Bartolomeo Schedoni The Deposition (of Jesus’ body by St. Joseph of Arimathea) 1613

Several people punch sizable holes in the UK story blaming Russia. Found on Twitter, from “Harry Dilemma”:

“Without any evidence, the probability of millions of people being infected with bullshit is higher than the probability of two people being infected with a toxic agent.”

• The Art of (Cold) War (Claire Connelly)

Here’s what we know so far: • UPDATE I: Former spy and double agent, Sergey Skripal and his daughter, Julia were allegedly poisoned. • Initial reports claimed the culprit was a chemical which falls under the category of ‘novichoks’, a collection of nerve agents developed by the Soviet Union in the 1970s and 1980s, there has been no official medical or scientific confirmation of these claims. The doctor that was allegedly one of the first people on the scene of the Skripals’ poisoning asked to remain anonymous. • No pictures or footage of the victims have been provided. • Skripal’s daughter, Julia, is a member of the Russian Federation but has been denied consular access by the British government.

• The Russian Embassy officially requested the Foreign Office provide information on Sergey and Julia Skripal’s health and details of investigation the day after the poisonings occured on March 5th. Almost two weeks have passed and it still has received no confirmation from the UK government, nor granted access to the alleged victims. • Skripal received at least $100,000 for sharing Russian state secrets with British intelligence. • Skripal was feeding secrets to MI6 at the time Christopher Steele was an MI6 officer in Moscow. • Skripal’s handler was British MI6 agent, Pablo Miller who was previously involved as a suspect in a criminal case against Skripal who in 2006 was sentenced to 13 years in prison for spying for Britain.

Russia is not alone in the development of novichok nerve agents. Former British Ambassador Craig Murray revealed that similar nerve agents are manufactured by the British Government in Porton Down, just 8 miles from where Skripal was poisoned. • Porton Down scientists are not able to identify the nerve gas as being of Russian manufacture. • The official British government story is that these nerve agents are only manufactured “To help develop effective medical countermeasures and to test systems”. • Israel also has a chemical and biological weapons program that manufactures similar poisons. A 1983 CIA intelligence estimate revealed that US spy satellites had uncovered a chemical nerve agent production facility in the Negev Desert the year prior. This fact was censored by the CIA before a version was released to the National Archives in 2009. The information would likely not have come to light were it not for the discovery of the redacted document by a researcher at the Ronald Reagan Presidential Library.

• Russia has never killed a swapped spy before. • Miller had a Salisbury address, according to his LinkedIn account which has since been deactivated. He specialised in the former Soviet Union, Russia and Eastern Europe and his diplomatic postings included Tallinn, Estonia. • Both Steele and Miller were members of Orbis Intelligence, the same firm that produced the sensational Steele Dossier which alleged Trump’s links with Russia, including a certain episode involving Russian prostitutes and golden showers.

There are quite a few tales about how the victims were supposedly infected with Novichok. Powder or liquid, in Russia or Britain.

• Killing Diplomacy (Dmitry Orlov)

• May claimed that the nerve agent was Novichok, developed in the USSR. In order to identify it, the UK experts had to have had a sample of it. Since neither the USSR, nor Russia, have ever been known to export it, we should assume that it was synthesized within the UK. The formula and the list of precursors are in the public domain, published by the scientist who developed Novichok, who has since moved to the US. Thus, British scientists working at Porton Down could have synthesized it themselves. In any case, it is not possible to determine in what country a given sample of the substance was synthesized, and the claim that it came from Russia is not provable.

• It was claimed that the victims—Mr. Skripal and his daugher—were poisoned with Novichok while at a restaurant. Yet how could this have been done? The agent in question is so powerful that a liter of it released into the atmosphere over London would kill most of its population. Breaking a vial of it open over a plate of food would kill the murderer along with everyone inside the restaurant. Anything it touched would be stained yellow, and many of those in the vicinity would have complained of a very unusual, acrid smell. Those poisoned would be instantaneously paralyzed and dead within minutes, not strolling over to a park bench where they were found. The entire town would have been evacuated, and the restaurant would have to be encased in a concrete sarcophagus by workers in space suits and destroyed with high heat. None of this has happened.

