Dorothea Lange A Family Of Mexican Migrants, On The Road In California 1936

It’s obvious there is only one story today, which ironically(?!) blows the whole Trump-Russia accusation narrative to bits, even though of course Russia gets the blame for this too in all sorts of corners. But the files are reported to have been ‘out there’ for a while, in the hands of hackers and possible foreign agencies. The CIA spent a huge wad of taxpayer money on this, and then lost it all. It’s early days to say what this will mean for the agency’s abilities, and the nation’s safety, as well as that of American citizens, but it’s not good. Question is: who’s going to investigate how this could have happened? (Snowden and Kim Dotcom could)… And who’s going to repair the damage done? Anyone could be spying on your phone and your TV by now, not just the CIA -as if that wouldn’t be bad enough.

And this is just the first part. Wikileaks has announced more from where this came from.

• Wikileaks ‘Vault 7’, Largest Ever Publication Of Confidential CIA Docs (ZH)

A total of 8,761 documents have been published as part of ‘Year Zero’, the first in a series of leaks the whistleblower organization has dubbed ‘Vault 7.’ WikiLeaks said that ‘Year Zero’ revealed details of the CIA’s “global covert hacking program,” including “weaponized exploits” used against company products including “Apple’s iPhone, Google’s Android and Microsoft’s Windows and even Samsung TVs, which are turned into covert microphones.”

WikiLeaks tweeted the leak, which it claims came from a network inside the CIA’s Center for Cyber Intelligence in Langley, Virginia.

Among the more notable disclosures which, if confirmed, “would rock the technology world“, the CIA had managed to bypass encryption on popular phone and messaging services such as Signal, WhatsApp and Telegram. According to the statement from WikiLeaks, government hackers can penetrate Android phones and collect “audio and message traffic before encryption is applied.”

Another profound revelation is that the CIA can engage in “false flag” cyberattacks which portray Russia as the assailant. Discussing the CIA’s Remote Devices Branch’s UMBRAGE group, Wikileaks’ source notes that it “collects and maintains a substantial library of attack techniques ‘stolen’ from malware produced in other states including the Russian Federation.

“With UMBRAGE and related projects the CIA cannot only increase its total number of attack types but also misdirect attribution by leaving behind the “fingerprints” of the groups that the attack techniques were stolen from. UMBRAGE components cover keyloggers, password collection, webcam capture, data destruction, persistence, privilege escalation, stealth, anti-virus (PSP) avoidance and survey techniques.”

As Kim Dotcom summarizes this finding, “CIA uses techniques to make cyber attacks look like they originated from enemy state. It turns DNC/Russia hack allegation by CIA into a JOKE“

CIA uses techniques to make cyber attacks look like they originated from enemy state. It turns DNC/Russia hack allegation by CIA into a JOKE

— Kim Dotcom (@KimDotcom) March 7, 2017

But perhaps what is most notable is the purported emergence of another Snowden-type whistleblower: the source of the information told WikiLeaks in a statement that they wish to initiate a public debate about the “security, creation, use, proliferation and democratic control of cyberweapons.” Policy questions that should be debated in public include “whether the CIA’s hacking capabilities exceed its mandated powers and the problem of public oversight of the agency,” WikiLeaks claims the source said.

The FAQ section of the release, shown below, provides further details on the extent of the leak, which was “obtained recently and covers through 2016”. The time period covered in the latest leak is between the years 2013 and 2016, according to the CIA timestamps on the documents themselves. Secondly, WikiLeaks has asserted that it has not mined the entire leak and has only verified it, asking that journalists and activists do the leg work.

Among the various techniques profiled by WikiLeaks is “Weeping Angel”, developed by the CIA’s Embedded Devices Branch (EDB), which infests smart TVs, transforming them into covert microphones. After infestation, Weeping Angel places the target TV in a ‘Fake-Off’ mode, so that the owner falsely believes the TV is off when it is on. In ‘Fake-Off’ mode the TV operates as a bug, recording conversations in the room and sending them over the Internet to a covert CIA server.

As Kim Dotcom chimed in on Twitter, “CIA turns Smart TVs, iPhones, gaming consoles and many other consumer gadgets into open microphones” and added ” CIA turned every Microsoft Windows PC in the world into spyware. Can activate backdoors on demand, including via Windows update”

BREAKING: CIA turns Smart TVs, iPhones, gaming consoles and many other consumer gadgets into open microphones. #Vault7

— Kim Dotcom (@KimDotcom) March 7, 2017

Dotcom also added that “Obama accused Russia of cyberattacks while his CIA turned all internet enabled consumer electronics in Russia into listening devices. Wow!”

Obama accused Russia of cyberattacks while his CIA turned all internet enabled consumer electronics in Russia into listening devices. Wow!

— Kim Dotcom (@KimDotcom) March 7, 2017

Julian Assange, WikiLeaks editor stated that “There is an extreme proliferation risk in the development of cyber ‘weapons’. Comparisons can be drawn between the uncontrolled proliferation of such ‘weapons’, which results from the inability to contain them combined with their high market value, and the global arms trade. But the significance of “Year Zero” goes well beyond the choice between cyberwar and cyberpeace. The disclosure is also exceptional from a political, legal and forensic perspective.”

“…first public evidence US [Government] secretly paying to keep US software unsafe”

• Snowden: What The Wikileaks Revelations Show Is “Reckless Beyond Words” (ZH)

While it has been superficially covered by much of the press – and one can make the argument that what Julian Assange has revealed is more relevant to the US population, than constant and so far unconfirmed speculation that Trump is a puppet of Putin – the fallout from the Wikileaks’ “Vault 7” release this morning of thousands of documents demonstrating the extent to which the CIA uses backdoors to hack smartphones, computer operating systems, messenger applications and internet-connected televisions, will be profound. As evidence of this, the WSJ cites an intelligence source who said that “the revelations were far more significant than the leaks of Edward Snowden.”

Mr. Snowden’s leaks revealed names of programs, companies that assist the NSA in surveillance and in some cases the targets of American spying. But the recent leak purports to contain highly technical details about how surveillance is carried out. That would make them far more revealing and useful to an adversary, this person said. In one sense, Mr. Snowden provided a briefing book on U.S. surveillance, but the CIA leaks could provide the blueprints. Speaking of Snowden, the former NSA contractor-turned-whistleblower, who now appears to have a “parallel whisteblower” deep inside the “Deep State”, i.e., the source of the Wikileaks data – also had some thoughts on today’s CIA dump.

