DPC Betsy Ross house, Philadelphia. Birthplace of Old Glory 1900

” This may call for central banks to use a different set of policy tools than manipulating long-term rates, and may even argue for the Fed to actually raise long-term rates faster than what is recommended by traditional monetary policy.”

• Robert Merton: QE Makes Everything Worse (PiOnline)

[..] … while QE has increased absolute wealth, it has simultaneously lowered relative wealth for a large class of investors. This could lead to the opposite of the desired effect for this group of investors. Lower relative wealth means investors need to save more to improve their funded status, especially where regulations are strict, and it results in less consumption and investment, and may not remove the deflationary overhang. [..] An alternate, more sophisticated approach to explaining why QE may not work to stimulate aggregate consumption is, perhaps, because the demographic mix of the U.S. (and most parts of the developed world) has shifted toward older people. Unlike 30 or 40 years ago, the enormous baby boomer generation, and even retirees, are much wealthier (including human capital) than in the past, and they are wealthier than current generations earlier in their life cycle.

So the wealth effect does not lead to an increase in consumption and, potentially, has the opposite outcome. [..] When baby boomers were in the sweet spot for housing needs, expenditures on children and cars, etc. 30 to 40 years ago, the effect the central banks were expecting from QE might have worked better, as they expected it would, but that need not be a reliable prediction under the changed current demographic and wealth distribution. [..] We believe it is imperative for central banks and academia to examine this perspective immediately and develop a new monetary policy toolkit, because it would be tragic if the central banks’ attempts to improve economic security with the current orthodoxy leads, instead, to less consumption, less investment and greater retirement insecurity. [..]

A recent study by the Center for American Progress shows that millions of Americans (as high as 50% of households) are in danger of retiring with insufficient money to maintain the standard of living to which they are accustomed, and the problem is getting progressively worse. Your previous editorial argues that QE by the central bank may impose unintended costs on pensions, at both the institutional and retail level. This suggests more research needs to be conducted to examine how monetary policy affects relative wealth, not just absolute wealth, and whether traditional approaches are outdated given the current retirement landscape. This may call for central banks to use a different set of policy tools than manipulating long-term rates, and may even argue for the Fed to actually raise long-term rates faster than what is recommended by traditional monetary policy.

Read more …

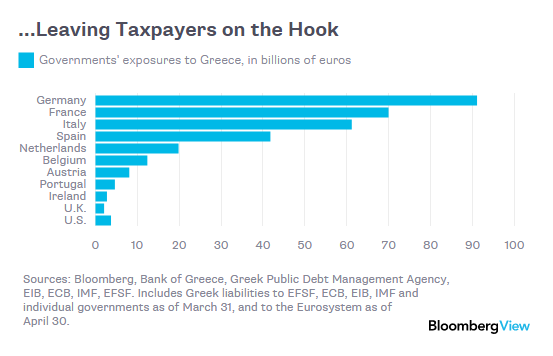

The ECB as a political party will not work out.

• ECB Is Studying Curbs on Greek Bank Support (Bloomberg)

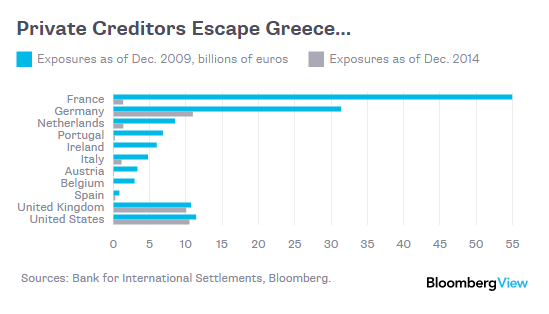

The European Central Bank is studying measures to rein in Emergency Liquidity Assistance to Greek banks, as resistance to further aiding the country’s stricken lenders grows in the Governing Council, people with knowledge of the discussions said. ECB staff have produced a proposal to increase the haircuts banks take on the collateral they post when borrowing from the Bank of Greece, the people said, asking not to be named as the matter is private. While the measure hasn’t been formally discussed by the Governing Council, it may be considered if Greece’s leaders fail to quickly convince euro-area finance ministers they can reform their economy and secure bailout funds, one of the people said.

Greek lenders are mostly locked out of regular ECB cash tenders while the country’s government, which holds talks with euro-area partners in Riga this week, tussles with its creditors over the much-needed aid payments. Instead, the banks currently have access to about €74 billion of emergency funds from their own central bank – an amount that has been rising and which will be reviewed this week. There’s “no doubt” that the ECB is losing patience with Greece, said Frederik Ducrozet, an economist at Credit Agricole CIB in Paris. “Greek banks will need more funding before long, so in a way larger haircuts or a lower ELA cap are equivalent.”

Read more …

Does Q€ make Greece’s position weaker?

• Investors May Be Ignoring Potential ‘Collateral Damage’ From Greece (MarketWatch)

Investors aren’t really sweating the potential for a Greek exit from the eurozone, a prospect that had the markets on the verge of panic just a few summers ago. Are market participants too relaxed? Only time will tell for sure, but here’s a look at what’s happening and why some analysts think investors are underplaying risks while others remain relaxed. While Greek bond yields continue to jump and the German 10-year bund yield moves ever closer to zero on safe-haven flows, the yields on other seemingly vulnerable eurozone countries aren’t showing much stress. Italian and Spanish government-bond yields jumped at the end of last week as Greek fears were revived, but remain near historic lows.

