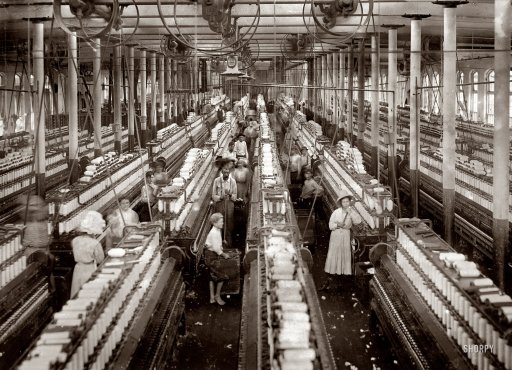

Lewis Wickes Hine Child Labor in Magnolia Cotton Mills spinning room, Mississippi 1911

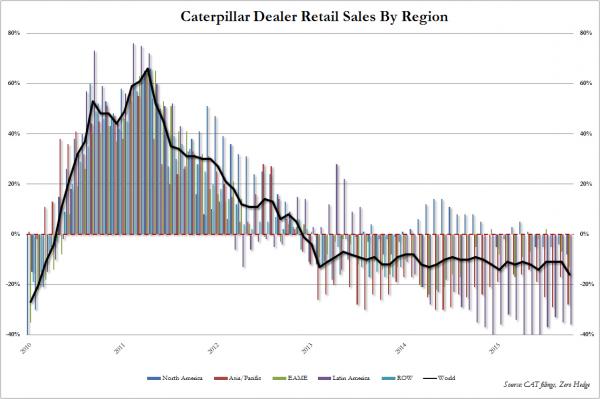

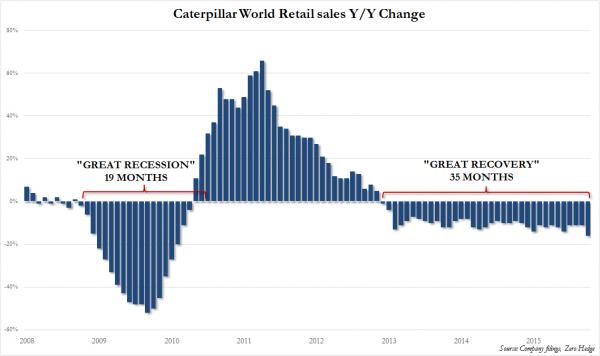

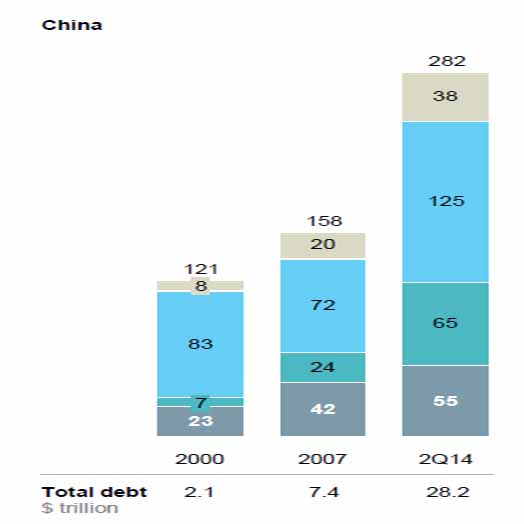

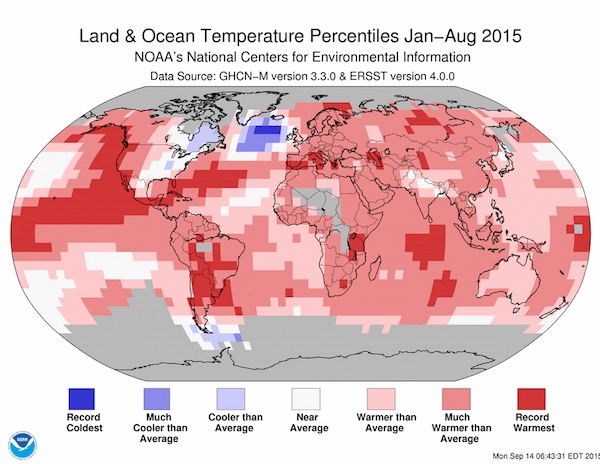

China demand tanks. For oil, for everything. If there is to be a ‘Story of 2015’, it should be that. But instead, denial pushes it forward to 2016.

• Brent Oil Slides to 11-Year Low as Producers Seen Worsening Glut (BBG)