In a series of tweets, Snowden notes that “what @Wikileaks has here is genuinely a big deal”, and makes the following key observations “If you’re writing about the CIA/@Wikileaks story, here’s the big deal: first public evidence USG secretly paying to keep US software unsafe” and adds that “the CIA reports show the USG developing vulnerabilities in US products, then intentionally keeping the holes open. Reckless beyond words.” He then asks rhetorically “Why is this dangerous?” and explains “Because until closed, any hacker can use the security hole the CIA left open to break into any iPhone in the world.” His conclusion, one which many of the so-called conspiratorial bent would say was well-known long ago: “Evidence mounts showing CIA & FBI knew about catastrophic weaknesses in the most-used smartphones in America, but kept them open – to spy.”

“..WikiLeaks, which has sometimes been accused of recklessly leaking information that could do harm, said it had redacted names and other identifying information from the collection. It said it was not releasing the computer code for actual, usable weapons “until a consensus emerges on the technical and political nature of the C.I.A.’s program and how such ‘weapons’ should be analyzed, disarmed and published.”

• WikiLeaks Releases Trove of Alleged CIA Hacking Documents (NYT)

In what appears to be the largest leak of C.I.A documents in history, WikiLeaks released on Tuesday thousands of pages describing sophisticated software tools and techniques used by the agency to break into smartphones, computers and even Internet-connected televisions. The documents amount to a detailed, highly technical catalog of tools. They include instructions for compromising a wide range of common computer tools for use in spying: the online calling service Skype; Wi-Fi networks; documents in PDF format; and even commercial antivirus programs of the kind used by millions of people to protect their computers. A program called Wrecking Crew explains how to crash a targeted computer, and another tells how to steal passwords using the autocomplete function on Internet Explorer. Other programs were called CrunchyLimeSkies, ElderPiggy, AngerQuake and McNugget.

The document dump was the latest coup for the antisecrecy organization and a serious blow to the C.I.A., which uses its hacking abilities to carry out espionage against foreign targets. The initial release, which WikiLeaks said was only the first installment in a larger collection of secret C.I.A. material, included 7,818 web pages with 943 attachments, many of them partly redacted by WikiLeaks editors to avoid disclosing the actual code for cyberweapons. The entire archive of C.I.A. material consists of several hundred million lines of computer code, the group claimed. In one revelation that may especially trouble the tech world if confirmed, WikiLeaks said that the C.I.A. and allied intelligence services have managed to compromise both Apple and Android smartphones, allowing their officers to bypass the encryption on popular services such as Signal, WhatsApp and Telegram. According to WikiLeaks, government hackers can penetrate smartphones and collect “audio and message traffic before encryption is applied.”

Unlike the National Security Agency documents Edward J. Snowden gave to journalists in 2013, they do not include examples of how the tools have been used against actual foreign targets. That could limit the damage of the leak to national security. But the breach was highly embarrassing for an agency that depends on secrecy. Robert M. Chesney, a specialist in national security law at the University of Texas at Austin, likened the C.I.A. trove to National Security Agency hacking tools disclosed last year by a group calling itself the Shadow Brokers. “If this is true, it says that N.S.A. isn’t the only one with an advanced, persistent problem with operational security for these tools,” Mr. Chesney said. “We’re getting bit time and again.”

No ‘evidence’ (and remember none was provided to date) of Russian spying is the least bit credible anymore after today.

• Wikileaks: CIA Capable Of Cyber “False Flag” Attack To Blame Russia (TAM)

According to a Wikileaks press release, the 8,761 newly published files came from the CIA’s Center for Cyber Intelligence (CCI) in Langley, Virginia. The release says that the UMBRAGE group, a subdivision of the center’s Remote Development Branch (RDB), has been collecting and maintaining a “substantial library of attack techniques ‘stolen’ from malware produced in other states, including the Russian Federation.” As Wikileaks notes, the UMBRAGE group and its related projects allow the CIA to misdirect the attribution of cyber attacks by “leaving behind the ‘fingerprints’ of the very groups that the attack techniques were stolen from.”

In other words, the CIA’s sophisticated hacking tools all have a “signature” marking them as originating from the agency. In order to avoid arousing suspicion as to the true extent of its covert cyber operations, the CIA has employed UMBRAGE’s techniques in order to create signatures that allow multiple attacks to be attributed to various entities – instead of the real point of origin at the CIA – while also increasing its total number of attack types. Other parts of the release similarly focus on avoiding the attribution of cyberattacks or malware infestations to the CIA during forensic reviews of such attacks. In a document titled “Development Tradecraft DOs and DON’Ts,” hackers and code writers are warned “DO NOT leave data in a binary file that demonstrates CIA, U.S. [government] or its witting partner companies’ involvement in the creation or use of the binary/tool.” It then states that “attribution of binary/tool/etc. by an adversary can cause irreversible impacts to past, present and future U.S. [government] operations and equities.”

While a major motivating factor in the CIA’s use of UMBRAGE is to cover it tracks, events over the past few months suggest that UMBRAGE may have been used for other, more nefarious purposes. After the outcome of the 2016 U.S. presidential election shocked many within the U.S. political establishment and corporate-owned media, the CIA emerged claiming that Russia mounted a “covert intelligence operation” to help Donald Trump edge out his rival Hillary Clinton.[..] the U.S. intelligence community’s assertions that Russia used cyber-attacks to interfere with the election overshadowed reports that the U.S. government had actually been responsible for several hacking attempts that targeted state election systems.

For instance, the state of Georgia reported numerous hacking attempts on its election agencies’ networks, nearly all of which were traced back to the U.S. Department of Homeland Security. Now that the CIA has been shown to not only have the capability but also the express intention of replacing the “fingerprint” of cyber-attacks it conducts with those of another state actor, the CIA’s alleged evidence that Russia hacked the U.S. election – or anything else for that matter – is immediately suspect. There is no longer any way to determine if the CIA’s proof of Russian hacks on U.S. infrastructure is legitimate, as it could very well be a “false flag” attack.

