Paul Gauguin Nevermore 1897

Negotiating.

• Trump Sets Tariffs On $50 Billion In Chinese Goods; Beijing Strikes Back (R.)

U.S. President Donald Trump said he was pushing ahead with hefty tariffs on $50 billion of Chinese imports on Friday, and the smoldering trade war between the world’s two largest economies showed signs of igniting as Beijing immediately vowed to respond in kind. Trump laid out a list of more than 800 strategically important imports from China that would be subject to a 25 percent tariff starting on July 6, including cars, the latest hardline stance on trade by a U.S. president who has already been wrangling with allies.

China’s Commerce Ministry said it would respond with tariffs “of the same scale and strength” and that any previous trade deals with Trump were “invalid.” The official Xinhua news agency said China would impose 25 percent tariffs on 659 U.S. products, ranging from soybeans and autos to seafood. China’s retaliation list was increased more than six-fold from a version released in April, but the value was kept at $50 billion, as some high-value items such as commercial aircraft were deleted.

Soybeans R Us.

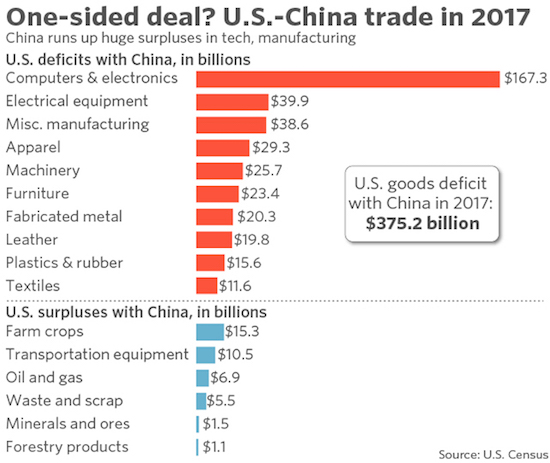

• Why The U.S.-China Trade Deficit Is So Huge (MW)

President Donald Trump will let tariffs on Chinese goods worth up to $50 billion take effect after talks between the two countries failed to appease White House demands on reducing huge U.S. trade deficits. The U.S. has run large deficits with China for years and in some cases no longer produces certain goods such as consumer electronics that are popular with Americans. It won’t be easy, and it might even be impossible, to reduce the gap much any time soon. In 2017, the U.S. posted a $375.6 billion deficit in goods with China.

Most glaring is the huge deficit in computers and electronics, but the U.S. is a net importer from China in most market segments except for agriculture. The U.S. is excluding Chinese-made cellphones and televisions from its tariffs. China has been a big buyer of American-grown soybeans and other crops. Planes made by Boeing also are a product in demand in China. What happens next? Trump has vowed to increase tariffs if China retaliates, but the Chinese promised to return the favor. A trade dispute between the two largest economies in the world could result in lasting damage to the global economy if it metastasizes.

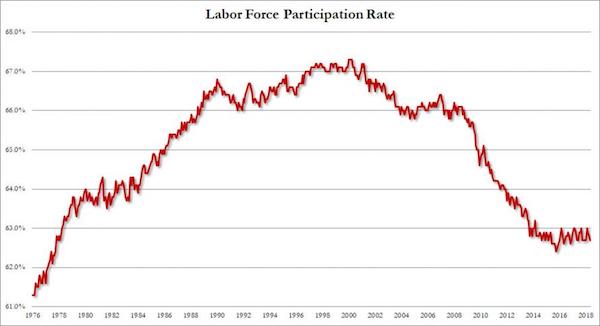

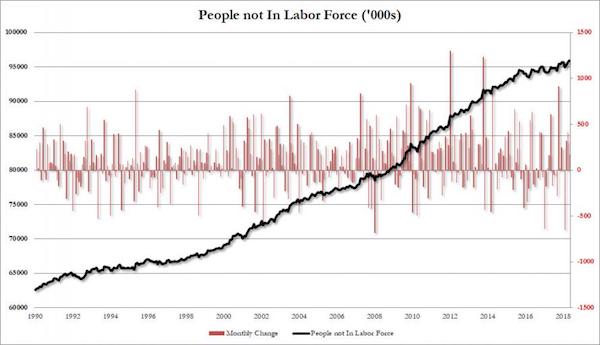

What happens when there is no price discovery.

