Arthur Rothstein Interior of migratory fruit worker’s tent, Yakima, Washington 1936

Tried to find a better source for this, not as one-sided as CNN, but does it really matter anymore at this point? Anyone who wants to believe more secret and anonymous ‘news’ about Russia and the US elections, can and will. Others find it hard to believe that the WaPo comes with yet another unsubstantiated ‘story’. CNN calls this ‘revelations’, but that really is not the word. And saying things like “the comments from Trump’s camp will cause concern in the Intelligence community” can probably best be seen as an attempt at comedy.

• Donald Trump Team Takes Aim At CIA (CNN)

President-elect Donald Trump’s transition team slammed the CIA Friday, following reports the agency has concluded that Russia intervened in the election to help him win. In a stunning response to widening claims of a Russian espionage operation targeting the presidential race, Trump’s camp risked an early feud with the Intelligence community on which he will rely for top secret assessments of the greatest threats facing the United States. “These are the same people that said Saddam Hussein had weapons of mass destruction,” the transition said in a terse, unsigned statement. “The election ended a long time ago in one of the biggest Electoral College victories in history. It’s now time to move on and ‘Make America Great Again.'”

The sharp pushback to revelations in The Washington Post, which followed an earlier CNN report on alleged Russian interference in the election, represented a startling rebuke from an incoming White House to the CIA. The transition team’s reference to the agency’s most humiliating recent intelligence misfire – over its conclusion that Iraq under Saddam Hussein had weapons of mass destruction — threatens to cast an early cloud over relations between the Trump White House and the CIA. The top leadership of the agency that presided over the Iraq failure during the Bush administration has long since been replaced. But the comments from Trump’s camp will cause concern in the Intelligence community about the incoming President’s attitude to America’s spy agencies.

CNN reported this week that Trump is getting intelligence briefings only once a week. Several previous presidents preparing for the inauguration had a more intense briefing schedule. Multiple sources with knowledge of the investigation into Russia’s hacking told CNN last week that the US intelligence community is increasingly confident that Russian meddling in the US election was intended to steer the election toward Trump, rather than simply to undermine or in other ways disrupt the political process. On Friday, the Post cited US officials as saying that intelligence agencies have identified individuals connected to the Russian government who gave Wikileaks thousands of hacked emails from the Democratic National Committee and Hillary Clinton’s campaign chairman John Podesta.

Trump has repeatedly said there is no evidence to suggest that President Vladimir Putin’s Russia, with which he has vowed to improve relations, played a nefarious role in the US election. “I don’t believe it. I don’t believe they interfered,” Trump said in an interview for the latest issue of Time magazine, adding that he thought intelligence community accusations about Russian interventions in the election were politically motivated.

“The Economy Isn’t A Thing”.

• A Rising Stock Market Does Not Signal Economic Health (FEE)

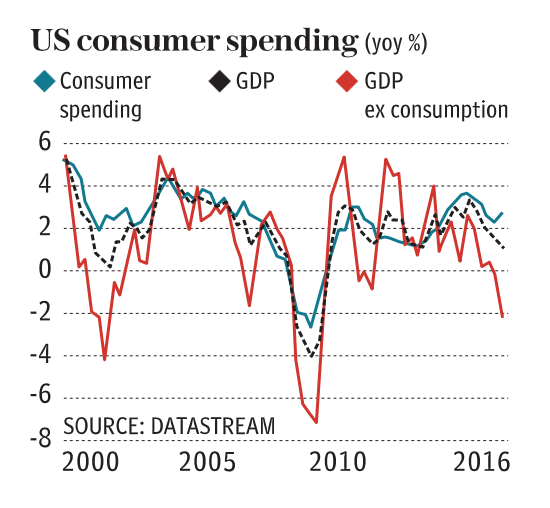

The headlines tell us that the Dow Jones is up around 1,000 points since Donald Trump won the election on November 8th. The conventional wisdom is that this shows how much confidence people have in Trump’s ability to generate a healthy American economy. The argument is that if people are willing to buy stock in American firms, this indicates their belief that those firms will see improving profits over the next few years. They then draw the conclusion that more profitable firms indicate a healthier American economy. Although this argument is correct about stock prices reflecting an increasing belief in the profitability of US firms, it makes a major error in assuming that profitable firms necessarily mean a better economy. First, it’s important to understand that phrases like “a healthier economy” are themselves problematic. The “economy” is not the thing we should be concerned about. In fact, in some fundamental sense there’s no such thing as “the economy.”

As Russ Roberts and John Papola memorably put it in the music video “Fight of the Century:”

The economy’s not a car.

There’s no engine to stall.

No experts can fix it.

There’s no “it” at all.

The economy is usThings are not “good/bad for the economy.” They are good or bad for the people who comprise the market process, specifically in our capacity as consumers. All the economy amounts to is people engaging exchanges in order to better satisfy their wants. What we should care about is whether or not people are able to better satisfy those wants. And “better satisfy” here means not just more and better goods and services, but at cheaper prices too. Lower prices mean that consumers have income left over to purchase goods they otherwise couldn’t, enabling them to better satisfy their wants by satisfying more of them. In a genuinely free market, the profitability of firms is a good reflection of their ability to better satisfy the wants of consumers. Our willingness to pay for their goods and services reflects the fact that we receive value from those products, so their profits are at least a general signal of having created that value and satisfied consumer wants.

