NPC Walker Hill Dairy, Washington, DC 1921

The yen keeps rising. Pressure is building. Relentlessly.

• Japanese Stocks Fall Sharply in the Morning (WSJ)

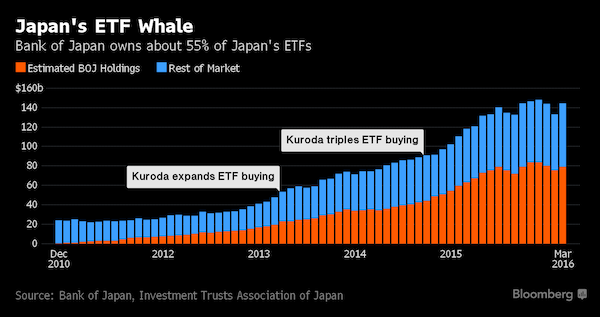

Japanese stocks fell sharply early Monday, leading declines in the rest of Asia, on the yen’s surge to a new 1 1/2-year high against the dollar, weak earnings results from several firms and selling after the Bank of Japan’s inaction on Thursday. The Nikkei Stock Average was down 3.6% at the lunch break in Tokyo. Japanese markets were closed on Friday for a national holiday. Australia’s ASX 200 was 1.3% lower, New Zealand’s NZX-50 was down 0.2% and South Korea’s Kospi was 0.5% lower. Many markets in Asia were closed for national holidays, including China, Hong Kong and Singapore. Japanese stocks are extending falls following the BOJ’s decision to keep its policies unchanged despite slowing inflation and previous expectations for a boost for its asset-purchase program, particularly in exchange-traded funds.

The yen’s surge against the dollar is also hitting Japanese exporters. The dollar was at ¥106.48 after falling to as low as ¥106.14, the lowest level since October 2014, according to EBS. “Bad news takes place all at once,” said Katsunori Kitakura, strategist at Sumitomo Mitsui Trust Bank. He said market turbulence around the BOJ policy meetings suggests the central bank’s communication with markets isn’t as smooth as it should be.“Westpac’s miss on headline expectations has set the tone for a nervous market this morning,” CMC Markets chief market analyst Ric Spooner said. He adds while Westpac’s first-half earnings were only marginally below expectations and there doesn’t appear to be anything seriously alarming, investors are concerned it is struggling to get cost growth down. Westpac is down 4.1%.

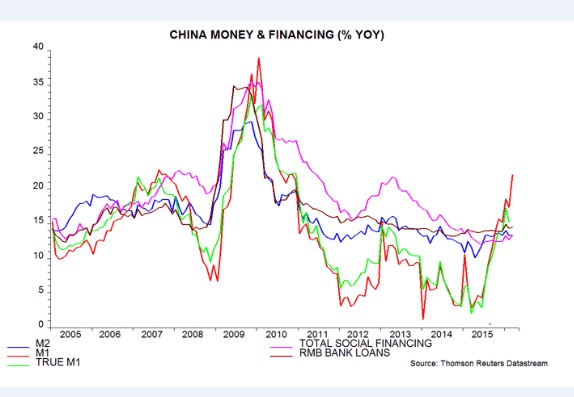

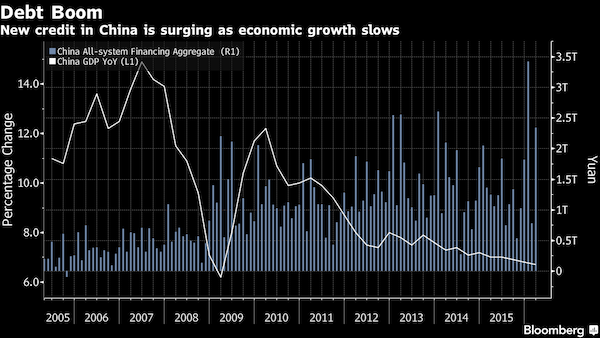

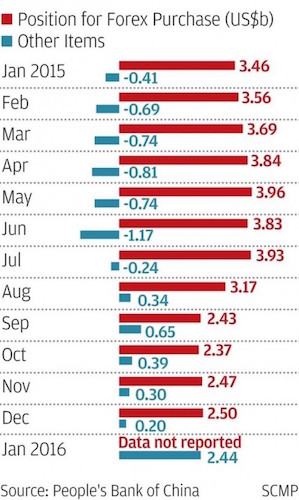

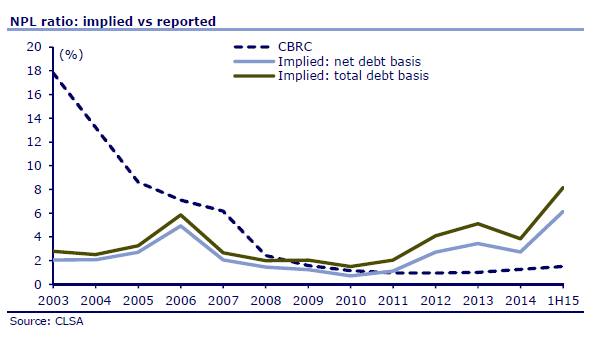

There’s only one thing to keep the BAU facade going in China and Japan: debt. And more debt.

• Asian Economies Stay Sluggish, Stimulus Lacks Traction (R.)

