Claude Monet The Manneporte at Étretat 1886

Please Note: The mailing lists I’ve used for many years all of a sudden stopped working. This appears to be because there is some sort of discrepancy between Gmail and Apple Mail. I’ve lost all access to one Gmail account in Apple Mail, though it still works in a browser. Two other Gmail accounts still function in Apple Mail, but bounce back all mails sent as part of the mailing lists. Working on a solution.

Ilargi

Not all that glitters is gold.

• America’s Sub-4% Unemployment Rate Means A Recession Is Not Far Off (Colombo)

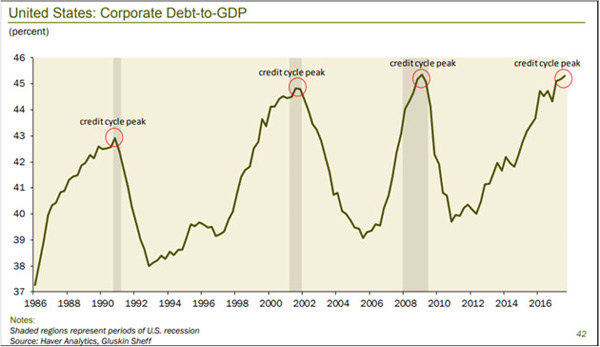

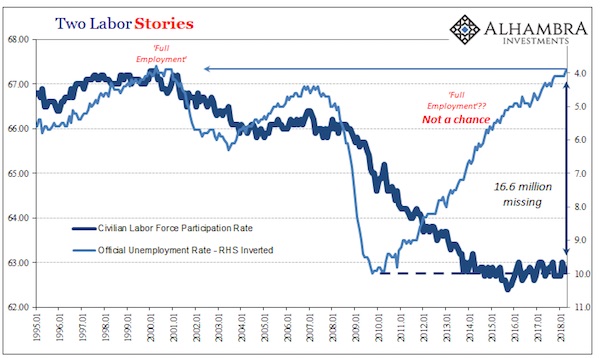

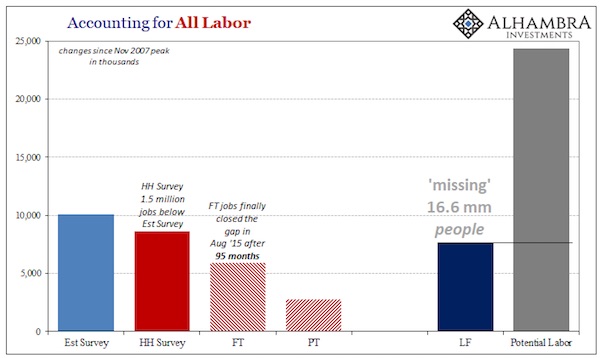

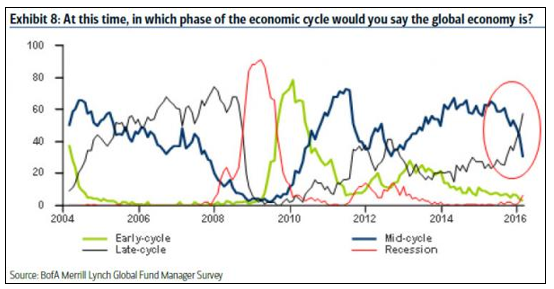

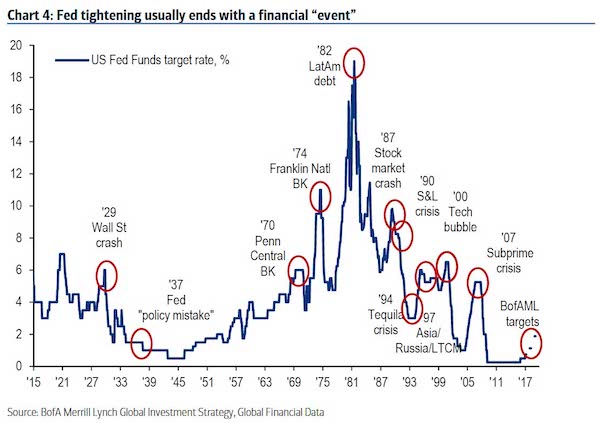

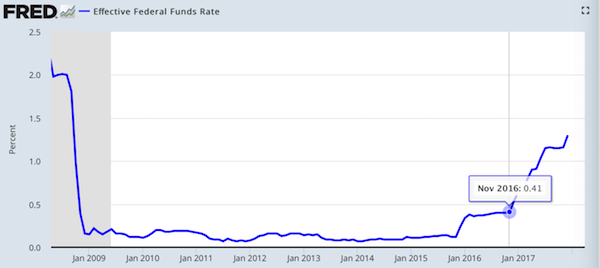

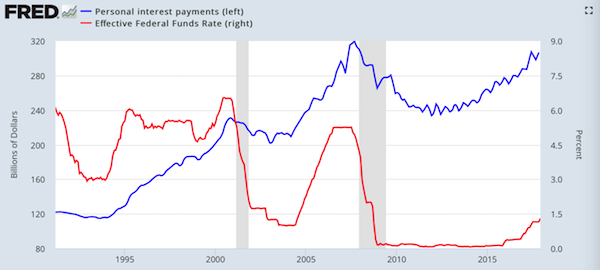

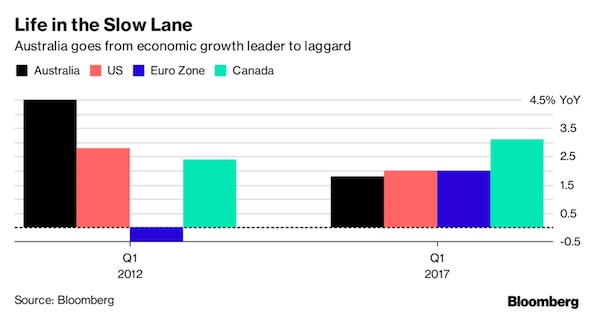

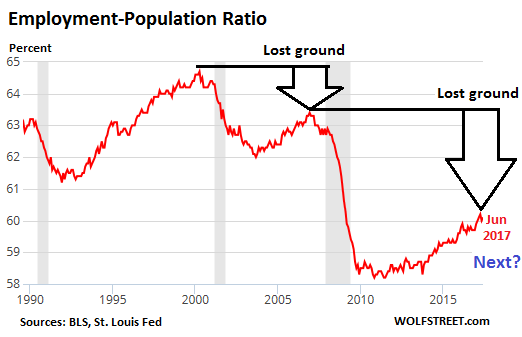

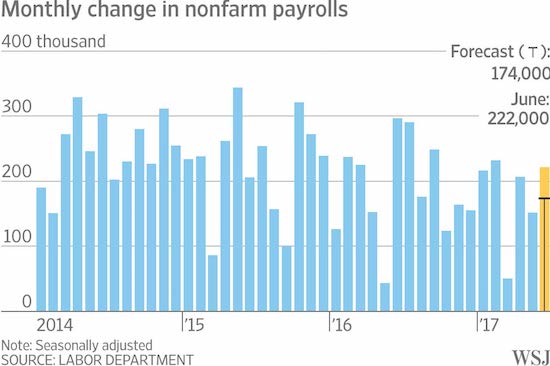

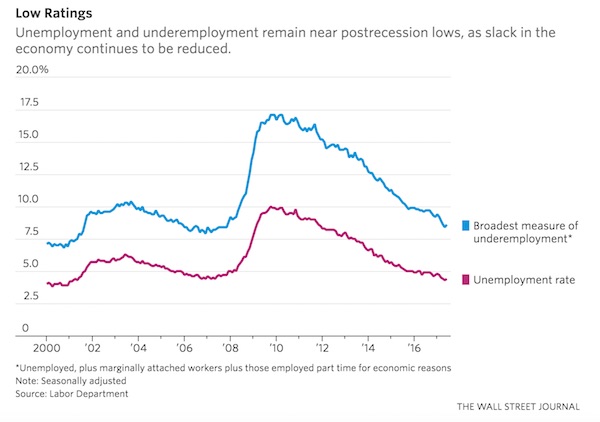

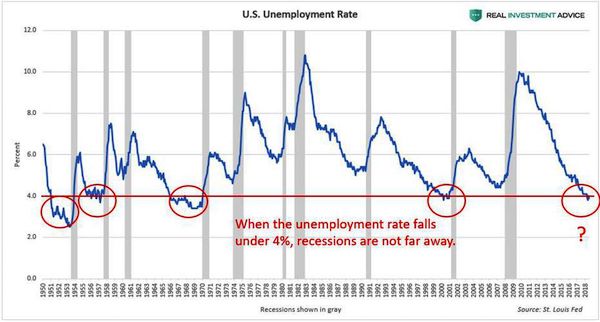

