Salvador Dali The Disintegration of the Persistence of Memory 1954

Nice way to start the week. I said this would happen, become a trend. Open thee, Sesame.

• Trump To Declassify Bruce Ohr, Carter Page Documents As Early As This Week (ZH)

President Trump is expected to declassify documents connected to the Obama administration’s surveillance of the Trump campaign during the 2016 US election, according to Axios, citing allies of the president who say it could happen as soon as this week. Specifically mentioned are documents concerning former Trump campaign adviser Carter Page, as well as the “investigative activities of Justice Department lawyer Bruce Ohr” – who was demoted twice for lying about his extensive relationship with Christopher Steele – the former MI6 spy who assembled the sham “Steele Dossier” used by the FBI in a FISA surveillance application to spy on Page.

Republicans on the House Intelligence and Judiciary committees believe the declassification will permanently taint the Trump-Russia investigation by showing the investigation was illegitimate to begin with. Trump has been hammering the same theme for months. • They allege that Bruce Ohr played an improper intermediary role between the Justice Department, British spy Christopher Steele and Fusion GPS – the opposition research firm that produced the Trump-Russia dossier, funded by Democrats. (Ohr’s wife, Nellie, worked for Fusion GPS on Russia-related matters during the presidential election – a fact that Ohr did not disclose on federal forms.) • And they further allege that the Obama administration improperly spied on Carter Page – all to take down Trump. -Axios

Ohr, meanwhile, met with Russian billionaire Oleg Deripaska in 2015 to discuss helping the FBI with organized crime investigations, according to The Hill’s John Solomon. The meeting with the Putin ally was facilitated by Steele. Three weeks ago, Trump called Ohr a disgrace, while also tweeting: “Will Bruce Ohr, whose family received big money for helping to create the phony, dirty and discredited Dossier, ever be fired from the Jeff Sessions “Justice” Department? A total joke!” According to emails turned over to Congressional investigators in August, Christopher Steele was much closer to Bruce Ohr and his wife Nellie than previously disclosed.

Steele and the Ohrs would have breakfast together on July 30, 2016 at the Mayflower Hotel in downtown Washington D.C., days after Steele turned in installments of his infamous “dossier” on July 19 and 26. The breakfast also occurred one day before the FBI formally launched operation “Crossfire Hurricane,” the agency’s counterintelligence operation into the Trump campaign. “Great to see you and Nellie this morning Bruce,” Steele wrote shortly following their breakfast meeting. “Let’s keep in touch on the substantive issues/s (sic). Glenn is happy to speak to you on this if it would help

