Fred Stein Hydrant, New York 1947

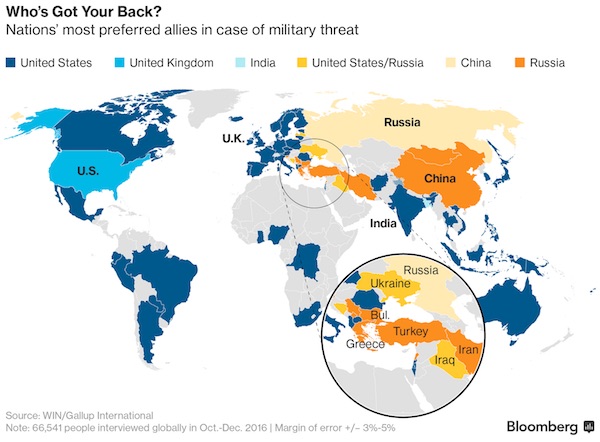

Debt leads to war.

• The Greatest Crisis In World History Is About To Be Unleashed (von Greyerz)

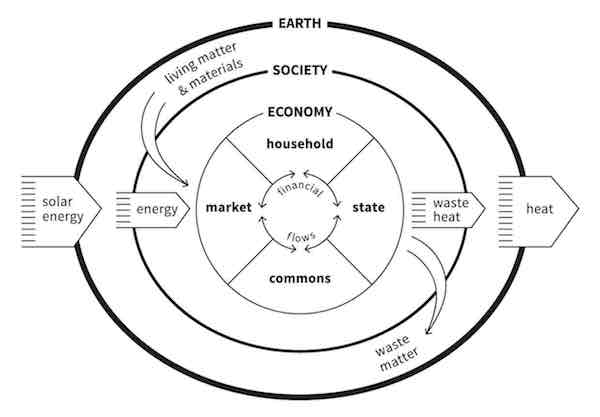

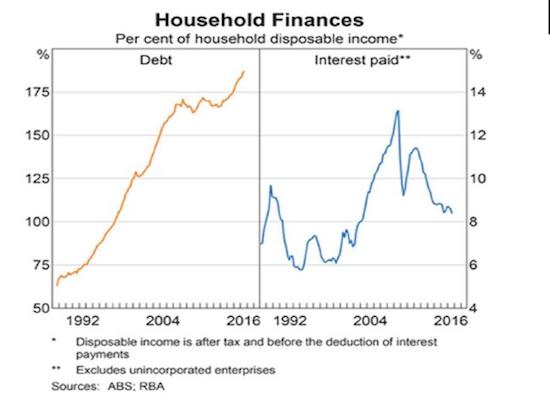

Totally irresponsible policies by governments and central banks have created the most dangerous crisis that the world has ever experienced. Risk doesn’t arise quickly as the result of a single action or event. No, risk of the magnitude that the world is experiencing today is the result of many years or decades of economic mismanagement. Cycles are normal in nature and in the world economy. And cycles that are the result of the laws of nature normally play out in an orderly fashion without extreme tops or bottoms. “Just take the seasons. They go from summer to autumn, winter and spring, with soft transitions that seldom involve drama or catastrophe. Economic cycles would be the same if they were allowed to happen naturally without the interference of governments.

But power corrupts and throughout history leaders have always hung on to power by interfering with the normal business cycle. This involves anything from reducing the precious metals content of money from 100% to nothing, printing money, leveraging credit, manipulating interest rates, taking total taxes from at least 50% + today from nothing 100 years ago etc, etc. Governments will always fail when they believe that they are gods. But not only governments believe they perform godly tasks but also hubristic investment bankers like the ex-CEO of Goldman Sachs who proclaimed that the bank was doing God’s work. It must be remembered that Goldman, like most other banks, would have gone under if they and JP Morgan hadn’t instructed the Fed to save them by printing and guaranteeing $25 trillion. Or maybe that was God’s hand too?

