’t do it enough to be prosecuted. In the context of democratic politics, if such existed in England, Tony Blair would be in the crosshairs of the ruling UK party, the Tories or Conservatives. Yet, as both parties represent the same private interest groups, the Conservative Prime Minister, David Cameron, who has announced his resignation effective next October, rushed to the opposition party’s defense and gave in Parliament what former British Ambassador Craig Murray calls a “dishonest, apologia for the invasion that bore no relationship to the Chilcot report.”

The UK media, for the most part, also came out in defense of Tony Blair, the war criminal and liar, providing, according to Amb. Murray, “unlimited airtime to Blair and his defender Alastair Campbell” and “almost no airtime to those who campaigned against the war.” Here is the judgement of a British Ambassador, Craig Murray: “Blair is still a creature of absolute self-serving slime.” You could make the same judgment on almost every member of the Bill Clinton, George W. Bush, and Obama regimes. And Hillary’s regime would be even worse. My prediction is that life on earth would not survive Hillary’s first term. Elect Hillary and die.

Read more …

Not Klare’s strongest effort, but the risk is there.

• The United States and NATO Are Preparing for a Major War With Russia (Klare)

For the first time in a quarter-century, the prospect of war—real war, war between the major powers—will be on the agenda of Western leaders when they meet at the NATO Summit in Warsaw, Poland, on July 8 and 9. Dominating the agenda in Warsaw (aside, of course, from the “Brexit” vote in the UK) will be discussion of plans to reinforce NATO’s “eastern flank”—the arc of former Soviet partners stretching from the Baltic states to the Black Sea that are now allied with the West but fear military assault by Moscow. Until recently, the prospect of such an attack was given little credence in strategic circles, but now many in NATO believe a major war is possible and that robust defensive measures are required.

In what is likely to be its most significant move, the Warsaw summit is expected to give formal approval to a plan to deploy four multinational battalions along the eastern flank—one each in Poland, Lithuania, Latvia, and Estonia. Although not deemed sufficient to stop a determined Russian assault, the four battalions would act as a “tripwire,” thrusting soldiers from numerous NATO countries into the line of fire and so ensuring a full-scale, alliance-wide response. This, it is claimed, will deter Russia from undertaking such a move in the first place or ensure its defeat should it be foolhardy enough to start a war.

The United States, of course, is deeply involved in these initiatives. Not only will it supply many of the troops for the four multinational battalions, but it is also taking many steps of its own to bolster NATO’s eastern flank. Spending on the Pentagon’s “European Reassurance Initiative” will quadruple, climbing from $789 million in 2016 to $3.4 billion in 2017. Much of this additional funding will go to the deployment, on a rotating basis, of an additional armored-brigade combat team in northern Europe.

As a further indication of US and NATO determination to prepare for a possible war with Russia, the alliance recently conducted the largest war games in Eastern Europe since the end of the Cold War. Known as Anakonda 2016, the exercise involved some 31,000 troops (about half of them Americans) and thousands of combat vehicles from 24 nations in simulated battle maneuvers across the breadth of Poland. A parallel naval exercise, BALTOPS 16, simulated “high-end maritime warfighting” in the Baltic Sea, including in waters near Kaliningrad, a heavily defended Russian enclave wedged between Poland and Lithuania.

Read more …

Greek politics has degenerated into Class B theater, and that’s if you want to be overly generous.

• Pressure Mounts For Varoufakis’ Secret Plan X To Be Investigated (Kath.)

Opposition parties kept up the pressure on the government Wednesday to give a clearer account of its actions over the revelations in US economist James K. Galbraith’s latest book regarding preparations in Greece last year for a possible exit from the euro. The opposition pressed home its views on the matter despite the fact that coalition officials distanced themselves from the academic, who clarified exactly what role he played in 2015 while Yanis Varoufakis was finance minister. Writing on the website belonging to the DiEM25 movement founded by Varoufakis, Galbraith said that he had been asked by the then finance minister in March 2015 to “help with a delicate task.” “This was the preparation of a preliminary plan – requested by the prime minister – for the contingency that Greece might be forced out of the euro,” he wrote.

Galbraith said that he worked on a memorandum, called Plan X, for six weeks with a small group of experts that were sworn to secrecy. The economist insisted that the final note, which touched on issues such as issuing a new currency, setting up a new central bank and ensuring law and order, was not intended as a blueprint for exiting the euro but “an outline of measures that might have to be taken and of problems that could occur.” “It was not our mission to make recommendations, and we made none; we were preparing for a scenario that everyone had hoped to avoid,” wrote Galbraith. Despite the academic’s explanation, Alternate Finance Minister Giorgos Houliarakis launched a strong attack on Galbraith during a session in Parliament Wednesday. “Who is this gentleman?” said the ministry official. “What he is saying is unbelievably frivolous.”

