Ansel Adams The Tetons and the Snake River 1942

The Last of the Mohicans. But does Japan really want to, and can it, carry the global financial system on its shoulders now the Fed and ECB no longer want to do their share?

• Is Bank of Japan The Latest To Take The Punch Bowl Away? (CNBC)

The Bank of Japan is seen as the last grown-up in the room actively filling the global liquidity punch bowl with both hands. That’s why a slight tweak to its bond-buying program caused a flurry across financial markets Tuesday, sparking speculation it was joining the Fed and ECB in cutting back on asset purchases, a move that could ultimately help drive up global interest rates. On Tuesday, the BOJ modestly trimmed its purchases of Japanese government bonds by about $10 billion in the 10- to 25-year maturities and another $10 billion in maturities of more than 25 years. The yen jumped about 0.5% to about 112.60 to the dollar, and bond yields rose. The U.S. 10-year yield also moved higher, breaking above the key 2.50% to as high as 2.55%. Meanwhile, the 10-year JGB yield moved in a range of about 0.16 and saw a high of 0.074%.

But some strategists say while the BOJ may have sent a powerful signal, it is just acting on a technicality that comes with changes it made to its bond purchase program back in 2016. Unlike the U.S. and Europe, where central banks have targeted the balance sheet size, the Japanese central bank is targeting interest rates and its purchases are based on prices. “I think it’s too early to proclaim the easy conditions in Japan are over. That said, I do think it’s constructive and it shows how sensitive the markets are to any potential change,” said Greg Peters, senior portfolio manager at PGIM Fixed Income. The Bank of Japan has been a poster child for central bank easing, taking its rates to negative levels and buying all types of assets, including stocks.

“They’re still buying ETFs, J-REITs, corporate paper. They changed how they’re easing, but they’re still easing,” said Marc Chandler, head of fixed-income strategy at Brown Brothers Harriman. “I think the market is overinterpreting this, partly because of their positions. They’re short yen. They’re long euros. They’re being squeezed on both legs today.” [..] While it’s last to leave the party, a change in BOJ policies would be the most symbolic move yet that the extreme policies adopted in the global financial crisis are finally coming to an end, and the juice that helped push risk assets higher is being slowly withdrawn. Chandler said the BOJ has made a point of saying it will continue to ease. “The BOJ says, ‘We’re going to be patient. We’re going to be the last one out.’ … [Prime Minister Shinzo] Abe told the Bank of Japan..

“If long rates continue to move higher, and the BOJ follows this with a continued reduction in the pace of the purchases, then we know we’re on to something. We’re on to a potential change in monetary policy in Japan,” said Peter Boockvar, chief investment officer at Bleakley Financial Group. “I think that is likely in 2018,” Boockvar said. “Whether this is the beginning of it, we’ll have to see. They have some cover too. They know what the Fed is going to do, and they know what the ECB is doing. Does the BOJ want to be the outlier of temporary insanity when every other central bank is pulling back? They are the epitome of extremity in terms of monetary policy.”

Fed interference will go down in history as the uttermost of stupidities. Not yet though, the narrative of saving the economy can still be kept alive. But wait till things go south.

• Fed Officials Are Scrambling To Figure Out How To Fight Next Recession (BI)

