Wyland Stanley Indian guides and Nash auto at Covelo stables., Mendocino County CA 1925

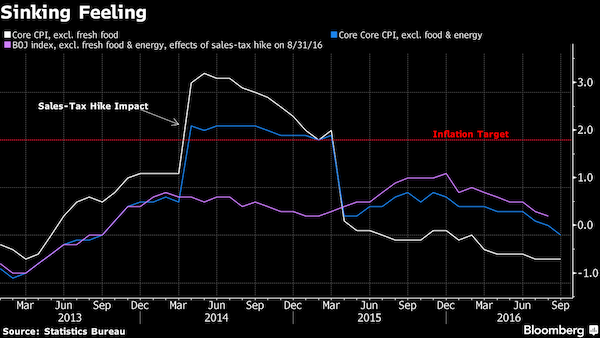

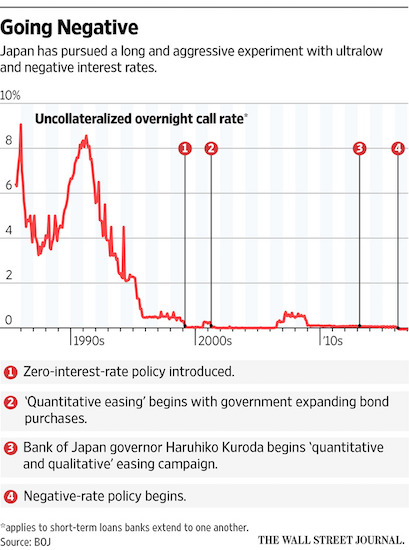

Policies that achieve the opposite of what’s intended. Scaring people does that. Lower consumer spending = lower money velocity = Deflation.

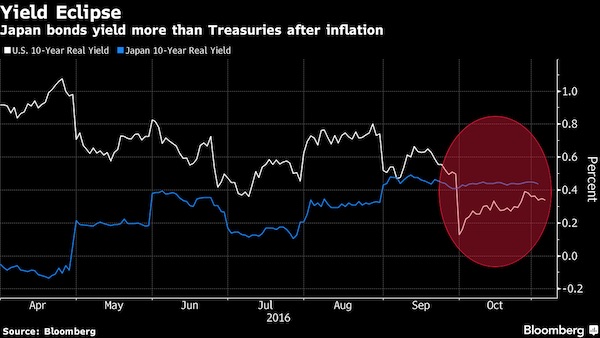

• The World’s Most Radical Experiment in Monetary Policy Isn’t Working (WSJ)

Keita Kameyama, a 30-year-old civil servant in Kagawa, a rural province, has been saving around 25% of his $40,000 salary each year to eventually marry his longtime girlfriend. He lives at home with his mother, drives an old Honda and rarely shops. The central bank’s stimulus measures had no effect on Mr. Kameyama’s spending. He still salts away his money in plain-vanilla bank accounts. He fears Japan’s long stagnation will wipe out his pension, and worries he won’t have enough money to care for his mother—a growing concern in a country with twice as many people over 60 than between 20 and 34. He sees bank accounts, which offer minuscule interest rates on deposits despite negative short-term rates, as the only way to save. Hyakujushi Bank, Ltd. the biggest in Kagawa, pays only 0.05% on deposits and has paid less than 1% since 1995.

“People in Kagawa love to save,” says Mr. Kameyama. “I have heard [the Bank of Japan] is trying very hard to get people to spend their money, but I don’t think I will be opening my wallet.” Many young Japanese economize because they simply don’t have enough money. More are working low-paying and temporary jobs with no benefits. “Companies aren’t growing, and they have aging workforces that they can’t fire,” says Takuji Okubo at the Japan Macro Advisors research group. “So there’s no room to hire young people.” Automobile, beer and cosmetics firms have slashed young-adult advertising and market to retirees instead, says Yohei Harada at Tokyo ad agency Hakuhodo. “The role of parents and children is getting reversed, where the parents from the bubble generation still act like children and want to buy the fancy car, while their children in the post-bubble generation worry about their parents’ spending,” he says.

