Amedeo Modigliani Nu allongé 1917

Do we want monopolies? We’re letting them grow in front of our eyes.

• Why All Companies Fear ‘Death By Amazon’ (G.)

Although its retail site is the most visible of its business strands, the $740bn company has quietly stretched its tentacles into an astonishing range of unrelated industries. Google and Facebook might have cornered the online advertising market, but Amazon’s business successes now include groceries, TV, robotics, cloud services and consumer electronics. “If you try to measure power by how many executives are up at night because of X company, I think Amazon would win,” said Lina Khan, legal fellow with the Open Markets Program at the thinktank New America. Amazon has a restaurant delivery service, a music streaming service and an Etsy clone called Amazon Homemade. It makes hugely successful hardware and software; it makes movies, television shows and video games.

It runs a labour brokerage for computer-based work and another for manual labour. It publishes books, sells books, and owns the popular social network site for book readers GoodReads.com. It sells diapers, baby food, snacks, clothing, furniture and batteries. It sells ads, processes payments, and makes small loans. It is the unexpected owner of a huge number of websites – everything from the gaming livestream site Twitch to the movie database IMDb. Of the top 10 US industries by GDP (information, manufacturing non-durable goods, retail trade, wholesale trade, manufacturing durable goods, healthcare, finance and insurance, state and local government, professional and business services, and real estate), Amazon has a finger in all but real estate.

And how confident can the real estate industry be right now that Amazon won’t at some point decide to allow people to buy and sell homes on its platform? “I see them as kind of a great white shark,” said Greer. “You don’t really want to mess with them.” “It’s basically become a railroad for the 21st century,” added Khan. “It’s existential for so many businesses but also competing with all those businesses.” What makes Amazon so frightening for rival businesses is that it can use its expertise in data analytics to move into almost any sector. “Amazon has all this data available. They track what people are searching for, what they click, what they don’t,” said Greer. “Every time you’re searching for something and don’t click, you’re telling Amazon that there’s a gap.”

Recovery.

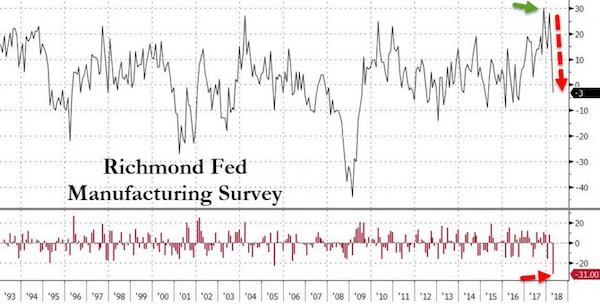

• Richmond Fed Manufacturing Survey Crashes By Most In 25 Years (ZH)

When hope dies… against expectations of a small rise from March to a 16 print, April came in at a disastrous -3 (the worst data since Sept 2016). From record highs just a couple months ago, Richmond Fed manufacturing has crashed by the most in the survey’s 25 year history into contraction…

It was a bloodbath below the surface too. New orders collapsed to -9 from +17, order backlogs plunged to -4 from +10 and while wages and employees rose, workweek dropped notably. Finally, prices paid rose once again even as new orders crashed… Must be the weather, right?

No, inflation is not “heating up by all metrics”. But we get the point.

• Markets Better Prepare for Stagflation (DDMB)

Investors better wake up to the growing risk of stagflation. The coming weeks promise to deliver the verdict on how they should be positioned. By all metrics, inflation is heating up. But it’s not clear the same can said for underlying economic activity. According to producers, input costs have risen for six of the past eight months. And it’s not just big companies that are feeling pressure. One in four small businesses say they plan to raise prices, a 10-year high, according to the National Federation of Independent Business. Inflation’s persistence will finally begin to trickle through to consumers.

