Model wearing Dior on the banks of the Seine, Paris 1948

Look, Guardian, this is a good piece. But your editor destroys it by adding a headline with a question mark. Reality is, Britain is nothing but a front for a criminal racket. Its arms sales -both abroad and to its own forces- are responsible for the misery of countless deaths and maimed and refugees each and every year. Which your PM phrases as “..the UK will be at the forefront of a wider western effort to step up our defence and security partnership.” But you as a paper don’t have to play that game. Just tell your readers what is happening, and what has happened for decades. You live by blood and destruction.

• Does UK’s Lucrative Arms Trade Come At The Cost Of Political Repression? (G.)

On 24 January 2015 a private jet touched down in Saudi Arabia’s capital, Riyadh. On board were a handful of Foreign Office officials, security personnel and the then prime minister, David Cameron, who was visiting the kingdom to pay his condolences following the death of King Abdullah bin Abdulaziz. The decision to charter the jet – at a cost to the taxpayer of £101,792 – raised eyebrows among Whitehall mandarins. But when it comes to Saudi Arabia, normal UK rules don’t seem to apply. For decades the two kingdoms have quietly enjoyed a symbiotic relationship centred on the exchange of oil for weapons. Analysis of HM Revenue and Customs figures by Greenpeace EnergyDesk shows that in 2015 83% of UK arms exports – almost £900m – went to Saudi Arabia. Over the same period, the UK imported £900m of oil from the kingdom.

Now this relationship has come under scrutiny as a result of a judicial review brought by the Campaign Against Arms Trade (CAAT), which has sent alarm bells ringing in Whitehall. The case follows concerns that a coalition of Saudi-led forces may have been using UK-manufactured weapons in violation of international humanitarian law during their ongoing bombardment of Yemen, targeting Iranian-backed Houthi forces loyal to the country’s former president. The legal challenge comes at a crucial time for the UK’s defence industry, which makes about 20% of arms exported globally. In recent years Ministry of Defence cutbacks have led to the sector looking abroad for new sales, and the government, with one eye on the post-Brexit landscape, is keen on the strategy. Last month Theresa May heralded a £100m deal involving the UK defence giant BAE and the Turkish military, and many defence experts see this as a sign of things to come.

But the policy – as the Saudi case makes clear – is controversial. Many of the UK’s biggest customers have questionable human rights records and there are concerns exported weapons are used for repression or against non-military targets. Thousands have died in the Yemen campaign, with the Saudis accused of targeting civilians. Four-fifths of the population is in need of aid, and famine is gripping the country. But despite this, and protests from human rights groups and the United Nations, the UK has continued to arm the Saudi regime, licensing about £3.3bn of weapons to the kingdom since the bombing of Yemen began in March 2015.

Orwell meets Samuel Beckett.

• UK Journalists Who Obtain Leaked Official Material Could Face Jail (Tel.)

Campaigners have expressed outrage at new proposals that could lead to journalists being jailed for up to 14 years for obtaining leaked official documents. The major overhaul of the Official Secrets Act – to be replaced by an updated Espionage Act – would give courts the power to increase jail terms against journalists receiving official material. The new law, should it get approval, would see documents containing “sensitive information” about the economy fall foul of national security laws for the first time. In theory a journalist leaked Brexit documents deemed harmful to the UK economy could be jailed as a consequence. One legal expert said the new changes would see the maximum jail sentence increase from two years to 14 years; make it an offence to “obtain or gather” rather than simply share official secrets; and to extend the scope of the law to cover information that damages “economic well-being”.

John Cooper QC, a leading criminal and human rights barrister who has served on two law commission working parties, added: “These reforms would potentially undermine some of the most important principles of an open democracy.” Jodie Ginsberg, chief executive of Index on Censorship, said: “The proposed changes are frightening and have no place in a democracy, which relies on having mechanisms to hold the powerful to account. “It is unthinkable that whistle blowers and those to whom they reveal their information should face jail for leaking and receiving information that is in the public interest.” Her organisation has accused the Law Commission, the Government’s statutory legal advisers, of failing to consult fully with journalists before making its recommendations in a 326-page consultation published earlier this month. “It is shocking that so few organisations were consulted on these proposed changes given the huge implications for public interest journalism in this country,” said Ms Ginsberg.

And this, too, is Britain, in 2017. And way before that too.

• Women And Children ‘Raped, Beaten And Abused’ In Dunkirk’s Refugee Camp (G.)

