Giuseppe Leone Ragusa Sicily 1953

Rumors about the demise of the dollar are greatly…

• US Dollar Hegemony Tripped Up by Chinese Renminbi? Um, No (WS)

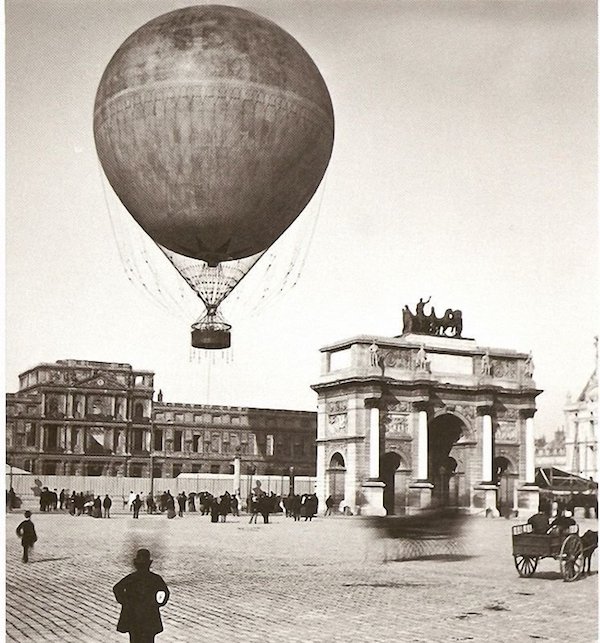

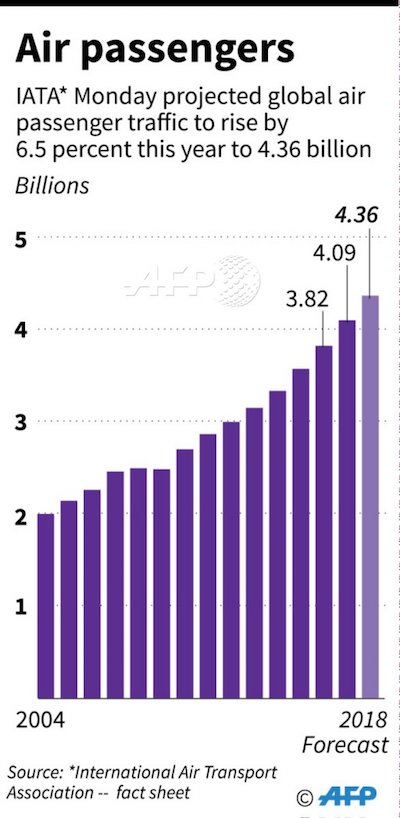

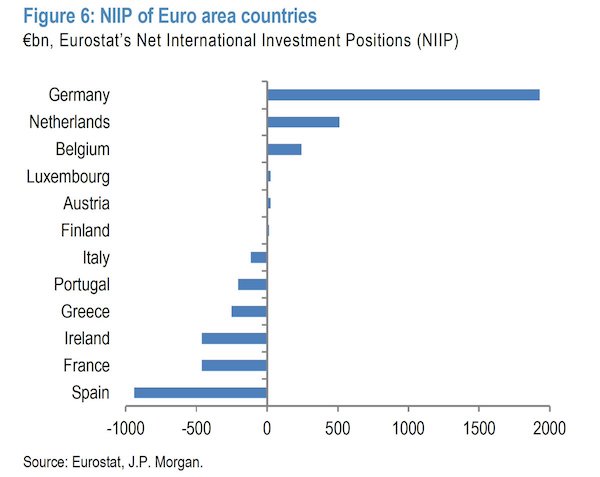

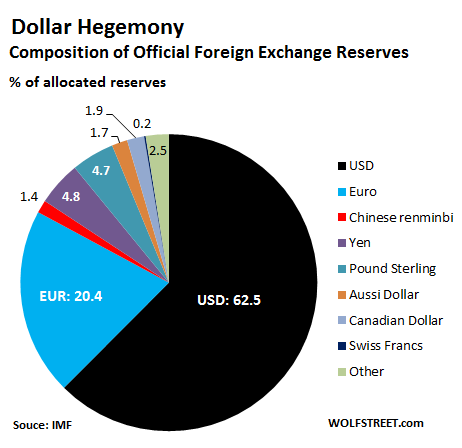

Global central banks are not dumping US-dollar-denominated assets from their foreign exchange reserves. They’re not dumping euro-denominated assets either. And they remain leery of the Chinese renminbi – despite China’s place as the second largest economy in the world and despite all the hoopla of turning the renminbi into a major global reserve currency. This is clear from the IMF’s just released “Currency Composition of Official Foreign Exchange Reserves” (COFER) data for the first quarter 2018. The IMF is very stingy with what it discloses. The COFER data for each individual country – each country’s specific holdings of reserve currencies – is “strictly confidential.” But it does disclose the global allocation of each major currency.

In Q1 2018, total global foreign exchange reserves, including all currencies, rose 6.3% year-over-year, or by $878 billion, to $11.59 trillion, within the upper range of the past three years (from $10.7 trillion in Q4 2016 to $11.8 trillion in Q3, 2014). For reporting purposes, the IMF converts all currency balances into US dollars. This data was for Q1. The dollar bottomed out in the middle of the quarter and has since been rising. US-dollar-denominated assets among foreign exchange reserves continued to dominate in Q1 at $6.5 trillion, or 62.5% of “allocated” reserves (more on this “allocated” in a moment).