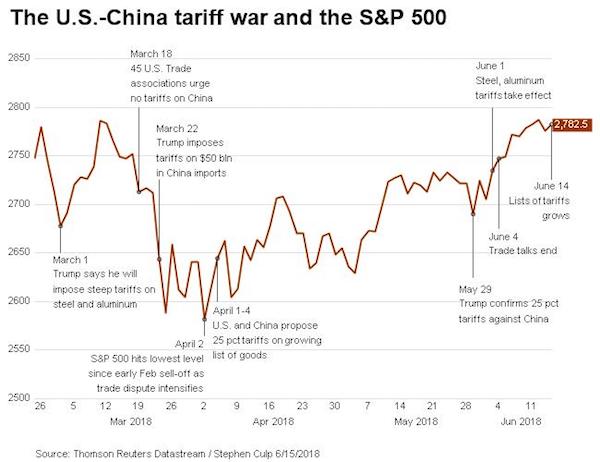

• Wall Street Builds Immunity To Trade War Rhetoric (R.)

Fears of tariffs and a potential global trade war have jostled U.S. stocks over the past few months, but there is a sense among investors that the market is taking the drum beat of rhetoric and statements more in stride. In the latest salvo, U.S. President Donald Trump announced hefty tariffs on $50 billion of Chinese imports on Friday, and Beijing threatened to respond in kind. But even as the developments threatened to ignite a trade war between the world’s two largest economies, the equity market largely shrugged it off. The benchmark S&P 500 index ended down only 0.1 percent on Friday.

That paled compared to losses earlier in the year that were sparked by fears of a U.S.-China trade war that would be detrimental to economic growth. “The market has gotten reasonably comfortably numb to this tariff stuff,” said Chuck Carlson, chief executive officer at Horizon Investment Services in Hammond, Indiana. “They are becoming more accustomed to this being a first foray and negotiating tool.” The U.S. Customs and Border Protection is to begin collecting tariffs on an initial tranche of 818 Chinese product categories on July 6. “It’s kind of the cry-wolf syndrome,” said Peter Tuz, president of Chase Investment Counsel in Charlottesville, Virginia. “I think people fear the tariffs and the uncertainty about it, but think, ‘OK, this is just another negotiating point.’”

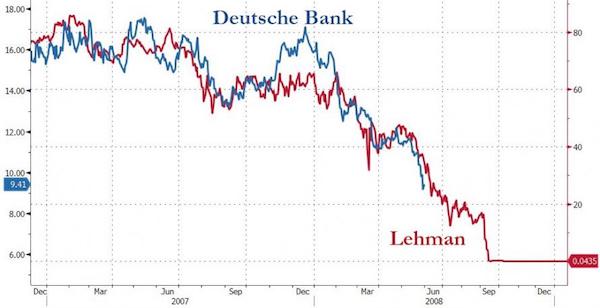

“..a de facto heist that has enabled the most dominant banks and central bankers to run the world”.

