René Magritte Le Cri du Coeur 1960

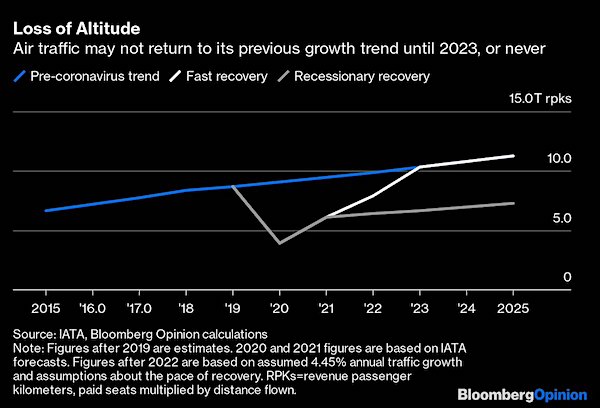

Tucker VDH We’re in the middle of a revolution

Ep. 27 Donald Trump appeared in court today, but it wasn’t a legal proceeding. It was a grotesque parody of the system our ancestors created. Victor Davis Hanson explains. pic.twitter.com/KhTHateWCZ

— Tucker Carlson (@TuckerCarlson) October 2, 2023

Trump trial

BREAKING – SEE IT: Trump explodes after controversial hearing in New York ahead of 2024 elections, says the Democratic judge has already made up his mind, says "It's ridiculous." WATCH pic.twitter.com/XzPlTh5Y7k

— Simon Ateba (@simonateba) October 2, 2023

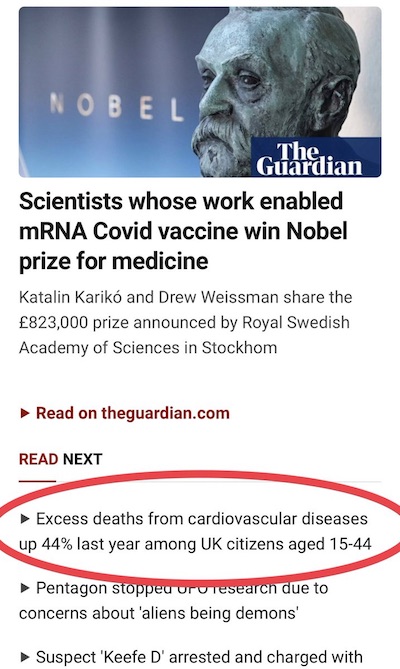

The Nobel Prize laureates do not trust their own ‘innovation’ and instead rely on…face diapers.

el gato malo: “world: there will never be a nobel prize for medicine worse than in 1949 when antonio moniz won for inventing “the frontal lobotomy.”

nobel committee: hold my beer and watch this…

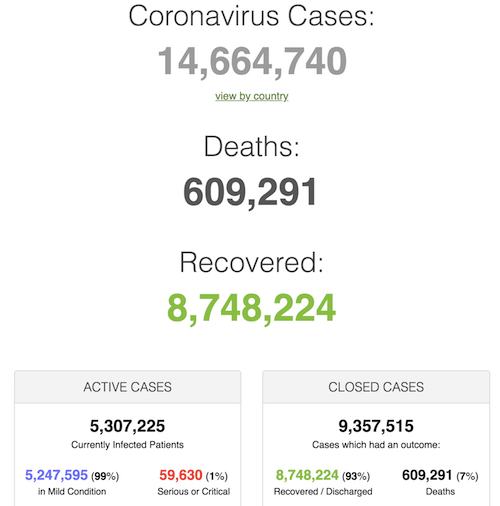

Vaccine Acquired Immunodeficiency Syndrome

Kanekoa

In 2018, Letitia James vowed to use the law as her weapon to remove Donald Trump from office, dubbing him “an illegitimate president for colluding with foreign powers.” She boldly declared, “We believe he’s engaged in a pattern and practice of money laundering. Laundering the money from foreign governments here in New York State.” “Understand that the days of Donald Trump are coming to an end,” she emphasized, “but we can only do it if all of you exercise the most fundamental right — the right to vote.” Fast forward five years, and what’s the grand finale? Trump is accused of taking out legally obtained loans that he repaid in full with interest. Bravo!

Meanwhile, in a twist worthy of a Hollywood plot, the Biden family has been on a money-laundering spree, washing millions from shady oligarchs in China, Russia, and Ukraine through a tangled web of 20 shell companies. The Treasury Department has a hefty stack of over 170 suspicious activity reports filed by 6 banks, all spelling out how the Biden family “engaged in a pattern and practice of money laundering,” with much of that foreign cash flowing right through the heart of New York City. Congratulations, Attorney General Letitia James!

Letitia 2018

In 2018, Letitia James vowed to use the law as her weapon to remove Donald Trump from office, dubbing him "an illegitimate president for colluding with foreign powers."

She boldly declared, "We believe he's engaged in a pattern and practice of money laundering. Laundering the… pic.twitter.com/h9PcI1atUE

— KanekoaTheGreat (@KanekoaTheGreat) October 2, 2023

Charlie Kirk

Donald Trump is facing a civil trial in New York for “fraud.” So, which of his victims is suing him? That’s a trick question: There aren’t any. None of New York’s banks or insurance companies, Trump’s supposed “victims,” are suing him. Trump’s loans are repaid and his accounts are current. Because one judge says Trump “overvalued” his properties, that same judge is empowered to fine him hundreds of millions of dollars, break up the Trump Organization, and seize control of his properties, including Trump Tower, all to remedy a phantom crime with no victims. When this happens in China or Russia, we call it what it is: Lawfare against an enemy of the regime. Normal people do not yet realize how patently insane this is.

