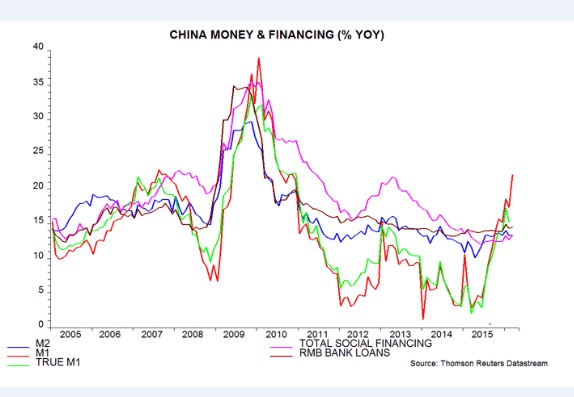

Well, I’ve pointed a zillion times to the size and power of China’s shadow banks. And here you go…

• Goldman Finds That China’s Debt Is Far Greater Than Anyone Thought (ZH)

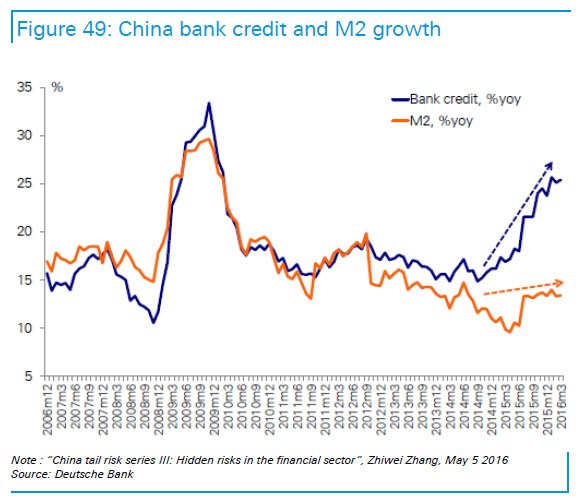

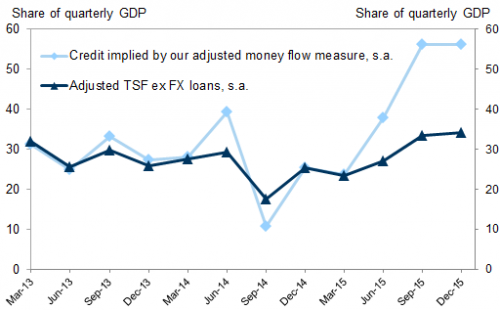

In an analysis conducted by Goldman’s MK Tang, the strategist notes that a frequent inquiry from investors in recent months is how much credit has actually been extended to Chinese households and corporates. He explains that this arises from debates about the accuracy of the commonly used credit data (i.e., total social financing (TSF)) in light of an apparent rise in financial institutions’ (FI) shadow lending activity (as well as due to the ongoing municipal bond swap program). Tang adds that while it is clear that banks’ investment assets and claims on other FIs have surged, it is unclear how much of that reflects opaque loans, and also how much such loans and off-balance sheet credit are not included in TSF. By the very nature of shadow lending, it is almost impossible to reach a conclusion on these issues based on FIs’ asset information.

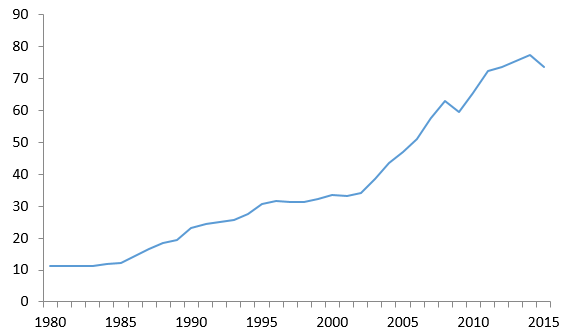

Goldman circumvents these data complications by instead focusing on the “money” concept, a mirror image to credit on FIs’ funding side. The idea is that money is created largely only when credit is extended—hence an effective gauge of “money” can give a good sense of the size of credit. We construct our own money flow measure, specifically following and quantifying the money flow from households/corporates. Goldman finds something stunning: true credit creation in China was vastly greater than even the comprehensive Total Social Financing series. To wit: “a substantial amount of money was created last year, evidencing a very large supply of credit, to the tune of RMB 25tn (36% of 2015 GDP). This is about RMB 6tn (or 9pp of GDP) higher than implied by TSF data (even after adjusting for municipal bond swaps). Divergence from TSF has been particularly notable since Q2 last year after a major dovish shift in policy stance.”

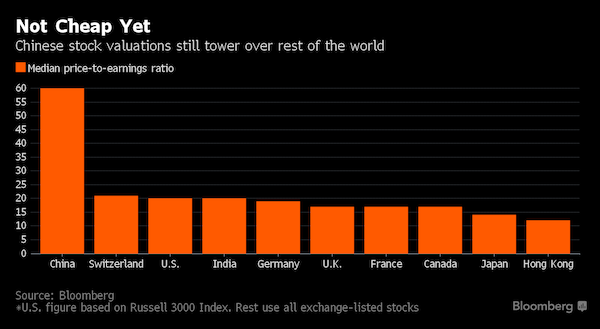

China stocks are already down 40% in 12 months, but look down below.

