Albrecht Dürer Study of the left hand of an apostle (for the Heller Altar) c.1508

And why not? He flip-flopped 5 times in one day last week, and his popularity rose.

• Trump’s Next Big Policy Reversal Could Be On The TPP (CNBC)

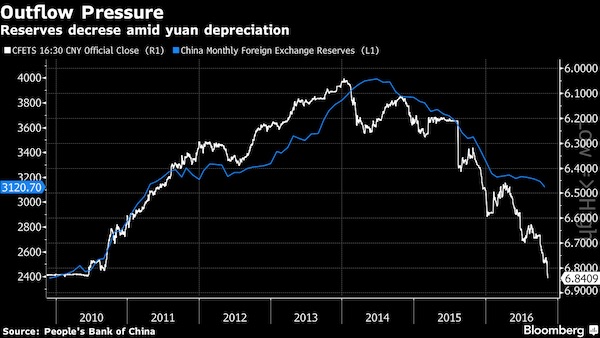

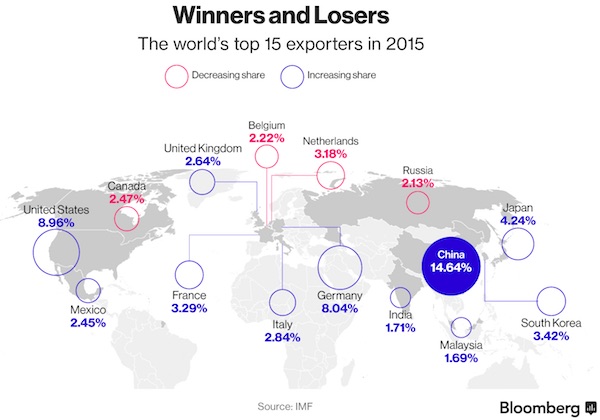

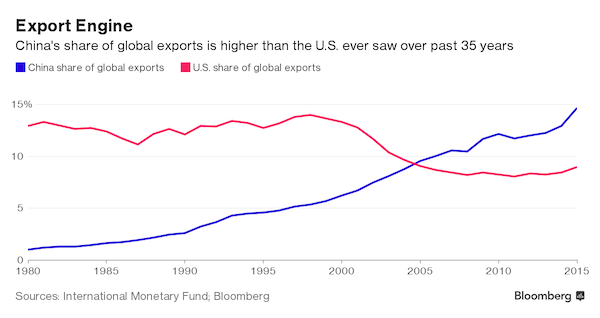

From NATO to health care, President Donald Trump has evidenced he is comfortable making major policy flip-flops. His most recent reversal came last week, when a U.S. Treasury report declined to name China as a currency manipulator despite Trump’s repeated promises to formally accuse Beijing — a signature pledge during his campaign trail. So, what could Trump backtrack on next? One analyst said he hopes it will be the Trans-Pacific Partnership, the world’s largest trade deal that Trump withdrew from in January on the claim that it would hurt U.S. manufacturing. “Whoever thought that Trump would let China, a rival, off the hook on currency? If he can do that with a country that’s clearly not a friend, maybe he could reconsider reversing himself on TPP for a friend like Japan,” Sean King, senior vice president of Park Strategies, told CNBC on Tuesday.

Japan was set to be a major beneficiary of TPP, particularly the country’s auto sector that would have obtained cheaper access to U.S. markets. Tokyo, which has long lamented the trade pact would be “meaningless” without the U.S., has decided to forge ahead with the other remaining 10 participating nations to revive the deal but many are doubtful of whether the TPP will be a game-changer in Washington’s absence. Trump still has time to change his mind on TPP, King warned, noting that the treaty text remains valid until February 2018. “Trump said [TPP] was a disaster, but I’m sure the other members would be willing to make concessions to get the U.S. back in, just like South Korea was willing to make concessions to Obama for his endorsement of the U.S.-Korea [free trade agreement],” King said. “He’s certainly made greater reversals and claimed victory. Why not do this for our friends who want to stand with us against countries like China and North Korea? I’m all for it.”