David Rosenberg, chief economist at the wealth management company Gluskin Sheff, recently quipped that investors “better say a prayer for Jay Powell,” the Federal Reserve chair. The deniers will dismiss the suggestion. But Rosenberg is serious, citing the core consumer price index’s March leap to 2.1%, a level that breaches the Fed’s 2% inflation target. “There is going to be a price to be paid for last year’s string of wireless-induced 0.1% prints which are falling out of the year-over-year math,” Rosenberg explained, referring to the collapse in wireless services that skewed inflation lower in 2017. “I see 50/50 odds of a 3% core inflation by year end.”

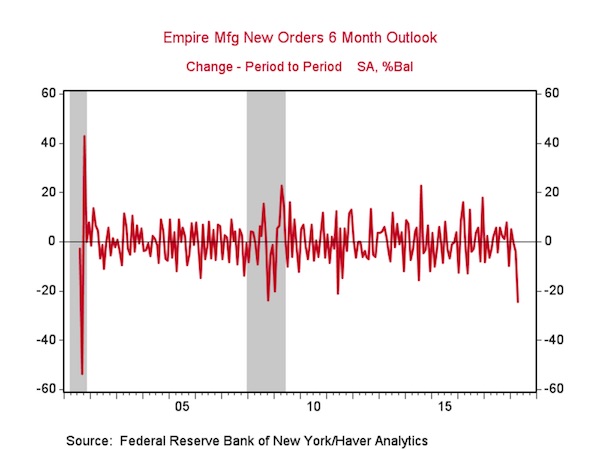

[..] The New York Fed’s regional survey also raised red flags. Delivery Times remained near their highest levels in seven years while New Orders, Backlogs and Employment all declined. The survey showed an even gloomier outlook for the future. The six-month business activity outlook dove to 18.8 from 44.1, the weakest since February 2016. Though one month can never make a trend, the depth of the plunge is bound to have raised eyebrows given that prior moves of its magnitude tend to coincide with recession.

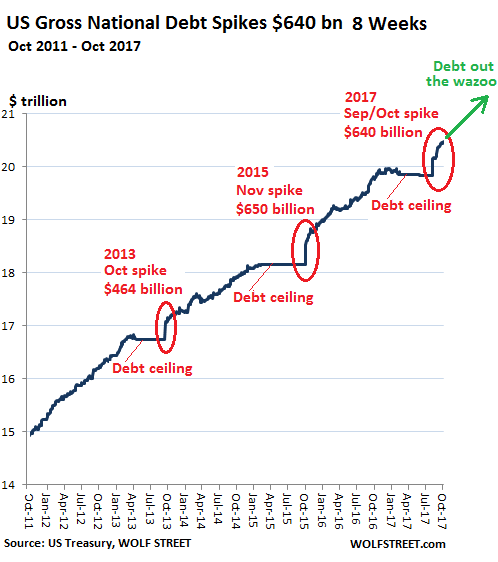

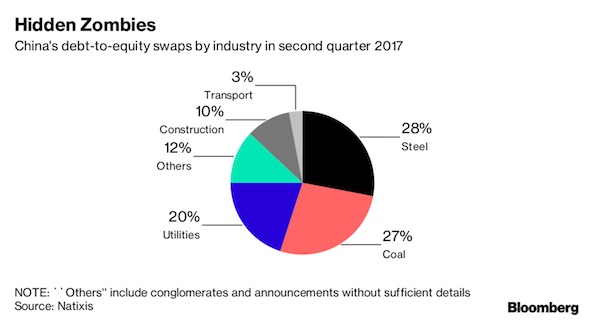

China’s so bloated with debt it is very vulnerable.

• Trade War With US And China’s $14 Trillion Debt-Ridden Economy (CNBC)

While some of the rhetoric around trade tariffs on China has died down over the last couple of weeks, the prospect of a trade war has not. On April 18, China imposed preliminary antidumping tariffs of 178.6% on sorghum, a crop used to make alcohol and biofuels, while President Donald Trump’s threat to impose tariffs on $150 billion worth of goods on everything from solar panels to aircraft to cars remains on the table. If an actual U.S. trade war ensues, then China’s economic growth prospects could be negatively impacted in a significant way. While the country’s economy has shifted inward over the last few years, relying on its own citizens to fuel growth, it still exports billions of dollars in goods and services every year.

