DPC “Ice fountain on Washington Boulevard, Detroit” 1906

It’s all fake. Great piece.

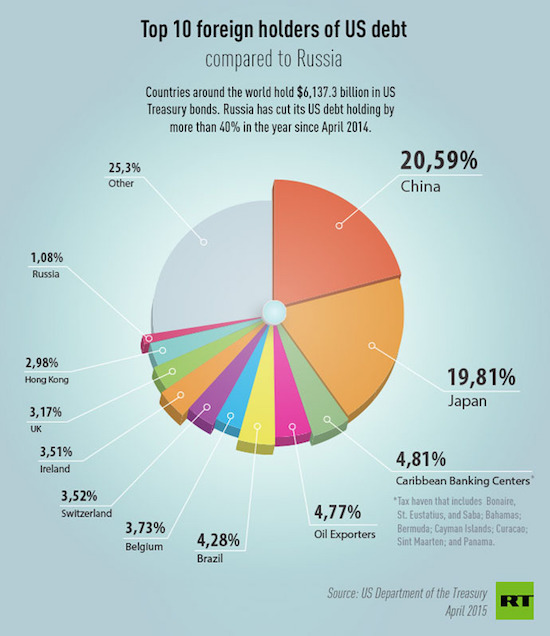

• China Does Not Have a Trade Surplus (Balding)

[..] Misinvoicing contributes a not entirely insignificant share to unrecorded capital inflows and outflows. However, Chinese authorities have become much more aware and concerned about these issues and gone through various waves of cracking down over this issue. Furthermore, the aggregate sums here are not enough to move the RMB and cause the currency pressures we are currently seeing. In fact, misinvoicing is merely the beginning of the financial flow problems in trade with Chinese innovation taking it a step further. China, as a country with strict currency controls, maintains records on international financial transactions sorted by a variety of categories. For instance, there is data on payment or receipt of funds by current or capital account, goods or service trade, and direct or portfolio investment.

For our purposes, this allows us to compare in a relatively straightforward manner, how international payments are flowing compared to the customs reported flow of goods. The differences in key data surrounding trade data is illustrative. Chinese Customs data reports goods exports valued at $2.27 trillion, with SAFE reporting goods exports of $2.14 trillion but Chinese banks report receipts of $2.37 trillion. In other words, funds received for exports of goods and services or about $100 billion higher than reported. At 4-11% higher than the Customs and SAFE reported values this is slightly elevated, but given expected discrepancies in the mid-single digits, this number is slightly elevated but not extreme. The differences between import and international payment data, however, is astounding.

Whereas Chinese Customs reports $1.68 trillion and SAFE report $1.57 in goods imports into China, banks report paying $2.55 trillion for imports. In other words, funds paid for imported goods and services was $870-980 billion or 52-62% higher than official Customs and SAFE trade data. This level of discrepancy is extreme in both absolute and relative terms and cannot simply be called a rounding error but is nothing less than systemic fraud. If we adjust the official trade in goods and services balance to reflect cash flows rather than official headline trade data as reported by both Customs and SAFE, the differences are even worse.

According to official Customs and SAFE data, China ran a goods trade surplus of $593 or $576 billion but according to bank payment and receipt data, China ran a goods trade surplus of only $128 billion. If we include service trade, the picture worsens considerably. China via SAFE trade data reports a $207 billion trade deficit in services trade. Payment data reported via SAFE actually reports about $42 billion smaller deficit of $165 billion. In other words, the supposed trade surplus of $600 billion has become a trade in goods and services deficit of $36 billion. Expand to the current, through a significant primary income deficit, and the total current account deficit is now $124 billion.

It’s all about the yuan by now, I’m afraid.

• China Equities Plunge 6.4% as Volatility Reignites (BBG)

China’s stocks tumbled the most in a month as surging money-market rates signaled tighter liquidity and the offshore yuan declined for a fifth day. The Shanghai Composite Index sank 6.4% at the close, with about 70 stocks falling for each that rose. Industrial and technology companies led losses. The overnight money rate, a gauge of liquidity in the financial system, climbed the most since Feb. 6. The plunge in equities underscores the challenge for China’s policy makers as they seek to project an image of stability in the nation’s financial markets as the economy slows.

Finance chiefs and central bankers from the Group of 20 will meet in Shanghai on Friday, while the annual meeting of the legislature begins in Beijing next week. The return of volatility is also a test for China’s new top securities regulator, who took over on the weekend after his predecessor was removed amid criticism of mismanagement. “The market is in a quite fragile state when everyone scrambles for an exit,” said Central China Securities Shanghai based strategist Zhang Gang.“None of the news in the market is sufficient enough to trigger such a slump.” Today’s declines almost erased a 10% rebound in the benchmark equity index from a January low. The Shanghai Composite has fallen 23% this year, the world’s worst performer after Greece. Volumes on the gauge were 43% above the 30-day average.

The numbers are stunning.