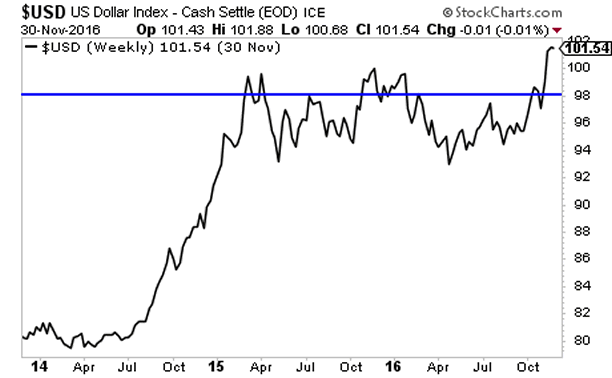

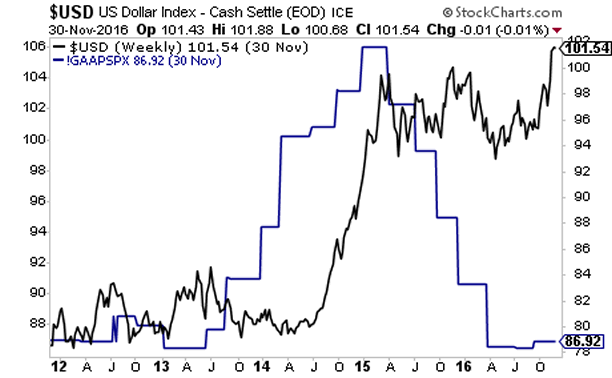

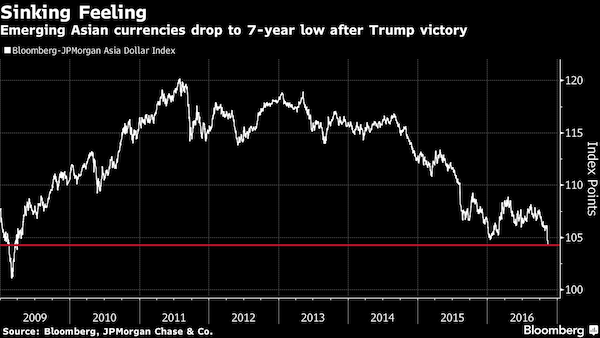

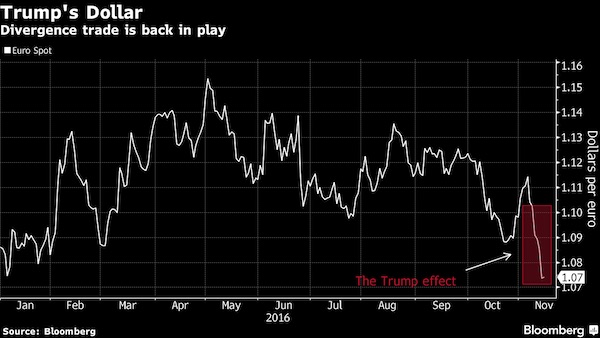

“There is no place to go but the dollar at this point.” “..you don’t collapse the core economy. It’s always the peripheral coming in.”

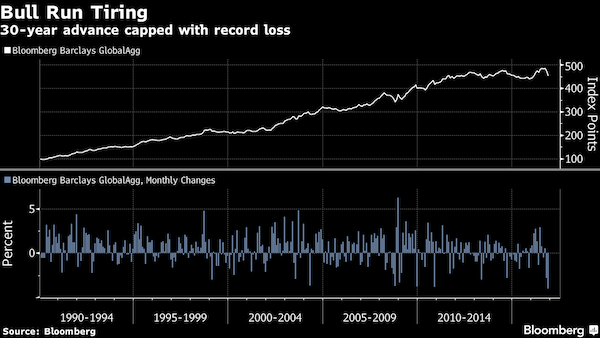

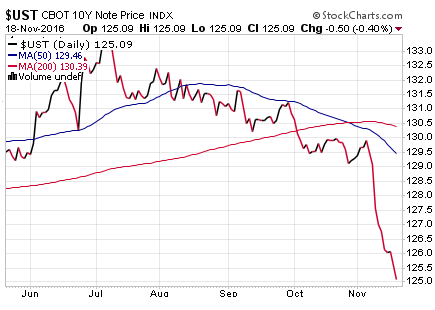

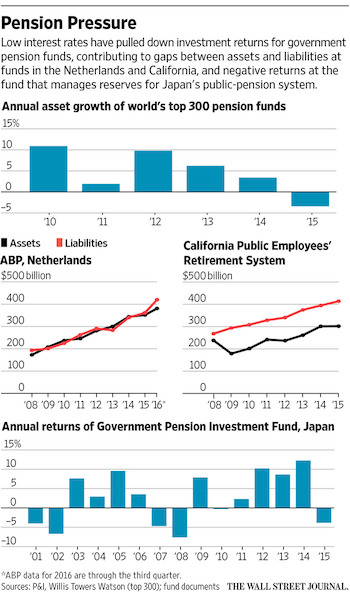

• Strong Dollar Could Cause Bond Market Crash – Martin Armstrong (USAW)