“There will not be Obama Care repeal and replace. There will be no tax cut. There will be no infrastructure stimulus. There will be just one giant fiscal bloodbath over a debt ceiling that has to be increased and no one wants to vote for.”

• Giant Fiscal Bloodbath Coming Soon – David Stockman (USAW)

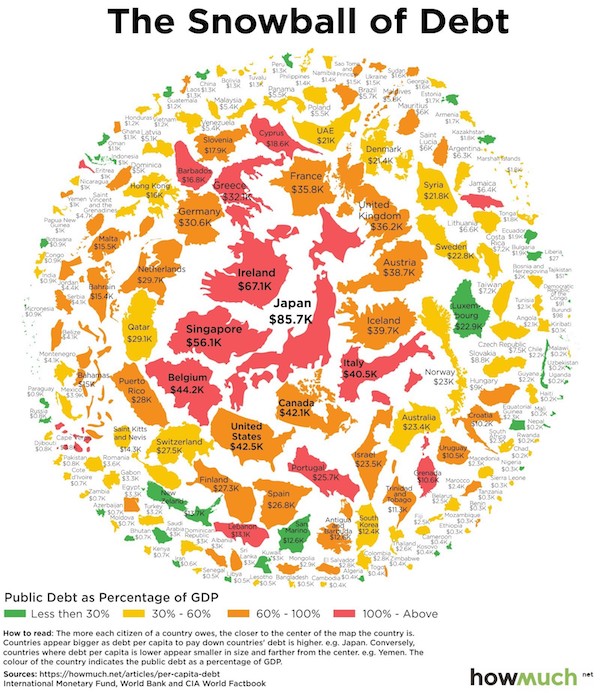

Former Reagan Administration White House Budget Director David Stockman says financial pain is a mathematical certainty. Stockman explains, “I think we are likely to have more of a fiscal bloodbath rather than fiscal stimulus. Unfortunately for Donald Trump, not only did the public vote the establishment out, they left on his doorstep the inheritance of 30 years of debt build-up and a fiscal policy that’s been really reckless in the extreme. People would like to think he’s the second coming of Ronald Reagan and we are going to have morning in America. Unfortunately, I don’t think it looks that promising because Trump is inheriting a mess that pales into insignificance what we had to deal with in January of 1981 when I joined the Reagan White House as Budget Director.”

So, can the Trump bump in the stock market keep going? Stockman, who wrote a book titled “Trumped” predicting a Trump victory in 2016, says, “I don’t think there is a snowball’s chance in the hot place that’s going to happen. This is delusional. This is the greatest suckers’ rally of all time. It is based on pure hopium and not any analysis at all as what it will take to push through a big tax cut. Donald Trump is in a trap. Today the debt is $20 trillion. It’s 106% of GDP. . . Trump is inheriting a built-in deficit of $10 trillion over the next decade under current policies that are built in. Yet, he wants more defense spending, not less. He wants drastic sweeping tax cuts for corporations and individuals. He wants to spend more money on border security and law enforcement. He’s going to do more for the veterans. He wants this big trillion dollar infrastructure program. You put all that together and it’s madness. It doesn’t even begin to add up, and it won’t happen when you are struggling with the $10 trillion of debt that’s coming down the pike and the $20 trillion that’s already on the books.”

Then, Stockman drops this bomb and says, “I think what people are missing is this date, March 15th 2017. That’s the day that this debt ceiling holiday that Obama and Boehner put together right before the last election in October of 2015. That holiday expires. The debt ceiling will freeze in at $20 trillion. It will then be law. It will be a hard stop. The Treasury will have roughly $200 billion in cash. We are burning cash at a $75 billion a month rate. By summer, they will be out of cash. Then we will be in the mother of all debt ceiling crises. Everything will grind to a halt. I think we will have a government shutdown. There will not be Obama Care repeal and replace. There will be no tax cut. There will be no infrastructure stimulus. There will be just one giant fiscal bloodbath over a debt ceiling that has to be increased and no one wants to vote for.”

“Very simply, the market starts to go down. As it goes down, it will start triggering selling, and then it will be like an avalanche..”

• Marc Faber Warns Investors An ‘Avalanche’ Could Be Coming (CNBC)

The man often hailed as the original ‘Dr. Doom’ is warning investors that the U.S. stock market is vulnerable to a seismic sell-off—one that could start any time in a very unassuming way. Marc Faber, the editor of “The Gloom, Boom & Doom Report,” predicted the rally’s disruption won’t be caused by any single catalyst. His argument: Stocks are very overbought and sentiment is way too bullish for the so-called Trump rally to continue. “Very simply, the market starts to go down. As it goes down, it will start triggering selling, and then it will be like an avalanche,” said Faber recently on “Futures Now.” “I would underweight U.S. stocks.” Faber, a supporter of President Donald Trump, isn’t blaming the new administration for his bearish forecast. “One man alone, he cannot make ‘America great again.’ That you have to realize,” he said.

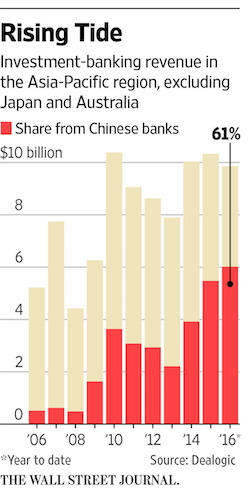

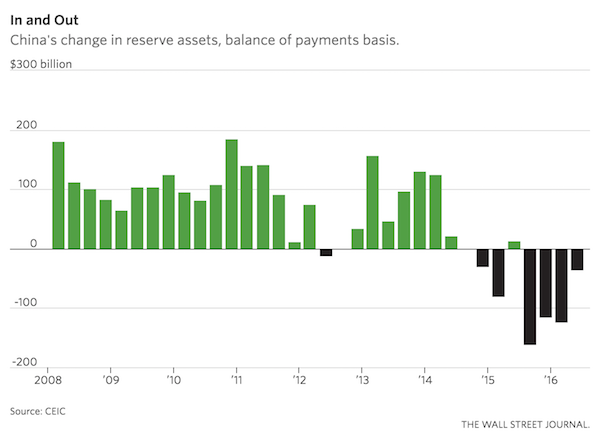

“Trump, unlike Mr. Reagan, is facing huge, huge headwinds — including a debt to GDP that is gigantic, as it is in other countries.” Faber lists interest rates going up, as well as earnings and margins at record levels, as additional risks to the historic rally. The Dow Jones Industrial Average registered its eleventh record close in a row on Friday. And, if you take a look at just the S&P 500 in February, it’s on track to see the fewest declines in any month since May 1990. [..] There are areas overseas which are in much better shape than the United States, according to the notoriously bearish investor. “China looks quite attractive,” said Faber. “For the next three months, money can flow into China. The economy, surprisingly, has begun to do quite well. We see that in retail in Hong Kong. We see that in the hotel industry, and we see that in the demand for commodities.”

According to Faber, resource commodities such as copper and gold could also give investors solid profits this year. “When you look at Trump and his administration, and the way the budget is, I think further money printing down the line is inevitable,” he said — a policy which would could lift commodities even higher.

Two Bannon articles today. Not because I’m a fan, as some people undoubtedly like to think. Just better to know something.

• What Does Steve Bannon Want? (NYT)

[..] some of the roots of Mr. Bannon’s ideology, like the roots of Mr. Trump’s popularity, are to be found in the disappointed hopes of the global economy. But Mr. Bannon, unlike Mr. Trump, has a detailed idea, an explanation, of how American sovereignty was lost, and of what to do about it. It is the same idea that Tea Party activists have: A class of regulators in the government has robbed Americans of their democratic prerogatives. That class now constitutes an “administrative state” that operates to empower itself and enrich its crony-capitalist allies. When Mr. Bannon spoke on Thursday of “deconstructing the administrative state,” it may have sounded like gobbledygook outside the hall, but it was an electrifying profession of faith for the attendees. It is through Mr. Bannon that Trumpism can be converted from a set of nostalgic laments and complaints into a program for overhauling the government.

Mr. Bannon adds something personal and idiosyncratic to this Tea Party mix. He has a theory of historical cycles that can be considered elegantly simple or dangerously simplistic. It is a model laid out by William Strauss and Neil Howe in two books from the 1990s. Their argument assumes an 80- to 100-year cycle divided into roughly 20-year “highs,” “awakenings,” “unravelings” and “crises.” The American Revolution, the Civil War, the New Deal, World War II — Mr. Bannon has said for years that we’re due for another crisis about now. His documentary about the 2008 financial collapse, “Generation Zero,” released in 2010, uses the Strauss-Howe model to explain what happened, and concludes with Mr. Howe himself saying, “History is seasonal, and winter is coming.”

What’s striking is that both Bannon articles are mild. Even if they’re from NYT and WaPo.

• Where Did Steve Bannon Get His Worldview? From My Book.. (Howe)

The headlines this month have been alarming. “Steve Bannon’s obsession with a dark theory of history should be worrisome” (Business Insider). “Steve Bannon Believes The Apocalypse Is Coming And War Is Inevitable” (the Huffington Post). “Steve Bannon Wants To Start World War III” (the Nation). A common thread in these media reports is that President Trump’s chief strategist is an avid reader and that the book that most inspires his worldview is “The Fourth Turning: An American Prophecy.” I wrote that book with William Strauss back in 1997. It is true that Bannon is enthralled by it. In 2010, he released a documentary, “Generation Zero,” that is structured around our theory that history in America (and by extension, most other modern societies) unfolds in a recurring cycle of four-generation-long eras.

While this cycle does include a time of civic and political crisis — a Fourth Turning, in our parlance — the reporting on the book has been absurdly apocalyptic. I don’t know Bannon well. I have worked with him on several film projects, including “Generation Zero,” over the years. I’ve been impressed by his cultural savvy. His politics, while unusual, never struck me as offensive. I was surprised when he took over the leadership of Breitbart and promoted the views espoused on that site. Like many people, I first learned about the alt-right (a far-right movement with links to Breitbart and a loosely defined white-nationalist agenda) from the mainstream media. Strauss, who died in 2007, and I never told Bannon what to say or think. But we did perhaps provide him with an insight — that populism, nationalism and state-run authoritarianism would soon be on the rise, not just in America but around the world. Because we never attempted to write a political manifesto, we were surprised by the book’s popularity among certain crusaders on both the left and the right.

[..] The cycle begins with the First Turning, a “High” which comes after a crisis era. In a High, institutions are strong and individualism is weak. Society is confident about where it wants to go collectively, even if many feel stifled by the prevailing conformity. Many Americans alive today can recall the post-World War II American High (historian William O’Neill’s term), coinciding with the Truman, Eisenhower and Kennedy presidencies. Earlier examples are the post-Civil War Victorian High of industrial growth and stable families, and the post-Constitution High of Democratic Republicanism and Era of Good Feelings.

The Second Turning is an “Awakening,” when institutions are attacked in the name of higher principles and deeper values. Just when society is hitting its high tide of public progress, people suddenly tire of all the social discipline and want to recapture a sense of personal authenticity. Salvation by faith, not works, is the youth rallying cry. One such era was the Consciousness Revolution of the late 1960s and 1970s. Some historians call this America’s Fourth or Fifth Great Awakening, depending on whether they start the count in the 17th century with John Winthrop or the 18th century with Jonathan Edwards.

The Third Turning is an “Unraveling,” in many ways the opposite of the High. Institutions are weak and distrusted, while individualism is strong and flourishing. Third Turning decades such as the 1990s, the 1920s and the 1850s are notorious for their cynicism, bad manners and weak civic authority. Government typically shrinks, and speculative manias, when they occur, are delirious.

Finally, the Fourth Turning is a “Crisis” period. This is when our institutional life is reconstructed from the ground up, always in response to a perceived threat to the nation’s very survival. If history does not produce such an urgent threat, Fourth Turning leaders will invariably find one — and may even fabricate one — to mobilize collective action. Civic authority revives, and people and groups begin to pitch in as participants in a larger community. As these Promethean bursts of civic effort reach their resolution, Fourth Turnings refresh and redefine our national identity. The years 1945, 1865 and 1794 all capped eras constituting new “founding moments” in American history.

Admiral Ben Moreell (1892 – 1978) was the chief of the U.S. Navy’s Bureau of Yards and Docks and of the Civil Engineer Corps. Best known to the American public as the Father of the Navy’s Seabees, Moreell’s life spanned eight decades, two world wars, a great depression and the evolution of the United States as a superpower. He was a distinguished Naval Officer, a brilliant engineer, an industrial giant and articulate national spokesman.

• Of Bread And Circuses (Admiral Ben Moreell, January 1, 1956)

A twentieth-century repetition of the mistakes of ancient Rome would be inexcusable.Rome was eight and a half centuries old when the poet, Juvenal, penned his famous tirade against his degenerate countrymen. About 100 A.D. he wrote: “Now that no one buys our votes, the public has long since cast off its cares; the people that once bestowed commands, consulships, legions and all else, now meddles no more and longs eagerly for just two things, bread and circuses.” (Carcopino, Daily Life in Roman Times [New Haven, Yale University Press, 1940], p. 202.) Forty years later, the Roman historian, Fronto, echoed the charge in more prosaic language: “The Roman people is absorbed by two things above all others, its food supplies and its shows.” (Ibid.)

Here was a once-proud people, whose government had been their servant, who had finally succumbed to the blandishments of clever political adventurers. They had gradually relinquished their sovereignty to government administrators to whom they had granted absolute powers, in return for food and entertainment. And the surprising thing about this insidious progression is that, at the time, few realized that they were witnessing the slow destruction of a people by a corruption that would eventually transmute a nation of self-reliant, courageous, sovereign individuals into a mob, dependent upon their government for the means of sustaining life.

There are no precise records that describe the feelings of those for whom the poet, Juvenal, felt such scorn. But using the clues we have, and judging by our own experience, we can make a good guess as to what the prevailing sentiments of the Roman populace were. If we were able to take a poll of public opinion of first and second century Rome, the overwhelming response would probably have been—“We never had it so good.” Those who lived on “public assistance” and in subsidized rent-free or low-rent dwellings would certainly have assured us that now, at last, they had “security.”

Those in the rapidly expanding bureaucracy—one of the most efficient civil services the world has ever seen—would have told us that now government had a “conscience” and was using its vast resources to guarantee the “welfare” of all of its citizens; that the civil service gave them job security and retirement benefits; and that the best job was a government job! Progressive members of the business community would have said that business had never been so good, that the government was their largest customer, which assured them a dependable market, and that the government was inflating currency at about 2 per cent a year, which instilled confidence and gave everyone a sense of well-being and prosperity.

These ‘people’ are actually proud of themselves. An opposition politician in Holland seriously suggested to let Dijjsselbloem stay on as FinMin and Eurogroup head even if he loses the March 15 election, ‘because he’s such a success’. His party stands to lose 2/3 of its votes…

• Dijsselbloem Comes Out Fighting as Wilders Holds Dutch Poll Lead (BBG)

Dutch Finance Minister Jeroen Dijsselbloem said his Labor Party is fighting for every seat as populist Geert Wilders maintained a poll lead less than three weeks before general elections. Dijsselbloem, who has served as finance minister in a coalition government with Prime Minister Mark Rutte’s Liberal Party since 2012, is campaigning for his political future in the March 15 elections. Dijsselbloem also leads the group of euro-area finance ministers, and a poor showing that cost Labor its coalition slot could put his post in doubt. “I am optimistic, we have had highs and lows, we will just need to keep on fighting,” Dijsselbloem, who is third on the Labor Party’s list of candidates, said at an event in Amsterdam on Sunday. “At home and relaxed, I get somber, but as long as I remain busy I get the feeling we are getting an extra seat.”

Wilders’s anti-Islam Freedom Party would place first with 29 out of the 150 seats in parliament compared to 25 seats for Rutte’s Liberal Party, according to a poll published by Peil.nl on Sunday. While that’s the same four-seat lead as last week’s Peil.nl survey, an Ipsos poll published Friday showed the Liberals overtaking the Freedom Party, with 28 seats to 26 seats. The Labor Party under Deputy Prime Minister Lodewijk Asscher’s leadership would take 12 seats in Sunday’s poll. Labor, which currently holds 38 seats, lost support after it formed a coalition with the Liberals. Though the parties differ in their ideology, they managed to agree on a broad range of reform measures.

Starting in the middle of the economic crisis, the coalition passed a €22 billion austerity package that included cost cuts in elderly care and healthcare, an increase in the pension age and a reform of the housing market. Rutte’s second cabinet will be the first government to complete a full term since Prime Minister Wim Kok’s first ended in 1998. “It has been a journey through the desert, but we are now the most competitive economy of Europe and also one of the fastest growing, with the largest drop in unemployment in 10 years,” Rutte said in an interview in Het Financieele Dagblad on Saturday. “So that’s quite an achievement.”

Please let them try to do more things that people don’t want.

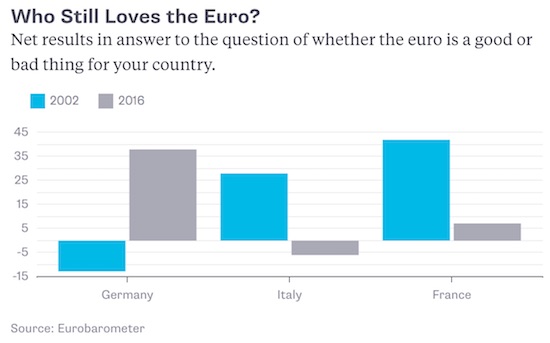

• EU Lawmakers Call For ‘Federal Union’ Of European States (RT)

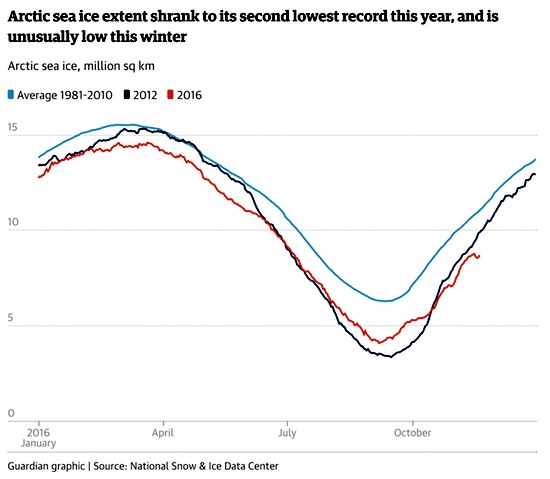

The leaders of the lower chambers of parliament of Germany, Italy, France, and Luxembourg have called for a European “Federal Union” in an open letter published in Italian newspaper La Stampa on Sunday. In the letter, four representatives of EU governments – Claude Bartolone of the French National Assembly, Laura Boldrini of the Italian Chamber of Deputies, Norbert Lammert of the German Bundestag, and Mars Di Bartolomeo of the Luxembourg Chamber of Deputies – say that closer cooperation is essential for dealing with problems that no one EU state can tackle on its own, such as immigration, terrorism, and climate change. “Now is the moment to move towards closer political integration — the Federal Union of States with broad powers. We know that the prospect stirs up strong resistance, but the inaction of some cannot be the paralysis of all. Those who believe in European ideals, should be able to give them a new life instead of helplessly observing its slow sunset,” the letter read.

The letter’s authors also warn that the European integration project is currently more at risk than ever before, with high unemployment and immigration problems driving populist and nationalist movements. The EU must also come to grips with the fact that, last June, the United Kingdom decided to leave the union after holding a national referendum, aka Brexit, becoming the first member nation to opt out of the bloc. On Sunday, a number of EU states, including Germany, France and Italy, called for the UK to pay a hefty price as a “divorce settlement.” The letter was published in the run-up to a meeting of parliamentary leaders in Rome on March 17 to mark the 60th anniversary of the Treaty of Rome, which established the European Economic Community (EEC). The treaty’s signing by six countries– Belgium, France, Italy, Luxembourg, West Germany and the Netherlands – in 1957 eventually paved the way for the Maastricht Treaty and the European Union in 1991.

In September of 2015, Lammert, Bartolone, Boldrini and di Bartolomeo also signed a declaration calling for deeper and faster European integration. However, greater European integration is being increasingly challenged by a number of Eurosceptic parties around the continent, including the Alternative for Germany, the National Front in France, and the Party for Freedom in the Netherlands. Upcoming elections could bring these parties closer to power. According to the European Parliament’s chief Brexit negotiator, Guy Verhofstadt, the EU must reform, or it risks disappearing under a barrage of internal and external attacks. Late last year Noam Chomsky also warned that the surge in right-wing and anti-establishment sentiment stemming from Europe’s failed neo-liberal policies is likely to lead to the EU’s collapse, adding that “it would be a tragic development” if the bloc fell apart.

Silent censorship. What’s not to like?

• EU Lawmakers, In Unusual Move, Pull The Plug On Racist Talk (AP)

At the European Parliament, where elections are due in 2019, many say the need for action against hate speech, and strong sanctions for offenders, is long overdue. The assembly— with its two seats; one in the Belgian capital of Brussels, and the other in Strasbourg in northeast France – is often the stage for political and sometimes nationalist theater. Beyond routine shouting matches, members occasionally wear T-shirts splashed with slogans or unfurl banners. Flags adorn some lawmakers’ desks. Yet more and more in recent years, lawmakers have gone too far. “There have been a growing number of cases of politicians saying things that are beyond the pale of normal parliamentary discussion and debate,” said British EU parliamentarian Richard Corbett, who chaperoned the new rule through the assembly.

“What if this became not isolated incidents, but specific, where people could say: ‘Hey, this is a fantastic platform. It’s broad, it’s live-streamed. It can be recorded and repeated. Let’s use it for something more vociferous, more spectacular,'” he told The Associated Press. In a nutshell, rule 165 of the parliament’s rules of procedure allows the chair of debates to halt the live broadcast “in the case of defamatory, racist or xenophobic language or behavior by a member.” The maximum fine for offenders would be around 9,000 euros ($9,500). Under the rule, not made public by the assembly but first reported by Spain’s La Vanguardia newspaper, offending material could be “deleted from the audiovisual record of proceedings,” meaning citizens would never know it happened unless reporters were in the room. Weingaertner said the IPA was never consulted on that.

A technical note seen by the AP outlines a procedure for manually cutting off the video feed, stopping transmission on in-house TV monitors and breaking the satellite link to halt broadcast to the outside world. A videotape in four languages would be kept running to serve as a legal record during the blackout. A more effective and permanent system was being sought. It is also technically possible to introduce a safe-guard time delay so broadcasts appear a few seconds later. This means they could be interrupted before offending material is aired. But the system is unwieldy. Lawmakers have the right to speak in any of the European Union’s 24 official languages. An offending act could well be over before the assembly’s President Antonio Tajani even has a chance to hit the kill switch. Misunderstandings and even abuses could crop up.

During a debate in December, Gerolf Annemans, from Belgium’s Flemish independence party Vlaams Belang, expressed concern that the rule “can be abused by those who have hysterical reactions to things that they qualify as racist, xenophobic, when people are just expressing politically incorrect views.”

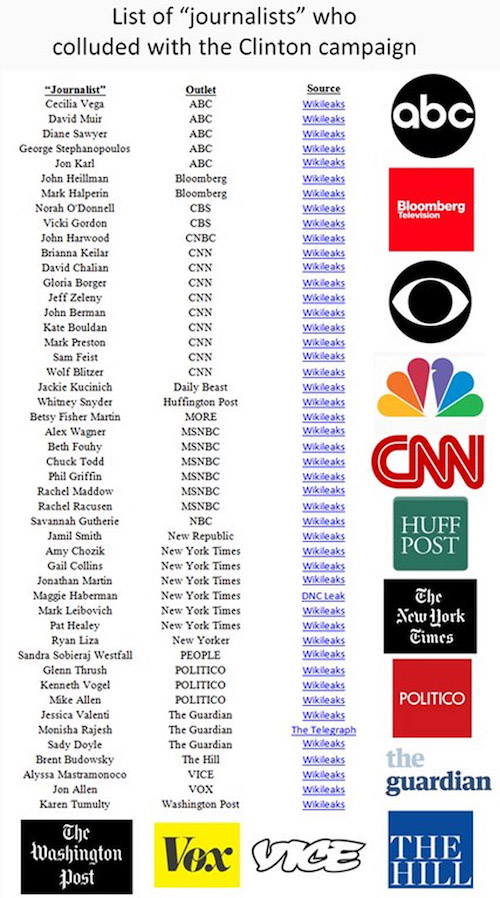

What a decade of fake news can achieve.

• No Debt Relief For Greece, Germany’s Deputy Finance Minister Says (R.)

Greece must not be granted a “bail in” that would involve creditors taking a loss on their loans, Germany’s deputy finance minister said in an interview broadcast on Sunday, reiterating the German government’s opposition to debt relief for Athens. “There must not be a bail-in,” Jens Spahn told German broadcaster Deutschlandfunk, according to a written transcript of the interview. “We think it is very, very likely that we will come to an agreement with the IMF that does not require a haircut,” he said, referring to losses that Greece’s creditors would have to take if debt was written off. The IMF has called for Greece to be granted substantial debt relief, but this is opposed by Germany, which makes the largest contribution to the budget of the European Stability Mechanism (ESM), the euro zone’s bailout fund.

Greece and its creditors agreed on Monday to further reforms by Athens to ease a logjam in talks with creditors that has held up additional funding for the troubled euro zone country. Inspectors from the European Commission, the ESM, the IMF and the European Central Bank are due to return to Athens this week. Spahn, a senior member of Chancellor Angela Merkel’s conservatives, said Greece’s problem was a lack of growth rather than debt and giving Athens debt relief would upset other euro zone countries such as Spain that had to deliver tough reforms. “Our Spanish friends, for example, say: ‘Hang on – that wouldn’t be fair: we carry out reforms and get no haircut and now you’re talking about giving Greece one?!'” Spahn said Germany was campaigning hard to keep the IMF on board in Greece’s bailout because of its expertise in helping countries that need to deliver reforms in return for aid.

Manfred Weber, who leads the conservative bloc in the European Parliament, said this month that if the IMF insisted on debt relief for Greece, it should no longer participate in the bailout, breaking ranks with Berlin’s official line that the program would end if the IMF pulled out.

Much more in the article. On how all public assets are forcibly sold at firesale prices etc.

• Germany Announces The Final Pillage Of Greece (RI)

It’s official: The Germans will not allow debt relief for Greece. Instead, Berlin wants to send in the repo man. The untold story of the Greek “bailouts” is that it wasn’t a “bailout” — it was an auction of Greek assets. Real, tangible things with real, tangible value were seized in exchange for pieces of paper that guarantee Athens will be chained to Berlin and Brussels for the foreseeable future. It’s your basic extortion racket. As one rather gloomy (but intriguing) analysis puts it:

The debt problem continues to erode the European Union from within – it is already impossible to hide, and Greek tragedy, for example, is growing. Against this background, Germany seems to have a consensus about how to get rid of Greece with its debts and inefficient economy. The scheme of this careless schoolboy by the ear from the class, it seems, differs only in details: either to expel or allow suffering – to provoke the Maidan in Athens, and then to expel in any case.

Bavaria’s 50-year-old finance minister and CSU politician Markus Soeder became the declarant of this ‘plan B’, who stated about the necessity of ‘a plan B’. “New billions should only flow when Athens implemented all the reforms. Even then, however, aid should only be given against a pledge “in the form of cash, gold or real estate”,” Soeder stated.

In his own way, he’s right – all conditions have been created for Maidan in Athens. Previously, the EU and the ECB assessed all the Greece’s public property at 50 billion euro that does not even cover the necessary new loans on debt payments of this country (80-90 billion euro). Therefore, the collateral should be gathered from private funds through the expropriation of gold and real estate. Implementation of reforms will lead to the final death of the Greek small and medium businesses after bringing the taxation to “European standards”, and namely such steps of the Ukrainian government have led to the Maidan in Kiev in 2013 with the collapse of the ruling regime in February 2014.

A bit too melodramatic? We forgot — we are supposed to use the friendly neoliberal term for this policy of national enslavement and communal suicide: “voluntary privatization.” Yes, we know. The poor, altruist Germans had to save irresponsible Greece. They did a fine job of it too.