After retreating on Friday, inspired in part by Greece as well as moves by China and other factors, European stocks rebounded on Monday, with Wall Street also bouncing back. Major indexes in both regions aren’t far off record highs. The euro fell versus the dollar, but is holding above recent lows below $1.06. It wasn’t that long ago that fears over contagion sent Italian and Spanish government debt yields soaring, briefly stretching above 7% for 10-year bonds—a level seen as unsustainable. That added to a vicious circle as investors worried that banks, carrying large amounts of government debt, would take massive hits, requiring bailouts from those same governments. The ECB’s subsequent creation in 2012 of a bond-buying program, though never used, reassured investors that a sufficient backstop was in place, allowing Italian and Spanish yields to fall back from crisis levels.

Now, the ECB is buying €60 billion of bonds a month as part of its quantitative-easing program—a move that has driven yields lower across most of the eurozone. Large chunks of the yield curve in Germany and other so-called core countries are now in negative territory, meaning bondholders pay for the privilege of parking money with those governments. Erik Nielsen at UniCredit Bank in London argued, in a note, that the ECB’s quantitative-easing program is part of the reason why markets aren’t—and probably won’t be—rattled by the threat of a Greek exit. “Markets are strong enough (yes, we’ll get volatility, but that would be a buying opportunity), the ECB’s toolbox is good enough and QE is already in place,” Nielsen wrote.

In fact, Greek politicians who think the threat of contagion gives them a bargaining chip may be misleading themselves, he said, because “whatever leverage they think they might have within the European context has been suspended by QE.”

Read more …

I doubt that everyone involved feels that way.

• Creditors Chase Consensus With Greece to Unlock More Aid (Bloomberg)

Greece and its creditors remained at loggerheads with time running out to unlock aid and avert a default. The sides haven’t even set 2015 budget targets, let alone on policies to meet them, an official representing creditors said Monday, asking not to be named as talks aren’t public. Euro-area finance ministers said in February that a list of measures must be agreed upon by the end of April. European leaders want Greece to do more to revamp its debt-burdened economy, with progress to be reviewed on April 24 in Riga, Latvia, when finance ministers from the currency bloc meet. European Commission Vice President Valdis Dombrovskis said in an interview in Washington that creditors might need to wait until mid-May to see what Greece can deliver.

“The situation with Greece needs to be resolved soon,” Cypriot Finance Minister Harris Georgiades said in a Bloomberg Television interview Monday. “It would be a negative development if no progress is made at the meeting in Riga.” Dutch Finance Minister Jeroen Dijsselbloem, who chairs meetings of his euro-region counterparts, said in Washington on Saturday that a deal won’t be ready by the Riga gathering. Greek bonds fell as yields on three-year notes rose 115 basis points to 27.9% as of 2:45 p.m in Athens. With the country running out of cash, credit-default swaps suggested there is about an 84% chance of Greece being unable to repay its debt in five years, compared with about 67% at the start of March, according to CMA data.

A default on the country’s €313 billion of obligations and an exit from the euro would be traumatic for the currency area and plunge Greece into a major crisis, ECB governing council member Christian Noyer told French newspaper Le Figaro in an interview published Monday. “The ball is in the court of the Greek government,” he said.

Read more …

“Deputy Finance Minister Dimitris Mardas had warned that such a move was coming. “Similar provisions already exist in Holland, Portugal and England..”

• Greece Orders Public Entities to Store Cash in Central Bank (WSJ)

Greece’s government issued a decree Monday requiring public bodies such as state-owned companies and public pension funds to transfer their cash reserves to the central bank as the country’s cash reserves continue to dry up. The decree, published in the government gazette late Monday, came as no surprise, the government having telegraphed the move last week. But it still represents evidence of an escalating cash squeeze amid renewed concerns of Greek default. Greece’s parliament has recently passed a bill allowing the Greek government to borrow funds held by state bodies and social-security funds via repurchase agreements, or repos, and has borrowed money from entities such as the central bank and the country’s job centers.

But this decree makes the transfer of state bodies’ cash reserves to the Bank of Greece compulsory, excluding the country’s social-security funds. “This practice already exists in several countries of the European Union,” a senior government official said Monday, adding that the state has the ability to borrow cash from state bodies that don’t have an immediate need for it, but for no more than 15 days. Greece needs a deal to secure billions of euros in bailout aid to avoid defaulting on its debts by this summer and potentially tumbling out of the euro. But the overhauls that creditors want, including further pension cuts and tax increases in a country reeling from years of drastic austerity, could split or bring down the government of radical-left Prime Minister Alexis Tsipras, which was elected in January on an anti-austerity ticket.

In remarks to journalists last week, Deputy Finance Minister Dimitris Mardas had warned that such a move was coming. “Similar provisions already exist in Holland, Portugal and England,” Mr. Mardas said last week. “It is one of the possibilities.” In Paris, French finance minister Michel Sapin said Monday that Greece’s decision to pool the cash reserves of public entities at the central bank was only an emergency solution and the country needs to move faster on economic overhauls. “Greece is dealing with an emergency,” Mr. Sapin said in an interview on French television channel BFM TV. “But that is not sufficient because it’s not just a question of urgency, it’s a question of getting down to the fundamentals.”

Read more …

But an act that raises many questions, nevertheless.

