Claude Monet Impression, sunrise 1872

Curious to see what that evidence is, and curious to know why iot has remained hidden to date.

• Nadler: Mueller Has Evidence Of Trump High Crimes And Misdemeanours (G.)

The eyes of America will be trained on Capitol Hill on Wednesday, as Robert Mueller testifies before two House committees about his report on Russian election interference, links between the Trump campaign and Moscow and potential obstruction of justice by the president. On Sunday, the chairman of the judiciary committee indicated the stakes when he said the 448-page report contained “very substantial evidence that the president is guilty of high crimes and misdemeanours” – the benchmark for impeachment. “It’s important that we not have a lawless administration and a lawless president,” the New York Democrat Jerrold Nadler told Fox News Sunday.

“And it’s important that people see what we’re doing and what we’re dealing with.” Nadler’s committee would initiate impeachment proceedings. Mueller, a former director of the FBI, will also appear before the intelligence panel. “The report presents very substantial evidence that the president is guilty of high crimes and misdemeanours,” he said, “and we have to present, or let Mueller present those facts to the American people and then see where we go from there because the administration must be held accountable and no president can be above the law.”

Surprise: not everyone agrees with Nadler. Is everybody citing from the same report? Bradley A. Blakeman was a deputy assistant to President George W. Bush from 2001 to 2004.

• Trump Has Nothing To Fear From Mueller (Hill)

The president has nothing to fear from the testimony from Robert Mueller because nothing Mueller could possibly say will change the result of the report he delivered. He conclusively found that there was no collusion with the Russians by the Trump 2016 campaign, and he did not bring any indictments for obstruction of justice against the President or even a referral. What Mueller left open with regard to obstruction — if at all — was conclusively dealt with by the Justice Department through the Attorney General and Deputy Attorney General who found that there was no probable cause to bring criminal charges against the president.

Congress is not bound by the Mueller investigation or its findings. Congress on its own could bring on impeachment proceedings in the House based on the report — if there was evidence contained therein to warrant such actions. Mueller’s testimony will add nothing other than to further politicize an investigation that was supposed to be apolitical. Mueller reminds me of the patient who decides not to be resuscitated only to find that doctors did so against his wishes. At best, Mueller is a reluctant witness and at worst — for Democrats — a hostile witness. He made it clear in his press conference months ago that he would like the report to speak for itself and that he would not go beyond his own reporting. Congress now runs the risk of further being seen as conducting a witch-hunt against the president by calling a witness who clearly has nothing further to add.