[..] The RMB is the thin red sliver in the pie chart below with a share of just 1.39% of allocated foreign exchange reserves. Minuscule as it is, it is the highest share ever, up from 1.2% in Q4 2017. In other words, its inclusion in the SDR basket hasn’t exactly performed miracles as central banks seem to remain leery of it and have not yet displayed any kind of eagerness to hold RMB-denominated assets.

[..] Note the term “allocated” reserves. Not all central banks disclose to the IMF how their overall foreign exchange reserves are allocated by specific currency. But over the years, more and more central banks have disclosed their holdings to the IMF, and the mystery portion has been shrinking. Back in Q4 2014, unallocated reserves – the undisclosed mystery portion – accounted for 41% of total reserves. In Q1, only 10.3% of the reserves remained undisclosed. [..] folks who’ve been eagerly anticipating “the death of the dollar” or similar scenarios will have to be very patient.

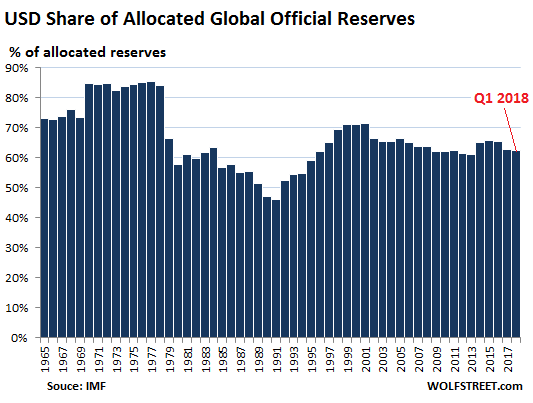

Since 1965, the dollar’s share has fluctuated sharply, and the current share of 62.5% remains in the middle of the range. The chart below shows the dollar’s share at year-end for each of the past 52 years, plus for Q1 2018. Note its low point in 1991 with a share of 46%. And note that the Financial Crisis made no visible dent:

Don’t cry 4-3 Argentina.

