NPC Wilkins-Rogers Milling Co., Washington, DC 1926

“China’s July exports of diesel and gasoline soared by 181.8% and 145.2% respectively..”

• Oil Falls As August Price Rally Seen Overblown, China Fuel Exports Soar (R.)

Oil prices fell on Monday as analysts doubted upcoming producer talks would rein in oversupply, saying that Brent would likely fall back below $50 a barrel as August’s more than 20% crude rally looks overblown. Soaring exports of refined products from China also pressured prices, as this was seen as the latest indicator of an ongoing global fuel glut, traders said. China’s July exports of diesel and gasoline soared by 181.8% and 145.2% respectively compared with the same month last year, to 1.53 million tonnes and 970,000 tonnes each, putting pressure on refined product margins. Brent crude futures were trading at $50.22 per barrel at 0224 GMT, down 66 cents, or 1.3%.

U.S. West Texas Intermediate (WTI) crude was down 51 cents, or 1.05%, at $48.01 a barrel. Analysts cast doubt on an August price rally, saying that much of it was a result of short-covering and anticipation of upcoming producer talks to discuss means to curb oversupply. “Positioning data seems to confirm our view that the latest oil bounce is more technical and positioning-oriented than fundamental. In fact, new buyers have been mostly absent the past few months,” Morgan Stanley said. Regarding the upcoming producer talks, the bank said a agreement was “highly unlikely” and that there were “too many headwinds and logistical challenges to a meaningful deal”.

Read more …

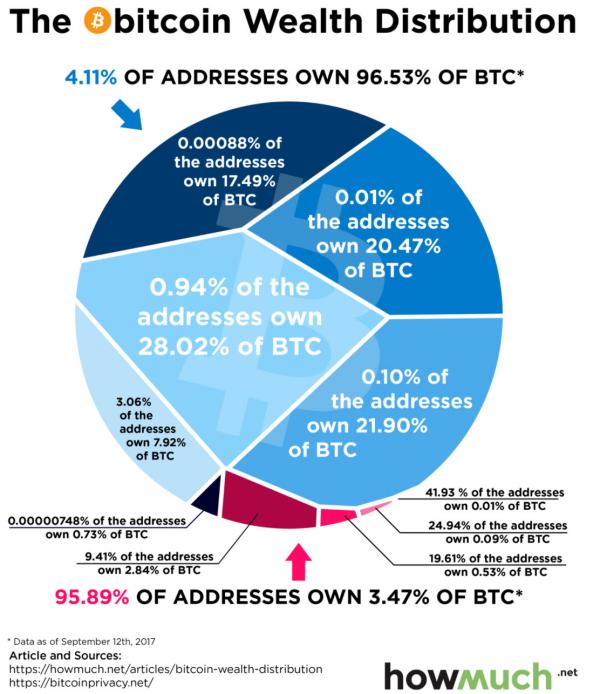

Less than 5% are wrong.

• Less Than 5% Of Japan Inc. Think Abe’s Stimulus Will Boost The Economy (R.)

Japanese companies overwhelmingly say the government’s latest stimulus will do little to boost the economy and the Bank of Japan should not ease further, a Reuters poll showed, a setback for policymakers’ efforts to overcome deflation and stagnation. Prime Minister Shinzo Abe this month unveiled a 13.5 trillion yen (£102.6 billion) fiscal package of public works projects and other measures, vowing a united front with the BOJ to revive the economy and raising speculation of a surge in government spending essentially financed by the central bank. But less than 5% of companies believe the steps will boost the economy near-term or raise its growth potential, according to the Reuters Corporate Survey, conducted August 1-16.

“It’s disappointing that the stimulus focuses on public works, and it lacks attention to promoting industry and technology that would lead to future growth,” said a manager at a precision-machinery maker. Abe took office 3 1/2 years ago, pledging to reboot the economy with aggressive monetary stimulus, fiscal spending and reform plans. After an early spurt of growth and surging corporate profits, helped by a sharp fall in the yen, the economy is again sputtering and prices are slipping, underscoring the challenge for Japan to beat nearly two decades of deflation and anaemic growth. “Unless drastic steps are taken to fix the root of Japan’s problems – the falling birthrate and working population – solid economic growth won’t return … only public debt would pile up without sustainable growth,” said an electrical machinery firm.

Read more …

You would still have to specify those who have nothing left to save; economists miss out on that.

• Grim Outlook for the Economy, Stocks: Stephanie Pomboy (Barron’s)

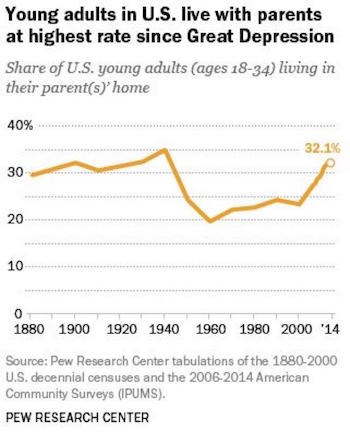

For some time, Stephanie Pomboy, an economist and the founder of MacroMavens, has pushed a provocative theory that a crisis-chastened U.S. consumer would retard global growth. That is why a U.S. recovery has taken so long to take off, and why Japan and Europe look set to embark on more rounds of quantitative easing. An avid reader of Shakespeare, Pomboy appreciates the comic and tragic dimensions of the markets—the giddy optimism for the second half of the year, and the potentially disastrous consequences of excessively low rates. As stocks teetered at new highs, we phoned Pomboy in Vail, Colo., where she lives when not in Manhattan, to hear her latest views. They aren’t rosy: Investors and policy makers are deluding themselves that we will soon return to a pre-financial crisis framework. Things have changed, she says, which means expectations for economic growth in the second half are far too optimistic. And today’s low rates could cause another financial crisis, bankrupting pension plans, putting retirees at risk, and hurting stocks.

Barron’s: You like to focus on the consumer—and plot U.S. consumer spending as a percentage of GDP versus world trade. Why? Pomboy: What ignited and supported the entire era of globalization was the spendthrift U.S. consumer; economies have been totally reliant on trade to U.S. consumers. This once-in-a-generation asset deflation will fundamentally change behavior, just as the Depression changed an entire generation’s attitude about spending and saving. Obviously, the burden of proof is on me, because for 20 years the consumer has reliably borrowed from China to buy their tube socks. Post-crisis, the consumer has clearly pulled back.

