NPC Dr. H.W. Evans, Imperial Wizard 1925

Great piece from Lee Adler. “It’s abstract impressionism. It’s a joke.”

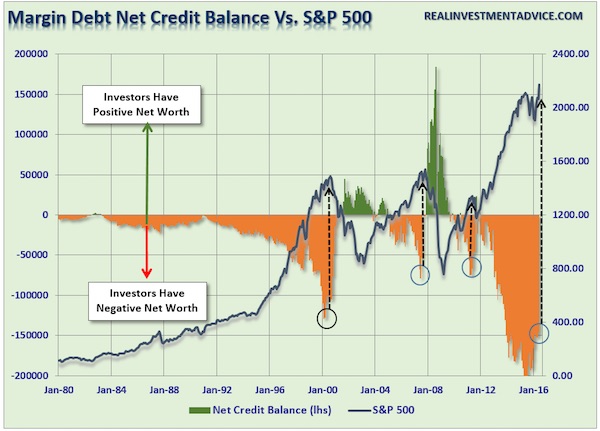

• The US Market Has Been And Remains Today, The Last Ponzi Game Standing (Adler)

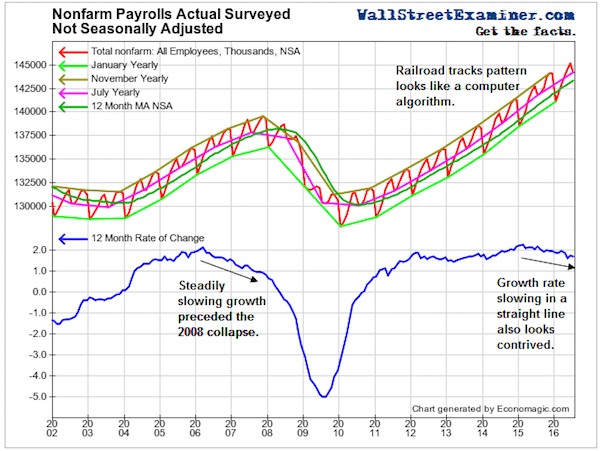

I’m not here to argue whether the July report was lousy or not. The US economy may well be spawning big numbers of crappy low paying jobs. Withholding tax collections were huge in the last 4 weeks of July. We know that that didn’t come from big wage gains by existing workers. They’re running at about a 2.5% annual growth rate. So when tax collections increase by a significant margin over a similar period a year ago, it suggests that there were new jobs, maybe a lot of them. I’m also not here to argue that the headline number bears any semblance of reality. The headline number is the seasonally adjusted month to month gain in the estimated number of jobs. The whole process of seasonal adjustment is a bogus attempt to smooth a jagged trend with peaks and valleys into a continuous modified moving average.

The number is a fiction. Because it’s based on a moving average it has a built in lag, for which statisticians try to compensate with a bunch of statistical hocus pocus. That includes constantly revising the number based first on subsequent surveys, and then on benchmarking the data with actual tax collections in the 5 subsequent years. Not only is the number revised twice after the first month it’s issued, but it’s then fit to the curve of actuality for the next 5 years until the reading is finalized. July’s reading won’t be final until July 2021. The process is really “seasonal finagling.” It’s abstract impressionism. It’s a joke. What I have come to argue here is that the not seasonally adjusted (NSA) numbers, which I have always relied upon in my analysis of the jobs trend, is probably also a joke.

Look at this chart. Do those railroad tracks look like the real world to you, or are these some kind of computer generated auto-numbers that merely make a pretense of reality. Law of Large Numbers or not, I have never seen any other economic series behave with such regularity. This is a joke, a farce, a sham. But it doesn’t matter because the economy doesn’t matter. The world’s central banks have attempted, and largely succeeded, in rigging the financial markets. One of the consequences, intended or unintended, is that the bulk of the benefit of that rigging flows to the US financial markets. That has been so been since 2009. The US market has been and remains today, the Last Ponzi Game Standing. All roads lead to the US.

Saxo Bank’s Mike McKenna comments on an Economist cheerleading piece on ‘Open Society’, which somehow -presumably because it sounds positive- has become synonymous to globalization. McKenna’s conclusion: the world can’t afford globalization. Which is what I’ve been saying: without growth there can be no centralization. The Saxo boys seem to think that a return to growth is still possible/desirable. I think not.

• Priced Out Of The ‘Open Society’ (McKenna)

The biggest problem facing globalism, however, is neither its hypocrisy nor its will-to-power – these are ordinary human failings common to all ideologies. Its biggest problem is much simpler: it’s very expensive. The world has seen versions of the wealthy, cosmopolitan ideal before. In both Imperial Rome and Achaemenid Persia, for example, societies characterised by extensive trade networks, multicultural metropoli and the rule of law (relative to the times) eventually succumbed to rampant inequality, inter-community strife, and expensive foreign wars in the case of Rome and a death-spiral of economic stagnation and constant tax hikes in the case of Persia.

