Edwin Rosskam Store in alley-dwelling section of Washington, DC 1941

No domestic consumers, no foreign clients. But a truckload of debt going forward.

• China’s Growth Story… Don’t Look For A Happy Ending! (Hamilton)

Many economists suggest China is on the cusp of significant growth in domestic consumer demand. That this rising domestic demand coupled with continued growth as the global exporter will push the global economy further. However, I’ll briefly show why neither of these outcomes is remotely likely.

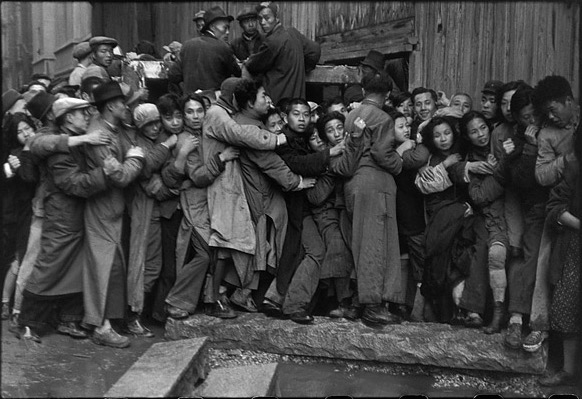

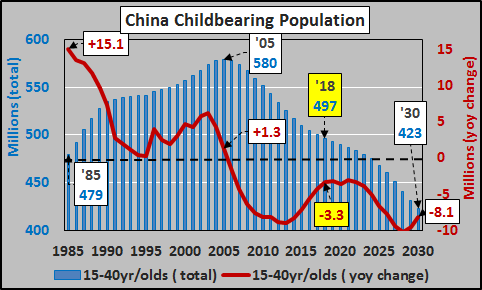

Problem #1- China as Consumer: According to the UN data, China’s 15-40yr/old childbearing population peaked in 2005 and has been rapidly shrinking since. Since ’05, China’s population capable of producing more Chinese has fallen by 83 million persons or a 14.3% decline. By 2030, China’s childbearing population will have declined by 157 million or a 27% reduction of those capable of childbirth (no estimate here…this is simply moving the existing population forward in adulthood). Couple a massive decline in the childbearing population and the ongoing negative birthrate and serious depopulation (particularly among the rural regions) is not only possible but growing more likely. Minor increases in wages will be no match for the massive declines in the consumer base. The chart below shows China’s total 15 to 40 year old population (in blue) and the annual change (in red).

Problem #2- China as Exporter:

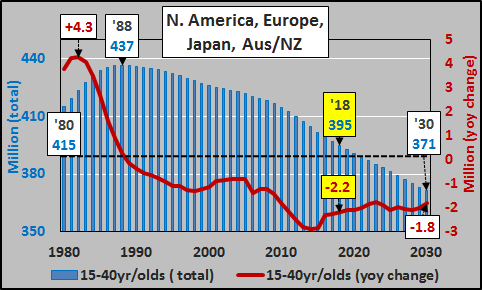

Who will China continue to export to? The primary importers of China’s goods are N. America (US/Canada), Europe (including Russia and Eastern Europe), Australia/New Zealand. These nations represent roughly one seventh of the world’s population but consume over half of all the worlds oil production. But here again I have the same problem; combined childbearing population peaked in 1988 and has been declining since. The population capable of childbirth has fallen over 40 million or nearly 10% since the ’88 peak. By 2030, despite many of these nations allowing, promoting, and/or enduring large immigrations of precisely this age of migrants, the population is anticipated to be 60 million fewer than during the peak, or a 15% fall from peak. The basis of present and future demand growth simply is non-existent.

Illiquidity.