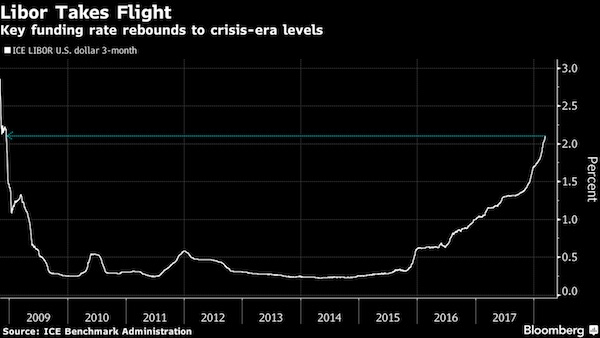

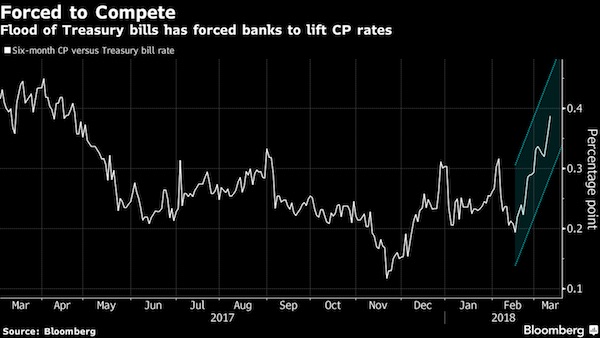

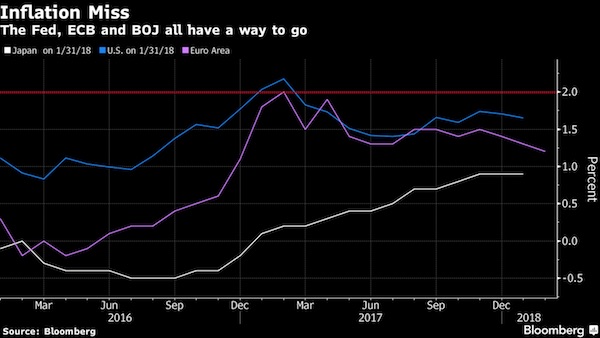

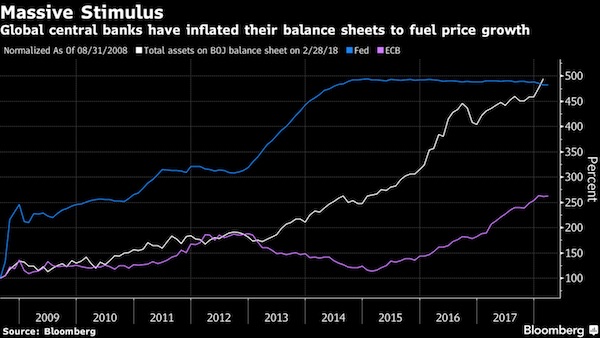

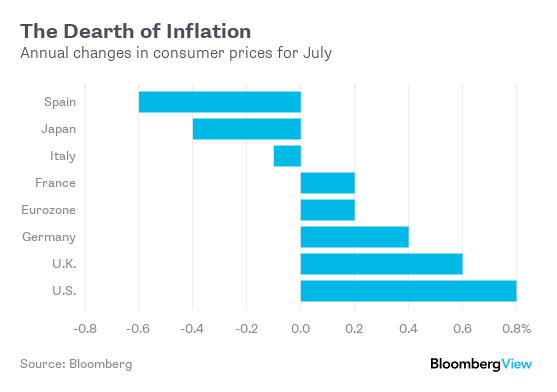

To reiterate once again: not long after Lehman, Bernanke said the Fed had entered ‘uncharted territory’. They’re still there, groping in the dark. Not a clue, but faking it like pros.

• Stronger US Economy May Warrant ‘Restrictive’ Rates: Boston Fed’s Rosengren (R.)

When Boston Federal Reserve Bank President Eric Rosengren switched from advocating low interest rates to tighter monetary policy, he argued it was time to start crawling back toward “normal” rates even with 5% unemployment and weak growth and inflation. Two years later, Rosengren has joined colleagues in beginning to lay the groundwork for those rate hikes to potentially continue longer and to a higher level than currently expected as the outlook for the economy strengthens. Rates may not only need to become “restrictive,” but the definition of that may be moving up as well, Rosengren said in an interview with Reuters on Saturday following an economic conference here.

“This is not hair on fire. There is upward pressure on inflation, and given that we are already at 2%, labor markets are already tight … that is going to be a situation where we start persistently having inflation above what our target is,” Rosengren said. “There is an argument to normalize policy and probably be mildly restrictive.” The Fed maintains a 2% inflation target, which it is only now reaching after a decade struggling to consistently hit and maintain it. He said the Fed does not need to move faster than the current gradual pace, which has translated into roughly one rate hike per quarter, with the next expected later this month. That steady pace is a luxury gained by starting early, he said, skirting the need to move more quickly and catch up with a tightening economy.

Incompetent one and all.

• Brexit Will Fail Regardless Of Boris Johnson And Theresa May’s Jabs (Ind.)

When Boris Johnson decides to go on leadership manoeuvres he tends to be noisy. His latest line is that the prime minister is like some sort of incompetent suicide bomber, handing over the ignition button on her suicide vest to none other than Michel Barnier. Presumably, Mr Johnson would like us to believe that he would in fact willingly blow himself to kingdom come, shouting “Leave means Leave” on his way to enjoying the company of the promised 72 virgins of the Leave campaign. These may prove as mythical as the extra £350m a week for the NHS he once promised his own fanatical supporters. Or something like that.

