Paul Klee Dancing Under the Empire of Fear 1938

UPDATE: There is a problem with our Paypal widget/account that makes donating hard for some people, but that Paypal apparently can’t be bothered to fix. At least not over the past 2 weeks. What happens is that for some a message pops up that says “This recipient does not accept payments denominated in USD”. This is nonsense, we do.

We have no idea how many people have simply given up on donating, but we can suggest a workaround (works like a charm):

Through Paypal.com, you can simply donate to an email address. In our case that is recedinghorizons *at* gmail *com*. Use that, and your donations will arrive where they belong. Sorry for the inconvenience.

The Automatic Earth and its readers have been supporting refugees and homeless in Greece since June 2015. It has been and at times difficult and at all times expensive endeavor. Not at least because the problems do not just not get solved, they actually get worse. Because the people of Greece and the refugees that land on their shores increasingly find themselves pawns in political games.

Therefore, even if the generosity of our readership has been nothing short of miraculous, we must continue to humbly ask you for more support. Because our work is not done. Our latest essay on this is here: The Automatic Earth for Athens Fund – Christmas and 2018 . It contains links to all 14 previous articles on the situation.

Here’s how you can help:

For donations to Konstantinos and O Allos Anthropos, the Automatic Earth has a Paypal widget on our front page, top left hand corner. On our Sales and Donations page, there is an address to send money orders and checks if you don’t like Paypal. Our Bitcoin address is 1HYLLUR2JFs24X1zTS4XbNJidGo2XNHiTT. For other forms of payment, drop us a line at Contact • at • TheAutomaticEarth • com.

To tell donations for Kostantinos apart from those for the Automatic Earth (which badly needs them too!), any amounts that come in ending in either $0.99 or $0.37, will go to O Allos Anthropos.

Please give generously.

Let’s not forget that 2017 was exceptional in many ways. Record debt and record tranquillity. What are the odds that 2018 will continue along that path?

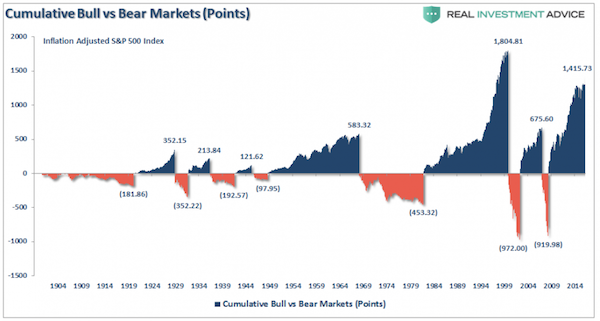

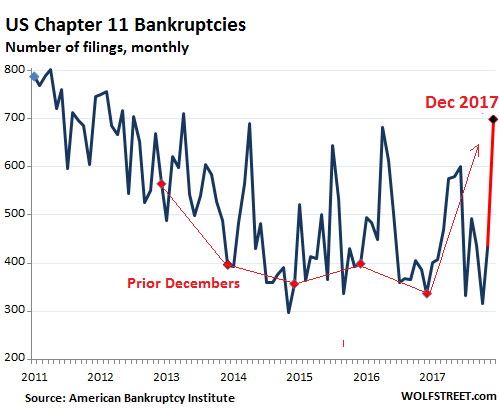

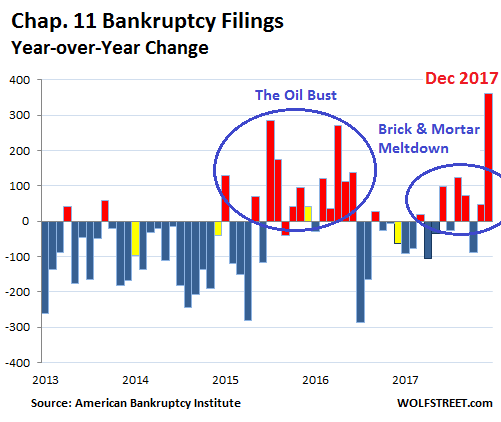

• 2017 Sets A Record (Roberts)