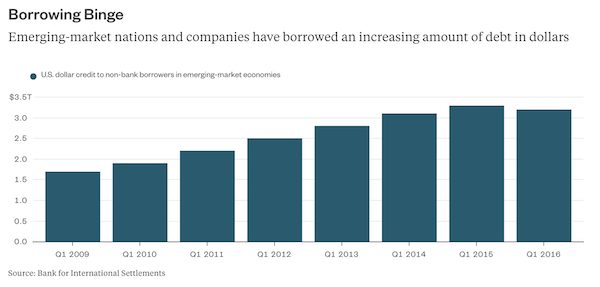

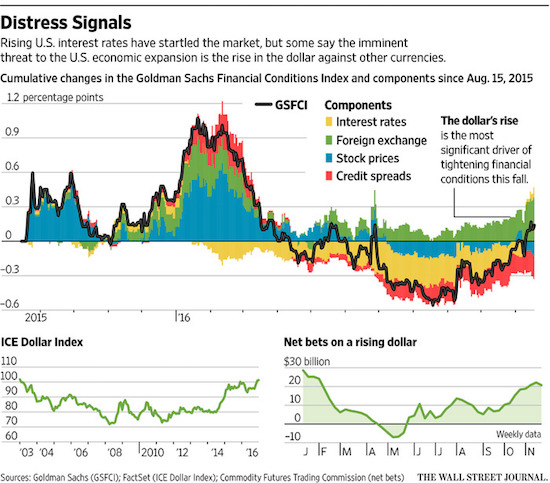

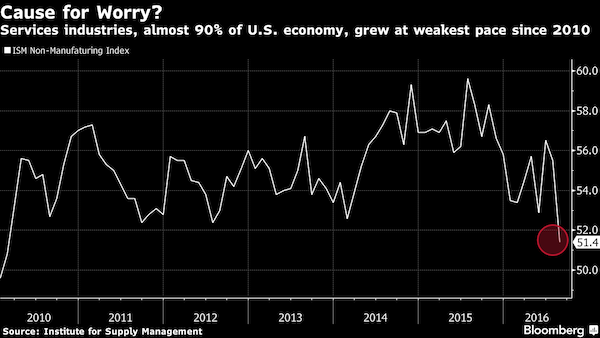

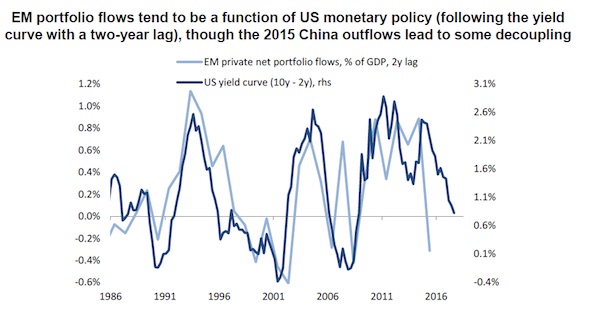

Renowned financial expert Martin Armstrong says the biggest risk out there is the effect a strong U.S. dollar has on the global bond market. Armstrong explains, “There’s these people who keep saying the dollar is going to crash. If the dollar crashes, the world is happier and basically celebrating. You have half the U.S. debt equivalent in emerging market debt issued in dollars. If the dollar goes up, they are in trouble. Then you are going to see sovereign defaults .. The U.S. is not going to default, but as you start defaults elsewhere outside the country, it makes people begin to get concerned about sovereign debt. Sovereign debt is the worst of all. It’s not secured. If the U.S. government defaulted on its debt, what would happen? You cannot go down to the National Gallery and start lifting Picassos.”

So, a bond market crash is a distinct possibility? Armstrong says, “Yes. All these things are contagions .. The real risk is coming from Europe and Asia. That is the real risk .. There is no place to go but the dollar at this point.” If and when a global collapse comes, it will come from China or Europe. Armstrong says, “Yes, because you don’t collapse the core economy. It’s always the peripheral coming in. It was the same thing in the Great Depression. It wasn’t the fact that the U.S. defaulted. The problem was the first bank that went down was in Austria, and it happened to be owned in part by the Rothschilds. When people hear a bank owned by the Rothschilds went down, people started to sell off all other banks. Then all the countries defaulted.”

Armstrong says there is going to be a major “monetary reform” in the not so distant future, and the U.S. will end up with a dollar for domestic use and a dollar used for international trade, sort of like a “domestic dollar” and an “international trade dollar.” Armstrong says, “Yes. All it is doing is replacing the dollar as the reserve currency. That would satisfy China and Russia, and it would simply be maintained by an international board. I strongly advise against the IMF. It’s way, way too corrupt.” So, is gold a good asset to have with a coming currency reset? Armstrong says, “Yes, at that point, you are talking about a hedge against government. When you go through these monetary crises, effectively, all tangible assets rise in price, not just gold and silver. . . .

Tangible assets have a value to everybody globally. The downside is on real estate. I would never put 100% of my money in real estate because it is not moveable.” Fast-forward to now, and Armstrong predicts, “The economy is not going to come back. We are not going to see economic growth.” Where is all this taking the world? Armstrong, who is an expert on economic and political cycles, says, “You have to understand what makes war even take place? It does not unfold when everybody is fat and happy. Simple as that. You turn the economy down, and that’s when you get war. It’s the way politics works.”

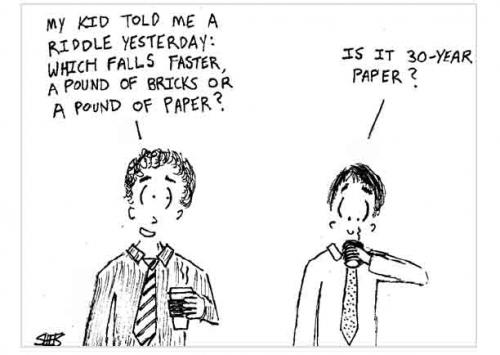

Are bonds the lesser bubble then?