The strong job market has become a reason for optimism for many Americans in the past couple years in stark contrast to the dark days of the Great Recession and the ensuing “jobless recovery.” The unemployment rate fell beneath 4% for the past several months, weekly jobless claims are at a 49-year low, and wages are growing at their fastest rate since 2009. So, what’s not to like? Obviously, everyone likes good news on the economic front, but these strong job market statistics are a sign that the economic cycle is much closer to the end (including a recession and bear market) rather than the beginning. As the chart below shows, when the U.S. unemployment rate falls under 4%, recessions follow soon after (recessions are marked by the gray shaded areas on the chart).

Historically, U.S. unemployment under 4% is quite rare and typically occurs after a long, powerful economic expansion. By the time the unemployment rate is under 4%, the economic cycle is already mature, the labor market is tight, and inflation is becoming a concern. At this time, the Federal Reserve has been hiking interest rates steadily, which eventually causes the demise of the economic cycle. According to Nicole Smith, chief economist at the Georgetown University Center on Education and the Workforce: “The 4 percent number is not exactly a number that economists are necessarily happy with.” “What’s been happening here is, if we look historically at other times when the unemployment rate has fallen below 4 percent, it’s times where it was the boom phase just before recession or just after a major war period.”

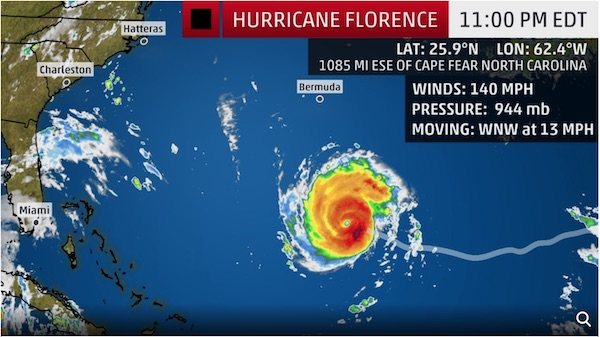

Florence is dangerous. Get out of the way.

• Mass Evacuations Ordered As Hurricane Florence Heads Toward Carolinas (R.)

Mass evacuations were ordered along the U.S. Atlantic Coast as Hurricane Florence, a Category 4 storm and the most powerful to menace the region in nearly three decades, barreled toward the region on Tuesday. Governor Ralph Northam issued an evacuation order for about 245,000 residents in flood-prone coastal Virginia beginning at 8 a.m. local time while South Carolina Governor Henry McMaster has ordered more than 1 million residents along his state’s coastline to leave starting at noon on Tuesday. “This is a serious storm and it’s going to effect the entire state,” Northam told a news conference. “Everyone in Virginia needs to prepare.”

