Lou Reed New York City 1966

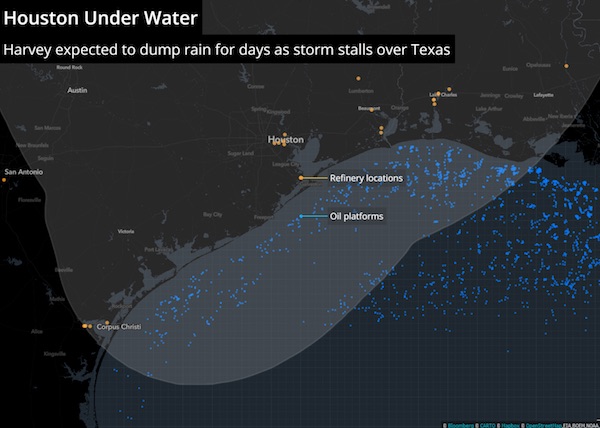

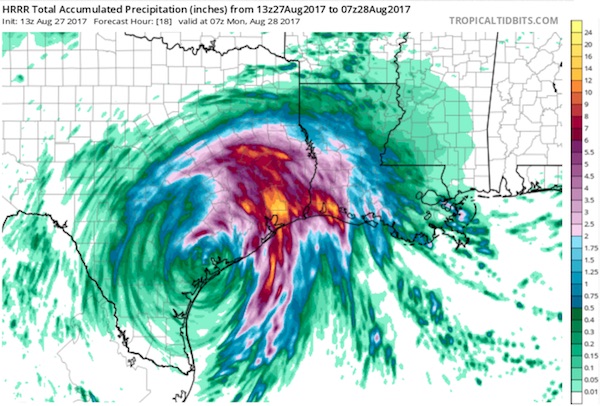

The real tragedy takes place below the surface. Sort of literally. Much more rain to come.

• Harvey’s Cost Reaches Catastrophe: Only 15% Of Homes Have Flood Insurance (BBG)

Hurricane Harvey’s second act across southern Texas is turning into an economic catastrophe – with damages likely to stretch into tens of billions of dollars and an unusually large share of victims lacking adequate insurance, according to early estimates. Harvey’s cost could mount to $24 billion when including the impact of relentless flooding on the labor force, power grid, transportation and other elements that support the region’s energy sector, Chuck Watson, a disaster modeler with Enki Research, said by phone on Sunday. That would place it among the top eight hurricanes to ever strike the U.S. “A historic event is currently unfolding in Texas,” Aon wrote in an alert to clients. “It will take weeks until the full scope and magnitude of the damage is realized,” and already it’s clear that “an abnormally high portion of economic damage caused by flooding will not be covered,” the insurance broker said.

[..] Most people with flood insurance buy policies backed by the federal government’s National Flood Insurance Program. As of April, less than one-sixth of homes in Houston’s Harris County had federal coverage, according to Aon. That would leave more than 1 million homes unprotected in the county. Coverage rates are similar in neighboring areas. Many cars also will be totaled. “A lot of these people are going to be in very serious financial situations,” said Loretta Worters, a spokeswoman for the Insurance Information Institute. “Most people who are living in these areas do not have flood insurance. They may be able to collect some grants from the government, but there are not a lot, usually they’re very limited. There are no-interest to low-interest loans, but you have to pay them back.”

The federal program itself is already struggling with $25 billion of debt. The existing program is set to expire on Sept. 30 and is up for review in Congress, which ends its recess Sept. 5. Costs still will likely soar for insurance companies and their reinsurers, biting into earnings. As Harvey bore down on the coastline Friday, William Blair, a securities firm that tracks the industry, said the storm could theoretically inflict $25 billion of insured losses if it landed as a “large category 3 hurricane.” Policyholder-owned State Farm Mutual Automobile Insurance has the largest share in the market for home coverage in Texas, followed by Allstate, which is publicly traded. William Blair estimated that, in that scenario, Allstate could incur $500 million of pretax catastrophe losses, shaving 89 cents off of earnings per share.