As Mr Johnson has discovered, metaphors around Brexit can easily get misconstrued and extended way too far. With the suicide bomber analogy, Mr Johnson displayed his usual contempt for good taste and, as ever, took delight on winding up his opponents. These include two of his own former ministers at the Foreign Office, Alistair Burt and Sir Alan Duncan, who know his ways well and may be forgiven for letting off steam. Sir Alan called it disgusting. True, but it did the trick: Johnson is dominating the headlines again, just ahead of the Tory conference and crucial EU summits. It’s pretty obvious what he is up to.

On the substance though, there was little new in this intervention. Mr Johnson has, at least privately, let it be known that he regards the issue of the Irish border as a subsidiary one, unnecessarily getting in the way of his vision of Brexit. He apparently now regards the whole question as a plot by closet Remainers to keep the UK either in the EU or as close to the EU as makes no difference – Brexit in name only.

The EU can’t solve these issues by moving back to laws that cover traditional media. They need education, or this will fail spectacularly.

• Battle Over EU Copyright Law Heads For Showdown (G.)

Fought with hashtags, mailshots, open letters and celebrity endorsements, the battle over the European Union’s draft directive on copyright heads for a showdown this week. After two years of debate, members of the European parliament will vote on Wednesday on the legislation, which could change the balance of power between producers of music, news and film and the dominant websites that host their work. Proposed in 2016 to update copyright law for the age of Facebook and Google, the directive has unleashed a ferocious lobbying war. Lawmakers have been bombarded with millions of emails and thousands of calls, many based on standard scripts written by lobbyists. Some have even received death threats, according to the French MEP Virginie Rozière.

Critics claim the proposal will destroy the internet, spelling the end of sharing holiday snaps or memes on Facebook. Proponents are exasperated by such claims, described by German Christian Democrat Axel Voss as “totally wrong” and “fake news”. Amid last-minute writing and rewriting of amendments, the final outcome cannot be predicted. The proposals were rejected by the European parliament in July, despite earlier support in a relevant committee. Among the latest to mobilise in favour were 165 film-makers and screenwriters, including the British director Mike Leigh, who launched an appeal at the Venice film festival last week calling on EU lawmakers to pass the law. In July McCartney pressed MEPs to stop tech firms exploiting musicians.

Europe’s biggest news agencies have also urged MEPs to vote for the law, as they accused Google and Facebook of “plundering” the news and their ad revenues, resulting in a “threat to democracy”. “For the sake of Europe’s free press and democratic values, EU lawmakers should press ahead with copyright reform,” said a statement signed by 20 agencies, including the Press Association and Agence France-Presse. Opponents are no less forceful. Wikipedia shut down its pages in some countries in protest at the plans, which it claims would force the closure of its user-generated encyclopaedia. Berners-Lee is among 70 internet luminaries to oppose the law, arguing it would be transform the internet from an open platform into a tool for “automated surveillance and control”. The UN special rapporteur on freedom of expression, David Kaye, has raised concerns about “prepublication censorship”.

RT reports first US chemical attck in Syria over the weekend.

• US Senator: MI6 Planning Fake Chemical Weapons Attack On Syria (WaPo)

Fresh off a sitdown with Syrian president Bashar al-Assad, Virginia state senator Richard Black turned up on Arab TV last week making an extraordinary claim about one of the US’ closest allies. Mr Black said Britain’s MI6 intelligence service was planning a chemical weapons attack on the Syrian people, which it would then blame on Mr Assad. “Around four weeks ago, we knew that British intelligence was working towards a chemical attack in order to blame the Syrian government, to hold Syria responsible,” Mr Black said on Al Mayadeen, an Arab news channel based in Beirut. Mr Black said later that he meant the British were planning not to carry out an attack themselves, but to either direct rebels to do so or stage a phoney attack, with actors posing as victims.