Read more …

“Clinton signed documents declaring she had turned over all of her work-related emails. We now know that is not true. But even more importantly, the absence of emails raises troubling questions about the nature of the correspondence that might have been deleted.”

• The Strange Gaps in Hillary Clinton’s Email Traffic (Pol.)

The past few weeks have brought a myriad of revelations about the private server Hillary Clinton used while she was secretary of state. First, there was the State Department inspector general’s devastating critique of the former secretary’s email practices. Then came sworn testimony of two key Clinton aides about how the server was set up and how the system worked (or didn’t). Just this weekend, Clinton met with the FBI to discuss her email arrangements. And on Tuesday, FBI Director James Comey announced that the agency would not recommend criminal charges over the handling of these emails, while at the same time offering a brutal assessment of how poorly Team Clinton handled classified information.

But, when it comes to Clinton’s correspondence, the most basic and troubling questions still remain unanswered: Why are there gaps in Clinton’s email history? Did she or her team delete emails that she should have made public? The State Department has released what is said to represent all of the work-related, or “official,” emails Clinton sent during her tenure as secretary—a number totaling about 30,000. According to Clinton and her campaign, when they were choosing what correspondence to turn over to State for public release, they deleted 31,830 other emails deemed “personal and private.” But a numeric analysis of the emails that have been made public, focusing on conspicuous lapses in email activity, raises troubling concerns that Clinton or her team might have deleted a number of work-related emails.

We already know that the trove of Clinton’s work-related emails is incomplete. In his comments on Tuesday, Comey declared, “The FBI … discovered several thousand work-related e-mails that were not in the group of 30,000 that were returned by Secretary Clinton to State in 2014.” We also already know that some of those work-related emails could be permanently deleted. Indeed, according to Comey, “It is also likely that there are other work-related e-mails that [Clinton and her team] did not produce to State and that we did not find elsewhere, and that are now gone because they deleted all emails they did not return to State, and the lawyers cleaned their devices in such a way as to preclude complete forensic recovery.”

Why does this matter? Because Clinton signed documents declaring she had turned over all of her work-related emails. We now know that is not true. But even more importantly, the absence of emails raises troubling questions about the nature of the correspondence that might have been deleted.

Read more …

Saw that coming from miles away.

• Marine’s Defense For Handling Classified Info Will Cite Hillary Case (WaPo)

A Marine Corps officer who has been locked in a legal battle with his service after self-reporting that he improperly disseminated classified information will use Hillary Clinton’s email case to fight his involuntary separation from the service, his lawyer said. Maj. Jason Brezler’s case has been tied up in federal court since he sued the service in December 2014. He became a cause celebre among some members of Congress, Marine generals and military veterans after he sent a classified message using an unclassified Yahoo email account to warn fellow Marines in southern Afghanistan about a potentially corrupt Afghan police chief. A servant of that police official killed three Marines and severely wounded a fourth 17 days later, on Aug. 10, 2012, opening fire with a Kalashnikov rifle in an insider attack.

An attorney for Brezler, Michael J. Bowe, said that he intends to cite the treatment of Clinton “as one of the many, and most egregious examples” of how severely Brezler was punished. FBI Director James B. Comey announced Tuesday that he would not recommend the U.S. government pursue federal charges against Clinton, but he rebuked her “extremely careless” use of a private, unclassified email server while serving as secretary of state. The FBI found that 110 of her emails contained classified information. Bowe said it is impossible to reconcile President Obama’s statement that Clinton’s intentional act of setting up a secret, unsecured email server did not detract “from her excellent ability to carry out her duties” while Brezler received a “completely opposite finding… involving infinitely less sensitive and limited information.”

Read more …

“..there are at least 15.8 million verified empty homes in Europe..”

• Europe Is Full … Of Empty Houses (LifeSeekers)

“Our country is full” is a statement you might often hear as a justification for not accepting any more migrants and refugees. According to this opinion, European countries do not have capacity to accept more newcomers, who put pressure on infrastructure – and especially housing. But when we look more closely, can it really be said that Europe is full? According to data from the censuses conducted across Europe in 2011, there are at least 15.8 million verified empty homes in Europe; in other words, there are enough empty homes in Europe to house all the asylum seekers that arrived in Europe last year, and all of Europe’s 4 million homeless people, several times over.

However, many Europeans are struggling with a housing market that makes it even more difficult for them to buy or rent a home. There are many reasons for this, including housing speculation, where investors buy houses to use simply as assets to be sold on when their value increases, as well as the economic situation and unstable employment. But what seems clear is that this market is not working for European people, and migrants and refugees are not the cause of the problem. This unfair housing market is especially serious for young people in Europe. Ever-rising rents mean that living situations for most young Europeans are unstable: it’s no surprise that over 48% of young people (aged 18-34) in the EU still live with their parents, unable to truly realise their independence. And meanwhile, there are millions of homes sitting empty.

Read more …