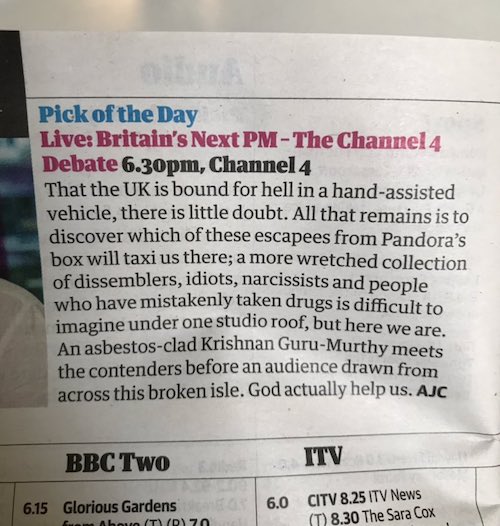

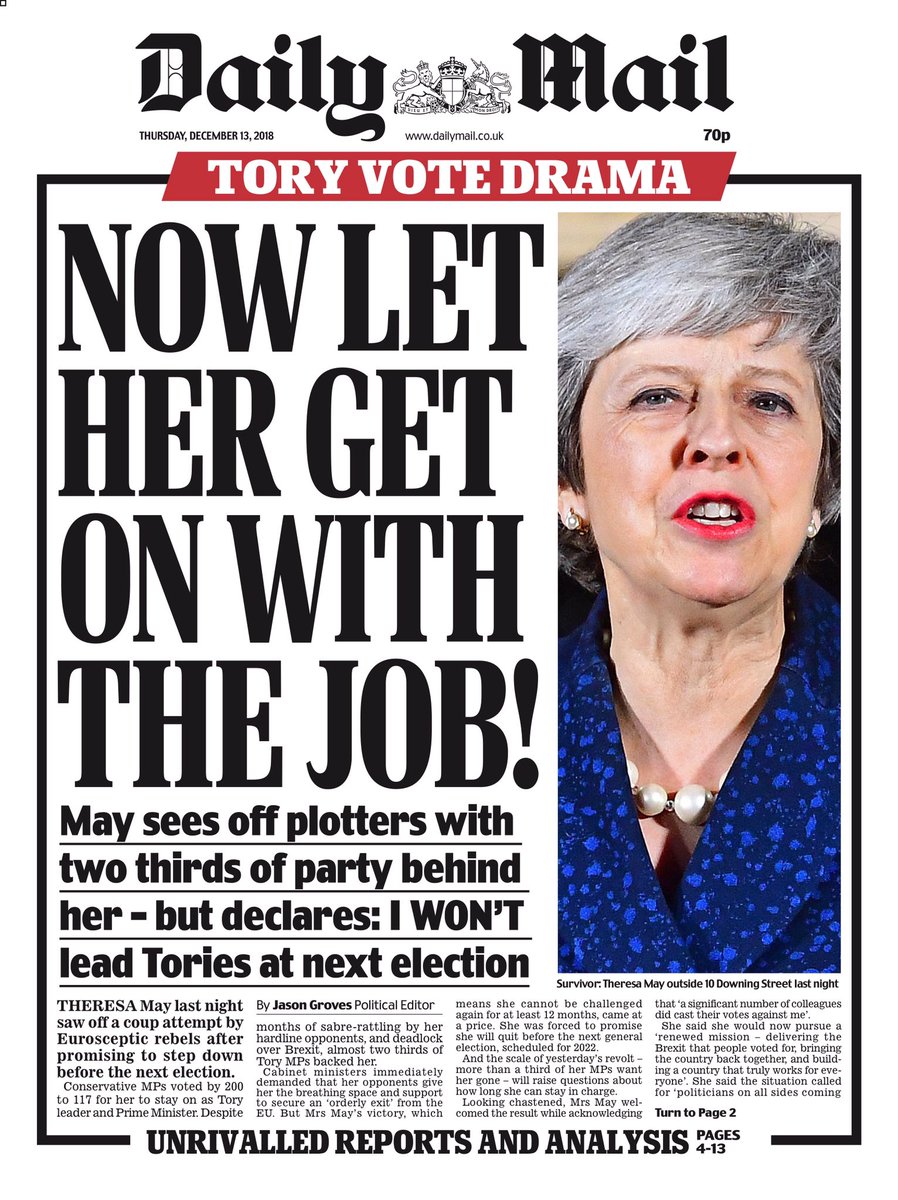

Quite a few could walk, starting today, but most on Wednesday, when he takes over.

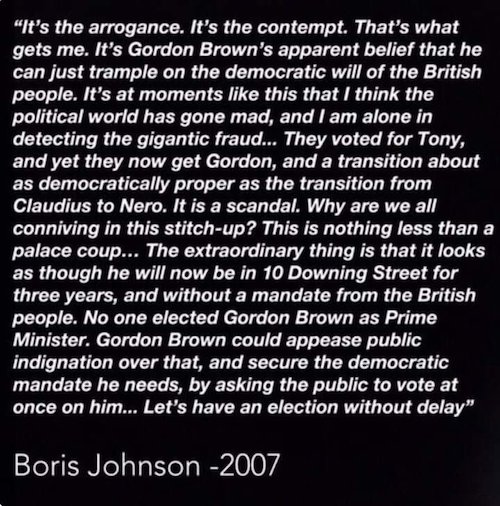

• Boris Johnson’s Brexit Plans Under Threat From Ministers’ Resignations (G.)

Boris Johnson’s hoped-for triumphant march into Downing Street this week is set to be dampened by a carefully timed series of resignations by senior ministers, who will retreat to the backbenches with a vow to thwart any moves towards a no-deal Brexit. The announcements by Philip Hammond and David Gauke that they will step down on Wednesday, immediately before Johnson is likely to head to Buckingham Palace, highlight the perilous political climate for Theresa May’s expected successor. It comes amid predictions that the Conservatives’ already wafer-thin working Commons majority of three could entirely disappear by the time MPs return from their summer recess, with mooted defections to the Lib Dems coming on top of a predicted byelection defeat.