Trump’s policies may well enrich many firms, but they will impoverish the average American. In fact, consumers get much more value out of most innovations than is reflected in the profits of firms. A famous study by economist William Nordhaus estimated that profits made up only about 2.2% of the total benefits created by innovations. If you doubt this, ask yourself how much it would take for you to give up your smartphone and its connectivity. Then multiply that by all of the smartphone users in the world. Then compare that to the profits made off smartphones. The total value to consumers will dwarf the profits of smartphone producers. However, when markets aren’t free, profits do not necessarily reflect value creation. Firms who profit through privileges, protections, and subsidies from governments demonstrate that they are able to please political actors, not that they can deliver value to consumers by better satisfying their wants.

Can’t give the article the space it deserves here.

• Economist Streeck Calls Time On Capitalism (G.)

Nothing in his work prepares you for meeting Streeck (pronounced Stray-k). Professionally, he is the political economist barking last orders for our way of life, and warning of the “dark ages” ahead. His books bear bluntly fin-de-siecle titles: two years ago was Buying Time, while the latest is called How Will Capitalism End? (spoiler: not well). Even his admirers talk of his “despair”, by which they mean sentences such as this: “Before capitalism will go to hell, it will for the foreseeable future hang in limbo, dead or about to die from an overdose of itself but still very much around, as nobody will have the power to move its decaying body out of the way.”

What does such gloom look like in the flesh? Small glasses, neat side parting and moustache, a backpack, a smart anorak and at least a decade younger than his 70 years. Alluding to Trump’s victory, he cheerily declares “What a morning!” as if discussing the likelihood of rain, then strolls into the gallery. [..] At a time when macroeconomists have failed and other academics have retreated into disciplinary solipsism, Streeck is one of the few to have risen to the moment. Many of the themes that will define this year, this decade, are in his work. The breakup of Europe, the rise of plutocrat-populists such as Trump, the failures of Mark Carney and the technocratic elite: he has anatomised all of them.

This summer, Britons mutinied against their government, their experts and the EU – and consigned themselves to a poorer, angrier future. Such frenzies of collective self-harm were explained by Streeck in the 2012 lectures later collected in Buying Time: “Professionalised political science tends to underestimate the impact of moral outrage. With its penchant for studied indifference … [it] has nothing but elitist contempt for what it calls “populism”, sharing this with the power elites to which it would like to be close … [But] citizens too can “panic” and react “irrationally”, just like financial investors … even though they have no banknotes as arguments but only words and (who knows?) paving stones.”

The structure of the EU makes it impossible for it to survive. That’s what these people miss.

• Nobel Economics Prize Winner: ‘The Euro Was A Mistake’ (EA)

The European Union should embark on a process of decentralisation and return certain areas of decision making to the member states if it wants to survive and thrive, according to Nobel Memorial Prize in Economic Sciences winner Oliver Hart. Today (9 December), Hart and his colleague, Bengt Holmström, will receive the top prize for their work on contract theory, which covers everything from how CEOs are paid to privatisation. Hart told EFE that he believes the keyword in EU politics is now “decentralisation” and that Brussels has “gone too far in centralising power”. The British-born economist said that “if it abandons this trend, the EU could survive and flourish, otherwise, it could fail”.

The Harvard University professor insisted that the EU member states are not “sufficiently homogeneous” to be considered one single entity, adding that trying to make the EU-28 into one was an “error”. Hart said that the concerns felt by the member states about decision making and centralisation of power in Brussels should be addressed by returning competences to the EU capitals. The Nobel winner conceded that the EU should retain control of “some important areas”, like free trade and free movement of workers, the latter of which he admitted is “ultimately, an idea that I personally like, although I understand that there are political worries”.

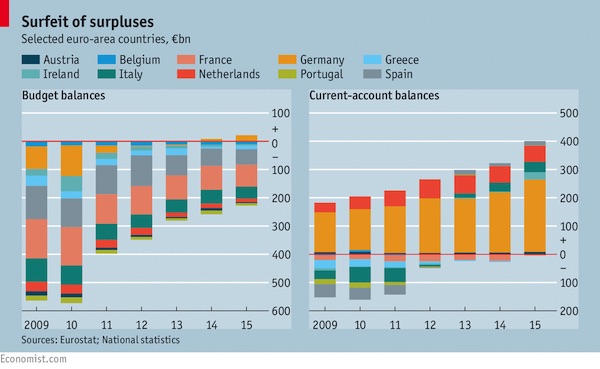

His prize-winning colleague, Holmström, also told EFE that the EU needs to “redefine its priorities, limiting its activities and its regulatory arm, in order to focus on what can be done on the essential things”. The Finnish economist, who also teaches at the Massachusetts Institute of Technology (MIT), said that Brussels needs to rejig its system of governance and its basic rules in order to make them “clearer and simpler”. Hart argued that “the euro was an mistake” and said that it’s an opinion that he has maintained ever since the monetary union was first introduced. The economist added that it “wouldn’t be a sad thing at all” if in the future Europe abandoned the single currency and that the British were “very clever” to stay out of it.

Wait till January.

