Christo & Jeanne Claude The Gates, Central Park NYC 2005 (Christo died yesterday at 84)

The riots have completely taken over the -US- news cycle from COVID19, to such an extent that I don’t really know what to add to it. Only perhaps to say there is an enormous amount of brutal videos circling around, more than on any topic ever before, and there’s no way that doesn’t influence people on all sides.

We're welcoming Switzerland to the green team today! They've had an amazing comeback. The tough work is mostly done, now they need to get to zero and keep it there.

To see how other countries are doing, visit: https://t.co/j3hjaxmCX3 pic.twitter.com/jm2if0yOh3

— EndCoronaVirus.Org (@endCOVID19) June 1, 2020

2/ Things that went intellectually bankrupt over the pandemics & will hardly recover:

Epidemiology

Fortune cookie (positive) "evidence" base science

Bureaucratic topdown structures: WHO, CDC, UK GroupRent seeking academia can no longer be financed. Universities will crumble.

— Nassim Nicholas Taleb (@nntaleb) May 31, 2020

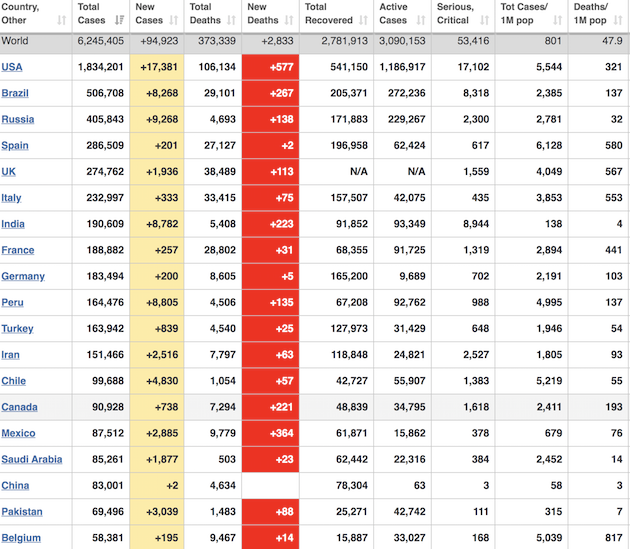

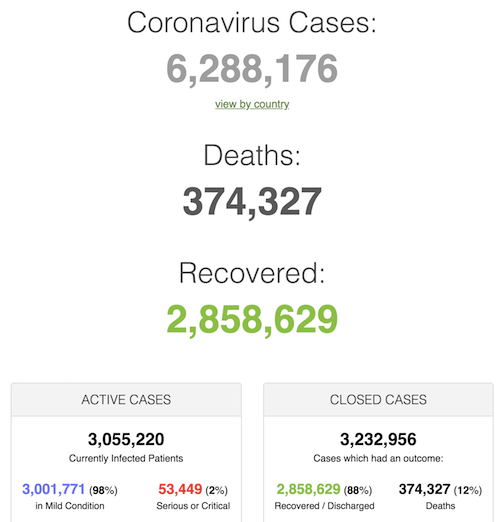

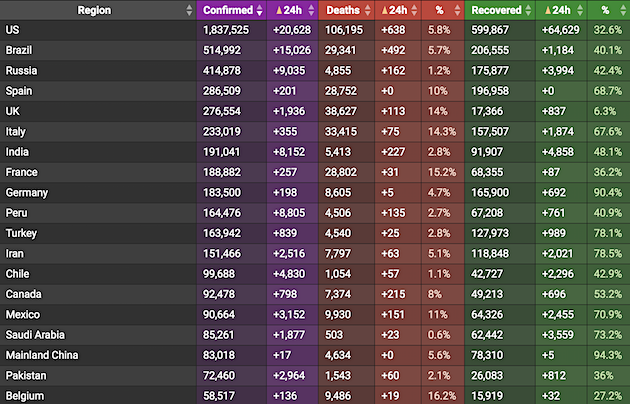

Counted from Saturday, since there was no Debt Rattle yesterday:

• Cases 6,288,176 (+ 233,399 from Saturday’s 6,054,777)

• Deaths 374,327(+ 7,039 from Saturday’s 367,288)

Note: I dropped the SCMP graph, it doesn’t appear very useful anymore.

From Worldometer yesterday evening -before their day’s close-:

From Worldometer:

From COVID19Info.live:

Would be good news, but this sounds a little goal-seeked.

• New Coronavirus Losing Potency, Top Italian Doctor Says (R.)

The new coronavirus is losing its potency and has become much less lethal, a senior Italian doctor said on Sunday. “In reality, the virus clinically no longer exists in Italy,” said Alberto Zangrillo, the head of the San Raffaele Hospital in Milan in the northern region of Lombardy, which has borne the brunt of Italy’s coronavirus contagion. “The swabs that were performed over the last 10 days showed a viral load in quantitative terms that was absolutely infinitesimal compared to the ones carried out a month or two months ago,” he told RAI television. Italy has the third highest death toll in the world from COVID-19, with 33,415 people dying since the outbreak came to light on Feb. 21. It has the sixth highest global tally of cases at 233,019.

