Henry Bacon� General View of the Acropolis at Sunset � 1927(?)

Deleveraging and shrinking liquidity.

• It’s Not Turkey, It’s The Debt Cycle (Steen Jakobsen)

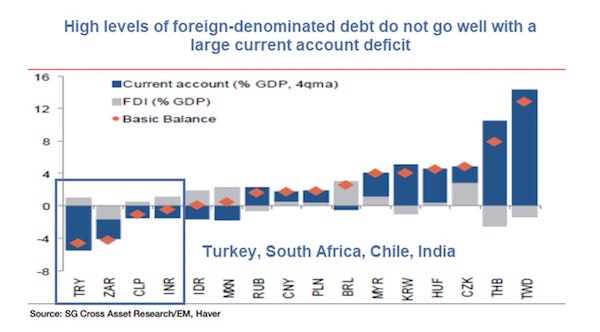

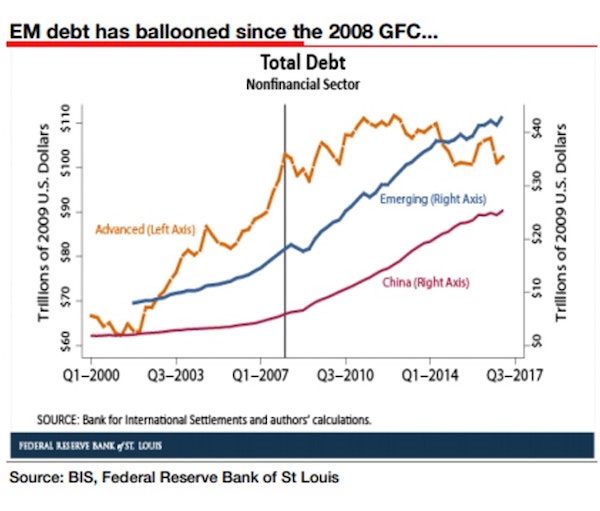

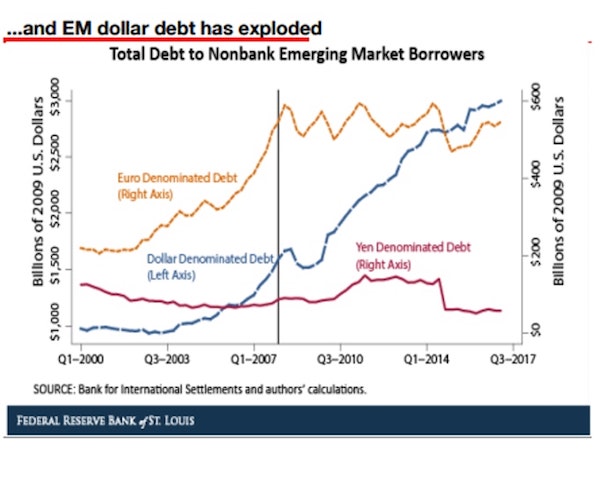

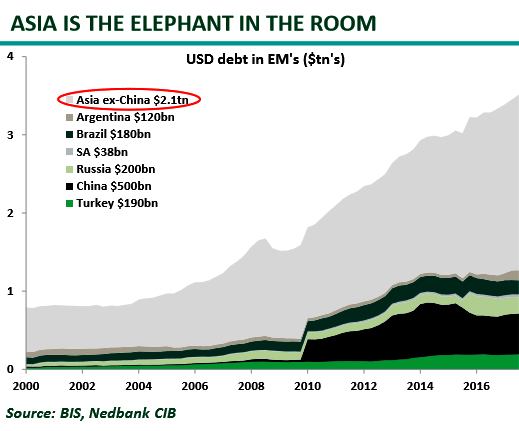

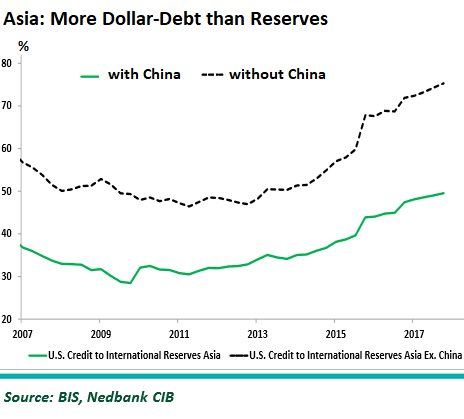

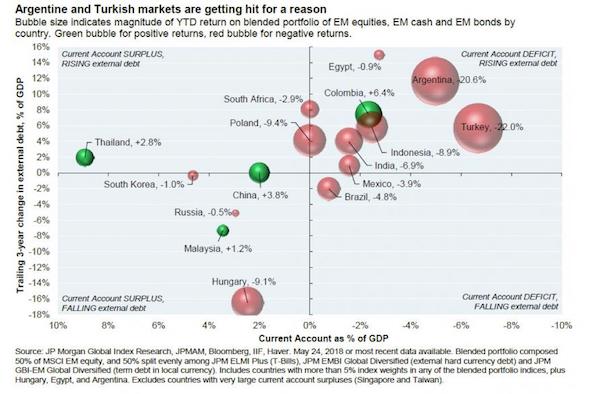

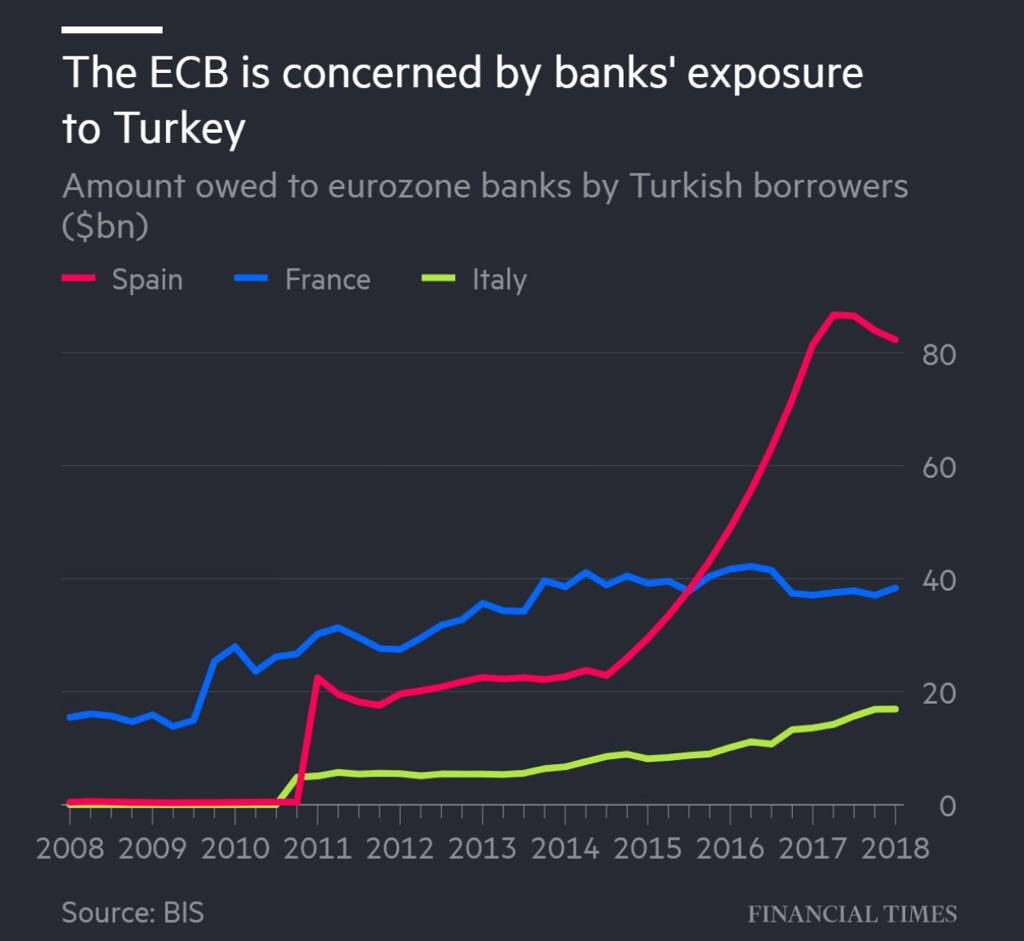

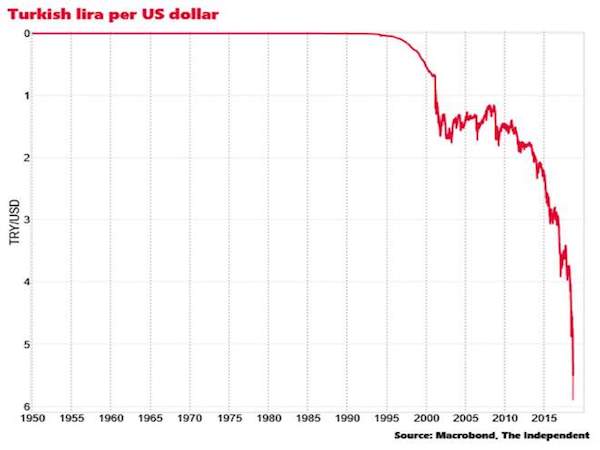

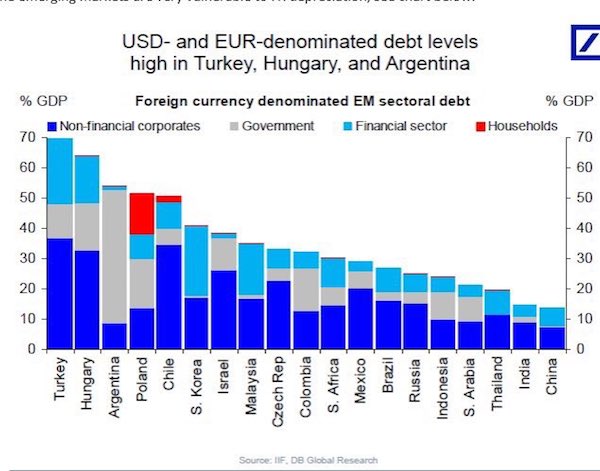

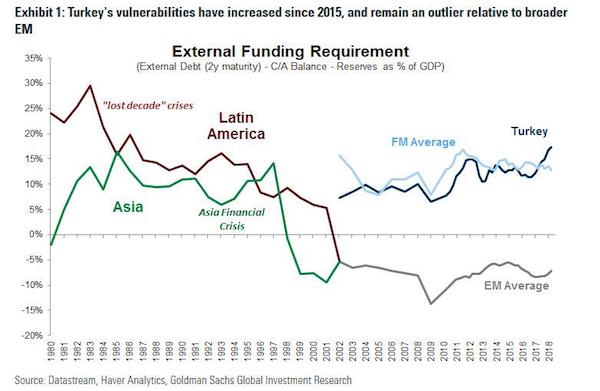

There is currently a lot of focus on Turkey, and for good reason, but Turkey is really only a second or third derivative of the global macro story. Turkey represents the catalyst for a new theme, which is “too much debt and current account deficits equals