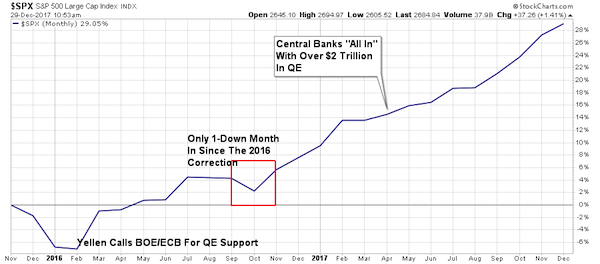

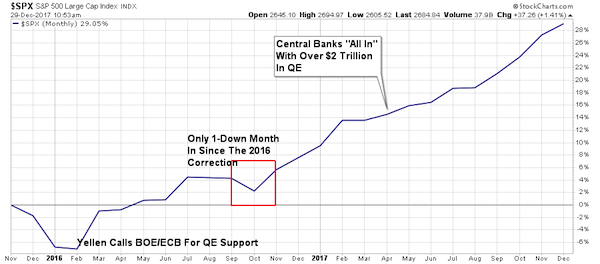

In just the past year, the markets set a record by going 12-straight months without a loss. That liquidity driven surge was accompanied by extremely low volatility as noted last week by Dana Lyons: “Specifically, the average daily closing price of the VIX in 2017 was 11.10 (through 12/26/17). That is the lowest of any year — by more than one and a half points — since the VIX inception in 1986 (by comparison, the ‘average yearly average’ is over 20).”

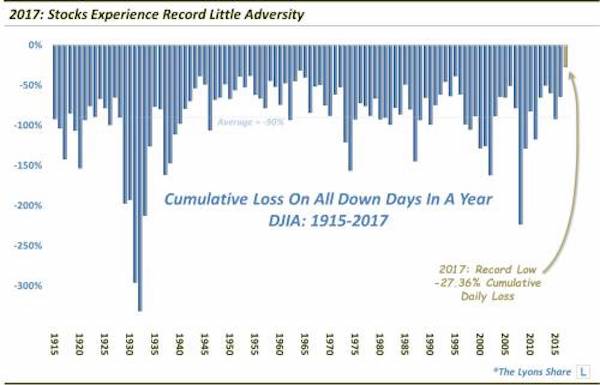

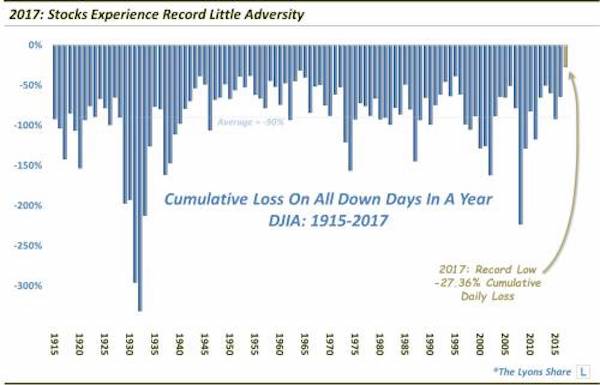

Of course, with very little volatility, there were very few draw downs along the way as markets continued their advance higher. “Accordingly, we took a look at the amount of losses incurred by the stock market during the year as a measure of adversity faced along the way to its solid full-year gains. Specifically, we tabulated the amount of losses incurred during every down day in the market. We used the Dow Jones Industrial Average (DJIA) as it has a longer history than the S&P 500. And based on these calculations, the stock market enjoyed less adversity in 2017 than any other year in history going back over 100 years (our daily DJIA data begins in 1915).”