“..we come to find out the same people who told us the Russians were our enemy, revealing corruption and depravity on a monumental scale via the Podesta emails, they were, in fact, the ones spying on us all along – both lying and mocking us like Lords in a fiefdom.”

• CIA Contractor on #VAULT7 Leak: ‘There is Heavy Shit Coming Down’ (RF)

Everything that Wikileaks has revealed over the past year has hurt both the integrity and honor of the United States. The question you have to grapple with, is it well deserved? After all, living inside of a vast and powerful empire has its benefits. As the empire expands, so does the wealth of its citizens. But it hasn’t worked out that way, has it? The CIA deep staters have turned their guns on the people they serve – using third world banana republic tactics to silence opposition, take down regimes not beholden to their world view, using advanced technology to both spy and monitor on American citizens – infringing on our civil rights like nothing we’ve ever seen before. The reason for the populist uprising and the lack of equanimity amongst those traditionally supportive of the CIA lies in the improper distribution of the spoils of war. There aren’t any.

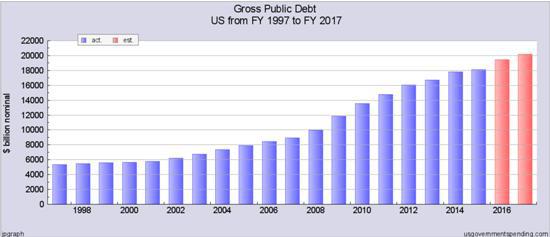

All the average American has received from $10 trillion in Obama inspired deficit spending is American casualties of war, jobs lost to cheaper labor overseas, expensive oil prices, expensive healthcare, and run away education costs – along with a sundry of social disturbances that have people fed up. While the elite flaunt hedonistic lifestyles, eschewing basic decency for the perverse, normies get more of the same old bullshit. After electing a true agent of change in Donald Trump, the people are laughed at and impugned by the elitist media. Their President is set upon by ‘permanent government’ officials in the intelligence agencies – whose only goal is to derail and destroy his term before it even begins.

Then we come to find out the same people who told us the Russians were our enemy, revealing corruption and depravity on a monumental scale via the Podesta emails, they were, in fact, the ones spying on us all along – both lying and mocking us like Lords in a fiefdom. Here’s Fox News reporting on the latest scandal to hit the wires, #VAULT7 Fox New sources inside the CIA said the agency was running around like headless chickens, saying ‘there is heavy shit coming down.’

US exports are plunging. 10.7% to Germany, 13.4% to China.

• US Trade Deficit Jumps To Five-Year High On Imports (R.)

The U.S. trade deficit jumped to a near five-year high in January as cell phones and rising oil prices helped to push up the import bill, suggesting trade would again weigh on economic growth in the first quarter. The Commerce Department said on Tuesday the trade gap increased 9.6% to $48.5 billion, the highest level since March 2012. The deficit was in line with economists forecasts. December’s trade shortfall was unrevised at $44.3 billion. When adjusted for inflation, the trade deficit rose to $65.3 billion from $62.0 billion in December. Both the inflation-adjusted exports and imports were the highest on record in January.

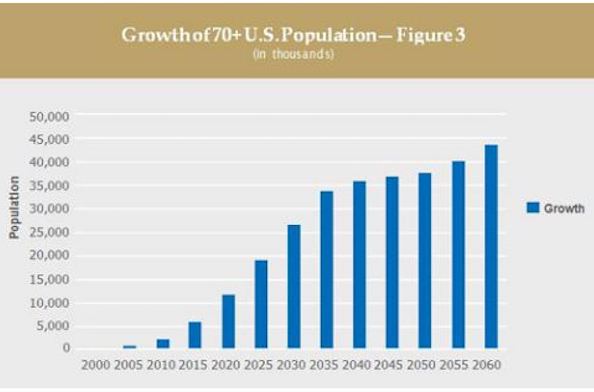

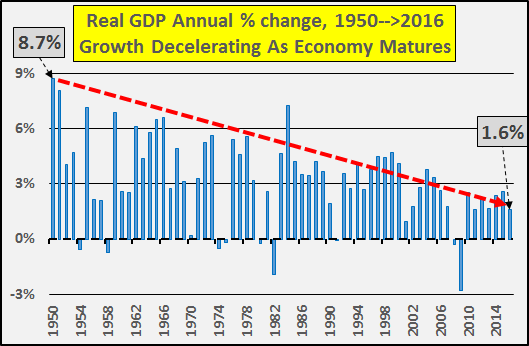

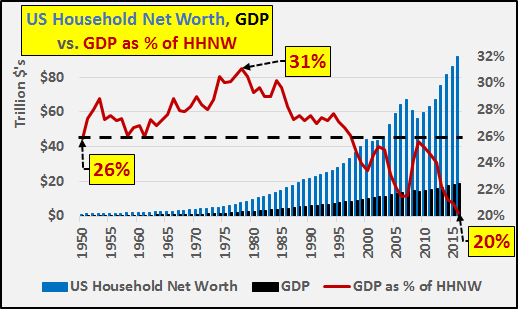

The wider trade gap added to weak data such as housing starts, consumer and construction spending in suggesting the economy struggled to regain momentum early in the first quarter after growth slowed to a 1.9% annualized rate in the final three months of 2016. The economy grew at a 3.5% pace in the third quarter. Trade cut 1.7 percentage points from GDP in the fourth quarter. The Atlanta Fed is forecasting GDP rising at a 1.8% rate in the first quarter. The dollar was trading marginally higher, while prices for U.S. government bonds were little changed. U.S. stock index futures were slightly lower. The Trump administration is eyeing trade as it seeks 4% annual GDP growth. President Donald Trump has vowed sweeping changes to U.S. trade policy, starting with pulling out of the 12-nation TPP.

[..] The bulk of the increase in the trade-weighted value of the greenback occurred in the final months of 2016 and will probably take a while to reflect in the trade data. Exports to Germany tumbled 10.7%. A Trump trade adviser has accused Germany of unfairly benefiting from a weak euro. Shipments of goods to China, also singled out by the Trump administration, dropped 13.4%. The politically sensitive U.S.-China trade deficit increased 12.8% to $31.3 billion in January, while the trade gap with Germany fell 8.0% to $4.9 billion. The United States also saw its trade deficit with Mexico shrink 10.1% to its lowest level since July 2015.

