Floris van Schooten Still-Life with Glass, Cheese, Butter and Cake 1st half 17th century

These are dark days.

• Assange Lawyers Barred From Visiting Client Ahead Of US Court Hearing (ZH)

After being cooped up for six years inside the Ecuadorian Embassy in London, the Department of Justice is finally closing in on Julian Assange, and the government of Ecuadorian President Lenin Moreno is doing everything in its power to evict its most infamous tenant. To wit, lawyers for Assange have been refused entry to the Ecuadorian Embassy in London, WikiLeaks announced in a tweet, which has only helped to spur fears that Assange will soon be evicted. And what’s worse, he’s being denied access to legal counsel at a time of desperate need. WikiLeaks said the Ecuadorian government refused to allow Assange’s lawyers, Aitor Martinez and Jen Robinson, to meet with their client this week, which is a huge problem for the whistleblower, because Assange is facing a US court hearing Tuesday, and needs to meet with his legal team to prepare.

The hearing is being called to remove the secrecy order on the charges against Assange (which were only publicly revealed because of a copy and paste error). “The hearing is on Tuesday in the national security court complex at Alexandria, Virginia,” WikiLeaks tweeted, adding it is to “remove the secrecy order on the US charges against him.” Visitors to Assange were only recently readmitted after being cut off by the Ecuadorian government. The government also restored Assange’s communications in October. But this was accompanied by restrictions on Assange’s communications. In another sign that Moreno is preparing to oust Assange, the Ecuadorian government recently terminated the credentials of Ecuador’s London ambassador Abad Ortiz without explanation. As Wikileaks explained: “Now all diplomats known to Assange have now been transferred away from the embassy.”

The Guardian has a guy named David Taylor in new York doing a series, in which yesterday he called Robert Mueller: ‘America’s straightest arrow’. Yeah, that’s the same Mueller who lied through his teeth about WMD in Iraq as FBI chief. Taylor lists ‘four distinct parts’ of Mueller investigation, and is fully oblivious to the fact that all four have been thoroughly dismantled long ago. Taylor and the Guardian count on you not reading anything but them.

In a few words:

1• Manafort is not linked to Trump-Russia collusion, not even Mueller suggests that

2• See article below

3• There was no hacking that we know of, and certainly not in connection with WikiLeaks and/or Democratic party

4• Papadopoulos was set up, and only a bit player

• ‘He Has Moved Incredibly Quickly’: Mueller Nears Trump Endgame (G.)

The investigation, which cost more than $16.6m in its first 11 months, can be broken down into four distinct parts which have all led to indictments:

1• Manafort and his business connections to Russia following years of work in support of the former Ukrainian president Viktor Yanukovych.

2• Russian use of fake social media accounts to influence the 2016 election.

3• Russian hacking of the Democratic party and the Clinton aide John Podesta – and the subsequent leak of thousands of emails by WikiLeaks.

4• Trump campaign connections to Russia – including the Trump Tower meeting and the adviser George Papadopoulos’s involvement with a professor who told him the Russians had “dirt” on Clinton including “thousands of emails”.

Anne Milgram, a law professor at New York University and a former prosecutor and attorney general of New Jersey, said Mueller and his 17 lawyers had done “a terrific job”. “Months have gone by – people think it’s a long time – it is not in criminal justice,” she said. “He has moved incredibly quickly, got a lot of co-operation agreements, charges, done an extraordinary job of running down Russian hacking of the election.”

As per the second point in the article above, here’s Gareth Porter ripping that to shreds.

• One Of The Most Spectacularly Misleading Uses Of Statistics Ever (Porter)

What Facebook general counsel Colin Stretch testified before the Senate Judiciary Committee on October 31, 2017 is a far cry from what the Times claims. “Our best estimate is that approximately 126,000 million people may have been served one of these [private Russian company, Internet Research Agency, ‘IRA’-generated] stories at some time during the two year period,” Stretch said. Stretch was expressing a theoretical possibility rather than an established fact. He said an estimated 126 million Facebook members might have gotten at least one story from the IRA –- not over the ten week election period, but over 194 weeks during the two years 2015 through 2017—including a full year after the election.