Children and women are being raped by traffickers inside a refugee camp in northern France, according to detailed testimony gathered ahead of fresh legal action against the UK government’s approach to the welfare of unaccompanied minors. Corroborating accounts from volunteers, medics, refugees and security officials reveal that sexual abuse is common within the large camp at Dunkirk and that children and women are forced to have sex by traffickers in return for blankets or food or the offer of passage to the UK. Legal proceedings will be issued by London-based Bindmans against the Home Office, which is accused of acting unfairly and irrationally by electing to settle only minors from the vast Calais camp that closed last October, ignoring the child refugees gathered in Dunkirk, 40 miles away along the coast.

The legal action, brought on behalf of the Dunkirk Legal Support Team and funded by a crowd justice scheme, says the Home Office’s approach was arbitrary and mean-spirited. On Wednesday the government’s approach to child refugees provoked widespread indignation when the home secretary, Amber Rudd, announced the decision to end the “Dubs scheme”, having allowed just 350 children to enter the UK, 10% of the number most MPs and aid organisations had been led to believe could enter. [..] On Friday the archbishop of Canterbury said the government’s decision meant that child refugees would be at risk of being trafficked and even killed. Justin Welby’s warnings of what could happen if child refugees were denied the opportunity of safe passage are graphically articulated in the testimonies gathered over several months by the Observer.

Accounts from those at the camp, which currently holds up to 2,000 refugees, of whom an estimated 100 are unaccompanied minors, portray a squalid site with inadequate security and atrocious living conditions. The Dunkirk Legal Support Team says the failure of the authorities to guard the site has allowed the smugglers to take control. One volunteer coordinator, who has worked at the camp’s women’s centre since October 2016, said: “Sexual assault, violence and rape are all far too common. Minors are assaulted and women are raped and forced to pay for smuggling with their bodies.” Testifying on condition of anonymity, she added: “Although the showers are meant to be locked at night, particularly dangerous individuals in the camp have keys and are able to take the women to the showers in the night to force themselves on them. This has happened to women I know very well.”

Looming, right?

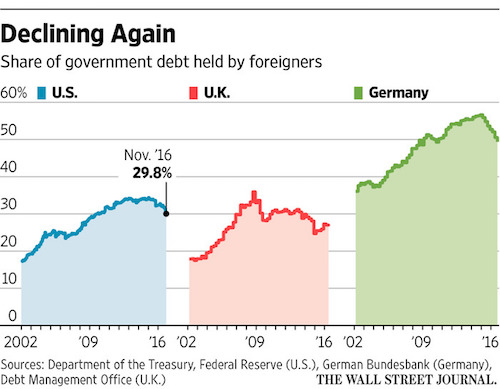

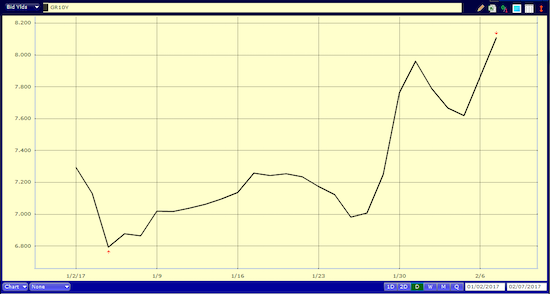

• Bank For International Settlements Warns Of Looming Debt Bubble (F.)