How many months did we have disappointing retail sales numbers that no one could explain? They’d say it’s too hot, too cold, there’s Brexit. But what’s really causing this slowdown in spending is that the post-crisis consumer is determined to save, and do it the old-fashioned way. Historically, when rates go down, people save less. In this cycle, things have completely reversed. Over the same stretch of time that the two-year note has gone from 4% to 1%, the savings rate has doubled. There are mountains of evidence to support my thesis. But every Wall Street analyst and the Fed is using the pre-crisis analytical framework to look at an economy that is fundamentally challenged.

Read more …

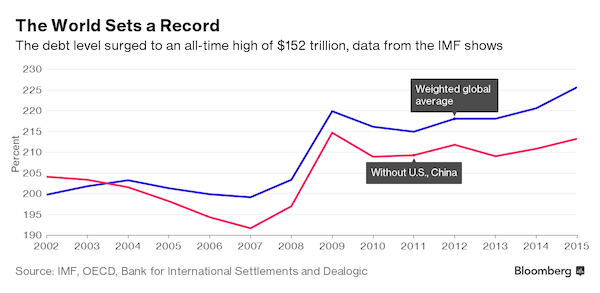

Note the numbers: “Credit Suisse prudently sold $380 billion of derivatives to Citi, thereby reducing its own leverage exposure by $5 billion.”

• Citi Is About to Relive the 2008 Derivatives Nightmare (MM)

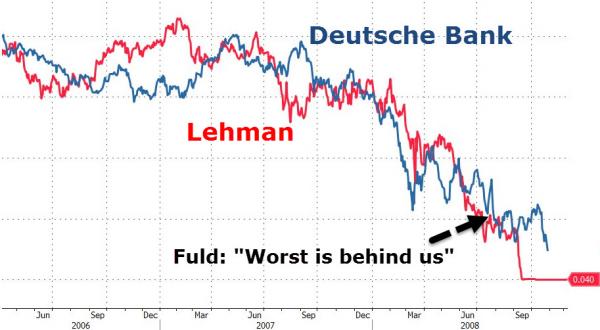

Deutsche Bank – with its stock now trading at a 30-year low – was recently called the world’s riskiest financial institution by the IMF. Better late than never… In a last-ditch effort to save itself, DB is trying to dump a bucket load of credit derivatives – the murky, risky financial instruments that triggered the 2008 financial crisis. You would think no one would buy these weapons of financial mass destruction… but you’d be wrong. In a staggeringly stupid move, the American bank I’m telling you about today has gone on a derivatives shopping spree, eagerly taking credit default swaps off the hands of failing Eurozone banks like DB and Credit Suisse. That means, of course, another outsize short opportunity for you to take…

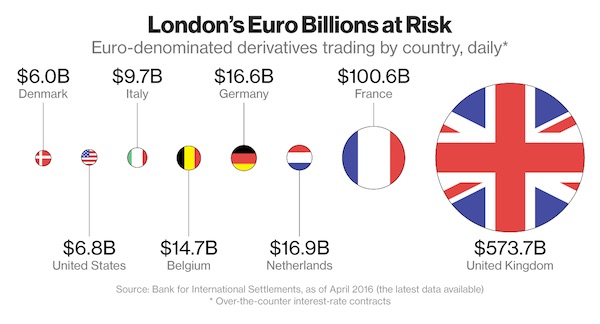

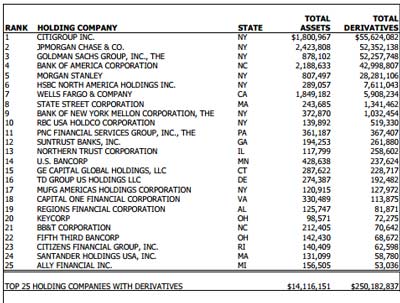

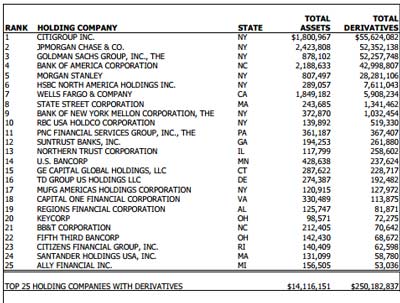

Citigroup already nearly destroyed itself with derivatives during the 2008 crisis, requiring the biggest taxpayer bailout in history in order to stay afloat. Strangely, it didn’t learn its lesson the first time its stock fell below $1. As rival banks see the writing on the wall and scramble to get rid of their derivatives, Citi is now cheerfully snapping up billions of dollars’ worth. Several weeks ago, Credit Suisse prudently sold $380 billion of derivatives to Citi, thereby reducing its own leverage exposure by $5 billion. Last year, Deutsche Bank palmed off $250 billion of credit default swaps on (guess who?) Citi, and is in talks to get rid of even more. The result is that Citi now holds the most derivatives of any of its U.S. rivals. That’s a staggering total exposure of nearly $56 trillion, according to the OCC’s latest report, shown here:

[..] our current $650 trillion derivatives market is a nightmare scenario waiting to happen. First problem: the size. It’s 36x the size of the U.S. GDP and over 8x larger than the world GDP – the entire global output of the entire world in a year. While credit default swaps shrank significantly in size since the financial crisis, they remain large enough to constitute a potential time bomb inside the financial system that could blow up any time. Second problem: the interconnectedness. Every derivative contract involves two parties that agree to make certain payments to each other. But if one party is unable or unwilling to live up to its agreement and make those payments, the other party is left holding the bag and nursing a big loss. In a crisis, this can leave a volume of broken contracts that will overwhelm these institutions and render them instantly insolvent.

Read more …

Where is the EU heading?

• The Brexit Question That Nobody Asked (BBG)

Mervyn King, former governor of the Bank of England, has written the best article I’ve read on Britain’s exit from the EU. In an essay for the New York Review of Books he makes many excellent points, but one is of surpassing importance. It’s an obvious point, or ought to be, that nonetheless has been almost entirely ignored by other respectable commentators: Whether Britain should stay in the EU depends on where the EU is heading. The EU is plainly in deep trouble with or without the U.K., and its condition as a political project is anything but stable. Judging whether Britain is better off as a member therefore requires a judgment not only about what Britain has gained or lost from membership up to now but also an assessment of the future character of the whole EU enterprise.

