DPC Looking south on Fifth Avenue at East 56th Street, NYC 1905

Go figure: 94.6 million ‘out of the labor force’, but NY Times states: “..weak demand for labor accounts for an estimated 2 million working-age men and women who currently do not have jobs or are not looking for jobs.”

• US Job Growth Disappoints Even More than Usual (NY Times)

The jobs report for September was a real letdown, and that is saying a lot, because what has passed for strong growth in the past year – 243,000 jobs a month on average before the latest data pulled the average down – has always been disappointing. It was a big improvement from job growth earlier in the recovery, but it was still too slow and too uneven to restore full employment and pull up wages. Then, last month, the economy added a scant 142,000 jobs and monthly tallies for July and August were revised down by 59,000 jobs. The labor force shrank – and not only because of retirements. Rather, weak demand for labor accounts for an estimated 2 million working-age men and women who currently do not have jobs or are not looking for jobs.

In addition, the share of 25 to 34-year-olds with jobs, a crucial demographic for home buying, has flattened recently, having never recovered its pre-recession level. There was, yet again, no meaningful wage growth in September. A slower pace of overall job growth plus flat wages is an especially bad sign for consumer spending. A cloudy outlook for spending implies a cloudy outlook for the economy. The best response to a report like September’s is to withhold judgment until more data comes in. It is hard, however, to be optimistic. In September, roughly as many industries gained employment as lost employment. In a healthy economy, employment gains outweigh employment losses across industries.

In the manufacturing sector, employment declines have been greater than employment gains for the past two months. The fear is of a continued slide. The Federal Reserve has rightly held off on interest rate increases in order to give the job market more time to recover. But robust recovery has been hindered, in large part, by the failure of Congress to use fiscal support to amplify the Fed’s efforts. If economic growth were to slow in what is still a near-zero interest rate environment, the Fed would not be able to jolt the economy with interest rate cuts. Janet Yellen, the Fed’s chairwoman, alluded to that possibility in a speech earlier this year. If it came to pass, Congress would be the economy’s best hope for stimulus policy. Would lawmakers step up? Like I said, it’s hard to be optimistic.

Read more …

“..the household survey was an unmitigated disaster, with 236,000 jobs lost in September..”

• US Payroll Disaster: Only 142K Jobs Added In September With Zero Wage Growth (ZH)

And so the “most important payrolls number” at least until the October FOMC meeting when the Fed will once again do nothing because suddenly the US is staring recession in the face, is in the history books, and as previewed earlier today, at 142K it was a total disaster, 60K below the consensus and below the lowest estimate. Just as bad, the August print was also revised far lower from 173K to 136K. And while it is less followed, the household survey was an unmitigated disaster, with 236,000 jobs lost in September. Putting it into perspective, in 2015 job growth has averaged 198,000 per month, compared with an average monthly gain of 260,000 in 2014. The recession is almost here.

As noted above, the headline jobs print was below the lowest Wall Street estimate. In other words 96 out of 96 economisseds did what they do best. The unemployment rate came in at 5.1% as expected but everyone will be focusing on the disaster headline print. And worst of all, average hourly wages stayed flat at 0.0%, also below the expected 0.2%. Actually, if one zooms in, the change was not 0.0%, it was negative, while weekly earnings actually declined from $868.46 to $865.61. Finally, not only were workers paid less, they worked less, as the average hourly weekweek declined from 34.6 hours to 34.5, suggesting an imminent collapse in economic output.

Read more …

“..there are nearly 100 million working-age Americans who could be in the labor force, but are not, “mostly” because they don’t want a job.”

• Fed: The 94.6 Million Americans Out Of The Labor Force ‘Don’t Want A Job’ (ZH)

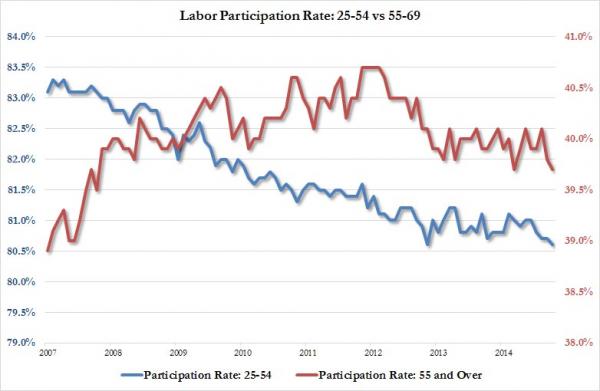

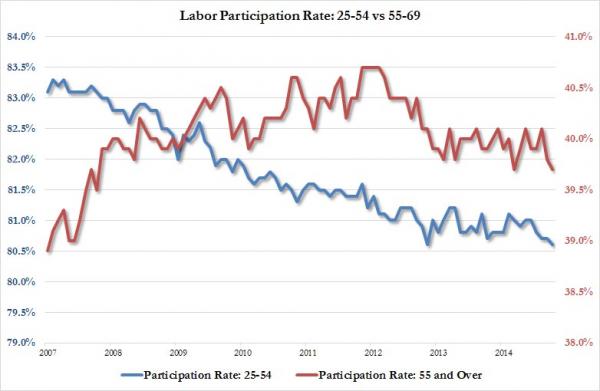

In a note seeking to “explain” why the US labor participation rate just crashed to a nearly 40 year low earlier today as another half a million Americans decided to exit the labor force bringing the total to 94.6 million people… this is what the Atlanta Fed has to say about the most dramatic aberration to the US labor force in history: “Generally speaking, people in the 25–54 age group are the most likely to participate in the labor market. These so-called prime-age individuals are less likely to be making retirement decisions than older individuals and less likely to be enrolled in schooling or training than younger individuals.”