Mr Black also said some chemical attacks previously reported to have occurred in Syria were British fakes, pulled off with help from volunteer first responders known as “White Helmets”. “From what I can tell, they have been planning a fake attack, not a genuine one, but one where they actually move people out of a town and they have trained people to portray victims of a gas attack,” Mr Black said in an interview with The Washington Post. “And the plan is to use the White Helmets who have always been involved in these notorious deceptions, to portray an attack.” The State Department flatly rejected Mr Black’s allegations, which echoed what it called “outrageous” Russian and Assad-regime claims that Britain and the US have carried out chemical attacks with help from the White Helmets.

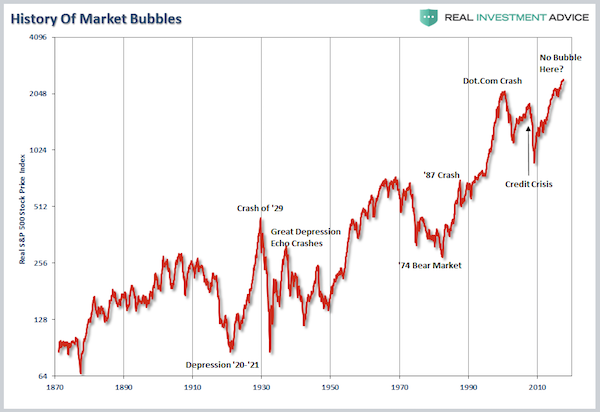

Not sure looking backward is the way to go. Tempting because of choice details that seem to fit, but this is new.

• What Caused The Crash Of 2008 Now Shapes Our Post-Modern 1930s (Varoufakis)

In the autumn of 2008 events unfolded in Wall Street that the crushing majority of people around the world had been led to believe could never occur. It was the financial equivalent of watching the sun spinning out of control soon after it rose above the horizon. Humanity watched on in collective disbelief. The ancient Greeks had a term for moments like that one: aporia – a state of intense bafflement urgently demanding a new model of the world we live in. The Crash of 2008 was such a moment. Suddenly, the world ceased to make sense in terms of what, a few weeks before, passed as conventional wisdom.

