Eugene Delacroix Greece expiring on the Ruins of Missolonghi 1826

European Commission president Jean-Claude Juncker, famous for his imbibition capacity and uttering -not necessarily in that order- the legendary words “when it becomes serious, you have to lie”, presented his State of the Union today. Which is of pretty much limited interest because, as Yanis Varoufakis’ book ‘Adults in the Room’ once again confirmed, Juncker is nothing but ventriloquist Angela Merkel’s sock puppet.

But of course he had lofty words galore, about how great Europe is doing, and how that provides a window for more Europe, in multiple dimensions. Juncker envisions a European Minister of Finance (Dutch PM Rutte immediately scorned the idea), and he wants to enlarge the EU by inviting more countries in, like Albania, Montenegro and Serbia (but not Turkey!).

Juncker had negative things to say about Britain and Brexit, about Poland, Prague and Hungary who don’t want to obey the decree about letting in migrants and refugees, and obviously about Donald Trump: Brussels apparently wants ‘to make our planet great again’.

What the likes of Jean-Claude don’t seem to be willing to contemplate, let alone understand or acknowledge, is that the EU is a union of sovereign countries. The meaning of ‘sovereignty’ fully escapes much of the pro-EU crowd. And if they keep that up, it will break the union into pieces.

The European Court of Justice has ruled that Poland, the Czech Republic and Hungary must accept their migrant ‘quota’, as decided in Brussels, and that, too, constitutes an infringement on these countries’ sovereignty. And don’t forget, sovereignty is not something that can be divided into separate parts, some of which can be upheld while others are discarded. A country is either sovereign or it is not.

The single euro currency is already shirking awfully close to violating sovereignty, if not passing over an invisible line, and a European Finance Minister would certainly constitute such a violation. At some point, the politicians in all these countries will have to tell their voters that they’re about to surrender -more of- their sovereignty and become citizens of Merkel Land. But they don’t want to do that, because as soon as people would realize this, the pitchforks would come out and the union would be history.