We now have unmanageable risks at many levels – politically, geopolitically, economically and financially. This is a RISK ON situation that is extremely dangerous and will have very grave consequences. There are numerous risks that can all cause the collapse of the world economy and they all have equal relevance. However, the political situation in the USA is very dangerous for the world. This the biggest economy in the world, albeit bankrupt with debt growing exponentially and real deficits every year since 1960. Before the dollar has collapsed, the US will still be seen as a powerful nation, although a massive economic decline will soon weaken the country burdened by debt at all levels, government, state, and private.

“There is absolutely no reason for the stock markets to be at current levels, let alone melting-up day after day.”

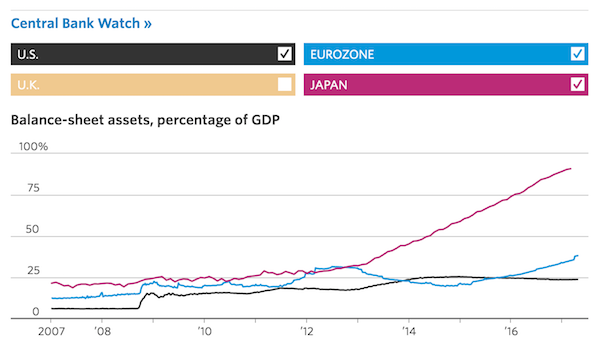

• After 100 Months of Buying The Dips – Peak Crazy (Stockman)

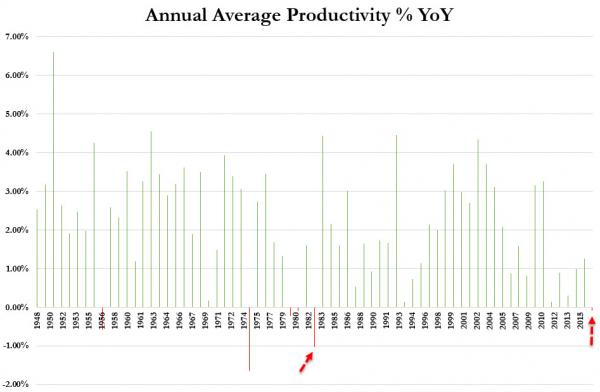

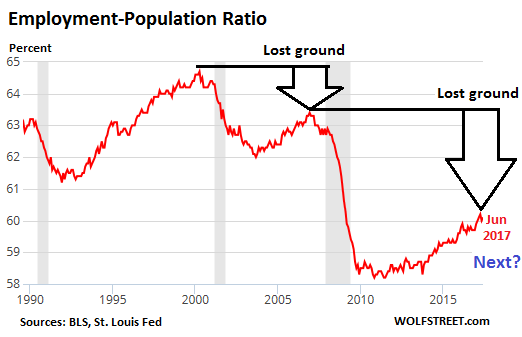

Just call it Peak Crazy and move on. There is absolutely no reason for the stock markets to be at current levels, let alone melting-up day after day. The fact that this is happening is a measure of how impaired capital markets have become as a result of massive central bank intrusion. The robo-machines and day traders keep buying the dips because that has “worked” for the last 100 months. There is nothing more to it than residual momentum. Under a regime of honest money and price discovery, the stock market discounts the future. There is no plausible future from here that’s worth 24 times S&P 500 value or 96 times the Russell 2000. Surely the year-ahead earnings boom that Wall Street’s artists have penciled in is not in the slightest bit plausible. With 84% of the S&P 500 reporting Q2 results, LTM earnings are still 1.3% below where they were in September 2014.

