Gutzon Borglum Repairing the Face of Abraham Lincoln, Mount Rushmore 1962

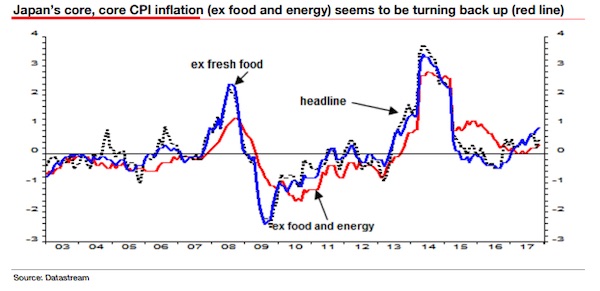

As Abenomics goes belly-up, so will a large segment of financial markets. Japan is done.

• Japan Will Trigger ‘The Great Unwind’ – Albert Edwards (MW)

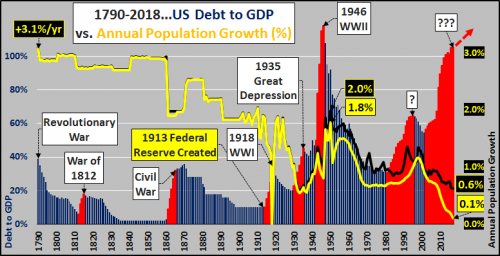

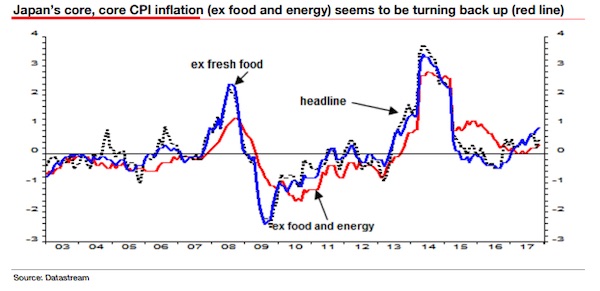

Japan is the catalyst that could bring the record-setting bull market for stocks across the globe to a screeching halt, according to Société Générale’s uberbear Albert Edwards. The prominent SocGen strategist says surprise monetary tightening in Japan could be the trigger that finally upend what has been an protracted and unrelenting global rally for assets considered risky. While most investors are busy eyeing rate increases in the U.S. and tapering by the ECB in the eurozone, Edwards says they should also watch developments in the world’s third-largest economy, Japan, where corporate profits are surging and inflation has picked up.

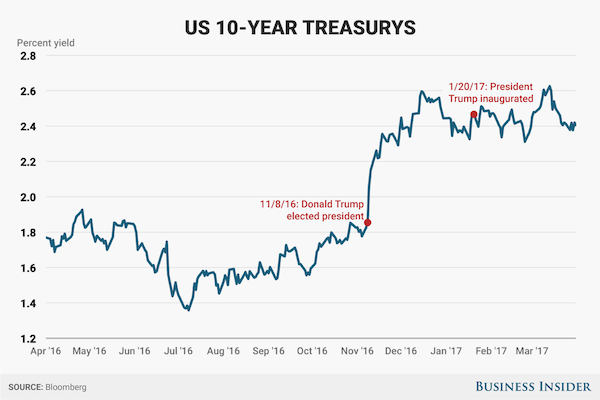

“We’ve been looking for surprises and one thing that can catch us out is if the Bank of Japan starts tightening. If it actually follows the Fed and the ECB and announces some sort of tapering,” he said, speaking at SocGen’s annual strategy conference in London on Tuesday. “This could be far more important than the Fed. A lot of major trends start with Japan. People don’t focus on Japan enough in my view,” he added. Investors on Tuesday got a taste of how BOJ tightening can rattle the markets. The central bank said it would buy less of its long-dated bonds, sparking speculation Gov. Haruhiko Kuroda could back away from its ultraloose monetary policy as early as this year. The surprise announcement sent global bond markets into spin on Tuesday. The yield on 10-year U.S. Treasury notes jumped above 2.5% to its highest since March and the 30-year bond yield logged its biggest one-day jump since Dec. 19.

[..] The BOJ has for years been among the most accommodative central banks in the world and as recent as December reaffirmed its commitment to aggressive qualitative and quantitative-easing program, also known as QQE. With inflation stubbornly running below the BOJ’s 2% annual target, the central bank has since early 2016 kept interest rates in negative territory and even introduced a 0%-target for its 10-year government bond yields to avoid deflation. The determined efforts by the BOJ to boost consumer prices have turned investors against the yen with data from the Commodity Futures Trading Commission showing an extreme bearishness toward the Japanese currency. However, downbeat investors on the yen could be caught flat-footed if inflation starts to pick up, prompting the BOJ to halt easing efforts, Edwards warned.

Read more …

A concerted effort to let markets implode. And blame Trump.