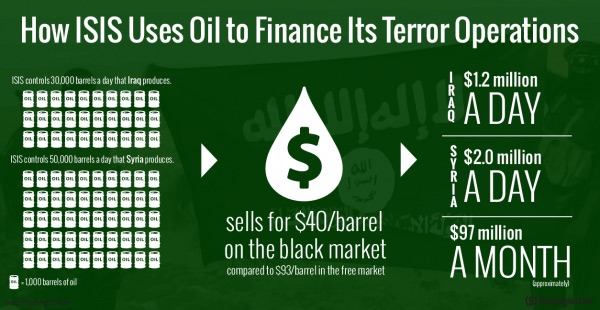

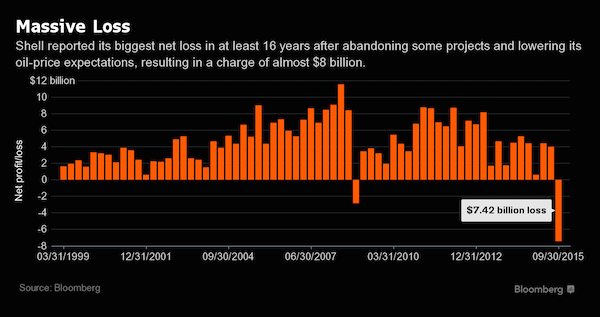

Brent crude slumped to the lowest level since 2004 amid speculation suppliers from the Middle East to the U.S. will exacerbate a record glut as they continue fighting for market share. Futures fell as much as 1.9% in London after a 2.8% drop last week. Producers are focusing on reducing costs amid the price decline, Qatar Energy Minister Mohammed Al Sada said Sunday at a meeting of Arab oil-exporting nations in Cairo. Drillers in the U.S. put the most rigs back to work since July, adding 17, data from Baker Hughes showed. Oil has fallen below levels last seen during the 2008 global financial crisis on signs the market’s oversupply will worsen. OPEC effectively abandoned output limits at a Dec. 4 meeting, while the U.S. on Friday passed legislation that lifted a 40-year ban on crude exports.

“There hasn’t been any significant signs of a pick-up in demand and we haven’t seen any meaningful cuts to production,” Ric Spooner, a chief analyst at CMC Markets in Sydney, said by phone. “Nothing has really changed in the oil market over the past couple of months apart from the price.” Brent for February settlement slid as much as 71 cents to $36.17 a barrel on the London-based ICE Futures Europe exchange, the lowest level in intraday trade since July 13, 2004. The contract was at $36.41 at 2:21 p.m. Singapore time after falling 18 cents to $36.88 on Friday, the lowest close since December 2008. Front-month prices are down 36% this year, set for a third annual loss. West Texas Intermediate for January delivery, which expires Monday, was 28 cents lower at $34.45 a barrel on the New York Mercantile Exchange. It dropped 22 cents to $34.73 on Friday, the lowest close since February 2009. The more active February contract was down 29 cents at $35.77. Total volume was close to the 100-day average.

Nobody has a choice.

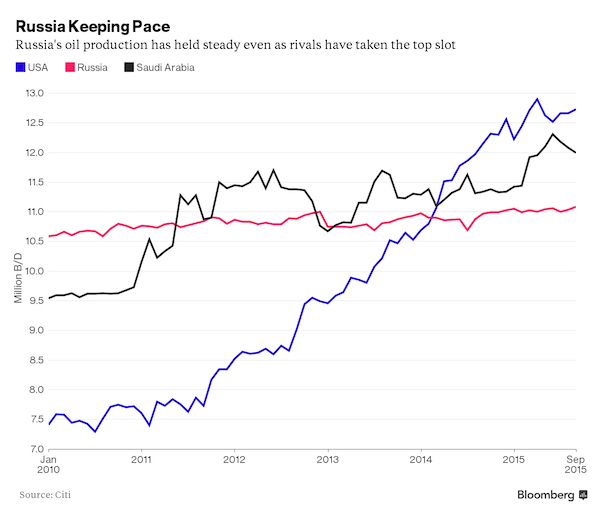

• Siberian Surprise: Russian Oil Patch Just Keeps Pumping (BBG)

In the fight for market share among the world’s oil producers this year, Russia wasn’t supposed to be a contender. But the world’s No. 3 producer has been pumping at the fastest pace since the collapse of the Soviet Union, adding to the flood on an already-swamped market and helping push prices to the lowest levels since 2009. Russia’s unexpected oil bounty this year is the result not of a new Kremlin campaign but of dozens of modest productivity improvements across the sprawling sector. Even pressured by plunging prices, as well as U.S. and European Union sanctions that cut access to much foreign financing and technology, Russian companies have managed to squeeze more crude out of some of the country’s oldest fields.

They have also brought new projects on line, offsetting steady declines in its core producing region of West Siberia. With a rise of 0.5% in the first nine months of 2015, Russia hasn’t boosted production as much as its larger rivals, the U.S. (up 1.3%) and Saudi Arabia (up 5.8%), according to Citigroup Inc. But having ignored OPEC’s calls earlier this year to join efforts to support prices by pumping less, Russia is keeping up with the cartel. “I know of no one who had predicted that Russian production would rise in 2015, let alone to new record levels,” said Edward Morse, Citigroup’s global head of commodities research. As recently as April, not even the Russian government thought 2015 would break the record.

It’s about the banks.

• This So-Called Rate Hike Is Completely Jerry-Rigged (E&M)

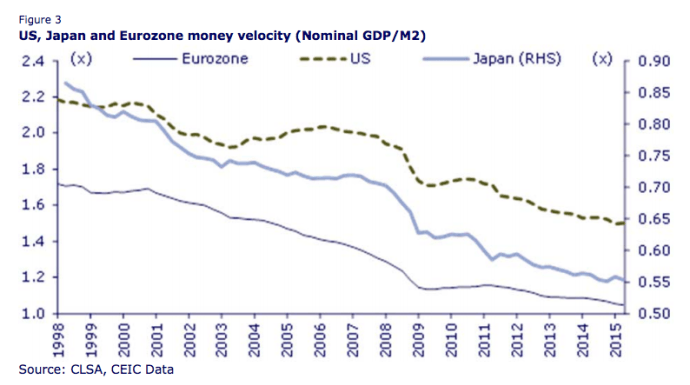

It’s official. [Last] week the Federal Reserve raised the key overnight Fed Funds rate by 0.25%. The move was discussed, debated, argued, and telegraphed to death. We all heard about it until we hoped anything else financial would happen so we could finally put the tired story to rest. Now that the rate hike is on the books, we can start talking about outcomes, like how in the world the Fed intends to enforce the rate hike, what it means, and what comes next. The first one is not so simple, the second is annoying, and the third is downright depressing. But we’d better start planning for this today, because it will definitely affect our investments in the months to come! This rate hike is unlike any other. It comes on the heels of several quantitative easing programs that have dumped trillions of new dollars into the banking system.