• Greek Mayors to Protest Government Decision to Seize Their Cash (Bloomberg)

As Greece struggles to find cash to stay afloat, local authorities say they oppose a government decision to use their reserves for short-term financing. “The government’s decision to seize our reserves not only raises legal and constitutional issues, but also a moral one,” said George Papanikolaou, mayor of Glyfada, the third-largest municipality in the metropolitan region of Attica after Athens and Piraeus. “We have a responsibility to serve our citizens,” Papanikolaou said by phone on Monday. Glyfada has about €16 million in cash reserves, he said. Running out of other options, Greek Prime Minister Alexis Tsipras ordered local governments and central government entities to move their cash balances to the central bank for investment in short-term state debt.

The decree to confiscate reserves held in commercial banks and transfer them to the Bank of Greece could raise as much as €2 billion, according to two people familiar with the decision. The money is needed to pay salaries and pensions at the end of the month, the people said. “It is a politically and institutionally unacceptable decision,” Giorgos Patoulis, mayor of the city of Marousi and president of the Central Union of Municipalities and Communities of Greece, said in a statement on Monday.“No government to date has dared to touch the money of municipalities.”

The Athens city council and the union of municipalities and communities in Greece will convene tomorrow to debate the order, a press officer of the mayor’s office said. “Central government entities are obliged to deposit their cash reserves and transfer their term deposit funds to their accounts at the Bank of Greece,” according to the decree posted Monday on a government website said. The “regulation is submitted due to extremely urgent and unforeseen needs.” The additional funding may be only enough to pay salaries and a €770 million tranche owed to the IMF on May 12, the people familiar with the decision said.

Read more …

“It is, in other words, not inconceivable there may be a Germexident before there is a Grexident..”

• Herr Schäuble’s Foibles: The Eurozone Rebalancing Conundrum (Parenteau)

[..] recognition of the shifting composition of Germany’s trade surplus may also hint at some of the reasons why German policy makers may not be terribly interested in Ponzi financing the external liabilities of peripheral Eurozone governments much longer. After all, the periphery no longer appears to be where the main customers of their tradable goods companies dwell. It is, in other words, not inconceivable there may be a Germexident before there is a Grexident, as Germany has less to lose with respect to its neo-mercantilist growth strategy now if the peripheral economies are left to fend for themselves in servicing their existing external debt loads. Recall also, as depicted in a recent piece called Draghi’s Doom Loops, that the profitability of Germany’s banks and insurance company is also being undermined by the ECB’s PSPP initiative.

For the time being, however, the result of the rabid pursuit Austerian policies has essentially made somewhat obsolete the hand-wringing over the Eurozone current account recycling mechanism design flaw that can be found in places like Yanis Varoufakis’ masterful treatise, The Global Minotaur. We will simply have to wait with bated breath for the second edition to be scribbled and released once the Troika has insured the current Greek Finance Minister will have much more free time on his hands.

This brings us to what we can and should recognize as Herr Schäuble’s Foibles. For you cannot possibly ask a country that has pursued a neo-mercantilist growth strategy to just drop it. You especially cannot expect a warm, favorable response from said country when key policy authorities and their key economic advisors, believe the whole world can (and should) follow in its virtuous footsteps by also running trade surpluses – a bold challenge to the rest of the world which unfortunately ignores the small algebraic fact that global trade balances have to net to zero. At least, that is, until we open up trade with Martians and Venusians.

You especially cannot expect to get anywhere by asking a neo-mercantilist nation to just drop it and take steps to deliver a trade deficit, if the policy makers of that nation also believe it is equally virtuous to maintain a fiscal balance near zero. Simply put, if you take away their trade surplus as a driver of growth, that means they can only get growth if their domestic household or business sectors are willing and able to deficit spend in perpetuity.

Read more …

“Iron ore prices have collapsed by close to 50% since last July and over 65% since the beginning of 2014. Falls have accelerated in recent weeks, almost becoming a rout, with prices down over 30% year-to-date.”

• Chinese Economic Outlook “Skewed Heavily To The Downside”: BNP (Zero Hedge)

With the country’s tough transition to a service-based economy being made all the more difficult by the hit industrial production will likely take as Beijing ramps up efforts to fight a pollution problem that was thrust back into the spotlight early last month thanks to a viral documentary, it’s reasonable to suspect we’ll be seeing a lot more of the idle cranes, empty construction sites, and half-finished abandoned buildings that greeted Bloomberg metals analyst Kenneth Hoffman who returned from a tour of the country earlier this month. Ultimately, Hoffman’s assessment was that metals demand in China is collapsing and isn’t likely to pick back up for the foreseeable future.

This is bad news for the Chinese economic machine and it’s also bad news for any iron ore miner out there whose marginal costs aren’t low enough to stay profitable in the face of a protracted downturn in prices because if you can’t convince the big guys that your price collusion idea will pass regulatory muster, well, they’ll likely take the opportunity to keep right on producing despite the slump and run you out of business. With the stage thus set, we bring you the following from BNP who explains why iron ore prices aren’t likely to rebound any time soon, and why the economic outlook for China is indeed “as bad as the data looks, if not worse” (to quote Mr. Hoffman). Via BNP:

Global commodity prices have fallen sharply since last summer, dragged down by a cocktail of fading Chinese industrial demand, surging supply and a strong USD. Oil has inevitably garnered the majority of headlines but iron ore prices have fallen even further. Iron ore prices have collapsed by close to 50% since last July and over 65% since the beginning of 2014. Falls have accelerated in recent weeks, almost becoming a rout, with prices down over 30% year-to-date.

Read more …

“It’s been a canary that has been chirping for some time..”