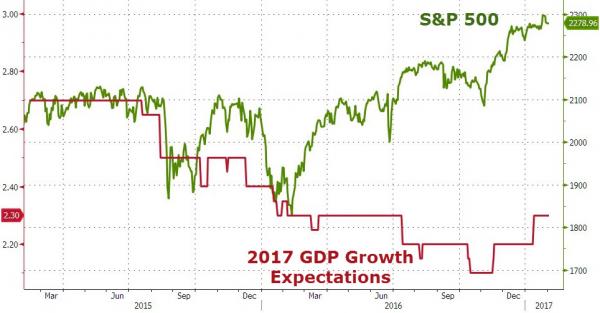

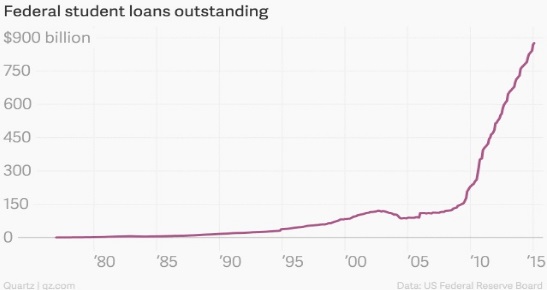

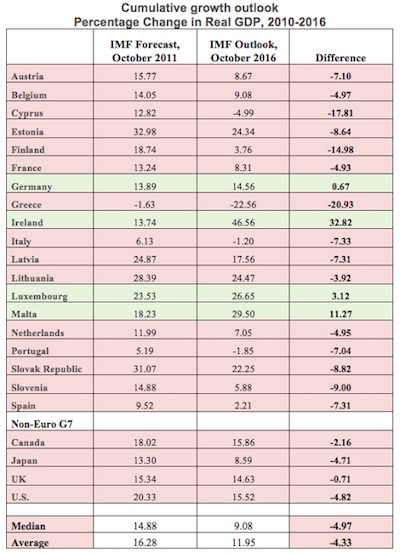

So you thought the world was deleveraging after the housing and derivatives bubble of 2008, hey? Well…fooled you! Global debt-to-GDP is now at a comfortable record high and the Bank for International Settlements, aka the central bank of central banks, noted on Friday that over the last 16 years, debts of governments, households and corporations has gone up…everywhere. In the U.S., debt is up 63%. The Eurozone, Japan, U.K., Canada and Australia average around 52%. And emerging markets, led by China, leverage is up 85%. In some important emerging economies like Brazil major cities are on the verge of bankruptcy. Rio is CCC credit thanks to mismanagement of a deep sea oil bonanza and over spending on the FIFA World Cup and the 2016 Olympics.

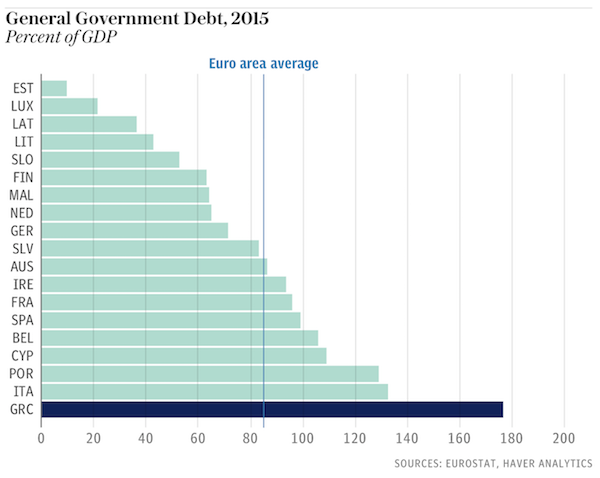

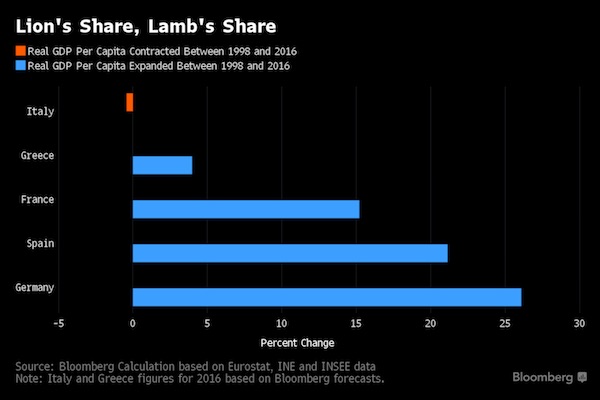

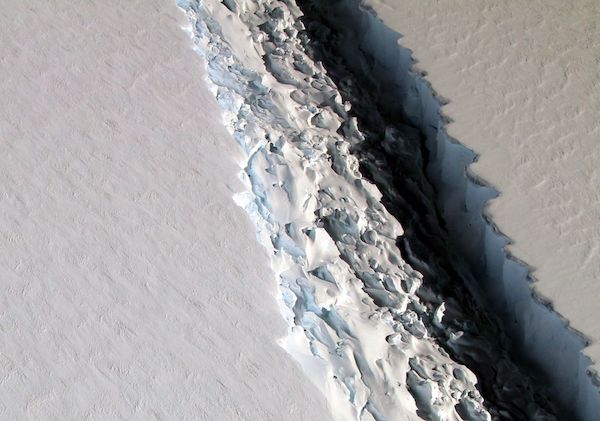

“The next financial crisis is likely to revolve around how this debt burden is managed,” warns Neil MacKinnon, an economist with VTB Capital in London. “In the U.K., most crises are related to boom and busts in the housing market, where there is an approximate 18-year cycle suggesting that the next bust will be in 2025.” That’s quite a ways away. And for London real estate, they always have the Saudis, the Russians and the Chinese to save them. But further south, in countries like France and Italy, credit downgrades are expected. And guess which southern European country is back to give us all headaches again? Greece! Greece is making headlines once more for its inability to work out a debt deal with its lenders. There is now a rift between the EU and the IMF over Greek debt sustainability.