Japanese manufacturing activity shrank in April at the fastest pace in more than three years as deadly earthquakes disrupted production, while output in China and the rest of Asia remained lukewarm at best. Even the former bright spot of India took a turn for the worse as both domestic and foreign orders dwindled, pulling its industry barometer to a four-month trough. Surveys due later on Monday are expected to show only sluggish activity in Europe and the US as the world’s factories are dogged by insufficient demand and excess supply. “The backdrop remains one of sub-trend growth, inflation that is below target, difficulty in increasing revenue as margins are sacrificed to win modest volume gains, slow wage growth cramping spending and central banks that have used up much of their policy ammunition,” said Alan Oster at National Australia Bank.

That is exactly why the U.S. Federal Reserve has been dragging its feet on a follow-up to its December rate hike, leaving the markets in a sweat in case they move in June. Doubts about policy ammunition mounted last week when the Bank of Japan refrained from offering any hint of more stimulus, sending stocks reeling as the yen surged to 18-month highs. The Nikkei was down another 3.6% on Monday while the yen raced as far as 106.14 to the dollar and squeezed the country’s giant export sector. Industry was already struggling to recover from the April earthquakes that halted production in the southern manufacturing hub of Kumamoto. The impact was all too clear in the Markit/Nikkei Japan Manufacturing Purchasing Managers Index (PMI) which fell to a seasonally adjusted 48.2 in April, from 49.1 in March.

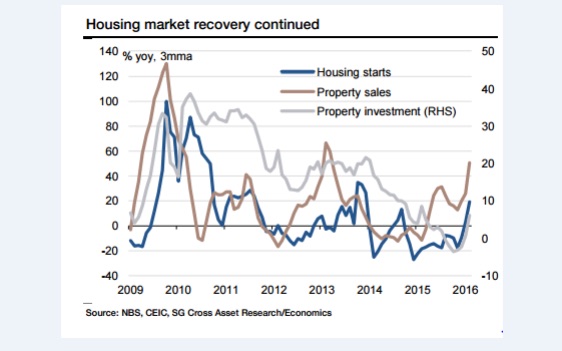

The index stayed below the 50 threshold that separates contraction from expansion for the second straight month. The news was only a little better in China where the official PMI was barely positive at 50.1 in April, a cold shower for those hoping fresh fiscal and monetary stimulus from Beijing would enable a speedy pick up. The findings were “a little bit disappointing”, Zhou Hao, senior emerging market economist at Commerzbank in Singapore, wrote in a note. “To some extent, this hints that recent China enthusiasm has been a bit overpriced and the data improvement in March is short-lived.”

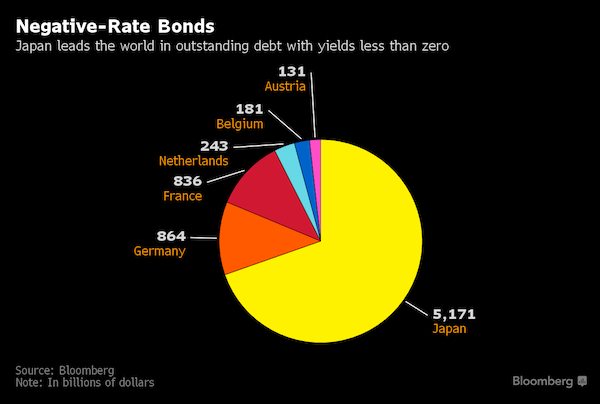

Negative rates lead to the exact opposite of what they’re allegedly intended for. And that’s predictable.

• World’s Longest NIRP Experiment Shows Perverse Effects (BBG)

When interest rates are high, people borrow less and save more. When they’re low, savings go down and borrowing goes up. But what happens when rates stay negative? In Denmark, where rates have been below zero longer than anywhere else on the planet, the private sector is saving more than it did when rates were positive (before 2012). Private investment is down and the economy is in a “low-growth crisis,” to quote Handelsbanken. The latest inflation data show prices have stagnated. As the Danes head even further down their negative-rate tunnel, the experiences of the Scandinavian economy may provide a glimpse of what lies ahead for other countries choosing the lesser known side of zero. Denmark has about $600 billion in pension and investment savings.

The people who help oversee those funds say the logic of cheap money fueling investment doesn’t hold once rates drop below zero. That’s because consumers and businesses interpret such extreme policy as a sign of crisis with no predictable outcome. “Negative rates are counter-productive,” said Kasper Ullegaard at Sampension in Copenhagen. The policy “makes people save more to protect future purchasing power and even opt for less risky assets because there’s so little transparency on future returns and risks.” The macro data bear out the theory. The Danish government estimates that investment in the private sector will be equivalent to 16.1% of GDP this year, compared with 18.1% between 1990 and 2012. Meanwhile, the savings rate in the private sector will reach 26% of GDP this year, versus 21.3% in the roughly two decades until Danish rates went negative, Finance Ministry estimates show.