However new infections and fatalities have fallen steadily in May and the country is unwinding some of the most rigid lockdown restrictions introduced anywhere on the continent. Zangrillo said some experts were too alarmist about the prospect of a second wave of infections and politicians needed to take into account the new reality. “We’ve got to get back to being a normal country,” he said. “Someone has to take responsibility for terrorizing the country.” The government urged caution, saying it was far too soon to claim victory. “Pending scientific evidence to support the thesis that the virus has disappeared … I would invite those who say they are sure of it not to confuse Italians,” Sandra Zampa, an undersecretary at the health ministry, said in a statement.

“We should instead invite Italians to maintain the maximum caution, maintain physical distancing, avoid large groups, to frequently wash their hands and to wear masks.” A second doctor from northern Italy told the national ANSA news agency that he was also seeing the coronavirus weaken. “The strength the virus had two months ago is not the same strength it has today,” said Matteo Bassetti, head of the infectious diseases clinic at the San Martino hospital in the city of Genoa. “It is clear that today the COVID-19 disease is different.”

A 56-second overview of the first 5 months of 2020. pic.twitter.com/WRpdHxSc4P

— Timur Kuran (@timurkuran) May 31, 2020

A bit better than remdesivir (which is not hard), and worse than HCQ?! What game is it that will be changed?

• Russia To Roll Out ‘Game Changer’ COVID19 Drug Next Week (R.)

Russia will start administering its first approved antiviral drug to treat coronavirus patients next week, its state financial backer told Reuters, a move it described as “a game changer” that should speed a return to normal economic life. Russian hospitals can begin giving the drug to patients from June 11, with enough to treat around 60,000 people per month, the head of Russia’s RDIF sovereign wealth fund told Reuters in an interview. There is currently no approved vaccine for the highly contagious and sometimes fatal illness and no consensus within the global scientific community about the efficacy of medication such as the Russian modified antiviral drug.

Registered under the name Avifavir, it is the first potential coronavirus treatment to be approved by Russia’s health ministry, however. It appeared on a government list of approved drugs on Saturday after clinical trials. RDIF head Kirill Dmitriev said clinical trials involved 330 people and showed that the drug successfully treated the virus in most cases within four days. Trials were due to be concluded in around a week, he said, and more would be conducted. The health ministry had given its approval for the drug’s use under a special accelerated process and manufacturing had begun in March, he added. “We believe this is a game changer. It will reduce strain on the healthcare system, we’ll have fewer people getting into a critical condition, and for 90% of people it eliminates the virus within 10 days,” he said.

“We believe that the drug is key to resuming full economic activity in Russia. People need to follow social distancing rules, and of course we need to have a vaccine, but it’s a combination of those three levers.” With 405,843 cases, Russia has the third highest number of infections in the world after Brazil and the United States, though with 4,693 official deaths, a much lower fatality rate, something that has been the focus of debate. Dmitriev said the new drug, which comes in tablet form, would allow people to spend less time in hospital and reduce the time they are contagious, saying the drug had few side-effects but was not suitable for pregnant women. It was particularly effective, he said, for patients suffering from mild or mid-level symptoms.

[..] Avifavir, known generically as favipiravir, was first developed in the late 1990s by a Japanese company later bought by Fujifilm as it moved into healthcare. The drug works by short-circuiting the reproduction mechanism of certain RNA viruses such as influenza. Russian specialists modified the generic drug to enhance its efficacy for treating COVID-19 [..]