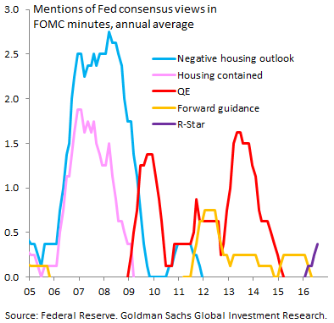

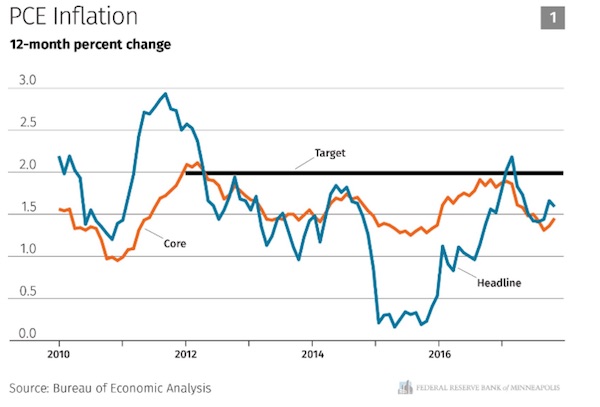

Federal Reserve officials puzzled by chronically-low US inflation seem to agree on at least one thing: They worry, almost universally, that they will lack the tools to fight the next recession, whenever it comes. Yet instead of focusing on tried and true policy measures like low interest rates and possibly bond buys, Fed officials current and former appear focused instead on broad shifts in the policy framework, including moving away from the current inflation targeting regime toward a potentially more aggressive approach. More importantly, the string of discordant ideas being offered up at a Brookings Institution conference by such high profile figures as former Fed Chairman Ben Bernanke, former White House economic advisor Lawrence Summers, and two current Fed members, does more to confuse the already muddled outlook for monetary policy than clarify it.

Boston Fed President Eric Rosengren suggested the Fed follow the model of the Bank of Canada, which periodically reviews its approach to maintaining price stability. He also called for the Fed to move toward an inflation target range, which he hinted might be from 1.5% to 3%, rather than the current 2% goal. John Williams, president of the San Francisco Fed, called for a system where the Fed would target the price level, meaning that it would compensate periods of undershooting the 2% inflation goal with periods of overshooting. US inflation has remained stubbornly below the Fed’s 2% target for much of the economic recovery, suggesting the labor market is not as healthy as the 17-year low unemployment rate of 4.1% suggests.

Shifting to a price-level target is “not nearly as scary as you might think” Williams told the audience of monetary economists, academics, and market participants. He worried about the “issue of credibility” that has resulted from persistently below-target inflation, which makes it look ” like the central bank is not committed to its goals.” Prolonged low inflation, which also reflects soft wage growth, can make monetary policy less effective because “it gets into inflation expectations and makes it harder to achieve 2% objective in good times.”

Possible in theory, but with CB tightening not in practice.

• Market Could Be Headed For A ‘Melt-Up’ Of 30% – Bill Miller (CNBC)

Worried about higher interest rates putting a dent on the stock market’s rip-roaring rally? Fear not, a rise in rates will actually help stocks, according to legendary investor Bill Miller. “Those 10-year yields go through 2.6% and head towards 3%, I think we could have the kind of melt-up we had in 2013, where we had the market go up 30%,” Miller, the founder of Miller Value Partners, told CNBC’s “Closing Bell” on Tuesday. “If we can get the 10-year towards that 3% level, you’ll see the same thing.” “In 2013, people finally began to lose money in bonds. They took money out of bond funds and put it into equity funds,” Miller said. Miller is considered one of the best investors ever, after beating the market for 15 years in a row while working at Legg Mason. Stocks have been on a rip-roaring rally for more than a year, as economic data and corporate earnings have improved.

On Tuesday, they closed at fresh record highs. But some experts fear the improvements in the economy could force the Federal Reserve to tighten monetary policy faster than they forecast, thus pushing interest rates higher. The 10-year U.S. Treasury yield rose to 2.55% on Tuesday and hit its highest level since March.The yield has not traded above 3% since early 2014. It last traded above 2.6% last March. But Miller thinks the stock market could get another boost from lower corporate tax rates. President Donald Trump signed a bill in December that slashed the corporate tax rate to 21% from 35%. “The tax cuts are probably partly in the market, but maybe not wholly in the market because we’re seeing things like companies raising the minimum wage, giving bonuses,” he said. “The people that are getting those $1,000 bonuses probably have a marginal propensity to consume of 99%.”

It’s high time for that decline then.

