René Magritte The song of love 1948

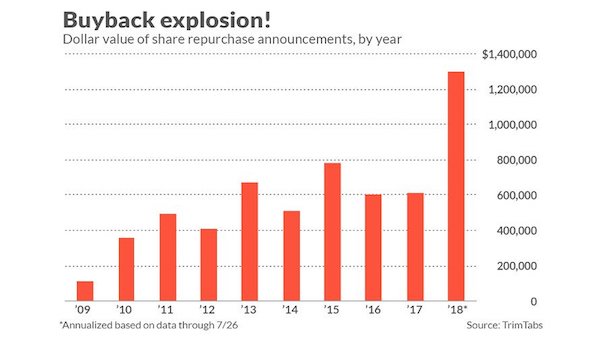

“.. in the last 12 months, the companies in the S&P 500 have purchased $646 billion of their own stock, 29 percent more than the previous 12 months..”

“..at least $350 billion of buybacks that have been planned for the year and are just waiting to be put to work.”

• Companies Buying Their Own Shares Could Fuel The Next Market Rally (CNBC)

With stocks down significantly, corporate buybacks could help stabilize the market. Buybacks have been one of the big stories supporting the market this year. DataTrek estimates that in the last 12 months, the companies in the S&P 500 have purchased $646 billion of their own stock, 29 percent more than the previous 12 months. And there’s plenty of “dry powder” left. One firm estimates at least $350 billion of buybacks that have been planned for the year and are just waiting to be put to work. And no, it is not just Apple that is buying its own stock. More than 300 large-cap companies have active buyback programs.

Unfortunately, some traders are resurrecting an old chestnut to help explain the current market weakness. They say we are entering a “blackout” period, when corporations cannot buy their stock because they are about to report quarterly earnings. It’s a neat explanation, except there’s not a lot to it. “Buybacks do occur during blackout periods,” Ben Silverman at InsiderScore told me. “Buyback volume does often decline in the first month of the quarter due to some buyback blackouts,” but companies can, and do, continue to buy back stock, he told me. Another trader (who declined to be identified) confirmed Silverman’s point. Corporate buybacks decline in the month before earnings, but only marginally. He estimated the decline is 30 percent or less.

“..disproportionate valuations…”

$20 trillion worth of them.

• Market Crash? Another ‘Red Card’ For The Economy (Lacalle)