• In view of the above, it seems unlikely that any of what has been described in the UK media and by May’s government has actually taken place. An alternative assumption, and one we should be ready to fully test, is that all of this is a work of fiction. No pictures of the two victims have been provided. One of them—Skripal’s daughter—is a citizen of the Russian Federation, and yet the British have refused to provide consular access to her. And now it has emerged that the entire scenario, including the Novichok nerve gas, was cribbed from a US/UK television drama “Strike Back.” If so, this was certainly efficient; why invent when you can simply plagiarize.

• This is only one (and not even the last) in a series of murders and assumed but dubious suicides on former and current Russian nationals on UK soil that share certain characteristics, such the use of exotic substances as the means, no discernible motive, no credible investigation, and an immediate, concerted effort to pin the blame on Russia. You would be on safe ground if you assumed that anyone who pretends to know what exactly happened here is in fact lying. As to what might motivate such lying—that’s a question for psychiatrists to take up.

Imagine the outrage.

• Russia’s EU Ambassador Says UK Lab Could Be Nerve Agent Source (BBC)

Russia’s EU ambassador has suggested a UK research laboratory could be the source of the nerve agent used in the attack on an ex-spy and his daughter. Vladimir Chizhov told the BBC’s Andrew Marr Show that Russia had “nothing to do” with the poisoning in Salisbury of Sergei Skripal and his daughter Yulia. He said Russia did not stockpile the poison and that the Porton Down lab was only eight miles (12km) from the city. The government dismissed his comments as “nonsense.” Retired military intelligence officer Mr Skripal, 66, and Yulia, 33, remain critically ill in hospital after being found slumped on a bench in Salisbury city centre on 4 March.

Theresa May had told MPs that personnel from the Defence Chemical Biological Radiological and Nuclear Centre at Porton Down in Wiltshire had identified the substance used on them as being part of a group of military-grade nerve agents developed by Russia known as Novichok. Mr Chizhov told the BBC that Mr Skripal could “rightly be referred to as a traitor” but “from the legal point of view the Russian state had nothing against him”. Asked how the nerve agent came to be used in Salisbury, he said: “When you have a nerve agent or whatever, you check it against certain samples that you retain in your laboratories.

“And Porton Down, as we now all know, is the largest military facility in the United Kingdom that has been dealing with chemical weapons research. And it’s actually only eight miles from Salisbury.” But pressed on whether he was suggesting Porton Down was “responsible” for the nerve agent in the attack, Mr Chizhov said: “I don’t have evidence of anything being used.” He added: “I exclude the possibility of any stockpiles of any chemical weapons fleeing Russia after the collapse of the Soviet Union but there were certain specialists, including some scientists who today claim to be responsible for creating some nerve agents, that have been whisked out of Russia and are currently residing in the United Kingdom.”

But of course.

• NATO Must Improve Defences Against ‘More Aggressive’ Russia – Stoltenberg (G.)

Nato must improve its defensive capabilities and willingness to act in the wake of increasingly aggressive and unpredictable actions by Russia, the head of the transatlantic alliance said in a German newspaper interview published on Sunday. The Nato secretary general, Jens Stoltenberg, said he expected the German chancellor, Angela Merkel, and other Nato leaders to revamp their approach at the next Nato summit this summer, given a risk that Russia could gradually give more weight to nuclear weapons in its doctrine, exercises and new military capabilities. “I think Chancellor Merkel and her colleagues will face new decisions at the Nato summit in July in Brussels. We must be alert and resolute,” Stoltenberg was quoted saying by Welt am Sonntag.

The Nato leader last week accused Russia of trying to destabilise the west with new nuclear weapons, cyber attacks and covert action, including the poisoning of a Russian former double agent and his daughter in the British town of Salisbury. “We can always do more and must reflect on that now. Salisbury follows, by all appearances, a pattern we’ve observed for some years – Russia is becoming more unpredictable and more aggressive,” he said. Russia denies any involvement and says it is the US-led transatlantic alliance that is a risk to peace in Europe. “Russia must not miscalculate,” Stoltenberg told the newspaper. “We are always ready to respond when an ally is attacked militarily. We want credible deterrence. We don’t want any war. Our goal is de-escalation.“

The curious valuations of Amazon and its profitless prosperity.