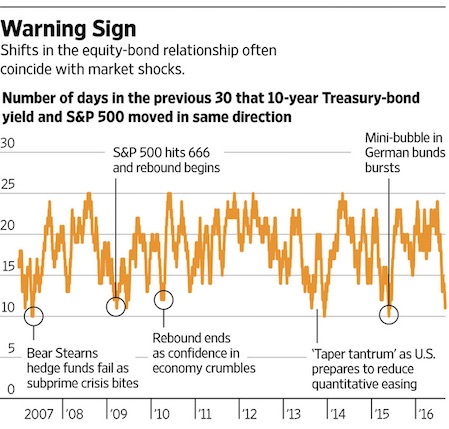

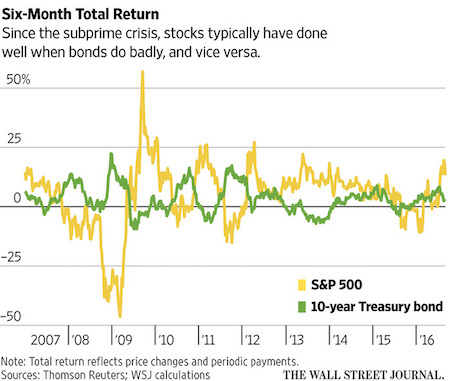

• Stocks, Bonds Diverge Over Trump Tax Reform, Stimulus Odds (CNBC)

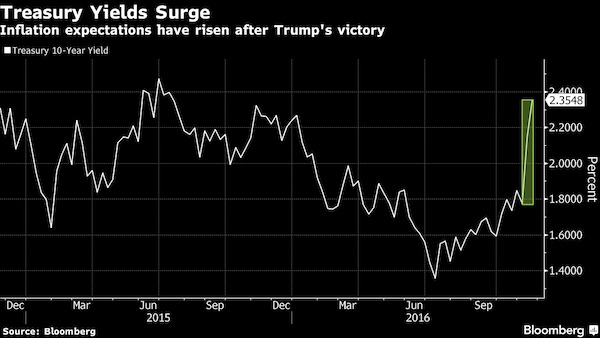

Optimism that the Trump administration will be able to drive through a hefty pro-growth plan or tax package this year is fading by the day. Treasury Secretary Steve Mnuchin on Monday became the latest official to dial back expectations for a time table that included a tax plan by August. In an interview with the Financial Times, Mnuchin said getting tax reform by August was an “aggressive timeline” and would probably be delayed because of health care. In the bond market, there was little surprise. Bond yields, which move inversely to prices, have been falling for weeks as traders have become more skeptical that Washington will adopt any pro-growth policy this year. Stocks, meanwhile, have traded side ways recently, and the S&P 500 is still up 10% since election day, boosted by hope of fiscal stimulus and tax cuts.

Mnuchin’s remarks did not surprise markets, and, in fact, stocks rallied hard based on his comments that Treasury is looking at ways to raise funds to pay for the tax plan without the controversial border-adjustment tax. “That’s exactly why the [stock] market rallied. People hate the border-adjustment tax,” said Peter Boockvar at Lindsey Group. The tax is part of the Congressional tax reform plan and would slap a 20% tax on all imports but not tax exports. Opponents claim it could cause inflation and penalize consumers, while proponents say it would encourage more manufacturing in the U.S. and level the playing field for U.S. companies. The market was not surprised by the push back in the timeline for tax reform, since President Trump last week said health care would come ahead of taxes. Ever since Congress failed to vote on health care in March, the market has become increasingly doubtful a tax plan would get done any time soon.

“Donald Trump is a tourist in the Imperial City of Washington D.C. He’s flipping, flopping and making it up as he goes.”

• We’re Borrowing Our Way to Economic Disaster – Stockman (DR)

David Stockman joined the Fox Business and the show Mornings with Maria to discuss the tax reform highlights for the current White House and GOP platform and what he views as a real threat of economic disaster in the U.S. During the discussion Stockman highlights what to expect from a border adjustment tax possibility, the creation of jobs and the impact on Wall Street in the age of Donald Trump. Stockman takes to point the cause of tax reform in the current White House. He begins the segment noting, “I think the border adjustment tax will come out of the retailers margin – and it should. We do need revenue. We need to have a consumption tax, or a value added tax or a border adjustment tax – so that we may reduce taxation on wages and income. We desperately need more jobs in this country.

If you keep taxing the payroll at 15.5%, which we’re doing today, you’re not going to encourage the creation of jobs. You’re going to take what jobs there are and impact the take-home pay of those jobs.” David Stockman was then asked about his read on Donald Trump’s border tax proposals and the possibility of what the President described as a ‘reciprocal tax.’ “He has no idea what he’s talking about. He’s making it up as he goes along. Donald Trump is a tourist in the Imperial City of Washington D.C. He’s flipping, flopping and making it up as he goes.” “The border adjustment tax, or a value added tax is the way to get at the problem he’s talking about. Every other country in the world has a value added tax. You take it off the exports and put it on the imports. There is a proper way to do it and he ought to allow the republicans on the hill who understand that to move forward.

The idea that we can have a multi-trillion dollar tax cut and not pay for it with new revenue or spending cuts is dangerous. We are at $20 trillion in debt and it is headed to $30 trillion.” When asked about the pragmatic nature of a border adjustment tax, Stockman pressed “I think it’s basic math. If you want to cut the corporate tax rate to 20%, which I think would be wonderful, you’ve got to raise $2 trillion over the next ten years to pay for it. Where are you going to get the money? Are you going to close loopholes? I doubt that. The lobby effort will kill that. You need a new revenue source. If you don’t do that you’re stuck with the current tax system. You’re stuck with massive deficits that are going to kill this country. We are basically borrowing our way to economic disaster.”