Before the financial crisis, banks held about $60 billion of excess reserves at the Fed. These are funds above and beyond their required reserves. Today, excess reserves total about $2.6 trillion, which represents part of the money the Fed printed and then used to buy bonds. Typically this cash would have flowed into the economy through lending, but in 2008 the Fed started paying interest on excess reserves, which has kept the funds out of circulation. With so much extra cash in their accounts, banks have almost no need to borrow from each other. This creates a problem for the Fed because adjusting the rate at which banks lend to each other, called the Fed Funds rate, is how it historically enforced its interest rate policy. Starting this week, the Fed will have to use new, largely untested tools.

Since there is almost zero demand for money between banks, the Fed is increasing the interest it pays on excess reserves from 0.25% to 0.50%. At the same time, the Fed intends to lend out up to $2 trillion of its own stash of bonds in the overnight repurchase market. It will lend these to banks, money market funds, and other institutions for one night, with an agreement to buy the bonds back the next day at a slightly higher price, effectively paying the counterparty 0.25% interest. It’s more than a little backwards. The upshot is that instead of banks paying each other the higher rate of interest after a rate hike, now it’s the Fed, which means it’s really me and you, since the Fed gets money by taking value from the rest of us. At the new, higher rate, this is about $10.5 billion per year that is nothing but a gift to banks.

“It depends less on fundamentals, and more on second-guessing what everyone else will do.”

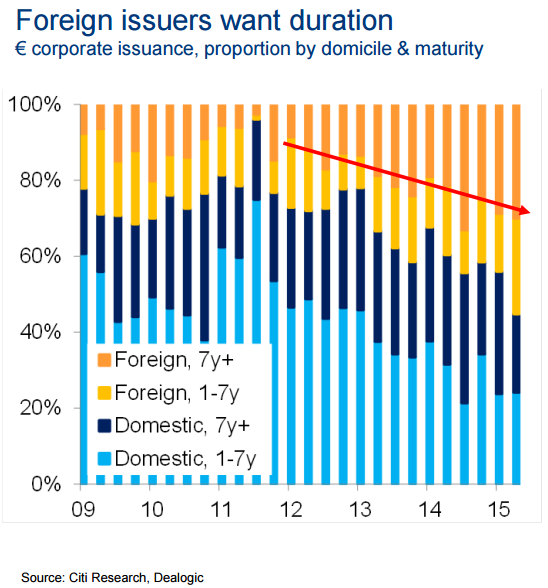

• Central Banks Created A Monster That Drives The Economy On The Way Down (King)

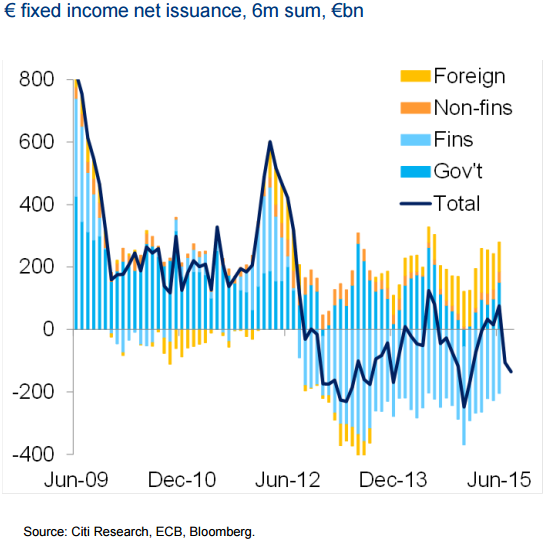

The broader narrative – in which central bank liquidity has pushed up asset prices without fostering a similar improvement in the underlying economy – is one we find the vast majority of [fixed income] investors are sympathetic to. The only question is on the timing: no one wants to get out too early. This is one of the reasons we find the outlook for next year so difficult, and why there is so little agreement about it (even internally at Citi, never mind across the street). It depends less on fundamentals, and more on second-guessing what everyone else will do. Of course, markets are always to some extent like that, but self-reinforcing processes seem to have grown in importance in recent years. Rather than the economy driving markets, as is supposed to be the case, the risk is that central banks have now created a monster such that markets drive the economy, if not on the way up, then certainly on the way down.

Suppose, for example, that all does not go according to plan, and that the current squeeze higher in markets fades and even reverses. Perhaps oil price and EM weakness prove persistent, markets and the developed economies continue to prove more susceptible to these than they “ought” to, inflation breakevens fall, spreads widen and equities suffer even in the face of continuing share buybacks and record M&A. The scenario is far from unthinkable: indeed, it would simply be a continuation of everything we’ve seen in the past six months. What we find really alarming in such a scenario is not only that the safety net might be a while in coming, but that we are increasingly doubtful of how much support it would provide, at least initially.