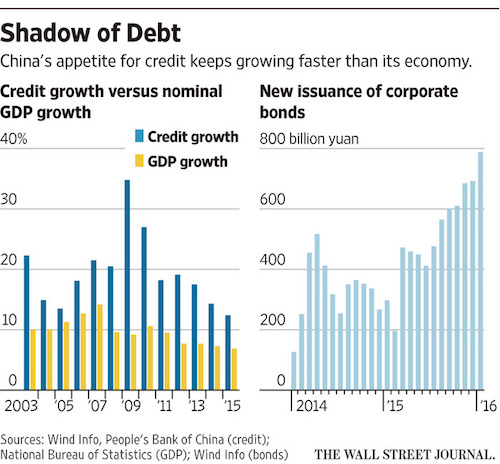

• Rush of Corporate Bonds Inflames Worries About China’s Debt (WSJ)

A surge of corporate bonds is adding to China’s already-high debt levels, amplifying risks to the economy as Beijing persistently encourages borrowing to fuel growth. The new rounds of corporate funding deepen anxieties among investors and analysts that China’s debt, already expanding at twice the pace of its gross domestic product, is feeding a nascent credit crisis that could further set back the country’s efforts to shift the economy to a slower, consumption-led model. Corporate debt now amounts to 160% of China’s gross domestic product, compared with 98% in 2008, according to Standard & Poor’s Ratings Services. The level in the U.S. is 70%. Outstanding corporate bonds in China last year surged 25% to 14.6 trillion yuan ($2.2 trillion), according to the central bank.

Worries over China’s rapid accumulation of credit, up 12.4% last year, are compounded by signs that not much of it is creating new wealth. State policy is directing the boom in corporate bonds, which can be 15% cheaper for borrowers than benchmark loans, meaning issuers can use them to favorably reschedule loans. The government says the push is part of a plan to have companies bear more direct risk as banks struggle with rising bad loans, and there is room for more. “This is in accordance with China’s reform direction,” Wang Yiming, vice minister at the Development Research Center of the State Council, the national cabinet’s think tank, said last week. “In the past, we’ve primarily relied on bank loans. We want to gradually increase direct financing.”

China has long sought to deepen its capital markets by developing debt and equity financing. Banks have traditionally accounted for about 70% of all lending in China. As souring loans began to pile up two years ago, regulators looked to the stock and bond markets to spread credit risk in the system, lower funding costs and expand financing channels for companies. Hopes to use equity markets as a key fundraising tool fell apart as stock prices collapsed last summer, but regulators still view the bond market as a viable channel to restructure risk. “In 2016, we want to adequately fulfill the financing function of the corporate bond market to further promote reform, steady growth and a bigger role for risk management,” the National Development and Reform Commission said in a statement on Wednesday.

Also on Wednesday, China’s central bank moved to make it easier for qualified foreign institutional investors to buy bonds on China’s interbank market, where issues from the Ministry of Finance and large government entities are traded. The move follows similar permission granted to some central banks and sovereign wealth funds last July and comes as China seeks to encourage use of the yuan to continue liberalizing its currency system. To accomplish its goal, analysts say, China needs to attract investment into its bonds, in particular by global institutional investors. [..] As the cost of debt servicing grows, capital is diverted from productive investment to interest payments. Research firm Gavekal Dragonomics estimates China now spends around 20% of its GDP just servicing its corporate and household debt.

And why not…

• PBOC Says China Can Handle Raising Budget Deficit to 4% (BBG)

China is able to increase its budget deficit to 4% of gross domestic product as the government seeks to cut corporate taxes, central bank officials wrote in an article on the Economic Daily’s website. Low levels of government debt, “relatively fast” economic growth and abundant state-owned assets give the country more capacity to sell more bonds, according to an article written by People’s Bank of China officials including Sheng Songcheng, head of the statistics department. China could maintain a debt-to-GDP ratio of up to 70% at end-2025 if the deficit were raised to 4%, the officials said.

China is looking to fiscal policy to help it grapple with the slowest growth since 1990. The deficit is likely to rise this year from 2.3% of GDP in 2015, the official Xinhua News Agency recently reported, citing a statement after a fiscal work conference. Vice Finance Minister Zhu Guangyao said last year the “red line” of 3% for the deficit-to-GDP ratio and 60% for the debt-to-GDP ratio should be revisited after lessons learned from the financial crisis. The article in the official Economic Daily publication comes ahead of a gathering of the nation’s top lawmakers early next month, when the year’s economic plans and targets will be agreed upon and announced.

Doesn’t look like it’s going to happen, though. Unless they’re all just faking the denials.