This is actually spot on; it is also the only thing the Atlanta Fed does get right in its entire taxpayer-funded “analysis.” However, as the chart below shows, when it comes to participation rates within the age cohort, while the 25-54 group should be stable and/or rising to indicate economic strength while the 55-69 participation rate dropping due to so-called accelerated retirement of baby booners, we see precisely the opposite. The Fed, to its credit, admits this: “participation among the prime-age group declined considerably between 2008 and 2013.” And this is where the wheels fall off the Atlanta Fed narrative. Because the regional Fed’s very next sentence shows why the world is doomed when you task economists to centrally-plan it:

The decrease in labor force participation among prime-age individuals has been driven mostly by the share who say they currently don’t want a job. As of December 2014, prime-age labor force participation was 2.4 percentage points below its prerecession average. Of that, 0.5 percentage point is accounted for by a higher share who indicate they currently want a job; 2 percentage points can be attributed to a higher share who say they currently don’t want a job.

And there you have it: there are nearly 100 million working-age Americans who could be in the labor force, but are not “mostly” because they don’t want a job.

Read more …

How to destroy your economy in 2 easy steps.

• Companies Are Cutting Jobs And Buying Back Stock At The Same Time (MarketWatch)

How would you feel if the company that just laid you off said it was spending millions of dollars, or even billions, to buy back its stock? At least you wouldn’t feel lonely. U.S. companies announced 205,759 job cuts during the third quarter, the most since the third quarter of 2009, just after the Great Recession, according to data provided by outplacement company Challenger, Gray & Christmas In September, the number of announced job cuts was nearly double what it was at the same time last year. On Friday, the Labor Department released a stinker of a September jobs report. At the same time, share repurchases announced by U.S. companies during the third quarter remains around the highest levels in at least the last decade, according to data provider Dealogic.

In September, companies authorized buybacks totaling $243.4 billion, more than seven times the amount announced in the same month a year ago, Dealogic said. One might think these corporate actions are mutually exclusive, but as the chart above shows, many companies are doing both. In fact, some companies have even announced job cuts and share buybacks in the same news release. Hewlett-Packard made the biggest job-cut announcement this year, according to Challenger, on Sept. 15, when it said it was laying off up to 30,000 people. In the same statement, it indicated it could spend $700 million on share repurchases in fiscal 2016. Late Thursday, Bebe Stores said in a statement that it will lay off over 50 employees, or nearly 2% of its workforce, to save about $4.8 million a year. In the next paragraph, Bebe said it authorized a $5 million share repurchase program, which at current prices represents nearly 6% of the shares outstanding.

Read more …

The US is drowning in debt. Anything else is just fluff.

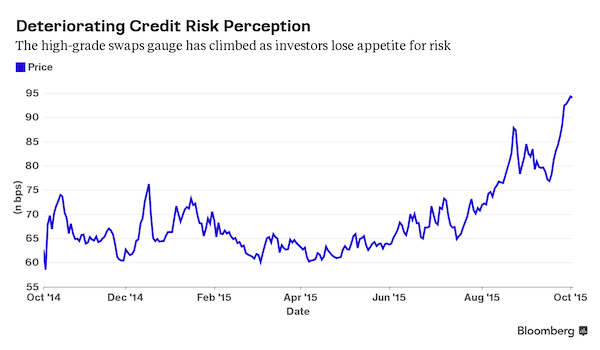

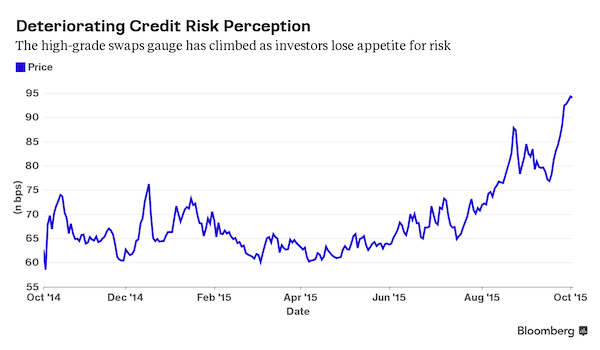

• Credit Investors Bolt Party as Economy Fears Trump Low Rates (Bloomberg)

Debt investors are a nervous lot these days, and new signs that global turmoil is weighing on the U.S. economic outlook are only adding to their angst. Measures of corporate credit risk spiked immediately after a Labor Department report showed that payrolls rose less than projected last month, wages stagnated and the jobless rate was unchanged. Investors are now demanding more than they have in three years to own junk bonds, which are on track to cap off their worst week this year. Frustration is growing that even after seven years of easy-money policies, economic growth remains sluggish. While the Federal Reserve is signaling that it’s in no hurry to normalize interest rates, investors are increasingly worried about what the data will mean for earnings at companies that have sold $9.3 trillion of corporate bonds since the start of 2009.

“At some point the financial markets say, ‘Enough about monetary stimulus, we need real growth,’” said Jack McIntyre at Brandywine Global Investment. “Bad things happen in a low-growth environment. There’s more risk, more potholes.” This was a tough week for the bond market. Glencore kicked things off with investor concerns that the mining and commodities trading company would have trouble harnessing its $30 billion in debt, which sent junk-bond yields skyrocketing. Weakness also spread to investment-grade credit as Hewlett-Packard had to increase the amount it was willing to pay investors to buy $14.6 billion of notes that will fund its split into two companies.

On Friday, the credit-default swaps benchmark tied to the debt of 125 investment-grade companies jumped 3.6 basis points to 98 basis points, the highest level since June 2013. The index pared the jump later in the day. Investors’ diminishing appetite for plowing money into corporate bonds has put the $6.5 trillion market for U.S. company borrowings on track to post losses this year for the first time since the 2008 financial crisis ravaged markets. “The risk environment for credit appears to have deteriorated substantially in the past few weeks,” Barclays strategists led by Jeffrey Meli and Brad Rogoff wrote in a report Friday. “There have been several examples of any negative news leading to an outsized repricing lower, particularly in high yield.”