Clearly the threshold for the Fed to reverse its hike, let alone do more QE or move to negative rates, is very high. And while the ECB should eventually do more, the bar to Draghi being able to spur the rest of the Governing Council to arms would now seem to have been raised. Worse, though, the broad market reaction to central bank stimulus seems to be waning. In credit, and in Europe, this is not too bad. We do still think negative rates and QE retain a positive effect, even if it seems to be driving almost as much money into US fixed income as into European credit and equities.

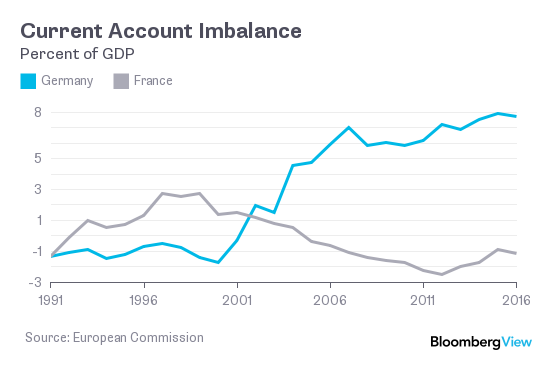

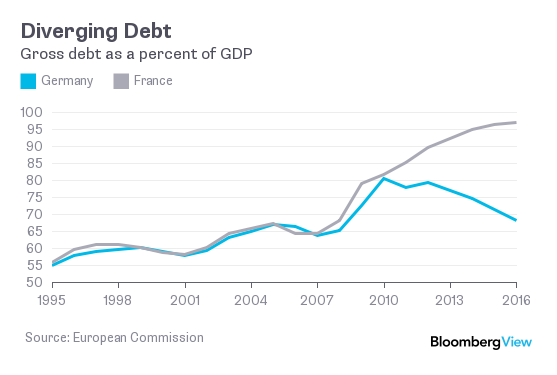

Brussels is a crisis-producing machine.

• Europe’s Year From Hell May Presage Worse To Come (Reuters)

By any measure, it has been a year from hell for the European Union. And if Britons vote to leave the bloc, next year could be worse. Not since 1989, the year the Berlin Wall fell and communism crumbled across eastern Europe, has the continent’s geopolitical kaleidescope been shaken up so vigorously. But unlike that year of joyous turmoil, which paved the way for a leap forward in European integration, the crises of 2015 have threatened to tear the Union apart and left it battered, bruised, despondent and littered with new barriers. The collapse of the Iron Curtain led within two years to the agreement to create a single European currency and, over the following 15 years, to the eastward enlargement of the EU and NATO up to the borders of Russia, Ukraine and Belarus.

That appeared to confirm founding father Jean Monnet’s prediction that a united Europe would be built out of crises. In contrast, this year’s political and economic shocks over an influx of migrants, Greek debt, Islamist violence and Russian military action have led to the return of border controls in many places, the rise of populist anti-EU political forces and recrimination among EU governments. Jean-Claude Juncker, who describes his EU executive as the “last chance Commission,” warned that the EU’s open-border Schengen area of passport-free travel was in danger and the euro itself would be unlikely to survive if internal borders were shut. Juncker resorted to gallows humor after the last of 12 EU summits this year, most devoted to last-gasp crisis management: “The crises that are with us will remain and others will come.”

His gloomy tone was a reality check on the “we can do it” spirit that German Chancellor Angela Merkel – Europe’s pre-eminent leader – has sought to apply to the absorption of hundreds of thousands of mostly Syrian refugees. Merkel has received little support from her EU partners in sharing the migrant burden. Most have insisted the priority is sealing Europe’s external borders rather than welcoming more than a token number of refugees in their own countries. This is partly due to latent resentment of German dominance of the EU and payback for its reluctance to share more financial risks in the eurozone. Some partners also accuse Berlin of hypocrisy over its energy ties with Russia, while friends such as France, the Netherlands and Denmark are simply petrified by the rise of right-wing anti-immigration populists at home.

One of the sharpest rebuffs to sharing more of the refugee burden came from close ally Paris. Prime Minister Manuel Valls said of Merkel’s open door policy towards Syrian refugees: “It was not France that said ‘Come!’.” Merkel’s critics rounded on her at an end-of-year EU summit. Italy’s Matteo Renzi, backed by Portugal and Greece, attacked her refusal to accept a eurozone bank deposit guarantee scheme. The Baltic states, Bulgaria and Italy denounced her support for a direct gas pipeline from Russia to Germany at a time when the EU is sanctioning Moscow over its military action in Ukraine and has forced the cancellation of a pipeline to southern Europe. “It was pretty much everyone against Merkel in the room,” a diplomat who heard the exchanges said.

Left wing coalition?

• Spain Election Confusion: Conservatives Win But Podemos Are Stars (Ind.)

Spain was plunged into the political unknown on Sunday night as no single party emerged as the winner in its closest general election since the end of the Franco dictatorship 40 years ago. The governing Popular Party (PP), led by the Prime Minister, Mariano Rajoy, secured 28.7% of the vote. That put the party in first place, but well below what it needs to maintain its majority. Mr Rajoy will now be given the first opportunity to persuade rival parties to join him in government before parliament reconvenes next month. But the night belonged to Podemos, and its leader, the ponytailed Pablo Iglesias. The left-wing party, which did not even exist two years ago, finished third with 20.6%. The mainstream left-wing opposition, the PSOE, just beat Podemos into second place with 22%.

