Lewis Wickes Hine Newsies Gus Hodges, 11, and brother Julius, 5, Norfolk VA 1911

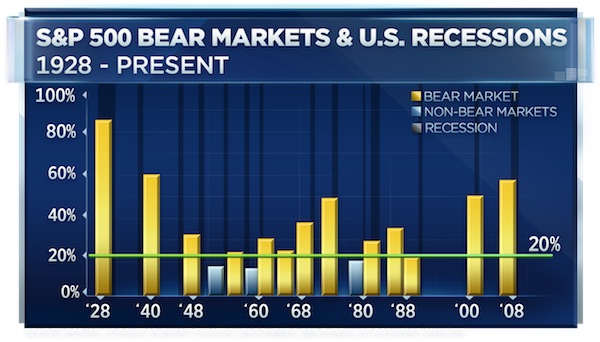

Prime candidate for biggest 2017 finance story.

• Trump-Powered Dollar To Be The Bogeyman Of 2017 For Emerging Markets (MW)

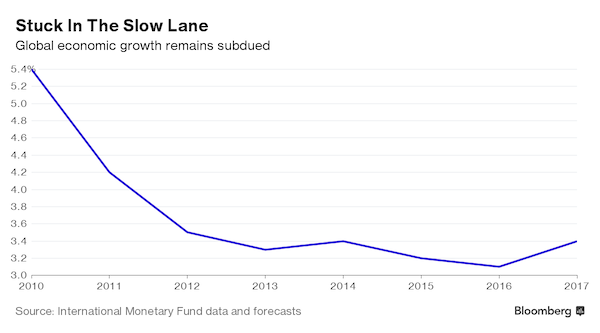

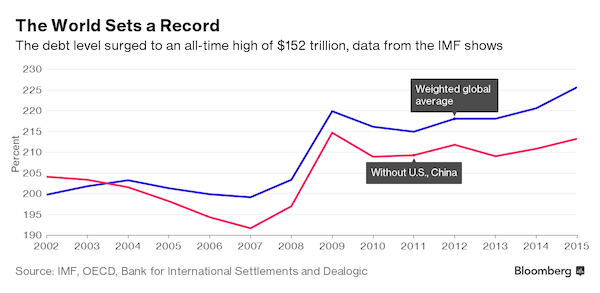

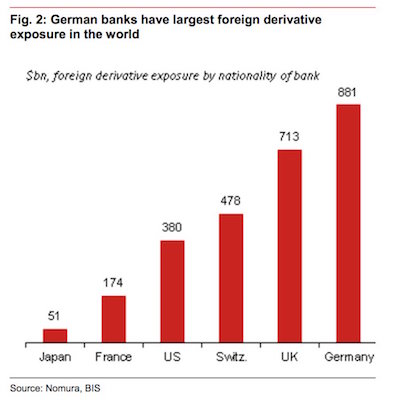

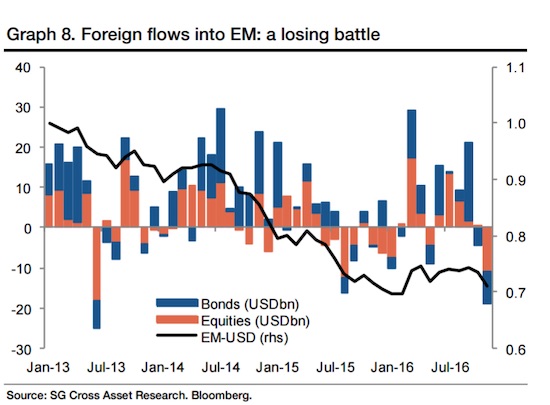

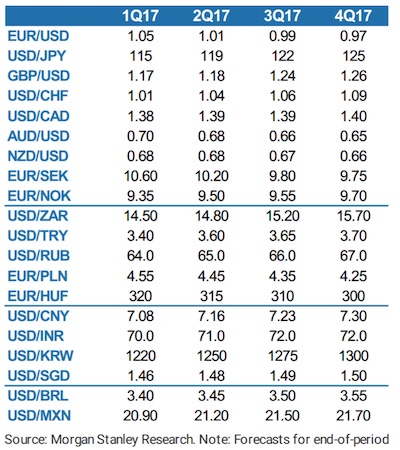

Foretelling the future is a daunting task. But the one thing that strategists are agreed on for 2017 is that Donald Trump’s presidency will usher in a new era of dominance for the U.S. dollar that will have wide-ranging implications. Among the biggest casualties of the buck’s rise will be developing economies, which tend to be more sensitive to external shock. Ethan Harris at BofAML cautioned that emerging markets are vulnerable on two fronts: capital outflows in response to higher rates in the U.S. and trade restrictions that will hurt economies that heavily depend on U.S. markets. The ICE U.S. Dollar index measure of the greenback’s performance against a basket of six rivals, has recently broken out of its narrow range to trade at the highest level since late 2002, FactSet data show.

That spells trouble for Brazil, China and Russia, which statistically have the highest negative correlation to the dollar, according to Mislav Matejka, an equity strategist at J.P. Morgan Cazenove. Even before Trump’s election, Matejka had downgraded emerging markets to neutral from overweight, citing the bullish dollar on the back of a Federal Reserve rate hike in December. Hans Redeker, a strategist at Morgan Stanley, expects the dollar index to gain 6% before topping out in the second quarter of 2018. Apart from the rallying dollar, Redeker warned that the possibility of a global shift toward protectionism will put trade-centric economies at a disadvantage, weigh on economic growth and add to deflationary pressure.

