Pablo Picasso Blue nude 1902

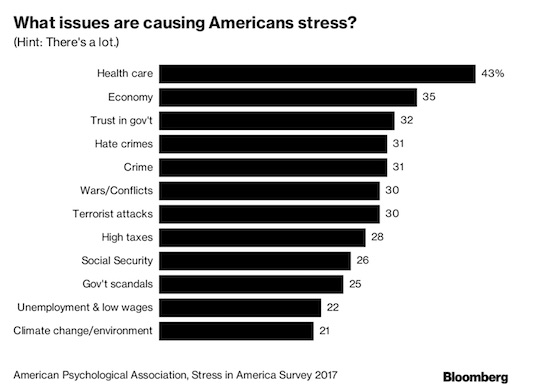

Major point in this: the media freaks out the people.

• Americans Are Officially Freaking Out (BBG)

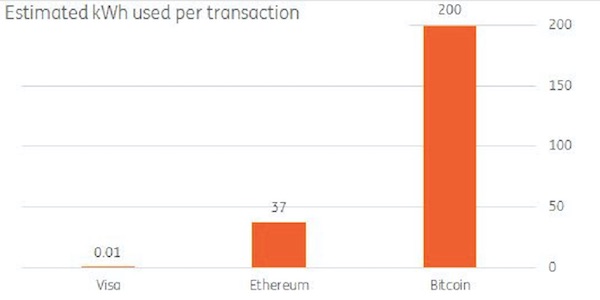

For those lying awake at night worried about health care, the economy, and an overall feeling of divide between you and your neighbors, there’s at least one source of comfort: Your neighbors might very well be lying awake, too. Almost two-thirds of Americans, or 63%, report being stressed about the future of the nation, according to the American Psychological Association’s Eleventh Stress in America survey, conducted in August and released on Wednesday. This worry about the fate of the union tops longstanding stressors such as money (62%) and work (61%) and also cuts across political proclivities. However, a significantly larger proportion of Democrats (73%) reported feeling stress than independents (59%) and Republicans (56%).

The “current social divisiveness” in America was reported by 59% of those surveyed as a cause of their own malaise. When the APA surveyed Americans a year ago, 52% said they were stressed by the presidential campaign. Since then, anxieties have only grown. A majority of the more than 3,400 Americans polled, 59%, said “they consider this to to be the lowest point in our nation’s history that they can remember.” That sentiment spanned generations, including those that lived through World War II, the Vietnam War, and the terrorist attacks of Sept. 11. (Some 30% of people polled cited terrorism as a source of concern, a number that’s likely to rise given the alleged terrorist attack in New York City on Tuesday.)

“We have a picture that says people are concerned,” said Arthur Evans, APA’s chief executive officer. “Any one data point may not not be so important, but taken together, it starts to paint a picture.” The survey didn’t ask respondents specifically about the administration of President Donald Trump, Evans said. He points to the “acrimony in the public discourse” and “the general feeling that we are divided as a country” as being more important than any particular person or political party. [..] And keeping up with the latest developments is a source of worry all its own. Most Americans—56%—said they want to stay informed, but the news causes them stress. (Yet even more, 72%, said “the media blows things out of proportion.”)

Who brought in Baby George? Haven’t seen anyone dig into his contacts. His story doesn’t seem to add up. Been pushing Russia on Trump far too much. A Trojan Horse?

• Mueller Mugs America: The Case Of Baby George Papadopoulos (Stockman)

This is how the Deep State crushes disobedience by the unwashed American public. It indicts not only ham sandwiches but, apparently, political infants in diapers too, if that’s what it takes. Hence the sudden notoriety of Baby George Papadopoulos, who pled guilty to “lying” about an essentially immaterial date to the FBI. Oh, and by all signs and signals that plea came after this 30 year-old novice had been wearing a wire for several months. So here’s how this noxious act of bullying by Robert Mueller’s Federally-deputized thugs came down. It seems that during the early months of 2016, when Trump was winning primary after primary against all mainstream media expectations, the Donald’s establishment betters began attacking his foreign policy credentials with special malice aforethought.

That was mainly owing to his sensible suggestion that it would be better to seek rapprochement with Russia rather than pursue Hillary’s Cold War 2.0 and that 25 years after the disappearance of the Soviet Union from the pages of history that NATO was obsolete. Since this totally plausible (and correct) viewpoint was deeply offensive to the Imperial City’s group think and threatened the Warfare State’s existential need for a fearsome enemy, Trump’s ruminations about making a deal with Putin were belittled. They were, in fact, attributed not to a fresh look at the realities abroad or the possibility that homeland security does not require a global empire, but to the candidate’s lack of any pedigreed foreign policy advisors. Indeed, when it came to the Republican-oriented foreign policy establishment-nearly all of which had joined the Never Trump cause-the Donald added insult to injury.