crisis”. In that sense, we have come full cycle from deficits and debt mattering in the 1980s and ‘90s but not in the ‘00s and ‘10s post- the Nasdaq crash and great financial crisis under the biggest monetary experiment of all time. In our view, the order of sequence for this crisis is as follows: 1. The debt cycle is on pause as first China and now the US have deleveraged and ‘normalised’.

2. The stock of credit or the ‘credit cake’ has collapsed. First it was the ‘change of the change of credit’, or the credit impulse, which tanked in late 2017 and into 2018. Now it is also the stock of credit. Right now, global M2 over global growth is less than one, meaning the world is trying to achieve 6% global growth with less than 2.5% growth in its monetary base… the exact opposite of the 00’s and ‘10s central bank- and politician-driven model. 3. This smaller credit cake is spilling over to a stronger USD (as US growth increases versus the rest of the world) and a higher marginal cost of funding (as the amount of dollars available in the credit system shrinks), leading to a mini-emerging market crisis.

4. Finally, the Turkish situation was really created by the aforementioned factors but it was made worse by President Erdogan’s autocratic and naive monetary and fiscal response. The reason this mini-crisis is not idiosyncratic is points one through three, but the market is still treating Turkey as the starting point of the current EM mini-crisis. Where do we go from here? More and more investors seem to believe that we are on the brink of an ‘Asian crisis 2.0’ or a liquidity crisis.

It costs Turks 25% more to pay off debt than it did in June.

