Marjory Collins “Crowds at Pennsylvania Station, New York” Aug 1942

Excellent: “The truth is evil people who commit evil acts transcend economic trigger points, which is why you can get mugged by a poor person the same day that a billionaire banker cheats you out of your retirement savings and a rich terrorist tries to blow up an airliner with a bomb in his pants.”

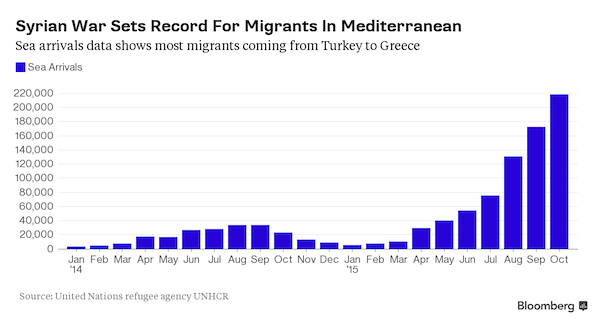

• This Is What Will Kill The EU (Novak)

It’s always the things you don’t expect that get you. After banking scandals, currency issues, and a Greek/Portugese/Spanish debt crisis just about every six months, the economic and political partnership that is the European Union seems much more likely to fall apart for an entirely different reason after all. That reason is ISIS. The direct cause is actually an extremely divisive and growing dispute about open borders, immigration, and refugee resettlement. But that conflict just became a lot more serious thanks to the horrific ISIS terrorist attacks in Paris Friday night. Now, this discussion has grown and migrated, (pun intended), from a political debate among E.U. elites to the #1 pressing issue on the streets of Europe.

When relatively smaller economic nations like Hungary began closing their borders to migrants and Syrian refugees last month, it could be written off as perhaps an isolated incident. But all bets are off now that France is closing its borders in response to the attacks, even if it is just temporarily. That’s because in so doing, President Francois Hollande has unambiguously connected the border issue with the effort to fight the spread of terror. It’s so obvious that even the most politically uninterested person can see what it means. And just in case the message still isn’t entirely clear to everyone, one of the major stories in Europe today is about how the alleged mastermind of the Paris attacks, Abdelhamid Abaaoud, boasted in videos about how easily he crisscrossed the borders of the E.U. for years.

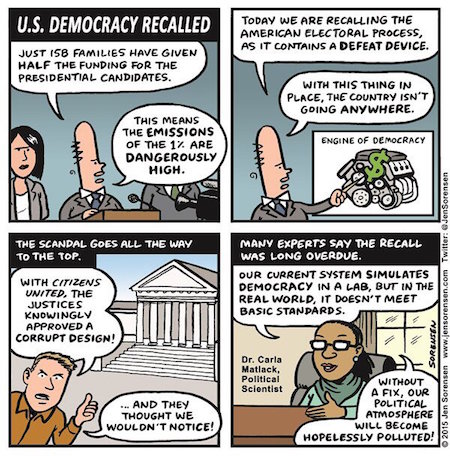

This is a political nightmare for the statist bureaucrats who have been working for decades to reduce true representative democracy all for the goal of a unified and monolithic economic entity without worrying about being hindered by annoying little things like the will of the people. Before these attacks and the border response, the E.U. simply glossed over dissent and most attempts to challenge its un-elected sovereignty. Its best weapon in that fight has always been using the accusations of racism and xenophobia against those who refused to integrate and obey the E.U. fully and quickly enough in all matters of economics, immigration, and tax law. With a mostly compliant state-sponsored news media on its side, the “racist” and “xenophobic” label has been used the most against Britain’s anti-E.U. UKIP party more and more in recent years.

UKIP does keep gaining in popularity in the U.K., but it still has to fight very hard to beat back those scare tactic accusations. But what do the people who spread accusations of racism and xenophobia do now that more Europeans than ever believe their governments are sacrificing their safety in favor of remaining compliant with E.U. immigration dogma? The simple answer is that they’re in trouble, and no amount of sanctimonious shaming or economic threats will do much good when the majority of the public doesn’t feel safe anymore.

No, Ambrose, OPEC’s pump and dump is not a strategy, it’s despair.

• Goldman Eyes $20 Oil As Glut Overwhelms Storage Sites (AEP)

The world is running out of storage facilities for surging supplies of oil and may soon exhaust tanker space offshore, raising the chances of a violent plunge in crude prices over coming weeks, experts have warned. Goldman Sachs told clients that the increasing glut of oil on the global market has combined with mild weather from a freak El Nino this winter. The twin-effect could send prices plummeting to $20 a barrel, the so-called ‘cash cost’ that forces drillers to abandon production. “Risks of a sharp leg lower remain elevated,” it said. Oil has fallen from $110 a barrel early last year and is hovering near $40 for US crude, and $44 for Brent in Europe. The US investment bank said the overall glut in the commodity markets may take another twelve months to clear.

It cited ‘red flag’ signals on the Shanghai Future Exchange over recent days. Copper contracts point to “imminent weakening” in China’s ‘old economy’ of heavy industry and construction, it said. The warnings came as OPEC producers and Russian companies fight a cut-throat battle for market share in Europe and Asia. Saudi Arabia is shipping crude to Poland and Sweden for the first time, poaching new customers in the Kremlin’s traditional backyard. Iraq is selling its low grade ‘Basra heavy’ crude on global markets for as little as $30 a barrel as the country runs out of operating cash and is forced to cut funding for anti-ISIS militias. Iraq is seeking a large rescue loan from the IMF. “The drop in oil prices is a difficult test for us,” said premier Haider al-Abadi.

It is estimated that at least 100m barrels are now being stored on tankers offshore, waiting for better prices. A queue of 39 vessels carrying 28m barrels is laid up outside the Texas port of Galveston, while the Iranians have a further 30m barrels offshore ready to sell as soon as sanctions are lifted. “The world is floating in oil, and commercial stocks on land are at a record high,” said David Hufton, head of oil brokers PVM Group. “The numbers we are facing now are dreadful. Stocks have been building continuously for two years. This is unprecedented.” “What has saved us so far is that China has been buying 200,000 to 300,000 barrels a day (b/d) for their strategic reserve,” he said.