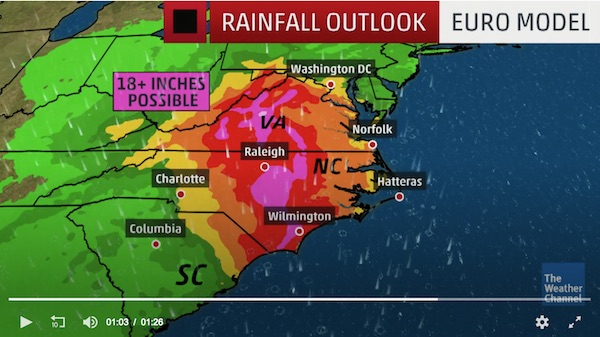

Florence, packing winds of 140 miles per hour (220 kph), was expected to grow even stronger before making landfall on Thursday, mostly likely in southeastern North Carolina near the South Carolina border, the National Hurricane Center in Miami said. North Carolina Governor Roy Cooper told a news conference his state was in “the bull’s eye.” At least 250,000 more people were due to be evacuated from the northern Outer Banks in North Carolina on Tuesday after more than 50,000 people were ordered on Monday to leave Hatteras and Ocracoke, the southernmost of the state’s barrier islands.

North Carolina, South Carolina, Virginia and Maryland governors have declared states of emergency. Authorities warned of life-threatening coastal storm surges and the potential for Florence to unleash prolonged torrential rains and widespread flooding, especially if it lingers inland for several days. NHC Director Ken Graham warned of “staggering” amounts of rainfall that may extend hundreds of miles inland and cause flash flooding across the mid-Atlantic region.

If the UK change their positions, that is.

• EU’s Barnier Says Brexit Deal Still ‘Realistic’ As Deadline Looms (Ind.)

It is “realistic” to believe Britain and the EU will sign a Brexit withdrawal agreement before the looming deadline, Michel Barnier has said. Speaking at the Bled Strategic Forum conference in Slovenia the EU’s chief negotiator said a deal was “possible” in the next six to eight weeks – the cutoff date set for talks. The pound jumped by nearly 1 per cent against the dollar on the foreign exchange markets following the comments, after traders apparently over-interpreted the official’s words. “If we are realistic, I want to reach an agreement on the first stage of the negotiation, which is the Brexit treaty, within six or eight weeks,” Mr Barnier said.

He added: “The treaty is clear, we have two years to reach an agreement before they leave… in March 2019. “That means that taking into account the time necessary for the ratification process in the House of Commons on one side, the European Parliament and the Council on the other side, we must reach an agreement before the beginning of November. I think it is possible.” The episode comes around a week after jumpy financial markets also boosted the pound after Mr Barnier repeated his mantra about wanting to do an ambitious and unique trade deal with the UK. Though little has changed on the ground, both sides of talks are staying publicly positive – if only to give them the upper hand in any ensuing blame game that follows a no deal.

“..a cast of rogue spooks from the CIA, various FBI officers, and British Intelligence in a scheme that is now going to grand juries.”

The likely confirmation of Brett Kavanaugh may be a last straw for the “Resistance.” It would certainly affect the adjudication of any new disputes that arise over relations between Mr. Trump and Special Counsel Robert Mueller in the weeks ahead. The Mueller investigation into 2016 election “collusion” between Russia and Trump looks more and more like a case of displacement-projection syndrome, since dumpster-loads of evidence now point to collusion between the Hillary campaign, the DNC, a cast of rogue spooks from the CIA, various FBI officers, and British Intelligence in a scheme that is now going to grand juries.

All that nasty business, starting with the news that a grand jury has been secretly grilling former FBI Deputy Director Andrew McCabe for weeks, suggests that events are about to unspool dramatically. The story has been coiling for months as fresh documents emerge and officials, such as the DOJ Inspector General, confirm what they mean. It remains to be seen whether the Web chatter about dozens of “sealed indictments” coming down is horse-shit. The baffling part is the role of Attorney General Jeff Sessions. I’m inclined to doubt that Mr. Trump’s regular vilifications of Sessions are a ruse, meant to mislead the media about the AG’s activities in these matters. But the DC Swamp is unnerved by Sessions’ extraordinary absence of presence on the scene. Has he actually been involved in any of this, or is he playing animal lotto on his desk?

The Korea’s want peace and unison. Let nobody put a loophole, a loophole in their way.