That is, by suggesting he got his foreign policy views watching TV (like most of Washington) and that he could do a better job against terrorism than the Pentagon generals (not hard). At length, however, the “who are your foreign policy advisors” meme got so relentless that the Donald relented. On March 21, 2016 he announced a group of five advisors that exactly no one who was anyone in the Imperial City had ever heard of, and for good reason. Trump apparently rarely even met with the Five and no one running the campaign paid much attention to them. Still, Baby George’s carelessness about the exact dates and sequences of utterly irrelevant and inconsequential events is enough to get him time in one of Uncle Sam’s hospitality suites.

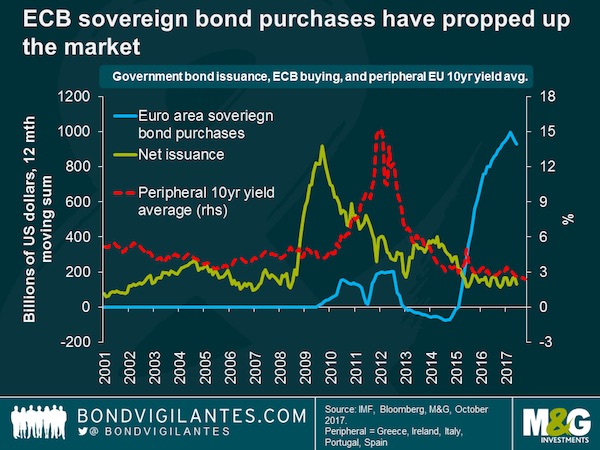

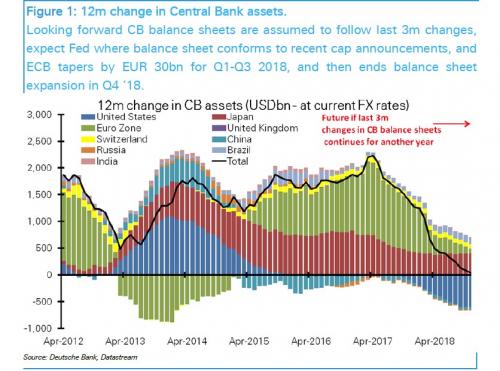

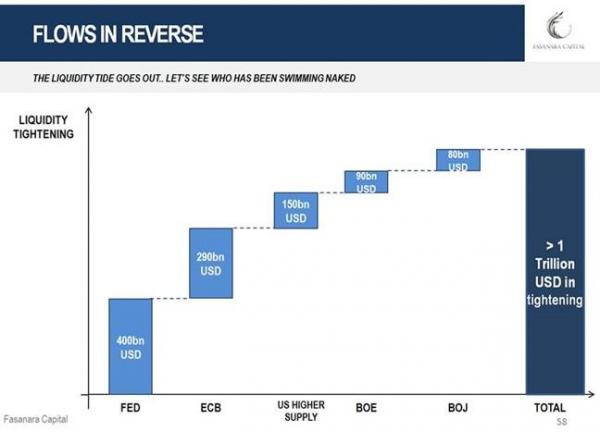

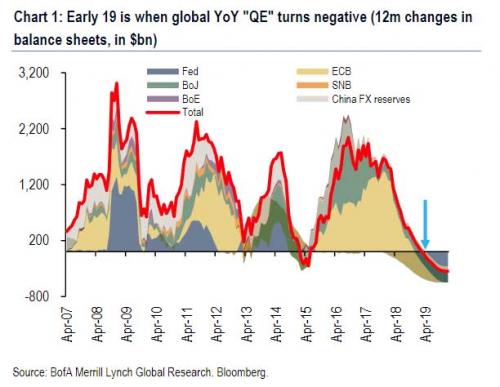

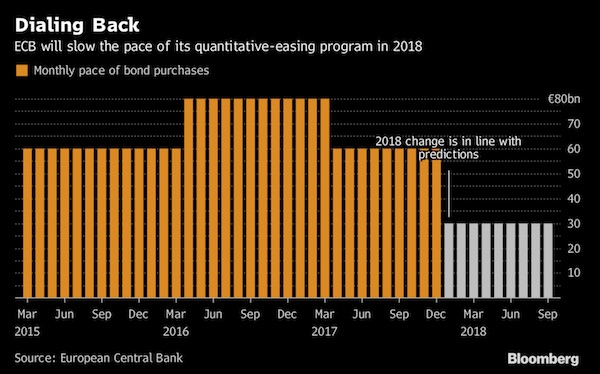

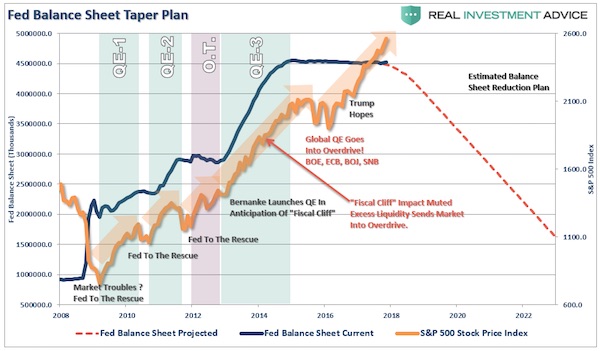

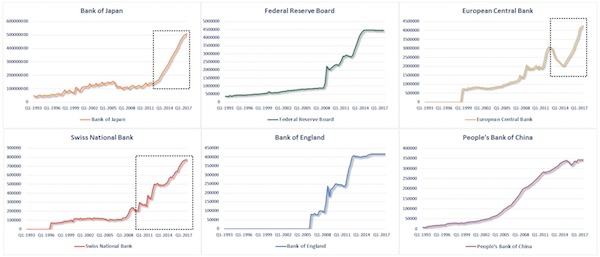

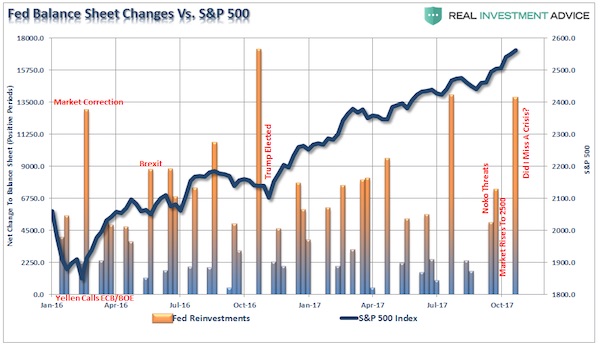

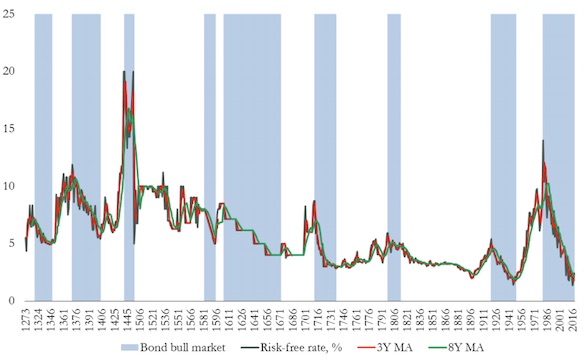

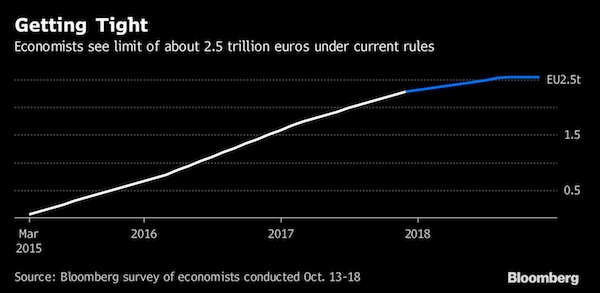

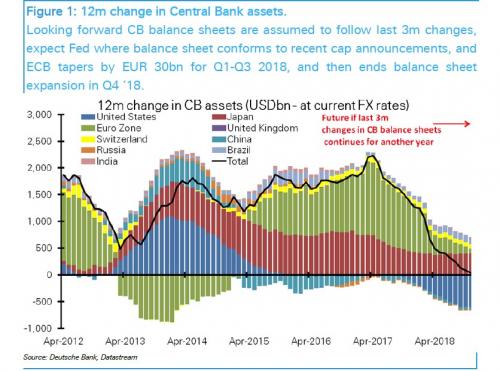

“..ECB QE is currently 7 times bigger than net issuance. So is it any wonder why yields have fallen, and what happens when the ECB tries to turn off the easy money tap?”