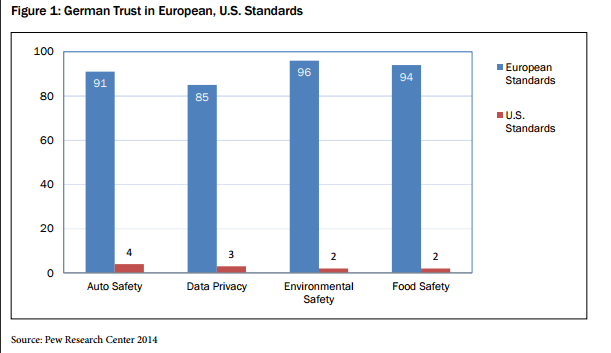

From ZH: “..55% of Germans and 53% of Americans thought the TTIP deals was beneficial for the two respective countries as recently as 2014; a recent YouGov poll found that support for the deal had tumbled to just 17% and 15% respectively…”

• Leaked TTIP Documents Cast Doubt On EU-US Trade Deal (G.)

Talks for a free trade deal between Europe and the US face a serious impasse with “irreconcilable” differences in some areas, according to leaked negotiating texts. The two sides are also at odds over US demands that would require the EU to break promises it has made on environmental protection. President Obama said last week he was confident a deal could be reached. But the leaked negotiating drafts and internal positions, which were obtained by Greenpeace and seen by the Guardian, paint a very different picture. “Discussions on cosmetics remain very difficult and the scope of common objectives fairly limited,” says one internal note by EU trade negotiators. Because of a European ban on animal testing, “the EU and US approaches remain irreconcilable and EU market access problems will therefore remain,” the note says.

Talks on engineering were also “characterised by continuous reluctance on the part of the US to engage in this sector,” the confidential briefing says. These problems are not mentioned in a separate report on the state of the talks, also leaked, which the European commission has prepared for scrutiny by the European parliament. These outline the positions exchanged between EU and US negotiators between the 12th and the 13th round of TTIP talks, which took place in New York last week. The public document offers a robust defence of the EU’s right to regulate and create a court-like system for disputes, unlike the internal note, which does not mention them.

Jorgo Riss, the director of Greenpeace EU, said: “These leaked documents give us an unparalleled look at the scope of US demands to lower or circumvent EU protections for environment and public health as part of TTIP. The EU position is very bad, and the US position is terrible. The prospect of a TTIP compromising within that range is an awful one. The way is being cleared for a race to the bottom in environmental, consumer protection and public health standards.” US proposals include an obligation on the EU to inform its industries of any planned regulations in advance, and to allow them the same input into EU regulatory processes as European firms.

American firms could influence the content of EU laws at several points along the regulatory line, including through a plethora of proposed technical working groups and committees. “Before the EU could even pass a regulation, it would have to go through a gruelling impact assessment process in which the bloc would have to show interested US parties that no voluntary measures, or less exacting regulatory ones, were possible,” Riss said.

“In a world that’s already choking on too much debt, the cost of money really isn’t an important variable and it is not a binding constraint on anybody’s decision making.”

• ‘The Fed Is Afraid Of Its Own Shadow’ (CNBC)

The Federal Reserve surprised few last week when it keep interest rates unchanged, noting that it “continues to closely monitor inflation indicators and global economic and financial developments.” However, one market watcher has a blunt message for Fed chair Janet Yellen: You’re placing your hope in a fairy tale. On a recent CNBC’s “Futures Now,” Lindsey Group chief market analyst Peter Boockvar made the case that the Fed will never get the “perfect” conditions they seek before increasing short-term rates once again. The Fed’s mandate “isn’t to have a perfect world. That only exists in fairy tales, dreams and in your econometric models,” Boockvar said in a recent note to clients. He believes that the Fed’s monetary has been far too accommodative under Yellen as well as under Ben Bernanke.

Boockvar argued that the Fed has been taking cues from shaky international banks, and that doing so will always offer a reason to keep interest rates low. In Wednesday’s statement, the strategist noted new suggestions that the Fed is shifting its focus to concerns over international development. In its March statement, the Fed said that “global economic and financial developments continue to post risks,” a line that does not appear in the more recent language. “It’s been excuse, after excuse, after excuse,” Boockvar said. “This is why, eight years into an expansion, they’ve only raised interest rates once. They’re afraid of their own shadow. They’re in a terrible hole that they’re not going to be able to get out of.”

Whether looking at the Fed, the Bank of Japan, or the European Central Bank, Boockvar sees a landscape littered with policy errors. “They all believe that, by making money cheaper, you can somehow generate faster growth,” Boockvar said. Based on this, Boockvar said that central bankers are losing their credibility and their ability to generate higher asset prices, putting the stock market in a precarious position. “In a world that’s already choking on too much debt, the cost of money really isn’t an important variable and it is not a binding constraint on anybody’s decision making.”

The Fed wants to hold investors’ hands at the crap table.

• Fed May Need More Powers To Support Securities Firms During Crises: Dudley (R.)