First of many. They all hark back to Civil War laws. As if today is similar to those days.

• US Supreme Court Rejects Challenge to Block Trump in 2024 (ET)

The U.S. Supreme Court on Oct. 2 declined to take a longshot challenge to former President Donald Trump’s eligibility to appear on New Hampshire’s ballots during the 2024 election. John Anthony Castro filed an appeal with the Supreme Court several weeks ago and claimed that the former president should be disqualified under a reading of a section of the U.S. Constitution’s 14th Amendment. Mr. Castro, a Texas lawyer who’s running for president, claimed that President Trump partook in an insurrection against the federal government because of the Jan. 6, 2021, Capitol breach. “The decision by the U.S. District Court for the Southern District of Florida dismissing Petitioner John Anthony Castro’s civil action on the grounds that he lacks constitutional standing to sue another candidate who is allegedly unqualified to hold public office in the United States pursuant to Section 3 of the 14th Amendment to the United States Constitution,” Mr. Castro wrote in a petition for a writ of certiorari.

At the same time, he asserted that because he’s a Republican candidate, President Trump’s name appearing on the ballot injures his ability to obtain donations. According to records from the Federal Election Commission, Mr. Castro hasn’t raised any money for his campaign and appears to have given his own campaign $20 million. His petition with the high court comes as a number of left-wing activist groups have tried to block the former president from appearing on state ballots, using a rationale similar to Mr. Castro’s arguments. For example, the left-wing group Free Speech for People wrote to the secretaries of state of Florida, New Hampshire, New Mexico, Ohio, and Wisconsin, calling on them to not include President Trump on state ballots. Six Colorado voters also filed a lawsuit in September to block him from appearing under their interpretation of the 14th Amendment, which was written in the aftermath of the U.S. Civil War in the mid-19th century.

However, even Democratic secretaries of state appear to have little appetite for blocking President Trump on those grounds. Some legal analysts have also said that the insurrection clause under the 14th Amendment was targeting individuals who fought for the Confederacy during the Civil War. “We’re not the eligibility police. We are responsible for ensuring that basic facts are met to get someone on the ballot,” Michigan Secretary of State Jocelyn Benson, a Democrat who has frequently been critical of the former president, told Axios in September. She was responding to calls from pressure groups to keep the former president from being on the ballot in her state.

[..] Meanwhile, retired Harvard Law professor Alan Dershowitz argued over the summer in an opinion article that President Trump can’t be disqualified under the 14th Amendment’s Section 3. That’s because, he wrote, “The amendment provides no mechanism for determining whether a candidate falls within this disqualification, though it says that [Congress can vote to] remove such disability” with a two-thirds majority in the House and Senate “A fair reading of the text and history of the 14th Amendment makes it relatively clear, however, that the disability provision was intended to apply to those who served the Confederacy during the Civil War,” Mr. Dershowitz wrote. “It wasn’t intended as a general provision empowering one party to disqualify the leading candidate of the other party in any future elections.”

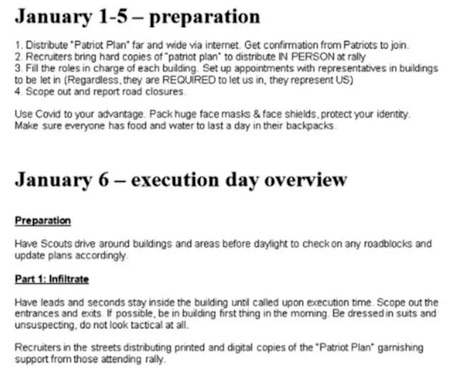

“Jurors were informed of this written plan to “fill buildings” “with patriots”—and were left to think it was a plan of Tarrio’s or co-defendants.” It was not. The plan was concocted by the FBI..”

• Now There is Evidence the FBI Planned the January 6 Operation (GP)

In February of this year, The Gateway Pundit’s Cara Castronuovo wrote about a shocking development in the US government’s case against the Proud Boys. it was discovered that the Government itself was the author of the mysterious “1776 Returns” document. The 1776 Returns document is the title of a 9-page paper that outlined strategic plans for the takeover of US government buildings on January 6, 2021. It was confirmed in court that the FBI was behind the document and an FBI operative was the author of the document. The mysterious document was sent unsolicited to Proud Boy Chairman Enrique Tarrio’s Telegram right before January 6th by a “love interest” named Erika Flores. Flores reportedly testified to the January 6th Committee that A GOVERNMENT OFFICIAL was the author of the entirety of the “1776 Returns” and that this FBI and CIA member or associate asked her to share it with Tarrio!

Tarrio was charged with Seditious Conspiracy and was later found guilty along with four fellow members of the Proud Boys. Enrique Tarrio was sentenced to 22 years in federal prison for planning the entire “seditious conspiracy.” We now know that it was the FBI who was behind the conspiracy. According to the Motion by attorney Roger Roots: “It appears that the government itself is the author of the most incriminating and damning document in this case, which was mysteriously sent at government request to Proud Boy leader Enrique Tarrio immediately prior to January 6 in order to frame or implicate Tarrio in a government- created scheme to storm buildings around the Capitol. As such, Exhibit 528-1 and the government’s efforts to frame or smear defendants with it, constitutes outrageous government conduct. This is either entrapment or outrageous government conduct, or both. Equally improper, it is a Brady violation because the Department of Justice must surely have known these revelations before putting Special Agent Dubrowski on the stand on February 9 to introduce this evidence.”