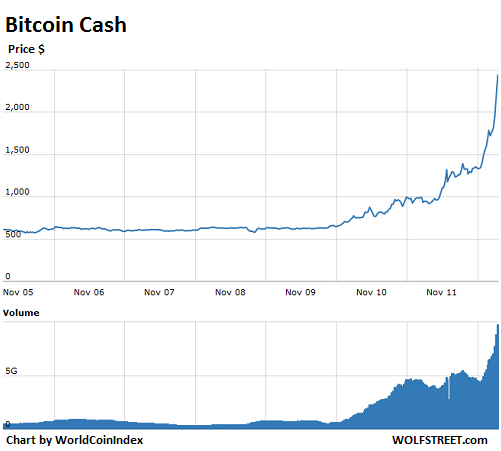

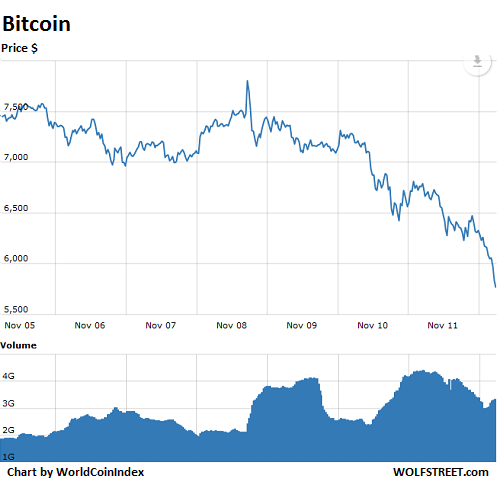

• One Of The Co-Founders Of Bitcoin.com Has Sold All Of His Bitcoin (BI)

Bitcoin.com is one of the world’s largest bitcoin sites, having grown its profile thanks to the insane price surge of the cryptocurrency this year. But its co-founder and CTO, Emil Oldenburg, a Swedish native, is extremely skeptical of bitcoin’s future. “I would say an investment in bitcoin is right now the riskiest investment you can make. There’s an extremely high risk,” he says in an interview with Swedish tech site Breakit. “I have in fact sold all my bitcoins recently and switched to bitcoin cash,” says Oldenburg, referring to the problems with bitcoin’s high transaction costs and lead times. Indeed, by some counts, bitcoin transaction fees are doubling every three months, and it now takes on average 4.5 hours to confirm a bitcoin transaction. Ars Technica reported that fees reached $US26 ($34) per trade recently. Bitcoin.com operates in everything that has to do with bitcoins.

Today, the site – based out of Tokyo but registered on St Kitts – has tens of millions of unique monthly visitors, according to Similarweb, a web analytics site. The company’s biggest single revenue stream is its so called bitcoin “mining pool”, where it forges new units of the cryptocurrency that are released on the market. Oldenburg doesn’t want to disclose any revenue numbers, more than revealing “it’s an awfully lot of money”, he says to Breakit. Even on a personal level. “All my salary in the past three years has come in bitcoin,” just as those of his 60 colleagues in Tokyo, Oldenburg says. But according to the Swedish bitcoin expert, it’s time to change to bitcoin cash. There’s a big reason for that switch, and it’s all about the market liquidity — or lack thereof — of bitcoin.

The reason why people haven’t understood the risks inherent in owning bitcoins, according to Oldenburg, is simply because most have so far only bought the cryptocurrency — but never sold or traded with them. “As soon as people realise that this is how it works, they will start to sell,” he tells Breakit. “The old bitcoin network is as good as unusable.” While buying, selling or trading in bitcoins is not an issue today, according to Oldenburg, the problems surface when bitcoin transactions are recorded on the blockchain, the digital ledger that records each transaction. The problem centres on the limited amount of transactions per second you can make in the bitcoin network, which in turn depends on the formation of the memory “block size” that store the transactions. This, according to Oldenburg, makes for a very illiquid and unusable cryptocurrency.

[..] In what may be considered somewhat ironic, Oldenburg says bitcoin.com is distancing itself from bitcoin and has even stopped developing services for it — to mostly focus on bitcoin cash, the currency that split from bitcoin back in August, and recently overtook Ethereum as the world’s second-largest cryptocurrency. “It only costs $0.012 (10 Swedish “öre”, the centesimal subdivision of krona) to send a [Bitcoin Cash transaction] and there are no lead times. The only drawback is that you need larger hard drives, but that’s not a problem for most people,” Oldenburg says to Breakit.

One tiny problem: how can you regulate something you don’t understand: “I don’t like it,” Le Maire said of bitcoin. [..] we need to look at it, study it,” he said.