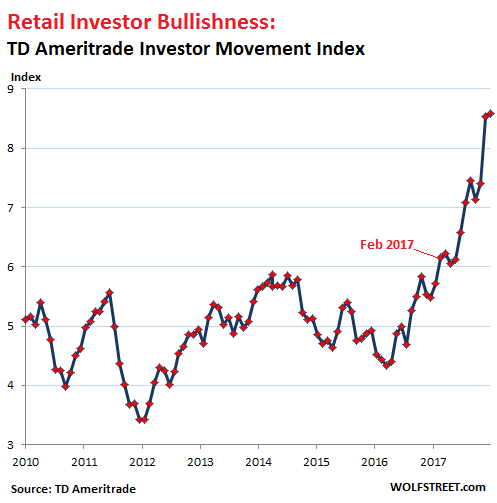

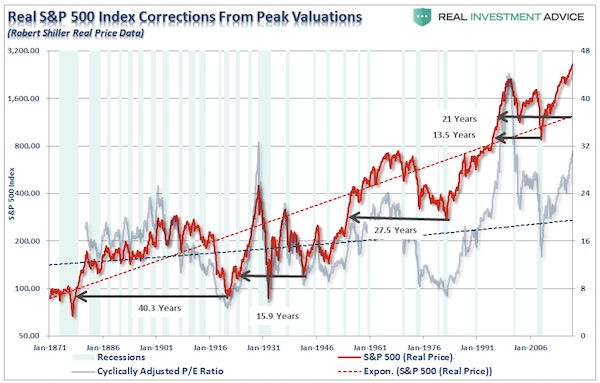

• People Have A Hard Time Even Imagining How The Market Could Decline (ZH)

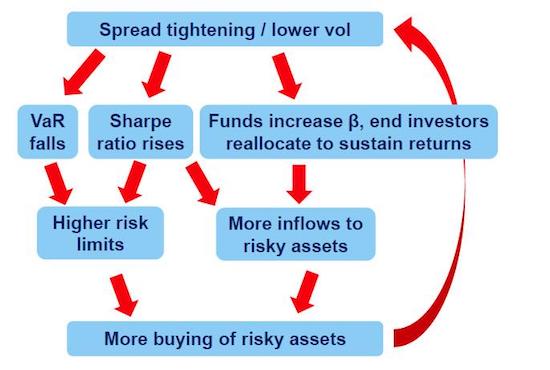

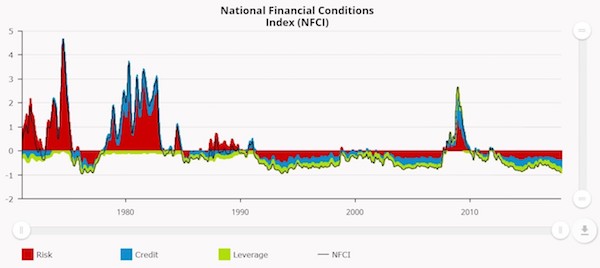

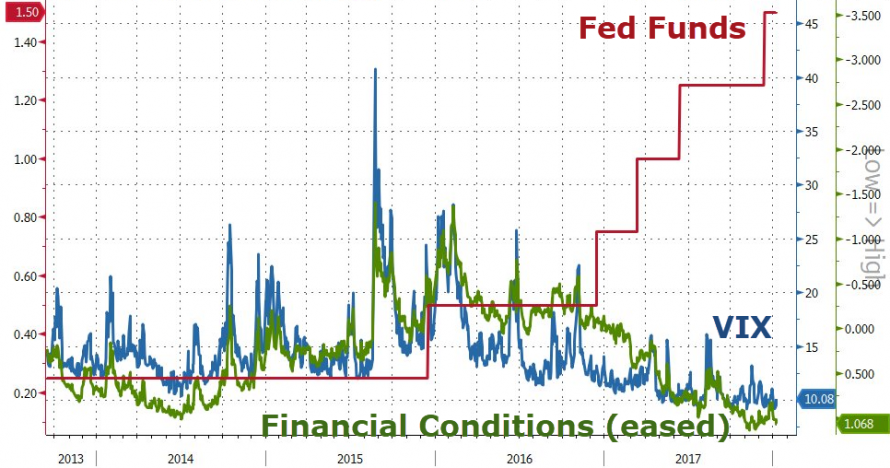

A calm complacency never before seen has fallen blanket-like over US equity markets. “The behavior of volatility has entirely changed since 2014,” noted BAML in a a recent note thanks to major central banks keeping interest rates near historic lows (and printed more money than ever before). As The Wall Street Journal points out, One sign of that: VIX closed below 10 more times last year than any others year in its history, and until today, closed below 10 for the first 5 days of 2018… And while correlation is not causation, there is a clear causal link between the conditioning now deeply embedded within investors’ minds and the endless expansion of central bank balance sheets…