[..] We are so “deep in the soup” debt wise and have such a massive, and building deficit that you have to have revenue neutral tax cuts. The border adjustment tax is dead. Without that you are not going to reduce the corporate tax rate down to 20% or 15%, etc.” “The Trump reflation fantasy is over. It is all downhill from here. The market it heading down 20 to 30% down, the 1600 on the S&P. We’re going to have negative shock after negative shock. It is about time they sober up. On April 28th the U.S government is going to shut down. That will be spring training on the continuing resolution until we get to MOAD in the summer.”

Never been tried before.

• BMO Bundles Uninsured Mortgages in a Canadian Bond First

Bank of Montreal is bundling uninsured residential mortgages into bonds in what could be the start of a new financing market for Canadian banks as the government scales back its support for home loans. The Toronto-based lender is planning to sell debt backed by nearly C$2 billion ($1.5 billion) of prime uninsured mortgages. That’s a new development in a country where big banks have historically packaged government-insured mortgages into bonds. If the Bank of Montreal deal is successful, other Canadian banks may follow its lead, providing banks with more financing to keep making mortgages, said Marc Goldfried, CIO at Canoe Financial. The net result may be that housing prices in Canada keep rising. “Right now the banks don’t have any other way to fund it, so there’s probably some form of internal limit on this kind of mortgage financing they’ll do,” Goldfried said by phone from Toronto.

But the Bank of Montreal deal may find headwinds, said Paul Gardner, partner and portfolio manager at Avenue Investment. Canada last year tightened access to the federal insurance to help tamp down rapid home price growth in areas like Toronto and Vancouver. The federal government or Ontario could craft more legislation to cool the housing market, Gardner said. The province’s finance minister is considering a foreign-buyers tax like the one that helped cool home prices in Vancouver. Canadian finance minister Bill Morneau, Ontario finance minister Charles Sousa, and Mayor John Tory are meeting in Toronto Tuesday to discuss the housing market in the Greater Toronto Area. “Residential mortgages, my God, it’s the last thing you want to invest in right now,” Gardner said by phone from Toronto. “When the capital markets are flush with cash, it makes sense that they would try at least to issue this stuff.”

[..] The bank will offer to renew the mortgage loans at the end of their term if the borrower is not in default, and if the borrowers satisfies the bank’s underwriting criteria at the time, which mitigates some of the risk of borrowers not being able to refinance. Canadian mortgage loans generally have a five-year term, and borrowers pay down their principal at a 25-to-30-year pace meaning they usually have to refinance a significant portion of their loan every five years.

Oh boy. If these are the kind of people you rely on for advice, you’re in trouble.

• UK Will Never Build Enough Homes To Keep Prices Down (Tel.)

Britain will never build enough houses to make property affordable for young people, according to research. A study presented to the Royal Economic Society’s annual conference said those hoping to get on the ladder may have to rely on windows of opportunity created by periodic slumps in the market. However, the overall trend will remain for residential property price rises to outpace salary growth, according to economists at the University of Reading. “The increases in housing supply required to improve affordability have to be very large and long-lasting; the step change would need to be much larger than has ever been experienced before on a permanent basis,” said Geoffrey Meen, Alexander Mihailov and Yehui Wang. The government has discussed moves to increase the supply of homes but the changes are on far too small a scale to act as a brake on price rises.

House prices in the UK stood at an average of £217,500 according to the Office for National Statistics. That is 7.7-times the average full-time salary in the UK of £28,200. By contrast in 2005 the average home cost £150,500, approximately 6.5-times the then-average full time salary of £22,888. Former Bank of England policymaker Kate Barker believes the country needs an additional 60,000 homes per year on top of those already being built. But the new paper argues there is little chance of this happening. “Although higher levels of house building are certainly desirable, the paper shows that there is a limit to what can be achieved by this route,” the report found. “The required increase in supply to stabilise the price to income ratio … is not feasible – permanent increases in construction would be required that have never been achieved in history.”

The risks of garage-selling an entire country.

• Greek Insurance Company Can Become a Weapon for China in Europe (GR)

It is no secret that the Chinese see Greece as a country that could help them get their foot (and saying) in the European Union. In GreekReporter’s recent documentary Athens Chinatown, it is the Cosco managing director in Greece who says the mediterranean country offers a strategic location and it was this factor that attracted Cosco to take over the Greek port of Piraeus. Furthermore, the editor of China-Greece times also states that the Chinese “see Greece as the gate to Europe.” The past few years, silently, China has looked into many Greek investments. After acquiring the Greek Port of Piraeus, now three Chinese companies are bidding for Greece’s biggest private insurer, Ethniki Asfalistiki. However what looks like a simple bidding, could possibly be of great importance to the future of Greece.

Established in 1891, Ethini Asfalistiki has invaluable contribution to the Greek economy for over a century. It is the largest insurance company in the country with total premiums of over €440 million and 18% market share, while it is in cooperation with the banking network for the sale of bank assurance products, provides access to a broad distribution network of about 500 offices. The estimated earnings for 2016 are €52 million. Ethniki Asfalistiki is also a sister company of Greece’s Ethniki Bank (National Bank), one of Greece’s four systemic banks. Whoever gets this bid will most likely acquire the bank as well. At the same time, another Chinese group has shown interest for Piraeus Bank. If they manage to close that deal then two out of Greece’s four main banks will be controlled by the Chinese. Eventually they will be able to have an important saying in the country’s economy, and maybe that’s what they are aiming for.