• Why China and the World Needs a New Plaza Accord (Barron’s)

Perhaps it’s time for a new Plaza Accord that focuses on Chinese imbalances in ways that calm world markets. The most obvious expression of those vulnerabilities is an overvalued yuan. Barclays speaks for many when it says the No. 2 economy needs a radical devaluation. Perhaps not in the 25%% neighborhood analysts Ajay Rajadhyaksha and Jian Chang suggest, but sizable enough to stimulate growth and keep pace with Beijing’s depleting currency-reserve holdings. Yet doing so could devastate jittery world markets – and President Xi Jinping knows it. The last thing Xi wants is to trigger Lehman Brothers 2.0. The Group of Seven nations could serve up a face-saving solution: a globally authorized yuan drop organized in a cooperative, transparent and orderly manner.

The model is what transpired 30 years ago in the New York hotel owned by U.S. presidential wannabe Trump. On Sept. 22, 1985, the then G-5 nations – France, Germany, Japan, the U.K. and the U.S. – plotted an unprecedented intervention in currency markets. One can argue Japan came out on the losing end of a deal to boost the yen, but traders marveled at the show the unity and relative competence of the moment. Arguably, it’s never been duplicated, even after the group expanded to include Canada and Italy to become the G-7. Of course, we live in more of a G-20 world nowadays – an admission that without Brazil, China, India, Saudi Arabia and Turkey at the table, many problems are intractable. But too many G-20 members fear retribution and won’t speak truth to Chinese power. That’s why the G-7 should quietly hatch a devaluation plan with Beijing.

If this sounds like a non-starter, consider the alternative: on an unsuspecting evening in the not-so-distant future, Beijing announces a 10% downshift, knocking the Dax, Dow Jones, FTSE, Nikkei and Shanghai Composite indexes several hundred points lower each. The yen surges, putting the final nail in the Abenomics coffin. Deutsche Bank executives call TV stations to insist, anew, their balance sheet is sound. Rumors of hedge-fund blowups ricochet around global markets. Politicians in London, Tokyo and Washington wonder how, of how, did this happen?

They got one chance, and then announce beforehand it’s a no-go?!

• Lew Says Don’t Expect ‘Crisis Response’ From G20 Meeting (BBG)

U.S. Treasury Secretary Jacob J. Lew downplayed expectations for an emergency response to global market turbulence when Group of 20 finance chiefs and central bankers meet this week in China, calling on nations to do more to boost demand without pursuing unfair currency policies. “Don’t expect a crisis response in a non-crisis environment,” Lew said in an interview broadcast Wednesday with David Westin of Bloomberg Television. “This is a moment where you’ve got real economies doing better than markets think in some cases.” Policy makers from the world’s biggest economies are unlikely to make the kind of detailed national commitments to restore growth they did to at the height of the global financial crisis, Lew said.

Instead, the group, which meets in Shanghai Feb. 26-27, may put more “meat on the bones” of the principles it has advocated in recent years, such as by strengthening the pledge that nations will refrain from competitive currency devaluations, he said. While the world economy isn’t in a moment of crisis, Lew said that “I don’t think it’s unreasonable to have the expectation that coming out of this will be a more stable understanding of what the future may look like.” Lew’s comments discount the prospect of a coordinated agreement to boost lackluster global growth and restore confidence after a selloff in world stocks to start the year. Some analysts and investors have called for a modern-day Plaza Accord, the 1985 deal among major economies to weaken the dollar and stabilize currency markets.

The world’s cloudy growth outlook and policy makers’ potential response will dominate the agenda in Shanghai, according to people familiar with the talks. It’s unlikely to produce the kind of action that came out of the G-20 meeting in London in April 2009, when countries collectively pledged more than $1.1 trillion in stimulus to rejuvenate a then-hobbled global economy.

You don’t say.

• IMF Warns The Global Economy Is “Highly Vulnerable” (BBC)

The IMF has said the global economy has weakened further and warned it was “highly vulnerable to adverse shocks”. It said the weakening had come “amid increasing financial turbulence and falling asset prices”. The IMF’s report comes before the meeting of G20 finance ministers and central bank governors in Shanghai later this week. It said China’s slowdown was adding to global economic growth concerns. China’s economy, the second-biggest in the world, is growing at the slowest rate in 25 years. “Growth in advanced economies is modest already under the baseline, as low demand in some countries and a broad-based weakening of potential growth continue to hold back the recovery,” the Washington-based IMF said.

“Adding to these headwinds are concerns about the global impact of China’s transition to more balanced growth, along with signs of distress in other large emerging markets, including from falling commodity prices.” The IMF also noted any future prospects for global growth “could be derailed by market turbulence, the oil price crash and geopolitical conflicts”. The agency has called on the G20 group to plan new mechanisms to protect the most vulnerable countries. Earlier this year, the IMF downgraded its forecast for global economic growth. It now expects economic activity to increase 3.4% this year followed by 3.6% in 2017.