Last year it sold $506 billion in exports to the United States — nearly 20% of its exports go to America — while the United States sold just $130 billion to the Chinese. In January the IMF said China’s economic growth would top 6.6% in 2018, but it could now drop by as much as 0.5% if these tariffs are imposed — and it could slow even further if a global trade war truly heats up. China’s economy can likely weather a small decline in growth, in part because of its increased reliance on domestic spending, but this isn’t the only potentially GDP-destroying situation it’s dealing with.

Over the last few years, China’s debt-to-GDP has ballooned to more than 300% from 160% a decade ago, causing many people, including Chinese officials, to warn of a financial-sector debt bubble that’s waiting to burst. [..] How did it get so bad? After the recession, the country spent trillions on infrastructure projects, with many banks, including unregulated or “shadow” banks, loaning money to companies that have been unable to pay back their debts. According to a Chinese news outlet, Lai Xiaoming, chairman of China Huarong Asset Management, one of the country’s biggest asset management firms, said that total volume of nonperforming loans could hit a record $476 billion by 2020.

Why the insects are dying. Europe should cut subsidies for anyone using chemicals.

• Big Farms Set To Pay The Price As EU Eyes Subsidy Cuts (Pol.)

EU Budget Commissioner Günther Oettinger said Monday that Brussels plans to cut its payments to Europe’s biggest farms in the next budget cycle in order to reduce the bloc’s lavish agricultural subsidies by 6%. Brussels is due to make a proposal for the EU’s 2021-2027 budget framework on May 2, and cutbacks are seen as inevitable because Britain will no longer be contributing funds. Agricultural spending is one of the most obvious targets for cost cutting because the Common Agricultural Policy represents almost 40% of the EU budget, or some €59 billion each year.

When asked by POLITICO about CAP cuts on the sidelines of a trade conference in Hannover, Oettinger said: “We cannot fully exempt the existing programs from cutbacks. And in comparison to 2020, as the last year of the existing financial framework, my proposal will focus on approximately 6%, a moderate 6%, reductions.” One of the biggest criticisms of the CAP is that it has prioritized big landowners with direct payments based on acreage. Some 80% of CAP funds go to 20% of farms, owned by the likes of British royalty and major multinational companies. Oettinger said the new budget model would aim to balance that slightly.

“What we have in mind is degressive funding: That means a very big business receives for its hectares a little bit less money than a small enterprise. And that’s exactly what we still have to discuss within the next next days. On Wednesday, we will have a discussion between [Agriculture Commissioner Phil] Hogan and me on this.” Hogan has already told farmers to prepare for belt-tightening. “We need to be realistic: In the absence of more money from member states, there will be a cut to the CAP budget. My job as I see it is to build the strongest possible coalition to resist the worst of these cuts, and achieve the best outcome in a difficult scenario,” he said last week.

Governments are starting to tackle Airbnb.

• In Japan, New Rules May Leave Home-Sharing Industry Out In The Cold (R.)

Japan’s new home-sharing law was meant to ease a shortage of hotel rooms, bring order to an unregulated market and offer more lodging options for foreign visitors ahead of next year’s Rugby World Cup and the 2020 Tokyo Olympics. Instead, the law is likely to stifle Airbnb Inc and other home-sharing businesses when it is enacted in June and force many homeowners to stop offering their services, renters and experts say. The “minpaku,” or private temporary lodging law, the first national legal framework for short-term home rental in Asia, limits home-sharing to 180 days a year, a cap some hosts say makes it difficult to turn a profit.