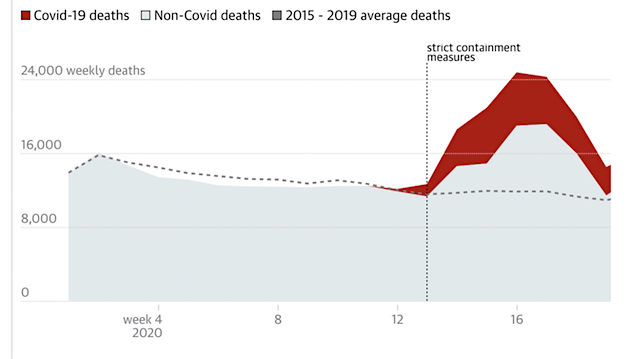

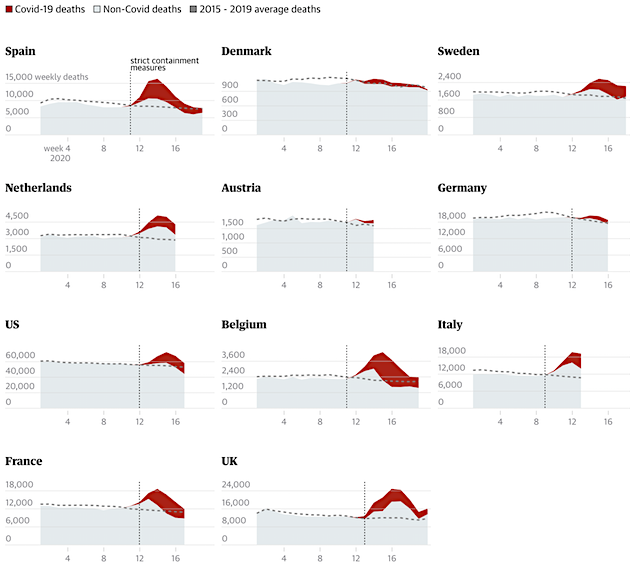

Excess deaths may be the best, if not only, way to get an accurate fatality number for COVID19.

• UK Has One Of Highest COVID19-Related Excess Deaths Levels In Europe (G.)

Britain’s excess death toll at the peak of the Covid-19 pandemic was the highest among 11 countries analysed by the Guardian. The UK had the biggest spike among countries including Sweden, France, Germany and Spain. At its peak the UK death toll was more than double that of an average week, at 109%, compared with Spain’s peak in week 14 where the death toll was double the average at 100%. By week 20 of 2020 the UK death toll – inclusive of both Covid-related and non-Covid deaths – was 21% higher than the average of recent years meaning, for every five deaths that occur in the UK in a normal year, six people have died this year to date.

Excess deaths are those above what we might expect to see in normal circumstances. The figure is the difference in the number of people who have died in a given week compared with the average number of deaths that occurred in the same period in the previous five years. Italy and the Netherlands also have excess deaths of 10% or more so far this year according to the latest data, although the data for those countries is not as up to date as that for the UK. Patterns in the data show countries that locked down earlier tended to have fewer deaths. Austria, which imposed strict containment measures on 16 March, when there was just one death attributed to Covid-19 in the country, recorded a peak in excess deaths of 14%.

By contrast, the Netherlands waited until its excess deaths were already 17% higher than usual before locking down, and at its peak the death toll was 74% above average. The data also shows that in Sweden, which has adopted a different approach with no lockdown in place, excess deaths peaked at 46%. The figures come from mortality statistics gathered by the Guardian. Not all of the deaths are directly attributable to Covid-19 but the figures indicate how many people have died directly and indirectly as a result of the virus in different countries.

That cat’s out of the bag. Too late.

• Health Officials Make Last-Minute Plea To Stop Lockdown Easing In England (G.)

Senior public health officials have made a last-minute plea for ministers to scrap Monday’s easing of the coronavirus lockdown in England, warning the country is unprepared to deal with any surge in infection and that public resolve to take steps to limit transmisson has been eroded. The Association of Directors of Public Health (ADPH) said new rules, including allowing groups of up to six people to meet outdoors and in private gardens, were “not supported by the science” and that pictures of crowded beaches and beauty spots over the weekend showed “the public is not keeping to social distancing as it was”.

On Saturday and Sunday, parks and seafronts were packed as people anticipated the lifting of restrictions on what has been dubbed “happy Monday”. Car showrooms and outdoor markets will also be reopened, millions of children will return to primary schools and the most vulnerable “shielded” people will be allowed out for the first time since lockdown began in March, all as long as physical distancing is maintained. But Jeanelle de Gruchy, president of the ADPH, said her colleagues across England were “increasingly concerned that the government is misjudging the balance of risk between more social interaction and the risk of a resurgence of the virus, and is easing too many restrictions too quickly”.

They have called on ministers to postpone the easing of restrictions until more is known about the infection rate, the test-and-trace system is better established and public resolve to maintain physical distancing and hygiene can be reinforced. “We have not spoken out in this way before,” De Gruchy said, “but we are concerned that if there is a spike it will be in our communities. We need to be confident we can get on top of it, and we are not confident yet.”

Awful headline for a reasonable piece.

• It’s The Virus, Stupid! (AHEB)

Many economists expressed disbelief after glancing at recent economic statistics. Since the arrival of the virus and the subsequent lockdowns we have observed a never-before-seen decline in production and consumption. In the UK alone, millions of jobs are at risk immediately. The IMF estimated that, for the UK, the expected economic growth this year will turn into a contraction of 6.5%. It was only the day after the presentation of this forecast when Kristalina Georgieva, the director of the IMF, said that the predictions had been overly positive. Globally, it is predicted that many hundreds of millions of people will fall back below the poverty line. The bad news just doesn’t seem to stop. And what for? To keep a virus in check.