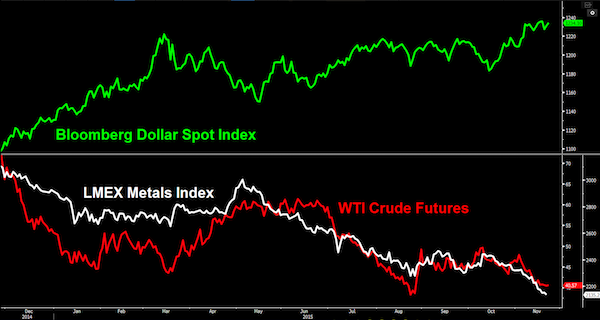

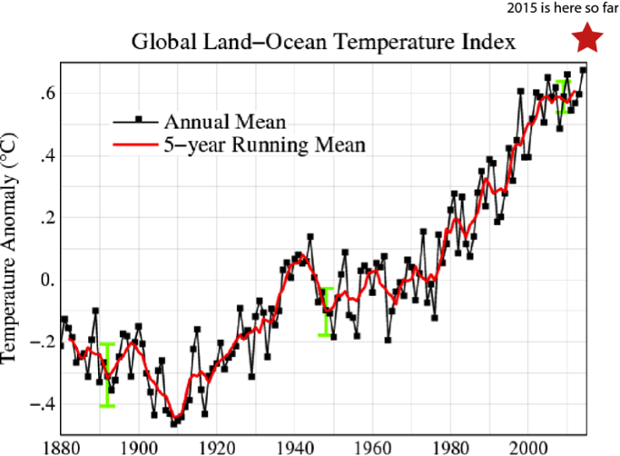

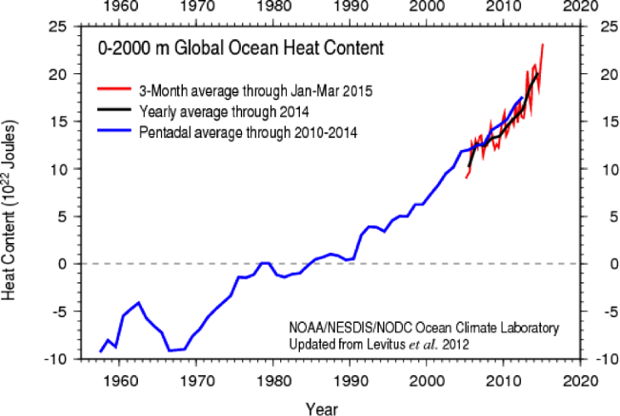

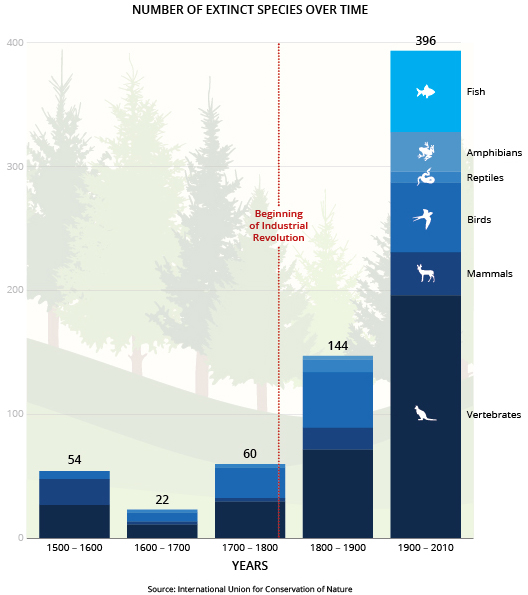

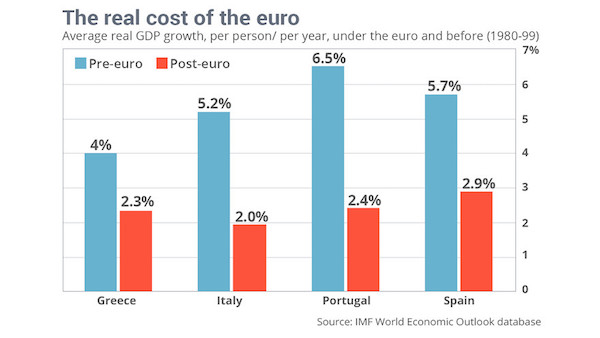

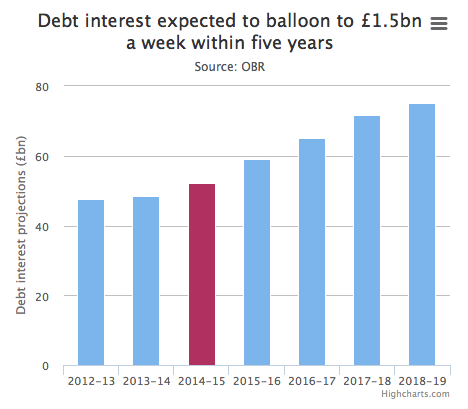

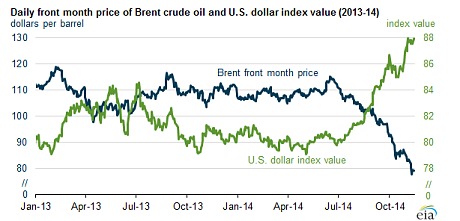

Them’s some graphs.