Britain’s Remain campaign, expressing the collective opinion of every expert on the subject, has had almost nothing to say about this. As King points out, the EU is structurally unsound. (Joseph Stiglitz in the FT makes the same point.) It has pressed political union both too far and not far enough. That is, it has created half a political union – with a single currency but without a collective fiscal policy or the political apparatus that would be necessary to legitimize it. King: Putting the cart before the horse – setting up a monetary union before a political union – has led the ECB to become more and more vocal about the need to “complete the architecture” of monetary union by proceeding quickly to create a Treasury and finance minister for the entire eurozone.

The ability of such a new ministry to make transfers between member countries of the monetary union would reduce pressure on the ECB to find new ways of holding the monetary union together. But there is no democratic mandate for a new ministry to create such transfers or to have political union – voters do not want either. And voters aren’t the only ones who don’t want it. German officialdom (backed by popular opinion) is viscerally opposed to a “transfer union,” which is Germany’s name for fiscal policy as it operates in any normal country. Germany’s position is understandable, since Germans would give much more than they received in any such arrangement. But that doesn’t alter the conclusion: Not only is the EU structurally unsound, but there’s also little prospect that the structure either can be or will be repaired.

Read more …

Color me baffled.

• China Is Grappling With Hidden Unemployment (BBG)

Cracks are starting to show in China’s labor market as struggling industrial firms leave millions of workers in flux. While official jobless numbers haven’t budged, the underemployment rate has jumped to more than 5% from near zero in 2010, according to Bai Peiwei, an economics professor at Xiamen University. Bai estimates the rate may be 10% in industries with excess capacity, such as unprofitable steel mills and coal mines that have slashed pay, reduced shifts and required unpaid leave. Many state-owned firms battling overcapacity favor putting workers in a holding pattern to avoid mass layoffs that risk fueling social unrest. While that helps airbrush the appearance of duress, it also slows the shift of workers to services jobs, where labor demand remains more solid in China’s shifting economy.

“Underemployment in overcapacity industries is a drag on the potential improvement of productivity in China, which will lead to a softening wage trend,” said Grace Ng at JPMorgan in Hong Kong. “It would exert pressure on private consumption demand and in turn affect the overall rebalancing of the economy.” Other projections indicate the employment situation is even worse. An indicator of unemployment and underemployment produced by London-based research firm Fathom Consulting has more than tripled since 2012 to 13.2%. The official jobless rate isn’t much help for economists: it’s been virtually unchanged at about 4.1% since 2010 even as the economy slowed. The gauge only counts those who register for unemployment benefits in their home towns, which doesn’t take into account 277 million migrant workers. Total employment is 775 million, National Bureau of Statistics data show.

Read more …

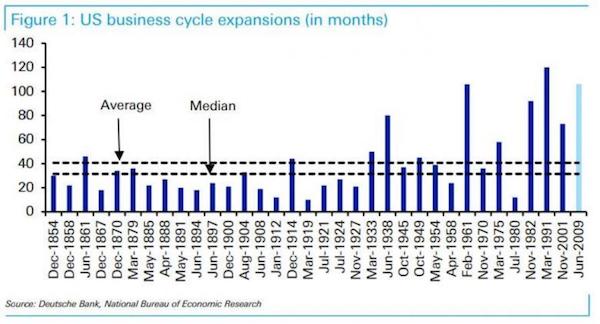

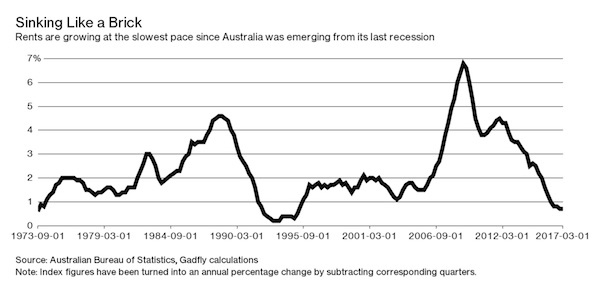

Wow. What a chart that is.

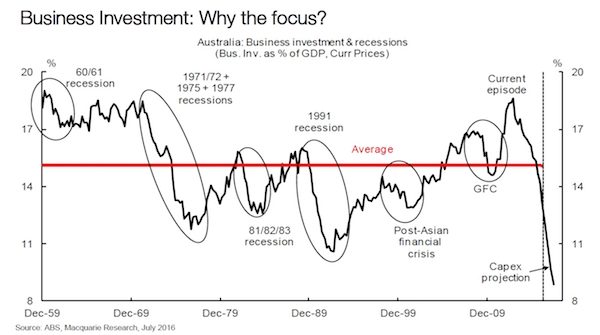

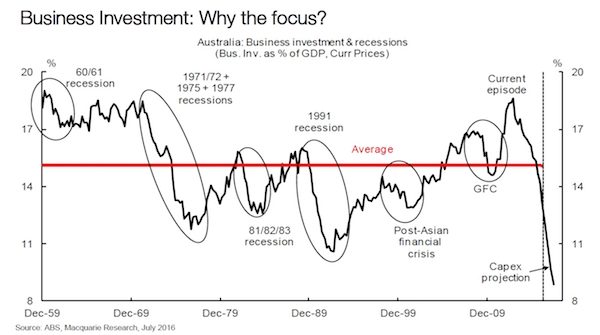

• Australia’s Unprecedented Collapse In Business Investment, In One Chart (BI)

You’ve probably heard of the “capex cliff”, the term for the collapse in capital expenditure plans by Australian businesses that is an inevitable feature of the economy following the once-in-a-lifetime mining investment boom driven mainly by the surge in Chinese demand over the past two decades. But with Australia’s manufacturing industry having been hollowed out too over the past decade, the capital investment pipeline for both mining and manufacturing are gone. So the fall-off, when measured in terms of a percentage of GDP, is nothing short of spectacular in historical context, as shown in this chart from Macquarie. It’s not hard to see why economists have occasionally mentioned the word “recessionary” in reference to the investment outlook.