• World’s Most Battered Market Is the Worst Place to Find Bargains (BBG)

It’s going to take more than the world’s deepest stock-market selloff to turn China into a destination for international bargain hunters. Even after a 40% tumble in the Shanghai Composite Index over the past 12 months, valuations for China’s domestic A shares are three times as expensive as every other major market worldwide. The median price-to-earnings ratio on the nation’s exchanges is 59, higher than that of U.S. technology shares at the height of the dot-com boom in 2000. One year after China’s equity bubble peaked, valuations have yet to fall back to earth as government intervention keeps stock prices elevated at a time of shrinking corporate profits.

For money managers at Silvercrest Asset Management and Blackfriars Asset Management who predicted last year’s selloff, China’s weak economic growth and fragile investor sentiment mean it’s too early to jump back into the $6 trillion market. “We do not own any A shares,” said Tony Hann, the London-based head of equities at Blackfriars, which oversees about $270 million. The firm’s Oriental Focus Fund has outperformed 83% of peers this year. “The bull case seems to be that I can buy at this P/E because someone else will buy it from me at a higher P/E. The biggest risk is that investor psychology on the mainland changes.”

There’s plenty for investors to be worried about. After expanding at the weakest pace since 1990 last year, China’s economy shows few signs of recovery. Earnings at Shanghai Composite companies have declined by 13% since last June, while corporate defaults are spreading and the yuan is trading near a five-year low.

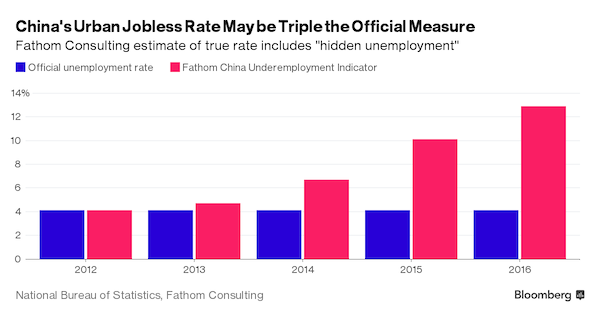

Debt is hidden, losses are hidden, unemployment is hidden.

• China’s Hidden Unemployment Rate (BBG)

China’s authorities may face a bigger worry than slowing economic growth. The jobless rate may be three times the official estimate, according to a new report by Fathom Consulting, whose China’s Underemployment Indicator has tripled to 12.9% since 2012 even while the official jobless rate has hovered near 4% for five years. The weakening labor market may explain China’s decision to uncork the credit spigots and revive old growth drivers in an effort to stabilize the world’s no. 2 economy. Leaders have stressed that keeping employment stable is a top priority. Fathom’s data shows that while mass layoffs haven’t materialized, the number of people not working at full capacity or hours has increased. “The degree of slack has surged in recent years,” analysts at the London-based firm wrote.

“China has a substantial hidden unemployment problem, in our view, and that explains why the authorities have come under so much pressure to re-start the old growth engines.” Leaders of the world’s most populous nation have promised to slash excess capacity in coal mines and steel mills while at the same time ensuring that the economy grows by at least 6.5% this year. Across the nation, state-backed ‘zombie’ factories are being kept alive by local governments to keep a lid on any social unrest. To keep the plants ticking over, employees in some cases have been asked to work half the time for half the pay. The official registered unemployment gauge is notorious for not changing during economic cycles. It’s compiled from the number of people who register at local governments for unemployment benefits, which excludes most of the nation’s more than 270 million migrant workers.

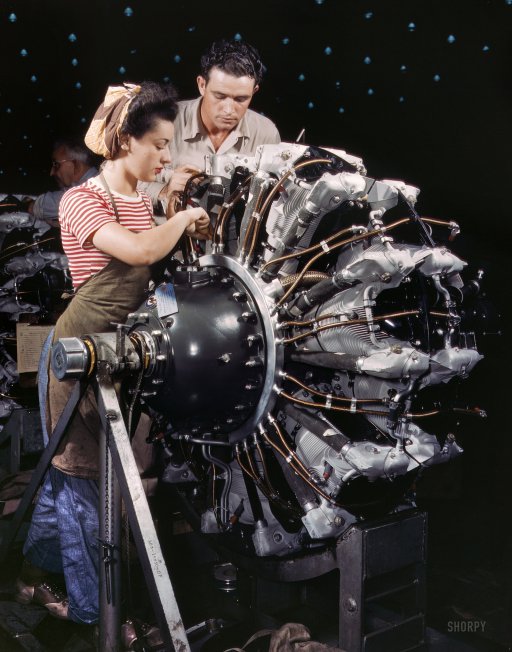

China as a robotics guinea pig. What could go wrong?