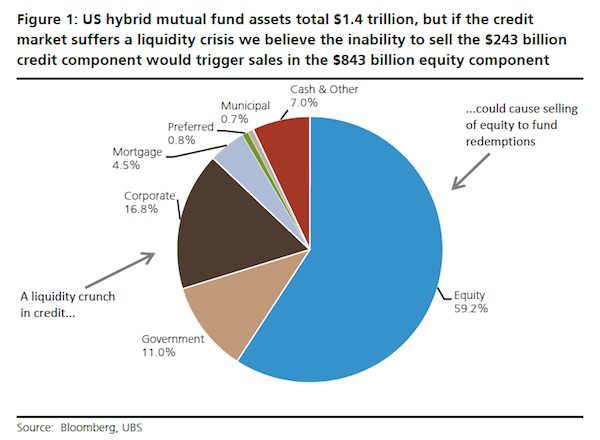

The U.S. Federal Reserve may need more powers to provide emergency funding to securities firms in times of extreme stress in order to deal with a liquidity crunch, New York Federal Reserve President William Dudley said on Sunday. “Providing these firms with access to the discount window might be worth exploring,” Dudley said in prepared remarks at a financial markets conference in Amelia Island, Florida organized by the Atlanta Fed. The discount window is a credit facility through which banks borrow directly from the U.S. central bank in order to cope with liquidity shortages. The Fed currently has limited ability to provide funding to securities firms in such situations, with the discount window only available to depository institutions.

But the transformation of securities firms since the financial crisis, Dudley said, with the major ones now part of bank holding companies and subject to capital and liquidity stress tests, meant the environment has now changed. “To me, this is a more reasonable proposition now than it was prior to the crisis when the major dealers weren’t subject to those safeguards,” he said. Other “significant gaps” remain in the lender-of-last-resort function, Dudley added. On this, he cited work being done on a global level by the Bank of International Settlements, which is studying deficiencies with respect to systemically important firms that operate across countries. Dudley called for greater attention in order to determine which country would be the lender-of-last-resort for such companies during another crisis. “Expectations about who will be the lender-of-last-resort need to be well understood in both the home and host countries,” he said.

The perhaps most interesting part: How will this spread to other states? Are we seeing a blueprint emerge?

• Puerto Rico To Default On Government Development Bank Debt Monday (CNBC)

Puerto Rico will miss a major debt payment due to creditors Monday, registering the largest default to date for the fiscally struggling U.S. territory. Governor Alejandro Garcia Padilla announced on Sunday the “very difficult decision” to declare a moratorium on the $389 million debt service payment due to bondholders of the island’s Government Development Bank (GDB), which acts as the island’s primary fiscal agent and lender of last resort. “We would have preferred to have had a legal framework to restructure our debts in an orderly manner,” Gov. Garcia Padilla said via a televised address in Spanish.

“But faced with the inability to meet the demands of our creditors and the needs of our people, I had to make a choice … I decided that essential services for the 3.5 million American citizens in Puerto Rico came first,” he said. This will not be the first default for Puerto Rico — according to Moody’s Investors Services, the government has failed to make about $143 million in debt obligation payments since its historic default in August on subject-to-appropriation bonds issued by the Public Finance Corporation (PFC). The commonwealth will pay the approximately $22 million in interest due on the GDB bonds, as well as the nearly $50 million owed to creditors on a handful of other securities that have payments slated for Monday, according to a source familiar with the situation.

Late on Friday, the bank announced it was able to come to an agreement with credit unions that hold approximately $33 million of the bonds due Monday. Under the deal, these bondholders will swap existing securities with new debt that matures in May, 2017. Gov. Garcia Padilla reiterated his plea to Congress to give the commonwealth the legal tools necessary to address Puerto Rico’s $70 billion debt pile and ensure the sustainability of the island. “Puerto Rico needs Speaker Paul Ryan to exercise his leadership and honor his word…we need this restructuring mechanism now,” he said.

Stupid games resulting from unconditional TBTF central bank support.

• Banks Told To Stop Pushing Own Funds (FT)

Brussels has moved to stamp out the practice of large banks funnelling clients towards poorly performing in-house asset management products under new rules designed to improve investor protection across Europe. Over the past two years, independent asset managers and investor rights groups have raised concerns that bank advisers are increasingly recommending in-house funds to clients when investors might be better off in external products. These concerns have been fuelled by the rapid growth of banks’ asset management divisions. Seven of the 10 bestselling asset management companies in Europe last year were subsidiaries of banks. But under new EU legislation known as Mifid II, bank advisers who want to continue receiving commission payments will have to offer funds from external investment companies.

Guidelines on how the rules will apply, released last month, state that advisers can only receive commissions if they offer a “number of instruments from third-party product providers having no close links with the investment firm”. Commentators said the new rules would be a big change for the market. Sean Tuffy, head of regulatory affairs at BBH, the financial services company, said the additional Mifid II guidelines were “unexpected”. He added: “Asset managers would welcome that provision. One of their biggest concerns is the ever-closed architecture world [where banks only push their own funds].” James Hughes at lobby group Cicero said: “When the new rules come into force in 2018] banks won’t be able to only offer their own products. This will be monitored by national [regulators] through a mixture of mystery shopping tests and customer service panels.”

Under the existing system, many banks solely recommend internal products to investors. This keeps fees and commission payments in-house and boosts the parent company’s profitability. Some banks, such as UBS, say they offer a small number of external funds to clients. Others — including Goldman Sachs, Deutsche Bank, Credit Suisse and Morgan Stanley — say they offer a high proportion of external funds to clients, a model known in the industry as “open architecture”. None of the banks mentioned are willing to provide a breakdown of the level of external funds sold versus internal products. The push to make banks recommend more external products can be circumvented if an adviser agrees to assess the suitability of a client’s investments on at least an annual basis.

“..Baker Hughes, which was valued at $34.6 billion when it was announced in November 2014, and is now worth about $28 billion..”