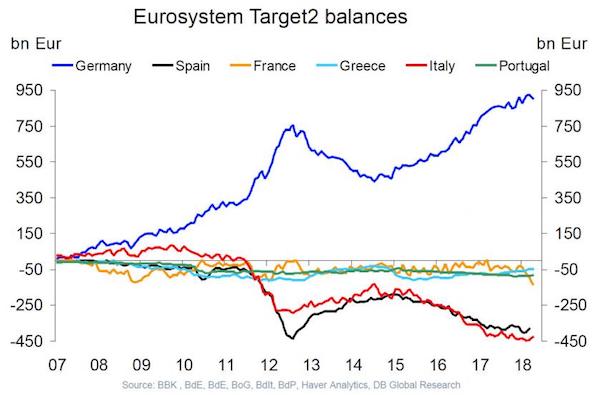

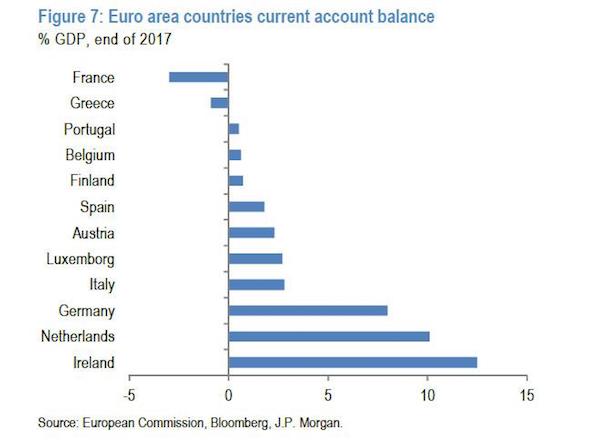

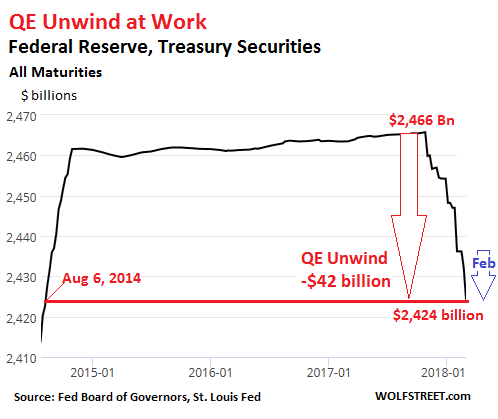

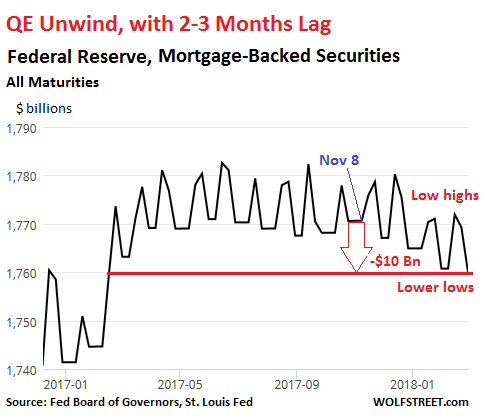

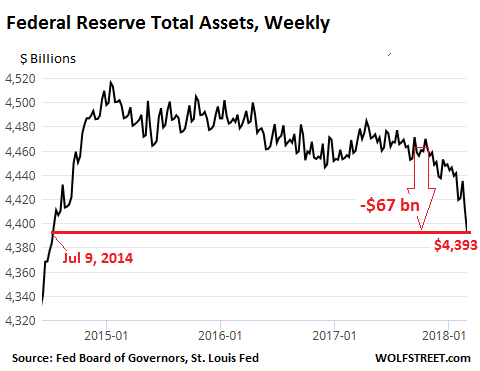

The EU will be able to muddle on for a while longer, but Europe is not at all doing great economically (however, to maintain the illusion ECB head Draghi buys €60 billion a month in ‘assets’), and when the next crisis comes people will demand their sovereignty back. It really is that simple. And what will the negotiations look like to make that happen? 27 times Brexit?

The real Europe is not the one Juncker paints a portrait of. The real Europe is Greece. That’s where you can see the economic reality as well as the political one. Greece has no sovereignty left to speak of, despite the fact that it is guaranteed it in EU law. Europe’s political reality is about raw power. About the rich waterboarding the poor, to the point that they are turned from sovereign citizens of their countries into lost souls in debt prisons.

This week, another chapter has been added to the dismal annals of the Greek adventures in the European Union. It’s like the Odyssee, I kid you not. Like the previous chapters, this one will not solve the Greek crisis, or even alleviate it, but instead it will deepen it further, and not a little bit. This chapter concerns the forced auctioning of -real estate- properties.

Not to Greeks, 90% of whom can’t afford to buy anything at all, let alone property, but to foreigners, often institutional investors. At the same time, bad loans, including mortgage loans, will be offloaded for pennies on the dollar to that same class of ‘investors’. Once the Troika is done with this chapter, Greece will have seen capital destruction the likes of which the world has seldom if ever witnessed.

People in the country have a hard time understanding the impact:

Greece Property Auctions Certain To Drive Market Prices Even Lower

Ilias Ziogas, head of property consultancy company NAI Hellas and one of the founding members of the Chartered Surveyors Association, said that the property market is certain to suffer further as a result of the auctions: “The impact on prices will be clearly negative, not because the price of a property will be far lower at the auction than a nearby property, but because it will diminish demand for the neighboring property.”

[..]Giorgos Litsas, head of the GLP Values chartered surveyor company, which cooperates with PQH [..] told Kathimerini that the only way is down for market rates. “I believe that unless there is an unlikely coordination among the parties involved – i.e. the state (tax authorities, social security funds etc.), the banks and the clearing firms – in order to prevent too many properties coming onto the market at the same time, rates will go down by at least 10%.”

He noted that “we estimate the stock of unsold properties of all types comes to 270,000-280,000, in a market with no more than 15,000 transactions per year. Therefore the rise in supply will send prices tumbling.” Yiannis Xylas, founder of Geoaxis surveyors, added, “I fear the auctions will create an oversupply of properties without the corresponding demand, which translates into an immediate drop in rates that may be rapid if one adds the portfolios of bad loans secured on properties that will be sold to foreign funds at a fraction of their price.”