We need to see: 1) dollar terms and 2) Lunar New Year distortions.

• China Posts Rare Trade Deficit As February Imports Surge in Yuan Terms (R.)

China unexpectedly posted a rare trade deficit in February as imports surged far more than expected to feed a months-long construction boom, driven by commodities from iron ore and copper to crude oil and coal. Imports in yuan-denominated terms surged 44.7 percent from a year earlier, while exports rose 4.2 percent, official data showed on Wednesday. That left the country with a trade deficit of 60.63 billion yuan ($8.79 billion) for the month, the General Administration of Customs said. Customs has not yet published dollar-denominated trade figures, on which most economists and investors base their forecasts and analysis. Apart from currency fluctuations, higher commodity prices and the timing of the long Lunar New year holidays early in the year also may have distorted the data.

Most of China’s commodity imports grew strongly in volume terms from a year earlier, but dipped from January. Still, economists say the upbeat readings reinforced a growing view that economic activity in China and globally picked up in the first two months of the year. That could give China’s policymakers more confidence to press ahead with oft-delayed and painful structural reforms such as tackling a mountain of debt. Containing the risks from years of debt-fueled stimulus and heavy spending has been a major focus at the annual meeting of China’s parliament which began on Sunday.

They know something?!

• Why Are Europe’s Small Central Banks Stocking Up Foreign Money? (WSJ)

Europe’s smaller central banks are loading up on foreign currencies at rates usually associated with periods of intense global stress, highlighting the fragile underpinnings of the global economic recovery despite the recent upbeat mood in financial markets. Switzerland’s holdings of foreign assets jumped last month at their fastest pace in over two years as its central bank fought the strong franc, which weakens exports and inflation. The Czech central bank intervened in January on a massive scale to maintain its currency target against the euro. Denmark has also stepped up its foreign-currency purchases to keep the krone from strengthening too much. These central banks are showing crisis-like behavior to protect their currencies even in the absence of obvious trouble. This exposes them to losses if their currencies fail to weaken on their own.

It also raises doubts as to how long they can keep this up in an era when economic and political uncertainties appear to be a lasting feature of the world economy. “There is a little bit of survivor behavior,” said Peter Rosenstreich, head of market strategy at Swissquote Bank. “They’ve been protecting their currencies so long and it’s hard to give up that defensive position.” The Swiss National Bank said Tuesday its foreign exchange reserves swelled nearly 25 billion Swiss francs ($24.63 billion) last month to 668 billion francs, the biggest rise since December 2014, the month before the Swiss abandoned a cap on the franc’s value. The pile of foreign reserves is greater than Switzerland’s entire gross domestic product. “It’s quite bizarre. You’d think at some time you’d run out of surprises,” said Stefan Gerlach, chief economist at BSI Bank in Zurich and a former deputy governor at Ireland’s central bank.

[..] Central banks accumulate foreign reserves when they purchase assets denominated in other currencies, using freshly created money. They do this to weaken their currencies, protecting exports and giving a boost to inflation. Foreign reserves can waver slightly due to changes in currency values, but big increases like Switzerland’s signal aggressive intervention. This tool has gained traction in recent years as official rates have turned negative in Denmark and Switzerland and are near zero in the Czech Republic.

A few good articles for International Women’s Day. Pettifor’s insistence that households are not like governments is important.

• Dispel The Economic Myths That Hold Women Back (Ann Pettifor)

There are two economic myths that fail the interests of women. The first is the fallacy that government budgets conform to “the household analogy”: that, as with family budgets, a state’s outgoings cannot exceed its income. The second is that “there is no money” for the services women use and need. On the first, the public are told that cuts in spending and in some benefits, combined with rises in income from taxes will – just as with a household – balance the budget. Even though a single household’s budget is a) minuscule compared to that of a government; b) does not, like the government’s, impact on the wider economy; c) does not benefit from tax revenues (now, or in the foreseeable future); and d) is not backed by a powerful central bank. Despite all these obvious differences, government budgets are deemed analogous (by economists and politicians) to a household budget.

To understand why the government/household analogy is false it is important to understand that the balance of the government budget, unlike that of a household, is entirely a function of the wider economy. If the economy slumps (as in 2008-9) and the private sector weakens, then like a see-saw the public sector deficit, and then the debt, rises. When private economic activity revives (thanks to increased investment, employment, sales etc) tax revenues rise, unemployment benefits fall, and the government deficit and debt follow the same downward trajectory. So, to balance the government’s budget, efforts must be made to revive Britain’s economy, including the indebted private sector.

Because government spending (unlike a household’s spending) has a big impact on the economy, governments can use loan-financed investment to expand tax-generating employment – both public (for example, nurses and teachers) and private sector employment (construction workers). Both nurses and construction workers will return a large part of their incomes into the economy through spending, benefitting the private sector. Thanks to the multiplier effect, that spending will generate VAT and corporation tax revenues – for repaying government debt. George Osborne believed that government spending cuts would be offset by a rise in private sector confidence, inspired by a government “getting its house in order”. But that did not happen.

As many of us predicted, government spending cuts contracted the economy further. Economic activity (investment, sales, employment) was weaker than expected. Even when employment revived, lower wages and insecure, part-time work meant that income and corporate taxes were lower than expected. So government borrowing did not fall. As a result, public debt as a share of GDP was higher than expected. In the meantime, massive harm had been done to public sector services and those employed in the sector – while the economy endured the slowest post-crisis recovery in history. And it was women who largely paid the price.

One woman can be said to have given the phrase “there is no money” much credibility. In her 1983 speech to the Conservative party conference, Margaret Thatcher declared that: “The state has no source of money, other than the money people earn themselves. If the state wishes to spend more it can only do so by borrowing your savings, or by taxing you more … There is no such thing as public money. There is only taxpayers’ money.” Today this framing of the debate is at odds with reality. After the financial crisis, the Bank of England injected £1,000bn into the private finance sector to prevent systemic economic failure. And after the shock of the Brexit vote, the Bank unveiled the “Term Funding Scheme” as part of a £170bn “stimulus package” aimed at the private finance sector. The money was “public money” offered at a historically low interest rate – to bankers. It was not raised by cutting spending, and it was not raised from “your taxes”, even while its issue was backed by Britain’s taxpayers.