Part of what’s driving this is that Australia’s economy is increasingly being driven by much less capital-intensive sectors such as education and tourism, which don’t require huge pieces of machinery and infrastructure like trains, tunnelling machines and factory plant equipment. And on the other side of the ledger, the huge increases in capital investment during the mining boom have laid the foundations for the vast increase in Australia’s commodity export volumes, which have been supporting economic growth since the spending started to fall away. The Macquarie research team notes, however, that “non-mining business capex has yet to meaningfully react to lower interest rates, and that companies are “waiting for clear signs of sustained demand before investing.” Right now, those signs are nowhere to be seen.

Read more …

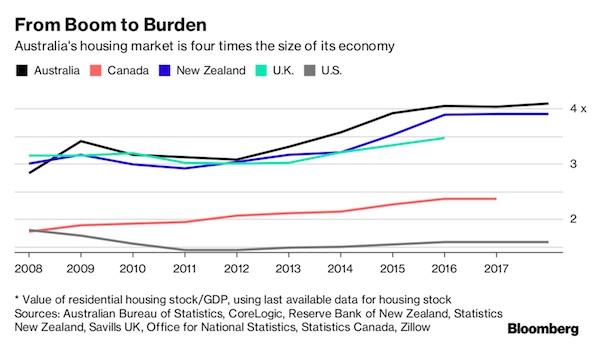

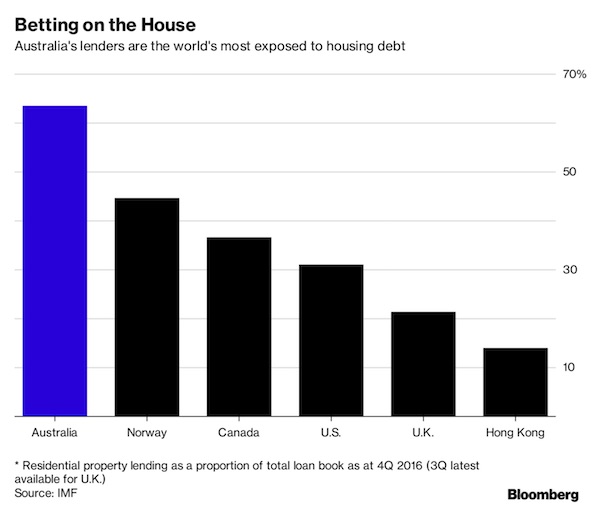

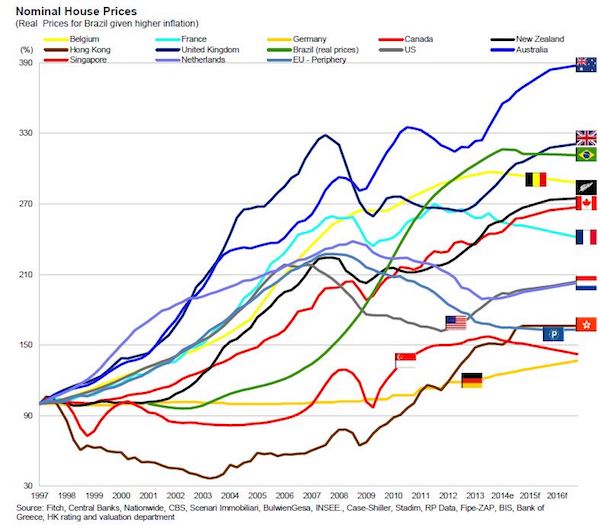

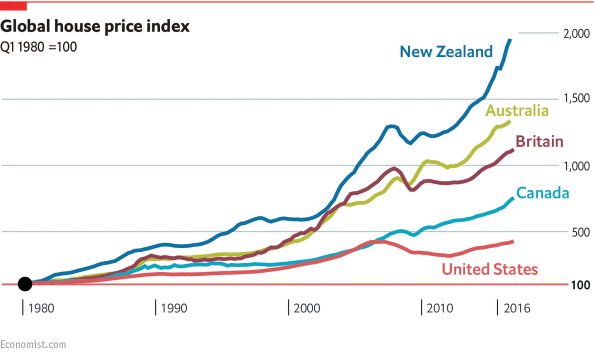

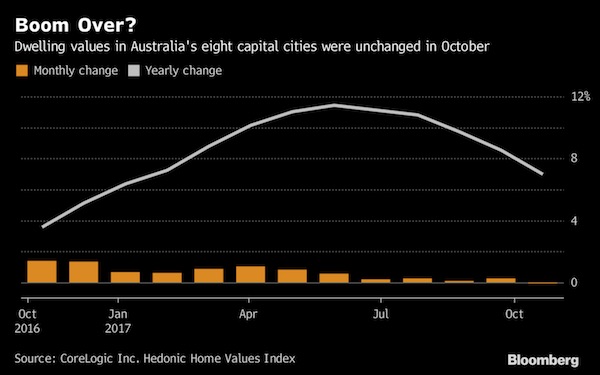

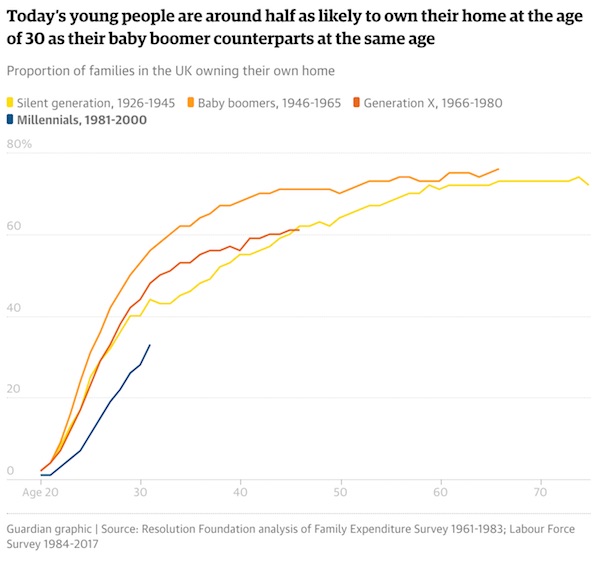

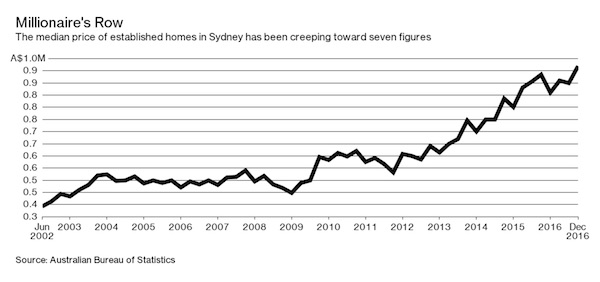

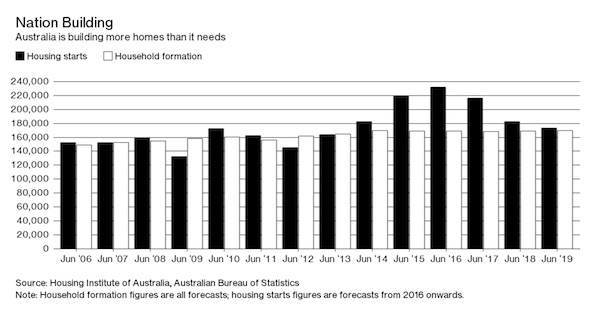

You can make charts just like this one for many countries.