• Even Eva Peron Would Be Crying… (ZH)

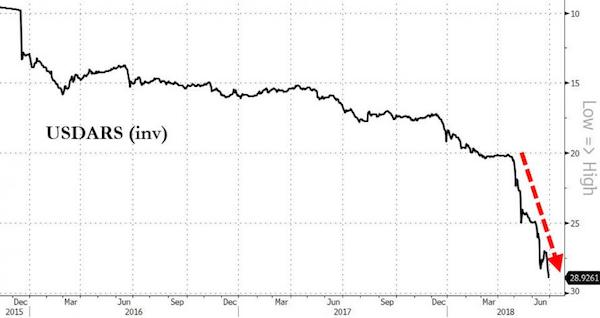

The last 24 hours have not been great for Argentina. First – despite endless jawboning about The IMF bailout and how it will secure the nation’s future and enable reforms, the currency collapsed to a new record low on Friday…

Second – the central bank decided to step in with their newly minted IMF funds and blew over a billion dollars to buy pesos, managing a very modest bounce (but ARS still closed down 3% on the day)

Third – IMF officials spoke with Argentina’s union leaders, warning of the social impact of the ongoing disruptions. IMF spokesman Raphael Anspach confirmed Werner and Cardarelli’s participation in the call, which “reiterated the main elements of the IMF support to the government’s economic plans, including the measures aimed at supporting the most vulnerable in Argentine society.” And union officials told the media that The IMF was not worried about the ongoing collapse: “They are betting on a virtuous behavior by private investors, with the economy falling in the third and fourth quarters of 2018, but rebounding 1.5% in the first quarter of 2019” “They were not worried about the flight of capital”

Fourth, and finally, and perhaps worst of all – Argentina is now out of The World Cup. A nation mourns.

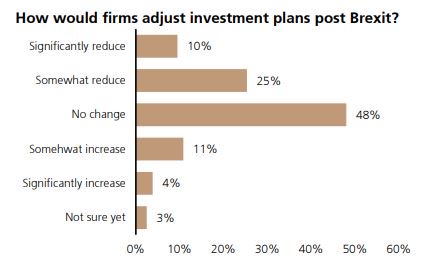

The British people don’t seem to have a clue what this means.

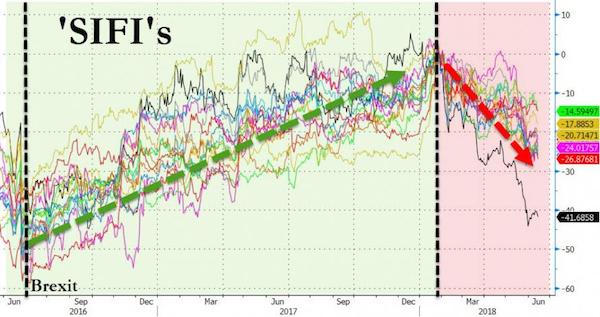

• No Chance Of Brexit Deal By October Says EU (Ind.)

EU negotiators have abandoned all hope that a Brexit deal will be signed with the UK at October’s European Council summit, The Independent has learned. Brussels officials said a complete standstill in talks with Britain means securing settlements on major outstanding issues in the remaining three-and-a-half months is fanciful. They point to the political logjam in Theresa May’s government as the obstacle blocking negotiations, piling pressure on the prime minister to break the deadlock this week. She is set to meet her full cabinet on Friday at Chequers for a meeting that may go late into the night, in a bid to finally thrash out the government’s approach to post-Brexit relations with the EU.

The EU officials were speaking after last week’s European Council summit which saw the bloc focus on tackling immigration from north Africa, while warning Ms May that time to secure a deal is now running out. One Brussels insider said: “There is no hope really for October now. We don’t know exactly what she is asking for yet, so how can there be? “First the UK needs to decide what it wants, then there needs to be a discussion here and even if it is acceptable, there are processes that have to take place first before everyone agrees to move forward.” Another source close to the European Commission told The Independent: “Now we are looking at December as a more likely option, but there are questions about how much time that leaves for the deal to be ratified in time before March.”

VW owns Audi.

• VW CEO Says Arrest Of Audi’s Stadler Hard To Comprehend (R.)

The CEO of Volkswagen, Herbert Diess, told a German newspaper the arrest of Audi head Rupert Stadler was a shock and hard to comprehend. VW has suspended Stadler, head of VW’s most profitable brand, after German authorities arrested him as part of an emissions probe. “It was a massive shock for me. The arrest of a CEO of a major car brand: that’s never happened before,” Diess told Germany newspaper Bild am Sonntag. “The arrest is hard to comprehend. I knew Rupert Stadler as a problem solver,” the newspaper quoted him as saying.