• Dear Janet, Mario, & Haruhiko – It’s Time For The ‘C’ Word (ZH)

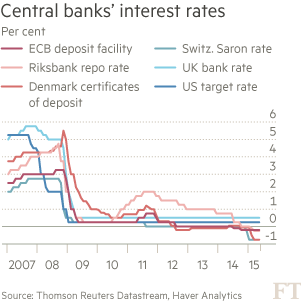

As policy errors pile up – just as they did in 2007/8 – around the world, we thought the following three charts might warrant the use of the most important word in modern central banking… "Contained"

Haruhiko, You Are Here…

Mario, You Are Here…

And Janet, You Are Here…

It does make one wonder, with all this carnage and so little action, whether "coordinated" inaction is the post-Davos decision – Don't just do something, stand there and jawbone!!

With the goal being a big enough catastrophe to warrant unleashing the war on cash, then NIRP, then the unlimited money drop… because as we stand, no matter what crazy policy has been imagined by the Keynesian "seers" – inflationary (well deflationary now) expectations have collapsed.

Weidmann keeps taking the other side.

• Bundesbank Chief Warns Of Zero-Rate Impact On Banks (Reuters)

Bank profits will shrink if rock-bottom interest rates stay in place for too long, the head of Germany’s central bank warned on Wednesday, signaling that he favors an eventual change in tack. The remarks from the Bundesbank’s influential president, Jens Weidmann, illustrate how seriously Germany is taking the fallout from years of low borrowing rates after a recent crash in bank stocks sucked in the country’s flagship Deutsche Bank. “The low interest-rate environment particularly weighs on banks’ earnings potential,” Weidmann told journalists, referring to the market slump. “The longer the low-interest-rate phase stays, the steeper interest rates fall, the … smaller banks’ profit,” said Weidmann, who also sits on the European Central Bank’s decision-taking Governing Council.

Early next month, ECB governors will meet to decide whether to loosen monetary policy further, for instance, by extending a €1.5 trillion money printing scheme to buy government bonds or by cutting interest rates further. A cut to the deposit rate, which translates into a charge on banks that park money with the ECB, would penalize banks. Weidmann referred to a survey of German banks that concluded they would see pre-tax profits shrivel by 25% by 2019 as a result. Should low interest rates remain in place until 2019, he said, profits could fall by up to half. Further cuts to borrowing rates during this time would make their results worse still.

The former adviser to German chancellor Angela Merkel, saying that he hoped interest rates would eventually rise again, played down any threat of deflation or falling prices and predicted that a modest economic recovery would continue. Falling price inflation is generally considered an economic alarm bell and is typically used as a trigger for ECB action. In talking down such a problem, Weidmann is also playing down the need for any action. He also voiced scepticism about the proposal to scrap the €500 note, saying that Germans still wanted to be free to pay in cash. “It would be fatal if the impression were to be created … that the discussion about the scrapping of the €500 note … was a step towards ending the use of cash generally.”

I’m convinced the real numbers are much worse.

• Oil Slump To Hit US Investment Banks’ Capital Market Revenue (BBG)

Revenue generated by U.S. investment banks through their capital markets businesses may “suffer” if oil and commodity prices stay low and the global economy slows further, Moody’s Investors Service has warned. While direct energy loan exposures for the largest U.S. banks look “manageable relative to earnings” and most of their exposures are to investment-grade borrowers, additional loss provisions will be necessary in some cases should oil remain subdued for an extended period, the credit assessor said in a report dated Feb. 24. Moody’s also warned that “lower-for-longer” oil prices presented a rising threat for lenders around the world.

JPMorgan Chase said this week its reserves for impaired energy loans would increase by about $500 million in the first quarter and it would have to add an additional $1.5 billion to the set-aside if oil prices held at $25 a barrel for about 18 months. Wells Fargo, the world’s largest bank by market value, said Wednesday in a filing soured energy loans climbed 49% in the last three months of 2015, while higher oil-and-gas provisions at Royal Bank of Canada crimped quarterly earnings. “Oil price volatility has contributed to increased market volatility, which could help boost trading activity and returns,” Moody’s said. “However, current weak sentiment in global equity and credit markets could work in the opposite direction, reducing trading volumes and banks’ related revenues.”

For U.S. global investment banks such as Bank of America, Citigroup and JPMorgan Chase, funded exposures to the oil and gas industry range from 1.5% to 5% and average 2.3% of total loans, according to Moody’s. The ratings company also underscored risks for banks in energy-exporting regions from the Middle East and Russia to Africa and Latin America. “Banks’ direct and indirect exposures to the drop in oil prices pose the potential for deterioration in asset quality, particularly in net oil-exporting countries,” Moody’s said. “While direct exposures appear broadly manageable from both a solvency and earnings perspective, low oil prices could still test the credit profiles of banks across our global rated portfolio.”