As JPMorgan’s infamous quant guru Marko Kolanovic wrote, “the first four Fed hikes in a decade have failed to generate the revival of volatilities that many had expected at the end of last year,” and a wave of political uncertainty linked to U.S. tensions with North Korea and the new presidential administration also raised the prospect that market tumults could occur with greater frequency… but no… In fact worse still for The Fed, financial conditions eased as they tightened and vol collapsed to levels never seen before…

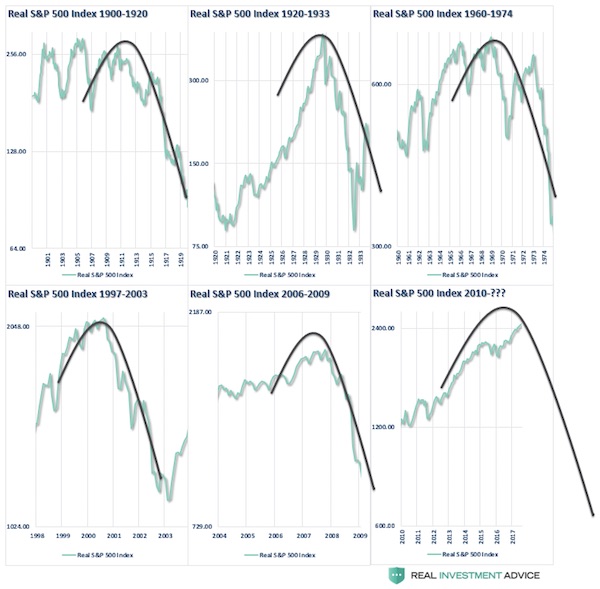

All of which has led, as The Wall Street Journal reports, to a number of investors abandoning defensive positions taken to protect against a market downturn, in the latest sign that many doubters are shedding caution as the long rally rolls on. “I haven’t seen hedging activity this light since the end of the financial crisis,” said Peter Cecchini, a New York-based chief market strategist at Cantor Fitzgerald. “It started in late 2016 and accelerated in the second half of the year.” But as Morgan Stanley warns in a recent note, what goes up (this fast) typically comes down… “Our team has observed a dramatic shift in sentiment since we initiated coverage in April. In April, it felt as if people were looking for a reason for the market to fail. Now, we have seen a total reversal with people having a hard time even imagining how the market could decline.”

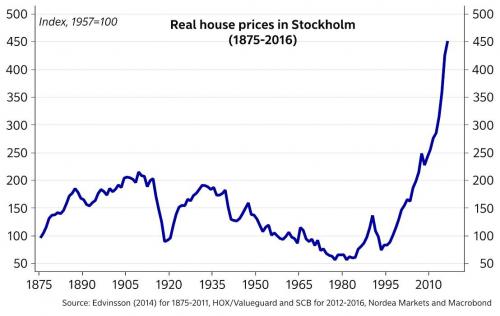

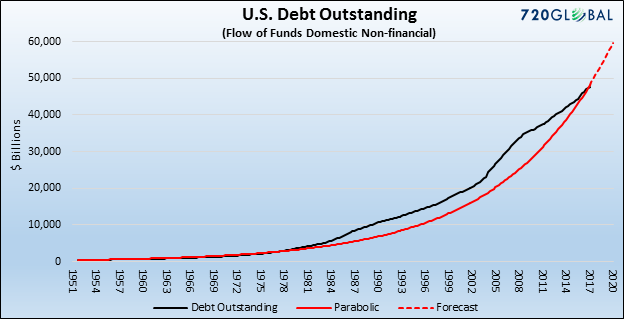

Recovery is just a story. Unless it has become viable to fight debt with more debt.