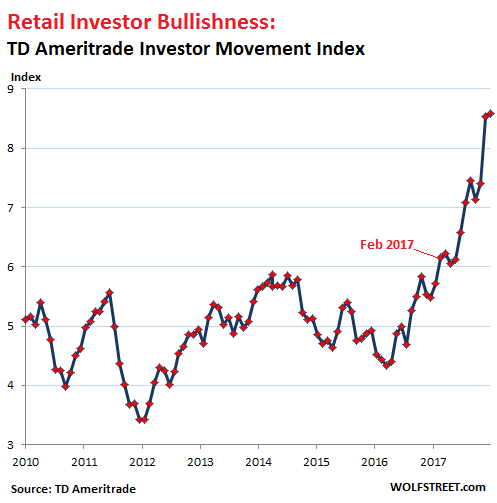

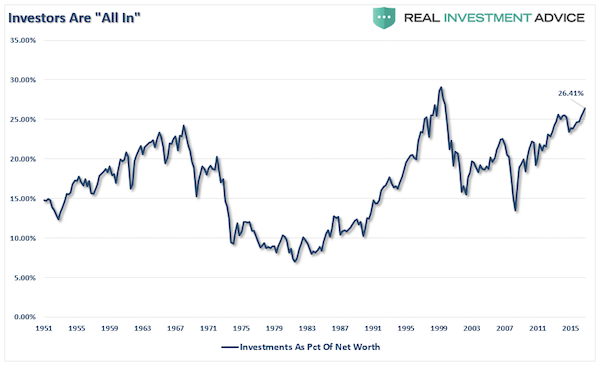

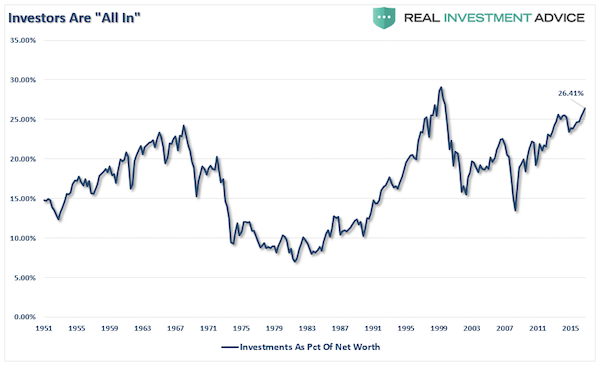

All that exuberance has got Wall Street already prognosticating that next year could be as good, or better, than 2017. “‘I would expect 2018 to be an almost repeat of 2017,’ said Saut, chief investment strategist at Raymond James. ‘People are still way underinvested. Earnings are starting to come in better than expected. And with the tax reform, and especially the corporate tax cuts, I think earnings are going to continue to surprise on the upside. The professional investors are all in for the most part but the individual investor is not all in.’” Maybe. But there is more than sufficient evidence that not only professional investors, but individuals, are “all in.”

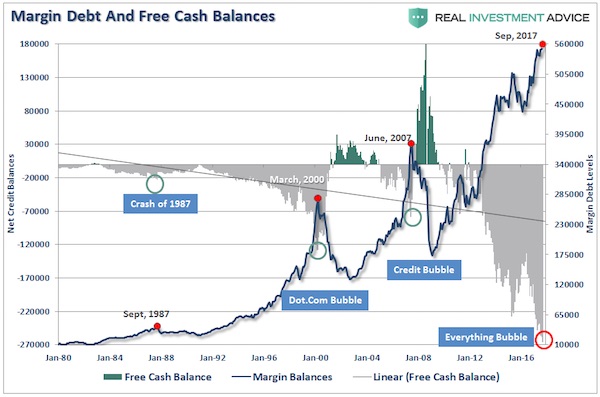

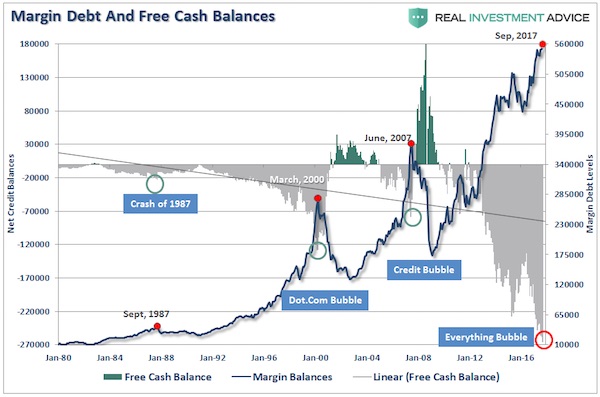

And, not only are they “all in,” they are all in with leverage as I noted previously: “While investors have been chasing returns in the “can’t lose” market, they have also been piling on leverage in order to increase their return.”

Read more …

In a 2-part article, Stockman doesn’t see 2018 as being quiet.