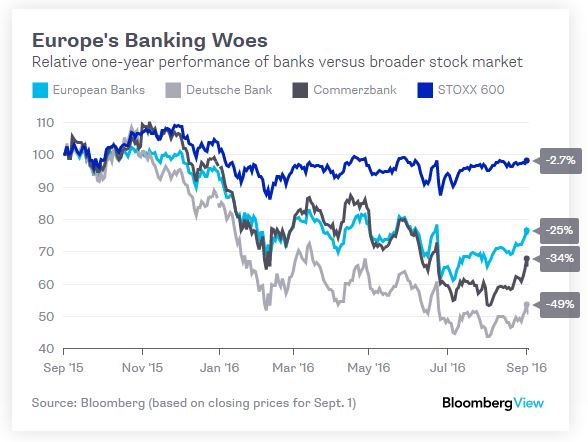

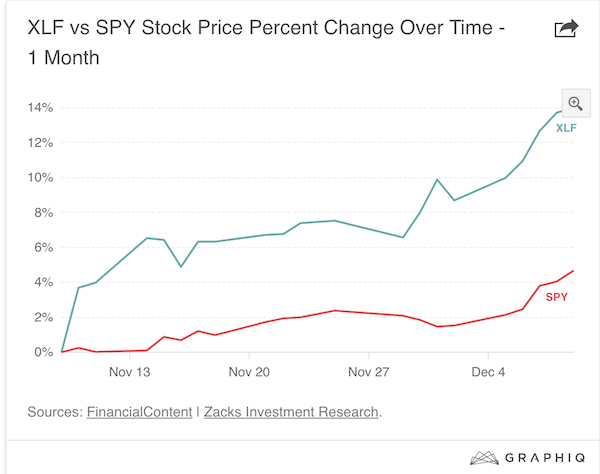

• Beware Of Panic Buying In Bank Stocks (MW)

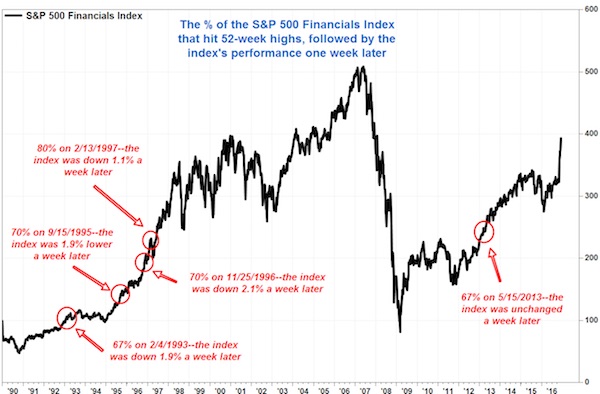

Buying of banking stocks has reached panic proportions, suggesting a trend reversal over the next couple of weeks may be likely. The SPDR Financial Select Sector exchange-traded fund rose 0.2% Friday, closing at the highest level since Feb. 1, 2008. Financials have been the best performer of the S&P 500’s 11 key sectors since Donald Trump was elected president, with the sector tracking stock (XLF) soaring 18.8% since Nov. 8, compared with a 5.6% gain in the S&P 500 index. The XLF produced this week its best rolling one-month (22 sessions) %age gains since August 2009, as the financial crisis was ending. Investors appear to be banking that President-elect Donald Trump will provide a Goldilocks scenario for financials, as his promises of lower regulations, lower corporate taxes and a revived economy that results in higher longer-term interest rates are just right for the sector.

A number of technical warnings signs have flashed, however, suggesting the postelection buying frenzy is petering out. On Thursday, 73% of the S&P 500 financial sector hit 52-week highs, the most since Feb. 13, 1997, and the second highest%age since 1990, according to Jason Goepfert, president of Sundial Capital. His research suggests that the previous five-largest surges in 52-week highs in financials produced a median loss of 1.9% over the next week, and a decline of 2.5% over the next two weeks. In comparison, his data showed the average for all days was a gain of 0.2% in a week and a 0.4% rise in two weeks. “There is no doubt that momentum is impressive in the sector—the problem is that it seems to have entered panic mode and that rarely lasts,” Goepfert wrote in a note to clients.

Question is, how long for?

• Trump Has Unleashed The Stock Market’s ‘Animal Spirits’ (MW)

You don’t have to call it a Trump rally. But some market specialists appear to be struggling to pin a name to the recent moves across global markets, which has pushed the S&P 500, DJIA, the Nasdaq – and most recently the Dow Jones Transportation Average – into record territory since President-elect Donald Trump’s Nov. 8 victory over rival Hillary Clinton. The Dow scored its 14th record close on Friday. Steve Barrow at Standard Bank said in a Nov. 30 research note that “whatever fears might exist in some quarters about Trump’s win, some sort of animal spirits might have been spurred.” So-called animal spirits is an oft-used term on Wall Street coined by famed economist John Maynard Keynes to describe gut instinct.