More important, local governments, which have final authority to regulate services in their areas, are imposing even more severe restrictions, citing security or noise concerns. For example, Tokyo’s Chuo ward, home to the tony Ginza shopping district, has banned weekday rentals on grounds that allowing strangers into apartment buildings during the week could be unsafe. That’s a huge disappointment for Airbnb “superhost” Mika, who asked that her last name not be used because home-renting is now officially allowed only in certain zones. She has enjoyed hosting international visitors in her spare two-bedroom apartment but will stop because her building management has decided to ban the service ahead of the law’s enactment.

“I was able to meet many different people I would have not met otherwise,” said Mika, 53, who started renting out her apartment after she used a home-sharing service overseas. “I may sell my condo.” Mika added that if she were to rent the apartment out on a monthly basis, she would only make one-third of what she does from short-term rentals. The ancient capital of Kyoto, which draws more than 50 million tourists a year, will allow private lodging in residential areas only between Jan. 15 and March 16, avoiding the popular spring and fall tourist seasons.

“..only 645 of 11,000 holiday rentals being offered to tourists on Palma have the licence required to do so.”

• Palma de Mallorca To Ban Holiday Rentals After Residents’ Complaints (BBC)

The Spanish resort city of Palma, on the island of Majorca, is to ban flat owners from renting their apartments to travellers, becoming the first place in Spain to introduce such a measure. The restrictions follow complaints from residents of rising rents due to short holiday lets through websites and apps. Palma’s mayor says the ban, to be introduced in July, will be a model for cities suffering with mass tourism. But business associations say many families will be financially impacted. It was not immediately clear if the ban was restricted only to private flats advertised by their owners on apps or websites.

Houses and chalets will be exempt from the restrictions unless they are located inside protected areas, next to the airport or in industrial zones. Palma, like many other cities around the world, has seen an increase in visitor numbers driven, in part, by private rental accommodation offered through websites and apps. Officials from the local left-wing governing coalition cited a study suggesting that the number of non-licensed apartments on offer to tourists increased by 50% between 2015 and 2017. According to Spanish newspaper El País, only 645 of 11,000 holiday rentals being offered to tourists on Palma have the licence required to do so.

Locally, there is resentment over tourism pushing up prices – rents in Palma have reportedly increased 40% since 2013 – but also about deteriorating conditions in neighbourhoods popular with travellers due to noise and bad behaviour. “Palma is a determined and courageous city,” Mayor Antoni Noguera said. “We agreed on this [ban] based on the general interest [of the city] and we believe it will set the trend for other cities when they see that finding a balance is key.”

They’re all doing it all wrong. Simply force Airbnb to supply numbers on all rentals.

• Greece Uncovers Tax Evading Airbnb Owners By Posing as Customers (KTG)

Tax inspectors uncover tax evading Airbnb owners by pretending to be customers. According to Greece’s Independent Authority for Public Revenue (AADE), the trap has revealed a total of 55 Airbnbn tax evaders, so far. In some cases, the ‘fake customers’ even proceeded to booking an Airbnb flat. The first Airbnb owners who failed to declare their earnings from home-sharing practices were uncovered by Greece’s Independent Authority for Public Revenue (AADE) this week. Under a pilot program aiming to weed out violators, AADE inspectors posed as customers seeking to rent out short-term accommodation via the Airbnb platform. The undercover inspections focused on central points in the Greek capital as well as on luxury options available on popular Greek islands. In some cases, AADE authorities even proceeded to book.

According to AADE, 55 proprietors who had not proceeded with the mandatory declaration of earnings from home-sharing services were notified of the violation. A total of 39 came forward and proceeded with corrections to their income tax declarations indicating additional property income of approximately 921,163 euros resulting in over 200,000 euros going into state coffers. It should be noted that all owners renting out their properties on home-sharing platforms are required by Greek law to declare earned incomes from short-term lease in 2017 on their E2 Forms (column 7).

For income up to 12,000 euros, tax is imposed at a rate of 15%. Takings between 12,001 and 35,000 euros will be taxed at a 35% rate; annual gains over 35,000 euros at a 45% rate. For those offering additional services on the side, the earnings are assessed as income from business activity and taxed at 22% for earnings up to 20,000 euros, 29% for yields between 20,001 and 30,000 euros, 37% for takings between 30,001 and 40,000 euros, and 45% for profits exceeding 40,000 euros.