• The Greatest Bubble Ever: Why You Better Believe It, Part 2 (Stockman)

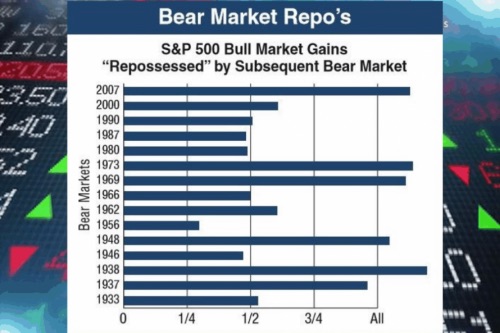

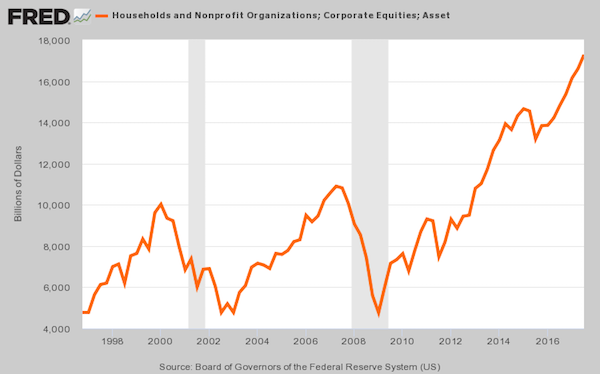

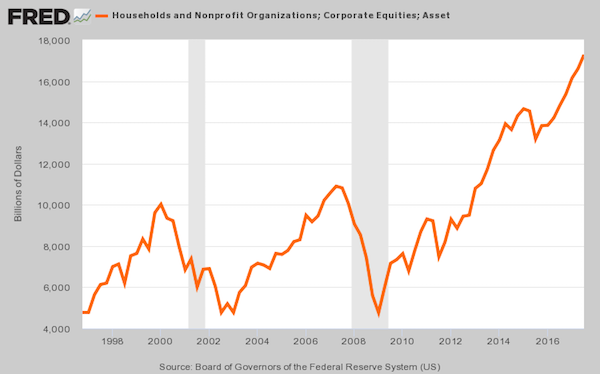

During the 40 months after Alan Greenspan’s infamous “irrational exuberance” speech in December 1996, the NASDAQ 100 index rose from 830 to 4585 or by 450%. But the perma-bulls said not to worry: This time is different – it’s a new age of technology miracles that will change the laws of finance. It wasn’t. The market cracked in April 2000 and did not stop plunging until the NASDAQ 100 index hit 815 in early October 2002. During those a heart-stopping 30 months of free-fall, all the gains of the tech boom were wiped out in an 84% collapse of the index. Overall, the market value of household equities sank from $10.0 trillion to $4.8 trillion – a wipeout from which millions of baby boom households have never recovered. Likewise, the second Greenspan housing and credit boom generated a similar round trip of bubble inflation and collapse.

During the 57 months after the October 2002 bottom, the Russell 2000 (RUT) climbed the proverbial wall-of-worry – rising from 340 to 850 or by 2.5X. And this time was also held to be different because, purportedly, the art of central banking had been perfected in what Bernanke was pleased to call the “Great Moderation”. Taking the cue, Wall Street dubbed it the Goldilocks Economy – meaning a macroeconomic environment so stable, productive and balanced that it would never again be vulnerable to a recessionary contraction and the resulting plunge in corporate profits and stock prices. Wrong again! During the 20 months from the July 2007 peak to the March 2009 bottom, the RUT gave it all back. And we mean every bit of it – as the index bottomed 60% lower at 340.

This time the value of household equities plunged by $6 trillion, and still millions more baby-boomers were carried out of the casino on their shields never to return. Now has come the greatest central bank fueled bubble ever. During nine years of radical monetary experimentation under ZIRP and QE, the value of equities owned by US households exploded still higher – this time by $12.5 trillion. Yet this eruption, like the prior two, was not a reflection of main street growth and prosperity, but Wall Street speculation fostered by massive central bank liquidity and price-keeping operations. Nevertheless, this time is, actually, very different. This time the central banks are out of dry powder and belatedly recognize that they have stranded themselves on or near the zero bound where they are saddled with massively bloated balance sheets.

Read more …

Are card withdrawals an actual issue, or is this a show?

• China To Cap Overseas Withdrawals Using Domestic Bank Cards (R.)