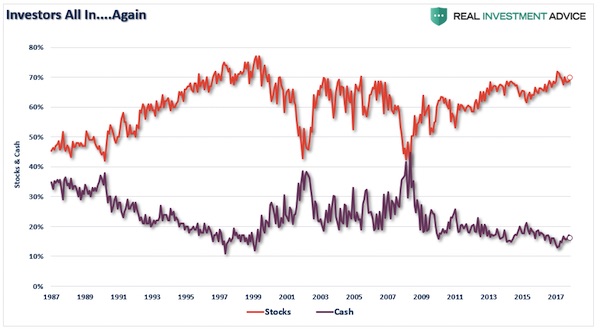

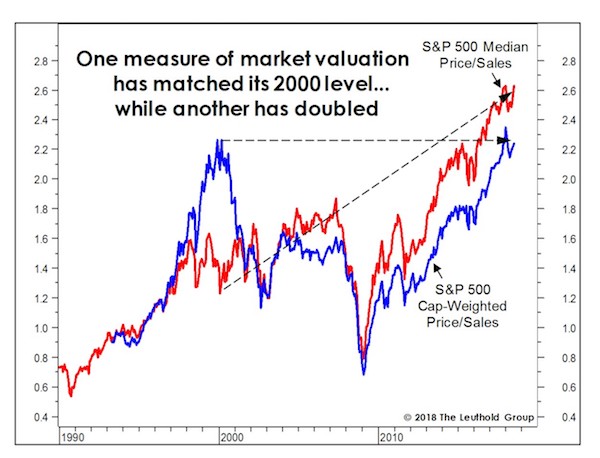

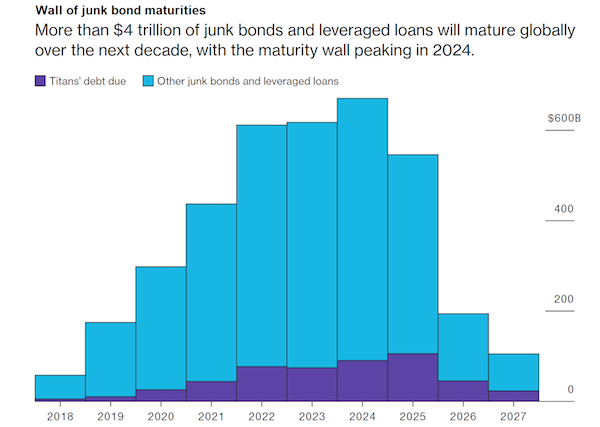

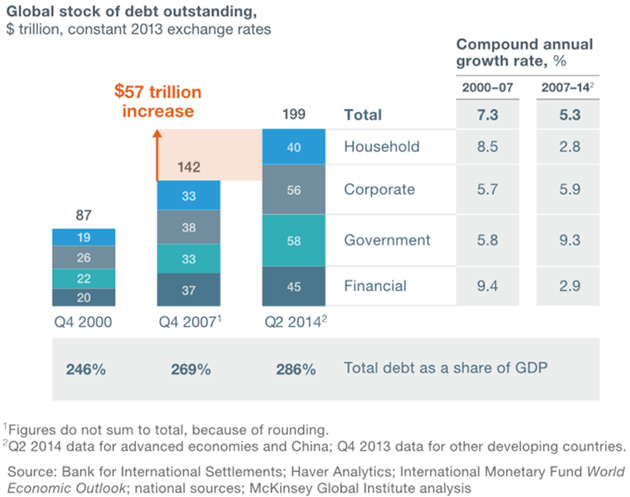

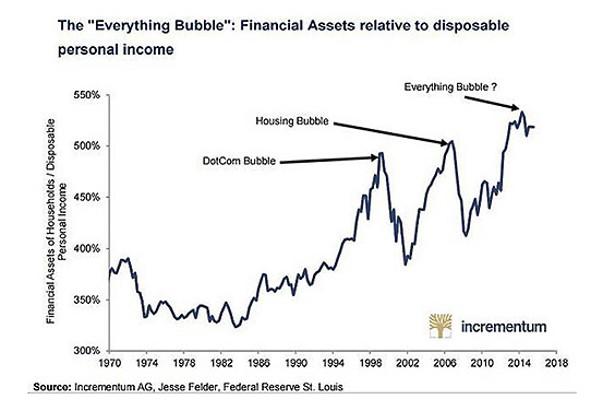

The first thing we must understand is that we are not facing a panic created by a black swan, that is, an unexpected event, but by three factors that few could deny were evident: 1) Excessive valuations after $20 trillion of monetary expansion inflated most financial assets. 2) Bond yields rising as the US 10-year reaches 3.2%. 3) The evidence of the Yuan devaluation, which is on its way to surpass 7 Yuan per US dollar. 4) Global growth estimates trimmed for the sixth time in as many months. Therefore, the US rate hikes – announced repeatedly and incessantly for years – are not the cause, nor the alleged trade war. These are just symptoms, excuses to disguise a much more worrying illness.

What we are experiencing is the evidence of the saturation of excesses built around central banks’ loose policies and the famous “bubble of everything”. And therein lies the problem. After twenty trillion dollars of reckless monetary expansion, risk assets, from the safest to the most volatile, from the most liquid to the unquoted, have skyrocketed with disproportionate valuations.