You can’t make this stuff up! The cover to the sketchy and poorly written “1776 Returns” was allegedly created by a Government Official who claims to have been “groomed” to join the CIA or FBI. Apparently, an individual by the name of Samuel Armes is responsible for writing the “1776 Files”. Armes is “a former State Department and Special Operations official” who was also interviewed by the January 6th Unselect Committee. Armes said “he recognized components of the document as ideas he had composed as part of a “war gaming” exercise he did in August or September of 2020. Armes “co-founded a Florida-based cryptocurrency LLC — Government Blockchain Systems” “Armes said that in college he had been groomed to join the CIA and FBI before his stint in the State Department and special operations. . . . In his studies, he often participated in “war gaming” scenarios, skills he used during his stint in government.” (*The J6 Committee was resistant in releasing these documents.)

To reiterate, this government asset, Armes, passed this document off to a “love interest” of Enrique Tarrio named “Erika”, who then testified she forwarded the document AT THE REQUEST OF ARMES to Tarrio via Telegram. “This means that the most damning document in this trial was authored by the intelligence community—someone “groomed” by the FBI itself,” said Roger Roots (the Proud Boys attorney who authored this Blockbuster Motion). “And this CIA and FBI asset requested Tarrio’s friend to share the document with Tarrio just prior to January 6.” According to the Motion- “During Special Agent Dubrowski’s chilling testimony, Assistant U.S. Attorney Conor Mulroe took lengths to emphasize segments of the document describing a plan to lay siege to Capitol Hill by strategically occupying most of the congressional office space around the Capitol. Jurors were informed of this written plan to “fill buildings” “with patriots”—and were left to think it was a plan of Tarrio’s or co-defendants.” It was not. The plan was concocted by the FBI and planted inside the Proud Boys Telegram page days before January 6.

“[The Trump National Doral Miami hotel] would sell for at least a billion dollars. Mar-a-Lago at least a billion,” Habba said. “The value is what someone is willing to pay. The Trump properties are Mona Lisa properties.” “That is not fraud, that is real estate..”

That Trump gave Ivanka the option to buy her rental apartment cheap, now means fraud?!

• The Donald v. New York (DeMartino)

The attorney general’s office alleges Trump inflated the value of properties he owned by the billions between 2011 and 2021 in order to secure favorable loans and insurance arrangements, with some property values reportedly being inflated by over $2 billion. Some of those properties include Trump Park Avenue and the famed Mar-a-Lago Florida resort, which was raided by multiple FBI agents looking to retrieve troves of classified documents that were being stored on the grounds. Trump defense attorney Chris Kise countered in his opening arguments by saying that Trump made his billions by utilizing his real estate knowledge – not by engaging in fraudulent business practices. “President Trump has made billions of dollars building one of the most successful real estate empires in the world,” Kise said. “He has made a fortune literally about being right about real estate.”

Kise also pointed out that while the leading German Deutsche Bank valued Trump’s net worth at $2 billion less than he did, they still underwrote a loan for him. That is evidence, Kise argued, that real estate valuations can vary greatly. The lawyer went on to remark that when is comes down to business in the Big Apple, “this is what happens every day in this city.” In order to ground the argument, reports have indicated that the Trump camp is seeking to call in witnesses from Deutsche Bank. Another Trump defense attorney, Alina Habba, argued that Engoron’s valuations of Trump properties were wildly inaccurate, comparing the estates to the Mona Lisa, which is commonly said to be the most valuable painting in the world. “[The Trump National Doral Miami hotel] would sell for at least a billion dollars. Mar-a-Lago at least a billion,” Habba said. “The value is what someone is willing to pay. The Trump properties are Mona Lisa properties.” “That is not fraud, that is real estate,” she added.

[..] Donald Bender, a former accountant and tax consultant for Trump was called as the first witness in the case, and was promptly moved to be disqualified by the Trump team although Engoron ruled against them. [..] .. in one incident Bender recalled that he pointed out a discrepancy involving the penthouse of Trump’s daughter Ivanka Trump. Bender said he corrected the number at least twice. The discrepancies with the penthouse were mentioned in documents in the case. “Ms. Trump’s rental agreement for Penthouse A in Trump Park Avenue included an option to purchase the unit for $8,500,000. But in the 2011 and 2012 Statements of Financial Condition, this unit was valued at $20,820,000—approximately two and a half times as much as the option price, with no disclosure of the existence of the option,” the lawsuit stated.

“Law is a weapon used against those who are not in power. It is nothing else.”

“Lenders go by success, not by valuations, because value is determined by success.”

• Two Democrat Gangsters Try to Steal Trump’s Real Estate (Paul Craig Roberts)

Two New York Democrats, one being NY attorney general Letitia James, a black female helped into office by money from George Soros, who made his billions by manipulating the British pound to the disadvantage of the British population, and the other being NY state judge Arthur Engoron, a Donald Trump hater who was put in office by Trump-hating NY Democrats, have conspired to steal Trump’s real estate empire including Mar-a-Lago. [..] The obvious point is that Letitia James has no idea of the value of Trump’ properties. What she has done is so obviously totally dishonest that she should immediately be removed from office. She has picked low values that are so low as to be ridiculous as a statement of the value of Trump’s holdings. Who correctly valued the properties? Letitia James on her personal vendetta against President Trump, or the sophisticated lenders to Trump?