Diess said that for him, Stadler was innocent until proven guilty. Stadler, who has not made any public comment, has not been charged and prosecutors are set to continue questioning him next week. Asked whether he could imagine Stadler returning, Diess said it depended on what facts emerge: “Should the accusations of the state prosecutors prove to be true, then it’s a clear decision.”

2 millions barrels a day in spare capacity? Don’t think so. He may have to ask Putin to join in.

• Trump Claims Saudi Arabia Has Agreed To Boost Oil Production Amid Turmoil (G.)

Donald Trump said on Saturday he had received assurances from King Salman of Saudi Arabia that the kingdom would increase oil production “maybe up to 2,000,000 barrels”, in response to turmoil in Iran and Venezuela. Saudi Arabia acknowledged the call took place, but mentioned no production targets. Trump wrote on Twitter that he had asked the king in a phone call to increase oil production “to make up the difference … Prices to [sic] high! He has agreed!” A little over an hour later, the state-run Saudi Press Agency acknowledged the call, but offered few details. “During the call, the two leaders stressed the need to make efforts to maintain the stability of oil markets and the growth of the global economy,” the statement said.

It added that there also was an understanding that oil-producing countries would need “to compensate for any potential shortage of supplies”. It did not elaborate. Oil prices have edged higher as the Trump administration has pushed US allies to end all purchases of oil from Iran. Prices have also risen given ongoing unrest in Venezuela, as well as with fighting in Libya over control of that country’s oil infrastructure. Last week, members of the OPEC cartel led by Saudi Arabia agreed to pump 1m barrels more crude oil per day, a move that should help contain the recent rise in global energy prices. However, summer months in the US usually lead to increased demand for oil, which would push up the price of gasoline in a midterm election year. A gallon of regular gasoline sold on average in the US for $2.85, up from $2.23 a gallon last year.

But Putin.

• Trump Ally Giuliani Says End Is Near For Iran’s Rulers (R.)

U.S. President Donald Trump will suffocate Iran’s “dictatorial ayatollahs”, his close ally Rudy Giuliani said on Saturday, suggesting his move to re-impose sanctions was aimed squarely at regime change. The former New York mayor who is now Trump’s personal lawyer, was addressing a conference of the Paris-based National Council of Resistance of Iran (NCRI), an umbrella bloc of opposition groups in exile that seek an end to Shi’ite Muslim clerical rule in Iran. “I can’t speak for the president, but it sure sounds like he doesn’t think there is much of a chance of a change in behavior unless there is a change in people and philosophy,” Giuliani told Reuters in an interview.

“We are the strongest economy in the world … and if we cut you off then you collapse,” he said, pointing to protests in Iran. In May, Trump withdrew the United States from a 2015 international deal to curb Tehran’s nuclear program in exchange for lifting some sanctions. Trump supporters have spoken at NCRI events in the past, including national security adviser John Bolton, who, before taking his post at the same conference last July, told the group’s members they would be ruling Iran before 2019 and their goal should be regime change. Bolton said in May that the administration’s policy was to make sure Iran never got nuclear weapons and not regime change.

In Tehran, supreme leader Ayatollah Ali Khamenei said Trump would fail in any attempt to turn the Iranian people against the ruling system. “They bring to bear economic pressure to separate the nation from the system … but six U.S. presidents before him (Trump) tried this and had to give up,” Khamenei said on his website.

From DiEM 25 members: “..a tool to control speech, expression, criticism and increase the surveillance levels imposed on all EU citizens.

• The EU Is Killing Our Democratic Spaces Using Copyright As A Trojan Horse (OD)

Europe was one of the regions that connected massively to the Internet. Not only that, it was one of the few adopting literacy and inclusion programs early enough on to unleash the power of connected citizens, showing them how to create new business models and improve education but also how to express themselves, create, organize and protest. But alarmingly, the European Parliament is on the verge of a dramatic change of direction. The EU has recently embarked on a new mission: controlling the Internet through the monopoly of copyright. This attempt to reform and control the Internet has not received half the attention it deserves.