Read more …

Authers has been consistently looking at things from the wrong side. And even as he’s slowly waking up, he still does.

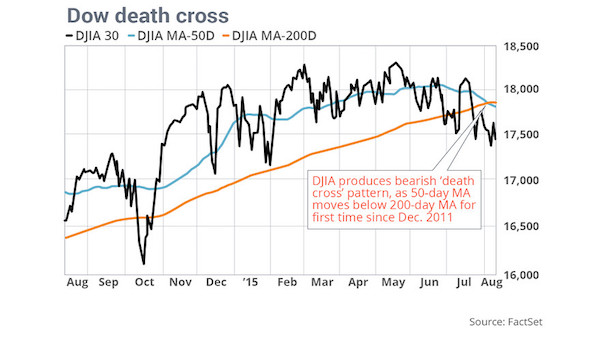

• Market Signals Mean Investors Must Start To Question Assumptions (John Authers)

Markets trade on a number of unspoken assumptions. For those who want to understand why markets are now signalling concern, let me list the assumptions that have recently been called into question. First, and most important, was the belief that low interest rates had driven stock markets up (particularly in the US where the central bank had been most aggressive in pumping out cheap money), and that cheap rates would keep share prices up. Last month, after much debate, the Federal Reserve made the marginal decision not to raise rates — and it triggered a sharp sell-off in world stock markets. The “good news” of cheap money was swamped by the “bad news” of the reasons for that decision. Friday’s publication of September’s employment data for the US confirms the wisdom of the Fed’s decision, and also the market’s response.

Payrolls grew by less than 150,000 for two consecutive months — the first time this has happened since 2012. Employment is still growing, and employment data are notoriously noisy. But that rate of growth is now unambiguously slowing, while long-term unemployment remains damagingly high. The instant response, judging by the Fed Funds futures market, was to put the market’s estimate of when the Fed will indeed start raising rates all the way back to March of next year. And the instant response of the stock market to the good news that money would stay cheaper for longer was to sell off, while investors piled into bonds, taking the yield on 10-year Treasury bonds below 2%.

We are now at a point where bad news on growth simply reveals that monetary policy has become impotent in the minds of investors. Economic growth is a concern, and enough of a concern to swamp any relief at countermanding easy monetary policy. Why? Because of the overturning of a second assumption — that China’s remarkable economic growth story can continue uninterrupted, under capable guidance from its political leaders. China continues to grow, but the sharp slowing of its pace, and the perceived miscues of its leaders over the summer, while handling its stock market and a slight devaluation in its currency, have shaken confidence.

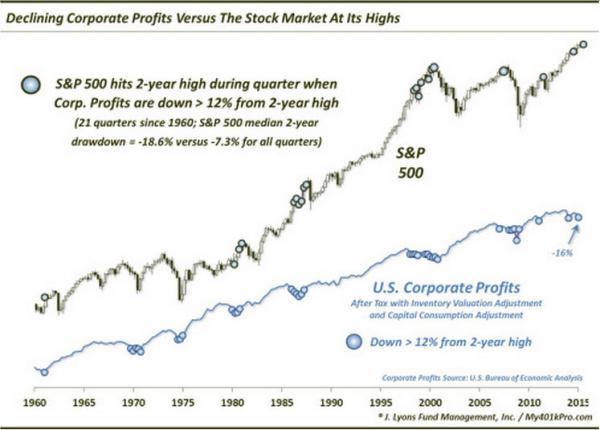

There are good reasons for concern over China’s economy, and the Asian economies that surround it. As the latest supply manager surveys demonstrate, export orders are growing at their slowest since the 2009 recession, while inventories are high. The fear is that a slowing Asia will export deflation to the west — a problem that manifests itself most directly in falling prices for metals, of which China is the world’s biggest consumer. That leads to a third assumption: corporate America can be the “little engine that can”, and keep churning out rising profits. The consistent recovery of US companies’ profits since their sudden collapse during the credit crisis of 2008 and 2009 has been a wonder of the age. Cheap money, enabling buybacks of stock, helped. But that growth has also now come to a halt.

Read more …

“..Markets need buying to go up and they need volume to go up.They can fall just on gravity.”

• Jeff Gundlach: Expect ‘Another Wave Down’ In Markets (Reuters)

DoubleLine Capital co-founder Jeffrey Gundlach, widely followed for his investment calls, warned after the weak jobs number on Friday that the U.S. equity market as well as other risk markets including high-yield “junk” bonds face another round of selling pressure. “The reason the markets aren’t going lower is people are holding and hoping,” Gundlach said in a telephone interview with Reuters. “The market bottoms out when people are selling and sold out — not when they are holding and hoping. I don’t think you’ve seen real selling in risk assets broadly. Markets need buying to go up and they need volume to go up.They can fall just on gravity.”

Investors piled into government bonds on Friday, sending the 10-year Treasury yield below 2%, after the Labor Department said employers hired 142,000 workers last month, far below the 203,000 forecasters had expected, and August figures were revised sharply lower to show only 136,000 jobs added. Gundlach said junk bonds are vulnerable: “I’ll think about buying when it stops going down every single day.” “People are acting like everything is great. Junk bonds are at a four-year low. Emerging markets are at a six-year low and commodities are at a multi-year low – same level as in 1995… GDP is not growing at a nominal basis.” Gundlach, whose Los Angeles-based DoubleLine was overseeing $81 billion in assets under management as of the end of the third quarter, said: “Clearly what’s happening is people are waking up to the idea that global growth is not what they thought it was.”