Good points.

• Austerity Is A Feminist Issue (G.)

Women are massively more affected by budget cuts than men, says the Labour peer. They are more likely to be single parents, earn less and work part time than their male counterparts. She argues the government must replace ‘gender-neutral’ budgeting with economic policies that put women first.

100 years ago.

• The Women’s Protest That Sparked The Russian Revolution (G.)

The first day of the Russian revolution – 8 March (23 February in the old Russian calendar) – was International Women’s Day, an important day in the socialist calendar. By midday of that day in 1917 there were tens of thousands of mainly women congregating on the Nevsky Propsekt, the principal avenue in the centre of the Russian capital, Petrograd, and banners started to appear. The slogans on the banners were patriotic but also made forceful demands for change: “Feed the children of the defenders of the motherland”, read one; another said: “Supplement the ration of soldiers’ families, defenders of freedom and the people’s peace”. The crowds of demonstrators were varied. The city’s governor, AP Balk, said they consisted of “ladies from society, lots more peasant women, student girls and, compared with earlier demonstrations, not many workers”. The revolution was begun by women, not male workers.

In the afternoon the mood began to change as female textile workers from the Vyborg side of the city came out on strike in protest against shortages of bread. Joined by their menfolk, they swelled the crowds on the Nevsky, where there were calls for “Bread!” and “Down with the tsar!” By the end of the afternoon, 100,000 workers had come out on strike, and there were clashes with police as the workers tried to cross the Liteiny bridge, connecting the Vyborg side with the city centre. Most were dispersed by the police but several thousand crossed the ice-packed river Neva (a risky thing to do at -5C) and some, angered by the fighting, began to loot the shops on their way to the Nevsky. Balk’s Cossacks struggled to clear the crowds on the Nevsky. They would ride up the demonstrators, only to stop short and retreat. Later it emerged that they were mostly young reservists who had no experience of dealing with crowds.

How to kill a city part 829.

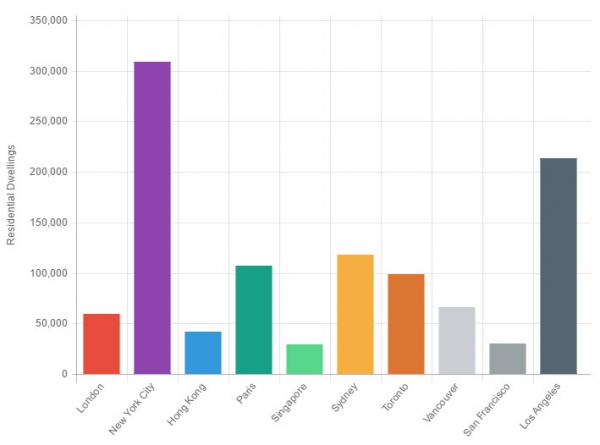

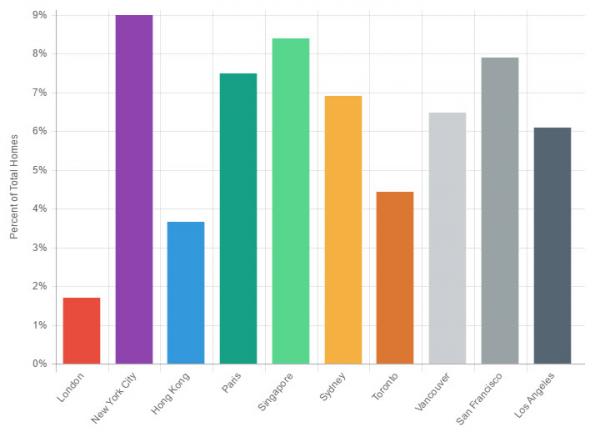

• Vacant Homes Are A Global Epidemic (BD)

Runaway real estate speculation has been filling global capitals with vacant homes, creating artificial shortages in the world’s most sought after cities. The “shortage” has made local home owners wealthy overnight, but it comes at the cost of turning lively cities into empty shells. The city of Paris has decided it’s had enough, and implemented a tax in 2015. They didn’t quite get the results they wanted, so they’re now tripling the tax to 60%. Paris has been trying to deal with vacant property owners for some time. Despite warnings that the city will have to take action, the number of vacant homes is growing. There’s now 107,000 vacant homes, representing 7.5% of all residential dwellings in the city according to France’s INSEE. Deputy Mayor Ian Brossat told Le Monde that 40,000 of those vacant homes aren’t even connected to the electrical grid.

Local developers have argued that more new construction is the solution. However Brossat argues “In a city as dense as Paris, where it is very difficult to build, controlling the occupancy of housing is strategic.” It appears the city believes they have 107,000 reasons more construction is not the solution. Paris implemented a tax recently, but it didn’t quite produce the desired outcome. Starting in 2015 the city elected to tax vacant homes the equivalent of 20% of the fair market value of rent. On January 30 this year, they decided to triple that amount to 60%. The idea isn’t to punish those fortunate enough to own a second (or twelfth) home. They’re trying to discourage speculation and promote a healthy rental market.

Paris’ 107,000 empty homes might seem like a lot, but it’s becoming strangely normal around the world. New York City had a whopping 318,831 vacant units in 2015. It’s a hot topic in Sydney, where 118,499 vacant units were counted in 2013. Heck, London considers it a critical issue, and they “only” have 22,000 empty homes. There’s a massive numbers of vacant homes across the globe, but only Paris has decided to take aggressive action to tackle it. Growing populations have barely put a dent in the vacant homes in global real estate capitals. The amount of speculation has been scaling with demand, which is a curious paradox. This signifies an issue that’s more complex than just a basic supply and demand problem.

And you can’t call it perjury. But look at the article below this one.