• Germany Backs French-Led Push for Global Bitcoin Regulation (BBG)

Germany joined European governments pushing for global bitcoin regulation amid mounting alarm that the world’s most popular digital currency is being used by money-launderers, drug traffickers and terrorists. Germany’s Finance Ministry said it welcomed a proposal by French Finance Minister Bruno Le Maire to ask his counterparts in the Group of 20 to consider joint regulation of bitcoin. The concerns are shared by the Italian government, which is also open to discussing regulation, while the European Union is bringing in rules backed by the U.K. that would apply to bitcoin. “It makes sense to discuss the speculative risks of virtual currencies and their impact on the financial system at international level,” the Finance Ministry in Berlin said in an email. The next meeting of G-20 finance ministers and central bank governors would be “a good opportunity to do so.”

Signs of growing European concern came as bitcoin took another step toward acceptability with the launch of futures trading Sunday night at CME’s venue. That’s a week after Chicago rival Cboe Global Markets introduced similar derivatives on the volatile cryptocurrency that was created in the wake of the 2008 financial crisis as an alternative to banks and government-issued currencies. Bitcoin was closing in on a fresh record of $20,000 on Monday. The Finance Ministry in Germany, Europe’s biggest economy, “monitors developments in the financial market very closely,” it said. “This also applies to the current development of bitcoin.” While Europe’s concerns have been voiced before in select forums about a currency which is stepping further into the mainstream financial world, Le Maire made those worries public in a weekend interview. “I don’t like it,” Le Maire said of bitcoin. “It can hide activities such as drug trafficking and terrorism,” and he has concerns for savers. “There is an obvious speculative risk, we need to look at it, study it,” he said.

You can’t forever hide behind the word ‘tech’. Or every company can do it.

• The EU’s Top Court Will Decide Whether Or Not Uber Is A Taxi Company (BBG)

Uber Technologies is set to reach the end of the road in a legal battle over a question that’s reached the European Union’s top court – is the world’s most valuable startup a taxi company or not? Uber has argued that it’s a technology platform connecting passengers with independent drivers, not a transportation company subject to the same rules as taxi services. The decision is being closely watched by the technology industry because it could set a precedent for how other companies in the burgeoning gig economy are regulated across the 28-nation bloc. “The judgment will either promote the digital single market or lead to more market fragmentation for online innovators,” said Jakob Kucharczyk, of the Computer & Communications Industry Association, which speaks for companies like Uber, Amazon.com, Google and Facebook. “The court should make a clear distinction between the online intermediation and the underlying service it facilitates.”

The case centers around UberPop, an inexpensive ride-hailing service Uber launched in several European cities that allowed drivers without a taxi license to use their own cars to pick up passengers. Legal challenges have forced Uber to shutter its UberPop services in most major European companies in favor of UberX, which requires drivers to get a license. A loss for Uber would mean countries in the EU will have to classify Uber as a transportation service. While Uber adheres to many taxi laws in countries where it operates, the case could lead to new regulations and fees. “Any ruling will not change things in most EU countries where we already operate under transportation law,” Uber said in a statement. “However, millions of Europeans are still prevented from using apps like ours. As our new CEO has said, it is appropriate to regulate services such as Uber. We want to partner with cities to ensure everyone can get a reliable ride at the tap of a button.”

The question of whether Uber is a transport service has long vexed regulators and lawmakers across Europe. Uber has faced roadblocks, real and regulatory, across Europe, amid complaints brought by taxi drivers who say the company tries to unfairly avoid regulations that bind established competitors. Without the pressure from regulators, companies in the gig economy will force other businesses to employ similarly aggressive business practices, said Andrew Taylor, who earlier this year was commissioned by U.K. Prime Minister Theresa May to come up with recommendations to regulate the gig economy. “There’s a danger of a race to the bottom,” said Taylor. “Major American companies are treating national norms, culture, regulators and tax systems in a cavalier way.”

What’s going to be left of Britain without the City?

• UK Cannot Have A Special Brexit Deal For The City – EU (G.)

Britain cannot have a special deal for the City of London, the European Union’s chief Brexit negotiator has told the Guardian, dealing a blow to Theresa May’s hopes of securing a bespoke trade agreement with the bloc. Michel Barnier said it was unavoidable that British banks and financial firms would lose the passports that allow them to trade freely in the EU, as a result of any decision to quit the single market. “There is no place [for financial services]. There is not a single trade agreement that is open to financial services. It doesn’t exist.” He said the outcome was a consequence of “the red lines that the British have chosen themselves. In leaving the single market, they lose the financial services passport.”