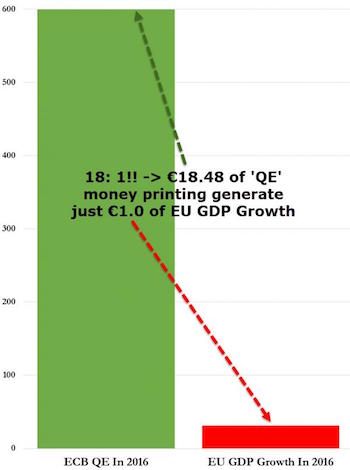

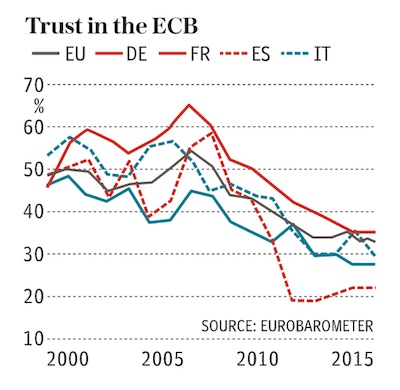

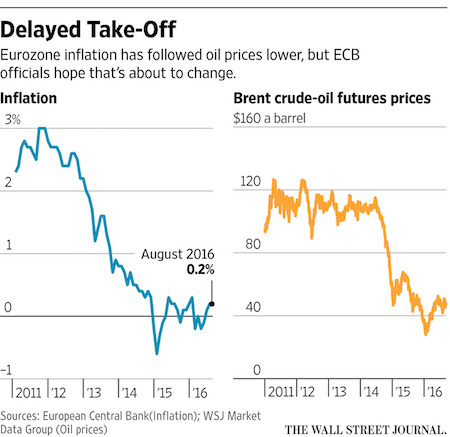

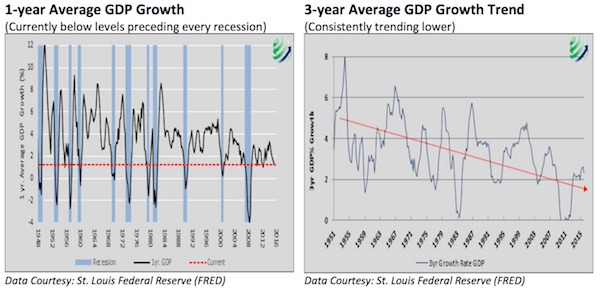

Or as Keynes explained, “a spontaneous urge to action rather than inaction”. A certain verve to scoop up assets has certainly appeared to be at play since early November. Indeed, the Dow industrials as of Friday’s close have risen nearly 8% since the election outcome, the broad-stock benchmark S&P 500 index has climbed 5.6%, while the Nasdaq has picked up 4.8% over the same 30-day period. The Nasdaq scored its first record close since Nov. 29 on Wednesday. Meanwhile, the small-cap focused Russell 2000 which is most sensitive to economic prospects for the country, has jumped more than 15.2% since Nov. 8. To be sure, the U.S. has been a shining star compared with its weaker sisters abroad when it comes to economic growth. The ECB on Thursday said it planned on scaling back elements of its stimulus program but noted that it would extend it “if necessary.”

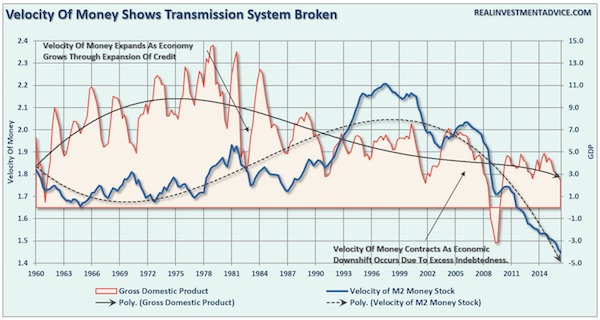

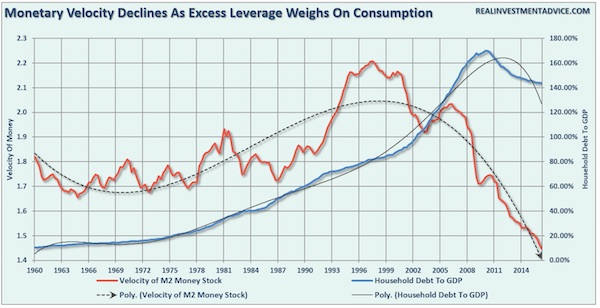

Barrow speculates that global growth has mostly stagnated in the aftermath of the 2008-09 financial crisis because the market didn’t put much faith in the tools, namely asset-repurchases and ultralow rates, that have been put in place by central bankers. By contrast, Trump has proposed a raft of fiscal-stimulus measures to upgrade the U.S.’s ailing infrastructure. The market now appears to be betting, in part, that the incoming leader of the free world will make good on those promises, which could inject a dose of spending that could create jobs and break a trend of economic stagnation. As a result infrastructure companies, commodities associated with construction and bank shares, among other asset classes, vaulted higher. Wall Street is euphoric over the possibilities.

People like Draghi have come to rely on docile markets. Once that’s gone….

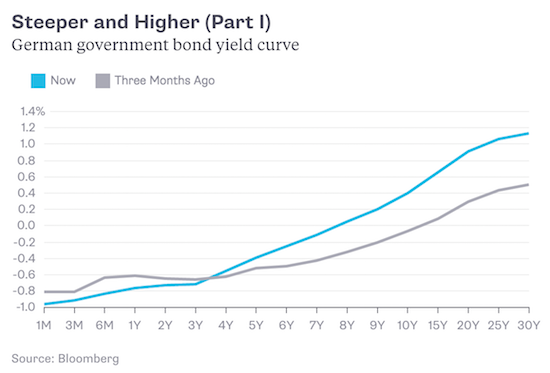

• The Bond Market Doesn’t Believe Draghi (BBG)