As Julia Reda, MEP for the Pirate Party, has explained, the current project of EU legislation would impose automatic filters that control ANY content that anyone wants to upload. The reason would be the protection of copyright, a monopoly right that primarily benefits large media behemoths, without any possibility of advance verification. You read that right: the EU wants to put in place a global censorship machine, on the basis of unverifiable monopoly rights, mostly held by large media corporations. In DiEM25, we do not see this as just an outdated law, isolated from current politics. Indeed, that is precisely what is most worrying about it.

We cannot see it as unconnected to the big push in Europe by authoritarian leaders wanting to restrict, to truly shrink the spaces of civil society. Increasing censorship online will reduce the ability of citizens to say what they think, filtering content before it is published. This will not only harm speech but increase surveillance and the meting out of punishments for things we say online. This is combined with all the existing online state surveillance already endured by EU citizens, which remains as powerful as ever. With dismay, we are witnessing now an open boycott of the democratic achievement of a connected Europe. The European Parliament Legal Committee has just given the green light to a law that will be a tool to control speech, expression, criticism and increase the surveillance levels imposed on all EU citizens.

It’s all and only about Save Angela now. Not about the refugees.

• Angela Merkel Secures Asylum Seeker Return Deals With 14 EU Countries (Ind.)

Angela Merkel has reportedly secured agreements with 14 European Union countries to rapidly return some asylum seekers arriving in Germany. The chancellor is seeking to end a divide in her coalition government over a migration policy that has attracted ire from immigration hardliners. Ms Merkel has said she also wants to establish “anchor centres” to process migrants at Germany’s borders, the DPA news agency reported on Saturday. The announcements came in a letter Ms Merkel wrote to leaders of her Christian Democratic Union’s Bavaria-only sister party, the Christian Social Union, as well as to her junior coalition government partner, the Social Democrats, after she attended a two-day EU summit in Brussels.

Ms Merkel on Friday came away from an EU summit with agreements from Greece and Spain to take back migrants previously registered in those countries, and an overall agreement by the 28-nation bloc to ease the pressures of migration into Europe. In the eight-page letter obtained Saturday by DPA, the chancellor said that she had also secured agreement with half of the EU nations to return migrants to them if they had first registered in those countries. The countries included Hungary, Poland and the Czech Republic, which have all been harsh critics of Ms Merkel’s welcoming stance to migrants, as well as Belgium, France, Denmark, Estonia, Finland, Lithuania, Latvia, Luxembourg, the Netherlands, Portugal and Sweden.

In addition, the chancellor threw her support behind establishing large collection centres in Germany for migrants as their cases are processed. DPA reported the centres would be used for migrants who attempt to bypass border controls and for those whose cases don’t fall under bilateral return agreements.

And so she stretches the truth a little here and there. Save Angela.

• Hungary, Poland & Czech Republic Deny Sealing Migrant Deal With Merkel (RT)

Three EU countries have denied reaching any final agreement with Germany on the return of migrants to the country of entry, despite Angela Merkel’s claim she’d received “political consent” from 14 EU nations to strike such a deal. “No such deal has been reached,” spokesman for Hungary’s government Zoltan Kovacs said, adding that Budapest has repeatedly rejected German attempts to “return” migrants to their first country of entry into the EU. Similar statements have been produced by Poland and the Czech Republic, which also denied reaching any agreements on the matter. “There are no any new agreements regarding the reception of asylum seekers from EU countries, we confirm (that), like the Czech Republic and Hungary,” Polish Foreign Ministry spokesman Artur Lompart said.

Earlier on Saturday, media reported that, during the EU summit, 14 European countries, including some outspoken opponents of German Chancellor’s ‘open door’ policy, had allegedly “consented on a political level” to make a deal on taking migrants back. The document on the deal has been sent by Merkel to her coalition partners, according to Reuters. “At the moment, Dublin repatriations from Germany succeed in only 15% of cases,” the document says, as quoted by Reuters. “We will sign administrative agreements with various member states… to speed the repatriation process and remove obstacles.”