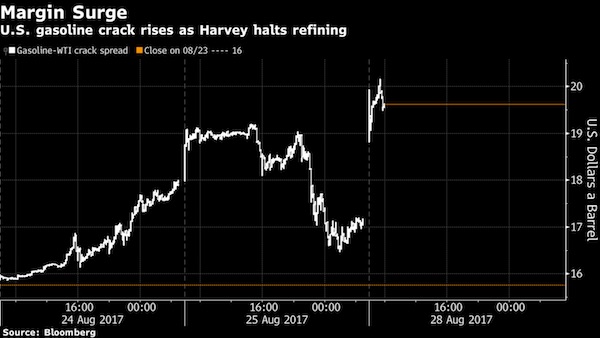

Most shutdowns so far are precautionary. But…

• Gasoline Surges, Oil Holds Near $48 as Harvey Shuts Refineries (BBG)

Gasoline surged to the highest in two years and oil was steady as flooding from Tropical Storm Harvey inundated refining centers along the Texas coast, shutting more than 10% of U.S. fuel-making capacity. Motor fuel prices rose as much as 6.8%, while oil held gains near $48 a barrel. Harvey, the strongest storm to hit the U.S. since 2004, made landfall as a hurricane Friday, flooding cities and shutting plants able to process some 2.26 million barrels of oil a day. Pipelines were closed, potentially stranding some crude in West Texas and starving New York Harbor of gasoline. Gasoline prices are going to continue to rise this week as we expect another three days of rain in the Houston area,” Andy Lipow, president of consultant Lipow Oil in Houston, said by phone.

“With pipeline operators beginning to shut down their crude oil and refined product infrastructure, I expect to see further curtailment of refinery operations. A spike in gasoline and diesel prices will drag up crude oil prices.” Oil has traded this month in the tightest range since February as investors weigh rising global supply against output cuts by members of OPEC and its allies. As Harvey led to widespread flooding, Shell shut its Deer Park plant, while Magellan Midstream suspended its inbound and outbound refined products and crude pipeline transportation services in the Houston area. Gasoline for September delivery climbed as much as 11.33 cents to $1.7799 a gallon on the New York Mercantile Exchange, the highest intraday price for a front-month contract since July 2015.

It traded at $1.7621 at 12:36 p.m. in Hong Kong. West Texas Intermediate oil for October delivery fell 16 cents to $47.71 a barrel after advancing 0.9% on Friday. Brent crude’s premium to WTI widened to the largest in two years with the global benchmark trading at as much as $4.96 above the U.S. marker. Brent for October settlement gained 18 cents, or 0.3%, to $52.59 a barrel on the London-based ICE Futures Europe exchange.

Waether Underground is probably the best source.

• Mammoth Flood Disaster in Houston: More Rain Yet to Come (WU)

Harvey’s winds are expected to remain modest, and it could become a tropical depression at any point, but winds are not the problem here. The NOAA/NWS National Hurricane Center now predicts that Harvey will inch its way into the Gulf of Mexico—though just barely—by Monday night, then arc northeast and make a second landfall just west of Houston on Wednesday. The 12Z GFS and 00Z European model runs agree on a general northward motion for Harvey across eastern Texas, beginning around midweek. At this point it may make little difference whether Harvey stays just inland or moves just offshore, since rainbands would continue to be funneled toward Houston either way. The fine-scale particulars of this outlook may shift over time, but the overall message is consistent: Harvey will be a devastating rainmaking presence in southeast Texas for days to come.

Harvey’s circulation is located in a near-ideal spot for funneling vast amounts of moisture from the Gulf of Mexico toward the upper Texas coast. Here, converging winds at low levels have been concentrating the moisture into north-south-oriented bands of intense thunderstorms with torrential rain. Since Harvey is barely moving, these bands are creeping only slowly eastward as individual cells race north along them—a “training” set-up that is common in major flood events. Mesoscale models, our best guidance for short-term, small-scale behavior of thunderstorms, show little sign of relief for southeast Texas anytime soon. Convection-resolving mesoscale models, which have a tight enough resolution to depict individual thunderstorms, are an invaluable tool in situations like this. The mesoscale nested NAM model predicts that 20” – 30” of additional rainfall is likely through Tuesday across the Houston metro area, with even larger totals at some points.