The debt figures are incredible. “Companies spent more on drilling than they earned selling oil and gas, plugging the difference with other peoples’ money.”

• Biggest Wave Yet of U.S. Oil Defaults Looms as Bust Intensifies (BBG)

In less than a month, the U.S. oil bust could claim two of its biggest victims yet. Energy XXI and SandRidge Energy, oil and gas drillers with a combined $7.6 billion of debt, didn’t pay interest on their bonds last week. They have until the middle of next month to either pay the interest, work out a deal with their creditors or face a default that could tip them into bankruptcy. If the two companies fail in March, it would be the biggest cluster of oil and gas defaults in a month since energy prices plunged in early 2015. “We’re just beginning to see how bad 2016 is going to be,” said Becky Roof, managing director for turnaround and restructuring with consulting firm AlixPartners.

The U.S. shale boom was fueled by junk debt. Companies spent more on drilling than they earned selling oil and gas, plugging the difference with other peoples’ money. Drillers piled up a staggering $237 billion of borrowings at the end of September, according to data compiled on the 61 companies in the Bloomberg Intelligence index of North American independent oil and gas producers. U.S. crude production soared to its highest in more than three decades. Oil prices have now fallen more than 70% from a 2014 peak, and banks and bondholders are fighting for scraps. Bond prices reflect investors’ fears. U.S. high yield energy debt lost 24% last year, the biggest fall since 2008, according to Bank of America Merrill Lynch U.S. High Yield Indexes.

Both Energy XXI and SandRidge could still reach an agreement with creditors that will give them time to turn their businesses around. SandRidge said last week that it missed a $21.7 million interest payment. The company owes $4.2 billion, including a fully-drawn $500 million credit line. Energy XXI, which owes $3.4 billion, said in a filing last week that it missed an $8.8 million interest payment. David Kimmel, a spokesman for SandRidge, said it has the money to make interest payments due in February, March and April. He wouldn’t comment on SandRidge’s options if it doesn’t make the interest payments by the end of the grace period.

And its shares soar…

• North Dakota’s Largest Oil Producer Suspends All Fracking (Reuters)

North Dakota oil producer Whiting Petroleum Corp said on Wednesday it will suspend all fracking and spend 80% less this year, the biggest cutback to date by a major U.S. shale company reacting to the plunge in crude prices. Shares of Whiting jumped 7.7% to $4 per share in after-hours trading as investors cheered the decision to preserve capital. During the trading session, Whiting had slid 5.6% to $3.72. Whiting’s cut is one of the largest so far this year in an energy industry crippled by oil prices at 10-year lows. The cuts will have a big impact in North Dakota, where Whiting is the largest producer.

Denver-based Whiting said it will stop fracking and completing wells as of April 1. Most of its $500 million budget will be spent to mothball drilling and fracking operations in the first half of the year. After June, Whiting said it plans to spend only $160 million, mostly on maintenance. Rival producers Hess Corp and Continental Resources Inc have also slashed their budgets for the year, though neither has cut as much as Whiting. “We believe this conservative strategy should help us to maintain our liquidity position and leave us well positioned to capitalize on a rebound in oil prices,” Whiting CEO Jim Volker said in a statement. The cuts will drag down production and likely reverberate in the economy of North Dakota, the second-largest U.S. oil producing state after Texas, which currently pumps 1.1 million barrels per day.

Excellent by Pedro da Costa.

• Big Banks and the White House Are Teaming Up to Fleece Poor People (FP)

When Wall Street and its regulators talk about servicing the so-called “unbanked,” people who are generally disconnected from the banking sector, it often sounds like a mission to do God’s work — bank unto others as thou banketh for thyself. “Basic financial services are out of reach for one in four individuals on Earth,” U.S. Treasury Secretary Jack Lew, a former Citigroup banker, said at a December speech launching the White House’s latest initiative targeted at the unbanked, which involves a partnership with JPMorgan Chase and PayPal. A report co-sponsored by JPMorgan Chase in 2014 speaks of the problem in similarly biblical terms: “Roughly 75% of the world’s poor — 2.5 billion people — do not have a bank account or otherwise participate in the mainstream financial system.” The lack of access to “secure, affordable financial products and services severely limits the global poor’s financial security and opportunities.”

Yet when bankers and regulators debate the travails of the unbanked or underbanked — effectively euphemisms for poor and lower-middle-class Americans — they usually avoid two key questions: Why is this cross-section of society so marginally attached to the banking system in the first place? And who is behind the provision of “alternative” services — high-cost loan sharks, payday lenders, cash checking stores, pawnshops — the poor turn to instead of banks? In reality, it is the banks themselves that appear to have cut off and driven away the low-income consumer, not the other way around. Wall Street won’t make loans to the poor — at least not directly. But large banks, it turns out, are behind many of the predatory nonbank, high-cost lenders that notoriously prey on poor communities.