• Nomi Prins: The Central Banking Heist Has Put The World At Risk (UH)

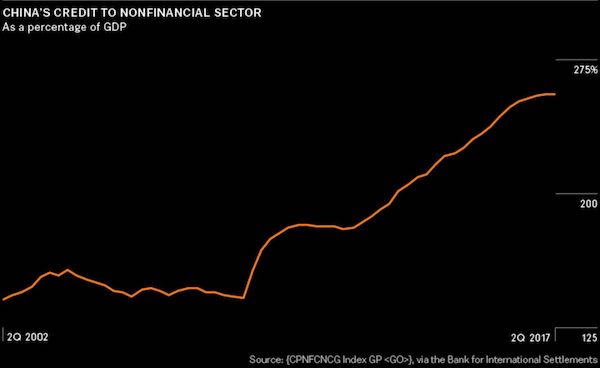

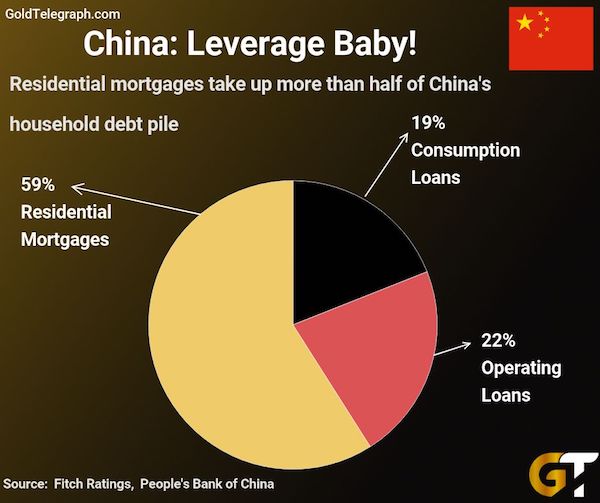

Over the last decade, she tells me when we meet in London, “under the guise of QE, central bankers have massively overstepped their traditional mandates, directing the flow of epic sums of fabricated money, without any checks or balances, towards the private banking sector”. Since QE began, in the aftermath of the financial crisis, “the US Federal Reserve has produced a massive $4.5 trillion of conjured money, out of a worldwide QE total of around $21 trillion”, says Prins. The combination of ultra-low interest rates and vast monetary expansion, she explains, has caused “speculation to rage … much as a global casino would be abuzz if everyone gambled using everyone else’s money”.

Much of this new spending power, though, has remained “inside the system”, with banks shoring up their balance sheets. “So lending to ordinary firms and households has barely grown as a result of QE,” says Prins, “nor have wages or prosperity for most of the world’s population”. Instead, “the banks have gone on an asset-buying spree”, she explains, getting into her stride, “with the vast flow of QE cash from central banks to private banks ensuring endless opportunities for market manipulation and asset bubbles – driven by government support”. Prins describes “the power grab we’ve seen by the US Federal Reserve, the European Central Bank, the Bank of Japan and other central banks”.

Using QE, she argues, “these illusionists have altered the nature of the financial system and orchestrated a de facto heist that has enabled the most dominant banks and central bankers to run the world”.

They run the world and they’re still failing. Follow the money.

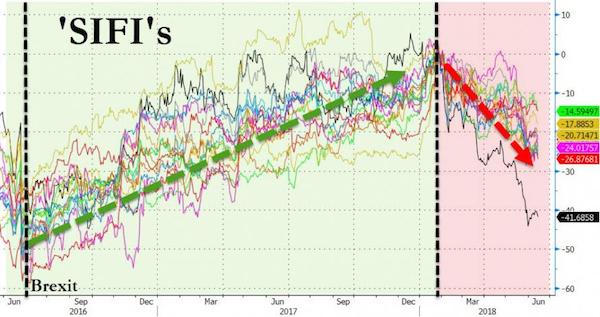

• Some Of The ‘Most Systemically Important Banks’ In The World Are Tumbling (ZH)

Since the Federal Reserve hiked rates, “big” US banks have dramatically underperformed “small” US banks, continuing a trend that has been going on since February… But it’s broader than that; this “big” bank blow-up is global. The stock prices of 16 of the most ‘Systemically Important Financial Institutions’ (SIFIs) in the world are now in bear market territory (down by 20% or more from their recent highs in dollar terms); and as the FT reports, this has caused Ian Hartnett, chief investment strategist at London-based Absolute Strategy Research, to issue his first “Black Swan” alert since 2009.