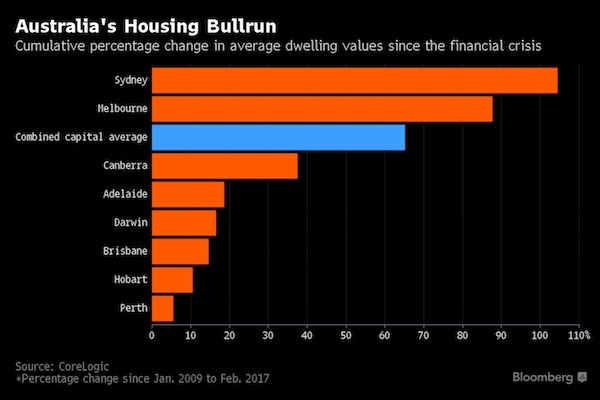

• There’s No Housing Bubble in Australia, Heads of Big Banks Say (BBG)

Soaring home prices in Australia’s biggest cities don’t necessarily mean the country is in the grip of a housing bubble, according to the heads of the nation’s biggest banks. Testifying before a parliamentary committee, the chief executives of National Australia, Westpac and Commonwealth Bank of Australia all said that while they are worried about elements of the housing market, prices aren’t over-inflated. “I would draw the distinction between a speculative bubble in prices and prices beyond what fundamentals would justify,” Westpac’s Brian Hartzer told the committee in Canberra Wednesday. A bubble isn’t occurring in Sydney or Melbourne, where house prices have risen the most, he said.

“There are increasing risks, but I still believe the answer is no,” National Australia Bank’s Andrew Thorburn said when asked if houses in Sydney and Melbourne are overpriced. Commonwealth Bank, the nation’s largest mortgage lender, is “lending at levels we are comfortable with” across Australia, CEO Ian Narev told the committee when he testified Tuesday. The bank chiefs were appearing in front of the committee, which was set up by the government to ward off calls for a more far-reaching inquiry into the financial industry, for the second time within six months. The banks have been under pressure from opposition parties after a series of scandals in their insurance and wealth divisions and concern they failed to pass on the full benefits of central bank interest-rate cuts to borrowers.

“Boosting leveraged demand to make housing affordable makes no sense.”

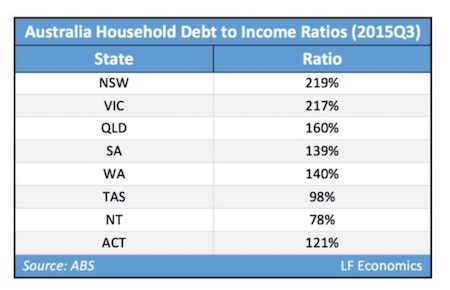

• Australian Lenders Are Handing Out Mortgages Like Confetti (LF)

In the thrall of irrational exuberance, Australia is experiencing a debt-financed housing bubble. In our two major cities of Sydney and Melbourne, the housing markets are out of control due to the rapid acceleration of debt enabled by lenders issuing remarkable amounts of mortgages. Household debt to income ratios for the states of NSW and VIC suggest this to be the case. Australian lenders are handing out mortgages like confetti – why? It demonstrates banks and non-bank lenders are quite willing to issue risky mortgages to applicants who will not have the long-term financial capability to repay. Lenders are indeed taking on these excessive risks. Throwing everything but the kitchen sink is today the common approach governments take to ensure housing prices continually rise given their fear of the political and economic damage caused by falling prices.

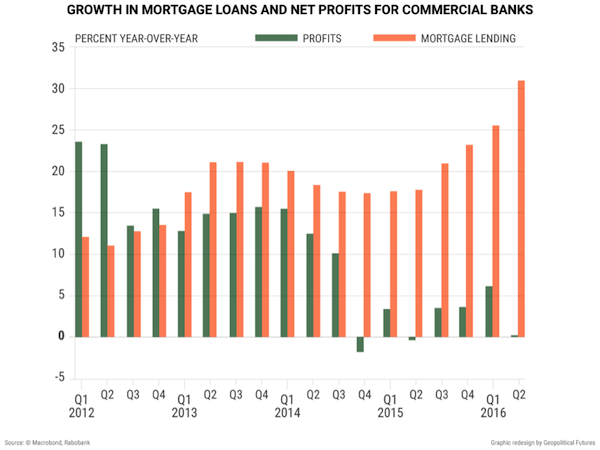

Governments engaged in co-buying and co-owning housing with FHBs stimulates debt accumulation and hence prices. The VIC government, for instance, is attempting to provide a large gift to current residential land owners and lenders at the cost of FHBs acquiring mortgages they cannot afford to service over the long-run. This is done through the proposed shared equity model whereby the government acquires 25% of the home price. To make matters worse, the VIC government is also cutting stamp duty for FHBs and doubling the FHOB (for new properties in regional areas); both in theory have the effect of boosting housing prices. The VIC government cannot allow housing prices in Melbourne and the rest of Victoria decline significantly because it will suffer the same adverse impact that Dublin and Ireland experienced last decade.

The problems are the same and the end result will be the same. Unfortunately, just like the federal government, the VIC government is stuck. Implementing policies on the demand and supply sides to reduce land prices will cause a great deal of pain to all stakeholders: governments, lenders, homeowners, investors, including employees – many may lose their jobs if debt growth craters and removes a considerable portion of demand from the economy. Government has dug itself into a hole but instead of assessing a way out, it simply continues to dig, hoping to kick the can down the road long enough for the next party in power to deal with the problems. Both the LNP and ALP at the federal and state levels have refused to deal with the issues at hand, and prefer to enslave a generation of Aussies to the most profitable and high-risk banking system in the western world.