• Goldilocks, R. I. P. – Part 3 (David Stockman)

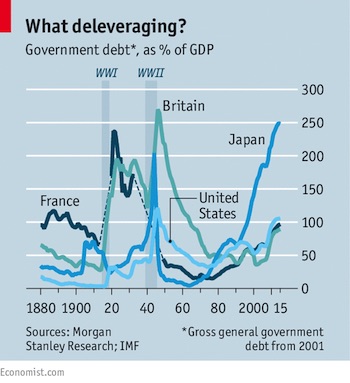

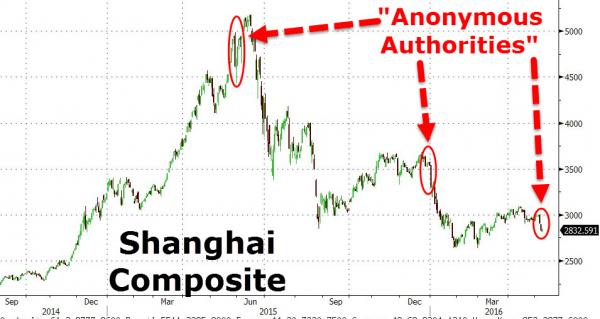

The first law of Bubble Finance is that stock market crashes trigger recessions, not vice versa. That stands your grandfather’s macroeconomics on its ahead, yet the casual chain from which it arises is straight forward. To wit, in a world of Peak Debt ($230 trillion globally), central bank money pumping mainly inflates financial bubbles. Such bubbles eventually reach blow-off extremes and then burst, thereby sending stock (option) obsessed corporate C-suites into paroxysms of restructuring and downsizing designed to appease the trading gods of Wall Street. The main street sacrificial lambs thus tossed overboard – workers, inventories, plants, stores, warehouses, other “redundant” fixed assets and CapEx outlays – are what we are pleased to call recessions nowadays.

Needless to say, you can’t see these bouts of C-suite mayhem coming if your dashboard is still cluttered with your grandfather’s macro-monitors. That is, the junk data from the BLS and Commerce Department. By the same token, you will most surely espy Goldilocks prancing through these incoming data reports because at this late stage of the business cycle they are really nothing more than a read-out on capitalism’s inherent impulse to trudge forward until it is monkey-hammered by the central bank and its imploding bubbles. That is to say, the next recession is embedded in the stock charts because they are the Bubble tracker in plain sight. And here is the leading indicator at the present moment – the utterly lunatic trading metrics for Amazon (AMZN).

As the current bubble metastized after the immediate post-recession rebound in the stock market, the momo crowd piled into AMZN because the “price action” was just plain awesome. Between the March 2009 bottom and January 2017, the stock soared from $65 to $750 per share or by nearly 1100%. And it did so without any regard for AMZN’s profitless prosperity—perhaps signified by its 170X PE multiple at the end of 2016. Then again, when it comes to miracle stocks and the Great Disrupters, profits are–apparently–a matter of will, not performance. If Jeff Bezos wanted profits, the true believers insist, he would will them. Simple. Still, since the beginning of 2017, even the willpower meme has begun to get way in front of its skis.

During the past 14 months, Amazon’s market cap exploded by $400 billion – rising from $360 billion in January 2017 to $760 billion at present. At the same time, its LTM operating free cash flow plunged from a meager $9.5 billion ( on $136 billion of sales) to just $6.5 billion during the year ending in December. Since the rules of arithmetic apparently have not yet been “disrupted”, AMZN’s implied multiple on operating free cash flow has erupted from an already frisky 39X to a completely absurd 120X. Needless to say, a 24-year old company with virtually no cumulative profits and free cash flow to show for itself should not trade at anything remotely close to a triple digit multiple – and that’s to say nothing of one that’s essentially in the books, schmatta, gadgets and food sourcing, moving, storage and moving business.

The Brexit mayhem hides behind the Russia story for now.

• UK Brexit Committee In Bitter Row Over Plan To Delay EU Withdrawal (Ind.)

An influential Commons committee has become mired in a bitter row after Leave members refused to back its report recommending a potential delay to Brexit and extending the transition period afterwards. After they fell out with Remain backing members of the Brexit Committee, the group was forced to publish two sets of recommendations on Sunday. Prominent Conservative Jacob Rees-Mogg, who is a member, attacked others in the group as the “high priests of Remain”, claiming they had attempted to force through a “partisan” document. The committee’s Labour chair Hilary Benn said the divisions demonstrated just how difficult achieving an agreement on Brexit will be.