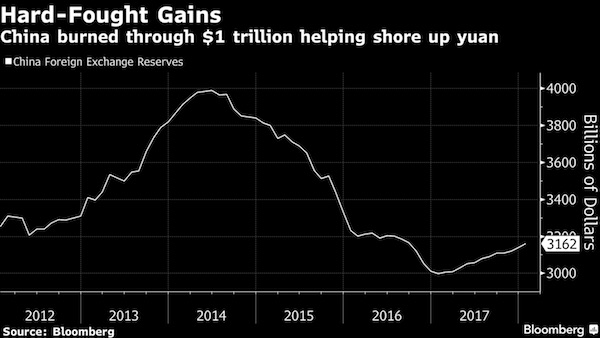

China’s foreign exchange regulator will cap overseas withdrawals using domestic Chinese bank cards at 100,000 yuan ($15,370) per year in an effort to target money laundering, terrorist financing and tax evasion, it said on Saturday. Individuals who exceed the annual quota will be suspended from overseas transactions for the remainder of the year and an additional year, the State Administration of Foreign Exchange (SAFE) said in a notice posted on its website. Under the new rules SAFE will submit a daily list of individuals banned from making overseas bank card withdrawals, and banks must suspend the users by no later than 5 p.m. the same day, the notice said.

Domestic card users will also be barred from withdrawing more than 10,000 yuan a day overseas, it said. The new rules come into effect on Jan. 1, and reporting adjustments must be adopted by banks by April 1, 2018, it said. China has strengthened regulatory oversight of overseas card transactions in the past year, targeting illegal cross-border transfers and money laundering. In September SAFE brought in regulations requiring Chinese banks to report daily their bank card holders’ overseas withdrawals as well as every transaction exceeding 1,000 yuan. China’s foreign exchange reserves rose for the 10th straight month in November due to tighter regulation and a stronger yuan, which continue to discourage capital outflows.

Read more …

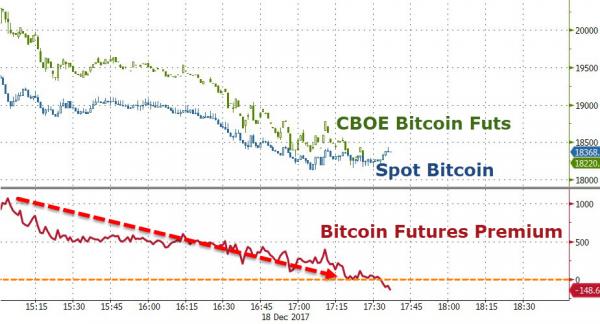

Banks targeting crypto. They’ve talked to each other beforehand, and presumably also with the government.

• Bitcoin Tensions Rise As Australia Investors Claim Banks Freeze Accounts (SMH)

Bitcoin investors are claiming Australia’s banks are freezing their accounts and transfers to cryptocurrency exchanges, with a viral tweet slamming the big four and an exchange platform putting a restriction on Australian deposits. Cryptocurrency trader and Youtuber Alex Saunders called out National Australia Bank, ANZ, the Commonwealth Bank of Australia and Westpac Banking Corporation on Twitter for freezing customer accounts and transfers to four different bitcoin exchanges – CoinJar, CoinSpot, CoinBase and BTC Markets. Bitcoin, a currency once known for its use by criminals trading online through a ‘Silk Road’ for drugs and weapons, has become a popular investment option.

After hundreds of shares and responses to the social media posts calling the banks’ alleged behaviour “disgusting” and “appalling” with some threatening to move their accounts, some users said their activities with the cryptocurrency had still been described as a “security risk” by their financial institutions. Banks were remaining tight-lipped on whether bitcoin activity was causing specific accounts to be closed or frozen, though its understood none had company-wide policies banning cryptocurrency investment activity. Yet the terms and conditions in some cases do reference Bitcoin. Commonwealth Bank’s June 2017 terms and conditions for CommBiz accounts specifically excludes this activity, saying it can refuse to process an international money transfer or an international cash management transaction “because the destination account previously has been connected to a fraud or an attempted fraudulent transaction or is an account used to facilitate payments to Bitcoins or similar virtual currency payment services”.

A Commonwealth Bank spokesman said it was receptive to innovation in alternative currencies and payment systems “however, we do not currently use or recommend any existing virtual currencies as we do not believe they have yet met a minimum standard of regulation, reliability, and reputation compared to other currencies that we offer to our customers”. “Our customers can interact with these currencies as long as they comply with our terms and conditions and all relevant legal obligations,” he said.

Read more …

This doesn’t ooze a healthy feeling.