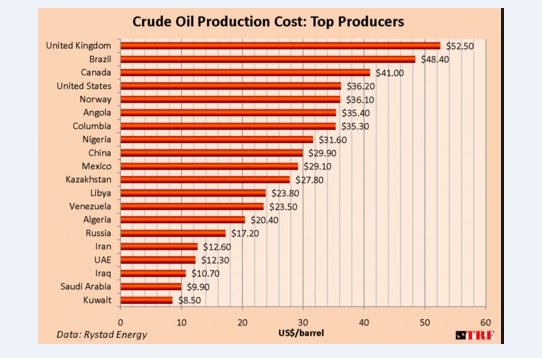

• Halliburton and Baker Hughes Scrap $34.6 Billion Merger (R.)

Oilfield services provider Halliburton and smaller rival Baker Hughes announced the termination of their $28 billion merger deal on Sunday after opposition from U.S. and European antitrust regulators. The tie-up would have brought together the world’s No. 2 and No. 3 oil services companies, raising concerns it would result in higher prices in the sector. It is the latest example of a large merger deal failing to make it to the finish line because of antitrust hurdles. “Challenges in obtaining remaining regulatory approvals and general industry conditions that severely damaged deal economics led to the conclusion that termination is the best course of action,” said Dave Lesar, chief executive of Halliburton.

The contract governing Halliburton’s cash-and-stock acquisition of Baker Hughes, which was valued at $34.6 billion when it was announced in November 2014, and is now worth about $28 billion, expired on Saturday without an agreement by the companies to extend it, Reuters reported earlier on Sunday, citing a person familiar with the matter. Halliburton will pay Baker Hughes a $3.5 billion breakup fee by Wednesday as a result of the deal falling apart. The U.S. Justice Department filed a lawsuit last month to stop the merger, arguing it would leave only two dominant suppliers in 20 business lines in the global well drilling and oil construction services industry, with Schlumberger being the other. “The companies’ decision to abandon this transaction – which would have left many oilfield service markets in the hands of a duopoly – is a victory for the U.S. economy and for all Americans,” U.S. Attorney General Loretta Lynch said in a statement on Sunday.

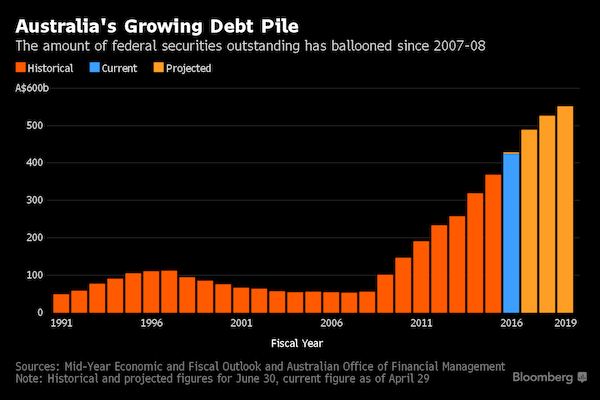

One thing only is sure: the debt is growing. All the rest is somewhere between propaganda and wishful thinking. If more debt is projected to provide more votes, what do you think will happen?

• Will Australia’s Ever-Growing Debt Pile Peak In Six Years? (BBG)

Australia’s drive to balance the books will see the federal government’s debt pile top out within about five or six years and then start to shrink again, according to Treasurer Scott Morrison. Speaking in Canberra just ahead of his first budget on Tuesday, Morrison said he expects the fiscal deficit to narrow over the government’s four-year forecast horizon and pledged to keep expenditure under control. “To start reducing the debt you’ve got to get the deficit down. To get the deficit down you’ve got to get your spending down,” Morrison said in a Channel Nine television interview on Sunday. “The deficit will decrease over the budget and forward estimates and we will see both gross and net debt peak over about the next five or six years, and then it will start to fall.”

The Australian budget was last in surplus in 2007-08 and attempts to rein in the deficit have been stymied by a slump in revenue as commodity prices fell. Morrison’s challenge is to maintain Australia’s public finances on a sound footing without increasing risks to the economy as it reduces its reliance on mining. He must also contend with the prospect of an upcoming election, which Prime Minister Malcolm Turnbull is expected to call for July 2. Total outstanding federal debt is now more than seven times larger than it was before the 2008 global crisis and net debt is predicted to increase to 18.5% of GDP in 2016-17, according to a Bloomberg survey of economists. The underlying cash deficit is expected to reach A$35 billion ($27 billion) next fiscal year, A$1.3 billion more than the government had forecast in its December fiscal update.

“It will then be punished further for being unable to do what was impossible in the first place.”

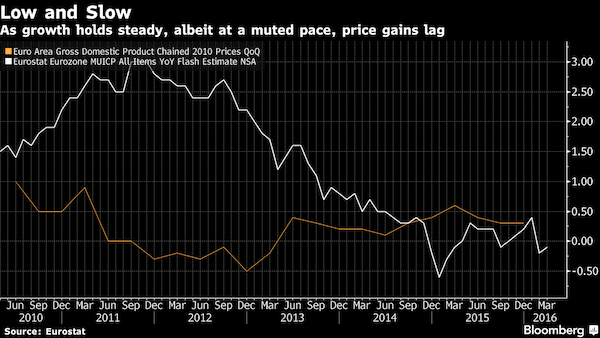

• Europe’s Liberal Illusions Shatter As Greek Tragedy Plays On (G.)