Ask yourself, if Trump did something wrong, why didn’t his creditors bring the lawsuit instead of a Trump-hating Democrat operative on a personal vendetta? No one was harmed, least of all Letitia James. What is Letitia James’ standing in the case? Nothing, Zero, Nada. That Trump’s property can be confiscated by two Democrats on a vendetta against Trump shows that the rule of law in the United States of America is stone dead. Let’s look at real estate valuations. Traditionally, the lowest appraisal is the tax appraisers. Then the foreclosure value. Then the “market value.” But what is the market value? It is different for different people. Appraisals of value are simply guesses. No lender has anything but their judgment of the borrower as to the success of the loan. If the borrower has a success record, as Donald Trump has, the lender has no interest in the listed value of the properties. Lenders go by success, not by valuations, because value is determined by success.

Letitia James is so ignorant of law that she does not know that law regards an owner’s opinion as admissible evidence of value. Thus, there is ZERO basis for her independent law suit, a suit not joined by any interested party. This example of total incompetence and total corruption of the American legal system is proof that law in America is no longer law. Law is a weapon used against those who are not in power. It is nothing else. Judge Engoran ruled that Trump had “inflated” his property values on his financial statements. Meaning, the judge applied an arbitrary low value as the properties worth and then ruled that Trump committed fraud by using a realistic value. Take for example Trump’s residence, Mar-a-Lago, which the judge determined was worth only $18 million!

Forbes estimated Mar-a-Lago’s value between $200 million and $725 million, based on broker opinions, and ultimately went with “a conservative” $350 million. For comparison, a 5-bedroom home recently sold in the same neighborhood for $75 million. The totally corrupt Democrat “judge” valued Trump’s enormous property at $18 million — $332 million less than Forbes–and convicted Trump of fraud for allegedly overstating its value, whereas the real fraud is the judge’s undervaluation. On the sole basis of an intentionally arbitrary low value the Democrat operative pretending to be a judge confiscated Trump’s property. This is law in Democrat America, a tyranny.

Jeff Childers is an attorney working in real estate. Paul Craig Roberts in the article above links to this article.

“Even though an owner might not be a real estate expert, the law considers the owner well positioned to know the value of their own property.” [..] “..under the law, an owner’s opinion is admissible evidence of value.”

“Nobody would use the tax appraiser’s value to guess at Mar-a-Lago’s selling price. Nobody.”

This case is right in my wheelhouse; I’ll explain the whole thing. It’s not complicated. The judge’s 35-page decision is, at bottom, only about how President Trump valued his real estate holdings when he was providing his personal financial statement to various people. I am qualified to comment because half of my commercial litigation cases are disputes over real estate. Before tumbling into constitutional and civil rights law, I also had a strong side practice in commercial loan workouts — negotiating for developers with banks — and commercial Chapter 11 bankruptcy, which (at least in Florida) is all about valuing real estate. Principle number one: Real estate valuation is not a science because values are subjective. Every effort to value real estate is just a guess at what someone will eventually be willing to pay for the land. Your dilapidated barn might be someone else’s castle.

Real estate — buildings and land — is worth different amounts to different people. A thousand acres of inexpensive pine forest zoned only for agricultural use could be worth a whole lot more to a developer who’s confident he can get a zoning change. It’s not nefarious. Maybe that developer also owns a half-acre parcel downtown somewhere that the County has long wanted for a park, so he knows he has something to trade the commissioners for rezoning the pine forest to residential. That hypothetical developer would pay a lot more for the thousand acres than anyone else. So what’s the property worth? The price to everyone else or the “highest and best use?” But legal disputes must be resolved and you have to start somewhere. Lawyers think about real estate values in three general categories, depending on who is doing the valuing.

From lowest value to highest, the normal categories are: the tax appraised value (the lowest, and least likely to be accurate), the “forced liquidation” value (think foreclosure sale), and then the highest, the “market” value (determined by professional appraisers who assume that the seller can market the property without pressure or time constraints). Even professional appraisers disagree on land value. Every single one of my cases involves competing appraisals, and the appraisers’ numbers are often wildly different. Lawyers and judges all know that appraisals are just guesses. When I negotiate with bank lawyers, I often offer to bet them a month’s salary that when the appraised property finally sells, it will bring a price at least 15% different than the bank’s appraisal. In all these years, no opposing lawyer has ever taken that bet.

A fourth category of valuation is the owner’s opinion of his property’s value. Even though an owner might not be a real estate expert, the law considers the owner well positioned to know the value of their own property. They probably think about it a lot. They know all the pro’s and con’s. Therefore under the law, an owner’s opinion is admissible evidence of value. The lowest valuation is usually the tax appraised value, which is the amount used by the state to calculate annual property taxes. There’s a good reason why it’s the lowest: tax appraisers calculations are limited in many ways under state law. For example, in Florida tax appraisers can’t increase the value of homestead property — where someone lives — more than a few percentage points at a time. Tax appraisers also can only change the assessment when certain things happen, like when a property is sold.

Judge Engoran ruled yesterday that Trump had “inflated” his property values on his financial statements. Meaning, the judge decided what the properties were worth and then found that Trump overestimated Trump’s values — on paper. Take for example Trump’s residence, Mar-a-Lago, which the judge determined was worth $18 million for the entire ten-year period between 2011 and 2021. That determination was based only on the county tax assessor, who appraised its value between $18 and $27 million. So of course the Judge used the lowest number in that range, $18 million, comparing that to Trump’s value of between $426 million and $612 million: Nobody would use the tax appraiser’s value to guess at Mar-a-Lago’s selling price. Nobody.