Most of the debt is with the European Commission itself, so German policy makers are basically the lenders and so far are not willing to take a haircut on bond prices. The IMF predicts that the Greek debt-GDP ratio, now at 180%, will soar to 275% all the while primary fiscal surplus is currently at zero. That means Greece’s debt to GDP is like Japan, only without the power of the Japanese economy to back it up. Greece is broke. “Greece is caught in a debt-trap which has shrunk the Greek economy by 25%,” notes MacKinnon. They owe Europe around €7 billion in July. Good luck with that. Jaime Caruana, General Manager for the Bank for International Settlements hinted in a speech in Brussels on Monday that the core central banks might not know what they’re in for.

“We need to escape the popular models that prevent us from recognizing the build-up of vulnerabilities,” Caruana said. “Getting all the right dots in front of you does not really help if you do not connect the dots. Right now, I worry that even though we have data on aggregate debt, we are not properly connecting the dots and we are underestimating the risks, particularly when the high levels of debt are aggravated by weak productivity growth in many countries. The standard of evidence for precautionary action has to be the preponderance of evidence, not evidence beyond a shadow of doubt. Waiting for fully compelling evidence is to act too late.”

Long and deep from Nafeez.

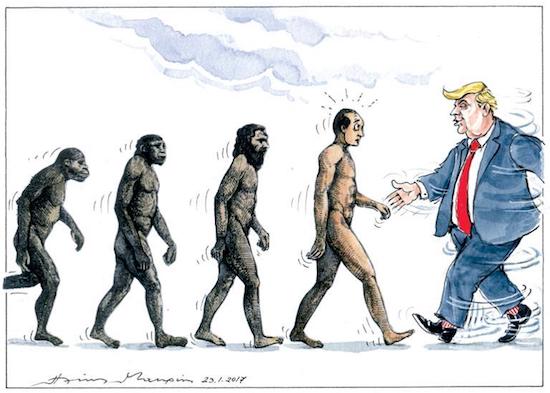

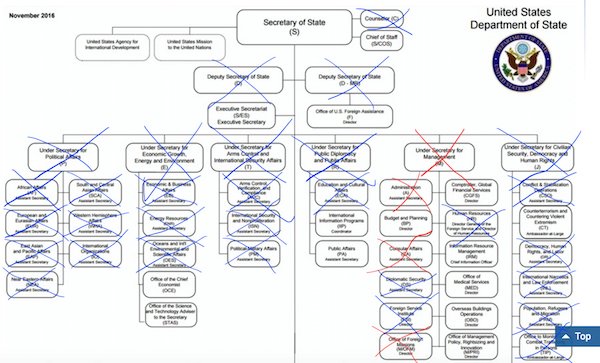

• Trump Regime Was Manufactured By A War Inside The Deep State (Nafeez Ahmed)

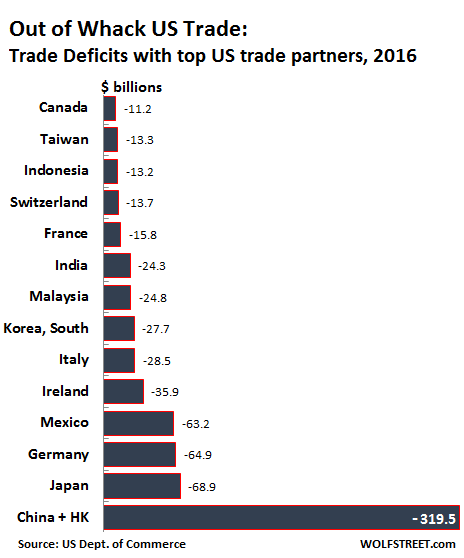

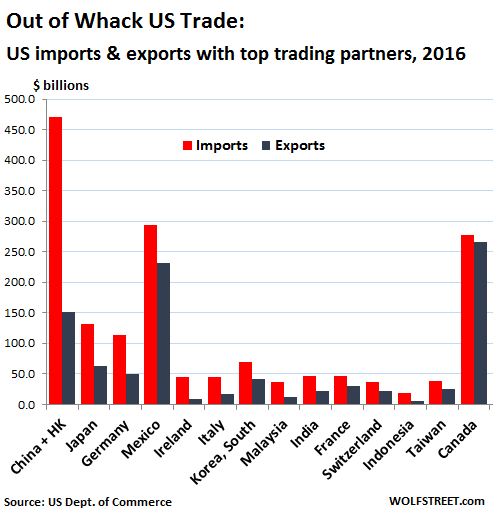

President Donald Trump is not fighting a war on the establishment: he’s fighting a war to protect the establishment from itself, and the rest of us. At first glance, this isn’t obvious. Among his first actions upon taking office, Trump vetoed the Trans Pacific Partnership, the controversial free trade agreement which critics rightly said would lead to US job losses while giving transnational corporations massive power over national state policies on health, education and other issues. Trump further plans to ditch the TTIP between the EU and US, which would have diluted key state regulations on the activities of transnational corporates on issues like food safety, the environment and banking; and to renegotiate NAFTA, potentially heightening tensions with Canada. Trump appears to be in conflict with the bulk of the US intelligence community, and is actively seeking to restructure the government to minimize checks and balances, and thus consolidate his executive power.