The group was set to call for an “extension to the Article 50 time”, which dictates the UK will formally leave the EU in March 2019, in order to ensure a comprehensive agreement can be reached. Their report was also due to back a provision in withdrawal arrangements to allow the transition period after departure, to be extended beyond the 21 months currently set, “if necessary”. Mr Benn highlighted that the extension would likely be needed because with just seven months left to reach an agreement, a host of highly complex issues remain. He said: “While the committee welcomes the progress that has been made in some areas, the Government faces a huge task when the phase two talks actually begin.

“The Government must now come forward with credible, detailed proposals as to how it can operate a ‘frictionless border’ between Northern Ireland and the Republic of Ireland because at the moment, the committee is not persuaded that this can be done at the same time as the UK is leaving the single market and the customs union.”

“There was a time when everyone in the bubble spoke French..”

• French Language Eyes ‘Le Comeback’ After Brexit (AFP)

Once upon a time speaking French was easy in Brussels, but things have changed. Bruno Le Maire, France’s finance minister, felt that keenly during a recent panel event with European steel-makers after several hours of speaking English with EU counterparts. “Maybe one in French if possible, otherwise I will run the risk of being criticised,” Le Maire, who speaks perfect English, said as he scanned the audience for questions. But raised hands quickly dropped away, leaving just one from a journalist, who asked the question in English anyway. Such is the fate of the speaker of French in today’s EU bubble, that small world of European decision-making where the language of Catherine Deneuve and Moliere was once essential.

Even after the shock vote of Brexit, English – or at least that simplified, beat-up version known as Globish – is firmly rooted as the lingua franca of the Brussels elite. “In the last 20 years, English has become completely dominant. French is not going to replace English in any way,” said Nicolas Veyron, one of the most respected economists in Brussels, who spends most of his day speaking English although he is French. That reality stings for French-speaking veterans of the Brussels bubble who remember a time when the top echelon of Europe was a coterie of francophones.

“The retreat of French has been catastrophic,” said Jean Quatremer, the longtime EU correspondent for French daily Liberation who has championed holding the line against the advance of English. “There was a time when everyone in the bubble – commissioners, officials, spokespeople, even (Brexit-backing British foreign minister) Boris Johnson, who was a journalist here – spoke French,” said AFP’s Christian Spillman, who first came to Brussels as a corespondent in 1991.

Whenever Europe talks about peace, remember this.

• Arms Deals Between Turkey And Germany Are Like A Well-Oiled Machine (Region)

Even after Turkey’s offensive in northern Syria’s Afrin, the German government has approved the supply of millions of euros in armaments to its partner, Turkey. The situation is revealed by a response from the Ministry of Economic Affairs to a request by the Green MP Omid Nouripour. In the first five and a half weeks of Turkey’s so-called “Operation Olive Branch” against the Kurdish militia YPG, and unfortunately civilians, in Afrin, 20 export authorisations for German armaments worth 4.4 million euros were granted. This is even more than the average value of the previous year for the same period (14 permits worth 3.6 million euros). Despite the strong opposition of German public opinion and media, arms sales to Turkey aren’t disrupted.

The type of armaments is unclear. In addition to weapons such as rifles, tanks or missiles, for example, unarmed military vehicles or reconnaissance armaments are possibly on the list. Foreign Minister Sigmar Gabriel (SPD), who resigned on Wednesday, had repeatedly assured in February, since the beginning of the Syrian offensive, that there is a complete export ban for all armaments to Turkey. “We did not deliver any armaments because of the conflict in northern Syria. That is forbidden in Germany, even to supply military armaments to a NATO partner like Turkey, “he said to the media on 16 February, the day of release of the journalist Deniz Yucel. Gabriel added, “Before this conflict, we would have been willing to deliver armaments that are not weapons. But that too has been stopped because of the conflict in Syria. And we can not and do not want to change that. ”

State Secretary Matthias Machnig (SPD), however, now writes in his reply to the request that the Federal Government has issued export licenses “in individual cases” even after the beginning of Turkey’s offensive. “These are either in connection with international arms cooperation, in which Germany is bound by contractual obligations to other EU and NATO partners, or they serve the NATO Alliance defence.” “The Federal Government has lied publicly and systematically to the public,” Nouripour told the media. “Permits, given despite the disproportionate assaults of the Turkish forces in northern Syria, cause heavy damage on the credibility of the new federal government and unmask their commitment to a restrictive arms export policy as empty promises.”