Of the 39 SIFIs, these are the 16 in bear market territory: Deutsche Bank, Nordea, ICBC, UniCredit, Crédit Agricole, ING, Santander, Société Générale, BNP Paribas, UBS, Agricultural Bank of China, AXA, Mitsubishi UFJ Financial Group, Bank of China, Credit Suisse and Prudential Financial. At some point, says Hartnett, central bankers will have to respond to bearish signals from almost half the global SIFIs, rather than continuing to tighten monetary policy: “The clue is in the name,” he said. “If these banks are supposed to be systemically important then policymakers ought to be watching them to see what is happening.” “The synchronised dips were a sign of global financial stress.”

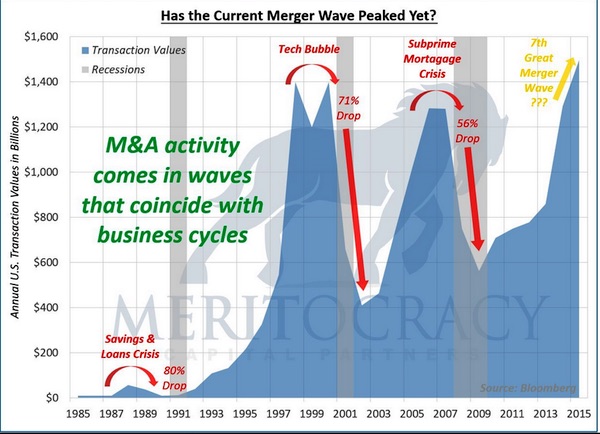

“..there has been $2 trillion in mergers in 2018, and its only June.”

We have written numerous articles describing how cheap money and poorly designed executive compensation packages encourage corporate actions that may not be in the best interest of longer-term shareholders or the economy. The bottom line in the series of articles is that corporations, in particular shareholders and executives, are willing to forego longer term investment for future growth opportunities in exchange for the personal benefits of short-term share price appreciation. Buybacks and mergers, both of which are fueled by the Federal Reserve’s ultra-low interest rate policy have made these actions much easier to accomplish.

On the other hand, corporate apologists argue that buybacks are simply a return of capital to shareholders, just like dividends. There is nothing more to them. Instead of elaborating about the longer term ill-effects associated with buybacks or the true short-term motivations behind many mergers, the powerful simplicity of the following two graphs stands on their own. The first graph, courtesy Meritocracy, shows how mergers tend to run in cycles. Like clockwork, merger activity tends to peak before recessions. Not surprisingly, the peaks tend to occur after the Federal Reserve (Fed) has initiated a rate hike cycle. The graph only goes through 2015, but consider there has been $2 trillion in mergers in 2018, and its only June.

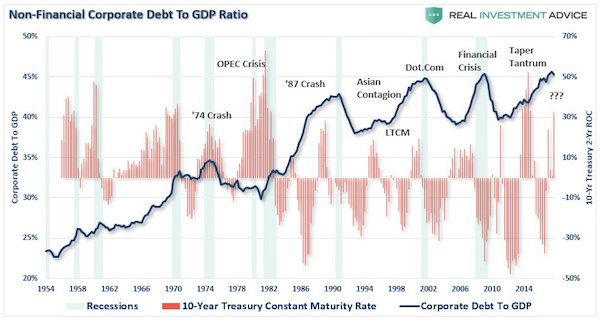

The following graph shows how corporate borrowing has accelerated over the last eight years on the back of lower interest rates. Currently, corporate debt to GDP stands at levels that accompanied the prior three recessions. There is a pattern here among corporate activities which seems similar to that which we see in investors. At the point in time when investors should be getting cautious and defensive as markets become stretched, they carelessly reach for more return. Based on the charts above, corporate executives do the same thing. The difference is that when an investor is careless, his or her net worth is at risk. A corporate executive on the other hand, loses nothing and simply walks away and frequently with a golden parachute.