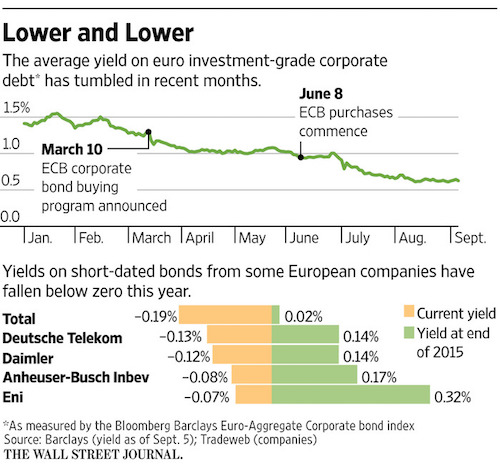

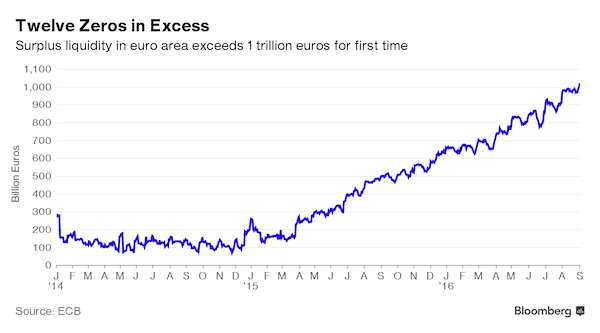

The beatings will continue until morale improves, the saying goes. That’s one interpretation of the ECB’s somewhat convoluted rejig of its quantitative easing program this week. By insisting he’s not tapering bond buying while simultaneously reducing the monthly purchases and extending the time frame, President Mario Draghi is sending a mixed message that likely reflects disagreements among his Governing Council members. Cutting the program to €60 billion per month from €80 billion throws a bone to those who worry that it’s time to withdraw the monetary medicine; lengthening the timeline until the end of next year pacifies policy makers who fear the patient isn’t yet on the road to recovery.

But in financial markets, bond yields are effectively tightening monetary conditions on the central bank’s behalf, suggesting investors are beginning to anticipate an improved economic outlook. That could play out in two ways: Either bonds are correct, and the ECB will find itself tapering properly next year, or bonds are wrong, in which case Draghi will have to make good on his pledge to do more if needed. The 10-year German bond yield has climbed to about 0.4% from a low of almost -0.2% in July. That’s still a ridiculously low level; the average in the past two decades is about 3.4%, and for most of the 1990s the range was between 5% and 9%. Nevertheless, it amounts to a significant tightening in monetary conditions in just three months as the yield curve has steepened:

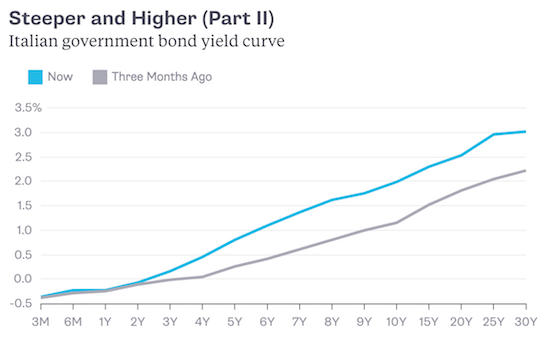

Also, don’t forget that the euro zone remains a fractured economic landscape. Germany, with an unemployment rate of 6%, will find it easier to withstand rising borrowing costs than Italy, where the jobless rate is almost twice as high. And the Italian yield curve has replicated the move seen in Germany, at higher levels that have doubled 10-year yields to 2% since August:

“China is caught between trying to prop up a currency facing long-term decline and letting capital leave at will, risking a bank crisis…”

• Why China Can’t Stop Capital Outflows (Balding)