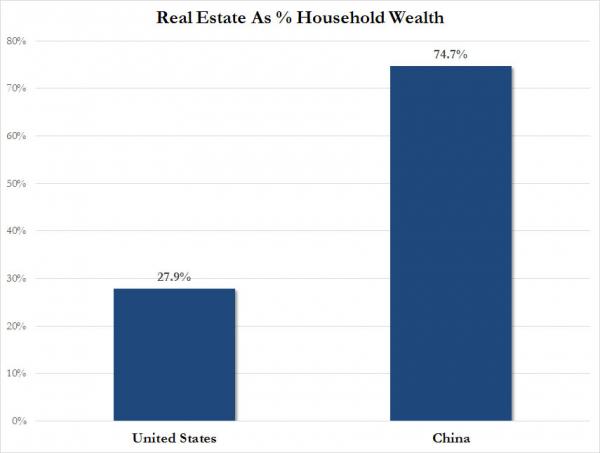

• Major China Real Estate Developer Kaisa Defaults On Its Dollar Debt (Bloomberg)

Kaisa Group became China’s first real estate company to default on its U.S. currency debt, capping a month of distress in bond markets amid an anti-corruption probe and fueling concern that losses will spread. The default coincides with the expiration of a 30-day grace period on $52 million of missed interest payments on two dollar-denominated bonds, according to a Hong Kong stock exchange statement Monday. Kaisa, based in the southern city of Shenzhen, is struggling to service 65 billion yuan ($10.5 billion) of debt owed to both onshore and offshore lenders while becoming embroiled in President Xi Jinping’s crackdown on graft.

The developer’s problems have rippled across the region’s debt market, where investors starved of yield elsewhere in the world have swooped in to boost returns. As the government’s anti-corruption probes widen, it’s raising concern that defaults will spread after overseas noteholders bought a record $21.3 billion of bonds issued by Chinese property companies. “It’s been a canary that has been chirping for some time,” Gary Herbert at Brandywine Global in Philadelphia said. “This is the beginning of an adjustment period in China that will see a lot of credit investors, who were chasing the promise of higher yields, ultimately disappointed.”

Kaisa’s default follows the surprise return of founder Kwok Ying Shing last week. The developer’s woes started late last year when the Chinese government blocked approvals of its property sales and new projects in Shenzhen, said to be linked to an investigation of the city’s former security chief Jiang Zunyu. Kaisa “is focused on facilitating the release of its 2014 audited financial results,” according to its statement. Following that release, the company “will continue its efforts to reach a consensual restructuring of its outstanding debts.”

Read more …

The whole housing sector is collapsing, so yeah, more defaults are certain.

• Does Collapse of Chinese Developer Kaisa Signal More Defaults? (Bloomberg)

Kaisa Group captivated Wall Street by minting fortunes from troubled real estate in China. Now the developer is in trouble itself – and the question is how far the pain will spread. On Monday, the news came that many had been dreading for months: The company, caught up in an anti-corruption probe, is buckling under its debts as a slumping real estate market drags down the entire Chinese economy. After missing $52 million in interest payments, Kaisa, once a stock market darling, now confronts an uncertain future. It’s a remarkable comedown for a company that burst onto the scene in 2007 as billions poured into Chinese real estate. Its troubles, long in coming, have set investors on edge and have many asking if Kaisa is a one-off or the start of something worse.

Just last week, Standard & Poor’s warned that “more defaults cannot be ruled out,” saying it’s concerned about how profitability in the Chinese property sector is faltering. “More than one big developer is going to go under,” said Erik Gordon at the University of Michigan. “Busts follow booms. There’s no reason for it to be any different in China.” While there was no immediate reaction in Chinese markets to the default Monday, the saga has sparked jitters among the country’s corporate bond investors on multiple occasions over the past several months. So while China’s equity market has been booming – the result of optimism that government stimulus efforts will shore up the economy – high-yield corporate bonds have posted almost no gains since the end of November, having sold off in January before rebounding in recent weeks.

Kaisa’s benchmark dollar bonds, meanwhile, are hovering at prices that show investors anticipate the company will saddle them with losses of more than 40% when a restructuring offer is made. Its stock has been suspended in Hong Kong since March 31 after sinking 48% in four months. The default, the first ever by a Chinese developer on dollar bonds, is in part emblematic of the slowdown in China’s property market. The real-estate market is helping drag down the economic expansion to its slowest pace since 1990 after serving as a key engine of outsized growth rates over the past five years. The average home price has fallen 6.1% in the past year, the steepest decline on record, according to the National Bureau of Statistics.

Read more …

“Mostly, though, she has no idea where history is taking us, in case you’re wondering at the stupefying platitudes offered up as representative of her thinking.”

• Change They Don’t Believe In (Jim Kunstler)

The unfortunate consequence of not allowing the process of “creative destruction” to occur in banking and Big Business is that the historic forces behind it will seek expression elsewhere in the realm of politics and governance. The desperate antics of central banks to cover up financial failure can’t help but provoke political upheaval, including war. It’s a worldwide phenomenon and one result will be the crackup of economic relations — thought by many to be permanent — that we call “globalism.” The USA has suffered mightily from globalism, by which a bonanza of cheap “consumer” products made by Asian factory slaves has masked the degeneration of local economic vitality, family life, behavioral norms, and social cohesion.