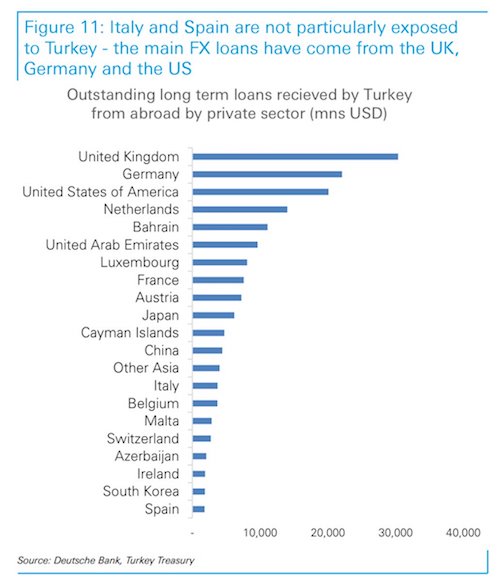

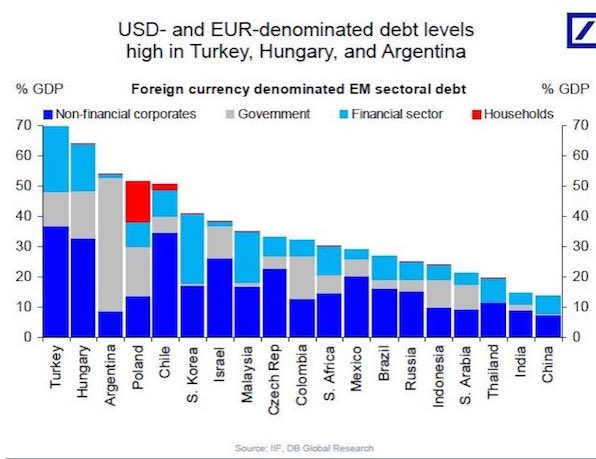

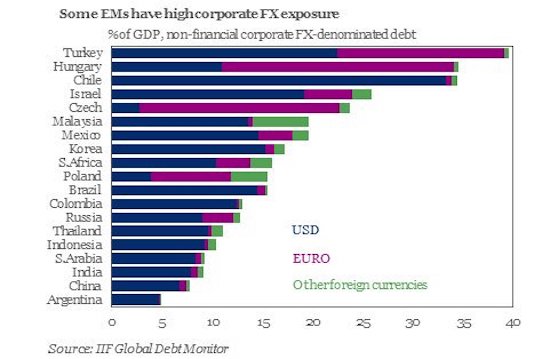

• Turkish Firms, Government Face $3.8 Billion Bond Crunch In October: SocGen (R.)

Turkey and its firms face repayments of nearly $3.8 billion on foreign currency bonds in October as the country struggles with a plunging lira that has lost more than a third of its value since the start of the year. Emerging market (EM) investors have been worried about Turkey’s external debt burden and the ability of its firms and banks to repay after a boom in hard currency issuance to help finance a rapidly growing economy. For companies, the cost of servicing foreign debt has risen by a quarter in lira terms in the past two months alone. “Turkey’s external financing requirements are large,” Jason Daw at Societe General wrote in a note to clients. “It has the highest FX-denominated debt in EM and short-term external debt of $180 billion and total external debt of $460 billion.”

Calculations by Societe General show that Turkish firms will face $1.8 billion of hard-currency denominated bonds maturing by the year-end while $1.25 billion of government bonds will come due. Additionally, a total of $2.3 billion in interest must be paid. The heaviest month for repayments is October, when $3 billion in principal and $762 million interest are due. “Principal and interest payments should be closely watched to year end – it is 25 percent more costly for the corporate sector to repay their obligations compared to June given FX depreciation,” Daw wrote.

When will stocks implode?

• David Stockman: ‘Unhinged White House’ To Cause Stock Market Crash (CNBC)

Just days before the anniversary of what’s expected to be the longest bull market in U.S. history, David Stockman is warning investors a crash is inevitable. Stockman, who served as the Office of Management and Budget director in the Reagan administration, puts a large part of the blame on Washington’s decision to place tariffs on China and the ballooning budget deficit. “This economy isn’t strong, and it can’t take the punishment that’s coming out of an unhinged White House and a Washington policy environment where they all have their heads in the sand,” Stockman said Thursday on CNBC’s “Futures Now.” According to Stockman, the China trade war is the primary catalyst that could finally pushes stocks over the edge.

“We’re not going to have a happy solution to this. We’re in a trade war big time. It’s going to keep getting worse because Donald Trump is unhinged. He is an economic ignoramus on trade,” Stockman added. “This is not caused by bad trade deals. Our big trade deficits are the result of bad monetary policy for decades. We priced [ourselves] out of the world market, and what he’s trying to do is going to cause a train wreck.” Stockman is relentlessly bearish, and his previous dire warnings have yet to materialize. Right now, Stockman isn’t ruling out another all-time high in what he’s been calling the “biggest stock market bubble in recorded history.” However, he warned a 20 to 40% shock could “easily” wipe out gains in the days that follow.