While the Chinese have done serious investments in Greece, this one, in combination with everything else they control can become a decisive factor on how much of a saying does Greece want the Chinese to have on the country’s future. Letting Ethniki Asfalistiki in the hands of China is probably allowing too much of their foothold in the Greek economy, which would mean a great political influence as well. China of course would like to be able to control and play with Greece’s economy in order to advance their interests. But it is dangerous for Greece when the country’s future becomes another argument on a geostrategic dialogue between the big powers. A forced Grexit threat, for example, could definitely be on the table and be directed to the EU or the U.S.A.

That record is definitely broken beyond repair.

• Greek Debt Must Be Sustainable For IMF To Join Bailout – Lagarde (R.)

The IMF will not take part in a bailout program for Greece if it deems the country’s debt is unsustainable, the international lender’s chief Christine Lagarde said in an interview published on Tuesday. Greece needs to implement reforms agreed by euro zone finance ministers earlier this month to secure a new loan under its €86 billion bailout programme, the third since 2010. The loan is needed to pay debt due in July, but talks continue and the IMF has not yet decided whether to join the bailout. The fund’s participation is seen as a condition for Germany to unblock new funds to Greece. “If Greek debts are not sustainable based on IMF rules and reasonable parameters, we will not take part in the program,” Lagarde told German newspaper Die Welt when asked if the IMF would take part in the plan if Greek debt is not restructured.

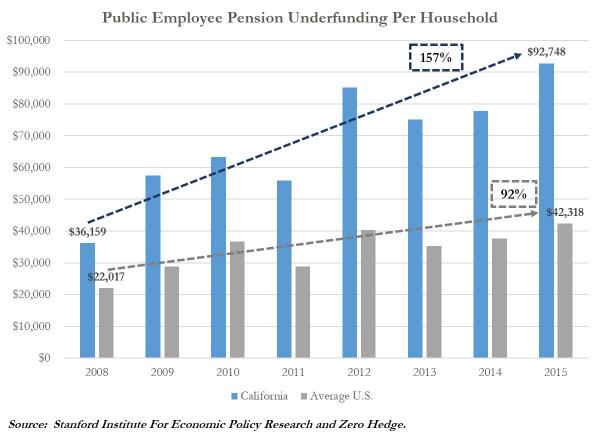

Minor problem: so many people are dependent on Social Security. Highly relevant going forward.

• Taxation is Theft (Napolitano)

With a tax code that exceeds 72,000 pages in length and consumes more than six billion person hours per year to determine taxpayers’ taxable income, with an IRS that has become a feared law unto itself, and with a government that continues to extract more wealth from every taxpaying American every year, is it any wonder that April 15th is a day of dread in America? Social Security taxes and income taxes have dogged us all since their institution during the last century, and few politicians have been willing to address these ploys for what they are: theft. During the 2012 election, then-Texas Gov. Rick Perry caused a firestorm among big-government types during the Republican presidential primaries last year when he called Social Security a Ponzi scheme. He was right. It’s been a scam from its inception, and it’s still a scam today.

When Social Security was established in 1935, it was intended to provide minimal financial assistance to those too old to work. It was also intended to cause voters to become dependent on Franklin Delano Roosevelt’s Democrats. FDR copied the idea from a system established in Italy by Mussolini. The plan was to have certain workers and their employers make small contributions to a fund that would be held in trust for the workers by the government. At the time, the average life expectancy of Americans was 61 years of age, but Social Security didn’t kick in until age 65. Thus, the system was geared to take money from the average American worker that he would never see returned.

Over time, life expectancy grew and surpassed 65, the so-called trust fund was raided and spent, and the system was paying out more money than it was taking in – just like a Ponzi scheme. FDR called Social Security an insurance policy. In reality, it has become forced savings. However, the custodian of the funds – Congress – has stolen the savings and spent it. And the value of the savings has been diminished by inflation. Today, the best one can hope to receive from Social Security is dollars with the buying power of 75 cents for every dollar contributed. That makes Social Security worse than a Ponzi scheme. You can get out of a Ponzi investment. You can’t get out of Social Security. Who would stay with a bank that returned only 75% of one’s savings?

Essential reading on how the region came to be what it is.

• Is America’s Alliance with Turkey Doomed? (SCF)

Shortly before his death in 1869, the pro-Western former Ottoman grand vizier and foreign minister Keçecizâde Mehmed Fuad Pasha commented, “It appeared preferable that . . . we should relinquish several of our provinces rather than see England abandon us.” In response to this commitment, the British made the territorial integrity of the Ottoman Empire against Russian aggression a key pillar of their foreign policy. Yet, in spite of the significance that Istanbul and London attached to their alliance in the 1850s, both sides were determined to eradicate each other by 1914. As Prime Minister Herbert Asquith put it, Britain was “determined to ring the death-knell of Ottoman dominion, not only in Europe, but in Asia as well.” In response, the Ottoman government described the British as “the greatest enemy” of not only the sultan’s empire but also of Islam itself.