That crackup is already underway in the currency wars aptly named by Jim Rickards, and you can bet that soon enough it will lead to the death of the 12,000-mile supply lines from China to WalMart — eventually to the death of WalMart itself (and everything like it). Another result will be the interruption of oil export supply lines. The USA as currently engineered (no local economies, universal suburban sprawl, big box commerce, despotic agribiz) won’t survive these disruptions and one might also wonder whether our political institutions will survive. The crop of 2016 White House aspirants shows no comprehension for the play of these forces and the field is ripe for epic disruption.

The prospect of another Clinton – Bush election contest is a perfect setup for the collapse of the two parties sponsoring them, ushering in a period of wild political turmoil. Just because you don’t see it this very moment, doesn’t mean it isn’t lurking on the margins. This same moment (in history) the American thinking classes are lost in raptures of techno-wishfulness. They can imagine the glory of watching Fast and Furious 7 on a phone in a self-driving electric car, but they can’t imagine rebuilt local economies where citizens get to play both an economic and social role in their communities. They can trumpet the bionic engineering of artificial hamburger meat, but not careful, small-scale farming in which many hands can find work and meaning.

The true genius of Hillary is that she manages to epitomize every failure of our current political life: the obsessive micro-manipulation of image, the obscene moneygrubbing, the tired cronyism, the entitlement masquerading as sexual equality. Mostly, though, she has no idea where history is taking us, in case you’re wondering at the stupefying platitudes offered up as representative of her thinking.

Read more …

“Right now, people desperately seeking a better life are drowning in politics. We have to restart the rescue – and now.”

• EU To Launch Military Operations Against Migrant-Smugglers In Libya (Guardian)

The European Union is to launch military operations against the networks of smugglers in Libya deemed culpable of sending thousands of people to their deaths in the Mediterranean. An emergency meeting of EU interior and foreign ministers in Luxembourg on Monday, held in response to the reported deaths of several hundred migrants in a packed fishing trawler off the Libyan coast at the weekend, also decided to bolster maritime patrols in the Mediterranean and give their modest naval mission a broader search-and-rescue mandate for saving lives. A summit of EU leaders is to take place in Brussels on Thursday to hammer out the details of the measures hurriedly agreed on Monday.

The 28 EU governments called for much closer cooperation with Libya’s neighbours, such as Egypt, Tunisia, and Niger, in an attempt to close down the migratory routes. But senior political figures and EU officials conceded this would be difficult and also voiced scepticism about the emphasis on targeting the traffickers. Following the reported deaths of around 1,300 migrants in three incidents in less than a fortnight in the waters south of Sicily, the pressure was on the EU and its member states to come up with new policies addressing headlines branding the incidents “Europe’s shame”. “I hope today is the turning point in the European conscience, not to go back to promises without actions,” said Federica Mogherini, the former Italian foreign minister who is the EU’s chief foreign and security policy coordinator and who chaired Monday’s meeting.

The meeting “identified some actions” aimed at combatting the trafficking gangs mainly in Libya, such as “destroying ships”, Mogherini said. Dimitris Avramopoulos, the European commissioner for migration issues, said the operation would be “civil-military” modelled on previous military action in the Horn of Africa to combat Somali piracy. The military action would require a UN mandate. No detail was supplied on the scale and range of the proposed operation, nor of who would take part in it. But European leaders from David Cameron to Angela Merkel and Matteo Renzi, the Italian prime minister, were emphatic on Monday in singling out the fight against the migrant traffickers as the top priority in the attempt to rein in a crisis that is spiralling out of control.

[..] Save the Children accused the EU of dithering as children drowned, after they failed to agree immediate action to set up a European search and rescue operation in the Mediterranean. Save the Children CEO Justin Forsyth said: “What we needed from EU foreign ministers today was life-saving action, but they dithered. The emergency summit on Thursday is now a matter of life and death. “With each day we delay we lose more innocent lives and Europe slips further into an immoral abyss. Right now, people desperately seeking a better life are drowning in politics. We have to restart the rescue – and now.”

Read more …

“One way countries could get around the sanctions is to set up joint ventures with Russian companies.”

• Embargo Relief? Russia Tests Food From Greece, Hungary and India (RT)

Russia began quality control fruits and vegetables from Hungary, Greece, and India in order to begin imports, said Aleksey Alekseenko the head of Russia’s food inspector Rosselkhoznadzor. Next week products from Cyprus will undergo similar tests. “Approximately two dozen companies in Greece will be tested, the same number in Hungary, and four or five in India. Due to technical reasons, Cyprus asked for a small ‘time out’, so testing will begin on April 27 where we will check six to eight companies,” Alekseenko told Russian media Monday, Rossiskaya Gazeta reported. EU countries Greece, Cyprus, and Hungary have all asked Russia to cancel or reduce the food import embargo they face.

However, during Greek Prime Minister Alexis Tsipras’ visit to Moscow two weeks ago, Russian President Putin dismissed the possibility. One way countries could get around the sanctions is to set up joint ventures with Russian companies. Inspection should be finished by April 30, and the preliminary results will be published immediately, with the final results a few days later, according to Alekseenko. Russia’s agricultural food import ban on EU countries doesn’t expire until August, a year after the restrictions were imposed in response to Western sanctions. The ban also applies to the US, Australia, Canada, Japan, and Norway and includes meat, fish, chicken, cheese, milk, fruit, and vegetables.

Researchers at the Gaidar Institute, the Russian Presidential Academy, and Russian Academy of Foreign Trade and Economic Development calculated that Russia has reduced its agriculture imports by 40%, and exports have decreased by 25-30%. The measure was taken as a counter to sanctions imposed by Western countries on Russia, but is also believed to boost domestic agriculture. By banning imports, Russian farmers would have to boost production and in theory start producing better products.