The stark declaration quashes the hopes of the Brexit secretary, David Davis, for a unique trade deal that would include financial services. The Brexit secretary has called for a “Canada plus plus plus” deal with the EU, a reference to the free trade agreement struck between Ottawa and Brussels in 2016, but with the crucial addition of financial services. In an exclusive interview with European newspapers, including the Guardian, Barnier gave examples of his own three pluses – judicial cooperation, defence and security and aviation.

The negotiator also said: • A trade deal could be agreed within a two-year transition period, but would have to be ratified by more than 35 national and regional parliaments. • The UK could not stop Brexit unilaterally, arguing that overturning the decision to leave would require the consent of 27 EU member states – a view at odds with one of the authors of article 50, Lord Kerr. • The UK must follow all rules and regulations of the EU during the transition period, including new laws passed after the UK has left. • The UK could negotiate trade agreements with the rest of the world during the transition, but they could not come into force. • He would not confirm British estimates that the final Brexit bill – the UK’s outstanding obligations to the EU – would be no more than €45bn (£39bn).

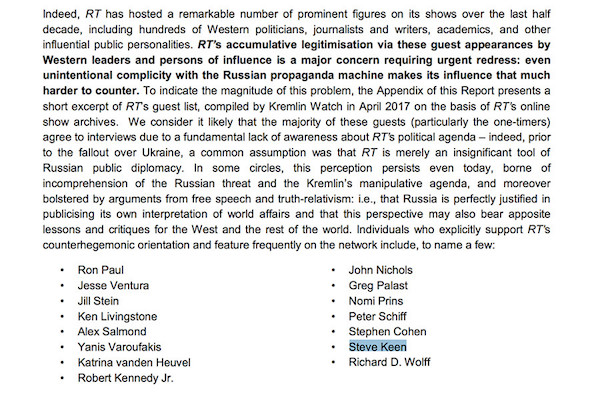

Boy, what a failure Russiagate has been. How do you recover from that?

• Bad Moon: (Trouble) Rising (Crooke)

President Obama lay very much in the globalist ‘struggle for a democratic-liberal world’ mould, (though he did try to make the ‘ruling interests’ understand that there were limits: that there had to be boundaries to US commitments). In other words, Obama accepted the globalist premise, though he tried to mitigate some of its military impulses. Notably however, he acquiesced to re-heating the Russia ‘threat’ (after Medvedev gave place to Mr Putin (thus ending Obama’s hope to seduce Russia into the embrace of the global economic order). But then Donald Trump, elected President by his deplorables’ base, made clear that he wished for détente with Russia, and even disdained the claims made on ordinary Americans by the maintenance of America’s unipolar global ‘order’.

For this heresy, he has been punished by the manufactured ‘Russiagate’ non-scandal. “Can a president, concerned that he might be removed from office by a special prosecutor or possibly assassinated, resist the march toward war?” – asks Paul Craig Roberts, who asserts that the President has been effectively caged, by a trifecta of Establishment generals, on the one hand; and by a Goldman Sachs posse, on the other. That the ‘ruling interests’ have managed substantially to contain President Trump is undeniable, but what is new, and perhaps – or perhaps, not – alters the calculus, is that these ‘ruling interests’ have had to come out from the shadows into the open.

The former Acting Director of the CIA, Mike Morrell, an early voice peddling the Russian collusion meme now publicly admits in a surprisingly frank interview with Politico, his leading role in the intelligence community waging political war against President Trump, describing his actions as something he didn’t “fully think through”, adding that maybe it wasn’t such a great idea to leak against, and bash a new president: “There was a significant downside”, Morrell acknowledges. Just to recall: Not only had Morell in an early NY Times op-ed piece asserted that he was committed to doing “everything I can to ensure that she [Hillary Clinton] is elected as our 45th president”, but he went so far as to call then candidate Trump “a threat to our national security”, while making the extraordinary claim that “in the intelligence business, we would say that Mr. Putin had recruited Mr. Trump as an unwitting agent of the Russian Federation.”