The Anglo-Russian Great Game, waged across the vast lands stretching from Europe to Central Asia during the nineteenth century, rendered the Ottoman Empire an invaluable strategic asset in the eyes of British policymakers. Although the British public frowned upon the Ottoman Turks’ “peculiar Oriental ways,” and regarded them as “uncivilized Mohammedan barbarians” for their treatment of Christian subjects, Whitehall recognized that they could serve as a bulwark against Russia. The Ottomans, likewise, recognized the value of having Britain as an ally given the looming threats posed by their neighbors, Russia and Austria. Though the Ottomans previously regarded the British as an untrustworthy non-Muslim power, the cooperation was a win-win venture, and the two powers agreed to partner economically and militarily. The strategic collaboration between them reached its zenith in 1853 when, along with other allies, they successfully waged war against Russia in Crimea.

America’s relative indifference to the Ottoman Empire and the early Turkish Republic was reminiscent of Otto von Bismarck’s famous remark that European Turkey “was not worth the bones of a single Pomeranian grenadier.” The United States and the Ottoman Empire fought World War I on opposite sides, but did not clash with each other. Moreover, while President Woodrow Wilson discussed the future of the Ottoman Empire in his Fourteen Points, the United States did not actively participate in its partition. In 1922–23, Washington merely sent observers to the Conference of Lausanne, which produced the final peace treaty between the victors of World War I and Turkey.

Only Trump has congratulated him.

• Erdogan Says He Doesn’t Care What Europe Thinks About Turkey’s Vote (BBG)

Turkish President Recep Tayyip Erdogan treated a crowd of supporters gathered outside his presidential palace on Monday evening to a speech laced with invective against Europe, saying his victory in a referendum on Sunday took place under conditions that were democratic beyond compare. Erdogan belittled both domestic and foreign critics of the voting process, which culminated in a slim majority of Turks approving changes to 18 articles of the constitution that concentrate more power in his hands. A monitoring group from the Organization for Security and Cooperation in Europe – which said the referendum took place on an “unlevel playing field” – “should know its place,” he said. “We don’t care about the opinions of ‘Hans’ or ‘George,’” Erdogan said, using the names as stand-ins for his European critics. “All debates about the constitutional referendum are now over.”

The OSCE’s head of mission, Tana de Zulueta, said on Monday that freedom of expression was inhibited during the campaign, that the conditions of the vote fell “well short” of international standards, and that the OSCE was inhibited from the election monitoring that it was invited to do. The vote was held under a state of emergency that’s been in place since just after a failed coup last July, and which Turkey’s security council will meet tonight to consider extending. Since the coup attempt, some 40,000 of Erdogan’s alleged opponents have been jailed, and at least 100,000 more fired by decree. The European monitoring organization’s criticisms were echoed by opposition parties inside Turkey, which are asking for the result of the vote to be annulled, as well as by the U.S. state department, whose spokesman Mark Toner cited “observed irregularities” in the way the election was carried out.

Wonder how redacted the files are.

• Opening Of UN Files On Holocaust Will ‘Rewrite Chapters Of History’ (G.)

War crimes files revealing early evidence of Holocaust death camps that was smuggled out of eastern Europe are among tens of thousands of files to be made public for the first time this week. The once-inaccessible archive of the UN war crimes commission, dating back to 1943, is being opened by the Wiener Library in London with a catalogue that can be searched online. The files establish that some of the first demands for justice came from countries that had been invaded, such as Poland and China, rather than Britain, the US and Russia, which eventually coordinated the post-war Nuremberg trials. The archive, along with the UNWCC, was closed in the late 1940s as West Germany was transformed into a pivotal ally at the start of the cold war and use of the records was effectively suppressed.

Around the same time, many convicted Nazis were granted early release after the anti-communist US senator Joseph McCarthy lobbied to end war crimes trials. Access to the vast quantity of evidence and indictments is timed to coincide with the publication on Tuesday of Human Rights After Hitler: The Lost History of Prosecuting Axis War Crimes by Dan Plesch, a researcher who has been working on the documents for a decade. The documents record the gathering of evidence shortly after the UN was founded in January 1942. They demonstrate that rape and forced prostitution were being prosecuted as war crimes in tribunals as far apart as Greece, the Philippines and Poland in the late 1940s, despite more recent suggestions that this was a legal innovation following the 1990s Bosnian conflict.

[..] By the late 1940s, the US and British governments were winding down prosecutions of Nazis. President Harry Truman made anti-communism, rather than holding Nazis to account, a priority, Plesch says. “Even action against the perpetrators of the massacre of British RAF officers attempting to escape from prison camp Stalag Luft III, a flight made iconic by films such as The Great Escape, was curtailed.”

One of the most important questions we can ask ourselves, said polio vaccine pioneer Dr Jonas Salke, is “Are we being good ancestors?”

