Jacques-Louis David Coronation of Napoleon in 1804 in Nôtre-Dame Cathedral 1805-7 (10 metres wide, 6 metres tall)

The financial crisis is 11-12 years old. But the deception is brilliant: everybody thinks it’s over.

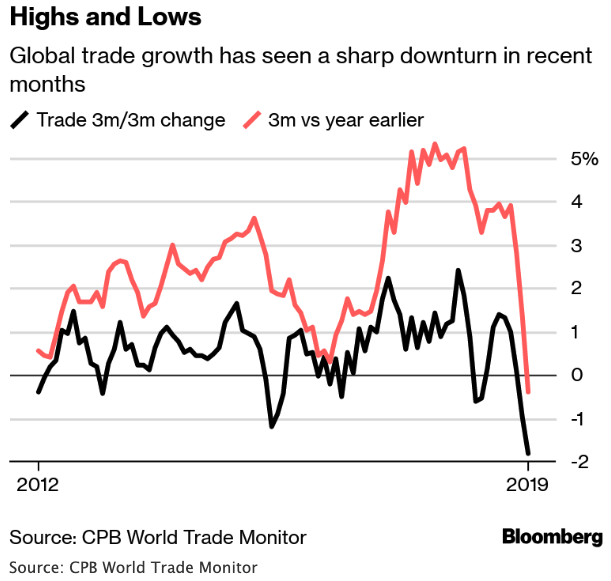

• World Trade Suffers Biggest Collapse Since Financial Crisis (ZH)

The recent collapse in world trade volume is the worst since the financial crisis and as dangerous as during the dot-com bubble of the early 2000s, according to The Telegraph. Data from the CPB Netherlands Bureau for Economic Policy Analysis revealed that world trade volume dropped 1.8% in the three months to January compared to the preceding three months as a synchronized global downturn gained momentum. “An industrial slump has been triggered by a perfect storm of factors, including China’s slowdown, the car industry downturn, Brexit paralysis and Donald Trump’s attempt to upend the international trade system with tariffs on European and Chinese goods,” explained The Telegraph.

A further escalation of the trade war between the U.S. and China could spark a world trade recession. Already, Washington has imposed steep tariffs on Chinese imports worth $250bn in a tit-for-tat battle with industrial centers in Asia and Germany experiencing sharp drops in trade in recent months. The Telegraph describes the sudden loss in trade momentum is equivalent to the months after the dot com bubble imploded in 2001 when trade volumes sank as much as 2.2%. Today’s current move is the biggest fall since the financial crisis of 2007–2008 when global trade plummeted, diving as much as 12.7%. The IMF warned last week that this is a “delicate moment” for the global economy as many countries are in the midst of a severe slowdown.

“We” are losing to Iran all over again.

• Iran Parliament Declares US Central Command A ‘Terrorist Organization’ (RT)

The US Central Command (CENTCOM) has been designated as a “terrorist organization” by the Iranian parliament, in a mirror response to Washington’s blacklisting of Tehran’s Revolutionary Guard. All organizations, institutions and forces under CENTCOM command were acknowledged to be “terrorists” by the overwhelming majority of the Iranian MPs, who approved the contents of the bill, which also condemns the US move to blacklist the IRGC, an official military branch of the Islamic Republic of Iran’s Armed Forces. “The Islamic Republic of Iran’s government and Armed Forces are required to adopt preventive actions and preemptive defensive measures whenever necessary, to deter any hostile US forces’ use of any possibilities against the Islamic Republic of Iran’s interests,” the bill states, according to Fars news.

Anyone offering military, intelligence, financial, or any other support to CENTCOM and its affiliate forces will be considered supporters of terrorism. The 13-article legislation also mandates the general staff to begin gathering intelligence about CENTCOM activities so that the material can be used in Iranian courts to prosecute specific individuals. The bill, however, does not mention the exact mechanisms through which Americans are expected to be brought to justice under Iranian laws. Last week the US, for the first time ever, designated an official foreign military institution –the IRGC– as a terrorist organization, as tensions between the states were pushed to the limit following President Donald Trump’s unilateral withdrawal from the Iranian Nuclear deal (JCPOA) and the reintroduction of sanctions that followed.

Ducks and babies. We kid you not.