A virus that will cause more death than a serious flu, but that does much less damage to health compared to other diseases like cancer or cardiovascular disease. Assuming an infection mortality risk of 1%, group immunity at 70% and 10 years of life lost per death, we arrive at an average loss of life expectancy of one month for the average UK person. This is in sharp contrast to, for example, the 2 to 3 years with which cancer shortens the life of the average UK person. Some economists read these numbers and conclude that the lockdown has to end immediately. That is understandable at first. The costs per year of life saved are higher than we are willing to spend on regular care. The difference is at least a factor 2, and probably much more. If we weren’t prepared to make such sacrifices for an extra year of life before, why now?

The comparison is flawed. While we can lift the lockdown, we cannot return to normality. If we assume 25% of the UK population is at risk, then 17 million people belong to one of the risk groups. For them, the virus is usually not fatal, but not safe either. Many of these people are likely to adopt a risk-averse position. The risks for the rest of the population are limited. However, they too will likely be cautious, as almost all of them are in direct contact with people from the risk groups. This raises the question to what extent the economic damage is caused by the lockdown or by the virus itself. The way to find out is to lift the lockdown in some regions and continue in others. Obviously, such an experiment will not be allowed because of the ethical aspects.

We import oil and rich people.

• Australia’s Stalled Migrant Boom Derails Golden Economic Run (R.)

Australia’s three decades of uninterrupted prosperity are coming to an abrupt end as the global coronavirus pandemic crashes one of its most lucrative sources of income – immigration. The country has been successful in managing the outbreak and reopening its A$2 trillion ($1.33 trillion) economy, thanks in part to an early closure of its borders. But the policy has led to a halt in mass immigration – a key source of consumer demand, labour and growth – in an economy which is facing its first recession since the early 1990s. Net immigration, including international students and those on skilled worker visas, is expected to fall 85% in the fiscal year to June 2021, curbing demand for everything from cars and property to education and wedding rings.

Gurmeet Tuli, who owns a jewellery store in the Sydney suburb of Parramatta, said his business is already hurting in a neighbourhood which is home to tens of thousands of migrants. “My main clientele is young people who come here to study, they find work here and settle down, fall in love and want to get married,” Tuli said. “I have not sold a single diamond ring in the past two months,” he added, noting business is down about 40% so far this year. So critical is migration to Australia that analysts reckon the economy would have slipped into a recession last year without new arrivals to boost population growth.

That’s not terribly interesting…

• Asia Stocks Hit 3-Month Peaks, Resilient To US Rioting (R.)

Asian shares pushed to three-month highs on Monday as progress on opening up economies helped offset jitters over riots in U.S. cities and unease over Washington’s power struggle with Beijing. There was also relief that while President Donald Trump began the process of ending special U.S. treatment for Hong Kong to punish China, he left their trade deal intact. “With specific and verifiable measures against China appearing to be weak, markets may draw hollow consolation that the U.S. is treading carefully,” said analysts at Mizuho in a note.

After a cautious start Asian markets were led higher by China on signs parts of the domestic economy were picking up. Hong Kong .HSI managed to rally 3.6%, while Chinese blue chips put on 2.4%. An official business survey from China showed its factory activity grew at a slower pace in May but momentum in the services and construction sectors quickened. A private survey showed a return to growth in May, though exports remained depressed. That helped lift MSCI’s broadest index of Asia-Pacific shares outside Japan 2.1% to its highest since early March. Japan’s Nikkei added 0.7% to also reach a three-month peak.

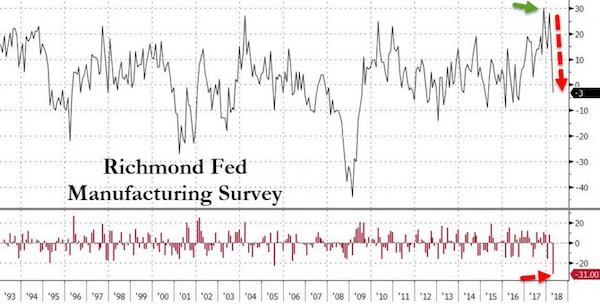

[..] The resilience was notable given major U.S. cities were cleaning up streets strewn with broken glass and burned out cars as curfews failed to stop confrontations between activists and law enforcement. The turmoil was a fresh setback for the economy which was only just emerging from a downturn akin to the Great Depression. Following poor data on spending and trade out on Friday, the Atlanta Federal Reserve estimated economic output could drop a staggering 51% annualised in the second quarter. The May jobs report due out on Friday is forecast to show the unemployment rate surged to 19.8%, smashing April’s record 14.7%. Payrolls are expected to drop by 7.4 million, on top of the 20.5 million jobs lost the previous month.