Greece is running out of money. The government in Athens is raiding the budgets of the health service and public utilities to pay salaries and pensions. Without fresh financial support it will struggle to make a debt payment due in July. No, this is not a piece from the summer of 2015 reprinted by mistake. Greece, after a spell out of the limelight, is back. Another summer of threats, brinkmanship and all-night summits looms. The problem is a relatively simple one. Greece is bridling at the unrealistic demands of the EC and the IMF to agree to fresh austerity measures when, as the IMF itself accepts, hospitals are running out of syringes and buses don’t run because of a lack of spare parts. Athens has already pushed through a package of austerity measures worth €5.4bn as the price of receiving an €86bn bailout agreed at the culmination of last summer’s protracted crisis and expected the deal to be finalised last October.

Disbursements of the loan have been held up, however, because neither the commission or the IMF believe that Greece will make the promised savings. So they are demanding that Alexis Tsipras’s government legislate for additional “contingency measures” worth €3.6bn to be triggered in the event that Greece fails to meet its fiscal targets. This is almost inevitable, given that the target is for the country to run a primary budget surplus of 3.5% of GDP by 2018 and in every year thereafter. This means that once Greece’s debt payments are excluded, tax receipts have to exceed public spending by 3.5% of GDP. The exceptionally onerous terms are supposed to whittle away Greece’s debt mountain, currently just shy of 200% of GDP. If this all sounds like Alice in Wonderland economics, then that’s because it is.

Greece is being set budgetary targets that the IMF knows are unrealistic and is being set up to fail. It will then be punished further for being unable to do what was impossible in the first place. Predictably enough, the government in Athens is not especially taken with this idea. It has described the idea as outlandish and unconstitutional, but is in a weak position because it desperately needs the bailout loan and threw away its only real bargaining chip last year by making it clear that it would stay in the single currency whatever the price. So Tsipras is doing what he did last year. He is playing for time, hopeful that by hanging tough and threatening another summer of chaos he can force Europe’s leaders to offer him a better deal – less onerous deficit reduction measures coupled with a decent slug of debt relief. For the time being though, the matter is being handled by the eurozone’s finance ministers, who want their full pound of flesh.

Not preparing to assist people, only banks.

• Bank Of England Busy Preparing For Brexit Vote (FT)

The Bank of England is consumed with preparing contingency plans for Britain to leave the EU, with staff across its financial stability, monetary policy and regulatory wings ready to calm any turmoil. In the days leading up to the June 23 poll, the Bank will hold additional auctions of sterling to ensure the banking system has sufficient funds to operate in a potentially chaotic moment. Three exceptional auctions of cash have already been planned for June 14, 21 and 28. But stuffing the banks full of cash will not prevent foreigners and UK households and companies dumping sterling in the event of a Brexit vote. Michael Saunders, the new member of the bank’s Monetary Policy Committee, expects the pound to come under severe pressure.

While still at Citi, he wrote that Brexit risks were “nowhere near priced yet”, adding that Britain should expect a 15 to 20% depreciation of sterling against Britain’s main trading partners. If such a decision to flee sterling leads British banks to become short of foreign currency, the BoE will rapidly offer foreign currency loans to the financial system, using swap lines with other central banks still in existence from the financial crisis. Philip Shaw of Investec said that using such swap lines would be needed only in “fairly extreme circumstances” and the BoE would also need to “make reassuring noises about the soundness of the financial system” to help shore up confidence.

Officials are already pointing to the 2014 stress test of banks, which assumed a reassessment of the health of the UK economy led to a “depreciation of sterling”, to suggest that the banking system would cope. “Unless any UK financial institutions have bet their shirt on an early recovery of sterling it is hard to see what Brexit would do in immediate terms,” said Stephen Wright, a professor at Birkbeck College, London University. The week after the referendum, the Financial Policy Committee will have an opportunity to loosen the requirements for banks to hold capital if there is a financial panic, putting in place the new regime of measures to counter the credit cycle. But even if the BoE could cope with immediate market gyrations from Brexit, it would soon face what Mr Saunders called “a major policy dilemma” over interest rates.

UK 2016. Lovely. And Cameron’s not done.

• Nearly Half Of British Parents Raid Children’s Piggy Banks To Pay Bills (PA)

Nearly half of parents admit to being “piggy bank raiders” who occasionally dip into their children’s cash to cover costs such as parking, takeaways, taxis, school trips and paying the window cleaner. Some 46% of parents of children aged between four and 16 years old said they have taken money from their child’s savings, a survey by Nationwide Building Society has found. The average amount taken over the past year was £21.41, while one in 10 parents had taken £50 or more during that period. Mums are more likely to raid their child’s savings than dads, but dads tend to swipe larger amounts the survey found. The months after Christmas, when many families are getting their finances back on track, also appear to be the time when piggy bank raiders are most prolific.

The survey of 2,000 parents found those in Yorkshire and the Humber, north-east England and south-west England were the most likely to use children’s savings, with those in London, Wales and north-west England the least likely. About 15% of piggy bank raiding parents said they used the cash to pay school lunch money, while the same proportion also use it to pay a bill; 11% used the money for school trips and 11% used it as loose change for parking. One in 12 took the money to tide themselves over as they were broke. A further 12% used the cash for other purposes, including bus fares, hair cuts, petrol costs, takeaways, paying the window cleaner and for the “tooth fairy”.

