Harris&Ewing Boy Scout farm 1917

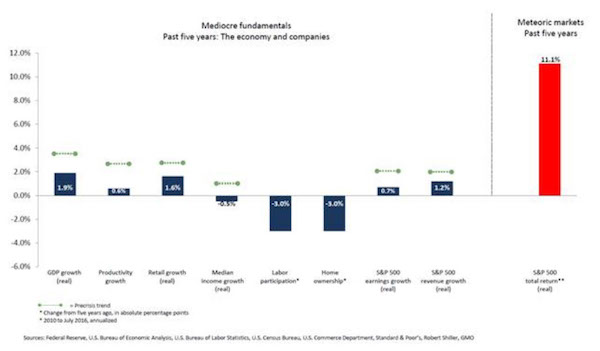

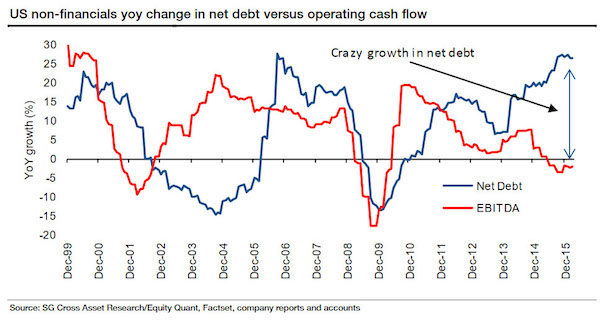

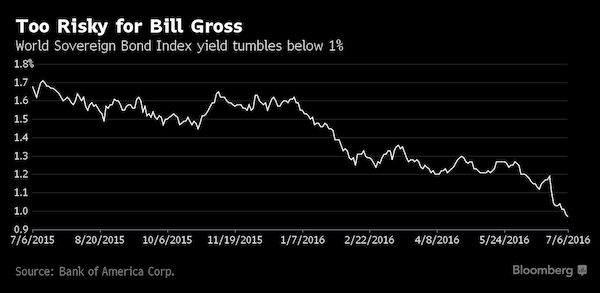

The level of high grade corporate debt is more than 2X its pre-crisis peak. As Capex is down 10%, and net fixed business investment is 20% below 2000 levels. Corporations are burning and bleeding cash left right and center. Question: what has the debt been used for?

• The Market Is In Line With History. The History Of Crashes (Stockman)

By punting again [this week], our dithering money printers at the Fed are continuing to fuel a monumental orgy of corporate bond issuance. It only enables companies to speculate in their own stocks with borrowed money, while heaping windfall gains on the fast money traders who hound corporate boards into strip-mining their own balance sheets. The level of high grade corporate debt outstanding has gone nearly parabolic in the last few years and now stands at more than 2X its pre-crisis peak. Yet even Yellen admitted during yesterday’s mindlessly meandering presser that business capital expenditure (CapEx) has been extraordinarily weak. In fact, non-defense CapEx orders excluding aircraft peaked in mid-2104 and are now down by 10%.

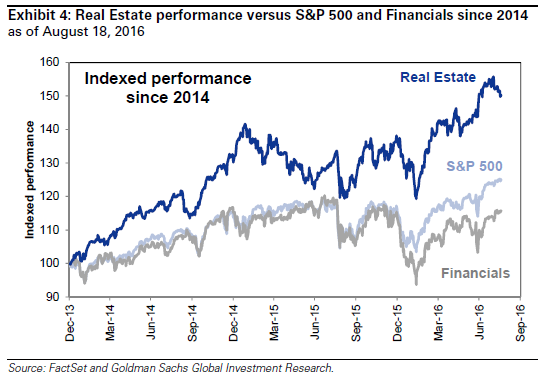

Even more to the point, real net fixed business investment after depreciation is still 20% below the level it reached way back in early 2000. That is, two bubbles ago. Perhaps the question about where all this hand-over-fist corporate borrowing is going might have occurred to at least one of the geniuses who voted to stand pat. But apparently it didn’t because once again Yellen insisted that “valuations are largely in line with their historical trends.” What in the world is our clueless school marm talking about? At the closing price yesterday, the S&P 500 traded at 25X the $87 per share reported for the last twelve month (LTM) period ending in June. And that was in the face of earnings that have plunged 19% since peaking in the September 2014 LTM period.