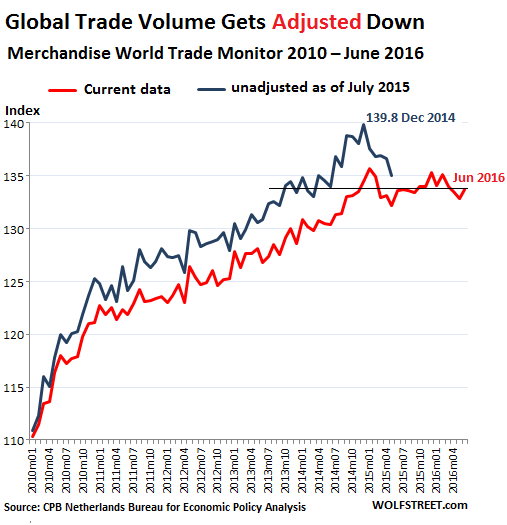

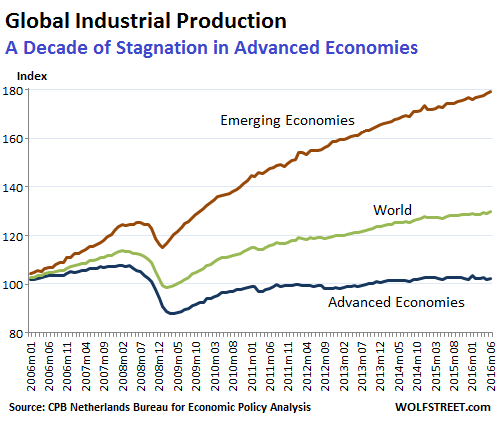

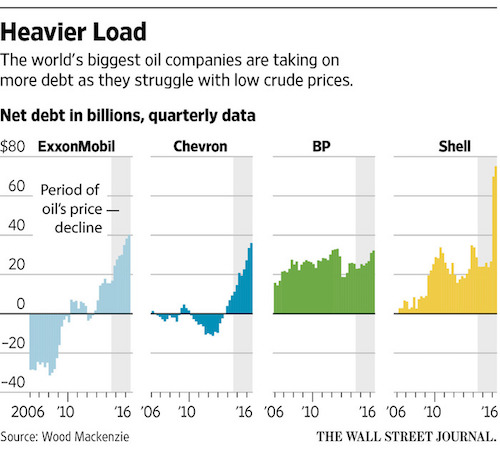

Before long, the repercussions were felt everywhere. The certainties created by decades of of establishment thinking were gone, along with around $40 trillion of equity globally, $14 trillion of household wealth in the US alone, 700,000 US jobs every month, countless repossessed homes everywhere; the list is as long as the numbers it includes are unfathomable. Even McDonald’s, for goodness’ sake, could not secure an overdraft from Bank of America! The collective aporia intensified by the response of governments that had hitherto clinged tenaciously onto fiscal conservatism, as perhaps the 20th century’s last surviving ideology: the pouring of trillions of dollars, euros, yen etc. into a financial system which had been, until a few months before, on a huge roll, accumulating fabulous profits and provocatively professing to have found the pot of gold at the end of some globalised rainbow.

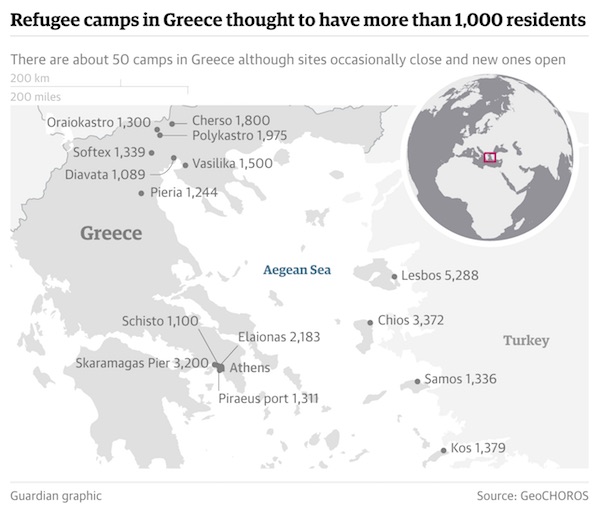

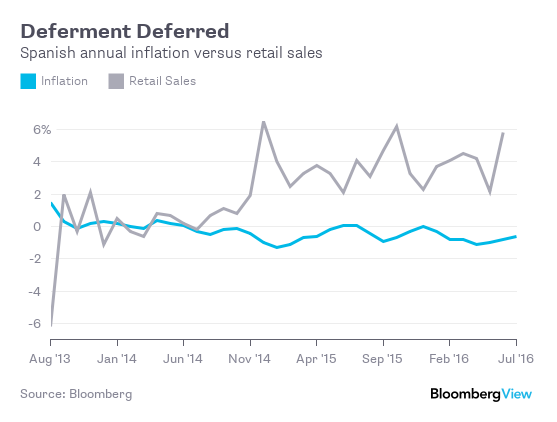

And when that response proved too feeble, our Presidents and Prime Ministers, men and women with impeccable anti-statist neoliberal credentials, embarked upon a spree of nationalising banks, insurance companies and automakers that put even Lenin’s 1917 exploits to shame. Ten years on, the crisis unleashed in Wall Street in 2008 is still with us. It takes different forms in different countries (i.e. a Great Depression in places like Greece, a scourge of middle class savers in countries like Germany, history’s greatest sponsor of brutal inequality in the United States, a permanent cause of geopolitical and trade tensions in Asia, Eastern Europe etc.). It migrates from continent to continent, from country to country. It morphs from an unemployment-generator to a deflation-machine, to another banking crisis, to a maximiser of trade and capital global imbalances.

Given their role in the whole crisis, why do these banks still exist?

• Greek Bank Profits Are Hurt By Credit Contraction (K.)