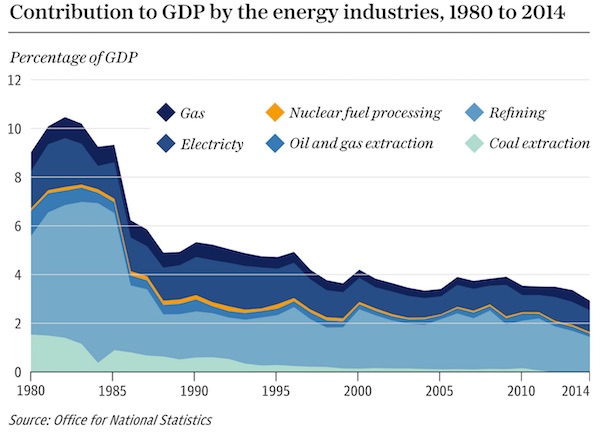

Hmm. But what if China manages to unload all its overcapacity on the Belt Road, and makes other countries pay?

• The Coming Collapse Of China’s Ponzi Scheme Economy (SCMP)

Friends who have a greater interest than I do in reading the tea leaves in Beijing tell me that the emphasis in relations with Hong Kong from now on will be on one country rather than two systems. I think this phrases things the wrong way. The one country bit was never in issue. What they actually mean to say is that Beijing’s system of state command of the economy will become dominant and Hong Kong’s more freewheeling system will fade away. I don’t think it will happen. In my view human society is so dynamic that no command system can last long in charge of an economy. Attempts at this particular form of hubris inevitably end in either war or financial crisis. For the Soviet Union it was financial crisis. I think the same fate awaits Beijing.

Consider crude steel production, a test-tube example of how command economies get it wrong. In the mainland this stood in June at an all time monthly record of 73 million tonnes, five times the total production in all of Europe. Steel was recently targeted for a reduction in capacity but then a regime of easy money intended to help the industry overcome a difficult period of contraction instead stimulated production. It has happened across the mainland’s rust belt industries. Why is so much steel needed? Simple. It is needed to build more steel mills so as to build more shipyards, ports, railways and bridges so that more ships can be built to carry more iron ore to more ports and thence along more rails and bridges to more steel mills so as to build more shipyards, ports, railways …

What we have here, in short, is a giant Ponzi scheme. In a Ponzi scheme you pay out the winnings of the first entrants with what others later pay into it. As long as it keeps growing everything is fine. When it stops growing it collapses. In this case you justify production with demand based purely on more production. As long as you keep pushing production up everything looks fine. At its peak in 2014 China turned out 30 times more cement than the United States, and the latest production figures are only a smidgen less than 2014’s.

What do you think? A good sign? It isn’t in China….

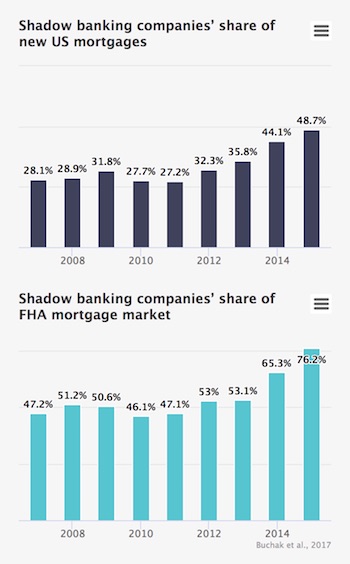

• What’s Driving The Growth In US ‘Shadow Banking’ (CBR)

In the wake of the 2007–10 financial crisis, there’s been sizeable growth of “shadow banking”— companies without banking charters entering lines of business traditionally associated with deposit-taking banks. Hedge funds that make direct loans to midsize businesses, online mortgage originators, peer-to-peer lending platforms, and payday lenders have all been on the rise. What’s behind this? According to Chicago Booth’s Gregor Matvos, Booth PhD candidate Greg Buchak, Columbia’s Tomasz Piskorski, and Stanford’s Amit Seru, much of the growth is due to regulations that have pushed banks out of traditional lending businesses. The researchers also attribute some growth to online technology that has lowered the barrier to entry in markets where lenders once needed networks of physical branches to have any hope of building business.