• World Bank Issues Warnings On Interest Rates And Inflation (G.)

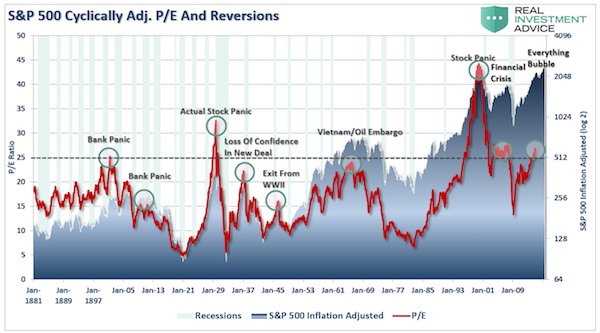

Financial markets are complacent about the risks of sharply higher interest rates that could be triggered by better than expected growth in the global economy this year, the World Bank has warned. The Washington-based organisation said that much of the rich west was running at full capacity as a result of a broad-based upswing in activity, but were now vulnerable to a period of rising inflation that would prompt action from central banks. Launching the Bank’s global economic prospects, the lead author Franziska Ohnsorge said: “There could be faster than expected inflation that would mean faster than expected interest rate hikes.” Ohnsorge added that stock markets were at levels similar to those seen before the Wall Street Crash of 1929, while bond markets were assuming that low inflation would keep official borrowing costs down.

“Financial markets are vulnerable to unforeseen negative news. They appear to be complacent,” she said, while announcing that the Bank has revised up its 2018 forecast for the global economy following a better than expected performance in the US, China, the eurozone and Japan in 2017. In its half-yearly assessment, the Bank said a recovery in manufacturing, investment and trade would mean global growth of 3.1% this year, up from the 2.9% pencilled in last June. But it warned the acceleration in growth would be temporary unless governments implemented structural reforms to raise long-term growth potential. “The broad-based recovery in global growth is encouraging, but this is no time for complacency,” said Jim Yong Kim, the World Bank’s president.

“This is a great opportunity to invest in human and physical capital. If policy makers around the world focus on these key investments, they can increase their countries’ productivity, boost workforce participation, and move closer to the goals of ending extreme poverty and boosting shared prosperity.”

They’re even planning to march in the Olympics opening ceremony together.

• South Korea’s Moon Says Trump Deserves ‘Big’ Credit For North Korea Talks (R.)

South Korean President Moon Jae-in credited U.S. President Donald Trump on Wednesday for helping to spark the first inter-Korean talks in more than two years, and warned that Pyongyang would face stronger sanctions if provocations continued. The talks were held on Tuesday on the South Korean side of the demilitarized zone, which has divided the two Koreas since 1953, after a prolonged period of tension on the Korean peninsula over the North’s missile and nuclear programs. North Korea ramped up its missile launches last year and also conducted its sixth and most powerful nuclear test, resulting in some of the strongest international sanctions yet. The latest sanctions sought to drastically cut the North’s access to refined petroleum imports and earnings from workers abroad. Pyongyang called the steps an “act of war”.

Seoul and Pyongyang agreed at Tuesday’s talks, the first since December 2015, to resolve all problems between them through dialogue and also to revive military consultations so that accidental conflict could be averted. “I think President Trump deserves big credit for bringing about the inter-Korean talks, I want to show my gratitude,” Moon told reporters at his New Year’s news conference. “It could be a resulting work of the U.S.-led sanctions and pressure.” Trump and North Korean leader Kim Jong Un exchanged threats and insults over the past year, raising fears of a new war on the peninsula. South Korea and the United States are technically still at war with the North after the 1950-53 Korean conflict ended with a truce, not a peace treaty.

Ads are killing the experience. Most people by now have ad blockers. That whole industry needs drastic change.