The return of Greek banks to profit becomes particularly fragile as long as the credit contraction persists. The reduction of loan issues, which has gone on for almost a decade, is depriving the credit system of its main source of revenues – takings from interests – while undermining efforts to improve the expenditure index that in the first half of the year deteriorated for local banks. Domestic lenders’ January-June financial results point to a fresh reduction in interest revenues, ranging from -1.5% to -22.5%, depending on the bank.

At the same time, revenues from commissions have increase by between 0.5% and 5.5% as banks have shifted their focus to increasing takings from commissions, especially after the imposition of capital controls in June 2015. However, the commissions are just a fraction of the interest revenues and cannot offset the losses from the main source of operating profits of banks. The biggest drop in interest revenues in the first half of the year belonged to National Bank (-22.5% to 564.4 million euros), which is attributed to the application of the new accounting standards (IFRS 9) in the first quarter and the repricing of mortgage loans amounting to 800 million euros. At the same time the NBG’s loan issues dropped 7.1% year-on-year.

Perfecting the art of faking it.

• Greek PM Promises Relief Measures After Years Of Austerity (G.)

Greek prime minister Alexis Tsipras has announced a raft of relief measures “to mend wounds” created during Greece’s prolonged economic crisis, as he attempts to recover the popularity he has lost since enforcing contentious austerity measures. In his first major policy address since debt-stricken Athens ended more than eight years of foreign tutelage under international bailout in August, the leftist leader pledged to raise wages, cut taxes and forge ahead with welfare spending. Far from backsliding on the fiscal progress the crisis-plagued country has made, the counter measures would help kickstart growth, Tsipras said, hailing a “new era of rebirth”.

“Higher wages, labour market regulation and respect for labour rights … are a prerequisite for growth,” he told delegates attending the Thessaloniki International Fair where annual economic policy goals are traditionally laid out. “The Greek economy is stabilised … we are a normal country now.” Tsipras said the tax cuts will include dramatically reducing a property levy for those worst affected by the crisis in 2019, and lowering sales VAT in 2021. Corporate tax, the bane of business development in the nation long on the frontline of the euro crisis, would be reduced from 29% to 25% by 2022. “It is the least we can do to mend wounds, reduce great burdens and create a growth dynamic in the Greek economy,” Tsipras said.

Other measures ranged from reinstating collective wage bargaining – a highly sensitive point among international creditors who have sought to trim the power of unions – and applying retroactive pay rises worth €1bn for university professors, the police, military and judiciary. [..] On Sunday, in his annual state of the nation press conference, Tsipras said because Greece was “outperforming all fiscal targets” his government would not only meet the new goals but argue that other cuts Athens has committed to were no longer necessary. At the behest of eurozone creditors the government has agreed to further scale back pensions in January 2019. “The economy is doing well,” Tsipras told reporters assembled in Thessaloniki. “I don’t know if you understand that, but the economy is doing well.”

By someone who doesn’t support it.

• Petition To Offer Assange Asylum To Be Presented To New Zealand Parliament (RT)

A petition with thousands of signatures supporting Julian Assange’s political asylum will be presented to New Zealand’s parliament. Labour Party politician Greg O’Connor said while he personally does not support Assange obtaining asylum in NZ, he will present the petition to parliament after more than 2,000 people signed their names in support of the WikiLeaks founder, reports Newstalk ZB. The parliamentary petition, launched in July 2018, will now be delivered to the Clerk of the house for allocation to a select committee for formal consideration. The ‘Free Assange NZ’ group said they haven’t forgotten the Australian’s plight and are following whistleblower Chelsea Manning on her tour of the country to remind people of the petition and its political progress. On Saturday night Assange supporters gathered outside the Embassy Theatre where Manning was speaking.

Let’s see them.

