Pablo Picasso Femme 1930

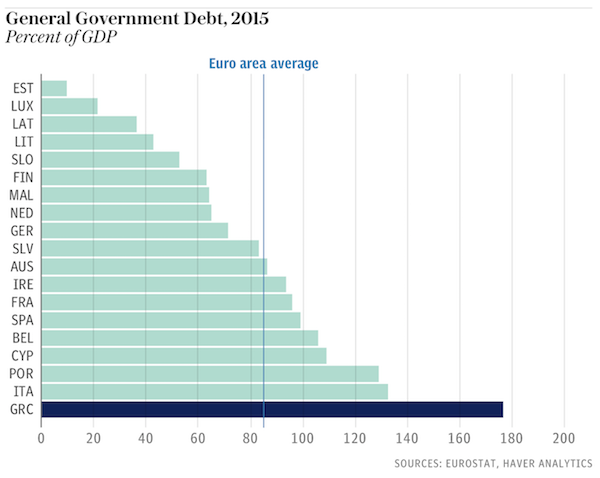

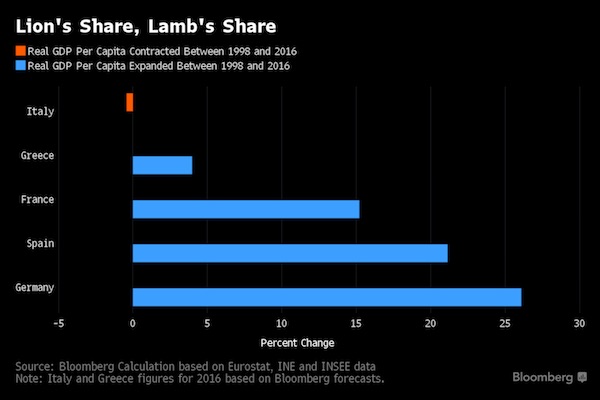

Great read from Ed. “..while Brazil and Greece faced the same type of downturn in dollar terms — about 45% in GDP per person — Brazilian living standards only deteriorated about 2%, compared to 26% in Greece.” Good part on Dutch elections too.

• Europe’s Delusional Economic Policies (Edward Harrison)

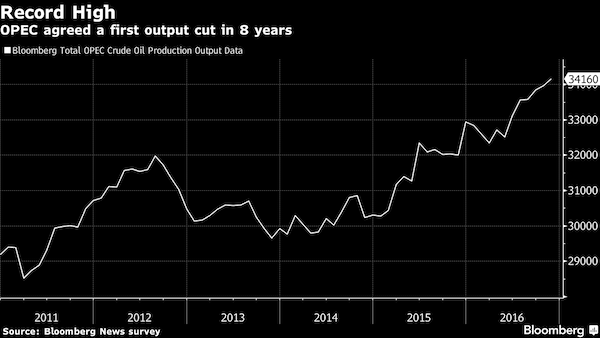

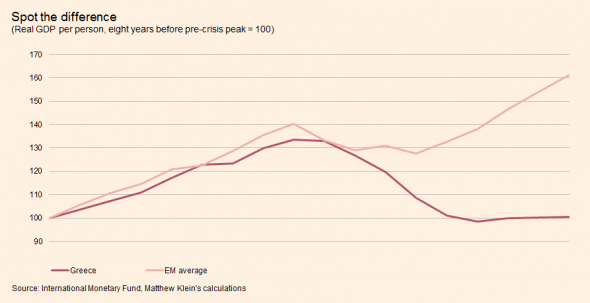

This chart encapsulates the narrative in Matt’s post – namely that Greece has underperformed other emerging market crisis countries on post-crisis growth. Here’s how Matt put it: Greece had a very different post-crisis experience: it never recovered. By contrast, all the other countries were well past their pre-crisis peak after this much time had elapsed. On average, Argentina, Brazil, Indonesia, Thailand, and Turkey have outperformed Greece by more than 40 percentage points after nine years. The reasonable question is why. Matt answers that in the paragraph before, saying: “But unlike those countries, Greece lacked the ability to use the exchange rate as a shock absorber. So while Brazil and Greece faced the same type of downturn in dollar terms — about 45% in GDP per person — Brazilian living standards only deteriorated about 2%, compared to 26% in Greece. The net effect is that Greece had a relatively typical crisis in dollars but an unprecedently painful one in the terms that matter most”.