The statement does have substance.

• The Key Word In The Trump-Kim Show (Escobar)

The Singapore joint statement is not a deal; it’s a statement. The absolutely key item is number 3: “Reaffirming the April 27, 2018, Panmunjom Declaration, the DPRK commits to work toward the complete denuclearization of the Korean Peninsula.” This means that the US and North Korea will work towards denuclearization not only in what concerns the DPRK but the whole Korean Peninsula. Much more than “…the DPRK commits to work toward the complete denuclearization of the Korean Peninsula”, the keywords are in fact “reaffirming the April 27, 2018, Panmunjom Declaration…” Even before Singapore, everyone knew the DPRK would not “de-nuke” (Trump terminology) for nothing, especially when promised just some vague US “guarantees”.

Predictably, both US neocon and humanitarian imperialist factions are unanimous in their fury, blasting the absence of “meat” in the joint statement. In fact there’s plenty of meat. Singapore reaffirms the Panmunjom Declaration, which is a deal between North Korea and South Korea. By signing the Singapore joint statement, Washington has been put on notice of the Panmunjom Declaration. In law, when you take notice of a fact, you can’t ignore it later. The DPRK’s commitment to denuclearize in the Singapore statement is a reaffirmation of its commitment to denuclearize in the Panmunjom Declaration, with all of the conditions attached to it. And Trump acknowledged that by signing the Singapore statement.

The Panmunjom Declaration stresses that: “South and North Korea confirmed the common goal of realizing, through complete denuclearization, a nuclear-free Korean Peninsula. South and North Korea shared the view that the measures being initiated by North Korea are very meaningful and crucial for the denuclearization of the Korean peninsula and agreed to carry out their respective roles and responsibilities in this regard. South and North Korea agreed to actively seek the support and cooperation of the international community for the denuclearization of the Korean Peninsula.”

The risk is real.

• Merkel’s Position As German Leader Under Threat Over Immigration Split (CNBC)

A split over immigration between Angela Merkel’s Christian Democratic Union (CDU) and its sister Christian Social Union (CSU) party is threatening to end her 12-year spell as Germany’s leader. Germany’s grand coalition government was formed in March after five months of political deadlock since an election the previous September. It resulted in Merkel’s fourth term as German chancellor. That vote saw a big upswing in support for the right-wing Alternative for Germany (AfD) party, who campaigned against Merkel’s open-door policy to refugees and migrants arriving from the Middle East and Africa.

Now the CSU, fearful of losing further support from its conservative base, is threatening to withdraw from the country’s grand coalition unless Merkel hardens her immigration stance. “My sources in Berlin say the situation is on a knife-edge right now, some are even giving it an 80 percent probability that Merkel will step down in the next two weeks,” said Nina Schick, director at political consultancy Rasmussen Global, in a telephone call to CNBC Friday. Schick, however, warned that writing Merkel off has long been a dangerous game. “The fundamental rule in German politics since 2006 is don’t underestimate Merkel,” she added.

CUT IT OUT! Bunch of crazies.

• US Government Says 2,000 Child Separations At Mexico Border In 6 Weeks (R.)

The government said on Friday that 1,995 children were separated from 1,940 adults at the U.S.-Mexico border between April 19 and May 31, as the Trump administration implements stricter border enforcement policies. The number represents a dramatic uptick from the nearly 1,800 family separations that Reuters reported had happened from October 2016 through February of this year. The official tally of separations is now nearly 4,000 children, not including March and the beginning of April 2018. In May, U.S. Attorney General Jeff Sessions announced a ‘zero tolerance’ policy in which all those apprehended entering the United States illegally would be criminally charged, which generally leads to children being separated from their parents.

The families were all separated so the parents could be criminally prosecuted, said a spokesman for the Department of Homeland Security, who declined to be named, on a call with reporters. “Advocates want us to ignore the law and give people with families a free pass,” said the official. “We no longer exempt entire classes of people.” The Department of Homeland Security did not immediately respond to a request to provide a breakdown of the age of children separated from their parents and held in custody, but the official said they do not separate babies from adults.