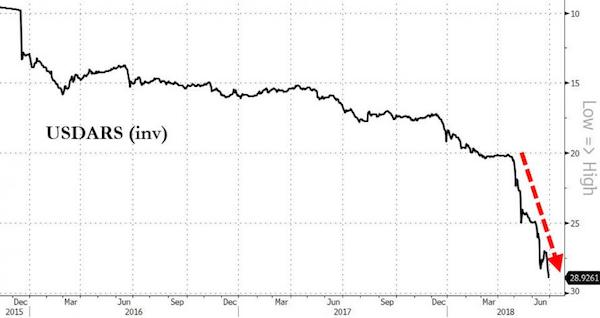

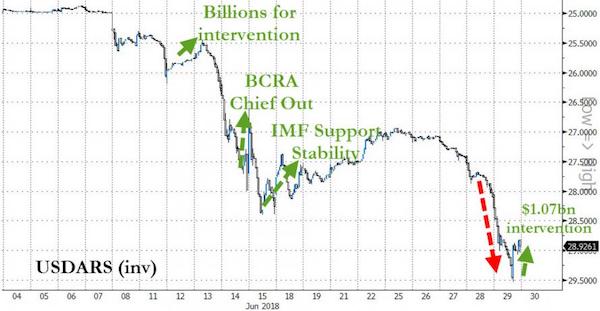

The cracks in the building always appear first with currencies. Countries that have become accustomed to the idea that “this time is different” and that debt does not matter, started to multiply their indebtedness in foreign currency. Debt in dollars from emerging countries soared to 41% of their total debt. In the first three months of 2018, global debt rose 11% to a record of 247 trillion dollars (according to the IIF), and that of emerging markets soared by 2.5 trillion to an all-time high of 58.5 trillion. . When the lowest risk bond, the United States 10-year, went to 3.1%, the synchronized growth and complacent veil lifted, and many assets showed how risky they truly are.

Markets woke up to a reality that we had decided to ignore. That rates do rise. And if the safest bond gives a return of 3.2% … Am I willing to buy bonds from much riskier countries with negligible spreads? Add to that “sobriety” effect, another one. The inevitable devaluation of the yuan , which soared to almost 7 against the dollar. Am I willing to buy emerging markets and commodities when China exports its imbalances sending disinflationary pressure to the rest of the world?

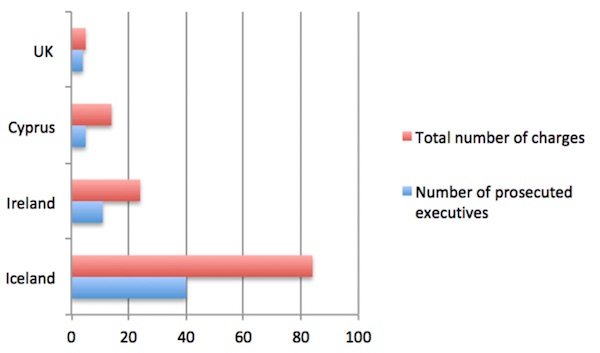

Iceland took it serious. No-one else did.

• 4 Lessons From Iceland On Dealing With A Financial Crisis (WEF)

Days after the collapse of 97% of its banking industry, Icelandic authorities designed a comprehensive policy of accountability, based on two overlapping objectives: establishing the truth and punishing those responsible. An independent truth commission was mandated to document the causes of the meltdown, and the newly established Office of the Special Prosecutor was tasked to thoroughly investigate and prosecute those responsible for any crimes committed in the run up to the crisis. Both mechanisms have been remarkably successful.

Published in 2010, the truth commission’s 2,200-page report not only documented the manifold failings of the financial system in Iceland but also offered specific recommendations to protect state institutions from a future crisis. The report instantly became a bestseller, with copies sold in supermarkets. It was a popular gift – parents even gave it to their children to help them avoid making the same mistakes. The Office of the Special Prosecutor successfully prosecuted 40 bank executives. This is remarkable, especially given the small population of the island and the comparative experience of other European countries affected by the recession, such as Ireland, Cyprus, or the UK (table below).

Not many people see is that way.

• ‘Crazy’ That Current Account Deficits Are ‘A Sin:’ Singapore Deputy PM (CNBC)

For decades, developing countries have relied on outside investments to boost their growth despite trade imbalances. But running a current account deficit has come to be regarded as “a sin,” according to Singapore’s deputy prime minister. Such a development is just “crazy,” Tharman Shanmugaratnam told CNBC on Friday during the annual meeting of the Institute of International Finance on the Indonesian island of Bali. Shanmugaratnam was referring to the widely held outlook that nations should seek to avoid current account deficits — which indicate they’re operating on borrowed means because the value of incoming goods, services and investments exceeds the amount leaving the country.