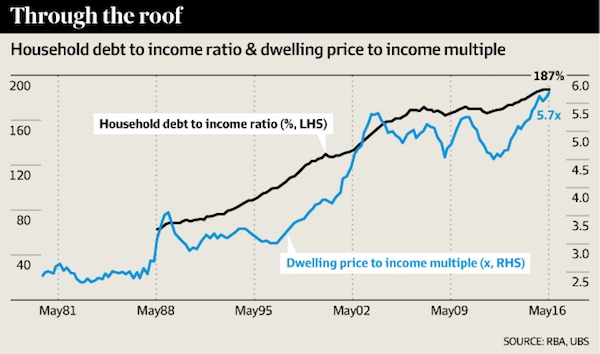

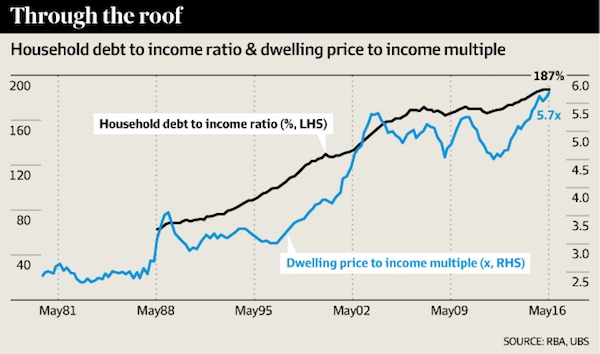

• Australia Central Bank Loses Credibility As Housing Boom Continues (AFR)

Australia’s booming housing market has once again head-faked the central bank, which is losing credibility every time it cuts on claims the world’s dearest residential property prices are nothing to worry about. In rationalising its decision to reduce the cash rate to 1.5% in August, the Reserve Bank of Australia alleged that “the likelihood of lower interest rates exacerbating risks in the housing market has diminished”. Yet auction clearance rates in our two largest cities, Sydney and Melbourne, which account for 47% of the metro population, have subsequently risen back to boom-time levels. CoreLogic reports that 86.4% of Sydney auctions on the weekend resulted in a sale, which is 10 percentage points higher than the equivalent clearance rate 12 months ago and just shy of the 89.7% record set in May last year.

In Melbourne, 76.1% of auctions saw a sale, besting the 74.3% clearance rate in the same week last year. Median clearance rates in Sydney and Melbourne over the four weeks since July 31 have been 78% and 76% respectively, materially above the median levels observed in these cities since the current housing boom commenced in 2013 on the back of the RBA’s stimulus. While the RBA argues that much lower sales volumes in 2016 signal weakness, this is likely more a reflection of a four-year boom exhausting supply. And it does not stack up with unusually strong clearance rates or persistently exuberant capital gains across Sydney and Melbourne.

Read more …

I can only fully agree. And no, again, that’s not because I support Trump. Everything and everyone should be scrutinized.

• American Journalism Is Collapsing Before Our Eyes (Goodwin)

Donald Trump may or may not fix his campaign, and Hillary Clinton may or may not become the first female president. But something else happening before our eyes is almost as important: the complete collapse of American journalism as we know it. The frenzy to bury Trump is not limited to the Clinton campaign and the Obama White House. They are working hand-in-hand with what was considered the cream of the nation’s news organizations. The shameful display of naked partisanship by the elite media is unlike anything seen in modern America. The largest broadcast networks – CBS, NBC and ABC – and major newspapers like The New York Times and Washington Post have jettisoned all pretense of fair play. Their fierce determination to keep Trump out of the Oval Office has no precedent.

Indeed, no foreign enemy, no terror group, no native criminal gang, suffers the daily beating that Trump does. The mad mullahs of Iran, who call America the Great Satan and vow to wipe Israel off the map, are treated gently by comparison. By torching its remaining credibility in service of Clinton, the mainstream media’s reputations will likely never recover, nor will the standards. No future producer, editor, reporter or anchor can be expected to meet a test of fairness when that standard has been trashed in such willful and blatant fashion. Liberal bias in journalism is often baked into the cake. The traditional ethos of comforting the afflicted and afflicting the comfortable leads to demands that government solve every problem. Favoring big government, then, becomes routine among most journalists, especially young ones.

I know because I was one of them. I started at the Times while the Vietnam War and civil-rights movement raged, and was full of certainty about right and wrong. My editors were, too, though in a different way. Our boss of bosses, the legendary Abe Rosenthal, knew his reporters leaned left, so he leaned right to “keep the paper straight.” That meant the Times, except for the opinion pages, was scrubbed free of reporters’ political views, an edict that was enforced by giving the opinion and news operations separate editors. The church-and-state structure was one reason the Times was considered the flagship of journalism. Those days are gone. The Times now is so out of the closet as a Clinton shill that it is giving itself permission to violate any semblance of evenhandedness in its news pages as well as its opinion pages.

Read more …

But then you think: well, well, what got into the Wall Street Journal editors? Expect pressure on Clinton Foundation to increase.

• The Clintons Really Do Think They Can Get Away With Anything (WSJ)

After years of claiming that the Clinton Foundation poses no ethical conflicts for Bill and Hillary or the U.S. government, Bill Clinton now admits the truth—sort of. If his wife becomes President, he says the Super PAC masquerading as a charity won’t accept foreign or corporate contributions. Bill will also resign from the foundation board, and Chelsea will stop raising money for it. Now they tell us. If such fund-raising poses a problem when she’s President, why didn’t it when she was Secretary of State or while she is running for President? The answer is that it did and does, and they know it, but the foundation was too important to their political futures to give it up until the dynastic couple were headed back to the Oval Office.

