Roy Lichtenstein Woman in Bath 1963

All economics is politics.

• When Politics Trumps Economics (Roach)

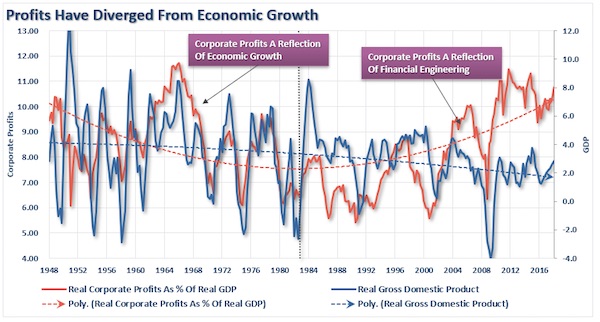

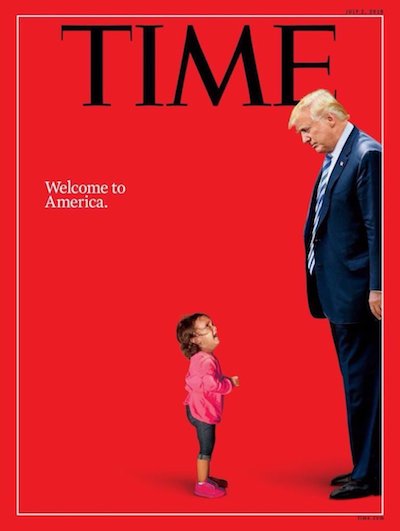

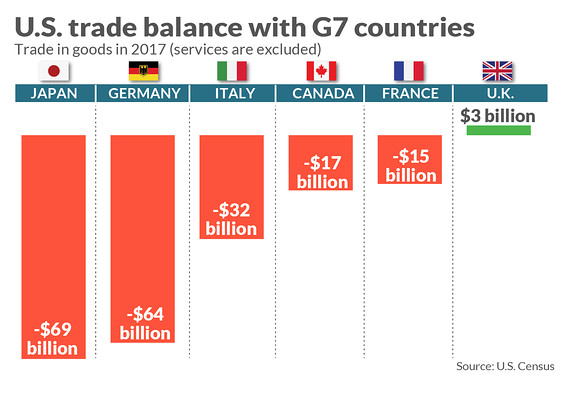

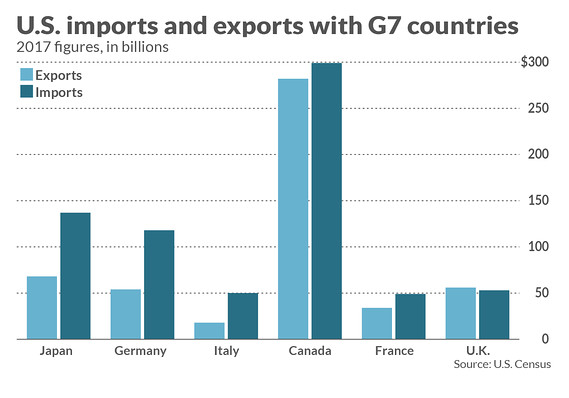

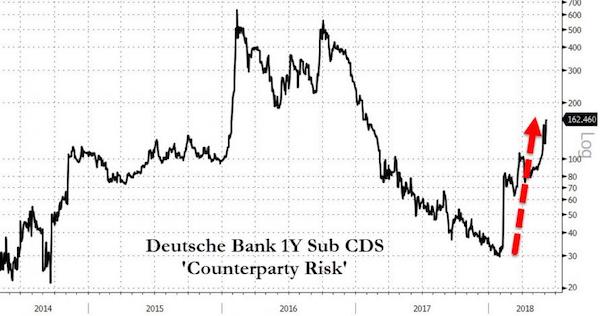

With each passing day, it becomes increasingly evident that US President Donald Trump’s administration cares less about economics and more about the aggressive exercise of political power. This is obviously a source of enormous frustration for those of us who practice the art and science of economics. But by now, the verdict is self-evident: Trump and his team continue to flaunt virtually every principle of conventional economics. Trade policy is an obvious and essential case in point. Showing no appreciation of the time-honored linkage between trade deficits and macroeconomic saving-investment imbalances, the president continues to fixate on bilateral solutions to a multilateral problem – in effect, blaming China for America’s merchandise trade deficits with 102 countries.

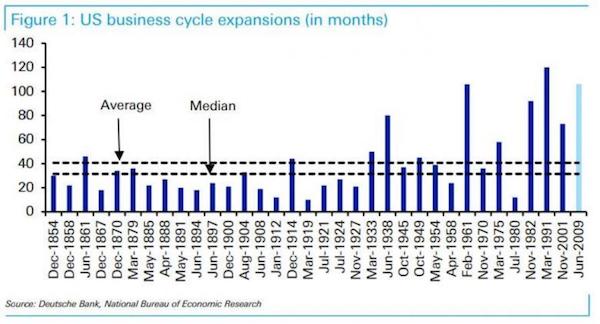

Similarly, his refusal to sign the recent G7 communiqué was couched in the claim that the US is like a “piggy bank that everybody is robbing” through unfair trading practices. But piggy banks are for saving, and in the first quarter of this year, America’s net domestic saving rate was just 1.5% of national income. Not much to rob there! The same can be said of fiscal policy. Trump’s deficit-busting tax cuts and increases in government spending make no sense for an economy nearing a business-cycle peak and with an unemployment rate of 3.8%. Moreover, the feedback loop through the saving channel only exacerbates the very trade problems that Trump claims to be solving.

With the Congressional Budget Office projecting that federal budget deficits will average 4.2% of GDP from now until 2023, domestic saving will come under further pressure, fueling increased demand for surplus saving from abroad and even bigger trade deficits in order to fill the void. Yet Trump now ups the ante on tariffs – in effect, biting the very hand that feeds the US economy.

A real threat to the entire Aussie economy.

• Update on Deflating Property Bubbles in Sydney & Melbourne (WS)

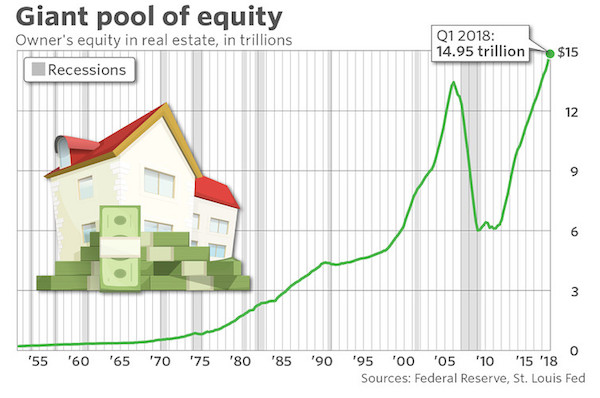

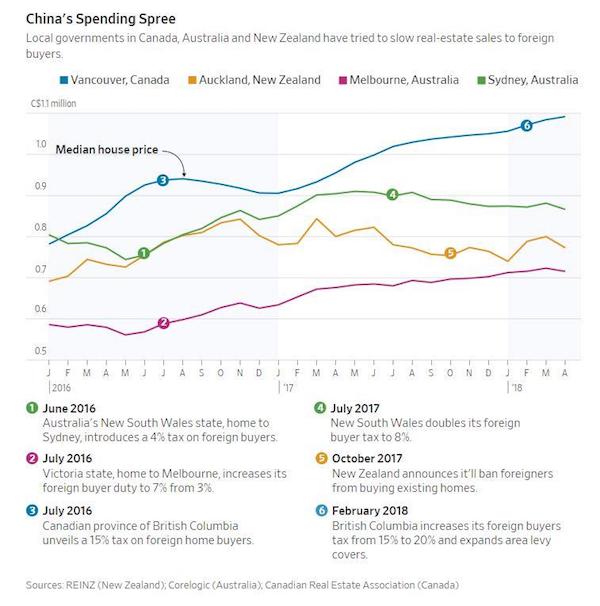

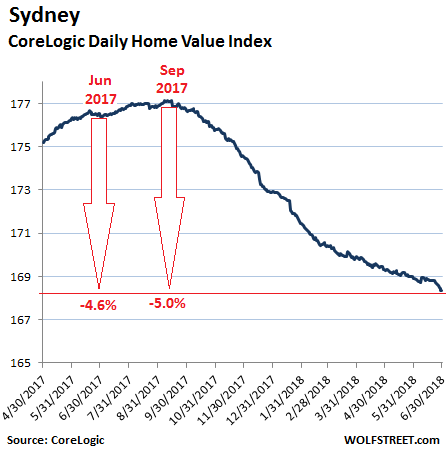

In Sydney, Australia’s largest property market and Petri dish for one of the world’s biggest housing bubbles, home prices fell 4.6% in June compared to a year ago, with house prices down 6.2%, and prices of condos (“units” as they’re called) down 0.7%, according to CoreLogic. The most expensive sector got hit the hardest: in the top quartile of home sales, prices fell 7.3%. In the nine months since the peak in September, the overall Daily Home Value Index has fallen 5.0%. But it had been one heck of a boom in Sydney, where home prices had jumped over 80% from the end of 2009 through the peak in September last year. Even during the big-bad Global Financial Crisis, they’d only dipped 4.6%.

So the market is changing, and the denying has stopped. Australian banks are getting put through the wringer by the Royal Commission with ongoing revelations of an ever longer list of misdeeds, particularly in the mortgage sector. The Australian Prudential Regulation Authority (ARPA), which is supposed to regulate the financial services industry, put in place some macroprodential measures to tamp down on the housing bubble, and they’re finally having an impact. Banks are suddenly focusing on borrowers’ debt-to-income ratios and other specifics, rather than just the assurance that home prices will always rise. They’re under investigation, and they’re tightening credit. And investors – a huge force in the market – have suddenly lost their appetite for property speculation, and banks have lost their appetite for funding them.

Just make all tariffs the same.

• EU Warns US Of $294 Billion Hit If Car Tariffs Imposed (R.)

The European Union has warned the United States that imposing import tariffs on cars and car parts would harm its own automotive industry and likely lead to counter-measures by its trading partners on $294 billion of U.S. exports. In a 10-page submission to the United States Commerce Department sent last Friday, the European Union said tariffs on cars and car parts were unjustifiable and did not make economic sense. he Commerce Department launched its investigation, on grounds of national security, on May 23 under instruction from President Donald Trump, who has repeatedly criticised the EU over its trade surplus with the United States and for having higher import duties on cars. The EU has a 10% levy, compared to 2.5% for cars entering the United States.

Trump said last week that the government was completing its study and suggested the United States would take action soon, having earlier threatened to impose a 20% tariff on all EU-assembled cars. The bloc exported 37.4 billion euros (33.10 billion pounds) of cars to the United States in 2017, while 6.2 billion euros worth of cars went the other way. The European Union says that for some goods, such as trucks, U.S. import duties are higher. In its submission, the EU said that EU companies make close to 2.9 million cars in the United States, supporting 120,000 jobs – or 420,000 if cars dealerships and car parts retailers are included. [..] Assuming counter-measures along the lines of those taken in response to existing U.S. import tariffs on steel and aluminium, up to $294 billion of U.S. exports – 19% of overall U.S. exports – could be affected, the submission said.

One last chance for Merkel.

• Key Merkel Ally Seehofer ‘Announces Intention To Resign’ Over Migration (G.)

The future of Germany’s coalition government is hanging in the balance after the country’s interior minister reportedly announced his intention to resign over a migration showdown with Angela Merkel. Horst Seehofer, who is also leader of the Christian Social Union, on Sunday night offered to step down from his ministerial role and party leadership in a closed-door meeting in which he and fellow CSU leaders had debated the merits of the migration deal Merkel hammered out with fellow European Union leaders in Brussels. But with CSU hardliners believed to have tried to talk the combative interior minister into staying, a press conference was postponed until Monday, with Seehofer seeking to go back to Merkel in search of a final compromise.

At a 2am media conference, Seehofer said he had agreed to meet again with Merkel’s party before he made his decision final. “We’ll have more talks today with the CDU in Berlin with the hope that we can come to an agreement,” Seehofer said. “After that, then we will see.” In the short term, Seehofer’s resignation would appear to be a let-up for a beleaguered Merkel, removing a politician who has become the chancellor’s biggest nemesis inside her own government since taking up his post at the interior ministry in March. But if Seehofer were to resign and his replacement continue an adversarial approach, it would threaten to bring an end to the historic alliance between Merkel’s party, the Christian Democratic Union, and the Bavarian CSU, pushing the chancellor’s coalition government to the brink of collapse.

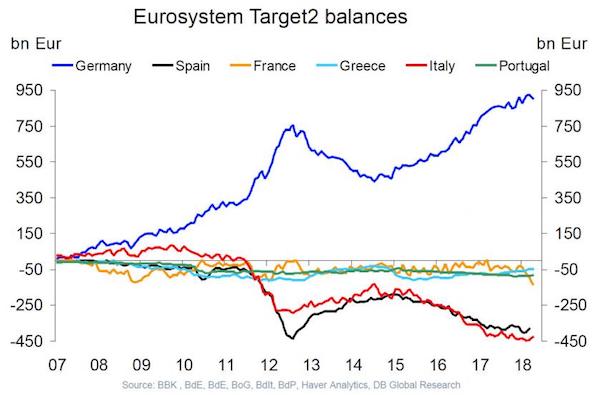

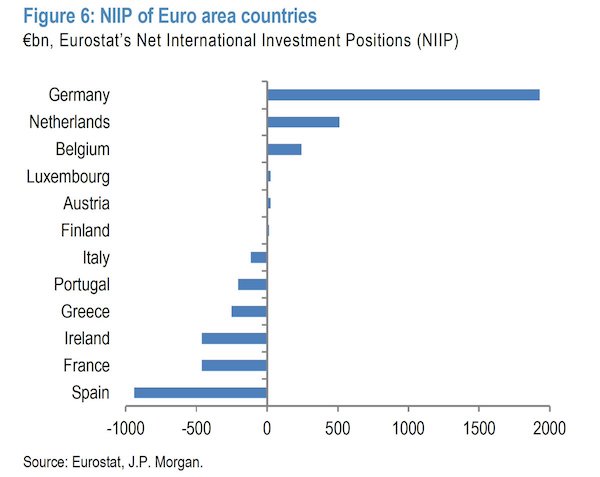

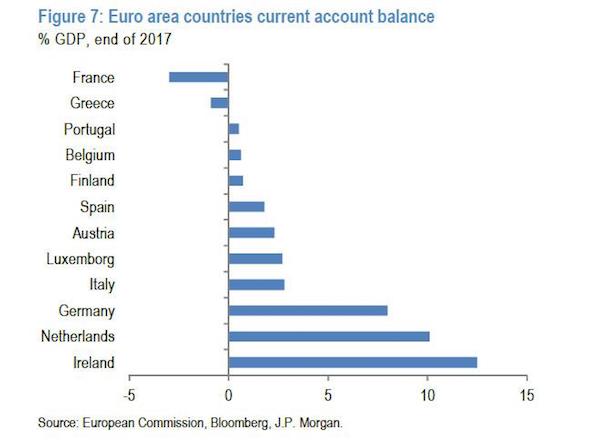

Germany has dictated policies far too long.

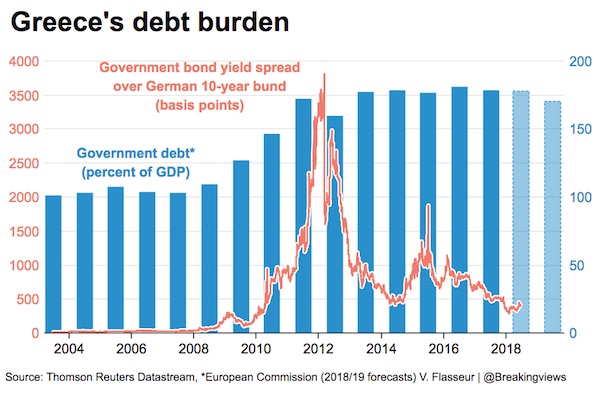

• Competing Visions Of Europe Are Threatening To Tear The Union Apart (G.)

[..] three competing visions have emerged. The first is Merkel’s idea of a “competitive” Europe. Under her “leadership” since the euro crisis began in 2010, the EU has increasingly become a vehicle for imposing market discipline on member states. It is in the name of this idea of a competitive Europe that, led by Germany, austerity has been imposed on debtor countries in the eurozone. In other words, although it is expressed in pro-European terms and involves further integration, it is essentially a neoliberal vision.

The second vision is the French president Emmanuel Macron’s idea of a “Europe qui protège”, a Europe that protects. Macron envisages an EU in which there would be greater solidarity between citizens and between member states. In practice, this means more redistribution and risk-sharing in the eurozone – the “transfer union” that Germany and other creditor countries fear. This is a centre-left vision of Europe – although in France, because Macron has implemented structural reforms in an attempt to gain credibility in Berlin, he is himself increasingly perceived as neoliberal.

The third vision is the Hungarian prime minister Viktor Orbán’s idea of a “Christian” Europe of sovereign states. His vision first emerged in response to the attempt, led by Germany, to force EU member states to accept mandatory quotas of refugees in 2015, but it has developed into a broader critique of the European project. Orbán defines himself as an “illiberal democrat” in opposition to what he sees as the undemocratic liberalism of the EU. His vision is shared not just by the Law and Justice party government in Poland but also by far-right parties in other EU member states.

Good luck. Mexico is such a mess. But they might beat Brazil today in the World Cup.

• Leftist ‘AMLO’ Sweeps To Mexican Presidency (AFP)

Anti-establishment leftist Andres Manuel Lopez Obrador swept to victory in Mexico’s presidential election Sunday, in a political sea change driven by voters’ anger over endemic corruption and brutal violence. The sharp-tongued, silver-haired politician known as “AMLO” won 53% of the vote, according to an official projection of the results. It is the first time in Mexico’s modern history a candidate has won more than half the vote in a competitive election, and a resounding rejection of the two parties that have governed the country for nearly a century. “This is a historic day, and it will be a memorable night,” Lopez Obrador said in a victory speech in Mexico City’s Alameda park, as thousands of ecstatic supporters flooded the capital’s central district, chanting “Yes we did!” and partying to mariachi music.

Lopez Obrador, 64, sought to downplay fears of radicalism, after critics branded him a “tropical Messiah” who would install Venezuela-style policies that could wreck Latin America’s second-largest economy. “Our new national project seeks an authentic democracy. We are not looking to construct a dictatorship, either open or hidden,” he told cheering supporters, promising to safeguard freedoms, respect the private sector and work to reconcile a divided nation. He also vowed to pursue a relationship of “friendship and cooperation” with the United States, Mexico’s key trading partner – a change in tone from some comments during the campaign, when he said he would put US President Donald Trump “in his place.”

Better to reorganize it?!

• Axios Leaks Trump Bill To Blow Up World Trade Organization (ZH)

Following the close of a second quarter that will be best remembered by President Trump’s vacillations on trade, Axios has dropped a Sunday night bombshell that may spook markets hoping for a respite from the daily escalating trade war rhetoric as the second half of the year begins: White House reporter Jonathan Swan has obtained a copy of a draft bill, purportedly ordered by Trump himself, that would allow the US to “walk away” from its commitments to the World Trade Organization. If passed, the bill (entitled the “United States Fair and Reciprocal Tariff Act”) would effectively blow up the WTO, an organization that the US helped create back in the 90s, by allowing Trump to unilaterally ignore the two most important principles:

The “Most Favored Nation” (MFN) principle that countries can’t set different tariff rates for different countries outside of free trade agreements; “Bound tariff rates” — the tariff ceilings that each WTO country has already agreed to in previous negotiations. “It would be the equivalent of walking away from the WTO and our commitments there without us actually notifying our withdrawal,” one anonymous source reportedly told Axios. The bill asks Congress to hand over to Trump unilateral power to ignore WTO rules and negotiate unilateral trade agreements. The leak of the draft bill follows another WTO-related scoop from Axios, published last week, where Swan reported that Trump has repeatedly badgered his aides about pulling the US out of the WTO, which the president has famously criticized as a “disaster”.

The bill’s chances of making it through Congress are extremely low. However, if Trump has taught us anything about his trade agenda, it’s never say never. “The good news is Congress would never give this authority to the president,” the source added, describing the bill as “insane.” “It’s not implementable at the border,” given it would create potentially tens of thousands of new tariff rates on products. “And it would completely remove us from the set of global trade rules.”

Another nonstarter.

• UK To Announce Third Post-Brexit Customs Model (BBC)

Downing Street has produced a third model for handling customs after the UK leaves the EU, the BBC understands. Details of the new plan have not been revealed publicly but senior ministers will discuss it at Chequers, the prime minister’s country retreat, on Friday. Ministers have been involved in heated discussions recently as they tried to choose between two earlier models. Tory backbencher Jacob Rees-Mogg says the PM risks a revolt if the type of Brexit she promised is not delivered. Theresa May hopes to resolve cabinet splits on the shape of Brexit at this week’s cabinet meeting. The prime minister has said the UK will then publish a White Paper setting out “in more detail what strong partnership the United Kingdom wants to see with the European Union in the future”.

It follows last week’s summit in Brussels where European Council president Donald Tusk issued a “last call” for the UK to agree its position on Brexit, saying the “most difficult” issues were unresolved and “quick progress” was needed if agreement was to be reached by the next meeting in October. BBC political correspondent Chris Mason says Downing Street hopes it has now found its way out of a bind on customs, the issue central to the practicalities of the UK’s future trading relationship with the EU, and a significant part of finding a solution to maintaining an open border with the Republic of Ireland.

Highest courts in every nation MUST be independent.

• The Supreme Court Has Already Reshaped America (G.)

“It’s not just that justice Kennedy’s successor is likely going to move the court to the right,” Vladeck said. “It’s that knowing that there are five conservative justices surely emboldens states and conservative interest groups to bring to the supreme court legal theories that they might have been reluctant to leave in justice Kennedy’s hands.” If that picture of the country’s jurisprudential future has left liberals distraught, it has also raised questions about the court’s increasingly politicized nature, its power to shape society and the erosion of its independence as one branch of government meant to balance the other two – Congress and the presidency – and to be checked in turn itself.

While past courts have had liberal or conservative bents, since the Bush v Gore decision that decided the 2000 election, the court has taken on a more explicitly political feel. “People say the founders would roll over in their graves – I think the founders would hang themselves”, said Mickey Edwards, vice-president of the Aspen Institute think-tank and formerly a congressman for 16 years. “The whole idea of the court being a separate and independent branch has totally disappeared. It is now a third branch of the policymaking process.” Extreme partisanship in Congress has led the legislature to relinquish its power to the presidency and the court, Edwards said.

“We now have become so accustomed to thinking of things – whether it’s foreign policy or trade policy or other things that the Congress has constitutional authority over – we now look at them all as presidential powers,” Edwards said. “So the presidency has grown much stronger. “I would also say that the supreme court has grown stronger and it’s become more partisan, which is very disturbing.”

Portrait of a nation.

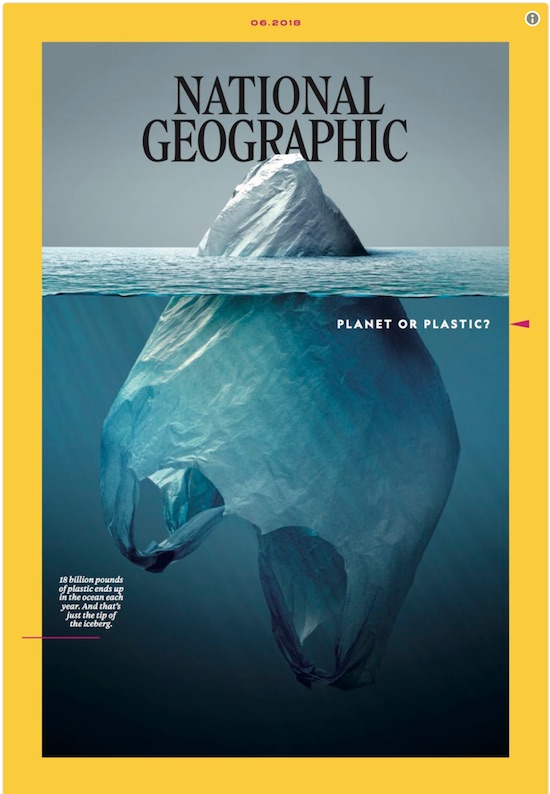

• Australian Plastic Bag Ban Sparks Abuse, Violence From Angry Shoppers (Ind.)

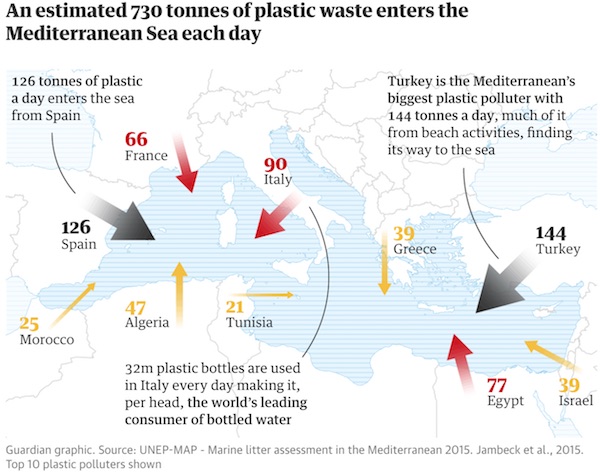

Supermarket staff in Australia have faced abuse and violence from shoppers angry at the removal of plastic bags as a ban comes into force. Customers rebelling against the end of free single-use bags have taken out their frustration on staff, prompting warnings to them to be considerate. In Western Australia, a shopper put his hands around the throat of an employee at Woolworths, which had stopped giving out free plastic bags days before the ban came into force. It was one of dozens of cases of shop staff being abused as Australia moves to reduce the amount of non-decomposing synthetic materials going into rivers and seas.

In a survey of supermarket workers this week, out of 132 who responded, 57 (43 per cent) said they had suffered abuse because of the plastic bag ban. “I work at Woolies and have already been abused countless times; it’s not our fault,” staff member Lauren McGowan told News.com.au. There have also been reports of customers stealing handfuls of bags before the ban. As of today, major retailers in Western Australia and Queensland face fines if they supply single-use plastic bags – which are already banned in Tasmania, South Australia, the Northern Territory and the Australian Capital Territory.

Because there are so many birds.

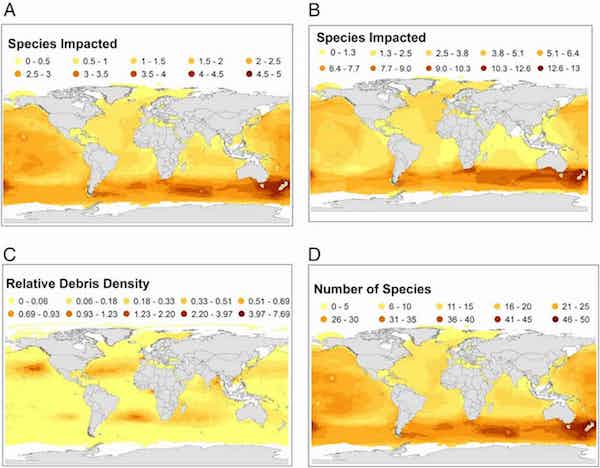

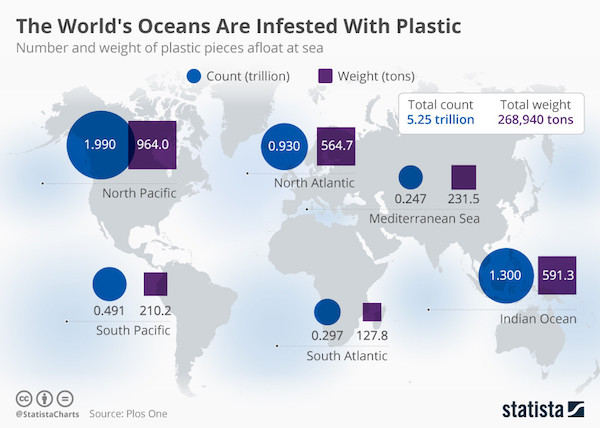

• New Zealand Most Perilous Place For Seabirds Due To Plastic Pollution (G.)

Seabirds are more at risk of dying due to plastic in New Zealand than anywhere else in the world, new research presented to parliament has shown. New Zealand is considered “the seabird capital of the world”, according to the country’s Department of Conservation, with the northern royal albatross raising their chicks on the Otago Peninsula, unique species of oystercatchers on the Chatham Islands and more penguin species than any country in the world. There are 36 seabird species that breed only in New Zealand. Mexico is a distant second with just five. More than a third of all seabird species are known to spend time in New Zealand’s waters.

Karen Baird from conservation group Forest & Bird, which produced the report, said: “Rubbish that ends up in our seas has a far worse effect on seabird species than anywhere else in the world.” “Even though we don’t have the most plastic pollution, we are unique in the world in having so many seabirds species. We also have the most threatened seabird species, many of which are found nowhere else.” Seabirds are particularly vulnerable to eating plastic because they are surface feeders, spotting food from the air and swooping down on it, scooping it up and swallowing it before the mistake is realised. Seabird chicks and adults face starvation when their stomachs fill up with plastic rather than food.

Forest & Bird called on the government to ban single-use plastic bags and commit to further research into how marine life is affected by plastic in New Zealand waters. One in three turtles that are found sick or dead in the country are caused by the animals eating plastic, Forest & Bird found, with marine mammals such as seals and sea lions also at risk. In neighbouring Australia, nine out of 10 fledglings in some shearwater colonies surveyed had eaten significant quantities of plastic, Baird said. New Zealand’s 10 shearwater species could be in for the same fate if plastic pollution wasn’t urgently addressed, Baird said.