Yellen is right about the historical trends, of course. But not at all in a good way. In fact, on the eve of the last crash when the market peaked in October 2007 at about 1550, S&P 500 earnings during the most recent LTM period had posted at $79 per share. That means the peak pre-crash multiple was substantially lower than today at 19.7X. Even when S&P earnings peaked at $54 per share in September 2000, the multiple was only a tad higher than today at 26.5X. So, yes, the market is in line with history. That is, the history of crashes! The truth is, the Fed is inherently, relentlessly and radically in the financial bubble business. But the Keynesian school marm who runs it wouldn’t know a bubble if one transported her to the moon and back.

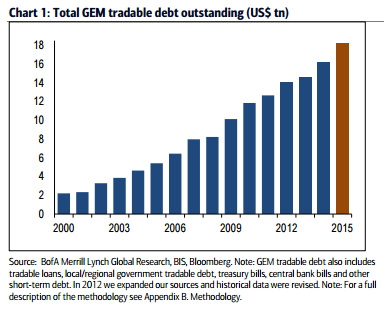

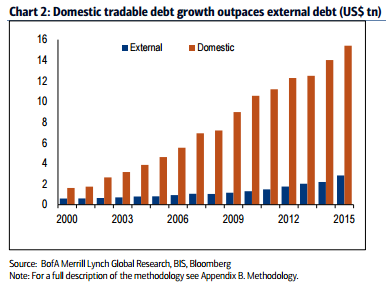

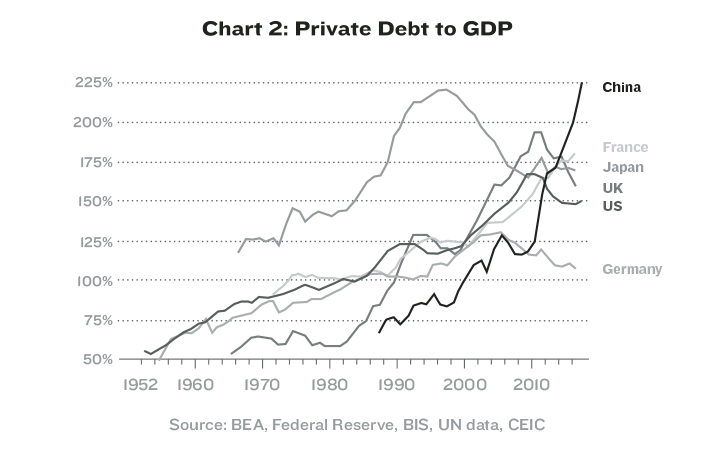

The role of debt has been growing for a long time.

• How to Suffocate Your Economy: Drown it in Massive Private Debt (Vague)

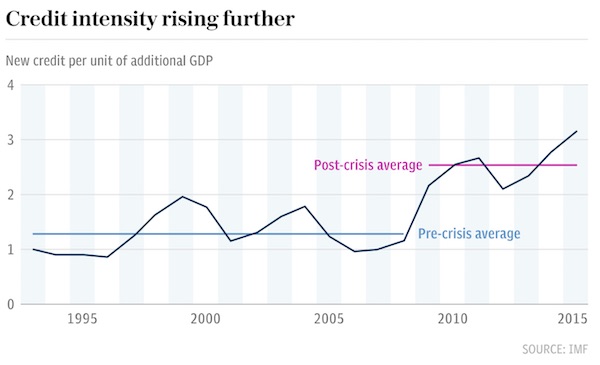

[..] if a country’s private debt to GDP ratio is low, let’s say 50%, then the households and businesses in that country generally have low loan-to-income ratios and are well positioned to power growth through increased leverage. And if a country’s private debt to GDP ratio is high, let’s say 200%, then the households and businesses in that country are generally overleveraged, with, on average, very high debt ratios. They are much less likely to be able to boost growth through more borrowing.