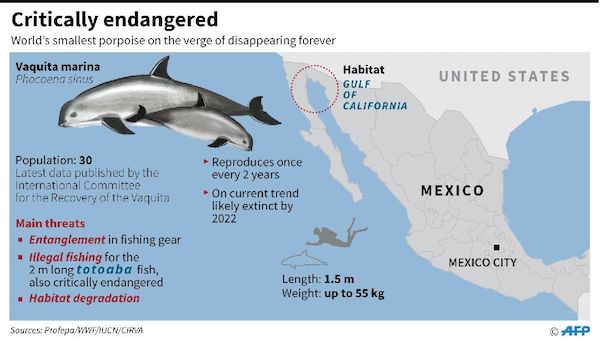

• Critically Endangered Species Poached In World’s Protected Natural Sites (AFP)

Illegal poaching, logging and fishing of sometimes critically endangered species is taking place in nearly half of the world’s most protected natural sites, environmental campaigners WWF warned Tuesday. Natural world heritage sites such as Australia’s Great Barrier Reef, Virunga National Park in the Democratic Republic of Congo and the Galapagos Islands support large populations of rare plant and animal species. But in a report WWF said species listed by the Convention on International Trade in Endangered Species (CITES) faced the threat of illegal harvesting and trafficking in 45% of the more than 200 natural world heritage sites on the planet. “Natural world heritage sites are among the most recognised natural sites for their universal value,” said Marco Lambertini, head of WWF International.

“Yet many are threatened by destructive industrial activities and… their often unique animals and plants are also affected by overexploitation and trafficking,” he added, stressing that “unless they are protected effectively, we will lose them forever.” Almost a third of the world’s remaining 3,890 wild tigers and 40% of all African elephants are found in UNESCO-listed sites, which are often a last refuge for critically endangered species such as the Javan rhino in Indonesia, the report said. Illegal poaching, logging and fishing inside such sites is therefore “driving endangered species to the brink of extinction”, WWF warned. The species most at risk because of illegal activity within natural world heritage sites is probably the vaquita, the world’s smallest porpoise, which is indigenous to Mexico’s Gulf of California, Colman O’Criodain, WWF’s wildlife policy manager, told AFP.

While the vaquita itself is not being fished illegally, it is being caught in nets used to poach the totoaba – a giant Mexican fish coveted in China for its swim bladder, which itself is considered a threatened species. “When I started working on the issue of vaquita two years ago, there were 96 left. Now it is less than 30,” O’Criodain said, adding that at the current rate the tiny porpoise could be extinct within a year. According to Tuesday’s report, poaching of vulnerable and endangered animal species such as elephants, rhinos and tigers occurs in 42 of the UNESCO-listed natural sites, while illegal logging of rosewood, ebony and other valuable plant species happens in 26 of them. Illegal fishing, including of sharks and rays occurs in 18 of 39 listed marine coastal world heritage sites, it said.

Until the world finally has the emergency UN conference I’ve been calling for, I don’t see this change. It’s a global issue, and no-one wants to touch it because it’s so politically toxic.

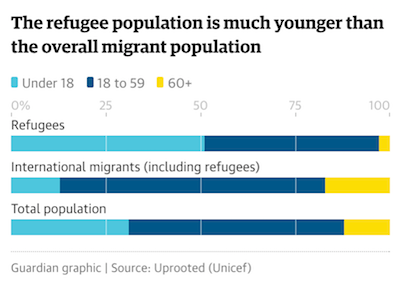

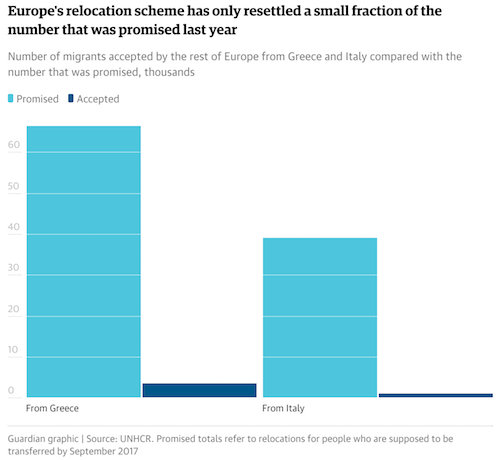

• At Least 8,500 Migrants Rescued From Mediterranean In Three Days (CNN)

Italian authorities were still bringing migrants and refugees to shore Monday after one of the busiest weekends ever for rescue services operating in the central Mediterranean sea. At least 8,500 refugees and migrants were plucked from small boats over the past three days in 73 separate rescue operations, the Italian Coastguard told CNN Monday. Thirteen bodies were recovered, including a pregnant woman and an eight-year-old boy. It is not known how many died before they were sighted. One 35-year-old woman from the Ivory Coast was giving birth as she was pulled aboard a rescue ship, Italian newspapers reported. The youngest migrant rescued over the weekend was just two weeks old. Asar was rescued along with her mother by the Migrant Offshore Aid Station (MOAS).

The Sea-Eye, a German charity boat that helped bring to safety hundreds of people stranded on rubber dinghies off the coast of Libya Sunday said in a statement it still had 210 on board “crowded closely together, exposed to the wind, the waves and the cold without protection. It said the Italian tanker La Donna and the coast guard ship CP920 was now accompanying the boat, whilst it waits for two smaller boats from the Italian island of Lampedusa, to bring the migrants to shore. The Italian Coastguard said 1004 migrants rescued on the board the ship the Panther would be disembarked in Messina in Sicily shortly. Frontex, the European Border and Coast Guard Agency, said in a statement it rescued more than 1,400 migrants in the central Mediterranean in 13 search and rescue operations from Friday to Sunday.