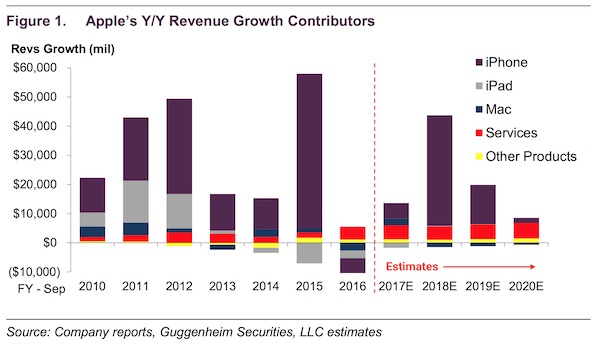

• Apple’s Privacy Feature Costs Ad Companies Millions (G.)

Internet advertising firms are losing hundreds of millions of dollars following the introduction of a new privacy feature from Apple that prevents users from being tracked around the web. Advertising technology firm Criteo, one of the largest in the industry, says that the Intelligent Tracking Prevention (ITP) feature for Safari, which holds 15% of the global browser market, is likely to cut its 2018 revenue by more than a fifth compared to projections made before ITP was announced. With annual revenue in 2016 topping $730m, the overall cost of the privacy feature on just one company is likely to be in the hundreds of millions of dollars. Dennis Buchheim, general manager of the Interactive Advertising Bureau’s Tech Lab, said that the feature would impact the industry widely.

“We expect a range of companies are facing similar negative impacts from Apple’s Safari tracking changes. Moreover, we anticipate that Apple will retain ITP and evolve it over time as they see fit,” Buchheim told the Guardian. “There will surely be some continued efforts to ‘outwit’ ITP, but we recommend more sustainable, responsible approaches in the short-term,” Buchheim added. “We also want to work across the industry (ideally including Apple) longer-term to address more robust, cross-device advertising targeting and measurement capabilities that are also consumer friendly.” ITP was announced in June 2017 and released for iPhones, iPads and Macs in September. The feature prevents Apple users from being tracked around the internet through careful management of “cookies”, small pieces of code that allow an advertising technology company to continually identify users as they browse.

Its launch sparked complaints from the advertising industry, which called ITP “sabotage”. An open letter signed by six advertising trade bodies called on Apple “to rethink its plan … [that risks] disrupting the valuable digital advertising ecosystem that funds much of today’s digital content and services.” It also accused the company of ignoring internet standards, which say that a cookie should remain on a computer until it expires naturally or is manually removed by a user. Instead, the industry said, Apple is replacing those standards “with an amorphous set of shifting rules that will hurt the user experience and sabotage the economic model for the internet”.

We haven’t heard the last of this flaw which is actually a feature.

• Antivirus Tools Caught With Their Hands In The Windows Cookie Jar (Reg.)

Microsoft’s workaround to protect Windows computers from the Intel processor security flaw dubbed Meltdown has revealed the rootkit-like nature of modern security tools. Some anti-malware packages are incompatible with Redmond’s Meltdown patch, released last week, because the tools make, according to Microsoft, “unsupported calls into Windows kernel memory,” crashing the system with a blue screen of death. In extreme cases, systems fail to boot up when antivirus packages clash with the patch. The problem arises because the Meltdown patch involves moving the kernel into its own private virtual memory address space. Usually, operating systems such as Windows and Linux map the kernel into the top region of every user process’s virtual memory space.

The kernel is marked invisible to the running programs, although due to the Meltdown design oversight in Intel’s modern chips, its memory can still be read by applications. This is bad because it means programs can siphon off passwords and other secrets held in protected kernel memory. Certain antivirus products drill deep into the kernel’s internals in order to keep tabs on the system and detect the presence of malware. These tools turn out to trash the computer if the kernel is moved out the way into a separate context. In other words, Microsoft went to shift its cookies out of its jar, and caught antivirus makers with their hands stuck in the pot. Thus, Microsoft asked anti-malware vendors to test whether or not their software is compatible with the security update, and set a specific Windows registry key to confirm all is well.