But Save Angela.

• EU’s New Refugee Policy Under Fire As Children Stuck In Limbo In Niger (G.)

Stop people in Africa, before they get anywhere near the Mediterranean, and sort them into refugees and migrants there, only allowing the refugees to continue to Europe. This was the big idea that came out of last week’s EU migration summit. But campaigners say the predicament of 260 children stuck in limbo in Niger demonstrates that there is no guarantee EU countries would eventually take the refugees, even if African countries agreed to this arrangement. In November, amid horrific tales of Africans being enslaved, imprisoned and tortured in Libya, Niger agreed to act as a halfway house for refugees that UNHCR, the UN’s refugee agency, had identified and could get out.

Evacuated from detention camps in Libya, the unaccompanied minors are among 1,200 people waiting in Niger for resettlement. Mainly aged 14 to 17, they were all in detention, and most are deeply traumatised by the violence they experienced and witnessed there. But so far no country has agreed to take them. “In Europe we have been talking a lot about legal pathways,” said UNHCR’s representative in Niger, Alessandra Morelli. “If we want to combat trafficking, if people in need of international protection, who fit the profile of asylum seekers, get out of that flow, I have to offer an alternative. Otherwise, what are we talking about here? But when I take them out I have no alternative. You see? This is our fight.” About 54,000 refugees and asylum seekers have been identified in Libya, but no more can leave until the 1,200 in Niger have been processed.

[..] One aspect of the migration deal reached on Friday looked to fall apart before it had even begun: four European countries – Austria, France, Germany and Italy – said they would not open “controlled centres” to assess asylum claims of people who had been rescued from the Mediterranean. At the same time they are asking some of the world’s poorest and least secure countries to do what Europe will not.

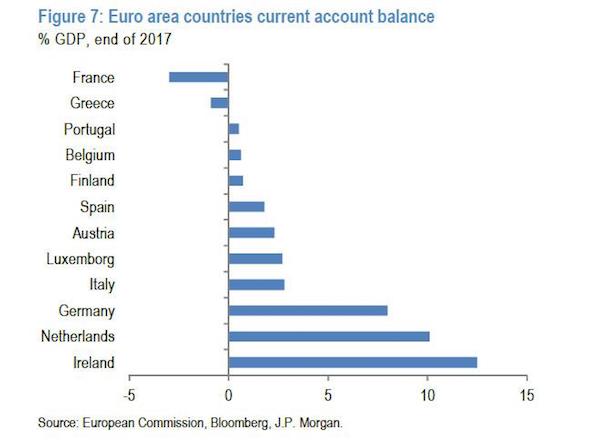

“Is there a solution for Greece? Yes, but it is in quite the opposite direction of the EU and IMF plans this far.”

• End Of The Bailouts And Onto A Path To A New Bankruptcy (Economides)