Read more …

Well written.

• How ‘The Guardian’ Milked Edward Snowden’s Story (Julian Assange)

The Snowden Files: The Inside Story of the World’s Most Wanted Man by Luke Harding is a hack job in the purest sense of the term. Pieced together from secondary sources and written with minimal additional research to be the first to market, the book’s thrifty origins are hard to miss. The Guardian is a curiously inward-looking beast. If any other institution tried to market its own experience of its own work nearly as persistently as The Guardian, it would surely be called out for institutional narcissism. But because The Guardian is an embarrassingly central institution within the moribund “left-of-center” wing of the U.K. establishment, everyone holds their tongue.

In recent years, we have seen The Guardian consult itself into cinematic history—in the Jason Bourne films and others—as a hip, ultra-modern, intensely British newspaper with a progressive edge, a charmingly befuddled giant of investigative journalism with a cast-iron spine. The Snowden Files positions The Guardian as central to the Edward Snowden affair, elbowing out more significant players like Glenn Greenwald and Laura Poitras for Guardian stablemates, often with remarkably bad grace. “Disputatious gay” Glenn Greenwald’s distress at the U.K.’s detention of his husband, David Miranda, is described as “emotional” and “over-the-top.” My WikiLeaks colleague Sarah Harrison—who helped rescue Snowden from Hong Kong—is dismissed as a “would-be journalist.”

I am referred to as the “self-styled editor of WikiLeaks.” In other words, the editor of WikiLeaks. This is about as subtle as Harding’s withering asides get. You could use this kind of thing on anyone. The book is full of flatulent tributes to The Guardian and its would-be journalists. “[Guardian journalist Ewen] MacAskill had climbed the Matterhorn, Mont Blanc and the Jungfrau. His calmness now stood him in good stead.” Self-styled Guardian editor Alan Rusbridger is introduced and reintroduced in nearly every chapter, each time quoting the same hagiographic New Yorker profile as testimony to his “steely” composure and “radiant calm.” That this is Hollywood bait could not be more blatant.

Read more …

Quelle coincidence!

• Political Murders in Kiev, US Troops to Ukraine (Ron Paul)

Last week two prominent Ukrainian opposition figures were gunned down in broad daylight. They join as many as ten others who have been killed or committed suicide under suspicious circumstances just this year. These individuals have one important thing in common: they were either part of or friendly with the Yanukovych government, which a US-backed coup overthrew last year. They include members of the Ukrainian parliament and former chief editors of major opposition newspapers. While some journalists here in the US have started to notice the strange series of opposition killings in Ukraine, the US government has yet to say a word. Compare this to the US reaction when a single opposition figure was killed in Russia earlier this year.

Boris Nemtsov was a member of a minor political party that was not even represented in the Russian parliament. Nevertheless the US government immediately demanded that Russia conduct a thorough investigation of his murder, suggesting the killers had a political motive. As news of the Russian killing broke, Chairman of the House Foreign Affairs Committee Ed Royce (R-CA) did not wait for evidence to blame the killing on Russian president Vladimir Putin. On the very day of Nemtsov’s murder, Royce told the US media that, “this shocking murder is the latest assault on those who dare to oppose the Putin regime.” Neither Royce, nor Secretary of State John Kerry, nor President Obama, nor any US government figure has said a word about the series of apparently political murders in Ukraine.

On the contrary, instead of questioning the state of democracy in what looks like a lawless Ukraine, the Administration is sending in the US military to help train Ukrainian troops!] Last week, just as the two political murders were taking place, the US 173rd Airborne Brigade landed in Ukraine to begin training Ukrainian national guard forces – and to leave behind some useful military equipment. Though the civil unrest continues in Ukraine, the US military is assisting one side in the conflict – even as the US slaps sanctions on Russia over accusations it is helping out the other side! As the ceasefire continues to hold, though shakily, what kind of message does it send to the US-backed government in Kiev to have US troops arrive with training and equipment and an authorization to gift Kiev with some $350 million in weapons? Might they not take this as a green light to begin new hostilities against the breakaway regions in the east?

Read more …

As Gazprom CEO Miller is visiting Athens today…

• EU To Charge Russia’s Gazprom With Market Abuse (Reuters)

The EU will launch a legal attack on Russian gas giant Gazprom this week, ramping up tensions with Moscow, when antitrust agents will accuse it of overcharging buyers in eastern Europe, EU sources told Reuters on Monday. The state-controlled company, a vital supplier of energy to Europe despite frequent political disputes, could receive a full charge sheet from European Competition Commissioner Margrethe Vestager on Wednesday, one source said. More than two years after Brussels started investigating Gazprom, the move comes just a week after the new EU antitrust chief charged U.S. tech giant Google with abusing its market power after five years of hesitation by her predecessor. Vestager has appeared determined to challenge big corporate powers since taking on the powerful post in November, regardless of past offers of compromise from both Google and Gazprom.

Despite the Danish commissioner’s insistence that she would look at only the legal merits of a case that focuses on Gazprom pricing policies differentiating between customers, the accusations will do nothing to ease EU frictions with Moscow over Ukraine in which gas supplies have played a major role. The sources said Vestager was likely to send the charge sheet, known as a statement of objections, to Gazprom once she returns from a trip to the United States, where she arrived within hours of charging Google. Such a document sets out concerns about possible anti-competitive practices. A source close to the Russian company said Gazprom had always wanted to find an amicable solution, so a statement of objections now “would not be a welcome move”.