Only when the key is set will the operating system allow the Meltdown workaround to be installed and activated. Therefore, if an antivirus tool does not set the key, or the user does not set the key manually for some reason, the security fix is not applied. In fact, until this registry key is set, the user won’t be able to apply any Windows security updates – not just this month’s patches, but any of them in the future.

UK and US will not give in any time soon.

• Julian Assange’s Stay In London Embassy Untenable, Says Ecuador (G.)

Ecuador’s foreign minister has said Julian Assange’s five-and-a-half-year stay in her country’s London embassy is “untenable” and should be ended through international mediation. The WikiLeaks founder has been holed up in Knightsbridge since the summer of 2012, when he faced the prospect of extradition to Sweden over claims that he sexually assaulted two women. He denies the accusations. Swedish prosecutors last year unexpectedly dropped their investigation into the allegations, which included a claim of rape. But Assange still faces arrest for breaching bail conditions if he steps outside the embassy and WikiLeaks has voiced fears that the US will seek his extradition and that there is a sealed indictment ordering his arrest. [..] Jeff Sessions, said last May that Assange’s arrest was now a “priority”.

Ecuador’s foreign minister, María Fernanda Espinosa, said her country was now seeking a “third country or a personality” to mediate a final settlement with the UK to resolve the impasse and said it was “considering and exploring the possibility of mediation”. “No solution will be achieved without international cooperation and the cooperation of the United Kingdom, which has also shown interest in seeking a way out,” she told foreign correspondents in Quito, according to Agence France-Presse. Assange, who has received numerous visitors to his modest quarters in the embassy, ranging from Nigel Farage to Lady Gaga, has described the period since his initial arrest as a “terrible injustice”. Not being able to see his children grow up was “not something I can forgive”, he said.

[..] On Tuesday evening, a lawyer for Assange appeared to welcome Ecuador’s proposal. He said his client had a right to asylum and argued that the risk of him being persecuted in the US had “escalated further in recent months under the Trump administration’s war on WikiLeaks” and that the investigation in Sweden had twice been discontinued. “If the UK wishes to show that it is a nation that respects its human rights obligations and commitments to the United Nations, it is time for Mr Assange to be allowed to enjoy his right to liberty, and fundamental right to protection against persecution in the United States,” he said. A spokesperson for the UK government said: “The government of Ecuador knows that the way to resolve this issue is for Julian Assange to leave the embassy to face justice.”

“Julian Assange isn’t hiding from justice, he’s hiding from injustice.”

• Australia Must Rescue Assange From The Establishment That Tortured Manning (CJ)

Private Manning was tortured. As sure as if they’d strapped her down and set upon her flesh with fire and steel, she was tortured. United Nations special rapporteur on torture Juan E. Mendez stated unequivocally in 2012 that Manning’s treatment at the hands of the US government during her imprisonment was “cruel, inhuman and degrading,” after 295 legal scholars had already signed a letter in 2011 declaring that she was being “detained under degrading and inhumane conditions that are illegal and immoral.” Humans, like all primates, are evolutionarily programmed to be social animals, which is why solitary confinement causes our systems to become saturated in distress signals as real as pain or fear. Studies have shown that fifteen days of this draconian practice causes permanent psychological damage. Manning was in solitary confinement for nearly a year.

Manning attempted suicide in July of 2016. To punish her for her attempt to end her misery, they tortured her some more. She attempted suicide again three months later. The same sadistic regime which inflicted these horrors upon Manning has during the current administration prioritized the arrest of WikiLeaks editor-in-chief Julian Assange, and the international arms of the US power establishment have been working to facilitate that aim. The Guardian reports that Ecuador’s foreign minister is now saying Assange’s continued stay in the nation’s London embassy has become “untenable” and is seeking international mediation, to which a spokesman for the UK government has responded that “The government of Ecuador knows that the way to resolve this issue is for Julian Assange to leave the embassy to face justice.”