“How did the Singapores and Koreas of the world grow?” he said. “We grew by running current account deficits at an early stage of development so we could invest ahead for growth while our savings were being built up.” Singapore was able to rely on financing through foreign direct investments and long-term investors during its early years of growth, as the international financial system at that time had capital flowing to developing economies, Shanmugaratnam said. “Today, it’s a sin to run a current account deficit and that’s crazy,” said the minister, who is also the chairman of the Monetary Authority of Singapore, the country’s central bank and financial regulator. “I mean, it’s bad in economics, it’s bad in policy sense, and the whole world is going to suffer.”

But Draghi’s still an Italian.

• Draghi to Rome: Don’t Expect An ECB Rescue If Budget Talks Fail (CNBC)

European Central Bank President Mario Draghi is sending a warning to Rome ahead of its formal budget submission: Don’t expect the ECB to save the day. In a Saturday press conference at the IMF and World Bank meetings in Bali, Indonesia, Draghi said he was confident that a budget agreement would be reached and urged all parties to “calm down with the tone.” He also voiced relief that there has not been evidence of a wider spillover effect in European bond markets, even as Italian yields hit multi-year highs. “Everything that happened today is local to Italy.”

When asked whether an eventual realization of contagion or a further rise in Italian yields would force the ECB to scrap tightening plans by year end, Draghi told CNBC: “I don’t want to speculate on this. I just don’t want to conceive such a hypothesis. I’m confident that the authorities — and by the way all parties, not only Italy — all parties will in the end find a compromise solution, an agreement.” He went on to suggest that the situation had been “dramatized,” and that was “not the first time there are deviations from established rules in Europe.” But investors are worried that the Italian government may seize on that precedent and take a gamble that running foul of EU budget rules won’t incur serious penalties, and that, if things do turn worse for Italian financial markets, they”ll be able to lean on the ECB for support. Draghi, for his part, told CNBC that would not be a possibility.

“..Saudi Arabia expelled the Canadian envoy. It then froze trade talks, cut academic ties, and suspended flights to Canada.”

But arms sales trump everything.

• Canada ‘Concerned’ About Khashoggi But Will Sell Arms To Saudis – Trudeau (RT)

Ottawa will keep its $15bn arms deal with Riyadh despite concerns over Saudi involvement in the disappearance of dissident journalist Jamal Khashoggi and the diplomatic row over human rights, Prime Minister Trudeau said. “We respected that contract,” Canadian Prime Minister Justin Trudeau told reporters on Friday, adding that his cabinet has put forward measures to make the arms sales more transparent. “We are making sure Canadians’ expectations and laws are always being followed,” he said. The contract was signed in 2014 by the previous conservative government, and has since been upheld by Trudeau. The specifics of the sales were originally not disclosed by the parties.

According to documents obtained by CBC News last month, a Canadian company is to ship 742 LAV-6 light armored vehicles to Riyadh. The same outlet revealed in March that hundreds of the LAV-6s will be outfitted as “heavy assault” and “anti-tank” types. [..] Human rights campaigners and journalists have criticized Canada’s approach to Saudi Arabia as inconsistent. They point out that the government doesn’t mince words when attacking the kingdom’s human rights record, but at the same time never waivers in its willingness to ship military hardware to Riyadh. Media reports have also strongly suggested that the Saudis might be using Canadian-made LAVs against civilians in Yemen.

[..] Canada stuck to the arms deal even after becoming embroiled in a diplomatic spat with Riyadh in August. Foreign Minister Chrystia Freeland called on the kingdom to release two high-profile dissidents. In response, Saudi Arabia expelled the Canadian envoy. It then froze trade talks, cut academic ties, and suspended flights to Canada.

She won’t have a cabinet left soon.

• David Davis Calls For Cabinet Rebellion Over Brexit Plan (BBC)

Cabinet ministers should “exert their collective authority” and rebel against Theresa May’s proposed Brexit deal, ex-Brexit Secretary David Davis has said. The PM has suggested a temporary customs arrangement for the whole UK to remain in the customs union while the Irish border issue is resolved. Brexiteers suspect this could turn into a permanent situation, restricting the freedom to strike trade deals. Writing in the Sunday Times, Mr Davis said the plan was unacceptable. “This is one of the most fundamental decisions that government has taken in modern times,” he added.

The issue of the border between Northern Ireland and the Republic Ireland is one of the last remaining obstacles to achieving a divorce deal with Brussels, with wrangling continuing over the nature of a “backstop” to keep the frontier open if a wider UK-EU trade arrangement cannot resolve it. The EU’s version, which would see just Northern Ireland remain aligned with Brussels’ rules, has been called unacceptable by Mrs May and the DUP. Mr Davis said the government’s negotiating strategy had “fundamental flaws”, arising from the “unwise decision in December to accept the EU’s language on dealing with the Northern Ireland border”.

On Saturday evening, German newspaper Suddeutsche Zeitung reported a deal had already been reached between Mrs May and the EU, and would be announced on Monday. But a No 10 source told the BBC the report was “100%, categorically untrue” and negotiations were ongoing. The paper said it had seen a leaked memo from EU negotiators to EU ambassadors stating: “Deal made.”

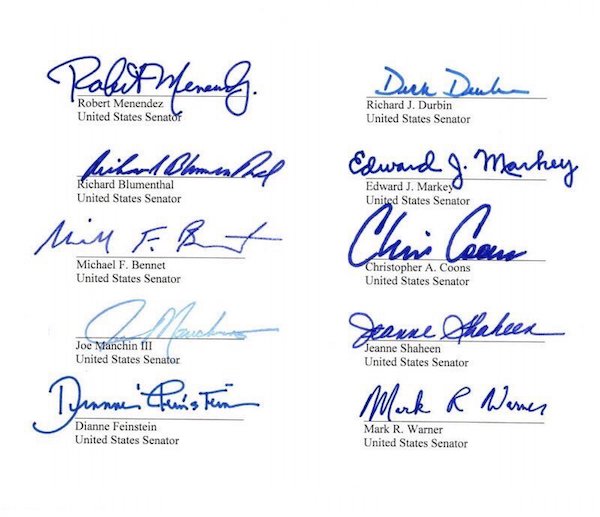

Too many people want too many too different things.

• Brexit Negotiators Poised To Miss Deal Deadline As UK Hardliners Rebel (ZH)

[..] early Sunday in London, the Brexiteer hardliners published an open letter signed by 63 Conservative MPs, including David Davis, the former Brexit secretary, Jacob Rees-Mogg, the chairman of the European Research Group of Eurosceptic backbenchers and former Brexit minister Steve Baker, the former Brexit minister. At the same time, Anne-Marie Trevelyan, a pro-leave MP, published an editorial in the Sunday Telegraph demanding that any possibility that the UK could remain in a “temporary customs arrangement” after the Brexit transition period ends in December 2020 be stricken from the final agreement – because leaving open the possibility would be tantamount to ignoring the political will of the 17.4 million Britons who voted for Brexit.

Meanwhile, Davis demanded in an editorial in the Sunday Times that Cabinet ministers should “exert their collective authority” and rebel against Theresa May’s proposed Brexit deal. All of this is happening amid even more conflicting reports, citing sources from the EU and sources from No. 10 Downing Street, affirming and denying that a deal had been reached. Underscoring the hostility to a deal, the leader of Northern Ireland’s Democratic Unionist Party said Sunday that she would prefer a “no deal” Brexit to a “backstop” transition agreement that would require any borders between Northern Ireland and the UK, arguing that this would amount to the “annexation” of Northern Ireland by the EU, per CNBC.

The Atlantic Council got going. Social media have become too big a threat to the narrative.

• Internet Censorship Just Took An Unprecedented Leap Forward (CJ)

While most indie media was focused on debating the way people talk about Kanye West and the disappearance of Saudi journalist Jamal Khashoggi, an unprecedented escalation in internet censorship took place which threatens everything we all care about. It received frighteningly little attention. After a massive purge of hundreds of politically oriented pages and personal accounts for “inauthentic behavior”, Facebook rightly received a fair amount of criticism for the nebulous and hotly disputed basis for that action. What received relatively little attention was the far more ominous step which was taken next: within hours of being purged from Facebook, multiple anti-establishment alternative media sites had their accounts completely removed from Twitter as well.

As of this writing I am aware of three large alternative media outlets which were expelled from both platforms at almost the same time: Anti-Media, the Free Thought Project, and Police the Police, all of whom had millions of followers on Facebook. Both the Editor-in-Chief of Anti-Media and its Chief Creative Officer were also banned by Twitter, and are being kept from having any new accounts on that site as well.

“I unfortunately always felt the day would come when alternative media would be scrubbed from major social media sites,” Anti-Media’s Chief Creative Officer S.M. Gibson said in a statement to me. “Because of that I prepared by having backup accounts years ago. The fact that those accounts, as well as 3 accounts from individuals associated with Anti-Media were banned without warning and without any reason offered by either platform makes me believe this purge was certainly orchestrated by someone. Who that is I have no idea, but this attack on information was much more concise and methodical in silencing truth than most realize or is being reported.”

Interesting man.

• Professor Exposes Rigged Markets One Academic Paper At A Time (ZH)

Finance professor John Griffin, along with his doctoral student companion, Amin Shams, were the two academics that drew market-moving conclusions about bitcoin last year, while the digital currency was trading around $20,000. After sifting through 2 terabytes of trading data, they alleged that bitcoin was being manipulated by someone using the cryptocurrency Tether to purchase it. Tether remains a relatively little-known crypto, which is pegged to one US dollar. Part of its appeal is that it can “stand in” for dollars when necessary, according to Bloomberg. Griffin and Shams authored a paper in June, with the results of their findings ultimately catalyzing many digital assets to move lower, despite the fact that the CEO of Tether publicly denied that its currency was used to prop up bitcoin.

Griffin works at the University of Texas at Austin, and has become quite an unpopular figure on Wall Street for similar work he has done in the past on ratings companies, the VIX and investment banks. In most of his findings, he claims that these well-known financial instruments and players are, in one way or another, rigged. And the professor seems to enjoy exposing precisely that: rigged, manipulated markets and shady players. “I not only want to understand the world, but make it better,” he told Bloomberg. Griffin’s work has become popular reading within the DOJ and the Commodity Futures Trading Commission, according to Bloomberg.

These regulators – many of them low on resources, time and staff – welcome any additional help they can get (the SEC’s budget has forced it into a hiring freeze and the CFTC budget was cut by Congress in March of this year). John Reed Stark, a former attorney in the SEC’s enforcement division, stated: “It’s incredibly helpful to have an expert of Griffin’s caliber.”

“..the threat to order might be so great that an unprecedented “emergency” has to be declared, with soldiers in the streets of Washington..”

If I were President, I’d declare Oct 12 Greater Fool Day. (Nobody likes Christopher Columbus anymore, that genocidal monster of dead white male privilege.) The futures are zooming as I write, a last roundup for suckers at the OD corral, begging the question: who will show up on Monday. Nobody, I predict. And then what? The great false front of the financial markets resumes falling over into the November election. The rubble from all that buries whatever is left of the automobile business and the housing market. The smoldering aftermath will be described as the start of a long-overdue recession — but it will actually be something a lot worse, with no end in sight.

The Democratic Party might not be nimble enough to capitalize on the sudden disappearance of capital. Their only hope to date has been to capture the vote of every female in America, to otherwise augment their constituency of inflamed and aggrieved victims of unsubstantiated injustices. It’s been fun playing those cards, and the Party might not even know how to play a different game at this point. Democratic politicians may also be among the one-percenters who watch their net worth go up in a vapor in a market collapse, leaving them too numb to act. The last time something like this happened, in the fall of 2008, candidate Barack Obama barely knew what to say about the fall of Lehman Brothers and the ensuing cascade of misery — though unbeknownst to the voters, he was already a hostage of Wall Street.

Complicating matters this time will be the chaos unleashed in politics and governing when the long-running “Russia collusion” melodrama boomerangs into a raft of indictments against the cast of characters in the Intel Community and Department of Justice AND the Democratic National Committee, and perhaps even including the Party’s last standard bearer, HRC, for ginning up the Russia Collusion matter in the first place as an exercise in sedition. The wheels of the law turn slowly, but they’ll turn even while financial markets tumble. And the threat to order might be so great that an unprecedented “emergency” has to be declared, with soldiers in the streets of Washington, as was sadly the case in 1861, the first time the country turned itself upside down.

Good angle.

• Who The Hell Cares What Old People Think About Climate Change? (Ol.)

The loudest and most powerful voices when it comes to the future of the planet — the ones with their hands on the levers of power — have a strong tactical advantage: they will be dead before the shit really hits the fan. This fact curiously goes unspoken, for the most part. Popular arguments tend to be framed around a rosy vision preserving the planet for future generations, which gives our boomer aristocracy the most effective cover story imaginable. They don’t need to care about that, as nice as it sounds. Why would they? It’s all completely hypothetical to them. You may as well be talking about climate patterns in Narnia. Make no mistake: older generations living in the developed world are part of history’s most under-appreciated death cult.

This isn’t abstract psychoanalysis. There is a brutal calculus going on in the minds of everyone from your skeptic uncle to the bankrollers of squillion dollar think tanks whenever they think or talk about climate change. They know that they will never have to really answer for their opinions on this matter, because they’ll be six feet under (and loving it!) when the world’s arable land is rendered infertile and its coastal cities flooded by rising oceans. In some dark and venal corner of their minds, they’re thinking about that fact all the damn time. Despite the frightening predictions of the new IPCC report, they’ve still got plenty of wiggle room to keep denying until they’re dead – which will be sooner rather than later. With any luck they’ll even avoid being held accountable in any concrete way, which for the conservative commentariat is an even worse fate than the Mad Max hellworld towards which we are hurtling.

One scary dude.

• What’s Another Way to Say ‘We’re F-cked’? (Goodell)

[..] a scientist named Richard Alley in a Skype discussion with students at Bard College, as well as with Eban Goodstein, director of the Graduate Programs in Sustainability at Bard. It would be just another nerdy Skype chat except Alley is talking frankly about something that few scientists have the courage to say in public: As bad as you think climate change might be in the coming decades, reality could be far worse. Within the lifetime of the students he’s talking with, Alley says, there’s some risk — small but not as small as you might hope — that the seas could rise as much as 15-to-20 feet.

[..] Richard Alley is not a fringe character in the world of climate change. In fact, he is widely viewed as one of the greatest climate scientists of our time. If there is anyone who understands the full complexity of the risks we face from climate change, it’s Alley. And far from being alarmist, Alley is known for his careful, rigorous science. He has spent most of his adult life deconstructing past Earth climates from the information in ice cores and rocks and ocean sediments. And what he has learned about the past, he has used to better understand the future. For a scientist of Alley’s stature to say that he can’t rule out 15 or 20 feet of sea-level rise in the coming decades is mind-blowing.

And it is one of the clearest statements I’ve ever heard of just how much trouble we are in on our rapidly warming planet (and I’ve heard a lot — I wrote a book about sea-level rise). To judge how radical this is, compare Alley’s numbers to the latest report from the Intergovernmental Panel on Climate Change, which was released on Monday. That report basically argued that if we don’t get to zero carbon emissions by 2050, we have very little chance of avoiding 1.5 Celsius of warming, the threshold that would allow us to maintain a stable climate. The report projected that with 2 Celsius of warming, which is the target of the Paris Climate Agreement, the range of sea level rise we might see by the end of the century is between about one and three feet.

Sure. But start giving back what was. Problem is, so much of it WAS looted that the museum would become a pretty empty place.

• ‘Not Everything Was Looted’: British Museum To Fight Critics (G.)

The British Museum is launching an initiative intended to counter the perception that its collections derive only from looted treasures. The monthly Collected Histories talks, which begin on Friday, will provide information on how certain artefacts entered the collection, with the museum saying it will offer a more nuanced take on these stories than is available elsewhere. The museum has long faced criticism for displaying – and refusing to return – looted treasures, including the Parthenon Marbles, Rosetta Stone, and the Gweagal shield.

Earlier this year, the art historian Alice Procter’s Uncomfortable Art Tours around London institutions, including the British Museum, made headlines for their attempts to expose the role of colonialism, with those on the tour given “Display It Like You Stole It” badges. Dr Sushma Jansari, the curator of the Asian ethnographic and South Asia collections at the British Museum, said she had devised Collected Histories in response to Procter’s tours. “There are a lot of partial histories and they tend to focus on the colonial aspect of the collecting so you have a bunch of people who tend to be quite angry and upset,” she said. “We’re trying to reset the balance a little bit. A lot of our collections are not from a colonial context; not everything here was acquired by Europeans by looting.”