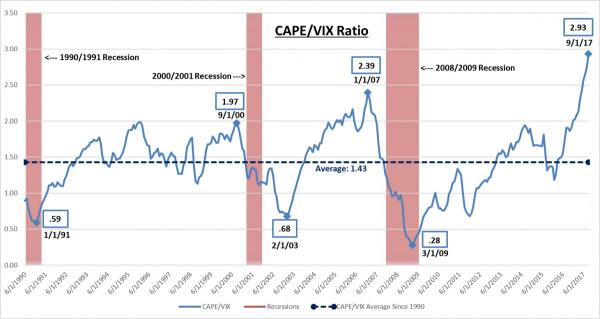

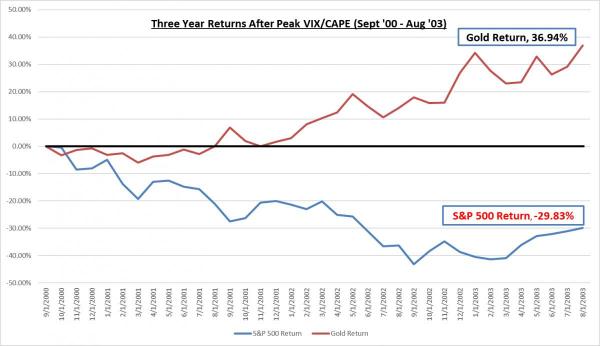

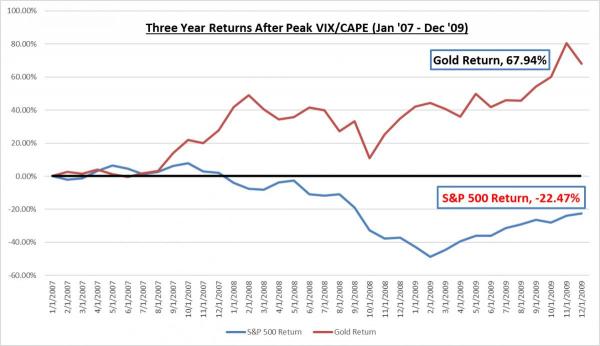

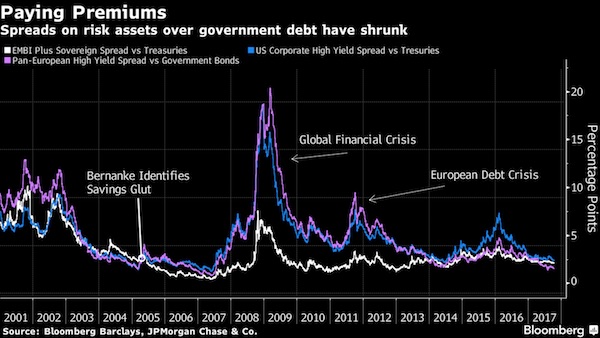

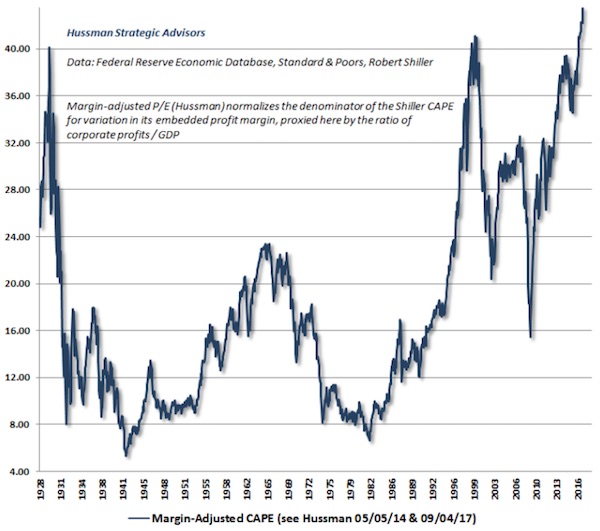

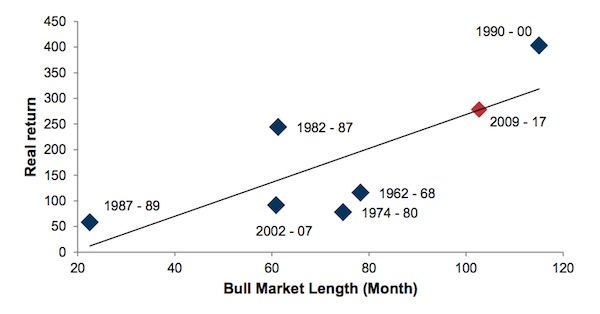

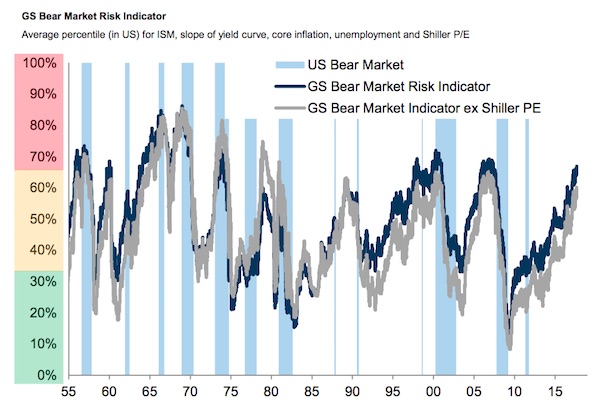

• Some Of The Scariest Charts In Finance To Celebrate Halloween (BV)

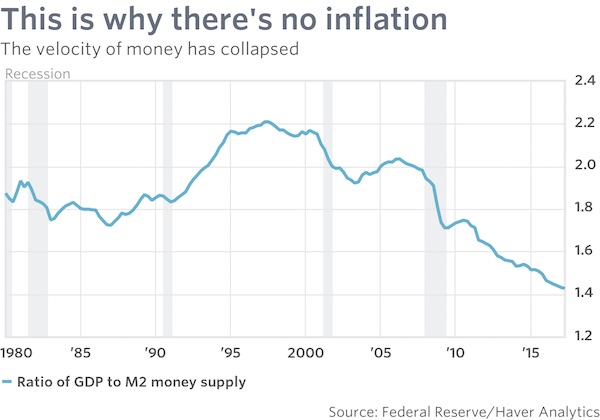

Investment markets have been remarkably resilient over the course of 2017. Sure, the geopolitical environment has thrown up a few frightening days which saw markets sell-off but on the whole volatility has been muted and most asset classes have generated solid total returns. That said, any horror movie fan will tell you that the scariest part of a horror film happens when things are relatively calm. With that in mind, here are a few charts that shine a light on a number of threats that are lurking just below the surface of the global economy.