• Kim Jong Un Asks Trump For Another Meeting In ‘Very Warm’ Letter (R.)

U.S. President Donald Trump received a “very warm, very positive” letter from North Korean leader Kim Jong Un asking for a second meeting and the White House is looking at scheduling one, White House spokeswoman Sarah Sanders said on Monday. The two countries have been discussing North Korea’s nuclear programs since their leaders met in Singapore in June, although that summit’s outcome was criticized for being short on concrete details about how and whether Kim is willing to give up weapons that threaten the United States. The likely timing of a second Trump-Kim meeting was unclear.

South Korea’s President Moon Jae-in is scheduled to have his third summit with Kim next week in Pyongyang, and his government had pushed for a three-way summit involving Trump, with the aim of agreeing a joint declaration to end the 1950-53 Korean War. The conflict ended with an armistice, not a peace treaty, leaving the U.S.-led United Nations forces including South Korea technically still at war with North Korea. While South Korea had hoped an accord formally ending the conflict could have been unveiled on the sidelines of the U.N. General Assembly later this month, Moon’s security chief Chung Eui-yong said last week, without elaborating, that the necessary conditions for a three-way meeting were missing.

The ICC was only ever meant to go after Arican dictators fallen out of favor with the west. Bolton protects himself and his ilk.

• US Threatens To Arrest ICC Judges Who Probe War Crimes (AFP)

The United States threatened Monday to arrest and sanction judges and other officials of the International Criminal Court if it moves to charge any American who served in Afghanistan with war crimes. White House National Security Advisor John Bolton called the Hague-based rights body “unaccountable” and “outright dangerous” to the United States, Israel and other allies, and said any probe of US service members would be “an utterly unfounded, unjustifiable investigation.” “If the court comes after us, Israel or other US allies, we will not sit quietly,” Bolton said. He said the US was prepared to slap financial sanctions and criminal charges on officials of the court if they proceed against any Americans.

“We will ban its judges and prosecutors from entering the United States. We will sanction their funds in the US financial system, and we will prosecute them in the US criminal system,” Bolton said. “We will do the same for any company or state that assists an ICC investigation of Americans.” Bolton made the comments in a speech in Washington to the Federalist Society, a powerful association of legal conservatives. Bolton pointed to an ICC prosecutor’s request in November 2017 to open an investigation into alleged war crimes committed by the US military and intelligence officials in Afghanistan, especially over the abuse of detainees. [..] He also cited a recent move by Palestinian leaders to have Israeli officials prosecuted at the ICC for human rights violations.

Veteran Intelligence Professionals for Sanity (VIPS) is made up of former intelligence officers, diplomats, military officers and congressional staffers.

• Moscow Has Upped the Ante in Syria (VIPS)

Mr. President:

We are concerned that you may not have been adequately briefed on the upsurge of hostilities in northwestern Syria, where Syrian armed forces with Russian support have launched a full-out campaign to take back the al-Nusra/al-Qaeda/ISIS-infested province of Idlib. The Syrians will almost certainly succeed, as they did in late 2016 in Aleppo. As in Aleppo, it will mean unspeakable carnage, unless someone finally tells the insurgents theirs is a lost cause. That someone is you. The Israelis, Saudis, and others who want unrest to endure are egging on the insurgents, assuring them that you, Mr. President, will use US forces to protect the insurgents in Idlib, and perhaps also rain hell down on Damascus.

We believe that your senior advisers are encouraging the insurgents to think in those terms, and that your most senior aides are taking credit for your recent policy shift from troop withdrawal from Syria to indefinite war. Russian missile-armed naval and air units are now deployed in unprecedented numbers to engage those tempted to interfere with Syrian and Russian forces trying to clean out the terrorists from Idlib. We assume you have been briefed on that — at least to some extent. More important, we know that your advisers tend to be dangerously dismissive of Russian capabilities and intentions. We do not want you to be surprised when the Russians start firing their missiles.