• Central Banks Ready To Pop The ‘Everything’ Bubble (Smith)

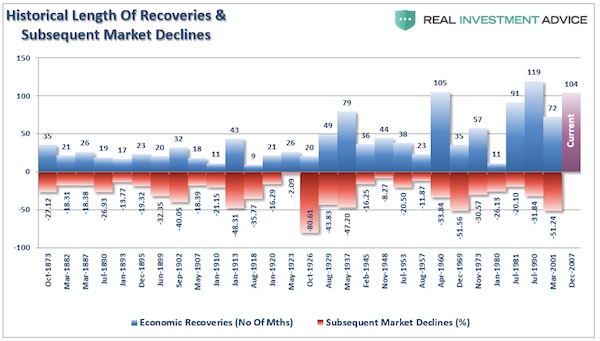

Many people do not realize that America is not only entering a new year, but within the next month we will also be entering a new economic era. In early February, Janet Yellen is set to leave the Federal Reserve and be replaced by the new Fed chair nominee, Jerome Powell. Now, to be clear, the Fed chair along with the bank governors do not set central bank policy. Policy for most central banks around the world is dictated in Switzerland by the Bank for International Settlements. Fed chairmen like Janet Yellen are mere mascots implementing policy initiatives as ordered. This is why we are now seeing supposedly separate central banking institutions around the world acting in unison, first with stimulus, then with fiscal tightening. However, it is important to note that each new Fed chair does tend to signal a new shift in action for the central bank.

For example, Alan Greenspan oversaw the low interest rate easy money phase of the Fed, which created the conditions for the derivatives and credit bubble and subsequent crash in 2008. Ben Bernanke oversaw the stimulus and bailout phase, flooding the markets with massive amounts of fiat and engineering an even larger bubble in stocks, bonds and just about every other asset except perhaps some select commodities. Janet Yellen managed the tapering phase, in which stimulus has been carefully and systematically diminished while still maintaining delusional stock market euphoria. Now comes the era of Jerome Powell, who will oversee the last stages of fiscal tightening, the reduction of the Fed balance sheet, faster rate increases and the final implosion of the ‘everything’ bubble.

As I warned before Trump won the election in 2016, a Trump presidency would inevitably be followed by economic crisis, and this would be facilitated by the Federal Reserve pulling the plug on fiat life support measures which kept the illusion of recovery going for the past several years. It is important to note that the mainstream media is consistently referring to Jerome Powell as “Trump’s candidate” for the Fed, or “Trump’s pick” (as if the president really has much of a choice in the roster of candidates for the Fed chair). The public is being subtly conditioned to view Powell as if he is an extension of the Trump administration. This could not be further from the truth. Powell and the Fed are autonomous from government.

[..] So, why is the media insisting on misrepresenting Powell as some kind of Trump agent? Because Trump, and by extension all the conservatives that support him, are meant to take the blame when the ‘everything’ bubble vaporizes our financial structure. Jerome Powell is “Trump’s guy” at the Fed; so any actions Powell takes to crush the recovery narrative will also be blamed on the Trump administration.

Read more …

Bond markets want their cake and eat it. First, low yields are a good thing; then rising yields show how good everything has become.

• The $50 Trillion Question for Bonds (BW)

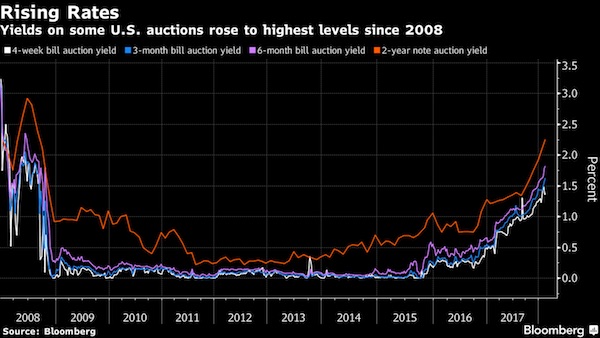

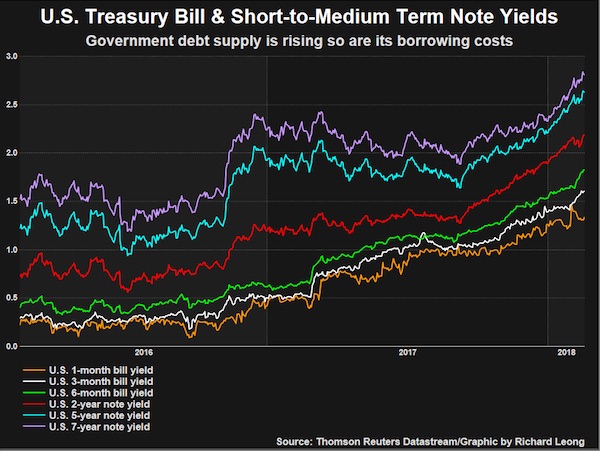

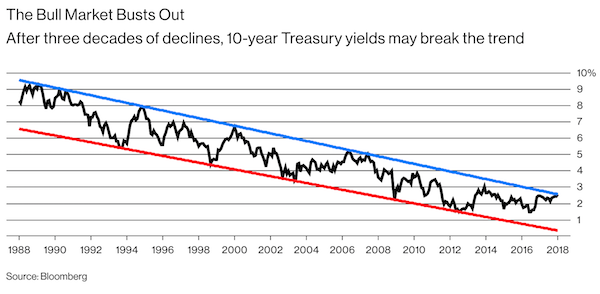

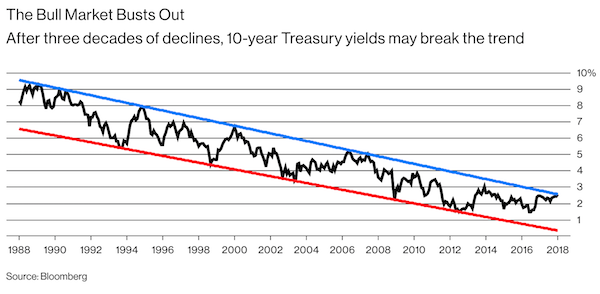

Government bond yields, exemplified by the benchmark 10-year U.S. Treasury, have enjoyed three decades of decline. Their recent jump is prompting a heated debate over whether that bull market is over. It matters because there’s more riding on the question than ever before.