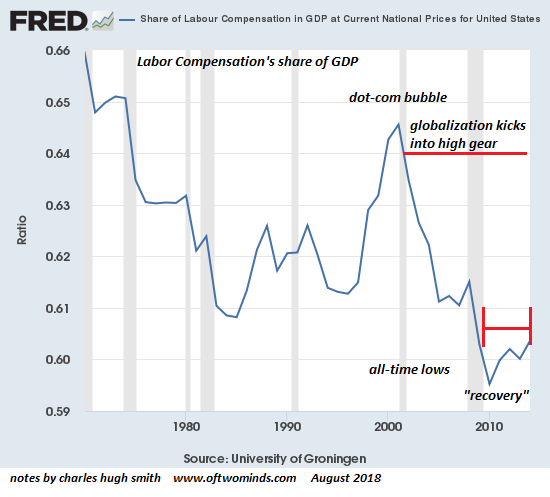

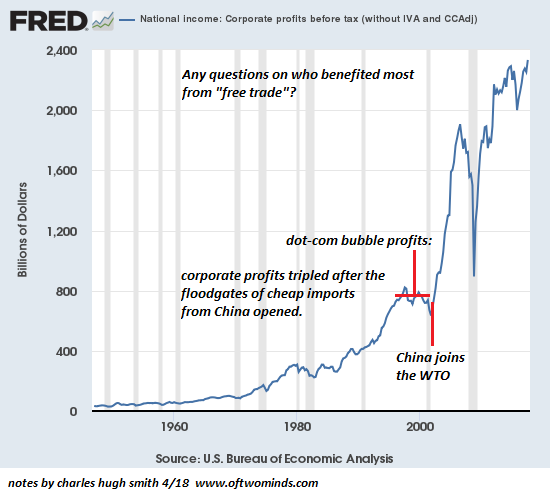

Who profits from the tax cuts?

• Trump Is The Unsung Hero Of The World Economy (CNBC)

Washington’s huge fiscal and monetary stimuli will give the world economy an estimated $600 billion shot in the arm this year. That amount represents the difference between the expected U.S. purchases and sales of goods and services in world trade. Technically, you can call it the U.S. current account deficit. Some people may recall that this is exactly the opposite of what President Donald Trump promised in 2015 and has repeated ever since. The data published earlier this month show that Trump is nowhere close to delivering on that promise. In fact, China, Japan and Europe are getting a big piece of his tax cut in their combined trade surplus of $297.8 billion during the first six months of this year. That is an 8.2 percent increase from what they got out of a more sluggish American economy a year ago.

In spite of that, China, Japan and the European Union keep complaining about U.S. protectionism, accusing Trump of allegedly destroying the multilateral trading system. And they don’t even have the courtesy to recycle some of their surplus dollars in purchases of American IOUs that are fueling their economic growth. In the first half of this year, Japan, China and Germany reduced their Treasury holdings by $31.1 billion, $6.2 billion and $1.1 billion respectively. Washington — and the national security strategists, in particular — may wish to think about what those countries did with all the dollars they got from dumping their goods and services on U.S. markets. In fact, Trump is playing nice with those trading partners. Unfortunately, while doing that, he is also saddling generations of Americans with the soaring and debilitating public debt that will inevitably lead to slowing growth of jobs and incomes at home.

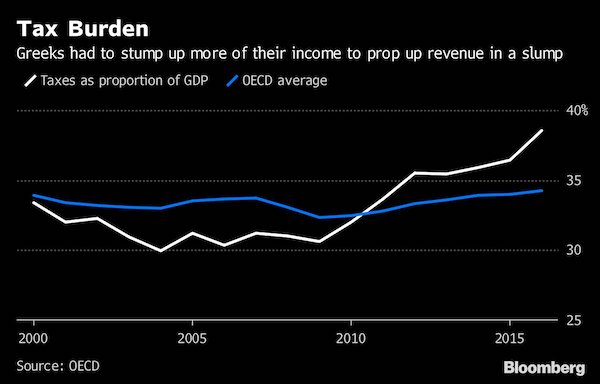

It’s a sad day. By far the highest tax burden and by far the lowest incomes in the EU. That’s not a viable model.