For four decades the PP and the PSOE have dominated Spanish politics, swapping power at regular intervals. Their combined grip on office is now almost certainly at an end. The 60-year-old Mr Rajoy, who lost two elections before his landslide four years ago, now faces a fight for his political career. Throughout the campaign, commentators have suggested that the PP – always the favourite to emerge as the strongest single party – could overcome a hung parliament by striking a deal with the new centrist party Ciudadanos, which collected 15.2% of the vote. Crucially for Mr Rajoy, however, the election arithmetic – even with Ciudadanos – appears to work against him. Although he only needs a simple majority to be confirmed as prime minister when the Spanish parliament reconvenes on 13 January, he will need at least 176 seats to carry through his programme. According to the exit poll, which surveyed 180,000 people, a combination of the PP and Ciudadanos will not reach that magic number.

Tsipras should pull the plug on the entire circus.

• Alexis Tsipras Pushes For IMF To Stay Out Of Next Greek Bailout (FT)

Greek prime minister Alexis Tsipras is pushing for the IMF to stay out of the country’s €86 billion third bailout, leaving the euro zone to take full responsibility for overseeing economic reforms. Mr Tsipras said in an interview with the Financial Times he was “puzzled by the unconstructive attitude of the fund on fiscal and financial issues”. He indicated that the IMF should leave his country’s third bailout to the euro zone when it decides whether to stay involved early next year. “We think that after six years of managing in extraordinary crisis, Europe now has the institutional capacity to deal successfully with intra-European issues.” Mr Tsipras’s assertion is likely to anger the German government, which has always insisted the IMF stay on board. Berlin values the fund’s technical expertise as much as it doubts the European Commission’s resolve.

Mr Tsipras also risks alienating the IMF, which is a strong advocate of debt relief for Athens while Germany and other euro zone members are strongly against debt writedowns, although he praised the fund’s support on this issue. Mr Tsipras said his government wanted to implement bailout measures as swiftly as possible with the aim of recovering sovereignty and getting rid of the so-called “troika” of bailout monitors from the commission, IMF and ECB. “We believe the sooner we get away from the [bailout] program the better for our country,” he said. “If Greece completes the first [progress] review in January, we’ll be covering more than 70% of fiscal and financial measures in the agreement.” Mr Tsipras also sounded confident that Greece would lift all remaining capital controls by March and resume borrowing on international capital markets “before the end of 2016”.

Greece saw 12 seperate pension cuts so far.

• After Jumping Over One Hurdle, Greece Faces Another With Pensions (CNBC)

Don’t look now, but 2016 may bring a host of new troubles for Greece, which just last week barely overcame a dispute with its international creditors. Struggling to meet the demands of its bailout terms, the Hellenic Republic was forced on Thursday to scrap an effort to alleviate the burden of its austerity program on poorer Greeks. The demise of its so-called “parallel program”, although a short-term defeat for Prime Minister Alexis Tsipras, triggered the release of €1 billion in new bailout funding, expected to be disbursed as early as Monday. The money was part of an agreement that was sealed last summer.

Now, momentum shifts to pension reform, which is expected as soon as next month. The battle will take shape just as the Greek government appears to have won a hard-fought consensus with creditors on other outstanding issues such as deregulation and the establishment of a privatization fund – which must gather €50 billion by 2030. A pension system overhaul, however, is shaping up to be a big hurdle for Greece, a hard sell at a time when the country’s economic crises have sent unemployment skyrocketing above 25% and average income plummeting 25% over the last four years. “Both the government’s willingness to reform and its internal cohesion appear to be weak which does not bode well for the prospects of reform,” said Stathis Kalyvas, a professor of political science at Yale University and the co-director of its Hellenic Studies program.

“On the flip side, there is no real alternative for the government right now and the fact that it has already embarked on reform process following last summer’s agreement will be pushing it to implement it sooner rather than later”. Greece challenge is to convince its creditors that it can reduce government expenditure by up to 1% of its economy via pension cuts. But in a country where the social costs of austerity weighs on the mood of the general population, some think new pension adjustments could be the straw that breaks the camel’s back. Some of the government’s 153 MPs have already made clear that they will not support new cuts to pensions. If as few as three MPs vote against pension reform, analysts say it is likely the government will lose its majority, once again sinking back into political crisis.

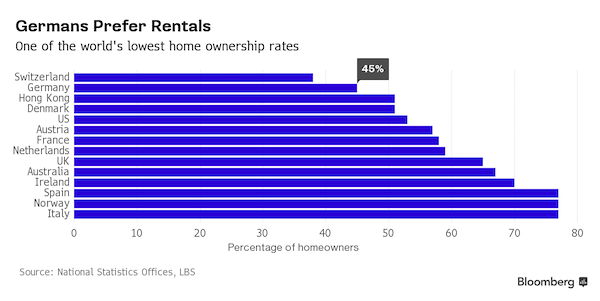

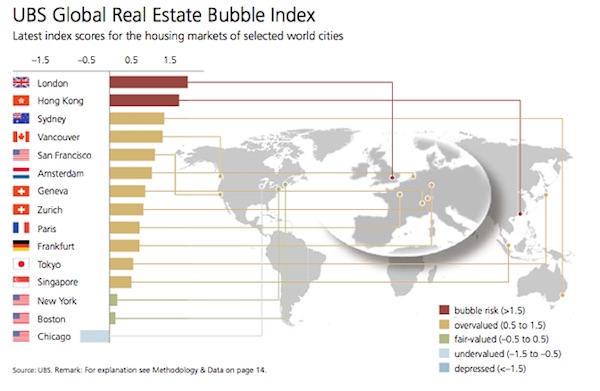

Prime candidate for dumbest term ever invented: housing ladder or property ladder. The UK, like Canada, Oz and New Zealand, is busy blowing up its own housing market, and refusing to halt it.