Read more …

“What we’re experiencing in the Chinese markets are the death throes of an economy that capital markets have realized is simply not productive enough to service that kind of debt.”

• The Reality Behind The Numbers In China’s Boom-Bust Economy (Mises Inst.)

Last year, the world was stunned by an IMF report which found the Chinese economy larger and more productive than that of the United States, both in terms of raw GDP and purchasing power parity (PPP). The Chinese people created more goods and had more purchasing power with which to obtain them – a classic sign of prosperity. At the same time, the Shanghai Stock Exchange more than doubled in value since October of 2014. This explosion in growth was accompanied by a post-recession construction boom that rivals anything the world has ever seen. In fact, in the three years from 2011 – 2013, the Chinese economy consumed more cement than the US had in the entire 20th century. Across the political spectrum, the narrative for the last fifteen years has been that of a rising Chinese hyperpower to rival American economic and cultural influence around the globe.

China’s state-led “red capitalism” was a model to be admired and even emulated. Yet, here we sit in 2015 watching the Chinese stock market fall apart despite the Chinese central bank’s desperate efforts to create liquidity through government-backed loans and bonds. Since mid-June, Chinese equities have fallen by more than 30 percent despite massive state purchases of small and mid-sized company shares by China’s Security Finance Corporation. But this series of events should have surprised nobody. China’s colossal stock market boom was not the result of any increase in the real value or productivity of the underlying assets. Rather, the boom was fueled primarily by a cascade of debt pouring out of the Chinese central bank.

Like the soaring Chinese stock exchange, the unprecedented construction boom was financed largely by artificially cheap credit offered by the Chinese central bank. New apartment buildings, roads, suburbs, irrigation and sewage systems, parks, and commercial centers were built not by private creditors and entrepreneurs marshaling limited resources in order to satisfy consumer demands. They were built by a cozy network of central bank officials, politicians, and well-connected private corporations.

Nearly seventy million luxury apartments remain empty. These projects created an epidemic of “ghost cities” in which cities built for millions are inhabited by a few thousand. At the turn of the century, the Chinese economy had outstanding debt of $1 trillion. Only fifteen years and several ghost cities later that debt has ballooned to an unbelievable $25 trillion. What we’re experiencing in the Chinese markets are the death throes of an economy that capital markets have realized is simply not productive enough to service that kind of debt.

Read more …

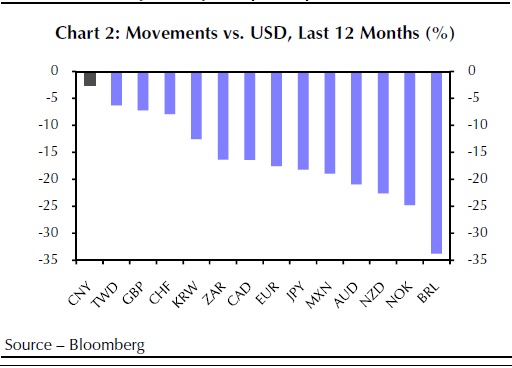

“The only way Beijing can support its currency is to sell foreign exchange, in most cases the dollar. Reporting by the FT at the end of August suggested that China was selling dollars at the rate of about $20 billion a day for this purpose..”

• China Imposes New Capital Controls (Chang)

The State Administration of Foreign Exchange, China’s foreign exchange regulator, has imposed annual limitations on cash withdrawals outside China on China UnionPay bank cards, the Wall Street Journal learned on Tuesday. The limitations are reportedly contained in a circular SAFE, as the regulator is known, sent to banks. Cardholders, under the new rules, may withdraw a maximum 50,000 yuan ($7,854) in the last three months of this year and a maximum 100,000 yuan next year. Because UnionPay processes virtually all card transactions in China, the new limits apply to all Chinese credit and bank cards. Beijing already imposes a 10,000-yuan daily limit on withdrawals.

And why should the rest of the world care about how much money a holder of a Chinese credit card can get from an ATM in, say, New York? The new rules could be the first in a series of measures leading to draconian prohibitions of transfers of money from China. Draconian prohibitions, in turn, could spark a global panic. Capital has been flowing out of China at a fast pace for more than a year, but the rate has been accelerating recently. In August, for instance, the country’s official foreign exchange reserves dropped by a stunning $93.9 billion according to SAFE, the biggest fall on record. Some analysts, however, had expected Beijing’s cash hoard to plunge by $150 billion, and it’s possible SAFE has underreported the outflow to avoid creating alarm.

Yet it’s hard for Chinese leaders to mask the situation. Wind Information, China’s leading financial data provider, says money is coming out of the country at the rate of $135 billion a month, net of inflow. That assessment appears more or less correct. Capital outflow in August, according to Bloomberg, was a record $141.7 billion, which topped July’s record of $124.6 billion. Goldman Sachs puts the August outflow at $178 billion. The global financial community has been focusing on the wrong crisis in China. Beijing’s efforts to prevent the collapse of equity values by massive purchases of stocks have received wide publicity since early July, but these purchases do not pose an immediate challenge to China’s technocrats.

They are, after all, using their own currency to acquire shares, and they can print as much of it as they like, especially because the country is in a general deflationary era. What is critical however, is Beijing’s defense of the renminbi. The People’s Bank of China, the central bank, began devaluing the currency on August 11th in a move that continues to puzzle observers. In any event, the devaluation triggered a run. Chinese officials, therefore, had to mount a heroic defense of the renminbi. The only way Beijing can support its currency is to sell foreign exchange, in most cases the dollar. Reporting by the Financial Times at the end of August suggested that China was selling dollars at the rate of about $20 billion a day for this purpose. At that “burn” rate, Beijing could use up all its foreign exchange reserves in a year.