My view is that what we are seeing, therefore, is the difference monetary sovereignty can make in post-crisis recovery because the currency does a lot of the heavy lifting. And this is true for developed economies as well. For example, we saw the UK and Sweden recover after a housing bubble and EMU turmoil in the early 1990s in part because of currency depreciations. But of course, Greece doesn’t have its own currency so the currency can’t depreciate. Greece must use the internal devaluation route, which makes its labor, goods and services cheaper through a deflationary path – and that is very destructive to demand, to growth, and to credit. This, in my view, accounts for much of Greece’s underperformance relative to emerging market crisis countries.

In response to my tweet on Greece, Danish economist Lars Christensen pointed out to me that he had compared Greece to Turkey in 2015 and Greece came out poorly too. And his post noted that: “14 years later Turkey is still in many ways politically dysfunctional – in fact it has gotten worse in recent years – there has been rumours of plans of military coups, there has been major corruption scandals even involving the Prime Minister (now president Erdogan) and the governing AKParty and lately the civil war in Syria has created a massive inflow of refugees and increased tensions with Turkish Kurdish population.” Translation: it’s not about reforms, people. It’s about growth. And the euro – and the policies tied to membership – is anti-growth, particularly for a country like Greece that is forced to hit an unrealistic 3.5% primary surplus indefinitely. And there will be no debt forgiveness either, as the IMF has said is necessary.

The WaPo takes a break from its political campaign and shows it still has at least one person left who can write an actual -and execellent- report.

• Austerity Was A Bigger Disaster Than We Thought (WaPo)

We now take a break from your regularly scheduled scandals to bring you some not-so-breaking news: austerity was as big a disaster as its biggest critics said it was. That, at least, is what economists Christopher House and Linda Tesar of the University of Michigan and Christïan Proebsting of the École Polytechnique Fédérale de Lausanne found when they looked at Europe’s budget-cutting experience the last eight years. It turns out that cutting spending right after the worst crisis in 80 years only led to a lower GDP and, in the most extreme cases, higher debt-to-GDP ratios. That’s right: trying to reduce debt levels sometimes increased debt burdens. Other than that, how was the policy, Mrs. Lincoln? But let’s back up a minute. This isn’t something that’s always true. In fact, it almost never used to be.

Cutting spending, you see, shouldn’t be a problem as long as you can cut interest rates too. That’s because lower borrowing costs can stimulate the economy just as much as lower government spending slows it down. What happens, though, if interest rates are already zero, or, even worse, you’re part of a currency union that means you can’t devalue your way out of trouble? Well, nothing good. House, Tesar and Proebsting calculated how much each European economy grew — or, more to the point, shrank — between the time they started cutting their budgets in 2010 and the end of 2014, and then compared it with what actually realistic models say would have happened if they hadn’t done austerity or adopted the euro.

According to this, the hardest-hit countries of Greece, Ireland, Italy, Portugal and Spain would have contracted by only 1% instead of the 18% they did if they hadn’t slashed spending; by only 7% if they’d kept their drachmas, pounds, liras, escudos, pesetas and the ability to devalue that went along with them if they hadn’t become a part of the common currency and outsourced those decisions to Frankfurt; and only would have seen their debt-to-GDP ratios rise by eight percentage points instead of the 16 they did if they hadn’t tried to get their budgets closer to being balanced. In short, austerity hurt what it was supposed to help, and helped hurt the economy even more than a once-in-three-generations crisis already had.

[..] the euro really has been a doomsday device for turning recessions into depressions. It’s not just that it caused the crisis by keeping money too loose for Greece and the rest of them during the boom and too tight for them during the bust. It’s also that it forced a lot of this austerity on them. Think about it like this. Countries that can print their own money never have to default on their debts — they can always inflate them away instead — but ones that can’t, because, say, they share a common currency, might have to. Just the possibility of that, though, can be enough to make it a reality. If markets are worried that you might not be able to pay back your debts, they’ll make you pay a higher interest rate on them — which might make it so that you really can’t. In other words, the euro can cause a self-fulfilling prophecy where countries can’t afford to spend any more even though spending any less will only make everything worse.

That’s actually a pretty good description of what happened until the ECB belatedly announced that it would do “whatever it takes” to put an end to this in 2012. Which was enough to get investors to stop pushing austerity, but, alas, not politicians. It’s a good reminder that you should never doubt that a small group of committed ideologues can destroy the economy. Indeed, it’s the only thing that ever has. That’s true whether you’re talking about the European politicians who pushed for the creation of the euro itself – they ignored the economists who warned them that it might turn out just as badly as it has – or the ones who pushed for austerity a few decades later. After all, it shouldn’t have been a surprise that trying to balance your budget when interest rates were zero would end badly.

What’s lacking in Europe is self-reflection. Maybe that’s because it has no flexibility in its policies. But that still doesn’t make Malloch wrong.

• ‘The European Project Has Failed’ – Trump EU Envoy Pick Malloch (Exp.)

Donald Trump’s likely EU ambassador has launched a blistering attack on the “undemocratic” bloc and its “elitist” leaders.In comments that will terrify Brussels, Ted Malloch said the EU had become “bloated” by bureaucracy and “anti-Americanism”. And he called for member states to hold their own Brexit-style referendums – which could spark the break-up of the union. It comes after Mr Trump hailed Brexit as a “blessing to the world” and said the UK would be far stronger outside the bloc. Mr Malloch, who is the President’s pick to become Washington’s envoy to Brussels, made the comments in The Parliament magazine.

He said: “Put the EU to a referendum vote in every member country. “It is time for greater scepticism and realism about the European Union and its not so hidden agenda and ever closer union.” He added: “The failure of the European integration project should by now be self-apparent to everyone. “This is simply not something Churchill or Roosevelt would countenance. “The European Union has become undemocratic and bloated by both bureaucracy and rampant anti-Americanism.” He said: “We want democracy and accountability, while the EU is intrinsically undemocratic and unaccountable. “So should the US continue to promote such a damaged European model, which is alien to our own traditions? Is it not working against US interests to do so?”

It may be an option considered fleetingly, but that’s it.

• Greece ‘May Ditch Euro In Favour Of The Dollar’ – Malloch (Ind.)

The man tipped to be Donald Trump’s ambassador to the European Union has said that Greece is contemplating leaving the euro in favour of the US dollar. According to the transcript of a translated interview with Greek local online news site ekathimerini.com, Professor Ted Malloch claimed Greek economists are looking into taking on the US banknotes if the country turns its back on the European single currency in a move that he said would “freak out” Germany. He said: “I know some Greek economists who have even gone to leading think tanks in the US to discuss this topic and the question of dollarisation. “Such a topic of course freaks out the Germans because they really don’t want to hear such ideas.”

Mr Malloch added that a “Grexit” would be the best options for Greek people as the current situation is “unsustainable”. Mr Malloch, a strident Brexiteer, has indicated he is no fan of Brussels on several occasions. Earlier this month, in an interview with Bloomberg, Mr Malloch said that he didn’t want to speak on behalf of the Greek people but “I think there is probably – from an economist’s perspective – a very strong reason for Greece moving away from the euro.” Last month, Mr Malloch said the euro “could collapse” in the next 18 months. “The one thing I would do in 2017 is short the euro,” he said. “I think it is a currency that is not only in demise but has a real problem and could in fact collapse in the coming year, year and a half,” he added.

‘He will die in jail’:

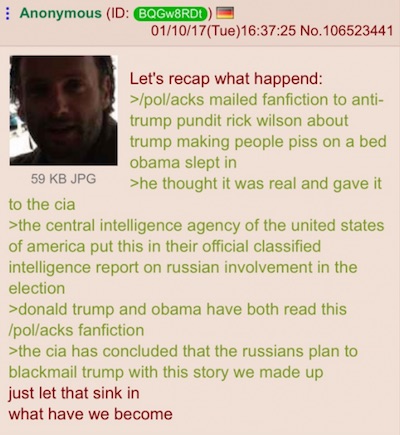

• US Intelligence Community Ready To ‘Go Nuclear’ On Trump (RawS)

U.S. national security officials are reportedly ready to “go nuclear” after President Donald Trump’s latest attack on the intelligence community. In a series of tweets on Tuesday and Wednesday, Trump insisted that the “real scandal” was not that former National Security Adviser Michael Flynn lied about his contact with Russia. Instead, the president blasted what he said were “un-American” leaks that led to Flynn’s ousting.On Wednesday, former NSA intelligence analyst John Schindler provided some insight into the reaction of national security officials. “Now we go nuclear,” he wrote on Twitter. “[Intelligence community] war going to new levels. Just got an [email from] senior [intelligence community] friend, it began: ‘He will die in jail.’” “US intelligence is not the problem here,” Schindler added in another tweet. “The President’s collusion with Russian intelligence is. Many details, but the essence is simple.”

No matter where you stand, this must be of concern. A state within the state is not what the founders had in mind.

• Spies Keep Intelligence From Donald Trump on Leak Concerns (WSJ)

U.S. intelligence officials have withheld sensitive intelligence from President Donald Trump because they are concerned it could be leaked or compromised, according to current and former officials familiar with the matter. The officials’ decision to keep information from Mr. Trump underscores the deep mistrust that has developed between the intelligence community and the president over his team’s contacts with the Russian government, as well as the enmity he has shown toward U.S. spy agencies. On Wednesday, Mr. Trump accused the agencies of leaking information to undermine him. In some of these cases of withheld information, officials have decided not to show Mr. Trump the sources and methods that the intelligence agencies use to collect information, the current and former officials said.

Those sources and methods could include, for instance, the means that an agency uses to spy on a foreign government. A White House official said: “There is nothing that leads us to believe that this is an accurate account of what is actually happening.” A spokesman for the Office of Director of National Intelligence said: “Any suggestion that the U.S. intelligence community is withholding information and not providing the best possible intelligence to the president and his national security team is not true.” Intelligence officials have in the past not told a president or members of Congress about the ins and outs of how they ply their trade. At times, they have decided that secrecy is essential for protecting a source, and that all a president needs to know is what that source revealed and what the intelligence community thinks is important about it.

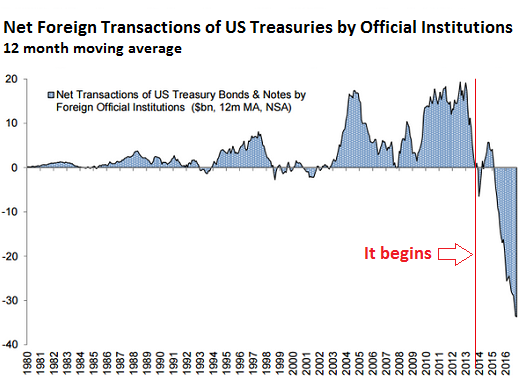

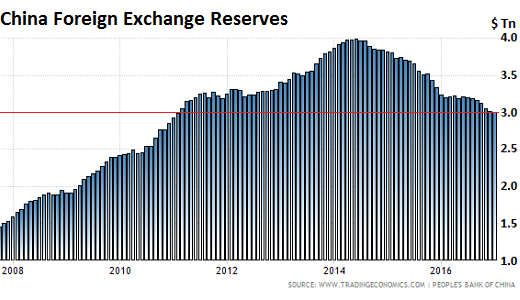

Fewer reserve requirements means less Treasury appetite.

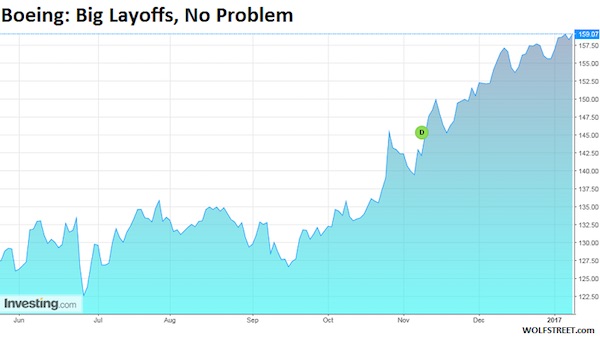

• How Trump Could Trigger A Massive Wave Of Selling In The Treasury Market (CNBC)

Since the financial crisis, banks have been stockpiling Treasurys because they qualify as “safe” assets that count toward required regulatory capital levels. U.S. commercial banks now hold $2.4 trillion in government debt and agency securities, more than double the total from nine years ago, according to the St. Louis Fed. But House Republicans – with the support of the administration – are pushing to roll back parts of the Dodd-Frank regulations that were put in place after the 2008 financial crisis. That means banks could get a reprieve from those capital level requirements, and they could reduce their Treasury holdings as a result. In a report, RBC managing director and banking analyst Gerard Cassidy calculates the 24 largest bank holding companies already hold $100 billion in excess capital, with Citigroup and JPMorgan Chase having the highest dollar amount.

As regulation eases, the capital that was once used as a large cushion against a future recession could be funneled into stock buybacks. Those Treasury-heavy portfolios “will certainly be the source of cash to use to buy back stock,” Cassidy wrote in an e-mail to CNBC. Banks have already been slowly selling off the debt, which causes yields to rise. Between the middle of 2013 and 2014, Bank of America’s holdings of U.S. Treasurys grew from $2.9 billion to $58 billion. At the end of 2016, that figure had dropped to $48 billion, according to the bank’s earnings. Wells Fargo’s $26 billion Treasury balance in September is down nearly 30% from a year ago. Not all banks break out the specific balance, but the totals as of the third quarter of 2016 range from $23 billion (Morgan Stanley) to $111 billion (Citigroup).

But banks are just one source of possible selling en masse. China is a creditor of a different magnitude: The country held $1.05 trillion in Treasurys as of November, down by $215 billion from a year earlier. It dumped $41 billion in U.S. debt in October alone, a move that relinquished its ranking as the largest foreign creditor to the United States. One reason for the country selling U.S. debt previously was its need to raise cash to prop up its currency, the yuan, after years of seeking to devalue it to make its exports more attractive. Its intervention in the currency markets led President Donald Trump, while campaigning, to label China a currency manipulator and threaten a 45% tariff on products made in China but sold in the United States.

Interesting phenomenon, but the writers have a hard time explaining.

• Houses as ATMs No Longer (NYFed)

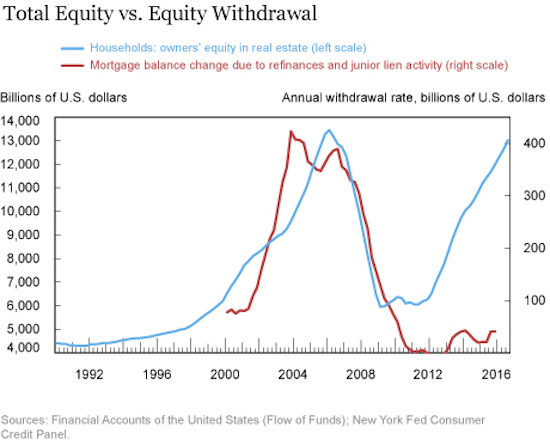

Housing equity is the primary form of collateral that households use for borrowing. This makes it a potentially important source of consumption funding, especially for younger households. In a previous post we showed that owner’s equity in residential real estate has finally, thanks to increasing home prices, rebounded to and essentially re-attained its 2005 peak level. Yet in spite of a gain of more than $7 trillion in housing equity since 2012, so far homeowners haven’t been tapping this equity at anything like the pace we witnessed during the housing boom that ended in 2006. In this post, we analyze the changes in equity withdrawal.

The blue line in the chart below shows total owner’s equity in real estate from the Flow of Funds—this is the same series as in our previous post. It shows a dramatic rebound in aggregate home equity over the last several years. The red line shows the combination of two ways that households can withdraw equity—assuming they have some—without selling the house: they can originate a junior lien against the property or they can refinance using a cash-out refinancing of an existing first-lien mortgage. The series in the chart, which we have shown in an earlier post on household debt, captures both of these, while excluding the equity withdrawal associated with selling a home.

The first observation that’s striking about the chart is the dramatic change in borrower behavior with respect to home equity. During the boom between 2000 and 2006, household equity and its extraction were both rising rapidly. From 2003 to 2007, homeowners were extracting more than $350 billion per year, resources that were available for use in a variety of purposes from home improvement to consumption. The second major point of the chart is the effect of the housing and financial crises. Beginning in 2008, equity extraction began to decline quickly and was hovering around zero by 2010, where it remained through 2012. The virtual elimination of equity withdrawal was a big contributor to the household deleveraging that ultimately shaved more than $1.5 trillion from household debt. It also likely contributed to the sharp decline of consumption during the Great Recession and its subsequent sluggish recovery.

Looks dangerous. Fighting bubbles with bigger bubbles is always a bad idea.

• Fed Frets about $2 Trillion Commercial Real Estate Bubble (WS)

Boom and bust: that’s the material CRE is made of. We had seven years of boom, and now the Fed is worried about the bust. Yellen didn’t mention CRE in her prepared testimony on Tuesday before the Senate Committee on Banking, Housing, and Urban Affairs. But it featured in the twice-yearly report that the Fed delivered to Congress in support of Yellen’s testimony. And it wasn’t the first time that it was mentioned in these twice-yearly reports – but the fifth time in a row. In its February report two years ago, the Fed first pointed at “valuation pressures” in CRE. And warnings about CRE have appeared since then in every report, twice a year, with growing sharpness, including in the report issued in June 2016, which warned that “valuations in the CRE sector appear increasingly vulnerable to negative shocks….”

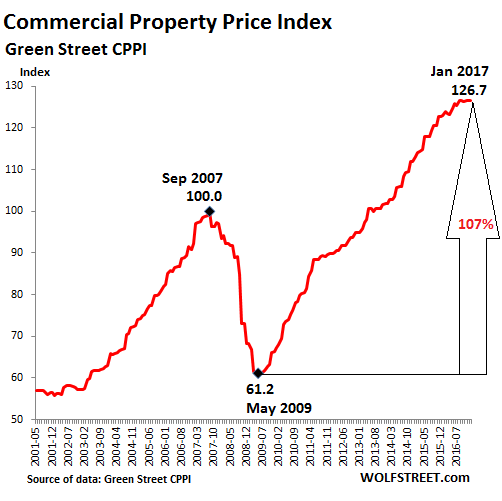

Other Fed governors have also warned about the CRE boom and a potential bust, particularly Boston Fed governor Eric Rosengren, who was gazing with amazement at a stunning crane forest in his own city. What concerns the Fed about CRE aren’t the valuations per se, but the fact that the sector is highly leveraged, and that when prices collapse, which they tend to do, the collateral value gets crushed, and banks are left to twist in the wind. That’s what happened during the Financial Crisis. Just how badly can prices get crushed? The national averages hide the drama that happens on the ground in particular cities. But even these national averages still show enough drama, as per data from the Green Street Commercial Property Price Index. The index shows that overall prices across the major markets in the nation plunged nearly 40% during the Great Recession and have since more than doubled:

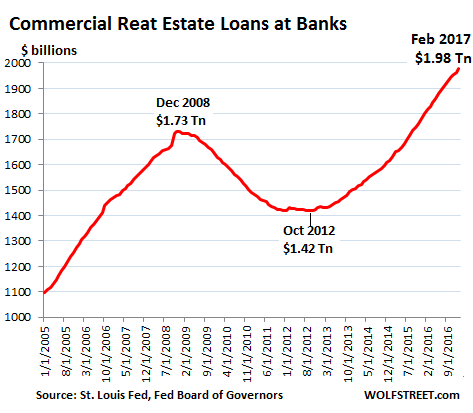

So that’s why the Fed is fretting about it. This time around, the Fed report said: “Commercial real estate (CRE) valuations, which have been an area of growing concern over the past year, rose further, with property prices continuing to climb and capitalization rates decreasing to historically low levels.” Then the report discusses the debt that nurtured this boom to these heights. This debt has ballooned to $1.98 trillion, and is now 14% higher than during the crazy peak of the prior bubble that collapsed with such spectacular results:

All of a sudden Hamon has 38%?! Oh wait, the numbers don’t add up at all. More countries should discuss their colonial past- and present.

• France’s Colonial Past Muscles Into Presidential Race (AFP)

French presidential frontrunner Emmanuel Macron drew a storm of criticism Wednesday after calling France’s colonisation of Algeria a “crime against humanity”. In a TV interview in Algiers this week, the centrist said French actions in Algeria, which achieved independence in 1962 after eight years of war, were “genuinely barbaric, and constitute a part of our past that we have to confront by apologising”. His visit also included a stop at the Martyrs’ Memorial in Algiers, saying he wanted to promote a “reconciliation of memories” between the two countries. His rivals on the right for the French presidency – due to be decided in a first round election in April and a run-off between the two top candidates in May – pounced on the comments.

Les Republicans candidate Francois Fillon on Wednesday denounced what he called “this hatred of our history, this perpetual repentance that is unworthy of a candidate for the presidency of the republic”. Wallerand de Saint-Just, an official in Marine Le Pen’s far-right National Front party, accused Macron of “shooting France in the back”, while Gerald Darmanin, an ally of ex-president Nicolas Sarkozy, tweeted “Shame on Emmanuel Macron for insulting France while abroad”. It was the not the first time Macron, who currently leads the polls for the two rounds of voting in April and May, has touched on the livewire issue. “Yes, there was torture in Algeria, but there was also the emergence of a state, or wealth, of a middle class,” he told the magazine Le Point in October.

“This is the reality of colonialism. There are elements of civilisation and elements of barbarism.” And Fillon has been tripped up by his own comments on French colonialism. In August, he drew claims of trying to sanitise history, claiming that “France is not guilty of having wanted to share its culture with the peoples of Africa”. Macron remains the frontrunner in the presidential race, with 39% of those surveyed in the latest survey by pollsters Ipsos giving him a favourable opinion. In the poll released by the magazine Le Point on Wednesday, Macron was followed by Socialist candidate Benoit Hamon, with 38%, while Fillon tumbled 18 percentage points to 25%, just behind Le Pen, on 26%.

One step away from a formal investigation. Does he really want it that bad?

• French Prosecutor Keeps Fillon Fake Work Probe Open (R.)

France’s financial prosecutor announced on Thursday that an investigation into fake work allegations surrounding presidential candidate Francois Fillon would remain open, in a new blow to the ex-prime minister’s campaign. A three week-old scandal over hundreds of thousands of euros in taxpayers’ money which his wife was paid for work she may not have done has cost conservative Fillon his status as favorite to win the French presidency in May. “It is my duty to affirm that the numerous elements collected (by investigators) do not, at this stage, permit the case to be dropped,” prosecutor Eliane Houlette said in a statement, after receiving an initial police report on the subject.

The prosecutor did not announce any further steps, but among the choices before it are dropping the case, taking it further by appointing an investigating magistrate, or sending it straight to trial. Fillon, 62, has said he would step down should he be put under formal investigation, but his camp has also challenged the legitimacy of the probe. The first round of the election is less than 10 weeks away.