Edward Hopper Western Motel 1957

Darkness and shame.

• Possible Hand-Over Of Julian Assange To The UK May Be Imminent (Vos)

What happens in a world without Julian Assange? It seems we may be in the unthinkable position of facing such a reality, after WikiLeaks Tweeted regarding the recent statement of Margarita Simonyan, RT’s Editor-in-chief. Her message read (In English): “My sources tell me that Julian Assange will be handed over to the UK in the next weeks or days. Like never before I wish that my sources are wrong’.’ An exceptionally brief article published by Russian Insider documented Simonyan’s foreboding Tweet, indicating that her statement seemed especially serious in light of the quality of her sources.

Russian media is hardly the first source of dire warnings regarding Assange’s safety in recent weeks. Just days ago, the World Socialist Website related: “The London Times reported July 15 on secret talks between the British and Ecuadorian governments. They are apparently intending to expel WikiLeaks editor Julian Assange from the Ecuadorian embassy in London, where he has enjoyed political asylum for six years. The article said the talks were “an attempt to remove Assange from the embassy,” and they were being run at the highest levels of government. The Secretary of State for Foreign Affairs, Sir Alan Duncan, is personally involved.” These reports also follow a chilling article penned by award-winning journalist Chris Hedges, who wrote:

“The failure on the part of establishment media to defend Julian Assange, who has been trapped in the Ecuadorean Embassy in London since 2012, has been denied communication with the outside world since March and appears to be facing imminent expulsion and arrest, is astonishing. The extradition of the publisher—the maniacal goal of the U.S. government—would set a legal precedent that would criminalize any journalistic oversight or investigation of the corporate state. It would turn leaks and whistleblowing into treason. It would shroud in total secrecy the actions of the ruling global elites.”

What should happen for Julian too.

• Spanish Court Drops International Warrant For Carles Puigdemont (G.)

A Spanish judge has dropped the international arrest warrants issued for the former Catalan president Carles Puigdemont and five other pro-sovereignty politicians over their roles in last year’s illegal referendum and subsequent unilateral declaration of independence. The supreme court judge Pablo Llarena announced the decision a week after a German court said it would extradite Puigdemont only over alleged misuse of public funds rather than the more serious charge of rebellion. The dropping of the international warrant means Puigdemont and his former colleagues – currently in Belgium, Scotland and Switzerland – no longer face extradition proceedings.

But domestic warrants remain in force, meaning the six will be arrested should they return to Spain. In his ruling, published on Thursday, Llarena hit out at the court in Schleswig-Holstein, accusing it of “a lack of commitment” over acts that could have “broken Spain’s constitutional order”. The German court’s refusal to extradite Puigdemont on the rebellion charge – which prosecutors had argued could be equated to “high treason” in the German penal code – meant the deposed president could not be tried for the offence if sent back to Spain.

More crazy reactions. Comparing Trump to Erdogan?!

• Trump Lays Into The Fed, Says ‘Not Thrilled’ About Interest Rate Hikes (CNBC)

In a stinging and historically rare criticism, President Donald Trump expressed frustration with the Federal Reserve and said the central bank could disrupt the economic recovery. Presidents rarely intercede when it comes to the Fed, which sets the benchmark interest rate that flows through to many types of consumer debt. Fed officials, including Chairman Jerome Powell, have raised interest rates twice this year and have pointed to two more before the end of 2018. Trump, in an interview with CNBC, said he does not approve, even though he said he “put a very good man in” at the Fed in Powell.

“I’m not thrilled,” he told CNBC’s Joe Kernen in an interview to air in full Friday at 6 a.m. ET on “Squawk Box.” “Because we go up and every time you go up they want to raise rates again. I don’t really — I am not happy about it. But at the same time I’m letting them do what they feel is best.” “But I don’t like all of this work that goes into doing what we’re doing.” Markets reacted to Trump’s comments, with stocks, the dollar and Treasury yields all falling.

Fed officials did not comment on the president’s remarks. The White House, in a statement after the interview excerpt aired on CNBC, emphasized that Trump did not mean to influence the Fed’s decision-making process. “Of course the President respects the independence of the Fed. As he said he considers the Federal Reserve Board Chair Jerome Powell a very good man and that he is not interfering with Fed policy decisions ” the statement said. “The President’s views on interest rates are well known and his comments today are a reiteration of those long held positions, and public comments.”

Keep talking.

• Trump Plans To Formally Invite Putin To US Later This Year (G.)

Donald Trump has asked his administration to formally invite Russian president Vladimir Putin to visit Washington later this year, the White House announced on Thursday. Sarah Sanders, the White House press secretary, said Trump asked his national security adviser John Bolton to extend the invitation to Putin for a “working level” dialogue between the two leaders. The invitation comes as the White House has faced a tumultuous week in the aftermath of Trump’s controversial summit with Putin in Helsinki. Trump was roundly criticized from Democrats and Republicans in Washington for siding with the Kremlin over the judgments of US intelligence on whether Russia interfered in the 2016 presidential election.