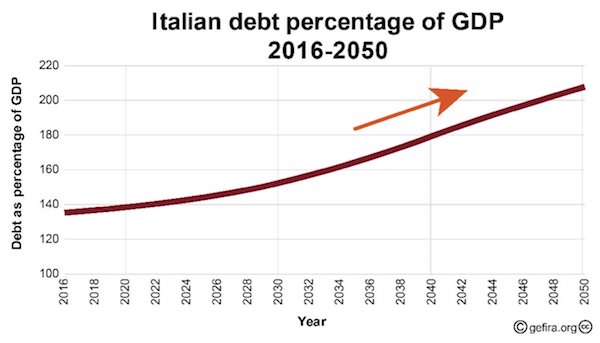

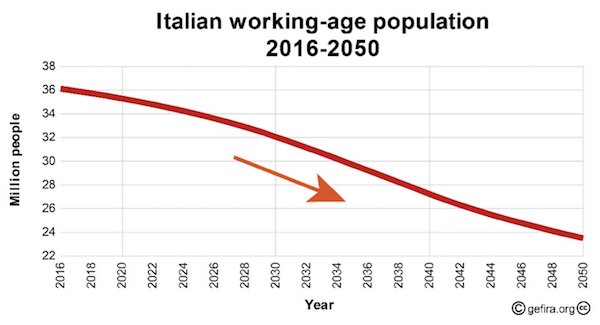

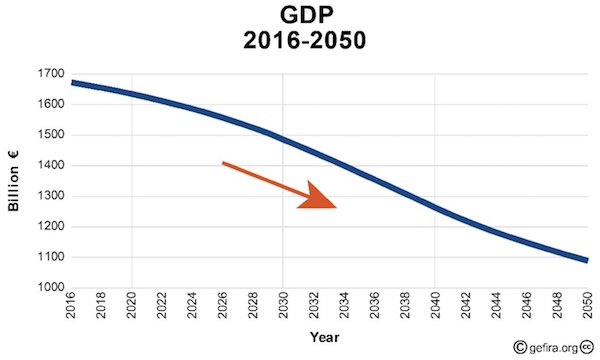

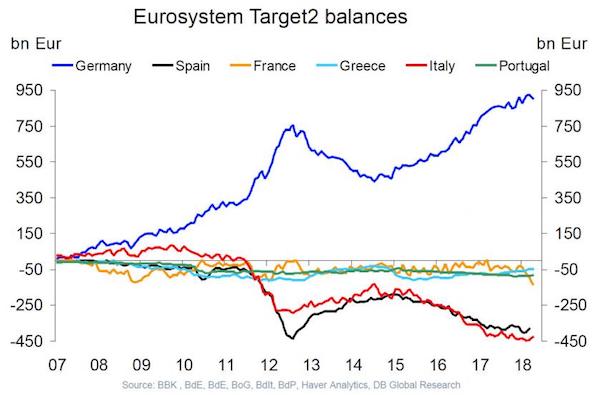

Last week’s Eurogroup set up the final conditions for the end of the third Greek bailout program in August. Since 2010, Greece has borrowed 275 billion euros from European Union countries and the IMF. Greece also shed 100 billion euros of private debt in an agreement with the borrowers in 2012. However, present debt is still over 300 billion euros for an economy of officially 185 billion GDP (plus 30% unaccounted illegal income). Thus, debt to gross domestic product remains extremely high. Even though the borrowing is over, the EU and the IMF have imposed new long-term austerity conditions on the Greek economy, including additional sharp pension decreases and the requirement that Greece produces a 3.5% of GDP budget surplus.

To achieve this, the government has imposed skyrocketing taxes including a 24% value-added tax (and plans to increase taxes to those making as little as 6,000 euros a year). Taxes suck out all the extra cash businesses and people have. Investment has plummeted, and consumption is 25% lower than a few years ago. Unemployment is at 23% but this number is misleadingly low because those working only two days a week are considered employed. With huge taxes and a business-unfriendly bureaucracy, Greece is unlikely to attract investment and will not achieve fast growth. Without growth, the country will be unable to pay back its debt in full despite a 10-year postponement of maturities on one-third of its debt granted by the EU last Thursday.

[..] Is there a solution for Greece? Yes, but it is in quite the opposite direction of the EU and IMF plans this far. Greece needs to achieve fast growth, 4-5% per year, for five years, and start paying its debt after that. To achieve high growth, the country needs to abandon the multi-year 3.5% surplus target for the much more reasonable 1.5-2% target. With lower surpluses, lower taxes and less bureaucracy, Greece will be able to attract investment and realize high growth. Once it has achieved high growth and its economy has expanded, only then will Greece start paying its debt, and it will be able to pay its debt in full over time.

Instead, the EU/IMF plan forces the country to create huge surpluses when its economy is hurting, thereby driving it in a downward spiral. Imposing the requirement of large surpluses now is catastrophic and forces Greece to take a path of low or zero growth and misery. Greece will never be able to pay back its debt in full on this path.

They seem to be waking up. But then it’ll all just go to a poorer place.