• US Lawyers Say They Have ‘Explosive’ Documents About Monsanto In Europe (EN)

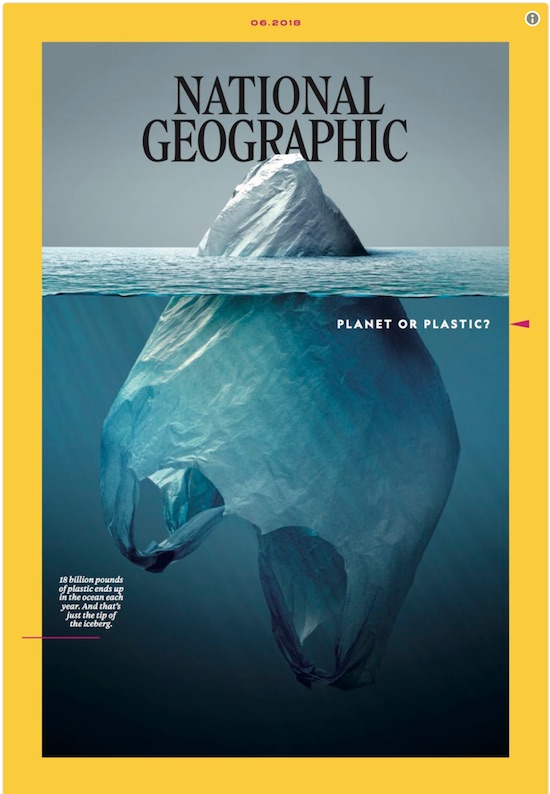

US lawyers say they have “explosive” documents about crisis-hit agribusiness giant Monsanto and their affairs in Europe. Those involved in a successful lawsuit against the firm have been in Brussels, addressing a European Parliament special committee. Last month, Monsanto was ordered to pay 289 million dollars to a former school groundskeeper dying of cancer, after it was agreed the firm’s Roundup weedkilled contributed to his disease. “What we have is the tip of the iceberg. And in fact we have documents now in our possession, several hundreds documents, that have not been declassified and some of those are explosive,” said US lawyer Robert Jr. Kennedy.

“And many of them are pertinent to what Monsanto did here in Europe. And that’s just the beginning.” Beyond the environmental battle, what’s happened also raises the issue of transparency. For one Green MEP, the US legal battle is also one for democracy. “They are fighting a fight for more democracy and for transparency and to get a better insight in how big corporation such as Monsanto act and try to manipulate the facts,” said Belgium’s Bart Staes. Last November, the EU approved the use of glyphosate, a chemical used in Monsanto’s Roundup product, for five years after a heated debate over whether it causes cancer.

Britain has shrunk to a sixe too small to have overseas territories.

• Turtles, Whales And Birds Under Threat From Brexit Funding Cuts (Ind.)

Whales migrating across the Atlantic Ocean, turtles in the Caribbean and unique cloud forests in St Helena are all under threat as EU conservation projects are set to grind to a halt after Brexit. Following reports of the Falkland Islands’ penguins entering troubled waters as European funding dries up, conservationists working across Britain’s overseas territories have raised the alarm about the wider impact of this lost money. Due to their unusual status as neither fully parts of the UK nor independent states, these territories cannot access most domestic and international funding. This means EU money has offered a lifeline, and supports around a third of their conservation efforts.

There is currently no plan to make up for the shortfall that will emerge when existing projects finish. Stretching from the British Antarctic Territory to the Cayman Islands, the 14 UK overseas territories are home to hundreds of creatures found nowhere else on Earth. “There’s lots still unknown about the territories, they are quite a frontier,” said Jonathan Hall, who leads the RSPB’s overseas territories operations. “But they do hold at least 1,500 unique species – compared to the UK which has about 90.” These forgotten corners of the globe are home to more penguins than any other nation, a third of the world’s albatrosses and the largest coral atoll on the planet.

Many of the animals and plants found in these territories are critically endangered, and scientists estimate there are more than 2,000 species still awaiting discovery in their forests and lagoons. As the Brexit date looms, the government has promised to continue supporting ongoing projects in these regions, but beyond that local environmental groups are worried about how they will stay afloat. “It’s a huge concern,” said Charlie Butt, Caribbean territories programme manager at the RSPB. “The loss of a third of funding would be catastrophic from a conservation perspective.”