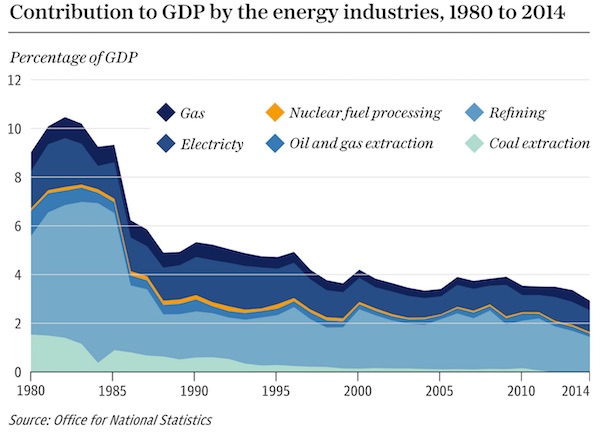

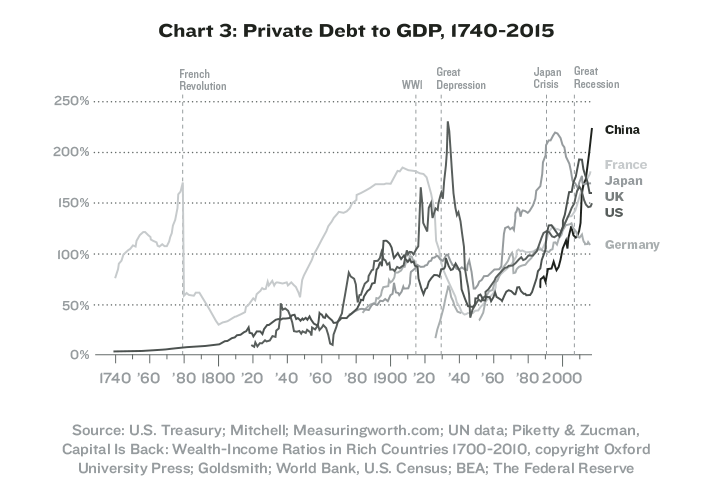

Chart 2 showed that private debt to GDP in major economies has been growing rapidly since World War II. However, it has been growing in size relative to GDP for a lot longer than that. It’s part of a process often described by economists as “financialization” or “financial deepening,” an increase in the size of a country’s debt and equity markets usually explained as simply the maturation of a market. But as we have seen, when it comes to debt, it is much more than that—it is the path from low leverage to overleverage for the participants in that economy. The benefit of increasing leverage from low levels has played a central role in the miraculous gains in incomes over the 200-plus years since the Industrial Revolution.

You can see this clearly in Chart 3. I have made a concerted effort to reconstruct more than 200 years of private debt history for the six countries in this chart—China, Japan, Germany, Britain, France, and the United States—because collectively, they have accounted for roughly 50% or more of global GDP since the Industrial Revolution. So studying the data of these six countries during this period gives us a fairly solid proxy for the world during the most important era of economic history. (This chart is a work-in-progress which will be augmented and refined in preparation for an upcoming book on this same subject.)

Auckland, Sydney, London etc. should do the same.

• Vancouver Property Sales To Foreigners Crash 96% (ZH)

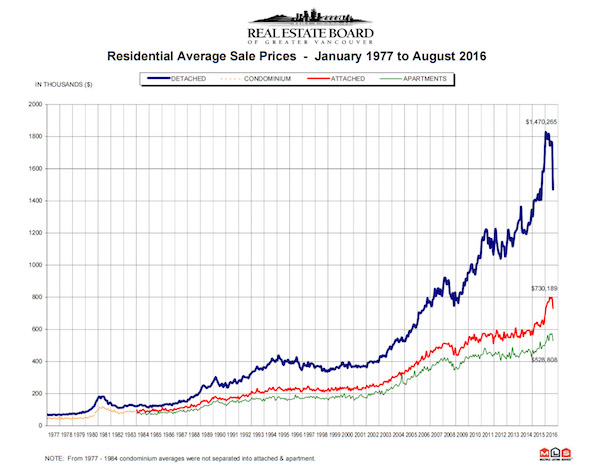

China’s favorite offshore money laundering hub is officially no longer accepting its money. According to data released by British Columbia’s Ministry of Finance on Thursday, foreign investors officially disappeared from Vancouver’s property market last month after the local government imposed a 15% surcharge to curb a record-shattering surge in home prices. Overseas buyers accounted for a paltry 0.7% of the C$6.5 billion of residential real estate purchases in August in Metro Vancouver; this represents a 96% plunge from the seven weeks prior, when foreigners were responsible for 16.5% of transactions by value. According to the latest data overseas buyers snapped up C$2.3 billion of homes in the seven weeks before the tax was imposed, and less than C$50 million in the next four weeks.

[..] As Bloomberg notes, the plunge in foreign participation joins other signs of a slowdown in Canada’s most expensive property market. The silver lining is that while transactions may have ground to a halt, the government did pick up some extra tax revenues: British Columbia has raised C$2.5 million in revenue from the new levy since it took effect. Budget forecasts released last week indicated that the Pacific coast province expects foreign investors to scoop up about C$4.5 billion of real estate through March 2019. That may prove optimistic, because as reported two weeks ago as Chinese buyers wave goodbye to Vancouver, they have set their sights on another Canadian city: Toronto. According to the Star, sales of $1-million-plus Toronto-area single-family homes rose 83% year over year in July and August. That’s 3,026 homes, with 55% of them inside Toronto’s borders.