• CIA Director Used Fake Skripal Incident Photos To Manipulate Trump (MoA)

An ass kissing portrait of Gina Haspel, torture queen and director of the CIA, reveals that she lied to Trump to push for more aggression against Russia. In March 2018 the British government asserted, without providing any evidence, that the alleged ‘Novichok’ poisoning of Sergej and Yulia Skripal was the fault of Russia. It urged its allies to expel Russian officials from their countries. The U.S. alone expelled 60 Russian officials. Trump was furious when he learned that EU countries expelled less than 60 in total. The expulsion marked a turn in the Trump administration’s relation with Russia: “The incident reflects a tension at the core of the Trump administration s increasingly hard-nosed stance on Russia: The president instinctually opposes many of the punitive measures pushed by his Cabinet that have crippled his ability to forge a close relationship with Russian President Vladimir Putin. “

Today the New York Times portraits Gina Haspel’s relation with Trump. The writers seem sympathetic to her and the CIA’s position. They include an anecdote of the Skripal expulsion decision that is supposed to let her shine in a good light. But it only proves that the CIA manipulated the president for its own purpose: “Last March, top national security officials gathered inside the White House to discuss with Mr. Trump how to respond to the nerve agent attack in Britain on Sergei V. Skripal, the former Russian intelligence agent. London was pushing for the White House to expel dozens of suspected Russian operatives, but Mr. Trump was skeptical. …

[..] During the discussion, Ms. Haspel, then deputy C.I.A. director, turned toward Mr. Trump. She outlined possible responses in a quiet but firm voice, then leaned forward and told the president that the strong option was to expel 60 diplomats. Ms. Haspel showed pictures the British government had supplied her of young children hospitalized after being sickened by the Novichok nerve agent that poisoned the Skripals. She then showed a photograph of ducks that British officials said were inadvertently killed by the sloppy work of the Russian operatives. Ms Haspel was not the first to use emotional images to appeal to the president, but pairing it with her hard-nosed realism proved effective: Mr. Trump fixated on the pictures of the sickened children and the dead ducks. At the end of the briefing, he embraced the strong option.

Can we throw in Pol Pot next? I’ll see your Bin Laden and raise you a Stalin.

• Affidavit Tries To Put WikiLeaks In Cahoots With The Taliban (ZH)

The document uses maximal and hyped language to describe “one of the largest compromises of classified information in the history of the United States,” yet struggles to ascertain whether “illegal agreement that Assange and Manning reached” specifically led to the release of the document trove (obviously crucial for charges against Assange to hold up). Concerning a potential extradition to the US, “probable cause” is cited to be the hundreds of messages sent between Manning and Assange on the Jabber platform. The argument is that Assange and Manning understood that it “would cause injury to the United States,” especially with US forces active on the ground in Afghanistan.

But on this point of whether the leaks did actual harm and damage to US efforts, the document is left reaching, trying to spin and insinuate a narrative that puts WikiLeaks and terrorist groups like the Taliban and al-Qaeda in cahoots. It starts by claiming that “after the release of the Afghanistan War Reports, a member of the Taliban contacted the New York Times.” The supposed Taliban member said, “We are studying the report… If they are US spies, then we will know how to punish them.” This strange and somewhat comical example is meant to support the notion that Assange ultimately aided America’s enemies with the leaks. [..] Worse, the affidavit makes Osama bin Laden — killed in a 2011 raid by US Navy Seals while living comfortably in an Abbottabad, Pakistan compound — out to be a WikiLeaks fan, given letters had been found instructing an al-Qaeda member to “gather” the publicly available material leaked by Manning.

Somehow this is meant to imply WikiLeaks in a round-about way assisted al-Qaeda’s mission. The FBI is perhaps left grasping with this “bin Laden benefited” theory given the relative flimsiness of evidence to support the original “conspiracy to commit computer intrusion” aspect on which the case originated.

This video is the most important thing you can watch when it comes to WikiLeaks and Assange: pic.twitter.com/h8liwZsQws

— Cassandra Fairbanks (@CassandraRules) April 14, 2019

Brilliant argument: “The question is not whether Julian is a journalist, the question is whether THEY are journalists.”

• Suzie Dawson on Julian Assange’s Mistreatment (Unity4J)

Suzie Dawson powerfully expresses her feelings of righteous indignation on witnessing Julian Assange being dragged from the Ecuadorean Embassy, and reflects on his mistreatment by the establishment and their propaganda arm, the complicit corporate media.

So let that Pope of yours stand up for Julian. Do something useful with the $600 million already donated for the Notre Dame. THAT is what your Jesus would have done.