The researchers focus on the US residential lending market, the largest consumer loan market in the country—and the market that drew the most attention from regulators after 2008. Between 2007 and 2015, shadow banks nearly tripled their market share, from 14% to 38%. They gained the most in the Federal Housing Administration (FHA) mortgage market, which serves lower-quality borrowers and is where shadow banks’ share rose from 20% to 75%. Traditional banks retreated from sectors of the mortgage market where the regulatory burden grew the most, the researchers note. Traditional banks have been particularly hindered by rules that increased monitoring of balance-sheet holdings and constrained what banks could hold in their own accounts.

Their retreat helped shadow banking succeed in the riskier FHA market and in more-traditional, conforming mortgages. The researchers also separated shadow banks into those that did and didn’t originate loans online. During the study period, lenders that originated loans online (fintech lenders) saw market share rise from 4% to 13%—but that remains less than half of the shadow-banking sector.

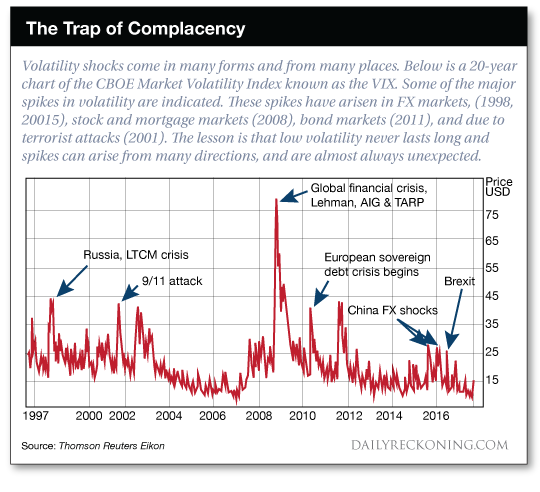

Super spikes.