Looked it up: World population 60 years ago was less than 3 billion (it hit that in 1960). It is now 7.5 billion. Ergo: people used to drink over 2x as much wine back then.

• World Wine Output Falls To 60-Year Low (R.)

Wine production totaled 250 million hectoliters last year, down 8.6% from 2016, data from the Paris-based International Organisation of Vine and Wine (OIV) released on Tuesday showed. It is the lowest level since 1957, when it had fallen to 173.8 million hectoliters, the OIV told Reuters. A hectoliter represents 100 liters, or the equivalent of just over 133 standard 75 cl wine bottles. All top wine producers in the EU have been hit by harsh weather last year, which lead to an overall fall in the bloc of 14.6% to 141 million hectoliters.

The OIV’s projections, which exclude juice and must (new wine), put Italian wine production down 17% at 42.5 million hectoliters, French output down 19% at 36.7 million and Spanish production down 20% at 32.1 million. The French government said last year production had hit a record low due to a series of poor weather conditions including spring frosts, drought and storms that affected most of the main growing regions including Bordeaux and Champagne. In contrast, production remained nearly stable in the United States, the world’s fourth largest producer, and China, which has become the world’s seventh largest wine producer behind Australia and Argentina.

Failed state.

• Homelessness In UK ’10 Times Worse’ Than Official Figures Suggest (Ind.)

The true scale of homelessness in the UK is almost 10 times worse than official figures suggest, according to a new report. Homeless charity Justlife warns thousands of people are being “forgotten in statistics” after it estimated that at least 51,500 people were living in B&Bs in the year to April 2016 – compared with 5,870 official B&B placements recorded by the government. It comes after a separate investigation found that 78 homeless people died last winter – an average of at least two a week. The report by the Bureau of Investigative Journalism revealed the fatalities included rough sleepers, people recognised as “statutory homeless” and people staying in temporary accommodation.

Justlife reached its estimate on the homeless B&B population using data gathered from Freedom of Information requests to local authorities, along with other information from the government’s Rural and Urban Classification for Local Authority Districts data. Christa Maciver, author of the report, said: “We can no longer ignore the tens of thousands of people stuck homeless, hidden and ignored in our cities. This report shows there is so much we don’t know and that we really need to be calculating homelessness more accurately.

And another failed state.

• Over One In Five Greeks Can’t Make Ends Meet (K.)

Last year 21.1% of Greeks – or more than one in five – were unable to cover their basic needs, such as the timely payment of utility bills and regular consumption of meat, according to Eurostat. That 21.1% in 2017 may constitute a minor improvement from the 22.4% rate in 2016, but is still a particularly high level. This rate was also the second highest in the European Union and translates to a large share of the population, or 2.24 million people.

The people or households in that category are by definition those unable to meet the costs of at least four of the following: payment of utility bills in time, sufficient heating at home, tackling extraordinary expenses, consumption of meat (or fish or the equivalent in vegetables) on a regular basis, a one-week vacation away from home, and capacity to purchase a TV set, a washing machine, a car or a telephone. The age group with the highest rate of material deprivation in Greece includes those between 20 and 24 years, amounting to 32.6% – or one in three – though this is according to 2016 data. Notably, the year with the highest material deprivation rate in Greece from 2003 to 2017 (for which Eurostat has data), was 2009.

Arrivals on Lesbos are 4 times what they were last year this time.

• Greek Minister Drafts Action Plans Amid Fears Over Refugee Influx (K.)