• Jesus Christ, Julian Assange: When Dissidents Become Enemies Of The State (JW)

And then there was Jesus Christ, an itinerant preacher and revolutionary activist, who not only died challenging the police state of his day—namely, the Roman Empire—but provided a blueprint for civil disobedience that would be followed by those, religious and otherwise, who came after him. Indeed, it is fitting that we remember that Jesus Christ—the religious figure worshipped by Christians for his death on the cross and subsequent resurrection—paid the ultimate price for speaking out against the police state of his day. A radical nonconformist who challenged authority at every turn, Jesus was a far cry from the watered-down, corporatized, simplified, gentrified, sissified vision of a meek creature holding a lamb that most modern churches peddle.

In fact, he spent his adult life speaking truth to power, challenging the status quo of his day, and pushing back against the abuses of the Roman Empire. Much like the American Empire today, the Roman Empire of Jesus’ day had all of the characteristics of a police state: secrecy, surveillance, a widespread police presence, a citizenry treated like suspects with little recourse against the police state, perpetual wars, a military empire, martial law, and political retribution against those who dared to challenge the power of the state. For all the accolades poured out upon Jesus, little is said about the harsh realities of the police state in which he lived and its similarities to modern-day America, and yet they are striking.

Yanis has this completely upside down, like so many other well-meaning people:

“Let’s join forces to block #Assange’s extradition from any European country to the #US so that he can travel to Stockholm & give his accusers an opportunity to be heard”.

The accusers, if they are real, which is by no means clear, have been silenced by the Swedish government for a reason. And to say now that you can’t speak on the allegations because you too are a man, only reinforces that reason.

Assange has offered for years to talk, and for his accusers to be heard. That never needed to take place in Stockholm, and it does not now. It wouldn’t help anyone.

• First They Came For Assange (Varoufakis)

My meetings with WikiLeaks founder Julian Assange all took place in the same small room. As the intelligence services of a variety of countries know, I visited Assange in Ecuador’s London embassy many times between the fall of 2015 and December 2018. What these snoops do not know is the relief I felt every time I left. I wanted to meet Assange because of my deep appreciation of the original WikiLeaks concept. As a teenager reading George Orwell’s Nineteen Eighty-Four, I, too, was troubled by the prospect of a high-tech surveillance state and its likely effect on human relations. Assange’s early writings – particularly his idea of using states’ own technology to create a huge digital mirror that could show everyone what they were up to – filled me with hope that we might collectively defeat Big Brother.

By the time I met Assange, that early hope had faded. Surrounded by bookcases featuring Ecuadorian literature and government publications, we would sit and chat late into the night. A device on top of a bookshelf emitted mind-numbing white noise to counter listening devices. As time passed, the claustrophobic living room, the badly hidden ceiling-mounted camera pointing at me, the white noise, and the stale air made me want to run out into the street. Assange’s detractors have been saying for years that his confinement was self-inflicted: he hid in Ecuador’s embassy because he jumped bail in the United Kingdom to avoid answering sexual assault allegations in Sweden. As a man, I feel I have no right to express an opinion regarding those allegations. Women must be heard when reporting assault.

Only the violence that men have inflicted upon women for millennia is viler than the disrespect and denigration to which women are subjected when they speak up. I recall saying to Julian that, had it been me, I would want to confront my accusers, and listen to them carefully and respectfully, regardless of whether official charges had been brought. He replied that he, too, wanted that. “But, Yanis,” he said, “if I were to go to Stockholm, they would throw me in solitary and, before I got a chance to answer any allegations, I would be bundled into a plane heading for a US supermax prison.” To drive the point home, he showed me his lawyers’ offer to Swedish authorities to go to Stockholm if they guaranteed that he would not be extradited to the United States on espionage charges. Sweden never considered the proposal.

During Assange’s years in Ecuador’s embassy, in circumstances that the United Nations deemed “arbitrary detention,” many friends and colleagues mocked his fear – and lambasted me for believing him. Last September, the historian and feminist intellectual Germaine Greer summed up that belief on Australian public radio: “He won’t be extradited to the United States,” she said derisively, blaming Julian’s lawyers for misleading him into fearing such an extradition while collecting his book’s royalties.

Make that 50. Jesus himself would have to help. Alternatively, we can see this as a sign that Macron doesn’t expect to last as president for 5 years.

• Macron Commits To Rebuilding Notre Dame Within Five Years (Ind.)