The vast majority of parents (93%) said they put the money back afterwards – and only 39% of children noticed the money had disappeared. Nearly a third of parents who took money said they had confessed to their child, while 23% sneaked the money back into their child’s piggy bank. One in seven added interest to the amount they had borrowed. Andrew Baddeley-Chappell, Nationwide’s head of savings and mortgage policy, said: “Despite being in charge of instilling a good approach to finance, almost half of parents have been caught in spring raids on their kid’s piggy bank stash. While liberating change for parking or to pay school lunch money could be viewed as excusable, one in 10 parents borrowed more than £50 in the last year, including for paying bills.

And the media are overflowing with questions.

• ‘Bitcoin Creator Reveals Identity’ (BBC)

Australian entrepreneur Craig Wright has publicly identified himself as Bitcoin creator Satoshi Nakamoto. His admission ends years of speculation about who came up with the original ideas underlying the digital cash system. Mr Wright has provided technical proof to back up his claim using coins known to be owned by Bitcoin’s creator. Prominent members of the Bitcoin community and its core development team have also confirmed Mr Wright’s claim. Mr Wright has revealed his identity to three media organisations – the BBC, the Economist and GQ.

At the meeting with the BBC, Mr Wright digitally signed messages using cryptographic keys created during the early days of Bitcoin’s development. The keys are inextricably linked to blocks of bitcoins known to have been created or “mined” by Satoshi Nakamoto. “These are the blocks used to send 10 bitcoins to Hal Finney in January [2009] as the first bitcoin transaction,” said Mr Wright during his demonstration. Renowned cryptographer Hal Finney was one of the engineers who helped turn Mr Wright’s ideas into the Bitcoin protocol, he said.

Meanwhile below the radar….

• Storm Clouds Gathering Over Kansas Farms (WE)

While the lush green sea of wheat filling Kansas fields will turn gold in a few weeks, beneath the comforting cycle of planting and harvest lies big trouble for the state’s farmers and rural communities. The value of farm ground here and across the country is beginning to fall. That drop can cause havoc for the farmers and ranchers who have borrowed a record amount of debt, as well as the banks that made loans to them and the governments that tax them. It will almost certainly lead to more farm foreclosures and ownership consolidation across Kansas and the country. How much is impossible to know, because it is just starting to unfold. But, so far, no one is saying that a return to the mass foreclosures of the 1980s farm crisis is likely. The state’s farm economy produced about $8.5 billion in 2015, about 6% of the state economy, according to the U.S. Bureau of Economic Analysis.

At the moment, farm foreclosures, loan delinquency and debt-to-asset ratios are near record lows, but conditions are eroding. A recent forecast by Mykel Taylor, a farm economist at Kansas State University, calls for a drop of 30 to 50% from the peak as land prices return to their long-term trend. Others are predicting somewhat less of a drop. Brokers say the decline has already started, with the price for prime Kansas crop ground down about 10% from its peak, while marginal crop land has fallen twice or three times that. Pasture land has not fallen yet, although it is expected to. How fast prices deflate will dictate the level of pain, Taylor said. “People keep asking: ‘Is this like the ’80s? Is this like the ’80s?’ ” she said. “I don’t know, but it’s going to be bad.”

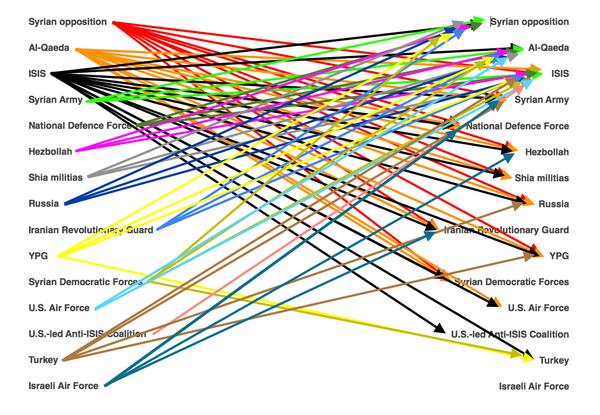

NATO is an increasingly dangerous entity. It’ll take us to war. That’s its reason to exist.

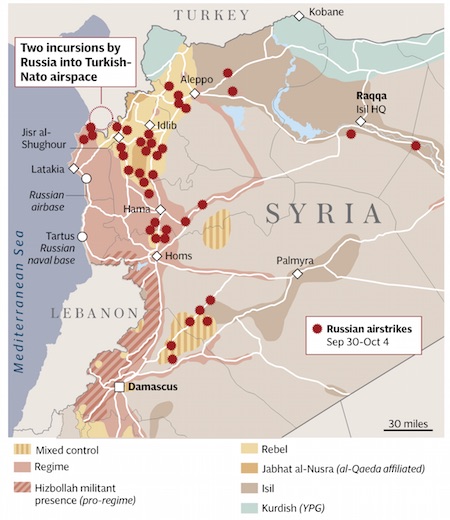

• NATO Moves Ever Closer To Russia’s Borders (RT)

NATO is deploying an additional four battalions of 4,000 troops in Poland and the three Baltic States, according to a report citing US Deputy Secretary of Defense Robert Work. Work confirmed the number of troops to be sent to the border with Russia, the Wall Street Journal reports. He said the reason for the deployment is Russia’s multiple snap military exercises near the Baltics States. “The Russians have been doing a lot of snap exercises right up against the borders, with a lot of troops,” Work said. “From our perspective, we could argue this is extraordinarily provocative behavior.” Although there have already been talks about German troops to be deployed to Lithuania, Berlin is still mulling its participation.