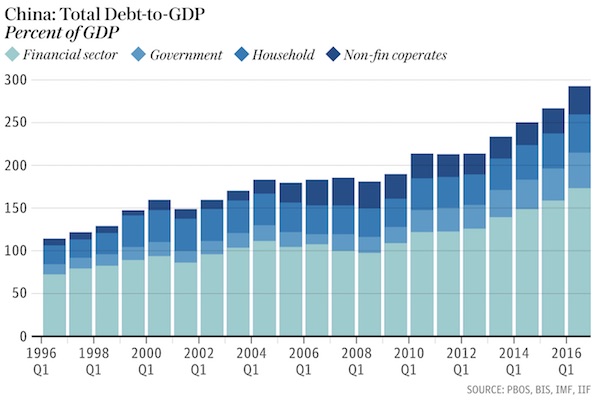

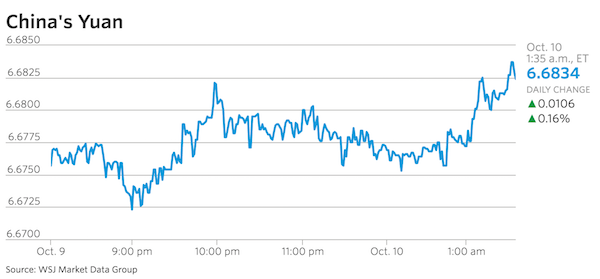

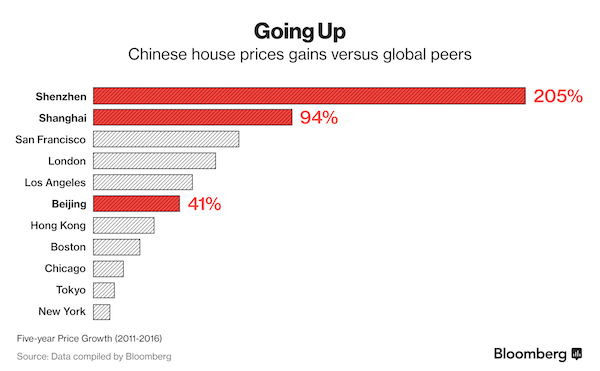

Meanwhile, higher bond yields on expectations of stronger growth and accelerated inflation will widen the yield spread in favor of the dollar against the Chinese yuan, where authorities are projected to maintain easy monetary policy. The yuan has retreated over 6% in 2016 to 6.92, with more room to fall in the coming months. “We expect the Chinese yuan depreciation to continue. The balance of payments position remains in deficit, indicated by declining foreign exchange reserves,” said Redeker in a report. Even though capital outflows from China have not been as large as they had been earlier this year, muted economic growth and limited investment opportunities domestically could lead to more funds fleeing the country, pressuring the yuan, he said.

Headfake.

• Oil Prices Moderate as Doubts Over OPEC’s Output-Cut Plan Set In (WSJ)

Crude-oil prices lost steam in early Asian trade Tuesday as investors turned bearish over oil producers’ commitment to observe a deal aimed at easing supply to the market. On the New York Mercantile Exchange, light, sweet crude futures for delivery in January traded at $52.75 a barrel at 0347 GMT, down $0.08 in the Globex electronic session. February Brent crude on London’s ICE Futures exchange rose $0.01 to $55.70 a barrel. The price fall is largely a reflection of investors’ bearishness over a deal that is supposed to lift prices to at least the $60-$70 range per barrel. This shows the market isn’t really buying the OPEC rhetoric and that they recognize the potential risks. Over the weekend, 11 non-OPEC countries, including Russia, agreed to slash their output by 558,000 barrels a day, in concert with OPEC’s own pledge to cut 1.2 million barrels a day.

The total sum represents almost 2% of global supply. The deal will take effect on Jan. 1 but the reduction will be carried out in phases. Participating countries will meet in six months to evaluate progress. Analysts say if producers fully adhere to agreed quotas, the oil market could shift into a deficit. OPEC’s own calculations forecasts world crude demand will hit 95.5 million barrels a day in 2017, an increase of 1.2 million barrels a day. Removing excess barrels will lift prices, possibly into the target range of $60-$70 per barrel, but it would mostly hinge on the compliance of the producers who have been known to cheat, BMI Research said. “We note that the higher the barrel price, the greater the temptation to break allocated quotas,” the firm said. In 17 production cuts since 1982, OPEC members have reduced output by an average of just 60% of their commitments, according to Goldman Sachs.

OPEC cuts, prices rise, shale expands.