Mere numbers.

• At Least 15 Refugees Die As Boat Sinks Near Greek Island In Aegean Sea (R.)

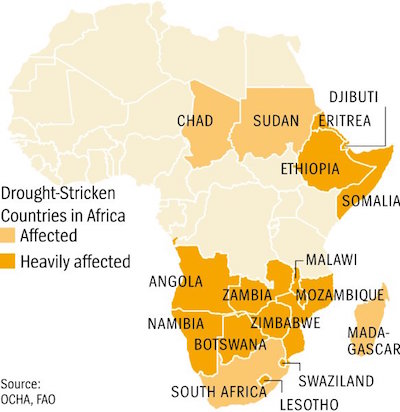

Fifteen people, including at least five children, drowned on Saturday when the small boat they were travelling on capsized in the Aegean Sea, Greek coast guard officials said. The incident occurred off Greece’s Agathonisi island, which is close to the Turkish coast. The identity and nationality of the victims was not immediately known. “At least four more [migrants] were unaccounted [for],” a coast guard official told Reuters. Three others were rescued. Saturday’s incident was thought to be the highest death toll of migrants trying to reach outlying Greek islands in months.

Greek authorities said they believed there were 22 people on the boat. Greek coast guard vessels assisted by two helicopters were searching for more survivors. “We can’t tolerate losing children in the Aegean Sea … the solution is to protect people, to implement safe procedures and safe routes for migrants and refugees, to hit the human trafficking circuits,” Greek migration minister Dimitris Vitsas said in a press release.

Because man is smarter than nature.

• Billion-Dollar Polar Bio-Engineering ‘Needed To Slow Melting Glaciers’ (G.)

Scientists have outlined plans to build a series of mammoth engineering projects in Greenland and Antarctica to help slow down the disintegration of the planet’s main glaciers. The controversial proposals include underwater walls, artificial islands and huge pumping stations that would channel cold water into the bases of glaciers to stop them from melting and sliding into the sea. The researchers say the work – costing tens of billions of dollars a time – is urgently needed to prevent polar glaciers melting and raising sea levels. That would lead to major inundations of low-lying, densely populated areas, such as parts of Bangladesh, Japan and the Netherlands.

Flooding in these areas is likely to cost tens of trillions of dollars a year if global warming continues at its present rate, and vast sea-wall defences will need to be built to limit the devastation. Such costs make glacier engineering in polar regions a competitive alternative, according to the team, which is led by John Moore, professor of climate change at the University of Lapland. “We think that geoengineering of glaciers could delay much of Greenland and Antarctica’s grounded ice from reaching the sea for centuries, buying time to address global warming,” the scientists write in the current issue of Nature. “Geoengineering of glaciers has received little attention in journals. Most people assume that it is unfeasible and environmentally undesirable. We disagree.”

Ideas put forward by the group specifically target the ice sheets in Greenland and Antarctic because these will contribute more to sea rise this century than any other source, they say. Their proposals include: • Building a 100-metre high wall on the seabed across a 5km wide fjord at the end of the Jakobshavn glacier in western Greenland. This would reduce influxes of warming sea water which are eroding the glacier’s base; • Constructing artificial islands in front of glaciers in Antarctica in order to buttress them and limit their collapse as their ice melts due to global warming; • Circulating cooled brine underneath glaciers such as the Pine Island glacier in Antarctica – in order to prevent their bases from melting and sliding towards the sea.

In each case, the team – which includes scientists in Finland and the US – acknowledges that costs would be in the billions. Construction is also likely to cause considerable disruption. For example, building a dam across the Jakobshavn fjord could affect ecology, fisheries and tourism, and large numbers of workers would have to be shipped in to complete the project. Similarly, building artificial islands in front of glaciers would mean importing about six cubic kilometres of material, a task that would be immensely difficult in stormy Antarctic waters. And drilling through ice that is kilometres thick to pump down cooled water would also stretch the capabilities of engineers.