Migration Minister Dimitris Vitsas conceded on Tuesday that he is “worried” about the significant increase in the flow of migrants and refugees to Greece observed recently. Vitsas said that arrivals on Lesvos had increased almost fourfold since last year, noting that daily arrivals were 54 on average last year compared to the 206 migrants who arrived on the island on Tuesday. Between January and April, more than 7,000 migrants and refugees arrived on the islands of the eastern Aegean, he said, noting that just 112 people were returned to Turkey during that same period. However, Vitsas appeared far more concerned with the increase in arrivals over the Greek-Turkish land border, noting that 340 people crossed the border on Tuesday.

“I’m not scared about the islands because we know what we have to do. What is really worrisome is the huge increase through Evros,” he said. Under pressure from the opposition over mistakes and omissions in the government’s current migration policy, Vitsas said that his ministry has prepared two plans to deal with the situation and pledged to outline their content to political party leaders in private. According to Bulgarian government statistics, 356 migrants have crossed into that country from Turkey since the beginning of the year. In the same period, more than 2,700 crossed Turkey’s land border with Greece, Vitsas said.

There are fears that the difference in flows is due to deteriorating ties between Greece and Turkey while relations between Sofia and Ankara are good, particularly since Bulgarian authorities returned alleged supporters of the US-exiled Turkish cleric Fethullah Gulen to Turkey in 2016. Security along Turkey’s border with Bulgaria has intensified since then. The opposite has been happening along the Greek border since the detention of two Greek soldiers who strayed across the border in early March. Greek border guards are now more cautious, and less inclined to crack down on migrants.

Curious. Athens should be open about EU pressure on the topic.

• Greek Government Defies Court on Asylum Seekers (HRW)

The Greek government’s move on April 20, 2018, overturning a binding court ruling ordering it to end its abusive policy of trapping asylum seekers on Greece’s islands raises rule of law concerns, 21 human rights and humanitarian organizations said today. Rather than carrying out the April 17 ruling by the Council of State, the country’s highest administrative court, the government issued an administrative decision reinstating the policy, known as the “containment policy.” It also introduced a bill on April 19 to clear the way to restore the policy in Greek law. Parliament members should oppose such changes and press the government to respect the ruling.

Parliament began discussing the draft law on April 24. But the government has preempted the debate on the bill, including the issue of the containment policy by reinstating it. On April 20, the new director of the asylum service reissued an administrative order setting down the reasons for the containment policy. Among grounds given to justify the restrictions imposed by the policy are the need to implement an EU-Turkey deal on migration and a broader public interest claim. But the decision goes against the Council of State ruling and Greece’s responsibilities under international, EU and Greek law, as it offers insufficient justification for the restrictions, the groups said.

The Council of State’s April 17 ruling said that Greece’s containment policy had no legal basis and that there were no imperative reasons under EU and Greek law justifying the restrictions to the freedom of movement of asylum seekers. It ordered the annulment of the administrative decision imposing the restrictions and permitted the free movement of asylum seekers arriving on the islands following the ruling’s publication. The ruling also highlighted that the disproportionate distribution of asylum seekers has overburdened the islands. The ruling is limited, however, applying only to new arrivals.

“Each litre of sea ice contained around 12,000 particles of plastic..”

• Arctic Sea Ice Contains Huge Quantity Of Microplastics (Ind.)

Scientists have found an unprecedented number of microplastics frozen in Arctic sea ice, demonstrating the alarming extent to which they are pervading marine environments. Analysis of ice cores from across the region found levels of the pollution were up to three times higher than previously thought. Each litre of sea ice contained around 12,000 particles of plastic, which scientists are now concerned are being ingested by native animals. Based on their analysis, the researchers were even able to trace the tiny fragments’ paths from their places of origin, from fishing vessels in Siberia to everyday detritus that had accumulated in the infamous Great Pacific Garbage Patch.

“We are seeing a clear human imprint in the Arctic,” the study’s first author, Dr Ilka Peeken, told The Independent. “It suggests that microplastics are now ubiquitous within the surface waters of the world’s ocean,” said Dr Jeremy Wilkinson, a sea ice physicist at the British Antarctic Survey who was not involved with the study. “Nowhere is immune.”