Harris&Ewing “Congressional Union for Woman Suffrage” 1916

China borrows itself into oblivion.

• China’s $16.1 Trillion Corporate Debt Threat (Reuters)

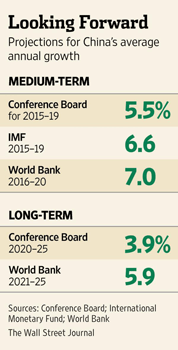

Beijing may have averted a crisis in its stock markets with heavy-handed intervention, but the world’s biggest corporate debt pile – $16.1 trillion and rising – is a much greater threat to its slowing economy and will not be so easily managed. Corporate China’s debts, at 160% of GDP, are twice that of the United States, having sharply deteriorated in the past five years, a Thomson Reuters study of over 1,400 companies shows. And the debt mountain is set to climb 77% to $28.8 trillion over the next five years, credit rating agency Standard & Poor’s estimates. Beijing’s policy interventions affecting corporate credit have so far been mostly designed to address a different goal – supporting economic growth, which is set to fall to a 25-year low this year.

It has cut interest rates four times since November, reduced the level of reserves banks must hold and removed limits on how much of their deposits they can lend. Though it wants more of that credit going to smaller companies and innovative areas of the economy, such measures are blunt instruments. “When the credit taps are opened, risks rise that the money is going to ‘problematic’ companies or entities,” said Louis Kuijs, RBS chief economist for Greater China. China’s banks made 1.28 trillion yuan ($206 billion) in new loans in June, well up on May’s 900.8 billion yuan.

The effect of policy easing has been to reduce short-term interest costs, so lending for stock speculation has boomed, but there is little evidence loans are being used for profitable investment in the real economy, where long-term borrowing costs remain high, and banks are reluctant to take risks. Manufacturers’ debts are increasingly dwarfing their profits. The Thomson Reuters study found that in 2010, materials companies’ debts were 2.8 times their core profit. At end-2014 they were 5.3 times. For energy companies, indebtedness has risen from 1.1 to 4.4 times core profit. For industrials, from 2.5 to 4.2.

It’s all just starting. The margin calls will come in fast and furious. From the shadow banking system. Will we see a ban on selling real estate too?

• Chinese Investors Flock To Sell Properties, Cancel Contracts (Nikkei)

Turbulence on China’s equity market is starting to rock the country’s property market. Investors are quickly pulling their cash out of housing they purchased to cover losses incurred by stock investments. Some have begun offering discounts on property due to difficulties with finding buyers. Continued turmoil on the stock market looks as though it will have a heavy impact on the country’s real estate market. China’s stock market rally also helped drive up sales of domestic homes. The Shanghai Composite Index surged 60% from its low of around 3,200 in early March, rising to 5,166 logged on June 12. China Securities Depository and Clearing said that the number of accounts opened to trade yuan-denominated A-shares reached 980,000 in May in Shenzhen, where property prices are climbing faster than other areas.

The figure accounted for roughly 80% of the total 1170,000 accounts in Guangdong Province, where large numbers of such account holders reside. Many newbie investors, who have just jumped into the stock market, likely gave a fresh impetus to the property market. China’s share price upswing prompted investors to reach out for new investments, including houses and other properties. A property analyst at major Chinese brokerage Guotai Junan Securities said that sales of luxury properties worth over 10 million yuan ($1.61 million) each for the first half of the year topped annual sales last year in Shanghai and Beijing. After this, Chinese stocks began to crumble. In early July, the Shanghai Composite Index dropped more than 30%, after hitting a seven-year high in mid-June.

Investors who suffered big losses on the stock market were forced to sell property and cancel real estate purchase agreements. The Hong Kong Economic Times said that consumers are increasingly asking real estate firms for grace periods on down payments for mortgage loans, as they run out of cash because of weak stocks. Some canceled home purchase contracts, while others canceled mortgage loans, according to China’s largest property developer China Vanke, which has a strong foothold in Shenzhen. Local media reported that an official at China Vanke is concerned about massive numbers of cancellations in the future.

“It’s not just that markets are about volatility. It is that volatility can never be eliminated.”

• Regulators Cannot Eliminate Volatility In China’s Stock Markets (Pettis)

For now I think we can safely say the panic is finally over, but none of the fundamental questions have been resolved and I expect continued volatility. Because I also think the market remains overvalued, however, I have little doubt that we will see at least one more very nasty bear market. Either way the panic and the policy responses have opened up a ferocious debate on China’s economic reforms and Beijing’s ability to bear the costs of the economic adjustment. Among these costs are volatility. Rebalancing the economy and withdrawing state control over certain aspects of the economy, especially its financial system, will reduce Beijing’s ability to manage the economy smoothly over the short term but it may be necessary in order to prevent a very dangerous surge in volatility over the longer term. Sunday’s Financial Times included an article with the following:

Critics of the measures unleashed by Beijing last week argue that they point to a fundamental tension at the heart of China’s political economy that a free-floating renminbi would test even more severely. The ruling Chinese Communist party, they argue, is ultimately incapable of surrendering control of crucial facets of the country’s economic and financial system. As one person close to policymakers in Beijing puts it: “The problem with this system is that it cannot tolerate volatility and markets are all about volatility.”