Read more …

“BMW, Chrysler, General Motors, Land Rover and Mercedes-Benz are under scrutiny from the US regulator that exposed Volkswagen’s manipulation of emissions tests.”

• VW Scandal Deepens As France And Italy Launch Deception Inquiries (Guardian)

The Volkswagen emissions-testing scandal is deepening, with authorities in France and Italy launching investigations into the embattled German carmaker. Italy’s competition regulator is to investigate whether VW engaged in “improper commercial practices” by promoting its vehicles as meeting emissions standards which it failed to reach without a “defeat device”. The inquiry involves Volkswagen, Audi, Seat and Skoda diesel vehicles sold between 2009 and 2015. VW has suspended the sale of affected vehicles in Italy and also said it will recall more than 650,000 vehicles in the country. In France, an official from the prosecutor’s office told Reuters that an inquiry had been opened, and the French magazine L’Express said this had been launched at the instigation of Pierre Serne, vice-president of the region Île-de-France responsible for transport.

It also emerged on Friday that other car manufacturers – BMW, Chrysler, General Motors, Land Rover and Mercedes-Benz – are under scrutiny from the US regulator that exposed Volkswagen’s manipulation of emissions tests. The EPA has broadened its investigation to include at least 28 diesel-powered car models made by those companies, according to the Financial Times. VW has admitted to the US regulator that it fitted up to 11m vehicles with software that manipulates the tests. Its chief executive, Martin Winterkorn, has stepped down and is facing a criminal investigation in Germany, along with other, unnamed, employees of the carmaker.

The EPA will initially test one used vehicle of each model and then widen the enquiry if it finds anything suspicious, a senior agency official close to the investigation told the FT. The investigation will include most of the diesel vehicles on US roads, such as BMW’s X3, Chrysler’s Grand Cherokee, GM’s Chevrolet Colorado, the Range Rover TDV6 and the Mercedes-Benz E250 BlueTec. Diesel engines make up a tiny proportion of the overall car market in the US, but are far more common in Europe.

Read more …

German journalists are digging deeper, and it will be that much harder to bury the scandal.

• Volkswagen: Full Chronology of The Scene of the Crime (Handelsblatt)

Volkswagen, the world’s largest automaker, has been brought to its knees by the emissions cheating scandal. The company’s share price has been virtually halved, its reputation is in tatters, customers are furious and employees are distraught. Handelsblatt pieces together the events that led up to the scandal, based on the facts as they are currently known. The following chronology is based on the work of six reporters and correspondents, who analyzed corporate documents and spoke to many of the people involved.

Chapter 1: The Big Plan is Hatched in Wolfsburg

February 2005 – Wolfgang Bernhard becomes head of the group’s core VW brand and, with the help of CEO Bernd Pischetsrieder, begins developing a new engine that will work with “common rail injection.” The new engine is to be used above all in the United States, where VW wants to start growing again. The group hopes that diesel engines, which are more economical and accelerate quickly, will help it gain ground against U.S. and Japanese rivals. There is one problem, however: The U.S. authorities have the strictest environmental standards.

May 2005 – Mr. Bernhard entrusts the new project to Rudolf Krebs, a developer at VW’s Audi brand. It quickly becomes apparent that it will be impossible to comply with U.S. emissions standards using current technology. Their solution is “adblue,” a technology used by German carmaker Daimler. Developers at VW and Audi are strongly opposed to the use of “adblue” in the planned engine, which later will come to be known as the EA 189, the engine containing the emissions cheating device. Mr. Bernhard is undeterred and presses on with plans for the new engine to incorporate “adblue” and common rail injection.

Fall 2006 – The first prototype is tested in South Africa. Martin Winterkorn, the head of Audi, and Ferdinand Piëch, the chairman of the VW group’s supervisory board and a major shareholder, are reported to have been present, but are not said to have been impressed.

November 11, 2006 – It emerges that Daimler and the VW group will offer diesel cars in the United States under the joint label “Bluetec.”

Chapter 2: The Plan Takes Shape in Wolfsburg

January 7, 2007 – VW subsidiary Audi launches its diesel offensive in the United States at the Detroit Motor Show. It is the first German manufacturer to do so. Wolfgang Bernhard does not attend the show, which surprises journalists. It soon emerges that he is to leave the company at the end of January, after less than two years in his post.

Read more …

Finally we find out who’s been sacked. But that doesn’t mean the right people have been.

• VW Tsunami: Falsified Emissions Push Company to Limits (Spiegel)

Since Sept. 20, when then-CEO Martin Winterkorn admitted that VW had cheated for years on emissions tests with the help of illegal software, Europe’s largest automobile company has been in crisis mode. Company managers don’t know what tasks to handle first. “It’s like we have been hit by a tsunami,” says one VW manager. Company attorneys have been overwhelmed by inquiries from national authorities on both sides of the Atlantic and by lawyers who have been notifying the company with threats of lawsuits. Beyond that, financial experts have to develop plans in case the company’s ratings fall, which would increase borrowing costs. And sales managers have to come up with promotions to help dealerships sell cars. Diesel models are currently extremely difficult to move off the lot without significant rebates.

And then there is the company investigation that hopes to quickly discover how the scandal could have happened in the first place and who was responsible. Because development of the diesel engine in question began back in 2005, documents, records and emails from the last 10 years have to be examined. But those involved in the investigation have also received clues from the press – for example, the fact that Bosch, a VW supplier, warned Volkswagen early on against using the emissions software in question. But the VW investigation team was unable to find a message to that effect in company records. They contacted Bosch with a request to please send a copy to company headquarters in Wolfsburg.

Four managers who were responsible for the development of engines or vehicles have thus far been suspended. Their experiences were similar to that of Audi board member Ulrich Hackenberg, a long-time confidant of Winterkorn’s and, up until just a few days ago, one of the most powerful men at VW. He received news of his immediate suspension from the personnel department and was asked to turn in his company phone and leave his office. He has also been told not to set foot on company premises. Wolfgang Hatz and Heinz-Jakob Neusser, the heads of R&D for Volkswagen and Porsche respectively, suffered similar fates. In the case of Neusser, there is probable cause: A company employee allegedly told him back in 2011 about the use of the forbidden emissions software.

The moves are vital, as the company seeks to find out what went wrong and begins what promises to be a long process of restoring its reputation. Some of the suspended managers, to be sure, are likely to be reinstated once it is proven that they had nothing to do with the implementation of the software in question. But for the moment, the development of new models at Volkswagen and its affiliates has come to a screeching halt. The old bosses are gone, new ones have yet to be named and projects cannot go forward. That, though, is a small price to pay in comparison to what likely lies ahead. New VW CEO Müller, who was head of Porsche prior to his promotion, has demanded an “unsparing and vigorous investigation.” But with the company’s very existence at risk, even that may not be enough.

Read more …

How long is this going to take?

• VW Emissions Cheating Scandal Heading To US Congress (CNBC)

Two weeks after revealing that Volkswagen had cheated on diesel emissions tests, officials from the EPA still have not formally ordered a recall of 482,000 VW products, but that step is “likely” to take place, according to an EPA spokesperson. Sources inside Volkswagen, meanwhile, told TheDetroitBureau.com that the automaker is now working with the federal agency to come up with an acceptable fix for diesel models that can produce as much as 40 times the allowed level of pollutants such as smog-causing NOx. VW has already said it is developing a retrofit for a total of 11 million diesel vehicles sold worldwide that contained a secret “defeat device” designed to reduce emissions levels during testing.

VW’s problems have continued to escalate in recent days, and even as prosecutors in both the U.S. and Germany look into the scandal, the automaker’s top U.S. executive has been summoned to Capitol Hill, where he will testify before a congressional oversight panel on Oct. 8. “The American people want to know why these devices were in place, how the decision was made to install them, and how they went undetected for so long. We will get them those answers,” said Rep. Tim Murphy, the Pennsylvania Republican who serves as chairman of the Energy and Commerce Subcommittee on Oversight and Investigations. The hearing will come less than a month after the EPA announced that Volkswagen had secretly added software code to its digital engine controllers designed to rein in emissions during testing.

But in the real world, the nearly half-million diesel vehicles sold in the U.S. over the last seven years were allowed to produce significantly higher levels of pollution than allowed by federal standards. The scandal threatens to consumer the automaker, with potential fines of more than $18 billion from the EPA alone. VW could face additional penalties resulting from the Justice Department investigation, as well as possible criminal sanctions. And the maker has been hit with a number of class-action lawsuits alleging, among other things, that it defrauded customers. September numbers released by VW on Thursday show that the maker did gain about 1% in sales compared to the same month a year ago. But the overall industry saw a 16% jump in volume for September. And since the scandal only hit mid-month, many analysts believe VW could be hit even harder in October.

Read more …

When -cheating- carmakers get into banking. As if GM’s experiences haven’t been bad enough. Oh wait, GM’s still propping up US cars with cheap loans.

• VW Financial Services Arm A Risk Investors May Be Overlooking (CNBC)

Volkswagen may be an even bigger risk for investors than previously thought, as a key part of its business – aside from making cars – is threatened by the diesel emissions scandal. The company’s financial services business, which gives consumers loans to buy its cars and accounts for close to half of its balance sheet, could be the next source for alarm, according to analysts at Credit Suisse. The previously successful business – which currently has more than €100 billion of outstanding loans to customers – may even need fresh capital, the analysts argue. “We increasingly see risk in VW’s Financial Services business which supported industrial growth in the past.

Higher refinancing costs and risk provisioning makes it difficult for the financial services business to fund itself going forward; thus a capital injection would likely be required unless growth is reduced materially,” Credit Suisse wrote in a research note Friday morning. In other words, the woes of the manufacturing arm of the business are likely to affect the financial services’ ability to borrow to fund its operations. VW’s borrowing costs, measured by its bond yields, are already up by 200 basis points since the company admitted lying about diesel emissions in mid-September. If it is more difficult to get a loan to buy a Volkswagen as a result, the number of consumers wanting to buy its cars may dwindle even further.

Read more …

But NDP is not high in the polls. On the brighter side, Harper’s not winning either. The liberals were a mess, but Stephen has been a calamity.

• Canada Opposition Warns TPP Deal Not Binding Ahead Of Imminent Election (G&M)

NDP Leader Thomas Mulcair is serving notice that a New Democratic Party government would not consider itself bound by the terms of a major Pacific Rim trade deal which the ruling Conservatives are negotiating on behalf of Canada in Atlanta. The NDP’s hardening of position on the Trans-Pacific Partnership talks comes as the deal appears likely. Discussions in Atlanta have gone into overtime as countries clear obstacles such as how much foreign content should be allowed in Japanese-made cars and Asian auto parts entering North America. Sources said Prime Minister Stephen Harper is being regularly briefed on developments as talks between 12 countries from Chile to Japan enter what is expected to be their final phase. Mr. Mulcair said Friday, however, that he feels the Conservative government has no mandate to agree to the big changes that a TPP deal would bring about.

His bombshell declaration on Friday promises to make the massive trade agreement a bigger factor in Canada’s 42nd federal election, which is 2 1/2 weeks away. It comes as polls suggest the NDP has dropped to third place in the national race. The new marker laid down by the NDP on a potential TPP deal sets it apart from the Conservatives, who favour a deal, and the Liberals, who have focused most of their criticism on the manner in which the Tories have negotiated the agreement rather than its substance. The NDP is trying to consolidate the anti-TPP vote with this move. Mr. Mulcair laid out his reasons in a letter to International Trade Minister Ed Fast, the Conservative government’s point man on the TPP talks, listing a slew of reasons why he’s distancing himself from the agreement, including the expected pain it will bring to Canadian dairy farmers and smaller auto parts makers.