ECB quantitative easing has propped up government bond markets

The strength of the European economy, and signs of labour market healing across the euro area, has been the surprise story of 2017. It is undeniable that the ECB, and its quantitative easing programme, has played a huge part in the economic success seen to date. Many point to the fall in yields on peripheral area debt as a sign that the euro sovereign debt crisis is well and truly over. The question is, do falling yields signify increasing confidence in the ability of euro area nations to repay their debt, or do they simply reflect the asset purchases that the ECB has conducted since the QE programme started? The above chart, published in the most recent IMF Global Financial Stability Report, shows that official purchases of euro area debt has eclipsed net issuance since May 2015. Indeed, ECB QE is currently 7 times bigger than net issuance. So is it any wonder why yields have fallen, and what happens when the ECB tries to turn off the easy money tap?

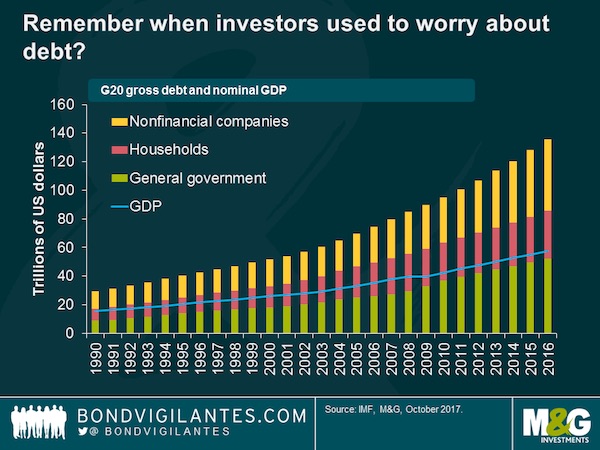

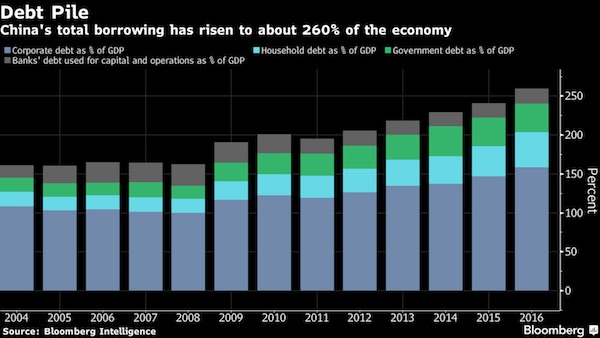

Debt is a beast that cannot be tamed

The EU forces food transports across the Union. Damn transport costs, including pollution. The result: “the system is very fragile”. Don’t depend for your essentials on people living 1000 miles away. It’s not that hard.

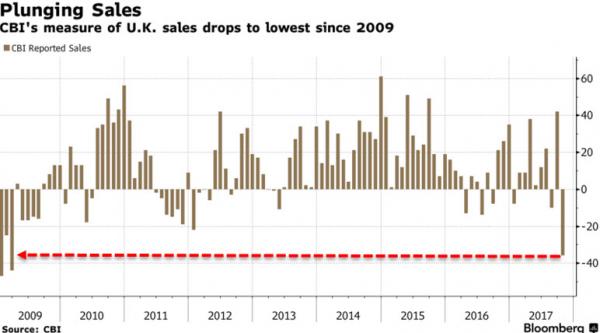

• Most Of UK Fruit And Veg Is From Other EU Nations, Brexit To Be Dramatic (G.)

The UK faces serious health implications if the government fails to agree a Brexit deal, finds a report that says of 35 portions of fruit and vegetables, a figure relating to the five-a-day recommendation for individuals, just one “portion” is grown in the UK and picked by British or non-EU workers. The report, to mark the launch of a new RSA commission examining the impact of Brexit on food and farming, found that the five-a-day health target – which adds up to the 35 portions of fruit and vegetables a week – was overwhelmingly met by food grown in the EU or harvested by EU workers in the UK. Sue Pritchard, director of the RSA Food, Farming and Countryside Commission, said Brexit offered a great opportunity to reshape farming and food, but warned that no deal over the exit from the union would have a dramatic and immediate effect.

“What would be available on the shelves would change dramatically. There will be delays at ports and all along the food supply system – the impact will be felt very, very quickly,” she said. The study found that of the average 28 portions consumed by Britons of the recommended weekly intake of 35 portions of fruit and vegetables, the equivalent of 11 portions came from the EU, seven from the rest of the world and nine arose from the UK and were harvested by workers from other EU countries. The equivalent of just one portion was grown in the UK and harvested by British or non-EU workers. Pritchard added: “If there is no deal the system is very fragile and the impact in the UK food supply is likely to be dramatic.” The majority of farmers backed Brexit, but the National Farmers’ Union has since suggested that crops will “rot in the fields” and that Britain will be unable to produce the food if the government cannot secure a deal that allows tens of thousands of EU workers to continue to work on UK farms.