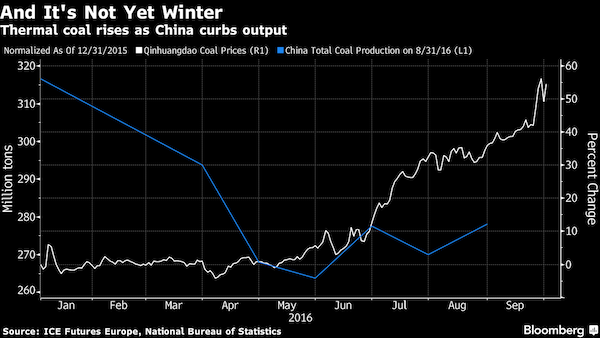

• Saudi Arabia Is Playing Defense To Hold On To Its Most Prized Customers (BBG)

As Saudi Arabia goes on a shock and awe attack to curb a global oil glut, it’s also playing defense to hold on to its most prized customers. The kingdom is largely sparing Asia from reductions in crude sales, at least for now. That’s amid the threat of more U.S. and European supply coming to the world’s biggest market, as Saudi-led production cuts have boosted the Middle East oil benchmark relative to other regions. Also, crude’s surge risks reviving shale output while American shipments are already making their way to countries including Thailand, Japan and South Korea. While OPEC’s biggest member could yet curb some volumes to Asia in coming months, it’s unlikely to completely abandon the battle for market share even as it changes tack from its pump-at-will policy of the past two years.

It’s counting on regional refiners’ inability to completely switch over to rival supply, as their plants are geared to process ‘sour’ sulfurous crudes like those produced by Saudi Arabia rather than ‘sweet’ shale or North Sea oil. It can afford to cut sales more significantly in other places that aren’t as valuable as Asia. “Now that Saudi Arabia has committed to such large production cuts, it’s important for them to retain market share in the region where they see the most growth potential,” said Peter Lee at BMI Research. “In Asia, we still have India and China where Saudi Arabia is vying for market share. It makes sense for them to concentrate on the region and try to keep buyers happy.”

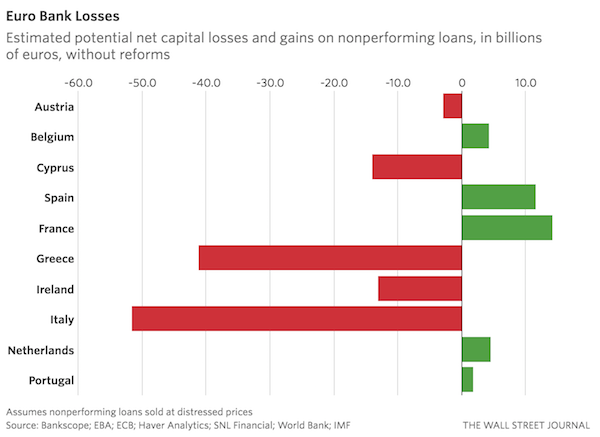

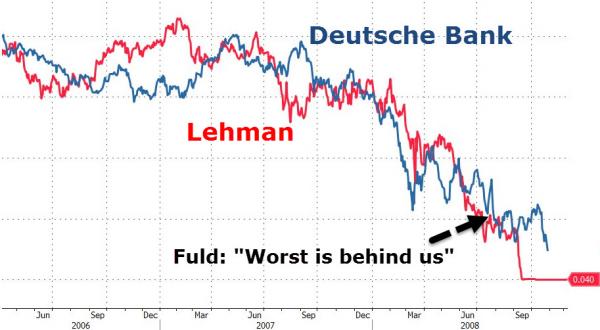

UniCredit’s entire market cap is €14 billion for pete’s sake.

• UniCredit To Raise €13 Billion In Fresh Capital, Lay Off 14,000 (AFP)

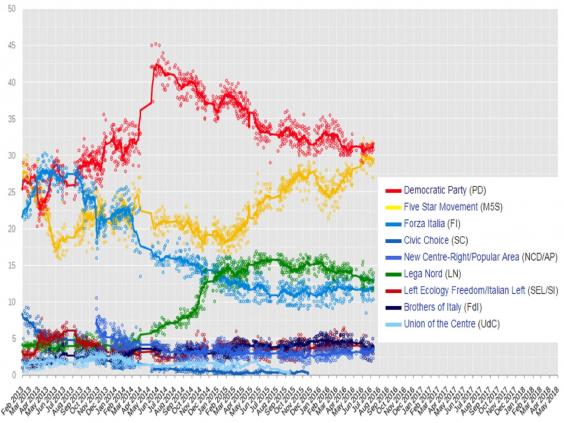

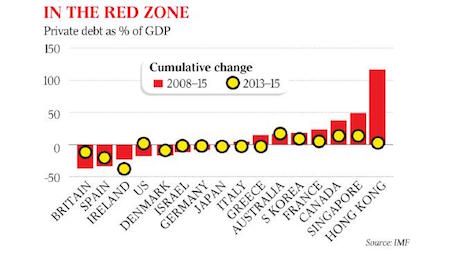

Italy’s biggest bank, UniCredit, on Tuesday confirmed plans for a capital increase worth €13 billion as it scrambles to raise funds amid market uncertainty. UniCredit also announced plans to shed around 14,000 jobs by the end of 2019, which it said would save it €1.1 billion in staff costs. The bank’s plans to raise fresh funds come at a time when investor confidence in Italy has been shaken by the collapse of former PM Renzi’s government. And the Italian banking sector is in a perilous state, with the world’s oldest bank, Monte dei Paschi di Siena, scrambling to put together a private-sector rescue after losing 80% of its market capitalisation in the past year. UniCredit’s announcement was part of a major strategic review launched under new chairman Jean-Pierre Mustier, that involves selling off assets to strengthen the bank’s capital base. Mustier said it was a “pragmatic plan based on conservative assumptions, with tangible and achievable targets.” The bank is targeting a net profit of €4.7 billion in 2019.