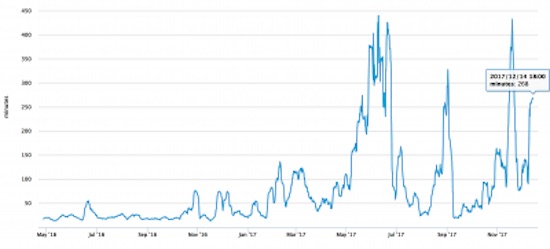

• South Korea’s “Bitcoin Zombies” (ZH)

[..] what happens in South Korean crypto trading, does not stay in South Korea: the country is the world’s third-largest market in bitcoin trading after Japan and the US, with roughly 2 million digital-currency investors by one estimate – one in every 25 citizens. The country is also home to one of the world’s biggest cryptocurrency trading exchanges, Bithumb. The country’s crypto-trading craze is so pervasive that the country has developed the term “bitcoin zombie” referring to people who check the cryptocurrency’s price around the clock. Even the country’s prime minister Lee Nak-yeon expressed concerns over Korea’s bitcoin craze, warning that “young people and students are rushing into virtual currency trading to earn huge profits in just a short period of time,” and that “it is time for the government to take action as it could lead to serious pathological phenomena if left unchecked” forcing young people into illegal activities like drug dealing.

For now, the “bitcoin zombies” are winning. As an example, as Reuters details in its just released deep dive in South Korea’s crypto-community, on a recent weeknight at Sungkyunkwan University in Seoul, more than a dozen students crammed into a classroom not to study, but to share tips on investing in so-called cryptocurrencies, which have driven tales of fantastic returns for savvy investors. “The group sat in rapt silence – broken only by a sudden shout of “there was just a big jump!” from someone monitoring his virtual currencies – as one student gave a presentation on how to read financial data and predict future trends.” Make no mistake: it’s a countrywide craze: “I no longer want to become a math teacher,” said 23-year-old Eoh Kyong-hoon, who founded the club, Cryptofactor.

“I’ve studied this industry for more than 10 hours a day over months, and I became pretty sure that this is my future.” [..] Eoh said the talk of more regulation had not dented his plans, especially after making what he said was a 20-fold gain on his investments over the past six months. He added that many students were bringing laptops to class to track the movements of their investments and participate in actual trading. “Even when professors are giving lectures right in front of them,” he said. Meanwhile, with Bitcoin soaring to record levels, younger investors have gravitated toward “altcoins” which often trade at much lower values, analysts say. Today’s surge in Ripple is just one such example. Another is Iota, which traded at $0.82 in late November and now stands at $3.89, a gain of 375%. Energo gained 400% during the same period.

Read more …

Her own people don’t even want a full term from her anymore. Hard to accept you lost power, Angela? You have though.

• Merkel Reclaims Role of EU Anchor in Outline of Her 2018 Agenda (BBG)

German Chancellor Angela Merkel said she’ll team up with France to hold the European Union together and pledged to her form next government “without delay.” In a New Year’s Eve speech to the nation, Merkel outlined a vision for her fourth term that includes an alliance with French President Emmanuel Macron to strengthen Europe’s economic clout and control migration, while upholding values of tolerance and pluralism within the EU and abroad. “Twenty-seven countries in Europe must be impelled more strongly than ever to remain a community,” Merkel said in a copy of the speech provided by her office in advance of the televised address on Sunday.

“That will be the decisive question of the next few years. Germany and France want to work together to make it succeed.” Merkel’s effort to combine the strengths of the euro area’s two biggest economies has been hamstrung by Germany’s longest post-election party deadlock since World War II, which has left her a caretaker chancellor since September. Exploratory talks on renewing her coalition with the Social Democrats are due to start on Jan. 7. After a poll this week suggested that Germans increasingly don’t want Merkel, 63, to serve another full term, the chancellor sought to put her stamp on the political debate. Merkel said she’s committed to forming “a stable government for Germany without delay in the new year.”

Read more …

Straight faced lies. Or is it Python?