“We are currently reviewing how we can continue or strengthen our engagement on the alliance’s eastern periphery,” Chancellor Angela Merkel said on Friday, in light of a recent poll from the Bertelsmann Foundation that found only 31% of Germans would welcome the idea of German troops defending Poland and the Baltic States. London has not made its mind either, yet is expected to do so before the upcoming NATO summit in Warsaw in July. Ahead of the deployment, NATO officials are also discussing the possibility of making the battalions multinational, combining troops from different countries under the joint NATO command and control system. Moscow has been unhappy with the NATO military buildup at Russia’s borders for some time now.

“NATO military infrastructure is inching closer and closer to Russia’s borders. But when Russia takes action to ensure its security, we are told that Russia is engaging in dangerous maneuvers near NATO borders. In fact, NATO borders are getting closer to Russia, not the opposite,” Russian Foreign Minister Sergey Lavrov told Sweden’s Dagens Nyheter daily. Poland and the Baltic States of Lithuania, Latvia and Estonia have regularly pressed NATO headquarters to beef up the alliance’s presence on their territory. According to the 1997 NATO-Russia Founding Act, the permanent presence of large NATO formations at the Russian border is prohibited. Yet some voices in Brussels are saying that since the NATO troops stationed next to Russia are going to rotate, this kind of military buildup cannot be regarded as a permanent presence.

How to kill a union in a few easy steps. They don’t even know that’s what they’re doing.

• Austria, Germany Press EU To Prolong Border Controls (AFP)

Austria and Germany said on Saturday they were in talks with the European Union’s executive body to extend temporary border controls brought in last year to help stem the migrant flow. The measures – triggered in case of “a serious threat to public policy or internal security” – are due to expire on May 12. “I can confirm that we are having discussions with the EU Commission and our European partners about this,” Austrian interior ministry spokesman Karl-Heinz Grundboeck told AFP. Member states must “be able to continue carrying out controls on their borders,” German Interior Minister Thomas de Maiziere said in a written statement to AFP. “Even if the situation along the Balkan route is currently calm, we are observing the evolution of the situation on the external borders with worry”.

His Austrian counterpart, Wolfgang Sobotka, said checkpoints along the Hungarian border had been reinforced in late April after “a rise in people-smuggling activity”. “The introduction of a coordinated border management system with our neighbouring countries after the [May 12] deadline expires would be the first step in the direction of a joint European solution,” Sobotka said. The remarks came after German media had reported that several EU states were urging Brussels to extend the temporary controls inside the passport-free Schengen zone for at least six months. The EU allowed bloc members to introduce the restrictions after hundreds of thousands of migrants and refugees began trekking up the Balkans from Greece towards western and northern Europe last September.

Austria, Belgium, Denmark, France, Germany and Sweden have all clamped down on their frontiers as the continent battles its biggest migration crisis since the end of World War II. “We request that you put forward a proposal, which will allow those member states who consider it necessary to either extend or introduce the temporary border controls inside Schengen as of May 13,” the six countries said in a letter addressed to the EU, according to German newspaper Die Welt. A source close to the German government told AFP the letter would be sent on Monday.

Doesn’t anybody have any decency left? Where is the UN?

• Newborn Baby Among 99 Dead After Shipwrecks In Mediterranean (G.)

A newborn baby is among 99 people believed to have drowned in two separate shipwrecks off the Libyan coast this weekend, according to survivors who arrived in Italy. Twenty-six survivors were rescued by a commercial vessel after a rubber dinghy in which they were travelling sank in the Mediterranean on Friday, a few hours after departing from Sabratha in Libya. They were transferred to Italian coastguard ships before being brought ashore in Lampedusa, Italy’s southernmost island, according to the International Organization for Migration (IOM). The baby was among 84 people still missing on Saturday..

“The dinghy was taking on water, in very bad conditions. Many people had already fallen in the sea and drowned,” said Flavio Di Giacomo, IOM spokesman in Italy. “They are all very shocked,” Di Giacomo said, adding they would receive psychological support in Lampedusa. The UN refugee agency, UNHCR, said that after taking on water the boat broke into two pieces and 26 people were saved from the sea. Survivors from a second shipwreck arrived in the Sicilian port of Pozzallo on Sunday, after an accident during a search-and-rescue operation the day before. Two bodies were recovered and brought ashore along with eight of about 105 people saved, who were taken to hospital in serious condition.

The shipwrecks are the latest incidents in which hundreds of people have lost their lives in the Mediterranean. Last week, up to 500 people were feared dead after a shipping boat hoping to reach Italy from eastern Libya sank. Forty-one survivors told UNHCR that smugglers had taken them out to sea and tried to move them to a larger, overcrowded boat that then capsized. So far this year, at least 1,360 people have been reported dead or missing after trying to cross the Mediterranean, including the latest two shipwrecks, while more than 182,800 have reached European shores.