[..] if they are looking in Canada, we believe Toronto will be the most logical place for people to consider. Montreal and Calgary will probably also get a look-see,” Henderson said. Or maybe not. As CBC reported earlier this week, economist Benjamin Tal of CIBC said that Ontario will have little choice but to copy Vancouver and implement a tax on foreign house buyers. In a recent note to clients, the economist said the biggest problem facing policymakers with regard to hot housing markets in Toronto and Vancouver is a limit on the supply of new homes. “The main reason behind higher prices in the [Greater Toronto Area] is a policy-driven lack of land supply,” Tal said. “And with no change on that front, policymakers have to use demand tools to deal with what is essentially a supply problem.”

I’m going to have my doubts here.

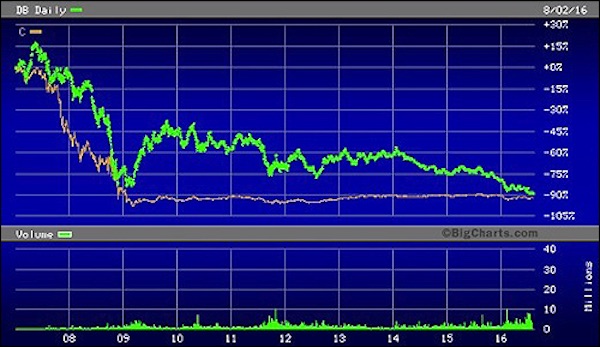

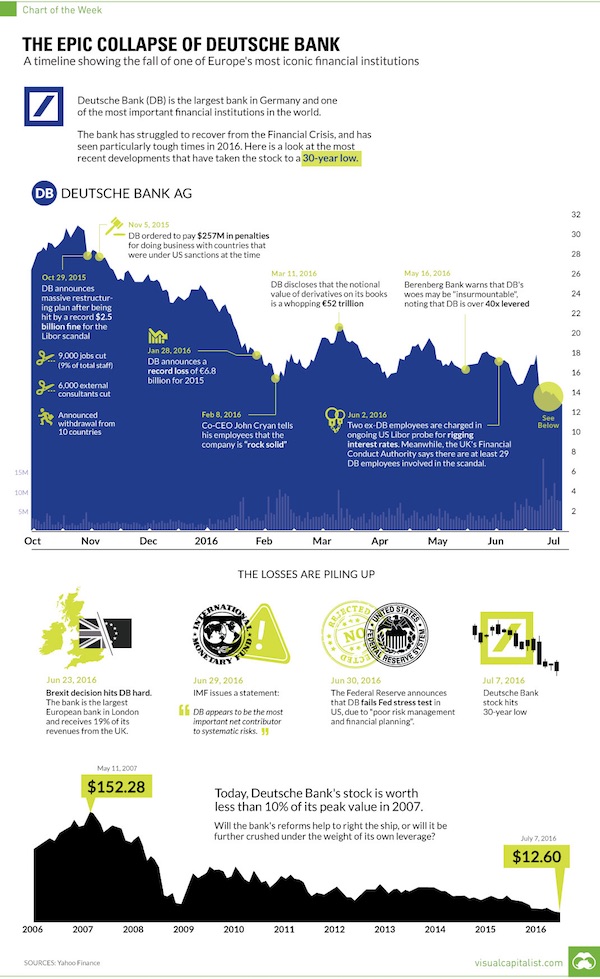

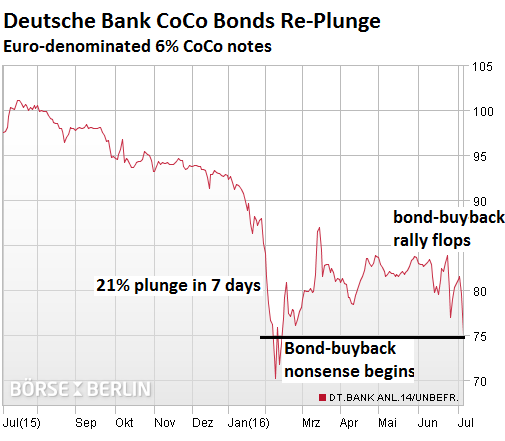

• Merkel Rules out State Assistance for Deutsche Bank (BBG)

Chancellor Angela Merkel has ruled out any state assistance for Deutsche Bank in the year heading into the national election in September 2017, Focus magazine reported, citing unidentified government officials. The German leader also declined to step into the bank’s legal imbroglio with the U.S. Justice Department, which may seek as much as $14 billion in sanctions against Deutsche Bank’s mortgage-backed securities business, the magazine said. The finances of Germany’s biggest lender, which has lost almost half of its market value this year, are raising concern among German politicians.