• May Says 2018 Brexit Progress Will Renew British Confidence And Pride (AFP)

Prime Minister Theresa May said 2018 would be a year of “renewed confidence and pride” for Britain as it confronts the challenges of negotiating Brexit, in her New Year message out Sunday. Divorce talks between London and Brussels are set to move on to transition arrangements, trade and security next year as Britain prepares to leave the European Union in March 2019. May said 2017 had been a year of progress for Britain as it struck agreement on its departure bill, Northern Ireland and the rights of EU citizens, in the first phase of Brexit negotiations. “I believe 2018 can be a year of renewed confidence and pride in our country,” the premier said. “A year in which we continue to make good progress towards a successful Brexit deal, an economy that’s fit for the future, and a stronger and fairer society for everyone.

“And whatever challenges we may face, I know we will overcome them by standing united as one proud union of nations and people.” However, the British Chambers of Commerce, which represents thousands of firms across the country, warned that business was losing patience waiting for clarity on what will happen once Britain leaves the EU. “That patience is now wearing thin. Businesses want answers,” director general Adam Marshall told The Observer newspaper. “Getting the twin challenges of Brexit and the economic fundamentals right will require leadership, consistency and clarity – after a year in which business has been dismayed by what it sees as division and disorganisation.”

Read more …

Once again we’ll see how the EU and democracy don’t go well together.

• Ex-Catalan Leader Demands Regional Government Be Reinstated (AFP)

Ousted Catalan president Carles Puigdemont on Saturday demanded Madrid reinstate his regional government, which was deposed after an independence referendum that Spanish courts judged illegal, as part of a political settlement. “As president, I demand the Spanish government and those who support it… restore all they have expropriated from the Catalans without their say-so,” Puigdemont said from Brussels as he called on Madrid to “negotiate politically.” Puigdemont’s administration followed up the October 1 referendum by declaring independence but Madrid promptly sacked him and his team and, facing arrest, he fled into Belgian exile while colleagues were arrested and jailed. Puigdemont campaigned for the region’s December 21 snap election from his Brussels exile after a Spanish court charged him with rebellion, sedition and misuse of public funds.

But a solid showing by pro-independence parties in the poll strengthened the hand of the secessionists, albeit they did not capture a majority of votes cast. In a seven-minute recorded message Puigdemont insisted he was still Catalonia’s “legitimate” leader and that the electorate had shown themselves to be “democratically mature, winning the right to constitute a republic of free men and women.” After the divisive regional elections, how the independence camp intends to rule remains a mystery, with other secessionist leaders, including Puigdemont’s former deputy Oriol Junqueras, behind bars pending trial. “The ballot box has spoken,” said Puigdemont, who said he hoped the election outcome could kickstart moves towards “dialogue and negotiation.” “So what is (Prime Minister Mariano) Rajoy waiting for to accept the results?”

Read more …

Facebook will be a big story next year.

• Facebook Deletes Accounts at the Direction of US and Israeli Governments (GG)

IN September of last year, we noted that Facebook representatives were meeting with the Israeli government to determine which Facebook accounts of Palestinians should be deleted on the ground that they constituted “incitement.” The meetings — called for and presided over by one of the most extremist and authoritarian Israeli officials, pro-settlement Justice Minister Ayelet Shaked — came after Israel threatened Facebook that its failure to voluntarily comply with Israeli deletion orders would result in the enactment of laws requiring Facebook to do so, upon pain of being severely fined or even blocked in the country. The predictable results of those meetings are now clear and well-documented. Ever since, Facebook has been on a censorship rampage against Palestinian activists who protest the decades-long, illegal Israeli occupation, all directed and determined by Israeli officials.

[..] Facebook now seems to be explicitly admitting that it also intends to follow the censorship orders of the U.S. government. Earlier this week, the company deleted the Facebook and Instagram accounts of Ramzan Kadyrov, the repressive, brutal, and authoritarian leader of the Chechen Republic, who had a combined 4 million followers on those accounts. To put it mildly, Kadyrov — who is given free rein to rule the province in exchange for ultimate loyalty to Moscow — is the opposite of a sympathetic figure: He has been credibly accused of a wide range of horrific human rights violations, from the imprisonment and torture of LGBTs to the kidnapping and killing of dissidents. But none of that dilutes how disturbing and dangerous Facebook’s rationale for its deletion of his accounts is.

A Facebook spokesperson told the New York Times that the company deleted these accounts not because Kadyrov is a mass murderer and tyrant, but that “Mr. Kadyrov’s accounts were deactivated because he had just been added to a United States sanctions list and that the company was legally obligated to act.” As the Times notes, this rationale appears dubious or at least inconsistently applied: Others who are on the same sanctions list, such as Venezuelan President Nicolas Maduro, remain active on both Facebook and Instagram. But just consider the incredibly menacing implications of Facebook’s claims. What this means is obvious: that the U.S. government — meaning, at the moment, the Trump administration — has the unilateral and unchecked power to force the removal of anyone it wants from Facebook and Instagram by simply including them on a sanctions list. Does anyone think this is a good outcome? Does anyone trust the Trump administration — or any other government — to compel social media platforms to delete and block anyone it wants to be silenced?

Read more …

It took almost a year and a half to decide this. In custody.

• One Of Eight Turkish Servicemen Granted Asylum By Greece (K.)

One of eight Turkish servicemen who sought protection in Greece in the wake of a botched coup in Turkey in the summer of 2016 was granted asylum on Saturday. The Asylum Appeals Committee that examines applications in the second degree approved a request for protection from the copilot of the helicopter that flew the eight servicemen into the northern Greek town of Alexandroupoli on July 16, 2016, a day after the attempted takeover by the military in Turkey.

According to the ANA-MPA news agency, the committee upheld an opinion from human rights groups, the Council of Europe and other international agencies decrying human rights violations in Turkey in the aftermath of the failed coup. The panel said that there is no evidence to suggest that the copilot was involved in the coup attempt, yet is nevertheless, being sought by Turkey for “political crimes” and on these grounds may not receive a fair trail if extradited. The other seven Turkish officers remain in custody until a decision is reached on their respective applications.

Read more …

At the exact same time that Athens lauds the independence of its courts, it seeks to interfere with their decisions.

• Greek Gov’t Applies For Cancellation Of Asylum Granted To Turkish Soldier (R.)

The Greek government said on Saturday that it had filed a request for the cancellation of the asylum granted to a Turkish soldier accused of involvement in last year’s coup attempt. Greece’s administrative court of appeal will now look into the case. Eight Turkish soldiers fled to Greece following Turkey’s abortive July 2016 coup. Seven of them applied for asylum and were rejected, but have been kept in preventive custody. Angered by a decision to grant asylum to the eighth soldier by the Greek asylum service committee, a panel of judges and experts, Turkey said earlier in the day that the move would affect bilateral relations and cooperation. Athens said it was following its standing position regarding the eight soldiers, “as it has been repeatedly expressed, also in public”, a government official said.

The Greek government has said that it does not support coup plotters and that the country’s justice system is independent. A Greek police official said the soldier who was granted asylum would be released from custody. “By granting asylum to one of eight coup plotters involved in the July 15 coup, Greece has once again showed that it is a country that protects and embraces coup plotters with this decision,” Turkey’s Foreign Ministry said in a statement. Greek courts have blocked two extradition requests by Turkish authorities, drawing an angry rebuke from Ankara and highlighting the tense relations between the NATO allies, who remain at odds over various issues. During his visit to Greece earlier this month, Turkish Foreign Minister Mevlut Cavusoglu said Ankara did not want Greece to turn into a safe haven for coup plotters.

Read more …

But the people still come to watch them.

• Calgary Zoo Moves Penguins Indoors Because Of The Cold (Ind.)

Temperatures have dropped so low in Canada that Calgary Zoo has had to move its penguins indoors. As an extreme-cold warning was in effect for the country – temperatures hit a frosty -25C late this week – zookeepers thought it safer to move the penguins to their indoor enclosure. Larissa Mark, manager of communications at Calgary Zoo told Global News that: “On cold days like this, we have to make that choice for them because it is so cold, but on other days, we do give them the option of coming in and out as they please.” Ms Mark explained that king penguins, like the ones at Calgary zoo, are not as accustomed to sub-zero temperatures as their cousins, the emperor penguins.

King penguins, characterised by the bright orange spots on the sides of their heads and feathers at the nape of their necks, are generally found in sub-Antarctic regions in Chile and Argentina and temperate places like the Falklands, Macquarie and the Sandwich islands. However, the cold snap has not stopped people from going to the zoo. “Calgarians are a hardy bunch. A cup of hot chocolate and a warm fire and they are still coming out and enjoying Zoolights. Our attendance is doing well, it is on par with where we were last year,” said Ms Mark of the annual holiday-lights display event put on by the zoo.

Read more …