• Greece’s Bailout Is Finally At An End – But Has Been A Failure (G.)

After eight years, Greece will on Monday be deemed strong enough to stand on its own feet. The international bailout programme that has provided Athens with emergency financial support will come to an end. Aside from the tough budget rules in place for the next decade or more, Greeks can wave goodbye to the troika – the officials from the IMF, the ECB and the EU – that has in effect been running the country since 2010. Beware the hype that trumpets this as a great success story, a tribute to solidarity and a commonsense approach that has restored economic stability and prevented Greece from being the first country to leave the euro. Nothing could be further from the truth.

Greece has been a colossal failure. It is a tale of incompetence, of dogma, of needless delay and of the interests of banks being put before the needs of people. And there will be long-term consequences. When Greece first received help in 2010, the plan was for it to have access to the financial markets within two years. It has taken two further rescue packages and six years for that to happen. The Greek economy has recently been growing, but it has a vast amount of ground to make up, following a peak-to-trough contraction that saw GDP shrink by almost a third. The loss of so much output could have been avoided, but Greece – like the rest of Europe – was subjected to the idea that the priority in the wake of the most serious financial crisis in a century was for governments to balance the books through deflation.

The only young Greeks who have a future have left.

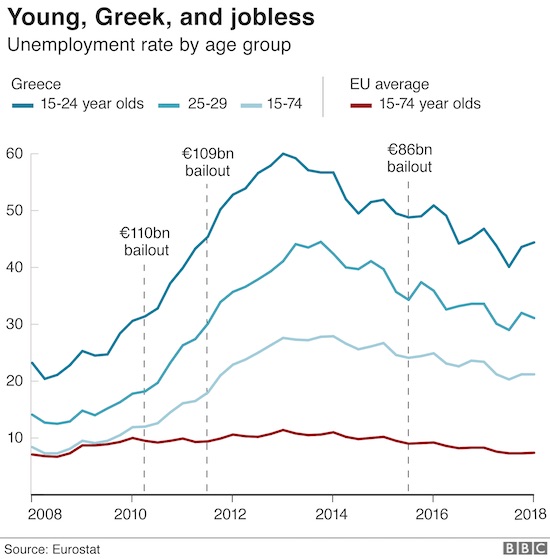

• End Of Greek Bailouts Offers Little Hope To Young (BBC)

The crisis hit all parts of Greek society – but it was particularly hard on the young. Between 2008 and 2016 the country lost almost 4% of its citizens to emigration – more than 400,000 people. And while Greece didn’t record the ages of those emigrating, the country is getting older. The average (median) age has jumped by more than four years since 2008; and while those aged 20 to 39 used to make up 29% of the population, that’s fallen to just 24%. Giorgios Christides is a Greek journalist covering his country for German news magazine Der Spiegel. Back in 2012 he wrote a piece for the BBC about his friends “fleeing Greece one by one”. He says the economic improvements since the peak of the crisis in 2012 are not enough to have changed that.

Greeks love their country, and many “would return the second they thought they could find a worthwhile job and good prospects back home”, he says. Low wages and high taxes for the self-employed make those good prospects rare. Even a “best-case scenario” of a permanent job presents difficulties “if you want to leave your parents’ home, have children, lead a full and meaningful life,” he said. Part of the reason for the exodus is a lack of job opportunities. Greece’s unemployment rate peaked at 27.5% in 2013 – but for those under 25, it was more than double that, at 58%. Last year, more than four in every 10 young Greeks were still jobless.

“They are doing me a great honor by trying to pass on their sins to me.”

• Varoufakis Says Biggest Mistake Was Trusting Tsipras (K.)

Almost three years after the SYRIZA-ANEL coalition government signed the third bailout program and two days before Greece is set to complete it, former finance minister Yanis Varoufakis said his biggest mistake during his tumultuous tenure was “trusting Tsipras.” “My mistake was trusting Mr. Tsipras – [trusting] that we had been elected with a clear mandate not to extend the country’s debt colony status with a new memorandum and that we would fight until the end to link the total debt and the repayment rate with the GDP and its growth rate – what we call the growth clause,” he told SKAI television on Saturday. Asked to comment on the estimation made by the head of the European Stability Mechanism (ESM) Klaus Regling that the first six months of 2015, when Varoufakis was at the helm of the finance ministry, cost the country €86-200 billion, the former minister was dismissive.