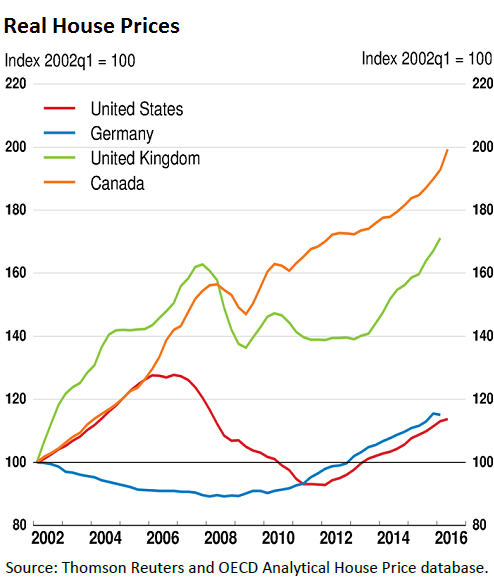

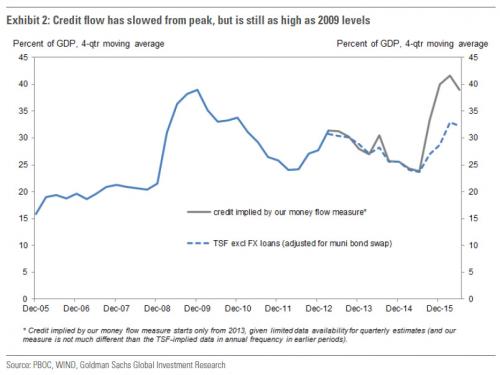

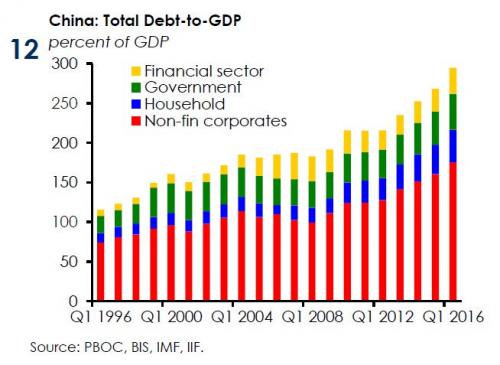

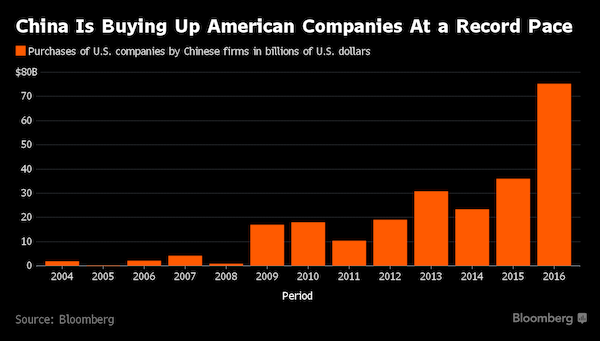

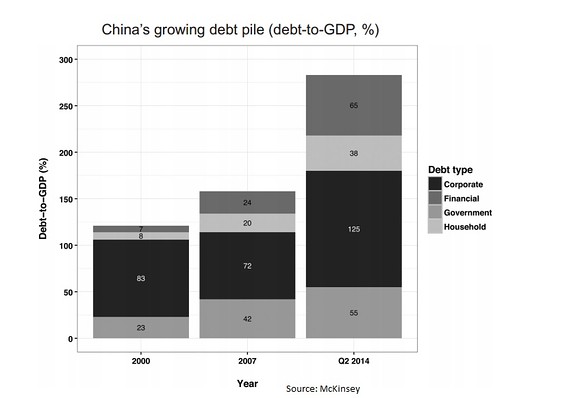

How China manages its currency is likely to be the global economic story of 2017. Despite the government’s best efforts, capital continues to leave the country at a brisk pace, with a balance-of-payments deficit through the third quarter of $469 billion. Attempts to arrest this flow probably won’t work. But they may well create new risks. Capital outflows began gathering steam in 2012, when the government liberalized current-account payment transactions in goods and services. Enterprising Chinese figured out that while they couldn’t officially move money abroad to buy a house via the capital account – individuals are barred from moving more than $50,000 out of the country each year – they could create false trade invoices that would allow them to deposit money where they needed it.

The result was a huge discrepancy between payments recorded for imports and the declared value of goods passing through customs, amounting to $526 billion in hidden outflows last year. The problem has only worsened in 2016. French investment bank Natixis estimates that outflows will total more than $900 billion this year, despite new restrictions on yuan movements, including prohibitions on using credit and debit cards to pay for insurance products in Hong Kong. Last week, the government added yet another restriction. It announced that all international capital-account transactions of more than $5 million will need to be approved by the State Administration of Foreign Exchange. This has businesses deeply concerned, given that the administration likely doesn’t have the manpower for the sheer number of transactions it will need to review.

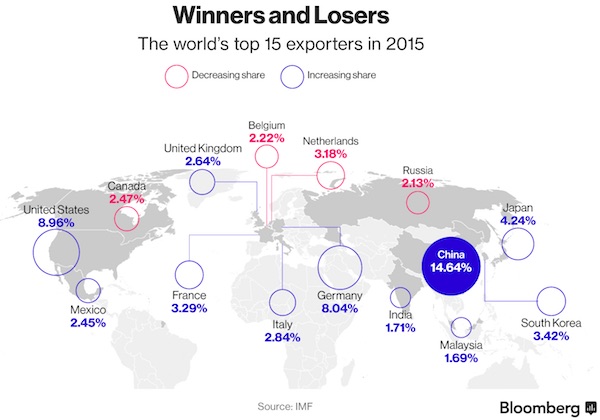

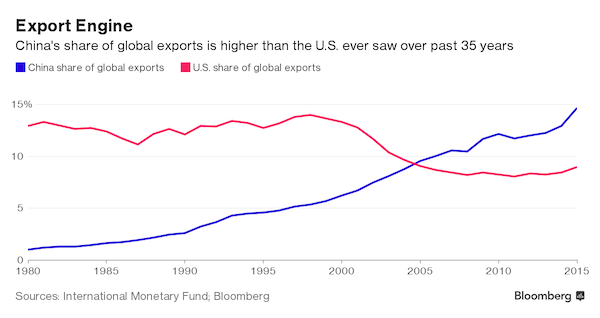

And if such restrictions can be placed on the capital account, it seems only a matter of time until they’re imposed on goods and services transactions. All of which raises a simple question: Why is Beijing working so hard to prop up the yuan and crack down on outward capital flows? The common answer is that it fears the trade consequences of a declining yuan. But that’s not it. Since the government devalued the yuan on Aug. 11, the combined value of imports and exports has fallen by only 8%, even as the value of the yuan has fallen 8% against the U.S. dollar. Any coming decline in the currency won’t make much difference, given the weak global economy and the product mix China is buying and selling.

The real reason is that the government is concerned about the implications of further liberalizing. China’s rickety banks, with delinquency rates of 30%, are receiving regular liquidity injections from the PBOC. Money market rates have been rising, from under 2% this summer to above 2.3% in Shanghai today. Allowing international capital mobility could easily trigger larger withdrawals – and hence liquidity crunches for banks already feeling the pinch of bad loans. In other words, China is caught between trying to prop up a currency facing long-term decline and letting capital leave at will, risking a bank crisis.