It is unclear exactly how much more space China may have. The Chinese authorities certainly want to keep building stocks – and do so at bargain prices – since reserves cover just 50 days demand, far short of the 90-day minimum recommended by the International Energy Agency. But the new storage depots in Gansu and Xinjiang will not be ready until the end of the year, at the earliest. Data from the US Energy Department shows that America’s storage sites are 70pc full, in theory leaving room for another 150m barrels. But this is already tight enough to create regional bottlenecks. It will not be sufficient if OPEC continues to flood the global market in a bid to drive out rivals. Excess supply is running near 2m b/d.

I doubt that’s the total number. Try ten times that one.

• China Has a $1.2 Trillion Ponzi Finance Problem (Bloomberg)

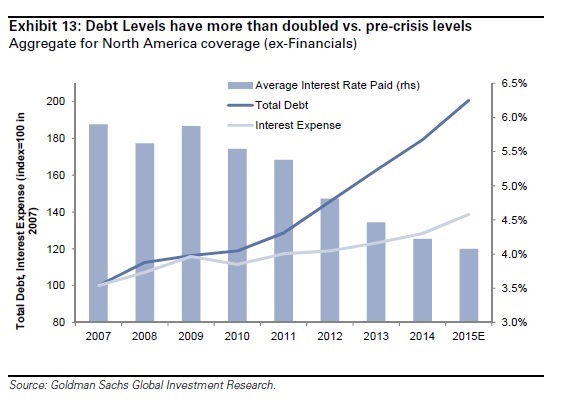

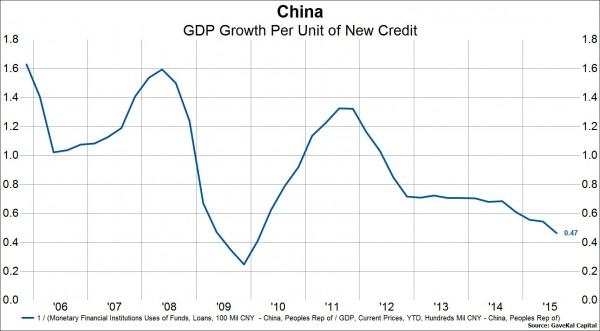

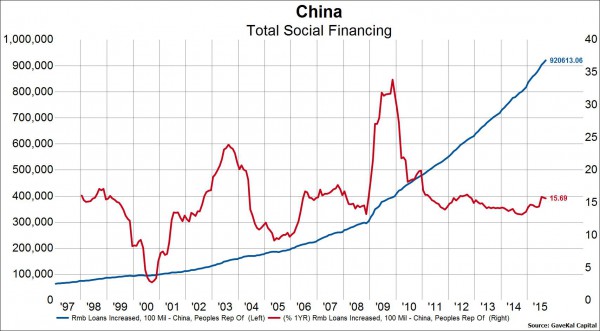

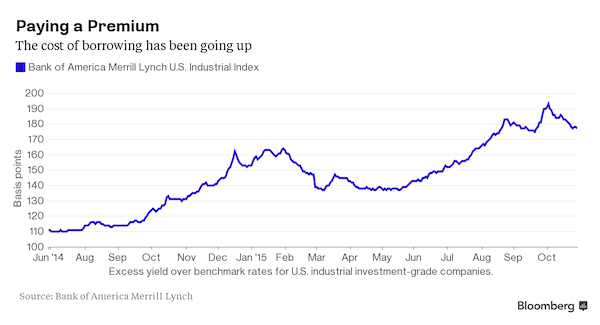

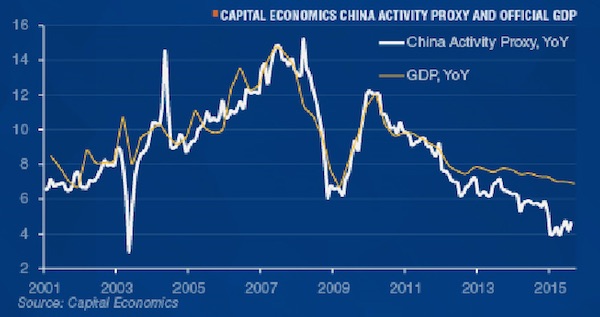

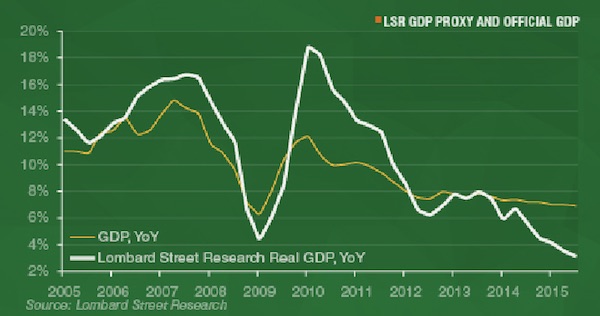

Chinese borrowers are taking on record amounts of debt to repay interest on their existing obligations, raising the risk of defaults and adding pressure on policy makers to keep financing costs low. The amount of loans, bonds and shadow finance arranged to cover interest payments will probably rise 5% this year to a record 7.6 trillion yuan ($1.2 trillion), according to Beijing-based Hua Chuang Securities. Dubbed “Ponzi finance” by Hyman Minsky, the use of borrowed funds to repay interest was seen by the late U.S. economist as an unsustainable form of credit growth that could precipitate financial crises. Chinese companies are struggling to generate the cash flow needed to service their obligations as economic growth slows to the weakest pace in 25 years and corporate profits shrink.

While the debt burden has been eased by six central bank interest-rate cuts in 12 months and a tumble in corporate borrowing costs to five-year lows, the number of defaults in China’s onshore corporate bond market has increased to six this year from just one in 2014. “Some Chinese firms have entered the Ponzi stage because return on investment has come down very fast,” said Shi Lei, the Beijing-based head of fixed-income research at Ping An Securities Co., a unit of the nation’s second biggest insurance company. “As a result, leverage will be rising and zombie companies increasing.” China Shanshui Cement became the latest company to default on yuan-denominated domestic notes last week as overcapacity in the industry hurt profits and a shareholder dispute stymied financing.