That means only an estimated 29 million FB users may have gotten at least one story in their feed in two years. The 126 million figure is based only on an assumption that they shared it with others, according to Stretch. Facebook didn’t even claim most of those 80,000 IRA posts were election–related. It offered no data on what proportion of the feeds to those 29 million people were. In addition, Facebook’s Vice President for News Feed, Adam Moseri, acknowledged in 2016 that FB subscribers actually read only about 10 percent of the stories Facebook puts in their News Feed every day. The means that very few of the IRA stories that actually make it into a subscriber’s news feed on any given day are actually read.

And now, according to the further research, the odds that Americans saw any of these IRA ads—let alone were influenced by them—are even more astronomical. In his Oct. 2017 testimony, Stretch said that from 2015 to 2017, “Americans using Facebook were exposed to, or ‘served,’ a total of over 33 trillion stories in their News Feeds.” To put the 33 trillion figure over two years in perspective, the 80,000 Russian-origin Facebook posts represented just .0000000024 of total Facebook content in that time.

Shane and Mazzetti did not report the 33 trillion number even though The New York Times’ own coverage of that 2017 Stretch testimony explicitly stated, “Facebook cautioned that the Russia-linked posts represented a minuscule amount of content compared with the billions of posts that flow through users’ News Feeds everyday.” The Times‘ touting of the bogus 126 million out 137 million voters, while not reporting the 33 trillion figure, should vie in the annals of journalism as one of the most spectacularly misleading uses of statistics of all time.

The new army chief himself is the greatest threat.

• Russia A Greater Threat Than ISIS or Al-Queda – New British Army Chief (PA)

Russia “indisputably” poses a far greater threat to national security than Islamic terrorist groups such as al-Qaida and Isis, the new head of the British army has warned. General Mark Carleton-Smith said the UK cannot be complacent about the threat Russia poses “or leave it uncontested”. The former SAS commander said Russia had made plain its preparedness to use force to expand its interests, while it had also been “systematic” in its efforts to exploit cyber space and undersea military arenas. “The Russians seek to exploit vulnerability and weakness wherever they detect it,” he told the Daily Telegraph.

“Russia today indisputably represents a far greater threat to our national security than Islamic extremist threats such as al-Qaida and Isil,” he said, using another name for Isis. Carleton-Smith, who graduated from Sandhurst in the final years of the Cold War, took over as chief of the general staff in June. He led the hunt for Osama bin Laden after the 9/11 terror attacks and later spearheaded Britain’s role in the campaign to defeat Isis. Now, with the threat from Islamist groups in the Middle East reduced by years of concerted international military action, the focus needs to shift to Russia, he said. “We cannot be complacent about the threat Russia poses or leave it uncontested,” Carleton-Smith warned.

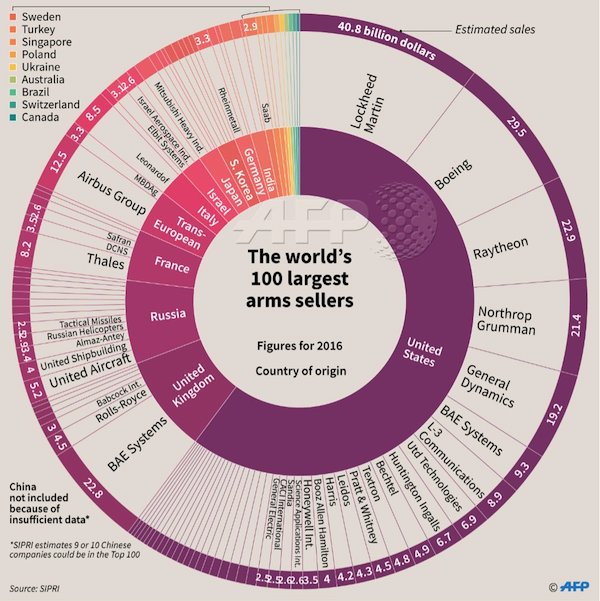

The European arms industry holds the entire continent hostage.