A list of people who never worked an honest job.

• The RussiaGate Witch-Hunt -The Deep State’s “Insurance Policy” (Stockman)

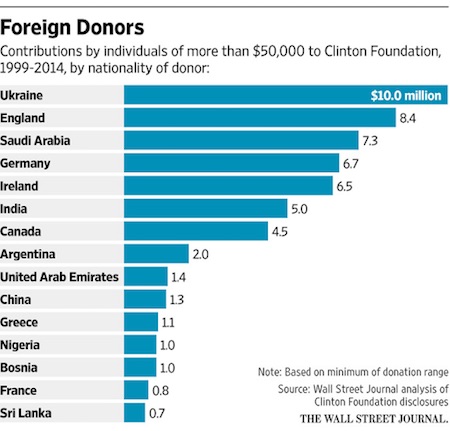

There was a sinister plot to meddle in the 2016 election, after all. But it was not orchestrated from the Kremlin; it was an entirely homegrown affair conducted from the inner sanctums – the White House, DOJ, the Hoover Building and Langley – of the Imperial City. Likewise, the perpetrators didn’t speak Russian or write in the Cyrillic script. In fact, they were lifetime beltway insiders occupying the highest positions of power in the US government. Here are the names and rank of the principal conspirators: John Brennan, CIA director; Susan Rice, National Security Advisor; Samantha Power, UN Ambassador; James Clapper, Director of National Intelligence; James Comey, FBI director; Andrew McCabe, Deputy FBI director; Sally Yates, deputy Attorney General, Bruce Ohr, associate deputy AG; Peter Strzok, deputy assistant director of FBI counterintelligence; Lisa Page, FBI lawyer; and countless other lessor and greater poobahs of Washington power, including President Obama himself.

To a person, the participants in this illicit cabal shared the core trait that made Obama such a blight on the nation’s well-being. To wit, he never held an honest job outside the halls of government in his entire adult life; and as a careerist agent of the state and practitioner of its purported goods works, he exuded a sanctimonious disdain for everyday citizens who make their living along the capitalist highways and by-ways of America. The above cast of election-meddlers, of course, comes from the same mold. If Wikipedia is roughly correct, just these 10 named perpetrators have punched in about 300 years of post-graduate employment – and 260 of those years (87%) were on government payrolls or government contractor jobs.

As to whether they shared Obama’s political class arrogance, Peter Strzok left nothing to the imagination in his now celebrated texts to his gal-pal, Lisa Page: “Just went to a southern Virginia Walmart. I could SMELL the Trump support……I LOATHE congress….And F Trump.” You really didn’t need the ALL CAPS to get the gist. In a word, the anti-Trump cabal is comprised of creatures of the state.

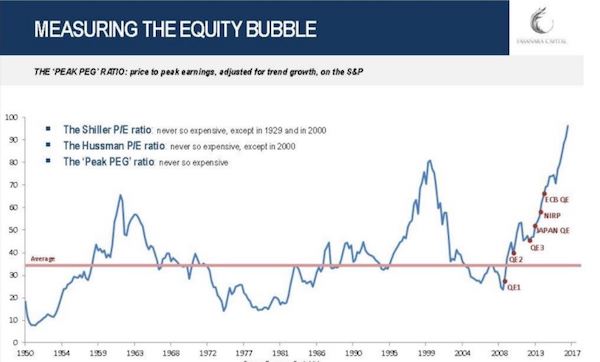

“..even hogs busy fattening up don’t have a clue about their imminent slaughter.”

• The Darkest Hours (Jim Kunstler)

The Tax “Reform” bill working its way painfully out the digestive system of congress like a sigmoid fistula, ought be re-named the US Asset-stripping Assistance Act of 2017, because that’s what is about to splatter the faces of the waiting public, most of whom won’t have a personal lobbyist / tax lawyer by their sides holding a protective tarpulin during the climactic colonic burst of legislation. Sssshhhh…. The media has not groked this, but the economy is actually collapsing, and the nova-like expansion of the stock markets is exactly the sort of action you might expect in a system getting ready to blow. Meanwhile, the more visible rise of the laughable scam known as crypto-currency, is like the plume of smoke coming out of Vesuvius around 79 AD — an amusing curiosity to the citizens of Pompeii below, going about their normal activities, eating pizza, buying slaves, making love — before hellfire rained down on them.