State-owned steelmaker Sinosteel, which pushed back an interest payment on a bond last month, postponed it again this week. Metrics of corporate health in Asia’s largest economy have deteriorated as growth slowed. The number of Shanghai and Shenzhen-listed companies that have less cash than short-term debt, net losses and contracting revenue has increased to 200 as of June from 115 in the year-earlier period, according to data compiled by Bloomberg. The amount of bad debt among Chinese banks rose 10% in the third quarter from the previous three months to 1.2 trillion yuan, about the size of New Zealand’s economy. Total debt at listed companies has climbed to 141% of common equity, based on a market-capitalization weighted average, the highest level in three years.

It already is.

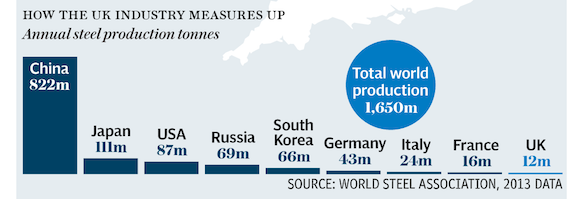

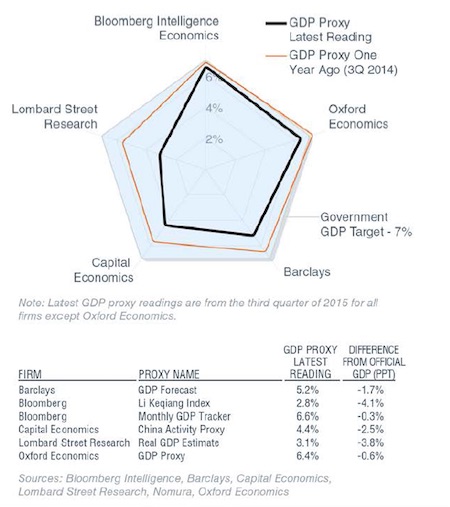

• A Hard Landing in China Could ‘Shake the World’ (Bloomberg)

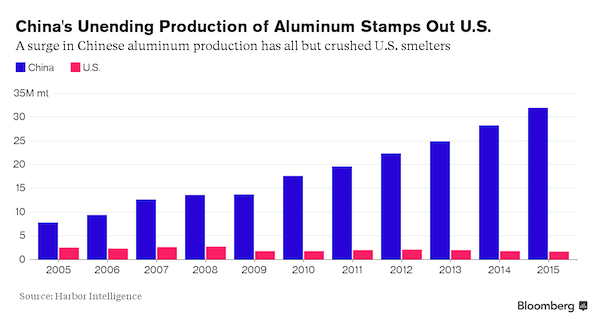

China’s slowdown is already playing out across the world, dragging down commodity prices and weighing on trade partners. And that’s while the economy is still growing at about 7%. So imagine what happens in a hard-landing scenario. The crew at Oxford Economics have done just that in a new report that makes stark reading for anyone with a stake in the global economy. China’s economic boom of the past 30 years means it now accounts for 11% of world GDP and around 10% of world trade. For resources, it’s an even bigger player, accounting for 11% of world oil demand and 40 to 70% of demand for other key commodities, according to the Oxford Economics research. Its financial system is massive, with its broad money supply now larger than the U.S.’s and amounting to over 20% of the world’s.

So were China to sneeze, the world may well catch a cold. First to trade. The volume of goods imported into China have already fallen by around 4% in the first three quarters of the year, after rising an average 11% per year from 2004-14. That means China has cut around 0.4 percentage point from world goods trade growth in the nine months to the end of September, after having added an average 1 percentage point a year in the previous decade. The biggest losers are those with the closest trade links and those whose economies are most open. For most advanced economies, their reliance on trade with China is lower, with Germany among the more dependent.

Then there’s the indirect effects as the drag on GDP of China’s trading partners works through the global economy. For instance, Japan would not only suffer from weaker exports to China but also to Korea and other Asian trading partners affected by China’s slowdown, the Oxford Economics research shows. Another transmission is via commodity prices, with any further slowdown in Chinese growth leading to additional price falls, especially as supply has expanded significantly in recent years. That would be bad news for the likes of Australia and Brazil. And here’s another spillover you may not have thought of: One consequence of the plunge in crude prices is that oil exporting countries and their sovereign wealth funds now have less money to invest in advanced economy financial assets.

Making shadow banks look less attractive..

• The Real Reason Behind China’s Latest ‘Stimulus’ (CNBC)

A decision by the People’s Bank of China (PBoC) to lower short-term borrowing costs for banks is not the standard pick-me-up aimed at a weakening economy. Instead, the latest step by the PBoC is an experiment towards finding alternatives to benchmark interest rates whose efficacy has been blunted in recent years by the surge in the shadow banking system as well as removal of limits that tied commercial bank rates to official policy rates, economists say. Late on Thursday, the central bank reduced its Standing Lending Facility (SLF) interest rates, yet another policy tool to inject cash into banks, with the seven-day rate cut to 3.25% and the overnight rate to 2.75% from 5.5% and 4.5%, respectively.

Typically, Chinese monetary stimulus relies on interest rate cuts or reductions in bank reserve requirements, with the lesser-known SLF only being used in anticipation of periods of tight liquidity, such as holidays. The facility hasn’t been used since March. Thursday’s departure from traditional policy tools suggests that the central bank wasn’t necessarily trying to boost economic growth, unlike previous easing episodes. Thursday’s cuts were to “discover the function of the Standard Lending Facility as the ceiling of the interest rate corridor,” according to the PBoC’s statement. Global central banks use the interest corridor system to guide market interest rates towards main policy rates.

When monetary conditions are tight, short-term money market rates move towards the upper end of the corridor as commercial lenders borrow from the central bank. Conversely, when financial markets are awash with cash, the lower end of the corridor ends up guiding policy.

Watch out housing bubbles.

• China Cracks $64 Billion ‘Underground Bank’ Moving Money Abroad (Bloomberg)

China said it cracked the nation’s biggest “underground bank,” which handled 410 billion yuan ($64 billion) of illegal foreign-exchange transactions, as the authorities try to combat corruption and rein in capital outflows that have hit records this year. More than 370 people have been arrested or face lawsuits or other punishment in the case centered in eastern Zhejiang province, the official People’s Daily reported on Friday, citing police officials. The case brought the total for underground banking and money-laundering activities to 800 billion yuan since April, the newspaper said. The probe began in September last year and the police took almost a year to sort through more than 1.3 million suspicious transactions, the state-run Xinhua News Agency reported separately. The authorities froze more than 3,000 bank accounts, Xinhua said.

The case highlights the nation’s struggle to control capital outflows that have helped to send real-estate prices soaring from Vancouver to Sydney – even when Chinese citizens are officially limited to converting $50,000 of yuan per year. Some people may be moving the proceeds of corruption, while others may be concerned about the outlook for the economy and the potential for the yuan to weaken. “The government wants to stem outflows and stabilize the yuan’s exchange rate, but the outflows cannot be stopped unless people change their expectation on yuan depreciation,” said Xi Junyang, a finance professor at Shanghai University of Finance & Economics. Besides illegal banking operations, “a lot of money is leaving the country by legal means,” Xi said.

Xi will probabbly be elated. The yuan goes down because the IMF wants it. Beggar thy neigbor by decree.

• China’s Yuan May Enter IMF Basket With Lower Share (Reuters)

China’s yuan may enter the IMF’s benchmark currency basket at a lower weighting than previously estimated because of changes in how to calculate the make-up of the basket, people briefed on the Fund’s discussions told Reuters. IMF policymakers are expected to add the Chinese currency to the Special Drawing Rights basket later this month, after a campaign by Beijing for the yuan, or renminbi, to have equal billing with the dollar, euro, pound sterling and yen. Two people familiar with IMF deliberations said policymakers were considering changing the way the weights of currencies in the basket are calculated to make export volumes less important and financial flows more important.

China, the world’s largest exporter, lags other countries in financial transactions and such a change would give China’s yuan, also known as the renminbi, a lower share in the basket than under the current formula. The yuan’s inclusion is largely seen as a recognition of China’s political and economic heft and as setting the seal of approval on its economic reforms and would likely not have a major impact on financial markets. IMF staff calculated in July the yuan could have a weighting of about 14 to 16% and HSBC estimated it would have about 14% under the current formula. “I would say that it’s too high,” one person briefed on the IMF discussions said, referring to the estimates.

A second person, an official of a major Asian country who saw the IMF staff report, said: “It’s barely a two-digit rate, just the minimum (rate to be a double-digit one).” The SDR basket determines the mix of currencies that countries like Greece can receive as IMF disbursements and economists expect that inclusion will boost demand for the yuan. A lower weighting may crimp demand slightly. Last set in 2010, the basket is currently 41.9% dollar, 37.4% euro, 11.3% sterling and 9.4% yen. Capital Economics economist Andrew Kenningham said the methodology change would impact the yuan the most, while the other countries would maintain similar ratios. “The renminbi is completely different because despite its inclusion in the SDR, it’s not really a fully convertible currency and has very thin, much less liquid markets,” he said.

The Chinese will soon follow, Beijing’s launching crackdowns.

• Asian And Russian Buyers Desert Prime London Property Market (FT)

Asian and Russian homebuyers who once made up a third of those buying property in London’s wealthiest areas have largely deserted the market this year as emerging market currencies plunged against sterling. Properties in leafy boroughs such as Kensington, where the average home price is £1.5m, have been a sought-after asset in recent years among wealthy buyers seeking a base or an investment in a global, politically stable city. But that has changed in 2015, in a shift that estate agents said was partly down to turmoil in emerging markets and partly to a change in stamp duty that means buyers of the priciest homes pay substantially more tax. Asian homebuyers made up 26% of those buying homes in areas such as Kensington, Chelsea and Belgravia in the first three-quarters of last year, but that number was down to 6% in the same period of 2015, according to figures compiled by Hamptons, a high-end estate agent.

Chinese buyers were down from 9% of the total to 3%. Russians made up just 1% of buyers in the prime London areas, which also include Knightsbridge and Mayfair, in the first three-quarters of 2015, down from 7% a year earlier. The fall has coincided with a period of turbulence in Chinese equity markets, which spread to other Asian emerging markets and prompted falls in the region’s currencies against sterling. China’s renminbi is down 6.6% since April. In Russia, the war in Ukraine and international sanctions, together with lower oil prices, have taken a big toll on the country’s economy and currency. The rouble has shed 25% against sterling since April and is down 53% over the past two years. [..] Total transactions in prime London boroughs were down 19 per cent in the first three-quarters of 2015 against a year earlier, according to figures from LonRes, with agents blaming the stamp duty rise.

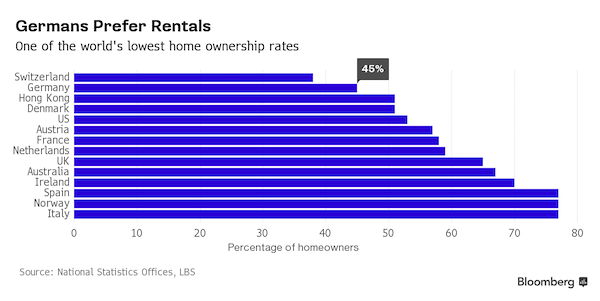

Germany catches the Anglo-Saxon housing disease.

• Here’s How the Boring German Housing Market Turned Piping Hot (Bloomberg)

Germany’s housing market is hot. Rents are rising in big cities including Berlin and Hamburg as young people seeking work move there from rural areas and elsewhere in Europe. Construction, however, has been slow to catch up, which has led to housing shortages and made leasing apartments a bonanza for landlords. Low interest rates make it cheaper than ever for companies to buy apartments, fueling record acquisitions by landlords including the country’s biggest, Vonovia. Portfolio sales rose from €5 billion in 2011 to €18.4 billion in the first nine months of this year, according to data compiled by Savills.

While shopping-mall owners and office developers dominate the listed-property sector in other countries, Germany’s residential property market is lucrative for landlords because it’s a nation of renters – and Germans tend to pay their rent on time. The surge in mergers and acquisitions, coupled with rising stocks, have allowed the market value of Germany’s publicly traded landlords to grow tenfold since 2012. The top two – Vonovia and Deutsche Wohnen – are now among the world’s biggest owners of homes, surpassing peers in the U.S. What’s more, Vonovia wants to buy its rival to create Europe’s No. 2 property company. With about 1 million refugees expected to enter Germany this year, the most of any European country, demand for apartments is unlikely to shrink anytime soon.

At what prices?

• Volkswagen Faces Pressure In US To Buy Back Older Diesel Cars (Reuters)

Volkswagen, which is set to provide detailed plans to fix vehicles that do not comply with U.S. emissions standards, faced more pressure on Thursday from officials in Washington and California to buy back older diesel cars. A California Air Resources Board spokesman said officials at the automaker are scheduled to meet Friday with CARB and the U.S. Environmental Protection Agency to present detailed proposals for recalling and fixing about 482,000 vehicles sold in the United States with diesel engines that emit more smog-forming pollutants than allowed by law. California has set a Nov. 20 deadline for Volkswagen to come up with a plan to fix the diesel cars affected by its rigging of emissions tests.

The carmaker said in September that around 11 million diesel powered cars were affected worldwide, including 482,000 in the United States. “I am personally hopeful we will be able to announce something soon about the remedies … and which we are discussing with the agencies in upcoming days,” Michael Horn, head of Volkswagen’s U.S. operations, said at the Los Angeles Auto Show on Wednesday. The CARB spokesman also confirmed that the agency’s head, Mary Nichols, told the German daily Handelsblatt that Volkswagen might have to buy back some of the older diesel models. “I think it is quite likely that they will end up buying back at least some portion of the fleet from the current owners,” the paper quoted Nichols as saying in an interview to be published on Friday.

Newer cars might get easy software fixes and medium generation ones might need software and hardware components to fix the issue, Nichols said, according to the paper. But older cars might have to be repurchased rather than fitted with new pollution control devices. Separately, U.S. Senators Ed Markey of Massachusetts and Richard Blumenthal of Connecticut on Thursday released a letter calling on the automaker to buy back diesel vehicles that don’t meet pollution standards. The lawmakers noted that Volkswagen had signaled it could buy back cars sold in Europe that have inaccurate carbon dioxide emissions ratings.

The California Air Resources Board is our best hope.

• Volkswagen Faces Major Spending Cuts And Regulatory Deadlines (NY Times)

Volkswagen is expected to announce substantial spending cuts on Friday as the carmaker braces for the financial impact of its emissions-cheating crisis — potentially setting up a confrontation with its powerful labor representatives. Volkswagen also faces a Friday deadline to inform regulators in the United States of how it plans to bring its diesel cars there into compliance with air-quality standards. The company admitted in September that it had installed software in the cars that was meant to enable the vehicles to cheat on emissions tests. That scandal, which involves about 11 million vehicles worldwide — most of them in Europe — is a big reason Volkswagen is now forced to cut costs.

The company must pay to modify the cars and could face billions of dollars in fines and legal settlements. Senior officials from the United States Environmental Protection Agency and the California Air Resources Board plan to meet with representatives from Volkswagen and its Audi division on Thursday and Friday to review the company’s proposed solutions, according to a spokeswoman for the E.P.A. Volkswagen is also under pressure to demonstrate to United States authorities that it is serious about identifying the people responsible for installing the software. Of the vehicles affected worldwide, about 500,000 are in the United States.

In addition, Volkswagen has admitted making exaggerated claims about the carbon dioxide output and fuel economy for 800,000 more cars in Europe. The Friday deadline was set by the California Air Resources Board, which helped to expose Volkswagen’s use of the so-called defeat software in its diesel vehicles. CARB, as it is known, is a particularly influential regulator in part because of the size of the California car market and also because it sets some of the most stringent emissions standards in the United States.

“A garage mechanic who soups up a car so a bank robber can make his getaway is participating in the crime.”

• US Probes VW Supplier Bosch In Cheating Scandal (Reuters)

U.S. authorities are investigating German auto supplier Robert Bosch over its role in Volkswagen’s massive scheme to cheat U.S. emission standards, according to people familiar with the matter. Federal prosecutors with the U.S. Department of Justice are examining whether Bosch, the world’s largest auto supplier, knew or participated in Volkswagen’s years-long efforts to circumvent U.S. diesel emissions tests, the people said. Bosch built key components in the diesel engine used in six Volkswagen models and one Audi model that the automaker has admitted to rigging to defeat emissions tests. Federal authorities are also investigating how deeply the scheme permeated VW’s hierarchy, according to people familiar with the matter.

The probe is at an early stage and there is no indication that U.S. prosecutors have found evidence of wrongdoing at Bosch, the people added, asking not to be named because the matter is not public. Volkswagen has admitted to installing software that allowed its 2.0 liter diesel models to pass U.S. clean air tests, while shutting off emissions control systems when its diesel cars are actually on the road. VW said in September that around 11 million diesel powered cars were affected worldwide, including 482,000 in the United States. Bosch provides the engine control module, called EDC17, and basic software for nearly all the four-cylinder diesel cars sold in North America, including by Volkswagen, BMW and Daimler’s Mercedes-Benz.

Those systems regulate how a vehicle cleans burned-up fuel before it is expelled as exhaust. Volkswagen had the engine software modified to turn on the vehicle’s emission control system when it was being tested in the lab, then turn it off when the vehicle was on the road, according to U.S. regulators. For authorities to bring charges against Bosch, they would have to prove the supplier knew that their technology was being used by Volkswagen to evade emissions requirements, said Daniel Riesel, an environmental attorney at Sive, Paget & Riesel P.C. “If you know that a crime is being committed and you actively facilitate part of the crime you are on the hook,” Riesel said. “A garage mechanic who soups up a car so a bank robber can make his getaway is participating in the crime.”

Having fun on the way down. Way down.

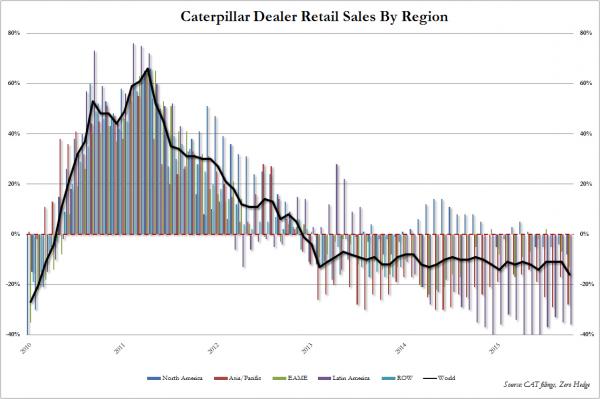

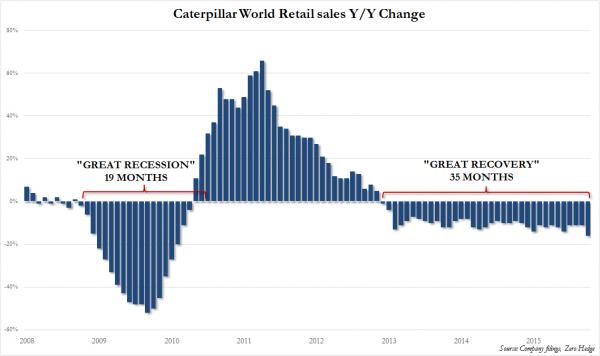

• Caterpillar’s Depression Has Never Been Worse .. But It Has A Cunning Plan (ZH)

Moments ago Caterpillar reported its latest monthly retail sales statistics and the numbers have never been worse: not only is the dead CAT bounce in US sales finally over, tumbling -8% Y/Y, after a -4% decline in September and hugging the flatline for the past few months, but sales elsewhere around the globe were a complete debacle: Asia/Pacific (mostly China) was down -28%, a dramatic drop from the -17% a month ago, EAME dropping -13%, and Latin America down -36%…

… but global retail sales just posted a massive -16% drop in the past month, after dropping 9% a year ago and another 12% in 2013, this was the biggest annual drop since early 2010. As the chart below shows, CAT has now suffered a record 35 months, or nearly 3 years, of consecutive declining annual retail sales – something unprecedented in company history, and set to surpass the “only” 19 months of decling during the great financial crisis by a factor of two!

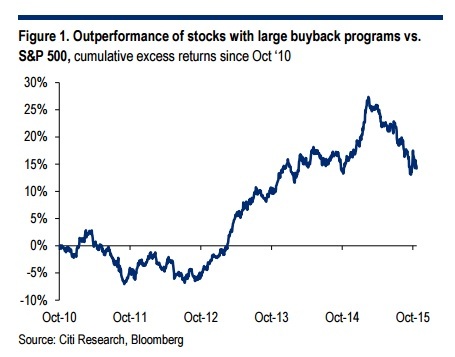

Worse, with the market no longer rewarding stock buybacks, Caterpillar suddenly finds itself flailing in the gale strength winds of what nobody can claims any longer is not a global industrial depression. However, there is good news – while Caterpillar’s revenues and cash flows may be plummeting with every passing month, at least the company has a cunning plan how to recover some inventory. According to the WSJ, Caterpillar is eager to reassure shareholders it won’t get burned on equipment leased to customers in China even as the economy cools there. CAT Financial Services President Kent Adams said during a conference call on Tuesday that the company keeps tabs on the position of machinery electronically through its Product Link system.

“If a customer falls behind, we have the ability to derate the engine or turn the engine off, and we’ve set up a legal presence in all of the provinces of China.” In other words, any and all Chinese lessors who fall behind on their payments will suddenly find their excavator’s engine shut down and no longer operable, stuck in the middle of a mine, quarry, or construction site with a paperweight weighing dozens of tons.

Sliding scales. There’s no proof Bitcoin is used this way.

• EU Targets Bitcoin, Anonymous Payments To Curb Terrorism Funding (Reuters)

EU countries plan a crackdown on virtual currencies and anonymous payments made online and via pre-paid cards in a bid to tackle terrorism financing after the Paris attacks. EU interior and justice ministers will gather in Brussels on Friday for a crisis meeting called after the Paris carnage of last weekend. They will urge the European Commission to propose measures to “strengthen controls of non-banking payment methods such as electronic/anonymous payments and virtual currencies and transfers of gold, precious metals, by pre-paid cards,” draft conclusions of the meeting said. Bitcoin is the most common virtual currency and is used as a vehicle for moving money around the world quickly and anonymously via the web without the need for third-party verification. Electronic anonymous payments can be made also with pre-paid debit cards purchased in stores as gift cards. EU ministers also plan “to curb more effectively the illicit trade in cultural goods,” the draft document said.

No reason to doubt ‘we’ know who they are.

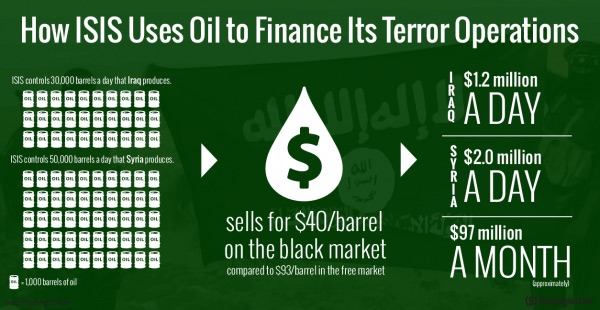

• Who Are The Traders Buying And Selling ISIS Oil? (Zero Hedge)

[..] what we have been wondering for months and what we hope some enterprising journalist will soon answer, is just who are the commodity trading firms that have been so generously buying millions of smuggled oil barrels procured by the Islamic State at massive discounts to market, and then reselling them to other interested parties. In other words, who are the middlemen. What we do know is who they may be: they are the same names that were quite prominent in the market in September when Glencore had its first, and certainly not last, near death experience: the Glencores, the Vitols, the Trafiguras, the Nobels, the Mercurias of the world.

To be sure, funding terrorist states is not something that some of the most prominent names in the list above have shied away from in the past. Which one (or ones) are the guilty parties – those who have openly breached terrorism funding laws – we don’t know: it may be one, or more of the above, or someone totally different. At this point, however, three things are certain: whoever the commodity trading house may be that is paying ISIS-affiliated “innocent civilians” hundreds of millions of dollars for their products, they are perfect aware just who the source of this deeply discounted crude is. Crude so deeply discounted, in fact, it results in massive profits for the enterprising middleman who are engaging in openly criminal transactions.

The second certainty: whoever said middleman is, it is very well known to US intelligence services such as the NSA and CIA, and thus to the Pentagon, and thus, the US government. The third certainty is that while the US, and Russia, and now France, are all very theatrically bombing something in the Syrian desert (nobody really knows what), the funding of ISIS continues unabated as someone keeps buying ISIS oil. We wonder how long until someone finally asks the all important question regarding the Islamic State: who is the commodity trader breaching every known law of funding terrorism when buying ISIS crude, almost certainly with the tacit approval by various “western alliance” governments, and why is it that these governments have allowed said middleman to continue funding ISIS for as long as it has?

Sickening. Shooting little children video game style.

• US Drone Operators: ‘Ever Step On Ants, Not Give It Another Thought?’ (Guardian)

When Michael Haas, a former senior airman with the US air force, looks back on the missions he flew over Afghanistan and other conflict zones in a six-year career operating military drones, one of the things he remembers most vividly is the colorful language airmen would use to describe their targets. A team of three would be sitting, he recalls, in a ground control station in Creech air force base outside Las Vegas, staring at computer screens on to which images would be beamed back from high-powered sensors on Predator drones thousands of miles away. The aim of the missions was to track, and when the conditions were deemed right, kill suspected insurgents. That’s not how they put it, though. They would talk about “cutting the grass before it grows out of control”, or “pulling the weeds before they overrun the lawn”.

And then there were the children. The airmen would be flying the Predators over a village in the tribal areas of Pakistan, say, when a series of smaller black shadows would appear across their screens – telling them that kids were at the scene. They called them “fun-sized terrorists”. Haas is one of four former air force drone operators and technicians who as a group have come forward to the Guardian to register their opposition to the ongoing reliance on the technology as the US military’s modern weaponry of choice. Between them, the four men clocked up more than 20 years of direct experience at the coalface of lethal drone programs and were credited with having assisted in the targeted killings of hundreds of people in conflict zones – many of them almost certainly civilians.

As a senior airman in the 15th reconnaissance squadron and 3rd special operations squadron from 2005 to 2011 – a period straddling the presidencies of George W Bush and Barack Obama – Haas participated in targeted killing runs from his computer in Creech that terminated the lives of insurgents in Afghanistan almost 8,000 miles away. He was a sensor operator, controlling the cameras, lasers and other information-gathering equipment on Predator and Reaper drones as well as being responsible for guiding Hellfire missiles to their targets once the pilot sitting next to him had pulled the trigger. Haas looks too youthful to be burdened by such enormous issues. Yet the existential sensation of killing someone by manipulating a computer joystick has left a deep and lasting impression on him.

“Ever step on ants and never give it another thought? That’s what you are made to think of the targets – as just black blobs on a screen. You start to do these psychological gymnastics to make it easier to do what you have to do – they deserved it, they chose their side. You had to kill part of your conscience to keep doing your job every day – and ignore those voices telling you this wasn’t right.”

Lowball 101: “There are currently an estimated 22,000 to 31,000 polar bears globally, but that number could shrink by as much as 30% by 2050..”

• Hottest October On Record Is Bad News For Polar Bears (MarketWatch)

If the month of October felt unusually hot, that’s because it was. The average temperature over land and ocean surfaces was the highest since records began in 1880, according to the National Oceanic and Atmospheric Administration. As the chart below illustrates, Africa and Australia had their hottest Octobers since records began, while must of the rest of the world baked in higher-than-average temperatures, said the NOAA in its October Global Analysis report. Among the report’s other findings, U.S. had its warmest October since 1963, and fourth-warmest since record keeping began in 1895. In South America, northern and central areas had warmer-than-average conditions, while southern areas had much cooler-than-average temperatures.

Parts of Argentina set new monthly record low temperatures. In Europe, Denmark had its driest October since 1972, while Latvia had its driest October on record. At the same time, Eastern Europe and areas of western Russia had cooler-than-average temperatures. Much of Africa was hotter-than-average in the month, yielding the highest October for the continent on record. Australia had its warmest October since record keeping started in 1910, while the departure from the average was also the highest for any month on record. Meanwhile, Arctic sea ice extent was 13.4% below the 1981 to 2010 average, marking the sixth smallest October since satellite records first began in 1979. Extent is the area measured in square miles that has at least some ice on it.

That’s bad news for polar bears, which on Thursday were added to a list of endangered species by a conservation watchdog. Polar bears are highly vulnerable to climate change as it is rapidly eroding their sea ice habitat, according to the International Union for Conservation of Nature (IUCN). There are currently an estimated 22,000 to 31,000 polar bears globally, but that number could shrink by as much as 30% by 2050, if they continue to lose the floating ice that allows them to hunt seals, said the IUCN.

Mary Shelley’s laughing.

• US Clears GMO Salmon For Human Consumption (Reuters)

U.S. health regulators on Thursday cleared the way for a type of genetically engineered Atlantic salmon to be farmed for human consumption – the first such approval for an animal whose DNA has been scientifically modified. Five years ago, the U.S. Food and Drug Administration first declared the product, made by Massachusetts-based AquaBounty Technologies, to be as safe as conventional farm-raised Atlantic salmon. AquaBounty’s product will not require special labeling because it is nutritionally equivalent to conventional farm-raised Atlantic salmon, the FDA said on Thursday.AquaBounty developed the salmon by altering its genes so that it would grow faster than farmed salmon, and expects it will take about two more years to reach consumers’ plates as it works out distribution.

AquaBounty is majority owned by Intrexon Corp, whose shares were up 7.3% at $37.55 in afternoon trading. AquaBounty says its salmon can grow to market size in half the time of conventional salmon, saving time and resources. The fish is essentially Atlantic salmon with a Pacific salmon gene for faster growth and a gene from the eel-like ocean pout that promotes year-round growth. Activist groups have expressed concerns that genetically modified foods may pose risks to the environment or public health. Several on Thursday said they would oppose the sale of engineered salmon to the public, while some retailers said they would not carry the fish on store shelves.

She’s fine for now, but what if there’s attacks in Germany?

• Merkel Confronts Refugee Policy Critics On Decade In Power (Bloomberg)

Angela Merkel heads to Bavaria on Friday for an appointment with some of the most persistent domestic critics of her refugee policy, in a test of her staying power just before her 10th anniversary in office. As terrorism fears add to Europe’s refugee crisis, the German chancellor’s address to the Christian Social Union will seek to preserve domestic harmony as she pursues international diplomacy to secure the region’s outer border. While Merkel is likely to reaffirm her goal of limiting the influx to Germany, she won’t offer the cap on migration that some in the CSU want, according to a person familiar with her thinking. It’s part of the balancing act as Merkel stakes her political future on persuading Germans they can cope with the biggest influx of migrants and refugees since World War II, putting at risk the standing she’s built up since taking the oath of office a decade ago Sunday.

“There is a lot of grumbling” within Merkel’s faction about her handling of the crisis as she pursues her humanitarian convictions, said Jan Kallmorgen, a partner at political consultancy Interel in Berlin. Her position is strengthened, though, because she’s “overwhelmingly respected” abroad and “the only one who has the international standing to work with other leaders” beyond the European Union, he said. With at least 800,000 asylum seekers expected in Germany this year, Merkel’s stance that the country is morally and legally obliged to accept them has spurred resistance in Bavaria, the main entry point. Merkel mollified Bavarian premier and CSU head Horst Seehofer with an agreement this month to restrict economic migrants from regions including the Balkans. [..]

As towns and cities struggle to shelter and feed refugees and winter approaches, support for Merkel’s CDU-CSU bloc has declined in polls while Alternative for Germany, or AfD, which advocates immigration limits, has gained. The CDU stumbled to 37.5% from 42% in September, while the AfD has doubled its support to 7%, according to an Allensbach poll for Frankfurter Allgemeine Zeitung newspaper. The Social Democrats, Merkel’s junior coalition partner, was unchanged at 26% in the Nov. 1-12 poll. Merkel’s poll numbers remain well above the lows reached at the height of the euro area’s debt crisis, giving her the clout to stand firm toward her Bavarian regional ally.

Cool people.

• Toronto Couple Cancels Big Wedding To Help Sponsor Syrian Refugees (CBC)

A Toronto couple has cancelled their plans for a big, expensive wedding and is instead putting the money toward sponsoring a family of Syrian refugees. Samantha Jackson and Farzin Yousefian were planning to have a traditional wedding with all the trimmings in March that would have cost tens of thousands of dollars. They had already booked a venue, hired caterers and invited their family and friends. But in September, they saw the pictures of three-year-old Syrian refugee Alan Kurdi’s lifeless body washed up on a Turkish beach. The couple cancelled their plans and instead put the wedding funds towards sponsoring a Syrian refugee family of four.

“We thought this really has to be an opportunity for us to really use our wedding as a platform, as a way to make a difference alongside our friends and family in what has obviously become an absolutely outstanding humanitarian crisis,” Jackson told CBC News. Jackson is a PhD student at Ryerson University, where she studies refugee health care policy and volunteers with the Ryerson University Lifeline Syria Challenge, which raises funds to sponsor refugees in Toronto. While planning their wedding, she and Yousefian would often talk about the global refugee crisis and wonder if there was anything they could do to help. “When there’s such a dire situation, it’s easy to become overwhelmed about thinking of ways to contribute,” Yousefian said.

“We just thought, wait a second, there’s a better way to do this. Given the circumstances, we need to turn the focus on the crisis and raise awareness and funds.” The couple tied the knot last month in a small ceremony at city hall. In lieu of wedding presents, friends and family donated to the cause. “I think the best part about this whole process has been seeing people’s reactions and then seeing just how thrilled they are for the idea and how excited they are about finding a way to contribute as well and to help us contribute,” Yousefian said. “We owe it all to our friends and family. Without them, this really couldn’t have happened a short time frame.”

All these bubble cities suffer the same thing.

• Half of New Yorkers Say They Are Barely or Not Getting By (NY Times)

Half of New York City residents say they are struggling economically, making ends meet just barely, if at all, and most feel sharp uncertainty about the future of the city’s next generation, a new poll shows. The poll, conducted by The New York Times and Siena College, shows great disparities in quality of life among the city’s five boroughs. The stresses weighing on New Yorkers vary widely, from the Bronx, where residents feel acute concern about access to jobs and educational opportunity, to Staten Island, where one in five report recently experiencing vandalism or theft. But an atmosphere of economic anxiety pervades all areas of the city: 51% of New Yorkers said they were either just getting by or finding it difficult to do so.

Even in Manhattan, three in 10 said they were just getting by. (58% said they were doing all right or thriving financially — the highest response of the five boroughs.) In some respects, the poll echoed the “tale of two cities” theme of Mayor Bill de Blasio’s 2013 campaign: Residents of the Bronx and Brooklyn shared the most pronounced sense of economic insecurity, and the lowest confidence in local government and the police — a distinctly different experience from the rest of the city. In those boroughs, nearly three in five residents said they were straining to make ends meet. In the Bronx, 36% said there had been times in the past year when they did not have the money to buy enough food for their family; only one in five said they and their neighbors had good or excellent access to suitable jobs.

But if the city appears divided into broad camps of haves and have-nots, it was, perhaps surprisingly, the less privileged segments of New York that shared the most positive outlook on the future. Four in 10 Brooklyn residents said their neighborhood was getting better, and 36% of Bronx residents said the same. Manhattanites and Staten Islanders were most likely to say things were getting worse in their area.

The land of the …?!

• Of America’s Half Million Homeless, Nearly A Quarter Are Children (Reuters)

More than 500,000 people – a quarter of them children – were homeless in the United States this year amid scarce affordable housing across much of the nation, according to a study released on Thursday. The report, from the U.S. Department of Housing and Urban Development (HUD), said the number was down slightly from 2014. Many U.S. cities are confronting a sluggish economic recovery, stagnant or falling wages among the lowest-income earners and budget constraints for social welfare programs. Los Angeles, Seattle, Portland, Oregon and Hawaii have all recently declared emergencies over the rise of homelessness, and on Thursday Seattle’s mayor toured a new encampment for his city’s dispossessed. “Despite national estimates, New York City continues to experience near record homelessness,” said Giselle Routhier at the Coalition for the Homeless.

According to HUD’s latest tally, nearly 565,000 people were living on the streets in cars, in homeless shelters or in subsidized transitional housing during a one-night national survey in January. Nearly one-fourth were aged 18 or under. That number was down 2% from the previous year’s count and 11% from 2007, HUD said. The actual U.S. homeless population is likely higher than HUD’s snapshot suggests because many people living without the means to put a roof over their heads are beyond the reach of the survey, sleeping on a friend’s couch or a relative’s basement. HUD reported separately this month that roughly 1.49 million individuals used a shelter in 2014, up 4.6% from 2013, agency spokeswoman Heather Fluit said.