• European Security Held Hostage By Washington’s Geopolitical Games – Lavrov (RT)

The blindness of the EU bureaucrats allows the US to instigate dangerous military activity near Russian borders, jeopardizing the security of the whole European continent, Sergey Lavrov, Russia’s Foreign Minister, said. The Ukrainian crisis, which was used as a justification for sanctions against Moscow, is “a result of geopolitical games, played by the US and their allies in several countries, as well as the blindness of the bureaucrats in Brussels,” Lavrov, who was visiting Portugal on Saturday, said in an interview with local Publico paper. The EU leadership “not only sacrificed its principles and values by turning a blind eye to the armed coup in Kiev, in which a democratically elected president was deposed, but followed Washington’s lead and joined the anti-Russian sanctions,” he added.

In February 2014, Ukrainian President, Viktor Yanukovich, was removed from power as a result of a violent uprising, in which a key role was played by the radical nationalist groups. A few months later, the new government in Kiev launched the so-called “anti-terrorist operation” in the south-east of the country after the local population refused to recognize the results of the coup. The conflict in Donbas, which has claimed more than 10,000 lives, is still ongoing as the Ukrainian authorities don’t seem willing to commit to the truce earlier reached with the Republics of Donetsk and Lugansk.

“And what have we now?” Lavrov wondered. “The architecture of dialogue between Russia and the EU is seriously damaged; the European producers suffer multi-billion losses [due to sanctions and countermeasures by Moscow]; there’s a new conflict in Europe.” Meanwhile, the Americans, who are directly responsible for the “unhealthy situation” in Europe, “suffer no losses,” he said.

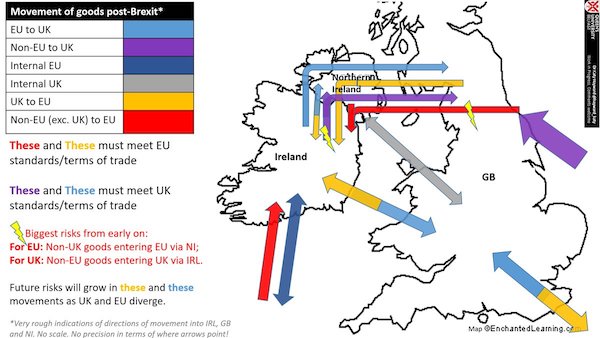

Good explanation by Frances Coppola of why the Irish border is such a hot iron in the Brexit talks.

• Why Theresa May’s Brexit Deal Is Terrible For The UK (Coppola)

After Brexit, the border between Northern Ireland and the Republic of Ireland will become an international border, rather than an intra-EU border as at present. In the absence of a trade agreement, both the EU and the U.K. would be obliged to apply the WTO’s “Most Favored Nation” (MFN) rules on that border. This would mean tariffs and regulatory checks on a border which is politically highly sensitive, because of its long history of conflict, and economically extremely important to the economies of Northern Ireland and its southern neighbour. Neither the U.K. nor the EU wants there to be a hard border between Northern Ireland and Ireland after Brexit. But preventing one is proving difficult.

The U.K. Government proposed technological solutions that it said would eliminate the need for actual checks at the border, but the EU doesn’t believe that the technology exists. The EU proposed a temporary arrangement which would keep Northern Ireland in the Customs Union and Single Market until a free trade agreement could be negotiated, but the U.K. objected on the grounds that customs checks on goods in transit between Northern Ireland and the rest of the U.K. would undermine the U.K.’s own internal market.

The Withdrawal Agreement breaks this deadlock by providing for the U.K. to remain in the EU’s Customs Union, and Northern Ireland in the Single Market, not merely until the end of the transitional period scheduled to end in December 2020, but until a replacement trade agreement can be negotiated, or (potentially) indefinitely if none can be agreed. This is by any measure unsatisfactory. Everyone hates “frozen Brexit.” But the backstop is not the only problem with this deal. Buried in the accompanying Political Declaration, which establishes the framework for future trade negotiations, is this conundrum:

“The future relationship will be based on a balance of rights and obligations, taking into account the principles of each Party. This balance must ensure the autonomy of the Union’s decision making and be consistent with the Union’s principles, in particular with respect to the integrity of the Single Market and the Customs Union and the indivisibility of the four freedoms. It must also ensure the sovereignty of the United Kingdom and the protection of its internal market, while respecting the result of the 2016 referendum including with regard to the development of its independent trade policy and the ending of free movement of people between the Union and the United Kingdom.” When combined with the backstop, this conundrum makes Mrs. May’s deal terrible for the U.K.