Most recently, the same JPMorgan Chase that’s working with the White House to reach the unbanked partnered with OnDeck Capital, an online lender that approves loans in a flash and charges eye-popping interest rates that averaged around 54% as of 2014. In other words, the big banks are already well-acquainted with the poor unbanked poor — and they’re fleecing them.In other words, the big banks are already well-acquainted with the poor unbanked poor — and they’re fleecing them. They’re simply doing it the clean, Wall Street way, through intermediaries and with little accountability. Some banks are willing to do the dirty work themselves.

This is how Wells Fargo advertises its Direct Deposit Advance Loan, which carries an annual percentage rate of 120%: “These short term loans … can assist you with getting through a short term financial crisis by providing you with options and flexibility…. [for example] a medical bill, car repair, or similar unplanned expense.” How sweet of them. Those who are already in the system don’t fare much better. Big banks push the poor into the more shadowy corners of consumer finance by charging those at the financial margins high and sometimes repeated and lofty overdraft fees, ATM charges, and checking account minimum balances. The poor often live in areas that lack bank branches, meaning that even after they open an account, they have to use a local ATM that charges them $3 on top of the $3 their own bank likely charges. So taking out a $20 bill could cost $6, a 30% surcharge.

Ungovernable poster child for recovery.

• Spanish Government Pact Dealt Fatal Blow Hours After Announcement (Reuters)

A government deal between Spain’s Socialists and liberal Ciudadanos was dealt a fatal blow hours after it was announced on Wednesday when both the Conservatives and anti-austerity Podemos refused to back it. Such is the fragmentation of Spain’s political landscape after an election last December that the Socialists and Ciudadanos, with only 130 seats in the 350-seat parliament between them, cannot govern alone. Podemos won 69 seats and the center-right People’s Party (PP) 123. Continued bickering between all sides means Spain could be without a government for several more months at a time when the economic recovery is still fragile and unemployment stubbornly high at over 20%. To be elected prime minister, socialist leader Pedro Sanchez needs an absolute majority on March 2 or a simple majority of seats in a second vote that would take place in parliament on March 5.

The pact with Ciudadanos could have gone through only if the PP or Podemos had backed it or at least abstained in the second vote, something they again ruled out. Podemos said it did not agree with the social and economic policies outlined in the deal, which includes tax reforms and measures to make government spending more efficient. The party also said it was suspending its own talks with the Socialists. “This is a deal that is incompatible with Podemos,” Inigo Errejon, a senior party member, told a news conference. Hours earlier, the leader of the PP, acting Prime Minister Mariano Rajoy, had also reiterated his party would vote against the pact which he called “misleading” because it fell way short of any majority.

Long article. Do read it though. Matt’s in a class of his own.

• How America Made Donald Trump Unstoppable (Matt Taibbi)

The first thing you notice at Donald Trump’s rallies is the confidence. Amateur psychologists have wishfully diagnosed him from afar as insecure, but in person the notion seems absurd. Donald Trump, insecure? We should all have such problems. At the Verizon Giganto-Center in Manchester the night before the New Hampshire primary, Trump bounds onstage to raucous applause and the booming riffs of the Lennon-McCartney anthem “Revolution.” The song is, hilariously, a cautionary tale about the perils of false prophets peddling mindless revolts, but Trump floats in on its grooves like it means the opposite. When you win as much as he does, who the hell cares what anything means? He steps to the lectern and does his Mussolini routine, which he’s perfected over the past months.

It’s a nodding wave, a grin, a half-sneer, and a little U.S. Open-style applause back in the direction of the audience, his face the whole time a mask of pure self-satisfaction. “This is unbelievable, unbelievable!” he says, staring out at a crowd of about 4,000 whooping New Englanders with snow hats, fleece and beer guts. There’s a snowstorm outside and cars are flying off the road, but it’s a packed house. He flashes a thumbs-up. “So everybody’s talking about the cover of Time magazine last week. They have a picture of me from behind, I was extremely careful with my hair … ” He strokes his famous flying fuzz-mane. It looks gorgeous, like it’s been recently fed. The crowd goes wild. Whoooo! Trump!

It’s pure camp, a variety show. He singles out a Trump impersonator in the crowd, tells him he hopes the guy is making a lot of money. “Melania, would you marry that guy?” he says. The future first lady is a Slovenian model who, apart from Trump, was most famous for a TV ad in which she engaged in a Frankenstein-style body transfer with the Aflac duck, voiced by Gilbert Gottfried. She had one line in that ad. Tonight, it’s two lines: “Ve love you, New Hampshire,” she says, in a thick vampire accent. “Ve, together, ve vill make America great again!” As reactionary patriotic theater goes, this scene is bizarre – Melania Knauss didn’t even arrive in America until 1996, when she was all of 26 – but the crowd goes nuts anyway. Everything Trump does works these days. He steps to the mic. “She’s beautiful, but she’s more beautiful even on the inside,” he says, raising a finger to the heavens. “And, boy, is she smart!”

Outcome is guaranteed.