At a closed session of Social Democratic finance lawmakers this week, Deutsche Bank’s woes came up alongside a debate over Basel financial rules, according to two people familiar with the matter. Germany’s government expects a “fair outcome” in the U.S. probe, the Finance Ministry said on Sept. 16. Deutsche Bank has said it’s unwilling to pay the maximum amount sought by U.S. authorities as investors fret about the bank’s capital. Chief Executive Officer John Cryan, 55, has struggled to boost profitability by selling riskier assets and eliminating jobs as unresolved legal probes and claims add to concerns that the lender will be forced to raise capital.

Cut off dividends and share prices will fall through the floor.

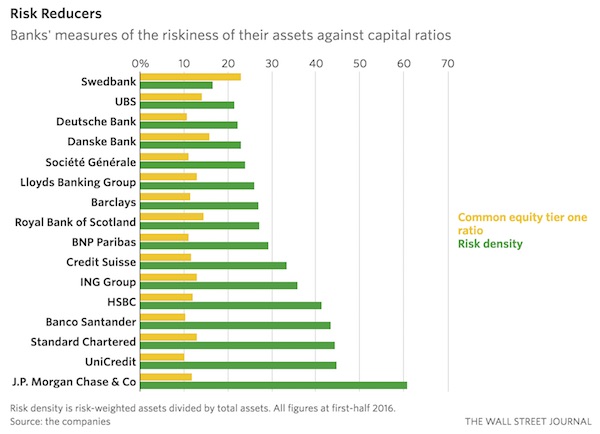

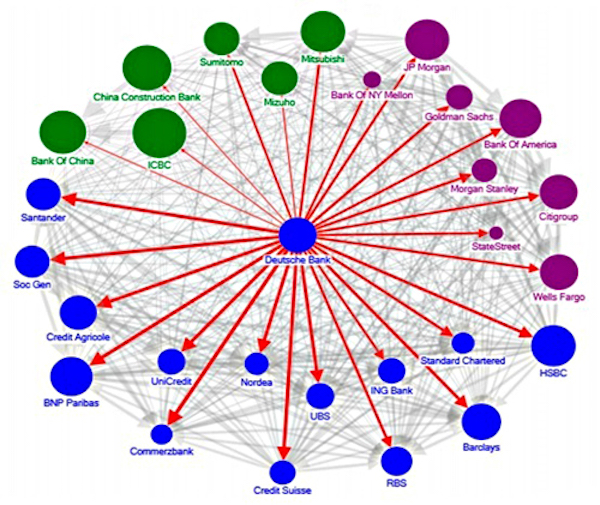

• EU Must Turn Off the Dividend Spigot at Under-Capitalized Banks (PS)

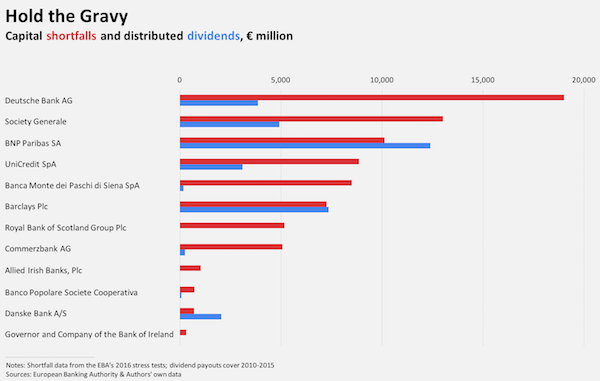

Dividend payments made by under-capitalized banks amount to a substantial wealth transfer from subordinated bondholders to shareholders, because it is bondholders who will suffer the losses in a crisis. Moreover, it is potentially a wealth transfer from taxpayers to private shareholders, because under new banking rules government bailouts are possible after bondholders have covered (bailed in) 8% of a bank’s equity and liabilities. By contrast, undercapitalized banks in the US are forced to halt all forms of capital distribution if they fail a stress test. Fortunately, following the 2016 round of stress tests, the EBA is now also considering this type of regulatory sanction. Thus, “competent authorities may also consider requesting changes to the institutions’ capital plan,” which “may take a number of forms such as potential restrictions on dividends required for a bank to maintain the agreed trajectory of its capital planning in the adverse scenario.”

We estimate that if European regulators had adopted this approach and forced banks to stop paying dividends in 2010 – the start of the sovereign debt crisis in Europe – the retained equity could have paid for more than 50% of the 2016 capital shortfalls. The figure above shows our calculated capital shortfalls, using the EBA stress test’s “adverse scenario” losses and the cumulative dividends these banks have distributed since 2010. Dividends paid out by some banks, such as BNP Paribas and Barclays, actually exceed the current capital shortfalls, while at others – such as Deutsche Bank, Commerzbank, and Société Générale – capital shortfalls far exceed dividends that would have been retained. The latter banks would still require substantial capital issuances on top of dividend restrictions to make up the difference. Nonetheless, our findings suggest a simple first step toward preventing bank capital erosion: stop banks with capital shortfalls from paying dividends (including internal dividends such as employee bonuses).

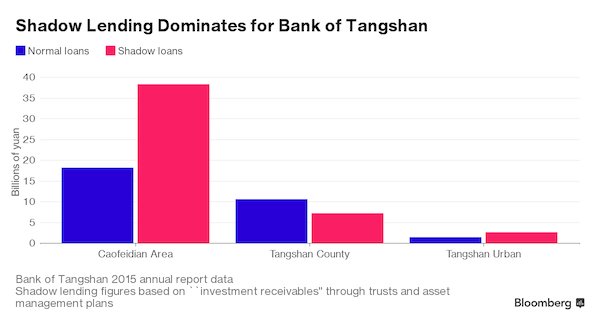

Not everyone believes the omnipotency tale Beijing likes to spread.

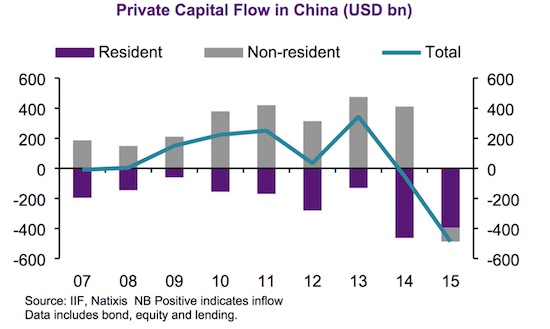

• China Continues to Battle Massive Capital Flight Problem (Brink)

Last summer, China’s stock market collapse and unexpected devaluation deepened its capital outflow problem and accelerated the fall of reserves, which had started in mid-2014. Since February, reserves have started to stabilize. While the situation is clearly better, China continues to struggle in terms of stabilizing its massive capital outflows. Within that context, foreign reserves seem to have become a policy target. Although capital outflows are still large, it’s not enough for reserves to start falling again. In 2015, the largest net outflows stemmed from the repayment of bank loans (close to $500 billion in “other investment” outflows), followed by unrecorded outflows of residents amounting to nearly $200 billion.

Portfolio flows (equity and bond) were also negative, but smaller. The situation has hardly improved in 2016, based on first quarter data. In fact, all types of capital recorded outflows, even net foreign direct investment (FDI), which was not the case in 2015. It’s important to note that Chinese residents have been driving capital outflows for years. The difference in 2015 is that non-residents stopped investing in China and started to move their capital out. Still, the bulk of the outflow was made by residents. These are unrecorded outflows and also include the investment of Chinese companies, as well as the loans of Chinese banks abroad (increasingly in the emerging world).

SEC? FBI? Who can be trusted to investigate?

• Naked Shorts Can’t Stay Naked Forever (Dayen)

A few years into his personal quest to understand how he had lost a million dollars on a penny stock, Chris DiIorio developed a sweeping hypothesis involving Knight Capital, the mammoth brokerage company that frequently traded in them. Knight earned $333 million in pre-tax profits in 2008, and another $232 million in 2009. But DiIorio didn’t think Knight was making that kind of money simply from executing transactions for clients. As a market maker, Knight was in the rare position of being able to legally sell a stock it didn’t have (the principle being that it will get that stock soon, so no worries). That’s called naked shorting. It’s illegal when regular people do it. DiIorio suspected that Knight, either on its own behalf or on behalf of clients, made a practice of artificially increasing the number of shares available in a stock through naked shorting, thereby depressing the price.

His suspicion grew when he noticed that Knight often traded in securities that were red-flagged on the Depository Trust Company’s “chill list.” The DTC is an obscure financial industry-owned company that manages the custody of more than $1 quadrillion in securities annually, recording the transfers with journal entries and guaranteeing the trade. The company makes it easy for people to buy and sell securities without needing to exchange paper stock But when the DTC senses trouble, it will stop clearing trades on a stock temporarily. A chilled stock can still trade — as long as the market participants handle the physical certificates themselves. But it can be a sign that something is gravely wrong. The DTC states on its website that it chills stocks “when there are questions about an issuer’s compliance with applicable law.” That doesn’t stop Knight from buying and selling them, though.

Its chief legal officer, Thomas Merritt, acknowledged at a 2011 Securities and Exchange Commission roundtable that the company actively traded chilled stocks, saying that as long as the security still trades, “we are going to be involved in that business.” And DiIorio found numerous examples of Knight trading chilled penny stocks. “I didn’t know they did that,” said Jim Angel, a Georgetown University business school professor. “I’m kind of shocked to think that Knight would be working with paper stock certificates.” He suggested that Knight might simply want to accommodate customers trying to get out of chilled stocks. “Or maybe they feel there’s enough interest in a security that they can trade profitably, even if they have to shuffle the certificates.” Because most other market makers flee chilled stocks, however, this means Knight can assume even more control over the stock price.

Upper management should be dragged before a public committe.

• Whistleblower Describes Years Of Fraudulent, Criminal Culture At Wells Fargo (BB)

Beth Jacobson was a Wells Fargo loan officer who blew the whistle on the bank’s predatory, racist loan-fraud in the runup to the 2008 financial crisis, which tanked the world’s economy and nearly wiped out Wells Fargo (they were rescued with a $36B taxpayer-funded bailout). Eight years later, Wells Fargo has fired 5,300 employees for participating in a scam that involved opening 2,000,000 fake accounts in its customers’ names, stealing their money and crashing their credit-ratings – the exec who oversaw this a $125M taxpayer-subsidized bonus, and CEO John Stumpf, who took home $200M in bonuses based on profits from the fraud, will keep the money and his job, but the whistleblowers who reported the fraud starting in 2011 were all illegally fired.

Jacobson describes how Stumpf – now CEO, then a top exec – was complicit in the fraud that helped precipitate the crash and the worst recession since the Great Depression. She pins blame for the loan-fraud on the bank’s aggressive sales targets – the same thing that caused the current fraud, suggesting that the bank hasn’t learned a fucking thing since 2008, except that it can get away with crime, every time. “One means of falsifying loan applications that I learned of involved cutting and pasting credit reports from one applicant to another. I was aware of A reps who would ‘cut and paste’ the credit report of a borrower who had already qualified for a loan into the file of an applicant who would not have qualified for a Wells Fargo subprime loan because of his or her credit history.

I was also aware of subprime loan officers who would cut and paste W-2 forms. IDs deception by the subprime loan officer would artificially increase the creditworthiness of the applicant so that Wells Fargo’s underwriters would approve the loan. I reported this conduct to management and was not aware of any action that was taken to correct the problem. “High-ranking Wells Fargo managers knew that this practice was going on, because after about a year of these standby explanations being given, underwriters in the underwriting department were told to call the customers directly rather than contact the loan officer who was working with the customer. The loan officers quickly figured out how to work around this by warning customers that underwriters might call them and then coaching the customers about what to say.

CEO gone.

• Former Employees File Class Action Against Wells Fargo (R.)

Two former Wells Fargo employees have filed a class action in California seeking $2.6 billion or more for workers who tried to meet aggressive sales quotas without engaging in fraud and were later demoted, forced to resign or fired. The lawsuit on behalf of people who worked for Wells Fargo in California over the past 10 years, including current employees, focuses on those who followed the rules and were penalized for not meeting sales quotas. “Wells Fargo fired or demoted employees who failed to meet unrealistic quotas while at the same time providing promotions to employees who met these quotas by opening fraudulent accounts,” the lawsuit filed on Thursday in California Superior Court in Los Angeles County said.

Wells Fargo has fired some 5,300 employees for opening as many as 2 million accounts in customers’ names without their authorization. On Sept. 8, a federal regulator and Los Angeles prosecutor announced a $190 million settlement with Wells. The revelations are a severe hit to Wells Fargo’s reputation. During the financial crisis, the bank trumpeted being a conservative bank in contrast with its rivals. The lawsuit accuses Wells Fargo of wrongful termination, unlawful business practices and failure to pay wages, overtime, and penalties under California law. Former employees Alexander Polonsky and Brian Zaghi allege Wells Fargo managers pressed workers to meet quotas of 10 accounts per day, required progress reports several times daily and reprimanded workers who fell short.

Polonsky and Zaghi filed applications matching customer requests and were counseled, demoted and later terminated, the lawsuit said. While executives at the top benefited from the activity, the blame landed on thousands of $12-per-hour employees who tried to meet the quotas and were often required to work off the clock to do so, the lawsuit said.

It’s time to scrutinize the FBI’s role in the whole ‘affair’. That the Hillary people have not been fully honest is now so obvious one wonders why Comey et al have granted many immunity and let them off the hook in general.

• Clinton Server Tech Told FBI Of Colleagues’ Worries About System (R.)

A technician hired by Hillary Clinton to run the private email system she used while U.S. secretary of state told investigators he tried to pass on colleagues’ concerns that the system might not comply with records laws, FBI interview summaries show. Bryan Pagliano, the technician Clinton hired when she joined the State Department in 2009, told federal investigators he relayed the concerns to Cheryl Mills, then Clinton’s chief of staff. Mills has previously testified under oath she could not recall anyone alerting her to potential problems with Clinton’s email arrangement.

The episode had not been disclosed until the Federal Bureau of Investigation released on Friday night nearly 200 pages of additional records from its year-long investigation into the handling of classified government documents by Clinton and her staff via an unauthorized email server in the basement of her New York home. Clinton has said the decision to use a private email system was a mistake, but the controversy has dogged her campaign as the Democratic candidate for the presidency and raised public doubts about her trustworthiness, public opinion polls show. Republicans have criticized her for putting national security at risk. The FBI closed the year-long investigation in July, recommending no charges, although FBI Director James Comey said Clinton and her staff had been “extremely careless” in handling classified government secrets.

Pagliano has declined to answer questions by Republican lawmakers about his work on Clinton’s server, but spoke to federal investigators after securing a form of immunity from prosecution. He told investigators two colleagues from the technology office approached him with concerns during Clinton’s first year after learning about the email system. One said it could lead to a “federal records retention issue,” Pagliano told investigators, and urged him to raise the concern with Clinton’s “inner circle.” A colleague also warned Pagliano “he wouldn’t be surprised” if classified information was being sent through Clinton’s unsecure system, Pagliano told the FBI.

“Every day, on average, seven children and teens are killed by guns in America.”

• America’s War On Its Own Children (G.)

It was just another day in America. And as befits an unremarkable Saturday, 10 children and teens were killed by gunfire. They died in altercations at gas stations, accidents in bedrooms, standing on stairwells and walking down the street, in gangland hits and by mistaken identity. Like the weather, none of them would make the national news because, like the weather, their deaths did not disturb the accepted order of things. Every day, on average, seven children and teens are killed by guns in America. Firearms are the leading cause of death among black children under 19, and the second greatest cause of death for all children of the same age, after car accidents. I picked this day at random, and spent two years trying to find out who these children were.

I searched for their parents, pastors, baseball coaches, and scoured their Facebook and Twitter feeds. The youngest child was nine, the oldest 19. Four years ago, for a moment, there was considerable interest in the fact that large numbers of Americans were being fatally shot. On 14 December 2012, 20-year-old Adam Lanza shot his mother, then drove to Sandy Hook Elementary School and shot 20 small children and six staff dead. Mass shootings comprise a small proportion of gun violence, but they disturb America’s self-image in a way that the daily torrent of gun deaths does not. “Seeing the massacre of so many innocent children … it’s changed America,” said the Democrat senator Joe Manchin, who championed a tepid gun-control bill. “We’ve never seen this happen.”

“At the current rate, the death toll for 2016 is expected to easily surpass the figure for 2015 of 3,771..”

• Death Toll In Migrant Shipwreck Off Egypt Rises To 300 (G.)

A record number of migrants is expected to drown in the Mediterranean in 2016, after the estimated death toll in this week’s latest shipwreck rose to about 300 on Friday. Egyptian officials have rescued about 160 survivors from Wednesday’s shipwreck off the country’s north coast, leaving about 150 people still unaccounted for, according to the International Organisation for Migration (IOM). Those confirmed dead include 10 women and a baby, taking the estimated number of migrants to die in the Mediterranean so far this year to more than 3,500. At the current rate, the death toll for 2016 is expected to easily surpass the figure for 2015 of 3,771, which was the highest ever recorded. By this stage in 2015, 2,887 people had drowned.

The number of people trying to reach Europe has fallen significantly since last year’s record levels, as a result of the deal struck between the EU and Turkey and the closure of a humanitarian corridor between Greece and Germany. The flow of migrants from the three main departure points – Libya, Turkey and Egypt – stands at roughly the same level as 2014.