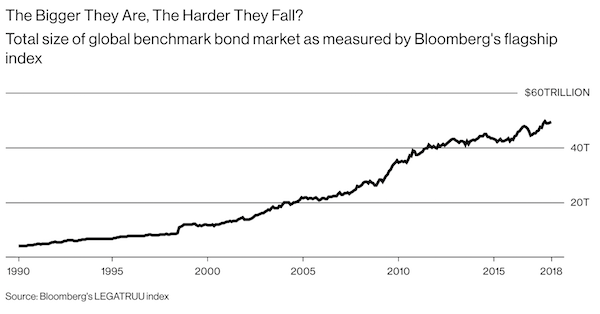

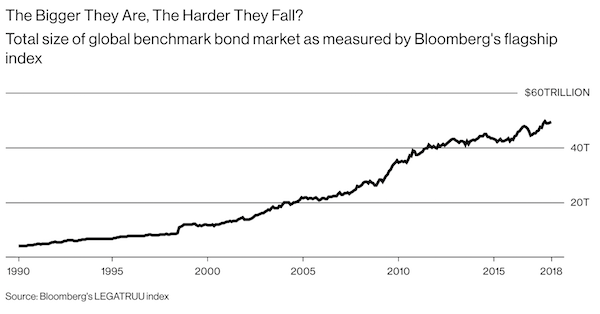

The value of benchmark bonds eligible for inclusion in the Bloomberg Barclays Global Aggregate Bond Index, which includes government, corporate and securitized debt from 24 local currency markets, has doubled in the past decade to almost $50 trillion.

While calling the turn in bonds, especially in Europe, has been a widow-making trade in recent years, recent moves certainly look like the trend is no longer your friend. The yield on the two-year Treasury has about doubled in the past year, and is a whisker away from 2%. Even at its current super-low level of about 0.55%, the 10-year German yield is up from its nadir of about minus 0.2% reached in July 2016.

Here’s the thing, though. Even if government bond yields are on a sustained path to higher levels, it’s arguably a positive sign for the global economy. A return to more normal borrowing costs would reinforce hopes that the world is finally free from the debilitating aftershocks from the financial crisis. Moreover, the new normal is still likely to be at lower levels than the old normal. Note that in the past 30 years, the 10-year Treasury yield peaked at about 9.4% in August 1988 and plateaued at 1.36% in July 2016. Its current poke above 2.5% still leaves it at about half of its three-decade average. For central banks seeking to normalize monetary policy, rising government bond yields will come as something for a relief. For investors who bought at the peak of the bull market, however, there could be painful times ahead.

Read more …

Only game in town.