When Europe’s bankers and politicians alike proved they’re inept.

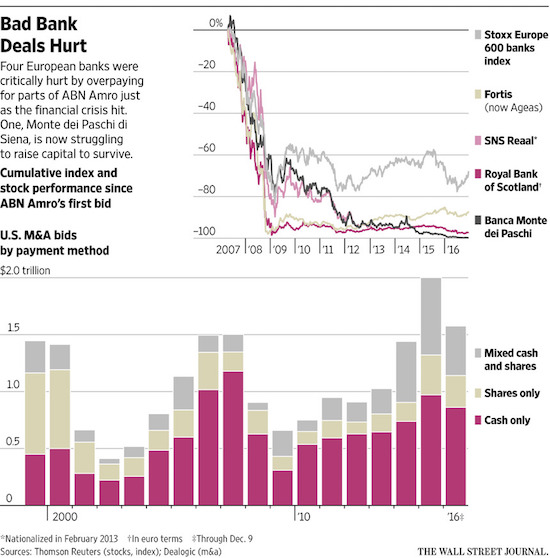

• One Bad Deal That Destroyed Four Bad Banks (WSJ)

The crisis engulfing the world’s oldest bank, Italy’s Banca Monte dei Paschi di Siena, has many causes, but its roots go back nine years to a lunch at a fancy Geneva hotel. It was there, at the Four Seasons Hotel des Bergues, that three of Europe’s top bankers gathered to plot a hostile bid to buy and break up Dutch bank ABN Amro in what became the biggest bank takeover, worth €71 billion (then $101 billion). The deal will go down as one of humankind’s worst business transactions. It led to government rescues of what was then the biggest bank in the world, Royal Bank of Scotland, and the biggest bank in Belgium, Fortis, as well as taking out Dutch bank SNS Reaal. Now its legacy threatens the oldest bank in the world.

With M&A booming again, have investors learned the lessons of ABN? The brief answer is probably that yes, enough of the lessons have sunk in that an equally catastrophic bank takeover is unlikely soon. The longer answer is a resounding no, and investors retain a pigheaded inability to avoid taking excessive risks when the good times beckon—as they do now. The Michelin-starred restaurant in Geneva gave the chief executives of RBS, Fortis and Santander a pleasant start to what became a vicious 2007 bidding battle for ABN. The weak Dutch bank had been an obvious target for years, with a complex string of small businesses spread across retail and investment banking in the Netherlands, U.S., U.K., Italy and Brazil. Each banker saw opportunities, but they had to wrest ABN away from an agreed deal with Barclays.

After succeeding, the canny Santander abandoned its stated aim of expanding in Italy and flipped ABN’s Banca Antonveneta to Monte dei Paschi for €9 billion—before it had even completed the deal. Santander was badly hurt by the crisis, but thanks to its highly profitable Italian switcheroo was the only bank involved not to be critically injured by ABN. Monte dei Paschi, after overpaying wildly, has been short of capital ever since, making it even harder to cope with years of Italian recessions. The biggest lesson is that the good times don’t last forever. RBS, Fortis and Monte dei Paschi took on too much debt to buy parts of ABN, leaving them even weaker than the rest of the overstretched banking system when the bust came.

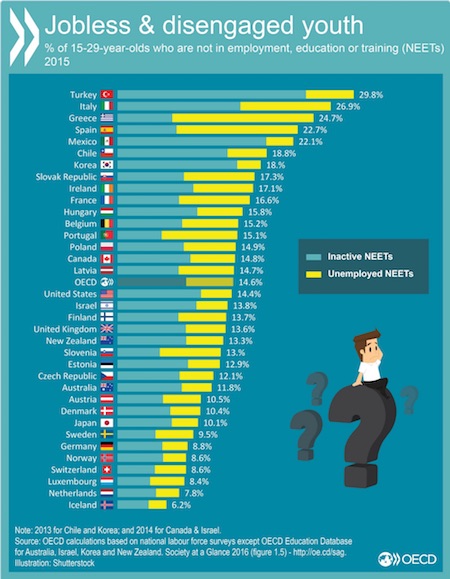

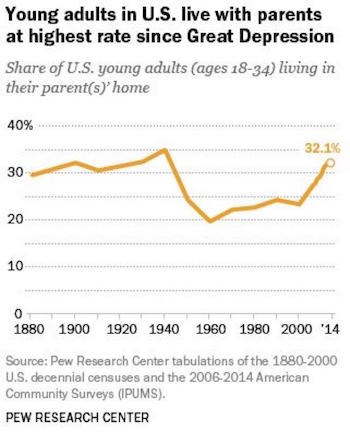

Throw in utter corruption and you have a recipe for unrest.

• Indian Banks’ Poisoned Chalice (BBG)

What should have been a cornucopia of new deposits from old cash has become a poisoned chalice. Lenders don’t have enough banknotes to meet even the restrictive withdrawal limits the central bank has set for depositors. People have died waiting in ATM queues, and bank staff fear the wrath of crowds. Safety concerns are rising amid pressure from authorities to expand card and online-payment systems that are still rudimentary. Even the ATM networks, running on outdated software, aren’t very secure.To top it all, the taxman is waiting in the wings, ready to confiscate any unusual surge in deposits that people don’t surrender voluntarily. Instead of sympathy for lenders, there’s schadenfreude. Some feel bank employees have colluded with the holders of ill-gotten cash to give their unaccounted wealth safe passage. The poor, and their bank accounts, are suspected to have been used as mules.