His chief strategist, Steve Bannon, has completely restructured the National Security Council under unilateral presidential authority. While Bannon and his Chief of Staff Richard ‘Reince’ Priebus now have permanent seats on the NSC’s Principals’ Committee, the Director of National Intelligence and the Chairman of the Joint Chiefs of Staff are barred from meetings except when requested for their expertise. The Secretary of Energy and US ambassador to the UN have been expelled entirely. Trump’s White House has purged almost the entire senior staff of the State Department, and tested the loyalty of the Department of Homeland Security with its new ‘Muslim ban’ order. So what is going on? One approach to framing the Trump movement comes from Jordan Greenhall, who sees it as a conservative (“Red Religion”) Insurgency against the liberal (“Blue Church”) Globalist establishment (the “Deep State”).

Greenhall suggests, essentially, that Trump is leading a nationalist coup against corporate neoliberal globalization using new tactics of “collective intelligence” by which to outsmart and outspeed his liberal establishment opponents. But at best this is an extremely partial picture. In reality, Trump has ushered in something far more dangerous: The Trump regime is not operating outside the Deep State, but mobilizing elements within it to dominate and strengthen it for a new mission. The Trump regime is not acting to overturn the establishment, but to consolidate it against a perceived crisis of a wider transnational Deep System. The Trump regime is not a conservative insurgency against the liberal establishment, but an act of ideologically constructing the current crisis as a conservative-liberal battleground, led by a particularly radicalized white nationalist faction of a global elite.

The act is a direct product of a global systemic crisis, but is a short-sighted and ill-conceived reaction, pre-occupied with surface symptoms of that crisis. Unfortunately, those hoping to resist the Trump reaction also fail to understand the system dynamics of the crisis.

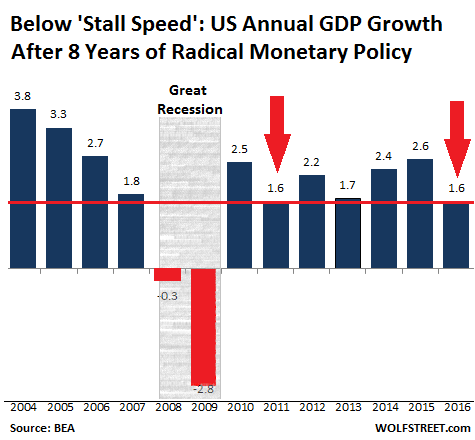

If you want to know what ails us, it doesn’t get much clearer than this.

• Banking, Credit & Norway (Steve Keen)

This was an invited talk during Oslo University’s “Week of Current Affairs”, so though my talk covered the global issues of credit and economic cycles, I paid particular attention to Norway, which is one of the 9 countries I have identified as very likely to experience a credit crunch in the next few years.

But illogical demans are all there is.

• Greece Says Bailout Deal Close, But Will Not Accept ‘Illogical’ Demands (G.)

Greek PM Alexis Tsipras said on Saturday he believed the country’s drawn-out bailout review would be completed positively but repeated that Athens would not accept “illogical” demands by its lenders. He warned all sides to “be more careful towards a country that has been pillaged and people who have made, and are continuing to make, so many sacrifices in the name of Europe”. Greece and its international lenders made clear progress on Friday toward bridging differences over its fiscal path in coming years, moving closer to a deal that would secure new loan disbursements and save the country from default. “(The review) will be completed, and it will be completed positively, without concessions in matters of principle,” Tsipras told a meeting of his leftist Syriza party. Reaching agreement would release another tranche of funds from it latest €86 billion bailout, and facilitate Greece making a major €7.2 billion debt repayment this summer.