It seems near-axiomatic that, in the absence of the sort of strong GDP growth that characterised the post-World War Two era, the pluralist ideal might begin to show strains along the seams of its own construction. Such strains can be inter-ethnic, ideological, religious, or whatever else, but the legitimacy of The Economists’s favoured worldview largely came about due to the wealth and living standards it was seen to provide in the post-WW2 and Cold War era. Now that this is beginning to falter, so too are the politicians and institutions that have long championed it. In Jakobsen’s view, the rising tide of populist nationalism is in no way the solution, but it is a sign that globalisation’s elites have grown distant from the population as a whole.

“The world has become elitist in every way,” says Saxo Bank’s chief economist. “We as a society have to recognise that productivity comes from raising the average education level… the key thing here is that we need to be more productive. If everyone has a job, there is no need to renegotiate the social contract.” Put another way, would the political careers of Trump, Le Pen, Viktor Orban, and other such nationalist leaders be where they are if the post-crisis environment had been one of healthy wage growth, inflation, an increase in “breadwinner” jobs, and GDP expansion?

Globalization crashing head first into its inherent limits.

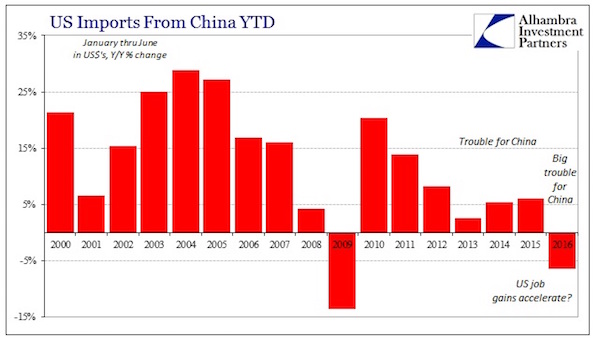

• Shrinking Imports And Exports—A Far More Meaningful Counterpoint To BLS (Alh.)

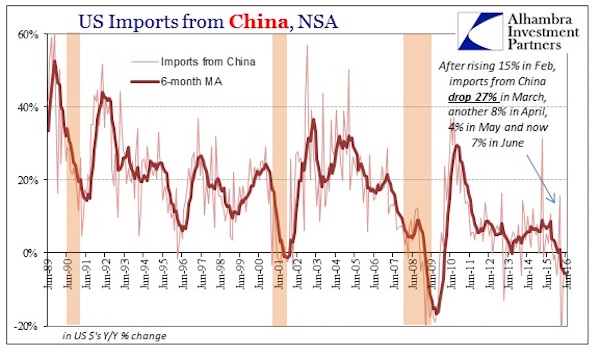

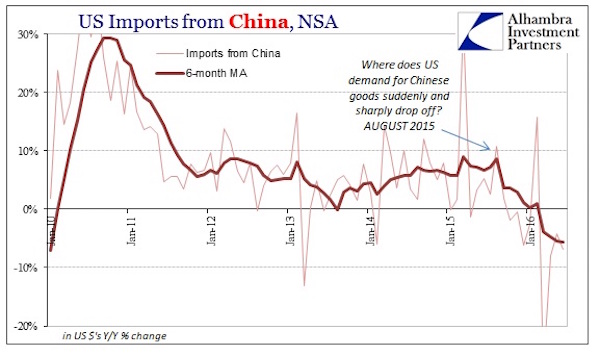

In the first six months of 2005, the US imported 27.2% more in Chinese goods than the first six months of 2004, and that was 28.8% more than the first six months of 2003. In the first six months of 2016, the US imported 6.5% less than the first six months of 2015, itself only 6.1% more than the first six months of 2014. The US actually imported slightly less from China so far this year than two years ago.

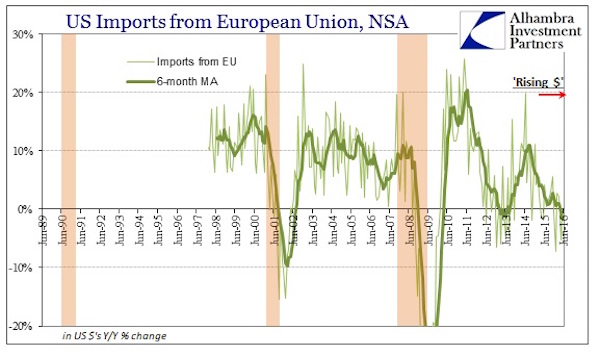

As we know very well from US production levels it’s not as if some native “buy American” grassroots opposition has successfully convinced American buyers to ditch the cheaper Chinese alternatives, redistributing “strong” consumer spending toward American products. There is much less goods being produced and traded with and within the United States – alarmingly so. Further, as you can see above and below, the timing of this most recent change from plain weakness to dangerous weakness is significant.

Starting September 2015, meaning dating back to August, US imports from China have dropped off a cliff. While year-over-year growth was slightly positive in September, it has been negative in every month since except February 2016 and that was due to calendar effects here and holiday weeks there (and was easily wiped out by the massive contraction in March). The mainstream reading of the payroll reports up to that point indicated that US demand would and should be nothing but strong. Instead, it has been much worse than it already was.

It isn’t just China that is feeling the increasing absenteeism of the US consumer. US imports from Europe contracted for the third straight month, where the -1.8% 6-month average is the lowest since 2010 and the initial recovery from the Great Recession. Imports from Japan were up for the first time in three months, but overall for the first half of 2016 are down nearly 5% in total.