“..Gaetz would only need a handful of Republicans to join him in removing McCarthy..”

My guess: the Dems will keep him in place. And down the line he will regret that.

• Gaetz Files Motion to Remove McCarthy From House Speakership (DeMartino)

US Rep. Matt Gaetz (R-FL) officially filed a motion late Monday to call for the removal of House Speaker Kevin McCarthy, a move likely to put the lower congressional chamber into chaos just days after a government shutdown was averted. Gaetz has been threatening McCarthy with a “vote to vacate” his position since the deal to avert the government shutdown was made. Gaetz has accused MacCarthy of making a “secret side deal on Ukraine” with Democrats. Gaetz and dozens of other House Republicans have stated their opposition to further funding of Kiev by Washington and aid to Ukraine was ultimately cut from the stop-gap funding bill.

“I rise to give notice of my intent to raise a question of the privileges of the house,” Gaetz said on the House floor while filing the motion. “[It is] resolved that the Office of Speaker of the House of Representatives is hereby declared to be vacant.” After filing the motion, Gaetz told reporters that he had enough Republican votes to oust McCarthy, unless he gets help from Democrats. “I have enough Republicans where at this point next week one of two things will happen: Kevin McCarthy won’t be the Speaker of the House or he’ll be the Speaker of the House working at the pleasure of the Democrats,” The firebrand representative said. “I’m at peace with either result because the American people deserve to know who governs them.”

The House will have two days to consider the measure, though it could be taken up earlier. A simple majority will be needed to oust McCarthy. Republicans have a slim nine-seat majority in the House. Typically, when House speakers are appointed, the minority party votes in unison against the nomination. If that holds for votes to vacate, Gaetz would only need a handful of Republicans to join him in removing McCarthy.

“.. that agreement includes a vote on term limits, a vote on a balanced budget amendment, single subject spending bills, and the full release of the January 6 tapes.”

• I’m Fighting For Taxpayers (Matt Gaetz)

I know who my bosses are. They aren’t the special interests in Washington, it isn’t party leadership, it’s my voters in Florida. Earlier this month, I sat down with some of my bosses in Destin, Florida for a podcast they host in their driveway. I was there to be held accountable. Congress has yet to achieve the things voters are asking for like term limits and a balanced budget. That’s what this fight in Congress is all about. It’s about making sure the promises we’ve made to voters are fulfilled. The Speaker made promises to me and other lawmakers in January, and I want to hold him to account. To be specific, that agreement includes a vote on term limits, a vote on a balanced budget amendment, single subject spending bills, and the full release of the January 6 tapes.

This isn’t about politics or personality. It’s about sticking to our word, and getting our nation back on track. In Joe Biden’s America, families are having to pinch pennies, so Congress should too. Politicians that have spent decades running up America’s deficit are taking this personally. Rep. John Carter, who has been on the appropriations committee since 2005, recently attacked me as an “idiot” to a reporter. Okay. What’s idiotic is that our nation’s national debt has increased more than $25 trillion since 2005. Some people are desperate to make a policy battle personal, because their policy failures are personally embarrassing. We have to stop the fiscal insanity in Washington and get our spending under control.

I’m not voting for a continuing resolution that funds Jack Smith’s election interference, dangerous chaos on the southern border, and money for the endless war in Ukraine. Just think about what it means for Congress to govern by Continuing Resolution. Every time we vote for a continuing resolution, we make no changes in policy or spending. It’s a vote to continue the status quo. If that’s all Congress is going to do, just replace us with AI bots, because we aren’t doing anything. The hearings are fun, but it’s the budgets where real policy changes are made. Moody’s chief economist recently said that the typical American household is spending $709 a month more than they were two years ago just to buy the same goods and services. That’s nearly $9,000 per year being stolen from Americans through the hidden tax of inflation.

Americans literally cannot afford Washington’s reckless spending. Politicians in Washington DC – on both sides of the aisle – are robbing the American people and their grandchildren to pay for war in Ukraine, drag queen shows in Ecuador, an open border, free stuff for illegal immigrants, and the Biden Department of Justice’s illegal election interference. I came to Washington to be a voice for my voters and fix this once great nation. I’m not here to empower the Democrats’ radical agenda. I’ll be damned if I’m going to sit by and do nothing while greed and corruption destroys our great nation.

“The attorney general added that all US Justice Department prosecutors are impartial and do not allow party considerations to affect their decisions.”

• AG Garland Promises to Resign if Biden Meddles in Trump Investigation (Sp.)

US Attorney General Merrick Garland said on Monday he would resign if US President Joe Biden interferes with investigations into former US President Donald Trump. “I am sure that that [Biden’s interference] will not happen, but I would not do anything in that regard. And if necessary, I would resign, but there is no sense that anything like that will happen,” Garland said in an interview. He also said he does not discuss the investigation into the former president with Biden or his administration, adding that the incumbent US president “never tried to put hands on these investigations.” The attorney general added that all US Justice Department prosecutors are impartial and do not allow party considerations to affect their decisions.

Last week, the US news broadcaster reported that Trump would attend first days of fraud trial against him in New York. New York Attorney General Letitia James stated last week that Trump inflated the value of his assets by between $812 million and $2.2 billion over a decade to obtain loans to build a golf resort in Miami and hotels in Washington and Chicago. Currently, the former US president is facing two federal indictments, including on alleged mishandling of classified documents at his house in Florida and an alleged attempt to overturn the outcome of the 2020 presidential election.

“If what Wallace says about the average age on the Ukrainian front is true, 40 years, then the worst assumptions about losses have been far exceeded..”