Gazprom tried to settle the case last year by offering concessions to Vestager’s predecessor but talks floundered over its refusal to cut prices for eastern European customers. The EU antitrust chief is taking a tougher line than her predecessor despite the political ramifications of some cases, said Mario Mariniello, a former economist at the Commission and now an expert at Brussels think tank Bruegel. “Vestager is sending a message that her mandate is not about settling cases. If she has a solid case, she will push ahead with charges,” he said. “Sending a statement of objections to Gazprom now would be her way of saying that she will focus on the substance of the case regardless of the political implications.”

Read more …

It took a few years, but that never made it any less real.

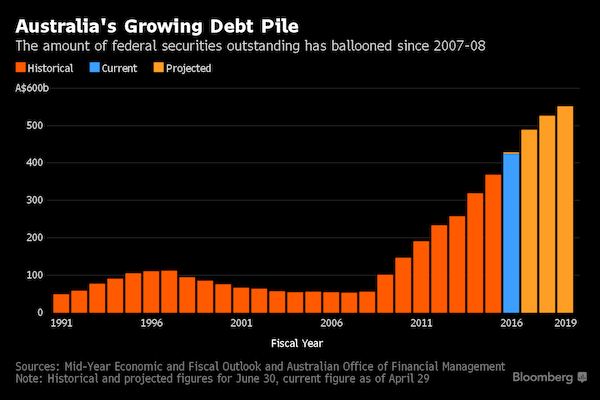

• Canadian Home Prices Inflated By More Than 25%, Economist Magazine Warns (G&M)

A fresh look at global house prices underscores the Bank of Canada’s angst over the Vancouver and Toronto markets. The magazine, which tracks prices in 26 markets, warned in its most recent report that homes are more than 25% overvalued in seven of those regions, “notably in Australia, Britain and Canada,” rising on every measure. Canada, of course, is not one market, but rather several regional ones that can differ markedly. Just last week, the Bank of Canada, which has pegged overvaluation at between 10% and 30%, again predicted a “soft landing” for the national market. But, as The Globe and Mail’s Tamsin McMahon reports, it warned that the oil hit to Alberta and the “continued robust price growth” in Toronto and Vancouver threaten “a correction in these markets.”

The Economist uses two ”yardsticks,” one of which is the ratio of home prices to rent, which is not deemed the best measure among some observers. But it also looks at the ratio of prices to after-tax income, a measure of affordability. Which in some ways backs up the Bank of Canada’s warning that “elevated house prices and debt levels relative to income continue to leave households vulnerable.” Bank of Montreal economist Robert Kavcic also tracks the Canadian markets, and his latest report, released last week, raised a red flag for Vancouver, in particular. The senior economist looked at average prices, resales, sales versus their 10-year average, and what he called the “historical market balance,” or conditions measured against the 20-year average.

Read more …

Canada, Australia, New Zealand, plenty housing corrections coming up.

• Sydney’s Housing Roulette Wheel: Are You Feeling Lucky? (SMH)

How you perceive the state of the Sydney rental market depends on who you are. Sydney tenants might think rents are steady or rising, but they’re falling for Sydney landlords. And that feeds into a bigger question about how close the Sydney housing price boom is to topping out and a yet-bigger question about how much longer housing construction can carry the Australian economy without a correction. Sydney auctions set a clearance rate record over the weekend with the market increasingly looking like a feeding frenzy – would-be owner-occupiers with FOMO (fear of missing out) and investors knowing no fear at all. Basically, after such a strong run, would-be players of housing investment roulette have to very carefully ask themselves if they’re feeling lucky.

Net rental yields are often miserable and, no, prices don’t keep galloping ahead at the present rate indefinitely. The latest Domain rental survey found rent for the average house in the nation’s real estate hot spot rose from $500 to $520 last year. So that provides a headline about rents rising despite increased supply. To keep the maths simple, let’s say a property renting for $500 a week a year ago was worth $800,000. That means a gross rental yield of 3.25%. The average increase in prices means a new landlord buying the property today would pay $907,200 (before the outrageous stamp duty) and collect $520 a week rent – a gross yield of 2.98%. Include 5% for stamp duty and a little conveyancing, the purchase price is more like $953,000 and the yield falls to 2.83%.

There are a number of estimates of rental yields around, none of them especially authoritative. In a comprehensive assessment of the state of the housing boom, AMP chief economist Shane Oliver put the gross rental yield of housing at about 2.9%, which, after costs, comes down to a net yield of around one%. Pre-tax, post-tax, negatively geared or whatever, that’s lousy. You can get more from a bank deposit. (My suspicion is that most punters aren’t very good at considering all the costs before joining the landlord class. As a rule of thumb, maintenance, agent’s fees, body corporate fees and sundries will always be greater than expected, while gaps between tenancies will be longer and rent and rent increases will be lower.)

Read more …

“Finance companies get paid to borrow money for a month in euros and yen in international markets and can use that cash to buy 10-year Aussie sovereign debt yielding 2.35%.”