This is far from over.

• EU Launches New Investigation Into Chinese Steel Imports (R.)

The EU has launched an investigation into whether Chinese producers of certain corrosion-resistant steels are selling into Europe at unfairly low prices, in its latest action against cheap Chinese steel imports. The European Commission has determined that a complaint brought by EU steelmakers association Eurofer merits an investigation, the EU’s official journal said on Friday. The EU has imposed duties on a wide range of steel grades after investigations over the past few years to counter what EU steel producers say is a flood of steel sold at a loss due to Chinese overcapacity.

Some 5,000 jobs have been axed in the British steel industry in the last year, as it struggles to compete with cheap Chinese imports and high energy costs. G20 governments recorecognized in September that steel overcapacity was a serious problem. China, the source of 50% of the world’s steel and the largest steel consumer, has said the problem is a global one. In October, the European Commission set provisional import tariffs of up to 73.7% for heavy plate steel and up to 22.6% for hot-rolled steel coming from China. Those investigations are set to conclude in April.

Feels political. They could have announced this just as easily a week ago, before the referendum. Now a crisis threatens that may help make the case for interim technocrats to step in, and keep Grillo out.

• ECB Refuses To Help Italy’s Crisis-Hit Monte dei Paschi Bank (G.)

Fears that the Italian government will have to prop up Monte dei Paschi di Siena (MPS) are mounting after the European Central Bank refused to give the world’s oldest bank more time to find major investors to back a €5bn (£4.2bn) cash injection. Trading in the troubled bank’s shares was repeatedly halted on the Italian stock exchange on Friday. The MPS share price closed 10% lower as the bank’s board held a meeting that had already been scheduled before the reports that the ECB had rejected its calls for an extension to the deadline to bolster its financial position. The ECB [..] decision may have closed the door to a private sector solution, under which major investors including the sovereign wealth fund of Qatar would pump billions into the bank.

But MPS said on Friday night that its board would next meet on Sunday night and that it was pressing on with its private sector solutions Even so there were concerns that the Italian government would still have to embark on a “precautionary recapitalisation” of the bank and potentially impose losses on retail investors who hold €2.1bn of the bank’s bonds. Under new EU rules, taxpayer money cannot be used unless bondholders take losses first. A precautionary recapitalisation takes place before a bank becomes insolvent. ECB officials had told Reuters they hoped the refusal to extend the deadline would pave the way for similar support for other Italian banks which are struggling with €360bn of bad loans.

It appeared to leave the Italian government with little option but to embark on a “precautionary recapitalisation” of the bank and potentially impose losses on retail investors who hold €2.1bn of the bank’s bonds. Under new EU rules, taxpayer money cannot be used unless bondholders take losses first. A precautionary recapitalisation takes place before a bank becomes insolvent. The bank has capital above regulatory minimums.

[..] The eurosceptic Five Star Movement, the second most popular party in Italy, said the government needed to step into the fray. “MPS can only be saved by state aid in order to avoid bail-in rules [that hurt] small savers, as happened a year ago,” the party’s MEPs said in a statement on founder Beppe Grillo’s blog. “This is not the time to fear the EU and a possible infraction procedure. The consequences of a disordered bail-in would be disastrous to say the least, almost apocalyptic if one considers the size of MPS.” They added that it was time to “slam our fists at the table in Brussels … while not giving a damn about the deficit”.

Not as bad as numbers suggest perhaps, but not exactly encouraging wither.

• 60% Of Americans Who Usually Fly Home For The Holidays, Won’t This Year (MW)

Rising travel costs, airport delays, and other stressors mean fewer people will be flying home for the holidays this December. Almost 60% of people who normally fly home for the holidays will not this year, a survey of more than 1,000 visitors to travel deals website Airfarewatchdog found; 36% of whom say because it is too expensive and 21% would prefer to drive than deal with delays and long lines. An additional 13% said “the skies are too crowded” to fly home this year. It’s also not cheap: 70% of people who fly home for the holidays spend between $500 and $1,000 and 20% spend more than $1,000, according to a study of more than 1,000 users from travel assistant app Mezi.

Most Americans have less than $1,000 in savings, making such steep spending a major yearly commitment. Still, 18% of respondents in the Airfarewatchdog study said they fly home every year and still plan to do so. Air travel makes up a small%age of holiday travel – less than 10% in 2015, according to travel and automotive services non-profit AAA. But whether driving or flying home for the holidays, the majority of Americans are stressed out – 65% of people say they have anxiety about going home for the holidays, including 72% of women and 58% of men. The top sources of dread for these respondents include being bored and having nothing to do, conflict with family members, and questions about their relationship status.

Makes you wonder how Schäuble spends Christmas. Scrooge comes to mind, prominently.

• Greece Under Fire Over Christmas Bonus For Low-Income Pensioners (G.)

A goodwill gesture to ease the plight of those hardest hit in Greece by tax increases and budget cuts has backfired spectacularly on the prime minister, Alexis Tsipras, with the country’s international creditors making clear he has acted out of step. In the starkest case yet of how closely watched loan-reliant Athens is, lenders reacted with unusual alacrity on Friday after the leftist leader announced a one-off Christmas bonus for 1.6 million low-income pensioners. “The programme includes clear commitments to discuss all measures related to programme objectives with the institutions in advance,” an EU spokeswoman said. “The commission was not made aware of all the details of the announcements before they were made. We will now need to study them.”