Justice. A government whose international operations are uniformly indistinct from America’s wants Assange to leave political asylum and trust his life to an international power establishment that tortures whistleblowers in the name of “justice”. Julian Assange isn’t hiding from justice, he’s hiding from injustice. What sane human being wouldn’t? Time after time after time we are shown that whistleblowers, leakers, and those who facilitate them are not shown anything remotely resembling justice by this depraved Orwellian establishment. Which is why Australia must intervene and protect him.

The value of your life plunges along with that of others.

• The Fog of War: Global Airstrike Deaths Up At Least 82% In 2017 (RT)

More than 15,000 civilians were killed by explosive weapons in 2017, a 42 percent increase on last year, while deaths by airstrikes increased by 82 percent, a new study by Action on Armed Violence has found. The research shows that, while official stats on civilian casualties are on the rise, they’re still modest in comparison to the “true figures.” “The US has a habit of assuming all fighting-aged men are, in fact, fighters…This is the hammer that the US uses to establish the truth in war,” the organization’s Executive Director Iain Overton told RT. Much of the increase is due to the battles to retake Islamic State strongholds in Mosul, Iraq and Raqqa, Syria. The Syrian conflict and the Saudi-led coalition bombing Yemen also accounted for a large proportion of civilian deaths.

The survey, found 8,932 civilians were killed by air-launched explosives in the first 11 months of 2017, compared to 4,902 during the same period in 2016. “At least 60 countries around the world saw explosive weapons being used last year,” Action on Armed Violence’s Executive Director Iain Overton told RT. “We have always acknowledged that our data would likely represent a lower figure of total civilians killed or injured than might actually be the case,” Overton said. “This is particularly true when there is a single fatality or wounding, and particularly in under-reporting of those injured by a bomb blast.” “When the fog of war descends casualty figures often fall short – both because they become highly politicized and because accurate reporting is often a casualty of war itself,” he added.

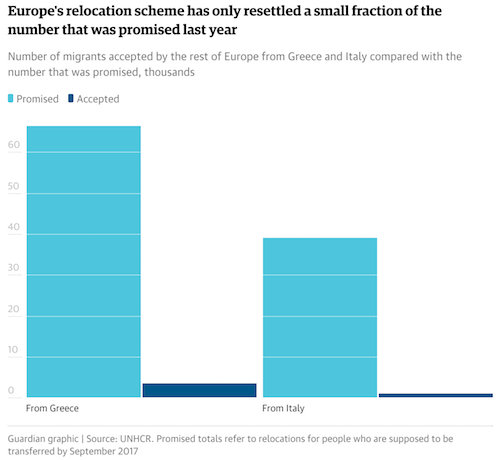

Europe has no morals left.

• Scores Feared Dead And Up To 100 Missing After Boat Sinks Off Libya Coast (G.)

Survivors from a boat that foundered off Libya’s coast on Tuesday said about 50 people who had embarked with them were feared dead, while the coastguard said the number of missing might be as high as 100. Libyan coastguard vessels picked up nearly 300 migrants from three boats off the coast of the North African country on Tuesday, but one rubber boat was punctured and the coastguard only found 16 survivors clinging to its wreckage. “We found the migrant boat at about 10 o’clock this morning. It had sunk and we found 16 migrants. The rest were all missing and, unfortunately, we didn’t find any bodies or [other] survivors,” said Nasr al-Qamoudi, a coastguard commander.

Several of the survivors, who were brought back to a naval base in Tripoli, said there were originally about 70 people on board the boat when it set off near the town of Khoms, east of the capital. A coastguard statement later said that “at least 90-100” migrants were missing. The two other migrant boats were found off Zawiya, west of Tripoli. [..] Libya is the most common departure point for migrants trying to reach Europe from Africa by sea. More than 600,000 have crossed the central Mediterranean in the past four years, generally travelling in flimsy inflatable craft provided by smugglers that often break down or puncture. Under heavy pressure from Italy, some Libyan armed factions have blocked smuggling since last summer. Libya’s Italian-backed coastguard has also stepped up interceptions, returning migrants to Libya, where they are detained and often re-enter smuggling networks.