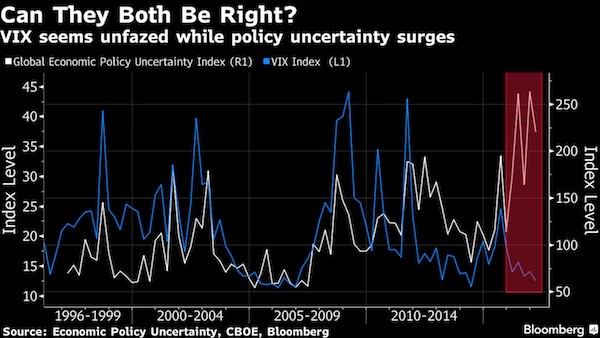

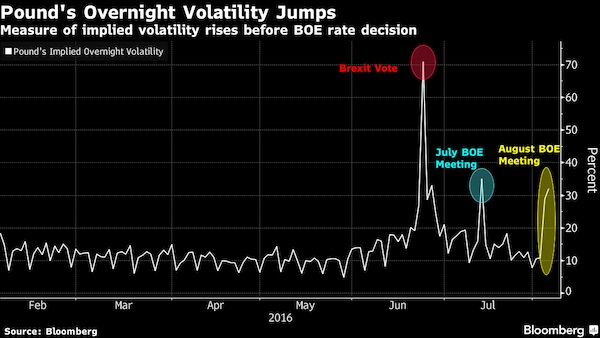

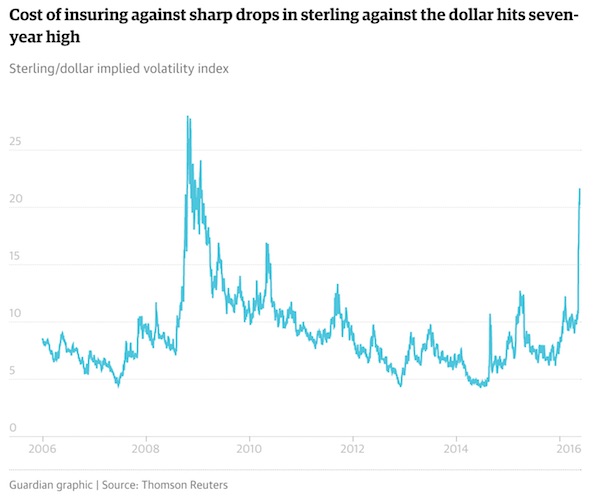

• Volatility Makes a Comeback (Rickards)

Volatility has languished near all-time lows for months on end. That’s about to change. For almost a year, one of the most profitable trading strategies has been to sell volatility. Since the election of Donald Trump stocks have been a one-way bet. They almost always go up, and have hit record highs day after day. The strategy of selling volatility has been so profitable that promoters tout it to investors as a source of “steady, low-risk income.” Nothing could be further from the truth. Yes, sellers of volatility have made steady profits the past year. But the strategy is extremely risky and you could lose all of your profits in a single bad day. Think of this strategy as betting your life’s savings on red at a roulette table. If the wheel comes up red, you double your money. But if you keep playing eventually the wheel will come up black and you’ll lose everything.

That’s what it’s like to sell volatility. It feels good for a while, but eventually a black swan appears like the black number on the roulette wheel, and the sellers get wiped out. I focus on the shocks and unexpected events that others don’t see. Right now looks like one of those highly favorable windows when the purchase of volatility is the right move. You could collect huge winnings as the short sellers scramble to cover their bets before they are wiped out completely. The chart below shows a 20-year history of volatility spikes. You can observe long periods of relatively low volatility such as 2004 to 2007, and 2013 to mid-2015, but these are inevitably followed by volatility super-spikes. During these super-spikes the sellers of volatility are crushed, sometimes to the point of bankruptcy because they can’t cover their bets.

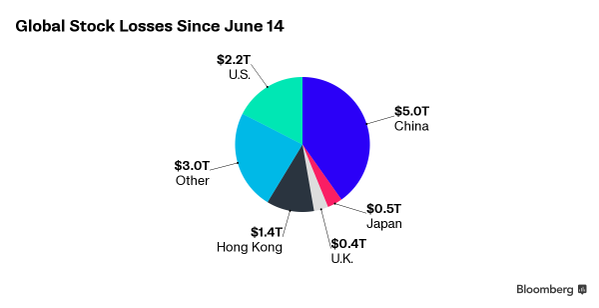

The period from mid-2015 to late 2016 saw some brief volatility spikes associated with the Chinese devaluation (August and December 2015), Brexit (June 23, 2016) and the election of Donald Trump (Nov. 8, 2016). But, none of these spikes reached the super-spike levels of 2008 – 2012. In short, we have been on a volatility holiday. Volatility is historically low and has remained so for an unusually long period of time. The sellers of volatility have been collecting “steady income,” yet this is really just a winning streak at the volatility casino. The wheel of fortune is about to turn and luck is about to run out for the sellers. It will soon be time for the buyers of volatility to collect their winnings, big time.

Sliding scales. One step before large tech is declared utility?!

• YouTube “Economically Censors” Ron Paul (ZH)

Former US Congressman Ron Paul has joined a growing list of independent political journalists and commentators who’re being economically punished by YouTube despite producing videos that routinely receive hundreds of thousands of views. In a tweet published Saturday, Wikileaks founder Julian Assange tweeted a screenshot of Paul’s “Liberty Report” page showing that his videos had been labeled “not suitable” for all advertisers by YouTube’s content arbiters. Assange claims that Paul was being punished for speaking out about President Donald Trump’s decision to increase the number of US troops in Afghanistan, after Paul published a video on the subject earlier this week. The notion that YouTube would want to economically punish a former US Congressman for sharing his views on US foreign policy – a topic that he is unequivocally qualified to speak about – is absurd.