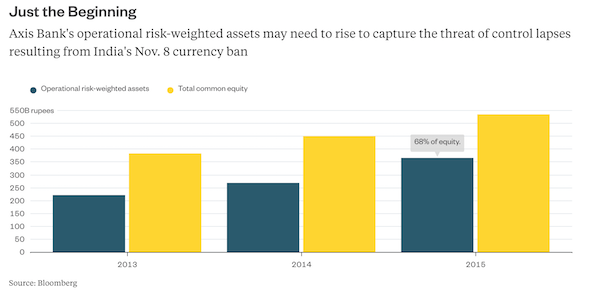

The initial premise of demonetization was that a big chunk of cash would be too tainted to dare return to the banking system, and canceling those liabilities would generate a bumper profit for the government. With most old currency deposited into accounts or exchanged into new money, however, that hypothesis has been shredded. Banks – and bankers – are in the crosshairs for robbing the nation of its demonetization rewards. Reporting requirements have gone through the roof: The government wants to know how much of lenders’ fresh deposits are old legal tender, and how much is new. Axis Bank suspended 19 employees for allegedly exchanging old banknotes illegally and asked KPMG to do a forensic audit. That, one suspects, is the genesis of the whisper campaign.

As banking regulator, the Reserve Bank of India ought to be keeping a lid on operational risks, lest they overwhelm the system and scar its reputation. But the monetary authority is too busy shoring up its own sullied credibility to be of any real assistance. The barrage of befuddling rule changes it has unleashed since Nov. 8 – including a temporary but ham-handed confiscation of banks’ excess liquidity with no compensation – have made things worse, and investors have been forced to change their minds about the impact of the cash ban. Amid the chaos, discussions about improving the governance of India’s dominant state-run banks, and selling or shuttering the weakest of them, have come to a standstill.

The more urgent task of cleaning up their compromised balance sheets has also lost the steam it had gathered under previous RBI Governor Raghuram Rajan. If a month ago there was fond but foolish hope that banks would get a big one-time recapitalization boost, now there’s despair about how long they can go on fighting fires without any chance of a revival in credit demand. It’s hard to believe PM Modi didn’t think through these unintended consequences. What’s even scarier is the possibility that he did, and topped up the banking industry’s chalice regardless.

No, their best.

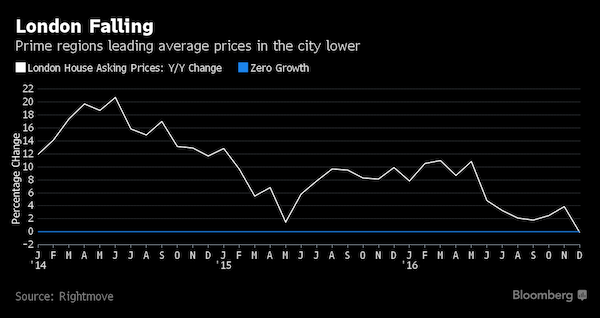

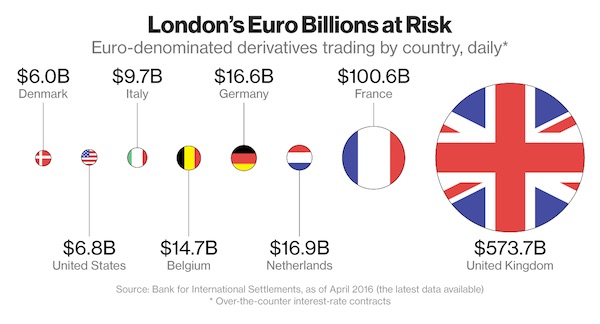

• London House Prices Are Having Their Worst December in Years (BBG)

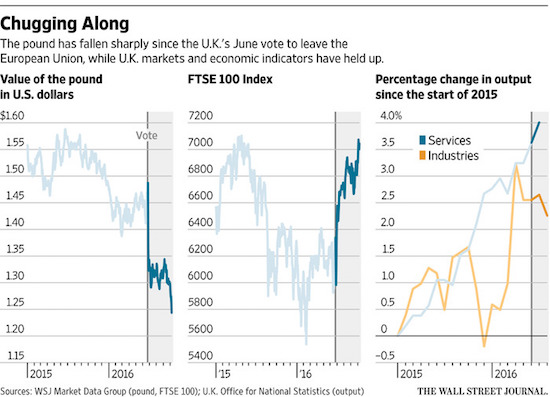

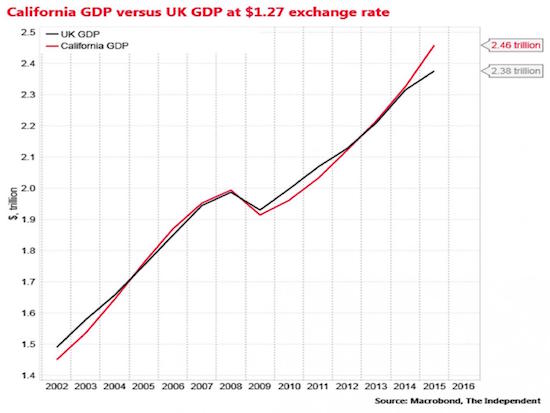

London home prices are having their worst December in six years, led by weakness in prime areas in the capital that is likely persist into 2017. Rightmove said on Monday that asking prices fell 4.3% from November to 616,160 pounds ($775,500), with inner London dropping 6%. The property website operator said the bubble in prime London “continues to deflate,” and it sees prices there declining 5% next year. “Alongside the seasonal slowdown, the readjustment of prices to match buyers’ greater reticence continues, especially in more expensive inner London,” said Rightmove Director Miles Shipside. “Buyers are being put off the really big-ticket purchases.” In a sign of the disparity within the city, average prices in inner London are down 2.6% over the past year, whereas outer areas are up 2.7%.

That left average prices across the capital little changed. The split partly reflects the luxury end of the market, where an April tax increase on property investors and worries about Brexit are sapping demand. Rightmove’s report also showed demand in London — as measured by sales agreements – was down 7.2% in November from a year earlier. Nationally, asking prices fell 2.1% in December from the previous month, in line with the seasonal average, and were up 3.4% from a year earlier. In contrast to London, Rightmove expects national prices to increase for a seventh consecutive year in 2017, forecasting a 2% advance.

One spark will do.

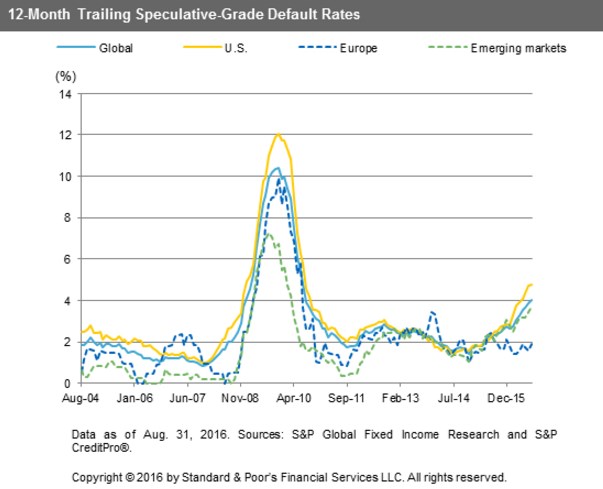

In 1871, a large portion of the city of Chicago burned to the ground. The Chicago Tribune attributed the fire to a cow owned by a Mrs. O’Leary. The Tribune stated that the cow kicked over a lantern as she was being milked, burning the barn and much of Chicago. Whether the story is accurate is of little concern. (Somebody always has to be found to take the blame for catastrophe.) Whatever started the barn fire in Mrs. O’Leary’s neighbourhood, a seemingly minor event resulted in a major conflagration. And so it is with economic events. Bankers are expected to maintain a fractional reserve of 3–10%, depending on the level and type of liabilities, but, not surprisingly, they often drop below the official level, especially in times of economic difficulties. Bank managers assume that they can always increase the reserve when good times return.

The trouble is they’re at their most exposed at a time when a substantial reserve is most critical. But why would bankers take such a risk? Aren’t they fearful that they’ll get caught out if a crisis occurs? Not really. Their assumption is very often that their indiscretion exists in isolation. They assume that if they alone cheat the system a bit, they can always catch up later. For whatever reason, it rarely occurs to them that, in a struggling economy, each of their associates in the industry is also cheating the system. Since each one keeps his activities under wraps, it doesn’t become apparent that the whole system is a house of cards until a black swan jolts the system, which, due to its overall instability, self-destructs. Similarly, in shaky economic times, there’s quite a bit of fiddling that’s done in the stock market.

As the public begins to lose their confidence in the system, they offers their shares for sale. In order to cover up the loss of confidence, these shares may be bought up by central banks, governments, and/or the corporations themselves – buying back their own shares. Of course, this is risky, as crashes are caused by loss of confidence. Papering over that loss of confidence by papering over the cause of the problem only means that when the crash comes, it will be worse than if it had been allowed to collapse earlier. Pensions tend to be heavily invested in the markets, which tends to put them at risk as well. The foremost mutual fund in the US is invested in 507 companies – commodities, energy, financials, industrials, IT, etc. To be sure, these will not suffer equally in a crash, but all will be affected – some severely.

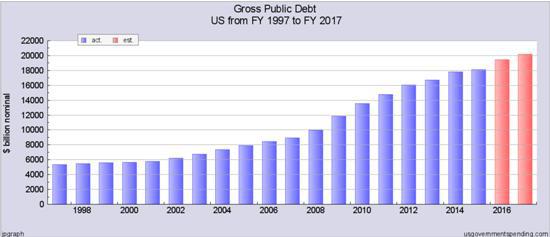

Trump may have buildings, but he has no room.

• Trumpxuberance… Until It’s Not (Jim Kunstler)

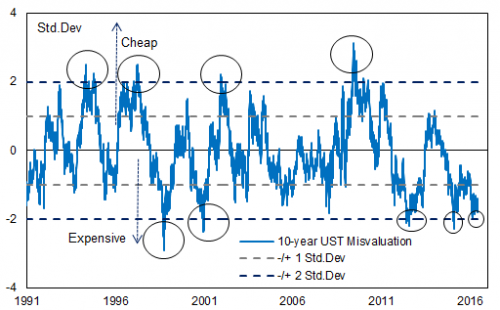

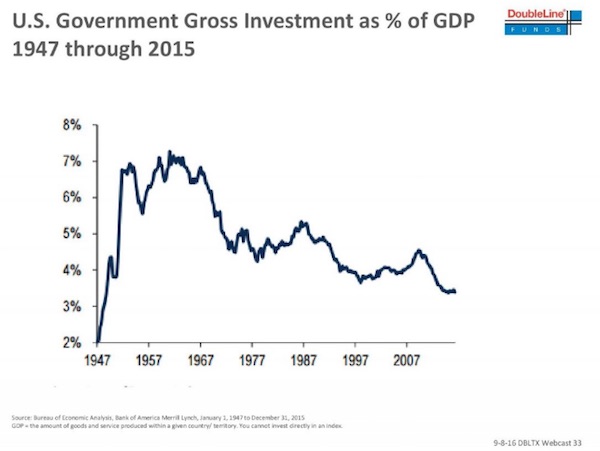

When Reagan stepped in the national debt was only (only!) about half a trillion dollars. It will be over $20 trillion when Trump hangs his golden logo on the White House portico. Oh, by the way, consider that a trillion dollars is a thousand billion dollars and a billion dollars is a thousand million dollars. Just so you know. Reagan had room for plenty of government finance monkey business. Trump has no room. Bush One, Clinton, Bush Two and Obama dug the deadfall debt trap for poor Donald and the election shoved him right into it. He thinks he’s on an upper floor of his enchanted tower; he’s actually down in a pit. Trump thinks he’s going to rebuild highways and bridges for another century of Happy Motoring — to make America like it was in 1962 forever. Fuggeddabowdit.

The bond market is poised for collapse as I write, and Trump’s money people (that is, the Goldman Sachs gang he has assembled) are talking about issuing fifty and 100 year “Build America” bonds. Their nostrils must be rimed with the frost of Medellin. They’re certainly not going to accomplish this trick by raising taxes. On who? Corporations? Ha! The 1%? Double-Ha! Everyone else? Pitchforks and torches! American oil companies can no longer make a buck doing their thing. Exxon-Mobil’s U.S. production business lost $477 million in the third quarter, the seventh straight quarter in the red. Why? Because it costs a lot more to get the stuff out of the ground than it did ten years ago, and that high cost is bankrupting oil companies and industrial economies. That is the stealth action of Peak Oil that so many people pretend is not happening. It will ultimately destroy the banking system.

The disappointment issuing from this dire set of circumstances is apt to be epic as Trump flounders and the furious tweets of futility waft out of the hole he’s trapped in. Christmas will be over, and with it the hopes of a retail reprieve. Gasoline may remain cheap, but the little people won’t be able to buy the cars to run it in. Or buy much of anything else. Not even tattoos. We’ll soon discover the temperamental difference between Donald J. Trump and Franklin Delano Roosevelt.

This will not stop.

• Greece Faces Permanent Crisis – IMF: Bail-Out Plan ‘Simply Not Credible’ (Tel.)

The IMF has hit back at claims that it is demanding more austerity in Greece, as the Fund warned that the country’s ambitious budget targets were “simply not credible”. Firing a broadside at Brussels and Athens, Maurice Obstfeld, the IMF’s chief economist, and Poul Thomsen, director of the IMF’s European department, said cuts to investment and discretionary spending had “gone too far” and would prevent the Greek economy from recovering. Just 48 hours after Euclid Tsakalotos, Greece’s finance minister, accused the IMF of “betraying” the country by pushing for more belt tightening, the senior IMF officials insisted that they were “not demanding more austerity”. “We have not changed our view that Greece does not need more austerity at this time. Claiming that it is the IMF who is calling for this turns the truth upside down,” they wrote in a blog post.

They warned that demands by Greece’s creditors for a sustained 3.5pc primary surplus – which excludes debt servicing costs – were unrealistic and unnecessary. The IMF has previously insisted that a primary surplus target of 1.5pc of GDP is more realistic. It has also called for significant debt relief that goes beyond the action taken this month to reduce Greece’s debt share by 20 percentage points. Mr Obstfeld and Mr Thomsen said the IMF was not demanding more cuts either now or in the future to lower the need for debt relief, as they signalled that Greece itself had signed up for tougher budget targets. “To be more direct, if Greece agrees with its European partners on ambitious fiscal targets, don’t criticise the IMF for being the ones insisting on austerity when we ask to see the measures required to make such targets credible,” they said.

Tsipras is going to call 2017 snap elections with the intent of losing them.

• Greece Heads Toward New Crisis in Debt Saga, Support for Tsipras Slumps (WSJ)

Greece’s crisis is approaching a potential breaking point after a year of relative calm, as a government with declining political stamina confronts creditors’ unyielding demands. The ruling left-wing Syriza party, grappling with slumping popularity, is considering the option of calling snap elections in 2017, as it loses hope of winning concessions on debt relief or austerity from the eurozone and IMF. No decision for elections has been made, said Greek officials, who added that they would review the state of negotiations in January, after pressing creditors again to show more flexibility. Elections would allow Syriza—if not Greece—to escape from the pressures of an unpopular bailout program whose strained math has eventually brought down every Greek government since the crisis began in 2009.