“A huge loss that will forever haunt that country.” It’s worse, the country won’t survive.

• The Average Age Of Ukraine’s Army (MoA)

Ben Wallace, the former Secretary of State for Defence of the UK, writes in the Telegraph: “Putin is desperately grasping at the final two things that can save him – time and the splitting of the international community. Britain can do something about both. We must help Ukraine maintain its momentum – and that will require more munitions, ATACMSs and Storm Shadows. And the best way to keep the international community together is the demonstration of success. Ukraine can also play its part. The average age of the soldiers at the front is over 40.

I understand President Zelensky’s desire to preserve the young for the future, but the fact is that Russia is mobilising the whole country by stealth. Putin knows a pause will hand him time to build a new army. So just as Britain did in 1939 and 1941, perhaps it is time to reassess the scale of Ukraine’s mobilisation. Let us not pause for one day. Let us see this through. The world is watching to see if the West has the resolve to stand up for our values and the rules-based system. What we do now for Ukraine will set the direction for all of our security for years to come.”

Think for a moment what the aside insert “The average age of the soldiers at the front is over 40” really means. Can Storm Shadows change that fact? Roland Popp @RoPoppZurich – 5:43 UTC · Oct 2, 2023: “If what Wallace says about the average age on the Ukrainian front is true, 40 years, then the worst assumptions about losses have been far exceeded. Paraguay 1870.”

Paraguayan War – Casualties of the war: “Paraguay suffered massive casualties, and the war’s disruption and disease also cost civilian lives. Some historians estimate that the nation lost the majority of its population.” Ukraine ain’t there yet. But looking at pictures of Ukrainian soldiers at the front Wallace seems to be right. If you are forty or above are you really still able to run, react and fight like when you were twenty? I am not. The young Ukrainians are gone. They either have fled from Ukraine or are wounded, disabled or died. You can not mobilize what is no longer there. A huge loss that will forever haunt that country. End this war now!

“..from Lisbon to Lugansk..” is the state of denial put in words.

• Zakharova Responds To German Promise To Add Russian Lands To EU (RT)

Russia would have to join the EU for German Foreign Minister Annalena Baerbock to fulfill her promise of the bloc spanning all the way “from Lisbon to Lugansk,” Russian Foreign Ministry spokeswoman Maria Zakharova has said. Speaking at an informal meeting of the bloc’s foreign ministers in Kiev on Monday, Baerbock insisted that “the future of Ukraine is in the EU, in our community of freedom, and soon [the EU] will stretch from Lisbon to Lugansk.” Lisbon is the capital of Portugal, which along with Ireland and part of Spain makes up the EU’s western edge. Lugansk is the main city of the People’s Republic of Lugansk, which officially became part of the Russian state last year, together with the People’s Republic of Donetsk and the Kherson and Zaporozhye regions.

The move followed referendums that saw the populace in the four regions overwhelmingly support reunification with Moscow. Ukraine and its Western backers refused to recognize the results of the votes. “It’s either us joining the EU or she forgot about the requirement to turn by 360 degrees,” Zakharova wrote on Telegram in response to Baerbock’s statement. The spokeswoman was referring to the blunder that the German FM made in February when she urged Russian President Vladimir Putin to “change by 360 degrees” his policy on Ukraine, unwittingly urging Russia to maintain the exact course it had been on. Baerbock’s claims about Lugansk being in the EU are a “figment of the sick imagination” of the German FM because the city is and will remain a part of Russia, Dmitry Belik, a member of the Russian Parliament’s Committee on International Affairs, told Izvestia newspaper.

Germany’s top diplomat “continues to add to her collection of absurd statements, which speaks of her incompetence and confirms the difficulty of seeking compromise with such politicians,” Belik added. On Monday, EU foreign ministers held their first ever meeting outside the bloc’s territory. Its foreign policy chief Josep Borrell said that the high-profile meeting was staged in Kiev “to express our solidarity and support to the Ukrainian people.” Ukraine was granted EU-candidate status in July 2022 amid its conflict with Russia. Sources told Bloomberg last month that the European Commission is expected to shortly recommend that formal talks begin to start the multi-year process of Kiev’s accession into the bloc.

It’s their way out. “You’re too corrupt, and you’re not changing that fast enough..”

• US Seems More Worried About Ukraine’s Corruption Than It Admits (Sp.)

A leaked US strategy document revealed that the Biden administration is far more worried about corruption in Ukraine than it publicly admits, an American newspaper reported on Monday. A high-level corruption could undermine confidence of the Ukrainian public and foreign leaders in the government in Kiev, the report said. The confidential version of the document, named “Integrated Country Strategy,” is about three times longer than its public version and contains many additional details related to the US goals in Ukraine, the report noted. That includes privatizing Ukrainian banks, encouraging the military to adopt NATO norms, and supporting local schools in teaching the English language.

The strategy also stresses that the Ukrainian government can not delay its anti-graft policies because the current situation could cause concern from allies in the West. The newspaper supposed that the fact of the quiet release of the strategy, along with the toughest language in the confidential version, shows the White House’s concerns over the situation in Ukraine. The Biden administration wants to press Ukraine to cut graft. However, excessive attention to this problem may strengthen the opposition of Washington to Kiev and could make European allies think once again about their own role in this process, according to the report.

One US official noted that the American and Ukrainian counterparts have “some honest conversations happening behind the scenes” over the issue. His colleague familiar with the topic of those discussions confirmed that Washington is talking to Kiev about potentially conditioning future economic aid on “reforms to tackle corruption and make Ukraine a more attractive place for private investment,” the report added. However, these conditions are not related to the military support for Ukraine, this official added. The strategy noted that US goals in Ukraine include providing military support and training to confront Russia. The classified version also revealed Washington’s readiness to help Kiev in reforming its national security apparatus, the report said.

Serious cracks. Cue Fico.

• Hungary’s FM Shuns EU Diplomats’ Summit in Kiev (Sp.)

Hungary’s Foreign Minister Peter Szijjarto has met with representatives of German industrial conglomerate ThyssenKrupp, he said in a Facebook* post, and skipped a meeting of European foreign ministers in Kiev. “The task now is to reduce inflation, and for 2024 – to rebuild economic growth. For this, the work has to start now and it requires companies like the German Thyssenkrupp,” Szijjarto wrote. Ties between Budapest and Brussels have been tense of late, with Hungary repeatedly voicing its protest as the EU’s blank checks for Kiev. It was earlier reported that Hungary believes that the EU has spent its share of a funding program on supporting Kiev regime. EU authorities had confessed to freezing over €6 billion intended for Budapest, citing political concerns.

However, Hungarian PM Viktor Orban is afraid that the funds were given to Ukraine. “It is possible that some of it [the money] is already in Ukraine. If there is no money to give Ukraine the sums promised before, and we promise to give new sums, and there are people who haven’t received the money, it is reasonable to assume that this money is already gone,” Orban said in an interview to a radio station. The Hungarian premier added that his country will block any funding for Kiev unless Budapest receives the designated funds. Another stumbling block between Hungary and Ukraine is the fate of Transcarpathian Hungarians, whose rights are systematically abused by Kiev.

“..what is happening in Ukraine has been far more similar to a First World War battlefield than anything else..”

• Why Ukrainian F-16 Trainees Won’t Turn the Tide of Conflict (Sp.)

The US Department of Defense has officially announced the beginning of English language courses for Ukrainian pilots as part of the program to train them to fly US-made F-16 fighter jets. The language training is said to be taking place at Lackland Air Force Base in Texas. In August, the Ukrainian Defense Ministry estimated that Kiev would get F-16 jets promised by Ukraine’s NATO backers in six-seven months. The Netherlands and Denmark since signaled that they would hand their F-16 fighters to Kiev at the beginning of 2024. However, Gen. James B. Hecker, commander of US Air Forces Europe, was quoted by the Western press as saying that the delivery of several dozens of the US-made fighter jets “isn’t going to be the silver bullet” for the Ukrainian military.

Previously, ex-Chiefs of Staff Chairman Mark Milley also warned Kiev that F-16s won’t be a “game-changer” or “magic weapon” that would change the balance of power on the battlefield. For its part, the Ukrainian military is blaming the failed counteroffensive on allegedly insufficient NATO training and flawed NATO tactics, insisting that the transatlantic alliance prepared them for the “wrong kind of war.” Could the training of Ukrainian pilots and delivery of fighter jets fix the problem? “The questions being asked here are about a decade too late for the US/NATO Ukraine proxy war project, and they certainly should have been considered before over $200 billion in US and NATO military aid has been shipped to Ukraine,” Retired Lt. Col. Karen Kwiatkowski, a former analyst for the US Department of Defense, told Sputnik.

“The US and NATO – to the extent that they have conducted military battles – have done so with combined arms, integrating sea, land and air – and command and control/intelligence — in both offensive and defensive actions. Our last real serious tank battles probably occurred in the early 1990s, with the first US invasion of Iraq. And that war was against a country that had a weak and outdated air force.” “We don’t remember how to fight a land battle from 30 years ago – and what is happening in Ukraine has been far more similar to a First World War battlefield than anything else. Americans in particular do not study lessons learned from the First World War – but that is no excuse in this case.

Ukraine’s ‘strategy’ vis-a-vis Russia has not been designed by Pentagon military strategists – as [Joe] Biden and [Antony] Blinken say, all decisions are [Volodymyr] Zelensky’s. The Pentagon’s role here has been logistics – scraping up goods and services and sending them over – without any connection to complementing an existing Ukrainian defense strategy or designing an effective strategy to push back the Russian forces,” the former Pentagon analyst continued.

Musk has seen enough. Took him a while.

• Musk Mocks Zelensky Over Aid Demands (RT)

SpaceX and Tesla CEO Elon Musk has ridiculed Ukrainian President Vladimir Zelensky over his demands for more financial support from the US and its allies amid the conflict with Russia. Posting on his X (formerly Twitter) social media platform on Sunday, Musk shared the popular ‘stressed guy’ meme with Zelensky’s face photoshopped onto it and with a caption reading: “When it’s been five minutes and you haven’t asked for a billion dollars in aid.” The post had already gained more than 25 million views and over 350,000 likes at the time of writing. The ‘stressed guy’ meme features an image of a male student whose neck and forehead are bulging with veins while he sits beside a girl in a classroom. The picture is commonly shared for humorous descriptions of frustrating or uncomfortable situations.

— Elon Musk (@elonmusk) October 1, 2023

Musk’s post comes after Zelensky attempted to drum up more support from the US during a visit to Washington in September. According to US Senate Majority Leader Chuck Schumer, the Ukrainian president told him that “if we don’t get the aid, we will lose the war.” The administration of US President Joe Biden has provided Kiev with around $46 billion since the beginning of the conflict with Russia in February 2022. However, no funding for Ukraine was included in the last-minute budget deal struck by Congress late on Saturday which allowed the US to avoid a federal government shutdown. US House Speaker Kevin McCarthy, who was among the Republicans to oppose the Biden administration’s request to allocate $6 billion more to Ukraine, said that the priority must be protecting America’s borders.