Fitting. The entire country is back in Victorian times.

• Corbyn Has a Plan to Get May’s Tories to Give Up 58 Brexit Secrets (BBG)

The main U.K. opposition party wants to deploy a parliamentary tool hardly used since the 19th century to get Theresa May’s Conservatives to spill Brexit secrets. The political prize? The release of 58 studies on how leaving the European Union will affect industries that make up 88 percent of the economy. Brexit Secretary David Davis said he didn’t want to publish the studies because it would compromise the U.K.’s negotiating position. On Monday, he listed the sectors in a letter but stopped short of revealing more. Jeremy Corbyn’s Labour wants to use an obscure legislative device to force the hand of Tories, who have been coy about what the economic fallout might be when the country leaves the 28-nation bloc.

On Wednesday, Labour will argue that lawmakers should have the right to see the studies, and will ask Parliament to vote to make “an humble address” to Queen Elizabeth II, asking her to order her ministers to release the assessments to the House of Commons Brexit Committee. This means-to-an-end hasn’t been used much since Victorian times. “Ministers cannot keep withholding vital information from Parliament about the impact of Brexit on jobs and the economy,” Labour Brexit spokesman Keir Starmer said in an emailed statement.

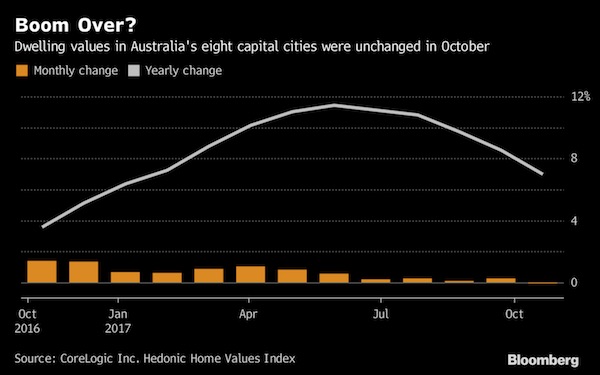

Panic in Canberra.

• Australia’s Housing Boom Is ‘Officially Over’ – UBS (BBG)

The housing boom that has seen Australian home prices more than double since the turn of the century is “officially over,” after data showed prices now flatlining, UBS said. National house prices were unchanged in October from September, while annual growth has slowed to 7% from more than 10% as recently as July, CoreLogic data released Wednesday showed. “There is now a persistent and sharp slowdown unfolding,” UBS economists led by George Tharenou said in a report. “This suggests a tightening of financial conditions is unfolding, which we expect to weigh on consumption growth via a fading household-wealth effect.”

An end to Australia’s property boom will be welcome news for first-time buyers, who have struggled to break into the market after surging prices propelled Sydney past London and New York to be the second-most expensive housing market. Less impressed may be property investors, already squeezed by regulatory lending curbs that drove up mortgage rates. The cooling housing market may encourage the Reserve Bank to keep interest rates at a record low. A rate hike would be undesirable as it would put further downward pressure on dwelling prices, said Diana Mousina, senior economist at AMP Capital Investors.

Once they start locking up people, will Catalans still be non-violent?

• Government Raids On Catalonia Police Spark Fears Of Wider Crackdown (Ind.)

The acrimony and recriminations which followed Catalonia’s declaration of independence shows little sign of defusing following the fleeing of president Carles Puigdemont to Brussels. Spain’s civil guard raided the headquarters of the regional police, Mossos d’Esquadra, today drawing accusations of starting a crackdown. Computers and documents were taken away from the building in Sabadell as well as seven other offices. “We are carrying out inspections related to the Mossos d’Esquadra’s communications on the day of the illegal referendum,” said a civil guard spokesman. “This is something we are entitled to do.” The Mossos had been ordered by Madrid to stop the vote taking place, but they had refused, pointing out that this would have led to clashes with activists who had been protecting the polling stations. The national police, who were sent in, seized ballot boxes sparking violence.

The raids were viewed by some as the beginning of a punitive drive which will continue against separatists. As the news of the raids came in the afternoon, a group of activists approached police in Plaza de Colon in Barcelona city centre, the scene of huge demonstrations in recent weeks, offering sympathy and solidarity. The officers, whose chief Josep Lluis Trapero was sacked by Madrid at the weekend, were cautious in their response. “We are waiting to hear more details,” said one. “We don’t know any more than you do.” For Adreia Carbonell, a 23-year-old student and supporter of independence, the civil guard action was an ominous pointer for the future. “It is a form of counter-revolution,” she said. “The Spanish can now do what they like. There will be more raids, more arrests soon, you will see. They are intimidating our police who protect us and of course our government has gone.”

Double-sided. He’s gotten much weaker by leaving. But probably avoided a long jail term.

• Puigdemont Says Can’t Return To Catalonia, Spain Intent On ‘Vengeance’ (Ind.)