It took the president several attempts to walk back his comments, amplifying the fallout from his joint appearance with Putin. Trump was nonetheless unfazed by the backlash, deeming the summit a “great success” in a tweet earlier on Thursday while saying he looked forward to a second meeting with Putin. “The Summit with Russia was a great success, except with the real enemy of the people, the Fake News Media,” Trump wrote. “I look forward to our second meeting so that we can start implementing some of the many things discussed, including stopping terrorism, security for Israel, nuclear … proliferation, cyber attacks, trade, Ukraine, Middle East peace, North Korea and more. There are many answers, some easy and some hard, to these problems…but they can ALL be solved!”

“Russophobia is running amok in this country.”

• American Cold War Experts: “The Real Threat Is Russophobia” (ZH)

And now for expert analysis that runs refreshingly contrary to the week’s Trump-Putin mass hysteria over the Helsinki summit, we find ourselves surprised to feature an unusually honest Vice segment on HBO: These American scholars say the real threat to the U.S. is Russophobia. “If he [President Trump] means what he said he was right. It would be great to cooperate with Russia — I would go farther, it’s imperative… We are eyeball to eyeball in a new Cold War with Russia,” begins Stephen F. Cohen, considered among the world’s foremost Russian academic experts, while sitting beside John Mearsheimer in this latest Vice interview, who nods his head in approval.

Both have long been a thorn in the side of the McCarthyite commentariat which alleges Russian collusion behind every decision of the Trump administration. Mearsheimer, a longtime International Security Policy program director at the University of Chicago, questions the now largely cemented narrative created by those who have least understanding of the history of US-Russia relations: “Why won’t people engage in a legitimate debate with people like Steve and me? And I believe the reason they won’t is they would lose the debate – I’m fully confident of that.”

As the American public has from the time of Trump’s election endured endless obtrusive and cacophonous media noise with no real smoking gun (as Former Director of National Intelligence James Clapper famously admitted a year ago) to back the charges of collusion — what CNN’s Van Jones early on admitted was “just a big nothing burger” — the voices of a small cadre of real Russian experts rarely breaks through to a mass audience. “There is an unwillingness to engage in debate on this issue, like I have never seen before,” Mearsheimer tells Vice. And Cohen adds: “We’ve demonized Putin and we’ve Putinized Russia so we demonize Russia. Russophobia is running amok in this country. I’ve seen these things from the inside. I’ve re-thought and re-thought how we got to the edge of war with Russia, where we haven’t been since Cuba in 1962. And I have concluded, and I would be happy to debate my opponents… It is 95 percent our own doing.”

Getting bored of this yet?

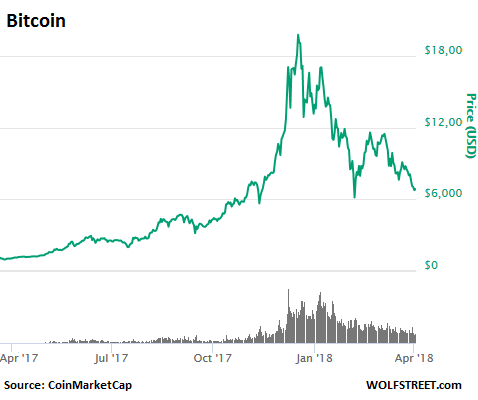

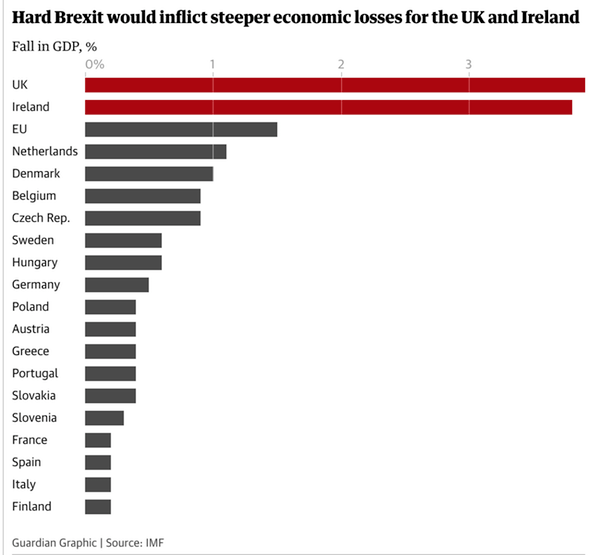

• No-Deal Brexit Would Harm EU Countries As Well As UK, Warns IMF (G.)

Britain crashing out of the EU without a deal would inflict significant economic pain across Europe, leaving the region without any winners, the International Monetary Fund has warned. As the new Brexit secretary, Dominic Raab warned Europe to prepare for a no-deal exit, the IMF said such an outcome would hurt the UK most but would also have damaging economic consequences for Ireland and other EU nations. In its annual health check for the euro area, the Washington-based fund said economic growth across the 27 remaining EU states would fall by as much as 1.5% by 2030, if Britain falls back on WTO rules for its trading relationship with the EU after leaving next year.