Hostile environment. Signed, Theresa May.

• UK Food Banks Fear Winter Crisis (G.)

Food banks in some of the poorest areas are preparing for a big rise in demand when universal credit is rolled out by calling for more donations and volunteers, and stockpiling essential supplies. Volunteers have told the Observer they are concerned about how their communities will cope this winter. In areas where the new benefit has been in place for months, the pressure on food banks has increased. Under the new system, people are made to wait for over a month to receive the benefit. When universal credit is paid out, it is often given as a lump sum, which many find difficult to budget. The Trussell Trust, which operates 428 food banks, reported in April that its facilities were four times busier in areas where the new credit had been in place for 12 months or more compared with those where it had been introduced more recently.

Blackpool, the Isle of Anglesey, Milton Keynes and parts of Liverpool and Glasgow will become some of the last places to introduce universal credit in the coming weeks. Roy Fyles, who supervises the Anglesey food bank, said he was not looking forward to its arrival on 5 December. “Even if there are only a few new claimants between now and Christmas, they will not get any money, unless they request an advance, until the new year,” he said. “We’re talking five weeks.” In nearby Flintshire, the credit piled a lot of pressure on food banks when it was brought in 20 months ago. “We are hoping that, because we’re only a small island, we’ll have fewer problems,” Fyles said. Already, the number of packages his food bank delivers has gone up by a third in the past few months. “We’re preparing by trying to get more volunteers and collecting food for Christmas hampers.”

Nice twist.

• UK Parliament Seizes Cache Of Facebook Internal Papers (O.)

Parliament has used its legal powers to seize internal Facebook documents in an extraordinary attempt to hold the US social media giant to account after chief executive Mark Zuckerberg repeatedly refused to answer MPs’ questions. The cache of documents is alleged to contain significant revelations about Facebook decisions on data and privacy controls that led to the Cambridge Analytica scandal. It is claimed they include confidential emails between senior executives, and correspondence with Zuckerberg. Damian Collins, the chair of the culture, media and sport select committee, invoked a rare parliamentary mechanism to compel the founder of a US software company, Six4Three, to hand over the documents during a business trip to London.

In another exceptional move, parliament sent a serjeant at arms to his hotel with a final warning and a two-hour deadline to comply with its order. When the software firm founder failed to do so, it’s understood he was escorted to parliament. He was told he risked fines and even imprisonment if he didn’t hand over the documents. “We are in uncharted territory,” said Collins, who also chairs an inquiry into fake news. “This is an unprecedented move but it’s an unprecedented situation. We’ve failed to get answers from Facebook and we believe the documents contain information of very high public interest.” [..] MPs leading the inquiry into fake news have repeatedly tried to summon Zuckerberg to explain the company’s actions. He has repeatedly refused.

Collins said this reluctance to testify, plus misleading testimony from an executive at a hearing in February, had forced MPs to explore other options for gathering information about Facebook operations. [..] The documents seized were obtained during a legal discovery process by Six4Three. It took action against the social media giant after investing $250,000 in an app. Six4Three alleges the cache shows Facebook was not only aware of the implications of its privacy policy, but actively exploited them, intentionally creating andeffectively flagging up the loophole that Cambridge Analytica used to collect data. That raised the interest of Collins and his committee.

Negotiating.

• Trump Says Asylum Seekers To Wait In Mexico, Incoming Government Denies (R.)

U.S. President Donald Trump tweeted on Saturday that migrants at the U.S.-Mexico border would stay in Mexico until their asylum claims were individually approved in U.S. courts, but Mexico’s incoming government denied they had struck any deal. Mexico’s incoming interior minister said there was “no agreement of any type between the future government of Mexico and the United States.” Olga Sanchez Cordero, also the top domestic policy official for president-elect Andres Manuel Lopez Obrador who takes office on Dec. 1, told Reuters that the incoming government was in talks with the United States but emphasized that they could not make any agreement since they were not yet in government.