Furthermore, the “review requested” marking on one of Paul’s videos reveals that they were initially flagged by users before YouTube’s moderators confirmed that the videos were unsuitable for a broad audience. Other political commentators who’ve been censored by YouTube include Paul Joseph Watson and Tim Black – both ostensibly for sharing political views that differ from the mainstream neo-liberal ideology favored by the Silicon Valley elite. Last week, Google – another Alphabet Inc. company – briefly banned Salil Mehta, an adjunct professor at Columbia and Georgetown who teaches probability and data science, from using its service, freezing his accounts without providing an explanation. He was later allowed to return to the service. Conservative journalist Lauren Southern spoke out about YouTube’s drive to stifle politically divergent journalists and commentators during an interview with the Daily Caller.

“I think it would be insane to suggest there’s not an active effort to censor conservative and independent views,” said Southern. “Considering most of Silicon Valley participate in the censorship of alleged ‘hate speech,’ diversity hiring and inclusivity committees. Their entire model is based around a far left outline. There’s no merit hiring, there’s no support of free speech and there certainly is not an equal representation of political views at these companies.” Of course, Google isn’t the only Silicon Valley company that’s enamored with censorship. Facebook has promised to eradicate “fake news,” which, by its definition, includes political content that falls outside of the mainstream. Still, economically punishing a former US Congressman and medical doctor is a new low in Silicon Valley’s campaign to stamp out dissent.

The most prosperous times of our societies coincide with the highest tax levels for the rich.

• Should The Rich Be Taxed More? (G.)

The past four decades have been extremely kind to those at the top. They have seen their incomes grow faster than the rest of the population and hold a far bigger share of wealth in the form of property and financial investments than the rest of the population. Over the years a bigger slice of national income has gone to capital at the expense of labour, and the rich have been the beneficiaries of that, because they are more likely to own shares and expensive houses. The trend has been particularly strong in the US, where labour’s share of income has fallen from a recent peak of 57% at the end of Bill Clinton’s presidency to 53% by 2015. The Gini coefficient – a measure of inequality – has been steadily rising since 1970 and is now at levels normally seen in developing rather than advanced economies.

Hatgioannides, Karanassou and Sala seek to take account of these profound changes in the distribution of income and wealth. They do so by dividing the average income tax rate of a particular slice of the US population by the%age of national income commanded by that same group and by their share of wealth. They then look at whether by this measure – the fiscal inequality coefficient – the US tax system has become more or less progressive over time. The findings show quite clearly that it has become less progressive. In terms of income, the poorest 99% of the US population paid nine times as much income tax as the richest 1%, both when John F Kennedy was president in the early 1960s and when Ronald Reagan beat Jimmy Carter in the 1980 race for the White House. By 2014, they paid 21 times as much.

Similarly, the bottom 99.9% in the US paid 28 times as much tax as the elite 0.1% in the early 1960s and the early 1980s, but by 2014 they were paying 76 times as much. The same trend applies – although it is not pronounced – when income tax is divided by the share of wealth. The bottom 99% paid 22 times as much income tax as the wealthiest 1% in 1980 but were paying 47 times as much in 2014. The bottom 99.9% paid 58 times as much income tax as the top 0.1% before the onset of Reaganomics; by 2014 they were paying 175 times as much. [..] As the authors note, since 1980, economic policy making has been dominated by the idea that deregulation, less generous welfare and tax cuts will stimulate higher investment, higher productivity, higher growth and higher living standards for all. None of this has occurred and, what’s more, the social mobility in the decades after the second world war has been thrown into reverse. The great American dream – the notion that anybody can strike it rich – is dead.