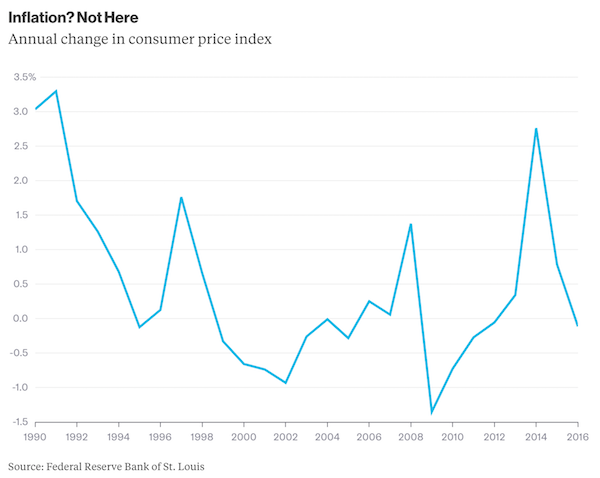

Nothing has happened to corporate earnings in the last three years except deflation in the energy, materials and industrial sectors. After hitting $106 per share in September 2014, the global deflation cycle brought them to a low point of $86.44 per share in March 2016 in response to low $30s oil prices. The latter has since recovered to the $50 dollar zone – bringing S&P 500 earnings back to $104.61 during the current quarter. The question remains: How does an aging business cycle and immense global headwinds justify the expectation of a red hot earnings breakout during the next 18 months? Yet that’s what’s happening on Wall Street. We’ve hit nearly $133 per share of GAAP earnings (and $145 of the ex-items variety) for the LTM period ending in December 2018, meaning a prospective surge of 27%.

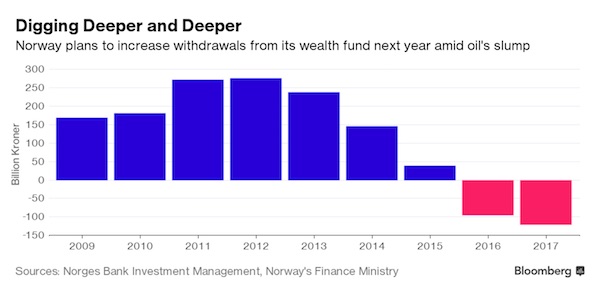

[..] In this machine driven market, any of these indices could resume their mad momentum based climb. But negative divergences are breaking out everywhere, and that’s usually a sign that the end is near. Margins on debt has again reached an all-time high of $550 billion. The chart below leaves little doubt as to what comes next. After the 2000 peak, margin debt collapsed by 50% as stocks were violently liquidated to meet margin calls. All this while in 2008 the shrinkage of margin debt was even larger – nearly 60%. This time, however, a similar shrinkage would cause a $325 billion decline in margin balances. That’s a lot of stocks on a fire sale.

“..outstanding bank loans and total social financing, both of which rose roughly 13% in July versus the same period last year..”

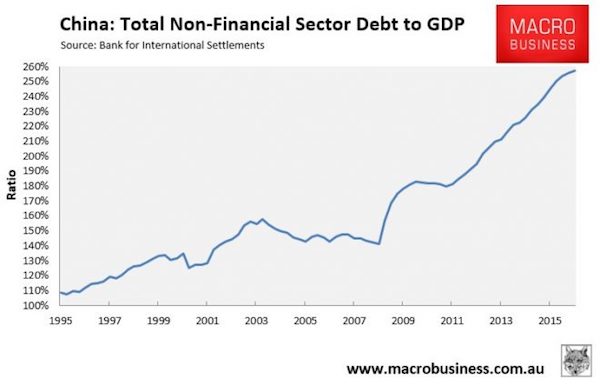

• China Has Got To Fix Its Debt Problem, IMF Says (CNBC)

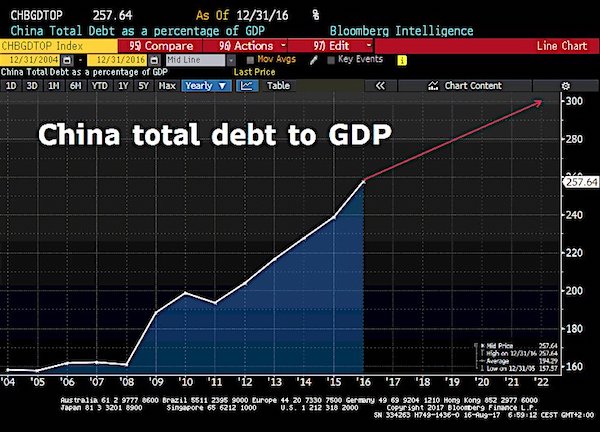

China’s economy is looking good enough that the IMF is raising its outlook, but the organization is doing so with a strong warning over growing debt in the world’s second-largest economy. The IMF issued its annual review of China on Tuesday, and has revised its growth forecast to 6.7% for 2017, which was up from 6.2%. The organization also said it expects China to average 6.4% growth between now and 2021, versus its previous estimate of 6%. Still, the organization warned that things were far from peachy. “The growth outlook has been revised up reflecting strong momentum, a commitment to growth targets, and a recovering global economy,” the IMF said. “But this comes at the cost of further large and continuous increases in private and public debt, and thus increasing downside risks in the medium term.”

What Beijing needs to do is to seize its current strong growth momentum “to accelerate needed reforms and focus more on the quality and sustainability of growth,” said the report. At the top of that list is working to tackle the debt issue: Going forward, the IMF sees China’s non-financial sector debt to hit nearly 300% of GDP by 2022, up from around 240% last year. Debt-fueled growth, the IMF warned, is a short-term solution that isn’t sustainable in the long run unless China tackles deeper structural issues. Experts have been sounding the alarm bell over this issue for years, urging China to rein in its old model of opening credit lines to fuel investment and spending and to find a better balance between supporting growth and controlling risks to the economy.

Chinese banks extended 825.5 billion yuan (about $123.44 billion) in new loans in July, down from 1.54 trillion yuan in June. Outstanding total social financing — a broad measure of credit and liquidity — came in at 1.22 trillion yuan last month versus 1.78 trillion yuan in June. Part of the drop is seasonal, and it’s “masking an uptick in underlying credit growth,” wrote China economist Julian Evans-Pritchard at Capital Economics. A better way to look at credit creation is to gauge growth in outstanding bank loans and total social financing, both of which rose roughly 13% in July versus the same period last year.

As long as things look good for the Party Congress, who cares?

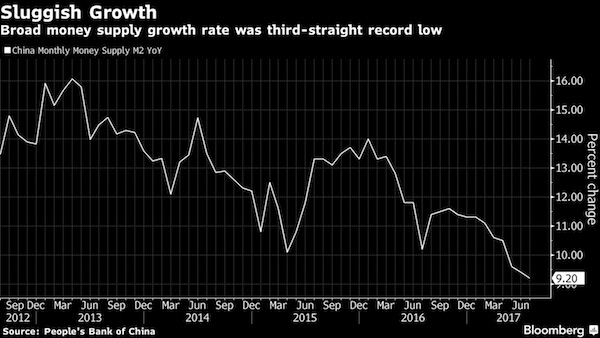

• China Money Supply Growth Slips Again as Leverage Crunch Goes On (BBG)

Growth in China’s broad money supply slipped to a fresh record low, signaling authorities aren’t letting up in their drive to curb excess borrowing and safeguard the financial system. Aggregate financing stood at 1.22 trillion yuan ($182.7 billion) in July, the People’s Bank of China said on Tuesday, compared with an estimated 1 trillion yuan in a Bloomberg survey. New yuan loans stood at 825.5 billion yuan, versus an projected 800 billion yuan. Broad M2 money supply increased 9.2%, while economists forecast a 9.5% increase . Authorities pushing to cut excess leverage have squeezed the massive shadow bank sector, which shrank for the first time in nine months. Yet with aggregate financing remaining robust and bond issuance rebounding, the central bank is still providing ample support for businesses to avoid derailing growth ahead of a key Communist Party congress this fall.

Slower M2 growth will become a “new normal,” the PBOC said Friday in its quarterly monetary policy report. “The relevance of M2 growth to the economy and its predictability has reduced, and its changes should not be over-interpreted.” “The deleveraging campaign is still focused on the financial sector, which leads to the slowdown in M2 growth,” said Yao Shaohua at ABCI Securities in Hong Kong. “Bank support for the real economy remains solid.” “The easing in credit conditions in July was probably part of the concerted stability play ahead of the Party Congress, thus more likely to be temporary,” said Yao Wei, chief China economist at Societe Generale in Paris. “We’re still looking for more deleveraging measures and tougher regulations afterwards.”

“The divergence between M2 growth and aggregate financing reflects that the PBOC is trying to balance cutting leverage while ensuring enough funds to support the real economy,” said Wen Bin at China Minsheng Banking in Beijing. “Single-digit M2 growth is likely to stretch until year-end. And with ample support from the central bank’s credit supply, the drag effect of financial deleveraging on the economic expansion will be limited.” “Banks are still creating credit, and this credit is important to support economic growth,” said Iris Pang, an analyst at ING in Hong Kong. “If liquidity is too tight, or credit growth shrinks, the whole deleveraging reform will run into the risk that there will be too many defaults and the whole banking system will be shaken up.”

“..first-time buyer registrations drop by almost 20% on the year..”

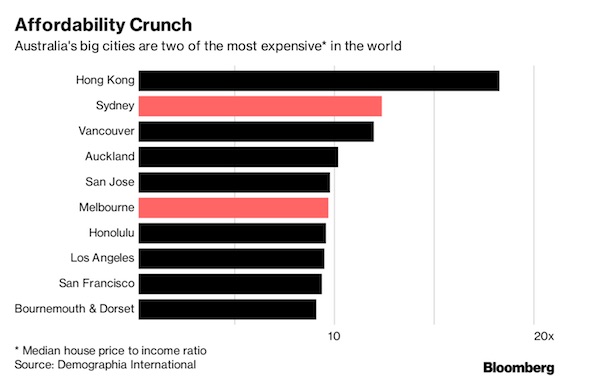

• UK Risks ‘Losing Its Place As Property-Owning Democracy’

The UK risks losing its place as a property-owning democracy if house prices continue to rise, according to the boss of the UK’s largest independent estate agent. Paul Smith, chief executive of haart, said that “unaffordability is reaching crisis point” and urged the Government to stop “excessive profiteering” at the expense of aspiring home owners. The call comes as official figures showed that the price of the average house in the UK increased by £10,000 last year to £223,000. Property values increased by 0.8% between May and June according to joint figures from the Office for National Statistics, Land Registry and other bodies. In the year to June average prices were up 4.9%, down marginally from 5% growth in the year to May.

The report released on Tuesday said the annual growth rate had slowed since mid-2016 but has remained steady at about 5% this year so far. “House prices continued to rally with unflinching determination once again in June despite the ongoing economic uncertainty,” Mr Smith said. “However this means that the average UK buyer now has to fork out an extra £10,000 more to own a home than the same time last year. “Along with consumer price hikes and falling wage growth, unaffordability is reaching a crisis point. This is creating real impact on the ground as we see first-time buyer registrations drop by almost 20% on the year across our branches.”

“..if you’re lucky enough to not be living in your parents’ basement, you’ll be relegated to renting your house from Blackstone.”

• The New American Dream: Rent Your Home From A Hedge Fund (Black)

About a month ago I joined the Board of Directors of a publicly-traded company that invests in US real estate. The position brings a lot of insight into what’s happening in the US housing market. And from what I’m seeing, the transformation that’s taking place today is extraordinary. Buying and renting out single-family homes has long been the mainstay investment of small, independent, individual investors. The big banks and hedge funds pretty much monopolize everything else. They own the stock market. They own the bond market. They own all the commercial real estate. They even own the farmland. Single-family homes were one of the last bastions of investment freedom for the little guy. (Real estate is how I got my own start in business and investing so many years ago; I was a 21-year-old Army lieutenant fresh out of the academy when I bought my first rental property.)

But all that’s changing now. Last week a huge merger was announced between Invitation Homes (owned by private equity giant Blackstone Group) and Starwood Waypoint Homes (owned by real estate giant Starwood Capital). If the deal goes through, the combined entity would be the largest owner of single-family homes in the United States with a portfolio worth over $20 billion. And this is only the latest merger in an ongoing trend. Three years ago, for example, American Homes 4 Rent bought Beazer Pre-Owned Rental Homes, creating another enormous player. A few months later, Starwood Waypoint bought Colony American Homes. And of course, Blackstone was one of the first institutional investors to start buying distressed homes, forking over around $10 billion on houses since the Great Financial Crisis.

[..] medium-sized funds are buying up all the little guys. And mega-funds like Blackstone are buying up all the medium-sized funds. This means there’s essentially an ‘arms race’ building among the world’s biggest funds to control the market, squeezing small, individual investors out of the housing market. [..] the average guy isn’t making any more money, or able to save anything… all while home prices soar to record levels as major funds gobble up the supply. This means that the new reality in America, especially for young people, is that if you’re lucky enough to not be living in your parents’ basement, you’ll be relegated to renting your house from Blackstone.

Prolonging the emergency with America’s own bridges to nowhere.

• Trump Signs Order to Speed Up Public-Works Permits (BBG)

President Donald Trump signed an executive order Tuesday that’s designed to streamline the approval process for building roads, bridges and other infrastructure by establishing “one federal decision’’ for major projects and setting an average two-year goal for permitting. “This over-regulated permitting process is a massive self-inflicted wound on our country,” Trump said in a press conference at Trump Tower in New York. “It’s disgraceful.” Among other things, the president’s order will rescind a previous decree signed by former President Barack Obama that required federal agencies to account for flood risk and climate change when paying for roads, bridges or other structures.

It also allows the Office of Management and Budget to establish goals for environmental reviews and permitting of infrastructure projects and then track their progress – with automatic elevation to senior agency officials when deadlines are missed or extended, according to the order. The order calls for tracking the time and costs of conducting environmental reviews and making permitting decisions, and it allows the budget office to consider penalties for agencies that fail to meet established milestones. Critics say there’s danger in streamlining the reviews. “This is yet another outrageous example of Trump’s insistence on putting corporate interests ahead of people’s health and safety,” said Alex Taurel, deputy legislative director with the League of Conservation Voters, a political advocacy group.

Way too late.

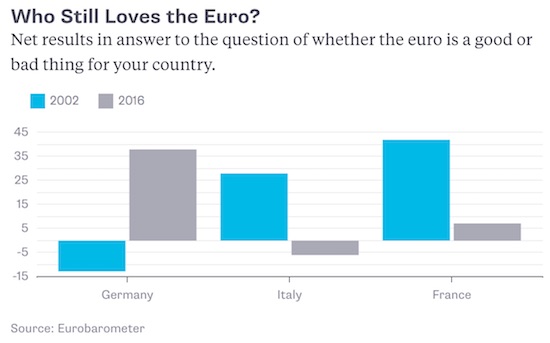

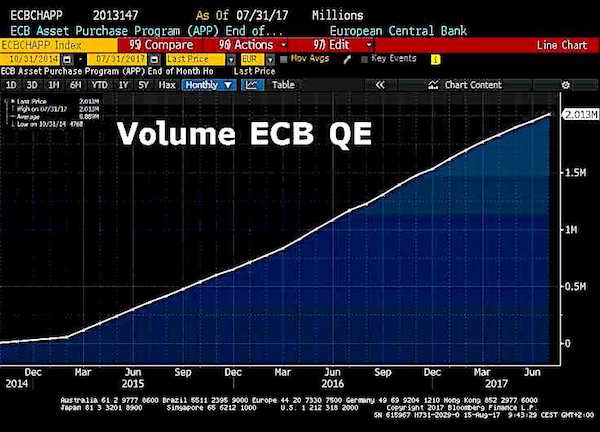

• German Challenge To ECB QE Asset Buys Sent To European Court (R.)

The European Central Bank may be violating laws on monetary financing in its €2.3 trillion ($2.7 trillion) asset purchase programme, Germany’s constitutional court said on Tuesday, and it asked Europe’s top court to make a ruling. In the biggest challenge yet to the ECB’s unprecedented effort to revive growth, the court said bond buys under the scheme may go beyond the bank’s mandate and inhibit euro zone members’ activities. “Significant reasons indicate that the ECB decisions governing the asset purchase programme violate the prohibition of monetary financing and exceed the monetary policy mandate of the European Central Bank, thus encroaching upon the competences of the Member States,” the court said. It said it would ask the European Court of Justice to review the programme.

The ECB acted swiftly to defend the scheme. “The extended asset purchase programme is in our opinion fully within our mandate,” it said in a statement. “That is ultimately for the European Court of Justice to assess.” It said the €60 billion per month asset buys would continue as normal. The European court has already backed the ECB’s more contentious emergency bond purchase scheme known as Outright Monetary Transactions or OMT with only relatively minor limitations, suggesting that the challenge – lodged by several academics and politicians – may face an uphill battle. The decision to pass the issue over to the ECJ means any final ruling will come either after the bond purchases end or near the end of the scheme, which has already been running for over two years and is expected to be wound down next year.

“The same State Department Official had written of Gadaffi in Libya that combining its oil wealth with public ownership of the economy “enabled Libyans to live beyond the wildest dreams of their fathers, and grandfathers.”

• Washington’s Long War on Syria (Ren.)

From Syria, to Iraq, Iran to Libya, our understandings of the long-wars in the Middle-East as moral, humanitarian interventions designed to democratise and civilise are the result of a carefully crafted propaganda campaign waged by the US and its allies. Each of these uprisings were launched by US proxies, designed to destabilize the regions, justifying regime change that suit the economic interests of its investors, banks and corporations, captured comprehensively in a new book by Canadian author and analyst, Stephen Gowans, Washington’s Long War on Syria. You might be surprised to know that both the Libyan, Syrian and Iraqi government, led by Muammar Gaddafi, Hafez Al Assad, (succeeded by Bashaar Al Assaad) and Sadaam Hussein respectively, were socialist governments. Or Ba’ath Arab Socialist governments, to be precise.

Ba’ath Arab Socialism can be summed up in their constitutions supporting the values of: ‘freedom of the Arab world, freedom from foreign powers and freedom of socialism’. Its doctrine was supported in Libya, as it was in Iraq and Syria. Of course, particularly in Hussein’s case, we cannot claim that these governments were without their problems. Ethnic cleansing is not to be overlooked, but condemned on the strongest grounds. But of course these were not the reasons the US and its allies decided to get into it. In the case of Iraq, it had combined its oil wealth with public ownership of the economy, leading to what is known as ‘The Golden Age’, where, according to a State Department Official: “Schools, universities, hospitals, factories, museums and theatres proliferated employment so universal, a labour shortage developed.”

When the Ba’ath Arab Socialists were driven from power in Iraq, the US installed military dictator, Paul El Briener who set about a ‘de-Ba’athification’ of the government, expelling every member of the Ba’ath Arab Socialist party and imposed a constitution forbidding any secular Arab leader from ever holding office in Iraq again. The same State Department Official had written of Gadaffi in Libya that combining its oil wealth with public ownership of the economy “enabled Libyans to live beyond the wildest dreams of their fathers, and grandfathers.” Gadaffi would soon be removed by Islamists, backed by NATO forces after Western oil companies agitated for his removal because he was “driving a hard bargain”. Canadian paramilitary forces even quipped that they were “al-Qaeda’s air-force”.

And then we eat it. Carbon will kill us yet.

• Fish Confusing Plastic Debris In Ocean For Food (G.)

Fish may be actively seeking out plastic debris in the oceans as the tiny pieces appear to smell similar to their natural prey, new research suggests. The fish confuse plastic for an edible substance because microplastics in the oceans pick up a covering of biological material, such as algae, that mimics the smell of food, according to the study published on Wednesday in the journal Proceedings of the Royal Society B. Scientists presented schools of wild-caught anchovies with plastic debris taken from the oceans, and with clean pieces of plastic that had never been in the ocean. The anchovies responded to the odours of the ocean debris in the same way as they do to the odours of the food they seek. The scientists said this was the first behavioural evidence that the chemical signature of plastic debris was attractive to a marine organism, and reinforces other work suggesting the odour could be significant.

The finding demonstrates an additional danger of plastic in the oceans, as it suggests that fish are not just ingesting the tiny pieces by accident, but actively seeking them out. Matthew Savoca, of the National Oceanic and Atmospheric Administration and lead author of the study, told the Guardian: “When plastic floats at sea its surface gets colonised by algae within days or weeks, a process known as biofouling. Previous research has shown that this algae produces and emits DMS, an algal based compound that certain marine animals use to find food. [The research shows] plastic may be more deceptive to fish than previously thought. If plastic both looks and smells like food, it is more difficult for animals like fish to distinguish it as not food.”