• Deluge Of Electronic Waste Turning Thailand Into ‘World’s Rubbish Dump’ (G.)

At a deserted factory outside Bangkok, skyscrapers made from vast blocks of crushed printers, Xbox components and TVs tower over black rivers of smashed-up computer screens. This is a tiny fraction of the estimated 50m tonnes of electronic waste created just in the EU every year, a tide of toxic rubbish that is flooding into south-east Asia from the EU, US and Japan. Thailand, with its lax environmental laws, has become a dumping ground for this e-waste over the past six months, but authorities are clamping down, fearful that the country will become the “rubbish dump of the world”. The global implications could be enormous.

A factory visited by the Guardian in Samut Prakan province, south of Bangkok, which was recently shut down in a raid for operating illegally, illustrated the mammoth scale of the problem. Printers made by Dell and HP, Daewoo TVs and Apple computer drives were stacked sky-high next to precarious piles of compressed keyboards, routers and copy machines. Labels showed the waste had mainly come from abroad. For locals, it is unclear why Thailand should be taking this waste. The Samut Prakan factory sits in the middle of hundreds of shrimp farms and there were concerns it was poisoning the landscape, with no environmental protections or oversight in place.

Until the beginning of this year, China was a willing recipient of the world’s electronic waste, which it recycled in vast factories. According to the UN, 70% of all electronic waste was ending up in China. But in January, having calculated that the environmental impact far outweighed the short-term profit, China closed its gates to virtually all foreign rubbish. It has prompted something of a global crisis, not just for e-waste but plastic waste as well. Asian nations such as Thailand, Laos and Cambodia stepped in. Chinese businessmen have set about attempting to open about 100 plastic and e-waste recycling plants across Thailand since January.

“Like a Hollywood villain falling into a crucible of molten steel only to turn up later in some altered state, Monsanto has been subsumed under the Orwellian-sounding ‘Bayer Crop Science’ division..”

• Bayer-Monsanto Partnership Signals Death Knell for Humanity (Bridge)

On what plane of reality is it possible that two of the world’s most morally bankrupt corporations, Bayer and Monsanto, can be permitted to join forces in what promises to be the next stage in the takeover of the world’s agricultural and medicinal supplies? Warning, plot spoiler: There is no Mr. Hyde side in this horror story of epic proportions; it’s all Dr. Jekyll. Like a script from a David Lynch creeper, Bayer AG of poison gas fame has finalized its $66 billion purchase of Monsanto, the agrochemical corporation that should be pleading the Fifth in the dock on Guantanamo Bay instead of enjoying what amounts to corporate asylum and immunity from crimes against humanity. Such are the special privileges that come from being an above-the-law transnational corporation.

Unsurprisingly, the first thing Bayer did after taking on Monsanto, saddled as it is with the extra baggage of ethic improprieties, was to initiate a rebrand campaign. Like a Hollywood villain falling into a crucible of molten steel only to turn up later in some altered state, Monsanto has been subsumed under the Orwellian-sounding ‘Bayer Crop Science’ division, whose motto is: “Science for a better life.” Yet Bayer itself provides little protective cover for Monsanto considering its own patchy history of corporate malfeasance. Far beyond its widely known business of peddling pain relief for headaches, the German-based company played a significant role in the introduction of poison gas on the battlefields of World War I.

Despite a Hague Convention ban on the use of chemical weapons since 1907, Bayer CEO Carl Duisberg, who sat on a special commission set up by the German Ministry of War, knew a business opportunity when he saw one. Duisberg witnessed early tests of poison gas and had nothing but glowing reports on the horrific new weapon: “The enemy won’t even know when an area has been sprayed with it and will remain quietly in place until the consequences occur.” Bayer, which built a department specifically for the research and development of gas agents, went on to develop increasingly lethal chemical weapons, such as phosgene and mustard gas. “This phosgene is the meanest weapon I know,” Duisberg remarked with a stunning disregard for life, as if he were speaking about the latest bug spray. “I strongly recommend that we not let the opportunity of this war pass without also testing gas grenades.”