The prospect of direct Russian-U.S. hostilities in Syria is at an all-time high. We are not sure you realize that. The situation is even more volatile because Kremlin leaders are not sure who is calling the shots in Washington. This is not the first time that President Putin has encountered such uncertainty . This is, however, the first time that Russian forces have deployed in such numbers into the area, ready to do battle. The stakes are very high. We hope that John Bolton has given you an accurate description of his acerbic talks with his Russian counterpart in Geneva a few weeks ago. In our view, it is a safe bet that the Kremlin is uncertain whether Bolton faithfully speaks in your stead, or speaks INSTEAD of you.

A government spending million to support what it itself has labeled ‘terrorists’. We’re not even surprised. Standard fare in the west.

• Netherlands Ends Support To Syrian Militants & White Helmets (RT)

The Netherlands has decided to end its support to militants in Syria, since the program did not yield “expected” results. The move comes as journalists found one of the groups had been labeled as terrorists by the country itself. “The opportunity to quickly change the situation [in Syria] is extremely small,” reads the letter the lower house of the parliament by Dutch Foreign Minister Stef Blok and Minister for Foreign Trade Sigrid Kaag, announcing the end of support programs for the militants in Syria. The program to support of “moderate” anti-government groups in Syria was established in close cooperation with “like-minded donors who pursued the same goals as the Netherlands” and cost the country over $80 million over the years, according to the document.

It failed to “bring the expected results,” however, and is to be closed since the Syrian troops “will soon win” the war against militant groups. Over the years, the Netherlands allocated $29 million to the so-called “non-lethal assistance” (NLA) program, $14.5 million were donated to the so-called White Helmets and $17.1 million went to the Access to Justice and Community Service (AJACS) program. The AJACS was supposedly designed to support “community police” work in Syria, specifically the so-called Free Syrian Police (FSP) group. The support for militants is set to end immediately, yet the White Helmets will be funded until December, according to the document.

Since the White Helmets now operate only in the Idlib province, which is believed to be the destination of the looming offensive by the Syrian Army and its allies, their future is quite doubtful, the document states. [..] The “non-lethal” goods supplied by the Dutch government included satellite phones, uniforms, assorted equipment and even the ‘iconic’ Toyota Hilux pick-up trucks, widely used by various militant groups in Syria. At least one of the groups supplied by the Netherlands, Jabhat al-Shamiya, turned out to be labeled a terrorist group by the country’s own justice department, the journalists have revealed. One Dutch man is currently prosecuted for joining the group back in 2015, with the indictment describing it as a “salafist and jihadist” movement which can qualify only as a “criminal organization with terrorist intent.”

What year is it?

• Catalan Separatists Plan Mass Rally Tuesday For Independence From Spain (R.)

Hundreds of thousands of Catalans are expected to fill the streets of Barcelona on Tuesday for the Spanish region’s first commemorative day since its leader declared independence last year and pitched the country into constitutional crisis. Supporters of splitting the wealthy northeastern region from the rest of Spain have in recent years used the Sept. 11 “Diada”, the anniversary of the fall of their coastal capital to Spanish forces in 1714, to promote the cause. This year, Catalonia’s leader Quim Torra, who took over from his exiled predecessor after Madrid ended an unprecedented period of direct rule, has called for a mass rally in support of his bid for a binding referendum on independence.

“Our government has committed to making the republic a reality,” Torra said in a televised address to mark the occasion. “I wish you all a very good Diada. Long live free Catalonia.” He wore a yellow ribbon signifying support for nine politicians whose jailing for their role in the independence bid is one of the Catalan government’s biggest grievances. Socialist Prime Minister Pedro Sanchez, who took power in June, has taken a softer approach to one of the thorniest issues in national politics than that of his conservative predecessor Mariano Rajoy, but he has stood firm against allowing a vote on secession, or any unilateral attempt by Catalonia to secede.

Last year’s Diada, in which marchers often climb on each other’s shoulders in shows of the traditional sport of forming human towers, fell as the regional government was preparing to hold a referendum in defiance of Madrid, which ultimately sent riot police to try to stop the vote.