Whatever the corporate tax rate might be, it won’t be enough to rescue the Ponzi scheme that governing has become, with its implacable costs of empire. So the real aim here is to keep up appearances at all costs just a little while longer while the table scraps of a four-hundred-year-long New World banquet get tossed to the hogs of Wall Street and their accomplices. The catch is that even hogs busy fattening up don’t have a clue about their imminent slaughter. The centerpiece of the swindle, as usual, is control fraud on the grand scale. Control fraud is the mis-use of authority in applying Three-Card-Monte principles to financial accounting practice, so that a credulous, trustful public will be too bamboozled to see the money drain from their bank accounts and the ground shift under their feet until the moment of freefall.

Control fraud is at work in the corporate C-suites, of course, because that is its natural habitat — remember that silver-haired CEO swine from Wells Fargo who got off scot-free with a life-time supply of acorns after scamming his account-holders — but their errand boys and girls in congress have been superbly groomed, pampered, fed, and trained to break trail and cover for them. The country has gotten used to thinking that the game of pretend is exactly the same as what is actually going on in the world. The now-seminal phrase coined by Karl Rove, “we make our own reality,” is as comforting these days to Republicans from Idaho as it is to hairy, “intersectional” professors of post-structural gender studies in the bluest ivory towers of the Ivy League. Nobody in this Republic really wants to get his-hers-zhe’s-they’s reality on.

How can you have a fair election with so many people either in jail or in exile?

• As Catalan Vote Looms, Jailed Leader Offers Olive Branch To Spain (R.)

The jailed leader of Catalonia’s main pro-independence party has backed away from demands for unilateral secession from Spain, days before a regional election that polls suggest will produce a hung parliament. The independence drive has tipped Spain into its worst political crisis since the return of democracy in the 1970s, dividing opinion in the region, denting an economic rebound and prompting a business exodus to other parts of the country. In reply to written questions from Reuters passed to him in prison where he is being held on allegations of rebellion and sedition, Oriol Junqueras struck a conciliatory tone. He wrote that he would continue to pursue independence if he became Catalonia’s next president, but also “build bridges and shake hands” with representatives of the Spanish state.

“I can assure you that we are democrats before we are separatists and that the aim (of gaining independence) does not always justify the means,” he said in comments that appeared to drop his party’s earlier demand for unilateral secession. Junqueras’ Esquerra Republicana (Republican Left) party is tipped to become the largest separatist force in parliament in Thursday’s ballot, but surveys suggest neither the pro-independence nor the pro-unity camp will win a majority. He was deputy leader of the Catalan government that was sacked in October after the regional assembly unilaterally declared independence following a referendum that central authorities had deemed illegal. Madrid also dissolved the assembly and called fresh elections.

The Spanish justice system’s actions against the region’s leaders has since then hamstrung the pro-independence camp and further muddied the electoral waters before Thursday’s vote. Catalonia’s ex-president Carles Puigdemont is campaigning from self-imposed exile in Brussels and Junqueras doing so from jail along with several other politicians. It is unclear if many of those likely to be elected will be able to attend parliament.

The Russians did it.

• Germany’s Entire Submarine Fleet Is Paralyzed (ZH)

Throughout 2017, America’s control of NATO policymaking has become more evident than ever, with the sole objective of war-making against Russia. NATO and Russia continue to build up arms, equipment, and troops along the eastern region of Europe, but there is a new development that has NATO worried. Germany’s operational readiness of its entire submarine fleet is dead in the water. Yes, you heard that correctly, Germany’s prized submarines are currently on maintenance calls or in desperate need of repairs. On October 15, Germany lost the last of its submarines when the Type 212a vessel was performing a diving maneuver off the Norweigan coast when it suffered a catastrophic blow to one of its four fins after the submarine struck a boulder. The submarine was quickly rendered not operational and had to be towed back to the German port of Kiel for maintenance work.