A 10% drop? Excuse me? Even in the center of Athens, rental prices for apartments that are not yet absorbed by Airbnb have plummeted. With so many people making just a few hundred euro a month that is inevitable. You can rent a decent place for €200 a month, and if you keep looking I’m sure you can find one for €100. An 80% drop?! But property prices would only go down by 10% in a market that has 20 times more unsold properties than it sells in a year?

The Troika creditors found they had to deal with attempts to prevent the wholesale fire sale of Greek properties. They now think they’ve found the solution. First, they will force the government to lower official valuations concerning the so-called “primary residence protection”, which protected homes valued at below €300,000 from foreclosure. Second, they will bypass the associations of notaries who refused to cooperate in ‘physical’ auctions, as well as protesters, by doing the fire sale electronically:

E-Auctions Of Foreclosed Property For First Time This Month In Greece

Environment and Energy Minister Giorgos Stathakis confirmed the development in statements to a local television station, announcing the relevant justice ministry is ready to begin electronic auctions in the middle of next week.At the same time, Stathakis noted that a law protecting a debtor’s primary residence from creditors will be expanded until the end of 2018. According to reports, the e-auctions will take place every Wednesday, Thursday and Friday over a four-hour period, i.e. from 10 a.m. to 2 p.m. or 2 p.m. to 6 p.m. Some 5,000 foreclosed commercial properties will be up for sale by the end of the year, which translates into 1,250 properties per month, on average.

Currently, the primary residence protection against foreclosure extends to properties valued (by the State tax bureau) at under €300,000, a very high threshold that shields the “lion’s share” of mortgaged residential real estate in the country, if judged by current commercial property values in Greece. Creditors and local lenders have called for a decrease in the protection threshold, a prospect that is very likely.

The development is also expected to generate another round of acrimonious political skirmishing, given that both leftist SYRIZA, and its junior coalition partner, the rightist-populist Independent Greeks party, rode to power in January 2015 on a election campaign platform that included an almost universal protection of residential property from bank foreclosures and auctions.

Associations representing notaries – professionals who in Greece are law school graduates specializing in drawing up contracts and maintaining registries of deeds, property transactions, wills etc. – had also blocked old-style auctions from taking place in district courts by ordering their members not to take part. The e-auction process aims to bypass this opposition, as well as disruptions and occupations of courtrooms by anti-austerity protesters.

The claim is that Greek banks must be made healthy again by removing bad loans from their books. The question is if selling both properties and bad loans to foreign institutional investors for pennies on the buck is a healthy way to achieve that. But yeah, if 50% of your outstanding loans are bad, you have a problem. Still, at the same time, the problem with that is that many if not most of those loans have turned sour because of the neverending carrousel of austerity measures unleashed upon the country. It’s a proverbial chicken and egg issue.

If Brussels were serious about Greek sovereignty, it would make sure that Greek homes were to remain in Greek hands. You can’t be sovereign if foreigners own most of your real estate. By bleeding the country dry, and forcing the sale of Greek property to Germans, Americans, Russians and Arabs, the Troika infringes upon Greek sovereignty in ways that will scare the heebees out of other EU nations.

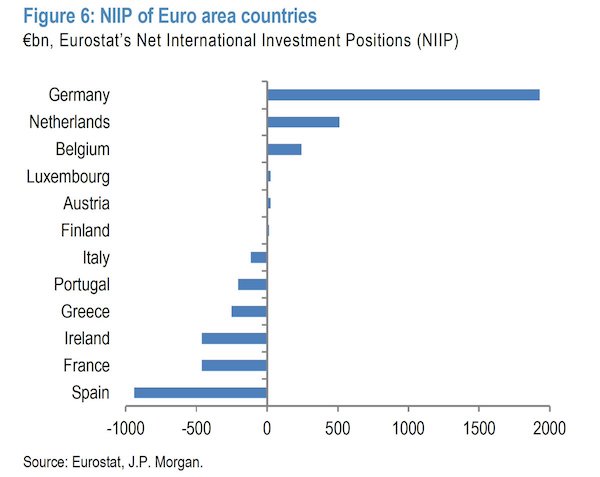

It’s not for nothing that the entire Italian opposition is talking about a parallel currency next to the euro. That is about sovereignty.

5,000 Greek Properties Under the Electronic Auction System by End of 2017

Auctions of foreclosed properties to settle bad debts are seen as key to returning Greek banks to health by helping reduce the burden of non-performing loans. These currently stand at roughly €110 billion, or 50% of the banks’ total loans. Under pressure from its lenders, in the summer of 2016 the Greek government passed measures allowing the sale of delinquent mortgages and small business loans to international funds, a move seen by many as yet another betrayal by the SYRIZA-led government.

Greek banks won’t return to health, they’ll simply shrink the same way the people do who can’t afford to rent a home or eat decent food. Austerity kills entire societies, including banks. If Mario Draghi would decide tomorrow morning to include Greece in his €60 billion a month QE bond-buying program, and Greece could use that money to stop squeezing pensions and wages, and no longer raise taxes and unemployment, both the people AND the banks could return to health. It would take a number of years, but still.

Attica! Attica!

Whatever you call what happens to Greece, and what’s been happening for nearly 10 years now, whether you call it fiscal waterboarding or Shock Doctrine, it is definitely not something that has a place in a union of sovereign nations bound together in mutual respect and dignity. And that will ensure the demise of that union.

Another aspect of the fire sale is the valuation of the properties austerity has caused to crumble (so many buildings in Athens are empty and falling apart, it’s deeply tragic, at times it feels like the entire city is dying). The press calls it a hard task, but that doesn’t quite cover it.

It’s not just about mortgages, many Greeks simply give up their properties because they can’t afford the taxes on them. People that inherit property refuse to accept their inheritance, even if it’s been in their families for generations, and it’s where they grew up. In that sense, it may be good to lower valuations to more realistic levels. But tax revenues will plunge along with the valuations, and the government is already stretched silly. Add a new tax, then?

Greece Property Value Review A Hard Task

The government is facing a daunting task in adjusting the so-called objective values (the property rates used for tax purposes) to market levels by the end of the year, as its bailout agreement dictates. The huge slump in transactions and the forced sales of properties due to their owners’ debts do not lead to any safe conclusions for the values per area. One in four sales are conducted with prices that lag the objective value by 60-70%, and the prices of 2008 by 70-80%. The Finance Ministry must overcome all the obstacles to bring to Parliament all the necessary adjustments and regulations.

Moreover, once the objective values are brought in line with market rates, the government will have to maintain the same amount of revenues from the Single Property Tax (ENFIA) either by raising the tax’s rates or by introducing a new tax in the form of the old Large Property Tax.

Furthermore, once the objective values are reduced by 40-50% to match the going prices, banks may see problems with their capital adequacy, as lenders will incur losses by having to revise the collateral they get. Mortgage loans in Greece amount to €59.44 billion, of which 42%, or €25.4 billion are nonperforming.

Yeah, there’s the health of the banks again. And the government. And the people. A wholesale fire sale is the worst possible thing that could happen at this point in time. Greece needs help, stimulus, hope, not more austerity and fire sales. Juncker and his Berlin ventriloquist have this all upside down and backwards, squared. The one thing the EU cannot afford itself to do, is the one thing it engages in.

They may as well pack in the whole thing today, and go home. Actually, that would be by far the best option, because more of this will inevitably lead to the very thing Europe prides itself in preventing for the past 70 years: battle, struggle, war, fighting in the streets, and worse. If the EU cannot show it exists for the good and benefit of its people, it no longer has a reason to exist.

Saving the banks in the richer countries by waterboarding an entire other country is not just the worst thing they could have thought of, it’s entirely unnecessary too. The EU and ECB could easily have saved Greece from 90% of what it has gone through, and will go through going forward, at virtually no cost at all. But yes, German, French, Dutch banks would likely have had to cut the bonuses of their bankers, and their vulture funds couldn’t have snapped up the real estate quite that cheaply.

Summarized: the EU is a disgrace, morally, politically, economically. I know that French President Macron on the one side, and Yanis Varoufakis’ DiEM25 movement on the other, talk about reforming the EU. But the EU is the mob, and you don’t reform the mob. You dismantle their organization and then you lock them up.