But that’s only due to who does the ‘expecting’.

• China’s July Exports, Imports Fall More Than Expected (R.)

China’s exports and imports fell more than expected in July in a rocky start to the third quarter, suggesting global demand remains weak in the aftermath of Britain’s decision to leave the EU. Exports fell 4.4% from a year earlier, the General Administration of Customs said on Monday, while adding that it expects pressure on exports is likely to ease at the beginning of the fourth quarter. Imports fell 12.5% from a year earlier, the biggest decline since February, suggesting domestic demand remains sluggish despite a flurry of measures to stimulate growth. That resulted in a trade surplus of $52.31 billion in July, versus a $47.6 billion forecast and June’s $48.11 billion.

Trying to keep the teapots alive…

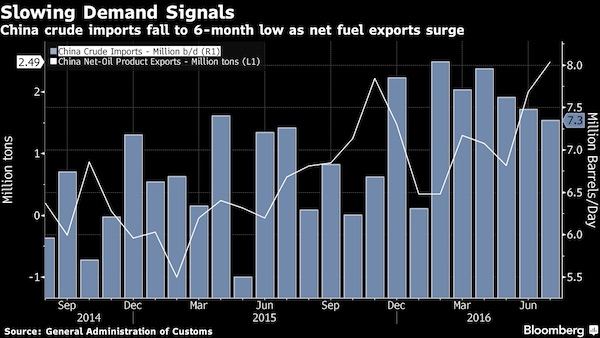

• China Crude Imports Fall to 6-Month Low, Fuel Exports Surge (BBG)

China’s crude imports fell to the lowest level in six months as demand from independent refineries eased. Net fuel exports surged to a record. The world’s biggest energy user imported 31.07 million metric tons of crude in July, according to data released by the General Administration of Customs on Monday. That’s about 7.35 million barrels a day, the slowest pace since January. Meanwhile, net fuel exports jumped to 2.49 million tons last month.

The nation’s appetite for overseas crude, which increased 14% in the first half year from the same period of 2015, may be weaker in the near term as insufficient infrastructure and scheduled maintenance at some independent refiners will likely hinder their crude purchases, BMI Research said in a report dated Aug. 4. “Teapots’ crude buying has slowed in the third quarter amid maintenance,” Amy Sun, an analyst with ICIS China, said before data were released. “Some plants have also seen their crude-import quotas filling up.”

They have no intention of halting this either.

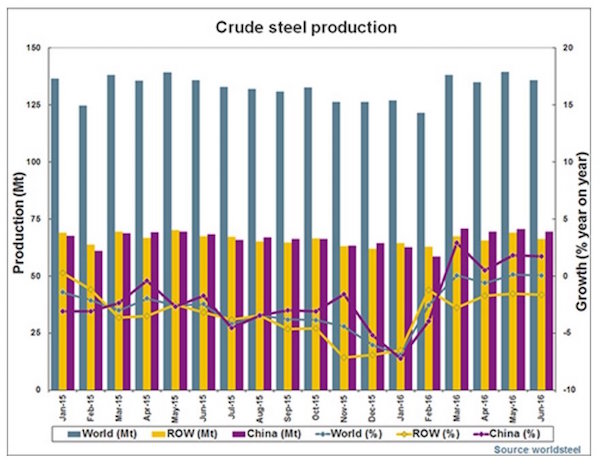

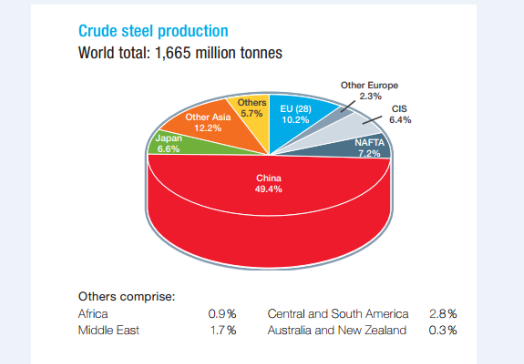

• China’s Great River of Steel Swells as Trade Tensions Build (BBG)

There’s a river of steel flooding from China despite the best efforts of governments around the world to dam the flow from the world’s top producer, with data on Monday showing that overseas shipments held above 10 million tons in July. Sales increased 5.8% on-year to 10.3 million metric tons last month, compared with 10.9 million tons in June, according to China’s customs administration. Exports in the first seven months expanded 8.5% to 67.4 million tons, a record volume for the period. That’s in line with what South Korea, the world’s sixth-largest producer in 2015, makes in an entire year.

The robust export showing by China’s mills contrasts with the country’s broader performance last month, which fell in dollar terms, and risks further stoking trade tensions with partners from India to Europe after they imposed curbs to keep out the alloy. Premier Li Keqiang has defended the country’s growing presence in overseas steel markets, saying last month that overcapacity isn’t the fault of a single country. “Orders from abroad have held up relatively well as steelmakers in China have a cost advantage,” Dang Man, an analyst at Maike Futures Co. in Xi’an, said before the data. “Attention is still on global trade friction as the number of cases against Chinese exports is quite large.”