In the latest operational summary provided by RT, there are six submarines in the German fleet and all are out of service. Two Type 212a vessels are undergoing scheduled maintenance, and will be redeployed in the second half of 2018, while another two are in a critical state for repairs, with no estimated time of completion. The fifth submarine, as we mentioned above, crashed in October. The sixth submarine was commissioned in October and is currently undergoing rigorous sea trials before it will become operational in May 2018. Germany’s submarine fleet will be paralyzed for the next 4-5 months, which presents an enormous national security risk for the country. The submarines’ most fundamental feature is stealth, coupled with defense capabilities and surveillance, but as mentioned above, there is currently a major gap in Germany’s military defense at the moment, which we hope is not exploited by an adversary.

The German parliament’s Defense Commissioner Hans-Peter Bartels told ARD, “this a real disaster for the navy and it’s the first time in history that none [of the U-boats] would be operational for months.” Bartels blamed the lack of spare parts for the broken submarines with the lack of government funding. Ever since the Cold War, German authorities have decided against stockpiling spare parts due to its high costs.

Without waste our economies collapse.

• We’re Buying More Stuff We Don’t Need (BBG)

Here’s a Grinchian question for the holidays: How much do Americans spend on stuff they don’t really need? A very rough analysis suggests they’re blowing more money on nonessential items than they have in more than 17 years. Back in the 1950s, the economist John Kenneth Galbraith made a bleak argument about modern capitalism: Advertising can create artificial wants – say, for the latest gadget or skin cream – that spur ever-greater consumption without actually making people better off. As a result, economies can grow without improving the lot of humanity. Whether or not he’s right – it remains a matter of debate – the idea raises an interesting empirical question: How much of what we consume is related to wants rather than needs?

This isn’t easy to answer using even the most detailed data on consumer spending, because many categories could go either way. A car, for example, could be pure transportation or a Ferrari. That said, a number of categories – such as gambling, hairdressers and recreational vehicles – are pretty clearly nonessential. Following them consistently over time can give at least a sense of trend. So how are we doing? In the third quarter of this year, nonessential items (of my own subjective selection 1) accounted for almost 18.5 percent of total U.S. consumer spending. That’s the highest share since June 2000. Here’s a chart:

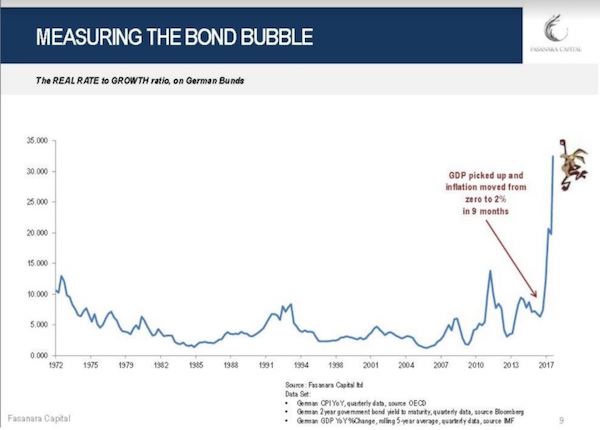

This is about liquidity, not about the refusal to include in the ECB bond purchases. But it’s equally unjustifiable politically as well as economically. The ECB should not be able to do these things under cover of darkness.

• ECB Sued Over Decision To Freeze Help To Greek Banks (R.)

Former Greek finance minister Yanis Varoufakis and a German parliamentarian are suing the ECB to gain access to a document underpinning the ECB’s decision to freeze vital funding to Greek banks in 2015. That move left Alexis Tsipras’ government with little choice but to shut down banks and impose capital controls, weakening his negotiating position with the country’s international lenders during bailout negotiations. Eventually, hard-liner Varoufakis resigned and Tsipras made a deal that gave Greece cash in return for austerity measures and reforms. Varoufakis and a German leftist parliamentarian, Fabio De Masi, are asking the EU’s top court to force the ECB to disclose a legal opinion that informed that decision, which they say might be unlawful.