Syriza’s leader and Prime Minister Alexis Tsipras, like his predecessors, is struggling to meet strict fiscal targets in a recession-scarred country weary of austerity. A renewed flare-up of the Greek debt crisis in 2017 would create a further test for the cohesion of the EU, whose political establishment is facing challenges from EU-skeptic populists in a string of major elections next year. European governments’ appetite for another bout of Greek drama is low—but so too is willingness to grant Athens concessions to avoid one. The embattled Mr. Tsipras, who is due to hold talks with the leaders of Germany and France in the coming days, surprised Greeks and creditors last week with fiscal gifts that were widely seen as preparing the option of elections.

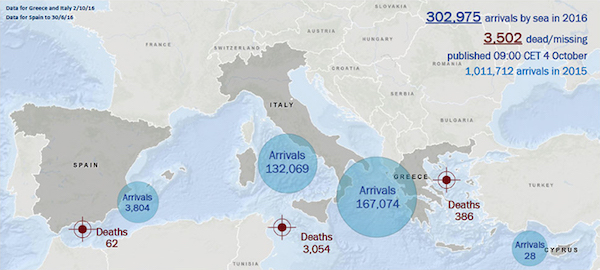

He promised 1.6 million pensioners a Christmas bonus of between €300 and €800. He also suspended a planned increase in sales tax for Aegean islands that have received large numbers of Middle-East refugees. EU officials said they would study whether Mr. Tsipras’s promises are compatible with Greece’s bailout commitments.

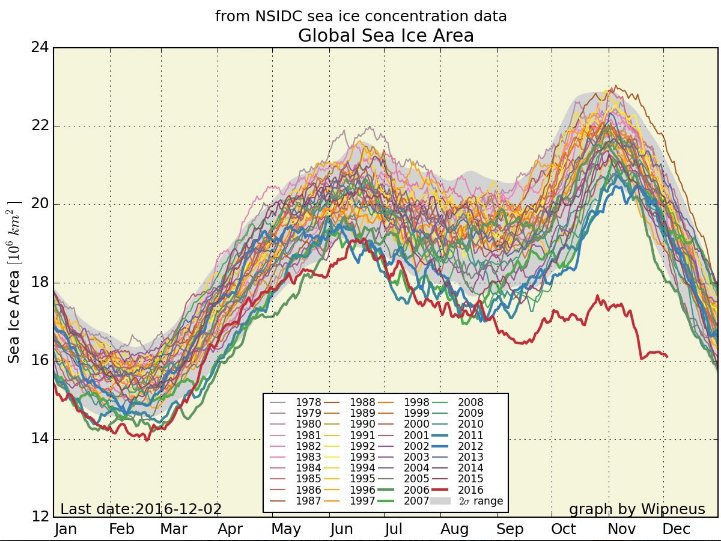

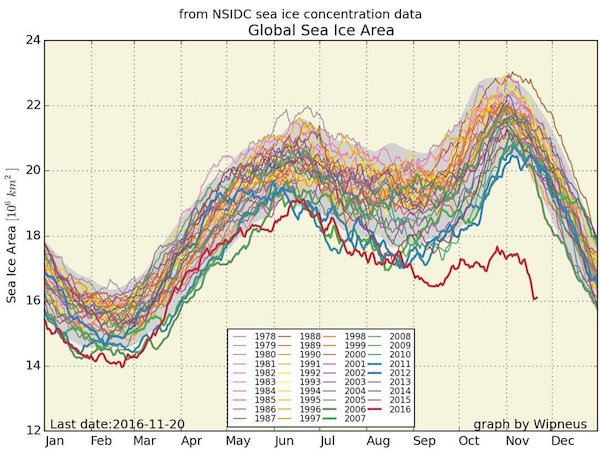

It all dies baby, that’s a fact. We’re not even trying to stop it from happening. All we got is words.

• World’s Largest Reindeer Herd Plummets (BBG)

The world’s largest wild reindeer herd has fallen by 40% since 2000, scientists have warned. They say that the animals, which live in the Taimyr Peninsula in the northernmost tip of Russia, are being affected by rising temperatures and human activity. This is causing the animals to change their annual migration patterns. The research has been presented at the Fall Meeting of the American Geophysical Union (AGU). “There is a substantial decline – and we are also seeing this with other wild reindeer declining rapidly in other parts of the world,” said Andrey Petrov, who runs the Arctic Centre at the University of Northern Iowa, US. The Taimyr herd is one of the most monitored groups of reindeer in the world. The animals have been tracked for nearly 50 years by aerial surveys and more recently by satellite imagery.

The population reached a peak of one million in 2000, but this latest research suggests that there are now only 600,000 reindeer. “Climate change is at least one of the variables,” explained Prof Petrov. “We know in the last two decades that we have had an increase in temperatures of about 1.5C overall. And that definitely impacts migration patterns.” Industrial development is increasing in the region, which is also changing the animals’ distribution. The researchers found that in the summer, the reindeer were moving east to avoid human activity. But they were also shifting north and to higher elevations. The team thinks this is to try to get to cooler ground and also to avoid the mosquitoes that are booming as the region gets warmer and wetter.

“They just move and move and move to escape them,” said Prof Petrov. This is extending the distance that the animals have to migrate between winter and summer. “They now have to travel much longer distances to reach those areas with their newborn calves, and that means there is an increase in calf mortality.”