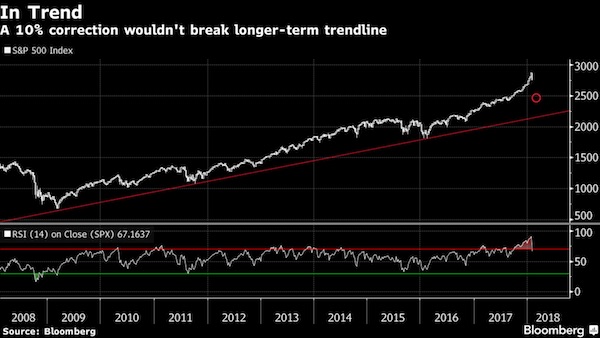

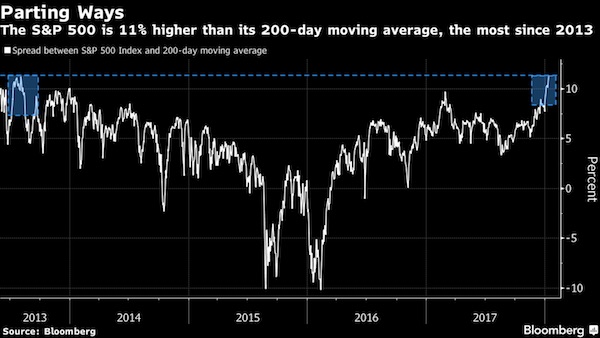

… this is far more interesting. Why are stocks “resilient” and hitting peaks as economies plunge?

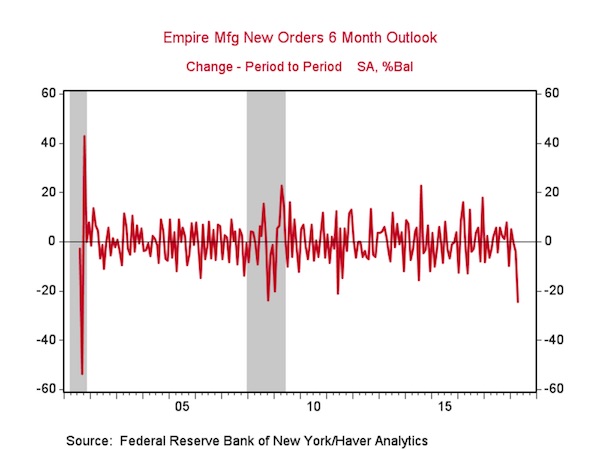

• Asia’s Factory Pain Worsens As China’s Recovery Fails To Lift Demand (R.)

Asia’s factory pain deepened in May as the slump in global trade caused by the coronavirus pandemic worsened, with export powerhouses Japan and South Korea suffering the sharpest declines in business activity in more than a decade. A series of manufacturing surveys released on Monday suggest any rebound in businesses will be some time off, even though China’s factory activity unexpectedly returned to growth in May. China’s Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) hit 50.7 last month, marking the highest reading since January as easing of lockdowns allowed companies to get back to work and clear outstanding orders.

But with many of China’s trading partners still restricted, its new export orders remained in contraction, the private business survey showed on Monday. China’s official PMI survey on Sunday showed the recovery in the world’s second-largest economy intact but fragile. Japan’s factory activity shrank at the fastest pace since 2009 in May, a separate private sector survey showed while South Korea also saw manufacturing slump at the sharpest pace in more than a decade. [..] Taiwan’s manufacturing activity also fell in May. Vietnam, Malaysia and the Philippines saw PMIs rebound from April, though the indices all remained below the 50-mark threshold that separates contraction from expansion. Official data on Monday showed South Korea extending its exports plunge for a third straight month.

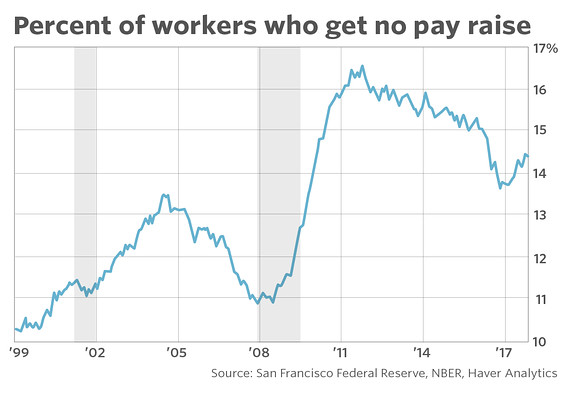

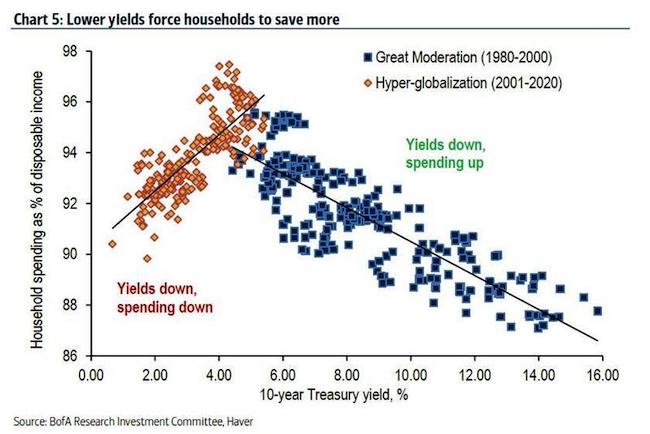

Japan’s policy for years now hs been to force people to spend. The more -and longer- you do that, the more afraid they get and the less they spend.

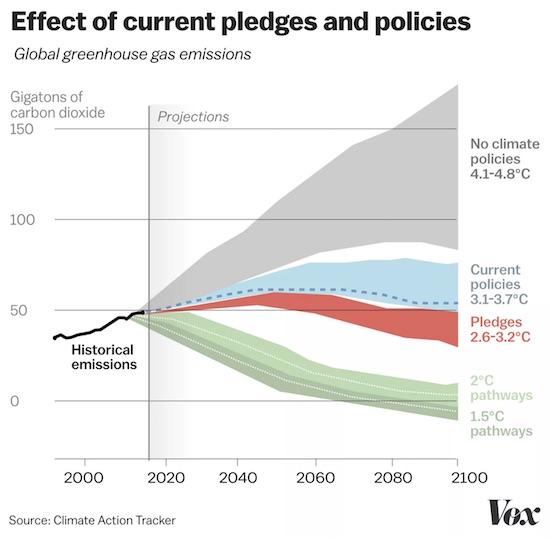

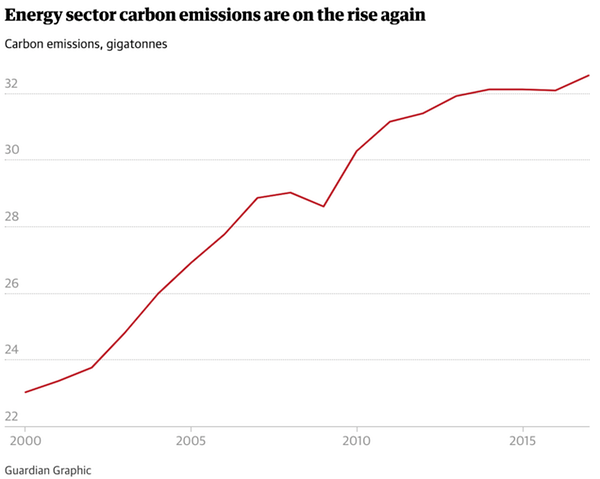

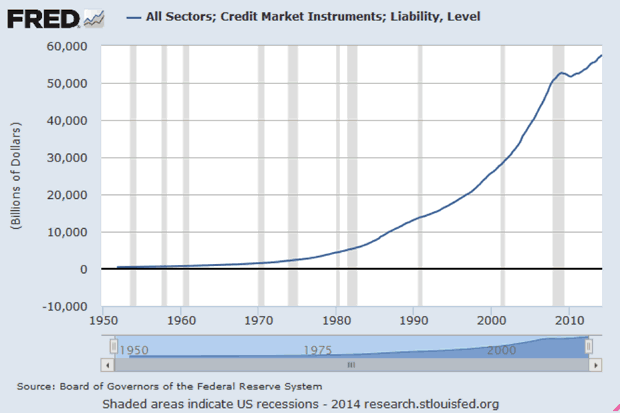

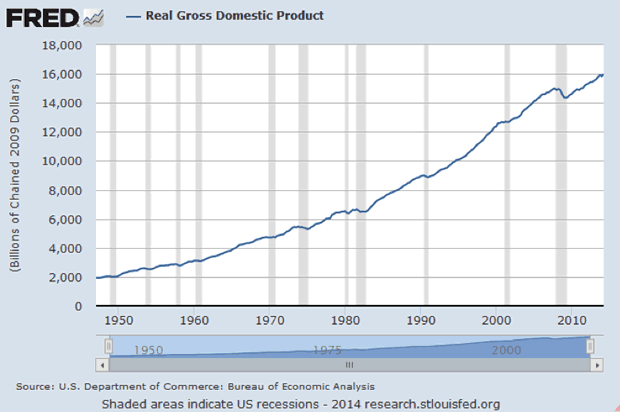

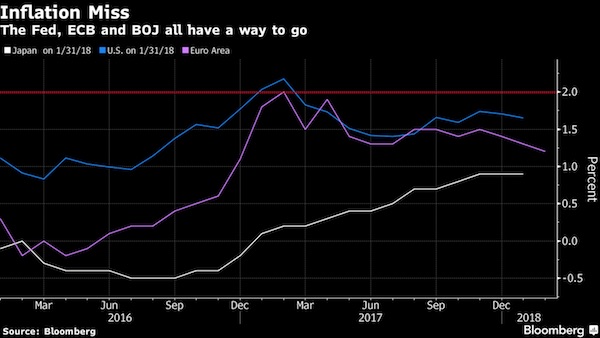

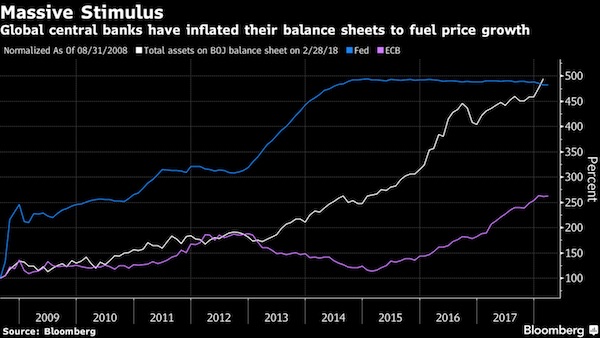

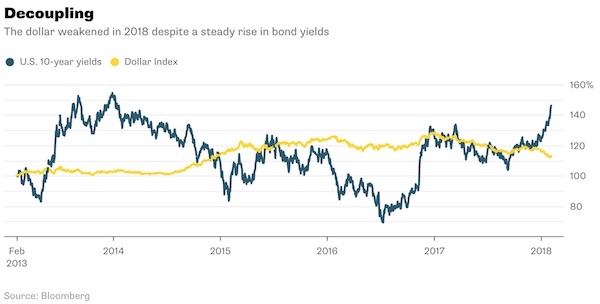

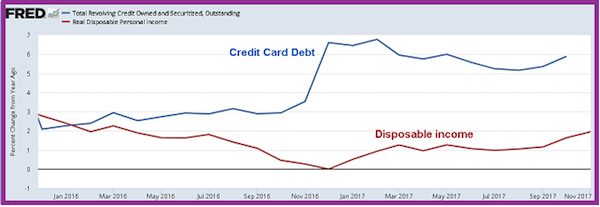

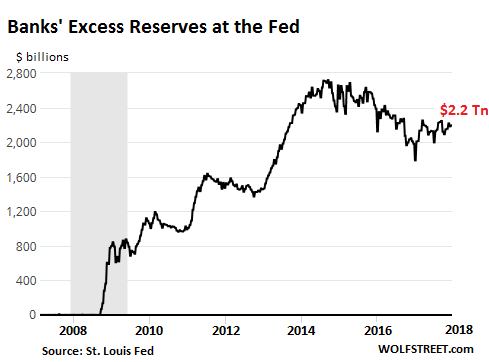

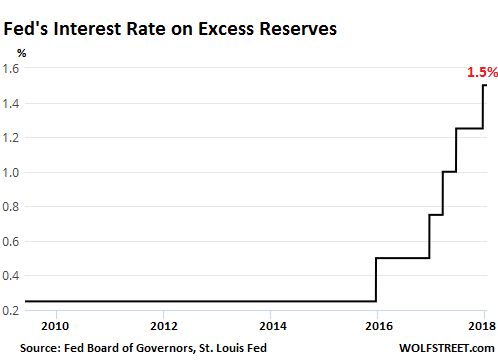

Also, as mentioned 1000 times, talking about inflation means zilch unless velocity of money is included. The Deutsche bank graph down below gives that point a lot more perspective.

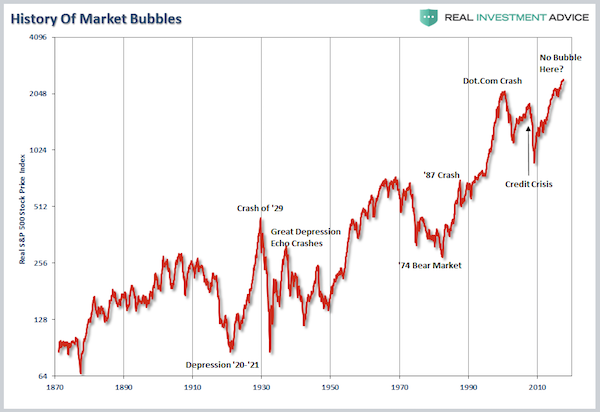

• The Stunning Chart That Blows Up All Of Modern Central Banking (ZH)

[..] amusingly it was all the way back in 2015 that we predicted – correctly in retrospect – just what the monetary endgame is: “fear not: when even “moar” QE and NIRP do not work, and the economists of the ECB admit the “monetary twilight zone” was a disaster, there is one last “tool” they can and will use – helicopters. Because when it comes to printing money, whether in digital reserve format, or physical paper format, there is literally no limit how much can and will be created to achieve what is the endgame of the current monetary dead end: the total destruction of fiat as a store of wealth in order to preserve the global equity tranche while wiping away a few hundred trillion in debt.”

Thanks to covid-19, we have now moved beyond merely the “twilight” and are now in the “helicopter” zone. But what about the relationship between rates and savings, and by extension inflation? After all that is the topic of this post. Well, we can now confirm that our intuition from 2015 that negative rates are not only not inflationary but outright deflationary, and encourage consumers to save even more, was correct all along. Below we post a chart from the latest Research Investment Committee report by BofA titled “Stagnation, stagflation or elevation”, which with just one image blows up everything that is flawed with monetary policy. It shows that while lower rates indeed stimulate spending and lead to lower savings, this effect peaks at around 4% and then goes negative. In fact, the lower yields – and rates – drop below 4% – not to mention to 0% or below – the lower the propensity to spend and the higher the savings rate!

There is another reason why this chart of such epic importance: it confirms what so many have known but were afraid to voice as it ran against decades of flawed economic theory: it demonstrates without a shadow of doubt, that hyper-easy monetary policy is not inflationary but is deflationary. Which is catastrophic for central banks, who publicly state that the only reason they are pursuing ultra easy monetary policy which includes QE and negative rates, is not to goose the market higher (even though by now we all know that’s the real reason) but to stimulate inflation. This is how Bank of America summarizes this stunning observation: As low growth & inflation make low-risk-asset income scarce (e.g. from government bonds), households are forced to reduce consumption and increase savings in order to meet retirement goals. Forced saving further depresses demand in a vicious cycle.

This means that the lower (and more negative) central banks push rates, the lower (not higher) the spending, the higher (not lower) the savings rate, the lower the inflation, the higher the disinflation (or outright deflation), which in turn forces central banks to cut rates even more, to add QE, yield curve control, buy junk bonds, buy ETFs, or pursue any of a host of other monetary policies that are even more devastating to consumer psychology, forcing even more savings, resulting in even more disinflation, causing even more intervention by central banks in what is without doubt the most diabolical feedback loop of modern monetary policy and economics. Said otherwise, monetary easing is deflationary. Let that sink in.

Via DB’s Slok: Past 20 years, relationship btw velocity & inflation driven by GDP instead of money printing. Ergo, you can increase Fed balance sheet the money supply as much as you want, if money goes into asset transactions rather than GDP transactions, it won’t be inflationary pic.twitter.com/v67UejNiMU

— Danielle DiMartino Booth (@DiMartinoBooth) May 31, 2020

Not entirely sure what this is. The DOJ supposedly tells the FBI’s top lawyer to leave. And there’s no protest, he just does.

Impossible to see this as something wholly separate from the entire developing issue, for which Susan Rice is an appropriate symbol.

• FBI’s Top Lawyer Resigns As Agency Faces Pressure From Trump (R.)

The FBI said on Saturday that its top lawyer, Dana Boente, had announced his resignation as the agency faces scrutiny over its investigations of former staffers and supporters of President Donald Trump. As a senior Justice Department official, Boente was involved in the investigation of Trump’s former national security adviser Michael Flynn, who pleaded guilty to lying to the FBI. The Justice Department has since asked a judge to drop those charges, arguing that prosecutors should not have brought them in the first place. Trump has repeatedly criticized the FBI for investigating Flynn and other allies.

NBC News, citing two sources, said Boente was asked to resign. Boente held several senior roles at the Justice Department and the FBI over the course of a 38-year career. He briefly served as acting Attorney General in 2017 after Trump fired Sally Yates, who held the job during the first weeks of his presidency. “Few people have served so well in so many critical, high-level roles at the Department,” FBI Director Christopher Wray said in a prepared statement.

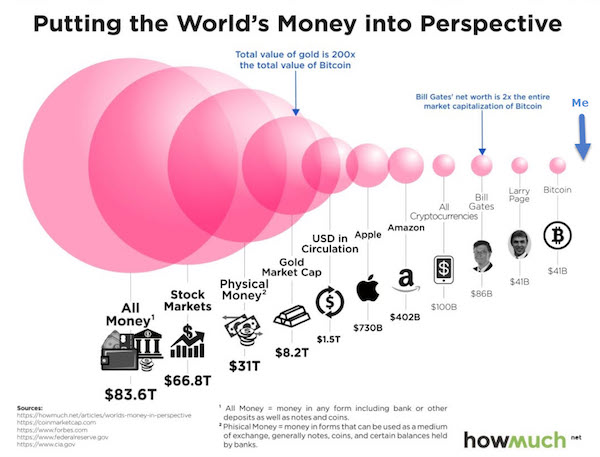

More of Susan Rice speculating on CNN that Russia is fueling US protests: "I would not be surprised to learn that they have fomented some of these extremists on both sides using social media. I wouldn't be surprised to learn that they are funding it in some way, shape, or form." pic.twitter.com/qLGdZuxBuo

— Aaron Maté (@aaronjmate) May 31, 2020

And today Susan Rice told CNN that the BLM protests are a Kremlin conspiracy to subvert America. We've come a long way, baby!https://t.co/3TkIvm3snY

— Mark Ames (@MarkAmesExiled) June 1, 2020

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

ICYMI: A New York chef has turned his Michelin three-starred restaurant into a charity kitchen, serving free meals to frontline workers and the underprivileged pic.twitter.com/naaeAdXI9X

— Reuters (@Reuters) June 1, 2020

Support the Automatic Earth in virustime.