“The cost was huge since 2010 and it is entirely due to the troika’s wrong program,” he said, referring to the European Commission, the ECB and the IMF who supervised Greece’s three adjustment programs. “They are doing me a great honor by trying to pass on their sins to me. A finance minister is judged by the debt levels he leaves behind, in relation to what he found, the cash reserves and the GDP. You will see that I mostly delivered what I had received,” he added. Varoufakis described the ESM as a “a sinful mechanism of alleged stability, which in essence destabilised the Greek economy and Europe.”

They’re nowhere.

• First No-Deal Brexit Advisory Notices To Be Released On Thursday (Ind.)

The government is to begin publishing its Brexit technical notices, setting out the consequences of crashing out of the EU without a deal, on Thursday, the prime minister’s office has said. The first of the explanatory documents are expected from the Department for Exiting the European Union (DExEU) within days and are designed to inform citizens and businesses how to cope with a no-deal scenario. All 84 of the notices are due to be published before the end of September. Some are thought to be broad in scope, covering issues like financial services, company law and climate change, while others will focus on specific problems including travelling abroad with pets.

Two days before the first publication, Brexit secretary Dominic Raab will travel to Brussels in a bid to pick up the pace of talks with the EU’s chief negotiator Michel Barnier, Theresa May’s office added on Saturday. “On the agenda will be resolving the few remaining withdrawal issues related to the UK leaving the EU and pressing ahead with discussions on the future relationship,” Downing Street said of Tuesday’s planned summit.

The perks of austerity. You see it in Greece, you see it in the UK.

• Britain’s Low-Earning Parents ‘Can’t Afford Basic Lifestyle’ (BBC)

Low-earning parents working full-time are still unable to earn enough to provide their family with a basic, no-frills lifestyle, research suggests. A single parent on the National Living Wage is £74 a week short of the minimum income needed, according to the Child Poverty Action Group. A couple with two children would be £49 a week short of the income needed, the charity said. But this was better than last year, when couples were £59 a week short. The National Living Wage is currently £7.83 an hour for those aged over 25. A government spokesperson said fewer families were living in absolute poverty.

“The employment rate is at a near-record high and the National Living Wage has delivered the highest pay increase for the lowest paid in 20 years, worth £2,000 extra per year for a full-time worker,” the spokesperson added. But the Child Poverty Action Group (CPAG) said gains from modest increases in wages had been “clawed back” through the freezing of tax credits. Rising prices and changes to various benefit schemes had also “hit family budgets hard”, it said. The CPAG’s definition of a “no-frills” lifestyle is based on the Minimum Income Standard, a set of criteria drawn up by the Centre for Research in Social Policy at Loughborough University. It calculates the income required for a minimum standard of living based on essentials such as food, clothes and accommodation, as well as “other costs required to take part in society”.

More consequences of austerity.

• In US, UK, People Die Early Due To ‘Shit-Life Syndrome’ (G.)

Britain and America are in the midst of a barely reported public health crisis. They are experiencing not merely a slowdown in life expectancy, which in many other rich countries is continuing to lengthen, but the start of an alarming increase in death rates across all our populations, men and women alike. We are needlessly allowing our people to die early. In Britain, life expectancy, which increased steadily for a century, slowed dramatically between 2010 and 2016. The rate of increase dropped by 90% for women and 76% for men, to 82.8 years and 79.1 years respectively.

Now, death rates among older people have so much increased over the last two years – with expectations that this will continue – that two major insurance companies, Aviva and Legal and General, are releasing hundreds of millions of pounds they had been holding as reserves to pay annuities to pay to shareholders instead. Society, once again, affecting the citadels of high finance. Trends in the US are more serious and foretell what is likely to happen in Britain without an urgent change in course. Death rates of people in midlife (between 25 and 64) are increasing across the racial and ethnic divide. It has long been known that the mortality rates of midlife American black and Hispanic people have been worse than the non-Hispanic white population, but last week the British Medical Journal published an important study re-examining the trends for all racial groups between 1999 and 2016 .

The malaises that have plagued the black population are extending to the non-Hispanic, midlife white population. As the report states: “All cause mortality increased… among non-Hispanic whites.” Why? “Drug overdoses were the leading cause of increased mortality in midlife, but mortality also increased for alcohol-related conditions, suicides and organ diseases involving multiple body systems” (notably liver, heart diseases and cancers). US doctors coined a phrase for this condition: “shit-life syndrome”.