• Hungary To Hold Referendum On EU Plan For Migrant Quotas (Reuters)

Hungary will hold a referendum on European Union plans to create a system of mandatory quotas for migrants, an initiative that Hungary’s government has rejected, Prime Minister Viktor Orban said on Wednesday. Orban has used harsh anti-migrant rhetoric since the migrant crisis escalated last year and gained notoriety for erecting a steel fence along Hungary’s southern border to keep out migrants – a policy now adopted by other Balkan countries. He said the plebiscite, the first of its kind in Europe, would be a major test of European democracy. The EU declined official comment, saying it was were trying to clarify what Orban was proposing.

Orban, who did not say when the vote might be held, has said the quotas would redraw the ethnic, cultural and religious map of Hungary and Europe. Under the plan, most EU nations would be obliged to accept a certain number of immigrants. “Nobody has asked the European people so far whether they support, accept, or reject the mandatory migrant quotas,” he said at a news conference. “The government is responding to public sentiment now: we Hungarians think introducing resettlement quotas for migrants without the backing of the people equals an abuse of power.” Orban said he was aware of potential wider ramifications of such a referendum, especially if Hungarians say “No” to quotas. “We had to think about the potential impact on European politics of such a proposal, but that was a secondary consideration,” he said.

Late last year expectations were for 3 million in Europe this year alone. Still, more realistic than ‘we have to stop them all’.

• German Government Expects Arrival Of 3.6 Million Refugees By 2020 (Reuters)

The German government expects a total influx of 3.6 million refugees by 2020, with an average of half a million people arriving each year, German media reported on Thursday, in a country that took in a record 1.1 million migrants last year. The calculations are based on internal estimates by the Economy Ministry in coordination with other ministries, German newspaper Sueddeutsche Zeitung said. In order to project economic development, the Economy Ministry created “an internal, purely technical estimate on migration in coordination with other government departments”. There is no official government estimate on how many refugees Europe’s biggest economy expects over the next years, as numbers are highly volatile.

But the unprecedented arrival of 1.1 million asylum seekers last year, included in the 3.6 million forecast, stretched public resources thin and put strains on German Chancellor Angela Merkel’s government. Merkel, whose open-door refugee policy has put her under much pressure, in recent months vowed to significantly reduce the number of people arriving this year. On Wednesday, German federal police said that they had only registered 103 migrants arriving on Tuesday, suggesting a sharp drop as a result of tighter controls along the Balkan route. At the start of the prior week, over 2,000 were arriving on a daily basis. Last autumn the daily arrivals sometimes totaled over 10,000.

Things are intensifying fast here.

• Greek Authorities Scramble To Find Shelter For Refugees (Kath.)

Government officials were on Wednesday night trying to find more places to host refugees and migrants as the number of people arriving continued to rise while limits on those leaving remained in place. Tens of thousands of migrants are thought to be in Greece at the moment, waiting to find a way out after border controls were stepped up north of the country. An official at the Migration Policy Ministry said that the government had made contingency plans for looking after 50,000 people. But these plans may prove inadequate as the Former Yugoslav Republic of Macedonia (FYROM) is only allowing a few hundred migrants to cross from Greece each day. In contrast, an average of around 3,000 people have been arriving on Greek islands each day this week.

On Wednesday, more than 1,700 migrants arrived at Piraeus on passenger ferries from the islands. Greek authorities are trying to find ways, including stopping coaches on the national highway, to prevent all the arrivals traveling to Idomeni, next to the border with FYROM, where some 3,000 people have already gathered. The migrants who have been stopped on their journey north are being housed in motels and sports centers. The transit centers at Schisto, Elaionas and Elliniko in Athens, as well as Diavata in Thessaloniki have filled up over the last few days. The camps at Schisto and Diavata are hosting around 2,000 people each. There are concerns that the lack of spaces will mean that migrants will start camping out in city squares. Some 300 people set up camp in Victoria Square, central Athens, on Wednesday.

The talks will not be very friendly for much longer.

• Tsipras: “We Will Not Allow Greece To Turn Into A Warehouse Of Souls” (Afp)

EU interior ministers hold fresh talks on migration on Thursday, seeking to reduce the flow of people through the Balkans and plan for what the bloc has warned is a looming humanitarian crisis. Ministers from non-EU members Serbia, Former Yugoslav Republic of Macedonia (FYROM) and Turkey will also be in Brussels as the European Union reaches outside the borders of the 28-nation bloc in a desperate attempt to deal with the stream of people. Ahead of the talks, Greek Prime Minister Alexis Tsipras threatened not to cooperate with future EU agreements on the migrant crisis if the burden was not fairly shared among member states.

Athens is seething over a series of border restrictions along the migrant trail to northern and western Europe that has caused a bottleneck in Greece, the main entry point to Europe. “Greece will no longer agree to any deal if the burdens and responsibilities are not shared proportionally,” Tsipras told the Greek parliament Wednesday, adding: “We will not allow our country to turn into a warehouse of souls.”