“By restricting liquidity to the Greek banking sector to force cuts in pensions, tax increases and fire-sale privatizations, the ECB overstepped its mandate,” De Masi said. After their request was rejected by the ECB, Varoufakis and De Masi are turning to the General Court of the European Union to obtain the document. An ECB spokesman said the legal opinion preceded the decision to withhold funding by at least two months. The ECB decided not to disclose it to protect its legal advisers and its internal deliberations, he said. The ECB’s Agreement on Emergency Liquidity Assistance (ELA), published earlier this year, prohibits national central banks from providing ELA if it “interferes with the objectives and tasks” of the Eurosystem, such as maintaining price stability and safeguarding payments.

“There is an overriding public interest in knowing how far the ECB … weighed different goals against each other and how they themselves and their legal experts have interpreted the legal framework in this respect,” the complainants’ lawyer, Andreas Fischer-Lescano, said in the appeal.

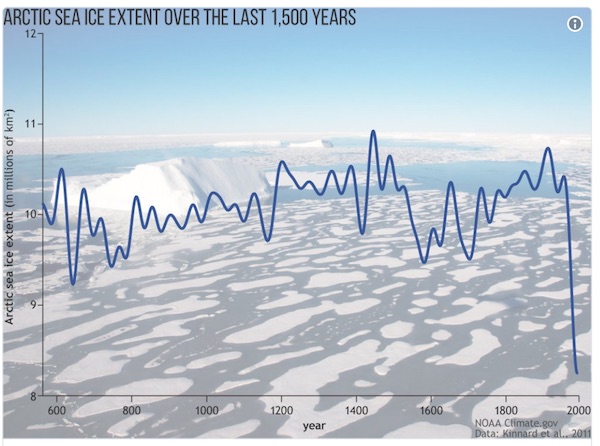

No more Santa. Or reindeer, polar bears.

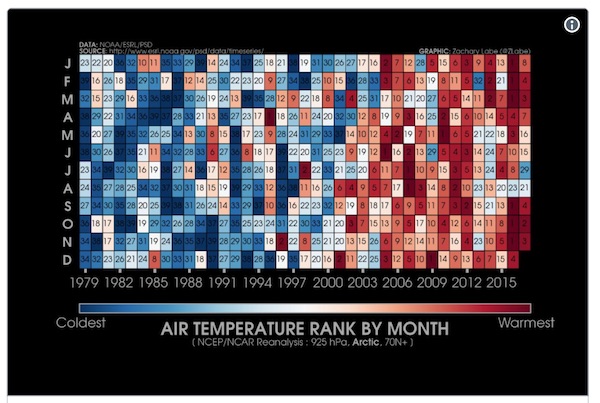

• Let It Go: The Arctic Will Never Be Frozen Again (Grist)

Last week, at a New Orleans conference center that once doubled as a storm shelter for thousands during Hurricane Katrina, a group of polar scientists made a startling declaration: The Arctic as we once knew it is no more. The region is now definitively trending toward an ice-free state, the scientists said, with wide-ranging ramifications for ecosystems, national security, and the stability of the global climate system. It was a fitting venue for an eye-opening reminder that, on its current path, civilization is engaged in an existential gamble with the planet’s life-support system. In an accompanying annual report on the Arctic’s health — titled “Arctic shows no sign of returning to reliably frozen region of recent past decades” — the National Oceanic and Atmospheric Administration, which oversees all official U.S. research in the region, coined a term: “New Arctic.”

Until roughly a decade or so ago, the region was holding up relatively well, despite warming at roughly twice the rate of the planet as a whole. But in recent years, it’s undergone an abrupt change, which now defines it. The Arctic is our glimpse of an Earth in flux, transforming into something that’s radically different from today. At a press conference announcing the new assessment, acting NOAA Administrator Timothy Gallaudet emphasizes the “huge impact” these changes were having on everything from tourism to fisheries to worldwide weather patterns. “What happens in the Arctic doesn’t stay in the Arctic — it affects the rest of the planet,” Gallaudet said.

[..] Take, for instance, the hypothesis of University of Alaska-Fairbanks permafrost scientist Vladimir Romanovsky: So far, 2017 has seen the highest permafrost temperatures in Alaska on record. If that warming continues at the current rate, widespread thawing could begin in as few as 10 years. The impact of such defrosting “will be very very severe,” Romanovsky says, and could include destruction of local infrastructure — like roads and buildings — throughout the Northern Hemisphere and the release of additional greenhouse gases that have been locked for generations in the ice.