Barring a hugely unexpected twist, Johnson is expected to be announced on Tuesday as the victor over Jeremy Hunt in the vote of Conservative members, formally taking over the next day, after May holds a valedictory prime minister’s questions. However, some of the gloss will be removed with the promised resignations of Hammond, the chancellor, and Gauke, the justice secretary, with predictions that other ministers and junior ministers opposed to no deal, such as the international development secretary, Rory Stewart, could follow.

Headline is just wrong. The EU has seen Boris coming from miles away. They know he will put the blame with Brussels. They know he wants to ditch the backstop, and they won’t let him. Then Boris will be known as the man who broke the Good Friday Agreement.

• Incoming Prime Minister Poses A Brexit Puzzle For Brussels (G.)

While Westminster has been gripped by the Conservative leadership race, Brussels has been on a Brexit break. That respite will soon be over. And despite rumours of Brussels compromises in the works, the EU has no off-the-shelf Brexit plan for the new prime minister, who is expected to be announced on Tuesday. “It wouldn’t make any sense to start working on this now,” one senior EU source said. “Because we really need to know [what he wants]. The only thing we have seen are his public statements.” EU negotiators have had no contact with the teams of Boris Johnson – the widely presumed winner – or his rival, Jeremy Hunt. Danuta Hübner, a Polish centre-right member of the European parliament’s Brexit steering group, said there was a “worrying” lack of time to find a compromise before Britain’s departure day on 31 October.

She could not imagine the EU putting anything new on the table, but said it remained open to renegotiating the political declaration on future relations. “We cannot change the major red lines on our side, that there is no possibility of renegotiating the agreement, including the backstop.” Johnson and Hunt have vowed to tear up the backstop, the fallback plan to prevent a hard border on the island of Ireland, which both men have voted for at least once. Recent reports have suggested the EU is ready to offer a five-year transition to break the deadlock over the backstop. But three EU sources said this was a rehash of debates from the negotiation period, rather than fresh ideas. “It’s all quite ancient” and “not something that we are considering at all”, an official said.

Ann Pettifor: “Hammond has quietly overseen the dismantling through austerity of a decent society…..”

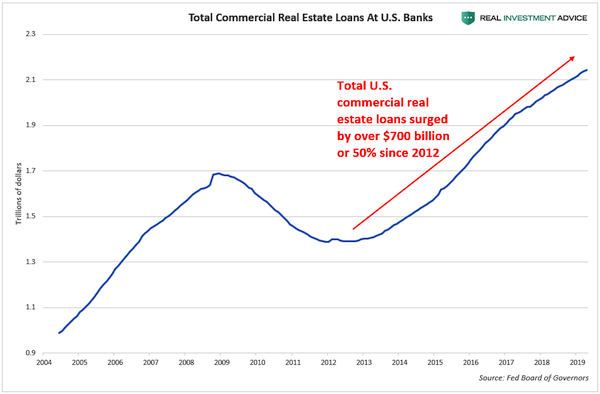

• From Hammond on to Johnson – Where Next For Fiscal Policy? (PE)

As Mr Johnson takes over as Leader of the Conservative Hard Brexit Cult, and by virtue thereof as Prime Minister, it is timely to take a quick look at what his economic and fiscal policy options are – at least in the lead up to DD-Day (Do or Die) on 31st October. It’s equally important to take stock of Mr Hammond’s record as he quietly fades away after three years as Chancellor of the Exchequer. Johnson proposes tax cuts for corporates (reduction in corporate tax rate, already one of the lowest of major economies), and praises President Trump’s example: “He has been very clever in allowing businesses to offset capital investment in tax, with capital allowances. I think we should think about that sort of thing for start-ups, in addition to cutting corporation tax, which would also be effective.” (Via Tom Newton Dunn, The Sun)

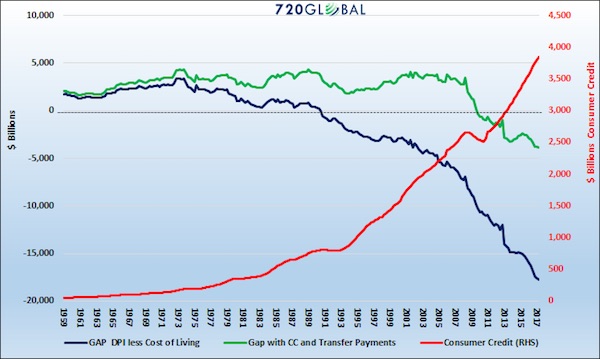

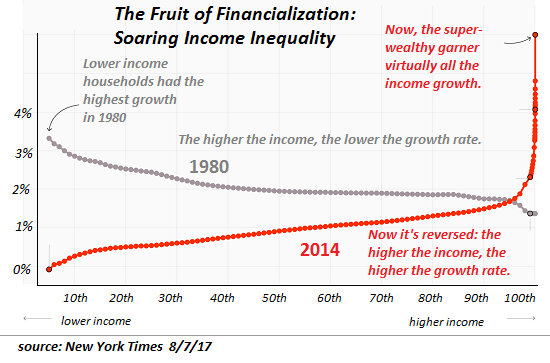

Johnson also promises significant tax cuts for the rich and well-to-do, notably by a big rise in the 40% income tax threshhold to £80,000 and by raising the starting-level of earnings for national insurance contribution (NIC) purposes. On the higher tax threshold, Paul Johnson of the Institute for Fiscal Studies (IFS) says this “costs about £9 billion and benefits the 4 million or so income taxpayers with the highest incomes. Most of the gain goes to those in the top 10% of the income distribution would gain an average of nearly £2,500 a year.” On the NIC issue, he calculates this costs £3 billion for every £1,000 the starting level is raised. All these measures will reduce the immediate tax take for government, probably by £20 to 30 billion per year initially, which is 1-1.5% of GDP.

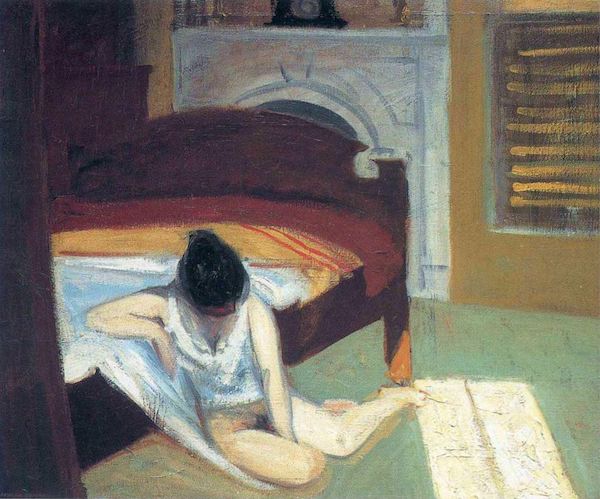

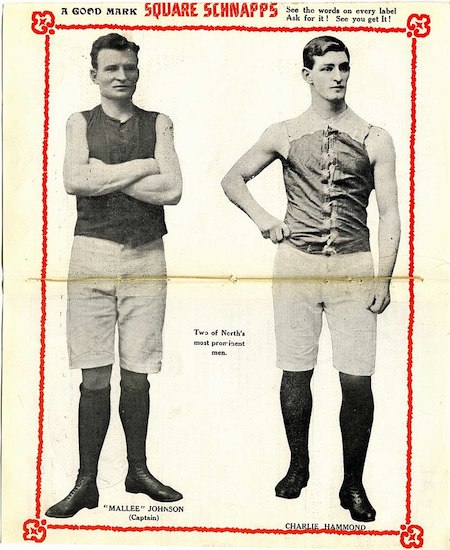

Messrs Johnson & Hammond, circa 1910

“The provisions, imposed by the United States after World War II, are popular with the public at large, but reviled by nationalists like Abe..”

• Abe Fails To Get Enough Votes To Change Japan’s Pacifist Constitution (AT)

Japanese Prime Minister Shinzo Abe claimed victory Sunday for his ruling coalition in the upper house election, but appeared to fail to secure a “super majority” in the chamber in support of his dream to amend the nation’s pacifist constitution. With the results, the 64-year-old Abe, who is on course to become Japan’s longest-serving prime minister, aims to shore up his mandate ahead of a crucial consumption tax hike later this year, along with trade negotiations with Washington. “The ruling parties were given a majority … as people decided to urge us to firmly push for policies under the stable political base,” Abe told public broadcaster NHK.

“I want to meet their expectations soundly,” he said at the headquarters of his Liberal Democratic Party. Abe’s LDP and its coalition partner Komeito are forecast to take at least 69 of the 124 seats – about half the chamber – up for election on Sunday, with six seats still undecided, according to NHK. The two parties control 70 seats in the half of the 245-seat chamber that is not being contested, putting them on track to maintain their overall majority. [..] Local media did predict that forces in favor of revising the constitution, led by Abe’s LDP, were certain to fail to reach 85 of the seats up for grabs, which would have given them a two-thirds “super majority” in the chamber.

Following the vote, however, Abe said he would continue trying to expand support for the revision even if the pro-revision group eventually misses the target, necessary for proposing a constitutional amendment. Abe has pledged to “clearly stipulate the role of the Self-Defence Forces in the constitution,” which prohibits Japan from waging war and maintaining a military. The provisions, imposed by the United States after World War II, are popular with the public at large, but reviled by nationalists like Abe, who see them as outdated and punitive.

Crazy. But Chinese.

• Armed Mob Violence On Protesters Leaves Hong Kong In Shock (BBC)

Hong Kong has been left in shock after a night of violence on Sunday which saw dozens of masked men storm a train station. The men – dressed in white shirts and suspected to be triad gangsters – assaulted pro-democracy protesters and passers-by in the Yuen Long area. This is the first time this kind of violence has been seen in the ongoing anti-extradition demonstrations. Several lawmakers questioned why police were slow to arrive at the scene. Footage posted on social media showed dozens of men attacking people with batons inside the station. Forty-five people were injured, with one person in critical condition.

Lawmaker Lam Cheuk-ting said police had taken more than an hour to arrive. “Hong Kong has one of the world’s highest cop to population ratio,” said another pro-democracy lawmaker Ray Chan in a tweet. “Where were [they?]” Police on Monday said they had not made any arrests but were still carrying out investigations. The mob attack followed a pro-democracy rally on Sunday in the centre of Hong Kong, where riot police had fired tear gas and rubber bullets at protesters. The masked men stormed Yuen Long MTR station at about 22:30 local time (14:30 GMT), attacking passengers and people making their way back from the protest.

“Protesters gave an ultimatum to the Governor after his address. “You have until 11:59pm to leave. If you refuse, we will make this country unmanageable“

• Puerto Rico’s Week Of Massive Protests, Explained (Vox)

Thousands of protesters demonstrated in the streets of San Juan, Puerto Rico Saturday, marking the eighth straight day of rallies calling for the resignation of the island’s governor. The crowds show no sign of ebbing, and analysts say that the protests are quickly becoming the biggest political demonstration in the US territory’s modern history. The protests arose in response to the leak of Telegram app messages in which Gov. Ricardo Rosselló and his inner circle make light of the casualties caused by Hurricane Maria and disparage political opponents using vulgar, homophobic, and sexist language.

The text message leak came days after another scandal: The FBI arrested two former top officials in Rosselló’s government as part of a corruption probe over their handling of $15.5 million in contracts. The officials, former Education Secretary Julia Keleher and Ángela Ávila-Marrero (former chief of Puerto Rico’s Health Insurance Administration), are accused of funneling the contracts to businesses they had personal ties to, regardless of those companies’ relevant experience or ability. The incidents have galvanized a public that feels neglected and exploited by political and economic elites, and one that has endured great suffering in the wake of Hurricane Maria in 2017 and a seemingly unresolvable debt crisis.

Calls for Rosselló’s resignation were growing following the corruption scandal; they exploded after the group chat scandal. Two cabinet officials have resigned in the wake of the scandals, but so far Rosselló has said that he plans to stay in office. Pressure on the governor is rising, however. The protests have garnered international attention, and a number of Puerto Rican celebrities like singer Ricky Martin (who was mocked in the leaked texts), Hamilton creator Lin-Manuel Miranda, and reggaeton star Bad Bunny have backed the demonstrations. “They mocked our dead, they mocked women, they mocked the LGBT community, they made fun of people with physical and mental disabilities, they made fun of obesity. It’s enough. This cannot be,” Martin said in a video on Twitter.

Many politicians from the US mainland have started to weigh in on the issue as well. President Donald Trump — who has called Puerto Rican officials “incompetent or corrupt” and who has opposed increased Hurricane Maria aid to the territory — was critical of Rosselló on Twitter. “The Governor is under siege, the Mayor of San Juan is a despicable and incompetent person who I wouldn’t trust under any circumstance, and the United States Congress foolishly gave 92 Billion Dollars for hurricane relief, much of which was squandered away or wasted, never to be seen again,” Trump tweeted on Thursday.

Populism as a result of decaying power.

“As European affairs minister in Portugal, I had quickly become used to thinking of Poland as the EU’s fourth power, ahead of Spain and Italy”

• The Secret Sources of Populism (Bruno Maçães)

Populism is a direct result of significant shifts in the global distribution of power. Namely, it is a reaction to the loss of power by a formerly hegemonic West. The populist parties competing for power in many European countries are reminiscent of the nationalist movements of the 1800s and 1900s in developing countries, which won support from people tired of feeling dependent on Europe and the United States. In particular, they sensed that their ancient civilizations had come to abandon their way of life for Western ideas. They lamented that their countries had been so deeply Westernized that only the sense of emptiness remained. “Our country resembles a hospital,” the Turkish writer Kazim Nami wrote in Turkish Country, a journal published between 1911 and 1931, “deprived of medicine, doctors and care.”

In Russia, a Europeanized aristocracy existed in an entirely different world from the peasantry. They spoke French, listened to different music and songs, ate different food, and had a radically different view of religion and the ends of life. It was as two countries rather than as two classes that they looked at each other, plotting a final and decisive struggle over Russia’s soul. Even in France, England, Germany, and the United States, a creeping sense of alienation was slowly developing between the classes, but it was of a different sort. Because these were the world’s ruling nations, elites assumed the responsibility of managing the affairs of foreign countries. Their outlook was more universal in character, although rooted in colonialism, and that created an inevitable distance with their compatriots.

Of course, as long as Western hegemony persisted, the spoils of empire flowed to the lower classes and reconciled them with those in power. But as the balance of power shifted, cosmopolitan elites appeared in a different light. It was implausible for them to dictate to the rest of the world from a position of growing weakness, and some had learned too well to incorporate the interests of the rest of humanity when formulating their positions. Today, many voters in Europe and the United States are starting to regard the elites as profoundly disconnected from what they see as the national interest. Distrust and alienation will keep growing.

Divide and rule. Long read. Here’s one of its stories.

• Latest Secret Government File Reveals UK Middle East Policy (TP)

In April 1941, nationalist army officers known as the Golden Square staged a coup in Iraq, overthrowing the pro-British regime, and signalled they were prepared to work with German and Italian intelligence. In response, the British embarked on a military campaign and eventually crushed the coup leaders two months later. But Suarez discovered in the files that the British were already wanting such a “military occupation of Iraq” by November 1940 – well before the Golden Square coup gave them a pretext for doing so. The reason was that Britain wanted to end “the mufti’s intrigues with the Italians”. One file notes: “We may be able to clip the mufti’s wings when we can get a new government in Iraq. FO [Foreign Office] are working on this.”

Suarez notes that a prominent thread in the British archive is: “How to effect a British coup without further alienating ‘the Arab world’ in the midst of the war, beyond what the empowering of Zionism had already done.” As British troops closed in on Baghdad, a violent anti-Jewish pogrom rocked the city, killing more than 180 Jewish Iraqis and destroying the homes of hundreds of members of the Jewish community who had lived in Iraq for centuries. The Farhud (violent dispossession) has been described as the Iraqi Jews’ Kristallnacht, the brutal pogrom against Jews carried out in Nazi Germany three years earlier.

There have long been claims that these riots were condoned or even orchestrated by the British to blacken the nationalist regime and justify Britain’s return to power in Baghdad and ongoing military occupation of Iraq. Historian Tony Rocca noted: “To Britain’s shame, the army was stood down. Sir Kinahan Cornwallis, Britain’s ambassador in Baghdad, for reasons of his own, held our forces at bay in direct insubordination to express orders from Winston Churchill that they should take the city and secure its safety. Instead, Sir Kinahan went back to his residence, had a candlelight dinner and played a game of bridge.” Could this be the reason that UK government censors want the file to remain secret after all these years? It would neither be the first, nor the last time that British planners used or created pretexts to justify their military interventions.

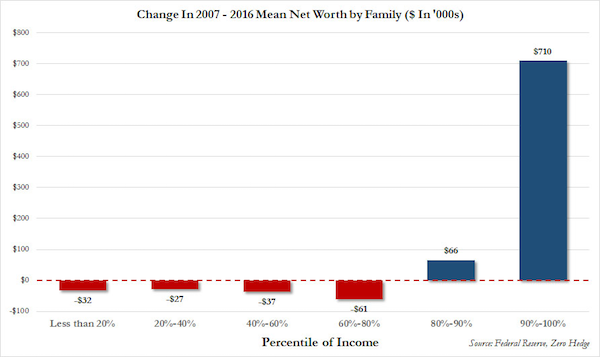

“Between 1910 and 1997, African-Americans lost about ninety per cent of their farmland. This problem is a major contributor to America’s racial wealth gap; the median wealth among black families is about a tenth that of white families.”

• Kicked Off the Land (New Yorker)

In the spring of 2011, the brothers Melvin Davis and Licurtis Reels were the talk of Carteret County, on the central coast of North Carolina. Some people said that the brothers were righteous; others thought that they had lost their minds. That March, Melvin and Licurtis stood in court and refused to leave the land that they had lived on all their lives, a portion of which had, without their knowledge or consent, been sold to developers years before. The brothers were among dozens of Reels family members who considered the land theirs, but Melvin and Licurtis had a particular stake in it. Melvin, who was sixty-four, with loose black curls combed into a ponytail, ran a club there and lived in an apartment above it. He’d established a career shrimping in the river that bordered the land, and his sense of self was tied to the water. Licurtis, who was fifty-three, had spent years building a house near the river’s edge, just steps from his mother’s.

Their great-grandfather had bought the land a hundred years earlier, when he was a generation removed from slavery. The property—sixty-five marshy acres that ran along Silver Dollar Road, from the woods to the river’s sandy shore—was racked by storms. Some called it the bottom, or the end of the world. Melvin and Licurtis’s grandfather Mitchell Reels was a deacon; he farmed watermelons, beets, and peas, and raised chickens and hogs. Churches held tent revivals on the waterfront, and kids played in the river, a prime spot for catching red-tailed shrimp and crabs bigger than shoes. During the later years of racial-segregation laws, the land was home to the only beach in the county that welcomed black families. “It’s our own little black country club,” Melvin and Licurtis’s sister Mamie liked to say.

In 1970, when Mitchell died, he had one final wish. “Whatever you do,” he told his family on the night that he passed away, “don’t let the white man have the land.” Mitchell didn’t trust the courts, so he didn’t leave a will. Instead, he let the land become heirs’ property, a form of ownership in which descendants inherit an interest, like holding stock in a company. The practice began during Reconstruction, when many African-Americans didn’t have access to the legal system, and it continued through the Jim Crow era, when black communities were suspicious of white Southern courts. In the United States today, seventy-six per cent of African-Americans do not have a will, more than twice the percentage of white Americans.

Many assume that not having a will keeps land in the family. In reality, it jeopardizes ownership. David Dietrich, a former co-chair of the American Bar Association’s Property Preservation Task Force, has called heirs’ property “the worst problem you never heard of.” The U.S. Department of Agriculture has recognized it as “the leading cause of Black involuntary land loss.” Heirs’ property is estimated to make up more than a third of Southern black-owned land—3.5 million acres, worth more than twenty-eight billion dollars. These landowners are vulnerable to laws and loopholes that allow speculators and developers to acquire their property. Black families watch as their land is auctioned on courthouse steps or forced into a sale against their will.

Carter leaves the Southern Baptist Convention after 60 years.

• Losing My Religion For Equality (Jimmy Carter)

I have been a practising Christian all my life and a deacon and Bible teacher for many years. My faith is a source of strength and comfort to me, as religious beliefs are to hundreds of millions of people around the world. So my decision to sever my ties with the Southern Baptist Convention, after six decades, was painful and difficult. It was, however, an unavoidable decision when the convention’s leaders, quoting a few carefully selected Bible verses and claiming that Eve was created second to Adam and was responsible for original sin, ordained that women must be “subservient” to their husbands and prohibited from serving as deacons, pastors or chaplains in the military service.

This view that women are somehow inferior to men is not restricted to one religion or belief. Women are prevented from playing a full and equal role in many faiths. Nor, tragically, does its influence stop at the walls of the church, mosque, synagogue or temple. This discrimination, unjustifiably attributed to a Higher Authority, has provided a reason or excuse for the deprivation of women’s equal rights across the world for centuries. At its most repugnant, the belief that women must be subjugated to the wishes of men excuses slavery, violence, forced prostitution, genital mutilation and national laws that omit rape as a crime. But it also costs many millions of girls and women control over their own bodies and lives, and continues to deny them fair access to education, health, employment and influence within their own communities.

The impact of these religious beliefs touches every aspect of our lives. They help explain why in many countries boys are educated before girls; why girls are told when and whom they must marry; and why many face enormous and unacceptable risks in pregnancy and childbirth because their basic health needs are not met.