Hot, last-minute and chaotic, ousted Catalan leader Carles Puigdemont’s first press conference since fleeing Barcelona for Brussels was a fitting tribute to the political crisis that has gripped Spain. Amid speculation that he and members of his former cabinet would seek political asylum, fuelled by the comments of a Belgian minister, the disputed Catalan president instead recommitted himself to the independence cause. It is believed that Mr Puigdemont and his colleagues drove across the border into France before flying to Brussels on Monday, after Spain took over control of the Catalan region’s government and agencies. Mr Puigdemont said he could not return to Spain unless given clear assurances that he will be protected, accusing Madrid of being intent on “vengeance”.

He and his colleagues would stay in Belgium as long as their safety was not assured in Spain and would “continue our work despite the limits imposed on us.” Insisting he remained the rightful leader of Catalonia, Mr Puigdemont said his centre-right PDeCAT party would nonetheless accept the challenge of regional elections called for 21 December “with all our strength” and vowed that Catalan separatists would come out to vote. Spain wants Catalonia “to abandon our political project, and they won’t achieve it,” he said. As the news emerged on Monday that Mr Puigdemont’s contingent had fled the country, there was a distinct sense of deflation among those of his allies who remained in Barcelona to carry out a planned campaign of civil disobedience.

And as he entered the building in Brussels, he walked past protesters holding Spanish national flags and a sign that read “Estado de Derecho” – “Rule Of Law”. Other anti-independence demonstrators waving Catalan and Spanish flags chanted “viva Espana, viva Cataluña!” amid a heavy presence from Belgian police.

Horses and barns.

• New Jersey Sues OxyContin Maker, Links Marketing To Opioid Crisis (R.)

New Jersey on Tuesday sued Purdue Pharma LP, accusing the maker of the chronic pain medication OxyContin of fueling the state’s opioid crisis through deceptive marketing to doctors and patients, including the elderly and the “opioid-naive.” The state’s attorney general, Christopher Porrino, faulted what he called Purdue’s “almost inconceivable callousness and irresponsibility” in a decade-long campaign of downplaying the risks and exaggerating the benefits of opioids in the pursuit of profit. “We vigorously deny these allegations and look forward to the opportunity to present our defense,” Purdue said in a statement. “We are deeply troubled by the opioid crisis and we are dedicated to being part of the solution.” At least 11 U.S. states have sued Purdue over opioids, including a complaint filed by Alaska on Monday.

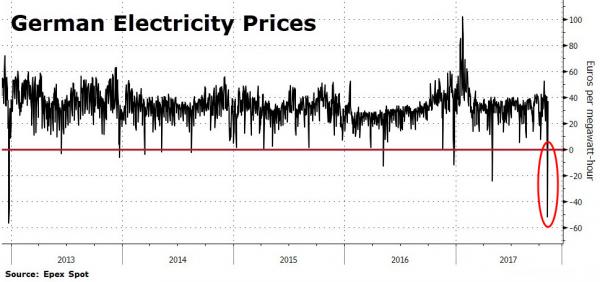

The grid’s a harsh mistress.

• Germany Forced To Pay Consumers To Use More Electricity

A stormy weekend led to free electricity in Germany, as Bloomberg reports wind generation reached a record, forcing power producers to pay customers the most since Christmas 2012 to use electricity. Power prices turned negative as wind output reached 39,409 megawatts on Saturday, equivalent to the output of about 40 nuclear reactors. To keep the grid supply and demand in balance, negative prices encourage producers to either shut power stations or else pay consumers to take the extra electricity off the network.

We get the intent, but what does this solve?

• Greece Plans An Unprecedented €30 Billion Debt Swap (BBG)

The Greek government is planning an unprecedented debt swap worth 29.7 billion euros ($34.5 billion) aimed at boosting the liquidity of its paper and easing the sale of new bonds in the future. Under a project that could be launched in mid November, the government plans to swap 20 bonds issued after a restructuring of Greek debt held by private investors in 2012 with as many as five new fixed-coupon bonds, according to two senior bankers with knowledge of the swap plan. The bank officials requested anonymity as the plan has yet to be made public. The maturities of the new bonds may be the same as for the existing notes, which range from 2023 to 2042. “The move aims to address the current illiquidity of the Greek bond market, ” according to analysts at Pantelakis Securities SA in Athens.

It will also “establish a decent yield curve, thus facilitating the country’s return to public debt markets.” The move comes as Greece prepares for life after the end of its current bailout program in August 2018. The debt swap is a step toward the country’s full return to markets required to avoid a new bailout program. The government plans to tap the bond market in 2018 to raise at least 6 billion euros to create an adequate buffer to honor debt obligations, according to a government official. The government has yet to decide on the exact timing of the swap, the Greek official said on condition of anonymity. One of the bank officials said that transaction could start on Nov. 13 and the settlement could happen a week later. The goal is to conclude the swap before the next mission of the country’s creditors, which is scheduled for the last week of November.