Now that Hillary is running ahead of Donald Trump, Bill can graciously accept new restrictions on their pay-to-play politics. Bill must be having a good laugh over this one. The foundation served for years as a conduit for corporate and foreign cash to burnish the Clinton image, pay for their travel expenses for speeches and foreign trips, and employ their coterie in between campaigns or government gigs. Donors could give as much as they wanted because the foundation is a “charity.” President Obama may have banished Sidney Blumenthal from the State Department, but Bill could stash his conspiratorial pal at the foundation, keeping him on the family payroll while Sid flooded Hillary with foreign-policy advice. Her private email server was supposed to hide their email traffic—until that gambit was exposed last year.

But FBI Director James Comey let Hillary off the hook on the emails, and he declined to investigate the foundation, so it looks like they’re home free. By now the corporate and foreign cash has already been delivered, in anticipation that Hillary Clinton could become the next President. So now it’s the better part of political prudence to claim the ethical high ground. If you choose to believe or have a short memory. Readers may recall that the foundation promised the White House when Mrs. Clinton became Secretary of State that the foundation would restrict foreign donations and get approval from the State Department. It turned out the foundation violated that pledge, specifically when accepting $500,000 from Algeria.

The foundation also agreed to disclose donor names but failed to do so for more than 1,000 foreign donors until the failure was exposed by press reports. [..] Far from offering some new clean ethical slate, this latest foundation gambit ought to be a warning about a third Clinton term. Protected by Democrats and a press corps desperate to beat Donald Trump, the Clintons really do think they can get away with anything.

Read more …

“.. In 2013, for instance, the Clinton Foundation took in $140 million, but spent just $9 million (6.4%) on direct aid. A typical charity devotes about 75% of receipts to aid.”

• Clinton Not In The Clear (Jack Kelly)

Hillary Clinton has little to fear from Donald Trump. But she may be casting nervous glances over her shoulder at Preet Bharara. You may not have heard of Mr. Bharara. Sheldon Silver, former speaker of the New York State Assembly, a Democrat, and Dean Skelos, former majority leader of the New York Senate, a Republican, wish they hadn’t. In May, they were sentenced to 12 years and five years in prison, respectively, for corruption. Preet Bharara is the U.S. attorney for the Southern District of New York. Since his appointment in 2009, Mr. Bharara “has launched a one-man crusade against evil-doers, ranging from corrupt politicians to the Mafia,” wrote Alan Chartock, a political science professor who’s a longtime watcher of New York state government.

The Southern District of New York is the lead of three U.S. attorneys’ offices investigating the Clinton Foundation, a recently retired deputy director of the FBI told the Daily Caller. The Clinton Foundation is headquartered in New York. It was begun in Little Rock, Ark., to raise funds for the Clinton library. The office in Washington, D.C., may focus on when Hillary was secretary of state. The Clinton Foundation has received more than $2 billion in contributions. More than 1,000 donors are foreigners. The foundation won’t disclose their names or amounts donated. Few of the funds raised have been spent on charitable works. In 2013, for instance, the Clinton Foundation took in $140 million, but spent just $9 million (6.4%) on direct aid. A typical charity devotes about 75% of receipts to aid.

Much more is spent on pay and benefits for staff, office rent, conferences and travel. Some of the highest-paid staffers are political operatives, such as Huma Abedin, who for a time was on the payrolls of both the Clinton Foundation and the State Department, and Sid Blumenthal, who ran a private intelligence network for Hillary in Libya. The most ballyhooed project, relief for Haiti after a devastating earthquake in 2010, was an example of “Robin Hood in reverse”— robbing the poor for the benefit of the rich, said financial analyst Charles Ortel. The Clinton Foundation is a “charity fraud network,” Mr. Ortel wrote on his blog. “What possesses powerful, wealthy and educated persons to prey on the most desperately poor humans on earth as they posture as philanthropists?”

Read more …

Interesting view.

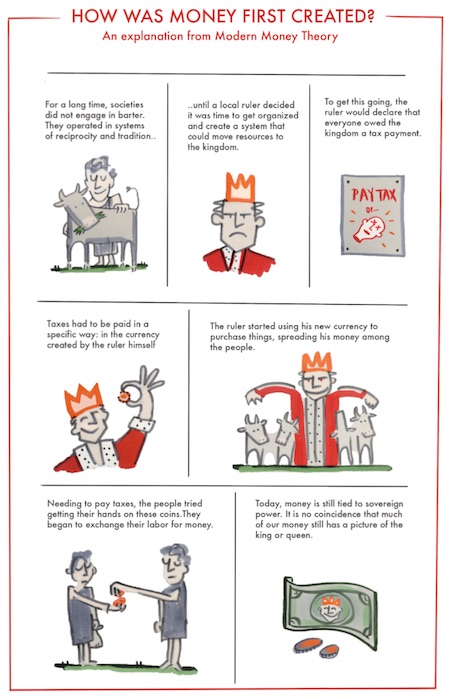

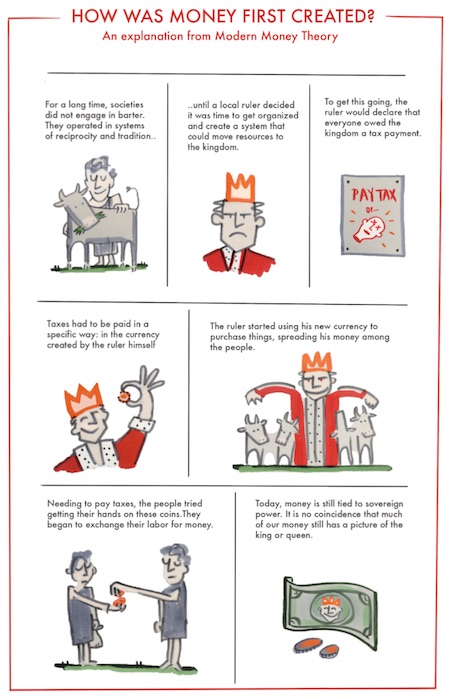

• The History of Money: Not What You Think (Minskys)

Most of us have an idea of how money came to be. It goes something like this: People wanted to exchange goods for other goods, but it was difficult to coordinate. So they started exchanging goods for money, and money for goods. This tells us that money is a medium of exchange. It’s a nice and simple story. The problem is that it may not be true. We may be understanding money entirely wrong. The above story assumes that first there was a market, and then people introduced money to make the market work better. But some people find this hard to believe. Those who subscribe to the Chartalist school of thought give a different history. Before money was used in markets, they say, it was used in primitive criminal justice systems.