Retirees have been among those most affected by the gruelling regime of austerity the debt-stricken country has been forced to enact in exchange for over €300bn in emergency rescue funding. Once unassailable, Tsipras’s own popularity has plummeted amid scenes of pensioners being teargassed and beaten as they took to the streets in protest. Under the scheme – announced in a televised address following a nationwide strike when anti-austerity demonstrations had swept the country – Tsipras said handouts of €617m would be given to those living on €800 or less a month. [..] State minister Alekos Flambouraris, the 42-year-old politician’s closest mentor, said creditors had not been forewarned as the money came out of the surplus Greece had managed to achieve through stringent belt-tightening.

[..] social tensions are also spiralling. “Tsipras is worried and that is why he made this move,” Grigoris Kalomoiris, chief policy maker at the union of public sector employees Adedy, told the Guardian. “Come January there will be more cuts to salaries and pensions in very real terms. We are all being pushed to breaking point. This, believe me, is the calm before the storm.” Ignoring creditor anger, Tsipras’s beleaguered administration dug in its heels late on Friday, saying the bonus did not threaten fiscal targets and would not be rescinded. “It is up to the Greek government to distribute expenditure in the way it sees most fit and socially correct, as long as agreed goals are reached,” the prime minister’s office said. “Greece is not a colony.”

No ferries for 9 days?! In Greece, land of ferries?!

• Greece Seamen Strike: Angry Farmers Throw Flares, Set Offices On Fire (KTG)

The port of Heraklion on the island of Crete turned into a battle field when hundreds of raging farmers attacked striking seamen and set the ticket offices of ANEK shipping company on fire on Friday evening. Angry about the ongoing strike of the seamen, the farmers threw flares at a ferry docked at the port. The sailors of Blue Horizon ferry answered with water drops. A farmer from Ierapetra had claimed that the ferry captain had put in operation the machines so that the ferry depart from the pier and that the lines were cut at risk of injuring farmers. The farmers were shouting “traitors” and some climbed on the lines. They kept demanding that the ferry opens its doors so that they can ship their products to the mainland.

Almost at the same time, a group of farmers moved to the ticket offices of shipping company ANEK and set it on fire. Hundreds of angry and determined farmers arrived at the port of Heraklion around 5pm and declared that they will not step back until 150 trucks loaded with vegetables get on board and leave for Piraeus. The harbormaster of Heraklion was injured and taken to the hospital with an ambulance. He was reportedly when he hit at a door during the incidents. In the 9th day of the seamen strike, the farmers are in rage as they cannot forward their products to the mainland and abroad, thus losing thousands of euros.

I’m not at all a fan of these kinds of comparisons, but what exactly sets Australian ‘policy’ apart from German concentration camps?

• Broken Men in Paradise (NYT)

MANUS, Papua New Guinea — The plane banks over the dense tropical forest of Manus Island, little touched, it seems, by human hand. South Pacific waters lap onto deserted beaches. The jungle glistens, impenetrable. At the unfenced airport, built by occupying Japanese forces during World War II, a sign “welcomes you to our very beautiful island paradise in the sun.” It could be that, a 60-mile-long slice of heaven. But for more than 900 asylum seekers from across the world banished by Australia to this remote corner of the Papua New Guinea archipelago, Manus has been hell; a three and a half year exercise in mental and physical cruelty conducted in near secrecy beneath the green canopy of the tropics.

A road, newly paved by Australia as part payment to its former colony for hosting this punitive experiment in refugee management, leads to Lorengau, a capital of romantic name and unromantic misery. Here I find Benham Satah, a Kurd who fled persecution in the western Iranian city of Kermanshah. Detained on Australia’s Christmas Island after crossing in a smuggler’s boat from Indonesia and later forced onto a Manus-bound plane, he has languished here since Aug. 27, 2013. Endless limbo undoes the mind. But going home could mean facing death: Refugees do not flee out of choice but because they have no choice. Satah’s light brown eyes are glassy. His legs tremble.

A young man with a college degree in English, he is now nameless, a mere registration number — FRT009 — to Australian officials. “Sometimes I cut myself,” he says, “so that I can see my blood and remember, ‘Oh, yes! I am alive.’ ” Reza Barati, his former roommate at what the men’s ID badges call the Offshore Processing Center (Orwell would be proud), is dead. A fellow Iranian Kurd, he was killed, aged 23, on Feb. 17, 2014. Satah witnessed the tall, quiet volleyball player being beaten to death after a local mob scaled the wall of the facility. Protests by asylum seekers had led to rising tensions with the Australian authorities and their Manus enforcers.

The murder obsesses Satah but constitutes a mere fraction of the human cost of a policy that, since July 19, 2013, has sent more than 2,000 asylum seekers and refugees to Manus and the tiny Pacific island nation of Nauru, far from inquiring eyes. (Unable to obtain a press visa to visit Manus, I went nonetheless.) The toll among Burmese, Sudanese, Somali, Lebanese, Pakistani, Iraqi, Afghan, Syrian, Iranian and other migrants is devastating: self-immolation, overdoses, death from septicemia as a result of medical negligence, sexual abuse and rampant despair. A recent United Nations High Commissioner for Refugees report by three medical experts found that 88% of the 181 asylum seekers and refugees examined on Manus were suffering from depressive disorders, including, in some cases, psychosis.

On a lighter note: