Pablo Picasso Portrait de femme au col d’hermine (Olga) 1923

At least they all agree on Venezuela.

• Trump Calls For End To ‘Politics Of Revenge,’ Touts ‘Hottest Economy’ (AP)

Facing a divided Congress for the first time, President Donald Trump on Tuesday called on Washington to reject “the politics of revenge, resistance and retribution.” He warned emboldened Democrats that “ridiculous partisan investigations” into his administration and businesses could hamper a surging American economy. Trump’s appeals for bipartisanship in his State of the Union address clashed with the rancorous atmosphere he has helped cultivate in the nation’s capital — as well as the desire of most Democrats to block his agenda during his next two years in office. Their opposition was on vivid display as Democratic congresswomen in the audience formed a sea of white in a nod to early 20th-century suffragettes.

Trump spoke at a critical moment in his presidency, staring down a two-year stretch that will determine whether he is re-elected or leaves office in defeat. His speech sought to shore up Republican support that had eroded slightly during the recent government shutdown and previewed a fresh defense against Democrats as they ready a round of investigations into every aspect of his administration. “If there is going to be peace and legislation, there cannot be war and investigation,” he declared. Lawmakers in the cavernous House chamber sat largely silent.

[..] One bright spot for the president has been the economy, which has added jobs for 100 straight months. He said the U.S. has “the hottest economy anywhere in the world.” He said, “The only thing that can stop it are foolish wars, politics or ridiculous partisan investigations” an apparent swipe at the special counsel investigation into ties between Russia and Trump’s 2016 campaign, as well as the upcoming congressional investigations. The diverse Democratic caucus, which includes a bevy of women, sat silently for much of Trump’s speech. But they leapt to their feet when he noted there are “more women in the workforce than ever before.”

Haven’t heard Moon for a while. There’s talk of a NoKor industrial area reopening.

• Trump, Kim To Hold Second Summit In Vietnam At End Of February (AP)

President Donald Trump said Tuesday that he will hold a two-day summit with North Korea leader Kim Jong Un Feb. 27-28 in Vietnam to continue his efforts to persuade Kim to give up his nuclear weapons. Trump has said his outreach to Kim and their first meeting last June in Singapore opened a path to peace. But there is not yet a concrete plan for how denuclearization could be implemented. Denuclearizing North Korea is something that has eluded the U.S. for more than two decades, since it was first learned that North Korea was close to acquiring the means for nuclear weapons. “As part of a bold new diplomacy, we continue our historic push for peace on the Korean Peninsula,” Trump said in his State of the Union address.

Director of National Intelligence Dan Coats told Congress last week that U.S. intelligence officials do not believe Kim will eliminate his nuclear weapons or the capacity to build more because he believes they are key to the survival of the regime. [..] At the second Trump-Kim summit, some experts say North Korea is likely to seek to trade the destruction of its main Yongbyon nuclear complex for a U.S. promise to formally declare the end of the 1950-53 Korean War, open a liaison office in Pyongyang and allow the North to resume some lucrative economic projects with South Korea. “Our hostages have come home, nuclear testing has stopped, and there has not been a missile launch in 15 months,” Trump said. “If I had not been elected President of the United States, we would right now, in my opinion, be in a major war with North Korea.

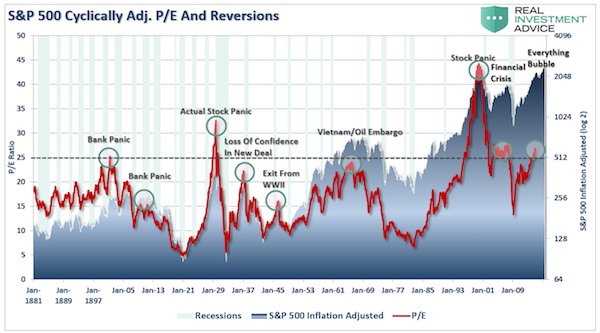

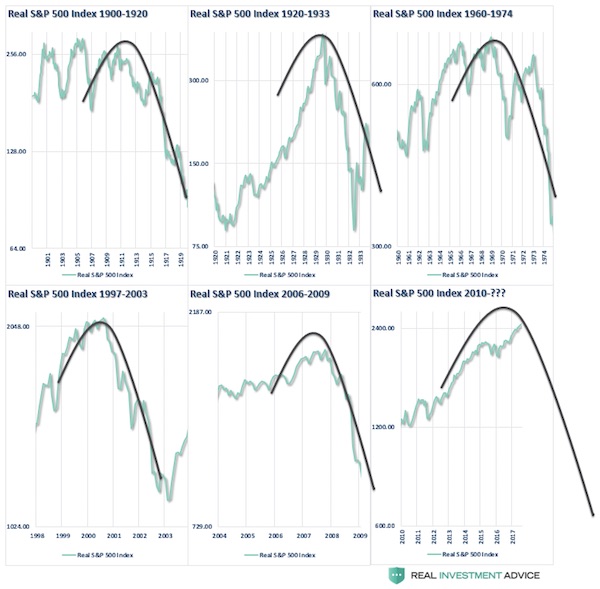

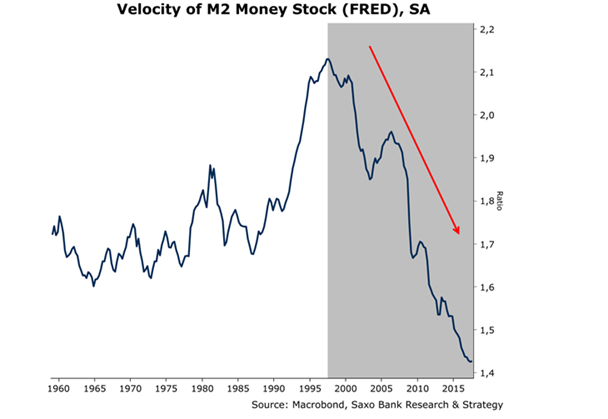

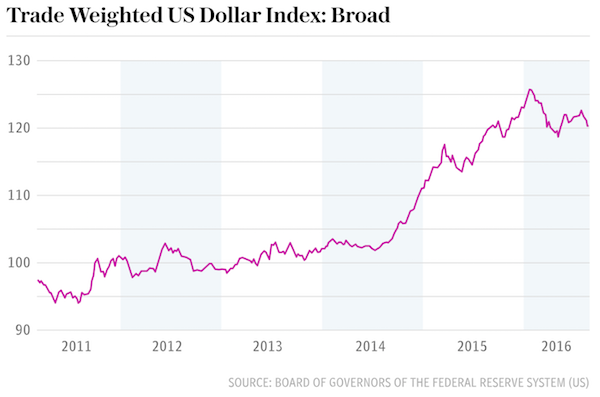

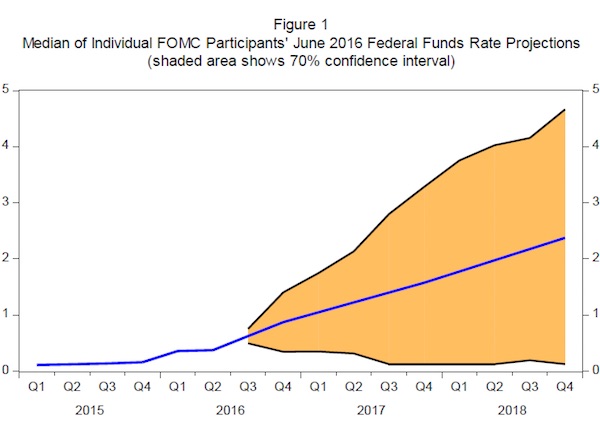

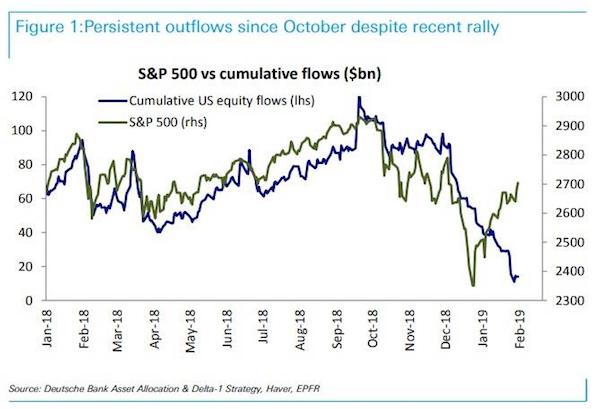

Interesting, good graph. It’s just that referring to ‘markets’ means you’re guaranteed to get so many things wrong. There are no markets when the Fed decides prices insead of allowing markets to do so.

• Too Fast, Too Furious (Roberts)

As noted by Deutsche Bank’s Parag Thatte noted recently: “While the S&P 500 rallied +15% since late December, equity funds have continued to see large outflows. As Thatte elaborates, “US equity funds in particular have continued to see large outflows (-$40bn) since then, following massive outflows (-$77bn) through the sell-off from October to December.” This confirms our concern the recent rally has primarily been a function of short-covering and repositioning in the markets rather than an “all-out” buying spree based on a “conviction” the “bull market” remains intact.

David Rosenberg recently confirmed the same: “Let’s go back to December for a minute. This was the worst December since 1931, mind you, followed by the best January since 1987. This is nothing more than market that has gone completely manic. To suggest that there is anything fundamental about this dead-cat bounce in equities is laughable. This is an economy, and a market, that couldn’t even sustain a 3% yield on the 10-year T-note. It sputtered at the thought of the Fed taking the funds rate marginally above zero on a ‘real’ basis, even as it feasted on unprecedented stimulus for a such a late-cycle economy. Yes, Powell et al. helped trigger this latest up-leg, not just at last week’s meeting, but in the lead-up to the confab as well. The Fed has been crying uncle for weeks now.”

Too many attempts at covering lies with other ones. What was she thinking?

• Elizabeth Warren Apologizes For Identifying As Native American (MW)

Sen. Elizabeth Warren apologized Tuesday for previously identifying herself as a Native American. In an interview with the Washington Post, the Massachusetts Democrat expanded on an apology issued last week to the Cherokee Nation. “I can’t go back,” she told the Post. “But I am sorry for furthering confusion on tribal sovereignty and tribal citizenship and harm that resulted.” As a presidential candidate, Warren has been trying to fight accusations that she identified as Native American to advance her career as a professor at Harvard and Penn law schools. In the same report, the Post published Warren’s previously undisclosed 1986 registration card to the State Bar of Texas, in which she handwrote her ethnicity as “American Indian.”

Thought she might flee into an Article 50 extension. But it wouldn’t bring anything. She’s close to checkmate.

• May Rules Out Brexit Delay And Hard Border With Ireland (G.)

Theresa May fired a warning shot at Brexit supporters on Tuesday, insisting there was “no suggestion” Britain would leave the EU without an insurance provision to protect against a hard border in Northern Ireland. At a speech in Belfast, May would only accept that technology could “play a part” in any alternative arrangements and that she would not countenance anything that would disrupt the lives of border communities. Brexit supporters immediately expressed their alarm at some of May’s language, which they fear could be read as a step back from previous assurances. “She knows what she promised us,” one ERG source said. “Even if she didn’t mean what she said, we do.”

The comments came as May prepared to meet EU leaders in Brussels for the first time since the historic defeat of her Brexit deal, where she is expected to formally request the reopening of the withdrawal agreement in order to address concerns about the backstop. The prime minister will travel to the Belgian capital on Thursday, meeting the European commission president, Jean-Claude Juncker, the EU parliament president Antonio Tajani, and the European council president. Donald Tusk. Both Tusk and Juncker have been adamant that the withdrawal agreement will not be reopened.

Number 10 sources suggested they did not expect a warm reception, but that it would signal the start of a new diplomatic process, involving proposals on the backstop worked on by MPs and ministers. Earlier on Tuesday, May told her cabinet she would not countenance any delay to the UK’s exit on 29 March, a message to ministers such as Jeremy Hunt and Sajid Javid who have suggested at least some delay might now be inevitable. Ministers who are more pessimistic about the prospects of the UK leaving on time with a deal held their tongues in the meeting after May’s warning. “She was pretty clear she had no time for anyone calling for it to be extended,” one cabinet source said.

“He has previously said Ireland would seek “mega-money” from the EU.”

• Ireland And EU Discuss Emergency Funding For No-Deal Brexit (G.)

Ireland is in talks with the EU over a substantial Brexit emergency fund to offset the damage caused to the country’s €4.5bn (£3.96bn) food exports to Britain if the UK crashes out of the bloc with no deal next month. As Theresa May prepares for a crunch meeting in Brussels on Thursday, officials at the European commission are already looking at continuous compensatory measures for Ireland as part of an ongoing arrangement that could last years. Contingency funds to compensate farmers have already been discussed at the highest levels and are expected to arise in talks with the taoiseach, Leo Varadkar, during a round of meetings in Brussels on Wednesday.

Sources say Ireland will be looking for a “long-term fix” in EU budget talks in April rather than a lump sum Brexit bailout. Politicians have cited the ongoing assistance given to the Baltic states after Russia banned certain food exports from the EU as an example of financial solidarity it hopes to win in a no-deal Brexit. Ireland exports €4.5bn worth of food and drink a year to the UK, ranging from beef to cheddar cheese. Calculations by the Department of Agriculture put the cost of tariffs under World Trade Organization rules at €1.7bn. Michael Creed, Ireland’s minister for agriculture, food and the marine, has said this would be an “existential challenge” for the food and drink sector. He has previously said Ireland would seek “mega-money” from the EU.

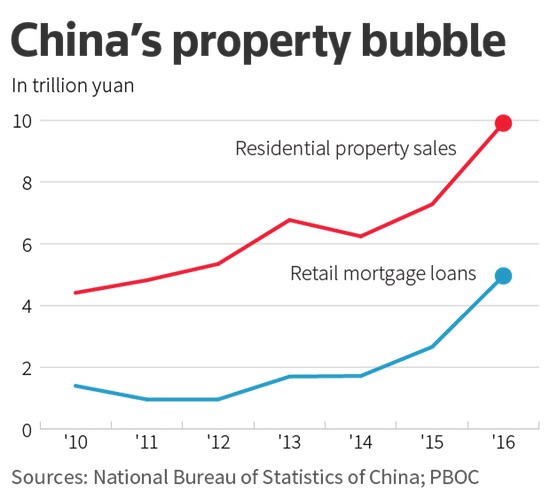

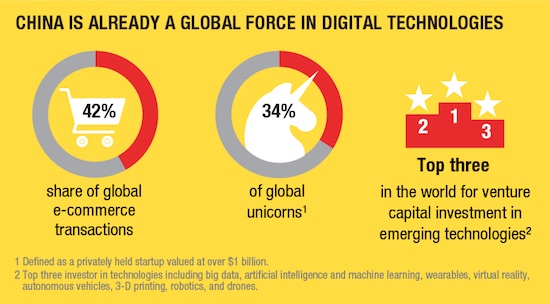

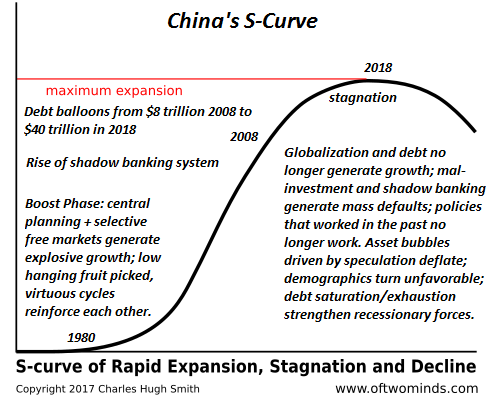

“China entered 2008 with $8 billion in officially counted debt; 10 years later that debt is $40 trillion..”

• China: Expansion, Stagnation and Decline (CHSmith)

China entered 2008 with $8 billion in officially counted debt; 10 years later that debt is $40 trillion, plus unknown trillions more in the shadow banking system which expanded the options for risky speculation and massive expansions of credit. Like all the other stagnating economies, China’s “solution” to stagnation was to expand debt-funded speculation and “investments” with little to no actual return. The high water mark of China’s financialization orgy was 2018. From now on, adding debt simply adds more drag on the underlying economy, as income is diverted to service speculative debt and defaults start hollowing out both the official banking system and the shadow banking system.

All the policies that worked in the Boost Phase no longer work. the policy tool chest is empty, and so China’s leadership is doing more of what’s failed: burying bad debt off the visible balance sheets, re-issuing new loans to pay off defaulted debt, and all the usual tricks of a failed banking/credit system. Japan has papered over its systemic rot and decline for 30 years by using a financial Perpetual Motion Machine: the state borrows and spends trillions by selling bonds to the central bank, which in effect prints “free money” for the state to burn propping up a sclerotic, corrupt, failed status quo.

If that’s policy makers’ idea of success, they are delusional. Credit/asset bubbles all deflate, and central bank buying of assets only gives the lie to the illusion of stability and market liquidity. Simply put, there is no indication China’s leadership has any plan to manage the inevitable stagnation and decline of China’s economy that is now painfully obvious to anyone with the slightest willingness to look beneath the flimsy propaganda of official statistics. They are not alone, of course; every other major economy is equally bereft of policies and equally dependent on bogus statistics and debt to paper over the decline.

Macron support slips further. “50 MPs from Macron’s own party abstained from voting”.. but “The main thing is that there were no votes against..”, says the party.

• French Lawmakers Approve Controversial ‘Anti-Riot’ Bill (F24)

French MPs on Tuesday approved an anti-rioting bill giving security forces the power to ban suspected hooligans from demonstrating, in a controversial bid to crack down on violence that has marred Yellow Vest protests over the last three months. Opponents say the bill, approved by the lower house of parliament by 387 votes to 92, contravenes the constitutional right to demonstrate. Under its most contentious provision, government officials would be able to ban people suspected of being hooligans from taking part in demonstrations – without oversight from a judge. Inspired by legislation used to crack down on football hooligans, the new law calls for a six-month prison sentence and a €7,500 ($8,500) fine for violators.

The legislation, if passed by the upper house and approved by the constitutional council, would also allow fines of €15,000 ($17,000) and a one-year prison term for demonstrators covering or masking their faces to escape identification. It would also hand French police greater powers to search would-be demonstrators for weapons. [..] Unusually, some 50 MPs from Macron’s own party, the Republic on the Move (LREM), abstained from voting in favour of the legislation on Tuesday in a sign of divisions within the group. [..] “The main thing is that there were no votes against,” Gilles Le Gendre, who heads LREM’s parliamentary group, told reporters after the vote on Tuesday.

A very curious case. We’ll hear much more of it.

• Judge Pauses Lawsuits Against Cryptocurrency Company Quadriga (R.)

A cryptocurrency platform that lost access to millions of dollars when its founder died with sole knowledge of company passwords has been granted a temporary reprieve from creditor lawsuits. Halifax judge Michael Wood on Tuesday ordered a 30-day stay that precludes filing of claims against Quadriga, a Canadian cryptocurrency exchange that has left thousands of investors without their money after the death of founder Gerald Cotten. Customers have threatened lawsuits. Ernst & Young has been appointed the company’s third-party monitor, to help manage Quadriga’s finances during the process.

Cotten, who died in December of complications from Crohn’s disease while in India, was the only person who had passwords to digital wallets containing C$180 million ($137.13 million) in cryptocurrencies, according to court filings. He was 30 years old. “Despite repeated and diligent searches, I have not been able to find (the passwords) written down anywhere,” his widow Jennifer Robertson said in an affidavit. A court file indicates Quadriga owes 115,000 users the equivalent of C$250 million ($190.46 million). The document showed Quadriga has $30 million in bank drafts, many of which it has had trouble depositing. Lawyer Maurice Chiasson told the court the company wants time to find the C$250 million it owes users. According to court filings the company is considering selling its platforms to cover its debts.

The riches of smartphones.

• 5G Wireless: A “Massive Health Experiment” (SHTF)

Experts are warning that superfast broadband known as 5G could cause cancer in humans, and the usage of 5G is nothing more than a “massive health experiment.” 5G could very well be a global catastrophe that kills wildlife, gives people terminal diseases, and causes the Earth’s magnetic field to change, according to shocking claims by a technology expert. Arthur Robert Firstenberg is an American author and an activist for electromagnetic radiation and health. In his 1997 book Microwaving Our Planet: The Environmental Impact of the Wireless Revolution, he claimed: “The telecommunications industry has suppressed damaging evidence about its technology since at least 1927.”