• Australia Central Bank Fights Resurgent Carry Trade In Aussie Dollar (SMH)

Add a resurgent carry trade to the list of things keeping Reserve Bank Governor Glenn Stevens from getting a weaker Aussie dollar. A widening yield advantage on the nation’s debt amid a drop in currency volatility is luring investors back to the strategy. Borrowing equally in yen and euros to buy Aussie earned 1.6% this month, after the same trade lost money in the first quarter. Expectations for swings in the Aussie are approaching the lowest levels this year as there is some speculation of the timing of any US or Australian rate changes. “In a world of zero and negative yields, Aussie stands out as king – or if not king, certainly a member of the royal family,” said Robert Rennie, Westpac’s global head of currency and commodity strategy.

“Carry is here to stay for the foreseeable future.” Finance companies get paid to borrow money for a month in euros and yen in international markets and can use that cash to buy 10-year Aussie sovereign debt yielding 2.35%. The RBA has raised concerns that central bank bond-buying will prop up the Aussie at a time when the local exporters need depreciation to cope with slumping prices of iron ore, the country’s biggest export earner. The local dollar headed for its strongest two- week gain in a year as Germany’s average yields dropped below zero for the first time. Japanese investors bought a net 345 billion yen ($3.7 billion) of Australian sovereign debt in February, the most since August 2011, Japan’s Finance Ministry said.

Excluding debt held by the RBA, central banks owned 29% of Australia’s public debt as of December 31, according to the International Monetary Fund. Overall, foreign investors owned 67% of the total, a level Barclays calls “very high.” “Japanese and European investors still stand out,” said Kieran Davies, Barclays’s Sydney-based senior economist. “Relative to other currencies, our interest rates are quite attractive.” The premium offered by Aussie debt over its triple A-rated peers rose to 1.59 percentage points last week, the most in five weeks, and was headed for its biggest monthly increase since November 2013.

Read more …

“6% of the population – or 1.5 million people – were classed as living in entrenched poverty..”

• One Million Australians ‘Entrenched In Disadvantage’ (Guardian)

More than a million Australians are “entrenched in disadvantage”, with many of them having little hope of getting out of poverty, research released before the federal government’s budget has found. Despite two decades of economic expansion in the country, up to 6% of the population – or 1.5 million people – were classed as living in entrenched poverty, the Committee for Economic Development of Australia report said. Before the launch of the report on Tuesday, the Ceda chief executive, Prof Stephen Martin, said it was time to “tear up the rulebook” on the way the government approached poverty. Any policy aimed at curbing disadvantage had to also tackle issues such as education and social exclusion, he said, identifying them as key areas for government intervention.

“Labour market programs – essentially using a big stick to tell people they’ve got to get a job or face even further financial disadvantage – should not be the primary policy instrument for this group of people,” Martin wrote in a piece accompanying the report. “It is absolutely clear that labour market policies have not worked because they fail to tackle the heart of the problem and yet it seems they are the only approach successive governments are willing to focus on. “The main problem often isn’t that people don’t have a job, but the consequence of a range of other issues including education levels, mental health, social exclusion or discrimination. “It may well be that welfare spending may have to increase but the payoff longer term is potentially significant.” Martin said it was a waste of taxpayers’ money and short-sighted to continue to spend welfare money without having effective policies in place to help people move out of poverty.

Read more …

The future of the world.

• Permaculture In Malawi: Food Forests To Prevent Floods And Hunger (Guardian)

As January’s floods showed, Malawi’s climate is challenging. We have seven to eight months without rain, followed by torrential downpours pounding our parched landscapes. Climate change may make things worse, but the pursuit of charcoal and firewood, and the wholesale destruction of indigenous forests in favour of maize, has left the country vulnerable. Forests regulate water flow and protect topsoil. Restore the forests and you will go a long way to preventing flooding. Design the forests along holistic permaculture principles and you will achieve much more: water harvesting, fuel wood, high-quality timber, indigenous forest restoration and highly diverse food production.

In a country where almost half the children under five are malnourished and chronic hunger is common, any holistic solution must consider food sovereignty. One solution is forest gardening, an approach to food production based on the fact that forests are resilient and highly productive systems that have existed for thousands of years. Natural forests do not need pesticides or chemicals to ensure their yields, but rather exist in a constant flow of production and recycling. Permaculture has adopted this concept to create “food forests”, systems designed along the same principles as natural forests but with more of a focus on multipurpose plants and animals of direct benefit to humans.

A natural forest consists of roughly seven layers: the rhizosphere, ground covers, herbaceous layer, shrub layer, climbers, lower canopy and climax layer. While the species in a natural forest might not be of direct use to humans, in a food forest they are. Imagine a dense forest of mango trees, acacias, citrus trees, coconut palms, guavas, moringas, towering tamarinds and mahoganies. Climbing up many of these trees are passion fruit, air potato, loofa and shushu. Pigeon pea, cassava, the purple flowering tephrosia, hibiscus, amaranth and the big yellow flowers of cassia alata, occupy the shrub and herbaceous layers. Turmeric, arrow root and ginger grow in abundance. Aloe vera grows here and there and cow pea, sweet potato and watermelon crawl along the forest floor or edge.

The ground is strewn with a thick layer of decomposing leaves which serve to build rich, healthy soils and maintain the link with microorganisms. A mass of flowering species create excellent environments for bees and other beneficial insects. The system is self-replicating, has great commercial value and is highly beneficial to the health of all creatures that interact with it. Such forests can flourish in Malawi, and I believe it is our duty to provide these beautiful and plentiful systems for future generations. Indeed there are a number of successful examples of similar systems here already. Lukwe in Livingstonia is one of the best examples of well-established passive water harvesting systems in Malawi.

Read more …