I said: CUT IT OUT!

• French Police Cut Soles Off Migrant Children’s Shoes – Oxfam (G.)

French border police have been accused of detaining migrant children as young as 12 in cells without food or water, cutting the soles off their shoes and stealing sim cards from their mobile phones, before illegally sending them back to Italy. A report released on Friday by the charity Oxfam also cites the case of a “very young” Eritrean girl, who was forced to walk back to the Italian border town of Ventimiglia along a road with no pavement while carrying her 40-day-old baby. The allegations, which come from testimony gathered by Oxfam workers and partner organisations, come two months after French border police were accused of falsifying the birth dates of unaccompanied migrant children in an attempt to pass them off as adults and send them back to Italy.

“We don’t have evidence of violent physical abuse, but many [children] have recounted being pushed and shoved or shouted at in a language they don’t understand,” Giulia Capitani, the report’s author, told the Guardian. “And in other ways the border police intimidate them – for example, cutting the soles off their shoes is a way of saying, ‘Don’t try to come back’.” Daniela Zitarosa, from the Italian humanitarian agency Intersos, said: “Police [officers] yell at them, laugh at them and tell them, ‘You will never cross here’. “Some children have their mobile phone seized and sim card removed. They lose their data and phonebook. They cannot even call their parents afterwards.”

France’s role is not pretty. Macron’s criticism of Italy unveils it.

• In ‘Calais of Italy’ Tension Soars Over Migrant Crisis (AFP)

Emmanuel Macron is not a welcome guest in the Italian border town of Ventimiglia, a flashpoint in Europe’s migration crisis. Residents are furious at the French president for charging Rome with “cynicism and irresponsibility” this week after it turned away a rescue boat carrying more than 600 asylum-seekers. “It’s bad what happened to the Aquarius (ship) but how dare Macron criticise Italy!” vented retired teacher Fulvia Semeria who volunteers for the Secours Catholique charity, a key aid group for migrants. “It’s unacceptable from a country that does nothing for migrants and even rejects them,” she said, calling his remarks “insulting and totally unfair”.

The pretty northern town at the gates of the French Riviera has received tens of thousands of asylum seekers pushed back by France since the eruption of Europe’s worst migration crisis three years ago. This is in addition to scores of desperate African refugees landing on its shores after undertaking the perilous journey across the Mediterranean. The influx has seen Ventimiglia dubbed the “Calais of Italy”, in reference to the French coastal town notorious for its sprawling migrant camps. [..] At least 16 migrants have died trying to cross from France into Italy since September 2016, falling off mountains, being hit by cars or electrocuted while hiding under train carriages.

Pretty crazy. All over a name change.

• Greek Police Hunt Golden Dawn Lawmaker Faced with Charges of Treason (GR)

A Golden Dawn lawmaker is on the run after Greece’s authorities issued an arrest warrant following his call in the parliament on Friday for the arrest of the country’s prime minister and president over the provisional ‘Macedonia’ name deal. According to reports, Konstantinos Barbarousis, who could face charges of high treason, escaped a police blockade late on Friday in the western region of Aetoloakarnania where he sought refuge. A huge police operation is under way to locate him and bring him to justice. Judicial authorities do not need Parliament’s approval to lift an MP’s immunity in the case of treason-related charges.

Speaking in Parliament, Barbarousis accused the government of “not legislating in the nation’s interests but in its own.” He called for a coup d’etat and asked on the Greek armed forces to “abide by their oath” and arrest Prime Minister Alexis Tsipras, Defense Minister Panos Kammenos and President Prokopis Pavlopoulos. His outburst led to his expulsion form the extremist party, as the speaker of the house barred any members of Golden Dawn speaking during the debate on a no-confidence motion against the government tabled after the Greece, FYROM agreement.