European and IMF lenders want Greece to make €1.8 billion – or 1% of GDP – worth of new reforms by 2018 and another €1.8 billion after then and the measures would be focused on broadening the tax base and on pension cutbacks. But further cutbacks, particularly to pensions which have already gone through 11 cuts since the start of the crisis in 2010, are hard to sell to a public worn down after years of austerity. Representatives of Greece’s lenders are expected to return to Athens this week to report on whether Greece has complied with a second batch of reforms agreed under the current bailout, its third. “We are ready to discuss anything within the framework of the (bailout) agreement and within reason, but not things beyond the framework of the agreement and beyond reason,” Tsipras said. “We will not discuss demands which are not backed up by logic and by numbers,” he said.

One minute of devastating numbers.

• Greece 2017: Numbers And Facts About 8 Years Of Recession (AthensLive)

While Greece is back in the headlines, we got together some numbers and facts about eight years of economic recession.

Well, they won’t stop.

• Tsipras Warns IMF, Germany To Stop ‘Playing With Fire’ Over Greek Debt (AFP)

Greek PM Alexis Tsipras on Saturday warned the IMF and German Finance Minister Wolfgang Schaeuble to “stop playing with fire” in the handling of his country’s debt. Opening a meeting of his Syriza party, Tsipras said he was confident a solution would be found, a day after talks between Greece and its creditors ended in Brussels with no breakthrough. He urged a change of course from the IMF. “We expect as soon as possible that the IMF revise its forecast.. so that discussions can continue at the technical level.” Referring to Schaeuble, Tsipras also called for German Chancellor Angela Merkel to “encourage her finance minister to end his permanent aggressiveness” towards Greece. Months of feuding with the IMF has raised fears of a new debt crisis.

Greece is embroiled in a row with its eurozone paymasters and the IMF over debt relief and budget targets that has rattled markets and revived talk of its place in the euro. Eurogroup chief Jeroen Dijsselbloem said progress had been made in the Brussels talks with Greek Finance Minister Euclid Tsakalotos and other EU and IMF officials. But he provided few details. The Athens government faces debt repayments of €7.0 billion this summer that it cannot afford without defusing the feud that is holding up new loans from Greece’s €86 billion bailout. Breaking the stalemate in the coming weeks is seen as paramount with elections in the Netherlands on March 15 and France in April through June threatening to make a resolution even more difficult.

Mostly rehashing Yanis’ time as FinMin. That’s a shame, because his views on today are much more interesting.

• Yanis Varoufakis: Grexit ‘Never Went Away’ (AlJ)

With the UK on the cusp of leaving the European Union and Greece increasingly facing the same fate, is it over for the beleaguered body? An “epidemic” washing over other European countries may see the end of the EU, warns Yanis Varoufakis, Greece’s former finance minister. “The right question is: Is there going to be a eurozone and the European Union in one or two years’ time?” asks Varoufakis, who served as finance minister for five months under the Syriza government. Italy is already on the way out, Varoufakis tells UpFront. “When you allow an epidemic to start spreading from a place like Greece to Spain … to Ireland, then eventually it gets to a place like Italy,” says Varoufakis. “As we speak, only one political party in Italy wants to keep Italy in the eurozone.”

When asked about his failure to pull Greece out of its debt crisis during his tenure as finance minister, Varoufakis blamed the so-called troika – the IMF, the EU Commission and the European Central Bank – by intentionally sabotaging any debt-repayment agreement. “They were only interested in crushing our government, making sure that there would be no such mutually advantageous agreement,” says Varoufakis, who claims Greece was being used as a “morality tale” to scare voters in other European countries away from defying the troika. “The only reason why we keep talking about Greece … is because it is symptomatic of the architectural design faults and crisis of the eurozone.”

To pop the bubble? To allow people to live where their families do?

• Why Falling Home Prices Could Be a Good Thing (NYT)

Suppose there were a way to pump up the economy, reduce inequality and put an end to destructive housing bubbles like the one that contributed to the Great Recession. The idea would be simple, but not easy, requiring a wholesale reframing of the United States economy and housing market. The solution: Americans, together and all at once, would have to stop thinking about their homes as an investment. The virtues of homeownership are so ingrained in the American psyche that we often forget that housing is also a source of economic stress. Rising milk prices are regarded as a household tragedy for some, and spiking gas prices stoke national outrage. But whenever home prices go up, it’s “a recovery,” even though that recovery also means millions of people can no longer afford to buy.

Homes are the largest asset for all but the richest households, but shelter is also a basic necessity, like food. We have a variety of state and federal programs devised to make housing cheaper and more accessible, and a maze of local land-use laws that make housing scarcer and more expensive by doing things like prohibiting in-law units, regulating how small lots can be, and capping the number of unrelated people who can live together. Another big problem: High rent and home prices prevent Americans from moving to cities where jobs and wages are booming. That hampers economic growth, makes income inequality worse and keeps people from pursuing their dreams. So instead of looking at homes as investments, what if we regarded them like a TV or a car or any other consumer good? People might expect home prices to go down instead of up.