It’s not just that markets are about volatility. It is that volatility can never be eliminated. Volatility in one variable can be suppressed, but only by increasing volatility in another variable or by suppressing it temporarily in exchange for a more disruptive adjustment at some point in the future. When it comes to monetary volatility, for example, whether it is exchange rate volatility or interest rate and money supply volatility, central banks can famously choose to control the former in exchange for greater volatility in the latter, or to control the latter in exchange for greater volatility in the former.

Regulators can never choose how much volatility they will permit, in other words. At best, they might choose the form of volatility they least prefer, and try to control it, but this is almost always a political choice and not an economic one. It is about deciding which economic group will bear the cost of volatility.

China is two-faced being. Economic collapse at home, aid offers abraod.

• Greece Should Turn To China To Break Debt Spiral – John Perkins (ABC.au)

A prominent economist says China’s banks are circling debt-stricken countries like Greece, offering an alternative to the brutal austerity measures proposed by the IMF and EU. Former adviser to the IMF and the World Bank, John Perkins, told the ABC’s The Business that China’s Asian Infrastructure Investment Bank (AIIB) and the BRICS bank were courting countries like Greece. Mr Perkins said he believed China had sent people to Greece to offer an alternative bailout deal. “If I were the finance minister running the system I would seriously be looking at that alternative. I think that the Chinese are presenting a competitive edge here,” he said.

Mr Perkins revealed in his international bestseller, Confessions of an Economic Hit Man, how international organisations like the IMF and the World Bank enslave countries like Greece by offering crippling and unsustainable loans which never deliver the economic growth they promise. He said he believed Greece and the other European countries in similar positions should turn to China as a means of breaking the debt spiral. “These austerity programs are not the right program, even the IMF said recently there has to be more debt forgiveness we have to readjust the debt and the Europeans don’t seem willing to do this,” he said. Mr Perkins was surprised by the IMF’s public criticism of the eurozone’s bailout deal this week and said it shows the growing influence of China’s banks.

“I think the motivation may have been the Chinese because the Chinese have stepped in before, in Ecuador and several other countries, and we now have these very powerful banks that the Chinese are heading up,” he said. Mr Perkins said the growing strength of the banks will result in a major shift of power away from the United States and European Union. He conceded that there is nothing to stop China from becoming another “economic hit man” but said the Chinese have a good record so far, particularly in South American countries like Ecuador. “I recently met with a minister of Ecuador – and he said ultimately that he has no idea what China will do but we do know that the IMF, the World Bank, the Europeans and the US have screwed us over,” he said. “They’ve put military bases around here and threatened us and China hasn’t done that, so right now we trust China more than the US.”

“Countries that don’t play ball with Germany will see their banking system used against their democratically elected politicians.”

• ‘Plan B’ Needed As Euro One Recession Away From Implosion – David McWilliams (GC)

Europe’s next recession will “kill the euro” according to economist, writer and journalist David McWilliams. McWilliams, who is among the best economics commentators from the only Anglophone nation in the euro – Ireland, warns that we only have a few months to plan an alternative to the disastrous consequences on peripheral nations of what he sees as German hegemony. He describes the mismanagement of the euro currency as “both laughable and terrifying”. Marathon negotiation sessions are not conducive to clear headed, rational decision making on the future of a nation or the eurozone. Indeed, it smacks of coercion. He lambasts the suggestion offered that Greece could have a “temporary euro”, adding, “If the board and management of a public company dealt with problems like this, the share price would collapse. There is quite simply no corporate governance within the euro”.

David McWilliams believes that Germany is out control. France is no longer strong enough to offer a counterweight and Britain is happy to allow the circus to continue as they focus on potentially getting out of the EU. He describes last weekends negotiations in Brussels as a “teutonic kangaroo court”. Should Britain successfully navigate its way out of the EU, other countries will likely follow rather than exist as provinces of Germany. Norway and Switzerland have coped just as well from the outside as their EU neighbours. He makes the obvious, though seldom heard assertion that “when economic negotiations stop making economic sense, you should begin to question the motives of the EU”. Pointing to the plundering of Greek state assets to pay off creditors whilst forcing further austerity on the Greek people.

Each previous round of austerity has caused the economy to contract further – thus forcing Greece into a debt trap from which it cannot escape. We believe this is a crucial point. While Germany have played a major role it in the subjugation of Greece it is worth asking who truly benefits from economic negotiations that have stopped making economic sense. Could it be the large banks who, following a similar model imposed on countries in Latin America, Southeast Asia and Africa since the 1970’s, continue to extract wealth from the poorest people on earth? Has not almost every development in the EU in the past ten years served to consolidate the power of financial institutions at the expense of the citizenry?

McWilliams highlights the dramatic u-turn in policy where membership of the EU is now conditional. When Mario Draghi initiated the “whatever-it-takes” mass purchase of bonds of peripheral nations the message was clear – the euro is forever. Now, however, countries must bend to Germany’s demands which are the demands of politicians who want to keep their electorate happy if they are to be re-elected. “Countries that don’t play ball with Germany will see their banking system used against their democratically elected politicians. The banking system is the soft underbelly and the Germans are prepared to orchestrate bank runs in member states to get their way. This is not only new, it is outrageous.”

Amen.