“Your government forfeited a mandate to conclude negotiations on a major international trade agreement the day the election was called,” he writes. The letter also throws into question what would happen should the Conservatives lose power in the Oct. 19 election. “As you participate in Trans-Pacific Partnership negotiations this week in Atlanta, I wish to advise you that an NDP government will not consider itself bound to any agreement signed by your Conservative government during this federal election,” Mr. Mulcair says. He says a caretaker government like the one now running Ottawa during an election campaign is supposed to step carefully and ensure Canada’s interests are “vigorously defended” in Atlanta.

Read more …

Well put: “Going down under”.

• Australia Is “Going Down Under”: “The Bubble Is About To Burst”, RBS Warns (ZH)

[..] just because other vulnerable countries aren’t beset with ethnic violence and/or street protests doesn’t mean they too aren’t facing crises due to falling commodity prices and the slowdown of the Chinese growth machine. One such country is Australia, which in some respects is an emerging market dressed up like a developed economy, and which of course has suffered mightily from the commodities carnage and China’s transition away from an investment-led growth model. Out with a fresh look at the risks facing Australia is RBS’ Alberto Gallo. Notable excerpts are presented below. From RBS:

Australia has become a commodity focused economy, with an increasing exposure to China. For the past decades, Australia has been buoyed by the rapid Chinese expansion, which outpaced the rest of the world. Australia benefited from China’s strong demand for commodities given its investment-led growth model. China is Australia’s top export destination and 59% of those exports are in iron-ore. But as China struggles to manage its ongoing credit crunch and continues its shift to consumption-led growth Australia’s economy is likely to be hurt by lower demand for commodities. The economy is slowing due to external headwinds. Last quarter, Australian GDP grew at just 0.2% QoQ, its lowest level in the last three years (and below the market consensus of 0.4%).

According to the Australian Bureau of Statistics (ABS) the growth rate was driven by higher domestic demand, while lower exports and a declining mining industry continue to present headwinds. Mining’s gross value-added to GDP fell by – 0.3% QoQ in Q2. Despite Reserve Bank of Australia (RBA) governor, Glenn Stevens, citing lower growth as potentially a “feature of the post financial crisis world” meaning that “potential growth is a bit lower”, Australia’s slowing economy is more than just a victim of the post financial crisis world, in our view. Rising unemployment coupled with soaring house prices and vulnerabilities in the commodity and construction sectors are all cause for concern. Unemployment is rising, and could increase further, given the high proportion of employment in the vulnerable mining and construction sectors.

Unemployment is at 6.2%, just shy of the ten year high of 6.3%. Although the number itself is not worryingly high, unemployment has been rising for the last three years, and is likely to continue in our view. Mining and commodity sectors employ 4.5% of the workforce. With lower demand for commodities from China, unemployment in these sectors could rise. Also, unemployment may rise in the construction sector (8.9% of workforce) given vulnerabilities in the housing market. There are domestic headwinds, too. The housing market is vulnerable, with overvalued properties and over-levered households. House prices in Australia have risen by 22% in the last three years, with property prices in Sydney overtaking those in London. House prices have risen faster than both disposable income and inflation in recent years, with the gap between growth in house prices and household income closing by over 40% in the last three years.

Read more …

Like oil.

• Half of World’s Coal Output Is Unprofitable (Bloomberg)

Half of the world’s coal isn’t worth digging out of the ground at current prices, according to Moody’s Investors Service. The global metallurgical coal benchmark has fallen to the lowest level in a decade, settling last month at $89 a metric ton. “Further production cuts are necessary to bring the market back into balance,” Moody’s analysts including Anna Zubets-Anderson wrote in a report on Thursday. China’s slowing appetite for the power-plant fuel and steelmaking component has depressed the seaborne market, creating a worldwide glut. In the U.S., cheap natural gas is stealing coal’s share of the power generation market. And the strong dollar has tempered exports.

In North America, the credit rating company said it expects the industry’s combined earnings before interest, taxes, depreciation and amortization to decline by 10% next year after a 25% plunge in 2015. The Illinois Basin stands to be the “most resilient to current market dynamics” because of its lower mining costs and its location in the middle of the country where power plants still burn the fuel, Moody’s said. “We believe that Foresight Energy, a producer concentrated in the region, will be able to maintain steady production volumes over the next two to three years,” Zubets-Anderson wrote.

Read more …

Armstrong swims in dark waters.

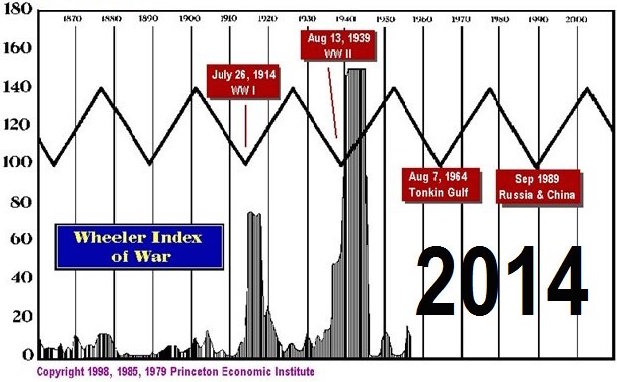

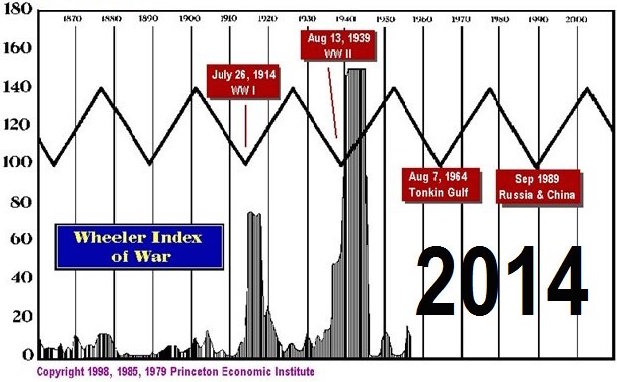

• From Here On Out, This Is Not A Video Game – This Is Real (Martin Armstrong)

The unleashing of Russian firepower in Syria in support of the Syrian government came precisely on the day of the Economic Confidence Model. I have come to learn from observing this model that major world events, whatever the major focus may be, appear to line up with the ECM. This target has been huge for us given that we have TWO WAR CYCLE MODELS: (1) civil unrest that leads to revolution, and (2) international war. It is sort of like the Blood Moon stuff insofar as it does not line up so easily. The main convergence of the War Cycle between both models began to turn in 2014. The economic war against Russia imposing sanctions began on March 6, 2014 (2014.178) when Obama signed Executive Order 13660 that authorizes sanctions on individuals and entities responsible for violating the sovereignty and territorial integrity of Ukraine.

The next day, this order was followed by Executive Order 13661, which claimed that Russia had undermined the democratic processes. On March 20, 2014, Obama issued a new Executive Order: “Blocking Property of Additional Persons Contributing to the Situation in Ukraine”. This order expanded the scope of the two previous orders to the Government of the Russian Federation; it included its annexation of Crimea and its use of force in Ukraine, which the U.S. claimed was a threat to the national security and foreign policy of the United States. Then on April 28, Obama imposed more sanctions on Russia. The third round of U.S. sanctions on Russia began from October into December 2014 over the turning point. On October 3, 2014, Joe Biden said, “It was America’s leadership and the president of the United States insisting, oft times almost having to embarrass Europe to stand up and take economic hits to impose costs.”

The EU imposed sanctions on December 18, 2014, which banned some investments in Crimea and halted support for the Russian Federation Black Sea exploration of oil and gas. The EU sanctions also prevented European companies from offering tourism services and purchasing real estate or companies in Crimea. On December 19, 2014, Obama imposed sanctions on Russian-occupied Crimea by executive order, which prohibited exports of U.S. goods and services to the region. The actual turning point was 2014.8871: November 20, 2014. The one event that took place precisely on that day was the Supreme Court’s ruling to allow same-sex marriage in South Carolina. This decision sparked civil unrest against the government throughout the Bible Belt states. On that same day, Obama took executive action on immigration. On November 24, the Missouri Grand Jury made ruled not to indict Officer Wilson in the shooting of Michael Brown on August 9, which sparked the beginning of civil unrest, such as the Black Lives Matter movement, in a rebuke of corrupt police forces.

Read more …

Is there any sense of humanity left in Britain? These few thousand people can obviously be of much more value than an equal number of fat Brits.

• Channel Tunnel Closed As Migrants Occupy Complex (AFP)

Traffic through the Channel Tunnel connecting Britain and France was suspended early this morning after around 100 migrants entered the French side of the tunnel complex, the company operating it said in a statement. “At around 12:30 am, around 100 migrants forced a closure and the entry of security agents into the tunnel,” a Eurotunnel spokeswoman told AFP. She said police were at the site and that traffic remained suspended. Ten people, including seven migrants, suffered minor injuries in the storming of the tunnel, a firefighter at the scene said.

The interior ministers of France and Britain in August signed an agreement to set up a new “command and control centre” to tackle smuggling gangs in Calais, as Europe grapples with its biggest migration crisis since World War II. It came after attempts to penetrate the sprawling Eurotunnel site spiked that month, with migrants trying several times a night to outfox hopelessly outnumbered security officials and police. Thousands of people from Africa, the Middle East and Asia are camped in Calais in slum-like conditions, and at least 13 have died since 26 June trying to cross over into Britain, where many have family and work is thought easier to find.

Read more …

Count on more.

• UN Refugee Agency: Over 1.4 Million To Cross Mediterranean To Europe (Reuters)

The UN refugee agency expects at least 1.4 million refugees to flee to Europe across the Mediterranean this year and next, according to a document seen by Reuters on Thursday, a sharp rise from initial estimates of 850,000. “UNHCR is planning for up to 700,000 people seeking safety and international protection in Europe in 2015,” reads the document, a revision to the agency’s existing appeal for funds. “… It is possible that there could be even greater numbers of arrivals in 2016, however, planning is based for the moment on similar figures to 2015.” UNHCR launched the appeal on Sept. 8 with preliminary plans for 400,000 refugee arrivals in 2015 and 450,000 in 2016. But the 2015 figure was surpassed within days of its publication, and by Sept. 28, 520,957 had arrived.

The revised appeal totals $128 million, a sharp increase from the initial appeal for $30.5 million, and UNHCR asked donors to allow their funds to be allocated flexibly because of the “very volatile operational context”. The appeal is also broadened to include transit countries in the Middle East and North Africa, to enable refugees to get help from UNHCR at an earlier stage of their journey. Although the vast majority of recent arrivals have travelled from Turkey through Greece, Macedonia and Serbia, possible alternative routes mapped out by UNHCR include the sea route from Turkey to Italy, from Greece through Albania to Montenegro or Italy, and from Montenegro by boat to Croatia. Most are fleeing the Syrian civil war, with many others seeking to escape conflict or poverty in Iraq, Afghanistan, Africa or elsewhere.

Read more …