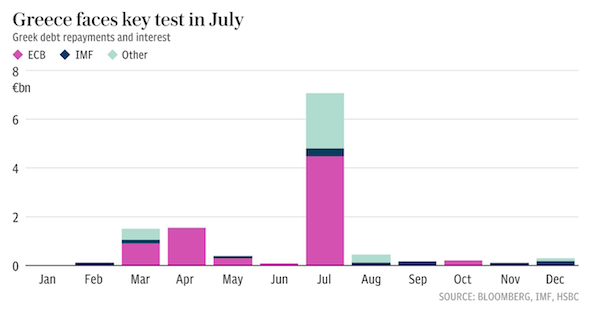

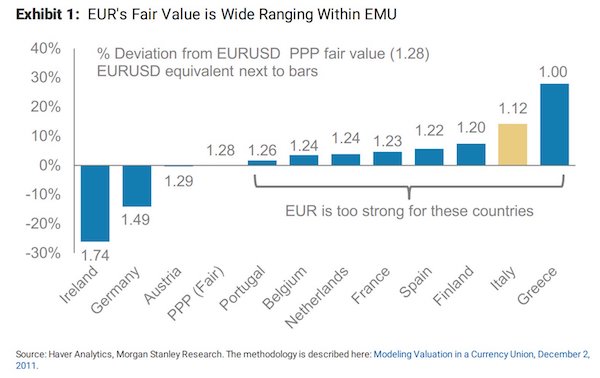

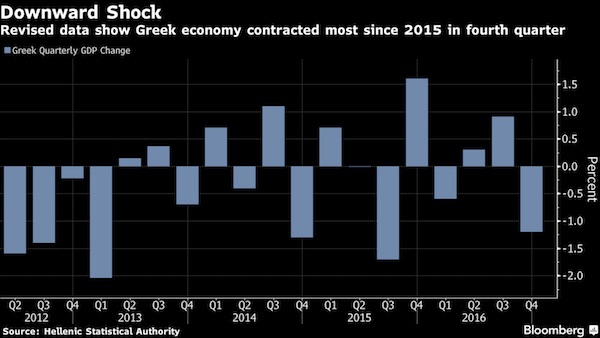

As I’ve been saying forever. Recovery is unpossible in Greece.

• Greece’s Still-Falling GDP Dispels Creditors’ “Recovery” Myth (Prime)

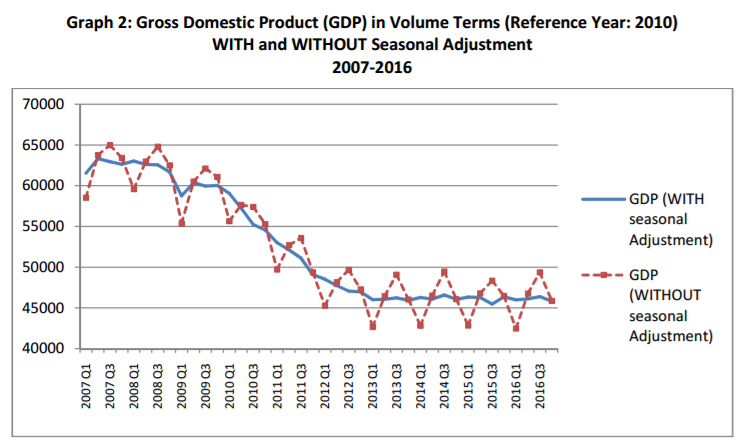

The latest GDP figures for Greece, relating to Q4 of 2016, are disastrous. For Greece first and foremost, but also for the credibility of the EU and IMF’s failed harsh austerity (but on the EU side no-debt-cancellation) policy. Far from evidencing the long-promised recovery, they show a new decline in GDP – both on the previous quarter (after seasonal adjustment) and year on year. In fact, the economy has been broadly stagnant at a low level since 2013. In constant volume terms, GDP fell by over 27% from (peak) Q2 2007 to Q4 2013, and in Q4 2016 it was 0.3% smaller than in Q4 2013. In Q4 it was only marginally higher than the post-crisis record low to date, Q3 2015. This chart from Elstat (the Greek Statistical Office) shows the development of GDP over the last decade:

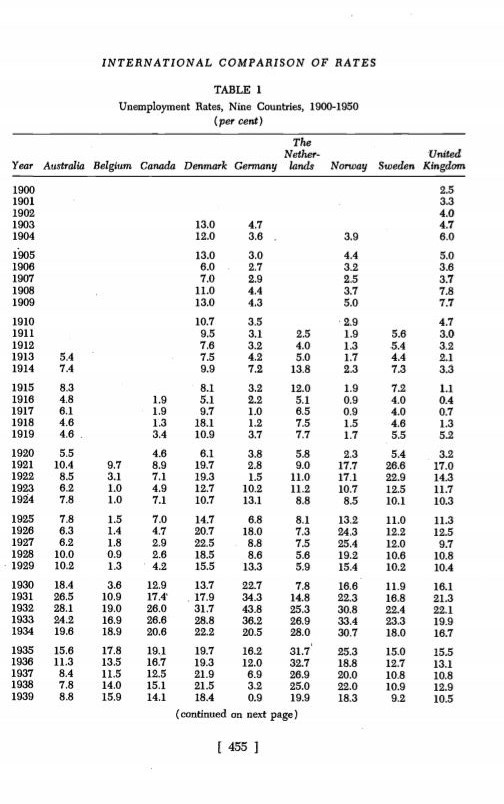

What is more extraordinary is that current price (i.e. nominal) GDP has fallen even further than real GDP over the decade – by 28.5% From 2008 to 2016, GDP fell quarter-on-quarter in no fewer than 27 out of 36 quarters, of which two in 2016. [..] there has been some modest improvement, with unemployment in November 2016 about 66,000 lower than a year before, and employment up by about 50,000. But employment is still 200,000 below its 2011 level. The unemployment rate remains a disastrous 23%, which reminds one of chronic European levels in the 1920s and 1930s:

The Financial Times’ Mehreen Khan yesterday (6 March) described the current state of negotiations towards the absurd requirement of a contractionary 3.5% of GDP budget surplus (i.e. after interest): “Progress on the country’s €86bn rescue deal has stuttered this year following a standoff between the EU and IMF over the level of austerity, reforms and debt relief baked into Greece’s three-year programme. Bailout monitors however returned to Athens last week to ensure the left-wing Greek government was making steps towards legislating for around €2bn in tax and pension measures that will help the country meet a surplus target of 3.5 per cent of GDP from 2018. Approval of the second review would unlock around €6bn in rescue cash for the economy.”

And ah yes, as Jeroen Dijsselbloem, Chair of the Eurogroup finance ministers, put it on 20th February, in an interview with CNBC (h/t Professor Helen Thompson ): “…anyone who wants to talk about crisis can talk to someone else because the Greek economy is gradually recovering and what we need to do is to strengthen that and give that more opportunity and that is what I’m trying to do.” Alas, Mr Dijsselbloem comes from the Dutch Labour Party, not the conservatives, and here symbolizes all that is so profoundly wrong with the Eurozone’s economic policy and ideology. It’s high time he looked again at that table of unemployment in the 1930s – and the terrible ordeal imposed on the Dutch working class.