They won’t be.

• The West’s Wealth Is Based On Slavery. Reparations Should Be Paid (G.)

Malcolm X explained that “if you stick a knife in my back nine inches and pull it out six inches, that’s not progress. If you pull it all the way out, that’s not progress. The progress comes from healing the wound that the blow made”. Instead of attempting to fix the damage, we are completely unable to progress on issues of equality because countries such as Britain “won’t even admit the knife is there”. It is the height of delusion to think that the impact of slavery ended with emancipation, or that empire was absolved by the charade of independence being bestowed on the former colonies.

[..]It is not just governments that owe a debt; some of the biggest institutions and corporations built their wealth on slavery. Lloyds of London is one of Britain’s most successful companies and its roots lie in insuring the merchant trade in the 17th century. The fact that this was the slave trade has already led to civil action being taken by African Americans in New York. The church, many of the biggest banks, much of the ironworks industry and port cities gorged themselves on the profits from human flesh. It is clear that it would be just to pay reparations, and it is also possible to calculate the amount that Britain and other nations owe. A lot of work has been done in the United States to determine the damages owed to African Americans. The figure owed comes to far more than the “forty acres and a mule” that were promised to some African Americans who fought in the civil war.

The latest calculations from researchers estimates that for unpaid labour, taking into account interest and inflation, African Americans are owed anywhere between $5.9tn and $14.2tn. It would not be prohibitively complicated to work out the debts owed by the western powers, or the companies that enriched themselves off exploitation. The obviousness of the issue is such that a federation of Caribbean countries (Caricom) is now demanding reparations, as is the Movement for Black Lives in America and Pan-Afrikan Reparations Coalition in Europe. In many ways the calls for reparatory justice do not take go far enough. Caricom includes a demand to cancel third world debt, and the Movement for Black Lives for free tuition for African Americans.

Both of these are examples of removing the knife from our backs, rather than healing the wound. Third world debt was an unjust mechanism for maintaining colonial economic control and; allowing free access to a deeply problematic school system will not eradicate the impacts of centuries of oppression. In order to have racial justice we need to hit the reset button and have the west account for the wealth stolen and devastation caused. Nothing short of a massive transfer of wealth from the developed to the underdeveloped world, and to the descendants of slavery and colonialism in the west, can heal the deep wounds inflicted.

Cows to Qatar, cown to SIberia: the new backpackers?!

• Danone Sends 5,000 Cows to Siberia in Quest for Cheaper Milk (BBG)

President Vladimir Putin’s ban on European Union cheese imports has driven up milk prices in Russia by so much that French yogurt maker Danone is transporting almost 5,000 cows to a farm in Siberia to ensure it has an affordable supply. The Holstein cows are traveling as many as 2,800 miles (4,500 kilometers) in trucks from the Netherlands and Germany, boosting the herd on a farm near the city of Tyumen, according to Charlie Cappetti, head of Danone’s Russian unit. That should protect the company from the increase in raw milk prices, which are up 14% this year, he said. “Milk prices have been going up steadily,” Cappetti said in an interview in Moscow. “That puts products such as yogurt under pressure.” While the French dairy company doesn’t normally invest in agriculture, it made an exception for Russia.

After Putin’s ban on dairy imports took hold in 2014, demand for milk surged as local cheesemakers rushed to replace French camembert and Italian pecorino. That has exacerbated the inflationary effects of the ruble’s weakness. Danone invested in the 60-hectare (150-acre) farm with local producer Damate, Cappetti said. The first cows started to provide milk for Danone in May, and a final shipment of cattle is due to arrive in September. “We hope that Russian milk inflation will slow down next year,” the executive said. The difference between supply and demand is narrowing as new milk is coming to the market, including from the Siberian farm. While easing milk inflation may help the Russian dairy market rebound in volume terms, Danone isn’t expecting a fast economic recovery in the country, according to Cappetti. Sales in Russia have been growing in line with inflation in the first half and should rise in 2018, he said.