• UK Buyers Need To Save For Up To 24 Years To Get On Property Ladder (Guardian)

Homebuyers now have to save for up to 24 years to set aside a deposit large enough to buy them a foot on Britain’s housing ladder, according to new research. The Resolution Foundation thinktank has used the Bank of England’s latest survey of household finances to show that with house prices rising sharply, it would now take almost a quarter of a century for low- and middle-income households to accumulate a deposit on average, if they set aside 5% of their disposable income each year. It is lower than the peak reached before the financial crisis, but dramatically higher than the three years that was the norm in the 1980s and 1990s – and comes despite interest rates remaining at the emergency level of 0.5% set by the Bank of England in the depths of recession.

George Osborne has introduced a series of help-to-buy policies, including shared ownership schemes and taxpayer guarantees for mortgages for first-time buyers, and pledged in his spending review last month to “turn generation rent into generation buy”. But Resolution’s chief economist, Matt Whittaker, warned that help to buy may simply boost house prices, lifting them further out of the reach of lower-income households. “To the extent that these schemes have stoked demand and so propped up house prices in recent years, they have served to make homeownership even less attainable for many, while increasing the gains flowing to older homeowners who have been the main beneficiaries of the sustained housing boom,” he said.

It’s an Anglo disease. Trudeau’s too scared to rock the boat, just like the others.

• Canada’s Trudeau Cites Risk in Curbing Foreign Real-Estate Investment (WSJ)

Imposing curbs on foreign investment in Canadian real estate could have unintended consequences for the broader economy, Canadian Prime Minister Justin Trudeau warned in a year-end interview with Canada’s Global Television Network, scheduled to air Christmas Day. Mr. Trudeau said there is a lack of “concrete data” about the impact of foreign buying on Canadian real estate, so moving ahead without proper information is risky. Mr. Trudeau’s comments emerge as a debate heats up over the impact overseas buyers may be having on housing affordability in the two of the country’s biggest housing markets—Toronto and Vancouver, British Columbia.

“You know you have to be cautious about decisions like that that are based on a single factor because at the same time [it] would potentially devalue the equity that a lot of people have in their homes right now,” Mr. Trudeau said, according to a transcript of the interview distributed by Global TV. “We have to be very, very cautious about restricting foreign investment in our country at a time where we know we need foreign investment in businesses, in resource development.”

Economists indicate strong sales and price growth in Toronto and Vancouver are supported by job creation in the two metropolitan areas, and an increasing number of people migrating to those urban centers as resource-rich parts of the country suffer under the weight of low commodity prices, as opposed to foreign investment. Meantime, Evan Siddall, the president of Canada Mortgage and Housing Corp., a government-owned mortgage insurer and housing agency, said in a recent speech that foreign investment could be contributing to the overvaluation of housing prices in the two markets. But, he said, the country lacks “accurate and reliable data” to determine the role foreign investment has on housing prices in the country.

Almost funny.

• Kansas Suspends Debt Limits To Pay For Tax Cuts (Wichita Eagle)

Right-wing Republican lawmakers have operated under the radar to suspend all statutory limits on highway debt, and that unprecedented authority was recently used to issue record-breaking levels of long-term debt to pay for their reckless income tax cuts this year and next. Six lines buried deep in a 700-page appropriation bill last spring gave the Kansas Department of Transportation unlimited authority to issue debt, and in early December, without public disclosure, the agency used that authority to issue $400 million in highway bonds. State law requires those debt proceeds to be used for improving state highways, but do not expect that to happen. Lawmakers directed that $400 million and more be swept from the highway fund to help pay for the $700 million dip in state revenues caused by income tax cuts in 2012 and 2013.

The $400 million in new highway debt represents the largest single highway bond in state history and bumps up total outstanding highway debt to $2.1 billion, also a state record. The size of the bond issue was boosted 60% higher than planned last January in order to stabilize at least temporarily the precarious condition of state finances. Never before in state history has a state agency been granted unlimited powers to issue debt. Prior to this extraordinary action, state lawmakers had carefully placed specific limits on the state’s ability to borrow money. KDOT’s authority to issue unlimited debt continues through this fiscal year and next, so additional highway bonds could be issued at any time over the next 18 months. The governor and legislative leaders went to extraordinary lengths to hide their suspension of debt limits from public scrutiny.

The governor’s budget report made no mention of the suspension. Republicans who controlled the appropriations conference committee never raised the issue. The Statehouse press corps missed it as well. Further, neither the governor nor KDOT disclosed to the public that KDOT had issued $400 million in new, record-breaking debt. Only after press inquiries last week, two weeks after the fact, did KDOT acknowledge that new bonds had been issued.Gov. Sam Brownback and Republican legislative leaders have elevated the practice of confiscating highway funds to pay for other state obligations to a new level. In this year alone $436 million will be swept from the highway fund – the single largest transfer ever. That amount plus prior transfers during Brownback’s term brings their displacement of highway funds to a breathtaking total of $1.6 billion.

How empires fall: overreach.

• The Empire Files: ‘America’s Ship is Sinking’: Former Bush Official (TeleSur)

“This ship is sinking,” retired U.S. Army Colonel Lawrence Wilkerson tells Abby Martin, adding that “today the purpose of US foreign policy is to support the complex that we have created in the national security state that is fueled, funded, and powered by interminable war.” The former national security advisor to the Reagan administration, who spent years as an assistant to Secretary of State Colin Powell during both Bush administrations reflects on the sad but honest reflection on what America has become as he exposes the unfixable corruption inside the establishment and the corporate interests driving foreign policy. “It’s never been about altruism, it’s about sheer power.”

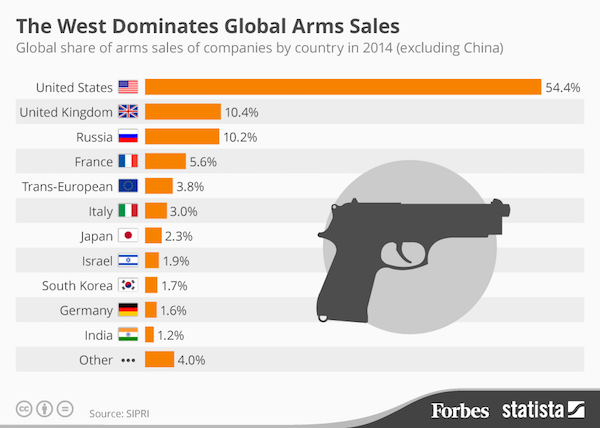

This does not include what’s sold domestically.

• The West Dominates Global Arms Sales (Forbes)

In 2014, sales of the world’s top-100 arms manufacturers totalled $401 billion, according to a report from the the Stockholm International Peace Research Institute. There was a moderate 1.5% decline in sales between 2013 and 2014, primarily due to lower sales for companies based in North America and Western Europe. Despite that decline, the West still dominates global arms sales. In 2014, seven out of the top ten largest arms-producing companies were American. Lockheed Martin grabbed the top spot for the first time since 2009, acccording to SIPRI, with arms sales totaling $37.5 billion. Boeing was in second place with $28.3 billion while Britain’s BAE Systems came third with just under $26 billion in sales.

Last year, the United States accounted for 54.4% of the world’s arms sales. The United Kingdom was in second place, with 10.4% while Russian companies had a 10.2% share of the market. Arms sales by Western European countries fell 7.4% in 2014 with only German and Swiss companies showing growth (9.4 and 11.2% respectively). Increasing national military expenditure and exports in Russia have seen the country’s arms industry grow steadily. According to SIPRI, Russia’s top eleven military companies experienced revenue growth of 48.4% between 2013 and 2014.

“Are other countries’ wars our responsibility? That’s a question you hear a lot these days. But no one wants to hear the answer.”

• The Refugee Crisis Is Forcing Germans To Ask: Who Are We? (Guardian)

I recently read that criminality is on the rise in German towns that have accepted refugees. But it’s not the refugees who are responsible for this crime wave: Germans in these towns have been committing arson, damaging property and attacking refugees. In other words, Germans have been making their own worst fears come true. Often the fear of loss leads to the very loss we fear – a principle that holds true not only for jealous lovers but also, it seems, for those who turn to violence out of fear that the refugees will cost them their safety and peace. The refugees haven’t even all been registered yet, but already they raise questions about who we are. Some Germans can imagine what it means to lose everything – hence their empathy; some can imagine what it means to lose everything – hence their fear.

We no longer have a universal frame of reference. Angela Merkel’s declaration that refugees are fundamentally deserving of protection – hers was the only declaration of its kind in Europe – has two main sticking points in her own country. First, there’s the free-market logic according to which the German government will prohibit neither the export of weapons by German companies to warring nations nor the ruthless exploitation of resources under corrupt systems in Africa, Asia and eastern Europe. And then there’s the ever-growing violence, both verbal and physical, from part of the German population: those who would like to see their country walled off with barbed wire – as is happening in Hungary – or, failing that, to at least have the Berlin government refuse to accept even the ridiculously low numbers of refugees mandated by the European Union – as Poland and the UK have done.

But which “European values” are best upheld with barbed wire and fences, regulations, harassment and attacks? Liberté, égalité, fraternité? Or is this mainly about our own survival? In eastern Germany, you can once again hear people chanting Wir sind das Volk (“We are the people”). In 1989 that sentence opened a border; now it’s being used to close a border, to insulate this finally unified Volk from the newcomers, who lack any unity since they are fleeing so many different wars. Are other countries’ wars our responsibility? That’s a question you hear a lot these days. But no one wants to hear the answer.

Lest we forget: one prediction is for 3 million refugees in 2016. Even ‘just’ half that will lead to complete mayhem.

• Vice Chancellor: Austria Can’t Accept Over 100,000 Migrants A Year (Reuters)

Austria’s Vice Chancellor said on Monday that Austria could not accept more than 100,000 migrants a year, following a pledge from its larger neighbor Germany to limit arrivals. Hundreds of thousands of people, many of them fleeing conflict and poverty in the Middle East, Afghanistan and elsewhere, have entered Austria on their route northwest from the Balkans since early September. Most have moved on to Germany, but Austria still expects to have received about 95,000 asylum applications this year, equivalent to more than 1% of its population, compared with the 28,000 registered in 2014. Of those, 38% were approved.

“Around 90-100,000 – a lot more will simply not be possible,” Reinhold Mitterlehner, from the conservative OVP, junior partner in the coalition, told ORF radio. Chancellor Werner Faymann, a Social Democrat who has generally adopted a more compassionate tone on the issue than the conservatives, was quoted as saying on Saturday that Austria should step up deportations of migrants who do not qualify for asylum. Faymann has also emphasized that policy decisions have been closely coordinated with his German counterpart Angela Merkel, who has pledged to “noticeably reduce the number of refugees”, fending off a challenge from critics of her own.

“If I cry in this Jungle, will anyone help me? No. I am in the Jungle, so I have to try and smile.”

• My Baby, The Refugee: Mothers On The Hardest Journey Of Their Lives (Guardian)

In a caravan in Calais, two little girls are playing a game. While their mother’s attention is elsewhere, they hang out of the small gap of an open window, giggling as they see who can lean the farthest. They could be on a family holiday, if it wasn’t for the squalor surrounding them. Instead, the children are living on mud-covered scrubland, without electricity or heating – just two more inhabitants of the unofficial refugee camp on Britain’s doorstep. A few minutes’ drive from the ferry port, the “new Jungle” is a symbol of the UK’s reluctance to deal with the refugee crises on our borders. Here, 200 women and children are said to be living among the 4,000 refugees, crammed into water-logged tents, caravans and even garden sheds. Thousands more live in similar conditions in nearby Dunkirk. While the young men who risk their lives jumping on to trains or lorries crossing the Channel have become the faces of this crisis, hidden in their midst are these families, trapped in an agonising limbo.

Rima, her shy son Adnan, five, and lively three-year-old daughter, Nour, are among them. The family fled Syria two months ago – just in time, Rima says, to avoid the fate of their nextdoor neighbours, who were killed in their homes the week before we speak. The children’s father was imprisoned in 2012, when Nour was two months old. “There is no security in our city,” Rima tells me. “You don’t have to have done anything for them to put you in prison. Every day I begged the guards to release him. They asked me for money, so I sold everything, but it was never enough. Finally, after a year, they told me he was dead. They allowed me to come every day and plead for him when he was dead. They never gave me his body.” Rima and her children joined the stream of refugees on what has become known as the “ant road”, from Turkey to western Europe.

“Walking through the night was terrifying,” Rima says. “I had a bag on my back and I put my daughter in it. She was ill; she had a temperature of 41C. The most frightening point was when a man on a motorbike wanted to carry my little boy – he said he’d take only the boy, not the girl. I thought he might snatch him.” Like many of the mothers here, Rima’s fear of imminent danger has been replaced with anxieties about the filthy, cold and sometimes violent conditions of the camp. As it becomes more permanent, little shops, cafes and even nightclubs have sprung up, giving a cruel imitation of a music festival – until the riot police come into view, standing guard near the motorway bridge. Despite being just yards from pleasant French houses, and a short drive from Calais’s squares and restaurants, the Jungle residents rely on candles for light and open fires for warmth.

Small fires that rip through caravans and tents are now a regular occurrence. In heavy rain, the area floods. At night, when the police clash with refugees, tear gas fills the air. The noise and insecurity are taking their toll on the already exhausted, traumatised children. “Now, there are no bombs, but we are freezing and still afraid,” Rima says, adding that she developed a heart condition after her husband was imprisoned. “There is no heating and we are living in the mud. In the night, my daughter screams in her sleep and hits out, because she has bad dreams. Four days ago, my heart felt so bad that I thought I would die. If I am not here, who will look after my children?”

Around 400 luckier women and children have found a space in the state-run Jules Ferry Centre, which also provides a hot meal every day for up to 2,500 Jungle residents who live outside, and a hot shower for around 1,000. Dedicated British and French donors and charities have also stepped in, offering warm clothes and nappies, and opening a women and children’s centre with a playground. But their goodwill alone cannot provide lights, heating or somewhere private to wash. For the mothers trapped here, all that is left is to put on a brave face and hope for a better life. Communities have sprung up; neighbours look after each other’s children and try to offer support. Despite their trying circumstances, people greet each other warmly. As one woman tells me, with heart-breaking honesty, “If I cry in this Jungle, will anyone help me? No. I am in the Jungle, so I have to try and smile.”

Just another day in the Aegean.

• 18 Migrants Drown After Boat Sinks Off Turkey’s Southwestern Coast (Reuters)

Eighteen people died and 14 were rescued late on Friday after a boat carrying migrants trying to sail to Greece sank off the southern Turkish town of Bodrum, Dogan News Agency reported. Fishermen hearing the migrants’ screams of migrants alerted the Turkish coast guard, who picked up the bodies from the sea after the wooden boat carrying migrants from Iraq, Pakistan and Syria capsized about 3.5 km off the coast. Those rescued were taken to the hospital in Bodrum, many in serious condition, the agency said. The coast guard was not immediately available for comment.

A record 500,000 refugees from the four-year-old civil war in Syria have traveled through Turkey then risked their lives at sea to reach Greek islands this year, their first stop in the EU before continuing to wealthier countries. Despite the winter conditions and rougher seas, the exodus has continued, albeit at a slower pace. Nearly 600 people have died this year on the so-called eastern Mediterranean sea route for migrants, according to the International Organization for Migration. Turkey struck a deal with the EU on Nov. 29 pledging to help stem the flow of migrants into Europe in return for €3 billion of cash for the 2.2 million Syrians Ankara has been hosting, visas and renewed talks on joining the 28-nation bloc.