The creditors force Greek companies into contortionist tricks just to survive. There is such a thing as too much tax.

• Tax Weary Greek Employers Pay In Kind As Creditor Demands Rise (BBG)

When Maria’s employer, a large communications company in Athens, gave her additional tasks at one of its new units, it told her she wouldn’t be paid for the work in euros. “I was informed that this extra payment of 150 euros per month would be in coupons that I can use in supermarkets,” said the 45-year-old, declining to provide her last name for fear of losing her job. Payments in kind are among practices companies are using in Greece as they seek to cap payroll costs, undermining efforts to balance the books of the country’s cash-strapped social security system. As creditors push the government to boost its budget surplus, companies avoiding payroll charges and effectively expanding the shadow economy are making the task harder. By some estimates, the so-called black market already accounts for as much as a quarter of Greece’s economy.

“Such practices help companies to avoid social contributions, but the burden for the economy is huge,” said Panos Tsakloglou, a professor at the Athens University of Economics and Business. “Less contributions for pensions means more budget transfers to them which then leads to more austerity measures to meet fiscal targets, measures that will probably hit pensioners.” Greek officials have been meeting in Athens with representatives of the euro area and IMF to set out the policies the country must undertake to unlock more bailout loans. The government foresees an accord in March or early April, but the scale of pending issues raises concerns they may be politically hard to sell at home. Greece has agreed to target for a budget surplus before interest payments equal to 3.5% of GDP for 2018, which could mean more belt-tightening.

Prime Minister Alexis Tsipras’s government finds itself between a rock and a hard place as it tries to appease creditors while avoiding mass protests. After an anemic recovery, the Greek economy shrank again in the fourth quarter, raising the specter of growing tensions at home even as European creditors and the IMF push for more austerity. With an economy that has shrunk by more than a quarter in the last seven years, Greece has an unemployment rate of 23%, close to a historic high. Creditors, meanwhile, are demanding greater labor-market flexibility that would make it easier for companies to hire and fire people. They want the threshold of collective dismissals to be doubled to 10% and demand that Athens not revoke any of the measures legislated during the crisis.

[..] For overtaxed Greek companies, dodging social security contributions through payments in kind has become a way to make ends meet. According to the latest available data from the Organisation for Economic Co-operation and Development, the average single worker in Greece faced a tax wedge of 39.3% compared with an average of 35.9% among developed economies. About half of the burden falls upon employers. “We do not have the exact picture,” said Nasos Iliopoulos, an official in Greece’s Labor Ministry. “But it is clear that it is not legal to replace payments with coupons. It is only permitted to give coupons as an extra bonus. Companies are seeking to gain from lower social contributions and also from not paying for extra working hours.”

There’s nothing new.

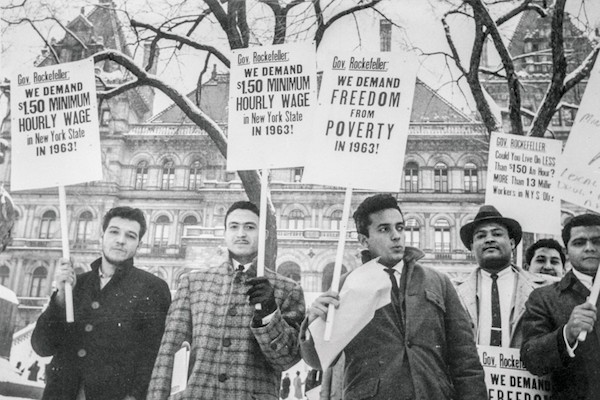

• America’s Forgotten History of Illegal Deportations (Atlantic)

It was a time of economic struggle, racial resentment and increasing xenophobia. Installed in the White House was a president who had never before held elected office. A moderately successful businessman, he promised American jobs for Americans—and made good on that promise by slashing immigration by nearly 90 percent. He wore his hair parted down the middle, rather than elaborately piled on top, and his name was Herbert Hoover, not Donald Trump. But in the late 1920s and early 1930s, under the president’s watch, a wave of illegal and unconstitutional raids and deportations would alter the lives of as many as 1.8 million men, women and children—a threat that would seem to loom just as large in 2017 as it did back in 1929.

What became colloquially known as the “Mexican repatriation” efforts of 1929 to 1936 are a shameful and profoundly illustrative chapter in American history, yet they remain largely unknown—despite their broad and devastating impact. So much so that today, a different president is edging towards similar solutions, with none of the hesitation or concern that basic consciousness would seem to require. [..] Back in Hoover’s era, as America hung on the precipice of economic calamity—the Great Depression—the president was under enormous pressure to offer a solution for increasing unemployment, and to devise an emergency plan for the strained social safety net. Though he understood the pressing need to aid a crashing economy, Hoover resisted federal intervention, instead preferring a patchwork of piecemeal solutions, including the targeting of outsiders.

According to former California State Senator Joseph Dunn, who in 2004 began an investigation into the Hoover-era deportations, “the Republicans decided the way they were going to create jobs was by getting rid of anyone with a Mexican-sounding name.” “Getting rid of” America’s Mexican population was a random, brutal effort. “For participating cities and counties, they would go through public employee rolls and look for Mexican-sounding names and then go and arrest and deport those people,” said Dunn. “And then there was a job opening!” “We weren’t rounding up people who were Canadian,” he added. “It was an absolutely racially-motivated program to create jobs by getting rid of people.”

[..] The so-called repatriation effort was, in large part, a misnomer, given the fact that as many as sixty percent of those sent to “home” Mexico were U.S. citizens: American-born children of Mexican-descent who had never before traveled south of the border. (Dunn noted, “I don’t know how you can repatriate someone to a country they’ve not been born or raised in.”) “Individuals who left at 5, 6 and 7 years old found themselves in Mexico dealing with process of socialization, of learning the language, but they maintained an American identity,” said Balderrama. “And still had the dream to come back to ‘my country.’”