Firstenberg has also founded the independent campaign group the Celluar Phone Task Force and since 1996 he has argued in numerous publications that wireless technology is dangerous. According to a report by the Daily Star, Firstenberg has also recently started an online petition calling on world organizations, such as the United Nations, World Health Organisation (WHO), and European Union to “urgently halt the development of 5G,” which is due to be rolled out this year. In fact, Verizon has activated the world’s first 5G networks in four cities in the United States: Houston, Indianapolis, Los Angeles, and Sacramento. According to the Firstenberg, wireless networks are “harmful for humans” and the development of the next generation is “defined as a crime” under international law, as he states it in the online petition.

When speaking to The Daily Star Online, Firstenberg said this 5G rollout is deadly. “There is about to be as many as 20,000 satellites in the atmosphere. The FCC approved Elon Musk’s project for 12,000 satellites on November 15th and he’s going to launch his in mid-2019. I’m getting reports from various parts of the world that 5G antennas are being erected all over and people are already getting sick from what’s there now and the insect population is getting affected,” Firstenberg stated.

More riches of smartphones. Someone soon will propose a better term than ‘smart’-phones.

• 18% Of Young People In UK Do Not Think Life Is Worth Living (G.)

The number of young people in the UK who say they do not believe that life is worth living has doubled in the last decade, amid a sense of overwhelming pressure from social media which is driving feelings of inadequacy, new research suggests. In 2009, only 9% of 16-25-year-olds disagreed with the statement that “life is really worth living”, but that has now risen to 18%. More than a quarter also disagree that that their life has a sense of purpose, according to a YouGov survey of 2,162 people for the Prince’s Trust, a charity that helps 11 to 30-year-olds into education, training and work. Youth happiness levels have fallen most sharply over the last decade in respect of relationships with friends and emotional health, the survey found, while satisfaction with issues like money and accommodation have remained steady.

The Prince’s Trust has been gauging youth opinion for 10 years and found that just under half of young people who use social media now feel more anxious about their future when they compare themselves to others on sites and apps such as Instagram, Twitter and Facebook. A similar amount agree that social media makes them feel “inadequate”. More than half (57%) think social media creates “overwhelming pressure” to succeed. The gloomy view on life being taken by a growing minority of young people comes amid reports of an increased rate of teenage suicide. It was reported on Sunday that official statistics due later this year will show that suicides now occur at more than five in 100,000 teenagers in England. That contrasts with a figure of just over three in 100,000 in 2010.

“Social media has become omnipresent in the lives of young people and this research suggests it is exacerbating what is already an uncertain and emotionally turbulent time,” said Nick Stace, UK chief executive of The Prince’s Trust. “Young people are critical to the future success of this country, but they’ll only realise their full potential if they believe in themselves and define success in their own terms. It is therefore a moral and economic imperative that employers, government, charities and wider communities put the needs of young people centre stage.”

Britain gets rid of its old and its young. And presumably other ‘weaker’ groups.

• 50,000 Elderly In UK -77 Per Day- Die Waiting For Social Care (G.)

More than 50,000 people have died waiting for care while ministers dither over long-awaited plans to overhaul the funding of social care, a charity has claimed. Age UK estimated that 54,000 people – or 77 a day – have died while waiting for a care package in the 700 days since the government first said in March 2017 it would publish its social care green paper, which has since been delayed several times. The claim came as a cross-party group of MPs warned that the government was “in denial” about the perilous state of English local authority finances – a crisis driven by a growing demand for the care of vulnerable adults and children.

The Commons public accounts committee (PAC) said that after eight years in which central government funding had halved, councils were under “enormous pressure” just to maintain essential services. MPs accused ministers of having no meaningful plan to ensure local authority finances were sustainable in the future. Overall spending by local authorities on services fell by 19.2% in real terms between 2010-11 and 2016-17, according to the report. Meg Hillier, the committee chair said: “Government needs to get real, listen fully to the concerns of local government and take a hard look at the real impact funding reductions have on local services.”

The chancellor, Philip Hammond, announced a funding boost for councils at last autumn’s budget, amounting to £1.4 bn in 2018-19 and 2019-20. But the PAC said such short-term fixes failed to deal with the underlying challenges facing councils. It urged the government to focus on assuring the long-term sustainability of local authority finances, and be more ambitious than simply allowing them to “cope”.