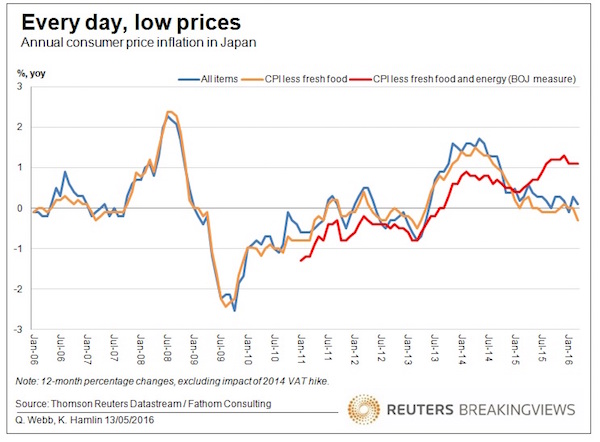

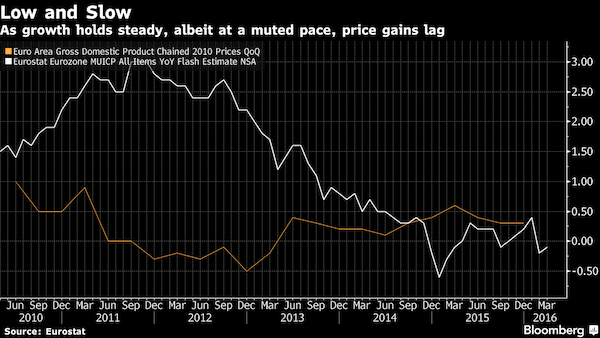

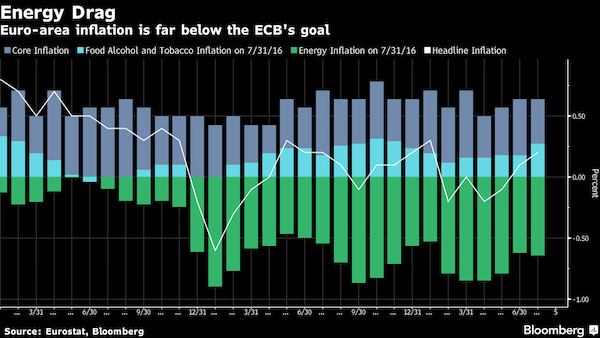

The graph illustrates one thing alright. Food, Alcohol and Tobacco prices rise only because of taxes. That suggests governments could get rid of deflation just by raising taxes. Which, really, is nonsense. Therefore, so is the graph and the methodology it is based on. Rising prices don’t equal inflation.

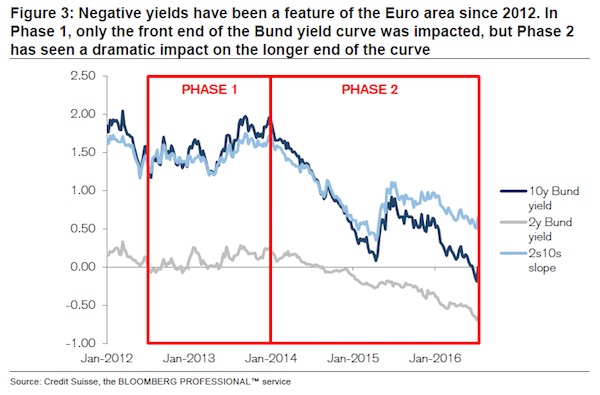

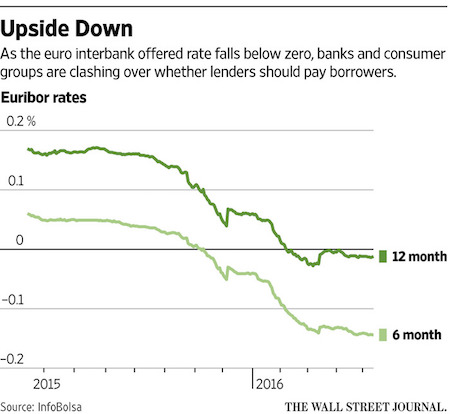

• Draghi Jumps Brexit Hurdle to Find Oil Damping Price Outlook (BBG)

Whenever Mario Draghi clears a hurdle on his path to higher inflation, a new one appears. Just as the 19-nation economy sends encouraging signals that challenges from Brexit to terrorism won’t derail the modest recovery, a new decline in oil prices is casting a shadow over an expected pick-up in inflation. With growth not strong enough to generate price pressures, the ECB president may have to revise his outlook yet again. Inflation remains far below the ECB’s 2% goal after more than two years of unprecedented stimulus and isn’t seen reaching it before 2018.

Staff will begin to draw up fresh forecasts in mid-August, and while officials are in no rush to adjust or expand their €1.7 trillion quantitative-easing plan in September, economists predict Draghi will have to ease policy before the end of the year. “Now that the euro-area economy seems to have shrugged off the Brexit vote, focus will again shift on inflation, against the background of those negative news from oil prices,” said Johannes Gareis, an economist at Natixis in Frankfurt. “Yes, the ECB has managed to dispel deflation fears, but all the uncertainty means inflation will stay lower for longer – and Draghi will have to take notice.”

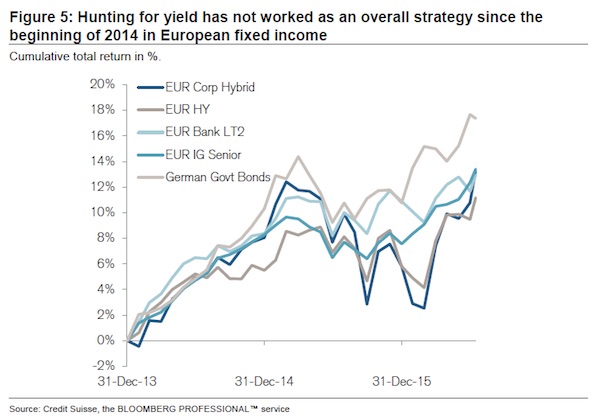

Maybe Zimbabwe bonds still offer some yield?

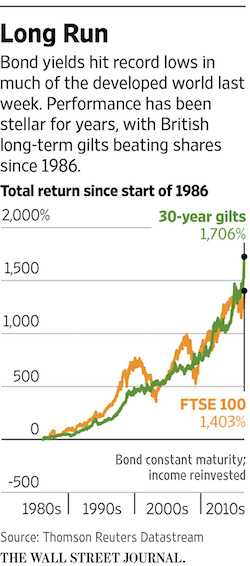

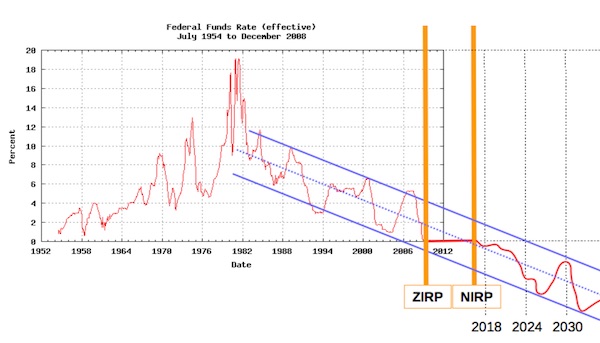

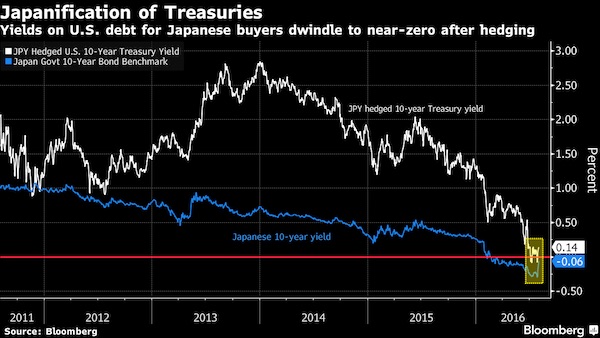

• Bond Market’s Big Illusion Revealed as US Yields Turn Negative (BBG)

For Kaoru Sekiai, getting steady returns for his pension clients in Japan used to be simple: buy U.S. Treasuries. Compared with his low-risk options at home, like Japanese government bonds, Treasuries have long offered the highest yields around. And that’s been the case even after accounting for the cost to hedge against the dollar’s ups and downs – a common practice for institutions that invest internationally. It’s been a “no-brainer since forever,” said Sekiai, a money manager at Tokyo-based DIAM. That truism is now a thing of the past. Last month, yields on U.S. 10-year notes turned negative for Japanese buyers who pay to eliminate currency fluctuations from their returns, something that hasn’t happened since the financial crisis.

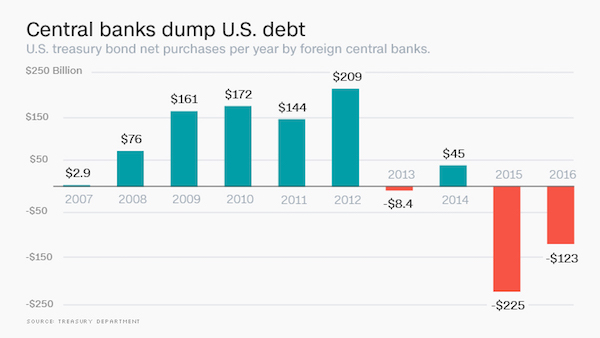

It’s even worse for euro-based investors, who are locking in sub-zero returns on Treasuries for the first time in history. That quirk means the longstanding notion of the U.S. as a respite from negative yields in Japan and Europe is little more than an illusion. With everyone from Jeffrey Gundlach to Bill Gross warning of a bubble in bonds, it could ultimately upend the record foreign demand for Treasuries, which has underpinned their seemingly unstoppable gains in recent years. “People like a simple narrative,” said Jeffrey Rosenberg at BlackRock. “But there isn’t a free lunch. You can’t simply talk about yield differentials without talking about currency differentials.”

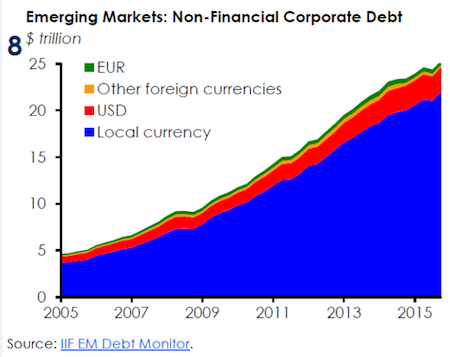

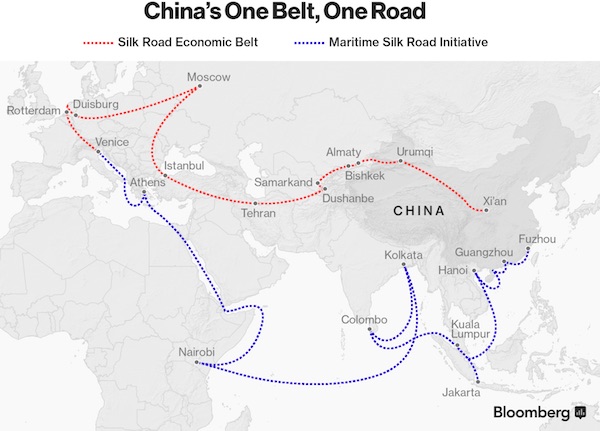

Imagine the enormous amounts of debt that would be involved in this. Then look at China’s current debt. Then draw your conclusions. More globalization nonsense. The next Chinese bubble.

China’s ambition to revive an ancient trading route stretching from Asia to Europe could leave an economic legacy bigger than the Marshall Plan or the EU’s enlargement, according to a new analysis. Dubbed ‘One Belt, One Road,’ the plan to build rail, highways and ports will embolden China’s soft power status by spreading economic prosperity during a time of heightened political uncertainty in both the U.S. and EU, according to Stephen L. Jen, CEO at Eurizon SLJ Capital, who estimates a value of $1.4 trillion for the project. It will also boost trading links and help internationalize the yuan as banks open branches along the route, according to Jen.

“This is a quintessential example of a geopolitical event that will likely be consequential for the global economy and the balance of political power in the long run,” said Jen, a former IMF economist. Reaching from east to west, the Silk Road Economic Belt will extend to Europe through Central Asia and the Maritime Silk Road will link sea lanes to Southeast Asia, the Middle East and Africa. While China’s authorities aren’t calling their Silk Road a new Marshall Plan, that’s not stopping comparisons with the U.S. effort to rebuild Western Europe after World War II. With the potential to touch on 64 countries, 4.4 billion people and around 40% of the global economy, Jen estimates that the One Belt One Road project will be 12 times bigger in absolute dollar terms than the Marshall Plan.

China may spend as much as 9% of GDP – about double the U.S.’s boost to post-war Europe in those terms. “The One Belt One Road Project, in terms of its size, could be multiple times larger and more ambitious than the Marshall Plan or the European enlargement,” said Jen. It’s not all upside. Undertaking an expansive plan like this one will inevitably run the risk of corruption, project delays and local opposition. Chinese backed projects have frequently run into trouble before, especially in Africa, and there’s no guarantee that potential recipient nations will put their hand up for the aid. In addition, resurrecting the trading route will need funding during a time of slowing growth and rising bad loans in the nation’s banks. Sending money abroad when it’s needed at home may not have an enduring appeal.

Still, at least China has a plan. “The fact that this is a 30-40 year plan is remarkable as China is the only country with any long-term development plan, and this underscores the policy long-termism in China, in contrast to the dominance of policy short-termism in much of the West,” said Jen. And that’s a win-win for soft power. “The One Belt One Road Project could be a huge PR exercise that could win over government and public support in these countries,” he said.

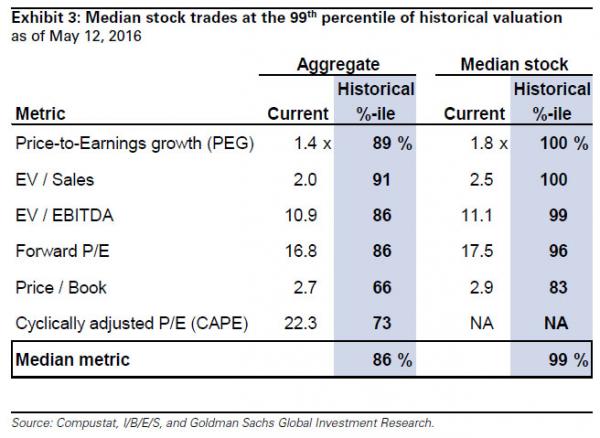

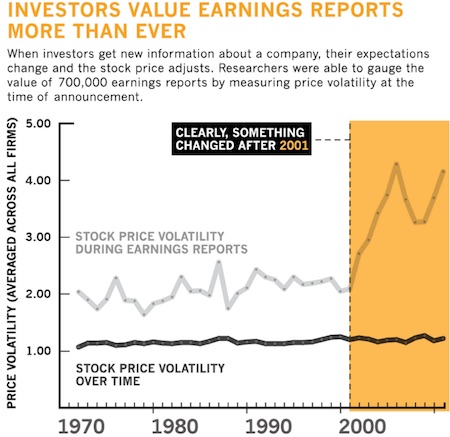

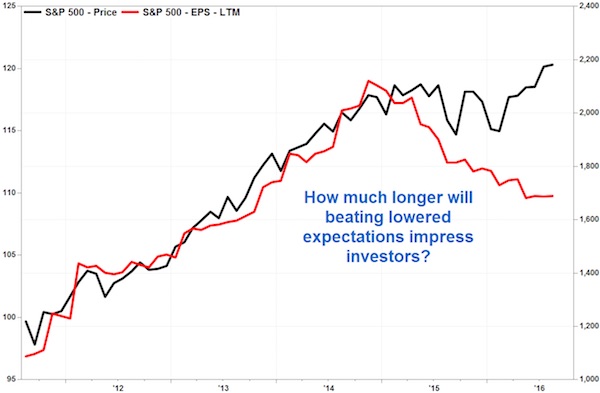

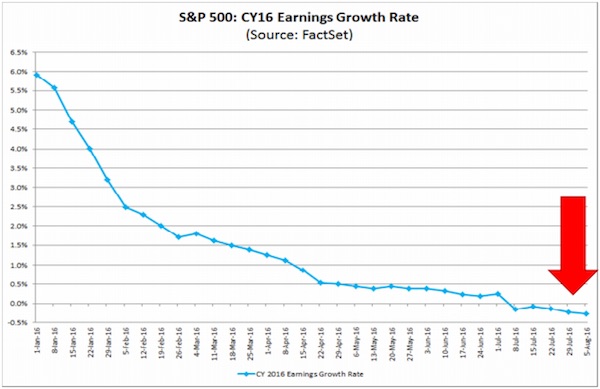

“The beat on earnings is due at least in part to negative earnings revisions heading into earnings season, similar to what we have seen for the last 29 quarters..”

• Earnings Beats Are Concealing Bad Results (MW)

Investors shouldn’t be fooled by this season’s “better-than-expected” earnings—they are still pretty bad. With nearly 90% of the S&P 500 companies having reported second-quarter results through Friday morning (437 out of 505), aggregate earnings-per-share for the group are on course to decline 3.5% from a year ago, according to FactSet. Many Wall Street strategists are pleased, because that is a lot better than expectations of a 5.5% decline on June 30, just before earnings reporting season kicked off. So are investors, as the S&P and Nasdaq Composite Index closed in record territory Friday, and the Dow Jones Industrial Average closed less than 0.3% away. But that is like saying you should be happy with the “D” you got, because it would really be a “B” if the teacher changed the scale to grade on a curve.

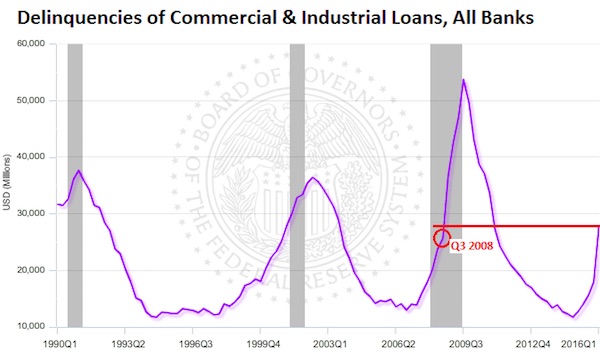

“The beat on earnings is due at least in part to negative earnings revisions heading into earnings season, similar to what we have seen for the last 29 quarters with aggregate upside to expectations,” Morgan Stanley equity strategists wrote in a recent note to clients. Earnings might be beating lowered expectations, but they are still worse than the aggregate FactSet consensus of a 3.1% decline at the end of the first quarter on March 31. It also means S&P 500 earnings will suffer the fifth-straight quarter of year-over-year declines, the longest such streak since the five-quarter stretch from the third quarter of 2008 through the third quarter of 2009, the heart of the Great Recession.

By fooling ourselves into thinking we’d never get there again?

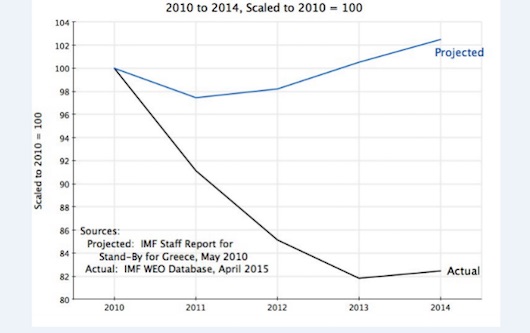

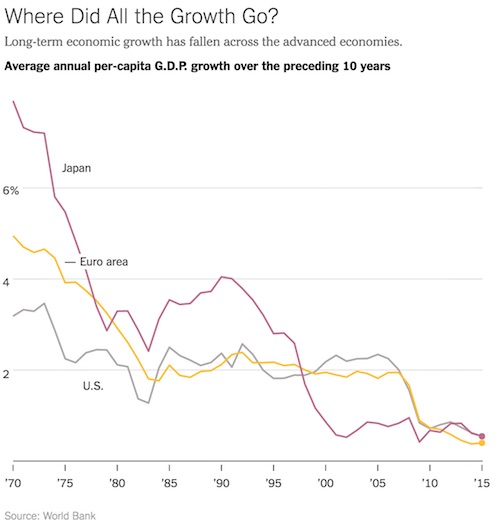

• We’re in a Low-Growth World. How Did We Get Here? (NYT)

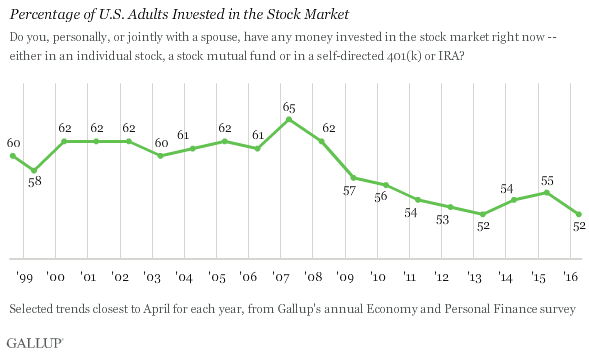

One central fact about the global economy lurks just beneath the year’s remarkable headlines: Economic growth in advanced nations has been weaker for longer than it has been in the lifetime of most people on earth. The United States is adding jobs at a healthy clip, as a new report showed Friday, and the unemployment rate is relatively low. But that is happening despite a long-term trend of much lower growth, both in the United States and other advanced nations, than was evident for most of the post-World War II era. This trend helps explain why incomes have risen so slowly since the turn of the century, especially for those who are not top earners. It is behind the cheap gasoline you put in the car and the ultralow interest rates you earn on your savings.

It is crucial to understanding the rise of Donald J. Trump, Britain’s vote to leave the European Union, and the rise of populist movements across Europe. This slow growth is not some new phenomenon, but rather the way it has been for 15 years and counting. In the United States, per-person gross domestic product rose by an average of 2.2% a year from 1947 through 2000 — but starting in 2001 has averaged only 0.9%. The economies of Western Europe and Japan have done worse than that. Over long periods, that shift implies a radically slower improvement in living standards. In the year 2000, per-person G.D.P. — which generally tracks with the average American’s income — was about $45,000.

But if growth in the second half of the 20th century had been as weak as it has been since then, that number would have been only about $20,000. To make matters worse, fewer and fewer people are seeing the spoils of what growth there is. According to a new analysis by the McKinsey Global Institute, 81% of the United States population is in an income bracket with flat or declining income over the last decade. That number was 97% in Italy, 70% in Britain, and 63% in France.

“Since 2007, the world has been in an unacknowledged depression.”

• Musical Chairs in a Depression (Thomas)

Economics is a bit like musical chairs. In a recession, the economy takes a hit and there are some casualties. Some players fail to get a chair in time and are out of the game. The game then goes on without them. The economy eventually recovers. But a depression is a different game entirely. Since 2007, the world has been in an unacknowledged depression. A depression is like a game of musical chairs in which ten children are walking around, but suddenly nine of the chairs are taken away. This means that nine of the children will soon be out of the game. But it also means that all ten understand that the odds of them remaining in the game are quite slim and that desperate times call for desperate measures. It’s time to toss out the rule book and do whatever you have to, to get the one remaining chair.

Of course, the pundits officially deny that we have even been in a depression. They regularly describe the world as “in recovery from the 2008–2010 recession,” but the “shovel-ready jobs” that are “on the way” never quite materialize. The “green shoots” never seem to blossom. So, what’s going on here? Depressions do not occur all at once. It takes time for them to bottom and, if an economy is propped up through economic heroin (debt), the Big Crash can be a long time in coming. In that regard, this one is one for the record books. As Doug Casey is fond of saying, a depression is like a hurricane. First there are the initial crashes, then a calm as the eye of the hurricane passes over, then, we enter the trailing edge of the other side of the hurricane.

This is the time when things really get rough—when even the politicians will start using the dreaded “D” word. We have entered that final stage, as the economic symptoms demonstrate, and this is the time when the game of musical chairs will evolve into something quite a bit nastier. In normal economic times, even including recession periods, we observe financial institutions maintaining their staunchly conservative image. For the most part, they deliver as promised. But, as we move into the trailing edge of the second half of the hurricane, we notice more and more that the bankers are rewriting the rule book in order to take possession of the wealth that they previously held in trust for their depositors.

And they don’t do this in isolation. They do it with the aid of the governments of the day. New laws are written in advance of the crisis period to assure that the banks can plunder the deposits with impunity. Since 2010, such laws have been passed in the EU, the US, Canada and other jurisdictions. Trial balloons have been sent up to ascertain to what degree they will get away with their freezes and confiscations. Greece has been an excellent trial balloon for the freezes and Cyprus has done the same for the confiscations. The world is now as ready as it’s going to be for the game to be played on an international level.

So what will it look like, this game of musical chairs on steroids? Well, first we’ll see the sudden crashes of markets and/or defaults on debts. Shortly thereafter, one Monday morning (or more likely one Tuesday after a long weekend) the financial institutions will fail to open their doors. The media will announce a “temporary state of emergency” during which the governments and banks must resolve some difficulties in order to “assure a continued sound economy.” Until that time, the banks will either remain shut, or will process only small transactions.