Homebuilders would probably spend more time talking about technology and design than financing options. Politicians might start talking about their plans to lower home prices further, as they often do with fuel prices. In this thought experiment, housing prices would probably adjust. They would be somewhat cheaper in most places, where population is growing slowly. But they would be profoundly cheaper in places like super-expensive San Francisco. That was the conclusion of a recent paper by the economists Ed Glaeser of Harvard and Joe Gyourko at the Wharton School of the University of Pennsylvania. The paper uses construction industry data to determine how much a house should cost to build if land-use regulation were drastically cut back. Since the cost of erecting a home varies little from state to state — land is the main variable in housing costs — their measure is the closest thing we have to a national home price.

Hope they get their media organized so news can get out. If it does it could be the worst PR disaster ever.

• Army Veterans Return To Standing Rock To Form Human Shield Against Police (G.)

US veterans are returning to Standing Rock and pledging to shield indigenous activists from attacks by a militarized police force, another sign that the fight against the Dakota Access pipeline is far from over. Army veterans from across the country have arrived in Cannon Ball, North Dakota, or are currently en route after the news that Donald Trump’s administration has allowed the oil corporation to finish drilling across the Missouri river. The growing group of military veterans could make it harder for police and government officials to try to remove hundreds of activists who remain camped near the construction site and, some hope, could limit use of excessive force by law enforcement during demonstrations. “We are prepared to put our bodies between Native elders and a privatized military force,” said Elizabeth Williams, a 34-year-old Air Force veteran, who arrived at Standing Rock with a group of vets late Friday.

“We’ve stood in the face of fire before. We feel a responsibility to use the skills we have.” It is unclear how many vets may arrive to Standing Rock; some organizers estimate a few dozen are on their way, while other activists are pledging that hundreds could show up in the coming weeks. An estimated 1,000 veterans traveled to Standing Rock in December just as the Obama administration announced it was denying a key permit for the oil company, a huge victory for the tribe. The massive turnout – including a ceremony in which veterans apologized to indigenous people for the long history of US violence against Native Americans – served as a powerful symbol against the $3.7bn pipeline. Since last fall, police have made roughly 700 arrests, at times deploying water cannons, Mace, rubber bullets, teargas, pepper spray and other less-than-lethal weapons.

Private guards for the pipeline have also been accused of violent tactics. “We have the experience of standing in the face of adverse conditions – militarization, hostility, intimidation,” said Julius Page, a 61-year-old veteran staying at the vets camp. Dan Luker, a 66-year-old veteran who visited Standing Rock in December and returned this month, said that for many who fought in Vietnam or the Middle East it was “healing” to help water protectors.“This is the right war, right side,” said Luker, a Vietnam vet from Boston. “Finally, it’s the US military coming on to Sioux land to help, for the first time in history, instead of coming on to Sioux land to kill natives.” Luker said he was prepared to be hit by police ammunition if necessary: “I don’t want to see a 20-something, 30-something untrained person killed by the United States government.”

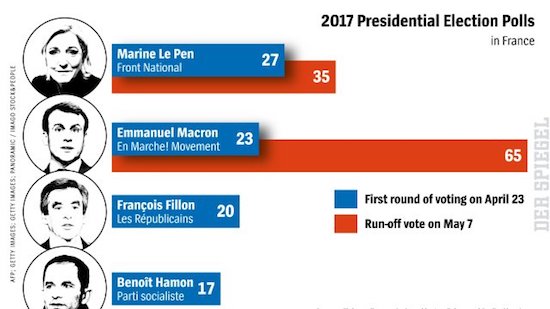

Good overview of what is only 2 months away and could change Europe dramatically. Opinionated, but then that’s Der Spiegel.

• France’s Bumbling Search for a Candidate to Stop Le Pen (Spiegel)

[..] even if Fillon survives as a candidate, he will be so damaged that he has virtually no chance of winning. Last week, in fact, his own party began discussing a “Plan B” so openly that it was almost disrespectful. Juppé is one possible replacement candidate being discussed, but the names of some young conservatives have also been circulating. Regardless, none of these alternatives would be as capable of taking voters away from Marine Le Pen and her project “Marine 2017” as the pre-scandal Fillon would have been. This, of course, is welcome news for Marine Le Pen, who transformed the fascist clique surrounding her father into a modern party, the right-wing populist Front National, with her at the center. Over the weekend, she introduced “140 proposals for France” as she launched the main segment of her campaign.