• China’s Factory to the World Is in a Race to Survive (BBG)

China’s shift to consumption and services lies at the heart of Xi’s quest for new growth drivers to escape the middle-income trap, when productivity and profit margins fail to keep up with wage growth. That’s spurred provincial leaders to encourage cities to attract new businesses and upgrade factories, headlined by the aphorisms that China’s administrators are fond of. “Empty the cages to welcome better birds,” demanded former Guangdong Communist Party Chief Wang Yang, meaning let the old industries leave and replace them with new, higher-value ones.

“Replace humans with robots,” added his successor, Hu Chunhua, 53, one of the youngest members of the Politburo, in a 950 billion yuan ($144 billion) plan to upgrade 2,000 companies in three years, the official Guangzhou Daily reported in March 2015, adding that the move is not expected to cause heavy layoffs. Dongguan replaced 43,684 workers with robots in 2015, cutting costs at those factories by nearly 10%, according to the local government. Lu Miao, a vice general manager of Lyric Robot in Guangdong’s Huizhou city, said the government pays as much as 50,000 yuan to Lyric’s customers for each robot they use to replace workers. “The government at all levels in Guangdong has been encouraging companies to replace human workers as rapidly as possible,” said Lu. “I can see our business increasing more than 50% this year.”

The ultimate result is so-called “dark factories” that don’t need lighting because only robots work on the production line. TCL has such a plant making LCD displays, Li said in an interview at the company’s headquarters in Huizhou, about an hour’s drive from Dongguan. “For society at large, some workers will be laid off,” said Huizhou Mayor Mai Jiaomeng. “But it’s good for companies to improve their competitiveness.” Local officials say the layoffs are under control, but are reluctant to provide details on how many plants have shut or moved away. A municipal report from Shenzhen in January said that the city has “washed out” or “transformed” more than 17,000 low-end factories over the past five years.

Looks inevitable, just a question of where on the globe it will begin.

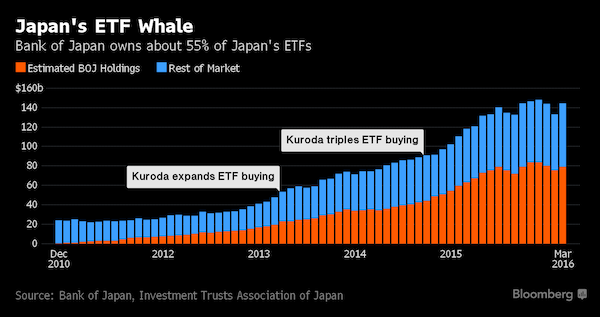

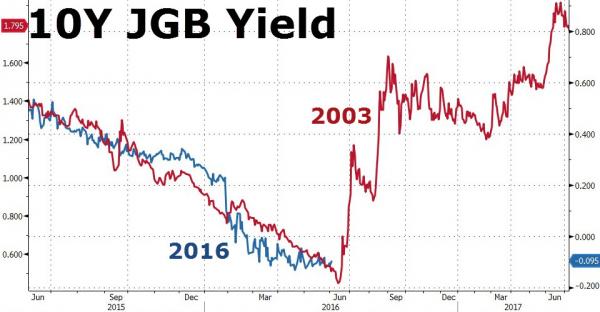

• BOJ Board Member Warns Of “2003 Shock” Historic Bond Market Collapse (ZH)

In a somewhat shocking break from the age-old tradition of lying and obfuscation, Bank of Japan policy board member Takehiro Sato raised significant concerns about global financial stability in a speech last week. In addition to raising concerns about Japanese economic fragility, Sato warned that due to the impact of negative interest rates, he “detected a vulnerability similar to that seen before the so-called VaR (Value at Risk) shock in 2003.”

Financial institutions are facing the risk of a negative spread for marginal assets due to the extreme flattening of the yield curve and the drop in the yield on government bonds in short- to long-term zones into negative territory. When there is a negative spread, shrinking the balance sheet, rather than expanding it, would be a reasonable business decision. In the future, this may prompt an increasing number of financial institutions to take such actions as restraining loans to borrowers with potentially high credit costs and raising interest rates on loans to firms with poor access to finance.

…a weakening of the financial intermediary functioning could affect the financial system’s resilience against shocks in times of stress. In addition, an excessive drop in bond yields in the super-long-term zone could also make the financial system vulnerable by increasing the risk of a buildup of financial imbalances in the system.

There is also the risk that financial institutions that have problems in terms of profitability or fiscal soundness will make loans and investment without adequate risk valuation. From financial institutions’ recent move to purchase super-long-term bonds in pursuit of tiny positive yield, I detect a vulnerability similar to that seen before the so-called VaR (Value at Risk) shock in 2003.

Simply put, as Bloomberg notes, Sato is concerned the government bond market is heading for an historic collapse after 10-year yields plunged below zero, forcing banks to pile into super-long-term bonds in pursuit of tiny positive yields. This is creating huge concentrated positions with increasing duration risk (as we detailed previously), causing a vulnerability “similar to that seen before the so-called VaR (Value at Risk) shock in 2003,” when an initial jump in yields triggered a spectacular sell-off by breaching banks’ models for estimating potential losses.