Sanchez ruled out that Mexico would be declared a “safe third country” for asylum claimants, following a Washington Post report of a deal with the Trump administration known as “Remain in Mexico,” which quoted her calling it a “short-term solution.” The plan, according to the newspaper, foresees migrants staying in Mexico while their asylum claims in the United States are being processed, potentially ending a system Trump decries as “catch and release” that has until now often allowed those seeking refuge to wait on safer U.S. soil.

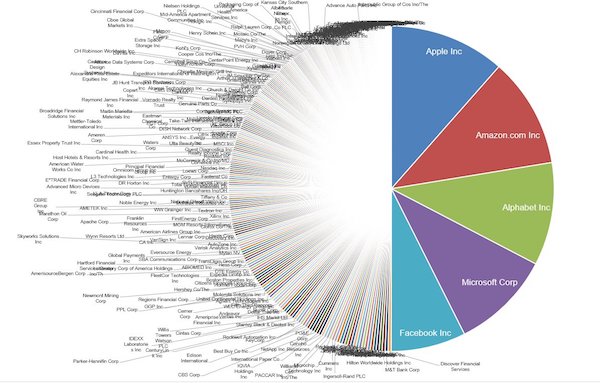

At what point will we call it a monopoly? Apparently not at 50%. How about 75%?

• Amazon To Contribute Over Half Of Q4 Earnings Growth For S&P 500 Retail (MW)

Amazon.com’s fourth quarter earnings are expected to account for more than half of earnings growth among S&P 500 retailers, according to a report from FactSet. FactSet expects Amazon to report earnings per share of $5.51, more than double the $2.16 the e-commerce giant reported last year. Amazon beat FactSet earnings expectations the last five quarters. “Amazon.com is expected to report the highest earnings growth and is expected to be the largest contributor to earnings growth for the Retailing Industry Group and Food & Staples Retailing Industry Group combined,” wrote John Butters at FactSet. “If Amazon were excluded, the estimated earnings growth for Q4 for these two retail industry groups would fall to 6.8% from 15%.”

Ten of the 13 retail sub-industries, including internet and direct marketing retail (projected for 69.4% growth), automotive retail (expected to be up 22.4%) and home improvement retail (forecast for 20.1% growth) are expected to report higher fourth-quarter earnings. Other categories projected for double-digit growth include general merchandise stores (up 12.3%) and food distributors (up 11.1%). Drug retail, department stores and specialty stores are forecast to grow 6.9%, 6.8% and 6.4% respectively. “Amazon alone accounts for more than half of the projected earnings growth for all S&P 500 retailers for the fourth quarter,” Butters wrote.

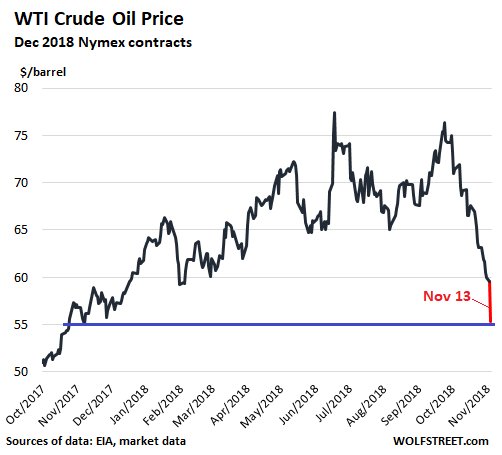

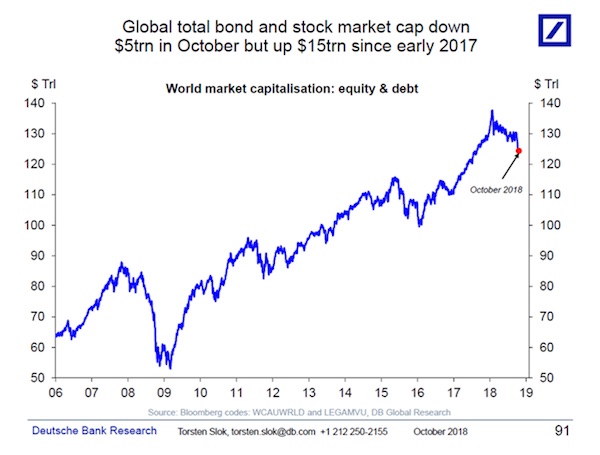

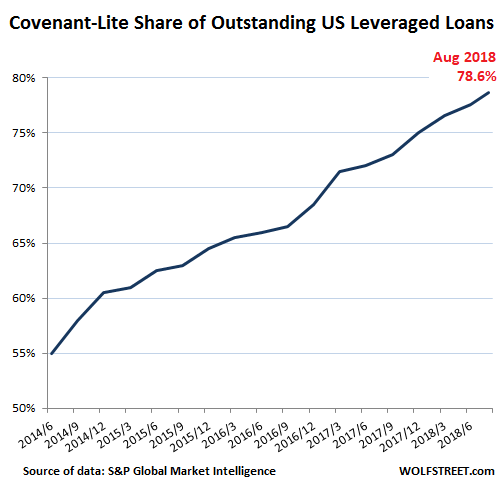

As supply skyrockets, central banks stop buying. A recipe for fun, we’re sure.

• JPMorgan Spots The Next Big Problem: A Plunge In Global Bond Demand (ZH)

[..] with traders – across all asset classes, including equity, credit and rates, all focusing on what happens to US Treasury yields next, the JPMorgan strategist revisits his previous analysis on global bond demand and supply, incorporating updated supply forecasts both for the balance of 2018 as well as for 2019. “Given this year has seen the largest increase in excess supply of bonds since 2010, which as we noted last week has together with continued Fed hikes contributed to a tightening in financial conditions that has been reverberating across markets, there has been considerable interest in how next year is shaping up.”

Attention on 2019 is especially acute as the Fed’s balance sheet normalization process is set to accelerate given that it is only in 4Q18 that the monthly cap for the quantity of maturing bonds that are allowed to roll off has reached its steady state of $50Bn/month, which unlike 2018 when QT was just starting, will induce a further increase in net supply that needs to be absorbed by the market of more than $100bn. It’s not just the Fed: with the ECB set to end its QE purchases in December this year and we see the BoJ continuing its gradual slowdown in bond purchases to ¥30tr in 2019 compared to around ¥40tr this year, JPMorgan notes that this collective shrinkage of the G-4 balance sheet means that the market needs to absorb a further decrease in price-insensitive QE demand of more than $400bn next year.

Here’s the bad news: adding together both the supply and demand side impact, the G4 central bank flow looks set to decline a further $550bn next year. Which begs the question: will there be an incremental increase in demand to offset this dramatic net increase in supply in the coming year? JPMorgan’s answer is hardly what bond bulls are looking for…

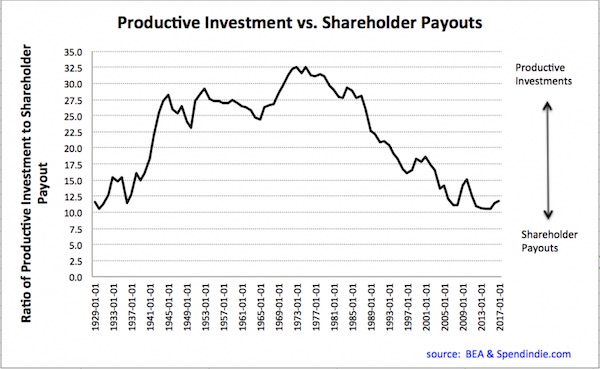

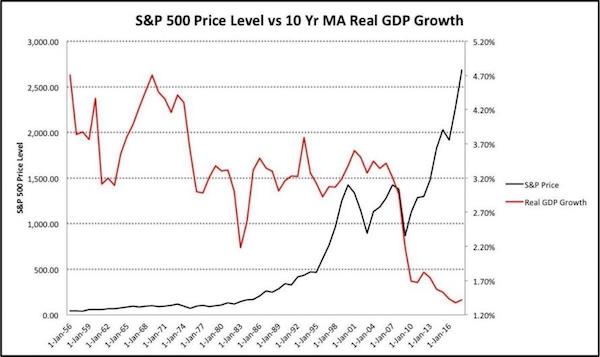

Entertainment.

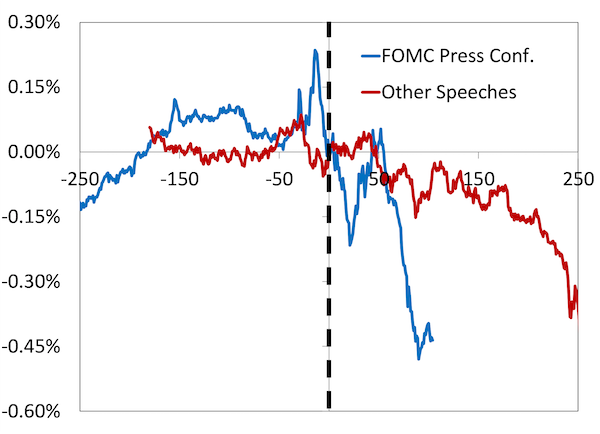

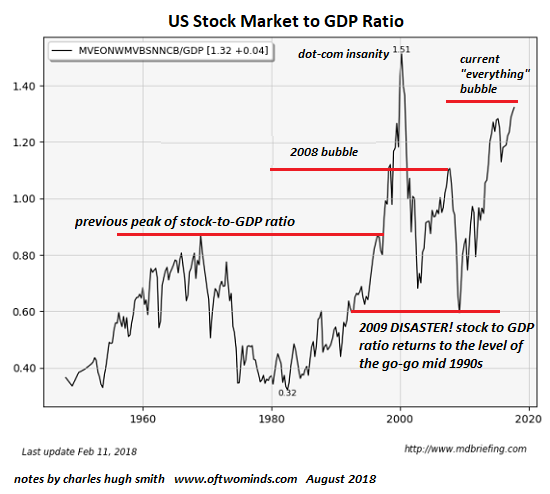

• Bear Necessities: The Charts That Predict Market Downturns (MW)

Is a bear market on the horizon? WSJ markets reporter Riva Gold analyzes the trends that came before the dot-com bubble burst and the financial crisis hit.

Yes, that’s right, lignite. But that’s not what bothers the EU.

• EU Unhappy With China Penetrating Greek Energy Market (K.)

Brussels is raising obstacles to Chinese plans to enter Greece’s energy market, reversing the situation in the tender for the privatization of Public Private Corporation’s lignite-fired plants where CHN Energy had appeared to be the favorite. Days before bid submissions for the four plants at Meliti and Megalopoli, the European Commission’s Directorate-General for Energy sent a letter to Greece’s Regulatory Authority for Energy, seen by Kathimerini, raising the issue of European law violation and asking for the review of ADMIE’s certification after China State Grid purchased 24 percent of the grid operator.

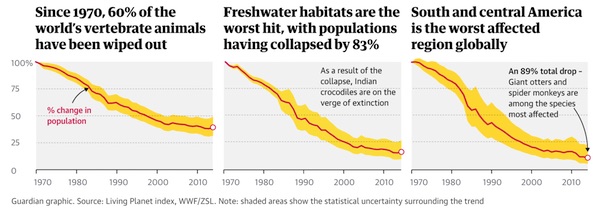

People may feel vindicated in some way because of this, especially because of Trump. But really, expressing environmental damage in dollars is a road to nowhere at all. If economic growth is your main worry, you’re not too smart.

• Climate Change Will Wreck Economic Growth – US Government Report (MW)

Climate change is a threat to Americans’ health and the country’s economic well-being, a major report issued Friday by 13 federal agencies said. “Without substantial and sustained global mitigation and regional adaptation efforts, climate change is expected to cause growing losses to American infrastructure and property and impede the rate of economic growth over this century,” wrote the authors of the Fourth National Climate Assessment Volume II. The report, authored by more than 300 experts, spells out a litany of impacts linked to climate change, including problems with human health, water quality, agriculture, tourism, and infrastructure.

Flooding will decrease crop yields, warming oceans will slow the shellfish industry, and heat stress will cause a drop in dairy production, the authors wrote, describing just a few of the economic effects. If people don’t take action to lessen its effects, climate change is expected to affect import and export prices and U.S. businesses with overseas operations and supply chains, the report notes. “With continued growth in emissions at historic rates, annual losses in some economic sectors are projected to reach hundreds of billions of dollars by the end of the century — more than the current GDP of many U.S. states,” the authors wrote.