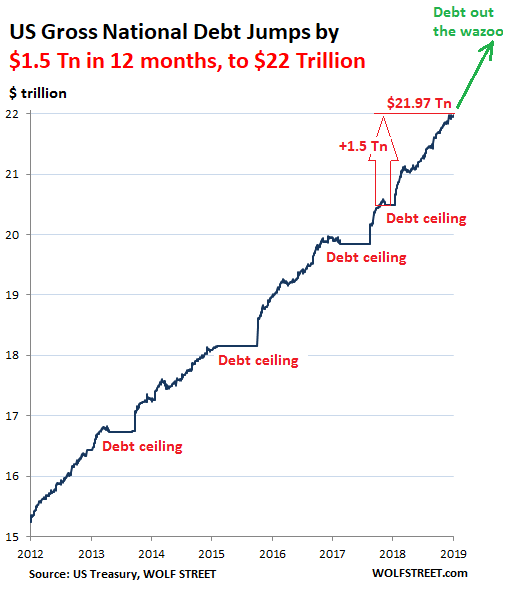

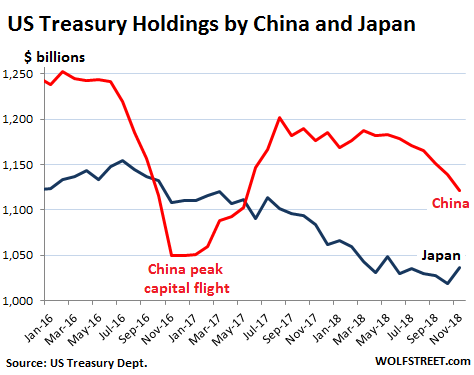

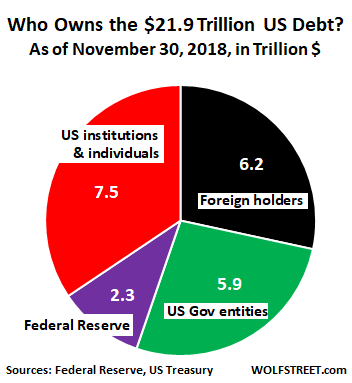

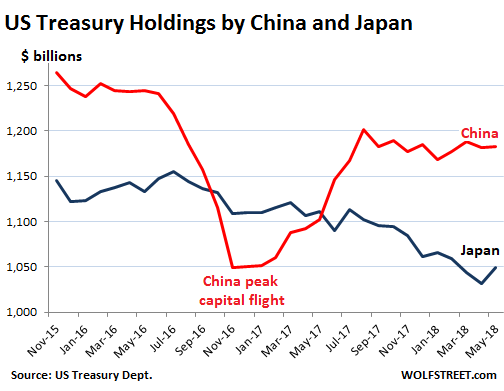

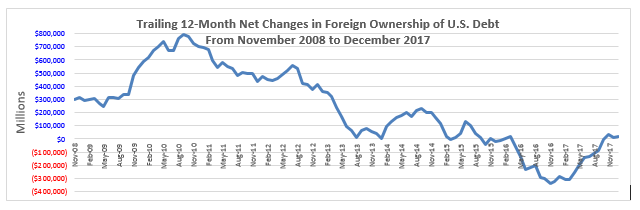

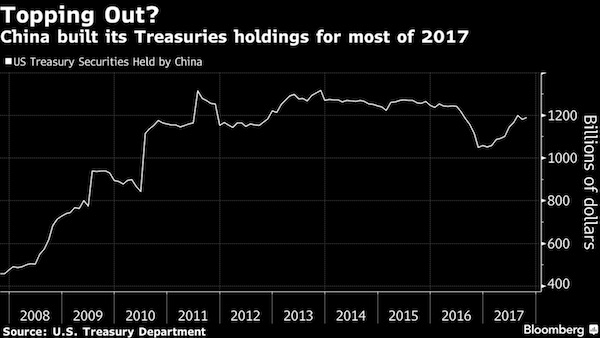

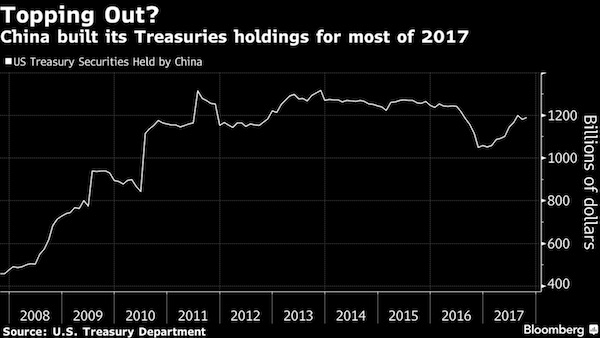

• China Weighs Slowing or Halting Purchases of US Treasuries (BBG)

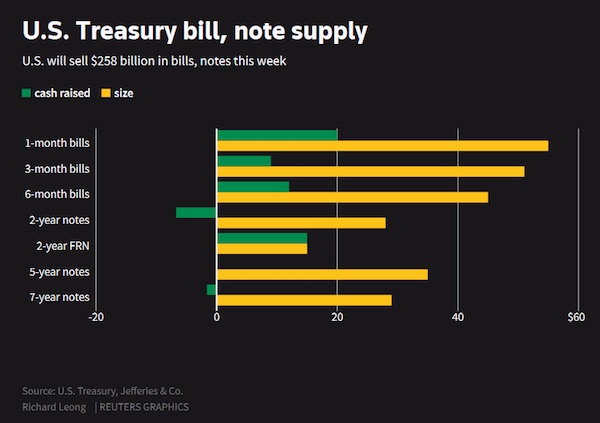

China added to bond investors’ jitters on Wednesday as traders braced for what they feared could be the end of a three-decade bull market. Senior government officials in Beijing reviewing the nation’s foreign-exchange holdings have recommended slowing or halting purchases of U.S. Treasuries, according to people familiar with the matter. The news comes as global debt markets were already selling off amid signs that central banks are starting to step back after years of bond-buying stimulus. Yields on 10-year Treasuries rose for a fifth day, touching the highest since March. China holds the world’s largest foreign-exchange reserves, at $3.1 trillion, and regularly assesses its strategy for investing them. It isn’t clear whether the officials’ recommendations have been adopted.

The market for U.S. government bonds is becoming less attractive relative to other assets, and trade tensions with the U.S. may provide a reason to slow or stop buying American debt, the thinking of these officials goes, according to the people [..] “With markets already dealing with supply indigestion, headlines regarding potentially lower Chinese demand for Treasuries are renewing bearish dynamics,” said Michael Leister at Commerzbank. “Today’s headlines will underscore concerns that the fading global quantitative-easing bid will trigger lasting upside pressure on developed-market yields.” The Chinese officials didn’t specify why trade tensions would spur a cutback in Treasuries purchases, though foreign holdings of U.S. securities have sometimes been a geopolitical football in the past.

[..] Any reduction in Chinese purchases would come just as the U.S. prepares to boost its supply of debt. The Treasury Department said in its most recent quarterly refunding announcement in November that borrowing needs will increase as the Federal Reserve reduces its balance sheet and as fiscal deficits look set to widen. “It’s a complicated chess game as with everything the Chinese do,” said Charles Wyplosz, a professor of international economics at the Graduate Institute of International and Development Studies in Geneva. “For years they have been bothered by the fact that they are so heavily invested in one particular class of U.S. bonds, so it’s just a question of time before they would try to diversify.”

Read more …

The dollar is still king.

• Is Beijing Bluffing On Treasuries? (BBG)

The Bloomberg News report that senior government officials in Beijing recommended slowing or halting purchases of U.S. Treasuries is encountering a wall of skepticism, and rightly so. Even China’s State Administration of Foreign Exchange said Thursday that the report “might have cited wrong sources or may be fake news.” There’s a third possibility: that Beijing floated a trial balloon to see how the market would react.To the extent China would have to scoop up incoming dollars to keep the value of the yuan from rising too much too soon, what else can it possibly purchase with those dollars? Treasuries maturing in five years pay 2.32%. If China tries to alter the composition of its $3.1 trillion foreign-exchange war chest by swapping dollars to buy comparable securities denominated in any of the world’s main reserve currencies, it will find German bunds and British gilts paying even less.

Japanese and Swiss bonds offer somewhat higher yields. However, if every central bank in the world had given up on the world’s most liquid security every time it got a half-percent extra yield somewhere else, the dollar’s share in the world’s known reserves wouldn’t have held above 60% for almost a quarter-century. (It’s 63.5% now.) If Beijing wants a bargaining chip in trade tensions with the U.S., it should look elsewhere.In 2009, the Chinese central bank did try to diversify away from the dollar. The euro’s share in known global reserves peaked at 28% a few months after Wen Jiabao, the then Chinese premier, said he was “worried” about the huge amount of money his country had lent to the U.S.Then he – and the world – got something rather more real to worry about as the European debt crisis became an existential threat to that region’s single currency. According to the most recent data from the IMF, the euro’s share in worldwide foreign-exchange reserves is now down to 20%.

Read more …

As 2018 progresses, we’ll see many reports, across the globe, of taxes owed on 2017 crypto gains.

• South Korea’s Largest Cryptocurrency Exchanges Raided For Tax Evasion (R.)

South Korea’s largest cryptocurrency exchanges were raided by police and tax agencies this week for alleged tax evasion, people familiar with the investigation said on Thursday. “A few officials from the National Tax Service raided our office this week,” an official at Coinone, a major cryptocurrency exchange in South Korea, told Reuters. “Local police also have been investigating our company since last year, they think what we do is gambling,” said the official, who spoke on condition of anonymity. He said Coinone was cooperating with the investigation. Bithumb, the second largest virtual currency operator in South Korea, was also raided by the tax authorities on Wednesday.

“We were asked by the tax officials to disclose paperwork and things yesterday,” an official at Bithumb said, requesting anonymity due to the sensitivity of the issue. South Korean financial authorities had previously said they are inspecting six local banks that offer virtual currency accounts to institutions, amid concerns the increasing use of such assets could lead to a surge in crime. The crackdown on Seoul-based operators of some of the world’s busiest virtual currency exchanges comes as the government attempts to calm frenzied demand for cryptocurrency trading in Asia’s fourth largest economy. Bitcoin’s 1,500% surge last year has stoked huge demand for cryptocurency in South Korea, drawing college students to housewives and sparking concerns about a gambling addiction.

Read more …

They’re getting serious.

• South Korea Preparing Bill That Will Ban All Cryptocurrency Trading (CNBC)

South Korea’s justice minister said on Thursday that a bill is being prepared to ban all cryptocurrency trading in the country. That news is a major development for the cryptocurrency space, as South Korea is one of the biggest markets for major coins like bitcoin and ethereum. According to industry website CryptoCompare, more than 10% of ethereum is traded against the South Korean won — the second largest concentration in terms of fiat currencies behind the dollar. Meanwhile, 5% of all bitcoin are traded against the won. “There are great concerns regarding virtual currencies and justice ministry is basically preparing a bill to ban cryptocurrency trading through exchanges,” Park Sang-ki said at a press conference, according to the ministry’s press office.

Bitcoin tumbled more than 12% following Park’s remarks, according to CoinDesk’s bitcoin price index that tracks prices from four exchanges. At 1:26 p.m. HK/SIN, the cryptocurrency price retraced some of its losses to trade at $13,547.7. Park added that he couldn’t disclose more specific details about proposed shutdown of cryptocurrency trading exchanges in the country, adding that various government agencies would work together to implement several measures. Reuters further reported that a press official said the proposed ban on cryptocurrency trading was announced after “enough discussion” with other government agencies including the nation’s finance ministry and financial regulators.

Cryptocurrency trading in South Korea is very speculative and similar to gambling. Major cryptocurrencies like bitcoin and ethereum are priced significantly higher in the country’s exchanges than elsewhere in the world. For example, bitcoin traded at $17,169.65 per token at local exchange Bithumb, which was a 31% premium to the CoinDesk average price. That difference in price is called a “kimchi premium” by many traders. [..] earlier this week, industry data provider CoinMarketCap tweeted that it would exclude some South Korean exchanges in price calculations due to the “extreme divergence in prices from the rest of the world” and for “limited arbitrage opportunity.”

Read more …

Beijing doesn’t see bitcoin as an asset to its power politics.

• China Moves To Shutter Bitcoin Mines (CNBC)

China is moving to eradicate the country’s bitcoin mining industry over concerns about excessive electricity consumption and financial risk, reflecting authorities’ judgment that cryptocurrencies are not a strategic industry. A multi-agency task force has instructed provincial governments to “actively guide” companies in their respective regions to exit the cryptocurrency mining industry, according to a document seen by the Financial Times. The move to pressure miners follows China’s shutdown of local bitcoin exchanges and its ban on initial coin offerings. Miners create new bitcoins by solving complex maths problems whose solutions are used to validate new bitcoin transactions. Though ostensibly a computational task, the reliance on raw computing power makes the process more akin to industrial manufacturing than traditional high-technology businesses.

Many bitcoin miners have established operations in remote areas without even registering a company. Some have also skirted Chinese regulations that forbid end users from purchasing electricity directly from power producers rather than grid operators. China mines about three-quarters of the world’s bitcoins, according to Liao Xiang, chief executive of Lightningasic, a Shenzhen-based mining operation. Chinese miners have taken advantage of cheap electricity in regions rich in coal or hydroelectric power, including Xinjiang, Inner Mongolia, Sichuan and Yunnan. The global industry accounts for 0.17% of global electricity consumption, more than 161 individual countries, according to Digiconomist, a website that tracks the industry.

[..] Bitcoin mining “consumes a large amount of electricity and also encourages a spirit of speculation in ‘virtual currencies'”, according to the document. Mining operations contradict efforts to prevent financial risk and to discourage activities that “deviate from the needs of the real economy”, it added. The internet finance task force, which includes the People’s Bank of China, has previously led regulatory tightening efforts on peer-to-peer lending and online consumer loans. The order does not call on regional authorities to shut mining operations directly, but rather to squeeze them out by strictly enforcing policies on electricity consumption, land use, tax collection and environmental regulation

Read more …

How Democrats sell out Dreamers.

• Buy Off Trump With the Wall (Lowry)

There is a very easy way for Democrats to get major concessions from President Donald Trump on immigration: Give him his Wall. This is the key to a deal codifying the Deferred Action for Childhood Arrivals program, the Obama-era de facto amnesty for a segment of so-called Dreamers. All it takes is giving Trump a plausible start to the Wall that the president can then, in his inimitable way, promote as the greatest structure built on a border since Hadrian began his famous handiwork at the northern limit of the Roman Empire in 122. That the Democrats very likely won’t do this speaks to their irrational aversion to a Wall that they can’t view dispassionately any more than Trump can. It used to be that enhanced security on the border, and yes, a physical structure that in places is effectively a wall, had bipartisan support.

The Secure Fence Act of 2006 passed the House by a vote of 283-138 and the Senate 80-19. It called for building roughly 700 miles of double-layer fencing on the border, and no one seemed to believe that the United States had irreparably sullied its reputation. This wasn’t the first time anyone had thought of a fence, of course. There had been barriers in the San Diego area for a very long time, although not particularly robust ones. Beginning in the 1980s, more serious structures were built. According to the San Diego Union-Tribune, there are 46 miles of fencing overall and 13 miles of double fencing in the San Diego-Tijuana corridor, where there used to be a nightly influx of undocumented immigrants. In some sections, the barriers are 10-feet-tall military helicopter pads indistinguishable from a wall.

Again, no one believes San Diego has closed itself off from the world by adopting a common-sensical and — in this urban area — effective prophylactic against illegal immigration. But Democrats now find find physical barriers on the border offensive, especially if they have enough solidity to be called a Wall. One immigration advocate, in a typical sentiment, told The Huffington Post that the Wall is a “tool to instill hate and division.” This lunacy has rapidly become Democratic orthodoxy. Harry Enten of 538 notes that in 2006 almost 40% of Democrats supported building a Wall. By February of last year, Democrats were against it by 89% to 8%.

The hostility toward the Wall is part of a broader Democratic leftward lurch on immigration, but also a simple schoolyard calculus that if Trump supports something, they must oppose it. This forecloses the most basic legislative give-and-take. If Nancy Pelosi and Chuck Schumer gave Trump something significant on the Wall, they would be able to find their way home — as John Jay said after concluding an unpopular treaty with the British in 1795 — by the light of their own burning effigies. Their voters would scorn them as traitors complicit in the alleged horrid bigotry of Donald J. Trump.

Read more …

Well, no. Just another instance of everything being insinuated, in the hope that a sliver is remembered. Fake news.

• Russian Bid To Influence Brexit Vote Detailed In New US Senate Report (G.)

Russia’s attempts to influence British democracy and the potential vulnerability of parts of the UK political system to anti-democratic meddling during the EU referendum have been detailed in a report prepared by the US Senate. The report by Democrats on the Senate foreign relations committee, titled Putin’s asymmetric assault on democracy in Russia and Europe: implications for US national security, pinpoints the way in which UK campaign finance laws do not require disclosure of political donations if they are from “the beneficial owners of non-British companies that are incorporated in the EU and carry out business in the UK”. This opacity, the report suggests, “may have enabled Russian-related money to be directed with insufficient scrutiny to various UK political actors”.

“Investigative journalists have also raised questions about the sources of sudden and possibly illicit wealth that may have been directed to support the Brexit ‘Leave’ campaign.” The UK Electoral Commission has already launched an investigation into the issue. The senators point out that Ukip and its then-leader, Nigel Farage, did not just fan anti-EU sentiment but also “criticised European sanctions on Russia, and provided flattering assessments of Russian President Putin”. The report adds that although officially the Russian government asserted its neutrality on Brexit, its English-language media outlets RT and Sputnik covered the referendum campaign extensively and offered ‘’systematically one-sided coverage’’. The senators also challenge the adequacy of the investigations by Facebook and Twitter into the allegations of widespread social media interference by the Russians during the referendum.

They reference University of Edinburgh research showing more than 400 Russian-run Twitter accounts that had been active in the US election had also been actively posting about Brexit. In addition, the senators noted that research conducted by a joint team of experts from the University of California at Berkeley and Swansea University reportedly identified 150,000 Twitter accounts with various Russian ties that disseminated messages about Brexit. The report also points to the vast flow of Russian money into the UK, including the London property market. It records how the Metropolitan police noted that a total value of £180m in properties in the UK had been put under investigation as possibly purchased with corrupt proceeds by secretive offshore companies.

Overall the report breaks little new ground in terms of fresh evidence but says the picture remains incomplete. “The allegations that have emerged of Russian interference prior to the Brexit referendum are all the more stunning given the innate resilience within British society to the Kremlin’s anti-democratic agenda,” the senators wrote. The report, which chronicles Russian disinformation efforts in 19 countries, calls on Donald Trump to assert leadership on Russian meddling in the 2016 presidential election, saying: “Never before in American history has so clear a threat to national security been so clearly ignored by a US president.”

Read more …

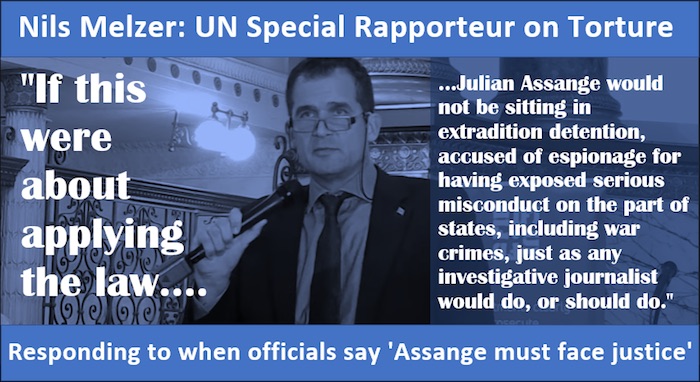

Don’t hold your breath. US and UK want revenge.

• Assange Gets Ecuador ID; ‘First Step’ To Diplomatic Immunity? (RT)

The Ecuadorian ID reportedly granted to Julian Assange could mark his first step to obtaining diplomatic immunity, as Ecuador wants to resolve Assange’s indefinite embassy stay, human rights activist Peter Tatchell told RT. “Granting an identity card is potentially the first step towards granting citizenship of Ecuador. And there is a possibility that he could be then granted a diplomatic status, which would give him diplomatic immunity,” Tatchell said. He added that diplomatic immunity would mean that the WikiLeaks co-founder would be “free to leave the embassy and travel to Ecuador and the British government would not be able to lay a finger on him.”

Ecuadorian media reports Assange was given an ID card issued on December 21, citing “reliable sources” and providing the civil registry number of the document. The whistleblower also uploaded a photo of himself on Twitter wearing a yellow, blue and red shirt, the colors of the Ecuadorian flag, but made not comments on the issue. nEcuador usually issues such ID cards for people claiming residency status, which are called cedulas. It is, however, unclear whether Assange was granted residency status or full citizenship.

However, Tatchell says “the Ecuadorian government has made it very clear that it wants a resolution [of this whole situation around Assange] and they are prepared to negotiate [to give] a way for Julian Assange [to leave] the embassy.” He added that “granting him [Assange] an identity card is a new development that can open the door for further things in the future.” The Vienna convention on diplomatic relations states that someone who holds a diplomatic passport is immune from prosecution, the activist explained. It is still no guarantee, however. “There is still a possibility that, even if he was granted diplomatic immunity by the Ecuadorians, the British government might still try to snatch him,” Tatchell said, although “many British officials would be glad to see Assange getting a diplomatic passport and leaving [the UK],” he added.

Read more …

Debt. Colony. Forever.

• Greece to Remain Under Lenders’ Supervision Until 2059 – Handelsblatt (GR)

In a report about Greece’s new omnibus bill and a potential break from its bailout in August 2018, German newspaper Handelsblatt claims the country will remain under lenders’ supervision for another 40 years. The newspaper says the enormous bill, which was introduced to parliament on Tuesday and is expected to be put to vote next Monday, is highly detailed but lawmakers have not been given enough time to scrutinize it. “The plan is that the multi-bill will pass from the Greek parliament before the next Eurogroup meeting on January 22, so that Greece’s lenders can release the next €5.5 billion bailout tranche, leading the country out of its bailout obligations by August 2018,” the paper notes. It adds that the short time afforded to lawmakers to study the bill and debate it is exactly what Greek PM Alexis Tsipras needs for a smooth vote.

The German paper also notes protests and strikes against the bill scheduled for next Friday and Monday. In spite of the fact the bill will lead to further wage and pension cuts, as well as tax increases, the government majority in parliament — despite vocal unhappiness from some of Tsipras’ own SYRIZA lawmakers — is expected to vote for it, the report says. “Tsipras has pledged to his supporters that the country will break its austerity vicious circle next August and throw out its despised lenders for good,” the report adds. “But with the country committed to more austerity measures until 2022, that is self-delusion.” “A total of 80% of the Greek debt remains in the hands of the country’s lenders,” Handelsblatt concludes. “This means that until Greece pays up its debt, which, with today’s rates it will manage to do by 2059, the country will be under its lenders’ financial supervision.”

Read more …

Same findings as the German report last year. This is the food chain that feeds us.

• Insect Declines: New Alarm Over Mayfly Is ‘Tip Of Iceberg’ (G.)

Modest levels of pollution found in many English rivers are having a devastating impact on mayflies, new research suggests, killing about 80% of all eggs. Clouds of emerging mayflies were once a regular sight on English summer evenings and they are a key part of the food chain that supports fish, birds and mammals. The finding that even pollution well below guidelines can cause serious harm adds to concerns about plummeting insect numbers. In October, a study found that the abundance of flying insects has plunged by 75% in 25 years, prompting warnings that the world is “on course for ecological Armageddon”, with profound impacts on human society.

Paul Knight, chief executive of Salmon and Trout Conservation (STC), which is conducting an in-depth three-year survey of rivers, said: “The results of this groundbreaking new study are irrefutable. We believe this is just the tip of the iceberg. Lose your invertebrates and other species will follow.” The new research looked at the blue-winged olive, a common mayfly present across the British Isles and most of continental Europe. Its numbers have fallen significantly in recent decades and it has almost vanished from some English rivers. The prime suspects for this decline are fine sediment and phosphate pollution in rivers, which are washed off farmed fields and also result from untreated sewage. Some research has been done on how the larval and adult stages of mayflies are affected by pollution, but not on their eggs.

“The young life stages are the most vulnerable, just as with human babies,” said Nick Everall, at the Aquascience Consultancy and who led the research published in the journal Environmental Pollution. Blue-winged olive eggs are laid on river beds and then have to survive for up to eight months over winter before hatching into nymphs. However, experiments in the laboratory found that the fine sediment settles on the eggs and suffocates them, by preventing oxygen transferring into the egg. The sediment can also allow fungus to grow and kill the eggs, while phosphate is known to affect the development of eggs.

Read more …

The Cynical Society:

1) The BBC broadcasts David Attenborough’s new Blue Planet 2 series, in which one episode is all about -plastics- pollution

2) All of Britain watches, so the national conversation becomes ‘something must be done’

3) May has to do/say something, but the plastics industry are her friends, and she judges it’s all lip service anyway that will fade (and those who really care are not her voters)

4) She decides to pay only lip service too, and pushes the issue forward by 25 years, i.e. not her problem

• Theresa May Vows To Eliminate UK Plastic Waste By 2042 (Ind.)

Theresa May will commit the UK to eliminating all avoidable plastic waste by 2042 as she launches the Government’s environmental plan for the next 25-years. Under the pledge waste such as the carrier bags, food packaging and disposable plastic straws that litter the country and pollute the seas would be abolished. But the target was given a frosty reception from environmental groups with one leading organisation saying it “lacks urgency, detail and bite”, while another said the country “can’t afford to wait” so long. The broader 25-year plan, first promised three years ago, will also urge supermarkets to set up “plastic-free aisles” for goods with no packaging and confirm plans to extend the 5p charge for carrier bags to all English retailers.

It comes as the Government seeks to burnish its environmental credentials with recent pledges on animal protection and plastic microbeads. But with concern growing around plastic waste, Ms May will say: “We look back in horror at some of the damage done to our environment in the past and wonder how anyone could have thought that, for example, dumping toxic chemicals, untreated, into rivers was ever the right thing to do. “In years to come, I think people will be shocked at how today we allow so much plastic to be produced needlessly. [..] Friends of the Earth CEO Craig Bennett said: “A 25 year plan is clearly needed – but with the nation facing an accelerating environmental crisis we can’t afford to wait a quarter of a century for urgent action to tackle the issues that already threaten our lives, health and planet.”

He went on: “If Theresa May wants to champion the environment she must spell out the bold measures her Government will take in the next few weeks and months.” WWF Chief Executive Tanya Steele welcomed “any step” to reduce plastic waste, adding that plastic-free aisles can spur change. But she said: “If we really want to solve this problem, we need to think bigger and ultimately move towards an end to single-use plastics.” Shadow Environment Secretary Sue Hayman said the plan was now “years behind schedule” branding the plan “a cynical attempt at rebranding the Tories image”. She went on: “[It] appears to contain only weak proposals with Britain’s plastic waste crisis kicked into the long grass.” Liberal Democrat leader Vince Cable said “The Conservatives should be eliminating all avoidable plastic waste now – a target of 2042 beggars belief.”

Read more …