Maybe SYRIZA is the only force that can stop this.

• Greek PM Under Fire Over Migrants, Refugees (K.)

Prime Minister Alexis Tsipras and his migration minister came under a hail of fire Monday from a radical faction within SYRIZA over the plight of the thousands of refugees and migrants stranded in Greece. The criticism was launched during a meeting of the party’s political secretariat at which Tsipras had hoped to showcase his government’s success in steering the country toward a post-bailout era. But instead, the government and Migration Policy Minister Yiannis Mouzalas were slammed by members of the political secretariat that represent the Group of 53 faction – seen as a custodian of party purity – within SYRIZA, over the consistent violation of migrants and refugees’ human rights. More specifically, they blamed the leftist-led coalition government and Mouzalas for delays in providing migrants and refugees with appropriate accommodation as winter approaches.

Moreover, they slammed Tsipras for failing to absorb funds from the European Union and other international organizations intended to aid migrants and refugees. The government was also chided by the Group of 53 for giving its full support to last year’s agreement between the European Union and Turkey to stem the flow of migrants into Europe, while EU countries were not doing the same. “If you think I’m doing everything wrong, then I’ll resign,” Mouzalas told his critics at the meeting. However, members of the faction shot back, calling Mouzalas a hypocrite as they said he is planning to leave the ministry anyway as his name has been put forward for a seat on the Council of Europe.

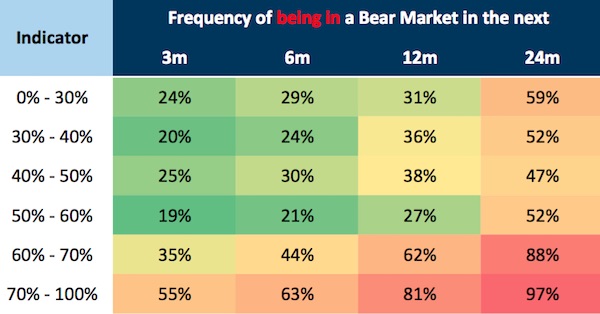

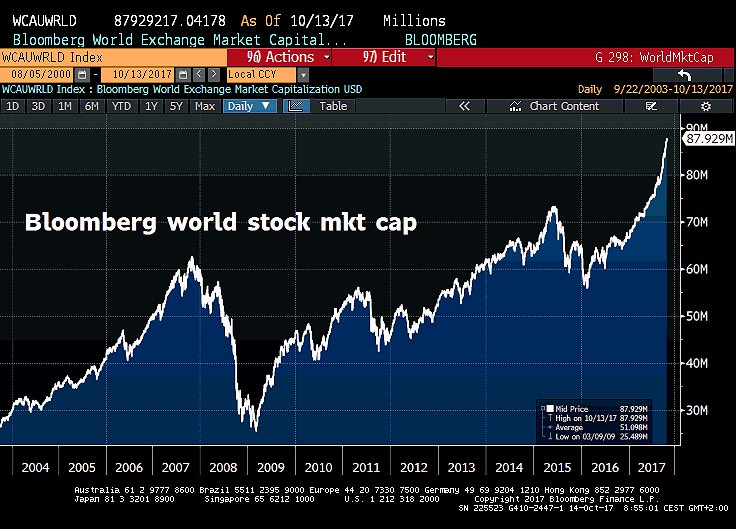

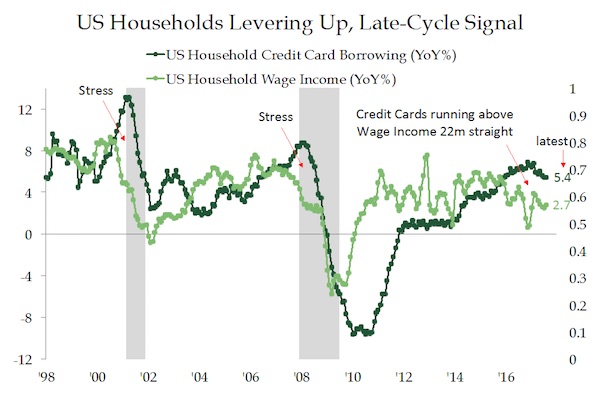

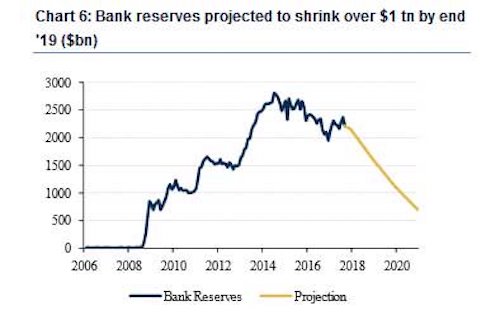

Historically, when the indicator is at 67%, there is an 88% chance of stocks falling into a bear market in two years’ time, the Goldman analysts say:

Historically, when the indicator is at 67%, there is an 88% chance of stocks falling into a bear market in two years’ time, the Goldman analysts say: