John M. Fox Garcia Grande newsstand, New York 1946

So Nikkei up 7%, more mad stimulus expected.

• Japan’s Economy Shrinks 1.4% As Abenomics Is Blown Off Course (Guardian)

Japan’s economy shrank at an annualised rate of 1.4% in the last quarter of 2015, new figures showed on Monday, dealing a further blow to attempts by the prime minister, Shinzo Abe, to lift the country out of stagnation. Last quarter’s contraction in the world’s third largest economy was bigger than the 1.2% decline that had been forecast, as slow exports to emerging markets failed to pick up the slack created by weak demand at home. The economy shrank 0.4% in October-December from the previous quarter, according to cabinet office figures. Slower exports and weak domestic demand were largely to blame for the contraction – a sign that Abe’s attempts to boost spending is failing to deliver.

Private consumption, the driving force behind 60% of GDP, slumped by 0.8% between October and December last year, a bigger fall than the median market forecast of 0.6%. Some analysts, though, expect domestic spending to pick up ahead of a planned rise on the consumption (sales) tax, from 8% to 10%, in April 2017. “However, this should be short-lived, as activity will almost certainly slump once the tax has been raised,” said Marcel Thieliant of Capital Economics. “The upshot is that the Bank of Japan still has plenty of work to do to boost price pressures.” The Nikkei benchmark index opened sharply higher on Monday, gaining more than 3% off the back of gains on Wall Street and in Europe on Friday, as well as encouraging US retail sales figures.

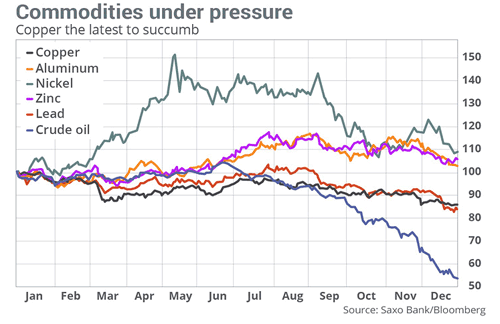

Not much in imports left after 15 months in a row. Do note difference between dollar- and yuan terms.

• China Imports Plunge -18.8% YoY In January, Exports Fall -11.2% (FT)

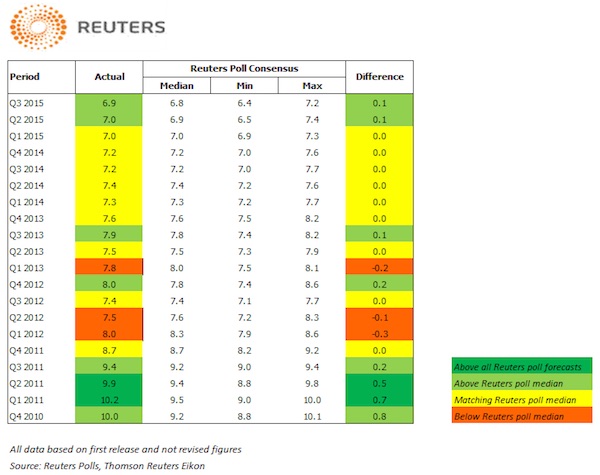

China’s exports and imports suffered larger-than-expected drops in the first month of this year in both renminbi- and dollar-denominated terms. Exports fell 6.6% year-on-year in January to Rmb1.14tn, following a 2.3% gain in December. Economists expected a gain of 3.6%. It was the biggest fall in exports since an 8.9% drop in July last year. The drop was even more pronounced measured in US dollars, with exports crashing 11.2% year-on-year last month to $177.48bn. That was from a 1.4% drop in December, and versus expectations for a 1.8% slide. It was the biggest drop since a 15% fall in March last year. The import side of the equation fared worse in both renminbi- and dollar-terms. Shipments to China cratered by 14.4% year-on-year to Rmb737.5bn in January. That’s from a 4% drop in December, and versus expectations for a 1.8% rise.

In dollar terms, imports plunged 18.8% last month to $114.19, from a 7.6% drop in January and versus an expected drop of 3.6%. This was the biggest monthly drop in imports since last September and also means shipments have contracted year-on-year for the past 15 months straight. The general weakness in the renminbi, which fell 1.3% in January and had weakened by 2.2% in the final quarter of 2015, is likely playing a part, by making overseas goods more expensive. However, exports have yet to receive a boost from the currency’s depreciation. China’s trade surplus grew to Rmb496.2bn last month from Rmb382.1bn in December. Economists expected it to inch higher to Rmb389bn. In dollar terms, China’s trade surplus rose to $63.29bn from $60.09 in December and versus expectations of $60.6bn.

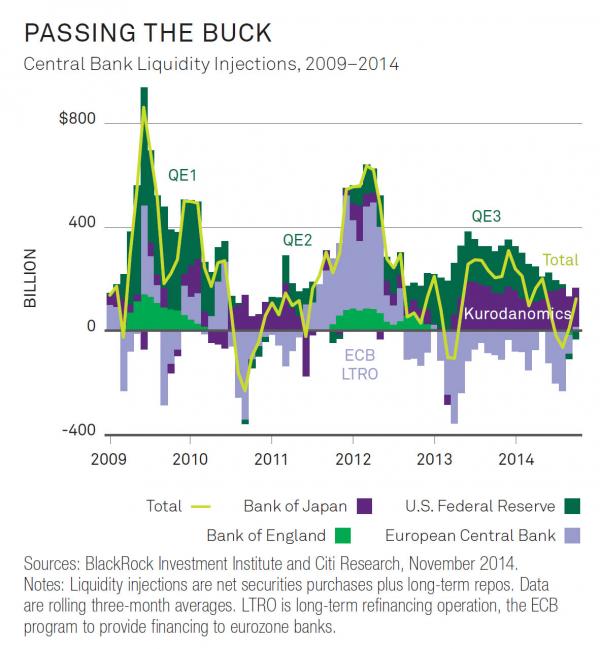

Whatever it takes revisited.

• Yuan Rises Most Since 2005 as PBOC Voices Support, Raises Fixing (BBG)

China’s yuan surged by the most in more than a decade, catching up with dollar declines during a week-long holiday, after the central bank chief voiced support for the exchange rate and set its fixing at a one-month high. The currency advanced 0.9%, the most since the nation scrapped a peg to the dollar in July 2005, to 6.5170 a dollar as of 10:50 a.m. in Shanghai. The offshore yuan fell 0.16% to 6.5186 to almost match the onshore rate, compared with a 1% premium last week when mainland Chinese markets were shut for the Lunar New Year holidays. The People’s Bank of China on Monday raised its daily fixing against the greenback, which restricts onshore moves to a maximum 2% on either side, by 0.3%, the most since November, to 6.5118. A gauge of dollar strength declined 0.8% last week, while the yen rose 3% and the euro advanced 0.9%.

China’s balance of payments position is good, capital outflows are normal and the exchange rate is basically stable against a basket of currencies, PBOC Governor Zhou Xiaochuan said in an interview published Saturday in Caixin magazine. The nation’s foreign-exchange reserves shrank by $99.5 billion in January, the second-biggest decline on record, as the central bank sold dollars to fight off yuan depreciation pressure. An estimated $1 trillion of capital left China last year. “In the near term, the stronger fixing and Zhou’s comments reflect the PBOC’s consistent view of stabilizing the yuan,” said Ken Cheung at Mizuho. “Containing yuan depreciation expectations and capital outflows remain top-priority tasks. Mild depreciation could be allowed, but that would be done only after stabilizing depreciation expectations.”

What is this, some sort of reverse psychology? By now nobody trusts him anymore.

• PBoC Governor Zhou Breaks Long Silence (BBG)

China’s central bank has stepped up efforts to restore stability to the nation’s currency and economy, with Governor Zhou Xiaochuan breaking his long silence to argue there’s no basis for continued yuan depreciation. The nation’s balance of payments is good, capital outflows are normal and the exchange rate is basically stable against a basket of currencies, Zhou said in an interview published Saturday in Caixin magazine. That’s an escalation in verbal support after such comments have been left in recent months to deputies and the central bank research department’s chief economist. Zhou dismissed speculation that China plans to tighten capital controls and said there’s no need to worry about a short-term decline in foreign-exchange reserves. The country has ample holdings for payments and to defend stability, he said.

“He’s desperately trying to make sure that all of his work in the past few years on capital liberalization does not go to waste,” said Victor Shih, a professor at the University of California at San Diego who studies China’s politics and finance. “He’s trying hard to instill investor confidence in the renminbi so that the Chinese government does not have to resort to the extreme measure of unwinding all of the progress on offshore renminbi in the past few years.” The comments come as Chinese financial markets prepare to reopen Monday after the week-long Lunar New Year holiday. The weakening exchange rate and declining Chinese share markets have fueled global turmoil and helped send world stocks to their lowest levels in more than two years. The PBoC set the daily fixing against the dollar, which restricts onshore moves to a maximum 2% on either side, 0.3% higher at 6.5118, the strongest since Jan. 4. The Shanghai Composite Index dropped 2.3% as of 9:39 a.m. local time.

Lost amid the angst over China’s stocks, currency and sliding foreign exchange reserves is the flush liquidity situation at home. The People’s Bank of China has been putting its money where its mouth is, pumping cash into the financial system to offset record capital outflows amid fears the yuan could weaken further. Data that could come as soon as Monday is expected to show China’s broadest measure of new credit surged in January on a seasonal uptick in lending, and as companies borrowed to pay off foreign debt. Aggregate financing likely grew 2.2 trillion yuan ($335 billion), according to the median forecast of a Bloomberg survey of economists. [..] Even as foreign exchange reserves have declined since mid 2014 – to a four-year low of $3.23 trillion in January – M1 money supply has continued to rise.

No-one has a clue where it’ll be in a week, a month.

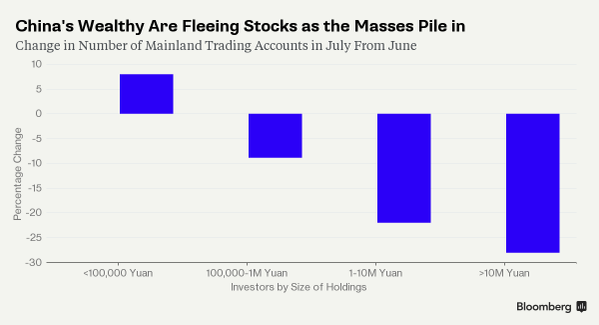

• Chinese Start to Lose Confidence in Their Currency (NY Times)

As the Chinese economy stumbles, wealthy families are increasingly trying to move large sums of money out of the country, worried that the value of the currency will fall and their savings will be worth less. To get around the country’s cash controls, individuals are asking friends or family members to carry or transfer out $50,000 apiece, the annual legal limit in China. A group of 100 people can move $5 million overseas. The practice is called Smurfing, named after the blue, mushroom-dwelling cartoon characters, and it is part of an exodus of capital that is casting doubt on China’s economic prospects and shaking global markets. Over the last year, companies and individuals have moved nearly $1 trillion from China.

Some methods are perfectly legal, like investing in real estate elsewhere, buying businesses overseas and paying off debts owed in dollars. Others, like Smurfing, are more dubious, and in certain cases, outright illegal. Chinese customs officials caught a woman last year trying to leave the mainland with $250,000 strapped to her chest and thighs and hidden inside her shoes. If the government cannot keep citizens from rushing to the financial exits, China’s outlook could darken. The swell of outflows is a destabilizing force in China’s slowing economy, threatening to undermine confidence and hurt a banking system that is struggling to deal with a decade-long lending binge. The capital flight is already putting significant pressure on the country’s currency, the renminbi.

The government is trying to prevent a free fall in the currency by stepping into the markets and tapping its huge cash hoard to shore up the renminbi. But a deep erosion of those reserves may set off further outflows and create turbulence in the markets. China is also trying to put the brakes on outflows, by tightening its grip on the country’s links to the global financial system. The government, for example, just started to clamp down on people’s use of bank cards to buy overseas life insurance policies. Such moves have trade-offs. The limits create concerns that the government is pulling back on reform efforts that China needs to keep growth humming in the decades to come. But the near-term pressure also requires serious attention, given the global shock waves.

“The currency has become a very near-term threat to financial stability,” said Charlene Chu, an economist at Autonomous Research. Navigating such problems is fairly new for China. For years, China soaked up much of the world’s investment money, as the economy grew at annual rates in the double digits. A largely closed financial system kept China’s own money corralled inside the country. Now, with growth slowing, money is gushing out of the country. And the government has a looser grip on the spigot, because China dismantled some currency restrictions to open up its economy in recent years. “Companies don’t want renminbi and individuals don’t want renminbi,” said Shaun Rein, the founder of the China Market Research Group. “The renminbi was a sure bet for a long time, but now that it’s not, a lot of people want to get out.”

Huh? What is that?: “There will be an incredible amount of strong psychological pessimism in China this week..”

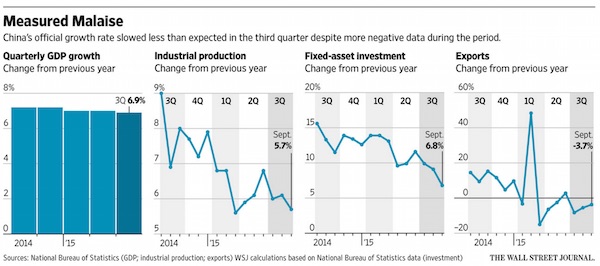

• China Markets Brace for Wild Swings in Year of the Monkey (WSJ)

Investors in Chinese stocks are facing a tumultuous return to action Monday after a weeklong holiday in mainland markets for the Lunar New Year shielded them from the global market turmoil. Chinese shares are already among the world’s worst-performing this year, with the main benchmark Shanghai Composite Index down 21.9% at 2763.49. The market has almost halved in value since its peak last June, dropping some 47% since then. But analysts say both the Shanghai and Shenzhen stock exchanges could face further sharp losses at Monday’s open, as they catch up with the past week’s mostly gloomy global markets. Japanese stocks sank 11% last week and the yen shot up, defying a recent move by the Bank of Japan to introduce negative interest rates, partly designed to keep the local currency weaker and help Japanese exporters.

Markets in Europe and the U.S. whipsawed as investors lost faith in banking stocks, while Australian shares entered bear market territory, having fallen more than 20% since their most recent peak in late April. Meanwhile, Chinese stocks trading in Hong Kong lost 6.8% and the city’s benchmark Hang Seng Index fell 5% in the two days markets were open here at the end of last week. “There will be an incredible amount of strong psychological pessimism in China this week,” said Richard Kang at Emerging Global Advisors. “[Global assets] are going up and down together, it’s very macro-driven right now.” China was at the epicenter of market mayhem at the start of 2016, as shares fell sharply and the country’s currency, the yuan, dipped in value. Before last summer, Chinese market slumps had little impact beyond the country’s borders, mainly because stock-buying there remains largely driven by local retail investors.

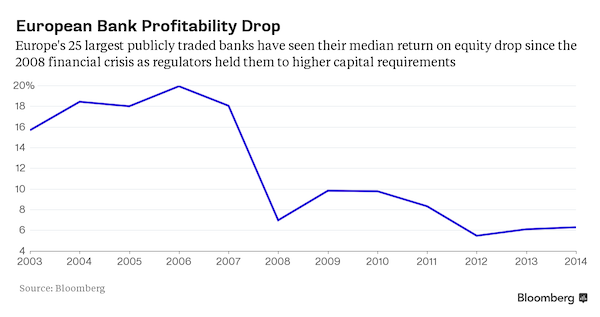

Foreign investors still account for a small amount of stock ownership in China. But the Chinese selloff early this year was met with a confused response from Beijing policy makers, who flip-flopped on new measures to stem the market bleeding and were criticized for failing to communicate clearly a change in currency strategy. That contributed to a perception among global investors that Chinese leaders have lost their grip on the country’s economy. The nervousness in markets around the world has now taken on new dimensions. Central banks are struggling to boost growth, despite the Bank of Japan joining the European Central Bank in setting negative interest rates for the first time. Bank profits face a squeeze as the margin between what they pay out on deposits and what they make on lending narrows.

Not a small detail.

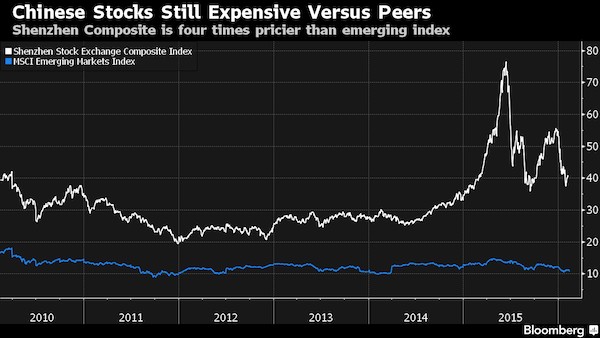

• Selloff Plus A Market Holiday Make China Stocks Look Even More Expensive (BBG)

For once, it wasn’t China’s fault. With the country’s markets closed for lunar new year holidays last week, global equity investors found plenty of other reasons to sell – everything from sliding oil prices to shrinking bank profits and crumbling faith in global monetary policy. The MSCI All-Country World Index plunged 2.6%, entering bear-market territory for the first time in more than four years. While the rout may help Communist Party officials counter perceptions that China is the biggest risk for global markets, investors in yuan-denominated A shares will find little to cheer about as trading resumes Monday. Valuations in the $5.3 trillion market, already inflated by a record-breaking bubble last year, now look even more expensive versus their beaten-down global peers.

The Shanghai Composite Index trades at a 34% premium to MSCI’s emerging-markets index – up from an average gap of 10% over the past five years – and equities in the tech-heavy Shenzhen market are almost four times more expensive than their developing-nation counterparts. Shares with dual listings, meanwhile, are valued at a 46% premium on the mainland relative to Hong Kong, near the widest gap since 2009. “There’s been a lot of embedded selling pressure in the A-share market,” said George Hoguet at State Street Global Advisors, which has $2.4 trillion under management. “I don’t think the market is fully cleared yet.” While the Shanghai Composite has dropped 22% in 2016, the gauge is still up 31% over the past two years, a period when the MSCI Emerging Markets Index sank 22%.

The Chinese stock measure is valued at 15 times reported earnings, versus 11 for the developing-nation gauge. Chinese markets will be volatile when they reopen as investors determine where they “sit in the global marketplace,” Garrett Roche, a global investment strategist at Bank of America Merrill Lynch, said by phone from New York. The firm oversees $2.5 trillion in client assets. “From the Chinese perspective, we are relatively nervous about it anyway, so it won’t change our view that the selloff hurts,” he said. Investors shouldn’t read too much into what happens in global markets when assessing the outlook for Chinese equities because the country still has a relatively closed financial system, said Eric Brock at Clough Capital Partners. The Shanghai Composite’s correlation with the MSCI All-Country index over the past 30 days was less than half that of the Standard & Poor’s 500 Index.

Stick a fork in it?!

• Hong Kong Land Price Plunges Nearly 70% in Government Tender (BBG)

In the latest sign that Hong Kong’s property correction is deepening, a piece of land sold by the government in the New Territories sold for nearly 70% less per square foot than a similar transaction in September. The 405,756 square foot (37,696 square meter) parcel of land in Tai Po sold for HK$2.13 billion ($274 million) or HK$1,904 per square foot, in a tender that closed on Feb. 12, according to the Hong Kong Lands Department website. The buyer was Asia Metro Investment, a subsidiary of China Overseas Land & Investment.

The plunge in the price of land comes amid weaker appetite from Hong Kong developers against the backdrop of a nearly 11% drop in housing prices since their September high, according to the Centaline Property Centa-City Leading Index. In January, sales of new and secondary homes reached their lowest monthly level since Centaline started tracking data in January 1991. Hong Kong home prices surged 370% from their 2003 trough through the September peak before the correction began, spurred by a rising supply of housing and a slowdown in China. Lower prices paid for land could eventually lead to cheaper home prices down the road, and are viewed as a leading indicator of the negative sentiment on the market.

Asia’s troubles are sure to spread. Reporting on it is slow, that’s all.

• Pakistan Default Risk Surges as $50 Billion Debt Bill Coming Due (BBG)

Bets are rising that Pakistan will default on its debt just as it starts to revive investor interest with a reduction in terrorist attacks. Credit default swaps protecting the nation’s debt against non-payment for five years surged 56 basis points over the past week amid the global market sell-off, the steepest jump after Greece, Venezuela and Portugal among more than 50 sovereigns tracked by Bloomberg. About 42% of Pakistan’s outstanding debt is due to mature in 2016 – roughly $50 billion, equivalent to the size of Slovenia’s economy. Prime Minister Nawaz Sharif has worked to make Pakistan more investor-friendly since winning a $6.6 billion IMF loan in 2013 to avert an external payments crisis. The economy is forecast to grow 4.5%, an eight-year high, as a crackdown on militant strongholds helps reduce deaths from terrorist attacks.

“Pakistan’s high level of public debt, with a large portion financed through short-term instruments, does make the sovereign’s ability to meet their financing needs more sensitive to market conditions,” Mervyn Tang, lead analyst for Pakistan at Fitch said by e-mail. Since Sharif took the loan, Pakistan’s debt due by end-2016 has jumped about 79%. He’s also facing resistance in meeting IMF demands to privatize state-owned companies, leading to a strike this month at national carrier Pakistan International Airlines. The bulk of this year’s debt, some $30 billion, is due between July and September, and repayments will get tougher if borrowing costs rise more. The spread between Pakistan’s 10-year sovereign bond and similar-maturity U.S. Treasuries touched a one-year high on Thursday.

Making it up as they go along. Not a confidence booster.

• ECB In Talks With Italy Over Buying Bundles Of Bad Loans (Reuters)

The ECB is in talks with the Italian government about buying bundles of bad loans as part of its asset-purchase program and accepting them as collateral from banks in return for cash, the Italian Treasury said. The move could give a big boost to a recently approved Italian scheme aimed at helping banks offload some of their €200 billion ($225 billion) of soured credit and free up resources for new loans. Nonetheless, it would likely fuel a debate in other countries about whether the ECB is taking on too much risk by buying asset-backed securities (ABS) based on loans that have not been repaid for roughly three months. Italian Treasury officials told reporters the ECB may buy these securities as part of its €1.5 trillion asset-purchase program or accept them as collateral from banks in return for cash, in so called repurchase agreements.

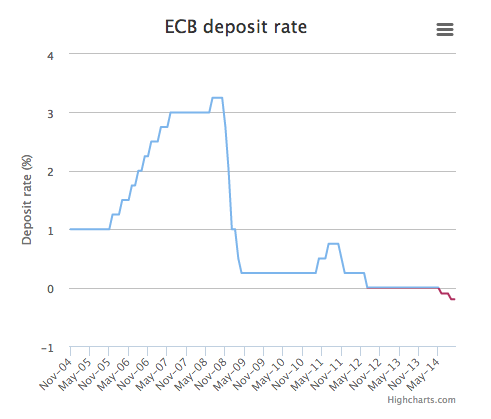

In November last year, an ECB source said that buying rebundled non-performing loans could be an extreme option if the euro zone’s economic situation became “really bad”. The bank has been struggling to revive inflation and is likely to cut its deposit rate again next month. Italy’s high stock of bad loans has been a drag on the euro zone’s third-largest economy and is a growing concern for investors, who have been selling shares in Italian banks heavily since the start of the year. The ECB has been buying an average of €1.19 billion of ABS every month since November 2014, Datastream data showed, and prefers securities backed by performing loans. Under existing rules, the ECB can buy ABS as long as they have a credit rating above a certain threshold, thereby ensuring it only buys high-quality securities.

Nothing stops the ECB, least of all its own rules.

• Italy’s Banking Crisis Spirals Elegantly out of Control (WS)

Italy, the Eurozone’s third largest economy, is in a full-blown banking crisis. Four small banks were rescued late last year. The big ones are teetering. Their stocks have crashed. They’re saddled with non-performing loans (defined as in default or approaching default). We’re not sure that the full extent of these NPLs is even known. The number officially tossed around is €201 billion. But even the ECB seems to doubt that number. Its new bank regulator, the Single Supervisory Mechanism, is now seeking additional information about NPLs to get a handle on them. Other numbers tossed around are over €300 billion, or 18% of total loans outstanding. The IMF shed an even harsher light on this fiasco. It reported last year that over 80% of the NPLs are corporate loans. Of them, 30% were non-performing, with large regional differences, ranging from 17% in some of the northern regions to over 50% in some of the southern regions. The report:

High corporate NPLs reflect both weak profitability in a severe recession as well the heavy indebtedness of many Italian firms, especially SMEs, which are among the highest in the Euro Area. This picture is consistent with corporate survey data which shows nearly 30% of corporate debt is owed by firms whose earnings (before interest and taxes) are insufficient to cover their interest payments.

The reason these NPLs piled up over the years is because banks have been slow to, or have refused to, write them off or sell them to third parties at market rates. Recognizing the losses would have eaten up the banks’ scarce capital. Reality would have been too ugly to behold. The study found that the average time for writing off bad loans has jumped to over six years by 2014. And this:

In 2013, on average less than 10% of bad debt, despite already being in a state of insolvency, was written off or sold. The bad debt write-off rate varies significantly across the major banks, with banks with the highest NPL ratios featuring the lowest write-off rates. The slow pace of write-offs is an important factor in the rapid buildup of NPLs.

Now, to keep the banks from toppling, the ECB has an ingenious plan: it’s going to buy these toxic assets or accept them as collateral in return for cash. That’s what the Italian Treasury told reporters, according to Reuters. Oh, but the ECB is not going to buy them directly. That would violate the rules; it can only buy assets that sport a relatively high credit rating. And this stuff is toxic. So these loans are going to get bundled into structured Asset Backed Securities (ABS) and sliced into different tranches. The top tranches will be the last ones to absorb losses. A high credit rating will then be stamped on these senior tranches to make them eligible for ECB purchases, though they’re still backed by the same toxic loans, most of which won’t ever be repaid.

The ECB then buys these senior tranches of the ABS as part of its €62.4-billion per-month QE program that already includes about €2.2 billion for ABS (though it has been buying less). Alternatively, the ECB can accept these highly rated, toxic-loan-backed securities as collateral for cash via so-called repurchase agreements. But buying even these senior tranches would violate the ECB’s own rules, which specify:

At the time of inclusion in the securitisation, a loan should not be in dispute, default, or unlikely to pay. The borrower associated with the loan should not be deemed credit-impaired (as defined in IAS 36).

Hilariously, the NPLs, by definition, are either already in “default” or “unlikely to pay,” most of them have been so for years, and the borrower is already “deemed credit impaired” if the entity even still exists. But hey, this is the ECB, and no one is going to stop it. Reuters: “The move could give a big boost to a recently approved Italian scheme aimed at helping banks offload some of their €200 billion of soured credit and free up resources for new loans.” But the scheme would limit ECB purchases to only the top tranches, and thus only a portion of the toxic loans. So there too is a way around this artificial limit.

Might as well move out now. There is no safe storage for nuclear waste.

• Nuclear Fuel Storage in South Australia Seen as Economic Boon (BBG)

The storage and disposal of nuclear waste in South Australia would probably deliver significant economic benefits to the state, generating more than A$5 billion ($3.6 billion) a year in revenue, according to the preliminary findings by a royal commission. Such a facility would be commercially viable, with storage commencing in the late 2020s, the Nuclear Fuel Cycle Royal Commission said in its tentative findings released Monday. It doesn’t make economic sense to generate electricity from a nuclear power plant in the state in the “foreseeable future” due to costs and demand, the report found. “The storage and disposal of used nuclear fuel in South Australia would meet a global need and is likely to deliver substantial economic benefits to the community,” the commission said. “

Such a facility would be viable and highly profitable under a range of cost and revenue assumptions.” South Australia, where BHP Billiton operates the Olympic Dam mine, set up the commission last year to look at the role the state should play in the nuclear industry — from mining and enrichment to energy generation and waste storage. While Australia is home to the world’s largest uranium reserves, it has never had a nuclear power plant. Concerns over climate change have prompted debate about whether to reverse Australia’s nuclear policy. Longer term, “Australia’s electricity system will require low-carbon generation sources to meet future global emissions reduction targets,” the commission said in its report. “Nuclear power may be necessary, along with other low carbon generation technologies.”

A ways to go.

• Oil Resumes Drop as Iran Loads Europe Cargo (BBG)

Oil resumed its decline below $30 a barrel as Iran loaded its first cargo to Europe since international sanctions ended and Chinese crude imports dropped from a record. West Texas Intermediate futures fell 0.5% in New York after surging 12% on Friday, while Brent in London slid 0.2%. A tanker for France’s Total was being loaded Sunday at Kharg Island while vessels chartered for Chinese and Spanish companies were due to arrive later the same day, an Iranian oil ministry official said. Chinese imports in January decreased almost 20% from the previous month, according to government data. “Iran is going to add headwinds to the market,” David Lennox, an analyst at Fat Prophets in Sydney, said. “We still have 500 million barrels of U.S. inventories and shale producers are still pumping. Until there are significant cuts to output, the rally is not sustainable.”

Oil in New York is down 21% this year amid the outlook for increased Iranian exports and BP Plc predicts the market will remain “tough and choppy” in the first half as it contends with a surplus of 1 million barrels a day. Speculators’ long positions in WTI through Feb. 9 rose to the highest since June, according to data from the U.S. Commodity Futures Trading Commission. WTI for March delivery slid as much as 49 cents to $28.95 a barrel on the New York Mercantile Exchange and was at $29.28 at 2:50 p.m. Hong Kong time. The contract gained $3.23 to close at $29.44 on Friday after dropping 19% the previous six sessions. Total volume traded was about 12% above the 100-day average. WTI prices lost 4.7% last week. Brent for April settlement declined as much as 69 cents, or 2.1%, to $32.67 a barrel on the ICE Futures Europe exchange. The contract climbed $3.30 to close at $33.36 on Friday. The European benchmark crude was at a premium of $1.59 to WTI for April.

Our old friend and oil expert Jeffrey Brown with an interesting take.

• Condensate Vs Crude Oil: What’s Actually in Those Storage Tanks? (Westexas)

After examining available regional and global production data (using EIA, OPEC and BP data sources), in my opinion actual global crude oil production – generally defined as 45 API Gravity or lower crude oil – has probably been on an “Undulating Plateau” since 2005. At the same time, global natural gas production and associated liquids, condensate and natural gas liquids (NGL), have so far continued to increase. Schlumberger defines condensate as: “A low-density, high-API gravity liquid hydrocarbon phase that generally occurs in association with natural gas.” The most common dividing line between crude oil and condensate is 45 API Gravity, but note that the upper limit for WTI crude oil is 42 API Gravity. However, the critical point is that condensate is a byproduct of natural gas production.

Note that what the EIA calls “Crude oil” is actually Crude + Condensate (C+C). When we ask for the price of oil, we generally get the price of either WTI or Brent crude oil, which both have average API gravities in the high 30’s, and the maximum upper limit for WTI crude oil is 42 API Gravity. However, when we ask for the volume of oil, we get some combination of crude oil + partial substitutes, i.e., condensate, NGL and biofuels. From 2002 to 2005, as annual Brent crude oil prices approximately doubled from $25 in 2002 to $55 in 2005, global natural gas production, global NGL production and global C+C production all showed similar rates of increase. For example, from 2002 to 2005 global natural gas production increased at a rate of 3.2%/year, as global C+C production increased at a rate of 3.3%/year.

From 2005 to the 2011 to 2013 time frame, annual Brent crude oil prices doubled again, from $55 in 2005 to an average of $110 for 2011 to 2013 inclusive, remaining at $99 in 2014. From 2005 to 2014, global natural gas production increased at 2.4%/year, while global C+C production increased at only 0.6%/year. Given that condensate production is a byproduct of natural gas production, the only reasonable conclusion in my opinion is that increasing global condensate production accounted for all, or virtually all, of the post-2005 slow rate of increase in global C+C production [..]

Haha! So glad Greer does it for us, so we don’t get the hate mail. But he’s right, obviously. Only thing is, he forgets a whole group of people. He says there are those who believe in renewables vs those who actually live with them. A third group are those who plan to make a killing off of renewables. And they drive the discussion.

• Renewables: The Next Fracking? (JMG)

I’d meant this week’s Archdruid Report post to return to Retrotopia, my quirky narrative exploration of ways in which going backward might actually be a step forward, and next week’s post to turn a critical eye on a common but dysfunctional habit of thinking that explains an astonishing number of the avoidable disasters of contemporary life, from anthropogenic climate change all the way to Hillary Clinton’s presidential campaign. Still, those entertaining topics will have to wait, because something else requires a bit of immediate attention. In my new year’s predictions a little over a month ago, as my regular readers will recall, I suggested that photovoltaic solar energy would be the focus of the next big energy bubble. The first signs of that process have now begun to surface in a big way, and the sign I have in mind—the same marker that provided the first warning of previous energy bubbles—is a shift in the rhetoric surrounding renewable energy sources.

Broadly speaking, there are two groups of people who talk about renewable energy these days. The first group consists of those people who believe that of course sun and wind can replace fossil fuels and enable modern industrial society to keep on going into the far future. The second group consists of people who actually live with renewable energy on a daily basis. It’s been my repeated experience for years now that people belong to one of these groups or the other, but not to both. As a general rule, in fact, the less direct experience a given person has living with solar and wind power, the more likely that person is to buy into the sort of green cornucopianism that insists that sun, wind, and other renewable resources can provide everyone on the planet with a middle class American lifestyle.

Conversely, those people who have the most direct knowledge of the strengths and limitations of renewable energy—those, for example, who live in homes powered by sunlight and wind, without a fossil fuel-powered grid to cover up the intermittency problems—generally have no time for the claims of green cornucopianism, and are the first to point out that relying on renewable energy means giving up a great many extravagant habits that most people in today’s industrial societies consider normal. Debates between members of these two groups have enlivened quite a few comment pages here on The Archdruid Report. Of late, though—more specifically, since the COP-21 summit last December came out with yet another round of toothless posturing masquerading as a climate agreement—the language used by the first of the two groups has taken on a new and unsettling tone.

Climate activist Naomi Oreskes helped launch that new tone with a diatribe in the mass media insisting that questioning whether renewable energy sources can power industrial society amounts to “a new form of climate denialism.” The same sort of rhetoric has begun to percolate all through the greenward end of things: an increasingly angry insistence that renewable energy sources are by definition the planet’s only hope, that of course the necessary buildout can be accomplished fast enough and on a large enough scale to matter, and that no one ought to be allowed to question these articles of faith.