French president Emmanuel Macron promised that Notre Dame will be renovated within five years and will be “even better than before” after the devastating fire that ravaged much of the building. Investigators have already begun assessing the damage and questioning people to try to establish what started the blaze that consumed the roof and spire of the 850-year-old Gothic masterpiece. More then €600m has already been raised for rebuilding and restoration and the UK has said it stands ready to help. Firefighters battled for 14 hours to extinguish the flames, as onlookers feared the entire structure would be wrecked. But Parisians breathed a sigh of relief when it became clear the twin medieval bell towers had been spared and later when fire investigators revealed that “most precious” treasures have been saved.

They included the Crown of Thorns, a relic venerated by Christians and believed to have been worn by Jesus Christ, as well as the cathedral’s 18th-century organ and a number of artworks. European Council president Donald Tusk called on the European Union’s member countries to help, saying the site in central Paris is a symbol of what binds Europe together. The fire, which began on Monday evening, is thought to have been caused by an accident rather than arson, the Paris public prosecutor said. Architects warned repairs could take decades but in a televised address to the nation Mr Macron said: “We will rebuild Notre Dame even more beautifully, and I want it to be completed in five years, we can do it.”

“..experts have concluded..”

• May Has ‘No Chance’ Of Avoiding EU Elections (Ind.)

Theresa May has “no chance” of passing her Brexit deal in time to pull the UK out of the European parliament elections and avoid a likely devastating defeat, experts have concluded. Time has already effectively run out on attempts to ratify the agreement by 22 May, they say – despite the prime minister insisting talks with Labour can still deliver a compromise before the deadline. The verdict puts the Conservatives on course to lose most of their MEPs, polls suggest, as Leave voters protest at the failure to deliver Brexit, a disastrous result that would trigger huge pressure on Ms May to resign. The staging of the elections will also be a personal humiliation for the prime minister, who repeatedly told MPs they should not take place, three years after the Brexit referendum.

More talks with Labour are planned, as No 10 claims the complex (Withdrawal Agreement) Bill – required to ratify EU withdrawal – can clear parliament before voters go to the polls on 23 May. But two respected think tanks have told The Independent the timetable is a fantasy, with one suggesting it will take “several months” to approve the legislation, which could involve up to 100 votes. Unlike the simple meaningful vote, the full legislation will trigger lengthy and gruelling parliamentary trench warfare, with echoes of the bitter battles over the Maastricht and Lisbon treaties. Approval of Maastricht took 41 days in 1993, while Lisbon required 25 days in 2008 – but there are only 17 sitting days planned before 22 May.

There is no way they could ever agree.

• Tory Deregulation Agenda Is Stalling Brexit Talks – Corbyn (G.)

Jeremy Corbyn has said Brexit talks with the government are stalling because of a Tory desire for post-withdrawal deregulation, including as part of a US trade deal. Corbyn said Labour had been putting forward a robust case for a customs union during the talks over the past week but suggested he feared the two sides would not find common ground. “There has to be access to European markets and above all there has to be a dynamic relationship to protect the conditions and rights that we’ve got for environment and consumer workplace rights,” he said. “We’ve put those cases very robustly to the government and there’s no agreement as yet.”

Meetings are scheduled this week between ministers and shadow ministers on environmental protections, security and workers’ rights, which Corbyn described as “quite interesting, quite long technical discussions, particularly on environment regulations”. However, there will be no discussion before Easter on the big issues of a customs union or a confirmatory referendum. Corbyn underlined again that an agreement could only be reached if Theresa May was prepared to accept Labour’s central demand for a common external tariff policy with the EU. “The government doesn’t appear to be shifting the red lines because they’ve got a big pressure in the Tory party that actually wants to turn this country into a deregulated, low-tax society which will do a deal with Trump. I don’t want to do that,” he said.

The Delusional Party.

• Not In It To Win It: The Dirty Little Secret Of The Democrats’ 2020 Battle (G.)

Political scientists are quick to point out two reasons why a record number of candidates is running for president on the Democratic side in 2020. One: the Republican president, Donald Trump, is vulnerable with a low-40s approval rating, so the Democratic nominee has a good shot at winning the White House. Two: there’s no bigfoot candidate this time around – no incumbent, no Hillary Clinton – to dissuade other potential candidates from running. Those conditions have lured 15 major candidates so far into the race for the Democratic nomination, with as many as half a dozen more potentially getting in, including former vice-president Joe Biden, who has yet to officially declare. The previous record for major candidates in a presidential primary field was 17, on the Republican side in 2016.