The Zelensky government considered Musk among its backers early in the conflict with Russia, when SpaceX donated $80 million worth of Starlink satellite internet terminals to Ukraine. Kiev’s forces have relied heavily on the system for communications. However, the billionaire was involved in a spat with Ukrainian officials and social media users last October after he proposed a peace plan to settle the conflict. Musk suggested that Russia should “redo elections of annexed regions under UN supervision,” while Ukraine would commit to neutrality and drop its claim to Crimea. Four former Ukrainian regions voted to join Russia a year ago, while Crimea held a similar referendum in 2014 after a Western-backed coup in Kiev.

Zelensky reacted to the idea by launching a social media poll, asking followers “which Elon Musk” they “like more” – the one “who supports Ukraine” or the one “who supports Russia.” Kiev’s then ambassador to Germany, Andrey Melnik, went further by telling the US billionaire to “f**k off.” A few days after the row, the Ukrainian military reportedly began experiencing problems with Starlink services. Musk’s biography by historian Walter Isaacson, which came out in September, described an indecent last autumn in which the billionaire allegedly told his engineers to shut down satellite internet coverage in Crimea amid an attempted Ukrainian drone assault on the Russian peninsula. According to Isaacson, the tech entrepreneur concluded that “allowing the use of Starlink for the attack… could be a disaster for the world.” Ukrainian presidential aide Mikhail Podoliak claimed that Musk was “committing evil and encouraging evil” with his decision, which he said was the result of “a cocktail of ignorance and big ego.”

“The woked-up suburban ladies who comprise the party’s main voting bloc grow moist in anticipation of Gov. Newsome landing on-stage like a demigod out of a Mozart opera..”

“[RFK Jr’s] on a hero’s journey at a moment in history when America dearly needs one.”

“Joe Biden” is now a monumental embarrassment and a liability to our country, let alone to the degenerate party that owns him. Sub rosa efforts must be in motion to persuade him to resign before the impeachment inquiry spotlights all those telltale bank records, but they will fail to overcome his demented pride. He’ll ride this thing out to the bitter end, when he can use the last tool at his disposal to officially pardon everyone involved in his family’s racketeering operation. The longer the party pretends to support him, the closer the party itself skates toward self-destruction. Also consider: if allowed to play out, the impeachment inquiry will implicate the DOJ and the FBI in obstruction of justice — exposing many Deep State blob players to danger of prosecution.

Gov Gavin Newsom dangles himself above the fray as the deus ex machina who can touch down in DC and make all the Democrat’s problems go away. Such an attractive fellow! Great teeth and hair! Tall as a sequoia! And such a smooth talker! The woked-up suburban ladies who comprise the party’s main voting bloc grow moist in anticipation of Gov. Newsome landing on-stage like a demigod out of a Mozart opera. But how do you think he’ll make out in an election when the airwaves are filled with oppo ads showing his toothy and hairy visage inset against scenes of homeless junkies and looting flash mobs? Try blaming that on climate change. What else does he stand for? Censorship? Forced vaccinations? Child sex mutilations? Open borders? News-flash: these are increasingly unpopular, except among an easily-identified depraved elite.

Indeed, the whole Left-Right demon-driven psychodrama is proving impossible to live in as it throbs and pulsates toward something like civil war. And it has obscured the truly potent idea that the nation might actually be capable of solving its problems by facing up to them and changing how we act. That potent idea might be what voters will see in Bobby Kennedy if he can get their attention. Mr. Kennedy would dismantle the heinous partnerships between private corporations and the US government that loosed the Covid-19 op on the world and asset-strips the middle-class. He favors closing the border and a reevalution of immigration policy. He aims to negotiate an end to the ignoble Ukraine war project. He’s determined to disassemble the security state apparatus that’s destroying the US Constitution and citizens natural rights with it.

Mr. Kennedy says he can bring divided Americans together on these dire matters. It’s conceivable that his message might go over with enough rancor-weary voters to pull off a tour-de-force plurality in a three-way race, where nobody wins enough electoral votes to settle the contest, which then moves to the House, like in the old days of Jefferson and Burr. The rest is election mechanics, some of it very sinister when you consider all the election-rigging booby-traps already in-place such as mass mail-in ballot harvesting, no voter ID requirements, and the still-mysterious hookups of vote-counting machines to the Internet. But, at least, Mr. Kennedy running on an independent line will be a hard whap upside the Democratic Party’s thick skull, maybe even a death-blow to the party. They made a big mistake trying to un-person him. He’s on a hero’s journey at a moment in history when America dearly needs one.

Yeadon

Former vice president at Pfizer, Dr. Mike Yeadon: The so-called "pandemic" was planned and co-ordinated in advance, by unelected globalist bodies like the WEF amd WHO, as a pretext to deliberately depopulate the planet via lethal mRNA injections:

"We're facing something much… pic.twitter.com/vdkmRxanf5

— Wide Awake Media (@wideawake_media) October 2, 2023

Octopus

https://twitter.com/i/status/1708899128858587197

Jump

This cat making the most precise jump over pic.twitter.com/hB3CxU71go

— place where cat shouldn't be (@catshouldnt) October 2, 2023

Ray

https://twitter.com/i/status/1708809366869062108

Camouflage

https://twitter.com/i/status/1709099401413562408

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.