While economic output for the UK would drop by more than twice that amount – wiping out almost 4% of GDP – Ireland would suffer by almost as much as a result of its strong ties to Britain and shared border. The Netherlands, Denmark and Belgium, with similar close proximity and trading links, would also lose around 1% of GDP. Smaller nations with deep financial links to the City of London, such as Malta, Cyprus and Luxembourg, would also be negatively affected by a hard Brexit, the fund warned. The IMF said the long-run impact from a hard Brexit would be spread across the EU as a result of the economic and financial ties spanning the region, which have grown closer by about 40% over the past quarter century. The UK ranks among the EU’s three largest trading partners, accounting for 13% of trade in goods and services. There are also complex supply chain links between companies across the bloc.

So no Brexit then?

• Theresa May: I Will Never Accept EU’s Ideas On Irish Brexit Border (G.)

Theresa May is to tell the European Union it is time to drop what she feels is their inflexible view on an Irish border solution and “evolve” their position to break the impasse in Brexit talks. In a speech in Belfast on Friday she is expected to brand the bloc’s calls for regulatory alignment north and south of the border as a “backstop” solution in the event of no deal as “unworkable”, and repeat her assertion that a border down the Irish Sea is unacceptable to any British prime minister. “The economic and constitutional dislocation of a formal ‘third country’ customs border within our own country is something I will never accept, and I believe no British prime minister could ever accept,” she will say.

May will tell an audience of business leaders and politicians that the EU proposal is in breach of the Belfast Agreement because it would create a barrier between Northern Ireland and Great Britain and leave the people of Northern Ireland “without their own voice” in trade negotiations. “It is not something the House of Commons will accept,” she is due to say. The EU’s other 27 states will have a chance to examine and respond to the white paper when its General Council of ministers meets in Brussels on Friday morning. They will also receive an update on negotiations from the European Commission’s chief negotiator, Michel Barnier.

They’ll force people to pay for the software now.

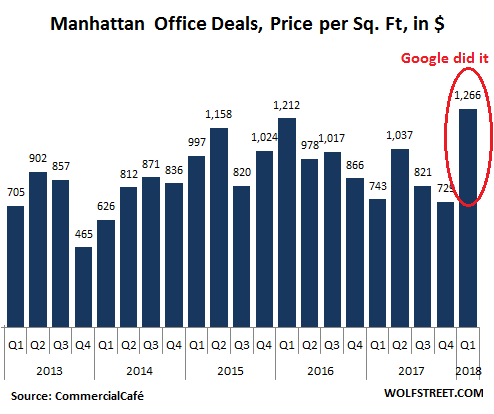

• Android Antitrust Fine Will Demolish Google Profit (MW)

When Alphabet Inc. reports earnings Monday, the European Union’s $5.07 billion Android antitrust fine will ruin the company’s profit. Alphabet stock was relatively flat Wednesday, when the fine formally was announced, and Google has said it plans to appeal the fine. However, the company disclosed in an SEC filing that it will account for the fine in its second-quarter report, due Monday after the bell. In terms of what it will cost the company in cash, the fine is not tax-deductible and worth roughly 75% of the company’s expected second-quarter net income of $6.72 billion, which will drastically lower per-share earnings as well.

Since analyst estimates largely do not include the fine as of yet, Alphabet’s earnings are likely to miss published expectations on the bottom line by a significant amount. The question that remains beyond the fine itself is how Google, in the long-term, will respond to the ruling, which prevents the search giant from effectively forcing mobile phone makers and telecom companies to pre-install its search engine and Chrome web browser, among other Google mobile apps, in exchange for use of the Android OS. The ruling is set to go into effect in 90 days, though an appeal would delay implementation.

How to spell sovereignty. When were countries growing fastest? When they had strong unions.

• IMF Raps Greece Over Its Bid To Reintroduce Labor Negotiations (K.)

The International Monetary Fund on Thursday issued a clear warning to the Greek government against its plans to reintroduce collective labor negotiations, saying that such a move would put the competitiveness of the Greek economy at risk. The IMF’s observation, included in its Article IV report that is not only about the Greek economy but concerns eurozone financial policies in general, comes almost a month before the party the government intends to stage for the end of the bailout program. The IMF intervention is particularly important for two additional reasons: first because it concerns a key dimension of the post-bailout government narrative, and second because the IMF is not an independent observer, as its technical experts will be conducting a considerable number of visits to Greece in the context of the post-program surveillance, and will prepare two assessment reports on the Greek economy every year.

There is also a third and possibly more important factor that adds to the significance of the IMF recommendation: It may be just a taste of the attitude the Fund will adopt toward Greece should the government implement its plans to increase the minimum salary. This may actually be an intervention with a preventative character. The government has already legislated the return from August – after the program ends – of two main principles in collective labor negotiations: the provision for the extension of collective contracts and the principle of the more favorable regulation.