Yet even as she hits the stump, she is comfortably secure in the knowledge that she has the support of at least one-quarter of the country’s voters no matter what she says and no matter what others might say about her. She has been accused of having systematically misappropriated EU funds for party purposes in the European Parliament. She is no longer able to hide the fact that she is sparring over the direction of the party with her own niece, Marion Maréchal-Le Pen. But it doesn’t matter: Her polling numbers have remained constant at 25%, indicating that it is very likely she will attract enough voters to make it into the second round of voting in the presidential election. The only question is who will be her challenger? Who will become the “lesser of two evils” of this campaign?

Will it be Socialist candidate Hamon, with his foolhardy plan of introducing an unconditional basic income for all French, starting at €600 and later rising to €750? The plan would likely lead to €380 billion in additional annual spending for the French government. Or will it be Emmanuel Macron? There is no doubt that he has the charisma of a leader, but he also has some weaknesses that make him prone to attack, including two that could become particularly dangerous. The first is a resume that is hardly consistent with the image of a young hero shaking up an ossified political system. Macron studied at France’s elite École nationale d’administration (ENA), he’s a wealthy former banker who worked at Rothschild before becoming an adviser to François Hollande. He has long been part of the elite on which he has declared war.

Then there’s Macron’s second problem: With the exception of a relatively refreshing and clear commitment to the EU, at least for a Frenchman, he doesn’t have much of a platform. He has said he will announce his plans in late February, once his movement’s hundreds of thousands of volunteers, organized in working groups across the country, assemble policy proposals on diverse issues. If this operation is successful and Macron does indeed produce a coherent political platform, it will represent yet another grassroots miracle for France. But is such a thing even possible? Can a new political course -neither left nor right, but simply correct and good- really be formulated by the masses? There is plenty of hope surrounding Macron, but mockery is never far away. A French comedian could be heard last week on the radio, still an important opinion-shaping media in France, saying that washing machines have more programs than Macron.

Recent polls showed him pulling in 23% of the vote. Leftist Jean-Luc Mélenchon, a man who thinks quite highly of himself and his ideas, stands at around 10%. Mélenchon is promising to allow people to retire at the age of 60 and draw full pension benefits and is calling for a monthly minimum wage of 1,300 euros. He wants France and the European Union to recognize Palestine as a state, he is calling for France to withdraw from NATO and is demanding the renegotiation of the EU treaties. Next.

Someday some fool will actually execute some of these schemes. Why stop the causes if you can play God?

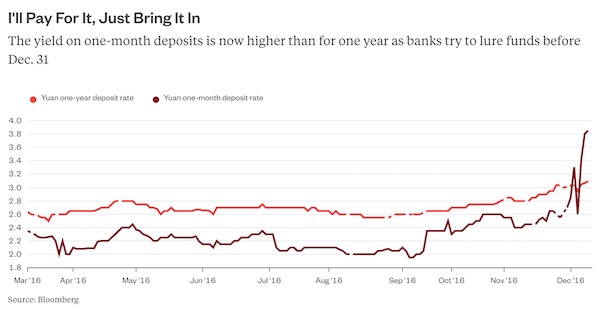

• A $500 Billion Plan To Refreeze The Arctic Before The Ice Melts (G.)

Physicist Steven Desch has come up with a novel solution to the problems that now beset the Arctic. He and a team of colleagues from Arizona State University want to replenish the region’s shrinking sea ice – by building 10 million wind-powered pumps over the Arctic ice cap. In winter, these would be used to pump water to the surface of the ice where it would freeze, thickening the cap. The pumps could add an extra metre of sea ice to the Arctic’s current layer, Desch argues. The current cap rarely exceeds 2-3 metres in thickness and is being eroded constantly as the planet succumbs to climate change. “Thicker ice would mean longer-lasting ice. In turn, that would mean the danger of all sea ice disappearing from the Arctic in summer would be reduced significantly,” Desch told the Observer.

Desch and his team have put forward the scheme in a paper that has just been published in Earth’s Future, the journal of the American Geophysical Union, and have worked out a price tag for the project: $500bn. It is an astonishing sum. However, it is the kind of outlay that may become necessary if we want to halt the calamity that faces the Arctic, says Desch, who, like many other scientists, has become alarmed at temperature change in the region. They say that it is now warming twice as fast as their climate models predicted only a few years ago and argue that the 2015 Paris agreement to limit global warming will be insufficient to prevent the region’s sea ice disappearing completely in summer, possibly by 2030. “Our only strategy at present seems to be to tell people to stop burning fossil fuels,” says Desch. “It’s a good idea but it is going to need a lot more than that to stop the Arctic’s sea ice from disappearing.”