But analysts also nod to a third factor inflating the gigantic 2020 Democratic field, a not-quite-dirty little secret about presidential politics. The fact is, not all of the people running for president are actually running for president. “There is almost always at least a few candidates in these kinds of fields that are either there to push an issue agenda, or these are candidates who are interested in building their name recognition, building their stature and status within the party,” said John Sides, professor of political science at George Washington University and editor-in-chief of The Monkey Cage politics analysis site.

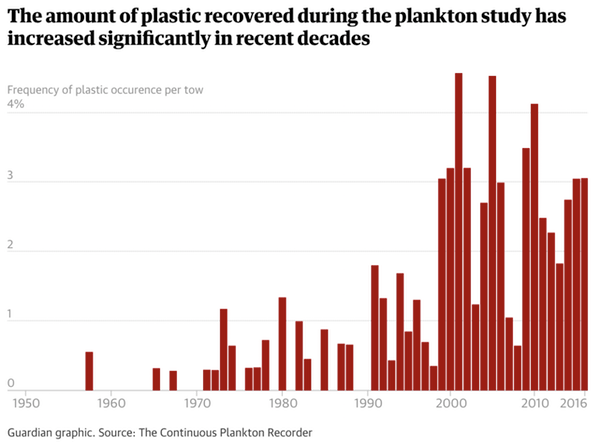

How much plastic is inside of you?

• Six-Decade Plankton Study Charts Rise Of Ocean Plastic Waste (G.)

A trove of data showing when the Atlantic began choking with plastic has been uncovered in the handwritten logbooks of a little-known but doggedly persistent plankton study dating back to the middle of the last century. From fishing twine found in the ocean in the 50s, then a first carrier bag in 1965, it reflects how the marine refuse problem grew from small, largely ignored incidents to become a matter of global concern. The unique dataset, published in Nature Communications, is based on records from the continuous plankton recorder, a torpedo-shaped marine sampling device that has been towed across more than 6.5m nautical miles of ocean over the past 60 years.

Bryozoans, nudibranchs, crabs, and barnacles live on a clear plastic bottle in the ocean. Photograph: Justin Hofman/Greenpeace/PA

Based firstly in Hull, then Edinburgh and Plymouth, the long-running programme was initially designed to collect pelagic plankton, which are an indicator of water quality and also a source of food for whales and other marine life. But the operators have also kept a chart-and-counter track of entanglements that disrupted their work: what snared the equipment, where it happened and when. This has proved a valuable source of data on plastic waste, according to contemporary researchers. “This consistent time series provides some of the earliest records of plastic entanglement, and is the first to confirm a significant increase in open ocean plastics in recent decades,” the paper notes.

The start of the problem was so slow it was barely noticed. The log shows strands of fishing twine found off the east coast of Iceland in 1957, then a carrier bag in waters to the north-west of Ireland eight years later. The paper states this was a couple of years before the first reports of turtles and seabirds becoming ensnared in plastic. Over the following decades the problem grew steadily. In the 50s, 60s and 70s, fewer than 1% of tows were disrupted by entanglements with synthetic materials. By the 90s it was almost 2%, and in the first decade of this century the increase “was of an order of magnitude”, according to the paper. The figure is now hovering somewhere between 3% and 4%.

Note: if you find yourself agreeing with Carney, and you fail to see the absurdity in this, seek treatment. Carney is a full-time douche. He’s saying going green is a profit opportunity.

• Mark Carney Tells Global Banks They Cannot Ignore Climate Change (G.)

The global financial system faces an existential threat from climate change and must take urgent steps to reform, the governors of the Bank of England and France’s central bank have warned, writing in the Guardian. In an article published in the Guardian on Wednesday aimed at the international financial community, Mark Carney, the Bank’s governor, and Villeroy de Galhau, the governor of the Banque de France, said financial regulators, banks and insurers around the world had to “raise the bar” to avoid catastrophe. They said: “As financial policymakers and prudential supervisors we cannot ignore the obvious physical risks before our eyes. Climate change is a global problem, which requires global solutions, in which the whole financial sector has a central role to play.”

The warning comes as concern over the impact of climate change and the lack of urgent action is increasing, reflected in the Extinction Rebellion protests and schoolchildren’s strikes across the world. The heads of two of the world’s most influential central banks urged other financial regulators around the world to carry out climate change stress tests to spot any risks in the system, while also calling for more collaboration between nations on the issue. They warned that a “massive reallocation of capital” was necessary to prevent global warming above the 2°C maximum target set by the Paris climate agreement, with the banking system required to play a pivotal role. “If some companies and industries fail to adjust to this new world, they will fail to exist,” Carney and De Galhau said.