Money started as—and still is—is a record of debt. It is a way to keep track of what one person owes another. There’s anthropological evidence to back up this view. Work by Innes, and Wray suggest that the origins of money are more like this: In a pre-market, feudal society, there was usually a system to maintain justice in the community. If someone committed a crime, the authority, let’s call him the king, would decide that the criminal owed a fine to the victim. The fine could be a cow, a sheep, three chickens, depending on the crime. Until that cow was brought forward, the criminal was indebted to the victim. The king would record the criminal’s outstanding debt. This system changed over time. Rather than paying fines to the victim, criminals were ordered to pay fines to the king.

This way, resources were being moved to the king, who could coordinate their use for the benefit of the community as a whole. This was useful for the King, and for the development of the society. But the amount of resources coming from a criminal here and there was not impressive. The system had to be expanded to draw more resources to the kingdom. To expand the system, the king created debt-records of his own. You can think of them as pieces of papers that say King-Owes-You. Next, he went to his citizens and demanded they give him the resources he wanted. If a citizen gave their cow to the king, the king would give the citizen some of his King-Owes-You papers. Now, a cow seems more useful than a piece of paper, so it seems silly that a citizen would agree to this.

But the king had thought of a solution. To make sure everyone would want his King-Owes-You papers, he created a use for them. He proclaimed that every so often, all citizens had to come forward to the kingdom. Each citizen would be in big trouble, unless they could provide little pieces of paper that showed the king still owed them. In that case, the king would let the citizen go, and not owe them any longer. The citizen would be free to go off and acquire more King-Owes-You papers, to make sure he would be safe the next time, too.

Read more …

Saw this on Reuters and other sites, but they all left out the need to store cash, for some reason, which is in the original directive. So I ran the article through Google Translate and corrected it a little.

A government advising people to store cash is not a minor point, I would think. Not in the days of plastic and a war on cash.

• German Government: Citizens Should Store Food, Water And Cash (DWN)

For the first time since the end of the Cold War, the federal government according to a report wants to encourage new stockpiling the population again, so that they, in the case of a disaster or an armed attack temporarily, can take care of themselves. “The population is ‘advised’ to hold a personal supply of food of ten days,” quoted the “Frankfurter Allgemeine Sonntagszeitung” from a concept for civil defense, which the government is requested to adopt on Wednesday. According to the report, the population should be able to protect themselves in an emergency before calling government action to ensure an adequate supply of food, water, energy and cash. Therefore, the population should also be ‘advised’, to hold, for a period of five days, two liters of drinking water per person per day, it is stated in the text drawn up by the Ministry of the Interior.

According to “FAS” is the first strategy for civil defense since the end of the Cold War in 1989. She had been given in 2012 by the Budget Committee of the Bundestag in order. In the 69-page concept it is stated “that an attack on the territory of Germany, which requires a conventional defense, play” was. Nevertheless, it was necessary, “nevertheless to such sufficiently prepared not fundamentally excluded for the future development of life-threatening”. Interestingly, the FAZ reported in this regard that the Federal Government also worry about their own safety. The newspaper writes that in the paper literally stand “. Precautions are the event the task of the service office to meet in order to relocate the performance of duties of a public authority to another, sheltered place (Emergency Seat) can”

It is not clear whether these preparations related to a possible war. The federal government has recently changed its military strategy and regarded Russia as an enemy. NATO considers Russia an attack on NATO territory possible. Therefore, NATO wants the US and the EU also defend outside their own territory. Reuters writes that in the concept of “the need for a reliable alarm system, a better structural protection of buildings and sufficient capacity discussed in the health system” would. Reuters: “The civilian support of the armed forces should be again a priority. These included modifications to the traffic steering when the Bundeswehr must relocate combat units. “

Read more …

Very far from over. Please help me support. Read: Meanwhile in Greece..

• ‘Nobody Believes In Anything Anymore’: Greek Crisis is Far From Over (CNBC)

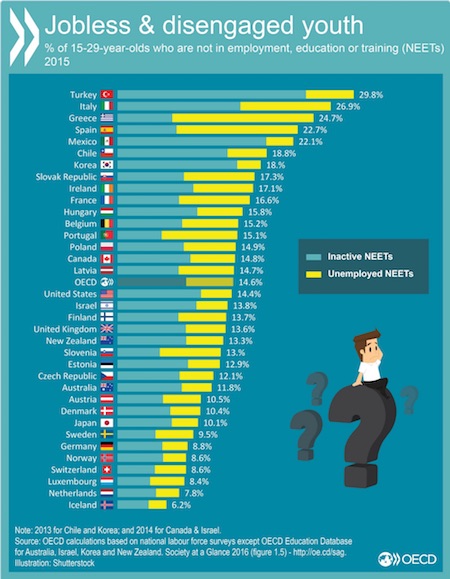

With Europe facing pressing crises including the refugee crisis, economic slowdown and political disintegration following the Brexit vote, it’s easy to forget that Greece’s political and economic crisis dominated headlines last summer. One year on and a third bailout worth €86 billion later, arrived at after tortuous negotiations between Greece and its lenders, and the situation in Greece is a game of two halves with many Greeks suffering – and some trying to make something out of a bad situation. Greece’s government has been forced to make widespread spending cuts over the course of its three separate bailout programs, making life harder for most Greeks of ordinary means. The cuts have affected all ages with unemployment rising to the highest level in Europe.

A survey by independent analysis firm DiaNEOsis in June revealed that many Greeks were facing an increasing struggle to get by. Extreme poverty in the Greek population (of 11 million people) had risen from 2.2% in 2009, to 15% in 2015, the public opinion survey of 1,300 people showed, with 1.6 million people now living below in extreme poverty. One resident of the northern Greek city of Thessaloniki, Evangelos Kyrimlis, told CNBC that the Greece’s crisis had taken its toll on society, both at a local and national level. “Disillusionment is the first big thing that’s going on,” he noted. “Nobody believes in anything anymore.” “The second big thing is withdrawal. People have retreated to their families and fight only for the family survival. Society has been fragmented,” he said.