Reuniting OPEC.

• As Iran’s Oil Exports Surge, International Tankers Help Ship Its Fuel (R.)

More than 25 European and Asian-owned supertankers are shipping Iranian oil, data seen by Reuters shows, allowing Tehran to ramp up exports much faster than analysts had expected following the lifting of sanctions in January. Iran was struggling as recently as April to find partners to ship its oil, but after an agreement on a temporary insurance fix more than a third of Iran’s crude shipments are now being handled by foreign vessels. “Charterers are buying cargo from Iran and the rest of the world is OK with that,” said Odysseus Valatsas, chartering manager at Dynacom Tankers Management. Greek owner Dynacom has fixed three of its supertankers to carry Iranian crude.

Some international shipowners remain reluctant to handle Iranian oil, however, due mainly to some U.S. restrictions on Tehran that remain and prohibit any trade in dollars or the involvement of U.S. firms, including banks and reinsurers. Iran is seeking to make up for lost trade following the lifting of sanctions imposed in 2011 and 2012 over its nuclear program. Port loading data seen by Reuters, as well as live shipping data, shows at least 26 foreign tankers with capacity to carry more than 25 million barrels of light and heavy crude oil, as well as fuel oil, have either loaded crude or fuel oil in the last two weeks or are about load at Iran’s Kharg Island and Bandar Mahshahr terminals.

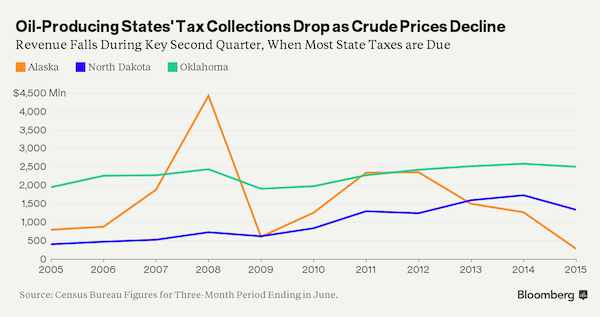

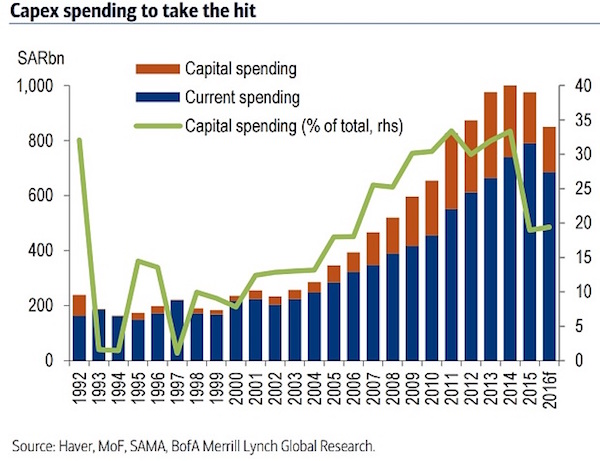

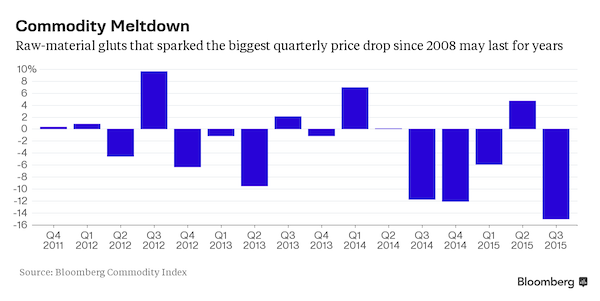

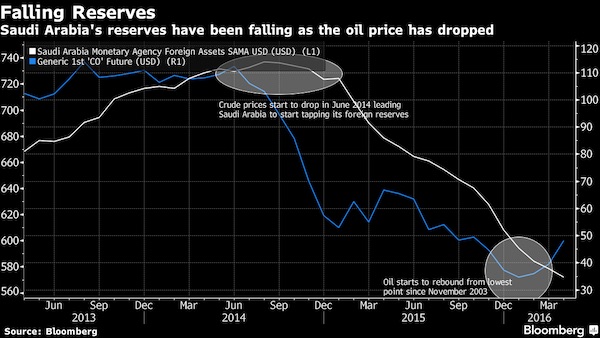

One more major price drop and we have panic.

• Saudi Arabia Races Through Financial Toolkit to Raise Funds (BBG)

Saudi Arabia’s plans to bolster its finances are taking on a new sense of urgency as lower oil prices put the economy under more strain than at any other time in the past decade. In recent weeks, the kingdom raised a $10 billion loan, clamped down on currency speculators and informed banks of plans to raise as much as $15 billion in its first international bond sale, people with knowledge of the matter said. It’s also said to be contemplating IOUs to pay contractor bills and hired HSBC Holdings Plc banker Fahad Al Saif to set up a new debt office. The speed of the measures underscores Deputy Crown Prince Mohammed bin Salman’s urgency to shore up the country’s finances as an era of oil-fueled abundance falters.

Though currency reserves remain strong – among the world’s largest – net foreign assets are at a four-year low after declining for 15 months in a row and the kingdom may post a budget deficit of about 13.5% of economic output this year. “The pace of the decline in Saudi Arabia’s foreign assets is faster than in previous oil downturns and the period over which they’ve been falling is longer,” Raza Agha, VTB Capital’s chief economist for the Middle East and Africa, said by e-mail. “This generates a real sense of urgency to get the ball rolling in raising external funding.”

Five years ago, oil surged to more than $100 a barrel, adding billions of dollars to the country’s reserves. The windfall allowed the kingdom to slash its debt and post an average budget surplus of 8.2% between 2000 and 2012, according to International Monetary Fund data. Now, with crude having tumbled about 50%, the country is moving to sell assets and find other ways to raise funds.

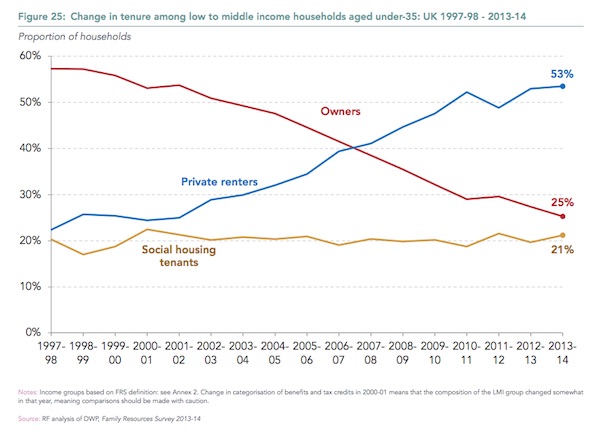

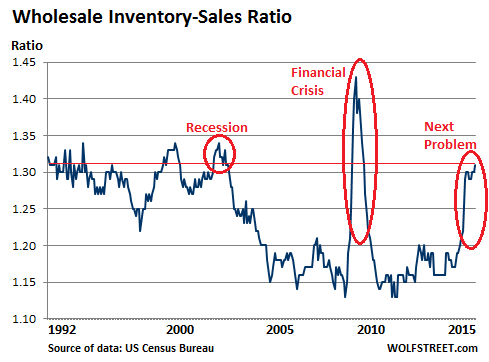

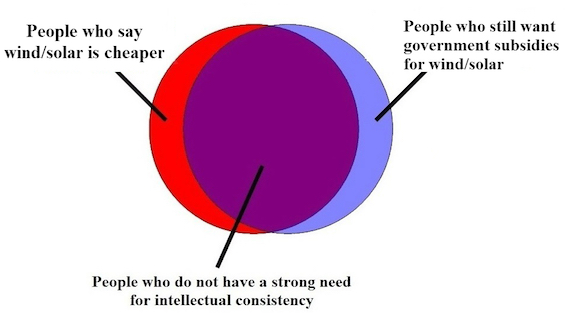

Just a cute graph.

• If Wind/Solar Is So Cheap, Why Require Government Subsidy? (SL)

I don’t have an inherent dislike of solar and wind energy, but I am suspicious of the way they are being pushed. Here’s an example: Renewable energy advocates such as Tony Seba are talking about how solar and battery technology will enable exponential uptake in renewable technology, and that people won’t want to invest in a thermal power plant anymore. But on the other hand: Renewable advocates want government legislation to support their chosen renewable energy targets. e.g. “50% renewable energy would put Australia in line with leading nations” at the Conversation. Or another example might be where energy companies are talking about how the government has to ‘support the transition’ in this AFR article: AGL says government must support power industry exit from coal.

But wait a minute, if wind and solar are truly so amazing and so cheap – why does the government need to get involved? Why wouldn’t these renewable energy companies and advocates find a way to profitably do it and not make any fuss about wanting governmental regulation/subsidies? Borrowing from Mark Perry’s excellent Venn diagram idea over at AEI Carpe Diem blog: (Could it be that renewable advocates are using the government to push renewable energy cost and risk onto taxpayers?)

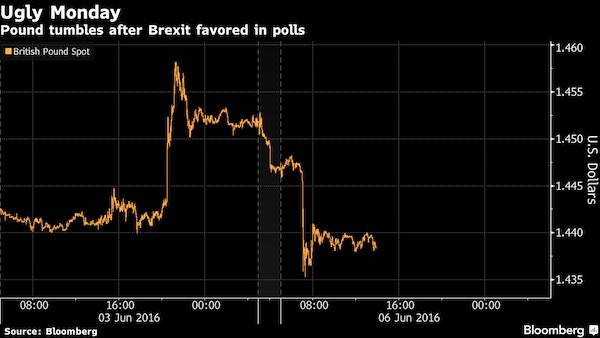

17 days still to go. Brace for increased madness. it’s going to be so much fun.

• Pound Tumbles, Volatility Jumps After Polls Show Brexit Momentum (BBG)

The pound slumped to a three-week low after polls showed more Britons favor exiting the European Union, reviving concern a June 23 referendum will throw global markets into turmoil and undermine confidence in the 28-nation trading bloc. Sterling weakened against all 10 developed-market peers after two surveys showed more voters were willing to vote to leave the EU than those wishing to stay. A gauge of the currency’s expected swings against the dollar during the next month surged to a seven-year high. The Bank of England has said uncertainty surrounding the referendum vote is damping U.K. growth, while global institutions including the IMF and OECD are warning of dire fallout if Britain votes to quit the EU.

Federal Reserve Bank of Chicago President Charles Evans said the referendum is undermining confidence in the outlook at a time when the international economy is already losing momentum. “A ‘Leave’ vote would expose a host of uncertainties,” said Sue Trinh at Royal Bank of Canada in Hong Kong. “It would be more negative for the euro and the EU since the issue will drag on for other members.” A YouGov poll for television network ITV found 45% would choose ‘Leave,’ compared with 41% picking ‘Remain.’ A separate survey by global market research company TNS showed 43% for ‘Leave’ and 41% for ‘Remain.’

Well, that seems modeled after the EU’s attitude towards democracy alright. They fit right in.

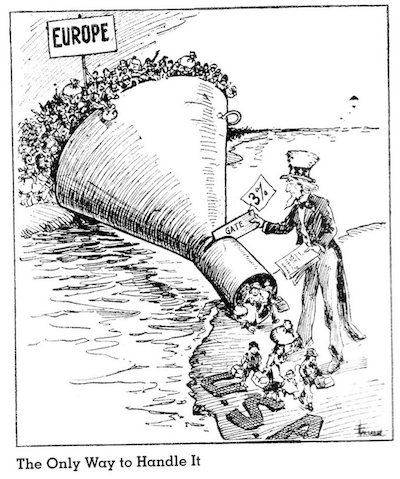

• Constitutional Crisis: Pro-Remain MPs Consider Pre-Empting Brexit Vote (BBC)

Pro-Remain MPs are considering using their Commons majority to keep Britain inside the EU single market if there is a vote for Brexit, the BBC has learned. The MPs fear a post-Brexit government might negotiate a limited free trade deal with the EU, which they say would damage the UK’s economy. There is a pro-Remain majority in the House of Commons of 454 MPs to 147. A Vote Leave campaign spokesman said MPs will not be able to “defy the will of the electorate” on key issues. The single market guarantees the free movement of goods, people, services and capital. The BBC has learned pro-Remain MPs would use their voting power in the House of Commons to protect what they see as the economic benefits of a single market, which gives the UK access to 500 million consumers.

Staying inside the single market would mean Britain would have to keep its borders open to EU workers and continue paying into EU coffers. Ministers have told the BBC they expect pro-EU MPs to conduct what one called a “reverse Maastricht” process – a reference to the long parliamentary campaign fought by Tory eurosceptic MPs in the 1990s against legislation deepening EU integration. Like then as now, the Conservative government has a small working majority of just 17. They say it would be legitimate for MPs to push for the UK to stay in the single market because the Leave campaign has refused to spell out what trading relationship it wants the UK to have with the EU in the future. As such, a post-Brexit government could not claim it had a popular mandate for a particular model.

Equal partners.

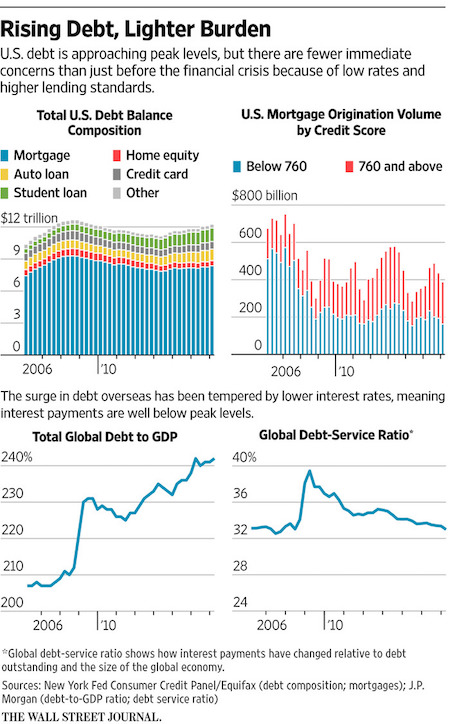

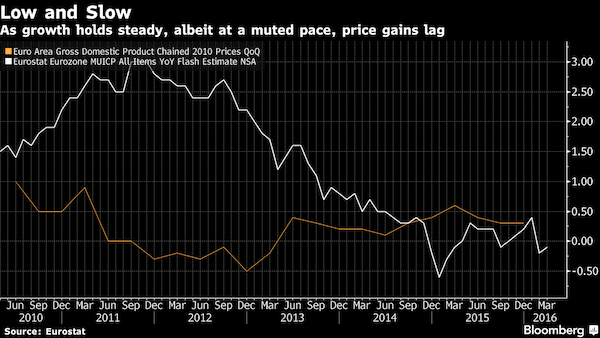

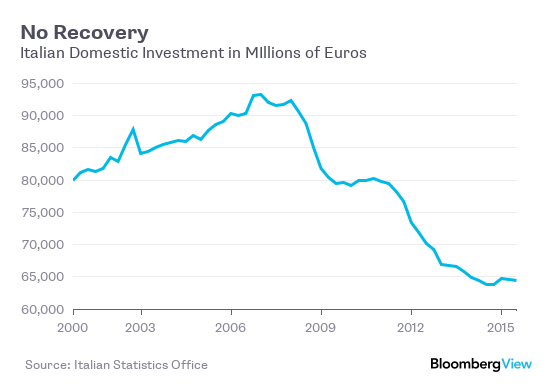

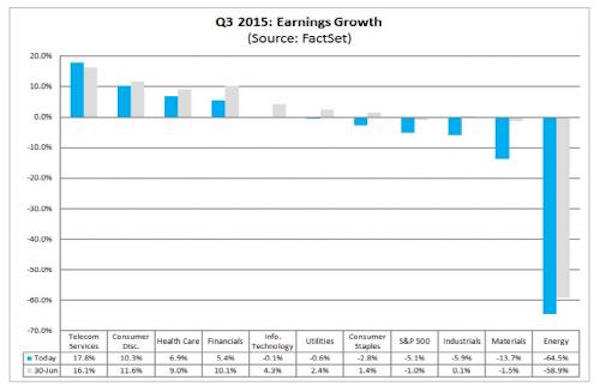

• Brexit May Seem Like The West’s Biggest Problem. But Look At The US Economy (G.)

Britain is trapped in its own little Brexit bubble. For the next two and a half weeks, the country will be obsessed with the result of the referendum on 23 June. Nothing that is going on in the rest of the world will get much of a look-in. But beyond these shores, things are happening. The authorities in China are desperately trying to shore up growth. Eurozone finance ministers have all but guaranteed that, sooner or later, the Greek crisis will flare up again. Most pressingly, the US economy looks to be heading for serious trouble. Make no mistake, the jobs report issued in Washington on Friday was a shocker. Wall Street had been expecting the non-farm payroll – the benchmark for the strength of the US labour market – to increase by 164,000. The actual figure was 38,000, the smallest monthly increase since September 2010.

True, the total was slightly distorted because 35,000 striking workers at Verizon were counted as jobless because they were not being paid. But that still would have meant an NFP increase of just 73,000. The weak jobs report comes at a particularly sensitive time because America’s central bank, the Federal Reserve, has been softening the markets up for an increase in interest rates, either this month or next. Any such move is now out of the question. US borrowing costs will not be going up again until the autumn at the earliest. This is all rather chastening for the Fed. When it raised interest rates in December for the first time since the Great Recession, the central bank signalled that there would be four more increases during the course of 2016.

Financial markets subsequently went into freefall during the early weeks of the year, forcing the Fed into a crash rethink. In March, it indicated that the number of 2016 rate increases had been halved from four to two – but the guidance was promptly ignored by traders, who based their decisions on the assumption that there would be no further tightening of policy by the Fed until 2017. With its reputation at stake, the Fed has gone out of its way since March to convince the markets that it was serious about two rate rises in 2016. Really, really it was. Janet Yellen, the Fed’s chair, told Wall Street that it might be “confused” about the way the central bank was going about its business.

Yet if anyone is confused it is Yellen, not the markets, which have rightly calculated that the Fed is all talk and should be judged by what it does and not by what it says. Here’s the position. The US economy grew at an annualised rate of 0.8% in the first quarter of 2016, which was not just weaker than the UK but substantially worse than the eurozone. Friday’s May payrolls were not a one-off, since the totals for March and April were revised downwards by a combined 59,000.

Not quite sure what Ambrose intends here, but yeah, Britons’ dislike of Cameron, Major and any and all EU mouthpieces may well decide the issue.

• ‘Brexit Voters Succumbing To Impulse Irritation And Anger’ (AEP)

British voters are succumbing to impulsive gut feelings and irrational reflexes in the Brexit campaign with little regard for the enormous consequences down the road, the world’s most influential psychologist has warned. Daniel Kahneman, the Israeli Nobel laureate and father of behavioural economics, said the referendum debate is being driven by a destructive psychological process, one that could lead to a grave misjudgment and a downward spiral for British society. “The major impression one gets observing the debate is that the reasons for exit are clearly emotional,” he said. “The arguments look odd: they look short-term and based on irritation and anger. These seem to be powerful enough that they may lead to Brexit,” he said, speaking to The Telegraph at the Amundi world investment forum in Paris.

The counter-critique is that the Remain campaign is equally degrading the debate, playing on visceral reactions and ephemeral issues of the day. In a sense the two sides are egging each other on. That is the sociological fascination of it. Professor Kahneman, who survived the Nazi occupation of France as a Jewish child in the Second World War, said the risk is that the British people will be swept along by emotion and lash out later at scapegoats if EU withdrawal proves to be a disastrous strategic error. “They won’t regret it because regret is rare. They’ll find a way to explain what happened and blame somebody. That is the general pattern when things go wrong and people are afraid,” he said. The refusal to face up to the implications of what is really at stake in the referendum comes as no surprise to a man imbued with deep sense of anthropological pessimism.

His life’s work is anchored in studies showing that people are irrational. They are prone to cognitive biases and “systematic errors in thinking”, made worse by chronic over-confidence in their own judgment – and the less intelligent they are, the more militantly certain they tend to be. People do not always act in their own economic self-interest. Nor do they strive to maximize “utility’ and minimize risk, contrary to the assumptions of efficient market theory and the core premises of the economics profession. “People are myopic. Our brain circuits respond to immediate consequences,” he said.

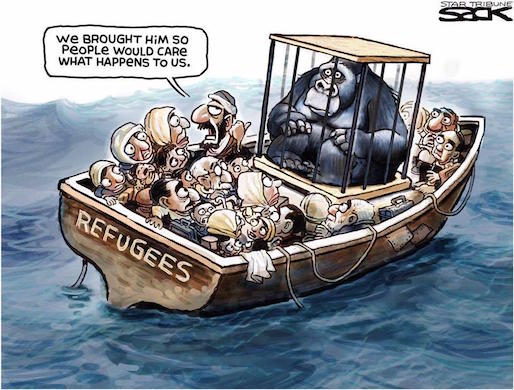

Added for entertainment value. BTW, what century is this?

• Erdogan: Childless Women Deficient, Incomplete: Have At Least 3 (AFP)

President Recep Tayyip Erdogan on Sunday urged Turkish women to have at least three children, saying a woman’s life was “incomplete” if she failed to have offspring. Erdogan’s comments were the latest in a series of controversial remarks aimed at encouraging women to help boost Turkey’s population, which had already risen exponentially in the last years. The president emphasised he was a strong supporter of women having careers but emphasised that this should not be an “obstacle” to having children. “Rejecting motherhood means giving up on humanity,” Erdogan said in a speech marking the opening of the new building of Turkey’s Women’s and Democracy Association (KADEM). “I would recommend having at least three children,” added the president.

“The fact that a woman is attatched to her professional life should not prevent her from being a mother,” he added, saying that Turkey had taken “important steps” to support working mothers. Erdogan had on Monday said that family planning and contraception were not for Muslim families, prompting fury among women’s activists. In his speech Sunday he went on to add: “A woman who says ‘because I am working I will not be a mother’ is actually denying her feminity.” “A women who rejects motherhood, who refrains from being around the house, however successful her working life is, is deficient, is incomplete,” he added.

And there we go.

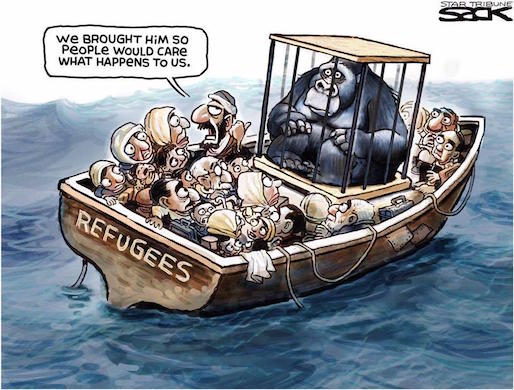

• Turkey Shelves Refugee ‘Readmission’ Deal With EU (DS)

The agreement between Turkey and the EU that will facilitate visa liberalization for Turkish nationals and allow readmission of Syrian refugees who enter Europe illegally is practically shelved due to ongoing disagreements, according to sources from the Foreign Ministry. The Turkey-EU agreement that will pave the way for visa liberalization was initially signed on Dec. 16, 2013 and was later included in the comprehensive refugee deal by both parties. Although Brussels says the deal will succeed, it also requires Turkey to meet the EU’s 72 benchmarks, which include narrowing its counterterrorism laws.

Turkey’s Aksam daily reported over the weekend that a senior official from the Foreign Ministry said Turkey has used its administrative measures correctly to temporarily suspend the Readmission Agreement, which will return undocumented, illegal refugees who enter Europe via Turkey in exchange for registered migrants. Sources from the Foreign Ministry who spoke to Daily Sabah yesterday said: “In order for the Readmission Agreement to be successfully fulfilled, a Cabinet decision approving the bill published in the Official Gazette must be announced.” Such an approval is not expected anytime soon. Although the European Commission had announced early last week that the Readmission Agreement would come into full force as of June 1, Ankara asserted that “the EU has failed to fulfill its duties resulting from the agreement,” stressing that it suspended the Readmission Agreement as part of administrative measures.