• Deeper Eurozone Integration Would Be A ‘Huge Mistake’ (Telegraph)

Deeper fiscal integration in the eurozone is a “huge mistake” that could end up tearing the bloc apart, Sweden’s former finance minister has warned. Anders Borg said forcing countries to cede sovereignty could trigger a right-wing backlash across Europe, as he predicted that countries such as Sweden and Poland, which are obliged to join the euro, would not adopt the single currency for “decades”. “If you go for tighter co-operation that basically brings higher taxes to the north to subsidise the south, you build in a political divide that is not sustainable in the long term,” he said. Mr Borg, who stepped down in October 2014, said that while the current structure of the eurozone was problematic, the only way to secure a broad-based recovery across the bloc without creating a political rift was to focus on competitiveness.

“We’re not talking about good and bad outcomes here, we are talking about only very problematic alternatives. If you push for further fiscal integration, moving more decisions to Brussels, taxing northern European countries more heavily and subsidising countries with long-term competitive issues and deep problems in the south you would obviously have a strong Right-wing reaction that would undermine the political support for that direction and create a less open, less liberal and less dynamic Europe,” he said. “I think there are great risks in connection to the course that we now hear from political integration. There is no voter base for that and it’s not certain either that you’re dealing with the right focus.”

Mr Borg said the eurozone and the wider EU area, which includes the UK, should focus on policies such as “completing the single market, voting for free trade co-operation with the US and increasing infrastructure investment”. “[Countries] are under-spending on infrastructure. We are under-spending in education. Our labour markets are over-regulated and we have tax levels for investment and work that are too high, so we need to do fundamental tax reforms and we need to fix our expenditure so that we are concentrating on the areas where public expenditures have most return.” Mr Borg, who voted for Sweden to join the euro in 2003, said the country’s membership was unlikely for “decades”. “It’s very difficult to argue today to your population that it’s a well functioning system,” he said.

Mr Borg, who predicted in 2012 that Greece would leave the euro, welcomed the news that the eurozone had opened the door to a third Greek bail-out package to begin. He said he was in “full agreement” with the IMF that creditors needed to write off some of the country’s debt “substantially”. “There is a need to establish a credible long-term programme for financing Greece. There is serious rethinking that has to be done on the Greek side but also on the creditors’ side. I would hope that people are ready to do this because the alternative is catastrophic for Greece. It’s clear that we’re not out of the woods yet,” he said.

Shouldn’t have left it in the hands of sociopaths.

• Built To Foster Friendship, The Euro Is Manufacturing Misery (Economist)

Unravelling the tangled logic of Greece’s bail-out talks, Charlemagne has learned, is a little like trying to explain the rules of cricket to an American. How to make sense of a process in which Greek voters loudly spurn a euro-zone bail-out offer in a referendum, only to watch Alexis Tsipras, their prime minister, immediately seek a worse deal that is flatly rejected by the euro zone, which in turn presses a yet more stringent proposal to which Mr Tsipras humbly assents? Better, perhaps, not to try. After six months of this nonsense, little wonder everyone is depressed. The immediate danger of Grexit has at least been averted, after Mr Tsipras and his fellow euro-zone heads of government pulled a brutal all-nighter in Brussels this week.

But it comes at the price of a vast taxpayer-funded bail-out for Greece, worth up to €86 billion over three years, and a humiliating capitulation by Mr Tsipras. Greece’s economy is in tatters, its creditors are fuming and Europe’s institutions are in despair. Much to Britain’s disgust even non-euro countries have been sucked into the nightmare: a bridge loan designed to keep Greece afloat while the bail-out talks proceed looks set to tap a fund to which all EU countries have contributed. But wasn’t this week’s agreement a triumph for the shock troops of austerity? Hardly. Finland’s coalition, formed only two months ago, tottered at the prospect of funding a third Greek bail-out. The Dutch prime minister, Mark Rutte, has admitted that it would violate an election pledge he made in 2012.

One euro-zone diplomat says that 99% of her compatriots would say “no” to the bail-out if offered a Greece-style referendum. Even Angela Merkel, Germany’s chancellor and Mr Tsipras’s chief tormentor, is damaged. The deal, crafted largely by Mrs Merkel, Mr Tsipras and François Hollande, France’s president, has exposed the German chancellor to competing charges: of cruelty abroad and of leniency at home, notably among Germany’s increasingly irritable parliamentarians, who must vote twice on the Greek package. Europe’s single currency, designed to foster unity and ease trade between its members, has thus become a ruthless generator of misery for almost all of them.

“Looked at separately, each of these suffocating tax rates might appear almost reasonable. Looked at together, they are totally unreasonable.”

• Greece Is Being Taxed To Death (Politico)

More than five years have passed since May 2010, when Greece was enticed to borrow €73 billion from the IMF, EC and ECB with painful strings attached. That 2010 program, said the IMF, “had two broad aims: to make fiscal policy and the fiscal and debt position sustainable, and to improve competitiveness.” There was no emphasis on improving domestic economic growth or employment — just “competitiveness” in trade. The IMF speculated that “restoring confidence” would “lead to a growth recovery” in 2012. When that didn’t happen, another €154 billion in loans was provided. And the IMF blamed the bad “investment climate” on a “lack of confidence,” rather than any lack of after-tax income.

Prominent U.S. economists blame the seven-year depression in Greece on savage cutbacks in government spending. “The contraction in government spending has been predictably devastating,” wrote Joseph Stiglitz in February. And Paul Krugman later criticized the period “from 2009 to 2013, the last year of major spending cuts” in Southern Europe. In reality, however, Greek government spending rose from 44.9% of GDP in 2006 to 53.7% from 2009 to 2012 and to 60.1% in 2013. That 2009-2013 “fiscal stimulus” was precisely when the economy contracted — by 4.4% in 2009, 5.4% in 2010, 8.9% in 2011, 6.6% in 2012 and 3.9% in 2013. By contrast, the economy grew slightly in 2014 when government spending was “only” half of GDP.

That is, the economy fell when government’s share rose, and the economy rose when government’s share fell. What is rarely or never mentioned in the typically one-sided misperception of spending “austerity” is the other side of the budget — namely, taxes. The latest Greek efforts to appease creditors would raise corporate tax again to 28%, raise the 5% “solidarity surcharge” on personal incomes, and discourage tourism by raising the VAT on restaurants and island shopping. Looked at separately, each of these suffocating tax rates might appear almost reasonable. Looked at together, they are totally unreasonable.

To offer a Greek employee an extra €100 requires that €42 be first subtracted for Social Security tax, and then up to €46 more subtracted for income tax. Out of the original €100 of marginal labor cost, the remaining €14 of after-tax income going to a skilled worker could only buy about €10 worth of goods after value-added tax is paid. The tax wedge between what employers pay for labor and what workers have left to spend, after taxes, is 43.4% for a Greek family of four with average earnings — the highest in the OECD and more than double the comparable U.S. wedge of 20.6%. This demoralizing tax wedge, which grows even larger at higher incomes, clearly depresses hiring and working in the formal economy. It also helps explain why a third of the Greek labor force is self-employed (making tax avoidance easier).

“..an economic death spiral — contraction leading to banking failure, banking failure leading to contraction — first in Greece and, later on, elsewhere in Europe.”

• Greece: Death Spiral Ahead (James K. Galbraith)

The Greek parliament has now voted to surrender control of the Greek state to platoons of bureaucrats from Brussels, Frankfurt and Berlin, who will now re-impose the full policy regime against which Greeks rebelled in January 2015 — and which they again rejected, by overwhelming majority, in the referendum of July 5. The orders from Brussels will impose strict new rules on the Greek people in the interest of paying down Greece’s debt. In return, the Europeans and the IMF will put up enough new money so that they themselves can appear to be repaid on schedule — thus increasing Greece’s debt — and the ECB will continue to prop up the Greek banking system. A hitch has already appeared in the plan: the IMF, whose approval is required, has pointed out — correctly — that the Greek debt cannot be paid, and so the Fund cannot participate unless the debt is restructured.

Now Germany, Greece’s main creditor, faces a new decision: either grant debt relief, or force Greece into formal default, which would cause the ECB to collapse Greece’s banks and force the Greeks out of the Euro. There are many ways to rewrite debt, and let’s suppose the Germans find one they can live with. The question arises: What then? An end to the immediate crisis is likely to have some good near-term effect. The Greek banks will “reopen,” likely on Monday, and the European Central Bank will raise the ceiling on the liquidity assistance on which they rely for survival. The ATMs will be filled, although limits on cash withdrawals and on electronic transfers out of the country will likely remain. There will be some talk of new public investment, funded by the EU; perhaps some stalled road projects will restart.

With these measures, it is not impossible that the weeks ahead will see a small uptick of economic life, and certainly, any such will make big news. It’s also possible that even without good news, Greece may limp along in stagnation, within the euro. ut if you walk through the requirements of Greece’s new program, there is another possibility. That possibility is an economic death spiral — contraction leading to banking failure, banking failure leading to contraction — first in Greece and, later on, elsewhere in Europe.

“This programme is going to fail whoever undertakes its implementation.” Asked how long that would take, he replied: “It has failed already.”

• Greece Reforms ‘Will Fail’ – Varoufakis (BBC)

Former Greek Finance Minister Yanis Varoufakis has told the BBC that economic reforms imposed on his country by creditors are “going to fail”, ahead of talks on a huge bailout. Mr Varoufakis said Greece was subject to a programme that will “go down in history as the greatest disaster of macroeconomic management ever”. The German parliament approved the opening of negotiations on Friday. The bailout could total €86bn in exchange for austerity measures. In a damning assessment, Mr Varoufakis told the BBC’s Mark Lobel: “This programme is going to fail whoever undertakes its implementation.” Asked how long that would take, he replied: “It has failed already.”

Mr Varoufakis resigned earlier this month, in what was widely seen as a conciliatory gesture towards the eurozone finance ministers with whom he had clashed frequently. He said Greek Prime Minister Alexis Tsipras, who has admitted that he does not believe in the bailout, had little option but to sign. “We were given a choice between being executed and capitulating. And he decided that capitulation was the optimal strategy.” Mr Tsipras has announced a cabinet reshuffle, sacking several ministers who voted against the reforms in parliament this week. But he opted not to bring in technocrats or opposition politicians as replacements. As a result, our correspondent says, Mr Tsipras will preside over ministers who, like himself, harbour serious doubts about the reform programme.

Greece must pass further reforms on Wednesday next week to secure the bailout. Germany was the last of the eurozone countries needing parliamentary approval to begin the talks. But the head of the group of eurozone finance ministers, Jeroen Dijsselbloem, has warned that the process will not be easy, saying he expected the negotiations to take four weeks. On Saturday, the Greek government ordered banks to open on Monday following three weeks of closures. Separately, the European Council approved the €7bn bridging loan for Greece from an EU-wide emergency fund. The loan was approved in principle by eurozone ministers on Thursday and now has the go-ahead from all non-euro states. It means Greece will now be able to repay debts to two of its creditors, the ECB and IMF, due on Monday.

Another very transparent essay from Yanis.

• Dr Schäuble’s Plan for Europe: Do Europeans Approve? (Yanis Varoufakis)

The avalanche of toxic bailouts that followed the Eurozone’s first financial crisis offers ample proof that the non-credible ‘no bailout clause’ was a terrible substitute for political union. Wolfgang Schäuble knows this and has made clear his plan to forge a closer union. “Ideally, Europe would be a political union”, he wrote in a joint article with Karl Lamers, the CDU’s former foreign affairs chief (Financial Times, 1st September 2014). Dr Schäuble is right to advocate institutional changes that might provide the Eurozone with its missing political mechanisms. Not only because it is impossible otherwise to address the Eurozone’s current crisis but also for the purpose of preparing our monetary union for the next crisis. The question is: Is his specific plan a good one? Is it one that Europeans should want?

How do its authors propose that it be implemented? The Schäuble-Lamers Plan rests on two ideas: “Why not have a European budget commissioner” asked Schäuble and Lamers “with powers to reject national budgets if they do not correspond to the rules we jointly agreed?” “We also favour”, they added “a ‘Eurozone parliament’ comprising the MEPs of Eurozone countries to strengthen the democratic legitimacy of decisions affecting the single currency bloc.” The first point to raise about the Schäuble-Lamers Plan is that it is at odds with any notion of democratic federalism. A federal democracy, like Germany, the United States or Australia, is founded on the sovereignty of its citizens as reflected in the positive power of their representatives to legislate what must be done on the sovereign people’s behalf.

In sharp contrast, the Schäuble-Lamers Plan envisages only negative powers: A Eurozonal budget overlord (possibly a glorified version of the Eurogroup’s President) equipped solely with negative, or veto, powers over national Parliaments. The problem with this is twofold. First, it would not help sufficiently to safeguard the Eurozone’s macro-economy. Secondly, it would violate basic principles of Western liberal democracy. Consider events both prior to the eruption of the euro crisis, in 2010, and afterwards. Before the crisis, had Dr Schäuble’s fiscal overlord existed, she or he might have been able to veto the Greek government’s profligacy but would be in no position to do anything regarding the tsunami of loans flowing from the private banks of Frankfurt and Paris to the Periphery’s private banks.

Those capital outflows underpinned unsustainable debt that, unavoidably, got transferred back onto the public’s shoulders the moment financial markets imploded. Post-crisis, Dr Schäuble’s budget Leviathan would also be powerless, in the face of potential insolvency of several states caused by their bailing out (directly or indirectly) the private banks. In short, the new high office envisioned by the Schäuble-Lamers Plan would have been impotent to prevent the causes of the crisis and to deal with its repercussions. Moreover, every time it did act, by vetoing a national budget, the new high office would be annulling the sovereignty of a European people without having replaced it by a higher-order sovereignty at a federal or supra-national level.

Ireland: “30% of people live in deprivation conditions – 40% of children..”

• Dublin, Lisbon And Madrid Beat The Bailout. It’s No Comfort To Athens (Guardian)

They used to be pejoratively labelled the “Pigs”: Portugal, Ireland, Greece and Spain, the “peripheral” countries carried into the eurozone on a wave of prosperity that were all forced to go cap in hand to their neighbours – and the IMF – when the financial crash came. Yet while Greece’s plight has only worsened over the five years since it was first rescued, the other three bailed-out countries have managed to return to growth, and send the inspectors from the International Monetary Fund back to Washington. Ireland graduated from its bailout programme in 2013. Spain – which never had a full-blown rescue, but received aid to prop up its ailing banks – did so in January last year; Portugal followed suit shortly afterwards.

As Greece attempts to rebuild its shattered economy with the aid of last week’s controversial bailout, it will be encouraged to take heart, and learn the lessons, from these success stories. Yet these countries have taken their own, tough paths back to economic growth – and the pain is still being felt. Ireland, which experienced an extraordinary property boom in the runup to the crisis and a deep downturn when the reckoning came, is expected to see GDP growth of around 5% this year. But its economic output is artificially boosted by the enthusiasm of multinationals for the country’s rock bottom 12.5% corporation tax rate — part of a long-term industrial strategy.

Ireland was also in a very different position to Greece when entering the crisis: until the country’s politicians chose to bail out its fragile banks, the public finances were in a relatively healthy state, with government debt at around 40% of GDP. Nevertheless, Michael Taft of the Unite trade union in Ireland says the deep spending cuts imposed as part of the post-crisis settlement have left long-term scars. “30% of people live in deprivation conditions – 40% of children,” he says. He adds that the fact that parties on both sides of the political divide shared a commitment to spending cuts meant it was hard for a Syriza-style, anti-austerity narrative to take hold: “The debate has been like the sound of one hand clapping.” However, more recently there was a noisy public revolt when the government considered imposing charges for water.