Sovereignty, 2018.

• Creditors Warn Greece On Debt Relief As Inspectors Return (AP)

Greece’s lead creditor warned the country on Monday not to stray from reforms agreed upon before the end of its international bailout, as European monitors arrived to check the nation’s finances. The five-day inspection is expected to focus on government promises over the weekend to offer tax relief as well as plans to scrap promised pension cuts that are due to take effect in 2019. Klaus Regling, managing director of the European Stability Mechanism, the eurozone’s rescue fund, told Austria’s Die Presse newspaper that Greece’s needed to stick to its commitments. “We are a very patient creditor. But we can stop debt relief measures that have been decided for Greece if the adjustment programs are not continued as agreed,” he said.

“The debt level appears to be frighteningly elevated. But Greece can live with that as the loan maturities are very long and the interest rates on the loans are much lower than in most other countries.” Left-wing Prime Minister Alexis Tsipras is trailing opposition conservatives in opinion polls and must call a general election within the next 12 months. Amid large protest rallies led by labor unions over the weekend, the prime minister said that relief measures promised to taxpayers would not jeopardize fiscal performance targets and would be introduced gradually. Greece has promised to deliver high primary surpluses — the budget balance before calculating the cost of servicing debt — for years to come, along with a series of reforms in exchange for better debt repayment terms.

The end of the bailout means Greece will have to return to international capital markets to finance itself. However, the country faces a troubled return after the financial turmoil in Turkey and Italy halted a decline in Greek borrowing rates. The yield on Greece’s 10-year-bond remains above 4 percent. The bailout program ended Aug. 20 but the country’s debt level remains near 180 percent of gross domestic product.

Let’s see what happens in the next 30 days.

• Greece’s Moria Migrant Camp Faces Closure Over Living Conditions (K.)

The Regional Authority of the Northern Aegean has given the Ministry of Migration Policy 30 days to clean up the overcrowded Moria hot spot for migrants and refugees on the island of Lesvos, or face closure. The announcement is part of a report compiled by environmental and health inspectors from Lesvos’ public health directorate who found the camp is unsuitable and dangerous for public health and the environment. According to the report, inspectors said there is an uncontrolled wastewater spill at the entrance of the camp, which ends into an adjacent stream or even on the road.

In another section of the camp, toilet waste pipes are broken, resulting in a strong stench and creating a danger to public health. Inspectors said the overcrowding living conditions in Moria, in which up to 15 people are squeezed into the small houses and up to 150 in every tent, increases the risk of disease transmission. “There was also a strong stench and insects (flies) due to the inability to properly clean the living quarters,” the report added. North Aegean Regional Governor Christiana Kalogirou says the ministry will have to restore every damage or problem detailed in the report, otherwise the authority will forbid the hot spot’s operation.

It’ll take years to assess the damage. And then it’ll be too late.

• US Teens Prefer Remote Chats To Face-to-Face Meeting (AFP)

American teenagers are starting to prefer communicating via text instead of meeting face-to-face, according to a study published Monday by the independent organization Common Sense Media. Some 35% of kids aged 13 to 17 years old said they would rather send a text than meet up with people, which received 32%. The last time the media and technology-focused nonprofit conducted such a survey in 2012, meeting face-to-face hit 49%, far ahead of texting’s 33%. More than two-thirds of American teens choose remote communication — including texting, social media, video conversation and phone conversation — when they can, according to the study. In 2012 less than half of them marked a similar preference.

Notably, in the six-year span between the two studies the proportion of 13 to 17-year-olds with their own smartphone increased from 41 to 89%. As for social networks, 81% of respondents said online exchange is part of their lives, with 32% calling it “extremely” or “very” important. The most-used platform for this age group is Snapchat (63%), followed by Instagram (61%) and Facebook (43%). Some 54% of the teens who use social networks said it steals attention away from those in their physical presence. Two-fifths of them said time spent on social media prevents them from spending more time with friends in person. The study was conducted online with a sample of 1,141 young people ages 13 to 17, from March 22 to April 10.