Kyrimlis works for his partner’s family firm, having returned to Greece after working for an engineering consultancy in London. Returning to Greece in the midst of the country’s financial breakdown, he said he now noted an increase in animosity between people, saying there was a “widespread hatred not directed to anyone in particular, it’s like all against all.”

Read more …

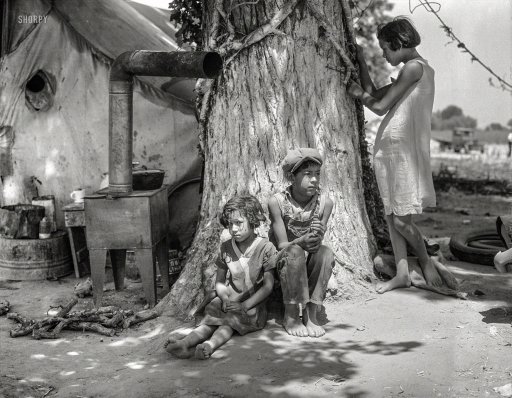

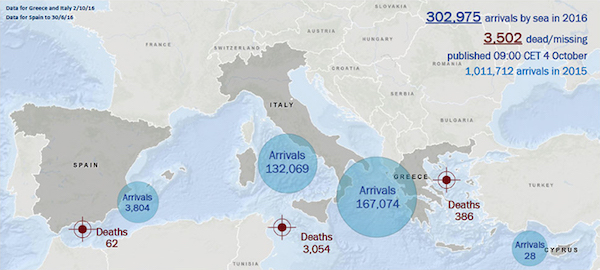

“When they reached the port in Sicily the Italian Red Cross were there, with coffins and flowers for every person who died [..] The tough MSF doctors who have been going from war to war cried because of the flowers..”

• Rescuing Refugees: ‘You Never Get Used To It – And That’s A Good Thing’ (G.)

It was the silence of the passengers that Hassiba Hadj-Sahraoui first noticed. Usually when the humanitarian rescue boat sees a tiny dinghy bobbing about in the Mediterranean there’s frantic waving and shouting. “When our team approached in smaller boats and everyone was so quiet we realised something was wrong,” she says. “We asked permission to go aboard and that’s when we realised the others had been waiting for rescue for hours with dead bodies in the boat.” Twenty-two bodies were recovered that day (21 of them women) and 209 people were saved by the crew of the Aquarius, a boat run by Medicins Sans Frontieres (MSF) that patrols the refugee route between Libya and Italy. MSF advocacy manager Hadj-Sahraoui got an idea of how they died from the testimonies of survivors once they were safely on the Aquarius.

A wooden board that had been placed along the bottom of the dinghy broke and water started to come in, mixing with leaking fuel cans. A panic ensued and the 22 people died either in a stampede or drowning in a mix of water and fuel. The people they rescued were in shock. “The priority – it’s sad to say – is with the living,” says Hadj-Sahraoui. “So there’s a very quick medical team, trying to assess needs.” Once the survivors were on the Aquarius they were each given a blanket, water and some food. The people who were soaked in fuel were sent for a shower, because the fuel and sea salt cause nasty burns. Then they registered them. Hadj-Sahraoui speaks Arabic, French and English, a great advantage in her line of work. She asks each person where they are from, how old they are, and if they are travelling alone.

“We don’t wear sunglasses, because we need to have eye contact. It’s about humanity. It’s big smiles saying: ‘You’re now safe. This is where you are. This is what’s going to happen next.’ What surprised me is how polite people are. How they take their time to say thank you.” Once all the survivors were safely on board, and being tended to, the crew of the Aquarius also felt it was right on this occasion to recover the bodies of the women and one man who died. “For several hours we tried to keep the living on one side of the boat. The bodies had spent hours in the water, so we were trying to protect the living from seeing that. The doctor took pictures for identification, because families will never know what happened to their loved ones.” When they reached the port in Sicily the Italian Red Cross were there, with coffins and flowers for every person who died.

“The tough MSF doctors who have been going from war to war cried because of the flowers,” says Hadj-Sahraoui. “I was one of the suckers who cried a lot.” She says that people who do humanitarian work need to learn to take care of themselves, because there’s a lot of emotional burnout. MSF staff have psychological debriefings before and after they go on missions, and after extreme experiences like this one.

Read more …

No-one’s going to stop this.

• Inuit Fear Being Overwhelmed As ‘Extinction Tourism’ Descends On Arctic (G.)

In a few days, one of the world’s largest cruise ships, the Crystal Serenity, will visit the tiny Inuit village of Ulukhaktok in northern Canada. Hundreds of passengers will be ferried to the little community, more than doubling its population of around 400. The Serenity will then raise anchor and head through the Northwest Passage to visit several more Inuit settlements before sailing to Greenland and finally New York. It will be a massive undertaking, representing an almost tenfold increase in passenger numbers taken through the Arctic on a single vessel – and it has triggered considerable controversy among Arctic experts. Inuit leaders fear that visits by giant cruise ships could overwhelm fragile communities, while others warn that the Arctic ecosystem, already suffering the effects of global warming, could be seriously damaged.

“This is extinction tourism,” said international law expert Professor Michael Byers, of the University of British Columbia. “Making this trip has only become possible because carbon emissions have so warmed the atmosphere that Arctic sea ice in summer is disappearing. The terrible irony is that this ship – which even has a helicopter for sightseeing and a huge staff-to-passenger ratio – has an enormous carbon footprint that is only going to make things even worse in the Arctic.” The Serenity is by far the biggest cruise vessel to traverse the fabled Northwest Passage, whose exploration has claimed the lives of hundreds of seamen. The ship has a crew of 655 and carries 1,070 passengers, who have paid between £19,000 and £120,000 for a voyage that Crystal Cruises says will take them on an “intrepid adventure” from Anchorage in Alaska to New York over 32 days.

For its part, Crystal insists its clients will have to follow a strict code of conduct during shore visits, while the ship’s air, water and rubbish discharges will be tightly controlled. Only low-sulphur fuel will be burned in the Serenity’s engines, said a spokesman. The Serenity will be accompanied by the UK icebreaker the RSS Ernest Shackleton, he added.

Read more …