The view from Germany.

• Alexis Tsipras Has Shown Greeks He Can Save Them (Spiegel)

At the moment it appears that Tsipras the pragmatist has knocked out Tsipras the ideologue. “He’s finally putting his country before his party,” one opposition politician said on Wednesday, expressing relief. But Tsipras didn’t have any other choice. If Tsipras hadn’t reached an agreement in Brussels, Greece would have collapsed. The banks would have collapsed; even more businesses would have gone under. And Tsipras would have been the one responsible for it all. But with his U-turn, he also showed that he is ultimately a politician and not a gambler. The latest summit in Brussels lasted 17 hours, during which Tsipras abandoned one position after the other. He repeatedly left the room, where he was negotiating with Angela Merkel, François Hollande and EC President Donald Tusk.

Outside, he telephoned with his people back in Athens. In the end, he did succeed in keeping the fund for privatizing state-owned assets — that was to be based in Luxembourg and used as collateral for the loans — under Athens’ control. The fact that the fund is unlikely to ever bring in the €50 billion expected hardly mattered. Tsipras needed the victory. It is virtually a certainty that this won’t be the only element in the new bailout deal that will not get implemented. Tsipras knows that and so do Greece’s international creditors. Greece will never be able to pay back its debts — the InMF isn’t the only party to have come to this conclusion.

Despite all the broken promises, despite the “no” vote on the austerity diktat that Tsipras would transform into a “yes” vote only a few days later, like some magician pulling a rabbit out of the hat, surveys showed 70% of Greeks supporting the deal, which they consider to be “necessary and without alternative.” 68% say they would vote for Tsipras again if there were new elections. Polls also suggest he would be able to govern without a coalition partner. Those are astonishing figures for a prime minister under whose watch the banks had to be shuttered because they were threatened with collapse. Under whom capital controls had to be introduced, limiting daily withdrawals by Greeks to €60.

Furthermore, the Greek economy hasn’t been in this bad a shape at any other point since the start of the crisis five years ago. After one and a half years of consolidation, the economy has fallen back into recession and is shrinking rapidly. The fact that he isn’t being loudly criticized and that he managed to get 61% of Greeks to back him in the July 5 referendum is Tsipras’ political masterpiece. He had pitted “democracy against the Troika” as he often stated. It was a demonstration of power and at the same time a slap in the face of the Europeans. It’s possible they underestimated Tsipras because he had always come across as being so polite and reserved. But Tsipras also tested the limits and had no qualms about crossing the line.

No, Stiglitz is not a scientist. Economics is NOT a science. See Popper and falsifiability.

• Stiglitz Meets With Greek Government Officials (GR)

Former World Bank chief economist and Nobel Prize winner Joseph Stiglitz expressed his serious concerns over the economic rationale behind Greece’s rescue agreement during his meetings with Greek government officials in Athens on Friday. He reassured, however, that both he and a large number of eminent scientists from Europe and America are willing to assist the Greek government in any way possible during its agonizing efforts to end the harsh austerity tantalizing the country and its people. The American economist has been opposed to the tactics of the IMF and the structure of the current financial system, defending Greece and the attempts of Greek Prime Minister Alexis Tsipras during his country’s negotiations with creditors, exerting harsh criticism toward Germany. “Germany has shown no common sense regarding the European economy, nor compassion,” he stressed, disapproving the measures imposed to Greece by European forces, and suggested a “brave” haircut to the Greek debt.

“It is testimony to the insouciance of our time that the stark inconsistency of globalism with American unilateralism has passed unnoticed..”

• Greece’s Lesson For Russia – and China (Paul Craig Roberts)

The termination of Greece’s fiscal sovereignty is what is in store for Italy, Spain, and Portugal, and eventually for France and Germany. As Jean-Claude Trichet, the former head of the European Central Bank said, the sovereign debt crisis signaled that it is time to bring Europe beyond a “strict concept of nationhood.” The next step in the centralization of Europe is political centralization. The Greek debt crisis is being used to establish the principle that being a member of the EU means that the country has lost its sovereignty. The notion, prevalent in the Western financial media, that a solution has been imposed on the Greeks is nonsense. Nothing has been solved. The conditions to which the Greek government submitted make the debt even less payable. In a short time the issue will again be before us.

As John Maynard Keynes made clear in 1936 and as every economist knows, driving down consumer incomes by cutting pensions, employment, wages, and social services, reduces consumer and investment demand, and thereby GDP, and results in large budget deficits that have to be covered by borrowing. Selling pubic assets to foreigners transfers the revenue flows out of the Greek economy into foreign hands. Unregulated naked capitalism, has proven in the 21st century to be unable to produce economic growth anywhere in the West. Consequently, median family incomes are declining. Governments cover up the decline by underestimating inflation and by not counting as unemployed discouraged workers who, unable to find jobs, have ceased looking.

By not counting discouraged workers the US is able to report a 5.2% rate of unemployment. Including discouraged workers brings the unemployment rate to 23.1%. A 23% rate of unemployment has nothing in common with economic recovery. Even the language used in the West is deceptive. The Greek “bailout” does not bail out Greece. The bailout bails out the holders of Greek debt. Many of these holders are not Greece’s original creditors. What the “bailout” does is to make the New York hedge funds’ bet on the Greek debt pay off for the hedge funds. The bailout money goes not to Greece but to those who speculated on the debt being paid. According to news reports, Quantitative Easing by the ECB has been used to purchase Greek debt from the troubled banks that made the loans, so the debt issue is no longer a creditor issue.

China seems unaware of the risk of investing in the US. China’s new rich are buying up residential communities in California, forgetting the experience of Japanese-Americans who were herded into detention camps during Washington’s war with Japan. Chinese companies are buying US companies and ore deposits in the US. These acquisitions make China susceptible to blackmail over foreign policy differences. The “globalism” that is hyped in the West is inconsistent with Washington’s unilateralism. No country with assets inside the Western system can afford to have policy differences with Washington. The French bank paid the $9 billion fine for disobeying Washington’s dictate of its lending practices, because the alternative was the close down of its operations in the United States. The French government was unable to protect the French bank from being looted by Washington.

It is testimony to the insouciance of our time that the stark inconsistency of globalism with American unilateralism has passed unnoticed.

Oh good god, she means tax collectors… Greece “needs” German tax collectors…. What, to revive biblical times?

• Europe’s Best And Brightest Need To Head For Greece (Helene Rey)

Last weekend’s negotiations were painful, but the Greeks were not entirely without friends. Amid the conflict and antagonism, France helped Athens draft its proposals and François Hollande, the French president, battled to avoid Grexit while keeping Germany and others on board. European solidarity looked exhausted. But contrary to some reports, it was not dead. The deal to keep Athens in the single currency, despite all its undesirable aspects, remains vastly preferable to Grexit. Now that the tricky business of implementation is about to begin, it is time that Greece received a little more help from its European friends. Admittedly, generosity was not Mr Hollande’s only motive. Grexit would have spelt still more hardship for Greek people and risked creditors losing all their money.

But it would also have imperilled the European project itself. It would have bolstered the likes of the Nationl Front’s Marine Le Pen in France, who is keen to see the euro disintegrate, and Vladimir Putin, Russian president, who has made clear his desire for European fragmentation. Mr Hollande’s actions were also well received by the ruling Socialist party’s disaffected leftwingers, who harbour sympathy for Greece’s Syriza-led government. But this is not enough of an effort, either on Greece’s part or that of its partners. The agreement comes in the wake of massive austerity in Greece, amid deteriorating economic and fiscal conditions and in an environment where elementary pro-growth reforms have yet to be made. The danger is that the deal, and what should be a healing process in Europe, will be derailed.

One huge issue is implementation: the Greek government needs to improve the judicial system, write a new civil code, fight cartels in product markets and reform public administration very quickly. Such reforms should improve the country’s wellbeing, but enacting them speedily would be a tall order for even the best-organised administration. And it is here that the rest of Europe can and should help out. The fabled École nationale d’administration might offer a few tips, but this is not a question of énarques — as its graduates are known — parachuting into Athens, or of more European overlords appearing in Greece. It is instead one of using European know-how to provide technical assistance in areas where Greece needs it and where Syriza, like its predecessor governments, has failed to deliver.

Goals such as more efficient tax collection (particularly from the rich) and fighting clientelism are part of the agreement and are vital. But they come bundled with other measures, such as value added tax increases, that will stifle any recovery. Hence the need for more solidarity to help the Greeks move fast.

Reich is right, of course. But why did he stay on in Bill Clinton’s cabinet when he disagreed so much on the repeal?

• Hillary Clinton and Glass-Steagall (Robert Reich)

For more than six decades after 1933, Glass-Steagall worked exactly as it was intended to. During that long interval few banks failed and no financial panic endangered the banking system. But the big Wall Street banks weren’t content. They wanted bigger profits. They thought they could make far more money by gambling with commercial deposits. So they set out to whittle down Glass-Steagall. Finally, in 1999, President Bill Clinton struck a deal with Republican Senator Phil Gramm to do exactly what Wall Street wanted, and repeal Glass-Steagall altogether. What happened next? An almost exact replay of the Roaring Twenties. Once again, banks originated fraudulent loans and sold them to their customers in the form of securities. Once again, there was a huge conflict of interest that finally resulted in a banking crisis.

This time the banks were bailed out, but millions of Americans lost their savings, their jobs, even their homes. [..] To this day some Wall Street apologists argue Glass-Steagall wouldn’t have prevented the 2008 crisis because the real culprits were nonbanks like Lehman Brothers and Bear Stearns. Baloney. These nonbanks got their funding from the big banks in the form of lines of credit, mortgages, and repurchase agreements. If the big banks hadn’t provided them the money, the nonbanks wouldn’t have got into trouble. And why were the banks able to give them easy credit on bad collateral? Because Glass-Steagall was gone. Other apologists for the Street blame the crisis on unscrupulous mortgage brokers. Surely mortgage brokers do share some of the responsibility. But here again, the big banks were accessories and enablers.

The mortgage brokers couldn’t have funded the mortgage loans if the banks hadn’t bought them. And the big banks couldn’t have bought them if Glass-Steagall were still in place. I’ve also heard bank executives claim there’s no reason to resurrect Glass-Steagall because none of the big banks actually failed. This is like arguing lifeguards are no longer necessary at beaches where no one has drowned. It ignores the fact that the big banks were bailed out. If the government hadn’t thrown them lifelines, many would have gone under. Remember? Their balance sheets were full of junky paper, non-performing loans, and worthless derivatives. They were bailed out because they were too big to fail. And the reason for resurrecting Glass-Steagall is we don’t want to go through that ever again.

As George Santayana famously quipped, those who cannot remember the past are condemned to repeat it. In the roaring 2000’s, just as in the Roaring Twenties, America’s big banks used insured deposits to underwrite their gambling in private securities, and then dump the securities on their customers. It ended badly. This is precisely what the Glass-Steagall Act was designed to prevent – and did prevent for more than six decades. Hillary Clinton, of all people, should remember.

All borrowed money anyway. Can someone please hold Brussels accountable?

• Don Quixote Airport Cost €1bn – It Could Sell To China For €10,000 (Guardian)

It cost €1bn (£694m) to build and was on sale for a knockdown price of €40m, but now looks set to be sold for just €10,000. Ciudad Real airport, one of the most notorious emblems of Spain’s economic crash, has found a buyer. A Chinese-led consortium has emerged as the only bidder for the deserted site 100 miles south of Madrid, for an apparent bargain price after no one met the much reduced valuation. Its facilities include a runway long enough to land an Airbus A380, the world’s largest passenger plane, along with a passenger terminal that could handle 10m travellers per year. It is also in pristine condition because it has barely been used, having opened to international flights in 2010 as the eurozone crisis raged, only to shut two years later.

Appropriately for such a vainglorious project, the La Mancha airport was previously named after the region’s most famous, and deluded, literary export: Don Quixote. But Tzaneen International, a Chinese company set up in March with just €4,000 in capital, believes it can succeed where others have failed. Its bid – the only offer – succeeded at a public auction. Its initial €10,000 outlay buys all the land and most of the buildings, including the runway and control tower. Tzaneen says it also wants to acquire the terminal building and the car parks and is prepared to invest up to €100m in the project because “there are several Chinese companies that want to make the airport the European point of entry for cargo”.

“I am sure that if they take back the drachma, they’ll have a year of trouble but then they will become paradise on earth with 10m people.“

• Lunch with Beppe Grillo (FT)

[..] when I ask him directly what he thinks of the deal, he seems more discouraged than angry. “I don’t know, it’s always the same story. Every nation has lost its sovereignty.” This leads into the first of many tangents. “We’ve delegated politics to bankers. The ECB is inside Deutsche Bank and Deutsche Bank is inside the Bundesbank,” he says before moving on to mention Japanese “just-in-time” manufacturing and Britain’s zero-hour labour contracts. “They trick all the statistics because, if you work one hour, it means you’re employed.” As we nibble on pane carasau, a traditional Sardinian flatbread, I try to reel him back to the main question. A week earlier, Grillo had showed his support for Greece by making the trip to Athens’ Syntagma Square, after Tsipras had unexpectedly called a referendum on earlier bailout terms proposed by Brussels. The “No” vote — backed by Tsipras — won a resounding victory that night.

Now that plebiscite of defiance seems to have been pointless. Greece still needed funds to avoid default, and Tsipras had been forced to cave on many points to get it. So was it worth it, I ask? Grillo, who has been vocal about his desire for Italy to hold its own referendum on the euro, hesitates. “I think it helped clear up the notion that these decisions should be taken by the people, not others,” he says. As for Tsipras, he says: “If he sells out the country, that’s exactly what the Greeks don’t want.” The food arrives and the best of my antipasto is the seared tuna with peach, and the marinated salmon. Grillo loads his salad up with salt and that seems to rev him up a notch. He starts attacking “those people” who have a stranglehold on Europe’s economy.

“They have a kind of illness, it’s called alexithymia, which means difficulty recognising the emotions of others: pain, pleasure, joy,” he says. Does he mean people like Merkel and Jean-Claude Juncker, president of the European Commission? “Yes,” he responds. “They don’t care if they have to put tens of millions of people into hunger to balance an account, it’s collateral damage. We’ve entrusted our lives to people who know nothing about life,” he adds. I suggest that a referendum on euro membership might not appeal to Italians, given the scenes of economic distress they have witnessed in Athens in the past few weeks. But Grillo tells me I’m wrong because Italy’s experience with the single currency has been awful.

The Italian economy has only just started growing again — by 0.3% in the first quarter of this year, after a bruising triple-dip recession. Unemployment remains high — at 12.4% — and for the country’s youth that figure is more than 40%. “We entered monetary union from one day to the next, and they said it was for our own good,” he says. “Since then, all our economic, social and financial indicators have got worse.” The chaos in Athens has, he says, been wildly overstated. “I went there with bread, cheese and nylon socks, to help. I thought there would be people on the ground, screaming, ‘Aaaaaah!’ Instead, I found a splendid city, the restaurants were full. There were many tourists. You ate well — with €18 or €20. It was clean. I am sure that if they take back the drachma, they’ll have a year of trouble but then they will become paradise on earth with 10m people.”